Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended September 30, 2010

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to .

Commission File Number 000-51383

ACCENTIA BIOPHARMACEUTICALS, INC.

(Exact name of registrant as specified in its charter)

| Florida | 04-3639490 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

324 South Hyde Park Ave., Suite 350

Tampa, Florida 33606

(Address of principal executive offices) (Zip Code)

(813) 864-2554

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, par value $0.001 per share

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer”, and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | ¨ | Smaller reporting company | x | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act.): Yes ¨ No x

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Section 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a Bankruptcy Plan confirmed by the Bankruptcy Court: Yes x No ¨

As of March 31, 2010, the aggregate market value of the voting common stock held by non–affiliates of the registrant, computed by reference to the last sale price of such stock as of such date on the Pink Sheets, was approximately $62,692,065.

As of November 30, 2010, there were 69,600,721 shares of the registrant’s Common Stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE:

The information required by Part III of Form 10-K, to the extent not set forth herein, is incorporated herein by reference to the registrant’s Proxy Statement for the 2011 Annual Meeting of Shareholders, to be filed with the Securities and Exchange Commission pursuant to Regulation 14A not later than 120 days after the end of the registrant’s fiscal year.

Forward-Looking Statements

Statements in this Annual Report on Form 10-K that are not strictly historical in nature are forward-looking statements. These statements may include, but are not limited to, statements about: the timing of the commencement, enrollment, and completion of our clinical trials for our product candidates; the progress or success of our product development programs; the status of regulatory approvals for our product candidates; the timing of product launches; our ability to protect our intellectual property and operate our business without infringing upon the intellectual property rights of others; and our estimates for future performance, anticipated operating losses, future revenues, capital requirements, and our needs for additional financing. In some cases, you can identify forward-looking statements by terms such as “anticipates,” “believes,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “projects,” “should,” “will,” “would,” “goal,” or other variations of these terms (including their use in the negative) or by discussions of strategies, plans or intentions. These statements are only predictions based on current information and expectations and involve a number of risks and uncertainties. The underlying information and expectations are likely to change over time. Actual events or results may differ materially from those projected in the forward-looking statements due to various factors, including, but not limited to, those set forth in “ITEM 1A. RISKS FACTORS” in this Annual Report on Form 10-K and those set forth in our other filings with the Securities and Exchange Commission. Except as required by law, we undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

PART I

| ITEM 1. | BUSINESS |

In this Annual Report on Form 10-K, unless the context indicates otherwise, references to “Accentia,” “the Company,” “our company,” “we,” “us,” and similar references refer to Accentia Biopharmaceuticals, Inc. and its subsidiaries. All references to years in this Form 10-K, unless otherwise noted, refer to our fiscal years, which end on September 30. For example, a reference to “2010” or “fiscal 2010” means the 12-month period ended September 30, 2010.

General

Headquartered in Tampa, Florida, Accentia Biopharmaceuticals, Inc. (Other OTC: “ABPI”) is a biotechnology company that is developing Revimmune™ as a comprehensive system of care for the treatment of autoimmune diseases. Additionally, through our, majority-owned subsidiary, Biovest International, Inc., we are developing BiovaxID® as a therapeutic cancer vaccine for treatment of follicular non-Hodgkin’s lymphoma (“FL”) and mantle cell lymphoma (“MCL”). Through our wholly-owned subsidiary, Analytica International, Inc., we conduct a health economics research and consulting business which we market to the pharmaceutical and biotechnology industries, using our operating cash flow to support our corporate administration and product development activities.

Revimmune™ is being developed as a treatment for various autoimmune diseases. The approximately 80 known autoimmune diseases generally arise from an overactive immune response against substances and/or tissue normally present in the body. As a system of care, Revimmune consists of administering high, pulsed doses of an FDA-approved drug, cyclophosphamide, over a four-day interval as part of an integrated risk management system including a panel of preventive tests, monitoring and medications which are intended to minimize risks while seeking to maximize the clinical benefit.

Through a collaboration with the National Cancer Institute (“NCI”), our majority-owned subsidiary, Biovest International, Inc. (OTCQB: “BVTI”) (“Biovest”) has developed a patient-specific cancer vaccine, BiovaxID®, which has demonstrated statistically significant Phase 3 clinical benefit by prolonging disease-free survival in follicular non-Hodgkin’s lymphoma patients treated with BiovaxID.

Additionally, through our wholly-owned subsidiary, Analytica International, Inc. (“Analytica”), based in New York City, we conduct a global research and strategy consulting business that provides professional services to the pharmaceutical and biotechnology industries. Since 1997, Analytica has expertly directed research studies and projects, including traditional health economic modeling projects, database studies, structured reviews, health technology assessments, reimbursement analyses, and value dossiers.

Corporate Overview

We were organized in 2002 to develop and commercialize biopharmaceutical products.

We commenced business in April 2002 with the acquisition of Analytica, a provider of analytical and consulting services to the biopharmaceuticals industry, including clinical trial services, pricing and market assessment and outcomes research. We acquired Analytica in a merger transaction for $3.7 million cash, $1.2 million of convertible promissory notes, and the issuance of 8.1 million shares of Series B preferred stock. Analytica, which was founded in 1997, has offices in New York and Germany.

In June 2003, we acquired 81% interest of Biovest, for investment of $20.0 million in Biovest pursuant to an investment agreement. Biovest is a biologics company that is developing our BiovaxID patient-specific vaccine for the treatment of FL. As of September 30, 2010, we owned of record approximately 75% of common stock of Biovest with the minority interest being held by approximately 400 shareholders of record. Biovest common stock is registered under Section 12(g) of the Securities Exchange Act of 1934, and Biovest therefore files periodic and other reports with the SEC.

2

Filing of Voluntary Petitions in Chapter 11

On November 10, 2008, we, along with all of our subsidiaries, filed a voluntary petition for reorganization under Case No. 8:08-bk-17795-KRM (the “Chapter 11”). On August 16, 2010, we filed our First Amended Joint Plan of Reorganization, and, on October 25, 2010, we filed the First Modification to the First Amended Joint Plan of Reorganization (collectively and as amended and supplemented, the “Plan”). On October 27, 2010, the Bankruptcy Court held a Confirmation hearing and confirmed the Plan, and, on November 2, 2010, the Bankruptcy Court entered an Order Confirming Debtors’ First Amended Joint Plan of Reorganization Under Chapter 11 of the Bankruptcy Code (the “Confirmation Order”), which approved and confirmed the Plan, as modified by the Confirmation Order. We emerged from Chapter 11 protection, and the Plan became effective, on November 17, 2010 (the “Effective Date”).

REVIMMUNE™

We are developing Revimmune as a comprehensive system of care for the treatment of various autoimmune diseases.

The Immune System and Autoimmunity

The immune system is the body’s natural defense mechanism for identifying and killing or eliminating disease-causing pathogens (such as bacteria, viruses, or other foreign microorganisms) and tumor cells. In humans, the primary disease fighting function of the immune system is carried out by white blood cells (leukocytes), which mediate two types of immune responses: innate immunity and adaptive immunity. Innate immunity refers to the broad first-line immune defense that recognizes and eliminates certain pathogens prior to the initiation of a more specific adaptive immune response. While the cells of the innate immune system provide a first line of defense, they cannot always eliminate or recognize infectious organisms. In some cases, new infections may not always be recognized or detected by the innate immune system. In these cases, the adaptive immune response has evolved to provide a highly specific and versatile means of defense which also provides long-lasting protection (immune memory) against subsequent re-infection by the same pathogen.

Autoimmune diseases are the result of white blood cells in the body recognizing and injuring or destroying normal (self) organs or tissues. In affected patients, the adaptive immune response (normally targeted against foreign antigens) becomes aberrantly targeted against self-tissues, leading to tissue damage, and chronic inflammation of affected organs. In severe cases patients may experience loss of function leading to disability or death. Autoimmune diseases are generally considered manageable in their early stages with immunosuppressive therapies or immunomodulating therapies. These therapies, however, are rarely considered “curative” and with modern standards of care, patients may suffer from chronic disease progression.

Autoimmune diseases pose a major burden to society. At least ten million Americans suffer from the more than eighty illnesses caused by autoimmunity. Many autoimmune diseases occur among young to middle-aged adults, leading to life-long disease and often life-changing disability. These conditions therefore also pose a disproportionate economic burden to healthcare systems in the industrialized world. Women are especially susceptible and comprise approximately 75% of diagnosed cases. Autoimmune diseases are among the ten leading causes of death among women in all age groups up to age 65.

Although many of these diseases can be treated clinically by currently available conventional immunosuppressive regimens, important problems remain: some patients are refractory to standard immunotherapy, and others respond only partially. In many cases, immunosuppressive therapies or therapies to control the symptoms of the disease must be continued indefinitely, maintaining an impaired immune system, and often resulting in increased risk of infections and other serious health problems.

3

Revimmune™ for the Treatment of Autoimmune Disease

In contrast to currently approved therapies available to treat autoimmune disease, Revimmune seeks to eliminate virtually all circulating white blood cells, including those driving autoimmunity, while seeking to spare the patient’s stem cells. As the patient’s eliminated white blood cells are replenished with new white blood cells derived from these stem cells, the patient’s immune system becomes effectively replaced or “rebooted”.

Revimmune consists of an approved active drug (cyclophosphamide) administered as part of an integrated risk management system designed to assure its consistent use and minimize the risks of treatment. Cyclophosphamide has been approved by the FDA to treat disorders other than autoimmune disease including various forms of cancer.

To facilitate our development and commercialization of Revimmune, we have entered into an agreement with Baxter Healthcare Corporation, which we believe is the only cGMP (“current Good Manufacturing Practice” enforced in the U. S. by the FDA) manufacturer of injectable/infusion cyclophosphamide used in the U.S. as referenced in the FDA Orange Book. This agreement grants us the exclusive right to use Baxter’s regulatory file and drug history (Drug Master File) for cyclophosphamide, which we believe will advance our planned clinical trials and anticipated communications with the FDA. Additionally, the agreement grants to us the exclusive right to purchase Baxter’s cyclophosphamide for the treatment of various autoimmune diseases including autoimmune hemolytic anemia, multiple sclerosis, and systemic sclerosis.

Cyclophosphamide is a nitrogen mustard alkylating agent (it destroys target cells by binding to DNA and interfering with cell division and function) which is converted by the liver into an active chemotherapeutic agent. Cyclophosphamide’s effects are dose-dependent. As used in Revimmune, cyclophosphamide is planned to be administered at a dose of 50 mg/kg which is a unit of measurement where drug dosage is measured in milligrams based on the patient’s body weight measured in kilograms delivered in a series of 4 daily infusions (which is generally referred to as “Pulsed”) corresponding to a total dose of 200 mg/kg. This dose represents an ultra-high dose of cyclophosphamide, which is generally administered to cancer patients in total doses ranging from approximately 40 to 50 mg/kg or less over a period of 2 to 5 days. We refer to the dosing schedule of cyclophosphamide as used in Revimmune as “High-Dose Pulsed Cyclophosphamide”.

Revimmune includes a comprehensive risk management system to restrict the use of High-Dose Pulsed Cyclophosphamide to those patients anticipated to most benefit from the drug and to exclude patients for whom the drug is contraindicated. The risk management system includes pre- and post-treatment drugs combined with careful monitoring during and after administration of cyclophosphamide to avoid or minimize infections and other adverse side effects which may result from the therapy. This computerized central risk management system, which we refer to as “Revimmune Bolstering Outcomes Of Therapy” or “REBOOT™”, is intended to assist physicians and other Revimmune care providers to maintain a consistent risk management approach when administering Revimmune. We anticipate that this system will incorporate a number of safety questionnaires, protocols, and other educational materials for patients and providers; in addition, we anticipate the system will provide a series of computer-verified diagnostic assays and compliance checks integrated with patients’ treatment. The REBOOT system may also include a patient and physician registry to enable long-term follow-up and research to improve outcomes and minimize risk in treated patients. Furthermore, we expect to enhance patient safety by packaging, labeling and distributing Revimmune therapy only as part of the REBOOT system.

We anticipate that our REBOOT system will be at the core of a formal risk evaluation and mitigation strategy subject to approval by the FDA. As such, it forms a critical part of our planned clinical trial(s) and investigational new drug application(s) (“IND”). Such risk evaluation and mitigation strategies are generally referred to as REMS, which were authorized by the 2007 amendment to the Food and Drug Act. REMS are frequently and increasingly included as part of new drug applications, approvals and/or labels to assure safety and to maximize benefit. REMS are subject to enforcement by the FDA through civil penalties.

4

Previous Clinical Studies in Cyclophosphamide to Treat Autoimmune Disease.

A number of small, single-arm, open label, uncontrolled trials that have been conducted at various institutions suggest the effect of cyclophosphamide on the disease course of certain autoimmune diseases. These prior studies form the basis of our belief that Revimmune, which incorporates High-Dose Pulsed Cyclophosphamide, may potentially represent a new treatment option for certain autoimmune diseases and support our decision to pursue the development of Revimmune. These prior studies are considered to be preliminary and we believe that significant additional development is required before High-Dose Pulsed Cyclophosphamide can be widely accepted as a therapeutic option for autoimmune disease. These additional developments, which are part of our Revimmune development plan, include: (i) conducting a definitive controlled and randomized trial for each specific autoimmune disease sufficient to demonstrate safety and efficacy to the satisfaction of the FDA as required to support potential marketing approval and (ii) developing a REMS for High-Dose Pulsed Cyclophosphamide to assure that the therapy properly balances risks and benefits in a manner which is sufficient to obtain the approval of the FDA under the Food and Drug Administration Amendments Act of 2007.

| Autoimmune Disease |

Study Site |

Number of Patients Treated |

||||

| Aplastic Anemia | JHU1, Hahnemann2, Wayne State | 82 | ||||

| Systemic Sclerosis (diffuse cutaneous) | JHU | 6 | ||||

| Systemic Lupus Erythematosus | JHU, Hahnemann | 43 | ||||

| Multiple Sclerosis | JHU, Hahnemann, Stony Brook3 | 47 | ||||

| Myasthenia Gravis | JHU, Stanford University | 13 | ||||

| Autoimmune Hemolytic Anemia (AIHA) | JHU, Hahnemann, University of Milan | 12 | ||||

| CIDP | Hahnemann | 5 | ||||

| Rheumatoid Arthritis | JHU, Queen Elizabeth Hospital4 | 5 | ||||

| Pemphigus | JHU, University of Miami | 4 | ||||

| TOTAL |

217 | |||||

| 1 | Johns Hopkins University, |

| 2 | Medical College of Pennsylvania-Hahnemann Hospital at Drexel University, |

| 3 | State University of New York at Stony Brook, 4Queen Elizabeth Hospital, Adelaide, South Australia |

Table 1. Published preliminary studies investigating High-Dose Pulsed Cyclophosphamide for treatment of Autoimmune Diseases listed by disease.

5

Revimmune Development Plan

Rationale

Notwithstanding the prior reports of High-Dose Pulsed Cyclophosphamide as a potential therapy for certain autoimmune diseases. cyclophosphamide is not currently FDA-approved for the treatment of any autoimmune diseases. These prior studies of High-Dose Pulsed Cyclophosphamide in the United States have been conducted at a limited number of large academic research hospitals and have featured non-uniform inclusion criteria and/or administration schedules. It is generally recognized that there may be significant potential risks of infection or other side effects when High-Dose Pulsed Cyclophosphamide is not administered by highly-qualified personnel in a controlled and regulated clinical setting. While the previous studies are important to our Revimmune development plan, they are not considered sufficient to support regulatory approval. At the core of our Revimmune development plan is a recognition that controlled and randomized clinical trials will be necessary to demonstrate the efficacy of High-Dose Pulsed Cyclophosphamide to the satisfaction of the FDA and that safety will be an important regulatory and clinical concern which we believe will require an FDA approved formal REMS.

There are approximately 80 recognized autoimmune diseases. We previously planned to conduct our first randomized and controlled trial of Revimmune in multiple sclerosis (MS), because of the potentially significant impact of such a study and the number of MS patients previously treated with High Dose Cyclophosphamide (Table 1). However, due to our limited capital and resources, we have modified our Revimmune development plan so as to initially focus on two less prevalent autoimmune diseases where we perceive a significant unmet medical need: diffuse systemic sclerosis and autoimmune hemolytic anemia. Subject to our capital availability, we plan to undertake clinical trials of Revimmune for the treatment of these two autoimmune diseases in a parallel manner. Diffuse systemic sclerosis and autoimmune hemolytic anemia represent diseases for which we believe significant unmet medical needs exist. There is no standard treatment for systemic sclerosis, and while the standard treatment for autoimmune hemolytic anemia is effective for a subset of patients, patients for which this treatment options is not effective, referred to as refractory patients, have very limited options. We believe that the significant unmet medical need, the shorter and severe disease course and the smaller prevalence of these autoimmune diseases make them appropriate for our initial focus. Notwithstanding the initial focus of our current Revimmune development plan, we continue to believe that new treatment options are needed for MS and we remain interested in ultimately conducting studies with Revimmune in MS.

In September 2007, we conducted a meeting with the FDA regarding our proposed design of a clinical trial for Revimmune to treat MS. We considered the FDA meeting to have been constructive. However, with the change in our Revimmune development plan, we are currently preparing for an additional meeting with the FDA to discuss possible studies in diffuse scleroderma and/or autoimmune hemolytoic anemia. Based on FDA input, we anticipate filing an Investigational New Drug Application(s) (IND) under which we hope to conduct our planned clinical trials. Further, we plan to discuss with the FDA our plans for a REMS to be developed under the Food and Drug Administration Amendments Act of 2007.

Provided that our planned clinical trials, once completed, demonstrate clinical benefit and safety, we would anticipate discussing next steps with the FDA which could include the suitability of seeking conditional accelerated approval and/or the appropriateness and design of additional trial(s).

Diffuse Cutaneous Systemic Sclerosis

Disease Background

Systemic sclerosis is a chronic, multisystem autoimmune disease characterized by hardening of the skin and affected tissues, blood vessel (vascular) alterations, and the presence of autoimmune antibodies (autoantibodies) in the blood. Patients with systemic sclerosis often experience Raynaud’s phenomenon, a condition associated with discoloration of fingers and/or toes when exposed to changes in temperature or emotional events Systemic sclerosis is most common in females who are 30 to 50 years of age.

6

The underlying disease etiology, or cause, of systemic sclerosis remains largely unknown but in affected patients, prolonged activation of the immune system and inflammation results in extensive tissue damage and repair. Continuous remodeling and repair and an inability to terminate the reparative processes leads to persistent connective tissue remodeling, scarring, and fibrosis. Some patients may have only a few affected areas, but others suffer from progressive skin involvement which becomes the source of much affliction as the condition worsens.

Systemic sclerosis can be divided into two primary forms, limited cutaneous systemic sclerosis (lcSSc) and diffuse cutaneous systemic sclerosis (dcSSc). Approximately 60% of scleroderma patients have limited cutaneous systemic sclerosis, while approximately 35% have the diffuse cutaneous form. lcSSc typically presents as skin manifestations affecting the hands, arms and face. Additionally, pulmonary arterial hypertension may occur in up to one third of patients and is the most serious complication for this form of systemic sclerosis. Diffuse cutaneous systemic sclerosis comprises a very severe form of systemic sclerosis which progresses rapidly and affects a large area of the skin and one or more internal organs, frequently the kidneys, esophagus, heart and lungs. dcSSc leads to substantial disability and/or death. We plan our clinical trials to study diffuse cutaneous systemic sclerosis, which has an estimated U.S. prevalence of approximately 30,000 cases with an estimated incidence of approximately 2100 annually.

Unmet Medical Need

dsSSc is a severe disease with the highest case-specific mortality of any rheumatic disorder, with 50% of patients dying or developing major organ complications within 3 years of diagnosis (Denton and Black 2005). Currently there is no treatment that has been proven to prevent progression of disease, underscoring a huge unmet medical need in this disease.

Autologous stem cell transplantation can significantly improve the skin score, a measure of disease progression in dcSSc. However, reported transplant-related mortality ranges from 8.7%-17%. Other immune modulatory agents have been studied with varying results; either the trials were too small or uncontrolled to definitively determine the efficacy of the treatment or randomized, controlled trials were conducted without demonstrating a clinically significant benefit.

High-Dose Pulsed Cyclophosphamide Experience in Diffuse Scleroderma

An open-label trial of High-Dose Pulsed Cyclophosphamide in patients with clinically active diffuse systemic sclerosis patients was conducted at Johns Hopkins University (Tehlirian et.al. published these results in 2008). This study forms the basis of our planned clinical trial of Revimmune.

In this study, six patients with diffuse cutaneous systemic sclerosis were treated. One patient died of a pulmonary infection (7 weeks after treatment) that was acquired after the absolute neutrophil count had normalized, indicating that the infection was not acquired during the immune ablation period. This patient experienced acute respiratory distress syndrome associated with a fungal infection and a decline in kidney function. This patient had extensive lung disease at the time of entry into the study. This highlights the need for a robust system of care during High Dose Cyclophosphamide treatment and the requirement for highly selective inclusion criteria, especially in patients with organ involvement and damage as a result of their autoimmune disease.

The primary endpoint was the modified Rodnan skin score (mRSS), a typical efficacy endpoint for systemic sclerosis trials. The mRSS measures skin thickness and collagen content of skin. In dcSSc, increasing skin thickness is associated with increased disease activity, and a reduction in mRSS is associated with a more favorable outcome, with a reduction of 25% considered clinically significant. The study reported that in 5 evaluable patients, mRSS was reduced by 60%, 55%, 41%, 31%, and 0%. The study further reported that four patients out of five responded initially, while one responded but relapsed at 6 months.

The physician’s global assessment (PGA), a was reported to have improved for four of five patients 47%, 69%, 56%, and 59% within first month after treatment and for one of five within the first 3 months (80%). The forced vital capacity (FVC), a measure of lung function, also stabilized in four of six patients. One patient’s FVC worsened due to an infection, then returned to baseline. Five of five patients improved on the Health Assessment Questionnaire Disability Index.

7

Planned Clinical Trial of Revimmune in dcSSc

Similar to the prior clinical trial conducted using High-Dose Pulsed Cyclophosphamide to treat diffuse cutaneous systemic sclerosis, we intend to enroll patients meeting established criteria for this diagnosis and who have evidence of moderately severe organ damage and clinical evidence of active disease.

Autoimmune Hemolytic Anemia (AIHA)

Disease Background

We plan to study autoimmune hemolytic anemia (AIHA), a disease in which the body’s immune system attacks its own red blood cells (RBCs), leading to their destruction, or hemolysis. While studies of prevalence of AIHA in the U.S. are few, we estimate the U.S. prevalence of AIHA at approximately 50,000 cases based on epidemiological studies in other countries. The U.S. incidence of AIHA is approximately 2,400 per year.

In affected patients, a process of increased destruction of red blood cells (RBCs) takes place mediated by the formation of anti-RBC autoantibodies (an autoantibody is an antibody produced by the body in reaction to the body’s own cells). AIHA can occur at any age and affects women more often than men. About half of the time, the cause of autoimmune hemolytic anemia cannot be determined (idiopathic autoimmune hemolytic anemia). Autoimmune hemolytic anemia can also be caused by or occur with another disorder, such as systemic lupus erythematosus (lupus), and rarely it follows the use of certain drugs, such as penicillin.

AIHA frequently commences as an acute, sometimes life-threatening disease often requiring hospitalization, but is considered a chronic disease. In some people, the destruction may stop after a period of time. In other people, red blood cell destruction persists and becomes chronic. There are two main types of autoimmune hemolytic anemia: warm antibody hemolytic anemia (WAIHA) and cold antibody hemolytic anemia (CAIHA). In the warm antibody type, the autoantibodies attach to and destroy red blood cells at temperatures equal to or in excess of normal body temperature. In the cold antibody type, the autoantibodies become most active and attack red blood cells only at temperatures well below normal body temperature. Rarely, patients have both cold- and warm-reactive autoantibodies and are classified as mixed-type AIHA.

Autoimmune hemolytic anemia as the cause of hemolysis is confirmed when blood tests detect increased amounts of certain antibodies, either attached to red blood cells (direct antiglobulin or Coombs’ test) or in the liquid portion of the blood (indirect antiglobulin or Coombs’ test). Other tests sometimes help determine the cause of the autoimmune reaction that is destroying red blood cells.

If symptoms are mild or if destruction of red blood cells seems to be slowing on its own, no treatment is needed. If red blood cell destruction is increasing, a corticosteroid such as prednisone is usually the first choice for treatment for WAIHA. High doses are used at first, followed by a gradual reduction of the dose over many weeks or months. When WAIHA patients do not respond to corticosteroids or when the corticosteroid causes intolerable side effects, surgery to remove the spleen (splenectomy) is often the next treatment. The spleen is removed because it is one of the places where antibody-coated red blood cells are destroyed. When destruction of red blood cells persists after removal of the spleen or when surgery cannot be done, immunosuppressive drugs may be used.

When red blood cell destruction is severe, blood transfusions are sometimes needed, but they do not treat the cause of the anemia and provide only temporary relief.

Unmet Medical Need

We believe that there is a need for additional therapeutic options to treat both warm and cold AIHA. Only 15-20% of patients achieve complete remission with standard first line therapy, corticosteroids. Adverse events related to corticosteroid therapy include excessive weight gain, skin flushing, neuropsychiatric disorders, sleep disturbances, increased risk of cardiovascular events, cataracts, and myopathy. Co-morbidities exacerbated by corticosteroids include diabetes, hypertension, hyperlipidemia, heart failure, glaucoma, and peptic ulcer disease.

8

Usually splenectomy, the surgical removal of the spleen, is used as a second-line therapy, which elicits a 50% response rate. Options for patients unresponsive or refractory to corticosteroids and splenectomy are limited. In WAIHA, the chance of spontaneous or drug-induced remission or cure is extremely low. An urgent need exists for new, better treatments of WAIHA, especially for steroid-refractory or unresponsive patients. CAIHA does not respond to either steroids or splenectomy and therefore remains a significant clinical challenge.

High-Dose Pulsed Cyclophosphamide Experience with AIHA

Following studies in other severe autoimmune disorders, High-Dose Pulsed Cyclophosphamide was studied in patients with severe AIHA that was refractory to standard therapies (Moyo, Smith et al. 2002). Nine patients were treated at Hahnemann University, Medical College of Pennsylvania and Johns Hopkins University. Seven patients displayed the warm type (WAIHA), one the cold-type (CAIHA), and one patient was mixed warm/cold. These patients had preciously failed at least 2 standard therapies (primary AIHA) or one standard therapy (secondary AIHA), and were steroid dependent.

High-Dose Pulsed Cyclophosphamide was well-tolerated in these patients. All patients were reported to have experienced transfusion independence following treatment. The study reported that six patients underwent a complete response, and the remaining 3 achieved a partial remission. At last follow-up (median follow-up duration 15 months, ranging from 4-29 months), only one patient in CR was still receiving doses of corticosteroids (although these were tapering) and one patient in PR was receiving a low dose of corticosteroids. All others discontinued steroids and no patient experienced relapse at a median of 15 months after treatment.

Three other patients with AIHA have been treated with High Dose Cyclophosphamide, in one small study (Brodsky 1998) and one case report (Panceri 2002). Of the two patients in the former study, one had Evan’s syndrome (a combination of AIHA and another disease). The AIHA patient experienced a complete recovery for 16 months but then came down with immune thrombocytopenic purpura, another autoimmune disease and subsequently died. The other patient experienced no symptomatic manifestations of disease after treatment and was independent of transfusion for more than 10 months. The case report (Panceri 2002) described the striking sudden improvement in a child with severe AIHA who was unresponsive to four other treatments. However, due to the absence of defined inclusion criteria as used in the Moyo study, these three patients have extremely heterogeneous characteristics and may not be comparable to the larger Moyo study in which patients were more similar.

Therefore, the small Moyo study forms the basis of our planned clinical trial of Revimmune in AIHA.

Planned Clinical Trial of Revimmune in AIHA

Similar to the prior clinical trial conducted using High-Dose Pulsed Cyclophosphamide to treat AIHA we intend to enroll patients with a diagnosis of severe autoimmune hemolytic anemia. We expect that these patients will have had a failure of at least 2 standard treatment approaches (e.g., prednisone therapy, splenectomy, intravenous immunoglobulin, or other immunosuppressants.), or an inability to taper prednisone dose to less than 10 mg/day. We plan to enroll both patients with both the warm and cold-types of AIHA and plan to structure the trial analyses to control for the differences between these types of AIHA. For example, if Revimmune is effective for only WAIHA, then the analysis plan will still be sufficient to determine efficacy in only the warm type.

Proprietary Rights to Revimmune

We have developed a multi-faceted strategy to maintain and protect our proprietary interests in Revimmune, involving various forms of intellectual property, including patent and non-patent exclusivity. We hold the exclusive world-wide rights to commercialize High-Dose Pulsed Cyclophosphamide to treat MS and certain other autoimmune diseases through a sublicense (the “Revimmune Sublicense”) from Revimmune, LLC, which is affiliated with one of our directors and shareholders, which holds the exclusive license for the technology from JHU (“the JHU License”). Under the Revimmune Sublicense, we are obligated to pay a royalty of 8% of net sales of Revimmune which is equally split between JHU and Revimmune, LLC until the later of the expiration of the last to expire patent under the JHU License on a country by country basis, or 10 years following the first commercial sale of a regulatory approved product regardless of the issuance of any such patents.

9

We believe that our JHU License creates an important relationship between us, JHU, and the inventors who are JHU faculty and pioneers in the study and development of High-Dose Pulsed Cyclophosphamide. JHU has filed patent applications in the U.S. and several foreign countries with claims pertaining to the use of High-Dose Pulsed Cyclophosphamide to treat MS and certain other autoimmune diseases which are covered by our JHU License. Some of these licensed patent applications are undergoing examination and are subject to pending patent office objections and/or rejections. Additionally, we have filed patent applications for our REBOOT system and certain screening protocols that maximize the safety and effectiveness of cyclophosphamide treatment regimens. Further, we anticipate that our computer software program being developed to implement our REBOOT system will be proprietary and protected through trademark and copyright filings.

To extend our proprietary rights to Revimmune, we have entered into an agreement with Baxter Healthcare Corporation, which we believe is the only cGMP (“current Good Manufacturing Practice” enforced in the U. S. by the FDA) manufacture of injectable cyclophosphamide in the U.S. This agreement grants us the exclusive right to use Baxter’s regulatory file and drug history (Drug Master File) for cyclophosphamide which we believe will facilitate our planned clinical trials and anticipated dealings with the FDA. Additionally, the agreement grants to us the exclusive right to purchase Baxter’s cyclophosphamide for the treatment of various autoimmune diseases including Autoimmune Hemolytic Anemia, Multiple Sclerosis, and Scleroderma.

BIOVAXID® - Therapeutic Cancer Vaccine

Through our majority-owned subsidiary, Biovest International, Inc. (“Biovest”) is developing BiovaxID as a cancer vaccine to treat follicular lymphoma (“FL”) and mantle cell lymphoma (“MCL”).

The Human Immune System

The immune system functions as the body’s natural defense mechanism for identifying and killing or eliminating disease-causing pathogens, such as bacteria, viruses, or other foreign microorganisms. However, with regard to cancer, including lymphomas, the immune system’s natural defense mechanism is believed to be largely thwarted by natural immune system mechanisms which seek to protect “self-cells” from attack. In humans, the primary disease fighting function of the immune system is carried out by white blood cells (leukocytes), which mediate two types of immune responses: innate immunity and adaptive immunity. Innate immunity refers to the broad first-line immune defense that recognizes and eliminates certain pathogens prior to the initiation of a more specific adaptive immune response. While the cells of the innate immune system provide a first line of defense, they cannot always eliminate or recognize infectious organisms. In some cases, new infections may not always be recognized or detected by the innate immune system. In these cases, the adaptive immune response has evolved to provide a highly-specific and versatile means of defense which also provides long-lasting protection (immune memory) against subsequent re-infection by the same pathogen. This adaptive immune response facilitates the use of preventative vaccines that protect against viral and bacterial infections such as measles, polio, diphtheria, and tetanus. Biovest believes that BiovaxID creates an adaptive immune response to cancerous B-cells.

Adaptive immunity is mediated by a subset of white blood cells called lymphocytes, which are divided into two types: B-cells and T-cells. In the bloodstream, B-cells and T-cells recognize antigens, which are molecules that are capable of triggering a response in the immune system. Antigens are molecules from bacterial, viral, or fungal origin, foreign (non-self) proteins, and in some cases, tumor-derived proteins that can stimulate an immune response. The human body makes millions of different types of B-cells that circulate in the blood and lymphatic systems and perform immune surveillance. Each B-cell has a unique receptor protein (immunoglobulin) on its surface that binds to one particular antigen. Once a B-cell recognizes its specific antigen and receives additional signals from a T-helper cell, it can proliferate and become activated in order to secrete antibodies (immunoglobulins; Ig) which can neutralize the antigen and target it for destruction. T-cells may also recognize antigens on foreign cells, whereby they can promote the activation of other white blood cells or initiate destruction of the targeted cells directly. A person’s B-cells and T-cells can collectively recognize a wide variety of antigens, but each individual B-cell or T-cell will recognize only one specific antigen. Consequently, in each person’s bloodstream, only a relatively few lymphocytes will recognize the same antigen.

10

Since B-cell cancers such as non-Hodgkin’s lymphoma (NHL) are tumors arising from a single malignant transformed B-cell, the tumor cells in NHL maintain on their surface the original malignant B-cell’s immunoglobulin (collectively referred to as, the “tumor idiotype”) that is distinct from those found on normal B cells. The idiotype maintained on the surface of each B-cell lymphoma serves as the tumor-specific antigen for the BiovaxID cancer vaccine.

In many cases, including in NHL, cancer cells produce molecules known as tumor-associated antigens, which may or may not be present in normal cells but may be over-produced in cancer cells. T-cells and B-cells have receptors on their surfaces that enable them to recognize the tumor associated antigens. While cancer cells may naturally trigger a B- or T-cell-based immune response during the initial appearance of the disease, this response may be only weakly specific or attenuated in such a way that it does not fully eradicate all tumor cells. Subsequently, tumor cells gradually evolve and escape from this weak immune response and are able to grow into larger tumors. In addition, because cancer cells arise from normal tissue cells, they are often able to exploit or increase existing immune tolerance mechanisms to suppress the body’s immune response which would normally destroy them. In other cases, chemotherapy or other treatment regimens used to treat the cancer may themselves weaken the immune response and render it unable to reject and kill tumor cells. Even with an activated immune system; however, the number and size of tumors can often overwhelm the immune system.

In the case of cancer and other diseases, immunotherapies are designed to activate a person’s immune system in an attempt to combat the disease. There are two forms of immunotherapy used to treat diseases: passive and active. Passive immunotherapy is exemplified by the intravenous infusion into a patient of antibodies specific to the particular antigen. While passive immunotherapies have shown clinical benefits in some cancers, they require repeated infusions and can cause the destruction of normal cells in addition to cancer cells. An example of passive immunotherapy to treat lymphoma is monoclonal antibodies such as rituximab. An active immunotherapy, on the other hand, seeks to generate a durable adaptive immune response by introducing an antigen into a patient, often in combination with other components that can enhance an immune response to the antigen. BiovaxID is an example of active specific immunotherapy. Although active immunotherapies have been successful in preventing many infectious diseases, their ability to combat cancers of various types has been limited by a variety of factors, including the inability of tumor antigens to elicit an effective immune response, difficulty in identifying suitable target tumor antigens, inability to manufacture tumor antigens in sufficiently pure form, and inability to manufacture sufficient quantities of tumor antigens.

Nevertheless, in 2010 one active immunotherapy, Provenge® developed by Dendreon Corporation, received marketing approval from the FDA. This represents the first case of an active immunotherapy to successfully gain marketing approval in the U.S. In addition to BiovaxID, there are a number of other active immunotherapeutics for cancer in various stages of clinical trials that have demonstrated promising results.

A number of features of the non-Hodgkin’s lymphomas make these tumors particularly suitable for treatment with a therapeutic cancer vaccine. The malignant B-cell lymphocytes of NHL express a unique, identifiable tumor-specific antigen which is not expressed by other (healthy) cells in the body. In contrast, the majority of human cancers typically lack strong ubiquitous expression of tumor-specific antigens to distinguish them from normal cells, or they express a potentially widely-varying mix of antigens which can be difficult to identify and formulate into a successful therapeutic vaccine.

Non-Hodgkin’s Lymphoma (NHL)

NHL is a heterogeneous group of malignancies of the lymphatic system with differing clinical behaviors and responses to treatment. BiovaxID has been studied in two distinct forms of non-Hodgkin’s lymphoma, namely, FL and MCL. NHL is the fifth most common type of cancer in the U.S., with an estimated prevalence of 438,325 cases in 2007 in the U.S. NHL accounts for 5% of all cancer deaths in the U.S. NHL is one of the few malignancies in which there continues to be a rise in incidence. Since the early 1970’s, incidence rates for NHL have nearly doubled. Moreover, in spite of recent advances in the standard of care, the overall five-year survival rate remains at approximately 63%. According to the NCI, in 2009 it is estimated that 65,980 new cases of NHL will be diagnosed and 19,500 Americans will die from the disease, with a comparable number estimated in Europe.

11

NHL is usually classified for clinical purposes as being either “indolent” or “aggressive,” depending on how quickly the cancer cells are likely to grow and spread. The indolent, or slow-growing, form of NHL has a very slow growth rate and may need little or no treatment for months or possibly years. Aggressive, or fast-growing, NHL tends to grow and spread quickly and cause severe symptoms, and patients with aggressive NHL have shorter overall survival.

Follicular Lymphoma

Indolent (slow growing) and aggressive NHL each constitute approximately half of all newly diagnosed B-cell NHL, and roughly half of the indolent B-cell NHL is FL. Accordingly, approximately 22% of new cases of NHL fall into the category of disease known as indolent FL. The U.S. prevalence (number of cases) for FL is estimated to be 100,603 cases in 2006. Biovest has conducted a Phase 2 clinical trial followed by a Phase 3 clinical trial in FL under Biovest’s IND. FL is a form of NHL that is derived from a type of cell known as a follicle center cell. Despite its slow progression, FL is almost invariably fatal. The median survival reported for FL patients ranges between 8 and 10 years, although these figures may have become slightly higher within the last decade as a result of improvements in the standard of care for FL.

The current standard of care for treatment of advanced, bulky follicular lymphoma (bulky Stage II, Stage III-IV) as specified by the National Comprehensive Cancer Network includes initial treatment of newly-diagnosed patients with rituximab-containing chemotherapy. Rituximab is a monoclonal antibody (an immune protein capable of selectively recognizing and binding to a molecule) which targets a protein primarily found on the surface of both healthy and cancerous B cells, known as CD20. Accordingly, rituximab seeks to bind and destroy all B-cells, including healthy B-cells, as a means of controlling the progression of FL in treated patients.

Rituximab and other biologics currently approved for lymphoma are characterized as “passive immunotherapies”. Following administration, rituximab exerts its effects primarily through an unselective and near total destruction of a patient’s B-cells, including malignant as well as healthy B-cells. Rituximab and other passive immunotherapies are often administered in sequential, repeated doses to achieve their effect, and following cessation of administration are over time eliminated from the patient’s circulation by normal bodily functions. Rituximab is characterized as a targeted therapy since it targets CD20, which is present on both healthy and tumor cells. Rituximab is manufactured in bulk and is not considered to be a personalized therapy.

By comparison, BiovaxID is characterized as an “active immunotherapy”. Active immunotherapies attempt to stimulate the patient’s immune system to respond to a disease. “Specific active immunotherapies” such as BiovaxID specifically seek to induce cellular and/or humoral immune responses focused on specific antigens present on a diseased cell (such as a tumor cell). As a specific, active immunotherapy, BiovaxID targets only the cancerous B-cells while sparing healthy B-cells. Accordingly, BiovaxID is highly targeted. BiovaxID is manufactured specifically and entirely for each patient and is considered to be a highly “personalized therapy”. If approved, BiovaxID will represent the only specific active immunotherapeutic approved for the treatment of FL and therefore will represent a new class of drugs that provide a new therapeutic option for patients with lymphoma.

The EMEA has recently approved the use of two years of rituximab maintenance therapy in FL patients responding to first line chemo-immunotherapy. In this context, patients receive rituximab repeatedly over a period of two years, during which the agent seeks to deplete all B-cells in the body in an attempt to extend tumor remission. BiovaxID, if approved, would likewise be considered to be a “maintenance” or remission consolidation therapy. However, BiovaxID differs from rituximab maintenance therapy in that BiovaxID is administered for a 6-month period during which it seeks to establish a targeted and persistent immune response to the patient’s tumor. BiovaxID seeks to establish an adaptive immune response which be can come into play and destroy the tumor cells every time the patient’s trained immune system encounters the specific tumor target.

12

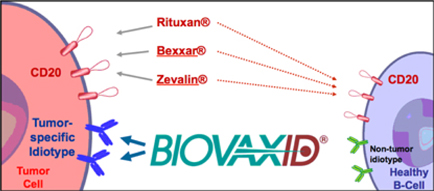

Figure 1: BiovaxID targets tumor-specific idiotype, a protein unique to the tumor and not found on healthy (non-malignant) B-cells. In contrast, current monoclonal antibody-based therapies for NHL, including rituximab (Rituxan®), tositumomab (Bexxar®), and ibritumomab tiuxetan (Zevalin®) target CD20, a cell-surface protein expressed by both tumor and healthy B-cells. As such, through its unique mode of action, BiovaxID represents a new therapeutic approach to treating FL.

Mantle Cell Lymphoma (MCL)

MCL is a rare, aggressive subtype of NHL characterized by short remissions and rapid progression similar to aggressive lymphomas and successive relapses, reflecting incurability similar to indolent lymphomas. The median overall survival for MCL has been cited as 3 to 5 years and the disease currently lacks a consensus standard of care. MCL represents approximately 6% of all NHL cases and worldwide there are approximately 7,800 new cases each year of which approximately one half are in the U.S.

The majority of MCL patients have disseminated disease and bone marrow involvement at diagnosis. Patients’ clinical outcomes from currently available therapies are poor. Although many therapeutic regimens are capable of rendering high initial response rates, these responses are of short duration (i.e., about 20 months) and the relative survival rates of MCL patients are among the lowest compared to other types of NHL. The prognostic after the first relapse is very poor, with an expected median overall survival of about 1-2 years. No currently available therapeutic regimens are curative.

While several therapeutic regimens are available to treat MCL patients, there currently exists no consensus standard of care for treatment of first-line relapsed MCL. As such, MCL remains incurable and it is generally considered that additional treatment options are required given this significant unmet medical need.

Currently upon first diagnosis of MCL patients are often evaluated for eligibility for autologous stem cell transplantation (autoSCT). Stem cell transplantation, an aggressive treatment protocol consisting of high-dose chemotherapy, immunotherapy and full-body radiation, aims to treat the patient’s tumor and purge the bone marrow of lymphoma cells. MCL patients who are eligible for autoSCT receive either R-CHOP (rituximab, cyclophophamide, doxorubicin, vincristine, prednisone) followed by autoSCT or R-HyperCVAD (rituximab, cyclophosphamide, vincristine, doxorubicin, and dexamethasone alternating with rituximab plus high dose methotrexate and cytarabine) followed by observation. Although these therapeutic approaches do yield high response rates, they are associated with high rates of treatment discontinuation, high risk of myelodysplastic syndrome, and high mortality rates. Consequently, the considerable toxicity associated with these regimens largely limits these options primarily to a select subset of the MCL patients who are younger and better fit to tolerate these high-intensity treatments. However, even this subset ultimately gains only modest benefits from existing treatment options. Moreover, the use of these more aggressive regimens appears not to result in superior overall survival as compared to standard therapies. Given that the median age for newly diagnosed mantle cell lymphoma patients is 60 years, less aggressive therapeutic approaches are needed.

13

Development Status of BiovaxID

Introduction

Preliminary studies demonstrated that treatment of patients with NHL with an active immunotherapy could allow a patient’s immune system to produce B-cells and/or T-cells that recognized numerous portions of their tumor antigen and generate clinically significant immune responses. These studies provided the rationale for large-scale trials of active specific immunotherapy of this disease. These studies have been published in The New England Journal of Medicine (October 1992), Blood (May 1997), and Nature Medicine (October 1999). In the treatment of cancer, residual tumor cells remaining in the patient after completion of surgery or anti-tumor therapy are often the cause of tumor relapse. These residual tumor cells cannot always be detected by standard imaging techniques but their destruction may be feasible by active immunotherapy. The use of such vaccines differs from traditional cancer treatment in that the ultimate mechanism of action against the tumor is indirect: the anti-tumor immunity induced by vaccination, rather than the vaccine itself, is ultimately responsible for treatment benefit.

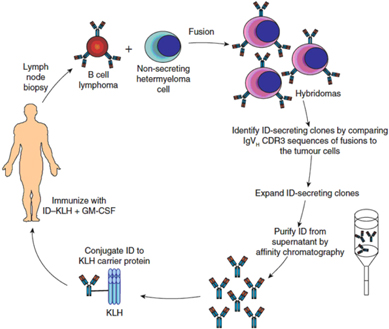

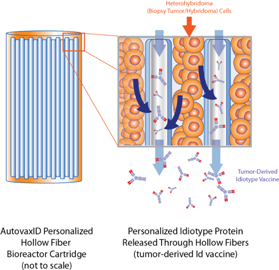

In 1994, the NCI filed for initiation of an IND for the purpose of conducting clinical trial(s) investigating the use of BiovaxID in NHL. Under this IND, the NCI began in 1994 a Phase 2 clinical trial in FL; in 1999, the Phase 3 clinical trial in FL; and in 2000 a Phase 2 clinical trial in MCL. The NCI selected Biovest to produce the vaccine for the initial Phase 2 clinical trial in FL. In 2001, Biovest entered into a formal cooperative research and development agreement (CRADA) with the NCI which formalized Biovest’s collaboration with the NCI. The IND filed by the NCI was formally transferred to Biovest in April 2004, which made Biovest the exclusive sponsor of the IND with full rights to complete the NCI-initiated Phase 3 clinical trial in FL and the NCI-initiated Phase 2 clinical trial in MCL, to communicate and negotiate with the FDA relating to marketing approval for BiovaxID and to conduct other clinical studies in NHL under the IND.

BiovaxID Clinical Trials

Phase 2 Clinical Trial of BiovaxID for Treatment of Follicular Lymphoma (FL)

In 1994, the Phase 2 clinical trial was commenced by the NCI to evaluate the ability of BiovaxID to eradicate residual lymphoma cells in 20 patients with FL who were in chemotherapy-induced first clinical complete remission. All 11 patients with a detectable lymphoma gene sequence (translocation) in their primary tumors had cells from the malignant clone detectable in their blood by DNA polymerase chain reaction (PCR) analysis both at diagnosis and after chemotherapy, despite being in complete remission. In this clinical trial, molecular remission was defined as patients lacking any detectable residual cancer cells bearing the translocation as determined by a very sensitive PCR technique. After vaccination, 8 of 11 patients converted to lacking cells in their blood from the malignant lymphoma clone detectable by PCR. Anti-tumor T-cell responses were found in the vast majority of the patients (19 of 20 patients), whereas anti-tumor antibodies were detected, but apparently were not required for molecular remission. Vaccination was thus associated with clearance of residual tumor cells from the blood and long-term disease-free survival. The demonstration of molecular remissions and uniform, specific T-cell responses against lymphoma tumor targets, as well as the addition of granulocyte–monocyte colony-stimulating factor (GM-CSF) to the vaccine formulation provided the rationale for the initiation of a larger Phase 3 clinical trial at the NCI in 2000. These results were published in Nature Medicine (October 1999).

Phase 2 Clinical Trial of BiovaxID for Treatment of Mantle Cell Lymphoma (MCL)

In 2000, the NCI initiated a Phase 2 open-label clinical trial (NCT00020215) of BiovaxID for the treatment of MCL. This Phase 2 clinical trial was based upon the NCI’s Phase 2 clinical trial in FL. The primary objective of this Phase 2 clinical trial was to study BiovaxID in treatment-naïve patients with MCL and to determine the safety and efficacy of BiovaxID following a rituximab-based immunotherapy. Twenty-six patients with untreated, mostly (92%) stage IV MCL, were enrolled. All patients received six cycles of EPOCH-R (which is an chemo-immunotherapy consisting of etoposide, prednisone, vincristine, cyclophosphamide, doxorubicin, rituximab); 92% of the patients achieved complete response (CR) and 8% achieved partial response (PR). All but 3 patients (i.e., due to disease progression or inability to manufacture the vaccine) received BiovaxID together with KLH on day 1, along with GM-CSF (100 µg/m2/day) on days 1-4 at 1, 2, 3, 4, and 6 months starting at least 3 months post-chemotherapy.

14

The results of NCI’s MCL Phase 2 clinical trial were reported in Nature Medicine (August 2005). As reported in Nature Medicine, after a median follow-up of 46 months, the OS was 89%, the median event-free survival (EFS) was 22 months, and five patients remained in continuous first CR. Antibody responses to immunization were detected in 30% of the patients, following a delayed pattern (i.e., detected mostly after the 4-5th vaccination) which paralleled the peripheral blood B-cell recovery. Most importantly, specific CD4+ and CD8+ T-cell responses were detected in 87% of patients post-vaccine, and in 7 of 9 patients tested these responses were detected after the 3rd vaccination when peripheral B-cells were by and large undetectable. The detected cytokine release response included GM-CSF, INF-g, and TNF-a (type I). In this study, BiovaxID induced both humoral and cellular immune responses following almost complete depletion of B-cells following rituximab-containing chemotherapy. The adverse events observed in this trial were minimal and comparable to the toxicities observed in the FL studies. These were limited mostly to injection site reactions, similar to those reported in the Phase 2 and Phase 3 FL clinical trials.

Phase 3 Clinical Trial of BiovaxID for Treatment of Follicular Lymphoma (FL)

Overview and Objectives. In January 2000, the Phase 3 clinical trial in FL was initiated by the NCI. The Phase 3 clinical trial was a multi-center, double-blind, randomized, controlled clinical trial that was designed to confirm the results reported in the NCI’s Phase 2 clinical trial.

As studied in the Phase 3 clinical trial, BiovaxID consisted of the patient-specific idiotype protein (Id) derived from the patient’s cancer cells conjugated or combined with keyhole limpet hemocyanin (KLH immunogenic carrier protein) and administered with granulocyte-monocyte colony stimulating factor (which is known as GM-CSF and which is a biological response enhancer). The comparator studied in the Phase 3 clinical trial was a control vaccine consisting of keyhole limpet hemocyanin (KLH) and administered with granulocyte-monocyte colony stimulating factor (GM-CSF; a biological response enhancer). Accordingly, the only difference between BiovaxID and the control vaccine was the inclusion of the idiotype protein from the patient’s own tumor in BiovaxID. BiovaxID or control vaccine were administered following chemotherapy (also referred to as induction therapy) with a drug combination referred to as PACE. Induction therapy represents the “first-line” treatment for FL patients and attempts to induce complete tumor remission as defined by radiological evidence (CT scans). In FL, patients treated with the current standard of care often achieve complete remission but these remissions almost always are of limited duration and most treated patients must eventually be re-treated for their disease. In the majority of cases, however, even with re-treatment, the disease often relapses and develops resistance to therapy, leading to a need for bone marrow transplant and eventually resulting in the death of the patient. In the Phase 3 clinical trial, patients who achieved complete response following induction therapy were assigned to a limited waiting period prior to vaccination to allow for immune reconstitution following the induction chemotherapy. Patients who relapsed during this immune reconstitution period did not receive either BiovaxID or control treatment. Patients who maintained their complete remission following this immune recovery period received either BiovaxID or control administered as five subcutaneous injections monthly over a six month period (one month was skipped).

The primary objectives of the Phase 3 clinical trial were to confirm the safety and efficacy of BiovaxID in two predefined groups:

| (1) | All Randomized Patients: all randomized patients (the “Randomized Patients”) including patients who completed initial chemotherapy but relapsed and did not receive either BiovaxID or control. |

| (2) | All Treated Patients: the Randomized Patients who were disease-free at the time of vaccination and consequently received at least one dose of BiovaxID or control. |

The secondary objectives of the Phase 3 clinical trial included: (1) to determine the ability of BiovaxID to produce a molecular complete response in subjects in clinical complete response, but with polymerase chain reaction (PCR) evidence of residual disease after standard chemotherapy; (2) to determine the impact of BiovaxID on molecular remission in FL patients; (3) to evaluate the ability of BiovaxID to generate an immune response against autologous tumor; (4) to determine and compare the overall survival (OS) of subjects randomized to receive either treatment assignment; and (5) to evaluate the safety of BiovaxID administered with GM-CSF.

Biopsy, Chemotherapy, and Immune Recovery. Prior to chemotherapy, a small tumor biopsy was performed to obtain tissue for tumor classification and characterization, and to provide starting material necessary to manufacture BiovaxID. Following this biopsy patients were initially treated with PACE chemotherapy (a combination of prednisone, doxorubicin, cyclophosphamide, etoposide) in order to induce a complete response (CR) or a complete response unconfirmed (CRu) as measured by CT radiological scans.

15

The trial protocol stipulated that for all patients, an Immune Recovery Period of approximately 6 months following completion of chemotherapy was required to be completed without relapse before vaccination. The Immune Recovery Period was required in order to maximize the potential for immune response to vaccine and to avoid confounding factors from any potential lingering immunosuppressive effects of chemotherapy.

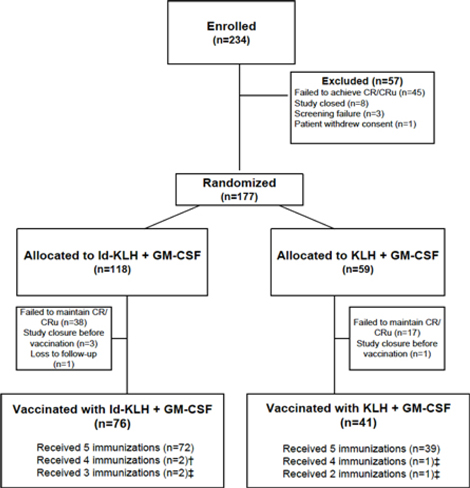

Randomization to Immune Recovery Followed by BiovaxID or Control. When the NCI designed the Phase 3 clinical trial protocol, a decision was made to randomize patients immediately after completion of chemotherapy and to not wait for the completion of the Immune Recovery Period in an effort to avoid expending NCI resources to manufacture patient-specific vaccines for patients who were not anticipated to receive the vaccine (e.g., control patients). In the Phase 3 clinical trial, of 234 patients initially enrolled into the clinical trial, 177 patients completed chemotherapy successfully and were randomized.

As per the design of the study, patients who relapsed during the Immune Recovery Period were excluded from treatment with BiovaxID or control notwithstanding the fact that they had been randomized. In the clinical trial, of the 177 initially randomized patients, 117 remained eligible to be treated with either BiovaxID (76 patients) or control (41 patients) at the end of the Immune Recovery Period. Sixty patients of the 177 randomized patients relapsed during the Immune Recovery Period and were not treated with either BiovaxID or control (Figure 2).

Figure 2: Flow Diagram of Phase 3, double-blind, randomized clinical trial of patient-specific vaccination with BiovaxID + GM-CSF in first complete remission. 234 patients were enrolled at 14 centers and assessed for eligibility. Of those enrolled, 57 were excluded from randomization for reasons indicated. 177 patients were randomized (ITT population), of which 118 were allocated to the BiovaxID (Id-KLH + GM-CSF) arm (treatment) and 59 were allocated to the KLH + GM-CSF arm (control). Patients that failed to remain in CR/CRu (60 total) did not receive either vaccine. As a result, 76 patients were vaccinated with Id-KLH + GM-CSF and 41 were vaccinated with KLH + GM-CSF, comprising the modified ITT (mITT) population. Patients receiving less than 5 immunizations either withdrew from the study or relapsed before completion.

16

Trial Enrollment and the Use of Rituximab-Containing Induction Chemotherapy. During the course of the Phase 3 clinical trial, the standard of care for induction chemotherapy in FL changed to include rituximab, which reduced the ability to recruit and enroll patients into the study. In order to facilitate enrollment in the clinical trial, Biovest amended the study protocol in 2007 to permit the use of a rituximab-containing chemotherapy regimen (CHOP-R), as induction therapy. However, the FDA requested that Biovest abstain from vaccinating any patients who received CHOP-R and Biovest did not vaccinate any of the patients who received CHOP-R chemotherapy under the clinical trial protocol.

Due to the protracted enrollment, the clinical trial’s Independent Data Monitoring Committee (DMC; a committee responsible for reviewing the available unblinded clinical trial data in the study and responsible for recommendations to the sponsor and the FDA) recommended an interim analysis of the clinical trial’s endpoints and overall safety profile which resulted in the termination and halting of the trial in 2008.

As of April 15, 2008, when the clinical trial was officially closed, a total of 234 subjects had been enrolled and 177 subjects had been randomized in the Phase 3 clinical trial, which was less than the original clinical trial plan which called for 629 subjects to be enrolled and 540 to be randomized. While the termination of the clinical trial before completion of the planned accrual resulted in a smaller sample size than was originally intended, Biovest believes that the randomized nature of Biovest’s clinical trial yields a valid conclusion because the baseline characteristics of the patients in the two groups were balanced, the allocation to treatment arms was concealed, and the study was double-blinded.

17

Results of Phase 3 Clinical Trial

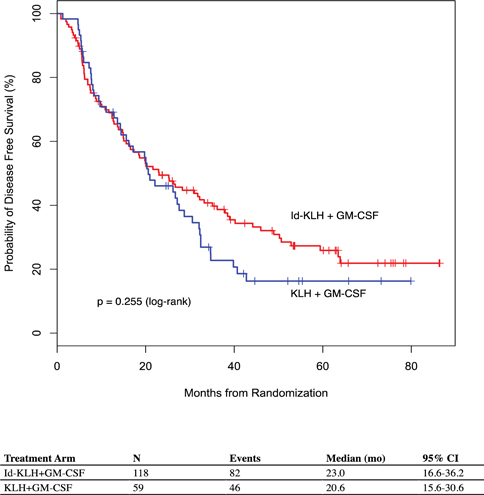

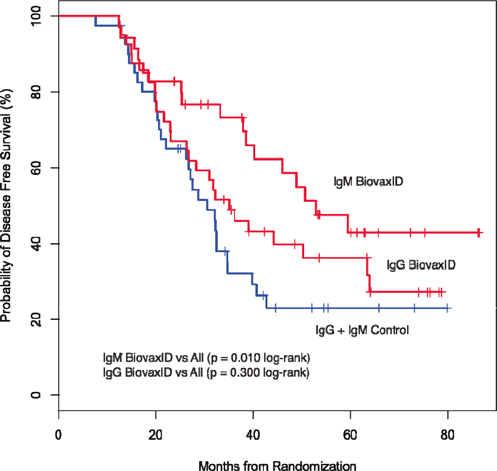

As reported at the plenary session of the Annual Meeting of the American Society of Clinical Oncology (ASCO 2009, Orlando, FL), the patient cohort of the 177 All Randomized patients (which included 117 (66%) Treated Patients and 60 (35%) patients who were not treated) did not demonstrate statistically significant difference in median DFS from randomization between treatment and control arms.

Figure 3. Disease-free survival (DFS) according to study group for all randomized patients (N = 177). Kaplan-Meier actuarial curves for DFS for all randomized patients are shown according to their study group of Id-KLH+GM-CSF (N = 118) or KLH+GM-CSF (N = 59). The number of events, median, and 95% confidence intervals for each group are also presented.

18

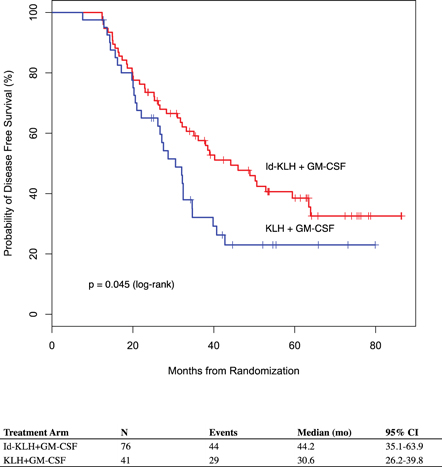

At ASCO, Biovest further reported the median DFS data for the patients who received at least one vaccination either with BiovaxID or control. In this cohort of 117 patients, which represents a modified intent-to-treat population, median DFS was 13.6 months longer in patients who received BiovaxID compared to patients who received control. This analysis reflects the prospectively defined primary clinical trial objective. Accordingly, there were 60 patients who were randomized but who did not receive either BiovaxID or control and who are not included in this analysis. Of these 117 treated patients, 76 patients received at least one dose of BiovaxID (referred to as the BiovaxID Arm) and 41 patients received at least one dose of control (referred to as the Control Arm). No serious adverse events were reported in either the BiovaxID Arm or the Control Arm. At the median follow-up of 56.6 mo (range 12.6-89.3 mo), a statistically significant improvement of 13.6 months was observed in DFS between patients in the BiovaxID Arm (44.2 mo), versus the Control Arm (30.6 mo) (log-rank p-value = 0.045; HR = 1.6). Using a Cox proportional-hazard model, a statistically significant hazard ratio (HR) of 0.62 was achieved (p=0.048; 95% CI: 0.39, 0.99). This means that patients receiving BiovaxID experienced an approximately 61% (1/0.62) lower risk of cancer recurrence compared to patients who received the control vaccine. The Phase 3 clinical trial’s secondary endpoint of overall survival (OS) has not yet been reached for either group due to the length of follow-up to date.

Figure 4. Disease-free survival (DFS) according to study group for the randomized patients who received blinded vaccinations (N = 117). Kaplan-Meier actuarial curves for DFS for the randomized patients who received at least one dose of the Id-KLH+GM-CSF (N = 76) or KLH+GM-CSF (N = 41) are shown. The number of events, median, and 95% confidence intervals for each group are also presented.

19

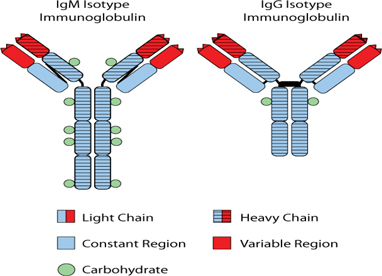

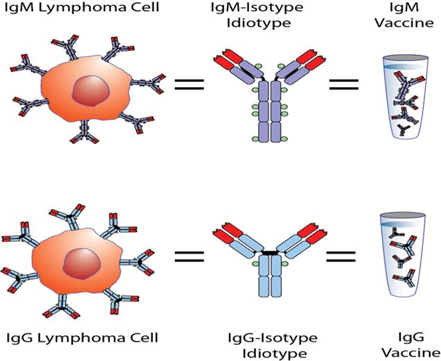

Analysis of Patients by Isotype. A typical antibody (immunoglobulin), including the lymphoma idiotype expressed on the surface of each cancerous lymphoma cell, is composed of protein “heavy chains” and “light chains”. In humans, the heavy chains are classified as IgG, IgM, IgA, IgD and IgE, and the light chains are classified as either kappa or lambda. The Id protein expressed on the surface of FL cells is an immunoglobulin protein characteristic of the single B-cell from which the tumor arose. The immunoglobulin protein contains a region known as the “heavy chain” and a region known as the “light chain” (Figure 5). Almost always in FL, the heavy chain region is characterized as either an IgM-isotype or an IgG-isotype. Figure 5 below illustrates the dramatic differences in the structure of immunoglobulin protein characterized as an IgM-isotype as opposed that characterized as an IgG-isotype. Accordingly, an antibody may be referred to as IgG-isotype or IgM-isotype depending on its heavy-chain classification. In the normal immune response, antibody isotypes may have different roles and may help direct the appropriate immune response. The small region at the tip of the antibody is known as the “variable region”, or antibody binding site, and the balance of the isotype is known as the “constant region”. When Biovest manufactures BiovaxID, Biovest screens each patient’s tumor cells obtained by biopsy for the isotype. Approximately 60% of patients with FL are diagnosed with tumors expressing an IgM isotype and approximately 40% of patients bear tumors expressing an IgG isotype. In rare cases (<1%), patients are diagnosed with another isotype (e.g. IgA). Infrequently, the patient’s tumor also contains cells with one or more isotype (a heterogenous or “mixed” isotype); in these patients we select either an IgG or IgM isotype for manufacture of BiovaxID. Each patient’s tumor isotype can be readily determined by standard analytical techniques (flow cytometry) at the time of the patient’s tumor biopsy. In both the Phase 2 and Phase 3 clinical trials, the determination of tumor heavy-chain isotype determined the specific manufacturing and purification process used to make that patient’s vaccine. For patients who have tumors expressing an IgG (or an IgG-containing “mixed” isotype), we manufacture an IgG isotype vaccine and for patients determined to have tumors expressing an IgM (or an IgM-containing “mixed” isotype), we manufacture an IgM vaccine. Due to Biovest’s manufacturing process (rescue fusion hybridoma), the isotype (IgG or IgM) of the tumor is directly reproduced in each patient’s vaccine so that each patient’s BiovaxID vaccine matches the patient’s original tumor isotype (IgG or IgM).

Figure 5: The Id protein expressed on the surface of FL cells is an immunoglobulin protein characteristic of the single B-cell from which the tumor arose. The immunoglobulin protein contains a region known as the “heavy chain” and a region known as the “light chain”. Almost always in FL, the heavy chain region is characterized as either an IgM-isotype or an IgG-isotype. The figure illustrates the dramatic differences in the structure of immunoglobulin protein characterized as an IgM-isotype as opposed that characterized as an IgG-isotype.

20

Preclinical data indicates that the ability to develop an immune response differs between IgM-isotype and IgG-isotype idiotypes. The IgG-isotype idiotype was reported to be tolerogenic, meaning that the immune response against the specific tumor target is suppressed. On the other hand, the IgM-isotype idiotype was reported to be highly immunogenic, meaning that it induces an ample, persistent immune response against the specific tumor target. The unique feature of Biovest’s trial- the manufacturing and administration of tumor-matched isotype idiotype vaccines- allowed Biovest to investigate whether these preclinical data translate into differential clinical efficacy of the two isotype vaccines in Biovest’s clinical trial.

Figure 6. The vaccines produced for each individual patient consist of the tumor idiotype with the same isotype as the tumor cells from which the vaccine was produced. Therefore, patients with IgM isotype tumors received IgM vaccine, and patients with IgG isotype tumors received IgG vaccine manufactured from their own tumor cells.

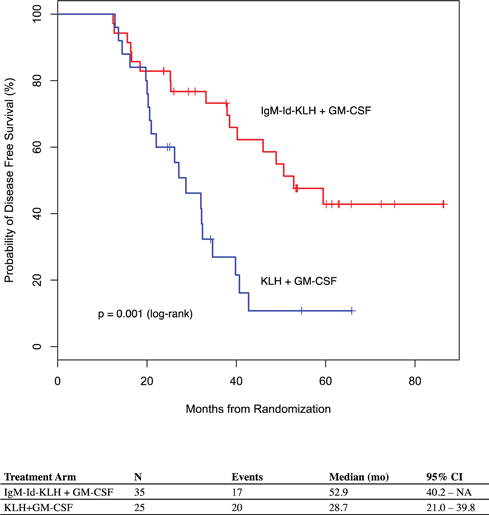

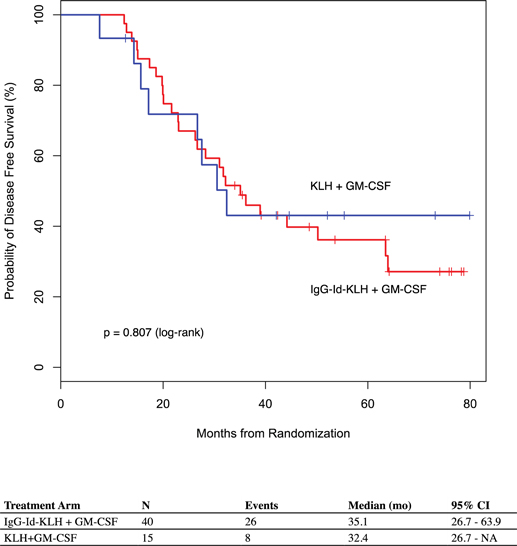

Biovest analyzed differences in median DFS in vaccinated patients in our Phase 3 clinical trial separately by tumor isotype. There were 35 IgM isotype patients who received BiovaxID and 25 IgM isotype patients who received control. There were 40 IgG isotype patients who received BiovaxID and 15 IgG isotype patients who received control. Two patients had mixed IgM/IgG biopsy isotypes and were excluded from this analysis. The baseline characteristics of the patients who received either IgM or IgG vaccine were balanced between each respective BiovaxID and control group.