Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

(MARK ONE)

FORM 10-K

[X ] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended September 30, 2010

OR

[ ] TRANSITION REPORT UNDER SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission file number: 333-87293

CHINA AMERICA HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

|

Florida

|

82-0326560

|

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

333 E. Huhua Road, Huating Economic & Development Area, Jiading District, Shanghai, China 201811

(Address of principal executive offices) (Zip Code)

Registrant's telephone number, including area code: 86-21-59974046

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Name of each exchange on which registered

|

|

|

None

|

Not applicable

|

Securities registered pursuant to Section 12(g) of the Act:

common stock, par value $0.001 per share

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [ ] No [X]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [ ] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [X]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company:

|

Large accelerated filer

|

[ ]

|

Accelerated filer

|

[ ]

|

|

|

Non-accelerated filer (Do not check if smaller reporting company)

|

[ ]

|

Smaller reporting company

|

[X]

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [ ] No [X]

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was sold, or the average bid and asked prices of such common equity, as of the last business day of the registrant's most recently completed second fiscal quarter: $1,734,123 on March 31, 2010.

Indicate the number of shares outstanding of each of the registrant's classes of common stock, as of the latest practicable date: 184,710,792 shares of common stock are issued and outstanding as of December 15, 2010.

DOCUMENTS INCORPORATED BY REFERENCE

None.

i

TABLE OF CONTENTS

|

Part I

|

Page No.

|

|

|

Item 1.

|

Business.

|

1 |

|

Item 1A.

|

Risk Factors.

|

6 |

|

Item 1B.

|

Unresolved Staff Comments.

|

11 |

|

Item 2.

|

Properties.

|

11 |

|

Item 3.

|

Legal Proceedings.

|

11 |

|

Item 4.

|

(Removed and Reserved).

|

11 |

|

Part II

|

||

|

Item 5.

|

Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases Of Equity Securities.

|

12 |

|

Item 6.

|

Selected Financial Data.

|

12 |

|

Item 7.

|

Management's Discussion and Analysis of Financial Condition and Results of Operations.

|

13 |

|

Item 7A.

|

Quantitative and Qualitative Disclosures About Market Risk.

|

23 |

|

Item 8.

|

Financial Statements and Supplementary Data.

|

23 |

|

Item 9.

|

Changes In and Disagreements With Accountants on Accounting and Financial Disclosure.

|

23 |

|

Item 9A.

|

Controls and Procedures.

|

23 |

|

Item 9B.

|

Other Information.

|

24 |

|

Part III

|

||

|

Item 10.

|

Directors, Executive Officers and Corporate Governance.

|

25 |

|

Item 11.

|

Executive Compensation.

|

27 |

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters.

|

30 |

|

Item 13.

|

Certain Relationships and Related Transactions, and Director Independence.

|

32 |

|

Item 14.

|

Principal Accountant Fees and Services.

|

32 |

|

Part IV

|

||

|

Item 15.

|

Exhibits, Financial Statement Schedules.

|

33 |

ii

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

This report contains forward-looking statements. These forward-looking statements are subject to known and unknown risks, uncertainties and other factors which may cause actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. These forward-looking statements were based on various factors and were derived utilizing numerous assumptions and other factors that could cause our actual results to differ materially from those in the forward-looking statements. These factors include, but are not limited to:

| • |

our ability to raise sufficient capital to satisfy our obligations,

|

||

| • |

risks associated with the lack of experience of our sole officer with U.S. public companies,

|

||

| • |

difference in legal protections under Chinese and U.S. laws,

|

||

| • |

the risk of doing business in the People's Republic of China ("PRC"),

|

||

| • |

restrictions on currency exchange,

|

||

| • |

dependence on key personnel,

|

||

| • |

enhanced government regulation,

|

||

| • |

compliance with PRC governmental regulation and environmental laws,

|

||

| • |

compliance with the United States Foreign Corrupt Practices Act,

|

||

| • |

limited insurance coverage,

|

||

| • |

market overhang from outstanding warrants and options,

|

||

| • |

absence of corporate governance protections, and

|

||

| • |

the impact of the penny stock rules on the trading in our common stock.

|

Most of these factors are difficult to predict accurately and are generally beyond our control. You should consider the areas of risk described in connection with any forward-looking statements that may be made herein. Readers are cautioned not to place undue reliance on these forward-looking statements and readers should carefully review this report in its entirety, including the risks described in "Item 1A. - Risk Factors." Except for our ongoing obligations to disclose material information under the Federal securities laws, we undertake no obligation to release publicly any revisions to any forward-looking statements, to report events or to report the occurrence of unanticipated events. These forward-looking statements speak only as of the date of this report, and you should not rely on these statements without also considering the risks and uncertainties associated with these statements and our business.

OTHER PERTINENT INFORMATION

Our web sites are www.chinaamericaholdings.com and www.china-aohong.com. The information which appears on our web sites is not part of this report.

iii

INDEX OF CERTAIN DEFINED TERMS USED IN THIS REPORT

“China America” “we,” “us,” “ours,” and similar terms refers to China America Holdings, Inc., a Florida corporation formerly known as Sense Holdings, Inc., and our subsidiaries;

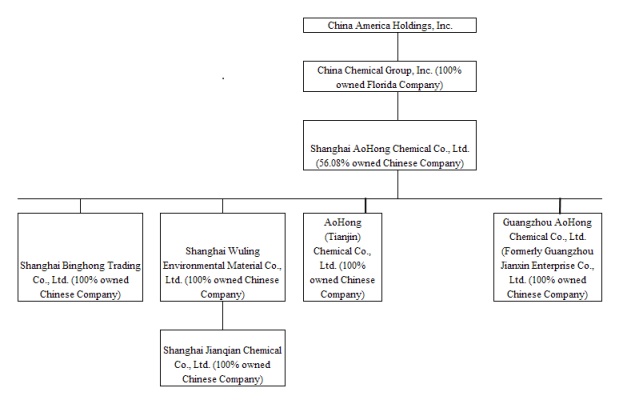

“AoHong” refers to Shanghai AoHong Chemical Co., Ltd., a Chinese limited liability company which is a majority owned subsidiary of China America, together with AoHong’s wholly owned subsidiaries Shanghai Binghong Trading Co., Ltd., a Chinese limited liability company, Shanghai Wuling Environmental Material Co., Ltd., a Chinese limited liability company, AoHong (Tianjin) Chemical Co., Ltd. a Chinese limited liability company (“AoHong Tianjin”), Shanghai Jinqian Chemical Co. Ltd. a Chinese limited liability company (“Jinqian Chemical”), and Guangzhou AoHong Chemical Co., Ltd, formerly known as Guangzhou Jianxin Enterprise Co., Ltd., a Chinese limited liability company (“Guangzhou AoHong”);

“China Direct” refers to China Direct Industries, Inc., a Florida corporation, and its subsidiaries. China Direct owns approximately 30% of our outstanding common stock;

"Sense Technologies" refers to Sense Technologies, Inc., a Florida corporation and a wholly-owned subsidiary of China America;

"Micro Sensor" refers to Micro Sensor Technologies, Inc., a Florida corporation and a wholly-owned subsidiary of China America;

"Big Tree" refers to Big Tree Toys, Inc., a Florida corporation formerly known as Big Tree Group Corp., and

"Jieyang Big Tree" refers to Jieyang Big Tree Toy Enterprise Co, Ltd., a Chinese limited liability company and wholly-owned subsidiary of Big Tree

In addition, in this report “2009” refers to the twelve months ending September 30, 2009, the “2009 transition period” refers to the nine month transition period ending September 30, 2009, and “2010” refers to the fiscal year ending September 30, 2010, unless the context otherwise specifically provides,.

iv

PART I

ITEM 1. BUSINESS.

Recent Developments

On December 9, 2010 Glodenstone Development Limited, a British Virgin Islands company (“Glodenstone”), advanced to us $1,780,000 in order to allow us to fulfill the remaining portion of our obligation to contribute capital to AoHong in connection with our negotiating the terms of an agreement to sell our 56.08% interest in AoHong to Glodenstone. On December 10, 2010 we made the required payment to AoHong. On December 23, 2010 we entered into a Membership Interest Sale Agreement with Glodenstone, Mr. Aihua Hu and Ying Ye, to sell our 56.08% membership interest in AoHong to Glodenstone for $3,508,340. The purchase price is payable by cancellation of the $1,780,000 debt we owe Glodenstone and a $1,728,340 promissory note Glodenstone will issue to us at closing. Completion of this transaction is subject to stockholder approval. See Business – Our History – Significant Transactions.

Our board of directors determined it was in our best interests to sell our interest in AoHong because of the difficulties in securing not only the capital to fund our remaining capital contribution obligations to AoHong, but additional capital necessary to properly finance its operations. The sale of our interest in AoHong will constitute a sale of all or substantially all of our assets and all of our business operations, including the revenues, expenses, assets and liabilities associated with the operation of AoHong. Consequently, if we do not acquire another business prior to completion of the sale, we will be treated as a shell corporation under Federal securities laws. We expect that we will then seek a business combination with an operating entity which, while wishing to avail itself of the benefits of being a U.S. public company, does not require the immediate level of capital AoHong requires.

If our stockholders approve the sale of our interest in AoHong to Glodenstone, AoHong’s operations will no longer be part of our business. The following discussion relates to AoHong’s operations and is applicable to our company so long as we own a controlling interest in AoHong.

Overview of AoHong’s Business

AoHong sells and distributes assorted chemicals in China through our AoHong subsidiary and its subsidiary companies. The majority of our revenues are generated through the sale and distribution of liquid coolants. While our products can be employed in a variety of applications, AoHong primarily sells and distributes refrigerants for use in air conditioning systems. AoHong also sells and distributes chemical products used in the application of fire extinguishing agents, aerosol sprays, insecticides, and tetrahydrothiophene (“THT”).

AoHong’s main product group is liquid coolants which are employed primarily as refrigerants in air conditioning systems. AoHong's operations are comprised of two basic functions:

| • |

Single Freon-based chemical products, which are distributed either in bulk quantities or in smaller packages.

|

||

| • |

Multiple Freon-based chemical products, which are custom mixed of various raw materials at AoHong’s facilities in accordance with customer specifications and distributed either in bulk quantities or in smaller packages.

|

AoHong’s customers include manufacturers and retailers of air conditioning systems, refrigerators, automobiles, coolants, pharmaceuticals and chemicals. In fiscal 2010, approximately 88% of AoHong’s net revenues were from the sale of single-freon based chemical products, 10% of AoHong’s net revenues were from the sale of multiple-freon based products and approximately 2% of AoHong’s net revenues were generated from the sale of non-refrigerant chemical compounds to the chemical and pharmaceutical industries. Approximately 67% of AoHong’s products were utilized domestically in fiscal 2010 while the balance was exported.

AoHong distributes products within China to 16 provinces and districts including Liaoning, Jilin, Beijing, Xinjiang, Shanxi, Chongqing, Sichuan, Jiangsu, Zhejiang, Anhui, Guangdong, Hainan, Hong Kong and Taiwan. AoHong exports to countries such as Russia and Thailand.

A significant portion of AoHong’s sales volume, approximately 12%, in 2010 and 2009, are derived from automobile, refrigerator and air conditioning manufacturers; as such, historically AoHong has witnessed a seasonal surge in demand for refrigerant products from March to July. AoHong utilizes a purchase order system for orders; generally it enters into supply agreements with major customers, which outline annual demand. Typically AoHong delivers product within 15 to 30 days from the time an order is placed. AoHong generally offers customers terms of net 60 days to net 90 days.

- 1 -

One customer, Shanghai 3F New Material Co., Ltd., accounted for 21% of AoHong’s net revenues in fiscal 2010.

Product Offerings

The following are a list of the major products we sell:

|

PRODUCT

|

STRUCTURAL FORMULA

|

APPLICATION

|

||

|

R22 Difluorochloro Methane

|

CHCLF2

|

Compressor for industrial and residential air conditioning systems; insecticides, painting spray and fire extinguishing agent

|

||

|

R134A

|

CH2FCF3

|

Refrigerant, common in automobile air conditioners and refrigerators

|

||

|

R22-1

|

CH2F2/CF3CHF2

|

Refrigerant, substitute for R22

|

||

|

R404A

|

CF3CHF2/CH3CF3/CF3CH2F

|

Refrigerant, substitute for R22

|

During fiscal 2010 and the 2009 transition period, sales of R22, R134A, and R22-1 represented approximately 82% and 86% of AoHong’s net revenues, respectively. The chemicals, R22, R134A, and R22-1 are coolants which are generally used as refrigerants in a variety of air conditioning systems.

AoHong focuses on the sale and distribution of environmentally responsible products, and seeks to emerge as a leader in the sale and distribution of environmentally responsible coolants within China. Approximately 35% and 30% of AoHong’s net revenues for 2010 and 2009, respectively, were derived from environmentally responsible products. Environmentally responsible products include hydrocarbon (HC) refrigerants and HFC refrigerants made of hydrogen, Fluorine and Carbon. Both refrigerants have zero ozone depletion potential (ODP) and much lower global warming potential (GWP) than traditional CFC and transitional HCFC refrigerants.

Environmentally responsible products AoHong offers include the following:

|

PRODUCT

|

STRUCTURAL FORMULA

|

APPLICATION

|

||

|

R134A

|

CH2FCF3

|

Refrigerant, common in automobile air conditioners and refrigerators

|

||

|

R600A

|

CH3(CH3) CHCH3

|

Refrigerant common in refrigerators

|

||

|

R404A

|

CF3CHF2/CH3CF3/CF3CH2F

|

Refrigerant, substitute for R22

|

||

|

R407C

|

CH2F2/CF3CHF2/CF3CH2F

|

Refrigerant, substitute for R22

|

||

|

R410A

|

CH2F2/CF3CHF2

|

Refrigerant, substitute for R22

|

||

|

R142B

|

CCIF2CH3

|

Refrigerant

|

Sales and Marketing

AoHong employs nine full time and two part-time salespersons. One part-time salesperson is dedicated to covering the Shandong Province and the other part-time salesperson dedicated to covering the Sichuan Province. These two salespersons travel frequently to these provinces. AoHong also markets and promotes its products through a variety of venues, including industry trade shows, online advertising, marketing literature, and referrals. The focal point of our marketing strategy is to deliver customized refrigerant supply solutions in an environmentally responsible manner. AoHong strictly adheres to the environmental protection regulations and policies to conduct its production and execute sales, storage, shipping, and delivery to customers’ demands.

Suppliers and Availability of Raw Materials

AoHong purchases products from a variety of sources, including:

|

Supplier

|

Product

|

|

|

JiangSu MeiLan Chemical Co., Ltd.

|

R22, R142b

|

|

|

Chevron Phillips Chemical (China) Co., Ltd.

|

R600a, THT (Tetrahydrothiophene)

|

|

|

Sinochem Modern Environmental Protection Chemicals (Xi’an) Co., Ltd.

|

R134A

|

|

|

Daikin Chemical International Trading(Shanghai) Co., Ltd.

|

R 404, R407C, R410A

|

- 2 -

During 2010, approximately 62% of the coolant products AoHong sold and distributed were supplied by JiangSu MeiLan Chemical Co., Ltd. as compared to approximately 70% of the supply in 2009. Also in 2010, approximately 14% and 11% of the coolant products AoHong sold were supplied by Sinochem Taichang Chemical Industry Park and Sinochem Modern Environmental Protection Chemicals (Xi’an) Co., Ltd., respectively, compared to 12% and 10% in 2009. AoHong has had a relationship with these companies since 2003. AoHong also sources liquid coolants from Chevron Phillips Chemical (China) Co., Ltd., (since 2003) and Daikin Chemical International Trading (Shanghai) Co., Ltd. (since 2005).

AoHong generally maintains a one month supply of liquid coolants and utilizes disposable steel cylinders to store various gases or liquids purchased in bulk quantities. These cylinders come in 30 pound and 50 pound capacity and meet the standards of European and U.S. markets. Generally 90% of AoHong’s net revenues are generated from current customers. AoHong estimates customer demand and maintains inventory levels in accordance with the anticipated orders from these customers. Utilizing its warehouse space, AoHong generally increases its inventory levels during the off-peak season which enables AoHong to offer shorter delivery times and in some cases better pricing during the peak selling season. Terms offered by AoHong’s suppliers are generally net 60 days.

AoHong believes it will have access to sufficient quantities of the coolant products it sells and distributes to meet its needs for the foreseeable future. AoHong has not experienced shortages of raw material in fiscal 2010.

Competition

The market for the sale of liquid coolants in China is very competitive. There are approximately 13 coolant distributors operating within China, of which approximately four or five are large companies and the remaining eight to nine are smaller companies. AoHong’s principal competitors include:

|

Competitors

|

Background

|

|

|

Zhejiang Ju Hua Co., Ltd.

|

Manufacturer for R22, R134a

|

|

|

Shandong Dongyue Chemical Co., Ltd.

|

Manufacturer for R22, R134a

|

|

|

Beijing Jinxing Jiaye Chemical Co., Ltd.

|

Packaging company

|

AoHong believes that it differentiates itself from its competitors through its ability to accommodate a variety of orders in the form of repacking, combining, or distributing products and its warehouse capacity enables AoHong to meet customer demand on short notice.

Discontinuation of Biometrics segment

Beginning in January 2007, our management began seeking a suitable target for a business combination in an effort to increase our revenues. In June 2007, we acquired a 56.08% interest in AoHong. In the fourth quarter of 2008, we decided to discontinue our Biometrics segment which accounted for less than 1% of our consolidated net revenues in 2007. Until our acquisition of AoHong, our Biometrics segment represented all of our operations.

In January 2009, we sold our historical operations related to the Biometrics segment to the Pearl Group Advisors, Inc. pursuant to an asset purchase agreement. Pearl Group Advisors, Inc. was wholly owned by Mr. Dore S. Perler, then a member of our Board of Directors and corporate secretary and our former Chief Executive Officer. The Biometric segment assets that were sold included customer and supplier lists, business records, trademarks and other intellectual property and vendor warranty claims. The consideration received by us in connection with the sale of these assets included the assumption of liabilities, if any, by Pearl Group Advisors, Inc. related to the Biometrics segment and the termination of Mr. Perler’s May 1, 2007 employment agreement with us. In 2009, the Biometric segment is reported on our financial statements as a discontinued operation and prior periods have been restated in our financial statements and related footnotes to conform to this presentation.

Intellectual Property

We do not claim any intellectual property rights with respect to the name AoHong. We have obtained the rights to the domain names www.chinaamericaholdings.com, www.china-aohong.com and www.caah.us. As with telephone numbers, we do not have and cannot acquire any property rights in an Internet address. We do not expect to lose the ability to use these Internet addresses; however, there can be no assurance in this regard and the loss of either of these addresses could materially adversely affect our future business financial condition and results of operations.

- 3 -

Government Regulations

AoHong’s operations must conform to the Industrial Chemical Control Law (ICCL) of the People’s Republic of China, The Management Regulation of Chemical Industry Environmental Protection and rules for private (non-state owned) companies doing business in China, and Regulations on the Safety Administration of Dangerous Chemicals. We are also subject to registration and inspection by The Ministry of China Chemical Industry with respect to the distribution of chemical products in China. We are licensed by the Shanghai Government for the distribution of chemical products. The applied regulations associated with inspection include the Principles for Gas Cylinder Safety Supervision, Safety Inspection Regulations for Gas Cylinders, and Regulations on Safety Supervision over Special Equipment.

As the Chinese government fills its pledge to gradually phase out ozone depletion containment, we believe that AoHong’s product offerings will be in compliance with the regulations that favor environmentally responsible products. These regulations are issued by the State Ministry of Environmental Protection, National Development and Reform Commission, Ministry of Commerce, General Administration of Customs and the General Administration of Quality Supervision, and Quarantine. In general, we believe AoHong’s operations conform to the Production Safety Law of the People’s Republic of China that specifies the mandatory measures to ensure production safety and emergency management and rescue. We also need to conform to the Labor Law of the People's Republic of China.

AoHong holds various certifications related to its operations, including:

| • |

Environmental Management System ISO14001: 2004 certificate;

|

||

| • |

ISO9001:2000 quality system certificate;

|

||

| • |

OQS Certificate that conforms to ISO/TS 16949 (international quality management certificate for the automotive industry);

|

||

| • |

Gas Cylinder Filling Certificate; and

|

||

| • |

Operating License for Hazardous Chemicals.

|

Doing Business in the PRC

Despite efforts to develop the legal system over the past several decades, including but not limited to legislation dealing with economic matters such as foreign investment, corporate organization and governance, commerce, taxation and trade, the PRC continues to lack a comprehensive system of laws. Further, the laws that do exist in the PRC are often vague, ambiguous and difficult to enforce, which could negatively affect AoHong’s ability to do business in China and compete with other companies in its industry.

As a U.S. company doing business in China, we seek to comply with all PRC laws, rules and regulations and pronouncements, and endeavor to obtain all necessary approvals from applicable PRC regulatory agencies such as the China's State Council, National Development and Reform Commission (“NDRC”), Ministry of Commerce (“MOFCOM”), the State Assets Supervision and Administration Commission (“SASAC”), the State Administration for Taxation, the State Administration for Industry and Commerce (“SAIC”), the China Securities Regulatory Commission (“CSRC”), and the State Administration of Foreign Exchange (“SAFE”).

Employees

At September 30, 2010 we had a total of 62 employees as follows:

|

Management

|

7 | |||

|

Accounting

|

6 | |||

|

Administration

|

11 | |||

|

Warehouse and delivery

|

7 | |||

|

Lab

|

4 | |||

|

Production

|

17 | |||

|

Sales

|

9 | |||

|

Purchase

|

1 | |||

|

Total

|

62 |

We believe that relations with our employees are good. As of September 30, 2010, all of AoHong’s employees were located in China, each full-time employee is a member of a local trade union. Labor relations have remained positive and we have not had any employee strikes or major labor disputes. Unlike trade unions in western countries, trade unions in most parts of China are organizations mobilized jointly by the government and the management of the company.

- 4 -

AoHong is required to contribute a portion of its Chinese employees' total salaries to the Chinese government's social insurance funds, including medical insurance, unemployment insurance and job injuries insurance, and a housing assistance fund, in accordance with relevant regulations. AoHong expects the amount of its contribution to the government's social insurance funds to increase in the future if it expands its workforce and operations.

Consultants

We rely on the services of consultants, some of which are affiliates, to assist us in various areas of our business. In August 2009 we entered into a consulting and management agreement with China Direct Investments, Inc., a subsidiary of China Direct Industries, Inc. The agreement is for a term of 24 months from October 1, 2009 to September 30, 2011. The agreement may be extended for an additional 12 months upon mutual agreement of both parties. We engage the services of the consultant as our representative in the United States. The services provided include but are not limited to general business consulting, management of professional resources, coordination of preparation and filing of public disclosures, assistance in financial management and the implementation of internal controls, investor relations activities and assisting in the implementation of acquisition and divestiture transactions. Under the term of the agreement, we will issue China Direct Investments, Inc. a total of 64,000,000 shares of our common stock. 8,000,000 shares are payable by the end of each quarter ending December 31, March 31, June 30, and September 30, commencing October 1, 2009. The fair value of the shares issued is determined using the average stock price over the quarter the services were earned. This agreement also provides for the payment of discretionary award fees to be paid to the consultant and/or its designees. Upon the mutual agreement of the parties, the fees can be paid either in cash or marketable securities.

Prior to the August 2009 agreement, in April 2009 we had entered into a one year consulting and management agreement with China Direct Investments, Inc, covering the period from January 1, through December 31, 2009. Under the terms of the April 2009 agreement, we were to issue to China Direct Investments, Inc. a total of 20,000,000 shares of our common stock valued at $400,000. Of these shares, 5,000,000 shares are payable at the end of each calendar quarter of 2009. We issued 15,000,000 shares under this agreement through September 30, 2009. This agreement also provided for the payment of discretionary award fees to be paid to the consultant and/or its designees. No discretionary awards were made under this agreement.

Our History and Significant Transactions

We were organized in Idaho on February 5, 1968 under the name Century Silver Mines, Inc. Originally, we developed mining properties, but by 1998 we had ceased those operations. Sense Technologies was organized under the laws of the State of Florida on July 13, 1998. Sense Technologies was formed for the purpose of engaging in developing and marketing biometric devices for use in employee identification and security-related products.

In January 1999, we acquired all of the outstanding shares of Sense Technologies for a purchase price consisting of 4,026,700 of our shares of common stock issued to the former shareholders of Sense Technologies. At the time of the acquisition, Century Silver Mines had no operations and Sense Technologies was developing its proprietary biometric security systems. Immediately following the acquisition, the former shareholders of Sense Technologies owned approximately 93% of our outstanding shares. In June 1999, we changed our corporate domicile from Idaho to Florida and changed our name to Sense Holdings, Inc.

On May 31, 2001, we acquired all of the outstanding shares of Micro Sensor from UTEK Corporation and UT-Battelle LLC, the shareholders of Micro Sensor, in a stock-for-stock exchange, for total consideration of 2,000,000 shares of our common stock. Pursuant to the stock-for stock transfer, UTEK received 1,850,000 shares of our common stock and UT-Battelle LLC received 150,000 shares of our common stock.

On June 27, 2007 we acquired a 56.08% interest in AoHong in exchange for our commitment to contribute $3,380,000. In addition, we issued Mr. Aihua Hu, a member of AoHong’s board and its CEO, 12,500,000 shares of our common stock valued at $1,187,500 as additional consideration. Our commitment to AoHong required us to provide an aggregate of $3,380,000 between September 2007 and June 2009 to the registered capital of AoHong. As of September 30, 2010 we owed $1,780,000 under this commitment to the noncontrolling owners of AoHong, who include Mr. Hu and his wife, Mrs. Ye. Mr. Hu and Mrs. Ye had orally agreed to extend the due date to November 20, 2010. On December 10, 2010 we paid the remaining $1,780,000 to fulfill the outstanding obligation for the registered capital of AoHong using all of the proceeds of the loan from Glodenstone (see “Recent Developments”).

In November 2007, we changed the name of our company to China America Holdings, Inc. to better reflect our business and operations at that time.

- 5 -

On August 31, 2007, we acquired a 60% interest in Big Tree, which together with its subsidiary Jieyang Big Tree, was a development stage company based in China that intended to operate in the toy business. In 2008 we discontinued our Toy Distribution segment and we no longer own any interest in Big Tree or Jieyang Big Tree. We do not intend to pursue any other business opportunities in the toy industry.

In the fourth quarter of 2008, we elected to discontinue our Biometrics segment and in January 2009, we sold our historical operations related to the Biometrics segment to Mr. Perler as described earlier in this section.

Significant Transactions.

On December 9, 2010 Glodenstone advanced to us $1,780,000 in order to allow us to fulfill the remaining portion of our obligation to contribute capital to AoHong as we negotiated the terms of an agreement to sell our 56.08% interest in AoHong to Glodenstone. On December 10, 2010 we made the required payment to AoHong. On December 23, we entered into a Membership Interest Sale Agreement with Glodenstone, Mr. Hu and Ms. Ye to sell our membership interest in AoHong to Glodenstone for aggregate consideration of $3,508,340, payable by cancellation of the $1,780,000 debt we owe Glodenstone and a $1,728,340 promissory note Glodenstone will issue to us at closing. The promissory note issued by Glodenstone will bear interest at the rate of 5% per annum, will be due on December 31, 2011 with accrued interest and will be secured by the membership interest in AoHong which we have agreed to sell to Glodenstone. Also on December 23, 2010 we signed a promissory note agreeing to repay Glodenstone the $1,780,000 it advanced to us on December 9, 2010 (the “Glodenstone Note”). We agreed to pay interest on this obligation at the rate of 5% per annum and the principal balance and accrued interest are due upon the earlier of May 31, 2011 or the closing on the sale of our 56.08% interest in AoHong to Glodenstone. In addition, Mr. Hu will resign all positions with our company upon closing of this transaction which is conditioned upon the approval of our stockholders.

We agreed to file an information statement with the SEC in compliance with applicable U.S. Federal securities laws describing the sale of our interest in AoHong and use our best efforts to respond to any comments from the SEC in order to facilitate shareholder approval as required under the terms of the Membership Interest Sale Agreement and applicable law.

ITEM 1A. RISK FACTORS

An investment in our common stock involves a significant degree of risk. You should not invest in our common stock unless you can afford to lose your entire investment. You should consider carefully the following risk factors and other information in this annual report before deciding to invest in our common stock. If any of the following risks and uncertainties were to develop into actual events, our business, financial condition or results of operations could be materially adversely affected and you could lose your entire investment in our company.

RISKS RELATED TO OUR COMPANY

WE WILL NEED TO RAISE CAPITAL TO SATISFY VARIOUS OBLIGATIONS.

We have approximately $13.9 million of short term obligations coming due during fiscal 2011 and we do not have sufficient capital to pay these obligations, including $8.8 million of debt payable by AoHong to various banks in the PRC and $0.8 million of loans and other amounts payable to China Direct, including a $400,000 promissory note for which the original due date of June 30, 2009 has since been extended, along with all of our other obligations to China Direct, to October 15, 2011, as well as $1.8 million payable under the Glodenstone Note due no later than May 31, 2011. If the sale of AoHong is completed, the $0.8 million payable to China Direct and the $1.8 million Glodenstone Note will continue, and we do not have the financial resources to repay these amounts when they become due. While we expect to receive $1.7 million in December 2011 in connection with the sale of AoHong, if the transaction is completed, we do not have any other sources to provide additional capital and we cannot assure you that funds will be available to us upon terms acceptable to us, if at all. Currently, our only sources of working capital are funds generated from AoHong’s operations and the proceeds from the exercise, if any of our outstanding warrants. There are also no assurances that any of our outstanding warrants will be exercised on a cash basis, if at all. If we do not raise funds as needed, our ability to satisfy our obligations is in jeopardy. In this event, you could lose all of your investment in our company.

- 6 -

WE MAY BE TREATED AS A SHELL CORPORATION AND CURRENTLY DO NOT HAVE PLANS TO ACQUIRE AN OPERATING BUSINESS AND MAY NOT BE ABLE TO IDENTIFY OR FULLY CAPITALIZE ON ANY APPROPRIATE BUSINESS OPPORTUNITIES.

If our stockholders approve the sale of AoHong and we do not acquire another business prior to completion of the transaction, we will not have any operating business. In that case, we will be treated as a shell corporation under Federal securities laws. In addition we would incur operating expenses while we consider a business combination with another operating company. We have not yet identified any appropriate business opportunities, and, due to a variety of factors outside of our control, we may not be able to identify or fully capitalize on any such opportunities. These factors include:

| • |

competition from other potential acquirors and partners of and investors in potential acquisitions, many of whom may have greater financial resources than we do;

|

||

| • |

in specific cases, failure to agree on the terms of a potential acquisition, such as the amount or price of our acquired interest, or incompatibility between us and management of the company we wish to acquire; and

|

||

| • |

the possibility that we may lack sufficient capital and/or expertise to develop promising opportunities.

|

Even if we are able to identify business opportunities that our Board deems appropriate, we cannot assure you that such a strategy will provide you with a positive return on your investment, and may in fact result in a substantial decrease in the value of your stock. In addition, if we enter into a combination with a business that has operating income, we cannot assure you that we will be able to utilize all or even a portion of our existing net operating loss carryover for federal or state tax purposes following such a business combination. If we are unable to make use of our existing net operating loss carryover, the tax advantages of such a combination may be limited, which could negatively impact the price of our stock and the value of your investment. These factors will substantially increase the uncertainty, and thus the risk, of investing in our shares.

OUR SOLE EXECUTIVE OFFICER WHO SERVES AS OUR CHIEF EXECUTIVE OFFICER AND CHIEF FINANCIAL OFFICER DOES NOT HAVE ANY EXPERIENCE WITH U.S. PUBLIC COMPANIES.

In January 2009, we appointed Mr. Shaoyin Wang as our President, Chief Executive Officer and Chief Financial Officer. Mr. Wang is located in China and does not have any experience in managing a U.S. public company. In addition, Mr. Wang is not an accounting professional and does not have any experience in the application of accounting principles generally accepted in the United States of America or the rules and regulations of the SEC. While we believe that Mr. Wang’s professional experience will benefit our current Chinese operations, we cannot assure you that his lack of experience with U.S. public companies will not result in greater professional and consulting expenses as we seek a business combination with another operating company. These activities are expected to increase our reliance on third parties to assist us in meeting our reporting obligations under Federal securities laws which will adversely impact our results of operations in future periods.

RISKS RELATED TO AOHONG

The following risk factors relate to our subsidiary, Shanghai AoHong Chemical Co., Ltd. which we plan to sell upon stockholder approval. If our stockholders approve this sale, the following risk factors will no longer be applicable to our company.

CERTAIN AGREEMENTS TO WHICH WE ARE A PARTY AND WHICH ARE MATERIAL TO OUR OPERATIONS LACK VARIOUS LEGAL PROTECTIONS WHICH ARE CUSTOMARILY CONTAINED IN SIMILAR CONTRACTS PREPARED IN THE UNITED STATES.

Our subsidiaries include AoHong, which was organized under the laws of the PRC and all of its business and operations are conducted in China. We are a party to certain contracts related to those operations. While these contracts contain the basic business terms of the agreements between the parties, these contracts do not contain certain provisions which are customarily contained in similar contracts prepared in the U.S., such as representations and warranties of the parties, confidentiality and non-compete clauses, provisions outlining events of defaults, and termination and jurisdictional clauses. Because these contracts omit these types of clauses, notwithstanding the differences in Chinese and U.S. laws we may not have the same legal protections as we would if the contracts contained these additional provisions. We anticipate that AoHong will likely enter into contracts in the future which will likewise omit these types of legal protections. While we have not been subject to any adverse consequences as a result of the omission of these types of clauses, and we consider the contracts to which we are a party to contain all the material terms of our business arrangements with the other party, future events may occur which lead to a dispute under agreements which could have been avoided if the contracts were prepared in conformity with U.S. standards. Contractual disputes which may arise from this lack of legal protection will divert management's time from the operation of our business and require us to expend funds attempting to settle a possible dispute. This possible diversion of management time will limit the time our management would otherwise devote to the operation of our business, and the diversion of capital could limit the funds we have available to pay our ongoing operating expenses.

- 7 -

AOHONG'S OPERATIONS ARE SUBJECT TO GOVERNMENT REGULATION. IF IT FAILS TO COMPLY WITH THE APPLICABLE REGULATIONS, ITS ABILITY TO OPERATE IN FUTURE PERIODS COULD BE IN JEOPARDY.

AoHong is subject to various state and local regulations related to the distribution of chemicals. It is also licensed by the Shandong Bureau of Quality and Technical Supervision to distribute chemicals. While AoHong is in substantial compliance with all provisions of those registrations, inspections and licenses and has no reason to believe that they will not be renewed as required, any non-renewal by these governmental authorities could result in the cessation of its business activities which would have a material adverse effect on our results of operations in future periods.

COMPLIANCE WITH ENVIRONMENTAL REGULATIONS CAN BE EXPENSIVE, AND NONCOMPLIANCE WITH THESE REGULATIONS MAY RESULT IN ADVERSE PUBLICITY AND POTENTIALLY SIGNIFICANT MONETARY DAMAGES AND FINES.

AoHong’s operations must conform to the Industrial Chemical Control Law (ICCL) of the People’s Republic of China, the Management Regulation of Chemical Industry Environmental Protection and rules for private (non-state owned) companies doing business in China, Regulations on the Safety Administration of Dangerous Chemicals, and it is subject to registration and inspection by The Ministry of China Chemical Industry with respect to the distribution of chemical products in China. AoHong is also required to comply with all national and local regulations regarding protection of the environment. If AoHong fails to comply with present or future environmental regulations, it may be required to pay substantial fines, suspend production or cease operations. AoHong uses, generates and discharges toxic, volatile and otherwise hazardous chemicals and wastes in operations. Any failure by AoHong to control the use of, or to restrict adequately, the discharge of hazardous substances could subject AoHong and our company to potentially significant monetary damages and fines or suspensions in AoHong’s business operations.

AOHONG AND OUR COMPANY DO NOT HAVE VARIOUS BUSINESS INSURANCE COVERAGE WHICH IS COMMONLY CARRIED BY U.S. COMPANIES

The insurance industry in China is still at an early stage of development. Insurance companies in China offer limited business insurance products. AoHong does not have any business liability or disruption insurance coverage. Accordingly, any business disruption or natural disaster may result in our incurring substantial costs and the diversion of our resources which would result in a material adverse impact on its operations in future periods.

RISKS RELATED TO DOING BUSINESS IN CHINA

ALL OF AOHONG’S ASSETS AND ALL OF ITS OPERATIONS ARE LOCATED IN THE PRC AND ARE SUBJECT TO CHANGES RESULTING FROM THE POLITICAL AND ECONOMIC POLICIES OF THE CHINESE GOVERNMENT.

AoHong’s business operations could be restricted by the political environment in the PRC. The PRC has operated as a socialist state since 1949 and is controlled by the Communist Party of China. In recent years, however, the government has introduced reforms aimed at creating a socialist market economy and policies have been implemented to allow business enterprises greater autonomy in their operations. Changes in the political leadership of the PRC may have a significant effect on laws and policies related to the current economic reform programs, other policies affecting business and the general political, economic and social environment in the PRC, including the introduction of measures to control inflation, changes in the rate or method of taxation, the imposition of additional restrictions on currency conversion and remittances abroad, and foreign investment. Moreover, economic reforms and growth in the PRC have been more successful in certain provinces than in others, and the continuation or increases of such disparities could affect the political or social stability of the PRC.

Although we believe that the economic reform and the macroeconomic measures adopted by the Chinese government have had a positive effect on the economic development of China, the future direction of these economic reforms is uncertain and the uncertainty may decrease the attractiveness of our company as an investment, which may in turn result in a decline in the trading price of our common stock.

- 8 -

WE CANNOT ASSURE YOU THAT THE CURRENT CHINESE POLICIES OF ECONOMIC REFORM WILL CONTINUE. BECAUSE OF THIS UNCERTAINTY, THERE ARE SIGNIFICANT ECONOMIC RISKS ASSOCIATED WITH DOING BUSINESS IN CHINA.

Although the majority of productive assets in China are owned by the Chinese government, in the past several years the government has implemented economic reform measures that emphasize decentralization and encourages private economic activity. In keeping with these economic reform policies, the PRC has been openly promoting business development in order to bring more business into the PRC. Because these economic reform measures may be inconsistent or ineffective, there are no assurances that:

| • |

the Chinese government will continue its pursuit of economic reform policies;

|

||

| • |

the economic policies, even if pursued, will be successful;

|

||

| • |

economic policies will not be significantly altered from time to time; or

|

||

| • |

business operations in China will not become subject to the risk of nationalization.

|

We cannot assure you that we will be able to capitalize on these economic reforms, assuming the reforms continue. Because our business model is dependent upon the continued economic reform and growth in China, any change in Chinese government policy could materially adversely affect our ability to continue to implement our business model. China’s economy has experienced significant growth in the past decade, but such growth has been uneven across geographic and economic sectors and has recently been slowing. Even if the Chinese government continues its policies of economic reform, there are no assurances that economic growth in that country will continue or that we will be able to take advantage of these opportunities in a fashion that will provide financial benefit to us.

THE CHINESE GOVERNMENT EXERTS SUBSTANTIAL INFLUENCE OVER THE MANNER IN WHICH AOHONG MUST CONDUCT ITS BUSINESS ACTIVITIES.

The PRC only recently has permitted provincial and local economic autonomy and private economic activities. The government of the PRC has exercised and continues to exercise substantial control over virtually every sector of the Chinese economy through regulation and state ownership. Accordingly, government actions in the future, including any decision not to continue to support recent economic reforms and to return to a more centrally planned economy or regional or local variations in the implementation of economic policies, could have a significant effect on economic conditions in the PRC or particular regions of the PRC, and could require us to divest ourselves of any interest we then hold in our Chinese subsidiaries.

RESTRICTIONS ON CURRENCY EXCHANGE MAY LIMIT OUR ABILITY TO RECEIVE AND USE OUR REVENUES EFFECTIVELY. WE MAY NOT HAVE READY ACCESS TO CASH ON DEPOSIT IN BANKS IN THE PRC.

Because a substantial portion of AoHong’s revenues are in the form of Renminbi (RMB), the main currency used in China, any future restrictions on currency exchanges may limit our ability to use revenue generated in RMB to fund any future business activities outside China or to make dividend or other payments in U.S. Dollars. Although the Chinese government introduced regulations in 1996 to allow greater convertibility of the RMB for current account transactions, significant restrictions still remain, including primarily the restriction that foreign-invested enterprises may only buy, sell or remit foreign currencies, after providing valid commercial documents, at those banks authorized to conduct foreign exchange business. In addition, conversion of RMB for capital account items, including direct investment and loans, is subject to government approval in China, and companies are required to open and maintain separate foreign exchange accounts for capital account items. At September 30, 2010 our PRC subsidiaries had approximately $2.1 million on deposit in banks in China, which represented substantially all of our cash. We cannot be certain that we could have ready access to that cash should we wish to transfer it to bank accounts outside the PRC nor can we be certain that the Chinese regulatory authorities will not impose more stringent restrictions on the convertibility of the RMB, especially with respect to foreign exchange transactions.

WE MAY BE UNABLE TO ENFORCE OUR RIGHTS DUE TO POLICIES REGARDING THE REGULATION OF FOREIGN INVESTMENTS IN CHINA.

The PRC’s legal system is a civil law system based on written statutes in which decided legal cases have little value as precedent, unlike the common law system prevalent in the United States. The PRC does not have a well-developed, consolidated body of laws governing foreign investment enterprises. As a result, the administration of laws and regulations by government agencies may be subject to considerable discretion and variation, and may be subject to influence by external forces unrelated to the legal merits of a particular matter. China’s regulations and policies with respect to foreign investments are evolving. Definitive regulations and policies with respect to such matters as the permissible percentage of foreign investment and permissible rates of equity returns have not yet been published. Statements regarding these evolving policies have been conflicting and any such policies, as administered, are likely to be subject to broad interpretation and discretion and to be modified, perhaps on a case-by-case basis. The uncertainties regarding such regulations and policies present risks which may affect AoHong’s ability to achieve its stated business objectives. If AoHong is unable to enforce any legal rights it may have under its contracts or otherwise, AoHong’s ability to compete with other companies in its industry could be limited which could result in a loss of revenue in future periods which could have a material adverse effect on our business, financial condition and results of operations.

- 9 -

FAILURE TO COMPLY WITH THE UNITED STATES FOREIGN CORRUPT PRACTICES ACT COULD SUBJECT US TO PENALTIES AND OTHER ADVERSE CONSEQUENCES.

We are subject to the United States Foreign Corrupt Practices Act which generally prohibits United States companies from engaging in bribery or other prohibited payments to foreign officials for the purpose of obtaining or retaining business. Corruption, extortion, bribery, pay-offs, theft and other fraudulent practices occur from time-to-time in the PRC. We can make no assurance, however, that our employees or other agents will not engage in such conduct for which we might be held responsible. If our employees or other agents are found to have engaged in such practices, we could suffer severe penalties and other consequences that may have a material adverse effect on our business, financial condition and results of operations.

RISKS RELATED TO OUR COMMON STOCK

THE EXERCISE OF OUTSTANDING WARRANTS AND OPTIONS WILL BE DILUTIVE TO OUR EXISTING SHAREHOLDERS.

At September 30, 2010, we had 176,710,792 shares of our common stock issued and outstanding and the following securities which are convertible or exercisable into shares of our common stock were outstanding:

| • |

60,345,863 shares of our common stock issuable upon the exercise of common stock purchase warrants with exercise prices ranging from $0.04 to $0.50 per share with a weighted average exercise price of $0.083; and

|

||

| • |

8,500,000 shares of our common stock issuable upon exercise of outstanding options with exercise prices ranging from $0.07 to $0.20 with a weighted average exercise price of $0.091.

|

The exercise of these warrants or options may materially adversely affect the market price of our common stock and will have a dilutive effect on our existing shareholders.

WE HAVE NOT VOLUNTARILY IMPLEMENTED VARIOUS CORPORATE GOVERNANCE MEASURES, IN THE ABSENCE OF WHICH, SHAREHOLDERS MAY HAVE MORE LIMITED PROTECTIONS AGAINST INTERESTED DIRECTOR TRANSACTIONS, CONFLICTS OF INTEREST AND SIMILAR MATTERS.

Recent Federal legislation, including the Sarbanes-Oxley Act of 2002, has resulted in the adoption of various corporate governance measures designed to promote the integrity of the corporate management and the securities markets. Some of these measures have been adopted in response to legal requirements. Others have been adopted by companies in response to the requirements of national securities exchanges, such as the NYSE or the Nasdaq Stock Market, on which their securities are listed. Among the corporate governance measures that are required under the rules of national securities exchanges are those that address board of directors' independence, audit committee oversight, and the adoption of a code of ethics. Although we have adopted a Code of Ethics and Business Conduct, we have not yet adopted any of these other corporate governance measures and, since our securities are not yet listed on a national securities exchange, we are not required to do so. We have not adopted corporate governance measures such as an audit or other independent committees of our Board of Directors nor have we adopted a related persons transaction policy. If we expand our board membership in future periods to include independent directors, we may seek to establish an audit and other committees of our Board of Directors. It is possible that if we were to adopt some or all of these corporate governance measures, shareholders would benefit from somewhat greater assurances that internal corporate decisions were being made by disinterested directors and that policies had been implemented to define responsible conduct. Prospective investors should bear in mind our current lack of corporate governance measures in formulating their investment decisions.

BECAUSE OUR STOCK CURRENTLY TRADES BELOW $5.00 PER SHARE, AND IS QUOTED ON THE OTC BULLETIN BOARD, OUR STOCK IS CONSIDERED A "PENNY STOCK" WHICH CAN ADVERSELY AFFECT ITS LIQUIDITY.

As the trading price of our common stock is less than $5.00 per share, our common stock is considered a “penny stock”, and trading in our common stock is subject to the requirements of Rule 15g-9 under the Securities Exchange Act of 1934. Under this rule, broker/dealers who recommend low-priced securities to persons other than established customers and accredited investors must satisfy special sales practice requirements. The broker/dealer must make an individualized written suitability determination for the purchaser and receive the purchaser's written consent prior to the transaction.

- 10 -

SEC regulations also require additional disclosure in connection with any trades involving a "penny stock," including the delivery, prior to any penny stock transaction, of a disclosure schedule explaining the penny stock market and its associated risks. These requirements severely limit the liquidity of securities in the secondary market because few broker/dealers are likely to undertake these compliance activities. In addition to the applicability of the penny stock rules, other risks associated with trading in penny stocks could also be price fluctuations and the lack of a liquid market.

ITEM 1B. UNRESOLVED STAFF COMMENTS.

Not applicable to a smaller reporting company.

ITEM 2. PROPERTIES.

Our principal offices are located in the Huating Economic & Development Area, Jiading District, Shanghai. We own a 218,000 square foot facility which includes 98,100 square feet of workshop and office space, 33,790 square feet of warehouse space and 115.7 cubic meters of storage tanks. This facility is owned by AoHong.

Land use rights in China emanate from an agreement with the Chinese government. The land use rights are valued at approximately $87,763 (RMB 600,082). Under the terms of the land use rights agreement, AoHong has these rights to use land until November 3, 2053.

In February 2009, AoHong Tianjin obtained the land use right for approximately 253,350 square feet of land located in Ji County Economic Development Park for approximately $751,394 which will be the location of a new production base and distribution facility for AoHong Tianjin. Under the terms of the land use rights agreement, AoHong Tianjin has these rights until February 22, 2059.

Through its acquisition of Guangzhou AoHong in August 2010, AoHong acquired land use rights for an 8.1 acre parcel of land located in Aotou, Conghua City, China for approximately $1,752,212. Aotou is located approximately 50 kilometers northwest of Guangzhou, China. Guangzhou AoHong plans to construct a 20,000 metric ton capacity repackaging, mixing and distribution facility on this land. In August 2010, AoHong purchased 3,391 square feet of office space and a proportionate share of the land use rights associated with that space in Shanghai, China from Shanghai Zhongye Xiangteng Investment Co., Ltd., an unrelated party for approximately $1.2 million. Prior to our agreement to sell our interest in AoHong, we had planned to move our corporate headquarters to this office. We have not determined where we will locate our corporate headquarters after completion of the sale of our interest in AoHong.

Upon the completion of the proposed sale of our interest in AoHong we will no longer own or have any rights to any of the aforementioned properties.

ITEM 3. LEGAL PROCEEDINGS.

We are not a party to any pending legal proceedings and, to our knowledge, none of our officers, directors or principal shareholders are party to any legal proceeding in which they have an interest adverse to us.

ITEM 4. (REMOVED AND RESERVED).

- 11 -

PART II

ITEM 5. MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Our common stock is quoted on the OTCBB under the symbol CAAH. The reported high and low sales prices for the common stock as reported on the OTCBB are shown below for the periods indicated. The quotations reflect inter-dealer prices, without retail mark-up, markdown or commission, and may not represent actual transactions.

|

High

|

Low

|

||||||

|

2009

|

|||||||

|

First quarter ended March 31, 2009

|

$

|

0.04

|

$

|

0.01

|

|||

|

Second quarter ended June 30, 2009

|

0.03

|

0.01

|

|||||

|

Nine months transition period ended September 30, 2009

|

0.02

|

0.01

|

|||||

|

2010

|

|||||||

|

First quarter ended December 31, 2009

|

$

|

0.03

|

$

|

0.01

|

|||

|

Second quarter ended March 31, 2010

|

0.03

|

0.01

|

|||||

|

Third quarter ended June 30, 2010

|

0.04

|

0.02

|

|||||

|

Fourth quarter ended September 30, 2010

|

0.03

|

0.01

|

|||||

On December 15, 2010, the last sale price of our common stock as reported on the OTCBB was $0.0132. As of December 15, 2010, there were approximately 879 record owners of our common stock. The number of record holders does not include beneficial owners of common stock whose shares are held in the names of banks, brokers, nominees or other fiduciaries.

Dividend Policy

We have never paid cash dividends on our common stock. Payment of dividends will be within the sole discretion of our Board of Directors and will depend, among other factors, upon our earnings, capital requirements and our operating and financial condition. In addition, under Florida law we may declare and pay dividends on our capital stock either out of our surplus, as defined in the relevant Florida statutes, or if there is no such surplus, out of our net profits for the fiscal year in which the dividend is declared and/or the preceding fiscal year. If, however, the capital of our company, computed in accordance with the relevant Florida statutes, has been diminished by depreciation in the value of our property, or by losses, or otherwise to an amount less than the aggregate amount of the capital represented by the issued and outstanding stock of all classes having a preference upon the distribution of assets, we are prohibited from declaring and paying out of such net profits any dividends upon any shares of our capital stock until the deficiency in the amount of capital represented by the issued and outstanding stock of all classes having a preference upon the distribution of assets shall have been repaired.

Recent Sales of Unregistered Securities

On August 18, 2010 we issued 8,000,000 shares of our common stock valued at $68,000 to China Direct for consulting services it performed during our third quarter of fiscal 2010 in connection with our August 2009 management and consulting agreement with them. On October 14, 2010 we issued 8,000,000 shares of our common stock to China Direct valued at approximately $176,000 for consulting services it performed during our fourth quarter of fiscal 2010 in connection with this agreement.

Each issuance of our common stock described in this Item 2 was exempt from registration under the Securities Act of 1933, as amended in reliance on an exemption provided by Section 4(2) of that act. China Direct was an accredited or otherwise sophisticated investor who had such knowledge and experience in business matters and was capable of evaluating the merits and risks of the prospective investment in our securities. In addition, China Direct had access to business and financial information concerning our company.

ITEM 6. SELECTED FINANCIAL DATA.

Not applicable to a smaller reporting company.

- 12 -

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATION.

Change in Fiscal Year End

Effective September 7, 2009, we changed our fiscal year end from December 31 to September 30. We have defined various periods that are covered in this report as follows:

| • |

“fiscal 2010” — October 1, 2009 through September 30, 2010.

|

||

| • |

“twelve months ended September 30, 2009” - October 1, 2008 through September 30, 2009

|

||

| • |

“2009 transition period” — the nine month period from January 1, 2009 through September 30, 2009.

|

||

| • |

“fiscal 2008” — January 1, 2008 through December 31, 2008.

|

As a result of the change in our fiscal year end, we are comparing our audited results of operations for the fiscal year ended September 30, 2010 to the unaudited twelve month period ended September 30, 2009. Our transition period for the fiscal year ended September 30, 2009 covered a period of nine months. We believe that a comparison of 12 month periods enhances a reader’s understanding of our results of operations.

OVERVIEW OF OUR PERFORMANCE AND OPERATIONS

Recent Developments

On December 9, 2010 Glodenstone Development Limited, a British Virgin Islands company (“Glodenstone”), advanced to us $1,780,000 in order to allow us to fulfill the remaining portion of our obligation to contribute capital to AoHong in connection with our negotiating the terms of an agreement to sell our 56.08% interest in AoHong to Glodenstone. On December 10, 2010 we made the required payment to AoHong. On December 23, 2010 we entered into a Membership Interest Sale Agreement with Glodenstone, Mr. Aihua Hu and Ying Ye, to sell our 56.08% membership interest in AoHong to Glodenstone for $3,508,340. The purchase price is payable by cancellation of the $1,780,000 debt we owe Glodenstone and a $1,728,340 promissory note Glodenstone will issue to us at closing. Completion of this transaction is subject to stockholder approval. See Business – Our History – Significant Transactions.

Our board of directors determined it was in our best interests to sell our interest in AoHong because of the difficulties in securing not only the capital to fund our remaining capital contribution obligations to AoHong, but additional capital necessary to properly finance its operations. The sale of our interest in AoHong will constitute a sale of all or substantially all of our assets and all of our business operations, including the revenues and expenses associated with the operation of AoHong. Consequently, if we do not acquire another business prior to completion of the sale, we will be treated as a shell corporation under Federal securities laws. We expect that we will then seek a business combination with an operating entity which, while wishing to avail itself of the benefits of being a U.S. public company, does not require the immediate level of capital AoHong requires.

If our stockholders approve the sale of our interest in AoHong to Glodenstone, AoHong’s operations will no longer be part of our business. The following discussion relates to AoHong’s operations and is applicable to our company so long as we own a controlling interest in AoHong.

AoHong’s Business

All of our operations are conducted through and revenues are generated by our AoHong subsidiary, which sells and distributes assorted chemicals in China. Substantially all of AoHong’s revenues are generated through the sale and distribution of Freon-based liquid coolants. While AoHong’s products can be employed in a variety of applications, we primarily sell and distribute refrigerants for use in air conditioning systems. We also sell and distribute chemical products used in chemical and pharmaceutical industries for the applications of fire extinguishing agents, aerosol sprays, insecticides, and tetrahydrothiophene (“THT”).

AoHong’s main product group is liquid coolants which are employed primarily as refrigerants in air conditioning systems. AoHong's operations are comprised of two basic functions:

| • |

Single Freon-based chemical products, which are distributed either in bulk quantities or in smaller packages.

|

||

| • |

Multiple Freon-based chemical products, which are custom mixed of various raw materials at our facilities in accordance with customer specifications and distributed either in bulk quantities or in smaller packages.

|

- 13 -

AoHong’s customers include manufacturers and retailers of air conditioning systems, refrigerators, automobiles, coolants, pharmaceuticals and chemicals. In fiscal 2010, approximately 88% of its net revenues were from the sale of single-freon based refrigerants, 10% were from the sale of multiple-freon based refrigerants and approximately 2% were from the sale of non-refrigerant chemical compounds. Approximately 67% of AoHong’s products are utilized domestically while the balance is typically exported.

AoHong distributes products within China to 16 provinces and districts including Liaoning, Jilin, Beijing, Xinjiang, Shangxi, Chongqing, Sichuan, Jiangsu, Zhejiang, Anhui, Guangdong, Hainan, Hong Kong and Taiwan. AoHong exports to countries in Southeast Asia, Africa, Europe, Australia such as Spain, South Africa, Australia, Russia and Thailand. In November 2008, AoHong created AoHong Tianjin to expand its distribution channels to the Beijing region. In July 2010, AoHong acquired a 100% interest in Guanzghou AoHong to expand its production base and distribution channels in the Guangdong province and neighboring regions in southeastern China.

Discontinued Operations

In 2008 we discontinued our Biometrics segment, which represented less than 1% of our consolidated revenues. In January 2009 we sold our historical operations related to the Biometrics segment to our former CEO and AoHong’s operations now represent all of our business and operations.

Our Performance

Our net revenues in fiscal 2010 totaled $51.0 million, an increase of $20.2 million, or 65.6%, compared to the twelve months ended September 30, 2009. Our gross profit increased to $4.1 million in fiscal 2010 from $2.1 million in the twelve months ended September 30, 2009. Our income from continuing operations for fiscal 2010 was $1.0 million, compared to a loss from continuing operations of $0.6 million for the twelve months ended September 30, 2009. Our fiscal 2010 net income of $0.4 million is comprised of $1.4 million of income associated with AoHong, of which we own 56%, and $1.0 million of expenses associated with the U.S. corporate activities of China America. As a result, we have a net loss attributable to China America Holdings, Inc. of $0.2 million in fiscal 2010, compared to $0.9 million for the twelve months ended September 30, 2009.

Our Outlook

If our stockholders approve the sale of AoHong and we do not acquire another business prior to completion of the transaction, we will not have any operating business. We have not yet identified any appropriate business opportunities, and, due to a variety of factors outside of our control, we may not be able to identify or fully capitalize on any such opportunities. We expect, however, that we will seek a business combination with an operating entity wishing to avail itself of the benefits of being a U.S. public company that does not require the immediate level of capital AoHong requires.

- 14 -

RESULTS OF OPERATIONS

Year ended September 30, 2010 compared to Twelve Months ended September 30, 2009 (unaudited)

The following table summarizes our results from continuing operations for fiscal 2010, the twelve months ended September 30, 2009 and the 2009 transition period. The percentages represent each line item as a percentage of revenues.

|

For the Twelve Months Ended September 30,

|

For the Nine Months Ended

|

|||||||||||||||||||||||

|

2010

|

2009

|

September 30, 2009

|

||||||||||||||||||||||

|

(unaudited)

|

||||||||||||||||||||||||

|

Net revenues

|

$ | 50,972,109 | 100.0 | % | $ | 30,781,461 | 100.0 | % | $ | 22,883,725 | 100.0 | % | ||||||||||||

|

Cost of sales

|

46,835,813 | 91.9 | % | 28,640,287 | 93.0 | % | 20,967,658 | 91.6 | % | |||||||||||||||

|

Gross profit

|

4,136,296 | 8.1 | % | 2,141,174 | 7.0 | % | 1,916,067 | 8.4 | % | |||||||||||||||

|

Total operating expenses

|

3,085,398 | 6.1 | % | 2,452,300 | 8.0 | % | 2,098,840 | 9.2 | % | |||||||||||||||

|

Other expenses

|

(24,321 | ) | 0.0 | % | (324,306 | ) | (5,164 | ) | ||||||||||||||||

|

Income (loss) from continuing operations before

|

||||||||||||||||||||||||

|

taxes and noncontrolling interest

|

1,026,577 | 2.0 | % | (635,432 | ) | -2.1 | % | (187,937 | ) | -0.8 | % | |||||||||||||

|

Loss from discontinued operations

|

- | (168,685 | ) | (75,375 | ) | |||||||||||||||||||

|

Loss before income taxes and

|

||||||||||||||||||||||||

|

noncontrolling interest

|

1,026,577 | 2.0 | % | (804,117 | ) | -2.6 | % | (263,312 | ) | -1.2 | % | |||||||||||||

|

Provision for income taxes

|

(594,859 | ) | -1.2 | % | (84,271 | ) | -0.3 | % | (98,739 | ) | -0.4 | % | ||||||||||||

|

Net income (loss)

|

431,718 | 0.8 | % | (888,388 | ) | -2.9 | % | (362,051 | ) | -1.6 | % | |||||||||||||

|

Less: income attributable to noncontrolling interest

|

(634,084 | ) | -1.2 | % | (27,543 | ) | -0.1 | % | (91,768 | ) | -0.4 | % | ||||||||||||

|

Net loss attributable to China America Holdings, Inc.

|

(202,366 | ) | -0.4 | % | (915,931 | ) | -3.0 | % | (453,819 | ) | -2.0 | % | ||||||||||||

Net revenues in fiscal 2010 increased by 65.6% as compared to the twelve months ended September 30, 2009. The increase was largely due to higher selling prices, particularly on the R22 refrigerant, which represented approximately 46% of our fiscal 2010 revenues. Our overall average selling price per metric ton increased by approximately $841, or 52%, and we had an increase in unit sales of 9%, from 19,021 metric tons in the twelve months ended September 30, 2009 to 20,780 metric tons in fiscal 2010.

Cost of sales includes the cost of raw materials, and applied manufacturing overhead for repackaging and custom mixing. Our cost of sales for fiscal 2010 increased $18.2 million, or 63.5%, compared to the twelve months ended September 30, 2009. Approximately $15.6 million of this increase is attributable to the increase in our average cost per metric ton of approximately $748, with the remainder being the result of the increased sales volume. As the increase in our average selling price per unit exceeded the increase in our average unit cost, our gross profit margin improved to 8.1% in fiscal 2010 from 7.0% in the twelve months ended September 30, 2009. Our cost of sales was adversely impacted by a one-time disruption of shipments of supplies during the third fiscal quarter due to severe flooding in the upper Yangtze delta region, resulting in an 81% increase in the cost of the R22 refrigerant, a 56% increase in the cost of R134, and a 5.0% increase in manufacturing costs and applied overhead during the third quarter.

- 15 -

Total operating expenses increased by 25.8% during fiscal 2010 as compared to the twelve months ended September 30, 2009. Included in this change are the following:

| • |

Selling expenses, which primarily consist of shipping and freight charges, salesperson compensation and travel expenses, increased by $0.2 million, or 24.5%, mainly due to the increase in sales volume and an increase in shipping expenses associated with the opening of our Tianjin facility. As a percentage of revenues, selling expenses decreased from 2.7% of revenues for the twelve months ended September 30, 2009 to 2.1% in fiscal 2010.

|

||

| • |