Attached files

| file | filename |

|---|---|

| EX-14.1 - CODE OF ETHICS - TRIMEX EXPLORATION INC. | exhibit14-1.htm |

| EX-32.2 - CFO SECTION 906 CERTIFICATIONS - TRIMEX EXPLORATION INC. | exhibit32-2.htm |

| EX-31.2 - CFO SECTION 302 CERTIFICATION - TRIMEX EXPLORATION INC. | exhibit31-2.htm |

| EX-32.1 - CEO SECTION 906 CERTIFICATIONS - TRIMEX EXPLORATION INC. | exhibit32-1.htm |

| EX-31.1 - CEO SECTION 302 CERTIFICATION - TRIMEX EXPLORATION INC. | exhibit31-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.

20549

FORM 10-K

(Mark One)

[ x ] ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended June 30, 2009

[ ] TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ______________ to ________________

Commission file number 333-153641

TRIMEX EXPLORATION

INC.

(Exact name of registrant as specified in its

charter)

| Nevada | N/A |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| 2200 – 1177 West Hastings Street, Vancouver, British | |

| Columbia Canada | V6E 2K3 |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code 604.647.0630

Securities registered under Section 12(b) of the Act:

| None | N/A |

| Title of each class | Name of each exchange on which registered |

Securities registered under Section 12(g) of the Act:

None

(Title of

class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [ x ]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes [ ] No [ x ]

Indicate by check mark whether the registrant (1) has filed all

reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the

registrant was required to file such reports), and (2) has been subject to such

filing requirements for the past 90 days.

Yes [ x ] No [ ]

Indicate by check mark whether the registrant has submitted

electronically and posted on its corporate Web site, if any, every Interactive

Data File required to be submitted and posted pursuant to Rule 405 of Regulation

S-T (§232.405 of this chapter) during the preceding 12 months (or for such

shorter period that the registrant was required to submit and post such

files).

Yes [ ] No [ ]

Indicate by check mark if disclosure of delinquent filers

pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not

contained herein, and will not be contained, to the best of registrant’s

knowledge, in definitive proxy or information statements incorporated by

reference in Part III of this Form 10-K or any amendment to this Form 10-K.

[

x ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer [ ] | Accelerated filer [ ] |

| Non-accelerated filer [ ] | Smaller reporting company [ x ] |

Indicate by check mark whether the registrant is a shell company

(as defined in Rule 12b-2 of the Act).

Yes [ x ] No [ ]

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter: $150,000 based on a price of $0.10, being the price per share of the last private placement of the issuer on July 16, 2008.

APPLICABLE ONLY TO REGISTRANTS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS:

Indicate by check mark whether the registrant has filed all

documents and reports required to be filed by Section 12, 13 or 15(d) of the

Securities Exchange Act of 1934 subsequent to the distribution of securities

under a plan confirmed by a court.

Yes [ ] No [ ]

(Not

Applicable)

(APPLICABLE ONLY TO CORPORATE REGISTRANTS)

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date. 450,000 shares of common stock as of December 22, 2010.

DOCUMENTS INCORPORATED BY REFERENCE

List hereunder the following documents if incorporated by reference and the Part of the Form 10-K (e.g., Part I, Part II, etc.) into which the document is incorporated: (1) any annual report to security holders; (2) any proxy or information statement; and (3) any prospectus filed pursuant to Rule 424(b) or (c) of the Securities Act of 1933. The listed documents should be clearly described for identification purposes (e.g., annual report to security holders for fiscal year ended December 24, 1980). Not Applicable

-2-

PART I

Forward-Looking Statements.

This annual report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements relate to future events or our future financial performance. In some cases, you can identify forward-looking statements by terminology such as “may”, “should”, “expects”, “plans”, “anticipates”, “believes”, “estimates”, “predicts”, “potential” or “continue” or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks in the section entitled “Risk Factors” and the risks set out below, any of which may cause our or our industry’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. These risks include, by way of example and not in limitation:

- risks and uncertainties relating to the interpretation of drill results, the geology, grade and continuity of mineral deposits;

- results of initial feasibility, pre-feasibility and feasibility studies, and the possibility that future exploration, development or mining results will not be consistent with our expectations;

- mining and development risks, including risks related to accidents, equipment breakdowns, labour disputes or other unanticipated difficulties;

- the potential for delays in the completion of feasibility studies;

- risks related to the inherent uncertainty of cost estimates and the potential for unexpected costs and expenses;

- risks related to commodity price fluctuations;

- the uncertainty of profitability based upon our history of losses;

- risks related to failure to obtain adequate financing on a timely basis and on acceptable terms for our planned exploration projects;

- risks related to environmental regulation and liability;

- risks related to tax assessments;

- political and regulatory risks associated with mining development and exploration; and

- other risks and uncertainties related to our prospects, properties and business strategy.

This list is not an exhaustive list of the factors that may affect any of our forward-looking statements. These and other factors should be considered carefully and readers should not place undue reliance on our forward-looking statements.

Forward-looking statements are made based on management’s beliefs, estimates and opinions on the date the statements are made and we undertake no obligation to update forward-looking statements if these beliefs, estimates and opinions or other circumstances should change. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

Our financial statements are stated in United States dollars (US$) and are prepared in accordance with United States Generally Accepted Accounting Principles.

In this annual report, unless otherwise specified, all dollar amounts are expressed in United States dollars and all references to “common stock” refer to the common shares in our capital stock.

As used in this annual report, the terms “we”, “us”, “our”, the “Company” and “Trimex” mean Trimex Exploration Inc. and its subsidiaries, unless the context clearly requires otherwise.

-3-

ITEM 1. BUSINESS

General

We are an exploration stage company engaged in the acquisition and exploration of mineral properties. We were incorporated in the state of Nevada on January 16, 2008. On June 2, 2008, we acquired a 100% interest in a mining concession that we refer to as the Venado property. The Venado property is located in the municipality of Sinaloa, state of Sinaloa and is described in detail under the heading “Properties — The Venado Property”. Exploration of this mining concession is required before a final determination as to its viability can be made. On May 1, 2008, we incorporated our wholly owned subsidiary, Trimex Exploracion, S.A. de C.V. in Mexico in order to hold our property in Mexico.

Recent Corporate Developments

Since our Form 10-Q filed on May 20, 2009 for the interim period ended March 31, 2009, being our last annual or quarterly report filed with the Securities and Exchange Commission, we experienced the following significant events.

| 1. |

We received a technical report (the “Technical Report”) dated July 21, 2009 from our consulting geologist, respecting the Venado property. Pursuant to the Report, our geological consultant recommended that we undertake the next phase of exploration at the Venado property, as described in detail under the heading “Properties — The Venado Property — Planned Exploration Program”. | |

| 2. |

On September 1, 2009, we dismissed Moore and Associates, Chartered Accountants and Advisers (“Moore”), as our independent principal accountant upon being informed that the Public Company Accounting Oversight Board (“PCAOB”) had revoked the registration of Moore. Effective October 25, 2009, we engaged the accounting firm of Saturna Group Chartered Accountants LLP, as our new independent principal accountant. See “Changes in and Disagreements with Accountants on Accounting and Financial Disclosure”. | |

| 3. |

Pursuant to the recommendations of the Technical Report, during the year ended June 30, 2009 we reduced the size of our claim to the Venado property by abandoning approximately 15 square kilometers of our claim. We reduced the size of our claim to decrease the ongoing costs including foreign tax expenses of carrying a large property. See “Properties — The Venado Property — Property Description and Ownership Interest ”. | |

| 4. |

Subject to obtaining additional financing, we intend to conduct a two phase exploration program for the Venado property. We intend to conduct the first phase of our exploration program when we receive additional financing. We estimate that the first phase will cost $23,000 and consists of an intense program of mapping and prospecting through the property. If the results of the first phase of our exploration program warrant the continuation into the second phase of the program, we intend to conduct the second phase of the program consisting of detailed geophysical surveying. We estimate that the second phase will cost $65,000. We estimate that the cost for reporting on the results of these two phases will be approximately $10,000. Our planned exploration program is described in detail under the heading “Properties — The Venado Property — Planned Exploration Program”. | |

| 5. |

Effective August 27, 2010, our shareholders approved a 10 for 1 reverse split of issued and outstanding common stock of our company, following which our issued and outstanding common stock decreased from 4,500,000 to 450,000. |

-4-

Our Current Business

Overview

We commenced our planned exploration program during the quarter ended December 31, 2008. Our consulting geologist, visited the Venado Property on December 10, 2008 in order to properly plan the first phase of the upcoming field program. Our plan of operation is to carry out exploration work on our Venado property in order to ascertain whether it possesses commercially exploitable quantities of gold, silver, and other metals. We intend to primarily explore for gold and silver, but if we discover that our mineral property holds potential for other minerals that our management determines are worth exploring further, then we intend to explore for those other minerals. We will not be able to determine whether or not the Venado property contains a commercially exploitable mineral deposit, or reserve, until appropriate exploratory work is done and an economic evaluation based on that work indicates economic viability.

Exploration Stage Company

We are an exploration stage company. We are considered an exploration stage company as we are involved in the examination and investigation of a mineral property that we believe may contain valuable minerals, for the purpose of discovering the presence of ore, if any, and its extent. Since we are an exploration stage company, there is no assurance that a commercially viable mineral deposit exists on our property, and a great deal of further exploration is required before a final evaluation as to the economic and legal feasibility of developing the Venado property is determined. We have no known reserves of any type of mineral. To date, we have not discovered an economically viable mineral deposit on the mineral property, and there is no assurance that we will discover one.

Acquisition of the Venado Property

On June 2, 2008, we entered into a cession mining rights agreement with Minera Canvista, S.A. de C.V., through our Mexican subsidiary, Trimex Exploracion, S.A. de C.V. Pursuant to the cession mining rights agreement, we acquired a 100% interest in a mining concession known as the Venado property in consideration for the sum of $20,000. Pursuant to the cession mining rights agreement, Minera Canvista, S.A. de C.V. also renounced any right to collect royalties for any production proceeds in the event that we proceed to the production stage on the Venado property. We selected the Venado property based on our review of historical exploration reports on the property and our management’s determination that the property contains potential mineralization.

Planned Exploration Program

Mineral property exploration is typically conducted in phases. Each subsequent phase of exploration work is recommended by a geologist based on the results from the most recent phase of exploration. We have not yet commenced the initial phase of exploration on our property. Once we complete each phase of exploration, we will make a decision as to whether or not we proceed with each successive phase based upon the analysis of the results of that program. Our management will make these decisions based upon the recommendations of the independent geologist who oversees the program and records the results.

We intend to conduct a two phase exploration program for the Venado property. We intend to conduct the first phase of our exploration program when we receive additional financing. We estimate that the first phase will cost $23,000 and consists of an intense program of mapping and prospecting through the property. If the results of the first phase of our exploration program warrant the continuation into the second phase of the program, we intend to conduct the second phase of the program consisting of detailed geophysical surveying. We estimate that the second phase will cost $65,000. We estimate that the cost for reporting on the results of these two phases will be approximately $10,000. Our planned exploration program is described in detail under the heading “Properties —The Venado Property — Planned Exploration Program”.

The existence of commercially exploitable mineral deposits in the Venado property is unknown at the present time and we will not be able to ascertain such information until we receive and evaluate the results of our exploration program.

-5-

Competition

We are a new junior mineral resource exploration company. We were incorporated on January 16, 2008 and our operations are not well-established. We compete with other mineral resource exploration companies for financing and for the acquisition of new mineral properties. Many of the mineral resource exploration companies with whom we compete have greater financial and technical resources than those available to us. Accordingly, these competitors may be able to spend greater amounts on acquisitions of mineral properties of merit, on exploration of their mineral properties and on development of their mineral properties. In addition, they may be able to afford more geological expertise in the targeting and exploration of mineral properties. This competition could result in competitors having mineral properties of greater quality and interest to prospective investors who may finance additional exploration and development. This competition could adversely impact on our ability to achieve the financing necessary for us to conduct further exploration of our mineral properties.

We will also compete with other junior mineral resource exploration companies for financing from a limited number of investors that are prepared to make investments in junior mineral resource exploration companies. The presence of competing junior mineral resource exploration companies may impact on our ability to raise additional capital in order to fund our exploration programs if investors are of the view that investments in competitors are more attractive based on the merit of the mineral properties under investigation and the price of the investment offered to investors.

We also compete with other junior and senior mineral resource exploration companies for available resources, including, but not limited to, professional geologists, camp staff, helicopter or float planes, mineral exploration supplies and drill rigs.

Governmental Regulations

In Mexico, mineral resources belong to the Mexican nation and all mining activity requires a concession from the federal government. A concession is granted over free land, pursuant to the first in time, first right principle, which establishes that the first person to request a concession over a portion of land will have the right to the same, provided all other requirements under the Mining Law of Mexico and its associated regulations are met.

A concession owner can perform:

-

exploration works on the ground to identify mineral deposits and quantifying and evaluating economically viable reserves and accordingly perform work to develop areas containing mineral deposits; and

-

exploitation works to detach and extract minerals from such deposits.

Only Mexican nationals or legal entities incorporated under Mexican law may hold concessions, although there are no restrictions on foreign ownership of such entities. Mining concessions are granted for 50 years, and can be renewed for another 50 years. The main obligations to keep them are the semi-annual payment of mining duties (taxes), based on the surface area of the concession, and the performance of work in the areas covered by the concessions, which is evidenced by minimum expenditures or by the production of ore.

In connection with mining and exploration activities in the Venado property, we are subject to extensive Mexican federal, state and local laws and regulations governing the protection of the environment, including laws and regulations relating to protection of air and water quality, hazardous waste management and mine reclamation as well as the protection of endangered or threatened species.

Currently, we are not required to submit any environmental impact statement to the Mexican government for our proposed two phase exploration program on the Venado property because exploration activities such as mapping and sampling do not require the preparation of the environmental impact statement. However, if, after we conduct our two phase exploration program on the Venado property, we decided to conduct a full drilling program, we will have to prepare the environmental impact statement to be submitted to the Mexican government, which will describe the anticipated environmental impact of our planned drilling program, as well as outlining our planned actions to minimize any potential environmental damage. Studies required to support the environmental impact statement include a detailed analysis of the area, among others: soil, water, vegetation, wildlife, cultural resources and socioeconomic impacts.

-6-

In reviewing the environmental impact statement, the Mexican government looks at potential impact on national Mexican environment, as well as reviewing for local concerns such as proximity to water supplies or potential interference with local farms. The Mexican government has ten days to respond after we file the environmental impact statement, and if it does not respond, authorization is deemed to have been granted. If the Mexican government does respond, then the time within which authorization will be granted can be increased to six to twelve months or longer. It is also possible that no authorization will be granted if the Mexican government is not satisfied that appropriate measure will be taken to protect the environment.

Employees

As of the date of this annual report, we have no employees other than our directors and officers. We retained a consulting geologist and intend to retain further consultants on a contract basis to conduct the work program on our mineral property in order to carry out our plan of operations.

On January 17, 2008, we entered into a consulting services agreement with Ezra Jimenez, a Mexican lawyer. Pursuant to the agreement, Mr. Jimenez has provided us with advisory services with respect to issues arising for incorporation of our subsidiary in Mexico as well as legal and business affairs related with mining issues. We pay Mr. Jimenez an hourly fee of CDN$150 plus goods and services tax and all reasonable disbursements or expenses.

On June 1, 2008, we entered into a contract for consulting services with Foremost Geological Consulting. Pursuant to the agreement, Foremost Geological Consulting has provided us with services such as planning, coordinating and performing exploration work on our property and compiling and reviewing geological, geochemical and geophysical data on our property. We pay Foremost Geological Consulting $500 per day and goods and services tax and all reasonable out-of-pocket expenses.

Intellectual Property

We do not own, either legally or beneficially, any patents or trademarks.

ITEM 1A. RISK FACTORS

Our common shares are considered speculative. Prospective investors should consider carefully the risk factors set out below.

Risks Associated with our Financial Condition

If we do not obtain additional financing, our business will fail.

As of September 30, 2010, we had cash in the amount of $18,278.82. We require additional financing in order to commence the first phase of our exploration program of the Venado property. If our exploration programs are successful in discovering reserves of mineral resources, we will require significant additional funds in order to develop the Venado property. We currently do not have any arrangements for financing and we may not be able to obtain financing when required. Obtaining additional financing would be subject to a number of factors, including the market prices for gold, silver, and other metallic minerals and the costs of exploring for or commercial production of these materials. These factors may make the timing, amount, terms or conditions of additional financing unavailable to us.

-7-

Because we have incurred a net loss of $137,055 since our inception on January 16, 2008 through June 30, 2009 and do not have any revenues, our independent auditors believe there is substantial doubt about our ability to continue as a going concern.

We have incurred a net loss of $137,055 since our inception on January 16, 2008 through June 30, 2009 and have no revenues to date. Our future is dependent upon our ability to obtain financing and upon future profitable operations from the commercial exploitation of an interest in a mineral property. Our independent auditors have issued a going concern opinion and have raised substantial doubt about our continuance as a going concern. When an auditor issues a going concern opinion, the auditor has substantial doubt that the company will continue to operate indefinitely and not go out of business and liquidate its assets. This is a significant risk to investors who purchase shares of our common stock because there is an increased risk that we may not be able to generate and/or raise enough resources to remain operational for an indefinite period of time. Potential investors should also be aware of the difficulties normally encountered by new mineral resource exploration companies and the high rate of failure of such enterprises. The independent auditors’ going concern opinion may inhibit our ability to raise financing because we may not remain operational for an indefinite period of time resulting in potential investors failing to receive any return on their investment.

Risks Associated with our Company

Because we have only recently commenced business operations, we face a high risk of business failure and this could result in a total loss of your investment.

The only exploration of the Venado property we have conducted is the completion of a technical report and thus we have no way to evaluate the likelihood whether we will be able to operate our business successfully. We were incorporated on January 16, 2008, and to date have been involved primarily in organizational activities, evaluating resource projects and acquiring a mineral property. We have not earned any revenues and have not achieved profitability as of the date of this annual report. Potential investors should be aware of the difficulties normally encountered by new mineral resource exploration companies and the high rate of failure of such enterprises. The likelihood of success must be considered in light of the problems, expenses, difficulties, complications and delays encountered in connection with the exploration of the Venado properties. These potential problems include, but are not limited to, unanticipated problems relating to exploration and additional costs and expenses that may exceed current estimates. We have no history upon which to base any assumption as to the likelihood that our business will prove successful, and we can provide no assurance to investors that we will generate any operating revenues or ever achieve profitable operations. If we are unsuccessful in addressing these risks, our business will likely fail and you will lose your entire investment.

Because we do not have any revenues, we expect to incur operating losses for the foreseeable future.

We have never earned revenues and have never been profitable. Prior to completing exploration on the mineral property, we anticipate that we will incur increased operating expenses without realizing any revenues. We therefore expect to incur significant losses into the foreseeable future. If we are unable to generate financing to continue the exploration of our mineral property, we will fail and you will lose your entire investment in our company.

Without additional financing, of which there is no assurance that we would be able to obtain. we will not be able to commence the first phase of our exploration program for our Venado property

We intend to carry out the exploration program that has been recommended by a consulting geologist. However, we do not have enough cash to commence the first phase of our exploration program. If we cannot raise additional financing, we may never commence the first phase of our exploration program. Further, there is no assurance that our actual costs will not exceed the estimated costs. Factors that could cause actual costs to exceed our estimated costs include increased prices due to competition for personnel and supplies during the exploration season, unanticipated problems in completing the exploration program and delays experienced in completing the exploration program. Increases in exploration costs could result in our not being able to carry out our exploration program without additional financing. There is no assurance that we would be able to obtain additional financing in this event.

-8-

All of our assets and all of our directors and officers are outside the United States, with the result that it may be difficult for investors to enforce within the United States any judgments obtained against us or any of our directors or officers.

All of our assets are located outside the United States and we do not currently maintain a permanent place of business within the United States. In addition, all of our directors and officers are nationals and/or residents of countries other than the United States, and all or a substantial portion of such persons’ assets are located outside the United States. As a result, it may be difficult for investors to enforce within the United States any judgments obtained against us or our officers and directors, including judgments predicated upon the civil liability provisions of the securities laws of the United States or any state thereof. Consequently, you may be effectively prevented from pursuing remedies under United States federal and state securities laws against us or our officers and directors.

Risks Associated with our Mining Operations

Because of the speculative nature of exploration of mining properties, there is substantial risk that no commercially exploitable minerals will be found and our business will fail.

We are in the initial stage of exploration of our mineral property, and thus have no way to evaluate the likelihood that we will be successful in establishing commercially exploitable reserves of gold, silver or other valuable minerals on our mineral property. Potential investors should be aware of the difficulties normally encountered by new mineral resource exploration companies and the high rate of failure of such enterprises. The search for valuable minerals as a business is extremely risky. We may not find commercially exploitable reserves of gold, silver or other valuable minerals in our mineral property. Exploration for minerals is a speculative venture necessarily involving substantial risk. The expenditures to be made by us on our exploration program may not result in the discovery of commercial quantities of mineral resources. The likelihood of success must be considered in light of the problems, expenses, difficulties, complications and delays encountered in connection with the exploration of the mineral properties that we plan to undertake. Problems such as unusual or unexpected formations and other conditions are involved in mineral exploration and often result in unsuccessful exploration efforts. In such a case, we would be unable to complete our business plan.

Because of the inherent dangers involved in mineral exploration, there is a risk that we may incur liability or damages as we conduct our business.

The search for valuable minerals involves numerous hazards. In the course of carrying out exploration of our Venado property, we may become subject to liability for such hazards, including pollution, cave-ins and other hazards against which we cannot insure or against which we may elect not to insure. We currently have no such insurance nor do we expect to get such insurance for the foreseeable future. If a hazard were to occur, the costs of rectifying the hazard may exceed our asset value and cause us to liquidate all of our assets, resulting in the loss of your entire investment.

If we discover commercial reserves of minerals on our mineral property, we can provide no assurance that we will be able to successfully achieve commercial production.

Our mineral property does not contain any known mineral resources. If our exploration programs are successful in establishing mineral resources, we will require additional funds in order to achieve commercial production. In such an event, we may be unable to obtain any such funds, or to obtain such funds on terms that we consider economically feasible, and you may lose your entire investment.

Because access to our mineral property is difficult, we may be delayed in our exploration and any future mining efforts.

Access to the Venado property is difficult and there are no roads within the Venado property. These limitations can result in significant delays in exploration efforts, as well as in mining and production in the event that commercial amounts of minerals are found. Such delays can cause our business to fail and the loss of your entire investment.

-9-

As we undertake exploration of our mineral property, we will be subject to compliance with government regulation that may increase the anticipated time and cost of our exploration program, which could increase our expenses.

We will be subject to the mining laws and regulations in Mexico as we carry out our exploration program. We will be required to pay mining taxes to the Mexican government. We will be required to prove our compliance with relevant Mexican environmental and workplace safety laws, regulations and standards by submitting receipts showing the purchase of equipment used for workplace safety or the prevention of pollution or the undertaking of environmental remediation projects before we are able to obtain drilling permits. If our exploration activities lead us to make a decision to go into mining production, before we commence a major drilling program, we will have to obtain an environmental impact statement authorization. This could potentially take more than 10 months to obtain and could potentially be refused. New regulations, if any, could increase our time and costs of doing business and prevent us from carrying out our exploration program. These factors could prevent us from becoming profitable.

If we do not find a joint venture partner for the continued development of our mineral property, we may not be able to advance the exploration work.

If the initial results of our mineral exploration program are successful, we may try to enter into a joint venture agreement with a partner for the further exploration and possible production of our mineral property. We would face competition from other junior mineral resource exploration companies if we attempt to enter into a joint venture agreement with a partner. The possible partner could have a limited ability to enter into joint venture agreements with junior exploration programs and will seek the junior mineral resource exploration companies which have the properties that they deem to be the most attractive in terms of potential return and investment cost. In addition, if we entered into a joint venture agreement, we would likely assign a percentage of our interest in the mineral property to the joint venture partner. If we are unable to enter into a joint venture agreement with a partner, our business may fail and you may lose your entire investment.

Risks Associated with our Management

Because our executive officers have limited experience in mineral exploration and do not have formal training specific to the technicalities of mineral exploration, there is a higher risk that our business will fail.

Our executive officers have limited experience in mineral exploration and do not have formal training as geologists or in the technical aspects of management of a mineral resource exploration company. As a result of this inexperience, there is a higher risk of our being unable to complete our business plan for the exploration of our mineral property. With no direct training or experience in these areas, our management may not be fully aware of many of the specific requirements related to working within this industry. Our decisions and choices may not take into account standard engineering or managerial approaches mineral resource exploration companies commonly use. Consequently, the lack of training and experience of our management in this industry could result in management making decisions that could result in a reduced likelihood of our being able to locate commercially exploitable reserves on our mineral property with the result that we would not be able to achieve revenues or raise further financing to continue exploration activities. In addition, we will have to rely on the technical services of others with expertise in geological exploration in order for us to carry out our planned exploration program. If we are unable to contract for the services of such individuals, it will make it difficult and maybe impossible to pursue our business plan. There is thus a higher risk that our operations, earnings and ultimate financial success could suffer irreparable harm and our business will likely fail and you will lose your entire investment.

Because our executive officers have other business interests, they may not be able or willing to devote a sufficient amount of time to our business operation, causing our business to fail.

Our executive officers devote approximately 15% of their working time on providing management services to us. If the demands on our executive officers from their other obligations increase, they may no longer be able to devote sufficient time to the management of our business. This could negatively impact our business development.

-10-

Risks Associated with our Common Stock

There is no active trading market for our common stock and if a market for our common stock does not develop, our investors will be unable to sell their shares.

There is currently no active trading market for our common stock and such a market may not develop or be sustained. We currently plan to have our common stock quoted on the OTC Bulletin Board. In order to do this, a market maker must file a Form 15c-211 to allow the market maker to make a market in shares of our common stock. However, we cannot provide our investors with any assurance that our common stock will be traded on the OTC Bulletin Board or, if traded, that a public market will materialize. Further, the OTC Bulletin Board is not a listing service or exchange, but is instead a dealer quotation service for subscribing members. If our common stock is not quoted on the OTC Bulletin Board or if a public market for our common stock does not develop, then investors may not be able to resell the shares of our common stock that they have purchased and may lose all of their investment. If we establish a trading market for our common stock, the market price of our common stock may be significantly affected by factors such as actual or anticipated fluctuations in our operation results, general market conditions and other factors. In addition, the stock market has from time to time experienced significant price and volume fluctuations that have particularly affected the market prices for the shares of exploration stage companies, which may affect the market price of our common stock in a materially adverse manner.

Because we do not intend to pay any dividends on our common stock, investors seeking dividend income or liquidity should not purchase shares of our common stock.

We do not currently anticipate declaring and paying dividends to our stockholders in the foreseeable future. It is our current intention to apply net earnings, if any, in the foreseeable future to increasing our working capital. Prospective investors seeking or needing dividend income or liquidity should, therefore, not purchase our common stock. We currently have no revenues and a history of losses, so there can be no assurance that we will ever have sufficient earnings to declare and pay dividends to the holders of shares of our common stock, and in any event, a decision to declare and pay dividends is at the sole discretion of our board of directors, which currently do not intend to pay any dividends on shares of our common stock for the foreseeable future. Unless we pay dividends, our shareholders will not be able to receive a return on their shares unless they sell them.

Since our common stock has never been traded, if a market ever develops for our common stock, the price of our common stock is likely to be highly volatile and may decline. If this happens, investors may have difficulty selling their shares and may not be able to sell their shares at all.

There is no public market for our common stock and we cannot assure you that a market will develop or that any stockholder will be able to liquidate his, her, or its investment without considerable delay, if at all. A trading market may not develop in the future, and if one does develop, it may not be sustained. If an active trading market does develop, the market price of our common stock is likely to be highly volatile. The market price of our common stock may also fluctuate significantly in response to the following factors, most of which are beyond our control:

-

variations in our quarterly operating results;

-

changes in market valuations of similar companies; and

-

the loss of key management.

The equity markets have, on occasion, experienced significant price and volume fluctuations that have affected the market prices for many companies’ securities and that have often been unrelated to the operating performance of these companies. Any such fluctuations may adversely affect the market price of our common stock, regardless of our actual operating performance. As a result, stockholders may be unable to sell their shares, or may be forced to sell them at a loss.

Because we can issue additional shares of our common stock, purchasers of our common stock may incur immediate dilution and may experience further dilution.

We are authorized to issue up to 100,000,000 shares of common stock and 100,000,000 shares of preferred stock. As of December 22, 2010, there were 450,000 shares of our common stock issued and outstanding and no shares of our preferred stock issued and outstanding. Our board of directors has the authority to cause our company to issue additional shares of common stock without the consent of any of our stockholders. Consequently, our stockholders may experience more dilution in their ownership of our company in the future.

-11-

Our stock is a penny stock. Trading of our stock may be restricted by the SEC’s penny stock regulations which may limit a shareholder’s ability to buy and sell our stock.

Our stock is a penny stock. The Securities and Exchange Commission has adopted Rule 15g-9 which generally defines “penny stock” to be any equity security that has a market price (as defined) less than $5.00 per share or an exercise price of less than $5.00 per share, subject to certain exceptions. Our securities are covered by the penny stock rules, which impose additional sales practice requirements on broker-dealers who sell to persons other than established customers and “accredited investors”. The term “accredited investor” refers generally to institutions with assets in excess of $5,000,000 or individuals with a net worth in excess of $1,000,000 or annual income exceeding $200,000 or $300,000 jointly with their spouse. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document in a form prepared by the SEC which provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction and monthly account statements showing the market value of each penny stock held in the customer’s account. The bid and offer quotations, and the broker-dealer and salesperson compensation information, must be given to the customer orally or in writing prior to effecting the transaction and must be given to the customer in writing before or with the customer’s confirmation. In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from these rules; the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction. These disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for the stock that is subject to these penny stock rules. Consequently, these penny stock rules may affect the ability of broker-dealers to trade our securities. We believe that the penny stock rules discourage investor interest in and limit the marketability of our common stock.

FINRA sales practice requirements may also limit a shareholder’s ability to buy and sell our stock.

In addition to the “penny stock” rules promulgated by the Securities and Exchange Commission, the Financial Industry Regulatory Authority (“FINRA”) has adopted rules that require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer’s financial status, tax status, investment objectives and other information. Under interpretations of these rules, the FINRA believes that there is a high probability that speculative low priced securities will not be suitable for at least some customers. The FINRA requirements make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may limit your ability to buy and sell our stock.

| ITEM 2. | PROPERTIES. |

Executive Offices

Our principal executive office consisting of 250 square feet is located at 2200 – 1177 West Hastings Street, Vancouver, British Columbia V6E 2K3, Canada. We use an office leased by Aaron Ui, our president, chief executive officer, and director, as our principal executive office, but Mr. Ui does not charge us for rent. Mr. Ui leases the office monthly.

The Venado Property

Property Description and Ownership Interest

We own a 100% interest in the mining concession that we refer to as the Venado property. The Venado property consists of a mining concession totaling 1,961.8752 hectares located within the municipality of Sinaloa of the state of Sinaloa. The mining concession has a claim title number of 229040 and was issued on February 27, 2007 and is granted for 50 years.

-12-

On June 2, 2008, we entered into a cession mining rights agreement with Minera Canvista, S.A. de C.V., through our Mexican subsidiary, Trimex Exploracion, S.A. de C.V. Pursuant to the cession mining rights agreement, we acquired a 100% interest in a mining concession known as the Venado property in consideration for the sum of $20,000. Pursuant to the cession mining rights agreement, Minera Canvista, S.A. de C.V. also renounced any right to collect royalties for any production proceeds in the event that we proceed to the production stage on the Venado property.

In accordance with the recommendations of our technical report dated July 21, 2009, and to reduce our ongoing expenses, during fiscal 2009, we reduced the size of our claim to the Venado property by abandoning approximately 15 square kilometers of our claim.

Technical Report

We received a technical report dated July 21, 2009 (the “Report”) from our consulting geologist Foremost Geological Consulting respecting the Venado property. Pursuant to the Report, our consulting geologist recommended a two phase exploration program on the Venado property to explore potential mineralization on the property, as described under the heading “Planned Exploration Activities”.

Location

The Venado property is located in the State of Sinaloa, western Mexico, and is close the border with the Durango State. The property is approximately 150 km northeast of the capital city of Culiacan and approximately 32 km from the town of Sinaloa De Leyva. It is within the municipality of Sinaloa. The Venado property is located approximately 70 km, as the crow flies, from the Pacific Ocean. The nearest coastal city is Topolebampa.

The property is made up of one claim block that covers 1,961.8752 hectares that contains two previously existing claims that belong to local Mexican owners.

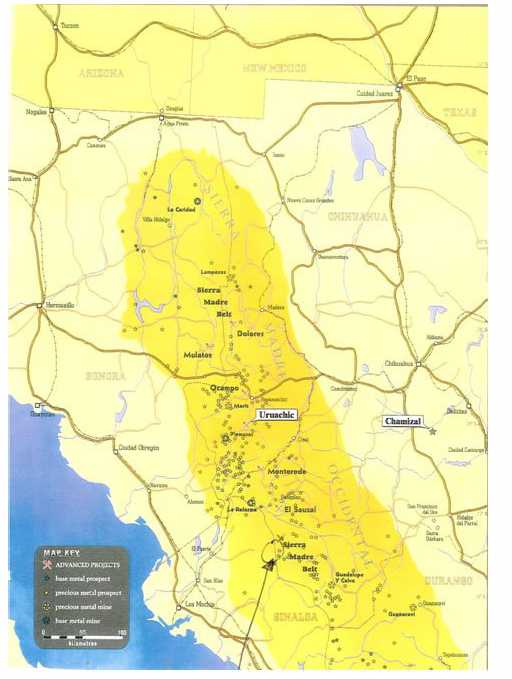

A map showing the location of the Venado property is provided below:

-13-

Location of Venado Property

The Venado Property

Exploration History

Historically, this area has been mined by small miners and prospectors. All prior production in this area has been mainly grass-roots, small family operations. No drilling has ever taken place on the property.

-14-

Present Condition

The Venado property presently does not have any known mineral reserves. There are some underground Artizno mines on the property. There is no plant or equipment located on the property.

Access

There is no road access within the Venado property and it takes approximately one and a half hours by horse to arrive at the centre of the property. Access to the stepping off point to the property is by dirt roads which are passable year round with a two-wheel drive pickup, with the exception of short periods during heavy rains when it may be necessary to wait a few hours for a river to subside and use four-wheel drive on portions of the road. The nearest town, Sinaloa De Leyva is approximately four hours by car from the property. Sinaloa De Leyva is approximately two and a half hours by car from the major centre of Culiacan by paved roads and highways.

Infrastructure

Sinaloa De Leyva is the nearest town to the property to get supplies. It is a town of approximately 10,000 people and includes cellular telephone service, telephone lines of sufficient quality for faxes and computer modems. There is daily bus service to the state capital of Culiacan. Available supplies include groceries, fuel and the normal range of tools and supplies that can be found in rural areas with a predominantly agricultural economy.

Current State of Exploration

Other than the Report, we have not conducted any exploration work on the Venado property.

Planned Exploration Program

We engaged Foremost Geological Consulting in Vancouver, British Columbia, Canada in order to conduct our exploration program on the Venado property. A consulting geologist from Foremost Geological Consulting will lead our exploration program on the Venado property.

In the Report, our consulting geologist recommended the completion of a two phase preliminary exploration program which is summarized below. We have determined, based on the recommendation of our consulting geologist, to proceed with this exploration program. The costs of the two phase preliminary exploration program is broken down as follows:

| Detailed geological mapping and sampling : | |||

| 1 Geologist for 20 days @ $500 per day: | $ | 10,000 | |

| 3 Field Assistants for 20 days @ $30 per day per person: | $ | 600 | |

| Food and accommodation @ $30 per man-day: | $ | 2,400 | |

| Field supplies: | $ | 1,000 | |

| Vehicle rental, fuel and maintenance: | $ | 5,000 | |

| Analytical costs: 100 samples @ $40 per sample: | $ | 4,000 | |

| Subtotal | $ | 23,000 | |

| Geophysical surveys: | |||

| Including mob/demob charges (2 days), line cutting (10 days) and surveying at 1.25 km per day (16 days) | $ | 65,000 | |

| Subtotal | $ | 65,000 |

-15-

| Report preparation: | |||

| For reporting on all of the above work, including drafting: | $ | 10,000 | |

| TOTAL COST: $98,000 |

Detailed geological mapping and sampling

The first phase of the exploration program is intended to be comprised of an intense program of mapping and prospecting throughout the property with special attention paid to the three areas (which we refer to as Agua Hedionda, Los Nachos, and Los Metates). Each of these areas of known mineralization will be re-sampled and all locations will be located using GPS, mapped in detail and photographed. We will try to sample the material within the workings as well as get a sense of the geological model and the exploration potential. We intend to engage in prospecting wherever access is not too difficult.

We estimate that the first phrase of the exploration program will cost $23,000. This work will be conducted by a team of a consulting geologist and 3 field assistants. The first phase of the exploration program should take approximately twenty days. We anticipate that this phase will not commence until we obtain additional financing. If we are unable to obtain additional financing, we may never commence this phase.

Geophysical Surveys

If the results of the first phase of the exploration program warrant the continuation into the second phase of the program and we obtain additional financing, we intend to conduct the second phase of the program. The second phase of the exploration program will be comprised of detailed follow-up geophysical surveying. We estimate that the second phase of the exploration program will cost $65,000.

Report Preparation

Throughout the first and second phase, we will need to prepare reports describing our activities and results. We estimate that the costs of preparing those reports will be $10,000 for both phases.

Continuation of Exploration

We plan to continue exploration of our Venado property for so long as the results of the geological exploration that we complete indicate the further exploration of the Venado property is recommended. If we determine not to proceed with further exploration of our Venado property because of results from geological exploration that indicate that further exploration is not recommended, we will attempt to acquire an interest in a new resource property. Due to our limited finances, there is no assurance that we would be able to acquire an interest in a new property that merits further exploration. If we were to acquire an interest in a new property, then our plan would be to conduct resource exploration of the new property. In any event, we anticipate that our acquisition of a new property and any exploration activities that we would undertake will be subject to our achieving additional financing, of which there is no assurance.

ITEM 3. LEGAL PROCEEDINGS.

We know of no material, active, or pending legal proceeding against our company, nor are we involved as a plaintiff in any material proceeding or pending litigation where such claim or action involves damages for more than 10% of our current assets. There are no proceedings in which any of our company’s directors, officers, or affiliates, or any registered or beneficial shareholders, is an adverse party or has a material interest adverse to our company’s interest.

ITEM 4. (REMOVED AND RESERVED)

-16-

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES.

Market for Securities

There is currently no trading market for our common stock. We do not have any common stock subject to outstanding options or warrants and there are no securities outstanding that are convertible into our common stock. Other than the shares of our common stock being offered under this prospectus, there are no shares of our common stock that is being, or have been proposed to be, publicly offered, the offering of which could have a material effect on the market price of our common stock.

Our common shares are issued in registered form. Wall Street Transfer Agents Inc., located at 12492 Harris Road, Pitt Meadows, British Columbia V3Y 2J4, Canada (telephone: 604.465.7475; facsimile 604.465.7485) is the registrar and transfer agent for our common shares.

Holders of our Common Stock

As of December 22, 2010, we have 38 registered stockholders and 450,000 shares issued and outstanding.

Dividend Policy

We have never declared or paid any cash dividends on our common stock. We currently intend to retain future earnings, if any, to increase our working capital. As a result, we do not anticipate paying any cash dividends in the foreseeable future.

So long as any shares of our preferred stock remain outstanding, unless all accrued and unpaid dividends for all prior dividend periods relating to our preferred stock have been paid or are contemporaneously declared and paid in full, no dividend whatsoever will be paid or declared on our common stock

Other than as stated above, there are no restrictions in our articles of incorporation or bylaws that prevent us from declaring dividends. The Nevada Revised Statutes, however, do prohibit us from declaring dividends where, after giving effect to the distribution of the dividend:

-

we would not be able to pay our debts as they become due in the usual course of business; or

-

our total assets would be less than the sum of our total liabilities plus the amount that would be needed to satisfy the rights of stockholders who have preferential rights superior to those receiving the distribution.

Recent Sales of Unregistered Securities

We did not issue any equity securities that were not registered under the Securities Act during the fiscal year ended June 30, 2009.

Securities Authorized for Issuance Under Equity Compensation Plans

We do not have any long-term incentive plans.

Purchase of Equity Securities by the Issuer and Affiliated Purchasers

We did not purchase any of our shares of common stock or other securities during the year ended June 30, 2009.

-17-

ITEM 6. SELECTED FINANCIAL DATA.

Not Applicable.

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATION

The following discussion should be read in conjunction with our audited financial statements and the related notes that appear elsewhere in this annual report. The following discussion contains forward-looking statements that reflect our plans, estimates and beliefs. Our actual results could differ materially from those discussed in the forward-looking statements. Factors that could cause or contribute to such differences include those discussed below and elsewhere in this annual report.

Our audited consolidated financial statements are stated in United States dollars and are prepared in accordance with United States generally accepted accounting principles.

Plan of Operation

We are an exploration stage company engaged in the acquisition and exploration of mineral properties. We were incorporated in the state of Nevada on January 16, 2008. On June 2, 2008, we acquired a 100% interest in a mining concession that we refer to as the Venado property. The Venado property is located in the municipality of Sinaloa, state of Sinaloa. Exploration of this mining concession is required before a final determination as to its viability can be made. On May 1, 2008, we incorporated our wholly owned subsidiary, Trimex Exploracion, S.A. de C.V. in Mexico for the sole purpose of holding our property interest in Mexico.

The existence of commercially exploitable mineral deposits in the Venado property is unknown at the present time and we will not be able to ascertain such information until we receive and evaluate the results of our exploration program.

Our plan of operation is to carry out exploration work on our Venado property in order to ascertain whether it possesses commercially exploitable quantities of gold, silver, and other metals. We intend to primarily explore for gold and silver, but if we discover that our mineral property holds potential for other minerals that our management determines are worth exploring further, then we intend to explore for those other minerals. We will not be able to determine whether or not the Venado property contains a commercially exploitable mineral deposit, or reserve, until appropriate exploratory work is done and an economic evaluation based on that work indicates economic viability.

There can be no assurance that our planned activities will be successful or that we will ultimately attain profitability. Our long term viability depends on our ability to grow our subsidiary’s business to fund the continuation of our consolidated business operations. We intend to use our common stock as payment for services of various consultants in order to help advance our business plan.

We intend to conduct a two phase exploration program for the Venado property. We intend to conduct the first phase of our exploration program when we receive additional financing. We estimate that the first phase will cost $23,000 and consists of an intense program of mapping and prospecting through the property. If the results of the first phase of our exploration program warrant the continuation into the second phase of the program, we intend to conduct the second phase of the program consisting of detailed geophysical surveying. We estimate that the second phase will cost $65,000. We estimate that the cost for reporting on the results of these two phases will be approximately $10,000. Our planned exploration program is described in detail under the heading “Properties —The Venado Property — Planned Exploration Program”.

Provided we obtain additional financing and complete the first phase of our exploration program, we anticipate that our estimated expenses over the next twelve months will be as follows:

-18-

| Cash Requirements during the Next Twelve Months | |||

| General, Administrative and Corporate Expenses | $ | 20,000 | |

| Expenditures on the Venado Property | 23,000 | ||

| Total | $ | 43,000 | |

We plan to raise the capital required to commence the first phase of our exploration program primarily through the continued financial support of our directors and stockholders and the continued issuance of equity to new stockholders. There is no assurance that we will be able to obtain further funds required for our continued working capital requirements. If we are not able to obtain additional financing on a timely basis, we will be unable to conduct our operations as planned, and we will not be able to meet our other obligations as they become due. In such event, we will be forced to scale down or perhaps even cease our operations.

Results of Operations for Year ended June 30, 2009 Compared to Year ended June 30, 2008

Our operating results for the years ended June 30, 2009 and June 30, 2008 are summarized as follows:

| Year Ended June 30, 2009 |

Period from January 16, 2008 (date of inception) to June 30, 2008 |

Percentage

Increase/(Decrease) | |

| Revenue | - | - | N/A |

| Expenses | $92,262 | $44,793 | 105.9% |

| Net Income (loss) | $(92,262) | $(44,793) | 105.9% |

Revenues

We have had no operating revenues for the years ended June 30, 2009 and June 30, 2008. We anticipate that we will not generate any revenues for so long as we are an exploration stage company.

Expenses

The major components of our expenses for the year are outlined in the table below:

| Year Ended June 30, 2009 |

Year Ended June 30, 2008 | |

| Foreign exchange loss | $310 | - |

| General and administrative | $83,892 | $24,793 |

| Mineral property costs | $8,060 | - |

| Write-down of mineral property costs | - | $20,000 |

| Total Expenses | $92,262 | $44,793 |

-19-

General and Administrative Expenses

The increase in our general and administrative expenses for the year ended June 30, 2009 was primarily due to accounting, audit and legal fees pertaining to the Company’s registration statement filing and subsequent quarterly filings.

Liquidity and Capital Resources

Working Capital

| As at June 30, 2009 |

As at June 30, 2008 | |

| Current Assets | $61,774 | $113,653 |

| Current Liabilities | $18,829 | $11,946 |

| Working Capital | $42,945 | $101,707 |

Current Assets

Our current assets deceased by $51,879 due to a net decrease in cash, as described below.

Cash Flows

| Year Ended June 30, 2009 |

Year Ended June 30, 2008 | |

| Cash used in Operating Activities | $(85,379) | $(12,847) |

| Cash provided by Investing Activities | - | $(20,000) |

| Cash provided by Financing Activities | $33,500 | $146,500 |

| Net Increase (Decrease) in Cash | $(51,879) | $113,653 |

Cash Provided by Financing Activities

On July 16, 2008, we issued 1,500,000 (pre 10:1 reverse split) shares of our common stock to 36 subscribers at an offering price of $0.10 per share for gross offering proceeds of $150,000, of which $116,500 was recorded as common stock subscribed as at June 30, 2008 and $33,500 was received during the fiscal year ended June 30, 2009.

Going Concern

The audited consolidated financial statements accompanying this report have been prepared on a going concern basis, which implies that our company will continue to realize its assets and discharge its liabilities and commitments in the normal course of business. Our company has not generated revenues since inception and has never paid any dividends and is unlikely to pay dividends or generate earnings in the immediate or foreseeable future. The continuation of our company as a going concern is dependent upon the continued financial support from our shareholders, the ability of our company to obtain necessary equity financing to achieve our operating objectives, and the attainment of profitable operations. As of June 30, 2009, we had cash of $61,774 and we estimate that we will require approximately $43,000 to fund our business operations over the next twelve months. Accordingly, we do not have sufficient funds for planned operations and we will be required to raise additional funds for operations after that date.

These circumstances raise substantial doubt about our ability to continue as a going concern, as described in the explanatory paragraph to our independent auditors’ report on the June 30, 2009 and June 30, 2008 consolidated financial statements which are included with this annual report. The consolidated financial statements do not include any adjustments that might result from the outcome of that uncertainty.

-20-

The continuation of our business is dependent upon us raising additional financial support. The issuance of additional equity securities by us could result in a significant dilution in the equity interests of our current stockholders. Obtaining commercial loans, assuming those loans would be available, will increase our liabilities and future cash commitments.

There are no assurances that we will be able to obtain further funds required for our continued operations. We are pursuing various financing alternatives to meet our immediate and long-term financial requirements. There can be no assurance that additional financing will be available to us when needed or, if available, that it can be obtained on commercially reasonable terms. If we are not able to obtain the additional financing on a timely basis, we will be forced to scale down or perhaps even cease the operation of our business.

Off-Balance Sheet Arrangements

We have no significant off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that are material to stockholders.

Critical Accounting Policies

The following are the accounting policies that we consider to be critical accounting policies. Critical accounting policies are those that are both important to the portrayal of our financial condition and results and those that require the most difficult, subjective, or complex judgments, often as results of the need to make estimates about the effect of matters that are subject to a degree of uncertainty.

Mineral Property Costs

The Company has been in the exploration stage since its inception on January 16, 2008 and has not yet realized any revenues from its planned operations. It is primarily engaged in the acquisition and exploration of mining properties. Mineral property exploration costs are expensed as incurred. Mineral property acquisition costs are initially capitalized when incurred. The Company assesses the carrying costs for impairment under ASC 360, “Property, Plant, and Equipment” at each fiscal quarter end. When it has been determined that a mineral property can be economically developed as a result of establishing proven and probable reserves, the costs then incurred to develop such property, are capitalized. Such costs will be amortized using the units-of-production method over the estimated life of the probable reserve. If mineral properties are subsequently abandoned or impaired, any capitalized costs will be charged to operations.

Long-lived Assets

In accordance with ASC 360, “Property, Plant, and Equipment”, the Company tests long-lived assets or asset groups for recoverability when events or changes in circumstances indicate that their carrying amount may not be recoverable. Circumstances which could trigger a review include, but are not limited to: significant decreases in the market price of the asset; significant adverse changes in the business climate or legal factors; accumulation of costs significantly in excess of the amount originally expected for the acquisition or construction of the asset; current period cash flow or operating losses combined with a history of losses or a forecast of continuing losses associated with the use of the asset; and current expectation that the asset will more likely than not be sold or disposed significantly before the end of its estimated useful life. Recoverability is assessed based on the carrying amount of the asset and its fair value which is generally determined based on the sum of the undiscounted cash flows expected to result from the use and the eventual disposal of the asset, as well as specific appraisal in certain instances. An impairment loss is recognized when the carrying amount is not recoverable and exceeds fair value.

New Accounting Pronouncements

In June 2009, the FASB issued guidance now codified as FASB ASC Topic 105, “Generally Accepted Accounting Principles” as the single source of authoritative accounting principles recognized by the FASB to be applied by nongovernmental entities in the preparation of financial statements in conformity with US GAAP, aside from those issued by the SEC. ASC 105 does not change current US GAAP, but is intended to simplify user access to all authoritative US GAAP by providing all authoritative literature related to a particular topic in one place. The adoption of ASC 105 did not have a material impact on the Company’s consolidated financial statements, but did eliminate all references to pre-codification standards.

-21-

In January 2010, the FASB issued an amendment to ASC 820, “Fair Value Measurements and Disclosure”, to require reporting entities to separately disclose the amounts and business rationale for significant transfers in and out of Level 1 and Level 2 fair value measurements and separately present information regarding purchase, sale, issuance, and settlement of Level 3 fair value measures on a gross basis. This standard, for which the Company is currently assessing the impact, is effective for interim and annual reporting periods beginning after December 15, 2009 with the exception of disclosures regarding the purchase, sale, issuance, and settlement of Level 3 fair value measures which are effective for fiscal years beginning after December 15, 2010.

The Company has implemented all new accounting pronouncements that are in effect and that may impact its financial statements and does not believe that there are any other new accounting pronouncements that have been issued that might have a material impact on its financial position or results of operations.

-22-

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA.

-23-

| TRIMEX EXPLORATION INC. |

| (An Exploration Stage Company) |

| Consolidated Financial Statements |

| Periods Ended June 30, 2009 and 2008 |

| (Expressed in U.S. dollars) |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and Stockholders of

Trimex

Exploration Inc.

(An Exploration Stage Company)

We have audited the accompanying consolidated balance sheets of Trimex Exploration Inc. (An Exploration Stage Company) as of June 30, 2009 and 2008, and the related consolidated statements of operations, stockholders’ equity, and cash flows for the year ended June 30, 2009, period from January 16, 2008 (date of inception) to June 30, 2008, and accumulated from January 16, 2008 (date of inception) to June 30, 2009. These financial statements are the responsibility of the Company's management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. An audit includes consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the consolidated financial position of the Company as of June 30, 2009 and 2008, and the consolidated results of its operations and its cash flows for the year ended June 30, 2009, period from January 16, 2008 (date of inception) to June 30, 2008, and accumulated from January 16, 2008 (date of inception) to June 30, 2009, in conformity with accounting principles generally accepted in the United States.

The accompanying consolidated financial statements have been prepared assuming the Company will continue as a going concern. As discussed in Note 1 to the financial statements, the Company has not generated any revenues and has incurred operating losses since inception. These factors raise substantial doubt about the Company’s ability to continue as a going concern. Management’s plans in regard to these matters are also discussed in Note 1 to the financial statements. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

/s/ “Saturna Group Chartered Accountants LLP”

Vancouver, Canada

September 24, 2010

| TRIMEX EXPLORATION INC. |

| (An Exploration Stage Company) |

| Consolidated Balance Sheets |

| (Expressed in U.S. dollars) |

| June 30, | June 30, | |||||

| 2009 | 2008 | |||||

| $ | $ | |||||

| ASSETS | ||||||

| Current Assets | ||||||

| Cash | 61,774 | 113,653 | ||||

| Total Assets | 61,774 | 113,653 | ||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | ||||||

| Current Liabilities | ||||||

| Accounts payable | 8,579 | 2,048 | ||||

| Accrued liabilities | 10,250 | 9,898 | ||||

| Total Liabilities | 18,829 | 11,946 | ||||

| Nature of Operations and Continuance of Business (Note 1) | ||||||

| Subsequent Event (Note 6) | ||||||

| Stockholders’ Equity | ||||||

| Preferred stock, 100,000,000

shares authorized, $0.001 par value Nil shares issued and outstanding |

– |

– |

||||

| Common stock, 100,000,000 shares authorized,

$0.001 par value 450,000 and 300,000 shares issued and outstanding, respectively |

450 |

300 |

||||

| Additional paid-in capital | 179,550 | 29,700 | ||||

| Common stock subscribed (Note 4) | – | 116,500 | ||||

| Deficit accumulated during the exploration stage | (137,055 | ) | (44,793 | ) | ||

| Total Stockholders’ Equity | 42,945 | 101,707 | ||||

| Total Liabilities and Stockholders’ Equity | 61,774 | 113,653 |

(The accompanying notes are an integral part of these consolidated financial statements)

F-2

| TRIMEX EXPLORATION INC. |

| (An Exploration Stage Company) |

| Consolidated Statements of Operations |

| (Expressed in U.S. dollars) |

| Period from | Accumulated from | ||||||||

| January 16, 2008 | January 16, 2008 | ||||||||

| Year ended | (date of inception) | (date of inception) | |||||||

| June 30, | to June 30, | to June 30, | |||||||

| 2009 | 2008 | 2009 | |||||||

| $ | $ | $ | |||||||

| Revenue | – | – | – | ||||||

| Expenses | |||||||||

| Foreign exchange loss | 310 | – | 310 | ||||||

| General and administrative | 83,892 | 24,793 | 108,685 | ||||||