Attached files

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

Annual Report Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

For the Fiscal Year Ended September 30, 2010

Commission File No. 000-16674

IMPERIAL SUGAR COMPANY

(Exact name of registrant as specified in its charter)

| Texas | 74-0704500 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

8016 Highway 90-A, P.O. Box 9, Sugar Land, Texas 77487-0009

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (281) 491-9181

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Name of each exchange on which registered | |

| Common Stock, without par value | The NASDAQ Stock Market LLC | |

| Rights to Purchase Preferred Stock | The NASDAQ Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act:

(Title of class)

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large Accelerated Filer ¨ Accelerated Filer x Non-Accelerated Filer ¨ Smaller Reporting Company ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant on March 31, 2010, the last business day of registrant’s most recently completed second fiscal quarter, based on the last reported trading price of the registrant’s common stock on the NASDAQ Stock Market LLC on that date, was approximately $181 million.

There were 12,125,214 shares of the registrant’s common stock outstanding on December 15, 2010.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement for registrant’s 2011 Annual Shareholders Meeting are incorporated by reference into Part III of this report.

Table of Contents

| PART I | ||||||

| ITEM 1. |

2 | |||||

| ITEM 1A. |

11 | |||||

| ITEM 1B. |

15 | |||||

| ITEM 2. |

16 | |||||

| ITEM 3. |

16 | |||||

| 18 | ||||||

| PART II | ||||||

| ITEM 5. |

19 | |||||

| ITEM 6. |

20 | |||||

| ITEM 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

21 | ||||

| ITEM 7A. |

33 | |||||

| ITEM 8. |

34 | |||||

| ITEM 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

35 | ||||

| ITEM 9A. |

35 | |||||

| ITEM 9B. |

36 | |||||

| PART III | ||||||

| ITEM 10. |

37 | |||||

| ITEM 11. |

37 | |||||

| ITEM 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Shareholder Matters |

37 | ||||

| ITEM 13. |

Certain Relationships and Related Transactions, and Director Independence |

37 | ||||

| ITEM 14. |

37 | |||||

| PART IV | ||||||

| ITEM 15. |

37 | |||||

Forward-Looking Statements

Statements regarding future market prices and margins, future expenses and liabilities arising from the Port Wentworth refinery incident, refinery construction costs, timelines and operational dates, future costs and liabilities arising from the Louisiana Sugar Refining LLC venture, future import and export levels, future government and legislative action, future environmental regulatory and compliance costs, future operating results, future availability and cost of raw sugar, our liquidity and ability to finance our operations and capital investment programs, operating efficiencies, results of future investments and initiatives, future cost savings, future product innovations, future energy costs, future pension plan contributions and other statements that are not historical facts contained in this report on Form 10-K are forward-looking statements that involve certain risks, uncertainties and assumptions. These risks, uncertainties and assumptions include, but are not limited to, market factors, farm and trade policy, unforeseen engineering and equipment delays, our ability to obtain financing and the terms of any such financing, our ability to realize planned cost savings and other improvements, the available supply of sugar, energy costs, the effect of weather and economic conditions, results of actuarial assumptions, actual or threatened acts of terrorism or armed hostilities, legislative, administrative and judicial actions and other factors detailed elsewhere in this report and in our other filings with the SEC. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual outcomes may vary materially from those indicated. We identify forward-looking statements in this report by using the following words and similar expressions:

| • expect |

• project |

• estimate | ||

| • believe |

• anticipate |

• likely | ||

| • plan |

• intend |

• could | ||

| • should |

• may |

• predict | ||

| • budget |

• possible |

Management cautions against placing undue reliance on forward-looking statements or projecting any future results based on such statements or present or future earnings levels. All forward-looking statements in this report on Form 10-K are qualified in their entirety by the cautionary statements contained in this section and elsewhere in this report.

1

Table of Contents

PART I

| ITEM 1. | Business |

Overview

Imperial Sugar Company was incorporated in 1924 and is the successor to a cane sugar plantation and milling operation founded in Sugar Land, Texas in the early 1800s that began producing granulated sugar in 1843. Imperial Sugar Company (which together with its subsidiaries is referred to herein as the “Company”, “we”, “us”, “our” and “ours”) is one of the largest processors and marketers of refined sugar in the NAFTA region. We refine, package and distribute cane sugar at refineries located in Georgia and Louisiana. For the year ended September 30, 2010, we sold approximately 23 million hundredweight, or cwt, of refined sugar. Additionally, through joint venture operations, we market sugar and other sweeteners in Mexico and Canada.

We offer a broad product line and sell to a wide range of customers directly and indirectly through wholesalers and distributors. Our customers include retailers, restaurant chains, distributors and industrial customers, principally food manufacturers. Our products include granulated, powdered, liquid and brown sugars marketed in a variety of packaging options (6 oz shakers to 50-pound bags and in bulk) under various brands (Dixie Crystals®, Imperial® and Holly® ) or private labels. In addition, we market organic and fair trade sweeteners and a sugar/stevia sweetener blend through joint ventures.

The Company experienced an industrial accident on February 7, 2008, at its sugar refinery in Port Wentworth, Georgia, which is located near Savannah, Georgia. Production at the refinery, which comprises approximately 60% of our capacity, was suspended after the accident until we commenced limited bulk sugar production in the summer of 2009 and initiated packaging production in the fall of 2009.

In November 2009, we entered into a joint venture agreement that will result in the vertical integration of our Gramercy, Louisiana refining operation with our Louisiana raw sugar supplier. Under the terms of the agreement, in January 2011 we will contribute our Louisiana refinery to the joint venture, which is constructing a new cane sugar refinery adjacent to the existing refinery. Please read “—Joint Venture Operations”.

Overview of the Domestic Sugar Industry

Refined sugar can be produced by either processing sugar beets or refining raw sugar produced from sugar cane. The profitability of cane and beet sugar operations is affected by government programs designed to support the price of domestic crops of sugar cane and sugar beets. Approximately 75% of domestic sugar demand is supplied by domestic crops, with the balance provided by Mexican imports under the North American Free Trade Agreement, or NAFTA, and foreign imports under a U.S. quota program.

Cane Sugar Production Process

Sugar cane is grown in tropical and semitropical climates throughout the world as well as domestically in Florida, Louisiana, Texas and Hawaii. Sugar cane is processed into raw sugar by raw cane mills promptly after harvest. Raw sugar is approximately 98% sucrose and may be stored for long periods and transported over long distances without affecting its quality. Raw sugar imports are limited by United States government programs.

Cane sugar refineries like those we operate purify raw sugar to produce refined sugar. Operating results of cane sugar refineries are driven primarily by the spread between raw sugar and refined sugar prices and by the conversion and other costs of the refining process.

Government Regulation

Federal government programs have existed to support the price of domestic crops of sugar beets and sugar cane almost continually since 1934. The regulatory framework that affects the domestic sugar industry includes

2

Table of Contents

the Food Conservation and Energy Act of 2008, known as the 2008 Farm Bill. The 2008 Farm Bill provides for loans on sugar inventories to first processors (i.e., raw cane sugar mills and beet processors), implements a tariff rate quota that limits the amount of raw and refined sugar that can be imported into the United States, and imposes marketing allotments on sugar beet processors and domestic raw cane sugar producers except under certain circumstances. NAFTA provides that sugar can be imported from or exported to Mexico duty free after January 1, 2008. Please read “—Sugar Legislation and Other Market Factors.”

Domestic Supply and Demand

Domestic demand for refined sugar has increased at a compound annual growth rate of 1.7% during the past five years. Demand for refined sugar has historically been consistent with population growth and is influenced by consumer preferences for sugar versus alternative sweeteners and dietary trends. In recent periods, a declining domestic consumption of high fructose corn syrup, or HFCS, has resulted in increased demand for refined sugar.

Domestic sugar supplies are most significantly influenced by the size of the domestic sugar beet crop, USDA import quotas and, in recent years, the availability of Mexican surpluses for import under NAFTA. Based on data published by the U.S. Department of Agriculture, or USDA, beet sugar production for the past five years has ranged from 39.7% to 49.4% of domestic demand, and is forecasted for crop year 2010/2011 to be 43.4%. Mexican imports during the same five-year period have ranged from 1.5% to 13.2% of U.S. demand, and are estimated by the USDA to be 11.3% in crop year 2010/2011. Current USDA supply and demand estimates forecast a relatively tight U.S. sugar supply in crop year 2010/2011 with ending stocks-to-use ratio of 13.4% at September 30, 2011 compared to 13.3% at September 30, 2010.

Domestic Refined Sugar Prices

Large sugar beet crops have historically led to relatively low refined sugar prices and small crops have led to relatively high refined sugar prices. Recently, the availability of Mexican sugar for import under NAFTA has also influenced supplies and prices in the U.S. A tightening U.S. supply/demand balance as reflected in USDA projections, as well as higher domestic raw sugar costs attributable to domestic as well as world market factors, have resulted in rising domestic prices during fiscal 2010. We cannot predict the duration of any pricing trend or the effect a sustained trend may have on the sugar industry. Please read “Management’s Discussion and Analysis of Financial Condition and Results of Operations”.

Raw Sugar Availability and Prices

Raw sugar is produced domestically or imported under limitations imposed in the 2008 Farm Bill, subject to minimum levels established in trade treaties. The price and availability of raw sugar to U.S. refiners is dependent on the size of the domestic sugar cane crop and the level of imports. Domestic raw sugar prices increased during the past 18 months to their highest levels in 30 years in part the result of a shortage in the world raw sugar market. We cannot predict the duration of any pricing trend or the effect a sustained trend may have on the sugar industry.

Our Products and Customers

Sugar Products

Imperial Sugar is one of the largest processors and marketers of refined sugar in the United States. Refined sugar is our principal product line and accounted for approximately 98% of our consolidated net sales for the year ended September 30, 2010. We produce refined sugar from raw cane sugar and market our sugar products to retailers, distributors and industrial food manufacturers directly through our sales force and indirectly through wholesalers and independent brokers. No customer accounted for more than 10% of our net sales in fiscal 2010.

We maintain sales offices at our headquarters in Sugar Land, Texas, in Port Wentworth, Georgia and at regional locations across the United States. Sales are accomplished through a variety of methods, including direct negotiation, publishing price lists, competitive bidding processes and trade promotions. We consider our marketing and promotional activities important to our overall sales effort and we advertise our brand names in

3

Table of Contents

print media, radio, internet websites and social media. We also distribute various promotional materials, including discount coupons and recipes.

We developed new, innovative products to our customers and consumers. Sugar packaging has not experienced as much innovation as some other consumer categories, and we believe that we can increase our share of retail sales and margins by offering consumers value-added products that provide easier usage and storage. We have introduced a number of new products in the past few years, including a stand-up pouch line, shaker lines for both consumer and foodservice distribution and a package of pre-measured, one-quarter cup envelopes of brown sugar.

Retail Sales—We produce and sell granulated white, brown and powdered sugar to retailers and distributors in packages ranging from 6 oz shakers to 50-pound bags. Retail packages are marketed under the trade names:

| • | Dixie Crystals® |

| • | Imperial® |

| • | Holly® |

Retail packages are also sold under retailers’ private labels, generally at prices lower than those for branded sugar. Core geographies for our branded sugar and private label products include the Southeast and Southwest United States. Our primary business strategy is to capitalize on our well-known brands and expand brand penetration through product and packaging innovation. Sales of refined sugar products to retail customers accounted for approximately 28% of our refined sugar sales revenue in fiscal 2010. Sales made to retail customers in the year ended September 30, 2010, were approximately 35% branded and 65% private label.

Industrial Sales—We produce and sell refined sugar, molasses and other ingredients to industrial customers, principally food manufacturers, in bulk, packaged or liquid form. Food manufacturers purchase sugar for use in the preparation of confections, baked products, frozen desserts, cereal, dairy products, canned goods, beverages and various other food products. Historically, we have made the majority of our sales to industrial customers under fixed price, forward sales contracts with terms of up to one year. Industrial sales generally provide lower margins than retail and distributor sales. For the year ended September 30, 2010, our sales of refined sugar products to industrial customers accounted for approximately 52% of our refined sugar sales revenue.

Distributor Sales—We sell a variety of sugar products (including granulated, powdered and brown sugar) in package sizes ranging from one-pound packages to 50-pound bags to foodservice and industrial distributors who in turn sell those products to manufacturers, restaurants and institutional foodservice establishments. For the year ended September 30, 2010, our sales of refined sugar products to distributors accounted for approximately 20% of our refined sugar sales revenue. Under the terms of a non-compete agreement negotiated in connection with the sale of a business, we agreed not to sell individual servings of sugar and certain non-sugar products for a period of time ending in 2012, in exchange for an agreed upon volume purchase requirement of the Company’s refined sugar from the other party. The agreement allows the Company to begin selling individual servings of sugar and certain non-sugar products upon certain notice requirements and an agreed reduction in the customer’s purchase obligation.

Joint Venture Operations

Wholesome Sweeteners—We have a 50% percent equity interest in Wholesome Sweeteners, Inc., a company with approximately $100 million of sales in the most recent fiscal year of organic, fair trade and other natural sweeteners in the U.S. and Canada. Wholesome’s product portfolio includes organic cane sugar, agave syrup, honey and other specialty sweeteners. Sustained growth has been achieved through the regular introduction of new products and the expanded interest in organic and natural food by North American consumers. Wholesome’s management believes that it has the largest share of the organic sugar business in the U.S. and Canada. We report our share of Wholesome’s earnings on the equity method of accounting. Additionally, we have an option until May 2011 to purchase the remaining 50% of Wholesome’s equity at a fixed multiple of earnings.

4

Table of Contents

Commercializadora Santos Imperial—In November 2007, we formed a 50/50 joint venture with Ingenios Santos, S.A. de C.V., or Santos, that markets sugar products in Mexico and the U.S. under the name Comercializadora Santos Imperial S. de R.L. de C.V., or CSI. With the elimination of certain NAFTA tariffs on sugar imported from and exported to Mexico in January 2008, the U.S. and Mexico effectively became a single sales region. Santos owns and operates five sugar mills that produce refined sugar and estandar, a less refined sugar traditionally sold in Mexico. The agreement provides that Santos and Imperial will market all their respective sugar products sold in Mexico through the joint venture. The joint venture entity also exports Santos’ sugar products to the U.S., which are marketed by the Company or may be used as a raw material in our U.S. refineries. We report our share of CSI’s earnings on the equity method of accounting.

Louisiana Sugar Refining—In November 2009, we completed the formation and funding of a three-party joint venture with Sugar Growers and Refiners, Inc., or SUGAR, and Cargill, Incorporated or Cargill to construct and operate a new 3,100 ton per day cane sugar refinery in Gramercy, Louisiana adjacent to our existing sugar refinery.

The venture, Louisiana Sugar Refining, LLC, or LSR, is owned one-third by each member, each of which agreed to contribute $30 million in cash or assets as equity to capitalize the venture. SUGAR’s contribution was $30 million cash; Cargill contributed $23.5 million cash and certain equipment and intellectual property valued at $6.5 million. Our contribution, which will occur in three stages, consists of the existing refinery assets with a book value of approximately $27.9 million at September 30, 2010, including approximately 207 acres of land.

We will operate the existing refinery with sales and earnings for our own account until December 31, 2010, during which time we were required to complete certain improvements. The equipment and personal property in the existing refinery (other than the small bag packaging assets) will be contributed to LSR on January 1, 2011. After January 1, 2011, we will continue to operate the small bag packaging facility in Gramercy, with 3.5 million cwt of refined bulk sugar purchased from LSR under a long term, supply agreement with market-based pricing provisions.

We contributed the footprint parcel of approximately 7 acres of land for the new refinery at LSR’s formation. Terms of the operative agreements require that LSR and Imperial jointly enroll the entire site (including the footprint parcel) in the Voluntary Remediation Program, or VRP, of the Louisiana Department of Environmental Quality, or LDEQ, to conduct an environmental assessment of the site and complete remediation of any identified contamination. We are required to pay for the cost of remediation, if the VRP uncovers contamination above the applicable industrial standard. We will convey the remainder of the land to LSR upon completion of the VRP and be released of future environmental liabilities to state and federal authorities. The VRP site assessment is underway to determine the extent of required remediation.

LSR has entered into financing agreements aggregating $145 million to provide construction and working capital financing for the project. The financing is non-recourse to LSR’s members. The members have agreed to proportionately contribute additional capital to LSR if necessary to cover certain construction cost overruns and certain costs relating to the VRP that LSR agreed to assume. Construction costs of the new refinery, which is expected to commence operations in the summer of 2011, are estimated at $120 million. The existing Gramercy refinery will operate during the construction and start-up phase of the new refinery. LSR’s raw cane sugar will be supplied by SUGAR through an evergreen raw sugar supply agreement. Cargill will serve as marketer of the refined sugar produced by LSR, other than refined sugar sold to Imperial.

Natural Sweet Ventures—In February 2010, we formed Natural Sweet Ventures, or NSV, a 50/50 joint venture with Pure Circle Limited to develop and commercialize sugar/stevia sweetener blends for sale in the NAFTA region. Stevia is an all natural, zero calorie, high intensity sweetener extracted from the leaf of the stevia plant. NSV has produced products at various blend levels and provided samples to a number of food manufacturers for testing by their product development groups. Additionally, we initiated a retail trial of Steviacane tm in November 2010. We can give no assurance as to the ultimate market acceptance of these products or the results of NSV.

5

Table of Contents

Operational Facilities

We own and operate two cane sugar refineries. Each facility has packaging and distribution capabilities, is served by adequate transportation and maintained in good operating condition. The Company experienced an industrial accident on February 7, 2008, at its sugar refinery in Port Wentworth, Georgia, which is located near Savannah, Georgia. Production at the refinery, which comprises approximately 60% of our capacity, was suspended after the accident until we commenced sustained liquid bulk sugar production in late June 2009. Granulated bulk sugar production was initiated in late July 2009 and granulated packaged production on certain lines began in September 2009.

The following table shows the location, current capacity and production of our cane sugar refineries:

| Cane Sugar Refineries |

Approximate Daily Raw Sugar Melt Capacity (cwt) |

Fiscal 2010 Production (cwt) |

Fiscal 2009 Production (cwt) |

Fiscal 2008 Production (cwt) |

Fiscal 2007 Production (cwt) |

|||||||||||||||

| Port Wentworth, Georgia |

63,000 | 12,494,000 | 1,146,000 | 4,930,000 | 14,510,000 | |||||||||||||||

| Gramercy, Louisiana |

45,000 | 10,646,000 | 11,707,000 | 11,802,000 | 11,075,000 | |||||||||||||||

| Total |

108,000 | 23,140,000 | 12,853,000 | 16,732,000 | 25,585,000 | |||||||||||||||

We also operate a distribution facility in Ludlow, Kentucky and we contract for throughput and storage at a number of warehouses and distribution stations. Co-packers are used under contract for small volume specialty products.

Raw Materials and Processing Requirements

Raw Cane Sugar

We currently purchase raw cane sugar from domestic sources of supply located in Louisiana, as well as from various foreign countries. The availability of foreign raw cane sugar for domestic consumption is determined by the import quota level designated by applicable regulation, as well as the provisions of NAFTA and other treaties. In fiscal 2010, we purchased substantially all of our raw sugar needs for our Port Wentworth, Georgia refinery from foreign sources under annual or spot contracts with traders. We expect to purchase substantially all of our requirements for our Port Wentworth facility from foreign sources in the foreseeable future.

Historically, substantially all of our purchases of domestic raw sugar and raw sugar quota imports were priced based upon the Intercontinental Exchange (ICE) Sugar No. 16 futures contract or its predecessor, the Sugar No. 14 futures contract. Non-quota imports under the re-export program, which constitute less than 10% of our raw sugar purchases, are priced based on the ICE Sugar No. 11 futures contract. The terms of raw cane sugar purchase contracts vary. Raw cane sugar purchase contracts can provide for the delivery of a single cargo or for multiple cargoes over a specified period or a specified quantity over one or more crop years. Contract terms may provide for fixed prices but generally provide for prices based on the futures market during a specified period of time. Contracts require delivery to the Company’s facility and provide for a premium if the quality of the raw cane sugar is above a specified grade or a discount if the quality is below a specified grade. Contracts based on the No. 16 contract provide that the seller pays freight, duties, insurance charges and other costs of shipping. Substantially all of the raw sugar requirements for our Gramercy, Louisiana refinery in fiscal 2010 were supplied by SUGAR, the cane sugar growing and milling cooperative which is our partner in LSR. The supply contract expires concurrent with our contribution of the Gramercy refinery to LSR on December 31, 2010 and provides for pricing of the majority of the raw sugar based on a margin on sales prices of refined sugar, rather than the raw sugar futures market prices.

The majority of our industrial sales and a portion of our distributor sales are made under fixed price, forward sales contracts. In order to mitigate price risk in raw and refined sugar commitments, we manage the volume of refined sugar sales contracted for future delivery in relation to the volume of raw cane sugar purchased

6

Table of Contents

for future delivery by entering into forward purchase contracts to buy raw cane sugar at fixed prices and by using raw sugar futures contracts.

We have access to approximately 226,000 short tons of aggregate raw sugar storage capacity: 80,000 short tons of storage at our Gramercy, Louisiana refinery and 146,000 short tons of storage capacity at our Port Wentworth, Georgia refinery. At Port Wentworth, we have the capability to segregate our raw sugar inventory, which allows us to store bonded sugar. Bonded sugar is sugar that is not entered as an import at the time of arrival, but stored in a bonded warehouse under U.S. federal customs service regulations for entry at a later time.

Energy

Sugar refining is an energy intensive process. We use natural gas at our Gramercy, Louisiana refinery and coal and natural gas in the Port Wentworth refinery. Fiscal 2010 energy usage, which was impacted by the startup of the Port Wentworth refinery, consisted of 4.2 million mmbtu of natural gas and 0.6 million mmbtu of coal.

In December 2007, we entered into a five-year, fixed price coal contract (subject to escalation factors based on mining costs and quality adjustments). The supplier is currently not performing under the contract, which has resulted in the Company filing a lawsuit against the supplier and necessitating the purchase of coal at higher current prices. Rail freight for coal supplies is generally contracted annually. Natural gas is contracted on a monthly basis. Pricing of natural gas generally is indexed to a spot market index, and we use financial tools such as futures, options, swaps and caps in an effort to stabilize the price for gas purchases under indexed contracts. Energy prices have been volatile in recent years and we cannot predict future energy prices or the effect that rising energy prices may have on our business in the future.

Seasonality

Sales of refined sugar are somewhat seasonal, normally increasing during the first and fourth fiscal quarters because of increased demand of various food manufacturers and consumer retail demand. Shipments of brown and powdered sugar increase in the first fiscal quarter due to holiday baking needs. Our second fiscal quarter ending March 31 historically experiences lower revenues and earnings than our other fiscal quarters as a result of reduced demand for refined sugar, margin reduction from product mix changes and lower absorption of fixed costs of our cane refineries.

Sugar Legislation and Other Market Factors

Our business and results of operations are substantially affected by market factors, principally the domestic prices for refined sugar and raw cane sugar. These factors are influenced by a variety of forces, including domestic supply, prices of competing crops, weather conditions and U.S. farm and trade policies.

The principal legislation supporting the price of domestic crops of sugar cane and sugar beets is the Food Conservation and Energy Act of 2008, otherwise known as the 2008 Farm Bill, which became effective October 1, 2008 and expires September 30, 2013. Imports of raw and refined sugars are controlled via a Tariff Rate Quota (“TRQ”), which is implemented under Additional U.S. Note 5 of Chapter 17 of the Harmonized Tariff Schedule of the United States and does not expire.

The TRQ limits the amount of raw and refined sugar that can be imported into the United States, subject to a minimum amount mandated under the General Agreement on Tariffs and Trade, by imposing a tariff, currently $15.36 per cwt, on over-quota sugar, which historically made its import uneconomical. The USDA reports that 210,000 tons of non-TRQ imports were made during 2010, as the spread between the domestic and world raw sugar prices widened significantly. The government administers the sugar program by adjusting duties and quotas for imported sugar to maintain domestic sugar prices at a level that discourages loan defaults under the

7

Table of Contents

non-recourse loan program. To the extent a processor sells refined sugar for export from the United States, it is entitled to import an equivalent quantity of non-quota eligible foreign raw sugar that would not be subject to the tariff.

Domestic sugar regulations have a number of important provisions:

| • | Non-recourse Loan Program. The 2008 Farm Bill provides for a loan program covering sugar cane and sugar beet crops. The program authorizes the Commodity Credit Corporation, or CCC, a federally owned and operated corporation within the USDA, to extend loans to first-processors of domestically grown sugar cane and sugar beet crops (i.e., raw sugar mills and sugar beet processors) secured by sugar inventories from current-year crop production. The Company is not eligible to participate in this loan program. During the term of the 2008 Farm Bill, national average loan rates are to increase from 18 cents per pound for raw cane sugar in 2008 to 18.75 per pound in 2011, while loan rates for refined beet sugar are established at 128.5% of the raw cane sugar rate. CCC loans are non-recourse in most circumstances and mature the earlier of nine months after the date of the loan or September 30th each year. The program provides price support to the first-processor by effectively enabling the sale of raw cane sugar and refined beet sugar by forfeiture of the collateral at the respective loan rates in the event that market prices drop below that level. |

| • | Marketing Allotments. The 2008 Farm Bill provided that marketing allotments on sugar beet processors and domestic raw cane sugar producers who supply raw sugar may be imposed by the USDA, but that allocation under these allotments may not initially be less than 85% of domestic consumption. Marketing allotments can have the effect of reducing the amount of domestic sugar that is available for marketing and are intended to strengthen sugar prices. Marketing allotments were in force in fiscal 2010 and continue to be in force for fiscal 2011. The USDA can adjust allotments for changes in domestic production or consumption projections. |

| • | TRQ Administration. Provisions of the 2008 Farm Bill require that the TRQ be established at the beginning of any crop year at World Trade Organization minimum of 1.25 million tons and maintain that level until March 31, unless a supply emergency is declared by the USDA. Additions to the TRQ (above the minimum levels) are required to be allocated to raw cane sugar imports until such point that domestic cane sugar refiners are operating at full capacity. |

The 2008 Farm Bill requires that the USDA operate its non-recourse sugar loan program so as to avoid forfeiture of sugar to the CCC to the maximum extent possible. This is normally done by restriction on the amount of sugar imported under the TRQ and if that is not sufficient, by restrictions on the amount of sugar that may be marketed by domestic producers. In a more rarely used option, if the USDA has taken sugar in default under price support loans, it also has the authority to accept bids from sugar cane and sugar beet processors to obtain raw cane sugar or refined beet sugar in CCC inventory in exchange for reduced production of raw cane sugar or refined beet sugar. This payment-in-kind authority, if employed by the USDA, effectively moves inventories of CCC-owned sugar back into commerce without increasing overall supply. Another provision of the 2008 Farm Bill requires the USDA to divert surplus sugar from the marketplace to the production of ethanol.

Free Trade Initiatives

NAFTA provided for the termination of sugar duties and quotas, so that sugar began to be freely traded without duty between the United States and Mexico in January 2008. Notwithstanding the existing import restrictions under the 2008 Farm Bill, the USDA has the right to re-allocate import levels among foreign countries if it deems the demand/supply situation within the United States warrants such action.

In addition to NAFTA, a number of other trade initiatives and negotiations involving the Americas and other quota holding countries are evolving. In 2005, the United States enacted the Central American-Dominican Republic Free Trade Agreement, or CAFTA-DR. Duty-free access to sugar from CAFTA-DR countries increased 109,000 metric tons over the previous amount during the first year, growing to a 151,000 metric ton increase over the first 15 years and 2,640 metric ton increases each year thereafter.

8

Table of Contents

There are additional agreements signed with Panama and Colombia which await Congressional approval. It is not known at this time when and if that approval will be granted. Additionally, a World Trade Organization round of negotiations continues. The impact of these negotiations is unknown at this time, but they could provide for additional raw sugar and/or refined sugar access into the United States. Generally, to the extent that additional sugar imports are in the form of raw sugar, such additional access would have a beneficial effect on our access to raw sugar. To the extent that such additional access is in the form of refined sugar, such product will be competitive with our product offerings.

Environmental Regulation

Our operations are governed by various federal, state and local environmental regulations and these regulations impose effluent and emission limitations, and requirements regarding management of water resources, air resources, toxic substances, solid waste and emergency planning. We make application for environmental permits required under federal, state and local regulations and we have obtained or have filed for environmental permits as required in Georgia and Louisiana. Additional expenditures may be required to comply with future environmental protection standards for current operating facilities, although the amount of any further expenditure cannot be fully estimated.

In conjunction with the contribution of our Gramercy, Louisiana refinery to LSR, we have enrolled the site in the VRP with the LDEQ. As part of the VRP, we have undertaken an environmental assessment to determine if the site contains contamination above the applicable industrial standard. If such contamination is detected, we are required to pay for the cost of remediation. The VRP site assessment is underway to determine the extent of required remediation. Upon completion of the VRP, the Company and LSR would be released from federal and state environmental obligations for the site.

Process wastewater from our Port Wentworth refinery is treated and discharged by another industrial company in the port under a contract for such services. The industrial company has given notice of termination of the contract effective August 2013, and we will either need to negotiate a new contract or make other arrangements for treatment and discharge of process wastewater. If a new contract for treatment cannot be negotiated, additional expenditures for treatment and discharge of process wastewater may be required, although the amount and timing of any such expenditures cannot currently be estimated.

The Company has permits that govern its discharge of cooling and storm water at the Port Wentworth refinery. The State of Georgia Department of Natural Resources Environmental Protection Division, or EPD, issued a notice of violation and a proposed fine of $45,000 in connection with discharges of excess sugar by the Company under its permits. The Company is in negotiations regarding the proposed fine and a comprehensive plan to assure full compliance with these permits and future environmental standards applicable to cooling and storm water. Additional expenditures may be required to comply with current and future permits and environmental standards associated with cooling and storm water, although the amount and timing of any further expenditure cannot currently be estimated.

In December 2010, LDEQ issued a Consolidated Compliance Order and Notice of Potential Penalty to the Company alleging violations of state environmental regulations and the terms of the wastewater discharge permit for the Company’s Gramercy, Louisiana refinery. The alleged violations relate to the release of foam into waters of the state and exceedances of applicable criteria for dissolved oxygen and pH. Issuance of a penalty assessment is being considered by LDEQ for the alleged violations. The Company is investigating the alleged violations, has taken measures to cease and contain the foam discharge, and is coordinating with the LDEQ to develop and implement a plan to remove and dispose of the foamy material and achieve and maintain compliance with the terms of its discharge permit and applicable regulations.

Health and Safety Regulation

Our operations are subject to a number of federal, state and local health, safety and food safety regulations that are designed to protect workers, customers and consumers of our products. In order to comply with these

9

Table of Contents

regulations, we have developed specific operating and maintenance procedures and are required to maintain records and report data on a timely basis. Additionally, we have made capital investment in the past and may be required to make additional investments in the future to comply with such regulations. Health, safety and food safety regulations are subject to change in the future and may require modifications of procedures or additional capital expenditures to comply with new requirements. Current regulatory efforts include OSHA’s development of a comprehensive combustible dust standard and pending federal legislation to address food safety matters. We are unable to predict the impact which these or other changes may have on our operating result, cash flow or financial position.

In July 2010, we settled OSHA citations arising from investigations of our refineries following the 2008 Port Wentworth industrial accident. While making no admission of liability, the Company agreed to pay penalties aggregating $6.05 million in four quarterly installments commencing in August 2010. Pursuant to the settlement, we agreed to abate the citations by December 31, 2010. In addition, we agreed to implement certain other measures related to worker and facility safety.

Research

We operate research and development centers in Sugar Land, Texas and Port Wentworth, Georgia where we conduct research relating to:

| • | manufacturing process technology; |

| • | factory operations; and |

| • | new product development. |

Intellectual Property

The Company engages in research and development activities for proprietary processes and products, including product purification and new sweetener products. The Company has filed patents on several of these technologies, including patents directed toward the manufacture of high-purity sugar products. Additionally, the Company has filed patents for processes used for the generation of reduced calorie natural sweeteners, as well as the products resulting from these processes including stevia extract/sugar blends. Such patents related to stevia extract/sugar blends have been exclusively licensed to NSV.

Competition

We compete with other cane sugar refiners and with beet sugar processors and, in certain product applications, with producers of other nutritive and non-nutritive sweeteners, such as HFCS, polyols, aspartame, saccharin, sucralose, acesulfame-k and stevia. We also compete with resellers and packaging operations in distributing bag sugar products. Our principal business is highly competitive, where the selling price and our ability to supply a customer’s needs in a timely fashion are important competitive considerations. Freight costs to transport products can affect our sales. Some of our competitors have an advantage of owning all or part of the agricultural production supplying their refined sugar requirements. We believe our key sugar competitors are Domino® Foods, Inc. and United Sugars Corporation. The principal suppliers of HFCS in North America are Cargill, Inc., Archer Daniels Midland Company and Corn Products, Inc.

Employees

On November 30, 2010, we employed 694 employees. Our Port Wentworth, Georgia refinery employs non-union labor while substantially all of the refinery employees at our Gramercy, Louisiana refinery are covered by a collective bargaining agreement which expires in February 2012.

In December 2010, the union which represents certain of the Company’s hourly employees at its Gramercy refinery, filed an unfair labor practices charge against LSR alleging that LSR is required and has failed to recognize and bargain with the Union in connection with its operation of the Gramercy refinery commencing

10

Table of Contents

January 1, 2011. The charge also alleges that LSR has discriminated against members of the union in job retention and employment for its Gramercy operations due to their membership in the union. The Company is not named in the complaint.

Available Information

Our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to these reports are available free of charge on our web site located at www.imperialsugar.com as soon as reasonably practicable after we file or furnish these reports electronically with the SEC. The information on our website is not incorporated by reference into this Form 10-K.

| ITEM 1A. | Risk Factors |

In addition to the other information set forth in this report, you should consider the following factors that could materially affect our business, financial condition or operating results. These risks are not the only risks facing our Company. Additional risks and uncertainties not currently known to us or that we currently deem to be immaterial also may materially adversely affect our business, financial condition or operating results.

The domestic sugar industry is affected by a number of external forces that we are unable to predict or control that could cause fluctuations in prices, which may negatively affect our results of operations.

Our business and results of operations are closely tied to conditions in the domestic sugar industry, principally the prices of both refined sugar and raw cane sugar. The sugar industry is affected by a number of external forces that we are unable to predict or control and that historically have been subject to considerable volatility.

A variety of external forces that we are unable to predict influence the domestic sugar industry and could adversely affect our business and results of operations, including:

| • | the U.S. farm and trade policies; |

| • | the number of domestic acres contracted to grow sugar cane and sugar beets; |

| • | prices of competing crops; |

| • | HFCS substitution rate; |

| • | energy costs; |

| • | supply and price of raw cane sugar in the world market; |

| • | Mexican peso to U.S. dollar exchange rate; |

| • | levels of domestic sugar refining capacity; and |

| • | weather conditions affecting the sugar cane and sugar beet crops and the operations of facilities operated by us and our competitors. |

The domestic sugar business has traditionally been subject to periods of high prices and margins, followed by periods of lower prices and margins. In the past, during periods of high prices, growers have tended to increase their production, which has generally caused a drop in sugar prices until the supply and demand return into balance. Our business consists exclusively of the processing and marketing of refined cane sugar. Consequently, we are unable to counteract the fluctuations to which our business may be subject with revenues or income from businesses that are more predictable or that are subject to different business cycles. As discussed below, partially as a result of the volatile nature of the sugar industry, we have at times in the past experienced operating losses and net losses.

Our Port Wentworth refinery is supplied almost exclusively by imported raw sugar. Supplies and pricing of imported raw sugar can be influenced by increased world raw sugar prices. Raw sugar imports into the

11

Table of Contents

United States compete for surplus production in exporting counties with alternative sales on the world raw sugar market. Recent events affecting the supply of raw sugar in the world market have increased prices to 30 year high levels, causing domestic raw sugar prices to increase substantially. We compete with domestic beet processors and other cane sugar refiners who own some or all of their source of supply and may not be impacted to the degree we are by these factors. We purchase raw sugar of varying quality from many different countries. Lower quality raw sugar can have an adverse effect on our operating performance. If we have an inadequate supply of raw sugar or unacceptable quality, we may be unable to efficiently operate our refineries or meet domestic demand for refined sugar. We may not be able to increase refined sugar prices to our customers to offset such higher raw sugar costs, which could adversely affect our refined sugar margins, financial condition, results of operations and cash flows.

Our liquidity and capital resources have been reduced and we are exploring alternative sources of capital.

We have used a significant portion of our liquidity since the February 2008 industrial accident in Port Wentworth to fund operating losses and capital expenditures in excess of the applicable insurance recoveries. Operating results have not returned to profitable levels, and we have ongoing capital expenditure and pension contribution requirements. Volatility in raw sugar prices may place additional demands on our liquidity as we maintain our raw sugar purchasing and hedging program. Our revolving credit agreement becomes subject to a minimum EBITDA covenant if our average total liquidity falls below $20 million.

While we believe that our available liquidity and capital resources are sufficient to meet our operating and capital needs, we are exploring alternative sources of capital to provide additional liquidity and capital resources. In conjunction with this initiative, we are seeking to renew or replace the revolving credit agreement, which is currently scheduled to expire December 31, 2011. There can be no assurance that financing will be available to us or that the terms of such financing would be attractive.

Our future financial condition and future operating results could be adversely impacted by the outcome of claims, litigation and regulatory proceedings.

The Company is party to a number of claims, including twenty lawsuits for injuries and losses suffered as a result of the Port Wentworth accident. If damages in these matters exceed insurance policy limits, we could be subject to liabilities, which could be material.

The Company’s workers compensation insurance contract provides that it reimburse the carrier for assessments if and when the assessments are levied based on workers compensation claims paid during a calendar year. Such assessments, if levied, could be significant.

Our business could be adversely affected by the effects of existing and future United States and Mexican farm and trade policies.

Legislative and regulatory actions substantially influence the domestic raw sugar industry. The principal current legislation supporting the price of domestic crops of sugar cane and sugar beets is the 2008 Farm Bill, which extends the sugar price support program for sugar cane and sugar beets until September 30, 2013. The USDA operates a tariff-rate quota that effectively limits the amount of raw and refined sugar that can be imported into the United States by imposing a tariff on over-quota sugar that makes its import uneconomical. This tariff-rate quota could adversely affect the supply and price of raw sugar available to our sugar refineries if there is a shortfall in domestic production. In addition, marketing allotments under the 2008 Farm Bill may reduce the amount and affect the cost of domestic raw sugar that is available to us for refining. United States farm and trade policy also influences domestic sugar grower acreage dedicated to alternate crops. Mexican farm and trade policies influence sugar production in Mexico and non-NAFTA imports, affecting the supply of sugar available for export to the United States. Any of these factors could adversely affect our results of operations.

12

Table of Contents

If demand for sugar decreases in the future, lower sales volumes and lower prices could result, which could affect us adversely.

We cannot predict the demand for sugar in the future and this demand could be affected adversely by numerous factors, including:

| • | imports of sugar containing products and sugar blends; |

| • | the impact of changes in the availability, development or potential use of various types of alternative sweeteners; |

| • | future changes in consumer sweetener preferences, including impact of dietary trend; |

| • | government nutritional guidelines and labeling laws; |

| • | changes in population; and |

| • | the impact of a weaker domestic and global economy |

Operations at the re-built Port Wentworth refinery have yet to return to prior volumes and efficiencies.

The reconstructed Port Wentworth refinery, which commenced operations in the summer of 2009, has yet to achieve sustained production volumes and efficiencies demonstrated prior to the 2008 accident. Future operating results and cash flows may be adversely affected if prior operating levels are not achieved on a sustained basis.

Construction of a new refinery by the LSR joint venture involves construction and other risks.

Under the terms of our LSR agreements, we will contribute our Gramercy, Louisiana refinery to the newly formed joint venture which will undertake to construct a new 3,100 ton per day cane sugar refinery. Cost overruns or construction delays could require that we contribute additional capital beyond our initial commitments to contribute our Gramercy assets. Additionally, we have contractual obligations to complete certain improvements in the existing refinery, and complete the VRP with the State of Louisiana. Unforeseen costs or liabilities arising from these matters could adversely impact our results of operations and cash flow. Additionally, after December 31, 2010, we will no longer have access to the cash flows generated by the existing Gramercy refinery, and distribution of cash flows generated by LSR are limited under LSR’s relevant financing agreements.

Costs and availability of energy may result in increased operating expenses and reduced results of operations.

Processing raw sugar into refined sugar requires a high level of energy use. We use natural gas and coal to fulfill our energy requirements and fuel prices also affect our transportation costs. Domestic energy prices, particularly natural gas and diesel prices, have been volatile in recent years and we are unable to predict the trend in future prices. Future high energy prices or disruptions of supply could adversely impact our production costs and operating efficiencies.

We sell commodity products in highly competitive channels of distribution and face significant price pressure.

We sell our products in highly competitive channels of distribution. We compete with other cane sugar refiners and beet sugar processors and, in certain product applications, with producers of other nutritive and non-nutritive sweeteners. We also compete with distributors and resellers in distributing bag sugar products. Our branded retail share of sales is under increasing pressure from private labels, requiring increased expenditures on innovation and trade promotion.

Competition in these channels is based primarily on price and the ability to meet timely customer quality and quantity requirements. As a result, we may be unable to protect our sales position by product differentiation and may be unable to raise prices. Our ability to service customer requirements has been disrupted since the 2008 industrial accident at our Port Wentworth refinery. Some of our customers have had to seek supply from alternate sources during that period, and our ability to return to normal supply levels with our customers has not been fully demonstrated.

13

Table of Contents

Historically, we have made the majority of our sales to industrial customers under fixed price, forward sales contracts which extend for up to one year. As a result, changes in our realized sales prices tend to lag behind market price changes.

Some competitors may be able to further reduce their product prices because their costs are less than ours or because they have greater financial, technological and other resources than we have. In addition, most of our competitors own or control a substantial portion of their supply of raw materials. This vertical integration may provide these producers a competitive advantage because they are better able to secure a stable supply of raw materials at more favorable costs than we can. Finally, our competitors may be able to respond more quickly to new or emerging technologies and changes in customer requirements than we can. Increased competition and price pressure could adversely affect our financial condition, results of operations and cash flows.

Damage to either of our refineries that results in prolonged interruption of operations could materially adversely affect our results.

The Company conducts its operations at two refineries and is dependent upon these facilities for production. Because these facilities are located in coastal areas, they are subject to severe weather conditions, including hurricanes, tornados and flooding, as well as to normal hazards that could result in material damage. Damage to either of these refineries, or prolonged interruption in the operation of the facilities due to our dependence on ocean-going raw sugar deliveries, or for repairs or other reasons, would have a material effect on the Company’s business, financial condition, results of operations and cash flows. After December 31, 2010, we will no longer operate the Gramercy, Louisiana refinery reducing the Company’s refinery capacity to a single site.

We have had losses in the recent past and may be unable to maintain profitable operations.

We have at times in the past experienced operating losses and net losses. Losses in future years could be incurred and could be attributable to a number of factors, including:

| • | low refined sugar prices; |

| • | low margins between raw sugar and refined sugar prices; |

| • | disruption of refinery operations; |

| • | reduced production and efficiencies of refinery operations; and |

| • | high energy costs. |

We compete in highly competitive labor markets.

We operate facilities in competitive labor markets. In the event we are unable to attract and retain qualified personnel, our production efficiencies and labor costs could be adversely affected.

The Company incurs substantial costs with respect to pension benefits and providing healthcare for its employees.

The Company’s estimates of liabilities and expenses for pensions and post-retirement healthcare benefits require the use of assumptions related to the rate used to discount future liability, the rate of return on plan assets, and the retirement age and mortality of current and retired employees. Future results may differ from these assumptions. In addition, rising healthcare costs and the costs of other employee benefits may affect the Company’s future benefit costs. Such future events may have a material effect on the Company’s financial condition, results of operations and cash flows. Declines in the stock market have reduced assets available to pay retirement benefits and may result in increased costs and funding requirements.

Our pursuit of acquisitions and other similar initiatives involves risk.

We may in the future acquire or invest in new lines of business or offer our products in new markets. We have an option until May 2011 to purchase the remaining 50% of Wholesome’s equity. While no decision on a

14

Table of Contents

course of action with regard to the Wholesome option has been made, acquisitions and similar investments involve numerous risks, including:

| • | assimilation of operations and personnel; |

| • | demands on existing management and other resources; |

| • | opportunity costs of employing capital in such investments; |

| • | potential loss of the capital invested; |

| • | consequences of incurring leverage to finance any investment; |

| • | loss of key employees or key customers of the acquired business; and |

| • | potential for unrecorded liabilities that are not discovered during due diligence. |

We may not realize the expected benefits from future acquisitions or similar investments, and the costs of unsuccessful investment efforts could adversely affect our business and results of operations.

We are exposed to costs arising from environmental compliance, and cleanup, health and safety regulation, and litigation, which may adversely affect our business, financial condition, operating results or cash flows.

Our operations are governed by various federal, state and local environmental laws and regulations. These regulations impose limitations on releases of effluents and emissions from our facilities. They also impose requirements on our management of:

| • | worker safety; |

| • | food quality, safety and integrity; |

| • | water resources; |

| • | air resources; |

| • | combustible dust risk mitigation; |

| • | toxic substances; |

| • | solid waste; and |

| • | emergency planning. |

We received a notice of termination of the contract to process our wastewater at the Port Wentworth refinery effective August 2013. If the Company cannot negotiate a new contract, we must make other arrangements for treatment and discharge of process wastewater, which may require future capital expenditures by the Company or result in increased operating costs.

The Company is negotiating with EPD regarding a comprehensive plan to assure full compliance with our discharge permits and future environmental standards applicable to cooling and storm water at the Port Wentworth refinery. The results of these negotiations may require future capital expenditures by the Company. Further, implementation of any plan negotiated with EPD may result in increased operating costs.

We cannot predict with certainty the extent of our future liabilities and costs under such laws and regulations, or how such regulations could impact our operations, and these impacts could be material.

| ITEM 1B. | Unresolved Staff Comments |

None.

15

Table of Contents

| ITEM 2. | Properties |

We own our Port Wentworth cane sugar refinery and our corporate headquarters in Sugar Land, Texas. We lease the land and own the property improvements and equipment at a distribution facility in Kentucky, and contract for production, throughput and storage at a number of co-packers, warehouses and distribution stations. Certain of these properties are subject to liens securing our credit facility.

We owned our Gramercy, Louisiana refinery at September 30, 2010. Under the terms of our LSR agreements, we contributed seven acres of vacant land adjacent to the refinery in November 2009 and are obligated to contribute the refinery and remaining property to the newly formed joint venture in January 2011. Please read “Business—Joint Venture Operations.”

| ITEM 3. | Legal Proceedings |

The Company is party to a number of claims, including twenty remaining lawsuits brought on behalf of 13 employees or their families and 7 third parties or their families, for injuries and losses suffered as a result of the Port Wentworth industrial refinery accident. None of the lawsuits demand a specific dollar amount of damages sought by the plaintiffs. During fiscal 2010, the Company settled twenty-eight lawsuits seeking recovery of injuries and losses from the Port Wentworth accident, with the settlement payments made to these claimants being funded by the Company’s insurers.

The Company has workers compensation insurance which provides for coverage equal to the statutory benefits provided to workers under state law. Additionally, the Company’s general liability policy provides for coverage for damages to third parties up to a policy limit of $100 million. While the Company believes, based on the facts of these cases, that claims by employees and certain contractors are limited to benefits provided under Georgia workers compensation law, the ultimate resolution of these matters could result in liability in excess of the amount accrued. The Company believes the likelihood of the aggregate liability, including the amounts paid in the settlements discussed above, exceeding the $100 million policy limit is remote.

In August 2010, the Company filed suit in the District Court of Fort Bend County, Texas, against one of its general liability excess insurers, XL Insurance Company America, Inc. (“XL”). XL issued a $25 million policy of insurance (a portion of the $100 million coverage described above) that provides coverage for lawsuits filed as a result of the Port Wentworth industrial refinery accident. XL, which has not denied coverage for payments for settlements or judgments, asserts that its policy does not include coverage of defense costs in litigation. The Company’s lawsuit seeks a declaration that pursuant to the insurance policy it issued to the Company, XL is required to pay the Company’s costs of defense in lawsuits filed by employees and third parties and their families for injuries and losses suffered as a result of the Port Wentworth refinery accident. XL subsequently had the lawsuit removed to the United States District Court for the Southern District of Texas.

Following the Port Wentworth accident, OSHA conducted investigations at the Company’s Port Wentworth and Gramercy refineries. OSHA concluded its Port Wentworth and Gramercy investigations on July 25, 2008, and issued numerous citations with total proposed penalties of $5.1 million in Port Wentworth and $3.7 million in Gramercy. Additionally, OSHA issued requirements for certain abatement actions to be undertaken by the Company at the Port Wentworth and Gramercy facilities. In July 2010, the Company settled the Port Wentworth and Gramercy citations and agreed to pay aggregate penalties of $6.05 million in four quarterly installments commencing in August 2010. The Company made no admission of liability in the settlements. The Company also agreed to abate the citations and to implement certain other measures related to worker and facility safety. The penalties, which had been provided for in prior fiscal years, are not covered by insurance and are not deductible for federal income tax purposes.

In January 2009, a shareholder filed a derivative lawsuit in the District Court of Harris County, Texas against twelve current and former directors and officers of the Company and named the Company as a nominal defendant, alleging mismanagement and breaches of fiduciary duty by the Company’s officers, directors and employees relating to the February 7, 2008 explosion at the Company’s refinery in Port Wentworth, Georgia. In

16

Table of Contents

October 2010, a settlement of the litigation and of the derivative claim of another shareholder was approved by the court. The terms of the settlement provide for implementation by the Company of certain management and governance measures and for the payment of attorneys’ fees of the derivative plaintiffs, which payment was made by the Company’s insurer. The defendants made no admission of liability in the settlement.

The Company’s workers compensation insurance contract requires the reimbursement of the carrier for certain loss-based assessments the carrier receives from the state of Georgia’s Subsequent Injury Trust Fund which are based on losses paid during a calendar year. The Company recorded a $3.7 million charge in fiscal 2010 attributable to losses paid in calendar 2008 and 2009.

In December 2010, AdvancePierre Foods, Inc. filed suit against the Company and its distributor, Evergeen Sweeteners, Inc. in the United States District Court for the Western District of North Carolina seeking damages in connection with sugar that had been voluntarily recalled by the Company in July 2010. The claims asserted against the Company seek recovery of losses allegedly incurred by the plaintiff due to its incorporation of recalled sugar in food products. Although the complaint does not specify alleged damages, the plaintiff previously indicated that its damages were approximately $3.2 million. The Company believes that its general liability insurance policy provides coverage for the damages asserted in connection with these claims, and that it may have additional coverage for these claims through another insurance policy. The insurer who provides the primary layer of coverage up to $1 million of limits has assumed the defense of this lawsuit. An insurer that provides excess coverage above $1 million of damages as part of the Company’s general liability program has denied coverage for these property damage claims. The Company believes that this excess insurance coverage is enforceable to respond to these claims.

In September 2010, EPD issued a notice of violation to the Company in connection with discharges of excess quantities of sugar under the Company’s discharge permits for storm water and cooling water at its Port Wentworth, Georgia refinery. EPD is seeking a penalty of $45,000 for these violations. The Company is in negotiations with EPD regarding the proposed penalties and a comprehensive plan to assure full compliance with these permits and future environmental standards applicable to storm water and cooling water. Additional expenditures may be required to comply with current and future permits and environmental standards associated with storm water and cooling water, although the amount and timing of any further expenditure cannot currently be estimated.

In December 2010, LDEQ issued a Consolidated Compliance Order and Notice of Potential Penalty to the Company alleging violations of state environmental regulations and the terms of the wastewater discharge permit for the Company’s Gramercy, Louisiana refinery. The alleged violations relate to the release of foam into waters of the state and exceedances of applicable criteria for dissolved oxygen and pH. Issuance of a penalty assessment is being considered by LDEQ for the alleged violations. The Company is investigating the alleged violations, has taken measures to cease and contain the foam discharge, and is coordinating with the LDEQ to develop and implement a plan to remove and dispose of the foamy material and achieve and maintain compliance with the terms of its discharge permit and applicable regulations.

In November 2010, the Company filed suit in the Fort Bend County, Texas District Court against Hills Fuel Company, its supplier of coal, for breach of contract. The supplier failed to make deliveries due under the contract and the Company has been sourcing its supply of coal at prices higher than stipulated under the contract.

The Company is party to other litigation and claims which are normal in the course of its operations. While the results of such litigation and claims cannot be predicted with certainty, the Company believes the final outcome of such matters will not have a materially adverse effect on its consolidated results of operations, financial position or cash flows. In connection with the sales of certain businesses, the Company made customary representations and warranties, and undertook indemnification obligations with regard to certain of these representations and warranties including financial statements, environmental and tax matters, and the conduct of the businesses prior to the sale. These indemnification obligations are subject to certain deductibles, caps and expiration dates.

17

Table of Contents

EXECUTIVE OFFICERS OF THE REGISTRANT

The table below sets forth the name, age and position of our executive officers as of December 8, 2010. Our by-laws provide that each officer shall hold office until the officer’s successor is elected or appointed and qualified or until the earlier of the officer’s death, resignation or removal by the Board of Directors.

| Name |

Age | Positions | ||||

| John C. Sheptor |

52 | President and Chief Executive Officer | ||||

| Louis T. Bolognini |

54 | Senior Vice President and General Counsel | ||||

| Patrick D. Henneberry |

56 | Senior Vice President—Commodities and Sales | ||||

| H.P. Mechler |

57 | Senior Vice President and Chief Financial Officer | ||||

| George Muller |

56 | Vice President—Sales Planning, Supply Chain & Information Technology | ||||

| J. Eric Story |

47 | Vice President and Treasurer | ||||

Mr. Sheptor became President and Chief Executive Officer of the Company in January 2008, after serving as Executive Vice President and Chief Operating Officer since joining the Company in February 2007. Prior to joining Imperial, Mr. Sheptor was Executive Vice President of Merisant Worldwide, Inc., the distributor of Equal®, from 2001 to 2004. Prior to that position, he held supply chain and manufacturing positions for Monsanto Company. From 2005 to 2007, he was Project Deputy Director for the Partnership for Supply Chain Management, a non-governmental organization funded by the President’s Emergency Plan for Aids Relief.

Mr. Bolognini joined the Company as Senior Vice President, General Counsel and Secretary in June 2008. Prior to joining the Company, he was Vice President and General Counsel of BioLab, Inc., a pool and spa manufacturing and marketing company from 1999 to 2008. Mr. Bolognini served as Assistant General Counsel to BioLab’s parent company, Great Lakes Chemical Corporation, from 1990 to 1999. Mr. Bolognini served as an executive officer of BioLab, Inc within a two year period prior to the March 18, 2009 Chapter 11 bankruptcy petition filed by BioLab’s parent company, Chemtura Corporation, on behalf of itself and 26 U.S. affiliates, including BioLab.

Mr. Henneberry joined Imperial as Senior Vice President in July 2002. Prior to joining Imperial, he was employed by Louis Dreyfus Corporation from 1984 to 2002. His more recent positions with Louis Dreyfus were: Vice President, Alcohol Division September 2001 to July 2002, Vice President, Louis Dreyfus eBusiness Ventures from May 2000 to March 2002 and Executive Vice President, Louis Dreyfus Sugar Company from April 1996 to April 2000.

Mr. Mechler became Senior Vice President and Chief Financial Officer in March 2005. He had served as Vice President—Accounting and Finance since February 2003 and was Vice President—Accounting from April 1997 to February 2003. Mr. Mechler had been Controller since joining Imperial in 1988. Mr. Mechler served as an executive officer of the Company when it filed a Chapter 11 bankruptcy petition on January 16, 2001.

Mr. Muller became Vice President—Sales Planning, Supply Chain & Information Technology in September 2010. He served as Vice President and Chief Information Officer from November 2002 to October 2008 and Vice President—Administration from October 2008 to September 2010. Mr. Muller joined the Company in March 1997 as Director of Management Information Systems.

Mr. Story became Vice President and Treasurer in September 2004 and previously served as Treasurer of Imperial since February 2003. He joined Savannah Foods & Industries, Inc. in 1987, which we acquired in 1997, and has held a number of finance and accounting positions within both Savannah Foods & Industries and Imperial. He became Corporate Controller for Savannah in 1994 and Director of Planning and Analysis for Imperial in 2002.

18

Table of Contents

PART II

| ITEM 5. | Market for Registrant’s Common Equity, Related Shareholder Matters and Issuer Purchases of Equity Securities |

Market Price of Common Equity and Related Shareholder Matters

Our common stock currently is listed on The NASDAQ Stock Market LLC (NASDAQ) under the symbol “IPSU”. As of December 21, 2010, there were approximately 1,506 shareholders of record of our common stock.

The following table contains information about the high and low sales price per share of our common stock for fiscal years 2009 and 2010 as reported by NASDAQ.

| Three months ended | Sales Price | Dividends Paid |

||||||||||

| High | Low | |||||||||||

| Fiscal 2009 |

||||||||||||

| December 31, 2008 |

$ | 16.74 | $ | 9.69 | $ | 0.07 | ||||||

| March 31, 2009 |

14.66 | 5.10 | 0.07 | |||||||||

| June 30, 2009 |

12.95 | 6.32 | 0.02 | |||||||||

| September 30, 2009 |

16.00 | 10.87 | 0.02 | |||||||||

| Fiscal 2010 |

||||||||||||

| December 31, 2009 |

$ | 17.80 | $ | 11.97 | $ | 0.02 | ||||||

| March 31, 2010 |

18.52 | 13.50 | 0.02 | |||||||||

| June 30, 2010 |

17.28 | 9.50 | 0.02 | |||||||||

| September 30, 2010 |

14.74 | 9.66 | 0.02 | |||||||||

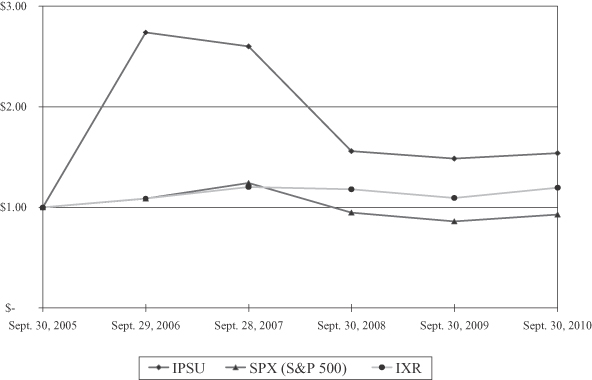

Dividend Policy