Attached files

| file | filename |

|---|---|

| 8-K - PRESENTATION AT CITI EMT CONFERENCE - MEREDITH CORP | form8kciti.htm |

1

Citi 21st Annual Global

Entertainment, Media &

Telecommunications Conference

Entertainment, Media &

Telecommunications Conference

January 5, 2011

2

Safe Harbor

This presentation and management’s public commentary contain certain forward-looking statements

that are subject to risks and uncertainties. These statements are based on management’s current

knowledge and estimates of factors affecting the Company’s operations. Statements in this presentation

that are forward-looking include, but are not limited to, the statements regarding broadcast and

publishing advertising revenues, as well as any guidance related to the Company’s financial

performance.

that are subject to risks and uncertainties. These statements are based on management’s current

knowledge and estimates of factors affecting the Company’s operations. Statements in this presentation

that are forward-looking include, but are not limited to, the statements regarding broadcast and

publishing advertising revenues, as well as any guidance related to the Company’s financial

performance.

Actual results may differ materially from those currently anticipated. Factors that could adversely affect

future results include, but are not limited to, downturns in national and/or local economies; a softening of

the domestic advertising market; world, national, or local events that could disrupt broadcast television;

increased consolidation among major advertisers or other events depressing the level of advertising

spending; the unexpected loss or insolvency of one or more major clients; the integration of acquired

businesses; changes in consumer reading, purchasing and/or television viewing patterns; increases in

paper, postage, printing, or syndicated programming costs; changes in television network affiliation

agreements; technological developments affecting products or the methods of distribution; changes in

government regulations affecting the Company’s industries; unexpected changes in interest rates; and

the consequences of any acquisitions and/or dispositions. The Company undertakes no obligation to

update any forward-looking statement, whether as a result of new information, future events, or

otherwise.

future results include, but are not limited to, downturns in national and/or local economies; a softening of

the domestic advertising market; world, national, or local events that could disrupt broadcast television;

increased consolidation among major advertisers or other events depressing the level of advertising

spending; the unexpected loss or insolvency of one or more major clients; the integration of acquired

businesses; changes in consumer reading, purchasing and/or television viewing patterns; increases in

paper, postage, printing, or syndicated programming costs; changes in television network affiliation

agreements; technological developments affecting products or the methods of distribution; changes in

government regulations affecting the Company’s industries; unexpected changes in interest rates; and

the consequences of any acquisitions and/or dispositions. The Company undertakes no obligation to

update any forward-looking statement, whether as a result of new information, future events, or

otherwise.

3

Online: Meredith

Women’s Network

Women’s Network

Magazines: Home, Family,

Health & Well-being

Health & Well-being

Consumer Events

Custom Marketing

Database Marketing

Video Studios

Brand Licensing

Mobile

E-Reader

Broad Capabilities Across Media Platforms

1. Advertising Update

2. Vision 2013 Growth Strategies

• Optimize our core businesses

• Expand our digital businesses

• Enhance and extend key brands

• Significantly grow Meredith Integrated Marketing

• Building shareholder value over time

4

Agenda

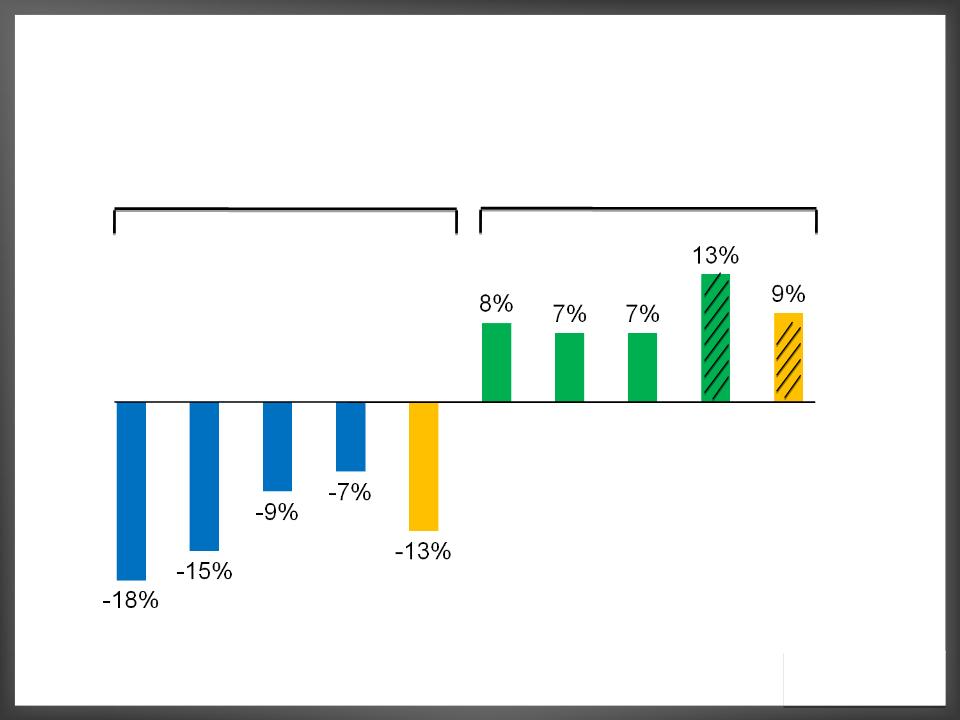

Improved Advertising Revenue Performance

Change from prior year period

Source: Meredith, calendar year quarters

E = Estimate

5

Calendar 2009

Calendar 2010

Q4

Q1

Q2

Q3

Q4

Q3

Q2

Q1

Full

year

2009

year

2009

Full

year

2010

year

2010

E

E

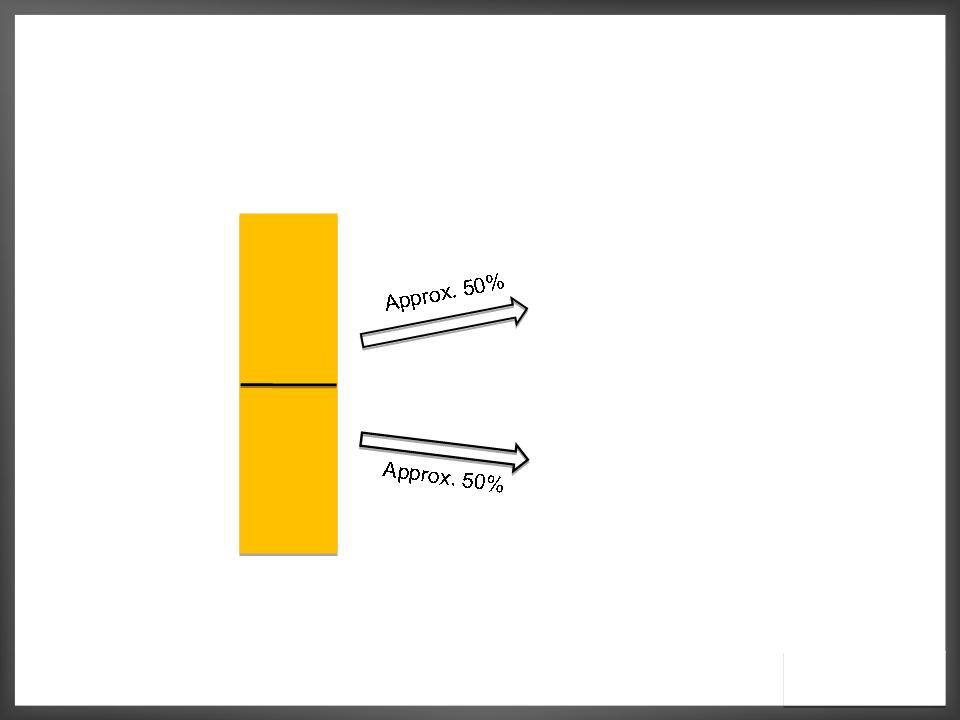

Calendar 2010 Advertising Revenue Growth

9%E

Total Company

advertising

revenue growth

advertising

revenue growth

• National Media

• Local Media

non-political

• Local Media political

Growth from:

E = Estimate

7

Delivered Record Political Advertising Revenues

$16

$22

$24

$36

$26

$39

Calendar years

$ in millions

E = Estimate

E

National Media Advertising Share Gains

9.1%

9.4%

11.1%

Quarterly market share as of 12/31

Source: Publishers Information Bureau

*Based on most current PIB data (November 2010)

8

11.8%

*

Advertising Spending Forecasts

|

|

Forecast

|

|

Estimates

|

CAGR

|

||

|

2010

|

2011

|

2012

|

2013

|

2014

|

2010-2014

|

|

|

Total

Advertising |

$183

|

$187

|

$201

|

$215

|

$235

|

6.4%

|

|

|

|

|

|

|

|

|

|

Consumer

Magazines |

$10.4

|

$10.4

|

$10.5

|

$10.9

|

$11.4

|

2.3%

|

|

Broadcast

Television |

$45

|

$44

|

$48

|

$48

|

$52

|

3.7%

|

Calendar years; $ in billions

Source: Veronis Suhler Stevenson, September 2010

10

Advertising Environment Summary

National Media:

• Volatile by issue and quarter-to-quarter

• Achieving higher rates per advertising page

• Online advertising up strongly

Local Media:

• Delivering strong top-line growth

• Political advertising season set record

• Automotive rebounding strongly; other categories also up

11

Agenda

1. Advertising Update

2. Vision 2013 Growth Strategies

• Optimize our core businesses

• Expand our digital businesses

• Enhance and extend key brands

• Significantly grow Meredith Integrated Marketing

• Building shareholder value over time

12

Building the National Media Business of the Future

Brand Strength

Revenue Growth

Cost and Expense

Containment

Containment

Next Generation

Operating Model

Operating Model

• Magazine readership up

• Digital audience growing

• Delivering higher net revenues per page

• Integrated marketing, brand licensing growing

• Q1 FY11 costs down 2 percent year over year

• Q1 FY11 costs down 14 percent over two years

• Optimized Special Interest Media business

• Moving consumer marketing activities online

13

Building the Local Media Business of the Future

Brand Strength

Revenue Growth

Cost and Expense

Containment

Containment

Next Generation

Operating Model

Operating Model

• Delivering strong TV news ratings

• Better daily show in 80 markets (4 of Top 5)

• Q1 FY11 spot ad revenue up 27 percent

• Increasing online and mobile activities

• Automated newsrooms

• Q1 FY11 costs down 1 percent over 2 years

• Centralized master control, traffic & research

• Creating 24-hour continuous news platform

14

Agenda

1. Advertising Update

2. Vision 2013 Growth Strategies

• Optimize our core businesses

• Expand our digital businesses

• Enhance and extend key brands

• Significantly grow Meredith Integrated Marketing

• Building shareholder value over time

Meredith Interactive Overview

National Media Group

Local Media Group

Total: 25 websites

Total: 30 websites + apps

15

16

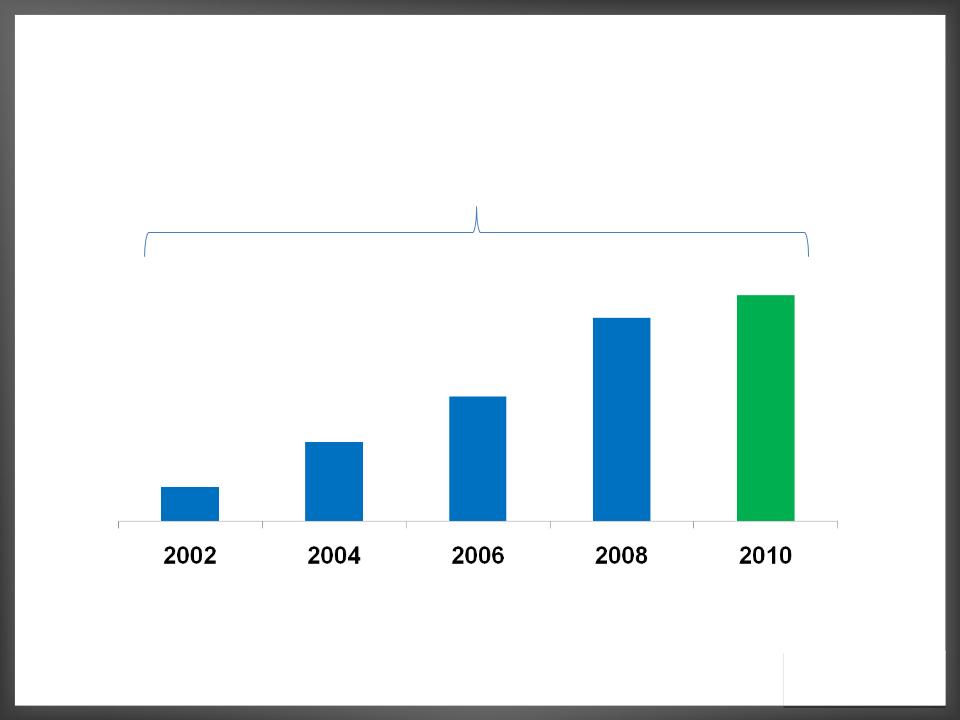

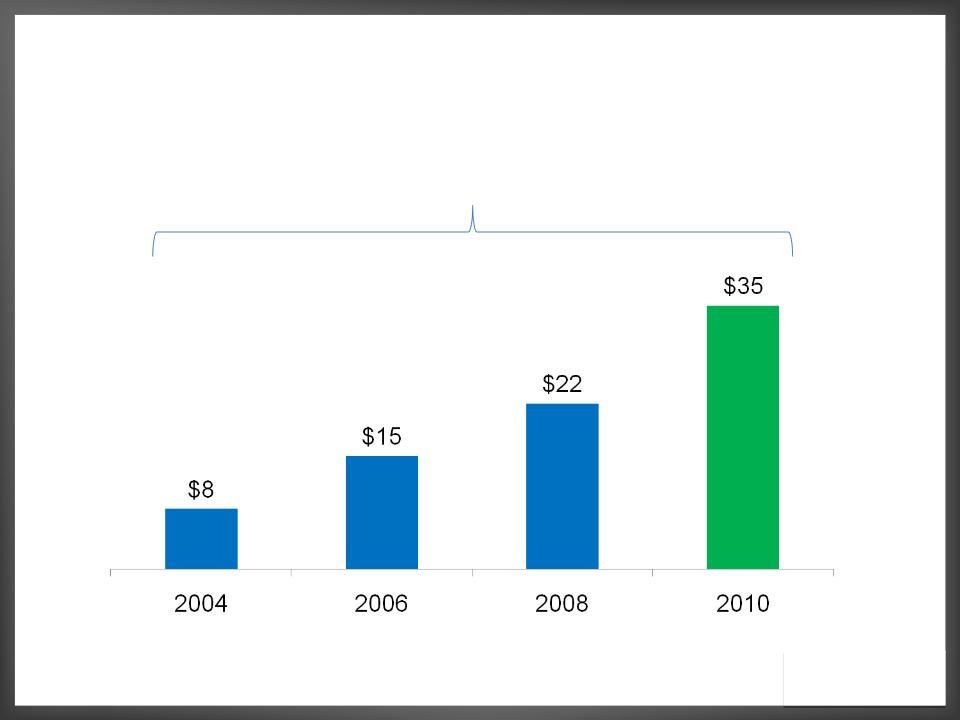

Growing Audience Online

20

Average Monthly Unique Visitors to all Meredith websites

27% CAGR

18

11

7

3

Fiscal years ended June 30

17

Growing Presence in Mobile

• Completed Hyperfactory acquisition:

– Mobile content and marketing specialist

– Working on additional B2B and B2C initiatives

• Business to Business:

– Developing mobile apps, web sites and

marketing campaigns for corporate clients

marketing campaigns for corporate clients

• Business to Consumer:

− Launched mobile versions of our key brands

− TV stations offer multiple apps

− Multiple eTablet initiatives

18

Interactive Tablet Editions to Launch in Spring 2011

19

Agenda

1. Advertising Update

2. Vision 2013 Growth Strategies

• Optimize our core businesses

• Expand our digital businesses

• Enhance and extend key brands

• Significantly grow Meredith Integrated Marketing

• Building shareholder value over time

Better Homes and Gardens I It’s Where Life Happens

Better Homes and Gardens 360º Approach

20

Better Homes and Gardens I It’s Where Life Happens

Better Homes and Gardens Products at Retail

21

22

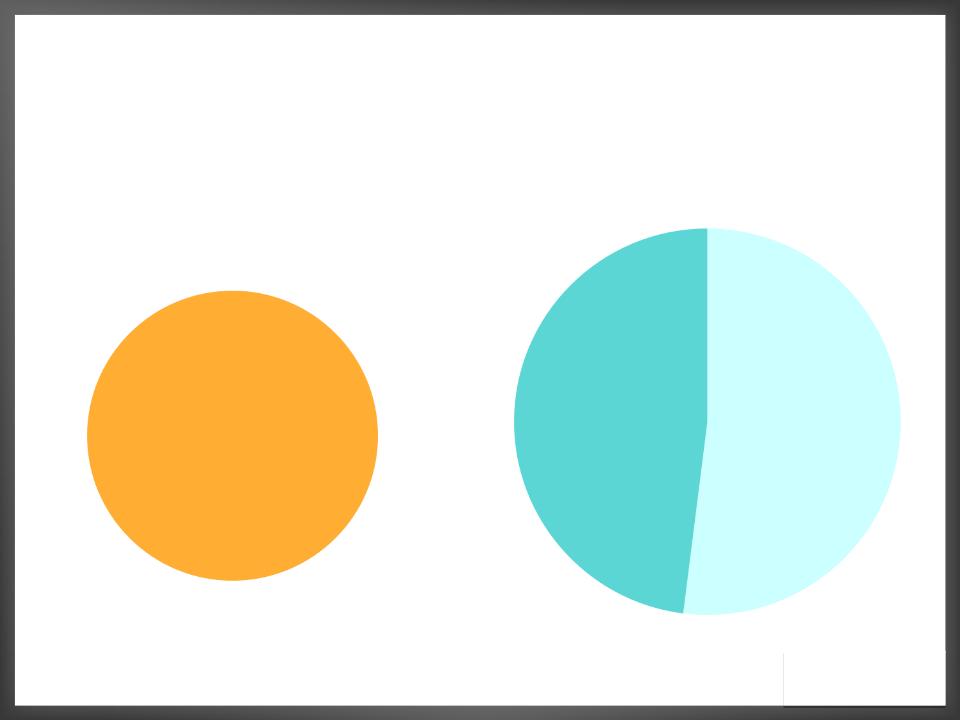

Growing Revenues from Brand Licensing

$ in millions

Fiscal years ended June 30

28% CAGR

23

1

3

3

Parents & American Baby: The Next Megabrand

23

24

Agenda

1. Advertising Update

2. Vision 2013 Growth Strategies

• Optimize our core businesses

• Expand our digital businesses

• Enhance and extend key brands

• Significantly grow Meredith Integrated Marketing

• Building shareholder value over time

25

Growing Integrated Marketing Capabilities

Digital

marketing

marketing

Online, social

media, database

marketing

media, database

marketing

Healthcare

marketing

marketing

Mobile

Marketing

Marketing

Custom

Publishing

& CRM

Publishing

& CRM

2006

2007

2008

2009

Pre-2006

Custom Publishing

100%

Custom Publishing

49%

CRM/

Digital

Digital

51%

Strong Revenue Growth and Diversification

26

Fiscal 2005

Fiscal 2010

iFood Assistant

Database

Digital Magazine

Video

Magazines

Emails

Social Marketing

Online

Kraft Case Study

27

28

Agenda

1. Advertising Update

2. Vision 2013 Growth Strategies

• Optimize our core businesses

• Expand our digital businesses

• Enhance and extend key brands

• Significantly grow Meredith Integrated Marketing

• Building shareholder value over time

29

Track Record of Dividend Increases

12% CAGR

Calendar years

30

200

Stock Option Exercises

$2,000

Utilization of Cash

200

Net Debt

300

Capital Expenditures

600

Acquisitions, Net of Dispositions

$2,000

Available Cash

$1,800

Operating Cash Flow

300

Dividends

$600

Share Repurchases

$900

SUBTOTAL

Returned to Shareholders

Reinvested in Business

$900

SUBTOTAL

Use of Cash: Fiscal 2001 through 2010

31

Fiscal 2011 Second Quarter and Full Year Outlook

|

Oct. 2010

|

Jan. 2011

|

|

$0.75 to $0.80

|

$0.85 to $0.88

|

|

$2.50 to $2.75

|

$2.60 to $2.80

|

• National Media ad revenue up low-to-mid single digits

• Local Media non-political ad revenue flat-to-up low single digits

• Local Media political ad revenue $22 million

Second Quarter:

• Second quarter

• Full year

Earnings per share

1. Optimize our core businesses

2. Expand our digital businesses

3. Enhance and extend key brands

4. Significantly grow Meredith Integrated Marketing

5. Build shareholder value over time

32

Vision 2013 Growth Strategies

33