Attached files

| file | filename |

|---|---|

| EX-5.1 - 6D Global Technologies, Inc | v205690_ex5-1.htm |

| EX-23.2 - 6D Global Technologies, Inc | v205690_ex23-2.htm |

As filed with the United States Securities and Exchange Commission on December

16, 2010

Registration

No.

333-

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

S-1

REGISTRATION

STATEMENT UNDER THE SECURITIES ACT OF 1933

CLEANTECH

INNOVATIONS, INC.

(Name of

Registrant as specified in its charter)

|

Nevada

|

3490

|

98-0516425

|

||

|

(State

or other jurisdiction

of

incorporation)

|

(Primary

Standard Industrial

Classification

Code Number)

|

(IRS

Employer

Identification

No.)

|

C

District, Maoshan Industry Park,

Tieling

Economic Development Zone,

Tieling,

Liaoning Province, China 112616

+(86)

0410-6129922

(Address

and telephone number of principal executive offices and principal place of

business)

Ms.

Bei Lu

Chief

Executive Officer

CleanTech

Innovations, Inc.

C

District, Maoshan Industry Park,

Tieling

Economic Development Zone,

Tieling,

Liaoning Province, China 112616

+(86)

0410-6129922

(Name

address and telephone number of agent for service)

Copies

to:

Robert

Newman, Esq.

The

Newman Law Firm, PLLC

44 Wall

Street, 20th Floor

New York,

NY 10005

Tel: (212)

248-1001 Fax: (212) 202-6055

If any of

the securities being registered on this Form are to be offered on a delayed or

continuous basis pursuant to Rule 415 under the Securities Act of 1933, check

the following box:

x

If this

Form is filed to register additional securities for an offering pursuant to Rule

462(b) under the Securities Act, check the following box and list the Securities

Act registration statement number of the earlier effective registration

statement for the same offering. o

If this

Form is a post-effective amendment filed pursuant to Rule 462(c) under the

Securities Act, check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same

offering.

o

If this

Form is a post-effective amendment filed pursuant to Rule 462(d) under the

Securities Act, check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same

offering.

o

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting company. See

the definitions of “large accelerated filer,” “accelerated filer,” and “smaller

reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large

accelerated filer ¨

|

Accelerated

filer

¨

|

|

Non-accelerated

filer ¨ (Do not check

if smaller reporting company)

|

Smaller

reporting company

x

|

CALCULATION

OF REGISTRATION FEE

|

Title of each class of securities to be registered

|

Amount to be

registered(1)

|

Proposed

maximum offering

price per(2)

|

Proposed

maximum aggregate

offering price(3)

|

Amount of

registration fee

|

||||||||||||

|

Common

Stock, par value $.00001 per share

|

2,500,000 | $ | 6.50 | $ | 16,250,000 | $ | 1,158.63 | |||||||||

|

Common

Stock, par value $.00001 per share

|

||||||||||||||||

|

Issuable

on exercise of warrants

|

1,987,500 | $ | 6.50 | $ | 12,918,750 | $ | 921.11 | |||||||||

|

Total

|

4,487,500 | $ | 29,168,750 | $ | 2,079.74 | |||||||||||

|

(1)

|

In

accordance with Rule 416(a), the Registrant is also registering hereunder

an indeterminate number of shares that may be issued and resold resulting

from stock splits, stock dividends or similar

transactions.

|

|

(2)

|

The

shares being registered for resale by the selling shareholders were issued

pursuant to private placements of securities completed on December 13,

2010, and are issuable upon the exercise of certain warrants of the

Registrant.

|

|

(3)

|

Estimated

pursuant to Rule 457(c) of the Securities Act of 1933 solely for the

purpose of computing the amount of the registration fee based on the

average of the high and low bid and ask prices reported on the OTC

Bulletin Board on December 13,

2010.

|

The

registrant hereby amends this registration statement on such date or dates as

may be necessary to delay its effective date until the registrant shall file a

further amendment which specifically states that this registration statement

shall thereafter become effective in accordance with section 8(a) of the

Securities Act of 1933, as amended, or until the registration statement shall

become effective on such date as the United States Securities and Exchange

Commission, acting pursuant to said section 8(a), may determine.

The

information in this prospectus is not complete and may be changed. We may not

sell these securities until the registration statement filed with the Securities

and Exchange Commission is effective. This prospectus is not an offer to sell

these securities and it is not soliciting an offer to buy these securities in

any state where the offer or sale is not permitted.

PRELIMINARY

PROSPECTUS; SUBJECT TO COMPLETION, DATED DECEMBER 16, 2010

CLEANTECH

INNOVATIONS, INC.

4,487,500

Shares of Common Stock

The

selling shareholders identified in this prospectus may offer and sell up to

4,487,500 shares of our common stock consisting of (i) 2,500,000 shares of

our common stock issued to investors in the Units (as defined below), (ii)

up to 1,987,500 shares of our common stock issuable upon exercise of warrants of

which (a) warrants to purchase 1,687,500 shares of our common stock were issued

to investors in the Units and (b) warrants to purchase 300,000 shares of our

common stock were issued to placement agents and qualified finders in

connection with the sale of the Units.

We are

not selling any shares of our common stock in this offering and will not receive

any proceeds from this offering. We may receive proceeds on the exercise of

outstanding warrants for shares of common stock covered by this prospectus if

the warrants are exercised for cash.

The

selling shareholders may offer the shares covered by this prospectus at fixed

prices, at prevailing market prices at the time of sale, at varying prices or

negotiated prices, in negotiated transactions, or in trading markets for our

common stock. We will bear all costs associated with this

registration.

Our

common stock trades on the NASDAQ Capital Market under the symbol

“CTEK.” The closing price of our common stock on the NASDAQ Capital Market

on December 15, 2010, was $8.40 per share.

You

should consider carefully the risk factors beginning on page 5 of this

prospectus.

Neither

the Securities and Exchange Commission nor any state securities commission has

approved or disapproved of these securities or determined if this prospectus is

truthful or complete. Any representation to the contrary is a criminal

offense.

The date

of this prospectus

is

, 2010.

TABLE

OF CONTENTS

|

PAGE

|

||

|

ABOUT

THIS PROSPECTUS

|

3

|

|

|

PROSPECTUS

SUMMARY

|

3

|

|

|

RISK

FACTORS

|

5

|

|

|

FORWARD-LOOKING

STATEMENTS

|

20 | |

|

AVAILABLE

INFORMATION

|

21 | |

|

USE

OF PROCEEDS

|

21 | |

|

MANAGEMENT’S

DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF

OPERATIONS

|

22 | |

|

OUR

BUSINESS

|

32 | |

|

OUR

PROPERTY

|

43 | |

|

LEGAL

PROCEEDINGS

|

43 | |

|

MANAGEMENT

|

43 | |

|

CERTAIN

RELATIONSHIPS AND RELATED PARTY TRANSACTIONS

|

46 | |

|

EXECUTIVE

COMPENSATION

|

46 | |

|

SECURITY

OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

|

48 | |

|

SELLING

SHAREHOLDERS

|

49 | |

| SHARES ELIGIBLE FOR FUTURE SALE | 49 | |

|

PLAN

OF DISTRIBUTION

|

50 | |

|

DESCRIPTION

OF SECURITIES

|

51 | |

|

INTEREST

OF NAMED EXPERTS

|

53 | |

|

LEGAL

MATTERS

|

53 | |

|

CHANGE

IN THE COMPANY’S INDEPENDENT ACCOUNTANT

|

53 | |

|

INDEMNIFICATION

OF DIRECTORS AND OFFICERS

|

53 | |

|

INDEX

TO FINANCIAL STATEMENTS

|

F-1

|

You may

only rely on the information contained in this prospectus or that we have

referred you to. We have not authorized anyone to provide you with different

information. This prospectus does not constitute an offer to sell or a

solicitation of an offer to buy any securities other than the common stock

offered by this prospectus. This prospectus does not constitute an offer to sell

or a solicitation of an offer to buy any common stock in any circumstances in

which such offer or solicitation is unlawful. Neither the delivery of this

prospectus nor any sale made in connection with this prospectus shall, under any

circumstances, create any implication that there has been no change in our

affairs since the date of this prospectus or that the information contained by

reference to this prospectus is correct as of any time after its

date.

ABOUT

THIS PROSPECTUS

This

prospectus is part of a registration statement we filed with the Securities and

Exchange Commission ("SEC"). You should rely only on the information provided in

this prospectus and incorporated by reference in this prospectus. We have not

authorized anyone to provide you with information different from that contained

in or incorporated by reference into this prospectus. The selling shareholders

are offering to sell, and seeking offers to buy, shares of common stock only in

jurisdictions where offers and sales are permitted. The information in this

prospectus is accurate only as of the date of this prospectus, regardless of the

time of delivery of this prospectus or of any sale of common stock. The rules of

the SEC may require us to update this prospectus in the future.

PROSPECTUS

SUMMARY

This

summary highlights selected information contained elsewhere in this prospectus

and does not contain all of the information you should consider in making your

investment decision. Before investing in the securities offered hereby, you

should read the entire prospectus, including our financial statements and

related notes included in this prospectus and the information set forth under

the headings “Risk Factors” and “Management’s Discussion and Analysis of

Financial Condition and Results of Operations.” In this prospectus, the terms

“CleanTech,” the “Company,” “we,” “us,” and “our” refer to CleanTech

Innovations, Inc. and its subsidiaries.

Our

Company

We are a

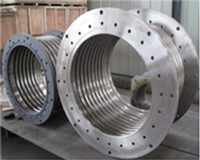

manufacturer of structural towers for megawatt-class wind turbines as well as

other highly engineered clean technology metal components in the People’s

Republic of China (“China” or “PRC”). We currently design, manufacture, test and

sell structural towers for 1 and 1.5 megawatt (“MW”) on-land and 3MW off-shore

wind turbines and have the expertise and manufacturing capability to provide

towers for larger MW on-land and off-shore turbines as they become more

prevalent in China. We are currently the only certified wind tower manufacturer

within Tieling, Liaoning Province, which provides significant competitive

advantage in supplying towers into the wind-rich northern provinces of China. We

also manufacture patented, specialty metal products that require advanced

manufacturing and engineering capabilities, including bellows expansion joints

and connecting bend pipes used for waste heat recycling in steel production and

in ultra-high-voltage electricity transmission grids, as well as industrial

pressure vessels. Our products provide clean technology solutions for China’s

increasing energy demand and environmental issues.

We sell

our products exclusively in the domestic market. Our current wind tower

customers include two of China’s five largest state-owned utilities, which are

among the top wind farm operators in China as measured by installed wind

capacity. We produce wind towers, a component of wind turbine installations, but

do not compete with wind turbine manufacturers. Our patented specialty metal

products are used by large-scale industrial companies involved mainly in the

steel and coke, petrochemical, high-voltage electricity transmission and

thermoelectric industries, which are actively seeking ways to reduce their

carbon and pollutant emissions.

We were

founded in September 2007 and have since experienced significant growth. For the

nine month period ending September 30, 2010, our net revenue was $14.7 million,

a 440% increase over the twelve month period ended December 31, 2009, and we

generated a 29% gross margin and a 20% net margin. Sales of our wind tower

products are increasing rapidly; we have shipped 137 wind towers, including

towers for 3MW off-shore wind turbines, since their recent introduction in

February 2010. Wind towers accounted for over 90% of our revenue for the nine

month period ending September 30, 2010.

Notwithstanding the large increase in

revenues, we may have payment delays and we do not recognize revenue until our

products are delivered, tested and accepted by our customers. Our agreements

with our customers generally provide for payments of 30% of the purchase

price to be due on order placement, completion of manufacturing milestones

and upon customer acceptance, with the final 10% payment due up to 24

months from the customer acceptance date. Our payment delays may last up to six

months from the due date, but we fully expect to receive all payments because

the majority of our customers are state-owned and publicly traded utilities and

industrial companies.

We

believe our rapid growth will continue to benefit from the following competitive

strengths:

|

|

§

|

Strong

customer relationships with leading utility, wind and industrial

companies

|

|

|

§

|

Geographical

proximity to the multi-gigawatt pipeline of wind development projects in

the northern provinces of China

|

|

|

§

|

Technically-advanced,

precision manufacturing expertise demonstrated, in part, by our Class III

A2 pressure vessel manufacturing license, a key criteria in customer

selection of wind tower suppliers

|

|

|

§

|

Proprietary

product designs and intellectual

property

|

|

|

§

|

Excellent

reputation for high-quality manufacturing, stringent testing, timely

delivery and customer service

|

Our

Company is headquartered in Tieling, Liaoning Province, China where we currently

operate two production facilities with approximately 16,120 square meters of

combined production space and an annual production capacity of up to 600 wind

tower units. As of October 2010, we had 175 full time

employees.

Our

Industry

Wind

power is the world's fastest-growing energy sector and China currently

represents the world's largest market for wind products. According to the Global

Wind Energy Council (“GWEC”) “Global Wind Energy Outlook 2010” (“GWEC 2010

Global Wind Outlook”), global installed wind capacity grew at a 27.8% CAGR from

2000 through 2009. In 2009, according to the GWEC “Global Wind 2009 Report”

(“GWEC 2009 Global Wind Report”), global installed wind capacity grew at a

record 31.8%, adding 38.3 gigawatts (“GW”) and bringing total installed wind

capacity to 158.5GW. China accounted for 36% of all newly installed wind

capacity and 16% of total worldwide wind capacity, first and second among all

countries, respectively, according to the World Wind Energy Association (“WWEA”)

“World Wind Energy Report 2009” (“WWEA 2009 Wind Report”). Installed wind

capacity within China grew at a 61.5% CAGR from 2000 through 2009 – more

than double the overall global rate – and capacity has more than doubled

for the past four consecutive years, according to the WWEA 2009 Wind Report. In

2009, according to the GWEC “China Wind Power Outlook 2010” (“GWEC 2010 China

Wind Outlook”), the domestic wind market grew 114.7%, adding 10,129 wind

turbines or 13.8GW of new capacity and bringing total installed wind capacity to

25.8GW. According to the GWEC 2009 Global Wind Report, China will add 20GW of

wind capacity annually through 2014 and the domestic wind market will reach

200-250GW in installed capacity by 2020.

3

We

believe that it costs approximately $1 billion to install 1GW of wind capacity

in China, thereby resulting in capital investments of approximately $200-$250

billion by 2020. Wind energy resources are widely distributed in China, with

rich resources concentrated in the three northern (northeast, north and

northwest), southeast coastal and inland regions. According to Zenith

International Research, “Wind

Power Capacity Analysis, February 25, 2009” (“Zenith 2009 Wind Analysis”),

approximately 80% of all wind resources in China exist within the nine

northern provinces of China, five of which are located within 500 miles of our

manufacturing facilities.

Company

History

We

operate through two wholly owned subsidiaries organized under the laws of the

PRC – Liaoning Creative Bellows Co., Ltd. (“Creative Bellows”) and Liaoning

Creative Wind Power Equipment Co., Ltd. (“Creative Wind Power”). Creative

Bellows, which was incorporated on September 17, 2007, is our wholly

foreign-owned enterprise (“WFOE”) and it owns 100% of Creative Wind Power, which

was incorporated on May 26, 2009. Creative Bellows produces bellows expansion

joints, pressure vessels and other fabricated metal specialty products. Creative

Wind Power markets and sells wind towers designed and manufactured by Creative

Bellows, which provides the production expertise, employees and facilities for

wind tower production.

We were

incorporated in the State of Nevada on May 9, 2006, under the name Everton

Capital Corporation as an exploration stage company with no revenues and no

operations and engaged in the search for mineral deposits or reserves. On June

18, 2010, we changed our name to CleanTech Innovations, Inc. and authorized an

8-for-1 forward split of our common stock effective July 2, 2010. Prior to the

forward split, we had 5,501,000 shares of our common stock outstanding, and,

after giving effect to the forward split, we had 44,008,000 shares of our common

stock outstanding. We authorized the forward stock split to provide a sufficient

number of shares to accommodate the trading of our common stock in the OTC

marketplace after the acquisition of Creative Bellows as described

below.

The

acquisition of Creative Bellows’ ordinary shares was accomplished pursuant to

the terms of a Share Exchange Agreement and Plan of Reorganization, dated July

2, 2010 (the “Share Exchange Agreement”), by and between Creative Bellows and

the Company. Pursuant to the Share Exchange Agreement, we acquired from Creative

Bellows all of its equity interests in exchange for the issuance of 15,122,000

shares of our common stock to the shareholders of Creative Bellows (the “Share

Exchange”). Concurrent with the closing of the transactions contemplated by the

Share Exchange Agreement and as a condition thereof, we entered into an

agreement with Mr. Jonathan Woo, our former Chief Executive Officer and

Director, pursuant to which he returned 40,000,000 shares of our common stock to

us for cancellation. Mr. Woo received compensation of $40,000 from us for the

cancellation of his shares of our common stock. Upon completion of the foregoing

Share Exchange transactions, we had 19,130,000 shares of common stock issued and

outstanding. For accounting purposes, the Share Exchange transaction was treated

as a reverse acquisition and recapitalization of Creative Bellows because, prior

to the transaction, the Company was a non-operating public shell and, subsequent

to the transaction, the Creative Bellows’ shareholders beneficially owned a

majority of the outstanding common stock of the Company and will exercise

significant influence over the operating and financial policies of the

consolidated entity.

Our

principal offices are located at C District, Maoshan Industry Park, Tieling

Economic Development Zone, Tieling, Liaoning Province, China 112616. Our phone

number is (86) 0410-6129922 and our website address is www.ctiproduct.com. The

information contained on our website is not a part of this

prospectus.

The

Offering

|

Common

stock outstanding before the offering

|

24,963,322 shares

|

|

|

Common

stock offered by selling shareholders

|

Up

to 4,487,500 shares

The

maximum number of shares to be sold by the selling

shareholders, 4,487,500 shares, represents 16.65% of our outstanding

stock, assuming full exercise of the warrants

|

|

|

Common

stock to be outstanding after the offering

|

26,950,822 shares,

assuming full exercise of the warrants

|

|

|

Use

of proceeds

|

We

will not receive any proceeds from the sale of the common stock. To the

extent that the selling shareholders exercise for cash all of the warrants

covering the 1,987,500 shares of common stock issuable upon exercise

of all of the warrants, we would receive $7,950,000 from such exercises.

We intend to use such proceeds for general corporate and working capital

purposes. See “Use of Proceeds” for a complete

description.

|

|

|

Risk

Factors

|

The

purchase of our common stock involves a high degree of risk. You should

carefully review and consider the “Risk Factors” beginning on page

5.

|

4

The

number of shares of our common stock shown in the preceding table to be

outstanding after this offering is based on 24,963,322 shares outstanding as of

December 13, 2010, which excludes 833,310 shares of our common stock issuable

upon exercise of warrants outstanding as of December 13, 2010, at an exercise

price of $3.00 per share and stock options outstanding as of December 13, 2010,

to purchase 30,000 shares of our common stock at an exercise price of $8.44 per

share.

The

shares of our common stock offered by the selling shareholders identified in

this prospectus were acquired by the selling shareholders through a private

placement offering conducted by the Company. On December 13, 2010, we completed

a closing of the private placement offering pursuant to which we sold 2,500,000

Units (as defined below) to the selling shareholders at $4.00 per Unit for

$10,000,000. Each “Unit” was offered and sold at a purchase price of $4.00 per

Unit and consisted of one share of our common stock and a warrant to purchase

67.5% of one share of our common stock. All warrants are immediately

exercisable, expire on the fifth anniversary of their issuance and entitle their

holders to purchase one share of our common stock at $4.00 per share. All of the

shares and warrants were issued to the selling shareholders prior to the filing

of this prospectus in a private placement offering exempt from registration

under the Securities Act of 1933, as amended (the “Securities Act”), under

Regulation S promulgated thereunder.

RISK

FACTORS

Our

business and an investment in our securities are subject to a variety of risks.

The following risk factors describe the most significant events, facts or

circumstances that could have a material adverse effect upon our business,

financial condition, results of operations, ability to implement our business

plan, and the market price for our securities. Many of these events are outside

of our control. If any of these risks actually occurs, our business,

financial condition or results of operation may be materially adversely

affected. In such case, the trading price of our common stock could decline and

investors in our common stock could lose all or part of their

investment.

Risks

Related to Our Business

Our

limited operating history may not serve as an adequate basis to judge our future

prospects and results of operations, and our limited revenues may affect our

future profitability.

We and

our subsidiaries began operations for the production of fabricated metal

specialty components in September 2007 and introduced our bellows expansion

joints products and pressure vessels in the first quarter of 2009 and our wind

tower products in the first quarter of 2010. Our limited history of designing

and manufacturing these fabricated metal specialty components may not provide a

meaningful basis on which to evaluate our business. Moreover, we have limited

revenues and we cannot assure you we will be able to expand our business and

gross revenue with sufficient speed to maintain our profitability and not incur

net losses in the future. While we expect our operating expenses to increase as

we expand, any significant failure to realize anticipated revenue growth could

result in significant operating losses. We will continue to encounter risks and

difficulties frequently experienced by companies at a similar stage of

development, including our potential failure to:

|

|

§

|

maintain

our proprietary technology;

|

|

|

§

|

expand

our product offerings and maintain the high quality of our

products;

|

|

|

§

|

manage

our expanding operations, including the integration of any future

acquisitions;

|

|

|

§

|

obtain

sufficient working capital to support our expansion and to fill customers’

orders in time;

|

|

|

§

|

maintain

adequate control of our expenses;

|

|

|

§

|

implement

our product development, marketing, sales, and acquisition strategies and

adapt and modify them as needed;

|

|

|

§

|

anticipate

and adapt to changing conditions in the wind power, steel, petrochemical

and thermoelectric industries as well as the impact of any changes in

government regulation, mergers and acquisitions involving our competitors,

technological developments and other significant competitive and market

dynamics.

|

Our

inability to manage successfully any or all of these risks may materially and

adversely affect our business.

Our

plans for growth rely on an increasing emphasis on the wind power industry; this

sector faces many challenges, which may limit our potential for growth in this

new market.

Our

principal plan for growth is to manufacture wind towers, our latest fabricated

metal specialty component, for the China domestic wind power industry. As of

September 30, 2010, approximately 92% of our revenues were from sales of our

wind towers. We expect a majority of our future revenues and earnings to come

from sales of wind towers for the growing wind power industry in

China.

5

The wind

power industry sector in China faces many challenges as it expands, however,

including a reliance on continued PRC government environmental and energy

conservation policies and incentive programs, which together are one of the

industry’s major growth drivers. Wind power accounts for a small percentage of

the power generated in China currently, and the existing power grid and

transmission system lags behind existing and planned wind power plant

construction. Furthermore, the wind power industry is generally not competitive

without government incentive programs and initiatives because of the relatively

high generation costs for wind power compared to most other energy sources. The

current government incentive programs and initiatives include a feed-in tariff

paid to wind power producers by grid utility companies, the mandatory obligation

of grid utility companies to purchase all the electricity generated by renewable

energy projects within its grid coverage, preferential tax treatment and

government spending and grants for renewable energy programs. Most of our

customers are highly dependent on these government incentives, initiatives and

other favorable policies to support their operations at a relatively acceptable

cost level. There can be no assurance that PRC government support of the wind

power industry will continue at its current level or at all, and any decrease or

elimination of government incentives currently available to industry

participants may result in increased operating costs incurred by our current

customers or discourage our potential customers from purchasing our

products.

Our

ability to market to this industry segment is dependent upon both an increased

acceptance of wind power as an energy source in China and the industry’s

acceptance of our products. We believe there will continue to be an increased

demand for wind power in China and that the power companies installing

wind-generated power equipment will purchase our products. We cannot assure you

that we will be able to continue to develop this business successfully, however,

and our failure to develop the business further will have a material adverse

effect on our overall financial condition and the results of our operations.

Additionally, any uncertainties or adverse changes in government incentives,

initiatives or policies relating to the wind power industry will materially and

adversely affect the investment plans of our customers and consequently our

growth.

Contracts

for wind power projects in China are awarded through competitive public bids and

there is no assurance that we will be asked to bid on new projects or that we

will win these bids.

Utilities

in China award contracts for wind towers on a competitive basis. We are

generally aware of upcoming projects by region as established in annual NDRC

wind development plans and through our proprietary customer relationships.

However, utilities disclose specific requests for proposals publicly via the

Internet, which we monitor on a regular basis, when they are prepared to accept

bids. As a precursor to bidding, suppliers like us must maintain their status as

a qualified supplier to the utility as well as possess a license to manufacture

Class III A2 pressure vessels, which is often a specific requirement to bid on

wind tower contracts. A substantial deposit based upon contract amount,

typically around $125,000, is required for each bid and is returned to the

bidder approximately three months following bid submission. This process helps

to ensure that only companies with competent manufacturing and sufficient

capitalization bid on projects. Competitive factors on wind tower bids include

price, geographical proximity of the manufacturer to the wind power project and

manufacturer reputation for quality and on-time delivery. It is our experience

that typically three to six companies bid per contract.

We may

not be successful in future bids and may fail to obtain new projects as a

result. We believe we remain competitive in our pricing and delivery schedules

for wind towers, but we cannot assure you our competitors will not underbid us.

If we are unable to maintain our good relationships and qualified supplier

status with the utilities, we may not be allowed to participate in the bidding

process on new projects. Our license to manufacture Class III A2 pressure

vessels expires in January 2013, and, although management believes we will be

able to renew the license without issue, if we are unable to renew our license,

we may not be able to bid on new wind tower contracts. Furthermore, we must

maintain sufficient capital to source deposits made in connection with our bids,

which may limit our ability to optimize our working capital allocation. To the

extent we are unsuccessful in our bids to provide wind towers to new wind power

projects, our future growth may be materially and adversely

affected.

We

derive a substantial part of our revenues from several major customers. If we

lose any of these customers or they reduce the amount of business they do with

us, our revenues may be seriously affected.

Our four

largest customers accounted for approximately 51% of total sales for the fiscal

year ended December 31, 2009, and our largest customer accounted for

approximately 19% of total sales in the fiscal year ended December 31, 2009. Our

four largest customers accounted for approximately 85% of total sales for the

nine months ended September 30, 2010, and our largest customer accounted for

approximately 24% of total sales for the nine months ended September 30, 2010.

These customers may not maintain the same volume of business with us in the

future. If we lose any of these customers or they reduce the amount of business

they do with us, our revenues and profitability may be seriously affected. With

our recent entry into the wind tower market, we expect to generate significant

revenues from a limited number of large-scale industrial customers. We do not

foresee our relying on these same customers for revenue generation as we

introduce new product lines and new generations of existing product lines

because we expect our customers to change with each large-scale project. We

cannot be assured, however, that we will be able to introduce successfully new

products for large-scale projects in the future.

Additionally,

many of our customers purchase our equipment as part of their capital budget. As

a result, we are dependent upon receiving orders from companies that are either

expanding their business, commencing a new business, upgrading their capital

equipment or otherwise require capital equipment. Our business is therefore

dependent upon both the economic health of these industries and our ability to

offer products that meet regulatory requirements, including environmental

requirements, of these industries and are cost justifiable, based on potential

regulatory compliance and cost savings in using our equipment in contrast to

existing equipment or equipment offered by others. Any economic slowdown can

affect all purchasers and manufacturers of capital equipment, and we cannot

assure you that our business will not be significantly impaired as a result of

the current worldwide economic downturn.

6

If

we lose our key personnel, or are unable to attract and retain additional

qualified personnel, the quality of our services may decline and our business

may be adversely impacted.

We rely

heavily on the expertise, experience and continued services of our senior

management, including our Chief Executive Officer, Ms. Bei Lu. Loss of her

services could adversely impact our ability to achieve our business objectives.

Ms. Lu is a key factor in our success at establishing relationships with the

major utility and industrial companies using our products because of her

extensive industry experience and reputation. The continued development of our

business depends upon the continued employment of Ms. Lu. We do not currently

have an employment agreement with Ms. Lu, and her standard labor contract does

not include provisions for non-competition or confidentiality.

We

believe our future success will depend upon our ability to retain key employees

and our ability to attract and retain other skilled personnel. The rapid growth

of the economy in China has caused intense competition for qualified personnel.

We cannot guarantee that any employee will remain employed by us for any

definite period of time or that we will be able to attract, train or retain

qualified personnel in the future. Such loss of personnel could have a material

adverse effect on our business and company. Moreover, qualified employees

periodically are in great demand and may be unavailable in the time frame

required to satisfy our customers’ requirements. We need to employ additional

personnel to expand our business. There is no assurance we will be able to

attract and retain sufficient numbers of highly skilled employees in the future.

The loss of personnel or our inability to hire or retain sufficient personnel at

competitive rates could impair the growth of our business.

We

may not be able to keep pace with competition in our industry.

Our

business is subject to risks associated with competition from new or existing

industry participants who may have more resources and better access to capital.

Many of our competitors and potential competitors may have substantially greater

financial and government support, technical and marketing resources, larger

customer bases, longer operating histories, greater name recognition and more

established relationships in the industry than we do. Among other things, these

industry participants compete with us based upon price, quality, location and

available capacity. We cannot be sure we will have the resources or expertise to

compete successfully in the future. Some of our competitors may also be able to

provide customers with additional benefits at lower overall costs to increase

market share. We cannot be sure we will be able to match cost reductions by our

competitors or that we will be able to succeed in the face of current or future

competition. In addition, we may face competition from our customers as they

seek to become more vertically integrated in order to offer full service

packages. Some of our customers are also performing more services

themselves.

Our

manufacturing facilities are located in one of the top wind power production

regions of China, thereby lowering transportation costs for delivery of our wind

towers and providing us a competitive advantage when bidding on new wind tower

contracts in the region. We currently are the sole certified wind tower

manufacturer in Tieling, Liaoning Province. Our competitive advantage in the

region based on location would be harmed if a competitor established wind tower

manufacturing facilities in or around Tieling.

We will

face different market dynamics and competition as we develop new products to

expand our target markets. In some markets, our future competitors would have

greater brand recognition and broader distribution than we currently enjoy. We

may not be as successful as our competitors in generating revenues in those

markets due to the lack of recognition of our brand, lack of customer

acceptance, lack of product quality history and other factors. As a result, any

new expansion efforts could be more costly and less profitable than our efforts

in our existing markets.

If we are

not as successful as our competitors in our target markets, our sales could

decline, our margins could be impacted negatively and we could lose market

share, any of which could materially harm our business.

Our

products may contain defects, which could adversely affect our reputation and

cause us to incur significant costs.

Despite

testing by us, defects may be found in existing or new products. Any such

defects could cause us to incur significant return and exchange costs,

re-engineering costs, divert the attention of our engineering personnel from

product development efforts, and cause significant customer relations and

business reputation problems. Any such defects could force us to undertake a

product recall program, which could cause us to incur significant expenses and

could harm our reputation and that of our products. If we deliver defective

products, our credibility and the market acceptance and sales of our products

could be harmed.

7

The

nature of our products creates the possibility of significant product liability

and warranty claims, which could harm our business.

Material

failure of any of our wind towers, bellows expansion joints or pressure vessels

would have a material adverse effect on our business. Customers use some of our

products in potentially hazardous applications that can cause injury or loss of

life and damage to property, equipment or the environment. In addition, some of

our products are integral to the production process for some end-users and any

failure of our products could result in a suspension of operations. Although we

perform extensive non-destructive testing on our products prior to delivery, we

cannot be certain our products will be completely free from defects. Our wind

towers are designed to exceed the entire expected life of its wind turbine

installation, typically 20 years, but we cannot assure you of the operational

life of our wind towers or about their medium to long-term performance and

operational reliability. As of September 30, 2010, we have delivered 137 wind

tower units. Moreover, we do not have any product liability insurance and may

not have adequate resources to satisfy a judgment in the event of a successful

claim against us. While we have not yet experienced any product liability claims

against us, as a result of our limited operating history, we cannot predict

whether product liability claims will be brought against us in the future or the

impact of any resulting negative publicity on our business. The successful

assertion of product liability claims against us could result in potentially

significant monetary damages and require us to make significant

payments.

We do not

accrue any warranty reserve because of our extensive quality control procedures

and short warranty period, factors which we believe will result in no warranty

expenses. Moreover, we have no historic basis to establish a reserve because of

our limited operating history and lack of warranty expense since our

commencement of production.

We offer

a warranty on our products to each of our customers to repair or replace any

defective product during the warranty term, which is a negotiated term of up to

24 months from the customer acceptance date, but we record no reserve for

warranty claims currently. Warranty

expense accrual is a company estimate of future warranty claims primarily based

on our extensive testing and quality control procedures with consideration also

given to our history of no prior warranty claims and abbreviated operating

history. As of September 30, 2010, the Company had not incurred any

warranty expense since our commencement of production in 2009. The Company has

implemented a stringent set of internal manufacturing protocols to ensure

product quality beginning at the time raw materials are received into our

facilities up to the final inspection at the time products are shipped to the

customer, including extensive non-destructive tests for defect detection. During

the manufacturing process, both our internal quality control staff and our

customers’ full time onsite inspectors track and inspect the work in progress.

Additionally, our products are tested by the Bureau of Quality and Technical

Supervision under national standards. Upon receiving the products, our customers

will inspect the products further prior to acceptance. The Company has analyzed

the need to make warranty accruals and concluded, based on the aforementioned

factors, that such accrual is not necessary. Although we believe our making of

no accrual for warranty expense is appropriate given our belief that our

stringent set of internal manufacturing protocols, redundant testing and

inspection of products and short term of warranty period together limit our

potential warranty expenses, if the Company incurs warranty claims in the

future, we would be required to adjust the reserve and accrue for warranty

expense accordingly.

We

are a major purchaser of certain raw materials that we use in the manufacturing

process of our products, and price changes for the commodities we depend on may

adversely affect our profitability.

The

Company’s largest raw materials purchases consist of stainless steel and carbon

steel. As such, fluctuations in the price of steel in the domestic market will

have an impact on the Company’s operating costs and related profits.

International steel prices were lower in 2009 than in 2008, but prices have

increased in 2010 along with the general economic recovery. The iron ore import

price in China has also increased since 2009, which will impact the price and

volume of steel produced by the China domestic steel industry.

Our

profitability depends in part upon the margin between the cost to us of certain

raw materials, such as stainless steel and carbon steel, used in the

manufacturing process, as well as our fabrication costs associated with

converting such raw materials into assembled products, compared to the selling

price of our products, and the overall supply of raw materials. It is our

intention to base the selling prices of our products in part upon the associated

raw materials costs to us. However, we may not be able to pass all increases in

raw material costs and ancillary acquisition costs associated with taking

possession of the raw materials through to our customers. Although we are

currently able to obtain adequate supplies of raw materials, it is impossible to

predict future availability or pricing. The inability to offset price increases

of raw material by sufficient product price increases, and our inability to

obtain raw materials, would have a material adverse effect on our consolidated

financial condition, results of operations and cash flows.

The

Company does not engage in hedging transactions to protect against raw material

fluctuations. We attempt to mitigate the short-term risks of price swings of raw

materials by obtaining firm pricing commitments from our suppliers in advance

for inclusion in our bids for large sales contracts. This strategy for

controlling raw material costs on large sales of our wind towers and other

fabricated metal specialty components is intended to help lock in our margins at

the time the bid is awarded or we enter into the sales contract.

As

the wind power industry continues to be a larger part of our business, our

business will become more seasonal.

Our

business is subject to seasonal-related fluctuations in sales volumes because we

sell products that are installed outdoors and, consequently, weather conditions

may affect demand for our products. Sales of our wind towers to the wind power

industry in the northern provinces of China are affected by seasonal variations

in both weather and customer operations. Utilities typically place requests for

proposals for new wind tower contracts in the fourth and first calendar quarters

according to their internal operational schedules and annual budget

requirements. In order to satisfy delivery schedules under these contracts, we

manufacture most of our wind towers during the second and third calendar

quarters for delivery in the second, third and fourth calendar quarters.

Customers request delivery during these quarters when the weather conditions in

the northern provinces of China, where our manufacturing facilities and our

customers’ wind farms are located, are more favorable for the installation of

wind towers by the customer. As we expect the majority of our future revenues

and earnings will be from the sale of wind towers to the wind power industry in

China, our business will become more affected by the industry’s seasonal

variations.

8

If

we are not able to manage our rapid growth, we may not be

profitable.

Our

business has undergone rapid growth since we commenced production in early 2009.

For the nine month period ending September 30, 2010, our net revenue was $14.7

million, a 440% increase over the twelve month period ended December 31, 2009.

Our continued success will depend on our ability to expand and manage our

operations and facilities. There can be no assurance we will be able to manage

our growth, meet the staffing requirements for our business or successfully

assimilate and train new employees. In addition, to manage our growth

effectively, we may be required to expand our management base and enhance our

operating and financial systems. If we continue to grow, there can be no

assurance the management skills and systems currently in place will be adequate.

Moreover, there can be no assurance we will be able to manage any additional

growth effectively. Failure to achieve any of these goals could have a material

adverse effect on our business, financial condition or results of

operations.

We

may need additional capital to execute our business plan and fund operations and

may not be able to obtain such capital on acceptable terms or at

all.

In

connection with the rapid development and expansion of our business, we will

incur significant capital and operational expenses. Management anticipates that

our existing capital resources and cash flows from operations and from our

recent private placement transaction and current short-term bank loans will be

adequate to satisfy our liquidity requirements for the next 12 months. However,

if available liquidity is not sufficient to meet our plans for expansion,

current operating expenses and loan obligations as they come due, our plans

include considering pursuing alternative financing arrangements. Our ability to

obtain additional capital on acceptable terms or at all is subject to a variety

of uncertainties, including:

|

|

§

|

investors’

perceptions of, and demand for, companies in our

industry;

|

|

|

§

|

investors’

perceptions of, and demand for, companies operating in

China;

|

|

|

§

|

conditions

of the United States and other capital markets in which we may seek to

raise funds;

|

|

|

§

|

our

future results of operations, financial condition and cash

flows;

|

|

|

§

|

governmental

regulation of foreign investment in companies in particular

countries;

|

|

|

§

|

economic,

political and other conditions in the United States, China, and other

countries; and

|

|

|

§

|

governmental

policies relating to foreign currency

borrowings.

|

We may be

required to pursue sources of additional capital through various means,

including joint venture projects and debt or equity financings. There is no

assurance we will be successful in locating a suitable financing transaction in

a timely fashion or at all. In addition, there is no assurance we will obtain

the capital we require by any other means. Future financings through equity

investments are likely to be dilutive to our existing shareholders. Also, the

terms of securities we may issue in future capital transactions may be more

favorable for our new investors. Newly issued securities may include preferences

or superior voting rights, be combined with the issuance of warrants or other

derivative securities, or be the issuances of incentive awards under equity

employee incentive plans, which may have additional dilutive effects.

Furthermore, we may incur substantial costs in pursuing future capital and

financing, including investment banking fees, legal fees, accounting fees,

printing and distribution expenses and other costs. We may also be required to

recognize non-cash expenses in connection with certain securities we may issue,

such as convertible notes and warrants, which will adversely impact our

financial condition.

If we

cannot raise additional funds on favorable terms or at all, we may not be able

to carry out all or parts of our strategy to maintain our growth and

competitiveness or to fund our operations. If the amount of capital we are able

to raise from financing activities, together with our revenues from operations,

is not sufficient to satisfy our capital needs, even to the extent that we

reduce our operations accordingly, we may be required to cease

operations.

We

may not be able to attract the attention of major brokerage firms because we

became public by means of a share exchange.

There may

be risks associated with our becoming public through the Share Exchange

Agreement. Analysts of major brokerage firms may not provide our company

coverage because there is no incentive for brokerage firms to recommend the

purchase of our common stock. Furthermore, we can give no assurance that

brokerage firms will, in the future, want to conduct any secondary offerings on

our behalf.

Our

accounts receivables remain outstanding for a significant period of time, which

has a negative impact on our cash flow and liquidity.

Our

agreements with our customers generally provide that 30% of the purchase price

is due upon the placement of an order, 30% upon reaching certain milestones in

the manufacturing process and 30% upon customer acceptance of the product. As a

common practice in the manufacturing business in China, payment of the final 10%

of the purchase price is due no later than the termination date of our warranty

period, which is a negotiated term of up to 24 months from the acceptance date.

We account for payments received from customers prior to customer acceptance of

the product as unearned revenue.

9

We

are required to maintain various licenses and permits regarding our

manufacturing business, and the loss of or failure to renew any or all of these

licenses and permits may require the temporary or permanent suspension of some

or all of our operations.

In

accordance with the laws and regulations of the PRC, we are required to maintain

various licenses and permits in order to operate our manufacturing business. We

are required to acquire a manufacturing license for specialized equipment from

the State General Administration of the PRC for Quality Supervision and

Inspection and Quarantine in order to manufacture pressure vessels of the Class

III A2 grade. Many large-scale industrial companies in China require

manufacturers like us to have this Class III A2 grade manufacturing license

before allowing for the submission of bids on contracts for fabricated metal

specialty components such as wind towers. Our nondestructive radiological

testing of products includes the use of x-rays for defect detection and we are

required to maintain our defect detection room in compliance with PRC Ministry

of Health standards for radiological protection standards for industrial x-rays.

Failure to maintain these standards, or the loss of or failure to renew such

licenses and production permits, could result in the temporary or permanent

suspension of some or all of our production or distribution operations and could

adversely affect our revenues and profitability.

We

may experience material disruptions to our manufacturing

operations.

While we

seek to operate our facilities in compliance with applicable rules and

regulations and take measures to minimize the risks of disruption at our

facilities, a material disruption at one of our manufacturing facilities could

prevent us from meeting customer demand, reduce our sales and/or negatively

impact our financial results. Any of our manufacturing facilities, or any of our

machines within an otherwise operational facility, could cease operations

unexpectedly due to a number of events, including: prolonged power failures;

equipment failures; disruptions in the transportation infrastructure including

roads, bridges, railroad tracks; and fires, floods, earthquakes, acts of war, or

other catastrophes.

We

cannot be certain our product innovations and marketing successes will

continue.

We

believe our past performance has been based on, and our future success will

depend, in part, upon our ability to continue to improve our existing products

through product innovation and to develop, market and produce new products. We

cannot assure you that we will be successful in introducing, marketing and

producing any new products or product innovations, or that we will develop and

introduce in a timely manner innovations to our existing products which satisfy

customer needs or achieve market acceptance. Our failure to develop new products

and introduce them successfully and in a timely manner could harm our ability to

grow our business and could have a material adverse effect on our business,

results of operations and financial condition.

The

technology used in our products may not satisfy the changing needs of our

customers.

While we

believe we have hired or engaged personnel who have the experience and ability

necessary to keep pace with advances in technology, and while we continue to

seek out and develop “next generation” technology through our research and

development efforts, there is no guarantee we will be able to keep pace with

technological developments and market demands in our target industries and

markets. Although certain technologies in the industries we occupy are well

established, we believe our future success depends in part on our ability to

enhance our existing products and develop new products in order to continue to

meet customer demands. With any technology, including the technology of our

current and proposed products, there are risks that the technology may not

address successfully all of our customers’ needs. Moreover, our customers’ needs

may change or vary. This may affect the ability of our present or proposed

products to address all of our customers’ ultimate technology needs in an

economically feasible manner, which could have a material adverse affect on our

business.

Our

insurance coverage may be inadequate to protect us from potential

losses.

We do not

maintain business interruption insurance. The insurance industry in China is in

its early stage of development and the business interruption insurance and the

product liability insurance available currently in China offers limited coverage

compared to that offered in many other countries, especially in the United

States. Any business disruption or natural disaster could result in substantial

costs and a diversion of resources, which would have a material and adverse

effect on our business and results of operations. On the other hand, our

business operations, particularly our production facilities, involve risks and

hazards that could result in damage to, or destruction of, property and

machinery, personal injury, business interruption and possible legal liability.

In addition, we do not have product liability insurance covering bodily injuries

and property damage caused by the products we sell. Therefore, as with other

manufacturers of fabricated metal specialty components in China, we are exposed

to risks associated with product liability claims and may need to bear the

litigation cost if the use of our products results in bodily injury or property

damage. We do not carry key-man life insurance, and if we lose the services of

any senior management and key personnel, we may not be able to locate suitable

or qualified replacements, and may incur additional expenses to recruit and

train new personnel, which could severely disrupt our business and prospects.

Furthermore, we do not have property insurance and as such we are exposed to

risks associated with losses in values of our equipment, facilities and

inventory due to fire, earthquake, flood and a wide range of natural disasters.

We do not have personal injury insurance and accidental medical care insurance.

Although we require that the third-party transportation companies we engage

maintain insurance policies with respect to inland transit risks for our

products, the coverage may be inadequate to protect us from potential claims

against us and the losses that may result.

10

We

face risks associated with managing domestic operations.

All of

our operations are conducted in China. There are a number of risks inherent in

doing business in such market, including the following:

|

|

§

|

unfavorable

political or economical factors;

|

|

|

§

|

fluctuations

in foreign currency exchange rates;

|

|

|

§

|

potentially

adverse tax consequences;

|

|

|

§

|

unexpected

legal or regulatory changes;

|

|

|

§

|

lack

of sufficient protection for intellectual property

rights;

|

|

|

§

|

difficulties

in recruiting and retaining personnel, and managing international

operations; and

|

|

|

§

|

less

developed infrastructure.

|

Our

inability to manage successfully the risks in our China domestic activities

could adversely affect our business. We can provide no assurances that any new

market expansion will be successful because of the risks associated with

conducting such operations, including the risks listed above.

We

may not be able to protect our technology and other proprietary rights

adequately.

Our

success will depend in part on our ability to obtain and protect our products,

methods, processes and other technologies, to preserve our trade secrets, and to

operate without infringing on the proprietary rights of third parties, both

domestically and abroad. Despite our efforts, any of the following may reduce

the value of our owned and used intellectual property:

|

|

§

|

issued

patents and trademarks that we own or have the right to use may not

provide us with any competitive

advantages;

|

|

|

§

|

our

efforts to protect our intellectual property rights may not be effective

in preventing misappropriation of our technology or that of those from

whom we license our rights to use;

|

|

|

§

|

our

efforts may not prevent the development and design by others of products

or technologies similar to or competitive with, or superior to those we

use or develop; or

|

|

|

§

|

another

party may obtain a blocking patent and we or our licensors would need to

either obtain a license or design around the patent in order to continue

to offer the contested feature or service in our

products.

|

Effective

protection of intellectual property rights may be unavailable or limited in

certain foreign countries. If we are unable to protect our proprietary rights

adequately, it would have a negative impact on our operations.

We,

or the owners of the intellectual property rights licensed to us, may be subject

to claims that we or such licensors have infringed the proprietary rights of

others, which could require us and our licensors to obtain a license or change

designs.

Although

we do not believe any of our products infringe upon the proprietary rights of

others, there is no assurance that infringement or invalidity claims (or claims

for indemnification resulting from infringement claims) will not be asserted or

prosecuted against us or those from whom we have licenses or that any such

assertions or prosecutions will not have a material adverse affect on our

business. Regardless of whether any such claims are valid or can be asserted

successfully, defending against such claims could cause us to incur significant

costs and could divert resources away from our other activities. In addition,

assertion of infringement claims could result in injunctions that prevent us

from distributing our products. If any claims or actions are asserted against us

or those from whom we have licenses, we may seek to obtain a license to the

intellectual property rights that are in dispute. Such a license may not be

available on reasonable terms, or at all, which could force us to change our

designs.

Our

business could be subject to environmental liabilities.

As is the

case with manufacturers of similar products, we use certain hazardous substances

in our operations. Currently, we do not anticipate any material adverse effect

on our business, revenues or results of operations as a result of compliance

with the environmental laws and regulations of the PRC. However, the risk of

environmental liability and charges associated with maintaining compliance with

PRC environmental laws is inherent in the nature of our business, and there is

no assurance that material environmental liabilities and compliance charges will

not arise in the future.

11

We

will incur significant costs as a result of our operating as a public company

and our management will be required to devote substantial time to new compliance

initiatives.

While we

are a public company, our compliance costs prior to the Share Exchange in July

2010 were not substantial in light of our limited operations. Creative Bellows

never operated as a public company prior to the Share Exchange. As a public

company with substantial operations, we will incur increased legal, accounting

and other expenses. The costs of preparing and filing annual and quarterly

reports, proxy statements and other information with the SEC and furnishing

audited reports to shareholders is time-consuming and costly.

It will

also be time-consuming, difficult and costly for us to develop and implement the

internal controls and reporting procedures required by the Sarbanes-Oxley Act of

2002 (the “Sarbanes-Oxley Act”). Certain members of our management have limited

or no experience operating a company whose securities are listed on a national

securities exchange or with the rules and reporting practices required by the

federal securities laws and applicable to a publicly traded company. We will

need to recruit, hire, train and retain additional financial reporting, internal

control and other personnel in order to develop and implement appropriate

internal controls and reporting procedures. If we are unable to comply with the

internal controls requirements of the Sarbanes-Oxley Act, we may not be able to

obtain the independent accountant certifications required by the Sarbanes-Oxley

Act.

If

we fail to establish and maintain an effective system of internal controls, we

may not be able to report our financial results accurately or prevent fraud. Any

inability to report and file our financial results accurately and timely could

harm our business and adversely impact the trading price of our common

stock.

We are

required to establish and maintain internal controls over financial reporting,

disclosure controls, and to comply with other requirements of the Sarbanes-Oxley

Act and the rules promulgated by the SEC. Our management, including our Chief

Executive Officer and Chief Financial Officer, cannot guarantee that our

internal controls and disclosure controls will prevent all possible errors or

prevent all fraud. A control system, no matter how well conceived and operated,

can provide only reasonable, not absolute, assurance that the objectives of the

control system are met. In addition, the design of a control system must reflect

the fact that there are resource constraints and the benefit of controls must be

relative to their costs. Because of the inherent limitations in all control

systems, no system of controls can provide absolute assurance that all control

issues and instances of fraud, if any, within the company have been detected.

These inherent limitations include the realities that judgments in

decision-making can be faulty and that breakdowns can occur because of simple

error or mistake. Furthermore, controls can be circumvented by individual acts

of some persons, by collusion of two or more persons, or by management override

of the controls. The design of any system of controls is based in part upon

certain assumptions about the likelihood of future events, and there can be no

assurance that any design will succeed in achieving its stated goals under all

potential future conditions. Over time, a control may become inadequate because

of changes in conditions or the degree of compliance with policies or procedures

may deteriorate. Because of inherent limitations in a cost-effective control

system, misstatements due to error or fraud may occur and may not be

detected.

We

are a holding company that depends on cash flow from our wholly owned

subsidiaries to meet our obligations.

After the

Share Exchange, we became a holding company with no material assets other than

the stock of our wholly owned subsidiaries, Creative Bellows and Creative Wind

Power, which is a wholly owned subsidiary of Creative Bellows. Accordingly,

Creative Bellows and Creative Wind Power will conduct all of our operations,

which are responsible for research, production and delivery of goods. We

currently expect that we will primarily retain the earnings and cash flow of our

subsidiaries for use by us in our operations.

All

of Creative Bellows’ liabilities survived the Share Exchange and there may be

undisclosed liabilities that could have a negative impact on our financial

condition.

Before

the Share Exchange, certain due diligence activities on the Company and Creative

Bellows were performed. The due diligence process may not have revealed all

liabilities (actual or contingent) of the Company and Creative Bellows that

existed or which may arise in the future relating to the Company’s activities

before the consummation of the Share Exchange. Notwithstanding that all of the

Company’s pre-closing liabilities were transferred to a third party pursuant to

the terms of the Share Exchange Agreement, it is possible that claims for such

liabilities may still be made against us, which we will be required to defend or

otherwise resolve. The transfer pursuant to the Share Exchange Agreement may not

be sufficient to protect us from claims and liabilities, and any breaches of

related representations and warranties. Any liabilities remaining from the

Company’s pre-closing activities could harm our financial condition and results

of operations.

12

New

accounting standards could result in changes to our methods of quantifying and

recording accounting transactions, and could affect our financial results and

financial position.

Changes

to the U.S. Generally Accepted Accounting Principles arise from new and revised

standards, interpretations, and other guidance issued by the Financial

Accounting Standards Board, the SEC, and others. In addition, these or other

U.S. entities may issue new or revised Cost Accounting Standards or Cost

Principles. The effects of such changes may include prescribing an accounting

method where none had been previously specified, prescribing a single acceptable

method of accounting from among several acceptable methods that currently exist,

or revoking the acceptability of a current method and replacing it with an

entirely different method, among others. Such changes could result in

unanticipated effects on our results of operations, financial position, and

other financial measures.

Risks

Related to Our Business being Conducted in China

China’s

economic policies could affect our business.

All of

our assets are located in China and all of our revenue is derived from our

operations in China. Accordingly, our results of operations and prospects are

subject, to a significant extent, to the economic, political and legal

developments in China. While China’s economy has experienced significant growth

in the past twenty years, such growth has been uneven, both geographically and

among various sectors of the economy. The PRC government has implemented various

measures to encourage economic growth and guide the allocation of resources.

Some of these measures benefit the overall economy of China, but they may also

have a negative effect on us. For example, operating results and financial

condition may be adversely affected by the government control over capital

investments or changes in tax regulations. The economy of China has been

transitioning from a planned economy to a more market-oriented economy. In

recent years, the PRC government has implemented measures emphasizing the

utilization of market forces for economic reform and the reduction of state

ownership of productive assets, and the establishment of corporate governance in

business enterprises; however, a substantial portion of productive assets in

China are still owned by the PRC government. In addition, the PRC government

continues to play a significant role in regulating industry development by