Attached files

| file | filename |

|---|---|

| EX-32.1 - NaturalShrimp Holdings Inc | ex32_1.htm |

| EX-31.1 - NaturalShrimp Holdings Inc | ex31_1.htm |

| EX-31.2 - NaturalShrimp Holdings Inc | ex31_2.htm |

| EX-32.2 - NaturalShrimp Holdings Inc | ex32_2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

x QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Quarterly Period Ended September 30, 2010

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Transition Period From ____to _____

Commission File Number: 000-54199

NATURALSHRIMP HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

|

Delaware

|

20-3350821

|

|

(State or other jurisdiction of

|

(I.R.S. Employer identification No.)

|

|

incorporation or organization)

|

|

2086 N. Valley Mills Road, Waco, Texas

Waco, TX 76710

(Address of principal executive offices)

(512) 442-2379

(Registrant’s telephone number, including area code)

|

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Date File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [ ] No [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ¨

Accelerated filer ¨

Non-accelerated filer ¨ (Do not check if a smaller reporting company)

Smaller reporting company x

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).Yes ¨ No x

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.Yes [ ] No [ ]

Number of shares of common stock outstanding as of December 12, 2010: 42,073,763

CAUTIONARY STATEMENT REGARDING FORWARD LOOKING INFORMATION

The discussion contained in this 10-Q under the Securities Exchange Act of 1934, as amended, contains forward-looking statements that involve risks and uncertainties. The issuer’s actual results could differ significantly from those discussed herein. These include statements about our expectations, beliefs, intentions or strategies for the future, which we indicate by words or phrases such as “anticipate,” “expect,” “intend,” “plan,” “we believe,” “the Company believes,” “management believes” and similar language, including those set forth in the discussions under “Notes to Consolidated Financial Statements” and “Management’s Discussion and Analysis or Plan of Operation” as well as those discussed elsewhere in this Form 10-Q. We base our forward-looking statements on information currently available to us, and we assume no obligation to update them. Statements contained in this Form 10-Q that are not historical facts are forward-looking statements that are subject to the “safe harbor” created by the Private Securities Litigation Reform Act of 1995.

|

NATURALSHRIMP HOLDINGS, INC.

FORM 10-Q

TABLE OF CONTENTS

|

||||

|

Page No.

|

||||

|

PART I – FINANCIAL INFORMATION

|

||||

|

Item 1. Condensed Financial Statements

|

3 | |||

|

Item 2. Management’s Discussion and Analysis of financial conditions and results of operations

|

11 | |||

|

Item 3. Quantitative and Qualitative Disclosures on Market Risk

|

21 | |||

|

Item 4T. Controls and Procedures

|

22 | |||

|

PART II – OTHER INFORMATION

|

||||

|

Item 1. Legal Proceedings

|

23 | |||

|

Item 1A. Risk Factors

|

23 | |||

|

Item 2. Unregistered Sales of Equity Securities and Use of Proceeds

|

23 | |||

|

Item 3. Defaults Upon Senior Securities

|

26 | |||

|

Item 4. Submission of Matters to a Vote of Security Holders

|

26 | |||

|

Item 5. Other Information

|

26 | |||

|

Item 6. Exhibits

|

26 | |||

2

PART 1 – FINANCIAL INFORMATION

Item 1. Condensed Financial Statements

INDEX TO NATURALSHRIMP HOLDINGS, INC. CONDENSED FINANCIAL STATEMENTS

NATURALSHRIMP HOLDINGS, INC. PAGE

Condensed Balance Sheets 4

Condensed Statements of Operations 5

Condensed Statements of Cash Flows 6

Notes to Condensed Financial Statements 7

3

NATURALSHRIMP HOLDINGS, INC. AND SUBSIDIARIES

(A Development Stage Company)

Condensed Consolidated Balance Sheets

September 30, 2010 and December 31, 2009

|

September 30,

|

December 31,

|

|||||||

|

2010

|

2009

|

|||||||

|

(Unaudited)

|

(Audited)

|

|||||||

|

ASSETS

|

||||||||

|

Current Assets

|

||||||||

|

Cash and Cash Equivalents

|

$ | 8,861 | $ | 24,490 | ||||

|

Total Current Assets

|

8,861 | 24,490 | ||||||

|

Fixed Assets

|

||||||||

|

Land

|

202,293 | 202,293 | ||||||

|

Buildings

|

1,327,425 | 1,327,425 | ||||||

|

Machinery and Equipment

|

662,155 | 640,082 | ||||||

|

Automobiles

|

26,731 | 26,731 | ||||||

|

Office Furniture

|

22,060 | 22,060 | ||||||

|

Accumulated Depreciation

|

(576,723 | ) | (493,090 | ) | ||||

|

Total Fixed Assets

|

1,663,941 | 1,725,501 | ||||||

|

Other Assets

|

||||||||

|

Deposits

|

500 | 500 | ||||||

|

Patents/Trademarks

|

53,837 | 53,837 | ||||||

|

Total Other Assets

|

54,337 | 54,337 | ||||||

|

Total Assets

|

$ | 1,727,139 | $ | 1,804,328 | ||||

|

LIABILITIES AND STOCKHOLDERS' EQUITY

|

||||||||

|

Current Liabilities

|

||||||||

|

Accounts Payable - Trade

|

$ | 174,201 | $ | 113,557 | ||||

|

Interest Payable - Related Parties

|

52,509 | 21,027 | ||||||

|

Accrued Liabilities

|

267,850 | 185,878 | ||||||

|

Current Portion of Lines of Credit

|

922,953 | 503,029 | ||||||

|

Notes Payable - Related Party

|

2,512,226 | 2,271,543 | ||||||

|

Current Portion of Long-Term Debt

|

22,288 | 7,586 | ||||||

|

Total Current Liabilities

|

3,952,027 | 3,102,620 | ||||||

|

Notes Payable - Related Parties, Less Current Portion

|

113,312 | 113,312 | ||||||

|

Long-Term Debt, Less Current Portion

|

- | 20,771 | ||||||

|

Total Long-Term Liabilities

|

113,312 | 134,083 | ||||||

|

Total Liabilities

|

4,065,339 | 3,236,703 | ||||||

See Notes to Condensed Financial Statements

4

NATURALSHRIMP HOLDINGS, INC. AND SUBSIDIARIES

(A Development Stage Company)

Condensed Consolidated Balance Sheets

September 30, 2010 and December 31, 2009

|

Stockholders' Equity

|

||||||||

|

Preferred Stock, $.01 Par Value 10,000,000 Shares Authorized,

|

||||||||

|

969,624 Shares Issued and Outstanding

|

9,696 | 9,696 | ||||||

|

Common Stock, $.01 Par Value, 50,000,000 Shares Authorized,

|

- | |||||||

|

42,414,763 Shares Issued and 39,066,311 Shares Outstanding in

|

- | |||||||

|

2009 and 42,273,763 Shares Outstanding in 2010

|

419,897 | 392,373 | ||||||

|

Additional Paid In Capital

|

17,955,654 | 17,432,488 | ||||||

|

Deficit Accumulated During Development Stage

|

(20,723,447 | ) | (19,266,932 | ) | ||||

|

Total Stockholders' Equity

|

(2,338,200 | ) | (1,432,375 | ) | ||||

|

Less Treasury Stock, 171,000 Shares at Cost in 2009

|

- | - | ||||||

| (2,338,200 | ) | (1,432,375 | ) | |||||

|

Total Liabilities and Equity

|

$ | 1,727,139 | $ | 1,804,328 |

See Notes to Condensed Financial Statements

5

NATURALSHRIMP HOLDINGS, INC. AND SUBSIDIARIES

(A Development Stage Company)

Condensed Consolidated Statement of Operations

For the Nine Months Ended September 30, 2010 and 2009

|

3 Months Ended

|

9 Months Ended

|

|||||||||||||||

|

Sept 30, 2010

|

Sept 30, 2009

|

Sept 30, 2010

|

Sept 30, 2009

|

|||||||||||||

|

(Unaudited)

|

(Unaudited)

|

(Unaudited)

|

(Unaudited)

|

|||||||||||||

|

Sales

|

$ | - | $ | - | $ | 3,000 | $ | 76 | ||||||||

|

Cost of Sales

|

72,635 | 18,702 | 161,441 | 82,644 | ||||||||||||

|

Gross Profit (Loss)

|

(72,635 | ) | (18,702 | ) | (158,441 | ) | (82,568 | ) | ||||||||

|

Operating Expenses

|

||||||||||||||||

|

Advertising and Marketing

|

- | - | 100 | 99 | ||||||||||||

|

Auto Expense

|

2,385 | 5,936 | 18,056 | 12,967 | ||||||||||||

|

Bad Debt Expense

|

6,249 | - | 19,979 | - | ||||||||||||

|

Bank Service Charges

|

283 | 31 | 587 | 118 | ||||||||||||

|

Computer Expenses

|

1,111 | 411 | 2,255 | 1,921 | ||||||||||||

|

Commissions

|

50,240 | - | 50,740 | 5,000 | ||||||||||||

|

Consulting Fees

|

127,177 | 2,005 | 127,600 | 6,224 | ||||||||||||

|

Depreciation

|

27,289 | 59,839 | 83,633 | 127,161 | ||||||||||||

|

Dues and Subscriptions

|

183 | - | 431 | 60 | ||||||||||||

|

Entertainment & Meals

|

6,513 | 4,972 | 17,199 | 5,963 | ||||||||||||

| Stock Bonus - Board Members | 70,000 | - | 70,000 | - | ||||||||||||

| Stock Bonus - Employess | 34,000 |

-

|

34,000 | - | ||||||||||||

|

Insurance

|

5,371 | 1,165 | 16,329 | 3,221 | ||||||||||||

|

Legal & Accounting

|

24,892 | 14,900 | 95,680 | 14,900 | ||||||||||||

|

License & Permits

|

50 | 0 | 370 | 471 | ||||||||||||

|

Maintenance & Repairs

|

3,823 | 1,663 | 7,848 | 10,999 | ||||||||||||

|

Miscellaneous

|

6,725 | (2,240 | ) | 9,647 | 7,157 | |||||||||||

|

Office Expense

|

1,322 | 1,240 | 3,361 | 2,600 | ||||||||||||

|

Outside Services

|

658 | (24 | ) | 2,502 | 751 | |||||||||||

|

Postage & Delivery

|

420 | 550 | 1,272 | 1,832 | ||||||||||||

|

Printing & Production

|

0 | (447 | ) | 305 | 37 | |||||||||||

|

Parking & Tolls

|

359 | 365 | 1,174 | 504 | ||||||||||||

|

Rent

|

(30,466 | ) | 3,159 | 10,846 | 6,483 | |||||||||||

|

Salaries

|

121,158 | 109,991 | 304,951 | 366,816 | ||||||||||||

| Guarantor Fees | 252,000 | - | 252,000 | - | ||||||||||||

|

Supplies

|

2,320 | (223 | ) | 2,320 | 1,406 | |||||||||||

|

Taxes - Payroll

|

7,178 | 2,621 | 16,545 | 9,305 | ||||||||||||

|

Taxes - Property and Other

|

17,681 | (0 | ) | 23,817 | 1,525 | |||||||||||

|

Travel

|

9,803 | 4,204 | 22,474 | 9,403 | ||||||||||||

|

Utilities and Telephone

|

3,147 | 3,362 | 9,507 | 8,635 | ||||||||||||

|

Total Operating Expenses

|

753,868 | 213,483 | 1,205,525 | 605,561 | ||||||||||||

|

Net Operating Income (Loss) Before Other Income (Expense)

|

(753,868 | ) | (232,184 | ) | (1,363,966 | ) | (688,128 | ) | ||||||||

|

Other Income (Expense)

|

||||||||||||||||

|

Interest Income

|

- | 0 | - | 20 | ||||||||||||

|

Interest Expense

|

(41,715 | ) | (5,428 | ) | (98,776 | ) | (18,128 | ) | ||||||||

|

Other Income

|

5,000 | (1,307 | ) | 6,229 | 10,707 | |||||||||||

|

Other Expenses

|

- | (376 | ) | - | (389 | ) | ||||||||||

|

Total Other Income (Expense)

|

(36,715 | ) | (7,111 | ) | (92,547 | ) | (7,790 | ) | ||||||||

|

Net (Income) Loss

|

$ | (863,218 | ) | $ | (239,295 | ) | $ | (1,456,513 | ) | $ | (695,918 | ) | ||||

|

Earnings (Loss) Per Common Share

|

(0.01 | ) | (0.01 | ) | (0.02 | ) | (0.01 | ) | ||||||||

|

Earnings (Loss) Per Common Share - Assuming Dilution

|

(0.01 | ) | (0.01 | ) | (0.02 | ) | (0.01 | ) | ||||||||

See Notes to Condensed Financial Statements

6

NATURALSHRIMP HOLDINGS, INC. AND SUBSIDIARIES

(A Development Stage Company)

Notes to Condensed Consolidated Statement of Cash Flows

For the Nine Months Ended September 30, 2010 and 2009

|

For the Nine Months Ended

September 30, |

||||||||

|

2010

|

2009

|

|||||||

|

(Unaudited)

|

(Unaudited)

|

|||||||

|

Cash Flows From Operating Activities

|

||||||||

|

Net Income (Loss)

|

$ | (1,456,513 | ) | $ | (942,915 | ) | ||

|

Adjustments to Reconcile Net Income to Net Cash

|

||||||||

|

Provided by Operating Activities:

|

||||||||

|

Depreciation

|

83,633 | 126,161 | ||||||

|

(Increase) Decrease In:

|

||||||||

|

Account Receivable Related Party

|

(30,000 | ) | ||||||

|

Increase (Decrease) In:

|

||||||||

|

Accounts Payable - Trade

|

60,644 | 125,414 | ||||||

|

Accrued Liabilities

|

116,071 | 200,081 | ||||||

|

Net Cash Provided (Used) by Operating Activities

|

(1,196,165 | ) | (461,259 | ) | ||||

|

Cash Flows From Investing Activities:

|

||||||||

| Purchase of Fixed Assets | (22,073) | |||||||

|

Sale of Fixed Assets

|

- | 1,100 | ||||||

| Issue Stock For Services | 496,691 | - | ||||||

|

Net Cash Provided (Used) by Investing Activities

|

(22,073) | 1,100 | ||||||

|

Cash Flows From Financing Activities:

|

||||||||

|

Proceeds from Related Party Line of Credit

|

391,067 | 51,126 | ||||||

|

Net Proceeds LT Debt

|

(6,841 | ) | 29,559 | |||||

|

Principal Payments/Proceeds on Long-Term Debt

|

(6,069 | ) | (6,062 | ) | ||||

| Diposition of Prototypes | - | 95,343 | ||||||

|

Sale of Stock

|

54,000 | 153,600 | ||||||

|

Net Cash Provided (Used) by Financing Activities

|

432,157 | 228,223 | ||||||

|

Net Increase (Decrease) in Cash

|

(255,885 | ) | (253,501 | ) | ||||

|

Cash at Beginning of Year

|

24,490 | 22,649 | ||||||

|

Cash at End of Year

|

$ | (231,395 | ) | $ | (230,852 | ) | ||

See Notes to Condensed Financial Statements

7

NATURALSHRIMP HOLDINGS, INC. AND SUBSIDIARIES

(A Development Stage Company)

Notes to the Consolidated Unaudited Financial Statements

September 30, 2010

Note A – Nature of the Organization

On March 5, 2001, NaturalShrimp Holdings, Inc. (the Company), a successor company, was incorporated under the laws of the State of Delaware. Pursuant to the organizing documents, the Company is authorized to issue 50,000,000 shares of common stock and 10,000,000 shares of preferred stock, both classes with a par value of $0.01 per share. The company has two wholly owned subsidiaries.

NaturalShrimp Corporation (NSC) was incorporated on August 12, 2005, under the laws of the State of Delaware and is a wholly-owned subsidiary of the Company. NSC merged with NaturalShrimp Corporation (a Texas corporation) on September 6, 2005 pursuant to an Agreement and Plan of Merger (NSC Agreement). Under the NSC Agreement, common stock changed from no par value to $0.01 par value and the number of shares authorized for issuance decreased to 1,000 shares. On March 24, 2008, NSC merged with NaturalShrimp San Antonio, L.P (NSSA) (a Texas limited partnership) pursuant to an Agreement and Plan of Merger (NSSA Agreement). NSC continued to exist as the surviving corporation. NSC is an agro-tech company that grows and sells shrimp in an indoor controlled production facility.

NaturalShrimp International, Inc. (NSI) was incorporated on August 12, 2005, under the laws of the State of Delaware and is a wholly-owned subsidiary of the Company. NSI merged with NaturalShrimp International, Inc. (a Texas Corporation incorporated November 12, 1999, as Quantum Access Corporation) pursuant to an Agreement and Plan of Merger (NSI Agreement) dated September 6, 2005. Under the NSI Agreement, common stock changed from no par value to $0.01 par value and the number of shares authorized for issuance decreased to 1,000 shares. NSI continued to exist as the surviving corporation. NSI was created for the purpose of establishing and maintaining all of the Company’s international joint ventures.

Note B – Basis of Presentation and Summary of Significant Accounting Policies

Basis of Accounting

The consolidated financial statements are prepared in conformity with United States generally accepted accounting principles (GAAP).

Financial Accounting Standards Board (FASB) Accounting Standards Codification™ (the Codification or ASC)

The Codification is now the single source of authoritative U.S. GAAP recognized by the FASB to be applied by nongovernmental entities. Rules and interpretive releases of the Securities and Exchange Commission (SEC) under authority of federal securities laws are also sources of authoritative GAAP for SEC registrants. The Codification became effective for interim and annual periods ending after September 15, 2009 and superseded all previously existing non-SEC accounting and reporting standards. All other nongrandfathered non-SEC accounting literature not included in the Codification is nonauthoritative. Commencing with the year ended December 31, 2009, all references to GAAP now use the specific Codification Topic or Section rather than prior accounting and reporting standards. The Codification did not change existing GAAP and, therefore, did not affect the Company’s financial position or results of operations.

Consolidation

The consolidated financial statements include the accounts of NaturalShrimp Holdings Inc. and its wholly owned subsidiaries, NaturalShrimp Corporation and NaturalShrimp International. All significant intercompany accounts and transactions have been eliminated in consolidation.

In December 2007, ASC Topic 810, Consolidation, was modified to provide guidance for the accounting and reporting of noncontrolling interests, changes in controlling interests, and the deconsolidation of subsidiaries. The adoption of the provisions of Topic 810, effective January 1, 2009, did not affect the Company’s financial position or results of operations.

Cash and Cash Equivalents

For the purpose of the statement of cash flows, the Company considers all highly liquid instruments purchased with a maturity of three months or less to be cash equivalent.

8

Inventories

Shrimp inventories are stated at the lower of cost (first-in, first-out method) or market. Purchased shrimp (Post Larvae or PL) are carried at purchase costs plus costs of maintenance through the balance sheet date. The Company had no inventory at the end of September 30, 2010.

Cost of Goods Sold

Cost of goods sold is normally attributable to the costs incurred for sales.

Bad Debts

Uncollectible accounts receivable are written off at the time amounts are determined to be a loss to the Company. An allowance for doubtful accounts receivable is maintained as necessary, based upon specific accounts receivable outstanding determined to be uncollectible and the appropriate charge is made to operations. Actual amounts charged off are reported for income tax purposes. As of September 30, 2010, no allowance for doubtful accounts was deemed necessary.

Equity Method of Accounting for Investments

NSI has a 50% joint venture interest in NaturalShrimp Europe Ltd. (NSE), which operates facilities in Spain. NSI’s investment in NSE is carried at cost and adjusted for NSI’s proportionate share of undistributed earnings or losses. As of December 31, 2009, and 2008 NSE has negative equity of $141,805 and $126,403, respectively. As a result, the amount of the investment is reported as zero on the Company’s balance sheets.

Intangibles

The cost of patents/trademarks for the nine months ended September 30, 2010 was $53,837. These items have not been amortized because the company is still in the development stage. In 2009, prototypes were deemed no longer in use and were written off.

Fixed Assets

Equipment is carried at cost and is depreciated over the estimated useful lives of the related assets. Depreciation on buildings is computed using the straight-line method, while depreciation on all other fixed assets is computed using the Modified Accelerated Cost Recovery System (MACRS) method. MACRS does not materially differ from GAAP. Estimated useful lives are as follows:

Automobiles 5 years

Buildings 27 ½ - 39 years

Machinery and Equipment 5 - 10 years

Office Furniture 3 - 10 years

The statement of operations reflects depreciation expense of $83,633 for the nine months ended September 30, 2010.

Shipping and Handling

The Company reports shipping and handling charges to customers as part of sales and the associated expense as part of cost of sales.

Income Taxes

Deferred income tax assets and liabilities are computed annually for differences between the financial statement and tax basis of assets and liabilities that will result in taxable or deductible amounts in the future based on enacted tax laws and rates applicable to the periods in which the differences are expected to affect taxable income. Valuation allowances are established when necessary to reduce deferred tax assets to the amount expected to be realized. Income tax expense is the tax payable or refundable for the period plus or minus the change during the period in deferred tax assets and liabilities.

Use of Estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect certain reported amounts and disclosures. Accordingly, actual results could differ from those estimates.

9

Fair Value Measurements

In September 2006, the FASB issued ASC Topic 820, Fair Value Measurements and Disclosures. Topic 820 defines fair value, establishes a framework for measuring fair value under GAAP, and expands disclosures about fair value measurements. The provisions of Topic 820 became effective for annual financial periods beginning after November 15, 2007. Effective January 1, 2008, the Company adopted Topic 820, with the exceptions allowed under the modification described below. The adoption of Topic 820 did not affect the Company’s financial position or results of operations.

In February 2008, the FASB modified Topic 820, which delayed the effective date for applying fair value disclosures for nonfinancial assets and nonfinancial liabilities, except for items that are recognized or disclosed at fair value in the financial statements on a recurring basis (at least annually), until fiscal years beginning after November 15, 2008. Effective January 1, 2009, the Company adopted this modification of Topic 820, which did not affect the Company’s financial position or results of operations.

Financial Instruments

The Company’s financial instruments include cash and cash equivalents, receivables, payables, and debt and are accounted for under the provisions of ASC Topic 825, Financial Instruments. The carrying amount of these financial instruments as reflected in the consolidated balance sheets approximates fair value.

Stock-Based Compensation

The Company issues stock-based compensation for both contractual services of non-related and related parties. Valuation of the stock is determined by the current investing price of the stock. Once the stock is issued the appropiate expense account is charged. All stock-based compensation currently issued is 100% vested.

Subsequent Events

In May 2009, the FASB issued ASC Topic 855, Subsequent Events, which established general standards of accounting for and disclosure of events that occur after the balance sheet date but before financial statements are issued or are available to be issued. In particular, guidance was provided regarding (i) the period after the balance sheet date during which management of a reporting entity should evaluate events or transactions that may occur for potential recognition or disclosure in the financial statements, (ii) the circumstances under which an entity should recognize events or transactions occurring after the balance sheet date in its financial statements, and (iii) the disclosures that an entity should make about events or transactions that occur after the balance sheet date. The provisions of Topic 855 became effective for interim or annual financial periods ending after June 15, 2009. Effective December 31, 2009, the Company adopted Topic 855. The adoption of Topic 855 did not affect the Company’s financial position or results of operations but did result in additional disclosure, which is provided in Note I.

Note C – Lines of Credit

The Company has a working capital line of credit with Community National Bank. On August 28, 2009, the Company renewed the line of credit for $30,000. The line of credit bears an interest rate of 7.5% and is payable quarterly. The line of credit matures on August 28, 2011, is secured by various Company assets, and is also personally guaranteed by two directors of the Company. The balance of the line of credit at September 30, 2010 was $30,000.

The Company also has a working capital line of credit with Extraco Bank. On March 12, 2009, the Company renewed the line of credit for $500,000. The line of credit bears an interest rate of 4.0% that is compounded monthly on unpaid balances and is payable monthly. The line of credit matures on March 12, 2011, and is secured by certificates of deposits and letters of credit owned by directors and shareholders of the Company. The balance of the line of credit, which includes accrued unpaid interest, was $474,014 at September 30, 2010.

Note D – Related Party Transactions

Accounting Fees

During the nine months ended September 30, 2010, the Company incurred and paid $830 in accounting fees to Walker and Vordenbaum, PC. Jack Walker, a shareholder of Walker and Vordenbaum, PC, is an officer, director and shareholder of the Company.

Note E – Going Concern

The Company has accumulated losses since inception, has negative working capital and negative equity, and is in default on one of its notes. These factors raise substantial doubt about the Company’s ability to continue as a going concern.

Management’s plans to address the going concern issues by raising additional capital for growth and plant expansion. The Company plans to improve the growth rate of the shrimp and the environmental conditions of its production facilities. Management also plans to acquire a hatchery in which the company can better control the environment in which to develop the post larvaes. If management is unsuccessful in these efforts, discontinuance of operations is possible. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

Note F – Subsequent Events

In January 2010, the Company entered into a Production Purchase Agreement with Nature’s Prime Organic Farms, in which Nature’s Prime agrees to purchase 500 pounds of shrimp every two weeks at a price of $6.00 per pound.

In August 2010, the Company entered into a Consulting agreement with Casson Media Group, Inc., in which Casson is to be paid $20,000 and $30,000 dollars after it has helped the Company raise $250,000 and $500,000 respectively.

The Company has evaluated subsequent events through December 31, 2010, the date which the financial statements were available to be issued.

10

Item 2. Management’s Discussion and Analysis of financial condition and results of operations

NaturalShrimp Holdings, Inc. is hereby providing cautionary statements identifying important factors that could cause our actual results to differ materially from those projected in forward-looking statements made in this quarterly report on Form 10-Q. Any statements that express, or involve discussions as to, expectations, beliefs, plans, objectives, assumptions or future events or performance (often, but not always, through the use of words or phrases such as “likely will result,” “are expected to,” “will continue,” “is anticipated,” “estimated,” “intends,” “plans” and “projection”) are not historical facts and may be forward-looking statements and involve estimates and uncertainties which could cause actual results to differ materially from those expressed in the forward-looking statements. Accordingly, any such statements are qualified in their entirety by reference to, and are accompanied by, the following key factors that have a direct bearing on our results of operations: the absence of contracts with customers or suppliers; our ability to maintain and develop relationships with customers and suppliers; our ability to successfully integrate acquired businesses or new brands; the impact of competitive products and pricing; supply constraints or difficulties; the retention and availability of key personnel; and general economic and business conditions.

We caution that the factors described herein could cause actual results to differ materially from those expressed in any forward-looking statements and that the investors should not place undue reliance on any such forward-looking statements. Further, any forward-looking statement speaks only as of the date on which such statement is made, and we undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which such statement is made or to reflect the occurrence of unanticipated events or circumstances. Consequently, no forward-looking statement can be guaranteed.

New factors emerge from time to time, and it is not possible for us to predict all such factors. Further, we cannot assess the impact of each such factor on our results of operations or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements.

Introduction to Our Business

NaturalShrimp Holdings, Inc. (“NaturalShrimp” or the “Company”) is the owner and creator of a commercially viable salt-water aquiculture production, research and distribution facility designed, built and operated in La Coste, Texas. We operate and license 100% self-contained shrimp aquiculture systems that recreate the natural ocean environment through an inland, enclosed, biosecure proprietary design that allows for high-density production of live shrimp. The NaturalShrimp production facility establishes an environmentally friendly, “green” system that does not rely on ocean water. The production system uses a state of the art "Microbial Floc" (Bio Floc) that encompasses a combination of prepared and natural marine proteins that are tailored for intensive growth. The Bio Floc is a collection of "good" bacteria that helps control water quality variables as well as provides a nutritious food source for the shrimp. The Bio Floc represents approximately twenty percent of the shrimp feed. Microbial floc is a combination of feed, shrimp detritus and bacteria. In addition to eating regular shrimp feed, as the shrimp swim through the floc they feed on it continuously through their gills. This is another form of feeding and provides an important percentage of their food intake. NaturalShrimp developed microbial floc as a part of our technology application to grow highly dense populations of shrimp in an enclosed, recirculating salt-water environment.

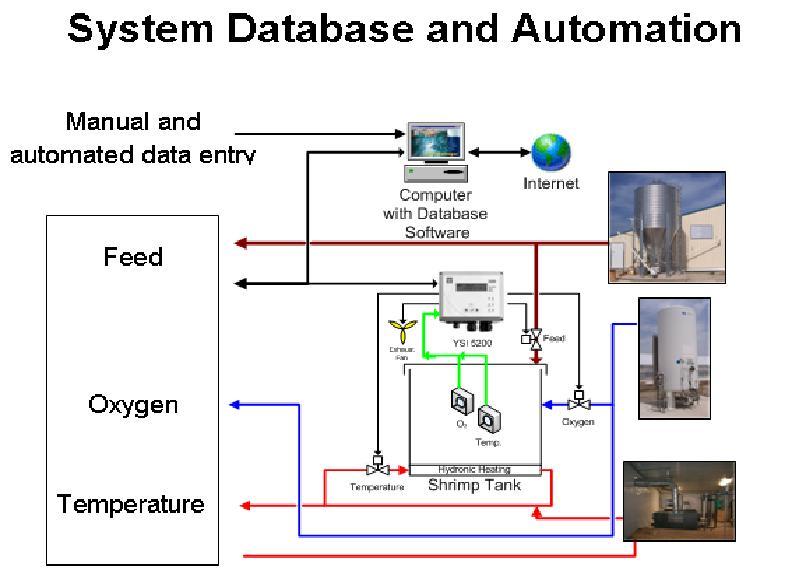

In addition, we have developed computer automated water controls that minimize labor costs and provide a disease-resistant production environment. NaturalShrimp has spent seven years developing this system and is ready to begin full-scale commercial production with the goal of licensing our technology to markets all over the world in the coming year.

Overview

The NaturalShrimp System consists of the technology utilized in a NaturalShrimp production facility, which allows the Company to raise shrimp in an ecologically controlled, high-density, low-cost environment.

The principle theories behind the NaturalShrimp System are characterized as:

1. High-density shrimp production

2. Natural ecology system

3. Regional production

4. Regional distribution

These principles form the foundation for the Company and its distributors so that customers are provided with continuous volumes of live and fresh shrimp at competitive prices.

11

Development

The Company began research and development in 2001 with the specific goal of developing and implementing a high-density, natural aquaculture system that could be located anywhere in the world and provide quality, fresh shrimp throughout the year. This process required the development of new and innovative techniques in shrimp aquaculture. The NaturalShrimp research team began by first growing shrimp in small systems. The team then improved the design, while slowly increasing the system size to meet targeted production goals.

In 2001, the Company began research and development of a high density, natural aquaculture system that is not dependent on ocean water to provide quality, fresh shrimp every week, fifty-two weeks a year. After three and half years, we developed a successful system but determined that it would not be economically feasible due to high operating costs. Over the next three and a half years, using the knowledge we gained from the first system, we developed a shrimp growth system that eliminated the high costs associated with the previous system and began growing shrimp. We have continued to refine this system, eliminating bacterial and other problems that affect enclosed systems and now have a successful shrimp growing process. Although we patented several features on the first system, we decided that it would be better to protect this system through the trade secret process, due to fact that the patent system is expensive and difficult to protect in other countries. Our research team consists of Doug Ernst, PhD, our Vice-President, Bill Botto, President of MicroTES Systems, a microbiology company located in San Antonio, Texas, and Tom Untermeyer, a systems engineer currently employed by Southwest Research Institute in San Antonio.

NaturalShrimp has produced many batches of shrimp over the last six years in order to develop a design that will consistently produce quality shrimp that grow to a large size at a specific rate of growth. This included experimenting with various types of natural live and synthesized feed supplies before selecting the most appropriate nutritious and reliable combination. It also included utilizing monitoring and control automation equipment to minimize labor costs and to provide the necessary oversight for proper regulation of the shrimp environment.

We have developed automation and control systems for our technology over the past three years. These systems control the feeding process, water quality controls, tank density levels and bacterial tests. We have designed the system to monitor our shrimp facilities around the world from our headquarters in La Coste, Texas. The automation also allows the Company to monitor facilities built throughout the world. The following figure shows the workflow design of the automation and control system:

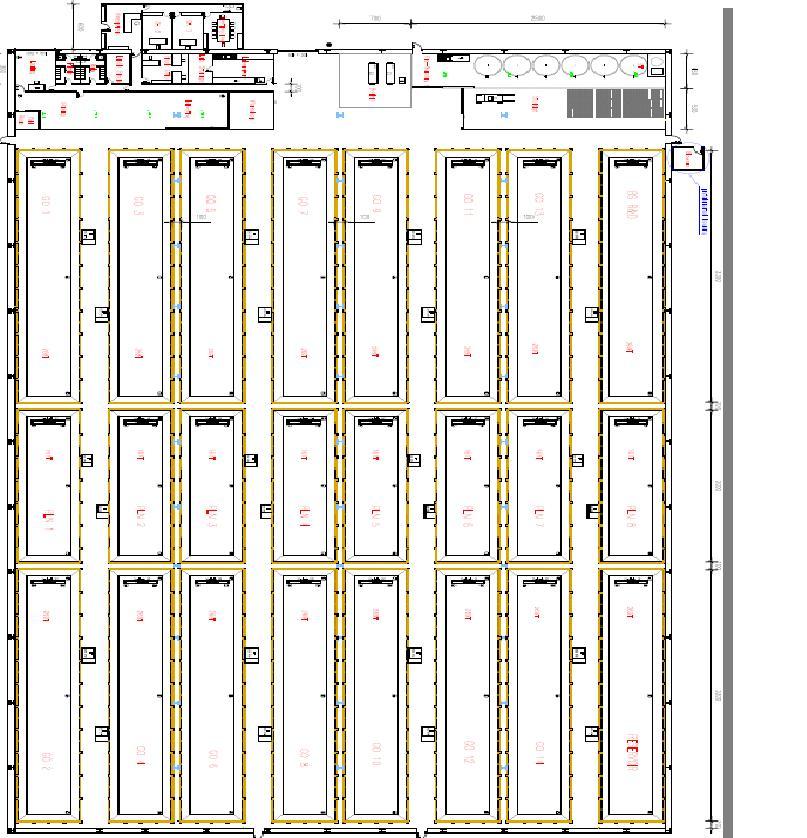

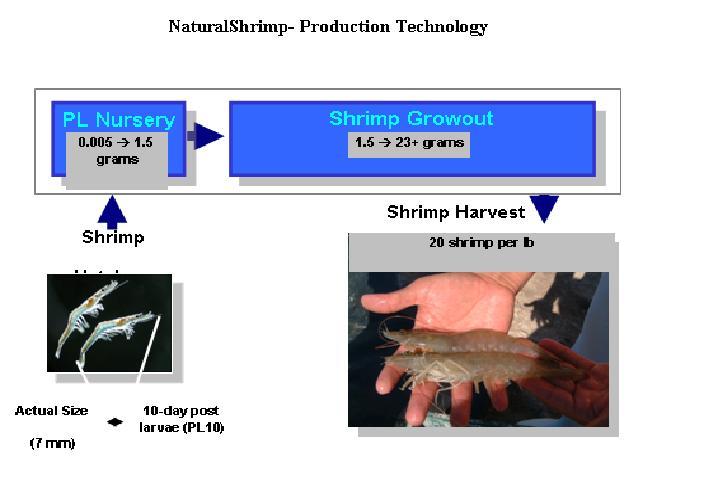

After the implementation of the first production facility in La Coste, Texas, the Company has made significant improvements that minimize the transfer of shrimp, which will reduce shrimp stress and labor costs. Our current system consists of a reception tank for new PL shrimp where the shrimp are acclimated; then moved to a nursery tank where they stay for six weeks to gain protected growth; then moved to a larger grow out tank for the rest of the twenty-four week cycle. Below is a diagram of our first production facility in La Coste, Texas.

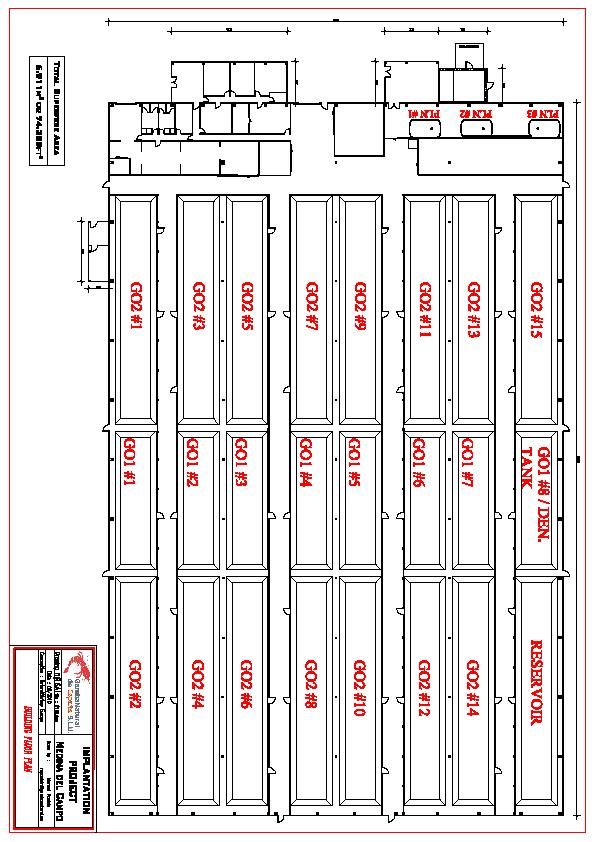

Our new design of a production facility consists of only three stages (PL Nursery, Grow-out and Harvest) as opposed to five stages in the current facility (above). The new system in Medina del Campo is a three-tank system, with the nursery tanks in the middle of the system. PL shrimp are acclimated in the nursery tanks for six-weeks and then moved to one of the grow out tanks on either side of the nursery where they stay for the rest of the twenty-four week cycle. When the PL shrimp are moved from the nursery tank to a grow out tank, more PL shrimp are brought into the nursery tank to start the process again. These shrimp will be moved to the grow out tank on the opposite side of the nursery once they are ready for final grow out. The new design of the nursery tank in the middle with grow out tanks on both sides is more efficient because the shrimp have to be moved less often and are in the main grow out tank longer without interruption.

In addition, the new design will encompass an automated tank cleaning system. The following figure shows the design layout of the tanks at in the Medina del Campo, Spain. The system in Medina del Campo, Spain is our newly designed system and consists of nursery tanks in the middle of the facility with grow out tanks on both ends. Funding for the system is complete and the building will be finished in December 2010. The production process will start in January of 2011.

12

Target Markets & Sales Price

The United States population is vast, with an annual shrimp consumption of 1.9 billion pounds of shrimp each year. The current average wholesale cost for frozen and delivered shrimp is $3.50 to $6.00 per pound, depending on quality and season, for large (18 to 22 per pound) shrimp. The target market for the Company is to establish NaturalShrimp production facilities and distribution networks in metropolitan areas of the United States, as well as international distribution networks through Joint Venture partnerships throughout the world. This should allow the Company to capture a significant portion of shrimp sales by offering locally grown, environmentally “green”, naturally grown, fresh shrimp at competitive wholesale prices.

On January 7, 2010, we signed a Production Purchase Agreement with Natures Prime Organic Foods (“Natures Prime) in Minnesota to purchase all the shrimp production at our La Coste facility and other facilities that we construct in the future at $6.00 per pound FOB. This is an exclusive agreement for a ten state Mid-West area. Pursuant to the Natures Prime agreement, the Company will deliver to Natures Prime shrimp production for each two-week period. Unless otherwise agreed in writing, each pound of shrimp shall consist of approximately 18-25 heads-on shrimp per pound delivered to Natures Prime. It is anticipated that the initial shrimp production from the Company’s facilities shall not be less than 500 pounds of shrimp per two-week period (the “Minimum Quantity”). The price charged for each pound of shrimp will be $6.00 per pound. Natures Prime agrees to send a fifty percent deposit on each order maturing for delivery thirty days before scheduled shipment and pay the balance by electronic bank transfer seven days before shipment. If during the initial growing period, the Company has more shrimp available than the Minimum Quantity for the delivery period, the Company shall notify Natures Prime of the amount of shrimp in excess of the Minimum Quantity ten (10) days prior to the projected shipment date and Natures Prime shall purchase the excess quantity, less amounts received by the Company in advance, by electronic bank transfer. The Natures Prime agreement commenced on the January 7, 2010 and will continue for a period of twelve (12) months. The Natures Prime agreement shall automatically renew for an additional twelve (12) months on the anniversary of the agreement unless terminated by either the Company or Natures Prime on sixty (60) days prior written notice. As of this filing, we have only set up the parameters for our long-term business relationship with Natures Prime. We have conducted a test run and have sent shrimp to Natures Prime to set up processing and shipping procedures. We plan to start shipping shrimp to Natures Prime by the end of 2010. The Natures Prime Organic Foods Agreement is attached as Exhibit 10.3 to our Form 10-12(g) and is hereby incorporated by reference.

A second market opportunity is through existing distributors in the South, Southwest and Western areas of the United States to purchase and distribute our shrimp on an exclusive basis. As further production ramps up, we intend to enter into agreements with one or more of these distributors.

A third market opportunity for the Company is to operate as a contract supplier to existing national processing companies to promote and distribute a frozen line of shrimp through their existing distribution channels.

A fourth market opportunity for the Company is to retail fresh shrimp through Shrimp Station. LLC outlets. During the test market Shrimp was retailed at $9-$11 per pound through this outlet. NaturalShrimp would wholesale the shrimp for $5 per pound to Shrimp Station, LLC outlets. In addition, NaturalShrimp would receive half of the profits of Shrimp Station, LLC from its 50% ownership stake in that concept. Pursuant to the Shrimp Station, LLC agreement, NaturalShrimp purchased 50% of the membership interests of Shrimp Station, LLC from Steve Easterling for the purchase consideration of 175,000 shares of common stock, $0.01 par value, of NaturalShrimp.

We have had discussions with Sysco Foods Services, Ben E. Keith Foods, HEB Foods, and distributors in Las Vegas and other seafood distributors in Texas and in the South, Southwest and Western areas of the United States. These distributors have indicated an interest in our shrimp and in doing business with us. Our hopes are to supply Natures Prime Organic Foods in the Midwest from facilities built in the corresponding region and then supply other potential distributors by building facilities in their corresponding region. We have done extensive marketing research with the Shrimp Station concept and hope to establish retail/wholesale outlets in major cities in the future. The focus of the research was to test consumer acceptance and develop long term pricing and marketing strategies.

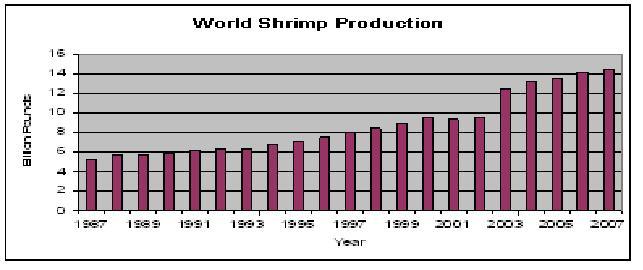

The world population consumes approximately 14 billion pounds of shrimp each year. This represents an annual wholesale market of approximately $50 billion. The following graph shows that shrimp production has been increasing over the past decade, but has been stabilizing over the past couple of years.

Source: USDA Foreign Agricultural Service. Live weight

13

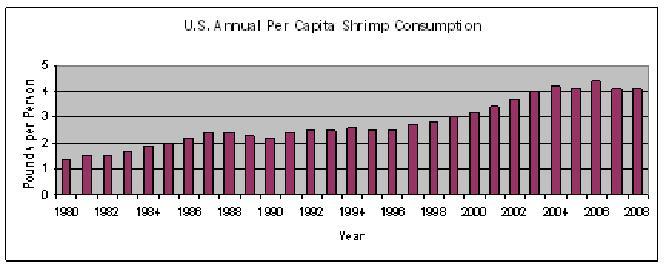

Since 1990, the amount of shrimp consumed per person in the United States has doubled to over 4 pounds per person, per year. In the past six years, consumption has increased 37.5%. The following graph depicts the annual per capita consumption of shrimp in the U.S. since 1990.

Source: USDA

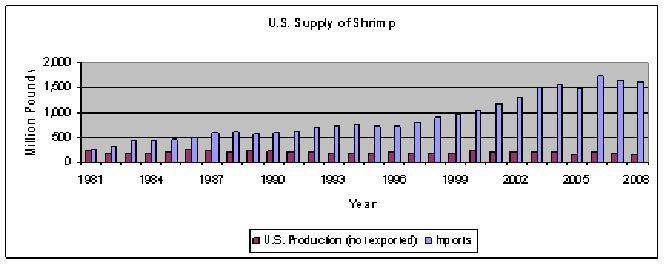

The following graph shows the world shrimp aquaculture production. The United States consumes over 1.7 billion pounds of shrimp per year. To achieve this total, it imports almost 1.5 billion pounds from other countries.

Source: USDA

New Products and Services

We continue to develop new products and growing procedures. Fresh shrimp is our major market at present. In 2011, we plan to install our own shrimp hatchery to develop a breeding program for growing stronger, more disease resistant shrimp. In 2011, our European partnership will begin testing the Peaneus Monodon species (commonly referred to as Tiger Shrimp), providing the Company with a jumbo size shrimp to complete our product line and thus, offer all shrimp sizes to clients.

Our Business Model

Nearly all of the shrimp consumed today are shipped frozen. Shrimp are typically frozen from six to twenty-four months before consumption. The NaturalShrimp system is designed to harvest a different tank each week, which provides for fresh shrimp throughout the year. We have a unique opportunity to create a niche market of “always fresh, never frozen” shrimp. As opposed to many of the foreign shrimp farms, we can also claim that our product is 100% free of antibiotics. The ability to grow shrimp locally, year round allows us to provide this high-end product to specialty grocery stores and upscale restaurants throughout the world. The growth period of our shrimp from post larva to market size is twenty-four weeks. We rotate the stocking and harvesting of our twenty-four tanks each week, which allows for weekly shrimp harvests. The NaturalShrimp product is free of all pollutants and is fed only all natural feeds.

Shrimp Density

The maximum density achieved by shrimp farms producing large quantities of shrimp is approximately 100,000kg* of shrimp per hectare**. Assuming a pond depth of one meter and an average large-size shrimp at harvest time, this translates to a shrimp density of approximately one shrimp per ten gallons of water. The NaturalShrimp production technology will deliver a density of one and a half to two shrimp per gallon of water.

* This figure is stated in the article found at http://www.shrimpnews.com/FreeReportsFolder/About.html as the maximum that a super-intensive shrimp farm currently produces. The cited reference actually says "Super-intensive shrimp farming...can produce yields of 20,000 to 100,000 kilograms per hectare per year"

100,000 kg/ha/yr = 10 kg/m2/yr

Yield (kg per per area per time) is not the same as density (kg per area or volume). For thecited yield at 2 crops per year, the max density would be 5 kg/m2. Our past production hasshown sustainable shrimp biomass densities at 8 - 10 kg/m3. Density expressed as kg/m2 and kg/m3 are the same when the water depth = 1.0 m.

** According to Wikipedia, a hectare (symbol ha) is a unit of area equal to, or one square hectometre (100 metres, squared), and is commonly used for measuring land area.

14

Shrimp Growth Period

The NaturalShrimp Production System is designed to produce shrimp at a harvest size of eighteen to twenty-two shrimp per pound in a period of twenty-four weeks. The Company currently purchases post-larva shrimp that are approximate ten days old (PL 10). In the future, the Company plans to build its own hatcheries to control the supply of shrimp to each of the NaturalShrimp facilities. Our NaturalShrimp Production System includes fourteen grow-out tanks and seven nursery tanks, which will produce fresh shrimp fifty-two weeks per year.

We move shrimp from the acclimation tanks to the mid-sized nursery tanks where they grow for six weeks. We refer to these tanks as nursery tanks. We then move the shrimp to the larger tank, a grow out tank, where they complete the 24-week growing period.

Distribution of Products

NaturalShrimp plans to build these environmentally “green” production facilities near major metropolitan areas of the United States. Today, we have one production facility in La Coste, Texas (near San Antonio) and plan to begin construction of a second facility in La Coste in the first half of 2011. Over the next five years, our plan is to increase construction of new facilities each year. In the fifth year, a new system will be completed each month, expanding first into the largest shrimp consumption markets of the United States.

Internationally, NaturalShrimp has entered into a joint venture agreement with a partner in Europe, BE Invest Ltd. Our partner has purchased the rights to grow and sell shrimp using the NaturalShrimp proprietary technology in twenty-eight European countries, starting in Spain. The joint venture partner is obligated to provide the capital needed for construction and operation of their initial facility. The construction of our first joint venture location began in Medina del Campo, Spain (northwest of Madrid). Each of the two members own 50% of the outstanding equity of NaturalShrimp Europe LTD, a Switzerland company (“NaturalShrimp Europe”). The purpose of the Members Agreement for NaturalShrimp Europe is to govern and address the business relationship between the Members in regards to the ownership, construction, operation, and management of shrimp production facilities throughout Europe and initially in Spain. Pursuant to the Members Agreement for NaturalShrimp Europe, the Company will provide certain services to NaturalShrimp Europe for a management fee of $10,000 per month. The Company will also provide certain consulting services to NaturalShrimp Europe for a consulting fee of $1,500 per consultant per visit, plus an additional $75.00 per hour for each hour worked by each consultant in excess of 20 hours per normal working hours for that shrimp product facility. Once the first facility is complete and functional, both partners are responsible for developing expansion capital. The agreement also calls for our partners to get their original development money back from 25% of the net profits of the European Company until it is paid. NaturalShrimp plans to enter into additional joint venture agreements in the coming years.

Shrimp Station, LLC (“Shrimp Station”), was a joint venture between NaturalShrimp and another party to test market a company controlled distribution and retail concept in the United States. We intend to pursue additional local and national distributors, as well as direct distribution to large accounts as new facilities are constructed. In addition, NaturalShrimp holds the right to purchase the remaining 50% of Shrimp Station from its partner at anytime. The Shrimp Station Agreement is attached as Exhibit 10.1. The Company plans to exercise that option and ultimately hold 100% ownership of the Shrimp Station distribution channel. Our target market includes upscale restaurants and specialty grocery stores. A few of the largest specialty grocery store chains in the U.S. have expressed an interest in our shrimp, and we are currently planning a test market. Furthermore, the fact that each facility is “local” to each market area means that, if we ever decide to produce and sell frozen shrimp through wholesale distributors, we can do so at lower shipping costs than our competitors. Whether fresh or frozen, our product can be marketed as local, sustainable and grown in an environmentally-friendly, “green” system.

Throughout the Shrimp Station test market, shrimp was purchased at $5.00 per pound and re-sold to restaurants for $6.99-$7.99 per pound and then retailed from $8.99 - $10.99 per pound, depending on size. We did not see any price resistance with our target market of upscale establishments. We developed the Shrimp Station concept over a two-year period, which is the establishment of retail/wholesale outlets in metropolitan areas. We did not recognize any revenues from this market opportunity and at this time, we are not conducting any operations with Shrimp Station.

As of this filing, we have sold limited amounts of shrimp over the past two years and plan to start full-scale commercial production by the end of 2010 through our agreement with Natures Prime Organic Foods.

15

Marketing and Sales, Growth Opportunities

Strategy

The Company owns 100% of NSC (formed to operate in the U.S. & Canada) and 100% of NSI (formed to create Joint Venture partnerships in all other countries of the world). Each entity will use the proprietary technology to penetrate shrimp markets throughout the world through Shrimp Station and existing food service distribution channels (i.e. food distributor such as Ben E. Keith). Because the NaturalShrimp system is not affected by the weather or disease, it will be able to provide live, natural, high-quality, fresh shrimp to the market each and every week. This will allow Shrimp Station and other distribution companies to leverage their existing customer relationships by offering an uninterrupted supply of high-quality, fresh and locally-grown shrimp. The Company will target distributors that currently supply fresh seafood to upscale restaurants and stores, whose clientele expect and appreciate fresh and natural products.

Shrimp Station

In addition to marketing through current distribution channels, the Company has evolved a concept called Shrimp Station. The Company owns 50% of Shrimp Station along with a partner. NaturalsShrimp has the legal right to purchase the remaining 50% of Shrimp Station from its partner. Shrimp Station sold direct to high-end restaurants through its wholesale distribution network as well as retail the shrimp through its storefront. The concept was to control the handling of the product all the way to the end user as well receive a better price point for the shrimp. The first location was established in the Dallas, Texas area and has sold the shrimp to high-end establishments such as The Rosewood Mansion on Turtle Creek, The Crescent Hotel, The W Hotel, Northwood Country Club, etc.

NaturalShrimp Corporation (U.S. & Canada)

The first production system has been completed in La Coste, Texas. The Company is ramping up the first system to produce approximately 4,000 pounds every week. The next facility in La Coste will be substantially larger than the current system. The target yield of shrimp for the new facility will be approximately 6,000 pounds per week. Both facilities combined will produce approximately 10,000 pounds of shrimp per week in La Coste. By staging the stocking and harvests from tank to tank, it enables us to produce weekly and therefore deliver fresh shrimp every week.

The Company plans on applying to the Business & Industry Loan Guarantee Program that the USDA makes available to businesses in rural areas. As part of the program, the USDA guarantees up to 80% of the loan for the land, building, equipment and working capital. Each company can qualify for up to $25 Million in loan guarantees. Each NaturalShrimp location will be a separate entity and therefore each NaturalShrimp location can obtain up to $25 Million in loan guarantees. This program is available in rural areas all over the United States.

After the completion of the next system in La Coste, the Company's long-term plan is to build additional production systems in Las Vegas, Chicago and New York. These locations are targeted to begin construction in 2011 and we hope that the funding for these plans will come from profits, agricultural guaranty programs, and investors. These cities are not surrounded by commercial shrimp production and the Company believes there will be a high demand for fresh shrimp in all of these locations. In addition, the Company will continue to use the land it owns in La Coste to build as many systems as the Texas market demands.

International Joint Ventures

NSI owns fifty percent of NaturalShrimp Europe GmbH, the Joint Venture in Europe. It is important to note that NaturalShrimp Europe GmbH is the official name of NaturalShrimp Europe, Ltd. It is not a separate company but rather the English translation of the legal name of NaturalShrimp Europe GmbH. The Joint Venture partner is responsible for the construction cost of the first facility and initial operating capital. The initial costs will be paid back to the partner through twenty-five percent of net cash flow. NaturalShrimp will share in fifty percent of all profits and expenses thereafter. In addition, upon initial start-up shrimp production the Joint Venture partnership will pay NSI a management fee of $10,000 per month for the work our domestic employees perform for the partnership.

NSI entered into an agreement in December 2005 with Joint Venture partners in Oslo, Norway. The Joint Venture owns the exclusive rights to use the NaturalShrimp technology to grow and sell shrimp in twenty-eight European countries. The first subsidiary under NaturalShrimp Europe, Ltd. has been formed in Spain and the name of the company is GambaNatural de España, S.L (“GambaNatural”).

The land for the first facility has been purchased in Medina del Campo, Spain and construction started in late 2008. Medina del Campo is approximately seventy-five miles northwest of Madrid, Spain. The building for the facility will be completed in December 2010. The land purchase and construction has been fully financed through bank loans and investor capital.

Additionally, GambaNatural has a distribution agreement with Izamar, S.A., one of the premier fresh food distributors in Madrid, Spain. Izamar, S.A., located in San Sebastian de los Reyes, a suburb of Madrid. Izamar, S.A. currently distributes live crabs and lobsters to over 300 customers around Madrid. In addition, Izamar, S.A. has a booth license at the Mercamadrid, which is the second largest seafood market in the world. Furthermore, Izamar, S.A. owns two high-end seafood restaurants and one specialty seafood market. In February 2007, GambaNatural entered into a distribution agreement with Izamar, S.A. Pursuant to the Izamar, S.A. Agreement, GambaNatural will provide live, fresh shrimp to Izamar, S.A. to distribute the shrimp throughout Spain and Portugal. The Agreement is a long-term agreement for five years, renewable for another period of five years and so on. Initially, GambaNatural’s average weekly production of 2,700kg shall be distributed on a best efforts basis by Izamar, S.A. Izamar, S.A.’s commission shall be 15% of the Sales Price (VAT excluded) provided that the average sales price per/kg for the previous three months is at least 15/kg.

The NaturalShrimp Europe, LTD Agreement is attached as Exhibit 10.2 to our Form 10-12(g) and is hereby incorporated by reference. The Izamar, S.A. Agreement is attached as Exhibit 10.10 to our Form 10-12(g) and is hereby incorporated by reference.

16

Fresh Shrimp Market

The Company believes that a substantial market exists for live and fresh shrimp throughout the world. The Company plans to sell shrimp by using distributors or delivering them directly to market by packing the shrimp in salt water or ice, without freezing them. The Company has the added advantage of being able to market its shrimp as fresh, natural and locally grown. Being able to advertise the shrimp as locally grown and the fact that very few resources were used to transport the product provides the Company with an immense marketing advantage over the competition. Many customers are willing to pay a premium for such products.

Shipping and Receiving

Each facility warehouse includes space for general shipping and receiving to accommodate the receipt of the necessary supplies and the packaging and shipment of the harvested shrimp crop to Shrimp Station and other distributors.

Market Awareness

As of July 9, 2010, we entered into a Consulting Agreement with Casson Media Group, Inc. (“Casson”), a Delaware Corporation effective for six months. Pursuant to the Consulting Agreement, Casson will provide consulting and advisory services as an independent management consultant. Casson will develop and facilitate the execution of a financial communications and market awareness program for the Company that may include a variety of media/marketing elements including but not necessarily limited to e-mail distribution of public information including research reports, expanded news release strategies, appropriate investment newsletter/analyst coverage, and web site exposure on www.investorinsight.com. The Company would like to develop and execute a financial communications strategy that is intended to increase market awareness of the Company's stock, which in turn may cause the stock to experience greater trading volume, and may increase the number of individual and institutional shareholders in the Company. The Company has agreed to pay Casson the sum of $60,000 and 240,000 shares of the Company’s common stock to be paid as follows: At the effective date of the Consulting Agreement the Company agrees to wire $10,000 to Casson, when the Company has raised $250,000, $20,000 will become due and payable, when the Company has raised $500,000, the final $30,000 will become due and payable. The Consulting Agreement with Casson Media Group is attached as Exhibit 10.9 to our Form 10-12(g) and is hereby incorporated by reference.

Competitive Business Conditions

NaturalShrimp has identified three indirect competitors (Marvesta Shrimp Farms, Blue Ridge Aquaculture & Happy Shrimp) that produce shrimp in enclosed systems. These companies use ocean water and therefore must be located near the coastline. Fresh shrimp sales are confined to an area near the facility or shipped with very high transportation cost in order to maintain the shrimp’s freshness. Any shrimp not sold locally or shipped within a few days must be frozen and sold at a discounted rate. Our technology and business model sets us apart from any competition today. It is possible that additional competition will arise in the future, but with the size and growth of the worldwide shrimp market, many competitors could exist and thrive in the fresh shrimp industry. Any new competitor would face significant barriers to entry into the market and would likely need years of research and development to develop the proprietary technology necessary to produce similar shrimp at a commercially viable level.

Shrimp farms use open-air ponds constructed near oceans to contain and grow shrimp for processing. Most farms continually circulate water from the ocean, through the ponds and then back into the ocean, to maintain adequate water chemistry for the shrimp. The shrimp farmers supply the shrimp with daily additions of dry food pellets as they grow. In the United States, most farms produce one crop per year, while a few farms are trying to develop a smaller second crop.

Competitive Operations

Over the next twenty-four months, the company plans to complete the following key milestones:

Domestic:

|

2010 – After beginning commercial production by the end of 2010, we hope to acquire capital to fund operations and expansion for two additional systems in La Coste, Texas

|

||

|

2011 – Build second and possible third shrimp production systems in La Coste

|

||

|

2011 - Open additional Shrimp Station outlet (potentially San Antonio)

|

||

|

2011 - Locate additional target markets and plan five year facility rollout (2010 – 2014)

|

||

|

2011, 2012 - Sign agreements with large upscale retailers (local, regional, and/or national)

|

||

|

2012 – Build four additional production systems

|

||

|

2012 – Build own hatchery in La Coste, Texas

|

International:

|

2010, 2011 - Build the first two shrimp production systems in Medina del Campo, Spain

|

||

|

2011 – Locate additional target markets and plan five year facility rollout for Europe

|

||

|

2012 – Build own hatchery in Medina del Campo, Spain

|

Competitive Advantages

|

•

|

Live, fresh shrimp available year-round.

|

|

| • |

Naturally grown.

|

|

|

•

|

Bio-secure and disease free.

|

||

|

•

|

Located near major metropolitan areas to reduce shipping costs.

|

||

|

•

|

Locally-grown fits today’s demand for “green” products.

|

||

|

•

|

Low-cost production.

|

||

|

•

|

Controlled food quality.

|

||

|

•

|

Environmentally-friendly. No by-catch, mangroves destroyed or polluted water filtered back into the ocean.

|

||

17

Ocean trawling provides approximately sixty-five percent of the world’s shrimp production and shrimp farms produce the remaining thirty-five percent. However, ocean trawling and shrimp farms suffer from a number of problems. Shrimp farming in the United States is limited to one or two harvest cycles per year. Open-air shrimp farms are subject to weather and predators, and the U.S. Government has expressed concern about the possibility of shrimp farm diseases spreading to ocean shrimp from the recycling of water from shrimp farms back into the ocean.

In addition, environmentalists are worried about the effect of shrimp farms on coastal estuaries. Environmentalists are concerned about the effect of shrimp nets on other aquatic species, and there is a growing public concern about pollutants affecting shrimp quality. The following table illustrates some of the differences between our enclosed system, traditional shrimp farming and ocean trawling:

|

NaturalShrimp Technology

|

Shrimp Farming

|

Ocean Trawling

|

|

|

Weather

|

Enclosed system, no weather factors

|

Many farms destroyed by hurricanes, typhoons, tsunami and tidal waves

|

Can only be on boat during good weather conditions

|

|

Pollution

|

No pollution being fed back into ocean

|

Return unfiltered water back into the ocean

|

Netting damages natural ocean ecosystem and kills other animals

|

|

Disease

|

If diseases are introduced through an outside source, they are isolated to one tank

|

Diseases are transferred in and out of the oceans and bays

|

No widespread diseases

|

|

Facility Location

|

Can build systems and provide fresh shrimp in markets throughout the world

|

Must locate near oceans

|

Oceans only

|

|

Production

|

Fresh shrimp 52 weeks per year

|

Seasonal, 1-2 crops per year in the U.S.

|

Varies, depending on weather and other extraneous conditions

|

|

Price

|

Fresh shrimp allows for premium pricing

|

Must freeze and sell in bulk, causing commodity pricing

|

Mostly frozen, causing lower market prices

|

|

Costs

|

Minimal shipping costs, no storage costs

|

High shipping and storage costs

|

High shipping and storage costs

|

Source and Availability of Raw Materials

We receive our raw materials in a timely manner. We currently buy our feed from Ziegler Feed Company in Pennsylvania. They have been an established producer of shrimp feed for many years. Probiotics for bacterial control are purchased from MicroTES Corporation in San Antonio, Texas. PL shrimp are purchased from Shrimp Improvement Systems (“SIS”) in Florida. SIS has been in the PL production business for many years and is an established supplier. Other products are purchased from established aquaculture suppliers in Texas and Florida. The following is further information of our raw material suppliers. We have had no issues regarding the availability of our raw materials. We also have favorable contacts and past business dealings with other major shrimp feed producers such as Rangen, Inc. and Cargill Feed Company if current suppliers fall through.

Shrimp Feed:

Zeiler Feed is our primary manufacturer of feed designed specifically for our enclosed system. Their website is http://www.zeiglerfeed.com/html/milestones.htm. We also receive shrimp feed from Rangen, a Texas based mill with a website at http://www.rangen.com/ and from Cargill, a world shrimp feed supplier with information at www.cargillanimalnutrition.com/aquaculture/dc_can_aqua.htm).

Shrimp Post Larva:

Our Shrimp Post Larva is supplied by Earthcare Aquaculture, Inc., and in Ft. Lauderdale Florida, Shrimp Improvement Systems in the Florida Keys, Islamorada, Florida.

Sea Salt:

Our Sea Salt is provided by Aquaculture Technologies doing business as Red Sea located at 18125 Ammi Trail, Houston, TX 77060.

Chemicals:

Our chemicals are provided by Brenntag Southwest, Inc. (www.brenntagsouthwest.com),

Freshwater:

Our freshwater is provided by East Medina County Water District.

Dependence on One or a Few Customers

We as a company are dependent on major customers. The loss of any of these customers could have a material adverse effect on our revenue and could adversely affect our liquidity and cash flow from operating activities. Because of our dependence on major customers, we strive to keep customers satisfied and thus build loyalty. The Company currently has a ten state exclusive "Production Purchase Agreement" with Natures Prime Organic Foods, LLC based out of Minnesota, http://npofoods.com/, to purchase all shrimp production. The Natures Prime Organic Foods, LLC agreement is attached as Exhibit 10.3 to our Form 10-12(g) and is hereby incorporated by reference.

18

Patents, Trademarks, Royalties, Etc.

The Company has filed and received patents on older technology but has decided to not pay the maintenance fees for keeping up the patent. The Company has decided to keep the NaturalShrimp propriety technology development as a trade secret.

Government Approvals

We do depend on government approval. Below is a list of permits acquired:

USDA Import and Export

|

-

|

License # LE120190-0

|

US Fish and Wildlife Service (USFWS)

|

-

|

Federal Fish and Wildlife Permit.

|

||

|

-

|

Import/Export License for “wildlife”

|

||

|

-

|

Licensee is required to maintain records.

|

Texas Parks and Wildlife Department (TPWD)

|

-

|

“Exotic species permit” to raise exotic shrimp (non-native to Texas). The La Coste facility is north of the coastal shrimp exclusion zone (east and south of H-35, where it intersects hwy 21 down to Laredo) and therefore outside of TPWD’s major area of concern for exotic shrimp.

|

||

|

-

|

Retail Fish Dealer Truck Permit

|

||

Texas Department of Agriculture (TDA)

|

-

|

“Aquaculture License” for aquaculture production facilities.

|

||

|

-

|

License to “operate a fish farm or cultured fish processing plant”.

|

||

|

-

|

“Must have a copy of license in vehicle”

|

||

|

-

|

Device Registration Certificate, Client No. 00388994, Account No. 0510242, Program No. 2310

|

||

Texas Department of Licensing and Regulation

|

-

|

Boiler Certificate of Operation (two permits for two boiler stations)

|

Texas Commission on Environmental Quality (TCEQ)

|

-

|

Regulates facility wastewater discharge. According to the TCEQ permit classification system, we are rated Level 1 – Recirculation system with no discharge.

|

San Antonio River Authority

|

-

|

No permit required, but has some authority over any effluent water that could impact surface and ground waters.

|

OSHA

|

-

|

No permit required but has right to inspect facility.

|

HACCP

|

-

|

None needed unless we process shrimp on site. Training and preparation of HACCP plans remain to be completed. There are multiple HACCP plans listed at http://seafood.ucdavis.edu/haccp/Plans.htm and other web sites that can be used as examples.

|

Texas Department of State Health Services

|

-

|

Food manufacturer license that must be displayed in office.

|

San Antonio Metropolitan Health District

|

-

|

Food establishment permit

|

ACC and BAP

|

-

|

Aquaculture Certification Council (ACC) and Best Aquaculture Practices (BAP). Provide shrimp production certification for shrimp marketing purposes to mainly well established vendors (e.g., Walmart, Costco).

|

||

|

-

|

ACC and BAP certifications require extensive record keeping.

|

||

19

Existing or Probable Governmental Regulations

We are subject to regulations regarding the need for field employees to be certified. We strictly adhere to these regulations. The cost of certification is an accepted part of expenses. Regulations may change and become a cost burden but compliance and safety are our main concerns.

Research and Development Expenses and Outcomes since Inception

|

•

|

Company invested nine years and more than $17 Million.

|

|

•

|

Shrimp will adapt to high-density environments and will feed throughout the entire water column.

|

|

•

|

Development of proprietary microbial floc utilizes a combination of natural and prepared feeds.

|

|

•

|

Maintaining shrimp in an intensified natural ecosystem is key to achieving a profitable production system.

|

|

•

|

Automated and manual data acquisition allow for system management and record keeping of over thirty variables that can be accessed locally or via the internet from locations around the world.

|

|

•

|

Found multiple issues that can occur from an indoor shrimp production system. These issues include: stressing of shrimp, vibriosis, filamentous bacteria, poor quality PL’s, high floc levels, high nitrite levels and other water quality variables. The Company believes it has developed processes and procedures to solve each issue when they occur. It has taken time to identify and solve each issue and has therefore delayed our time to production, which is common for new product development.

|

Cost and effects of compliance with environmental laws (federal, state and local)

We experience a minimal cost and effect of compliance with environmental laws. We approximate that our expense for these costs are less than $1,000 per annum.

Number of Employees

We currently have seven full time employees, including three full time management employees and four full time production employees. We also have thee consultants. Since most of our systems are automated, we are able to produce large quantities of shrimp with a relatively small number of employees on hand.

Description of Property

We have acquired 37 acres located outside the town of La Coste. On these 37 acres, we erected a 48,000 square foot enclosed facility in which we have constructed tanks holding an aggregate 920,00 gallons of floc, the medium in which we raise our shrimp, and laboratories for monitoring and controlling the production process. We have also located a 1,000 square foot production office building on the acreage.

We have also acquired 12 acres in Medina del Campo, Spain. On these 12 acres, we have erected a 74,389 square foot enclosed facility in which we have constructed our new tank design system in which we raise our shrimp, and laboratories for monitoring and controlling the production process. The building will be fully complete in December 2010.

Our executive office is located in the suite occupied by our Chief Executive Officer in Waco, Texas, for which we pay a monthly rental of $799.

RESULTS OF OPERATIONS

Results of Operations for NaturalShrimp Holdings, Inc. and Subsidiaries for the nine months ended September 30, 2010 and 2009 (Unaudited).

Revenues

Our revenues were approximately $3,000 for the nine months ended September 30, 2010 compared to revenues of approximately $76 for the nine months ended September 30, 2009.

Expenses

Operating expenses for the nine months ended September 30, 2010 were $709,335, compared to the operating expenses of $605,561 for the nine months ended September 30, 2009. The increase in expenses during the period was primarily attributable to auto expense, an increase in commissions and consulting fees, an increase in insurance expense, an increase in entertainment and meals, an increase in legal and accounting fees, an increase in property taxes, and an increase in travel expense.