Attached files

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the Fiscal Year Ended September 30, 2010

or

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the Transition Period from to

Commission File Number 0-23212

Telular Corporation

(Exact name of registrant as specified in its charter)

|

Delaware

|

36-3885440

|

|

(State or other jurisdiction of

|

(I.R.S. employer

|

|

incorporation or organization)

|

identification no.)

|

311 South Wacker Drive, Suite 4300, Chicago, Illinois 60606-6622

(Address of principal executive offices and zip code)

(312) 379-8397

(Registrant's telephone number, including area code)

Securities registered pursuant to 12(b) of the Act:

|

Title of Each Class

|

Name of each exchange on which registered

|

|

Common Stock, $.01 Par Value

|

The NASDAQ Stock Market LLC

|

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange.

|

Large accelerated filer o

|

Accelerated filer o

|

|

Non-accelerated filer x

(Do not check if a smaller reporting company)

|

Smaller reporting company o

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No x

As of March 31, 2010, the aggregate market value of the voting stock held by non-affiliates of the registrant was approximately $35,961,488 (based upon the closing sales price of such stock as reported by The NASDAQ Stock Market LLC on such date). The number of shares outstanding of the registrant's Common Stock as of December 6, 2010, the latest practicable date, was 14,988,724 shares.

DOCUMENTS INCORPORATED BY REFERENCE

Certain portions of the Proxy Statement to be filed with the Securities and Exchange Commission within 120 days after the close of the registrant's fiscal year ended September 30, 2010 are incorporated by reference in Part III of this Form 10-K.

FORWARD LOOKING INFORMATION

This report contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Statements regarding expectations, including performance assumptions and estimates relating to capital requirements, as well as other statements that are not historical facts, including statements beginning with the words “estimate”, “project”, “intend”, “expect”, “believe”, “target” and similar expressions, are forward-looking statements. These statements reflect management’s judgments based on currently available information and involve a number of risks and uncertainties that could cause actual results to differ materially from those in the forward-looking statements. With respect to these forward-looking statements, management has made assumptions regarding, among other things, customer growth and retention, pricing, operating costs and the economic environment. The following include some but not all of the factors that could cause actual results or events to differ materially from those anticipated:

|

|

·

|

our ability to keep pace with technology changes and meet the needs of our customers;

|

|

|

·

|

our ability to develop and introduce new products and to reduce the costs to produce existing products;

|

|

|

·

|

whether and when products from our investments in research and development of new products are realized;

|

|

|

·

|

the availability of resources to conduct research and development;

|

|

|

·

|

the impact of unfavorable economic events, including competitive pricing pressure in our target markets, on sales of our products;

|

|

|

·

|

our ability to successfully increase the focus of our production, marketing and sales efforts to the M2M market;

|

|

|

·

|

our reliance on third parties to manufacture our products and components for our products;

|

|

|

·

|

the availability of raw materials and other materials needed for our products;

|

|

|

·

|

the availability and lack of interruption of service on the cellular networks upon which our products and services are dependent;

|

|

|

·

|

our relationships with our customers, including our ability to maintain our significant customers and our exposure to the credit worthiness of our significant customers, including ADT;

|

|

|

·

|

our ability to sustain profitable operations and to obtain the funding we need to operate our business;

|

|

|

·

|

the impact of litigation on our business and financial condition;

|

|

|

·

|

our ability to manage costs by accurately forecasting our needs;

|

|

|

·

|

our ability to ensure that quality control procedures are enforced and effective;

|

|

|

·

|

the impact on our business of long sales cycles for our products;

|

|

|

·

|

the impact of volatility in the developing markets in which we operate;

|

|

|

·

|

our ability to successfully protect our intellectual property, including our patents, trademarks and know-how;

|

|

|

·

|

our ability to successfully manage any problems encountered in connection with any potential future acquisitions;

|

|

|

·

|

the impact of Delaware law and our charter documents on transactions that could be beneficial to common stockholders; and

|

|

|

·

|

the impact on our stock price of volatility of our operating results and sales of common stock issuable on the exercise of options and warrants.

|

In addition to the foregoing, forward-looking statements are found throughout Management’s Discussion and Analysis. You should not place undue reliance on forward-looking statements, which speak only as of the date of this report. Except as required by law, Telular is not obligated to publicly release any revisions to forward-looking statements to reflect events after the date of this report or unforeseen events. Other risks and uncertainties are discussed in Item 1A of this Annual Report on Form 10-K.

2

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly and current reports, proxy statements and other information with the Securities and Exchange Commission (the “SEC”). You can inspect, read and copy these reports, proxy statements and other information at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. You can obtain information regarding the operation of the SEC’s Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC also maintains a Web site at www.sec.gov that makes available reports, proxy statements and other information regarding issuers that file electronically.

We make available free of charge through a link on our website (www.telular.com) our Code of Ethics, Audit Committee Charter, Compensation Committee Charter, Nominating and Governance Committee Charter, as well as copies of materials we file with, or furnish to, the SEC. By referring to our website, we do not incorporate our website or its contents into this Annual Report on Form 10-K.

3

PART I

(Dollars in Thousands, Except Per Share Data)

ITEM 1. BUSINESS

OVERVIEW

Telular Corporation (“Telular”) develops products and services that utilize wireless networks to provide data and voice connectivity among people and machines. Telular’s product and service offerings are created through Telular’s historical competence in developing cellular electronics along with utilizing the data transport capabilities of today’s commercial wireless networks.

Telular was established in 1986 when it acquired the intellectual property rights for its cellular interface concept and methodology. Today, it creates solutions based on the development of specialized wireless terminals that work in conjunction with software systems to provide integrated event monitoring and reporting services for machine-to-machine (M2M) applications. M2M applications typically involve outfitting machinery with sensors and remotely reading those sensors to improve process efficiency in areas such as supply chain management, security monitoring, meter reading, vehicle tracking and many other commercial and industrial situations. Telular’s substantial experience with wireless networking evolved from its original focus on developing fixed wireless products for use in North America and in developing countries around the world.

COMPANY STRATEGY

Strategically, Telular is focused on M2M market segments in which Telular can create a differentiated product and service offering which will allow it to provide service and earn revenue on an ongoing basis as opposed to a one-time revenue generated by a one-time product sale.

Telular’s Telguard solution supports residential and commercial security dealers and generates a majority of Telular’s revenue. The Telguard solution includes a specialized terminal unit which interfaces with commercial security control panels and then communicates with Telular’s event processing servers to provide real-time transport of alarm signals from residential and commercial locations to an alarm company’s central monitoring station. Alarm monitoring companies purchase the products and cellular service from Telular and resell them to end users in order to provide wireless conveyance of alarm signals, which were historically sent over traditional wireline phone networks. While Telular’s Telguard solution can function as a backup to a traditional telephone line, it is more commonly used as the primary means for the transmission of alarm signals as end users eliminate traditional phone lines in favor of voice-over-IP (VoIP) connections and cellular telephones.

Telular’s TankLink solution combines a specially designed cellular communicator, wireless data services and a web-based application into a single offering which allows end-users to remotely monitor the level of product contained in a given tank vessel. Telular’s cellular communicator interfaces with a variety of commercially available sensors and conveys the level-reading of those sensors to our event processing servers. This information commonly feeds a vendor managed inventory (VMI) program that improves the efficiency and timeliness of product delivery, while optimizing the amount of product held by customers at any given time. Many of Telular’s existing TankLink systems are installed in fuel and lubricant tanks. Additional market segments served include industrial chemicals, food additives and waste water treatment.

In its Telguard and TankLink service lines, Telular embeds wireless data services in its solutions. Telular is able to resell and service its customers through agreements it has negotiated with major wireless network operators in the United States. Management believes Telular’s status as a wireless data reseller and service provider represents an advantage over a number of its competitors because we are able to offer this as an embedded service within our products and we have a high volume of subscribers to achieve economies of scale as a wireless service provider.

4

While Telular is focused on developing new M2M solutions similar to its Telguard and TankLink offerings, Telular continues to manufacture and sell a line of fixed cellular terminals (“FCTs”). The FCT business targets both commercial and residential consumers, who use FCTs for voice, fax, and Internet access over the wireless networks. At its most basic level, an FCT allows users to simultaneously plug in a standard telephone, fax machine and a computer data line, which the FCT then makes functional over the wireless phone network. In the United States, FCTs are most often used for remote or mobile applications in which cellular service is available but broadband Internet connectivity is not. In Latin America, Telular FCTs are used more extensively due to the fact that traditional wireline telephone and broadband networks were not built as extensively as in the United States, but cellular systems have been widely implemented.

Telular operates as a single-segment enterprise for financial reporting purposes. For financial information about geographic areas, see “Note 13. Major Customers” and “Note 14. Export Sales” to the consolidated financial statements of Telular set forth in Item 8 of this Form 10-K.

GEOGRAPHICAL MARKETS

Telguard products and service are currently sold only in the United States, although Telular is continuing its efforts to expand service to other North American countries during fiscal 2011.

Currently, the vast majority of M2M tank applications served by Telular are located within the United States, with some fiscal year 2010 sales to Mexico. Within the United States, these installations span the entire country and Telular expects to expand the number of tanks it monitors in Mexico during 2011, as well as expand into other Latin American countries, where it has strong relationships with the leading wireless carriers.

Telular currently focuses its FCT sales efforts in North and South America, but also has had sales in Africa, Asia and the Middle East.

In total, 99% of Telular’s revenues are derived from customers within the United States.

TECHNOLOGY

Integral to our success in the Telguard, TankLink and the M2M space in general is our experience in processing data messages over the cellular networks. Our data processing center is able to process hundreds of thousands of messages effectively and on a real-time basis each day, which is critical for our customers, particularly within the security space. Also critical to our success is the ability to develop new products and features that may become necessary as new applications are developed or are otherwise considered desirable by the markets that we serve. We can also leverage our technical knowledge related to cellular radios and our engineering skills to develop new products and services based on our core technology platform to serve other M2M vertical markets.

RESEARCH AND DEVELOPMENT AND PRODUCT LINES

Our Telguard and TankLink M2M solutions operate in conjunction with real-time, transaction processing servers which receive data, transform the data, and immediately forward the result to our customers. The M2M tank level monitoring and Telguard security solutions are a combination of hardware product design along with software system design. In both cases, the software system is capable of high-volume, real-time transaction processing of mission critical data (security alarms and tank fill levels). Such integrated hardware and software system solutions will be the focus of our research and development activities going forward and can be further applied to event monitoring opportunities in other vertical markets.

Because our products operate on a coordinated basis with wireless phone networks, Telular works closely with major carriers to certify our products on their networks. In many cases, the carriers themselves are our customers and they sell and distribute our products to end users upon certification. Based on this need to work closely with the major wireless phone carriers, Telular has developed strong working relationships with these carriers as customers and solution partners.

Research and development activities sponsored by Telular for the years ended September 30, 2010, 2009, and 2008, were $3,010, $2,974, and $4,448, respectively, and are included in engineering and development expense. There are no customer sponsored research and development activities included in any of those years.

The following details areas of product delivery and research during fiscal 2010 and anticipated in fiscal 2011.

5

Telguard - Telular’s engineering team continues to update the Telguard digital product portfolio by addressing the growing demand and technology changes in the electronics security market. In fiscal 2010, Telular launched its new TG-1 Express product and undertook a design update of certain other Telguard hardware devices in order to update components and establish a product that will enable new features in the future. Product innovation within this space is important for the long-term success of this business, and we expect to continue to enhance our Telguard hardware products as part of our overall business strategy.

TankLink – The fiscal 2009 acquisition of TankLink Corp. (formerly known as SupplyNet Communications, Inc.) brought Telular a successful wireless communicator product line for tank level monitoring. Enhancements to this hardware and its supporting message center have been made during 2010. Telular plans to further enhance this product line during fiscal 2011 to support a wider array of sensors and to add additional features to the hardware products which further enable the service offering.

Other M2M Solutions – During 2010, Telular evaluated a number of vertical and sub-vertical M2M markets to determine the viability of creating or acquiring a product and/or service in these markets. While Telular did not move forward with any such solutions, it will continue to examine growth possibilities and new solutions in the M2M market space.

SALES, MARKETING SERVICE AND SUPPORT

Domestic Sales

In the United States, Telular markets both its Telguard and FCT products through an Atlanta-based inside sales group. Telguard customers are security equipment distributors, who sell to independent security dealers, and larger security service dealers to which Telular sells on a direct basis, totaling approximately 2,700 customers. Telular also utilizes a number of manufacturer’s representatives to provide local sales support for the Telguard products. FCT customers are either large cellular carriers or Value Added Resellers (VARs) dedicated to niche market applications enabled by Telular’s FCT products. Telular’s TankLink solutions are sold through a small, Chicago-based sales team which focuses on supporting key VARs, which distribute the vast majority of Telular’s TankLink products and services. For fiscal years 2010, 2009 and 2008 Telular’s domestic revenues were $46,650 (99%), $46,218 (98%) and $56,786 (86%) of total revenues, respectively.

International Sales

Our international sales team is based in Miami and covers key markets such as Latin America. These markets include significant cellular carrier customers in countries such as Mexico. Currently, the international sales team is focused on expanding TankLink in Mexico and other Latin American countries. In addition, the international team continues to market Telular’s FCT products on a limited basis. In fiscal years 2010, 2009 and 2008 Telular’s international revenues were $704 (1%), $976 (2%) and $9,368 (14%) of total revenues, respectively.

Service and Support

Telular believes that providing customers with comprehensive product service and support is critical to maintaining a competitive position in the mobile telecommunications equipment industry. Telular offers warranty and repair service for its products through three primary methods: (1) advance replacement kits shipped with orders, (2) in-house service and technical support, and (3) authorized third-party service centers in Latin America.

MAJOR CUSTOMERS

In fiscal 2010, Telular derived 38% of its total revenues from ADT, a major U.S. securities systems provider.

6

MANUFACTURING

Telular’s products are manufactured by contract manufacturers in China and the United States and are tested with proprietary testing suites that Telular creates and provides to these manufacturers. We also conduct comprehensive quality control and quality assurance surveillance during the manufacturing process. Telular contracts directly with a number of key suppliers to buy certain, critical components of its products, including cellular transceiver modules.

EXECUTIVE OFFICERS

The executive officers of Telular and their ages as of December 14, 2010 are as follows:

|

Name

|

Age

|

Position

|

|

Joseph A. Beatty

|

47

|

President, Chief Executive Officer and Director

|

|

Jonathan M. Charak

|

41

|

Senior Vice President, Chief Financial Officer and Secretary

|

|

George S. Brody

|

55

|

Senior Vice President, Telguard and Terminals

|

|

Robert L. Deering

|

52

|

Controller, Treasurer and Chief Accounting Officer

|

Joseph A. Beatty has served as President, Chief Executive Officer and Director since January 2008 and Chief Financial Officer and Secretary from May 2007 to March 2008. From June 2003 until June 2006, he was President and Chief Executive Officer of Concourse Communications Group, a privately-held developer and operator of distributed antenna systems and airport Wi-Fi networks. From November 1996 until February 2001, Mr. Beatty was a co-founder and the CFO of Focal Communications Corporation, a competitive local exchange carrier that is now part of Level 3 Communications. Earlier in his career, Mr. Beatty was a securities analyst and also held numerous technical management positions for a local exchange carrier. Mr. Beatty has a BS in Electrical Engineering and an MBA in Finance. In addition, he is a Chartered Financial Analyst.

Jonathan M. Charak has served as Senior Vice President, Chief Financial Officer and Secretary since March 2008. From January 2007 through February 2008, he served as the Chief Financial Officer of Vanderbilt Financial, LLC. From June 2003 through October 2006, Mr. Charak was Chief Financial Officer at Concourse Communications Group, LLC. Prior to that, Mr. Charak served as Chief Financial Officer of Language Stars, LLC and as Controller at iFulfillment, Inc., both of which were early stage high growth companies. Mr. Charak began his career with 9 years of experience in the audit practice of Arthur Andersen LLP. Mr. Charak has a B.S. degree in Accounting from Indiana University and has a CPA certificate.

George S. Brody has served as Senior Vice President, Telguard and Terminals since June 2003. Previously, Mr. Brody worked as a consultant in the telecommunications industry from 2002 to 2003. From 2000 to 2002, Mr. Brody was Vice President of Sales and Marketing for Evolution Networks, Inc. From 1995 to 2000, Mr. Brody served as Vice President, Sales and Marketing for Philips Electronics. Prior to that, he was Vice President, Worldwide Marketing for Burle Industries (1987-1995). Mr. Brody began his career at RCA in 1978.

Robert L. Deering was appointed Controller, Treasurer and Chief Accounting Officer in October 2005. Mr. Deering had previously been the Corporate Controller for VASCO Data Security International, Inc. from June 2002 to October 2005. Prior to that, he was the Controller for various technology and manufacturing companies. Mr. Deering began his career in public accounting at PricewaterhouseCoopers in 1979. He has a BA in Accounting and has a CPA certificate.

EMPLOYEES

Telular has 83 full time employees, of which 42% are in sales, customer service and marketing, 13% in manufacturing support, 33% in engineering and product development and 12% in finance and administration. None of Telular’s employees are represented by organized labor and all of Telular’s employees are located in the United States.

COMPETITION

Telular believes its advantages over the competition include:

Greater Focus –Telular is focused on creating M2M solutions, which we develop by combining our historical competency in designing cellular networking electronics with the data transport capabilities of commercial wireless networks. This focus allows us to develop products best suited to our customers’ needs, resulting in products that are easier to install and maintain and are more reliable. Our primary competitors have the bureaucracy normally associated with large companies and the management distraction associated with overseeing a broad array of products and services; many of which are unrelated to one another.

7

More Experience – Telular has been in the cellular electronics business for over 20 years. We have deployed products in more than 130 countries worldwide, reflecting the quality, reliability and innovation of our product portfolio.

Broader Product line –Telguard, our largest line of business, includes a more diverse set of hardware products than any of our competitors and we believe this gives our customers a greater selection of devices from which to choose.

Economies of Scale –Telguard’s fully integrated end-to-end cellular solution is now utilized by over 560,000 individual subscribers, which helps to minimize costs on a per user basis. This large customer base also reflects our significant experience and demonstrates credibility to the market.

Service and Support – Telular provides customers with comprehensive customer service and product support. We believe that our commitment and ability to provide superior service differentiates us from our competition.

Financial Strength – Telular is currently generating cash from operations, has no indebtedness and maintains a substantial cash balance. We believe that this financial strength gives us an ability to develop new products & services and defend against competitive initiatives very well.

There are several firms that compete with Telular’s Telguard products and services. These primary competitors include: Honeywell, DSC, Numerex and Alarm.com. Telular believes it has a significant portion of the market share for cellular alarm communicators, having introduced the first such device for digital cellular networks in March 2006. Demand for cellular communicators has increased markedly over the past year. We believe this is due to consumers eliminating traditional telephone lines and therefore, requiring a cellular communicator to enable a home security system. If this trend continues, Telular believes that Telular and its competitors will continue to see substantial demand for products and related services.

Telular’s Telguard hardware products will only interface with Telular’s proprietary message center, which interprets and forwards any alarms received to Telular’s security monitoring customers in near real-time. Telular believes its competitive advantages for this service are the fact that its hardware products interface with the vast majority of alarm panels on the market and that installers can quickly activate the hardware and service.

There are numerous, small competitors to Telular’s TankLink offering. The most significant of these is Centeron, a division of Robertshaw Industries, which in turn is a subsidiary of Invensys, Inc. More often, the TankLink offering competes against the pre-existing, manual methods utilized by tank owners to determine the fill level and reorder timing for products held within tank vessels. Telular believes the key to growing its TankLink revenue is by lowering its prices to the greatest extent possible in order to cost justify implementation of the TankLink solution.

With regard to the FCTs sold by Telular, there are a large number of competitors that manufacture and sell FCTs. They include: Ericsson, Axesstel, YX and numerous other manufacturers in Asia and elsewhere. Much of the demand for these terminals is outside the United States and demand is concentrated among the large wireless carriers that operate in various countries around the world. Competition is based on reputation, features and pricing. Telular’s products have historically sold well in Latin America and Telular is able to realize an acceptable selling price due to Telular’s reputation for quality products in that region. The FCT business is not a primary focus of Telular but it continues to earn an acceptable contribution margin and will be maintained for as long as it continues to do so.

Telular has granted a license for its patents to Ericsson and currently faces competition for FCT sales from Ericsson.

8

PATENTS AND OTHER INTELLECTUAL PROPERTY

PATENTS

With respect to its intelligent interface technology, Telular currently has eight issued and active U.S. patents as well as four foreign patents. Telular has successfully defended some of its patents in court. These law suits have not had a material effect on Telular's financial position. Although Telular believes its intelligent interface can be adapted to accommodate emerging wireless technologies, there can be no assurance that these new applications will fall within the scope of the existing patent protection.

TRADEMARKS AND OTHER PROPRIETARY INFORMATION

Telular has 8 registered and 5 applications for U.S. trademarks, which are: Telular (block), TELULAR plus design, Hexagon Logo, PHONECELL, TELGUARD and WiPATH. Telular has 5 pending U.S. trademark applications (for "LOSE THE LINE KEEP THE CONNECTION", "WIRELESSLY PROTECTED TG-12", "TANKLINK", "TANKLINK" logo and “TTTTTT Telguard”). In addition, Telular has a total of 27 foreign trademark registrations covering the names and logos used for some of its products.

ITEM 1A. RISK FACTORS

You should carefully consider the following risks before you decide to buy our common stock. If any one of these risks or uncertainties were to occur, our business, financial condition, results and performance could be seriously harmed and/or the price of our common stock might significantly decrease. The risks and uncertainties described in this Annual Report on Form 10-K are not the only ones facing us. Additional risks and uncertainties that currently are not known to us or that we currently believe are immaterial also may adversely affect our businesses and operations.

Technology changes rapidly in our industry and our future success will depend on our ability to keep pace with these changes and meet the needs of our customers.

The wireless solutions industry is characterized by rapid technological advances, evolving industry standards, changing customer needs and frequent new product introductions and enhancements. The fixed cellular telecommunications industry also is experiencing significant technological change. The introduction of products embodying new technologies and the emergence of new industry standards could render our existing products and technology obsolete and unmarketable. The process of developing new technology and products is complex, uncertain and expensive, and success depends on a number of factors, including:

|

•

|

proper product definition;

|

|

|

•

|

component cost;

|

|

|

•

|

resolving technical hurdles;

|

|

|

•

|

timely completion and introduction to the market;

|

|

|

•

|

differentiation from the products of our competitors; and

|

|

|

•

|

market acceptance of our products.

|

We may not be successful in developing and marketing new products and enhancements or we may experience difficulties that prevent development of products and enhancements in a timely manner. In addition, our products may fail to meet the needs of the marketplace or achieve market acceptance. Any of these circumstances would seriously harm our results and financial condition.

9

Our results depend on our ability to develop and introduce new products and to reduce the costs to produce existing products.

The process of developing new technology is complex and uncertain, and if we fail to accurately predict the changing needs of our customers and emerging technological trends, our results and financial condition may suffer. We must commit significant resources, including those contracted from third parties, to develop new products before knowing whether our investments will result in products the market will accept. There can be no assurance that we will successfully identify new product opportunities, develop and bring new products to market in a timely manner, and achieve market acceptance of our products, or that products and technologies developed by others or new industry standards will not render our products or technologies obsolete or noncompetitive. Furthermore, we may not successfully execute on new product opportunities because of technical hurdles that we or our contractors fail to overcome in a timely fashion. This could result in competitors providing a solution before we do, and loss of market share, revenues and earnings.

Products from our investments in research and development of new products may not be realized for an extended period of time, if at all.

Telular has made significant investments in research and development for new products, services and technologies. Significant revenue from these investments may not be achieved for a number of years, if at all. Further, we may be required to purchase licenses from third parties in connection with the development of new products and these licenses may not be available on commercially reasonable terms, or at all. Even if we successfully introduce new products and technologies, our products may not be accepted by the market or we may be unable to sell our products at prices that are sufficient to recover our investment in developing those new products. Moreover, if these products are profitable, gross profit for these products may not be as high as the margins historically experienced for our other products.

We must devote substantial resources to research and development to remain competitive and we may not have the resources to do so.

For us to be competitive we must continue to dedicate substantial resources to research and development of new products and enhancements of current and future products as described above. If we are unable to devote sufficient resources to fund necessary research and development or if our research and development efforts are unsuccessful, such failure may have a material adverse effect on our business and our stock price may decline.

Unfavorable economic events including competitive pricing pressure in our target markets could lead to lower sales of our products.

Telular has identified significant growth opportunities in a variety of markets, such as the machine-to-machine (M2M) market. Each of these markets will develop at a different pace, and the sales cycle for these markets is likely to be several months or quarters.

Pricing for Fixed Cellular Terminals has been declining along with pricing in general for telecommunications equipment and other technology products. We believe that these pricing trends will continue in the future and perhaps accelerate, particularly if large companies with greater purchasing power enter the market or other competitors enter the market with lesser quality products or improper license rights.

In addition, unfavorable general economic conditions in any market will have a negative effect on sales in that market. Because economic conditions in one region often affect conditions globally, unfavorable general economic conditions in one market or region might result in damage to industry growth and demand in other markets as well.

A decline in the U.S. housing market may negatively impact sales and profitability of Telular’s Telguard products and services. Since end users oftentimes purchase security systems and associated cellular alarm communicators, such as Telguard, when they are moving into a new residence, a slowdown in the housing sector could cause purchases of Telguard products and services to slow or decline. Furthermore, if general economic conditions slow or if a recession occurs, end users may choose to eliminate the protection offered by Telguard services as consumers re-examine discretionary expenditures.

We believe recent demand for our Telguard products has been driven in part by end users eliminating traditional phone lines in favor of voice-over IP connections (VoIP) and cellular telephones. If this trend does not continue, overall demand for the Telguard products could be negatively affected.

10

Similarly, the adoption rate for our TankLink and other M2M solutions often depend upon the prices at which we are able to sell our products and services relative to the potential cost savings which end users anticipate. If we are unable to continually reduce our TankLink and other M2M solution pricing, we may not experience sufficient demand for our TankLink and other M2M products and solutions. Furthermore, if customers cannot obtain financing to fund the upfront purchase of such products and services, our TankLink and other M2M sales, growth rates, and profitability may be negatively impacted.

Our efforts to increase the focus of our production, marketing and sales efforts to the M2M market may not be successful.

The success of our current efforts to increase our focus on the M2M market will depend on our ability to develop and market solutions that are attractive to customers and to control our costs for those solutions. We cannot assure that these efforts will be successful.

We rely on third parties to manufacture our products and others to manufacture components for our products.

We use subcontractors to manufacture our products and product components, such as cellular transceivers and radio modules, and to assemble our products, such as Fixed Cellular Terminals. In the past, we experienced delays in receiving subcontracted components and assembled products that resulted in delays in our ability to deliver products. We may experience similar delays in the future.

Our inability to obtain sufficient quantities of raw materials and key components when required could result in delays or reductions in product shipments and increased costs for affected parts. In addition, production capacity constraints at our subcontractors could prevent us from meeting production obligations.

Delays in product deliveries for any reason or our failure to deliver products could significantly harm customer relationships and result in the loss of potential sales. Delivery delays or failures could also be subject to litigation.

We rely on limited or sole sources for many of our components, and the loss of any such sources may adversely impact our business.

It is not always possible to maintain multiple qualified suppliers for all of our components and subassemblies. As a result, some key components are purchased only from a single supplier or a limited number of suppliers. If demand for a specific component increases, we may not be able to obtain an adequate supply of that component in a timely manner. In addition, if our suppliers experience financial or other difficulties, the availability of these components could be limited. It could be difficult, costly and time-consuming to obtain alternative sources for these components or to change product designs to make use of alternative components. If we are unable to obtain a sufficient supply of components, if we experience any interruption in the supply of components or if the cost of our components increases, our ability to meet scheduled product deliveries could be harmed, which could result in lost orders, harm to our reputation and reduced revenues.

Several of our sole sourced components in existing products are at end-of-life from their manufacturers. We are attempting to source more of these components using brokers in the secondary market but expect that we may run out of these components for several of our products during fiscal 2011. While we can design replacement products with available components, we cannot assure you that we will successfully redesign these products and retain the revenue associated with the existing products which are subject to end-of-life components.

We rely on cellular networks for service revenue that may be affected by the following:

|

|

·

|

service may be interrupted or limited due to carrier transmission limitations caused by atmospheric, terrain, other natural or artificial conditions adversely affecting transmission.

|

|

|

·

|

interruption of service due to cellular carrier equipment modification, upgrades, repairs and other similar activities.

|

11

|

|

·

|

service may be limited based on available coverage.

|

|

|

·

|

interruption of service may occur between various cellular network and participating carriers.

|

|

|

·

|

the cost of this service could be increased such that it will affect our ability to compete while maintaining satisfactory margins.

|

|

|

·

|

carriers disclaim all liability of any nature to customers, whether direct, indirect, incidental or consequential, arising out of our customer’s use of their service.

|

In the event that we experience significant cellular networks delays or interruption of service, we would have difficulty maintaining customers and our revenues could decline substantially and harm our business.

AT&T Wireless provides the majority of our network capability. A network malfunction or a contractual dispute between us and this carrier or among this carrier and other major U.S. carriers could materially impact the operation of our services and/or our financial results.

Cellular South and Numerex Inc. provide a meaningful portion of our network capability for Telguard and TankLink, respectively. A network malfunction or a contractual dispute between us and these carriers or among these carriers and other major U.S. carriers could materially impact the operation of our services and/or our financial results.

ADT is a highly significant customer and the loss of this particular customer may seriously harm our business.

ADT represented 38% of our total revenue in fiscal 2010. If ADT chooses to use fewer of our products and services or stops using our products and services in total, our financial results could be materially impacted. In addition, ADT influences the purchasing decisions of its authorized dealers by specifying which equipment must be installed in end user security systems. If ADT further disincentivizes its authorized dealers from purchasing our products or removes our products from its list of acceptable equipment, our financial results may be materially impacted.

We have a large trade accounts receivable balance outstanding with one key customer.

As of September 30, 2010, a key VAR customer had a trade accounts receivable balance outstanding of $3,800. We have executed a security agreement with the key customer but there is no guarantee that this security agreement will allow us to realize our balance due should this customer become financially distressed. We have elected to charge interest on past due balances as an alternative to exercising our rights in our security agreement. If we are unable to collect our receivables balance from this customer, or other such customers in the future, our financial results could be materially impacted.

If we cannot sustain profitable operations, we may not be able to obtain the funding we need to operate our business.

At times in the past years, Telular has incurred net operating losses. We incurred a net loss of $1,379 for the year ended September 30, 2008. We cannot guarantee that we will be successful in maintaining profitability and our ability to continue operations depends on having adequate funds to cover our expenses. Our current operating plan provides for significant expenditures for research and development of new products, development of new markets for our products, and marketing programs for our products. At September 30, 2010, we had $27,678 in cash and cash equivalents and a working capital surplus of $34,046.

In the future, we may need to utilize financing sources such as public or private sales of our equity or debt securities. We cannot assure you that if we needed additional funds we would be able to obtain them or obtain them on terms we find acceptable. If we could not obtain the necessary financing we may cut back operations, which might include the scaling back or elimination of research and development programs.

12

Our operating results may fluctuate greatly on a quarterly and annual basis, which may cause the price of our common stock to be volatile.

Our quarterly and annual operating results may fluctuate greatly due to numerous factors, many of which are beyond our control. Factors that could affect our quarterly and annual operating results include those listed below as well as others listed in this “Risk Factors” section:

|

•

|

our reliance on large volume orders from only a few customers for most of our product sales, which may result in volatility when those orders are filled and not immediately followed by comparable orders;

|

|

|

•

|

variations in our distribution channels;

|

|

|

•

|

the mix of products we sell;

|

|

|

•

|

general economic conditions in our target markets;

|

|

|

•

|

the timing of final product approvals from our customers or regulators;

|

|

|

•

|

the timing of orders from and shipments to major customers;

|

|

|

•

|

the timing of new product introductions by us or our competitors;

|

|

|

•

|

changes in our pricing policies and the pricing policies of our suppliers and our competitors;

|

|

|

•

|

changes in the terms of our arrangements with customers and suppliers;

|

|

|

•

|

the availability and cost to us of the key components for our products;

|

|

|

•

|

ability of our customers to accurately forecast demand for our products by their end users;

|

|

|

•

|

delays or failures to fulfill orders for our products on a timely basis;

|

|

|

•

|

our inability to accurately forecast our manufacturing needs;

|

|

|

•

|

change in the financial position of our manufacturers;

|

|

|

•

|

an increase in product warranty returns or in our allowance for doubtful accounts;

|

|

|

•

|

operational disruptions, such as transportation delays or failures of our order processing system;

|

|

|

•

|

the timing of personnel hirings; and

|

|

|

•

|

delays in the introduction of new or enhanced versions of our existing products or market acceptance of these products.

|

A substantial portion of our sales in a given quarter may depend on obtaining orders for products to be manufactured and shipped in the same quarter in which those orders are received. As a result of these factors, period-to-period comparisons of our operating results may not be meaningful, and you should not rely on them as an indication of our future performance. In addition, our operating results may fall below the expectations of public market analysts or investors. In this event, our stock price could decline significantly. These period-to-period fluctuations may contribute to the volatility in the price of our common stock, as described below.

Our common stock price has been extremely volatile, and extreme price fluctuations could negatively affect your investment.

The market price of our common stock has been extremely volatile. Since October 1, 1999, the price of our common stock has ranged from a high of $32.00 to a low of $1.00 per share.

13

Publicized events and announcements may have a significant impact on the market price of our common stock. For example, the occurrence of any of the following events could have the effect of temporarily or permanently driving down the price of our common stock:

|

•

|

shortfalls in our revenue or net income;

|

|

|

•

|

the results of product trials or the introduction of new products by us or our competitors;

|

|

|

•

|

market conditions in the telecommunications, technology and emerging growth sectors; and

|

|

|

•

|

rumors related to us or our competitors.

|

In addition, the stock market from time to time experiences extreme price and volume fluctuations that particularly affect the market prices for emerging growth and technology companies, like Telular, and which often are unrelated to the operating performance of the affected companies. These broad fluctuations may negatively affect your ability to sell your shares at a price equal to or greater than the price you paid. In addition, a decrease in the price of our common stock could cause it to be delisted from the NASDAQ National Market.

From time-to-time we face litigation that could significantly damage our business and financial condition.

In the telecommunications equipment and other high technology industries, litigation increasingly has been used as a competitive tactic by both established companies seeking to protect their position in the market and by emerging companies attempting to gain access to the market. In this type of litigation, complaints may be filed on various grounds, such as:

|

•

|

antitrust;

|

|

|

•

|

breach of contract;

|

|

|

•

|

trade secret;

|

|

|

•

|

copyright or patent infringement;

|

|

|

•

|

patent or copyright invalidity; and

|

|

|

•

|

unfair business practices.

|

We are currently defending ourselves against several such claims. Whether or not they have any merit, we incur substantial expense and management’s attention may be diverted from operations. This type of litigation also may cause confusion in the market and make our licensees and distributors reluctant to commit resources to our products. Any of these effects could have a significant negative impact on our business and financial condition. In particular, an adverse result from intellectual property litigation could force us to do one or more of the following:

|

•

|

cease selling, incorporating or using products that incorporate the challenged intellectual property;

|

|

|

•

|

obtain a license from the holder of the infringed intellectual property right, which license may not be available on reasonable terms, if at all; and | |

|

•

|

redesign products that incorporate the disputed technology. |

If we are forced to take any of the foregoing actions, we could face substantial costs and shipment delays and our business could be seriously harmed. Although we carry general liability insurance, our insurance may not cover potential claims of this type or be adequate to indemnify us for all liability that may be imposed.

14

In addition, it is possible that our customers or end users may seek indemnity from us in the event that our products are found or alleged to infringe the intellectual property rights of others. Any such claim for indemnity could result in substantial expenses to us that could harm our operating results. Our largest customer is entitled to indemnification for such claims and has, in fact, sought such indemnification recently based on notice of infringement provided to this customer and to Telular by a party that has initiated litigation against Telular and our customer based on this infringement claim.

Although our patents have been successfully defended in courts in the United States and New Zealand, rulings in such cases may not apply to new products. In the event that any of our patents or other intellectual property rights were deemed invalid or were determined not to prohibit competing technologies as a result of litigation, our competitive position may be significantly harmed.

Our costs may increase if we are unable to accurately forecast our needs.

Lead times for ordering components from our manufacturers vary significantly and depend on various factors, such as the specific supplier, contract terms and demand for and availability of a component at a given time. If our forecasts are less than our actual requirements, we may not be able to obtain products in a timely manner. Furthermore, if we cannot produce our products in a timely manner, the liquidated damages provisions in some of our contracts with our customers may result in our selling our products at a loss. If our forecasts are too high, we and our manufacturer may be unable to use the components that were purchased based on our forecasts. The cost of the components used in our products tends to drop rapidly as volumes increase and technologies mature. Therefore, if we are unable to use components purchased based on our forecasts, our cost of producing products may be higher than our competitors’. Excess components or inventory will tie up working capital and cause us to incur storage and other carrying costs, which may cause us to borrow additional funds that may not be available on commercially reasonable terms. Further, excess components or inventory not used or sold in a timely manner may become obsolete, causing write-offs or write-downs, which could seriously harm our results of operations.

Quality control problems could harm our sales.

We believe that our products currently meet high standards of quality due to quality-monitoring procedures that we have instituted. Most of our major subcontractors also have quality control procedures in place and are ISO-9001:2000 compliant. Notwithstanding the existence of these controls, our operations and our dependency on subcontractors subjects us to the risk that these controls may not be effective. Quality control failures by us or by our third-party subcontractors or changes in their financial or business condition that affect their production could disrupt our ability to supply quality products to our customers. If we fail to provide quality products to our customers, product sales, and thereby our business, could be materially harmed.

We may experience long sales cycles for our products, as a result of a variety of factors.

Our sales cycle depends on the length of time required for adoption of new technologies in our target markets. In addition, the period between our initial contact with a potential customer and its decision to purchase our products is relatively long. The evaluation, testing, acceptance, proposal, contract negotiation, funding and implementation process can extend over many months. Based on our limited operating history, it generally takes us between three and nine months to complete a sale to a customer. However, in certain instances the sales cycle may be substantially longer. If our sales cycle unexpectedly lengthens in general or for one or more large orders, the timing of our revenues and results of operations could be harmed, which in turn could reduce our revenues in any quarter. Therefore, period-to-period comparisons of our results of operations may not necessarily be meaningful, and these comparisons should not be relied upon as indications of future performance. Further, sales cycles that are longer than we expect likely will harm our ability to generate sufficient cash to cover our working capital requirements for a given period.

We operate in developing markets, which may subject us to volatile conditions not present in the United States.

We target developing countries and some of our current and potential customers operate in these markets. As we expand our operations and products in these countries, our business and performance could be negatively affected by a variety of factors and conditions that businesses operating in the United States may not have to contend with, such as:

15

|

•

|

foreign currency exchange fluctuations and instability of foreign currencies;

|

|

|

•

|

political or economic instability and volatility in particular countries or regions;

|

|

|

•

|

limited protection for intellectual property;

|

|

|

•

|

difficulties in complying with foreign regulatory requirements applicable to our operations and products;

|

|

|

•

|

difficulties in obtaining domestic and foreign export, import and other governmental approvals, permits and licenses and compliance with foreign laws, including employment laws;

|

|

|

•

|

difficulties in staffing and managing international operations, including work stoppages or strikes and cultural differences in the conduct of business, labor and other workforce requirements and inadequate local infrastructure;

|

|

|

•

|

trade restrictions or higher tariffs, quotas, taxes and other market barriers;

|

|

|

•

|

transportation delays and difficulties of managing international distribution channels;

|

|

|

•

|

longer payment cycles for, and greater difficulty in collecting accounts receivable; and

|

|

|

•

|

public health emergencies such as SARS and avian bird flu.

|

To date, our sales have not been negatively affected by currency fluctuations. We currently seek prepayment or letters of credit on a substantial portion of our international orders, but some international customers are granted open credit terms and we are exposed to some international credit risk. We also try to conduct all of our international transactions in U.S. dollars to minimize the effects of currency fluctuations. However, if our international operations were to grow, foreign exchange fluctuations and foreign currency inflation may pose greater risks for us and we may need to develop and implement additional strategies to manage these risks. If we are not successful in managing these risks our business and financial condition could be seriously harmed.

If we are unable to protect our intellectual property rights, our business may be adversely affected.

Although Telular holds United States and foreign patents, core aspects of our technology are not covered by patent protection. As a result, a competitor may be able to develop technologies that are substantially similar to our products, which would have a material adverse effect on our business and future prospects.

It also is possible that a competitor may independently develop and/or patent technologies that are substantially equivalent to or superior to our technology. If this happens, our patents will not provide protection and our competitive position may be significantly harmed.

As we expand our product line or develop new uses for our products, these products or uses may be outside the protection provided by our current patents and other intellectual property rights. In addition, if we develop new products or enhancements to existing products we cannot assure you that we will be able to obtain patents to protect them. Even if we do get patents for new products, these patents may not provide meaningful protection. Any patent that we may obtain will expire, and it is possible that it may be challenged, invalidated or circumvented.

In some countries outside of the United States, patent protection is not available. Moreover, some countries that do allow registration of patents do not provide meaningful redress for violations of patents. As a result, protecting intellectual property in these countries is difficult. In addition, neither we nor any known competitors in the past obtained patent protection for our core intelligent interface technology in many countries, including the principal countries of Western Europe, and we and those competitors are now legally barred from obtaining patents in these countries.

16

In countries where we do not have patent protection or where patents provide little, if any, protection, we have to rely on other factors to differentiate our products from our competitors’ products.

Although we believe our products are superior to those of competitors, it may be easier for competitors to sell products similar to ours in countries where we do not have meaningful patent protection. This could result in a loss of potential sales.

We may initiate claims or litigation against third parties in the future for infringement of our proprietary rights or to determine the scope and validity of our proprietary rights or the proprietary rights of competitors. These claims could result in costly litigation and divert the efforts of our technical and management personnel. As a result, our operating results could suffer and our financial condition could be harmed.

We may not address successfully the problems encountered in connection with any potential future acquisitions.

We expect to continue to consider opportunities to acquire or make investments in other technologies, products and businesses that could enhance our capabilities, complement our current products or expand the breadth of our markets or customer base. We have limited experience in acquiring other businesses and technologies. Potential and completed acquisitions and strategic investments involve numerous risks, including:

|

•

|

problems assimilating the purchased technologies, products or business operations;

|

|

•

|

problems maintaining uniform standards, procedures, controls and policies;

|

|

•

|

unanticipated costs associated with the acquisition;

|

|

•

|

diversion of management’s attention from our core business;

|

|

•

|

adverse effects on existing business relationships with suppliers and customers;

|

|

•

|

risks associated with entering new markets in which we have no or limited prior experience; and

|

|

•

|

potential loss of key employees of acquired businesses.

|

If we fail to properly evaluate and execute acquisitions and strategic investments, our management team may be distracted from our day-to-day operations, our business may be disrupted and our operating results may suffer. In addition, if we finance acquisitions by issuing equity or convertible debt securities, our stockholders would be diluted.

Delaware law and our charter documents may inhibit a potential takeover bid that would be beneficial to common stockholders.

Delaware law and our certificate of incorporation may inhibit potential acquisition bids for Telular common stock at a price greater than the market price of the common stock. We are subject to the anti-takeover provisions of the Delaware General Corporation Law, which could delay, deter or prevent a change of control of Telular or make this type of transaction more difficult. In addition, our board of directors does not need the approval of common stockholders to issue shares of preferred stock having rights that could significantly weaken the voting power of the common stockholders and, as a result, make a change of control more difficult.

Sales of common stock issuable on the exercise of outstanding and contemplated options and warrants may depress the price of the common stock.

As of September 30, 2010, there were options granted to employees and directors to purchase 2,241,694 shares of Telular’s common stock. Options to purchase 1,530,021 of these shares were exercisable at that time. The exercise prices for the exercisable options range from $1.48 to $9.75 per share, with a weighted average exercise price of $4.14. Options to purchase the remaining 711,673 shares will become exercisable over the next two years. The exercise prices for the options that are not yet exercisable have a weighted average exercise price of $3.82.

17

In connection with a credit facility with Wells Fargo Bank (“Wells”) that matured on December 31, 2002, we issued to Wells warrants to purchase 50,000 shares of common stock at an exercise price of $16.29 per share. These warrants have no expiration date.

The issuance of shares of common stock issuable upon the exercise of options or warrants could cause substantial dilution to holders of common stock. It also could negatively affect the terms on which we could obtain equity financing.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

ITEM 2. PROPERTIES

The following is a list of properties that Telular leases:

|

Lease Dates

|

Square

|

Renewal

|

|||

|

Functions

|

Commencement

|

Termination

|

Footage

|

Options

|

|

|

Corporate Headquarters,

|

Finance and general administrations, operations

|

February 2007

|

February 2014

|

11,700

|

No

|

|

Chicago, Illinois

|

administration and TankLink sales and marketing

|

||||

|

Terminal and Security

|

Sales, marketing, operations and general

|

November 2007

|

December 2012

|

15,154

|

No

|

|

Products Operations and

|

administration for terminal products and

|

||||

|

Engineering, Atlanta, Georgia

|

product research and development

|

||||

|

International Sales Office,

|

Sales

|

January 2010

|

December 2011

|

433

|

Yes

|

|

Weston, Florida

|

|||||

|

Operations

|

Warehousing and shipping

|

January 2009

|

August 2013

|

9,480

|

No

|

|

Wheeling, Ilinois

|

|||||

ITEM 3. LEGAL PROCEEDINGS

Telular is involved in legal proceedings, which arose in the ordinary course of its business. While any litigation contains an element of uncertainty, management believes that the outcome of all pending legal proceedings will not have a material adverse effect on Telular’s consolidated results of operation, cash flows or financial position.

ITEM 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS

No matters were submitted to a vote of security holders during the fourth quarter of the fiscal year ended September 30, 2010.

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES.

MARKET PRICE OF AND DIVIDENDS ON COMMON STOCK

Telular’s Common Stock trades publicly on the NASDAQ National Market System under the symbol WRLS. The following table sets forth the quarterly high and low sales prices for each quarter of fiscal year 2010 and 2009, as reported by NASDAQ. Such quotations reflect inter-dealer prices without retail markup, markdown or commissions and may not necessarily represent actual transactions.

18

|

QUARTER ENDED DURING FISCAL YEAR 2010

|

|||||||

|

December 31

|

March 31

|

June 30

|

September 30

|

||||

|

High

|

$3.78

|

$5.14

|

$3.64

|

$3.23

|

|||

|

Low

|

$2.86

|

$2.95

|

$2.95

|

$2.33

|

|||

|

QUARTER ENDED DURING FISCAL YEAR 2009

|

|||||||

|

December 31

|

March 31

|

June 30

|

September 30

|

||||

|

High

|

$2.05

|

$1.82

|

$2.15

|

$3.52

|

|||

|

Low

|

$1.14

|

$1.32

|

$1.69

|

$2.05

|

|||

On December 6, 2010, there were approximately 204 shareholders of record, approximately 4,455 beneficial shareholders and 14,988,724 shares of Common Stock outstanding. Telular had not paid any dividends from its inception through September 30, 2010. On November 4, 2010, the Board of Directors approved a special one-time cash dividend of $1.00 per share of common stock and initiated a quarterly dividend of $0.10 per share of common stock. Both the special one-time cash dividend and the quarterly dividend will be payable on November 22, 2010 to shareholders of record on November 15, 2010.

TREASURY SHARES

Under the previously announced purchase program, there were 38,262 shares repurchased for $118 during the fourth quarter of fiscal 2010. The approximate dollar value of shares that may yet be purchased under the program is $4,588 as of September 30, 2010.

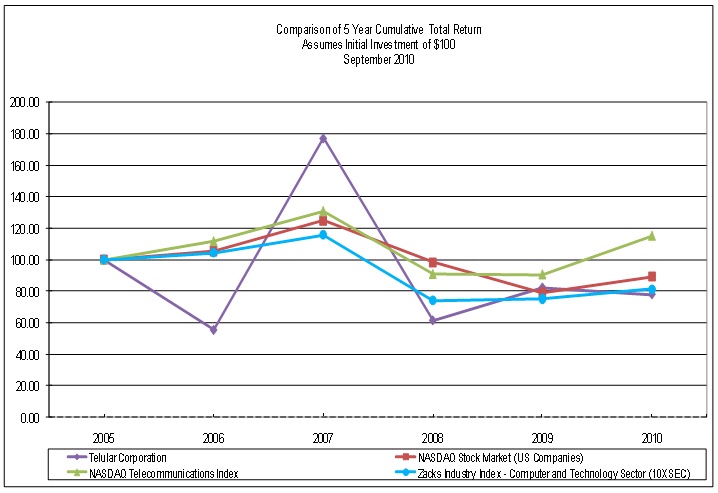

TELULAR CORPORATION COMMON STOCK PERFORMANCE GRAPH

The following Performance Graph and related information shall not be deemed “soliciting material” or to be “filed” with the Securities and Exchange Commission, nor shall such information be incorporated by reference into any future filing under the Securities Act of 1933 or Securities Exchange Act of 1934, each as amended, except to the extent that Telular specifically incorporates it by reference into such filing.

The Telular Corporation Common Stock Performance Graph compares total shareholder returns of Telular since September 30, 2005, to three indices: the NASDAQ Stock Market (U.S.) Index, the NASDAQ Telecommunications Index and the Zach Industry Index – Computer and Technology Sector. The total return calculations assume the reinvestment of dividends, although, until recently, dividends had not been declared as of September 30, 2010 for Telular's stock through September 30, 2010, and are based on the returns of the component companies weighted according to their capitalizations as of the end of each monthly period. The NASDAQ Stock Market (U.S.) Index tracks the aggregate return of all equity securities traded on the NASDAQ National Market System (the NMS). The NASDAQ Telecommunications Index tracks the aggregate return of equity securities of telecommunications companies traded on the NASDAQ National Market System (the NMS). The Zach Industry Index – Computer and Technology Sector tracks the aggregate return of technology companies, including electronics, medical and other related technology industries.

Telular's Common Stock is traded on the NMS and is a component of the NASDAQ Stock Market (U.S.) Index. Telular’s stock price on the last trading day of its fiscal year, September 30, 2010, was $3.06.

19

20

ITEM 6. SELECTED FINANCIAL DATA

The following table is a summary of certain condensed statement of operations and balance sheet information of Telular. The table lists historical financial data of Telular for the fiscal years ended September 30, 2010, 2009, 2008, 2007 and 2006. The selected financial data were derived from audited financial statements. The summary should be read in conjunction with financial statements and notes thereto appearing in Item 8 of this report.

|

Telular Corp

|

|||||||||||||||||||||

|

Selected Financial Data - 10K

|

|||||||||||||||||||||

|

Year ended September 30,

|

|||||||||||||||||||||

|

(In thousands, except share data)

|

|||||||||||||||||||||

|

2010

|

2009

|

2008 (a)

|

2007 (a)

|

2006

|

|||||||||||||||||

|

Results of Operations:

|

|||||||||||||||||||||

|

Total revenue

|

$ | 47,354 | $ | 47,194 | $ | 66,154 | $ | 74,507 | $ | 45,706 | |||||||||||

|

Income (loss) from continuing operations

|

38,121 | 2,285 | 6,101 | 5,625 | (644 | ) | |||||||||||||||

|

Loss from discontinued operations

|

- | (419 | ) | (7,480 | ) | (7,571 | ) | (11,174 | ) | ||||||||||||

|

Net income (loss)

|

$ | 38,121 | $ | 1,866 | $ | (1,379 | ) | $ | (1,946 | ) | $ | (11,818 | ) | ||||||||

|

Per Share Data:

|

|||||||||||||||||||||

|

Basic:

|

|||||||||||||||||||||

|

Income (loss) from continuing operations

|

$ | 2.55 | $ | 0.13 | $ | 0.32 | $ | 0.31 | $ | (0.04 | ) | ||||||||||

|

Income (loss) from discontinued operations

|

$ | - | $ | (0.02 | ) | $ | (0.39 | ) | $ | (0.42 | ) | $ | (0.66 | ) | |||||||

|

Net income ( loss)

|

$ | 2.55 | $ | 0.11 | $ | (0.07 | ) | $ | (0.11 | ) | $ | (0.70 | ) | ||||||||

|

Dilutive:

|

|||||||||||||||||||||

|

Income (loss) from continuing operations

|

$ | 2.49 | $ | 0.13 | $ | 0.32 | $ | 0.31 | $ | (0.04 | ) | ||||||||||

|

Income (loss) from discontinued operations

|

$ | - | $ | (0.02 | ) | $ | (0.39 | ) | $ | (0.42 | ) | $ | (0.66 | ) | |||||||

|

Net income ( loss)

|

$ | 2.49 | $ | 0.11 | $ | (0.07 | ) | $ | (0.11 | ) | $ | (0.70 | ) | ||||||||

|

As of September 30 - balance sheet data:

|

|||||||||||||||||||||

|

Total assets

|

$ | 81,551 | $ | 40,325 | $ | 47,969 | $ | 55,608 | $ | 57,937 | |||||||||||

|

Current loans payable

|

- | - | - | - | 3,313 | ||||||||||||||||

|

Long term obligations

|

529 | - | - | - | - | ||||||||||||||||

|

Stockholders' equity

|

74,887 | 35,422 | 40,167 | 38,366 | 38,812 | ||||||||||||||||

(a) In July 2007, Telular formulated a plan to sell the net assets of its FCP segment and exit the FCP market. During the third quarter of fiscal 2008, Telular determined it would be unable to secure a buyer for the FCP segment and made a strategic decision to abandon the FCP segment effective June 30, 2008. As a result, the FCP segment has been segregated and classified as discontinued operations and amounts for all periods presented have been reclassified to reflect this classification.

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATION

INTRODUCTION

Telular develops products and services that utilize wireless networks to provide data and voice connectivity among people and machines. Telular’s product and service offerings are created through Telular’s historical competence in developing cellular electronics along with utilizing the data transport capabilities of today’s commercial wireless networks.

21

Telular generates a majority of its revenue through the delivery of machine-to-machine (M2M) and event monitoring services, such as its Telguard and TankLink services. A portion of its revenue comes from the sale of specialty cellular hardware products designed by Telular for use exclusively with its M2M services. Although Telular has a wide base of customers in the Western Hemisphere, much of its revenue is generated from a small number of major customers.

Telular's operating expense levels are based in large part on its expectations for its future revenues. If anticipated sales in any quarter do not occur as expected, expenditure and inventory levels could be disproportionately high, and Telular's operating results for that quarter, and potentially for future quarters, could be adversely affected. Certain factors that could significantly impact expected results are described in Item 1A, Risk Factors.

The market for Telular’s products is primarily in North and South America and consists of a number of vertical applications including Telguard security alarm conveyance; TankLink storage tank monitoring; and, general purpose wireless terminals for voice calls and Internet access. These markets are addressed primarily through indirect channels consisting of third party Value Added Resellers (“VARs”), distributors, representatives and agents along with in-house sales and customer support teams. A direct sales model is utilized for certain large customers.

During June 2008, Telular abandoned its Fixed Cellular Phone (FCP) segment after unsuccessfully marketing this unit for sale. Many of the segment’s assets were parts and finished goods inventory which were sold prior to abandonment of the segment on June 30, 2008.