Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - REGAL BELOIT CORP | d8k.htm |

| EX-99.1 - NEWS RELEASE OF REGAL BELOIT CORPORATION DATED DECEMBER 13, 2010 - REGAL BELOIT CORP | dex991.htm |

John

M. Perino Vice President

Investor Relations

December 13, 2010

Charles A. Hinrichs

Vice President

Chief Financial Officer

Mark J. Gliebe

President

Chief Operating Officer

Henry Knueppel

Chairman

Chief Executive Officer

Regal Beloit’s acquisition of A.O. Smith’s

Electrical Products Company

A Strategically Important

Acquisition

Exhibit 99.2 |

1

Safe Harbor Statement

This presentation

contains

“forward-looking

statements”

as

defined

in

the

Private

Securities

Litigation

Reform Act of 1995.

Forward-looking statements represent our management’s judgment regarding

future events. In many cases, you can identify forward-looking statements by

terminology such as “may,”

“will,”

“plan,”

“expect,”

“anticipate,”

“estimate,”

“believe,”

or “continue”

or the negative of these terms or other similar words.

Actual results and events could differ materially and adversely from those contained in

the forward-looking statements due to a number of factors, including:

our

ability

to

timely

and

successfully

consummate

the

acquisition

of

EPC,

including

the

ability

to

satisfy

all

of

the

conditions

precedent

to

consummation

of

the transaction;

our

ability

to

timely

and

successfully

realize

the

potential

synergies

of

the

EPC

transaction;

economic

changes

in

global

markets where we

do business, such as reduced demand for products we sell, weakness in the housing and

commercial real estate markets, currency exchange rates, inflation rates,

interest rates, recession, foreign government policies and other external factors that we cannot control; unanticipated fluctuations in commodity prices

and raw material costs; cyclical downturns affecting the global market for capital

goods; unexpected issues, costs or liabilities arising from the acquisition and

integration of

EPC

and

other

acquired

companies

and

businesses,

or

the

effects

of

purchase

accounting

that

may

be

different

than

expected;

marketplace acceptance of new and existing products including the loss of, or a decline

in business from, any significant customers; the impact of capital market

transactions that we may effect; the availability and effectiveness of our information technology systems; unanticipated costs associated with

litigation matters; actions taken by our competitors, including new product

introductions or technological advances, and other events affecting our industry

and competitors; difficulties in staffing and managing foreign operations; other

domestic and international economic and political factors unrelated to our

performance, such as the current substantial weakness in economic and business

conditions; and other risks and uncertainties including but not limited to those

described in Item 1A-Risk Factors of the Company’s Annual Report on Form 10-K filed on March 2, 2010 and from time to time in our reports filed with

U.S.

Securities

and

Exchange

Commission.

All

subsequent

written

and

oral

forward-looking

statements

attributable

to

us

or

to

persons

acting

on

our

behalf

are expressly qualified in their entirety by the applicable cautionary

statements. The forward-looking statements included in this presentation are made only

as of

their

respective

dates,

and

we

undertake

no

obligation

to

update

these

statements

to

reflect

subsequent

events

or

circumstances.

See

also

Item 1A -

Risk Factors in the Company’s Annual Report on Form 10-K filed on March

2, 2010. The financial data prior to fiscal 2009 included in this

presentation have not been adjusted for our adoption of Financial Accounting Standards Board Staff

Position APB 14-1, "Accounting for Convertible Debt Instruments that May Be

Settled in Cash Upon Conversion (Including Partial Cash Settlement)," the

effects of which are described in Note 2 to our Condensed Consolidated Financial

Statements in our Quarterly Report on Form 10-Q for the Quarterly Period

Ended August 6, 2010. |

2

Agenda

Transaction overview

Overview of A.O. Smith Electrical Products Company

Transaction rationale and analysis

Questions |

3

Overview of Regal Beloit’s acquisition of EPC

Acquiror

Regal Beloit Corporation

Target

Electrical Products Company (“EPC”) of A.O. Smith Corporation

Consideration

$875 million

–

$700 million of cash

–

$175 million of RBC stock

–

2,834,026 shares based on the 10-day volume weighted share price

of $61.7496

Projected Synergies

and Tax Benefit

Targeted

synergies

of

$30

million

to

$40

million

achieved

over

3

to

4

years

Tax benefits expected to be at least $45 million to $55 million

Projected Earnings

Impact

Accretive in the first full year following the acquisition excluding

one- time transaction-related expenses and purchase accounting

adjustments |

4

Acquisition in line with strategic objectives

The Acquisition Of EPC Consistent With Regal Beloit’s Strategy

Objective

Increase revenues

by 15% annually

Objective

Improve

profitability

Objective

Improve customer

experience

Materially increases RBC top line

Additional channels to drive energy efficient technology

Approximately 150 unique patents

$30 million to $40 million of projected synergies

Provides meaningfully greater scale

EPC has improved profitability over the last two years

Allows RBC to offer a more complete suite of products and technologies to its

customers

Combined energy efficient technology provides ability to deliver

additional

value

to customers |

5

EPC

Key facts and figures

General

Industries

8%

Pump

16%

HVAC&R

21%

Hermetic

31%

Distribution

24%

Revenue distribution (based on 2010E):

7,800 employees as of 9/30/10

$688 million of revenue for LTM 9/30/10

Headquarters: Tipp City, Ohio

Manufacturing footprint: Global in low-cost regions

|

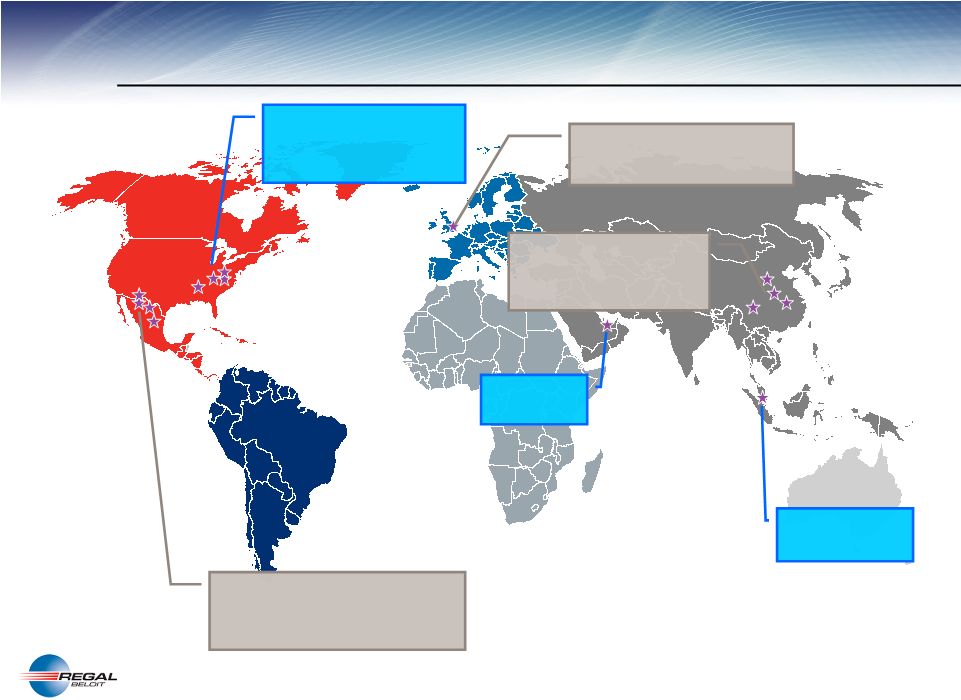

EPC’s

Low Cost Manufacturing Footprint

United States

Headquarters, 2 Manufacturing Facilities, 2

Distribution Facilities

.

751 Employees

Gainsborough, United Kingdom

Manufacturing Facility

91 Employees

China

3 Manufacturing Facilities, 1 Procurement

Office

2,317 Employees

Dubai, UAE

Sales Office

3 Employees

Singapore

Sales Office

4 Employees

Mexico

13 Manufacturing Facilities, 1 Center of Excellence, 1

Warehouse

4,693 Employees

6 |

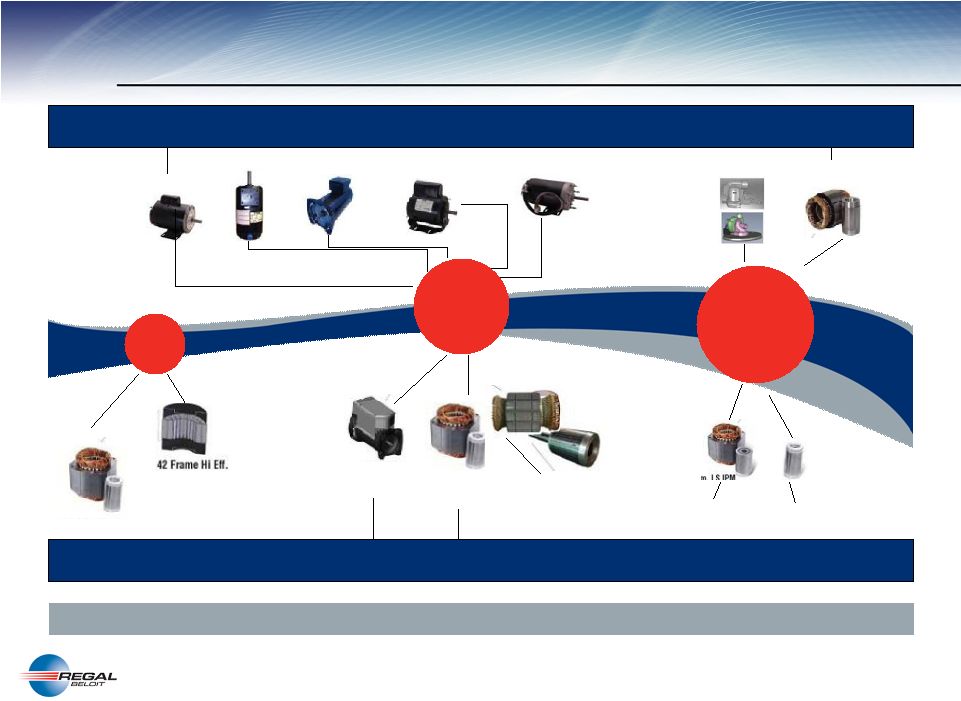

7

EPC’s

Track Record of New Products

New Products That Meet Customer Needs and Fuel Growth

2010

Commercial

Oil Fryer

Commercial

Rolled Steel

Residential

Pool

Commercial

Gate Operator Motor

Commercial

Garage Operator Motor

Residential

Commercial

A/C Compressor

2009

GI-Oil Circulator

IP55

Guardian

GI-Gate

Opener Motor

GI-SX Garage Door

Opener Motor

Power Vent

Water Heater Blower

Herm. VS IPM

2008

Residential

A/C Compressor

Res. –

A/C System

& Furnace Blower

Commercial

A/C Compressor

Residential

Pool

Residential

A/C Compressor

Residential

A/C Compressor

Residential

A/C Compressor

42 Frame Hi Eff.

Pump

56 Frame

Premium Eff.

Hermetic

1,500 HP –

13,800 Volts

Herm LS IPM

Herm. VS

IPM |

8

EPC: A Leader in Hermetic motors

Segment Commentary

Key Applications

Select Products

Leading independent supplier of hermetic motors

Strong relationships with leading customers in the industry

Supplier to a number of key OEM residential and

commercial HVAC&R industry participants

Strong global platform of commercial hermetic motors sold

throughout China, Japan, Europe and North America

Manufactured in Mexico and China

New variable speed capability for energy efficiency

Expected growth rates: 13.4% in 2010E & 11.8% in 2011E

Screw compressors

Reciprocating compressors

Scroll compressors

Centrifugal compressors |

9

EPC financial summary

($ in millions)

Electrical Products Company

Year ended

December 31,

Nine months

ended September 30,

LTM

September 30,

2009

2009

2010

2010

Sales

$620.4

$472.0

$539.4

$687.8

Adj. EBITDA

$62.5

$52.0

$87.3

$97.8

% Margin

10.1%

11.0%

16.2%

14.2%

Adj. Income from Operations

$33.0

$29.9

$67.6

$70.7

% Margin

5.3%

6.3%

12.5%

10.3%

Capex

$14.3

$10.5

$10.4

$14.2

% of Sales

2.3%

2.2%

1.9%

2.1%

Source:

Public filings and A.O. Smith management. |

10

Combination creates compelling value

Strong Cultural Fit And Similar Manufacturing Footprint Facilitates

Integration Increases scale

Complementary product

offerings

Creates shareholder

value

Builds upon strong product offering

Augments presence in low cost manufacturing locations

Talented management

Highly complementary products

Commercial and Residential Hermetic

Aftermarket and general industry distribution

Accretive in the first full year following the acquisition, excluding

one- time transaction-related expenses and purchase accounting

adjustments

Strategically deploys cash and utilizes debt capacity

Generates significant Free Cash Flow |

11

$35.0

$35.0

$30.0

$20.0

$10.0

YR 1

YR 2

YR 3

YR 4

YR 5

$30 million to $40 million of synergies

Anticipated Gross Synergies

Anticipated Integration costs

Explanation of synergies

Procurement Synergies

Logistics Synergies

Manufacturing Synergies

Revenue Synergies

Regal Beloit Projects Meaningful Synergies Resulting From The Acquisition Of

EPC ($ in millions)

$5.8

$2.2

$2.2

$0.0

$0.0

YR 1

YR 2

YR 3

YR 4

YR 5

($ in millions)

Explanation of integration costs

Expense

Capital |

12

Financial impact of combination

Combined Company Will Have Ability To Rapidly De-lever

($ in millions)

Pro Forma LTM 9/30/10 Financial Data

RBC

+

EPC

=

PF RBC

Sales

$2,146

$688

$2,833

Adj. EBITDA

$326

$98

$424

% Margin

15.2%

14.2%

15.0%

Capex

$38

$14

$52

% of Sales

1.8%

2.1%

1.8%

Free cash flow

$288

$84

$372

Total Debt

$433

$600

$1,033

Shareholder's Equity

$1,348

$175

$1,523

Total Debt / Capital

24.3%

40.4%

Source:

Public filings and A.O. Smith management.

(1)

Calculated as EBITDA less capex.

(2)

Assumes $600 million of new debt and $175 million of new equity issued in

connection with the transaction. (2)

(2)

(1) |

13

Regal Beloit and EPC: A Strong Combination

Nearly $3 billion of combined revenue and over $400 million of EBITDA in

2010E Broader reach with complementary product offerings

Combined technology offers additional value to customers

Additional channels to drive energy efficient technology

Global, low-cost manufacturing footprint

Combined management strength with deep bench

Creates meaningful shareholder value through accretion and significant Free Cash

Flow |

14 |

15

Adjusted EBITDA reconciliation –

EPC

($ in millions)

Electrical Products Company

Year ended

December 31,

Nine months

ended September 30,

LTM

September 30,

2009

2009

2010

2010

Income from Operations

$32.5

$27.5

$61.9

$66.9

Adjustments

Hedges

3.0

3.0

–

–

Inventory & LIFO

(6.8)

(2.1)

3.4

(1.3)

Restructuring & Other

4.3

1.5

2.3

5.1

Total Adjustments

0.5

2.4

5.7

3.8

Adjusted Income from Operations

$33.0

$29.9

$67.6

$70.7

D&A

29.5

22.1

19.7

27.1

Adjusted EBITDA

$62.5

$52.0

$87.3

$97.8

Source:

Public filings and A.O. Smith management. |

16

Adjusted EBITDA reconciliation –

RBC

Regal Beloit

Corporation

LTM September 30,

2010

Income from Operations

$253.0

D&A

72.9

Adjusted EBITDA

$325.9

Source:

Public filings.

($ in millions) |