Attached files

| file | filename |

|---|---|

| EX-32.1 - CHINA DAQING M&H PETROLEUM, INC. | exhibit32.htm |

| EX-31.1 - CHINA DAQING M&H PETROLEUM, INC. | exhibit311.htm |

| EX-32.2 - CHINA DAQING M&H PETROLEUM, INC. | exhibit322.htm |

| EX-31.2 - CHINA DAQING M&H PETROLEUM, INC. | exhibit312.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

|

[X]

|

ANNUAL REPORT UNDER SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended September 30, 2010

|

[ ]

|

TRANSITION REPORT UNDER SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from ___________ to ___________

Commission file number: 000-31469

CHINA DAQING M&H PETROLEUM, INC.

(Name of small business issuer in its charter)

|

Nevada

|

20-2388650

|

|

(State of organization)

|

(I.R.S. Employer Identification No.)

|

Jianqiao Road third Floor, Song Yuan City, Economic and Technology

Development District Jilin Province, China, Zip code: 138000

(Address of principal executive offices)

(406) 282-3188

(Registrant's telephone number)

SECURITIES REGISTERED UNDER SECTION 12(B) OF THE EXCHANGE ACT:

None

SECURITIES REGISTERED UNDER SECTION 12(G) OF THE EXCHANGE ACT:

Common Stock, $0.001 par value per share

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such report(s)), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (Section 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer,” and smaller reporting companies in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

o

|

Accelerated filer

|

o

|

|

|

Non-accelerated filer

(Do not check if a smaller reporting company)

|

o

|

Smaller reporting company

|

x

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No x

The aggregate market value of the registrant’s voting common stock held by non-affiliates as of December 31, 2010 based upon the closing price reported for such date was $16,015,570.

As of January 5, 2011, the registrant had 31,857,000 shares of its common stock outstanding.

Documents Incorporated by Reference: None.

TABLE OF CONTENTS

|

PAGE

|

||||

|

PART I

|

||||

|

ITEM 1.

|

Business

|

|||

|

ITEM 1A.

|

Risk Factors

|

|||

|

ITEM 2.

|

Properties

|

|||

|

ITEM 3.

|

Legal Proceedings

|

|||

|

ITEM 4.

|

(Removed and Reserved)

|

|||

|

PART II

|

||||

|

ITEM 5.

|

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

|||

|

ITEM 6.

|

Selected Financial Data

|

|||

|

ITEM 7.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operation

|

|||

|

ITEM 8.

|

Financial Statements and Supplementary Data

|

|||

|

ITEM 9.

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

|

|||

|

ITEM 9A(T).

|

Controls and Procedures

|

|||

|

PART III

|

||||

|

ITEM 10.

|

Directors, Executive Officers and Corporate Governance

|

|||

|

ITEM 11.

|

Executive Compensation

|

|||

|

ITEM 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

|||

|

ITEM 13.

|

Certain Relationships and Related Transactions

|

|||

|

ITEM 14.

|

Principal Accounting Fees and Services

|

|||

|

PART IV

|

||||

|

ITEM 15.

|

Exhibits, Financial Statement Schedules

|

|||

|

SIGNATURES

|

2

PART I

ITEM 1. BUSINESS

Our History

We were incorporated in Nevada on April 15, 2005 as “Fleurs De Vie” (“we”, the “Company” or “FDVI”). On June 9, 2005, we filed a Certificate of Correction with the State of Nevada to have our registered name corrected to “Fleurs De Vie, Inc.” We provided upscale custom floral design services and finished natural floral products to the general public before September 2007.

On or about June 29, 2007, certain majority shareholders of FDVI, including Harold A. Yount, Jr. and Brenda P. Yount, our Chief Executive Officer and Vice President, respectively, Loev Corporate Filings, Inc. and David M. Loev (the “Sellers”), entered into a stock purchase agreement with Huaqin Zhou, Xiaojin Wang and Huakang Zhou (the “Acquirers”) and certain other third parties, pursuant to which the Sellers sold an aggregate of 1,440,000 restricted shares of our common stock which they held, representing approximately 77.5% of its outstanding common stock to the Acquirers. The purchase price paid to the Sellers for the shares was $564,103 of which $50,000 had previously been received from the Acquirers in connection with the parties’ entry into a Letter of Intent. Additionally, finders and consulting fees paid out of the purchase price received by the Sellers totaled approximately $170,000. In connection with the share purchase transaction, on or about July 12, 2007, our Board of Directors increased the number of our members of the Board of Directors to two (2) and appointed David H. Smith as a Director of the Company.

On November 11, 2007, David H. Smith resigned from his position as a member of the Board of Directors. On November 27, 2007, Dr. Huakang Zhou resigned from his positions as President, Secretary and Treasurer of the Company, and as a member of its Board of Directors. On the same date, the Board of Directors elected Mr. Changming Zhang and Mr. Yongjun Wang to serve as a member of its Board of Directors. Mr. Zhang served as President, Chief Executive Officer. Mr. Wang served as Chief Financial Officer, Secretary, and Treasurer.

3

On August 11, 2009, we acquired 100% of the outstanding capital stock of American D&C Investment, Inc., a Delaware corporation (“ADCI”). ADCI is a holding company that owns 100% of the equity of DaQing YueYu Oilfield Underground Technology Service Co., Ltd (“DaQing Yueyu”), a corporation organized under the laws of People’s Republic of China. DaQing Yueyu is engaged in resale of oil drilling equipment and accessories and oilfield underground technology services (“Steel”) and through its 95% owned subsidiary Jilin Yifeng Energy Sources Co., Ltd. (“Jilin Yifeng”) is engaged in the business of extraction and sale of crude oil (“Extraction”) and subleasing of oil fields (the “Sublease”), in Jilin Province. All of Jilin Yifeng’s business is currently in China. In connection with the closing of the transaction on August 11, 2009, FDVI issued to the shareholders of ADCI 30,000,000 shares of FDVI Common Stock. Yongjun Wang resigned as our Chief Financial Officer and Chief Accounting Officer, and Changming Zhang resigned as our President and Chief Executive Officer, but remain as directors of the Company. Haimiao Sun was appointed a director of the Company. In addition, the following persons were appointed as officers of the Company: Yongjun Wang, as President, Linan Gong, as Chief Executive Officer and Secretary, and Dehai Yin as Chief Financial and Accounting Officer.

On August 31, 2009, we filed with the Nevada Secretary of State a Certificate of Amendment to our Articles of Incorporation to change the name of the corporation to “China Daqing M&H Petroleum, Inc.” On September 10, 2009, our Board of Directors approved a change in the Registrant’s fiscal year. The new fiscal year ends on September 30.

Our Subsidiaries and Affiliates

American D&C Investment, Inc.

American D&C Investment, Inc. was organized under the laws of the State of Delaware on October 29, 2007. In June 2008, American D&C Investment, Inc. acquired 100% of the registered capital of DaQing Yueyu Oilfield Underground Technology Service Co., Ltd in exchange for equity in American D&C Investment, Inc. Those shares represent the only asset of American D&C Investment. The only shareholder of American D&C Investment, Inc is Ms. Xiaojin Wang.

DaQing Yueyu Oilfield Underground Technology Service Co., Ltd.

DaQing YueYu Oilfield Underground Technology Service Co., Ltd (“DaQing Yueyu”), organized on November 2007, is a holding company that owns 95% of the registered capital of Jilin Yifeng Energy Sources Co., Ltd. (“Jilin Yifeng”), a corporation organized under the laws of People’s Republic of China. DaQing Yueyu is engaged in the business of developing, and extracting crude oil through its 95% owned subsidiary Jilin Yifeng in Jilin Province.

4

Jilin Yifeng Energy Sources Co., Ltd.

Jilin Yifeng was organized in 2002 as a liability limited company under the laws of The People’s Republic of China. Its offices and manufacturing facilities are located nearly from Jilin Oilfield, which is the sixth biggest oilfield throughout Fuyu region in Jilin Province. This location provides the company ready access to potential customers in the industrial sector of northeast China.

Our Business

Since 2003, we have been engaged in the development of oil wells and extracting oil from the Miao 14 oilfield blocks (“Miao 14”). Miao 14 covers 19.8 square kilometers, of which 15.6 square kilometers are oil-bearing areas. The geological reserve for the area is 6.07 million tons of oil, of which include proven oil reserves of 5.35 million tons. The thickness of the crust increases from 300 meters to 360 meters, inclining from the west to the east. Oil is found from 1,500 meters to 1,700 meters below sea level. Miao 14 is located in Song Yuan City of Jilin Province, at the intersection of the Nenjiang River and the Songhua River. The Chang Bai Railway and highway south of the oilfield provides the Company with the convenient access to transportation for the delivery of crude oil. Our current oil extracting facilities operate at full capacity. Below is a description of our historical production levels.

In February 2002, we signed an Exclusive Business Cooperation Agreement with PetroChina Jilin Oilfield Company, a subsidiary of PetroChina Group, a corporation organized and existing under the laws of the People’s Republic of China (“PetroChina”), and the biggest crude oil supplier in China. After reaching the agreement, we initiated our business in January of 2003. During the first year, we drilled 19 oil wells. As of the end of 2005, we had 52 working oil wells, and had produced a total of 29,000 tons of crude oil during the period from 2003 to 2005.

From 2006 to 2007, we were not able to explore for new oil wells due to a lack of capital resources. As a result of our limited working capital during these two years, our output of oil was at a lower level compared to previous years.

5

In November 2007, DaQing Yueyu Oilfield Underground Technology Services Co., Ltd and DaQing Chunyiyuan Trade & Economy Co., Ltd. acquired 95% and 5% of the equity of Jilin Yifeng respectively. Our new shareholders provided an infusion of capital and enabled us to explore for new wells in 2008. As of September 30, 2009, we had 85 producing oil wells and 6 injection wells. Of these oil wells, 33 wells were developed in the calendar year 2008.

As of September 30, 2009, our number of producing oil wells remained unchanged compared to September 30, 2008. There were no newly developed oil wells from October 1, 2008 to September 30, 2009. The primary reasons were a lack of sufficient working capital, and the low price of crude oil which limited the demand for new oil well exploration.

As of September 30, 2010, we had a total of 121 wells as compared to 91 as of September 30, 2009. For the year ended September 30, 2010, we developed 30 new oil wells and also converted 19 existing wells to injection wells, making our total oil wells to 96 (including 95 producing wells and 1 bailing well) and injection wells to 25.

We sell all of the crude oil we extract to PetroChina Jilin Oilfield Company (“PetroChina Jilin Oilfield”). The selling price is the average FOB price of the previous month as listed on the Singapore crude oil markets.

We believe the newly explored and developed oil wells are more profitable and productive than the old wells. To continue our exploration of new wells and maintain a steady output of oil, we will require additional capital.

Distribution Channels

Exclusive Business Cooperation Agreement: Pursuant to a 20-year Exclusive Business Cooperation Agreement entered into by and among Jilin Yifeng and PetroChina in February 2002, we have the right to explore, develop and produce oil at Miao 14 and are responsible for the well logging, drill-stem testing and core sampling.

6

Production

The Company commenced formal operation in 2003, after reaching an Exclusive Business Cooperation Agreement with Petro China Jilin Oilfield Company. From 2003 to 2005 we developed 52 wells, and produced 29,000 tons of crude oil during this period.

During the period from 2006 to early 2008, the Company suffered a downturn in results as there was not sufficient funding available for the Company to explore new wells. In the oil exploring business, it is critically important to have new well resources, since new wells are generally more productive and profitable than the old ones.

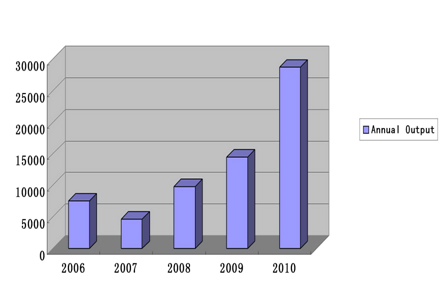

Below is the chart showing the Company’s output from 2006 to September 30, 2010 (unit: ton):

For the year ended September 30, 2010, the company’s output of crude oil was 28,829 tons.

7

Customers

The Company sells all its crude oil to PetroChina Jilin Oilfield on an exclusive basis. This agreement concludes in February 2022.

Facilities, Oil Properties and Activities

We currently own no real estate property. We lease our offices and land spaces from third parties under lease agreements which expire on December 5, 2011. Our office space totals approximately 5,704 square feet, and is located at Jianqiao Road, third floor, Song Yuan City, Economic and Technology Development District, Jilin Province. We rend it for an annual rent of ¥120,000 RMB (approximately $17,964) from December 6, 2009 until December 5, 2011.

As of September 30, 2010, we had a total of 121 wells as compared to 91 as of September 30, 2009. For the year ended September 30, 2010, we developed 30 new oil wells and also converted 19 existing wells to injection wells, making our total oil wells to 96 (including 95 producing wells and 1 bailing well) and injection wells to 25. The conversion is a common technique in oil drilling and the purpose of it is to restore underground pressure by water injection thus increase oil drilling productivity on oil wells. In addition, there were 95 traditional sucker-rod pumping machines in operation.

All of the Company’s crude oil production is exclusively sold to PetroChina Jilin Oilfield Company. Transportation expenses are limited and well-controlled. From October 1, 2009 to September 30, 2010, the Company incurred transportation expenses of approximately $49,382. This represents only 0.31% of our total net sales for the year ended September 30, 2010.

8

Industry and Market Overview

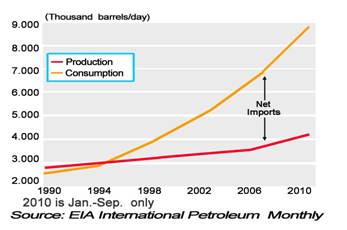

As shown in the graph below, the consumption of crude oil grew rapidly in the beginning of 21th century in China. During the 1990’s, compared to the annual growth rate of 1.67% in production, the annual growth rate in China’s crude oil consumption was 5.77%. Most recently, according to China National Bureau of Statistics, China’s crude oil consumption for the first ten months of 2010 was 393.38 million tons, up 13.77% from the same period last year.

Crude Oil Production of China and the world from 2002 to September 2010

|

November 2010 International Petroleum Monthly

|

||||||||

|

Posted: December 24, 2010

|

||||||||

|

(Thousand Barrels per Day)

|

||||||||

|

China

|

World

|

|||||||

|

2002 Average

|

3,390

|

67,162

|

||||||

|

2003 Average

|

3,409

|

69,434

|

||||||

|

2004 Average

|

3,485

|

72,493

|

||||||

|

2005 Average

|

3,609

|

73,737

|

||||||

|

2006 Average

|

3,673

|

73,461

|

||||||

|

2007 Average

|

3,729

|

73,012

|

||||||

|

2008 Average

|

3,790

|

73,697

|

||||||

|

2009 Average

|

3,799

|

72,314

|

||||||

|

2010 9-month Average (until September 30, 2010)

|

4,038

|

73,416

|

||||||

9

Currently, China is the second largest energy consumer in the world, after the United States. The demand for crude oil in China resulted from economic growth and industrial development, which is expected to continue at an increasing rate for the next ten years. The booming economic environment attracts international manufacturers to set up production facilities in China for lower labor costs and operational expenses. Meanwhile, the fast growth in the Chinese automobile market is another significant factor affecting crude oil demand. It is reported that China's automobile manufacturing output amounted to 13,082,700 for the first 9 months of 2010, up 36.1% over the same period last year. Thus, the upward trend of crude oil consumption is expected to continue for at least the next five years in China.

Competition

The energy and petroleum industries are highly competitive. There is competition within the industries and also with other industries to supply the energy, fuel and chemical needs of industrial and individual consumers. Currently, all of our output is sold to PetroChina Jilin Oilfield. However, if the relationship with PetroChina is terminated, we will encounter competition with other firms for the sale or purchase of various goods or services in many national and international markets and employ all methods of competition which are lawful and appropriate for such purposes. A key component of our competitive position is our ability to manage expenses successfully, and maintain long-term cooperation relationship with PetroChina.

Employees

We currently have 127 full-time staff and employees.

|

Department

|

Headcount

|

|||

|

Management and Administrative

|

25

|

|||

|

Accounting staff

|

5

|

|||

|

Site workers

|

97

|

|||

|

Total

|

127

|

|||

10

Regulation

We are subject to the environmental laws and regulations of the jurisdictions in which we carry on our business. Existing or future laws and regulations could have a significant impact on the exploration and development of natural resources by us. However, to date, we have not been required to spend any material amounts for environmental control facilities. The Chinese government strictly monitors compliance with these laws but compliance therewith has not had any adverse impact on our operations or our financial resources.

You should carefully consider the risks described below together with all of the other information included in this Form 10-K before making an investment decision with regard to our securities. The statements contained in or incorporated herein that are not historic facts are forward-looking statements that are subject to risks and uncertainties that could cause actual results to differ materially from those set forth in or implied by forward-looking statements. If any of the following risks actually occurs, our business, financial condition or results of operations could be harmed. In that case, you may lose all or part of your investment.

Risks Related to Our Business

We have a limited operating history.

Our limited operating history and the early stage of development of the industry in which we operate makes it difficult to evaluate our business and future prospects. We cannot assure you that we will maintain our profitability or that we will not incur net losses in the future. Any significant failure to realize anticipated revenue growth could result in operating losses.

11

We may be unable to continue to sublease our oilfields to Daqing Haihang Oilfield Technology Development Co., Ltd. or other companies, and it may significantly affect our revenues and results of operations.

Since January 2006, Jilin Yifeng has entered into a few oilfield sublease agreements with Daqing Haihang Oilfield Technology Development Co., Ltd. (“Daqing Haihang”). According to current Agreement, Jilin Yifeng subleases 63% out of its overall oilfield of 19.8 square kilometers to Daqing Haihang for the period from January 2007 to December 31, 2010. The lease provides for annual fixed subrental income of RMB 24,000,000 (approximately $3,592,800 based on September 30, 2010 exchange rate), which represents 22% of our total revenues for the year ended September 30, 2010. The current lease will expire on December 31, 2010 and on December 17, 2010, Jilin Yifeng entered a new sublease agreement with Daqing Haihang, which will start on January 1, 2011 and expire on December 31, 2015. The new lease provides for subrental income of RMB 16,000,000 (approximately $2,395,200) for the year 2011 and fixed annual subrental income of RMB 12,000,000 (approximately $1,796,400) thereafter till lease expiration. If we are not able to continue to sublease our oilfields to Daqing Haihang or sublease to other companies, our revenues and results of operations will be significantly decreased.

All of our sales are concentrated in only one customer; the loss or termination of our cooperation agreement would have a material adverse impact on our revenues.

Pursuant to a 20-year Exclusive Business Cooperation Agreement entered into by and among Jilin Yifeng and PetroChina in February 2002, we have the right to explore, develop and produce oil at Miao 14 oilfield and are responsible for the well logging, drill-stem testing and core sampling. According to the agreement, we will have priority in resigning the agreement with PetroChina upon expiration of the current one and all of our output is to be sold to PetroChina Jilin Oilfield. Though the chance is small, we cannot guarantee our agreement with PetroChina will not be terminated prematurely. If the relationship with PetroChina is terminated, we will not be able to continue to drill oil in the oilfield designated by the cooperation agreement. A key component of our competitive position is our ability to manage expenses successfully, and maintain long-term cooperation relationship with PetroChina. In addition, management has an understanding with PetroChina that if the price of oil declines below certain levels, then the Company will not produce and deliver oil to PetroChina.

12

Our ability to operate at a profit is partially dependent on market prices for crude oil. If the price drops significantly, we will be unable to maintain profitability.

Our results of operations and financial condition will be affected by the selling prices for crude oil. Prices are subject to and determined by market forces over which we have no control. The amount of our revenues depends on the market prices.

Our future success substantially depends on our ability to significantly increase both our manufacturing/storage capacity and output.

Our future success depends on our ability to significantly increase both our manufacturing/storage capacity and output. If we are unable to do so, we may be unable to expand our business, decrease our costs, maintain our competitive position and improve our profitability. Our ability to establish additional manufacturing/storage capacity and increase output is subject to significant risks and uncertainties, including:

|

·

|

the ability to raise significant additional funds to purchase and prepay for raw materials or to build additional manufacturing facilities, which we may be unable to obtain on reasonable terms or at all;

|

|

|

·

|

delays or denial of required approvals by relevant government authorities;

|

|

|

·

|

diversion of significant management attention and other resources; and

|

|

|

·

|

failure to execute our expansion plan effectively.

|

If we are unable to establish or successfully operate additional manufacturing/storage capacity or to increase manufacturing output, or if we encounter any of the risks described above, we may be unable to expand our business as planned.

13

If we need additional financing, which may not be available to find such financing on satisfactory terms or at all.

Our capital requirements may be accelerated as a result of many factors, including timing of development activities, underestimates of budget items, unanticipated expenses or capital expenditures, future product opportunities with collaborators, future licensing opportunities and future business combinations. Consequently, we may need to seek additional debt or equity financing, which may not be available on favorable terms, if at all, and which may be dilutive to our stockholders.

We may seek to raise additional capital through public or private equity offerings, debt financings or additional corporate collaboration and licensing arrangements. To the extent we raise additional capital by issuing equity securities, our stockholders may experience dilution. To the extent that we raise additional capital by issuing debt securities, we may incur substantial interest obligations, may be required to pledge assets as security for the debt and may be constrained by restrictive financial and/or operational covenants. Debt financing would also be superior to our stockholders' interest in bankruptcy or liquidation. To the extent we raise additional funds through collaboration and licensing arrangements, it may be necessary to relinquish some rights to our technologies or product candidates, or grant licenses on unfavorable terms.

We have never paid cash dividends and are not likely to do so in the foreseeable future.

We have never declared or paid any cash dividends on our common stock. We currently intend to retain any future earnings for use in the operation and expansion of our business. We do not expect to pay any cash dividends in the foreseeable future but will review this policy as circumstances dictate.

If we are unable to establish appropriate internal financial reporting controls and procedures, it could cause us to fail to meet our reporting obligations, result in the restatement of our financial statements, harm our operating results, subject us to regulatory scrutiny and sanction, cause investors to lose confidence in our reported financial information and have a negative effect on the market price for shares of our common stock.

Effective internal controls are necessary for us to provide reliable financial reports and effectively prevent fraud. We maintain a system of internal control over financial reporting, which is defined as a process designed by, or under the supervision of, our principal executive officer and principal financial officer, or persons performing similar functions, and effected by our board of directors, management and other personnel, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles.

14

As a public company, we will have significant additional requirements for enhanced financial reporting and internal controls. We will be required to document and test our internal control procedures in order to satisfy the requirements of Section 404 of the Sarbanes-Oxley Act of 2002, which requires annual management assessments of the effectiveness of our internal controls over financial reporting and a report by our independent registered public accounting firm addressing these assessments. The process of designing and implementing effective internal controls is a continuous effort that requires us to anticipate and react to changes in our business and the economic and regulatory environments and to expend significant resources to maintain a system of internal controls that is adequate to satisfy our reporting obligations as a public company.

We cannot assure you that we will not, in the future, identify areas requiring improvement in our internal control over financial reporting. We cannot assure you that the measures we will take to remediate any areas in need of improvement will be successful or that we will implement and maintain adequate controls over our financial processes and reporting in the future as we continue our growth. If we are unable to establish appropriate internal financial reporting controls and procedures, it could cause us to fail to meet our reporting obligations, result in the restatement of our financial statements, harm our operating results, subject us to regulatory scrutiny and sanction, cause investors to lose confidence in our reported financial information and have a negative effect on the market price for shares of our common stock.

Lack of experience as officers of publicly-traded companies of our management team may hinder our ability to comply with Sarbanes-Oxley Act.

It may be time consuming, difficult and costly for us to develop and implement the internal controls and reporting procedures required by the Sarbanes-Oxley Act. We may need to hire additional financial reporting, internal controls and other finance staff in order to develop and implement appropriate internal controls and reporting procedures. If we are unable to comply with the Sarbanes-Oxley Act’s internal controls requirements, we may not be able to obtain the independent auditor certifications that Sarbanes-Oxley Act requires publicly-traded companies to obtain.

We will incur increased costs as a result of being a public company.

As a public company, we will incur significant legal, accounting and other expenses that we did not incur as a private company. In addition, the Sarbanes-Oxley Act of 2002, as well as new rules subsequently implemented by the SEC, has required changes in corporate governance practices of public companies. We expect these new rules and regulations to increase our legal, accounting and financial compliance costs and to make certain corporate activities more time-consuming and costly. In addition, we will incur additional costs associated with our public company reporting requirements. We are currently evaluating and monitoring developments with respect to these new rules, and we cannot predict or estimate the amount of additional costs we may incur or the timing of such costs.

15

Risks Associated With Doing Business in China

Our operations and assets in China are subject to significant political and economic uncertainties.

Changes in PRC laws and regulations, or their interpretation, or the imposition of confiscatory taxation, restrictions on currency conversion, imports and sources of supply, devaluations of currency or the nationalization or other expropriation of private enterprises could have a material adverse effect on our business, results of operations and financial condition. Under our current leadership, the Chinese government has been pursuing economic reform policies that encourage private economic activity and greater economic decentralization. There is no assurance, however, that the Chinese government will continue to pursue these policies, or that it will not significantly alter these policies from time to time without notice.

Currency fluctuations and restrictions on currency exchange may adversely affect our business, including limiting our ability to convert Chinese Renminbi into foreign currencies and, if Chinese Renminbi were to decline in value, reducing our revenue in U.S. dollar terms.

Our reporting currency is the U.S. dollar and our operations in China use their local currency as their functional currencies. Substantially all of our revenue and expenses are in Chinese Renminbi. We are subject to the effects of exchange rate fluctuations with respect to any of these currencies. For example, the value of the Renminbi depends to a large extent on Chinese government policies and China’s domestic and international economic and political developments, as well as supply and demand in the local market. Since 1994, the official exchange rate for the conversion of Renminbi to the U.S. dollar had generally been stable and the Renminbi had appreciated slightly against the U.S. dollar. However, on July 21, 2005, the Chinese government changed its policy of pegging the value of Chinese Renminbi to the U.S. dollar. Under the new policy, Chinese Renminbi may fluctuate within a narrow and managed band against a basket of certain foreign currencies. As a result of this policy change, Chinese Renminbi appreciated approximately 2.5% against the U.S. dollar in 2005 and 3.3% in 2006. It is possible that the Chinese government could adopt a more flexible currency policy, which could result in more significant fluctuation of Chinese Renminbi against the U.S. dollar. We can offer no assurance that Chinese Renminbi will be stable against the U.S. dollar or any other foreign currency.

16

The income statements of our operations are translated into U.S. dollars at the average exchange rates in each applicable period. To the extent the U.S. dollar strengthens against foreign currencies, the translation of these foreign currencies denominated transactions results in reduced revenue, operating expenses and net income for our international operations. Similarly, to the extent the U.S. dollar weakens against foreign currencies, the translation of these foreign currency denominated transactions results in increased revenue, operating expenses and net income for our international operations. We are also exposed to foreign exchange rate fluctuations as we convert the financial statements of our foreign subsidiaries into U.S. dollars in consolidation. If there is a change in foreign currency exchange rates, the conversion of the foreign subsidiaries’ financial statements into U.S. dollars will lead to a translation gain or loss which is recorded as a component of other comprehensive income. In addition, we have certain assets and liabilities that are denominated in currencies other than the relevant entity’s functional currency. Changes in the functional currency value of these assets and liabilities create fluctuations that will lead to a transaction gain or loss. We have not entered into agreements or purchased instruments to hedge our exchange rate risks, although we may do so in the future. The availability and effectiveness of any hedging transaction may be limited and we may not be able to successfully hedge our exchange rate risks.

Although Chinese governmental policies were introduced in 1996 to allow the convertibility of Chinese Renminbi into foreign currency for current account items, conversion of Chinese Renminbi into foreign exchange for capital items, such as foreign direct investment, loans or securities, requires the approval of the State Administration of Foreign Exchange, or SAFE, which is under the authority of the People's Bank of China. These approvals, however, do not guarantee the availability of foreign currency conversion. We cannot be sure that we will be able to obtain all required conversion approvals for our operations or those Chinese regulatory authorities will not impose greater restrictions on the convertibility of Chinese Renminbi in the future. Because a significant amount of our future revenue may be in the form of Chinese Renminbi, our inability to obtain the requisite approvals or any future restrictions on currency exchanges could limit our ability to utilize revenue generated in Chinese Renminbi to fund our business activities outside of China, or to repay foreign currency obligations, including our debt obligations, which would have a material adverse effect on our financial condition and results of operations.

Our ability to implement our planned development is dependent on many factors, including the ability to receive various governmental permits.

In accordance with PRC laws and regulations, we are required to maintain various licenses and permits in order to operate our business including, without limitation, Safety Production Permits and Finished Oil Products Distribution License and Dangerous Chemical Distribution License. We are required to comply with applicable production safety standards in relation to our production processes. Our premises and equipment are subject to periodically inspections by the regulatory authorities for compliance with the dangerous chemical safety production laws and regulations and finished oil distribution laws and regulations.

17

We must comply with the Foreign Corrupt Practices Act.

We are required to comply with the United States Foreign Corrupt Practices Act, which prohibits U.S. companies from engaging in bribery or other prohibited payments to foreign officials for the purpose of obtaining or retaining business. Foreign companies, including some of our competitors, are not subject to these prohibitions. Corruption, extortion, bribery, pay-offs, theft and other fraudulent practices occur from time-to-time in mainland China. If our competitors engage in these practices, they may receive preferential treatment from personnel of some companies, giving our competitors an advantage in securing business or from government officials who might give them priority in obtaining new licenses, which would put us at a disadvantage. Although we inform our personnel that such practices are illegal, we can not assure you that our employees or other agents will not engage in such conduct for which we might be held responsible. If our employees or other agents are found to have engaged in such practices, we could suffer severe penalties.

Changes in foreign exchange regulations in the PRC may affect our ability to pay dividends in foreign currency or conduct other foreign exchange business.

The Renminbi is not a freely convertible currency currently, and the restrictions on currency exchanges may limit our ability to use revenues generated in RMB to fund our business activities outside the PRC or to make dividends or other payments in United States dollars. The PRC government strictly regulates conversion of RMB into foreign currencies. Over the years, foreign exchange regulations in the PRC have significantly reduced the government’s control over routine foreign exchange transactions under current accounts. In the PRC, the State Administration for Foreign Exchange, or the SAFE, regulates the conversion of the RMB into foreign currencies. Pursuant to applicable PRC laws and regulations, foreign invested enterprises incorporated in the PRC are required to apply for “Foreign Exchange Registration Certificates.” Currently, conversion within the scope of the “current account” (e.g. remittance of foreign currencies for payment of dividends, etc.) can be effected without requiring the approval of SAFE. However, conversion of currency in the “capital account” (e.g. for capital items such as direct investments, loans, securities, etc.) still requires the approval of SAFE.

In addition, on October 21, 2005, SAFE issued the Notice on Issues Relating to the Administration of Foreign Exchange in Fundraising and Reverse Investment Activities of Domestic Residents Conducted via Offshore Special Purpose Companies (“Notice 75”), which became effective as of November 1, 2005. Notice 75 replaced the two rules issued by SAFE in January and April 2005.

18

According to Notice 75:

|

·

|

prior to establishing or assuming control of an offshore company for the purpose of obtaining overseas equity financing with assets or equity interests in an onshore enterprise in the PRC, each PRC resident, whether a natural or legal person, must complete the overseas investment foreign exchange registration procedures with the relevant local SAFE branch;

|

|

·

|

an amendment to the registration with the local SAFE branch is required to be filed by any PRC resident that directly or indirectly holds interests in that offshore company upon either (1) the injection of equity interests or assets of an onshore enterprise to the offshore company, or (2) the completion of any overseas fund raising by such offshore company; and

|

|

·

|

an amendment to the registration with the local SAFE branch is also required to be filed by such PRC resident when there is any material change in the capital of the offshore company that does not involve any return investment, such as (1) an increase or decrease in its capital, (2) a transfer or swap of shares, (3) a merger or division, (4) a long term equity or debt investment, or (5) the creation of any security interests.

|

Moreover, Notice 75 applies retroactively. As a result, PRC residents who have established or acquired control of offshore companies that have made onshore investments in the PRC in the past are required to complete the relevant overseas investment foreign exchange registration procedures by March 31, 2006. Under the relevant rules, failure to comply with the registration procedures set forth in Notice 75 may result in restrictions being imposed on the foreign exchange activities of the relevant onshore company, including the payment of dividends and other distributions to its offshore parent or affiliate and the capital inflow from the offshore entity, and may also subject relevant PRC residents to penalties under PRC foreign exchange administration regulations.

The Chinese government exerts substantial influence over the manner in which we must conduct our business activities.

China only recently has permitted provincial and local economic autonomy and private economic activities, and, as a result, we are dependent on our relationship with the local government in the province in which we operate our business. Chinese government has exercised and continues to exercise substantial control over virtually every sector of the Chinese economy through regulation and state ownership. Our ability to operate in China may be harmed by changes in its laws and regulations, including those relating to taxation, environmental regulations, land use rights, property and other matters. We believe that our operations in China are in material compliance with all applicable legal and regulatory requirements. However, the central or local governments of these jurisdictions may impose new, stricter regulations or interpretations of existing regulations that would require additional expenditures and efforts on our part to ensure our compliance with such regulations or interpretations. Accordingly, government actions in the future, including any decision not to continue to support recent economic reforms and to return to a more centrally planned economy or regional or local variations in the implementation of economic policies, could have a significant effect on economic conditions in China or particular regions thereof, and could require us to divest ourselves of any interest we then hold in Chinese properties.

19

Future inflation in China may inhibit our activity to conduct business in China.

In recent years, the Chinese economy has experienced periods of rapid expansion and high rates of inflation. These factors have led to the adoption by Chinese government, from time to time, of various corrective measures designed to restrict the availability of credit or regulate growth and contain inflation. While inflation has been more moderate since 1995, high inflation may in the future cause Chinese government to impose controls on credit and/or prices, or to take other action, which could inhibit economic activity in China, and thereby harm the market for our products.

Government regulations on environmental matters in China may adversely impact on our business.

Our manufacturing operations are subject to numerous laws, regulations, rules and specifications relating to human health and safety and the environment. These laws and regulations address and regulate, among other matters, wastewater discharge, air quality and the generation, handling, storage, treatment, disposal and transportation of solid and hazardous wastes and releases of hazardous substances into the environment. In addition, third parties and governmental agencies in some cases have the power under such laws and regulations to require remediation of environmental conditions and, in the case of governmental agencies, to impose fines and penalties. We make capital expenditures from time to time to stay in compliance with applicable laws and regulations.

We may have difficulty establishing adequate management, legal and financial controls in the PRC.

The PRC historically has been deficient in Western style management and financial reporting concepts and practices, as well as in modern banking, computer and other control systems. We may have difficulty in hiring and retaining a sufficient number of qualified employees to work in the PRC. As a result of these factors, we may experience difficulty in establishing management, legal and financial controls, collecting financial data and preparing financial statements, books of account and corporate records and instituting business practices that meet Western standards. We may have difficulty establishing adequate management, legal and financial controls in the PRC.

20

We currently own no real estate property. We lease our offices and land spaces from third parties under lease agreements which expire on December 5, 2011. Our office space totals approximately 5,704 square feet, and is located at Jianqiao Road, third floor, Song Yuan City, Economic and Technology Development District, Jilin Province. We rent it for an annual rent of ¥120,000 RMB (equal to $17,964) from December 6, 2009 until December 5, 2011.

As of September 30, 2010, we had a total of 121 wells as compared to 91 as of September 30, 2009. For the year ended September 30, 2010, we developed 30 new oil wells and also converted 19 existing wells to injection wells, making our total oil wells to 96 (including 95 producing wells and 1 bailing well) and injection wells to 25. The conversion is a common technique in oil drilling and the purpose of it is to restore underground pressure by water injection thus increase oil drilling productivity on oil wells. In addition, there were 95 traditional sucker-rod pumping machines in operation.

There are no pending legal proceedings to which the Company is a party or in which any director, officer or affiliate of the Company, any owner of record or beneficially of more than 5% of any class of voting securities of the Company, or security holder is a party adverse to the Company or has a material interest adverse to the Company. The Company’s property is not the subject of any pending legal proceedings.

21

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, AND RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Market Information

Our common stock was deleted from the OTC Bulletin Board to the Pink Sheets on March 26, 2010. Currently our common stock is traded under the symbol “CHDP.PK” Our common stock is thinly traded and as a result, is subject to extreme fluctuations as shown by the table below.

The following table sets forth the high and low bid prices for our common stock for the periods indicated as reported by the NASDAQ OTC-Bulletin Board. The quotations reflect inter-dealer prices, without retail mark-up, mark-down or commission and may not represent actual transactions.

|

Closing Bid

|

||||||||

|

YEAR 2006

|

High Bid

|

Low Bid

|

||||||

|

3rd Quarter Ended September 30, 2006 (1)

|

$

|

0.45

|

$

|

0.05

|

||||

|

4th Quarter Ended December 31, 2006

|

$

|

0.40

|

$

|

0.25

|

||||

|

YEAR 2007

|

High Bid

|

Low Bid

|

||||||

|

1st Quarter Ended March 31, 2007

|

$

|

1.10

|

$

|

1.005

|

||||

|

2nd Quarter Ended June 30, 2007

|

$

|

1.75

|

$

|

1.75

|

||||

|

3rd Quarter Ended September 30, 2007

|

$

|

3.28

|

$

|

0.342

|

||||

|

4th Quarter Ended December 31, 2007

|

$

|

1.85

|

$

|

1.10

|

||||

|

YEAR 2008

|

High Bid

|

Low Bid

|

||||||

|

1st Quarter Ended March 31, 2008

|

$

|

2.30

|

$

|

1.30

|

||||

|

2nd Quarter Ended June 30, 2008

|

$

|

2.30

|

$

|

0.55

|

||||

|

3rd Quarter Ended September 30, 2009

|

$

|

1.00

|

$

|

0.40

|

||||

|

4th Quarter Ended December 31, 2008

|

$

|

1.25

|

$

|

0.35

|

||||

|

YEAR 2009

|

High Bid

|

Low Bid

|

||||||

|

1st Quarter Ended March 31, 2009

|

$

|

1.15

|

$

|

0.45

|

||||

|

2nd Quarter Ended June 30, 2009

|

$

|

1.10

|

$

|

1.10

|

||||

|

3rd Quarter Ended September 30, 2010

|

$

|

3.75

|

$

|

1.01

|

||||

|

4th Quarter Ended December 31, 2009

|

$

|

3.20

|

$

|

1.01

|

||||

|

YEAR 2010

|

High Bid

|

Low Bid

|

||||||

|

1st Quarter Ended March 31, 2010

|

$

|

1.01

|

$

|

0.62

|

||||

|

2nd Quarter Ended June 30, 2010

|

$

|

1.00

|

$

|

1.00

|

||||

|

3rd Quarter Ended September 30, 2010

|

$

|

1.00

|

$

|

0.03

|

||||

|

4th Quarter Ended December 31, 2010

|

$

|

1.01

|

$

|

0.03

|

||||

(1) The first reported sale of the Company’s common stock on the OTC-Bulletin Board was July 10, 2006.

22

Holders

As of the date hereof, in accordance with our transfer agent records, we had 30 record holders of our 31,857,000 shares of common stock.

Dividends

Holders of our common stock are entitled to receive dividends if, as and when declared by the Board of Directors out of funds legally available therefore. We have never declared or paid any dividends on our common stock. We intend to retain any future earnings for use in the operation and expansion of our business. Consequently, we do not anticipate paying any cash dividends on our common stock to our stockholders for the foreseeable future.

Penny Stock Regulations

The SEC has adopted regulations which generally define “penny stock” to be an equity security that has a market price of less than $5.00 per share. Our Common Stock, when and if a trading market develops, may fall within the definition of penny stock and be subject to rules that impose additional sales practice requirements on broker-dealers who sell such securities to persons other than established customers and accredited investors (generally those with assets in excess of $1,000,000, or annual incomes exceeding $200,000 individually, or $300,000, together with their spouse).

For transactions covered by these rules, the broker-dealer must make a special suitability determination for the purchase of such securities and have received the purchaser's prior written consent to the transaction. Additionally, for any transaction, other than exempt transactions, involving a penny stock, the rules require the delivery, prior to the transaction, of a risk disclosure document mandated by the SEC relating to the penny stock market. The broker-dealer also must disclose the commissions payable to both the broker-dealer and the registered representative, current quotations for the securities and, if the broker-dealer is the sole market-maker, the broker-dealer must disclose this fact and the broker-dealer's presumed control over the market. Finally, monthly statements must be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks. Consequently, the “penny stock” rules may restrict the ability of broker-dealers to sell our common stock and may affect the ability of investors to sell their common stock in the secondary market.

23

Securities Authorized for Issuance under Equity Compensation Plans

There have not been any equity compensation plans approved by our Board of Directors.

ITEM 6. SELECTED FINANCIAL DATA

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITIONS AND RESULTS OF OPERATIONS

Forward-Looking Statements

The following discussion may contain certain forward-looking statements. Such statements are not covered by the safe harbor provisions. These statements include the plans and objectives of management for future growth of the Company, including plans and objectives related to the consummation of acquisitions and future private and public issuances of the Company's equity and debt securities. The forward-looking statements included herein are based on current expectations that involve numerous risks and uncertainties. Assumptions relating to the foregoing involve judgments with respect to, among other things, future economic, competitive and market conditions and future business decisions, all of which are difficult or impossible to predict accurately and many of which are beyond the control of the Company. Although the Company believes that the assumptions underlying the forward-looking statements are reasonable, any of the assumptions could be inaccurate and, therefore, there can be no assurance that the forward-looking statements included in this report will prove to be accurate. In light of the significant uncertainties inherent in the forward-looking statements included herein, the inclusion of such information should not be regarded as a representation by the Company or any other person that the objectives and plans of the Company will be achieved.

The words “we,” “us” and “our” refer to the Company. The words or phrases “would be,” “will allow,” ?癷ntends to,” “will likely result,” “are expected to,” “will continue,” “is anticipated,” “estimate,” “project,” or similar expressions are intended to identify “forward-looking statements.” Actual results could differ materially from those projected in the forward looking statements as a result of a number of risks and uncertainties, including but not limited to: (a) limited amount of resources devoted to achieving our business plan; (b) our failure to implement our business plan within the time period we originally planned to accomplish; (c) our strategies for dealing with negative cash flow; and (d) other risks that are discussed in this report or included in our previous filings with the Securities and Exchange Commission.

24

For the purposes of this report, we have calculated there to be 7.315 barrels in 1 ton.

Overview

Through our subsidiaries, we are engaged in resale of oil drilling equipment and accessories and oilfield underground technology services (“Steel”), the business of extraction and sale of crude oil (“Extraction”) and subleasing of oil fields (“Subrental”).

Our 100% owned subsidiary DaQing YueYu Oilfield Underground Technology Service Co., Ltd (“Daqing Yueyu”) is engaged in the sale of steel and steel related products, and through its 95% owned subsidiary Jilin Yifeng Energy Sources Co., Ltd. (“Jilin Yifeng”) acquired on November 28, 2007, is engaged in the business of extraction and sale of crude oil and subleasing of oil fields. Since 2003, Jilin Yifeng has been engaged in the development of oil wells and extracting oil from the Miao 14 oilfield blocks (“Miao 14”). Miao 14 covers 19.8 square kilometers, of which 15.6 square kilometers are oil-bearing areas. The geological reserve is 6.07 million tons in this area, which include proven oil reserves of 5.35 million tons. The thickness of the crust increases from 300 meters to 360 meters, inclining from the west to the east. Oil is found from 1,500 meters to 1,700 meters below sea level. Miao 14 is located in Song Yuan City of Jilin Province, China, at the intersection of Nenjiang River and Songhua River. The Chang Bai Railway and highway south of the oilfield provides the Company with convenient access to transportation for the delivery of crude oil.

Pursuant to a 20-year Exclusive Business Cooperation Agreement entered into between PetroChina and our 95% owned subsidiary Jilin Yifeng in February 2002, we have the right to explore, develop and produce oil at Miao 14 Oilfield and take responsibility for well logging, drill-stem testing and core sampling. Pursuant to the agreement with PetroChina, during the first ten years of this agreement, the Company sells oil to PetroChina at 20% discount to market price. During the second ten years of this agreement, the Company sells oil to PetroChina at 40% discount to market price.

Since January 2006 Jilin Yifeng has entered into a few oilfield sublease agreements (“the Agreement”) with Daqing Haihang Oilfield Technology Development Co., Ltd. (“Daqing Haihang”). According to the Agreement, Jilin Yifeng subleases 63% out of its overall oilfield of 19.8 square kilometers to Daqing Haihang for the period from January 2007 to December 31, 2010. As prescribed in the Agreement, Daqing Haihang, a limited liability company founded and registered in China, owns the necessary knowledge and construction equipments of both exploring and extracting crude oil. During the effective term of the Agreement, Daqing Haihang needs to carry out and be responsible for the obligations to PetroChina from Jilin Yifeng, and all production of Daqing Haihang could only be distributed to PetroChina, in compliance with the description of the Agreement. On December 17, 2010, Jilin Yifeng extended the agreement with Daqing Haihang, which will start on January 1, 2011 and expire on December 31, 2015. The new lease provides for subrental income of RMB 16,000,000 (approximately $2,395,200) for the year 2011 and fixed annual subrental income of RMB 12,000,000 (approximately $1,796,400) thereafter till lease expiration.

25

The oilfield property the Company subleased to Daqing Haihang, accounts for about 63% of the overall area of Miao 14 oilfield, or 12.5 square kilometers, whereas the Company, Jilin Yifeng operates on the other 7.3 square kilometers during the effective term of the Agreement. The geological reserve for the area is 6.07 million tons of oil, which include proven oil reserves of 5.35 million tons. As of February 2002, the company’s operating ratio out of total reserve is about 1.97 million tons. The following table sets forth the information of the oilfield reserves and our output for the periods indicated.

|

Remaining Oil reserves we acquired (in tons) as of

|

Our Production (in tons)

|

|||||||||||||

|

September 30 2008

|

September 30, 2009

|

September 30, 2010

|

From November 28, 2007 to September 30, 2008

|

From October 1, 2008 to September 30, 2009

|

From October 1, 2009 to September 30, 2010

|

|||||||||

|

1.92 million

|

1.91 million

|

1.88 million

|

9,863

|

14,544

|

28,829

|

|||||||||

As of the end of 2005, Jilin Yifeng had 52 working oil wells, and produced approximately 29,000 tons or 212,135 barrels of crude oil from 2002 to 2005.

From 2006 to 2007, Jilin Yifeng was not able to explore for new oil wells due to a lack of capital resources. In addition, due to limited working capital, during these two years, output of oil was at a lower level compared to previous years.

As of September 30, 2008 and 2009, Jilin Yifeng had 91 wells in total including 6 injection wells. Of these wells, 34 wells were developed in 2008.

As of September 30, 2010, we had a total of 121 wells as compared to 91 as of September 30, 2009. For the year ended September 30, 2010, we developed 30 new oil wells and also converted 19 existing wells to injection wells, making our total oil wells to 96 (95 producing wells and 1 bailing well) and injection wells to 25. The conversion is a common technique in oil drilling and the purpose of it is to restore underground pressure by water injection thus increase oil drilling productivity on oil wells.

26

Results of Operations – For the Years Ended September 30, 2010 and 2009

All of the Company’s sales were generated within China. PetroChina is the only and exclusive customer for our crude oil products. We operate three reportable segments: extraction and sale of crude oil (“Extraction”), subleasing of oil fields (“Subrental”) and resale of oil drilling equipment and accessories and oilfield underground technology services (“Steel”).

Our Subrental business segment is limited to the subleasing of Miao 14 and our drilling equipment and materials to Daqing Haihang Oil Field Development Company (“Daqing Haihang”). Current sublease agreement was executed from January 1, 2008 and will expire on December 31, 2010 and provides for annual fixed income of RMB 24 million or approximately $3.5 million dollars. On December 17, 2010, Jilin Yifeng extended the agreement with Daqing Haihang, which will start on January 1, 2011 and expire on December 31, 2015. The new lease provides for subrental income of RMB 16,000,000 (approximately $2,395,200) for the year 2011 and fixed annual subrental income of RMB 12,000,000 (approximately $1,796,400) thereafter till lease expiration. The subrental to Daqing Haihang includes 63% of our total property including 12.5 square kilometers of oilfield. All oil wells operated by the Company are located at the remaining 7.3 square kilometers oilfield. Under the agreement between the Company and its oilfield leasee, the leasee is able to drill new oil wells, explore, extract oil from the oilfield subleased, and the leasee is also authorized to sell crude oil to a third Party.

The following table presents financial information about the Company’s reportable segments for the years ended September 30, 2010 and 2009:

|

|

|

For the Years Ended September 30,

|

||||||||||||||

|

2010

|

2009

|

|||||||||||||||

|

|

|

Extraction

|

|

Subrental

|

|

Steel

|

|

Total

|

|

Extraction

|

|

Subrental

|

|

Steel

|

|

Total

|

|

Revenue

|

$

|

12,612,299

|

$

|

3,527,760

|

$

|

-

|

$

|

16,140,059

|

$

|

4,576,040

|

$

|

3,517,200

|

$

|

889,474

|

$

|

8,982,714

|

|

Gross profit

|

$

|

5,652,064

|

$

|

3,251,887

|

$

|

-

|

$

|

8,903,951

|

$

|

1,517,429

|

$

|

3,242,151

|

$

|

14,666

|

$

|

4,774,246

|

|

Gross margin

|

|

45%

|

|

92%

|

|

-

|

|

55%

|

|

33%

|

|

92%

|

|

2%

|

|

53%

|

|

|

Percentage Change between the Years ended

|

||||||

|

September 30, 2010 and 2009

|

|||||||

|

|

Extraction

|

|

Subrental

|

|

Steel

|

|

Total

|

|

Revenue

|

176%

|

0.30%

|

-100%

|

80%

|

|||

|

Gross profit

|

272%

|

|

0.30%

|

|

-100%

|

|

86%

|

27

Revenues.

Revenues for the year ended September 30, 2010 totaled $16,140,059 as compared to $8,982,714 for the same period in 2009, an increase of $7,157,345 or 80%. The increase was due to we had more sales generated in our Extraction segment this period.

For the year ended September 30, 2010, the sale of crude oil generated net sales of $12,612,299, an increase of 176% as compared to the same period in 2009. We produced 28,829 tons (or 210,884 barrels) of oil for the year ended September 30, 2010 as compared to 14,544 tons (or 106,389 barrels) of oil during the same period in 2009.

As a result, during the year ended September 30, 2010, the Company sold approximately 23,063 tons or 168,707 barrels to PetroChina, and for the year ended September 30, 2009, approximately 11,598 tons or 84,839 barrels were sold to PetroChina (net of 20% quantity discount per agreement with PetroChina for both periods). The average selling price to PetroChina per barrel was $74.17 and $57.08 for fiscal 2010 and 2009, respectively. According to the agreement between the Company and PetroChina, PetroChina is entitled for 20% discount of the Company’s output during the first 10 years of the agreement term.

For the year ended September 30, 2010, our Subrental segment generated $3,527,760 in revenue, an increase of $10,560 or 0.3% compared to the same period in 2009. Our subrental income is fixed in RMB by contract with Daqing Haihang and the slight change in USD term was due to currency exchange rate effect.

For the year ended September 30, 2010, we didn’t engage in any trading activities in our Steel segment, while our Steel segment generated $889,474 in revenue during the year 2009.

Cost of Sales.

Cost of sales totaled $7,236,108 for the year ended September 30, 2010, an increase of $3,027,640 or 72% as compared to the same period in 2009. The increase is approximately in line with the increase in our total revenues and mostly due to more oil being sold in our Extraction segment this period. Cost of sales for our three business segments amounted to $6,960,235 for Extraction segment, $275,873 for Subrental segment, and $0 for Steel segment.

28

The breakdown of cost of sales from our oil extraction and sale segment of $6,960,235 or 96% of our total cost of sales is as follows:

|

|

Years Ended September 30,

|

|

||||

|

Cost of sales of crude oil

|

2010

|

2009

|

% Change

|

|||

|

Oil production costs

|

$

|

1,611,131

|

$

|

913,036

|

|

76%

|

|

Government oil surcharge

|

1,924,084

|

340,856

|

464%

|

|||

|

Depletion

|

|

3,425,020

|

|

1,804,719

|

|

90%

|

|

Subtotal

|

$

|

6,960,235

|

$

|

3,058,611

|

128%

|

|

As compared to the period earlier, the oil surcharge paid to the Chinese government increased because of much higher oil prices during the period. Particularly, under a government regulation introduced in June 2006, a surcharge of 20% is imposed on the portion of the selling price of crude oil between $40 and $45 per barrel, 25% between $45 and $50 per barrel, 30% between $50 and $55 per barrel, 35% between $55 and $60 per barrel, and a surcharge of 40% is imposed on the portion of the selling price of crude oil which exceeds $60 per barrel. The average selling price to PetroChina per barrel was $74.17 and $57.08 for fiscal 2010 and 2009, respectively. Our depletion and production costs increased in correlation with the increase of the amount of oil we extracted and sold this period.

Gross Profit.

Gross profit totaled $8,903,951 for the period as compared to $4,774,246 for the same period last year, of which $5,652,064 were contributed by extraction, $3,251,887 by Subrental and $0 by Steel. Gross profit increased by $4,129,705 or 86% as compared to last period, because of higher sales and margin on extraction segment. Gross margin of the Extraction segment increased from 33% in last period to 45% this period because of higher price for sale of crude oil partially offset by heavier government oil surcharge on higher oil price. Gross margin on Subrental segment remained stable from last period. Gross margin for all three segments as a whole stood at 55% this period as compared to 53% last year.

29

General & Administrative Expenses.

Operating expenses for the year ended September 30, 2010 was $492,663, an increase of $49,279 or 11% compared with the year ended September 30, 2009. For the year ended September 30, 2010, our general and administrative expenses include salary expense of $142,827, office expense of $41,163, entertainment expense of $21,602, supplies $30,101, travel expense of $19,840, repair and maintenance of $50,835, insurance of $14,164, totaling 65% of our overall operating expenses for the year ended September 30, 2010. The following is a comparison breakdown of operating expenses for the years ended September 30, 2010 and 2009, respectively.

|

|

|

|

For the Years Ended September 30,

|

|

|

||||||

|

General & Administrative Expenses

|

2010

|

% Total

|

2009

|

% Total

|

% Change

|

||||||

|

Salary

|

|

$

|

142,827

|

|

29%

|

$

|

157,445

|

|

36%

|

|

-9%

|

|

Office Expense

|

|

41,163

|

8%

|

33,401

|

8%

|

23%

|

|||||

|

Entertainment Expense

|

|

|

21,602

|

|

4%

|

|

30,137

|

|

7%

|

|

-28%

|

|

Supplies

|

|

30,101

|

6%

|

30,318

|

7%

|

-1%

|

|||||

|

Travel Expense

|

|

|

19,840

|

|

4%

|

|

27,658

|

|

6%

|

|

-28%

|

|

Repair and Maintenance

|

|

50,835

|

10%

|

29,258

|

7%

|

74%

|

|||||

|

Insurance

|

|

|

14,164

|

|

3%

|

|

29,603

|

|

7%

|

|

-52%

|

|

Other Expenses

|

172,131

|

35%

|

105,564

|

24%

|

63%

|

||||||

|

Total

|

|

$

|

492,663

|

|

100%

|

$

|

443,384

|

|

100%

|

|

11%

|

Income (loss) from operations.

Income from operations for year ended September 30, 2010 totaled $8,411,288 and consisted of operating income generated by three segments. It represents an increase of $4,080,427 or 94% as compared to the year ended September 30, 2009. The increase is primarily due to increased operating income from the Extraction segment because of more oil being sold and higher selling price this period. The details are as follows:

30

|

|

|

Income (loss) from Operations

|

||

|

Segment

|

FY2010

|

FY2009

|

||

|

Extraction

|

$

|

5,213,134

|

$

|

1,162,150

|

|

Subrental

|

3,241,887

|

3,232,152

|

||

|

Steel

|

|

(41,823)

|

|

(60,871)

|

|

Corporate

|

(1,910)

|

(2,569)

|

||

|

Total

|

$

|

8,411,288

|

$

|

4,330,862

|

Net Income Attributable to the Company.

We generated net income of $5,640,673 after non-controlling interest for the fiscal year ended September 30, 2010, an increase of $2,929,384 or 108% as compared to net income for the year ended September 30, 2009. The increase in net income is primarily a result of increased income from our Extraction segment. Our net margin was 35%, up from 30% for the same period last year, primarily due to higher oil selling price this period.

Liquidity and Capital Resources

On September 30, 2010, we had cash $147,326 and working capital deficit of $13,158,795. The working capital deficit was primarily due to our accounts payable of $7,566,936 and long-term bank loan of $5,239,500 that became current as of this period. Our accounts payables are mostly due to drilling companies for drilling expenditure.

Net cash flows provided by operating activities were $11,503,718 for the year ended September 30, 2010, improved from net cash flow of $2,190,478 provided by operating activities in the same period last year. This was due primarily to increased net income this period, increase in accrued income taxes, and reduction in accounts receivable as compared to the same period last year.

31

Net cash flows used in investing activities was $9,616,791 for the year ended September 30, 2010, as compared to net cash flow used of $2,274,883 for the same period last year. Capital expenditures have consisted principally of strategic asset acquisition related to the purchase of oil and gas equipments and exploitation and development of oil and gas properties. During this period, we invested $9,507,840 in exploration and development of oil and gas properties, as compared to $2,603,702 for the same period last year. During the year 2010, we developed 30 new oil wells and also converted 19 existing wells to injection wells

Net cash flows used in financing activities was $1,903,159 for the year ended September 30, 2010, primarily as a result of repayment of loans from former shareholder and other borrowings. During the period ended September 30, 2010, we repaid the remaining balance $1,794,903 of the purchase price owed to the former shareholder of Jilin Yifeng. For the same period last year, we borrowed $5,134,500 from bank and repaid $4,939,122 in loans from shareholder and unrelated parties.

Principal demands for liquidity are for acquisition of oil and gas properties, development of new oil wells, working capital and general corporate purposes. The Company’s management believes that, in order to develop additional wells, the Company may consider a number of different financing opportunities including loans and future equity financings. If funding is insufficient at any time in the future, we may be unable to develop additional oil wells, take advantage of other acquisition opportunities or respond to competitive pressures, any of which could have a material adverse effect on our financial position, results of operations and cash flows.

Critical Accounting Policies