Attached files

| file | filename |

|---|---|

| EX-3.2 - CarePayment Technologies, Inc. | v206102_ex3-2.htm |

| EX-32.1 - CarePayment Technologies, Inc. | v206102_ex32-1.htm |

| EX-32.2 - CarePayment Technologies, Inc. | v206102_ex32-2.htm |

| EX-31.2 - CarePayment Technologies, Inc. | v206102_ex31-2.htm |

| EX-31.1 - CarePayment Technologies, Inc. | v206102_ex31-1.htm |

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-Q/A

|

x

|

QUARTERLY

REPORT PURSUANT TO SECTION 13 or 15(d) OF

|

|

THE

SECURITIES EXCHANGE ACT OF 1934

|

|

|

for

the quarterly period ended March 31, 2010

|

|

|

OR

|

|

|

¨

|

TRANSITION

REPORT UNDER SECTION 13 or 15(d) OF THE SECURITIES

EXCHANGE

|

|

ACT

OF 1934 for the Transition Period from to

|

|

|

Commission

file number: 001-16781

|

|

|

CAREPAYMENT TECHNOLOGIES,

INC.

|

|

(Exact

Name of Registrant as Specified in its

Charter)

|

|

Oregon

|

91-1758621

|

|

|

(State

or Other Jurisdiction of

|

(I.R.S.

Employer Identification No.)

|

|

|

Incorporation

or Organization)

|

|

5300 Meadows Rd, Suite 400, Lake Oswego,

Oregon

|

97035

|

|

|

(Address

of Principal Executive

|

(Zip

Code)

|

|

|

Offices)

|

(Registrant’s

Telephone Number, Including Area Code): 503-419-3505

Former

Name: microHelix, Inc.

Indicate

by check mark whether the registrant (1) has filed all reports required to be

filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the

preceding 12 months (or for such shorter period that the registrant was required

to file such reports) and (2) has been subject to such filing requirements for

the past 90 days.

Yes ¨ No x

Indicate

by check mark whether the registrant has submitted electronically and posted on

its corporate Web site, if any, every Interactive Data File required to be

submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding

12 months (or for such shorter period that the registrant was required to submit

and post such files).

Yes ¨ No x

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, a non-accelerated filer, or a

smaller reporting company. See the definitions of “large accelerated

filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the

Exchange Act.

|

Large

accelerated filer ¨

|

Accelerated

filer ¨

|

|

|

Non-accelerated

filer ¨

|

Smaller

reporting company x

|

Indicate

by check mark whether the registrant is a shell company (as defined in Rule

12b-2 of the Exchange Act).

Yes ¨ No x

Shares of

Common Stock outstanding as of May 14, 2010 were:

|

Class

A

|

1,390,616 | |||

|

Class

B

|

6,510,092 | |||

| 8,900,708 |

On March

31, 2010, the Company’s shareholders authorized the Company to effect a 1-for-10

reverse stock split of its Common Stock and subsequent conversion of each share

of Common Stock into one share of Class A Common Stock. The

consolidated financial statements, notes, and other references to share and per

share data contained in this Report have been retroactively restated to reflect

such reverse stock split and conversion for all periods presented.

EXPLANATORY

NOTE

This

Amendment No. 1 (this "Amendment") on Form 10-Q/A is being filed in response to

comments the Registrant received from the Staff of the Securities and Exchange

Commission (the "Commission" or the "SEC") regarding the Registrant's Quarterly

Report on Form 10-Q for the fiscal quarter ended March 31, 2010, as originally

filed with the SEC on May 17, 2010 (the "Original Form 10-Q"). This

Amendment amends and restates the Original Form 10-Q in its entirety to provide

a complete presentation.

Except as

necessary to respond to the Staff's comments, the Registrant has not modified or

updated disclosures presented in the Original Form 10-Q. Accordingly,

this Amendment does not reflect events occurring after the date of filing of the

Original Form 10-Q or modify or update those disclosures, including the exhibits

to the Original Form 10-Q, affected by subsequent events. As such, this

Amendment should be read in conjunction with the Original Form 10-Q and the

Registrant's other reports filed with the SEC subsequent to the filing of the

Original Form 10-Q, including any amendments to those filings.

As

required by Rule 12b-15 under the Securities Exchange Act of 1934, as

amended (the "Exchange Act"), currently dated certifications by the Registrant's

principal executive officer and principal financial officer are filed as

exhibits to this Amendment.

2

CarePayment

Technologies, Inc.

Quarterly

Report on Form 10-Q

Quarter

Ended March 31, 2010

TABLE

OF CONTENTS

|

Page

|

||

|

PART

I. Financial Information

|

3

|

|

|

ITEM

1. Condensed Consolidated Financial Statements

(Unaudited)

|

||

|

Condensed

consolidated balance sheets as of March 31, 2010 and December 31,

2009

|

3

|

|

|

Condensed

consolidated statements of operations for the three months ended March 31,

2010 and 2009

|

4

|

|

|

Condensed

consolidated statements of cash flows for the three months ended March 31,

2010 and 2009

|

5

|

|

|

Notes

to condensed consolidated financial statements

|

6

|

|

|

ITEM

2. Management’s Discussion And Analysis Of Financial

Condition And Results Of Operations

|

17

|

|

|

ITEM

4T. Controls And Procedures

|

21

|

|

|

PART

II. Other Information

|

||

|

ITEM

I. Legal Proceedings

|

22

|

|

|

ITEM

2. Unregistered Sales Of Equity Securities And Use Of

Proceeds

|

22

|

|

|

ITEM

6. Exhibits

|

22

|

|

|

SIGNATURE

|

22

|

2

PART

I — FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS —

UNAUDITED

CAREPAYMENT

TECHNOLOGIES, INC.

CONDENSED

CONSOLIDATED BALANCE SHEETS

(UNAUDITED)

March

31, 2010 and December 31, 2009

|

2010

|

2009

|

|||||||

|

Assets

|

||||||||

|

Current

Assets:

|

||||||||

|

Cash

and cash equivalents

|

$ | 23,264 | $ | 69,097 | ||||

|

Related

party receivable

|

557,666 | — | ||||||

|

Prepaid

expenses

|

36,080 | — | ||||||

|

Total

current assets

|

617,010 | 69,097 | ||||||

|

Property

and equipment, net

|

458,333 | 500,000 | ||||||

|

Servicing

rights, net

|

9,454,500 | 9,550,000 | ||||||

|

Total

assets

|

$ | 10,529,843 | $ | 10,119,097 | ||||

|

Liabilities

and Shareholders' Deficit

|

||||||||

|

Current

Liabilities:

|

||||||||

|

Accounts

payable

|

$ | 1,154,263 | $ | 797,751 | ||||

|

Accrued

interest

|

396,589 | 324,082 | ||||||

|

Accrued

liabilities

|

175,193 | — | ||||||

|

Current

maturities of notes payable, net of debt discount

|

94,190 | 294,190 | ||||||

|

Total

current liabilities

|

1,820,235 | 1,416,023 | ||||||

|

Notes

payable, net of current potion

|

884,775 | 988,275 | ||||||

|

Mandatorily

redeemable preferred stock, no par value, 1,200,000 shares authorized,

1,000,000 shares issued and outstanding, liquidation preference of

$10,000,000

|

8,896,486 | 8,805,140 | ||||||

|

Total

liabilities

|

11,601,496 | 11,209,438 | ||||||

|

Shareholders'

Deficit:

|

||||||||

|

CarePayment

Technologies, Inc. shareholders’ deficit:

|

||||||||

|

Common

stock, no par value: Class A 65,000,000 shares authorized, 1,390,616 and

1,383,286 issued and outstanding at March 31, 2010 and December 31, 2009,

respectively; Class B 10,000,000 shares authorized, no shares issued or

outstanding at March 31, 2010 and December 31, 2009

|

18,022,850 | 18,022,591 | ||||||

|

Additional

paid-in capital

|

11,773,640 | 11,755,211 | ||||||

|

Accumulated

deficit

|

(30,870,568 | ) | (30,868,143 | ) | ||||

|

Total

CarePayment Technologies, Inc. shareholders' deficit

|

(1,074,078 | ) | (1,090,341 | ) | ||||

|

Noncontrolling

interest

|

2,425 | — | ||||||

|

Total

shareholders’ deficit

|

(1,071,653 | ) | (1,090,341 | ) | ||||

|

Total

liabilities and shareholders’ deficit

|

$ | 10,529,843 | $ | 10,119,097 | ||||

The

accompanying notes are an integral part of these condensed consolidated

financial statements.

3

CAREPAYMENT

TECHNOLOGIES, INC.

CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS

(UNAUDITED)

|

Three Months Ended

March 31

|

||||||||

|

2010

|

2009

|

|||||||

|

Service

fees revenue

|

$ | 1,304,717 | $ | — | ||||

|

Cost

of revenue

|

1,123,482 | — | ||||||

|

Gross

margin

|

181,235 | — | ||||||

|

Operating

Expenses:

|

||||||||

|

Sales,

general and administrative

|

890,224 | 131,901 | ||||||

|

Loss

from operations

|

(708,989 | ) | (131,901 | ) | ||||

|

Other

income (expense):

|

||||||||

|

Loss

reimbursement

|

873,371 | — | ||||||

|

Interest

expense

|

(164,049 | ) | (77,770 | ) | ||||

|

Other

income (expense), net

|

709,322 | (77,770 | ) | |||||

|

Net

income (loss) before income tax

|

333 | (209,671 | ) | |||||

|

Income

tax expense

|

333 | — | ||||||

|

Net

income (loss)

|

— | (209,671 | ) | |||||

|

Less:

Net income attributable to noncontrolling interest

|

(2,425 | ) | — | |||||

|

Net

loss attributable to CarePayment Technologies, Inc.

|

$ | (2,425 | ) | $ | (209,671 | ) | ||

| Net loss per share | ||||||||

|

Basic

and diluted

|

$ | (0.00 | ) | $ | (1.06 | ) | ||

| Weighted average number of shares outstanding | ||||||||

|

Basic

and diluted

|

1,384,915 | 197,379 | ||||||

The

accompanying notes are an integral part of these condensed consolidated

financial statements.

4

CAREPAYMENT

TECHNOLOGIES, INC.

CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED)

|

Three Months Ended

March 31

|

||||||||

|

2010

|

2009

|

|||||||

|

Cash

Flows Provided by (Used In) Operating Activities:

|

||||||||

|

Net

income (loss)

|

$ | — | $ | (209,671 | ) | |||

|

Adjustments

to reconcile net income (loss) to cash provided by (used in) operating

activities:

|

||||||||

|

Amortization

of intangibles

|

137,167 | — | ||||||

|

Accretion

of mandatorily redeemable preferred stock discount

|

91,346 | — | ||||||

|

Stock-based

compensation

|

18,429 | — | ||||||

|

Common

stock issued for services

|

— | 1,001 | ||||||

|

Amortization

of debt discount

|

— | 32,940 | ||||||

|

Change

in assets and liabilities:

|

||||||||

|

Increase

in assets:

|

||||||||

|

Related

party receivable

|

(557,666 | ) | — | |||||

|

Prepaid

expenses

|

(36,080 | ) | (16,666 | ) | ||||

|

Increase

in liabilities:

|

||||||||

|

Accounts

payable

|

356,512 | — | ||||||

|

Accrued

interest

|

72,507 | — | ||||||

|

Accrued

liabilities

|

175,193 | 30,076 | ||||||

|

Net

cash provided by (used in) operating activities

|

257,408 | (162,320 | ) | |||||

|

Cash

Flows Provided By (Used In) Financing Activities:

|

||||||||

|

Payments

on notes payable

|

(303,500 | ) | — | |||||

|

Proceeds

from revolving credit line

|

31,000 | — | ||||||

|

Payment

on revolving credit line

|

(31,000 | ) | — | |||||

|

Proceeds

from exercise of warrants

|

259 | — | ||||||

|

Proceeds

from issue of notes payable to shareholders

|

— | 100,000 | ||||||

|

Net

cash provided by (used in) financing activities

|

(303,241 | ) | 100,000 | |||||

|

Change

in cash

|

(45,833 | ) | (62,320 | ) | ||||

|

Cash,

beginning of period

|

69,097 | 98,433 | ||||||

|

Cash,

end of period

|

$ | 23,264 | $ | 36,113 | ||||

|

Supplemental

Disclosure of Cash Flow Information

|

||||||||

|

Cash

paid for interest

|

$ | 196 | $ | — | ||||

|

Cash

paid for income taxes

|

$ | 333 | $ | — | ||||

|

Supplemental

Disclosure of Non-cash Financing Activities:

|

||||||||

|

Warrants

issued to lenders-recorded as debt discount

|

$ | — | $ | 94,114 | ||||

|

Refinance

of accrued liability to note payable

|

$ | — | $ | 101,834 | ||||

The accompanying notes are an

integral part of these condensed consolidated financial

statements.

5

CAREPAYMENT

TECHNOLOGIES, INC.

NOTES

TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

1. Business

Overview

CarePayment

Technologies, Inc. (formerly microHelix, Inc.) (“we,” “us,” “our,” “CarePayment”

or the “Company”) was incorporated as an Oregon corporation in

1991. From inception until September 28, 2007, we manufactured custom

cable assemblies and mechanical assemblies for the medical and commercial

original equipment manufacturer (OEM) markets. We were experiencing

considerable competition by late 2006 as our customers aggressively outsourced

competing products from offshore suppliers. In the first quarter of

2007, a customer that accounted for over 30% of our revenues experienced a

recall of one of its major products by the U.S. Food and Drug

Administration. As a result the customer cancelled its orders with

us, leaving us with large amounts of inventory on hand and significantly reduced

revenue.

On May

31, 2007 we informed our three secured creditors, BFI Business Finance, VenCore

Solution, LLC and MH Financial Associates, LLC ("MH Financial"), that we were

unable to continue business operations due to continuing operating losses and a

lack of working capital. At that time we voluntarily surrendered our

assets to these secured creditors, following which we and our wholly owned

subsidiary, Moore Electronics, Inc. ("Moore"), operated for the benefit of the

secured creditors until September 2007, when we ceased manufacturing operations

and became a shell company. MH Financial was, at that time, and

currently is, an affiliate of ours due to its ownership of shares of our capital

stock.

Following

September 2007 and continuing until December 31, 2009, we had no

operations. Our Board of Directors, however, determined to maintain

us as a shell company to seek opportunities to acquire a business or assets

sufficient to operate a business. To help facilitate our search for

suitable business acquisition opportunities, among other goals, on June 27, 2008

we entered into an advisory services agreement with Aequitas Capital Management,

Inc. (“Aequitas”) to provide us with strategy development, strategic planning,

marketing, corporate development and other advisory services. In

exchange for the services to be provided by Aequitas under that agreement, we

issued to Aequitas warrants to purchase 106,667 shares of our Class A Common

Stock at an exercise price of $0.01 per share.

Effective

at the end of December 2009, we acquired certain assets and rights that enabled

us to begin building a business that services accounts receivable for other

parties. The assets and rights we acquired had been previously

developed by Aequitas and its affiliate, CarePayment, LLC, under the

CarePayment® brand for servicing accounts receivable generated by hospitals in

connection with providing health care services to their patients. The

assets and rights we acquired included the exclusive right to administer,

service and collect patient accounts receivable generated by hospitals and

purchased by CarePayment, LLC or its affiliates, and a proprietary software

product that is used to manage the servicing. Typically CarePayment,

LLC or one of its affiliates purchase patient accounts receivable from hospitals

and then we administer, service and collect them on behalf of CarePayment, LLC

for a fee. Although we intend to grow our business to include

servicing of accounts receivable on behalf of other parties, currently

CarePayment, LLC is our only customer.

To

facilitate building the business, on December 30, 2009, we, Aequitas and

CarePayment, LLC formed an Oregon limited liability company, CP Technologies LLC

("CP Technologies") (formerly WS Technologies LLC). We contributed

shares of our newly authorized Series D Convertible Preferred Stock ("Series D

Preferred") and warrants to purchase shares of our Class B Common Stock to CP

Technologies. Aequitas and CarePayment, LLC contributed to CP

Technologies the CarePayment® assets and rights described in the foregoing

paragraph. CP Technologies then distributed the shares of Series D

Preferred to Aequitas and CarePayment, LLC, and the warrants to purchase shares

of Class B Common to CarePayment, LLC, to redeem all but half of one membership

unit (a "Unit") held by each of them. Following these transactions,

we own 99% of CP Technologies, and Aequitas and CarePayment, LLC each own 0.5%

of CP Technologies as of December 31, 2009.

Aequitas

and CarePayment, LLC are affiliates due to their common control by Aequitas

Holdings, LLC (“Holdings”). Aequitas is a wholly owned subsidiary of

Holdings. CarePayment, LLC is a wholly owned subsidiary of Aequitas

Commercial Finance, LLC (“ACF”), which itself is a wholly owned subsidiary of

Holdings. On December 30, 2009, prior to the contribution of assets,

Holdings and its affiliates owned 13.1% of the Company’s common stock and

controlled 46.3% of the Company on a fully diluted basis.

6

The

Receivables Servicing Business

On

January 1, 2010 and as a result of the transactions described above, CP

Technologies began building a business to service hospital patient receivables

for an affiliate of the Company, CarePayment, LLC.

Generally,

a majority of a hospital's accounts receivable are paid by medical insurance,

Medicare and Medicaid. The balance of accounts receivable due

directly from the patient is not always a priority for many hospitals, due

primarily to the effort and expense required to collect those balances from

individuals. CarePayment, LLC, acting

alone or through its affiliates, purchases patient receivables from

hospitals. CP Technologies administers, services and collects the

receivables; CarePayment, LLC maintains ownership of the

receivables.

A patient

whose health care receivable is acquired by CarePayment, LLC becomes a

CarePayment® finance card customer and is issued a CarePayment® card, which has

an initial outstanding balance equal to the receivable purchased by CarePayment,

LLC. Balances due on the CarePayment ® card are generally payable

over 25 months with no interest. From the customer's point of view,

the CarePayment ® card functions much like a credit card even though CP

Technologies advances no credit to the customer. In addition to

servicing the receivables, CP Technologies also analyzes potential receivable

acquisitions for CarePayment, LLC and recommends a course of action when it

determines that collection efforts for existing receivables are no longer

effective.

In

exchange for its services, CP Technologies receives origination fees at the time

CarePayment, LLC purchases and delivers receivables to CP Technologies for

servicing, a monthly servicing fee based on the total principal amount of

receivables being serviced, and a quarterly fee based upon a percentage of

CarePayment, LLC's quarterly net income. CP Technologies’ servicing

agreement with CarePayment, LLC includes additional compensation during the

first six months of 2010 to cover the Company’s start up costs as it builds a

receivables servicing business. This compensation is equal to the

Company's actual monthly losses for the first quarter of 2010 and an amount

equal to 50% of actual monthly losses for the second quarter of

2010. The Company received $873,371 of such compensation from

CarePayment, LLC in the three-month period ended March 31, 2010.

CP

Technologies contracts with various vendors to service the CarePayment® finance

card product, send customer statements, accept payments, and transmit all

transaction history back to CP Technologies. Since CP

Technologies is responsible for the CarePayment® finance card's

compliance with various laws and regulations relating to consumer credit, these

vendors are selected for their specific expertise in such areas.

2. Summary

of Significant Accounting Policies

Basis

of presentation:

The

unaudited condensed consolidated financial statements have been prepared by the

management of CarePayment and in the opinion of management include all material

adjustments (consisting of normal recurring accruals) which are necessary to

present fairly the Company’s financial position and operating results for the

periods indicated. The results of operations for the three months ended

March 31, 2010 are not necessarily indicative of the results to be expected

for the entire year ending December 31, 2010.

Certain

information and note disclosures normally included in financial statements

prepared in accordance with generally accepted accounting principles have been

condensed or omitted from the interim financial statements presented in this

Quarterly Report on Form 10-Q pursuant to the rules and regulations of the

SEC. These unaudited condensed consolidated financial statements

should be read in conjunction with the Consolidated Financial Statements

and notes thereto included in the Company’s Form 10-K for the year ended

December 31, 2009.

Estimates

and assumptions:

The

preparation of consolidated financial statements in conformity with accounting

principles generally accepted in the United States of America requires

management to make estimates and assumptions that affect the reported amounts of

assets and liabilities and disclosure of contingent assets and liabilities at

the date of the consolidated financial statements and the reported amounts of

revenues and expenses during the reporting period. Actual results could

differ from those estimates.

7

Principles

of consolidation:

The

consolidated financial statements include the accounts of CarePayment, its

wholly owned subsidiary, Moore, and its 99% owned subsidiary, CP Technologies.

All intercompany transactions have been eliminated.

Concentration

of credit risk:

Receivables — The

Company’s receivables are all with a related party. The

Company does not anticipate any collection issues.

Revenue from one source — The

Company currently generates all its revenue through one servicing agreement with

a related party.

Cash and investments —

The Company maintains its cash in bank accounts; at times, the balances in these

accounts may exceed federally insured limits. The Company has not

experienced any losses in such accounts.

Cash

and cash equivalents:

Cash and

cash equivalents are stated at cost, which approximates fair value, and include

investments with maturities of three months or less at the date of

acquisition. Cash and cash equivalents consist of bank

deposits.

Property

and equipment:

Property

and equipment is comprised of servicing software which is stated at original

estimated fair value, net of accumulated amortization. Amortization is

computed using the straight-line method over the estimated useful lives of the

assets. The estimated useful life of the software is 3

years. The Company evaluates long-lived assets for impairment

annually or whenever events or changes in circumstances indicate that the

carrying amount of an asset may not be recoverable. Amortization

expense was $41,667 for the three months ended March 31, 2010.

Servicing

rights:

Servicing rights represent the

fair value of the identifiable intangible asset

associated with the acquisition of certain business assets. Effective

January 1, 2010, the Company began to amortize the

cost associated with this

asset on a straight line basis over an estimated useful life of 25

years, which is based on the term of the

servicing agreement that expires in 2034. The Company evaluates

servicing rights for impairment annually or whenever events or changes in

circumstances indicate that the carrying amount of the asset may not be recoverable by

analyzing the undiscounted and discounted future cash flows under the servicing

agreement with CarePayment, LLC. Amortization expense was $95,500 for

the three months ended March 31, 2010.

Revenue

recognition:

The

Company recognizes revenue in conjunction with a servicing agreement with

CarePayment, LLC. The Company receives a servicing fee equal to 5%

annually of total funded receivables being serviced and an origination fee equal

to 6% of the original balance of newly generated funded

receivables. The servicing agreement also provides that the Company

receives 25% of CarePayment, LLC’s quarterly net income, adjusted for certain

items. The Company recognizes revenue related to this agreement,

which is evidence of an arrangement, at the time the services are rendered; the

servicing fee is recognized as revenue monthly at 1/12 of the annual percent of

the funded receivables being serviced for the month; the origination fee is

recognized as revenue at the time CarePayment, LLC funds its purchased

receivables and the Company assumes the responsibility for servicing these

receivables; the 25% of CarePayment, LLC’s net income is recognized as revenue

in the quarter that CarePayment, LLC records the net income. The

collectability of the revenue recognized from these related party transactions

is considered reasonably assured.

Cost

of revenue:

Cost of

revenue is comprised primarily of compensation and benefit costs for servicing

employees, costs associated with outsourcing billing, collections and

payment processing services, and amortization of servicing rights and servicing

software.

Income

taxes:

The

Company accounts for income taxes under an asset and liability approach that

requires the recognition of deferred tax assets and liabilities that are

determined based on the differences between the financial statement bases and

tax bases of assets and liabilities using enacted tax rates. A

valuation allowance is recorded to reduce a deferred tax asset to that portion

of the deferred tax asset that is expected to more likely than not be

realized.

8

The

Company reports a liability, if any, for unrecognized tax benefits resulting

from uncertain income tax positions taken or expected to be taken in an income

tax return. Estimated interest and penalties, if any, are recorded as

a component of interest expense and other expense, respectively. No

liability has been recorded for uncertain tax positions, or related interest or

penalties as of March 31, 2010 and December 31, 2009. Tax

years that remain subject to examination by federal and state authorities are

the years ended 2006 through 2009.

Stock-based

compensation:

Stock-based

compensation cost is estimated at the grant date based on the award’s fair value

and is recognized as expense over the requisite service period using the

straight-line attribution method. Stock-based compensation for stock

options granted is estimated using the Black-Scholes option pricing

model.

Warrants

to purchase the Company’s stock:

The fair

value of warrants to purchase the Company’s stock issued for services or in

exchange for assets is estimated at the issue date using the Black-Scholes

model.

Earnings

(loss) per common share:

Basic

earnings (loss) per common share, (“EPS”), is calculated by dividing net income

(loss) attributable to the Company by the weighted average number of shares of

common stock outstanding during the period. Fully diluted EPS assumes the

conversion of all potentially dilutive securities and is calculated by dividing

net income by the sum of the weighted average number of shares of common stock

outstanding plus potentially dilutive securities determined using the treasury

stock method. Dilutive loss per share does not consider the impact of

potentially dilutive securities in periods in which there is a loss because the

inclusion of the potentially dilutive securities would have an anti-dilutive

effect.

Comprehensive

income (loss):

The

Company has no components of Other Comprehensive Income (Loss) and, accordingly,

no statement of Comprehensive Income (Loss) is included in the accompanying

Condensed Consolidated Financial Statements

Operating

segments and reporting units:

The

Company operates as a single business segment and reporting unit.

Recently

adopted accounting standards:

In

February 2010, the Financial Accounting Standards Board (“FASB”) issued amended

guidance on subsequent events. Under this amended guidance, SEC filers are no

longer required to disclose the date through which subsequent events have been

evaluated in originally issued and revised financial statements. This guidance

was effective immediately and the Company adopted these new requirements for the

period ended March 31, 2010.

Recently

issued accounting standards:

In

January 2010, the FASB issued guidance to amend the disclosure requirements

related to recurring and nonrecurring fair value measurements. The guidance

requires disclosure of transfers of assets and liabilities between Level 1 and

Level 2 of the fair value measurement hierarchy, including the reasons and the

timing of the transfers and information on purchases, sales, issuance, and

settlements on a gross basis in the reconciliation of the assets and liabilities

measured under Level 3 of the fair value measurement hierarchy. This guidance is

effective for the Company beginning January 1, 2011. The Company does not

expect the adoption of this guidance will have an impact on its consolidated

financial position or results of operations.

9

3. Notes

Payable

A summary

of the Company's notes payable outstanding as of March 31, 2010 and

December 31, 2009 is as follows:

|

2010

|

2009

|

|||||||

|

MH

Financial Associates, LLC

|

$ | 874,243 | $ | 977,743 | ||||

|

Aequitas

Capital Management, Inc.

|

94,190 | 294,190 | ||||||

|

Other

|

10,532 | 10,532 | ||||||

|

Total

Notes Payable

|

978,965 | 1,282,465 | ||||||

|

Current

maturities

|

(94,190 | ) | (294,190 | ) | ||||

|

Notes

Payable, less current maturities

|

$ | 884,775 | $ | 988,275 | ||||

On

June 27, 2008, the Company refinanced a promissory note payable to MH

Financial by issuing a note payable (the”Note”) in the amount of

$977,743. The loan amount included $477,743 that was owed to MH

Financial as of June 27, 2008 and an additional loan of up to

$500,000. The Company was advanced $200,000 on June 27, 2008,

$100,000 on December 31, 2008, $100,000 on February 27, 2009, and

$100,000 on November 6, 2009. Effective as of the date of this

refinance, interest accrued on the outstanding principal balance of the loan at

a rate of 20% per annum. The original due date of the Note was

December 27, 2008 and, as a condition of the December 31, 2008 advance, the

due date was extended to December 31, 2009. On December 31,

2009, the Company was granted a note extension to December 31, 2011, at

which time all unpaid interest and principal are due. In addition,

the interest rate on the principal amount outstanding under the Note decreases

from 20% to 8% per annum after the Company makes principal payments totaling

$400,000. As of March 31, 2010, the Company has made principal

payments of $103,500; the interest rate on the loan will decrease after the

Company makes additional principal payments of $296,500. The note

continues to be secured by substantially all of the assets of the

Company.

On

December 31, 2008, the Company entered into a multiple advance promissory

note payable to Aequitas. The note is a multiple advance note, with a

maximum advance amount of $360,000. Effective December 31, 2009,

there will be no additional advances made under the note and the note was

amended and was modified to reflect modified payment and maturity date

information. The maturity date was further extended on March 31, 2010

to be September 30, 2010. Under these modified terms all amounts

outstanding under this note are due and payable on the earliest of the

following: (a) September 30, 2010; (b) the closing of

a loan or other financing provided to the Company by a senior lender or other

source in an amount sufficient to pay off this note; (c) the closing of a

private investment in public equity financing and/or any other financing event

with gross proceeds to the Company in excess of $1,000,000; provided, however,

that after the occurrence of an event of default under the note, the outstanding

principal and all accrued interest will be payable on demand. Unless

otherwise agreed or required by applicable law, payments will be applied first

to expenses for which the Company is liable under the note (including unpaid

collection costs and late charges), next to accrued and unpaid interest, and the

balance to principal. In addition, the outstanding principal balance

and all accrued and unpaid interest will be due and payable in the event of (x)

a sale of all or substantially all of the assets of the Company, or (y) the

transfer of ownership or beneficial interest, by merger or otherwise, of 50% or

more of the stock of the Company.

On

January 15, 2010, CarePayment entered into agreements pursuant to which it

could borrow up to a maximum of $500,000 from ACF, an affiliate of

Aequitas. The Company was advanced $31,000 on January 14, 2010, which

was repaid on February 12, 2010. As of March 31, 2010,

there are no outstanding advances under these agreements with

ACF. These agreements expired on March 31, 2010.

4. Mandatorily

Redeemable Convertible Preferred Stock

On

December 30, 2009, the Company issued 1,000,000 shares of Series D

Preferred in connection with the transactions described in Note 1

above. Holders of the Series D Preferred receive a preferred dividend

of $0.50 per share per annum, when and if declared by our Board of Directors,

and a liquidation preference of $10 per share, plus cumulative unpaid

dividends. The Company may redeem all of the Series D Preferred at

any time upon 30 days' prior written notice, and is required to redeem all of

the Series D Preferred in January 2013 at a purchase price equal to the

liquidation preference in effect on January 1, 2013. If the

Company is unable to redeem the Series D Preferred with cash or other

immediately available funds for any reason, the holders of Series D Preferred

will have the right to exchange all shares of Series D Preferred for an

aggregate 99% ownership interest in CP Technologies.

10

The fair

value of the Series D Preferred was determined using a dividend discount model

assuming a 9% discount rate and that the cumulative dividends of $0.50 per share

will be accrued and received at the mandatory redemption date (Level 3 inputs in

the fair value hierarchy). The resulting fair value of the 1,000,000 shares of

Series D Preferred issued on December 30, 2009 was $8,805,140.

The

difference between the fair value of the Series D Preferred at December 31,

2009 of $8,805,140 and the redemption value of $10,000,000 will be accreted to

interest expense over the period to redemption in January 2013 using the level

yield method. The carrying value at March 31, 2010 is

$8,896,486.

5. Shareholders’

Deficit

Preferred

Stock:

As

of April 1, 2010, the Company's Certificate of Designation for Series

D Preferred was amended by adding a provision allowing for the conversion of the

Series D Preferred at any time after one year after its

issuance. Each share of Series D Preferred Stock is convertible into

such number of fully paid and nonassessable shares of Class A Common Stock of

the Company as is determined by dividing the amount of $10.00 per share (as

adjusted for stock splits, stock dividends, reclassification and the like with

respect to the Series D Preferred) by the Conversion Price (defined in the

following sentence) applicable to such share in effect on the date the

certificate is surrendered for conversion. The Conversion Price per

share of Series D Preferred is 80% of the volume weighted average price of the

Class A Common Stock; provided, however, that in no event will the Conversion

Price be less than $1.00 per share.

Effective

April 15, 2010, the Company sold 200,000 shares of Series D Preferred for

aggregate consideration of $2,000,000, which was paid pursuant to a promissory

note that accrues interest at 5% per annum and is due in full on or before April

15, 2011 (See Note 13).

Stock

Warrants:

As of

March 31, 2010, the Company had 4,417 warrants outstanding for Class A Common

Stock and 6,510,092 warrants outstanding for Class B Common Stock which are

exercisable as follows:

|

Warrants

|

Exercise Price

|

Expiration Date

|

||||||

| 3,189 | (1) | $ | 37.50 |

April

2015

|

||||

| 487 | (1) | $ | 72.00 |

June

2016

|

||||

| 667 | (1) | $ | 75.00 |

July

2011

|

||||

| 74 | (1) | $ | 4,077.00 |

March

2012

|

||||

| 6,510,092 | (2) | $ | 0.01 |

December

31,

2014

|

||||

|

(1)

|

Warrants

are exercisable for Class A Common

Stock

|

|

(2)

|

Warrants

are exercisable for Class B Common Stock. The Warrants were

exercised in full on April 2, 2010 (See Note

13).

|

Warrants

for 7,330 shares of Class A Common Stock were exercised on March 11, 2010,

resulting in $259 proceeds to the Company.

On April

15, 2010, the Company issued warrants for the purchase of up to 1,200,000 shares

of the Company's Class A Common Stock at an exercise price of $0.001 per share

(See Note 13).

Common

Stock:

At the

annual meeting of the shareholders held on March 31, 2010, the Company's

shareholders voted to amend the Company’s Articles of Incorporation to

effect a reverse stock split (“Reverse Stock Split”) of the Company's common

stock. Pursuant to the Reverse Stock Split, each ten shares of Common Stock

issued and outstanding immediately prior to the Reverse Stock Split were

combined and reclassified as one share of fully paid and nonassessable common

stock.

11

At the

same annual meeting of the shareholders on March 31, 2010, the Company's

shareholders also voted to amend the Company’s Articles of Incorpration to

create two classes of common stock, Class A Common Stock and Class B Common

Stock. The Articles authorize 75 million shares of common stock, of

which 65 million shares are designated as Class A Common Stock and 10 million

shares are designated as Class B Common Stock. Holders of Class A

Common Stock are entitled to one vote per share, and holders of Class B Common

Stock are entitled to ten votes per share, on any matter submitted to the

shareholders. Effective immediately after the Reverse Stock Split,

each share of common stock outstanding was automatically converted into one

share of Class A Common Stock.

The

condensed consolidated financial statements and notes thereto have been

retroactively restated to reflect the Reverse Stock Split and such conversion

for all periods presented.

6. Revenue

Fees

Revenue

The

Company recognizes revenue in conjunction with a servicing agreement

with CarePayment, LLC. CarePayment, LLC pays the Company a servicing

fee equal to 5% annually of total funded receivables being serviced, an

origination fee equal to 6% of the original balance of newly generated funded

receivables, and a “back end fee” based on 25% of CarePayment, LLC’s quarterly

net income, adjusted for certain items. The Company recognized

revenue related to this servicing agreement of $1,304,717 for the three months

ended March 31, 2010.

7. Other

Income (Expense)

Loss

Reimbursement

The

Company’s servicing agreement with CarePayment, LLC provides for CarePayment,

LLC to pay additional compensation equal to the Company’s actual monthly losses

for the first quarter of 2010 and an amount equal to 50% of actual monthly

losses for the second quarter of 2010. This additional compensation

is intended to reimburse the Company for transition costs that are not

specifically identifiable. For the three months ended March 31,

2010, the Company recorded this loss reimbursement of $873,371 as other

income.

Interest

Expense

Interest

expense of $164,049 for the three months ended March 31, 2010 includes

$91,346 of accretion of the discount on the mandatorily redeemable preferred

stock (See Note 4). Interest expense of $77,770 for the three months

ended March 31, 2009 includes $32,940 of amortization of debt

discount.

8. Earnings

(Loss) per Common Share

The

shares used in the computation of the Company’s basic and diluted loss per

common share are reconciled as follows:

|

Three Months Ended

March 31

|

||||||||

|

2010

|

2009

|

|||||||

|

Weighted

average basic common shares outstanding

|

1,384,915 | 197,379 | ||||||

|

Dilutive

effect of convertible preferred stock

|

(1 | ) | (2 | ) | ||||

|

Dilutive

effect of warrants

|

(1 | ) | (2 | ) | ||||

|

Dilutive

effect of employee stock options

|

(1 | ) | — | |||||

|

Weighted

average diluted common shares outstanding

|

1,384,915 | 197,379 | ||||||

|

(1)

|

Common

stock equivalents outstanding for the three months ended March 31,

2010 excluded in the computation of diluted EPS because their effect would

be anti-dilutive as a result of applying the treasury stock method

are: warrants to purchase 6,510,092 shares of Class B Common

Stock, warrants to purchase 4,417 shares of Class A Common Stock, 1

million shares of Series D Preferred Stock convertible to purchase

1,000,000 shares of Class A Common Stock, and stock options to purchase

787,030 shares of Class A Common

Stock.

|

|

(2)

|

Common

stock equivalents outstanding for the three months ended March 31,

2009 excluded in the computation of diluted EPS because their effect would

be anti-dilutive as a result of applying the treasury stock method

are: warrants to purchase 1,072,414 shares of Class A Common

Stock and Series C Preferred Stock convertible to purchase 18,605 shares

of Class A Common Stock.

|

12

9. Employee

Benefit Plans

Stock

Incentive Plan

In

February 2010, the Company adopted the 2010 Stock Option Plan (the "Plan")

pursuant to which the Company may grant restricted stock and stock options for

the benefit of selected employees and directors. The Plan authorized grants of

878,338 shares of Class A Common Stock. Grants are issued at prices equal to the

estimated fair market value of the stock as defined in the Plan on the date of

the grant, vest over various terms (generally three years), and expire ten years

from the date of the grant. The Plan allows vesting based upon

performance criteria; all current grants outstanding are time-based vesting

instruments. Certain option and share awards provide for accelerated

vesting if there is a change in control of the Company (as defined in the

Plan). The fair value of share based options granted is calculated

using the Black-Scholes option pricing model. A total of 91,308 shares of Class

A Common Stock remained reserved for issuance under the Plan at March 31,

2010.

The

Company accounts for stock-based compensation by estimating the fair value of

options granted using a Black-Scholes option valuation model. The

Company recognizes the expense for grants of stock options on a straight-line

basis in the statement of operations as operating expense based on their fair

value over the requisite service period.

For stock

options issued in February 2010, the following assumptions were

used:

|

Expected

life (in years)

|

5.5 | |||

|

Expected

volatility

|

40.90 | % | ||

|

Risk-free

interest rate

|

2.58 | % | ||

|

Expected

dividend

|

— | |||

|

Weighted

average fair value per share

|

$ | 0.061 |

Expected

volatilities are based on historic volatilities from traded shares of a selected

publicly traded peer group. Historic volatility has been calculated using the

previous two years’ daily share closing price of the index companies. The

Company has no historical data to estimate forfeitures. The expected term of

options granted is the safe harbor period approved by the Securities and

Exchange Commission using the vesting period and the contract life as factors.

The risk-free rate for periods matching the contractual life of the option is

based on the U.S. Treasury yield curve in effect at the time of

grant.

A summary

of option activity under the Plan as of March 31, 2010 and changes during the

three months ended is presented below:

|

Number of

Shares

|

Weighted

Average

Exercise

Price

|

Weighted

Average

Remaining

Contractual

Life (years)

|

Aggregate

Intrinsic

Value

|

|||||||||||||

|

Options

outstanding at December 31,

2009

|

— | |||||||||||||||

|

Granted

|

787,030 | $ | 0.20 | |||||||||||||

|

Cancelled

|

— | |||||||||||||||

|

Exercised

|

— | |||||||||||||||

|

Options

outstanding at March 31,

2010

|

787,030 | $ | 0.20 | 9.9 | $ | 2,991 | ||||||||||

|

Options

exercisable at March 31,

2010

|

262,343 | $ | 0.20 | 9.9 | $ | 997 | ||||||||||

The

Company recorded compensation expense for the estimated fair value of options

issued of $18,429 for the three months ended March 31, 2010. As

of March 31, 2010, the Company had $29,580 of unrecognized compensation

cost related to unvested share-based compensation arrangements granted under the

Plan. The unamortized cost is expected to be recognized over a weighted-average

period of 1.9 years.

13

401(k)

Savings Plan

Employees

of the Company are eligible to participate in a 401(k) Savings

Plan. The Company matches 100% of the first 3% of eligible

compensation and 50% of the next 2% of eligible compensation that employees

contribute to the plan; the Company’s matching contributions vest

immediately. The Company recorded expense of $11,051 for the three

months ended March 31, 2010.

10. Commitments

and Contingencies

Operating

Leases:

The

Company and its subsidiaries lease office space and personal property used in

their operations from Aequitas, an affiliate of the Company. At

March 31, 2010, the Company's aggregate future minimum payments for

operating leases with the affiliate having initial or non-cancelable lease terms

greater than one year are payable as follows:

|

Year

|

Required Minimum

Payment

|

|||

|

2010

|

$ | 168,000 | ||

|

2011

|

$ | 229,000 | ||

|

2012

|

$ | 233,000 | ||

|

2013

|

$ | 238,000 | ||

|

2014

|

$ | 202,000 | ||

For the

three months ended March 31, 2010 and 2009, the Company incurred rent expense of

$56,058 and $15,000, respectively.

Off-Balance

Sheet Arrangements:

The

Company does not have any off-balance sheet arrangements.

Litigation:

From time

to time the Company may become involved in ordinary, routine or regulatory legal

proceedings incidental to the Company’s business. The Company is not

engaged in any legal proceedings nor is the Company aware of any pending or

threatened legal proceedings that, singly or in the aggregate, could have a

material adverse effect on the Company.

11. Fair

Value Measures

Fair

Value:

Fair

value is defined as the price that would be received to sell an asset or paid to

transfer a liability in an orderly transaction between market participants at

the measurement date. It establishes a fair

value hierarchy that distinguishes between (1) market participant assumptions

developed based on market data obtained from independent sources (observable

inputs) and (2) an entity's own assumptions about market participant assumptions

developed based on the best information available in the circumstances

(unobservable inputs). The fair value hierarchy consists of three broad levels,

which gives the highest priority to unadjusted quoted prices in active markets

for identical assets or liabilities (Level 1) and the lowest priority to

unobservable inputs (Level 3). The three levels of the fair value hierarchy are

described below:

|

Level

1 –

|

Unadjusted

quoted prices in active markets that are accessible at the measurement

date for identical assets or

liabilities.

|

|

Level

2 –

|

Observable

inputs other than Level 1 prices such as quoted prices for similar assets

or liabilities; quoted prices in markets that are not active; or other

inputs that are observable or can be corroborated by observable market

data for substantially the full term of the assets or

liabilities.

|

|

Level

3 –

|

Valuations

derived from valuation techniques in which one or more significant inputs

or significant value drivers are

unobservable.

|

Fair

Value of Financial Instruments:

The

carrying value of the Company's cash and cash equivalents, related party

receivable, accounts payable and other accrued liabilities approximate their

fair values due to the relatively short maturities of those

instruments.

14

The fair

value of the Company’s mandatorily redeemable Series D Preferred issued on

December 30, 2009 (Note 4), was determined using a discounted cash flow on

December 31, 2009; the assumptions used in the fair value calculation at

December 31, 2009 would be the same at March 31, 2010. The difference

between the fair value at issue date and the redemption value is being

accreted into expense over the period to redemption in January 2013 using the

level yield method. The carrying value of the Series D Preferred at

March 31, 2010 is $8,896,486, which approximates fair value.

The fair

value of the notes payable was calculated using our estimated borrowing rate for

similar types of borrowing arrangements for the periods ended March 31,

2010 and December 31, 2009. The Company’s estimated borrowing

rate has not changed; therefore, the carrying amounts reflected in the unaudited

condensed consolidated balance sheets for notes payable approximate fair

value.

12. Related-Party

Transactions

Effective

January 1, 2010, Aequitas began providing CP Technologies certain

management support services such as accounting, financial, human resources and

information technology services, under the terms of the Administrative Services

Agreement dated December 31, 2009. The total fee for the

services is approximately $65,100 per month. The fees will increase

by 3% on January 1 of each year, beginning January 1,

2011. Either party may change the services (including terminating a

particular service) upon 180 days prior written notice to the other party, and

the Administrative Services Agreement is terminable by either party on 180 days

notice. The Company paid fees under the Administrative Services

Agreement to Aequitas of $195,300 for the three months ended March 31,

2010, which are included in sales, general and administrative

expense.

Under the

terms of the Sublease dated December 31, 2009 between CP Technologies and

Aequitas, CP Technologies leases certain office space and personal property from

Aequitas pursuant to the Sublease. The rent for the real property is

$12,424 per month, and will increase by 3% each year beginning January 1,

2011. The rent for the personal property is $6,262 per month, and CP

Technologies also pays all personal property taxes related to the personal

property it uses under the Sublease. The Company paid fees under the

Sublease to Aequitas of $56,058 for the three months ended March 31, 2010,

which are included in sales, general and administrative expense.

Effective

on December 31, 2009, the Company and Aequitas entered into an amended and

restated Advisory Agreement (“Advisory Agreement”). Under the terms

of the Advisory Agreement, Aequitas provides services to the Company relating to

strategy development, strategic planning, marketing, corporate development and

such other advisory services as the Company reasonably requests from time to

time. The Company pays Aequitas a monthly fee of $15,000 for such

services. In addition, Aequitas will receive a success fee in the

event of certain transactions entered into by the Company. The

Company paid fees under the Advisory Agreement to Aequitas of $45,000 for the

three months ended March 31, 2010, which are included in sales, general and

administrative expense.

Effective

December 31, 2009, a Royalty Agreement was entered into between CP

Technologies and Aequitas, whereby CP Technologies pays Aequitas a royalty based

on new products (the "Products") developed by CP Technologies or its affiliates

or co-developed by CP Technologies or its affiliates, and Aequitas or its

affiliates and that are based on or use the Software. The royalty is

calculated as either (i) 1.0% of the net revenue received by CP Technologies or

its affiliates and generated by the Products that utilize funding provided by

Aequitas or its affiliates, or (ii) 7.0% of the face amount, or such other

percentage as the parties may agree, of receivables serviced by CP Technologies

or its affiliates that do not utilize such funding. No fees were paid

under the Royalty Agreement to Aequitas for the three months ended

March 31, 2010.

Beginning

January 1, 2010, the Company recognized revenue in conjunction with a

servicing agreement with CarePayment, LLC. CarePayment, LLC pays the

Company a servicing fee based on the total funded receivables being serviced, an

origination fee on newly generated funded receivables, and a “back end fee”

based on CarePayment, LLC’s quarterly net income, adjusted for

certain items. The Company received fee revenue under this agreement

of $1,304,717 for the three months ended March 31, 2010.

15

CarePayment,

LLC also paid the Company additional compensation equal to the Company’s actual

monthly losses for the first quarter of 2010. The Company received

$873,371 under this agreement for the first three months ended March 31,

2010 (See Note 7).

The

Company issued a note payable to MH Financial as described in Notes 1 and

3. The Company recorded interest expense on the note payable to MH

Financial of $61,811 and $38,145 for the three months ended March 31, 2010 and

2009, respectively. The Company also recorded interest expense on the note

payable to Aequitas of $10,696 and $6,592 for the three months ended March 31,

2010 and 2009, respectively. The Company paid $196 of interest

expense to ACF, an affiliate of Aequitas, for the three months ended March 31,

2010.

As of

March 31, 2010, the Company had a receivable of $557,666, due from CarePayment,

LLC. The Company had accrued interest payable to MH Financial of

$344,523 and $282,711 as of March 31, 2010 and December 31, 2009,

respectively. Additionally, the Company had accrued interest payable

to Aequitas of $52,066 and $41,371 as of March 31, 2010 and December 31,

2009.

13. Subsequent

Events

On April

15, 2010, the Company sold 200,000 shares of Series D Preferred to Aequitas

CarePayment Founders Fund, LLC (“Founders Fund”) for a purchase price of $10.00

per share. The Company received a promissory note from Founders Fund

for $2,000,000 which bears interest at 5% per annum and is due April 15,

2011. In connection with the sale of the Series D Preferred,

effective April 15, 2010, and for no additional consideration, the Company

issued a warrant to Founders Fund to purchase up to 1,200,000 shares of the

Company's Class A Common Stock at an exercise price of $0.001 per

share. The warrant expires on April 15, 2015.

In

connection with the formation of CP Technologies, the Company contributed to CP

Technologies 1,000,000 shares of its Series D Preferred, and warrants to

purchase 65,100,917 shares of Class B Common Stock of the Company at an exercise

price of $0.001 per share in exchange for Units representing a 50% ownership

interest in CP Technologies (See Notes 1 and 4). On December 31,

2009, CP Technologies redeemed from Aequitas and CarePayment, LLC all but one

half Unit each of their CP Technologies ownership Units in exchange for all of

the Company’s Series D Preferred and the Warrants that were held by CP

Technologies, resulting in the Company owning 99% of CP

Technologies. On March 31, 2010 the Company's shareholders approved a

1-for-10 reverse stock split of the Company's Common Stock, with the result that

the Warrants became exercisable for 6,510,092 shares of Class B Common Stock at

an exercise price of $0.01 per share. The Warrants were exercised in

full on April 2, 2010 by Aequitas Holdings, LLC, an affiliate of and as the

assignee of CarePayment, LLC resulting in $65,101 proceeds to the

Company.

16

ITEM

2. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS

The

following discussion provides information that management believes is relevant

to an assessment and understanding of the Company's operations and financial

condition. This discussion should be read in conjunction with the

unaudited condensed consolidated financial statements and accompanying

notes.

Forward-Looking

Statements

This

Quarterly Report on Form 10-Q contains forward-looking statements. Such

statements reflect management's current view and estimates of future economic

and market circumstances, industry conditions, company performance and financial

results. Words such as "expects," "anticipates," "intends," "plans," "believes,"

"seeks," "estimates" and variations of such words and similar expressions are

intended to identify such forward-looking statements. These

statements are subject to risks and uncertainties that could cause our future

results to differ materially from the results discussed

herein. Factors that might cause such a difference include, but are

not limited to, those discussed elsewhere in this Quarterly Report on Form

10-Q. We do not intend, and undertake no obligation, to update any

such forward-looking statements to reflect events or circumstances that occur

after the date of this filing.

Overview

CarePayment

Technologies, Inc. (formerly microHelix, Inc.) (“we,” “us,” “our,” “CarePayment”

or the “Company”) was incorporated as an Oregon corporation in

1991. From inception until September 28, 2007, we manufactured custom

cable assemblies and mechanical assemblies for the medical and commercial

original equipment manufacturer (OEM) markets. We were experiencing

considerable competition by late 2006 as our customers aggressively outsourced

competing products from offshore suppliers. In the first quarter of

2007, a customer that accounted for over 30% of our revenues experienced a

recall of one of its major products by the U.S. Food and Drug

Administration. As a result the customer cancelled its orders with

us, leaving us with large amounts of inventory on hand and significantly reduced

revenue.

On May

31, 2007 we informed our three secured creditors, BFI Business Finance, VenCore

Solution, LLC and MH Financial Associates, LLC ("MH Financial"), that we were

unable to continue business operations due to continuing operating losses and a

lack of working capital. At that time we voluntarily surrendered our

assets to these secured creditors, following which we and our wholly owned

subsidiary, Moore Electronics, Inc. ("Moore"), operated for the benefit of the

secured creditors until September 2007, when we ceased manufacturing operations

and became a shell company. MH Financial was, at that time, and

currently is, an affiliate of ours due to its ownership of shares of our capital

stock.

Following

September 2007 and continuing until December 31, 2009, we had no

operations. Our Board of Directors, however, determined to maintain

us as a shell company to seek opportunities to acquire a business or assets

sufficient to operate a business. To help facilitate our search for

suitable business acquisition opportunities, among other goals, on June 27, 2008

we entered into an advisory services agreement with Aequitas Capital Management,

Inc. (“Aequitas”) to provide us with strategy development, strategic planning,

marketing, corporate development and other advisory services. In

exchange for the services to be provided by Aequitas under that agreement, we

issued to Aequitas warrants to purchase 106,667 shares of our Class A Common

Stock at an exercise price of $0.01 per share.

Effective

at the end of December 2009, we acquired certain assets and rights that enabled

us to begin building a business that services accounts receivable for other

parties. The assets and rights we acquired had been previously

developed by Aequitas and its affiliate, CarePayment, LLC, under the

CarePayment® brand for servicing accounts receivable generated by hospitals in

connection with providing health care services to their patients. The

assets and rights we acquired included the exclusive right to administer,

service and collect patient accounts receivables generated by hospitals and

purchased by CarePayment, LLC or its affiliates, and a proprietary software

product that is used to manage the servicing. Typically CarePayment,

LLC or one of its affiliates purchase patient accounts receivable from hospitals

and then we administer, service and collect them on behalf of CarePayment, LLC

for a fee. Although we intend to grow our business to include

servicing of accounts receivable on behalf of other parties, currently

CarePayment, LLC is our only customer.

17

To

facilitate building the business, on December 30, 2009, we, Aequitas and

CarePayment, LLC formed an Oregon limited liability company, CP Technologies LLC

("CP Technologies") (formerly WS Technologies LLC). We contributed

shares of our newly authorized Series D Convertible Preferred Stock ("Series D

Preferred") and warrants to purchase shares of our Class B Common Stock to CP

Technologies. Aequitas and CarePayment, LLC contributed to CP

Technologies the CarePayment® assets and rights described in the foregoing

paragraph. CP Technologies then distributed the shares of Series D

Preferred to Aequitas and CarePayment, LLC, and the warrants to purchase shares

of Class B Common to CarePayment, LLC, to redeem all but half of one membership

unit (a "Unit") held by each of them. Following these transactions,

we own 99% of CP Technologies, and Aequitas and CarePayment, LLC each own 0.5%

of CP Technologies as of December 31, 2009.

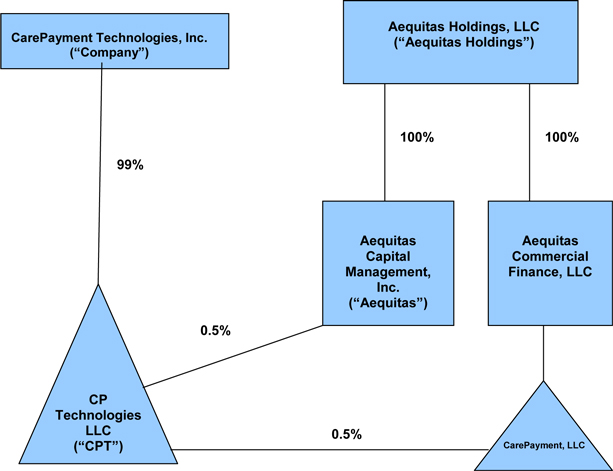

Aequitas

and CarePayment, LLC are affiliates due to their common control by Aequitas

Holdings, LLC (“Holdings”). Aequitas is a wholly owned subsidiary of

Holdings. CarePayment, LLC is a wholly owned subsidiary of Aequitas

Commercial Finance, LLC (“ACF”), which itself is a wholly owned subsidiary of

Holdings. On December 30, 2009, prior to the contribution of assets,

Holdings and its affiliates owned 13.1% of the Company’s common stock and

controlled 46.3% of the Company on a fully diluted basis.

Following

the transactions described above, our current corporate structure and

relationships with certain affiliates are depicted in the following

diagram:

|

|

•

|

Aequitas

controls approximately 46% of the issued and outstanding shares of the

Company’s Class A Common Stock on a fully diluted

basis.

|

18

The

Receivables Servicing Business

On

January 1, 2010 and as a result of the transactions described above, CP

Technologies began building a business to service hospital patient receivables

for an affiliate of the Company, CarePayment, LLC.

Generally,

a majority of a hospital's accounts receivable are paid by medical insurance,

Medicare and Medicaid. The balance of accounts receivable due

directly from the patient is not always a priority for many hospitals, due

primarily to the effort and expense required to collect those balances from

individuals. CarePayment, LLC, acting

alone or through its affiliates, purchases patient receivables from

hospitals. CP Technologies administers, services and collects the

receivables; CarePayment, LLC maintains ownership of the

receivables.

A patient

whose health care receivable is acquired by CarePayment, LLC becomes a

CarePayment® finance card customer and is issued a CarePayment® card, which has

an initial outstanding balance equal to the receivable purchased by CarePayment,

LLC. Balances due on the CarePayment® card are generally payable over

25 months with no interest. From the customer's point of view, the

CarePayment® card functions much like a credit card even though CP Technologies

advances no credit to the customer. In addition to servicing the

receivables, CP Technologies also analyzes potential receivable acquisitions for

CarePayment, LLC and recommends a course of action when it determines that

collection efforts for existing receivables are no longer

effective.

In

exchange for its services, CP Technologies receives origination fees at the time

CarePayment, LLC purchases and delivers receivables to CP Technologies for

servicing, a monthly servicing fee based on the total principal amount of

receivables being serviced, and a quarterly fee based upon a percentage of

CarePayment, LLC's quarterly net income. CP Technologies' servicing

agreement with CarePayment, LLC includes additional compensation during the

first six months of 2010 to cover the Company’s start up costs as it builds a

receivables servicing business. This compensation is equal to the

Company's actual monthly losses for the first quarter of 2010 and an amount

equal to 50% of actual monthly losses for the second quarter of

2010. The Company received $873,371 of such compensation from

CarePayment, LLC in the three months ended March 31, 2010.

CP

Technologies contracts with various vendors to service the CarePayment® finance

card product, send customer statements, accept payments, and transmit all

transaction history back to CP Technologies. Since CP Technologies is

responsible for the CarePayment® finance card's compliance with various laws and

regulations relating to consumer credit, these vendors are selected for their

specific expertise in such areas.

Other

Currently,

shares of our Class A Common Stock trade on the Pink Sheets under the symbol

CPYT.PK.

As of

August 2010, no class of our securities is registered under the Securities

Exchange Act of 1934, as amended (the "Exchange Act"), and we are not subject to

the information requirements of the Exchange Act. For additional

information, see the Explanatory Notes in our amendment to our Annual Report on

Form 10-K/A for the fiscal year ended December 31, 2009. On April 30,

2010, we filed a Form 10 with the Securities and Exchange Commission (the "SEC")

to register our Class A Common Stock under Section 12(g) of the Exchange

Act. We voluntarily withdrew the Form 10 on June 16, 2010 while we respond

to comments to the Form 10 that we received from the staff of the SEC. We

intend to re-file the Form 10, but cannot predict when we will do so or, once

re-filed, when the registration will be declared effective.

Critical

Accounting Policies and Estimates

The

discussion and analysis of the Company’s financial condition and results of

operations is based upon the Company's consolidated financial statements which

have been prepared in accordance with accounting principles generally accepted

in the United States. The preparation of these financial statements requires the

Company to make estimates and judgments that affect the reported amounts of

assets, liabilities, revenues and expenses, and related disclosure of contingent

assets and liabilities. The Company based the estimates on historical experience

and on various other assumptions that are believed to be reasonable under the

circumstances, the results of which formed the basis for making judgments about

the carrying value of assets and liabilities that are not readily apparent from

other sources.

19

The

Company believes the critical accounting policy and related judgments and

estimates identified in Note 2 to the Condensed Consolidated Financial

Statements (Unaudited) contained in this Report affect the preparation of the

Company's consolidated financial statements.

RESULTS

OF OPERATIONS

The

following discussion should be read in the context of the above overview and the

notes to the Condensed Consolidated Financial Statements (Unaudited) contained

in this Report.

THREE

MONTHS ENDED MARCH 31, 2010 AND 2009

Revenues:

The

Company had no revenue in 2009. As of January 1, 2010, the

Company began recognizing revenue in conjunction with a servicing agreement with

its affiliate, CarePayment, LLC. CarePayment, LLC pays the Company a

servicing fee equal to 5% annually of total funded receivables being

serviced, an origination fee equal to 6% of the original balance of newly

generated funded receivables, and a “back end fee” based on 25% of CarePayment,

LLC’s quarterly net income, adjusted for certain items. The Company

recorded fee revenues of $1,304,717 in the first three months of operations,

which were comprised of $408,448 of servicing fees, $896,269 of origination fees

and no “back end fees.”

Cost

of Revenues:

Cost of

revenue is comprised primarily of compensation and benefit costs for servicing

employees, costs associated with outsourcing billing, collection and

payment processing servicing, and the amortization of the servicing rights and

servicing software. For the three months ended March 31, 2010,