Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Kraton Corp | d8k.htm |

Bank

of America Merrill Lynch Global Industries Conference

December 14, 2010

Exhibit 99.1 |

Forward-Looking Statement Disclaimer

This

presentation

may

include

“forward-looking

statements”

that

reflect

our

plans,

beliefs,

expectations

and

current

views

with

respect

to,

among

other

things,

future

events

and

financial

performance.

Forward-looking

statements

are

often

characterized

by

the

use

of

words

such

as

“believes,”

“estimates,”

“expects,”

“projects,”

“may,”

“intends,”

“plans”

or

“anticipates,”

or

by

discussions

of

strategy,

plans

or

intentions.

All

forward-looking

statements

in

this

presentation

are

made

based

on

management's

current

expectations

and

estimates,

which

involve

risks,

uncertainties

and

other

factors

that

could

cause

actual

results

to

differ

materially

from

those

expressed

in

forward-looking

statements.

Readers

are

cautioned

not

to

place

undue

reliance

on

forward-looking

statements.

These

risks

and

uncertainties

are

more

fully

described

in

“Part

I.

Item

1A.

Risk

Factors”

contained

in

our

Annual

Report

on

10-K,

as

filed

with

the

Securities

and

Exchange

Commission

and

as

subsequently

updated

in

our

Quarterly

Reports

on

Form

10-Q,

and

include

risks

related

to:

conditions

in

the

global

economy

and

capital

markets;

our

reliance

on

LyondellBasell

Industries

for

the

provision

of

significant

operating

and

other

services;

the

failure

of

our

raw

materials

suppliers

to

perform

their

obligations

under

long-term

supply

agreements,

or

our

inability

to

replace

or

renew

these

agreements

when

they

expire;

limitations

in

the

availability

of

raw

materials

we

need

to

produce

our

products

in

the

amounts

or

at

the

prices

necessary

for

us

to

effectively

and

profitably

operate

our

business;

competition

in

our

end-use

markets,

by

other

producers

of

SBCs

and

by

producers

of

products

that

can

be

substituted

for

our

products;

our

ability

to

produce

and

commercialize

technological

innovations;

our

ability

to

protect

our

intellectual

property,

on

which

our

business

is

substantially

dependent;

infringement

of

our

products

on

the

intellectual

property

rights

of

others;

seasonality

in

our

Paving

and

Roofing

business;

financial

and

operating

constraints

related

to

our

substantial

level

of

indebtedness;

product

liability

claims

and

other

lawsuits

arising

from

environmental

damage

or

personal

injuries

associated

with

chemical

manufacturing;

political

and

economic

risks

in

the

various

countries

in

which

we

operate;

the

inherently

hazardous

nature

of

chemical

manufacturing;

health,

safety

and

environmental

laws,

including

laws

that

govern

our

employees’

exposure

to

chemicals

deemed

harmful

to

humans;

regulation

of

our

customers,

which

could

affect

the

demand

for

our

products

or

result

in

increased

compliance

costs;

international

trade,

export

control,

antitrust,

zoning

and

occupancy

and

labor

and

employment

laws

that

could

require

us

to

modify

our

current

business

practices

and

incur

increased

costs;

our

relationship

with

our

employees;

loss

of

key

personnel

or

our

inability

to

attract

and

retain

new

qualified

personnel;

fluctuations

in

currency

exchange

rates

;

the

fact

that

we

do

not

enter

into

long-term

contracts

with

our

customers;

a

decrease

in

the

fair

value

of

our

pension

assets,

which

could

require

us

to

materially

increase

future

funding

of

the

pension

plan;

and

concentration

of

ownership

among

our

principal

stockholder,

which

may

prevent

new

investors

from

influencing

significant

corporate

decisions.

We

assume

no

obligation

to

update

such

information.

Further

information

concerning

issues

that

could

materially

affect

financial

performance

related

to

forward

looking

statements

can

be

found

in

our

periodic

filings

with

the

Securities

and

Exchange

Commission.

2 |

GAAP

Disclaimer 3

This

presentation

includes

the

use

of

both

GAAP

(generally

accepted

accounting

principles)

and

non-GAAP

financial

measures.

The

non-GAAP

financial

measures

are

EBITDA

and

Adjusted

EBITDA.

The

most

directly

comparable

GAAP

financial

measure

is

net

income/loss.

A

reconciliation

of

the

non-GAAP

financial

measures

used

in

this

presentation

to

the

most

directly

comparable

GAAP

measure

is

included

herein.

We

consider

EBITDA

and

Adjusted

EBITDA

important

supplemental

measures

of

our

performance

and

believe

they

are

frequently

used

by

investors

and

other

interested

parties

in

the

evaluation

of

companies

in

our

industry.

EBITDA

and

Adjusted

EBITDA

have

limitations

as

analytical

tools

and

should

not

be

considered

in

isolation

or

as

a

substitute

for

analysis

of

our

results

under

GAAP

in

the

United

States. |

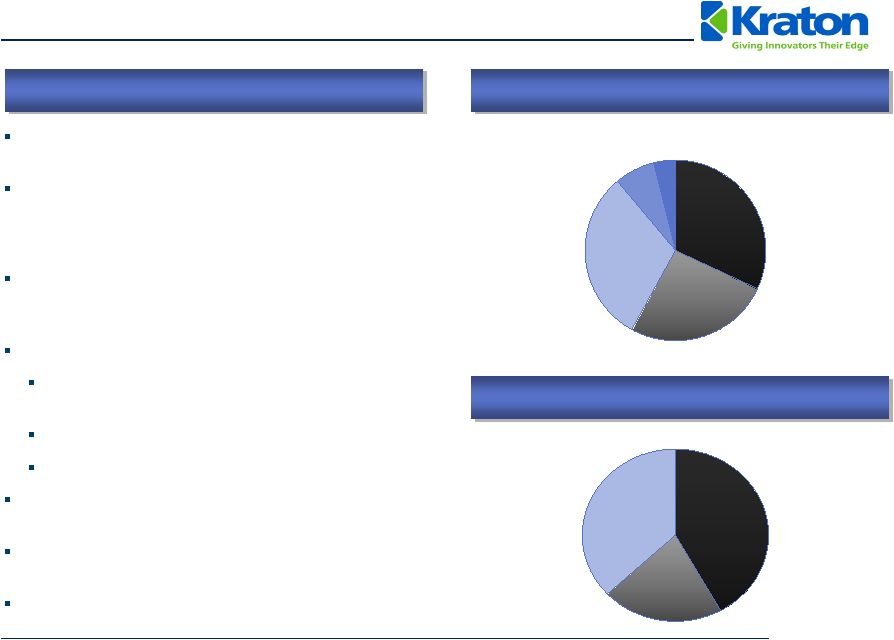

37%

21%

42%

4

4%

7%

31%

26%

32%

Kraton

Overview

We invented and commercialized Styrenic

Block

Copolymer (SBC) technology nearly 50 years ago.

We believe that we hold #1 market share positions in

each of our end-use markets providing industrial,

consumer and geographical diversification that is

second to none.

We design and manufacture customized SBC polymer

and compound solutions to meet our leading customers’

specific innovation needs.

We produce the following:

Unhydrogenated

Styrenic

Block Copolymers

(USBCs).

Hydrogenated Styrenic

Block Copolymers (HSBCs).

Isoprene Rubber and Isoprene Rubber Latex.

We currently offer approximately 800 products to more

than 700 customers, in over 60 countries.

We employ approximately 830 people in 9 locations in

all major regions of the world.

YTD September 2010 revenue of $940 million and

Adjusted EBITDA

(1)

of $161 million; 17% margin.

(1)

Adjusted EBITDA is GAAP EBITDA excluding management fees, restructuring and related

charges, non-cash expenses, and the gain on extinguishment of

debt. (2)

Management estimates.

2009

Revenue

by

End-Use

(2)

2009

Revenue

by

Geography

(2)

North and

South

America

Europe,

Middle

East &

Africa

Asia Pacific

Paving and

Roofing

Adhesives,

Sealants and

Coatings

Other

Emerging

Businesses

Advanced

Materials

Clear SBC Market Leader Globally |

5

SBCs

are engineered to meet customer needs

Primary Raw

Materials

Products

Customer Value

End-Use Applications

Styrene

Unhydrogenated

SBCs

SBS

SIS

SIBS

Butadiene

Isoprene

Hydrogenated

SBCs

SEBS

SEPS

Isoprene Rubber

and Latex

Compounds

Paving

Roofing

Personal Care

Tapes

Formulators

Labels

&

Printing

Compounds

Packaging

Auto

Lubricants

Medical

Stretch

Soft-Touch

Adhesion

Impact

Resistance

Durability

Thickening

Compatibility

Clarity

Recyclability

Kraton

is the only provider of these value components across

all products touching a wide array of applications |

6

Clear Leader in Attractive Markets

Market Position

2009 Revenue

(1)

#1

77%

Adhesives, Sealants,

and Coatings

Advanced Materials

#1

74%

Paving and Roofing

#1

63%

Emerging Businesses

(4)

#1

100%

32%

31%

26%

7%

1.9x

2.0x

1.6x

N/A

Source:

Management estimates.

(1)

Based on 2009 sales of $920 million (excludes by-product sales which are

reported as other revenues). (2)

Industry

volume

growth

from

2001-2009,

Emerging

Businesses

growth

rate

refers

to

Kraton’s

Isoprene

Rubber

(“IR”)

and

Isoprene

Rubber

Latex

(“IRL”)

growth

from

2005-2009.

(3)

Management’s estimates vs. next largest competitor based on 2009 sales.

(4)

The

Emerging

Businesses

end

use

market

includes

our

IR

and

IRL

business.

We

believe

that

we

are

the

only

major

third-party

supplier

of

IR

and

IRL,

and

therefore

end

use

market

share

metrics

are

not meaningful.

#1 Market Position and More than 1.6x the Size of Our Closest Competitors

Top 4 Market

Share

Kraton

Market

Share Relative

To #2

Competitor

(3)

Growth

(2)

5.9%

7.4%

6.5%

26.8% |

7

Before Kraton

After Kraton

Kraton

Makes Products Better

Stretch in legs only

(Spandex).

Not a fitted garment.

High leakage rate.

Overall improvement in stretch

(where it’s needed).

Better fit.

Low leakage rate.

Kraton

market share: 50%.

2001 –

2009 CAGR: 11.5%.

Kraton

material as % of Diaper cost: <2%

Phthalate plasticizers

are used to make PVC

soft but they can leach

from finished products

and create health

concerns.

Limited recyclability.

PVCs

are unsafe when

burned or incinerated

improperly.

Environmentally friendly –

100% recyclable.

Kraton

imparts softness, toughness and clarity.

Plasticizer & chlorine free.

Kraton material as % of finished product cost: <5%

|

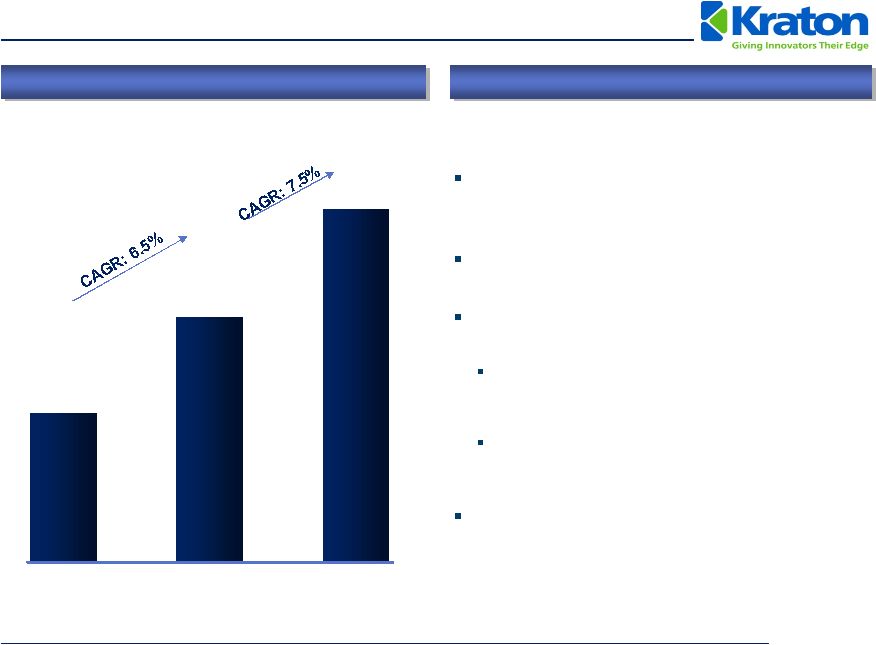

8

SBCs

Are a Growth Industry

SBC Industry Volume (kT)

(1)

SBCs

Grow Faster Than GDP

Adoption and penetration of SBCs

into new

applications and end-markets lead to

industry growth of ~2x GDP.

Growing demand from emerging

economies.

Innovation and new SBC product

introductions.

End use application growth (e.g., PVC

alternatives for wire & cable and medical

applications such as IV bags, etc.).

Growing demand for environmentally friendly

and greener alternatives in electronics, medical

and baby care markets.

Low cost relative to value added /

performance with limited substitution risk.

(1)

Management

estimates.

Excludes

footwear

end-use

in

which

Kraton

does

not

actively

compete.

675

1,112

1,599

2001

2009

2014 |

9

Sustainable Competitive Advantages

Almost 50 years of process know-how and expertise.

Performance-critical products and manufacturing

complexity.

Technical

Barriers

Globally

recognized

brand

–

Kraton

®.

Industry-leading R&D infrastructure.

Global low-cost manufacturing footprint.

Significant regulatory hurdles / barriers to new

manufacturing sites.

Stable raw material base with multiple sources of

supply and contracts / relationships.

Collaborative

customer

relationships

–

15+

years

with

majority; sole source with several customers.

Infrastructure

Barriers

Superior and

Innovative Products

+

High Customer

Switching Costs

+

Long-Term

Customers

Relationships

=

Leading

Market Position

Products designed collaboratively to meet specific

customer needs / applications.

Preferred partner based on manufacturing

consistency and process know-how.

Ongoing technical service offering.

100% of products offered with no lead times.

High

Value

Added |

Compelling Organic Growth Platforms

10

Advanced

Materials

Adhesives,

Sealants &

Coatings

Paving and

Roofing

Emerging markets growth.

Expansion into new and differentiated markets, such as

protective films, oilfield service applications, spray and

extrusion coatings, hot melt adhesives, elastic adhesives,

labels and sealant applications.

Superior performing SBS modified emulsions for

asphalt

modification.

Low VOC roof coating formulations for superior water

resistance, improved adhesion and reduced installation

cost.

“Green”

PVC alternatives to the wire and cable industry.

Enabling technology for high performance fabric solutions.

“Soft Touch”

covers and solutions to the automotive

industry.

NEXAR

®

–

high-end membrane technology markets for

performance clothing, HVAC applications and fuel cells.

Co-extrusion technology for surface protection.

Applications

Isoprene

Rubber Latex

Medical

applications

–

surgical

gloves.

Material

substitution

–

condoms.

Medical components

HiMA

Protective Films

Soft Skins

IRL Gloves |

Protective Films

Lower System Costs

One-step co-extrusion process eliminates multi-

step coating and drying of conventional films

Superior Protection

Resists dimples, rigid wrinkles, and moisture

permeation

Preserves integrity of finished surfaces and

protects against marring, scratching, and UV

tainting

High Flexibility and Customizable Peel Strength

Sustains tack on curved and textured surfaces

Tailored peel strength properties

Adheres to a wide variety of substrate

chemistries and topographies

Clean Film

Haze and residue-free formulation

Displays finished goods well

VOC-free

Simple removal |

NEXAR

TM

Polymer

Technology

FIRST RESPONDERS

MILITARY

Applications

Fabrics for performance garments

HVAC

Humidification / Gas drying

Nano

filtration

Features

Superior moisture vapor transport

properties

Water transport properties increase as

temperatures increase

Excellent mechanical properties and wet

strength

High perm selectivity

Chemical resistance

Not soluble in water

Nexar™

may be used on current casting or

laminating equipment

NEXAR polymer technology combines exceptional water

transport for increase comfort with structure, function

and reliability. |

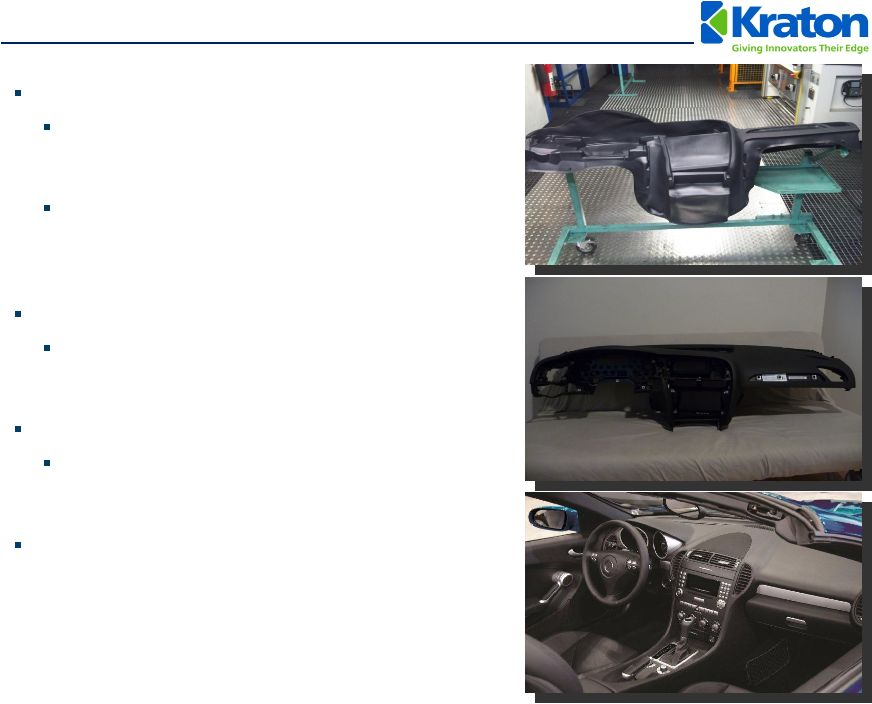

Slush

Molded Automotive Soft Skins Higher performance

Meets stringent requirements of the

automotive industry such as low melt

viscosity

Provides improvements on low

temperature ductility, dimensional

stability and emission values compared

to existing solutions.

Lighter weight

Lower specific gravity which provides a

30% weight reduction compared to PVC

and TPU at the same skin dimensions.

Lower cost

Can be processed

on existing slush

molding machines at lower process

temperatures and faster cycle times.

Environmentally-sustainable |

Features & Benefits

No protein

Low residual metals

Low gel content

No odour

Excellent transparency

Cariflex

is used:

As feedstock for IR Latex

In medical applications

In polymer modifications that are sensitive

to impurities (speciality paints & coatings,

electrical insulators)

Natural Rubber

Cariflex™

IR

Competitive IR

Cariflex

TM

Isoprene

Rubber |

Alternatives to PVC

Current focus on wire & cable and

medical applications

Features and benefits of Kraton

offering:

No plasticizers

Necessary for lower hardness

and improved processing

Address health concerns in

medical application

Better compatibility with PP than

conventional SEBS

Improved clarity, better impact

modification of PP

High melt flow

Low shear processing possible

Easy molding of thin parts

High flow elastic compounds for fiber

Recyclable |

27

62

149

2001

2009

2014

Investing for Growth In Asia

16

Asia Pacific SBC market –

53% of

global SBC consumption by volume in

2009

(1)

YTD September 2010, Asia Pacific

accounted for 20% of our total

revenue, with 46% derived from

higher margin HSBC products

In 2010 relocated Shanghai, China

office to a new facility (double the size

of the previous location)

Expanded warehouse capacity in

Shanghai Waigaoqiao Free Trade

Zone

Proposed HSBC expansion in Asia

Forecast strong worldwide growth in HSBC

driven by innovation

Initiated project assessment for a new 30 kT

per year HSBC plant in Asia

Site selection by early 2011 with start-up

planned for second half of 2013

Asia is an important component of Kraton’s growth strategy

(1)

Management estimates. Includes SBC consumption for footwear, a market in which

Kraton does not actively compete. Asian HSBC Industry Demand Trends (kT)

|

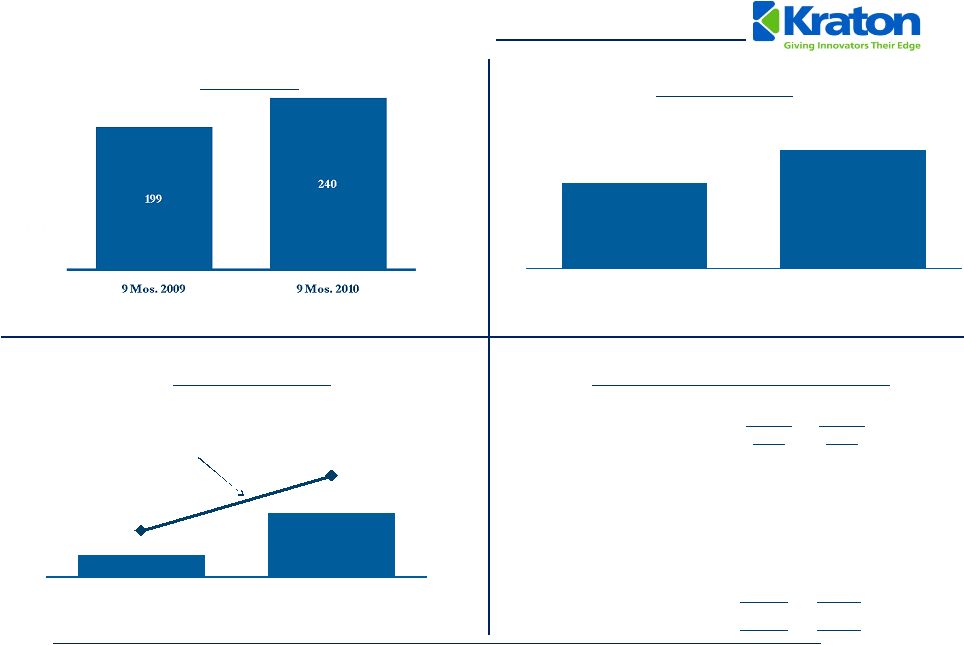

Volume (kT)

Selected Financial Trends

17

Sales

Revenue

(1)

(US $ in Millions)

Adjusted

EBITDA

(2)

(US $ in Millions)

9 Mos.

2009

9 Mos.

2010

EBITDA

$

67.1

$155.1

Management fees and expenses

1.5

---

Restructuring and related

charges

7.5

2.7

Gain on extinguishment of debt

(23.8)

---

Other non-cash expenses

4.0

2.8

Adjusted

EBITDA

(2)

$56.3

$160.6

EBITDA

to

Adjusted

EBITDA

(2)

Walk

(US $ in Millions)

$56

$161

7.9%

17.1%

0

10

20

30

40

50

60

70

80

90

100

110

120

130

140

150

160

170

180

190

200

210

220

230

240

250

260

270

280

290

300

9 Mos. 2009

9 Mos. 2010

$682

$940

$0

$50

$100

$150

$200

$250

$300

$350

$400

$450

$500

$550

$600

$650

$700

$750

$800

$850

$900

$950

$1,000

9 Mos. 2009

9 Mos. 2010

Adjusted

EBITDA

Margin

(1)

Excludes by-product revenue.

(2)

Adjusted EBITDA is GAAP EBITDA excluding management fees, restructuring and

related charges, non-cash expenses, and the gain on extinguishment of

debt. |

Selected 2010 Estimates

YTD September

2010 Estimate

Working capital (excluding cash) as

a % of revenue

~25%

Capital spending

$32.3

$50 to $55 million

Interest expense

$18.5

$24 to $25 million

Restructuring charges

$4 to $5 million

Depreciation and amortization

$36.0

$48 to $50 million

Book tax rate

14% to 15%

18 |