Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

ANNUAL REPORT

PURSUANT TO SECTIONS 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

(Mark One)

|

x

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended September 26, 2010

OR

|

o

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from to

Commission file number 1-16699

OVERHILL FARMS, INC.

(Exact name of registrant as specified in its charter)

|

Nevada

|

75-2590292

|

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification Number)

|

|

|

|

|

|

|

2727 East Vernon Avenue

|

|

|

|

Vernon, California

|

90058

|

|

|

(Address of principal executive offices)

|

(Zip code)

|

Registrant’s telephone number, including area code: (323) 582-9977

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Name of each exchange on which registered

|

|

|

|

|

|

|

Common Stock, par value $0.01

|

NYSE AMEX

|

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large Accelerated Filer o

|

Accelerated Filer o

|

|

Non-Accelerated Filer o

|

Smaller Reporting Company x

|

(Do not check if smaller reporting company)

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

The aggregate market value of voting common equity held by non-affiliates of the registrant, on March 26, 2010, which was the last trading day of the registrant’s second fiscal quarter ended March 28, 2010, was approximately $59.1 million based on a closing price of $6.01 per share on such date on the NYSE AMEX. For purposes of this computation, all executive officers, directors and 10% beneficial owners of the registrant are deemed to be affiliates. Such determination should not be deemed an admission that such executive officers, directors and 10% beneficial owners are affiliates. The registrant has no non-voting common equity.

There were 15,823,271 shares of common stock, par value $0.01, outstanding as of December 8, 2010.

Documents Incorporated By Reference: None

TABLE OF CONTENTS

|

PART I

|

||||

|

Item 1

|

1

|

|||

|

Item 1A

|

3

|

|||

|

Item 1B

|

7

|

|||

|

Item 2

|

7

|

|||

|

Item 3

|

8

|

|||

|

Item 4

|

9

|

|||

|

PART II

|

||||

|

Item 5

|

10

|

|||

|

Item 6

|

12

|

|||

|

Item 7

|

13

|

|||

|

Item 7A

|

24

|

|||

|

Item 8

|

24

|

|||

|

Item 9

|

24

|

|||

|

Item 9A

|

24

|

|||

|

Item 9B

|

25

|

|||

|

PART III

|

||||

|

Item 10

|

26

|

|||

|

Item 11

|

29

|

|||

|

Item 12

|

37

|

|||

|

Item 13

|

39

|

|||

|

Item 14

|

41

|

|||

|

PART IV

|

||||

|

Item 15

|

42

|

|||

|

45

|

||||

CAUTIONARY STATEMENT

All statements included or incorporated by reference in this Annual Report on Form 10-K, other than statements or characterizations of historical fact, are forward-looking statements. Examples of forward-looking statements include, but are not limited to, statements concerning projected net revenues, costs and expenses and gross margins; our accounting estimates, assumptions and judgments; our success in pending litigation; the demand for our products; the availability and pricing of commodities; the competitive nature of and anticipated growth in our industry; manufacturing capacity and goals; our ability to consummate acquisitions and integrate their operations successfully; and our prospective needs for additional capital.

These forward-looking statements are based on our current expectations, estimates, approximations and/or projections about our industry and business, management’s beliefs, and certain assumptions made by us, all of which are subject to change. Forward-looking statements can often be identified by words such as “anticipates,” “expects,” “intends,” “plans,” “predicts,” “believes,” “seeks,” “estimates,” “may,” “will,” “should,” “would,” “could,” “potential,” “continue,” “on-going,” similar expressions, and variations or negatives of these words. These statements are not guarantees of future performance and are subject to risks, uncertainties and assumptions that are difficult to predict. Therefore, our actual results could differ materially from those expressed in any forward-looking statements as a result of various factors, some of which are listed under “Risk Factors” in Item 1A of this report. These forward-looking statements speak only as of the date of this report. We undertake no obligation to revise or update publicly any forward-looking statement for any reason, except as otherwise required by law.

PART I

|

Business

|

History

Overhill Farms, Inc. was formed in 1995 as a Nevada corporation, with the acquisition of substantially all of the assets of IBM Foods, Inc., founded in 1968. Our headquarters and manufacturing facilities are located in Vernon, California. Our products are sold nationwide.

Products and Services

We are a value-added manufacturer of high quality, prepared frozen food products for branded retail, private label, foodservice and airline customers. Our product line includes entrées, plated meals, bulk-packed meal components, pastas, soups, sauces, poultry, meat and fish specialties, and organic and vegetarian offerings. We provide custom prepared foods to a number of prominent, nationally recognized customers such as Jenny Craig, Inc., American Airlines, Inc., Safeway Inc., Pinnacle Foods Group LLC and Panda Restaurant Group, Inc.

Sales and Marketing

We operate as a single business segment – the development and production of frozen food products. We market our products through an internal sales force, outside food brokers and other business affiliations. Our customers are foodservice, retail and airline accounts.

A significant portion of our total net revenues during the last three fiscal years was derived from three customers. Panda Restaurant Group Inc., Jenny Craig, Inc. and Safeway Inc. accounted for approximately 27%, 26% and 18%, respectively, of our revenues for the fiscal year ended September 26, 2010. For the fiscal year ended September 27, 2009, Panda Restaurant Group, Jenny Craig, Inc. and Safeway Inc. accounted for approximately 22%, 25% and 17%, respectively, of our revenues. For the fiscal year ended September 28, 2008, Panda Restaurant Group, Inc., Jenny Craig, Inc. and Safeway Inc. accounted for approximately 16%, 24% and 13%, respectively, of our revenues.

Manufacturing and Sourcing

Our headquarters, entrée manufacturing and warehousing, product development, sales and quality control facilities are located at a single location in Vernon, California. We also maintain a separate protein cooking facility in Vernon, California. In 2007, we invested approximately $7.0 million in capital expenditures to expand the manufacturing capacity of our entrée plant in order to accommodate new business opportunities.

Our ability to cost-effectively produce large quantities of our products, while maintaining a high degree of quality, is partially dependent on our ability to procure raw materials on an economical cost basis. We rely on several large suppliers for products, including poultry, and we purchase the remaining raw materials from suppliers in the open market. We do not anticipate any particular difficulty in acquiring these materials in the future. We store raw materials, packaging and finished goods on-site and in public frozen and dry food storage facilities until shipment. When possible and practical, we negotiate supply contracts at fixed prices to protect against the risk of market fluctuations.

Backlog

We typically deliver products directly from finished goods inventory. As a result, we do not maintain a large backlog of unfilled purchase orders. While at any given time there may be a small backlog of orders, our backlog is not material in relation to our total revenues, nor is it necessarily indicative of trends in our business.

Competition

Our products compete with those produced by numerous regional and national firms. Many of these competitors are divisions of larger, highly integrated companies. Competition is strong, with many firms producing alternative products for the foodservice and retail industries. Competitive factors include price, food safety standards, product quality, flexibility, product development, customer service and, on a retail basis, name recognition. We are competitive in this market as a result of our ability to produce mid-sized to large custom product runs within a short time frame on a cost-effective basis and our ability to provide ancillary support services such as research and development, assistance with regulatory matters, production planning and logistics.

Product Development and Marketing

We maintain a comprehensive, fully staffed research and development department that formulates recipes and upgrades specific products for current and prospective customers and establishes production and quality standards. We develop products based upon customer specifications, conventional recipes, new product trends or our own product initiatives. We are continuously developing recipes as customers’ tastes and client requirements change. We also maintain a quality control department for inspection, testing, monitoring and compliance to ensure that our products are produced consistently in accordance with our standards. In May 2010, our food safety systems were certified as meeting the standards of FSSC 22000: 2010, which is the latest and most complete safety certification standard for food manufacturers.

Intellectual Property

We have registered the “Overhill Farms” and “Chicago Brothers” trademarks with the United States Patent and Trademark Office. Also, during fiscal year 2008, we entered into a five-year licensing agreement with Better Living Brands tm Alliance (“Alliance”) for the exclusive right to produce and sell frozen entrées under the Eating Right tm and O Organics tm brands.

Subsequent to fiscal year 2010, we entered into a five-year licensing agreement with Boston Market Corporation (“BMC”) for the exclusive right to use BMC’s trademarks, trade dress and copyrights in connection with the manufacturing, advertising, promotion, sales and distribution of frozen food and certain shelf-stable licensed products. The agreement commences on July 1, 2011.

Employees

Our total hourly and salaried workforce consisted of 768 employees at September 26, 2010. Most of our operations are labor intensive, generally requiring unskilled employees. Approximately 79% of our employees are unionized with the United Food & Commercial Workers Union, Local 770 and are covered by a three-year collective bargaining agreement that expires on March 1, 2011. We believe our relations with our employees and the union are good.

Regulation

Food manufacturers are subject to strict government regulation, particularly in the health and environmental areas, by the United States Department of Agriculture (“USDA”) and the Food and Drug Administration (“FDA”), as well as the Occupational Safety and Health Administration (“OSHA”), the Environmental Protection Agency (“EPA”) and the federal Food, Drug and Cosmetic Act. Our food processing facilities are subject to continuous on-site examination, inspection and regulation by the USDA. Compliance with the current applicable federal, state and local environmental regulations has not adversely affected our financial position, results of operations or competitive position. However, we cannot predict whether regulation by various federal, state or local governmental entities and agencies may adversely affect our future business and financial results. If a product recall were to occur, we have processes and procedures in place to assist in the recall of products. Since 1997, we have used a Hazard Analysis Critical Point Plan to ensure proper handling of all food items. In May 2010, our food safety systems were certified as meeting the standards of FSSC 22000: 2010, which is the latest and most complete safety certification standard for food manufacturers.

Additional Information

Our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended (“Exchange Act”), are available free of charge on our website at www.overhillfarms.com as soon as reasonably practicable after being filed or furnished to the Securities and Exchange Commission (“Commission”). Our reports filed with the Commission are also made available to read and copy at the Commission’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. You may obtain information about the Public Reference Room by contacting the Commission at 1-800-SEC-0330. Reports filed with the Commission are also made available on its website at www.sec.gov.

|

Risk Factors

|

Our ability to compete effectively in the highly competitive food industry may affect our operational performance and financial results.

Our continued success depends in part on our ability to be an efficient producer in the highly competitive food industry. We face competition in all of our markets from large, national companies and smaller, regional operators. Some of our competitors, including diversified food companies, are larger and have greater financial resources than we do. From time to time, we experience price pressure in some of our markets as a result of competitors’ promotional pricing practices as well as general market conditions. Our failure to match or exceed our competitors’ cost reductions through productivity gains and other improvements could weaken our competitive position. Competition is based on product quality, food safety, distribution effectiveness, brand loyalty, price, effective promotional activities, the ability to identify and satisfy emerging consumer preferences and the ability to provide ancillary support services. We may not be able to effectively compete with these larger, more diversified companies. Also, a disruption of our supply chain could impair our ability to manufacture or supply goods. In addition, products have life cycles, and as the lives of products diminish, we may not be able to replace our existing customers.

The loss or consolidation of any of our key customers could adversely affect our financial results by decreasing our existing sales opportunities and prices and increasing our marketing and promotional expenses.

The largest purchasers of our products, Panda Restaurant Group, Jenny Craig, Inc. and Safeway Inc., accounted for approximately 27%, 26% and 18%, respectively, of our total net revenues during fiscal year 2010. We expect that our sales to these customers will continue to constitute a significant percentage of our net revenues in fiscal year 2011 and beyond. The loss of any of these customers as a significant outlet for our products could adversely affect our competitive position and operating results if we do not obtain additional customers to offset any change in these accounts.

Some of our significant customer and supplier contracts are short-term and may not be renewable on terms favorable to us or at all.

Some of our customers and suppliers operate through purchase orders or short-term contracts. Though we have long-term business relationships with many of our customers and suppliers and alternative sources of supply for key items, we cannot be sure that any of these customers or suppliers will continue to do business with us on the same basis. Additionally, although we try to renew these contracts as they expire, there can be no assurance that these customers or suppliers will renew these contracts on terms that are favorable to us, if at all. The termination of, or modification to, any number of these contracts may adversely affect our business and prospects, including our financial performance and results of operations.

Financial difficulties of foodservice and retail customers due to the economic downturn may adversely affect our revenues, costs and collections.

As the domestic economic recovery continues to stall, collectability of receivables from our customers may be adversely affected, causing an increase in aged receivables and/or a reduced collection rate. Our margins could be adversely affected if we are forced to write off uncollectible accounts. In addition, the economic downturn could adversely affect the fiscal health of key customers or impair their ability to continue to operate during a recessionary period, which would decrease our revenues unless we are able to replace any lost business.

Future airline mergers or bankruptcies, additional cost-cutting in the airline industry or other financial difficulties of our airline customers may adversely affect our revenues, costs and collections.

In fiscal year 2010, sales to airline customers were approximately $8.0 million, or 4.1% of total net revenues, compared to sales of $11.1 million in fiscal year 2009 and $20.7 million in fiscal year 2008, representing 5.3% and 8.7% of total net revenues in fiscal years 2009 and 2008, respectively. Additionally, accounts receivable from airline-related customers accounted for approximately 4.8% and 4.9% of the total accounts receivable balance at September 26, 2010 and September 27, 2009, respectively. Given the financial and business challenges facing the airline industry, we carefully monitor our receivables from all of our customers in this sector. The on-going effect of these challenges on the airline industry, airline revenues, and on our business in particular cannot be accurately determined and could further adversely affect our financial position, results of operations or cash flows by, among other things, decreasing our sales to and making it more difficult to collect receivables from airline customers.

We are a major purchaser of many commodities that we use as raw materials and for packaging, and price changes for the commodities we depend on may adversely affect our profitability.

When possible, we enter into contracts for the purchase of raw materials at fixed prices, which are designed to protect us against raw material price increases during the terms of the contracts. Where appropriate, we attempt to recover our commodity cost increases by increasing prices, promoting a higher-margin product mix and creating additional operating efficiencies.

We also use materials, such as corrugated cardboard, aluminum products, films and plastics to package our products. Substantial increases in prices of packaging materials or higher prices of our raw materials could adversely affect our operating performance and financial results. In addition, transportation costs have been unpredictable. If such costs rise to the levels that were seen in fiscal year 2008, our operating margins could be eroded.

Commodity price changes may result in unexpected increases in raw materials and packaging costs, and we may be unable to increase our prices to offset these increased costs without suffering reduced volume, revenue and income. Any substantial fluctuation in the prices we pay for raw materials and packaging, if not offset by increases in our sales prices, a higher-margin product mix or additional operating efficiencies, could adversely affect our profitability.

If our food products become adulterated or misbranded, we would need to recall those items and may experience product liability claims if consumers are injured as a result.

Food products occasionally contain contaminants due to inherent defects or improper storage or handling. Under adverse circumstances, food manufacturers such as us may need to recall some of their products if they become adulterated or misbranded or as a result of a government-mandated recall.

The scope of such a recall could result in significant costs incurred as a result of the recall, potential destruction of inventory, and lost sales. Should consumption of any product cause injury, we may be liable for monetary damages as a result of a settlement or judgment against us. A widespread product recall could result in changes to one or more of our business processes, product shortages, a loss of customer confidence in our food or other adverse effects on our business.

If we are required to defend against a product liability claim, whether or not we are found liable under the claim, we could incur substantial costs, our reputation could suffer and our customers might substantially reduce their existing or future orders from us.

Concerns with the safety and quality of food products could cause customers to avoid our products.

We could be adversely affected if our customers and the ultimate consumers of our products lose confidence in the safety and quality of various food products. Adverse publicity about these types of concerns, such as the publicity about genetically modified organisms and avian influenza, whether or not valid, may discourage our customers from buying our products or cause production and delivery disruptions. Negative changes in customer perceptions about the safety and quality of products we produce could adversely affect our business and financial condition.

Our business is subject to federal, state and local government regulations that could adversely affect our business and financial position.

Food manufacturing operations are subject to regulation by various federal, state and local government entities and agencies. As a producer of food products for human consumption, our operations are subject to stringent production, packaging, quality, labeling and distribution standards, including regulations mandated by the federal Food, Drug and Cosmetic Act, the FDA, OHSA, the EPA and the USDA. Future regulation by various federal, state or local governmental entities or agencies may adversely affect our business and financial results.

In addition, our business operations and the past and present ownership and operation of our properties are subject to extensive and changing federal, state and local environmental laws and regulations pertaining to the discharge of materials into the environment, the handling and disposition of wastes (including solid and hazardous wastes) or otherwise relating to protection of the environment. We cannot predict whether environmental issues relating to presently known matters or identified sites or to other matters or sites will require currently unanticipated investigation, assessment or expenditures.

Future instability or tightening in the credit markets could impair our ability to obtain financing as and when needed.

Future instability or tightening in the credit markets could impair our ability to obtain additional credit if and when needed to finance our operations and fund future plant or business expansions. In addition, tight credit markets or inflation could eventually result in an increase in interest rates, which would adversely affect us, as we have $7.7 million in long-term debt outstanding as of December 8, 2010 under our senior secured credit facility with Bank of America, with interest rates that adjust quarterly.

If we violate our financial and other covenants under our secured credit facility, our financial condition, results of operations or cash flows may be adversely affected if secured parties foreclose on our assets or impose default rates of interest.

Our senior secured credit facility with Bank of America, under which $7.7 million was outstanding as of December 8, 2010, is secured by a first-priority lien on substantially all of our assets. The facility contains covenants whereby, among other things, we are required to maintain compliance with agreed levels of fixed charge coverage, total leverage and incremental indebtedness limits. If we violate these covenants and are unable to obtain waivers or renegotiate the terms of the covenants, we could become subject to, among other things, interest rate increases and acceleration of maturity of the facility, which could adversely affect our financial condition, results of operations or cash flows.

A change in control could result in an event of default under our secured credit facility, which could adversely affect our financial condition, results of operations or cash flows.

Our secured credit facility with Bank of America provides that a change in control would occur if, among other occurrences, any person or group becomes the beneficial owner of 35% or more of our voting stock, or certain changes in the composition of our board occur during any period of twelve consecutive months. The occurrence of a change in control could permit Bank of America to terminate the credit facility, declare all or a portion of loans then outstanding to be due and payable, and/or exercise other available rights and remedies. Depending on our financial condition at the time, we may not be able to raise sufficient funds to repay this indebtedness upon an event of default. Accordingly, the occurrence of a change in control could adversely affect our financial condition, results of operations or cash flows.

A small number of stockholders beneficially own a significant percentage of our outstanding common stock and therefore could significantly influence or control matters requiring stockholder approval.

Assuming the exercise of the aggregate options issued to our executive officers and directors to purchase shares of our common stock, our executive officers, directors and stockholders who beneficially own greater than 5% of our common stock would collectively beneficially own, in the aggregate, approximately 43% of our outstanding common stock as of December 8, 2010. These stockholders, if acting together, could be able to significantly influence or control matters requiring approval by our stockholders, including the election of directors and the approval of mergers or other business combination transactions.

Our failure to attract and retain key management personnel could adversely affect our business.

Our business requires managerial, financial and operational expertise, and our future success depends upon the continued service of key personnel. As a value-added manufacturer of quality frozen food products and custom prepared foods, we operate in a specialized industry. Our key personnel have experience and skills specific to this industry, and there are a limited number of individuals with the relevant experience and skills. Though we have an employment agreement with James Rudis, our CEO and President, the agreement permits the voluntary resignation on the part of Mr. Rudis prior to the end of the term of the agreement. If we lose any of our key personnel, our business operations could be adversely affected.

We may not be able to protect our intellectual property and proprietary rights or may become subject to claims relating to our use of our customers’ trademarks, which could harm our competitive position, resulting in decreased revenue.

We believe that our trademarks and other proprietary rights, though few in number, are important to our success and competitive position. Accordingly, we devote what we believe are adequate resources to the establishment and protection of our trademarks and proprietary rights. However, these actions may be inadequate to prevent imitation of our products by others or to prevent others from claiming violations of their trademarks and proprietary rights by us.

From time to time, we manufacture products under our customers’ trademarks. While we generally require them to agree to indemnify us in connection with our use of their trademarks, it is possible that we could face infringement actions based upon the content provided by our customers. If any of these claims are proved valid, through litigation or otherwise, we may be required to cease using the trademarks and/or pay financial damages and/or expenses for which we are not indemnified.

Our common stock price is subject to significant volatility, which could result in substantial losses for investors.

During the 52-week period ended December 8, 2010, the high and low sales prices of our common stock on the NYSE AMEX were $6.67 per share and $4.05 per share, respectively. Prices for our shares are determined in the marketplace and may accordingly be influenced by many factors, including, but not limited to:

|

|

·

|

the depth and liquidity of the market for the shares;

|

|

|

·

|

quarter-to-quarter variations in our operating results;

|

|

|

·

|

announcements about our performance as well as the announcements of our competitors about the performance of their businesses;

|

|

|

·

|

investors’ evaluations of our future prospects and the food industry generally;

|

|

|

·

|

changes in earnings estimates by, or failure to meet the expectations of, securities analysts; and

|

|

|

·

|

general economic and market conditions.

|

In addition, the stock market has been experiencing significant volatility that may be unrelated to the operating performance of the specific companies whose stock is traded. This volatility could adversely affect the trading price of our shares.

The price at which investors purchase shares of our common stock may not be indicative of the price that will prevail in the trading market. Investors may be unable to sell their shares of common stock at or above their purchase price, which may result in substantial losses.

Future sales of shares of our common stock by our stockholders could cause our stock price to decline.

We cannot predict the effect, if any, that sales of shares of our common stock or the availability of shares of common stock for sale will have on the market price prevailing from time to time. As of December 8, 2010, we had outstanding 15,823,271 shares of common stock, most or all of which were eligible for resale without registration. Also, as of December 8, 2010, there were outstanding options to purchase up to 521,000 shares of common stock. All of the shares of common stock underlying these options are covered by an existing effective registration statement. Sales of shares of our common stock in the public market, or perceptions that those sales may occur, could cause the trading price of our common stock to decrease or to be lower than it might be in the absence of those sales or perceptions.

Certain provisions of our articles of incorporation, bylaws and Nevada law could make it more difficult for a third party to acquire us, even if doing so could be in our stockholders’ best interest.

Provisions of our articles of incorporation and bylaws require that certain procedures be followed, including advance notice, before matters can be proposed for consideration at meetings of our stockholders. This may make it difficult for a potential acquirer to bring an acquisition proposal to a vote of our stockholders. In addition, our board of directors has the right to fix the rights and preferences of an issue of shares of preferred stock without stockholder action. Our board could establish and issue a series of preferred stock with rights that make an acquisition less desirable by certain potential acquirers.

Provisions of Nevada’s business combinations statute also restrict certain business combinations with interested stockholders. We have elected not to be governed by these provisions in our amended and restated articles of incorporation. However, this election may not be effective unless we meet certain conditions under the Nevada statute.

|

Unresolved Staff Comments

|

Not applicable.

|

Properties

|

We lease two manufacturing facilities in Vernon, California. In January 2002, we entered into a ten-year lease, with an option for a five-year renewal, for a facility, Plant No. 1, that has been expanded to 170,000 square feet. Most of our principal executive office, manufacturing and warehousing, product development and sales and quality control facilities have been consolidated into this single location. In December 2008, we entered into a 60-month lease, with an option for a 60-month renewal, for a facility, Plant No. 2, that has been expanded to 123,000 square feet. Plant No. 2 is used primarily for cooking protein as well as dry and cold storage. In addition, we lease a 25,000 square foot dry goods storage facility in Vernon, California.

We believe that Plant No. 1, currently operating at approximately 50% capacity, is adequate to meet our requirements for the near future. In fiscal year 2010, items that were processed at Plant No. 1 (some of which included components that were processed at Plant No. 2) accounted for sales of approximately $136.1 million. Items that were processed in Plant No. 2 that did not require further processing in Plant No. 1 accounted for the balance of sales in fiscal year 2010 of approximately $59.4 million. As our sales of cooked protein grow, it may become necessary to augment the cooking capacity that we now have at Plant No. 2. We continue to monitor our cooking capacity. If we deem additional cooking capacity to be necessary, we expect capital expenditures for that capacity could range from $5 million to $10 million during fiscal years 2011 and 2012, depending on the amount of additional cooking capacity added.

|

Legal Proceedings

|

We are involved in certain legal actions and claims arising in the ordinary course of business. Management believes that such contingencies, including the matters described below, will be resolved without materially and adversely affecting our financial position, results of operations or cash flows. We intend to vigorously contest all claims and grievances described below.

Overhill Farms v. Larry (Nativo) Lopez, et al.

On June 30, 2009, we filed a lawsuit against Nativo Lopez and six other leaders of what we believe to be an unlawful campaign to force us to continue the employment of workers who had used invalid social security numbers to hide their illegal work status. Among other things, we allege that the defendants defamed us by calling our actions “racist” and unlawful. We have asserted claims for defamation, extortion, intentional interference with prospective economic advantage, and intentional interference with contractual relations. We filed the lawsuit in Orange County, California, and seek damages and an injunction barring the defendants from continuing their conduct.

All of the named defendants tried unsuccessfully to dismiss the action. In refusing to dismiss the case, the Court ruled on November 13, 2009, that we had established a probability of prevailing on the merits, and that we had submitted substantial evidence that the defendants’ accusations of racism were not true. The defendants thereafter filed an appeal, which was denied by the California court of appeals.

Agustiana, et al. v. Overhill Farms.

On July 1, 2009, Bohemia Agustiana, Isela Hernandez, and Ana Munoz filed a purported “class action” against us in which they asserted claims for failure to pay minimum wage, failure to furnish wage and hour statements, waiting time penalties, conversion and unfair business practices. The plaintiffs are former employees who had been terminated one month earlier because they had used invalid social security numbers in connection with their employment with us. They filed the case in Los Angeles County on behalf of themselves and a class which they say includes all non-exempt production and quality control workers who were employed in California during the four-year period prior to filing their complaint. The plaintiffs seek unspecified damages, restitution, injunctive relief, attorneys’ fees and costs.

We filed a motion to dismiss the conversion claim, and the motion was granted by the court on February 2, 2010.

The parties are engaged in the discovery phase of the case. We believe we have valid defenses to the plaintiffs’ remaining claims and that we paid all wages due to these employees.

Marcelino Arteaga, et al. v. Overhill Farms.

On July 7, 2009, we received an unfair labor practice charge that had been filed with the National Labor Relations Board (“NLRB”) on June 29, 2009. The charge was filed by Marcelino Arteaga on behalf of himself and two other ex-employees, Agapita Padilla and Fernando Morales Lira. In addition, on June 30, 2009, these three ex-employees separately submitted grievances and demanded arbitration arising out of our decision on June 26, 2009, to terminate their employment because they had publicly accused us of being “racist.” On August 7, 2009, the NLRB granted our request to defer further proceedings pending the resolution of the grievance and arbitration process.

On October 7, 2010, the Arbitrator ruled in our favor, upholding our decision to terminate the employment of these former employees. We do not know whether the NLRB intends to proceed separately with the unfair labor practice charge.

Alma Salinas, et al. v. Overhill Farms.

On May 12, 2010, Alma Salinas filed a purported “class action” in Los Angeles County Superior Court against us in which she asserted claims on behalf of herself and all other similarly situated current and former production workers for failure to provide meal periods, failure to provide rest periods, failure to pay minimum wage, failure to make payments within the required time, unfair business practice in violation of Section 17200 of the California Business and Professions Code and Labor Code Section 2698 (known as the Private Attorney General Act (“PAGA”)). Salinas is a former employee who had been terminated because she had used an invalid social security number in connection with her employment with us. Salinas seeks allegedly unpaid wages, waiting time penalties, PAGA penalties, interest and attorneys’ fees, the amounts of which are unspecified.

We expect this case to be consolidated with the earlier-filed Agustiana case (described above) because the claims in the two actions substantially overlap each other.

The parties are engaged in the discovery phase of the case. We believe we have valid defenses to the plaintiffs’ claims and that we paid all wages due to these employees.

|

(Removed and Reserved)

|

PART II

|

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

Market Information and Record Holders

Our common stock has traded on NYSE AMEX under the symbol “OFI” since November 1, 2002. At December 8, 2010, we had approximately 125 stockholders of record. These holders of record include depositories that hold shares of stock for brokerage firms which, in turn, hold shares of stock for numerous beneficial owners. On December 8, 2010, the closing sale price of our common stock on NYSE AMEX was $5.30. The following table sets forth the range of high and low sales prices for our common stock on NYSE AMEX for the periods indicated:

|

Fiscal 2009

|

High

|

Low

|

||

|

First Quarter from September 29, 2008 to December 28, 2008

|

$5.85

|

$3.00

|

||

|

Second Quarter from December 29, 2008 to March 29, 2009

|

5.40

|

2.95

|

||

|

Third Quarter from March 30, 2009 to June 28, 2009

|

5.98

|

3.40

|

||

|

Fourth Quarter from June 29, 2009 to September 27, 2009

|

6.08

|

5.05

|

||

|

Fiscal 2010

|

High

|

Low

|

||

|

First Quarter from September 28, 2009 to December 27, 2009

|

$6.60

|

$4.11

|

||

|

Second Quarter from December 28, 2009 to March 28, 2010

|

6.35

|

4.25

|

||

|

Third Quarter from March 29, 2010 to June 27, 2010

|

6.67

|

5.36

|

||

|

Fourth Quarter from June 28, 2010 to September 26, 2010

|

6.16

|

4.05

|

Performance Graph

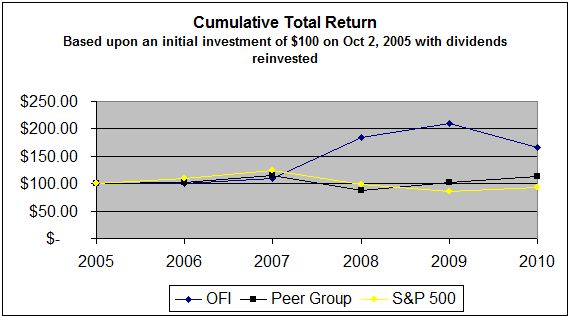

The following is a line graph comparing the yearly percentage change in the cumulative total return of the Company’s common stock to the cumulative total return of the Standard & Poor’s 500 Index and a peer group for the period commencing October 2, 2005 and ending September 26, 2010. The peer group is comprised of Tyson Foods, Inc.; Cuisine Solutions, Inc.; ConAgra Foods, Inc.; Armanino Foods of Distinction, Inc.; Smithfield Foods, Inc.; and Bridgford Foods Corporation.

The graph assumes that $100 was invested in the Company’s common stock, the Standard & Poor’s 500 Index and the peer group on October 2, 2005 and that all the dividends were reinvested on a quarterly basis. Returns for the companies included in the peer group have been weighted on the basis of the market capitalization for each company.

|

Fiscal Year-Ended

|

||||||||||||||||||||||||

|

2005

|

2006

|

2007

|

2008

|

2009

|

2010

|

|||||||||||||||||||

|

Overhill Farms, Inc. (OFI)

|

$ | 100.00 | $ | 100.31 | $ | 109.84 | $ | 184.10 | $ | 209.85 | $ | 166.62 | ||||||||||||

|

Standard & Poor's 500 Index

|

100.00 | 108.75 | 124.25 | 98.74 | 84.99 | 93.48 | ||||||||||||||||||

|

Peer Group

|

100.00 | 101.28 | 114.69 | 87.10 | 102.62 | 113.43 | ||||||||||||||||||

Dividends

We have never paid cash dividends on our common stock. We currently anticipate that no cash dividends will be paid on our common stock in the near term.

Recent Sales of Unregistered Securities

None.

|

Selected Financial Data

|

The following table sets forth selected historical financial data of Overhill Farms, Inc. The selected financial data as of and for each of the last five fiscal years are derived from the financial statements of Overhill Farms, Inc., which have been audited by Ernst & Young LLP, independent registered public accounting firm.

The data may not necessarily be indicative of our future results of operations or financial position. The historical data should be read in conjunction with “Management's Discussion and Analysis of Financial Condition and Results of Operation” and the financial statements and the related notes included elsewhere in this report.

|

Fiscal Year Ended

|

||||||||||||||||||||

|

Statements of Income Data

(in thousands, except per share data):

|

September 26, 2010

|

September 27, 2009

|

September 28, 2008

|

September 30, 2007

|

October 1, 2006

|

|||||||||||||||

|

(52 weeks)

|

(52 weeks)

|

(52 weeks)

|

(52 weeks)

|

(52 weeks)

|

||||||||||||||||

|

Net revenues

|

$ | 194,482 | $ | 209,877 | $ | 238,780 | $ | 192,642 | $ | 168,310 | ||||||||||

|

Operating income

|

13,925 | 15,579 | 20,616 | 11,900 | 14,288 | |||||||||||||||

|

Net income

|

7,575 | 8,301 | 10,321 | 4,562 | 5,102 | |||||||||||||||

|

Net income per share – Basic

|

$ | 0.48 | $ | 0.52 | $ | 0.66 | $ | 0.30 | $ | 0.34 | ||||||||||

|

Net income per share – Diluted

|

$ | 0.47 | $ | 0.52 | $ | 0.65 | $ | 0.29 | $ | 0.32 | ||||||||||

|

Weighted average shares outstanding – Basic

|

15,823,271 | 15,823,271 | 15,747,434 | 15,338,038 | 15,204,424 | |||||||||||||||

|

Weighted average shares outstanding - Diluted

|

16,049,587 | 16,028,698 | 15,992,467 | 15,803,109 | 15,880,507 | |||||||||||||||

|

As of Fiscal Year Ended

|

||||||||||||||||||||

|

Balance Sheet Data

(in thousands)

|

September 26, 2010

|

September 27, 2009

|

September 28, 2008

|

September 30, 2007

|

October 1, 2006

|

|||||||||||||||

|

(52 weeks)

|

(52 weeks)

|

(52 weeks)

|

(52 weeks)

|

(52 weeks)

|

||||||||||||||||

|

Total assets

|

$ | 65,777 | $ | 73,637 | $ | 79,420 | $ | 76,150 | $ | 58,128 | ||||||||||

|

Long-term debt

|

13,198 | 21,891 | 33,479 | 41,383 | 37,219 | |||||||||||||||

|

Total liabilities

|

26,706 | 42,141 | 56,224 | 63,731 | 51,191 | |||||||||||||||

|

Retained earnings (accumulated deficit)

|

27,355 | 19,780 | 11,479 | 1,157 | (3,405 | ) | ||||||||||||||

|

Stockholders’ equity

|

39,071 | 31,497 | 23,195 | 12,419 | 6,937 | |||||||||||||||

No cash dividends on our common stock were declared during any of the periods presented above.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

The following discussion and analysis should be read in conjunction with our consolidated financial statements and notes to consolidated financial statements included elsewhere in this report. This report and our consolidated financial statements and notes to consolidated financial statements contain forward-looking statements, which generally include the plans and objectives of management for future operations, including plans and objectives relating to our future economic performance and our current beliefs regarding revenues we might generate and profits we might earn if we are successful in implementing our business and growth strategies. The forward-looking statements and associated risks may include, relate to or be qualified by other important factors, including, without limitation:

|

|

·

|

the impact of competitive products and pricing;

|

|

|

·

|

market conditions that may affect the costs and/or availability of raw materials, fuels, energy, logistics and labor as well as the market for our products, including our customers’ ability to pay and consumer demand;

|

|

|

·

|

changes in our business environment, including actions of competitors and changes in customer preferences, as well as disruptions to our customers’ businesses;

|

|

|

·

|

seasonality in the retail category;

|

|

|

·

|

loss of key customers due to competitive environment or production being moved in-house by customers;

|

|

|

·

|

fulfillment by suppliers of existing raw material contracts;

|

|

|

·

|

natural disasters that can impact, among other things, costs of fuel and raw materials;

|

|

|

·

|

the occurrence of acts of terrorism or acts of war;

|

|

|

·

|

changes in governmental laws and regulations, including healthcare and income taxes;

|

|

|

·

|

change in control due to takeover or other significant changes in ownership;

|

|

|

·

|

financial viability and resulting effect on revenues and collectability of accounts receivable of our customers during the on-going economic recovery and any future deep recessionary periods;

|

|

|

·

|

ability to obtain additional financing as and when needed, and rising costs of credit that may be associated with new borrowings;

|

|

|

·

|

voluntary or government-mandated food recalls;

|

|

|

·

|

effects of legal proceedings in which we are or may become involved from time to time, which may be costly and may divert management’s attention, even if unfounded; and

|

|

|

·

|

other factors discussed in this report.

|

We do not undertake to update, revise or correct any forward-looking statements, except as otherwise required by law.

Any of the factors described above or in the “Risk Factors” contained in Item 1A of this report could cause our financial results, including our net income or loss or growth in net income or loss to differ materially from prior results, which in turn could, among other things, cause the price of our common stock to fluctuate substantially.

Overview

We are a leading value-added manufacturer of high quality, prepared frozen food products for branded retail, private label, foodservice and airline customers. Our product line includes entrées, plated meals, bulk-packed meal components, pastas, soups, sauces, poultry, meat and fish specialties, and organic and vegetarian offerings. Our extensive research and development efforts, combined with our extensive catalogue of recipes and flexible manufacturing capabilities, provide customers with a one-stop solution for new product ideas, formulations and product manufacturing, as well as precise replication of existing recipes. Our capabilities allow customers to outsource product development, product manufacturing and packaging, thereby avoiding significant fixed-cost and variable investments in resources and equipment. Our customers include prominent nationally recognized names such as Jenny Craig, Inc., American Airlines, Inc., Safeway Inc., Pinnacle Foods Group LLC, and Panda Restaurant Group, Inc.

Our goal is to continue as a leading developer and manufacturer of value-added food products and provider of custom prepared frozen foods. We intend to continue to execute our growth and operating strategies, including:

|

|

·

|

diversifying and expanding our customer base by focusing on sectors we believe have attractive growth characteristics, such as foodservice and retail;

|

|

|

·

|

investing in and operating efficient production facilities;

|

|

|

·

|

providing value-added ancillary support services to customers;

|

|

|

·

|

offering a broad range of products to customers in multiple channels of distribution; and

|

|

|

·

|

exploring strategic acquisitions and investments.

|

Overall, we have performed well in the midst of a poor economy. Despite decreased net revenues we continued to pay down our previous debt and were also able to refinance with more favorable terms. We were also able to increase investment spending in our plants, which enabled us to achieve certification under the new global Food Safety Management Systems standard FSSC 22000. This new certification will allow us to better compete for new business opportunities.

Sales during the first half of fiscal year 2010 reflected, in great part, rebuilding of customer inventories from low late-calendar year 2009 levels, in anticipation of a rebound in the economy. As the U.S. economic recovery lagged, most of our customers experienced decreased sales, particularly during our fiscal third quarter of 2010. While our foodservice accounts increased during fiscal year 2010, these gains were not enough to offset other account decreases. During the fourth quarter of fiscal year 2010, we were additionally impacted by the seasonality in our retail category, as retailers typically sell fewer frozen meals during warmer months. Despite all the above, in fiscal year 2010 we generated $16.9 million in net cash from operations, reduced total debt by $14.0 million and increased retained earnings by $7.6 million. In addition, we paid off an additional $5.5 million on our debt subsequent to fiscal year 2010.

As our top-line revenues decreased during fiscal year 2010, our margins, primarily in our third and fourth quarters, were negatively affected by higher overhead costs as a percentage of net revenues on the lower sales volume. Although we expect continued margin pressure, we anticipate margins will improve as sales revenues increase as the economy continues to recover. We believe we can offset the higher overhead costs through reduced purchase prices of raw materials, production efficiencies and a change in mix of customers between retail, foodservice and airlines.

Subsequent to fiscal year 2010, we entered into a five-year licensing agreement with Boston Market Corporation (“BMC”) for the exclusive right to use BMC’s trademarks, trade dress and copyrights in connection with the manufacturing, advertising, promotion, sales and distribution of frozen food and certain shelf-stable licensed products. The agreement commences on July 1, 2011. The agreement also contains options for two sixty-month renewal terms. We will pay BMC an earned royalty computed at four and a half percent of net sales during the initial term with no guaranteed minimum royalties. We will pay a guaranteed minimum royalty of $2.75 million and $3.25 million for the first and second renewal terms, respectively.

In addition, we have been selected to produce a line of 16 private label frozen meals for a major national retailer. The multi-year agreement with the national retailer is expected to generate initial annual sales in the range of $7 million, with the opportunity for increased volume over time. Full production is expected to begin in April of 2011.

Fiscal years 2010, 2009 and 2008 were 52-week periods. For fiscal year 2010, net revenues of $194.5 million reflected a 7.3% decrease as compared to fiscal year 2009. During fiscal year 2010, decreased sales in the retail and airline categories contributed to the decline. We experienced a 12.1% decrease in net revenues for fiscal year 2009, to $209.9 million, compared to $238.8 million for fiscal year 2008. The decrease in net revenues during fiscal year 2009 was due to decreased sales in the retail and airline categories.

Gross profit was $23.7 million in fiscal year 2010, compared to $25.6 million in fiscal year 2009 and $29.3 million in fiscal year 2008. Gross profit as a percentage of net revenues, or gross margin, during fiscal years 2010, 2009 and 2008 were 12.2%, 12.2% and 12.3%, respectively. In fiscal year 2010, gross profit decreased due to lower revenues but gross margin remained unchanged due to increased efficiencies and yields and favorable commodity prices offset by increased investment spending in our plants to achieve certification under the new global Food Safety Management Systems standard FSSC 22000 and brokerage paid to Safeway Inc., which now operates as a reduction to net revenues. During the latter part of the third quarter of fiscal year 2010, Safeway Inc. ended its brokerage agreement and took the function in-house, so the brokerage we pay to Safeway Inc. is now recorded as a reduction of revenue. The decrease in gross profit in fiscal year 2009 compared to fiscal year 2008 was due to lower net revenues.

Operating income as a percentage of net revenues for fiscal year 2010 was 7.1% compared to 7.4% in fiscal year 2009 and 8.6% in fiscal year 2008, due primarily to decreased net revenues and increased selling, general and administrative (“SG&A”) expenses as a percentage of net revenues. SG&A expenses as a percentage of net revenues increased to 5.0% in fiscal year 2010 compared to 4.8% in fiscal year 2009 and 3.6% in fiscal year 2008. SG&A expenses decreased $241,000 in fiscal year 2010 but increased as a percentage of the lower net revenues. Net income of $7.6 million decreased as a percentage of net revenues to 3.9% in fiscal year 2010 versus 4.0% in fiscal year 2009 and 4.3% in fiscal year 2008.

As described under “Liquidity and Capital Resources” below, during fiscal year 2010 we refinanced our then existing debt of $13.2 million. The new credit facility with Bank of America, N.A. is a $30 million three-year senior secured credit facility and is secured by a first priority lien on substantially all of our assets. We made an initial loan drawdown of $13.2 million, the proceeds of which were used to pay-off our prior credit facility with Guggenheim Corporate Funding, LLC (“GCF”). Subsequent to fiscal year 2010, we paid off an additional $5.5 million on our debt leaving us with a balance of $7.7 million.

Results of Operations

The tables presented below, which compare our results of operations from one period to another, present the results for each period, the change in those results from one period to another in both dollars and percentage change, and the results for each period as a percentage of net revenues. The columns present the following:

|

|

·

|

First four data columns in each table show the absolute results for each period presented and results for each period as a percentage of net revenues.

|

|

|

·

|

Last two columns entitled “Dollar Variance” and “% Variance” show the change in results, both in dollars and percentages for the fiscal years presented. These two columns show favorable changes as positives and unfavorable changes as negatives. For example, when our net revenues increase from one period to the next, that change is shown as a positive number in both columns. Conversely, when expenses increase from one period to the next, that change is shown as a negative in both columns.

|

Fiscal Year Ended September 26, 2010 Compared to Fiscal Year Ended September 27, 2009

|

Fiscal Year Ended

|

Change 2010 vs 2009

|

|||||||||||||||||||||||

|

September 26, 2010

|

September 27, 2009

|

Dollar Variance

|

% Variance

|

|||||||||||||||||||||

|

Dollars

|

% of Net Revenues

|

Dollars

|

% of Net Revenues

|

Favorable (Unfavorable)

|

Favorable (Unfavorable)

|

|||||||||||||||||||

|

(Dollars in thousands)

|

||||||||||||||||||||||||

|

Net revenues

|

$ | 194,482 | 100.0 | % | $ | 209,877 | 100.0 | % | $ | (15,395 | ) | (7.3 | )% | |||||||||||

|

Cost of sales

|

170,826 | 87.8 | 184,326 | 87.8 | 13,500 | 7.3 | ||||||||||||||||||

|

Gross profit

|

23,656 | 12.2 | 25,551 | 12.2 | (1,895 | ) | (7.4 | ) | ||||||||||||||||

|

Selling, general and administrative expenses

|

9,731 | 5.0 | 9,972 | 4.8 | 241 | 2.4 | ||||||||||||||||||

|

Operating income

|

13,925 | 7.1 | 15,579 | 7.4 | (1,654 | ) | (10.6 | ) | ||||||||||||||||

|

Interest and other (income) expense, net

|

1,668 | 0.9 | 2,279 | 1.1 | 611 | 26.8 | ||||||||||||||||||

|

Income before income taxes

|

12,257 | 6.3 | 13,300 | 6.3 | (1,043 | ) | (7.8 | ) | ||||||||||||||||

|

Income tax provision

|

4,682 | 2.4 | 4,999 | 2.4 | 317 | 6.3 | ||||||||||||||||||

|

Net income

|

$ | 7,575 | 3.9 | % | $ | 8,301 | 4.0 | % | $ | (726 | ) | (8.7 | )% | |||||||||||

Net Revenues. Net revenues for fiscal year 2010 decreased $15.4 million (7.3%) (5.5% was attributable to a volume/mix decrease and 1.8% was attributable to a pricing decrease) to $194.5 million from $209.9 million for fiscal year 2009, due to decreases in airline and retail net revenues offset partially by higher Foodservice revenue as discussed below.

Retail net revenues decreased $18.4 million (12.6%) to $128.0 million for fiscal year 2010 from $146.4 million for fiscal year 2009. The decrease in retail net revenues was largely due to the previously disclosed reduced volume from H. J. Heinz Company. This reduction in volume resulted in a decrease in retail net revenues of approximately $14.3 million. Fiscal year 2010 includes $10.1 million in net revenues from sales to Heinz as Heinz was delayed in transitioning to its own plants. The remaining decrease in retail net revenues is attributable to a $4.5 million decline in three other customers from the retail category due to the lagging economic recovery and their inventory management plans. For fiscal year 2010, the retail category as a percentage of net revenues decreased to 65.8% from 69.7%.

Foodservice net revenues increased $6.2 million (11.9%) to $58.5 million for fiscal year 2010 from $52.3 million for fiscal year 2009 due to the introduction of new products and increased volume from an existing customer offset by the conclusion of an existing customer’s promotional item ($2.4 million). For fiscal year 2010, the foodservice category as a percentage of net revenues increased to 30.1% from 24.9%. We continue to increase our sales efforts in this category and believe that foodservice represents a significant opportunity for us in 2011 and beyond.

Airline net revenues decreased $3.1 million (27.9%) to $8.0 million for fiscal year 2010 from $11.1 million for fiscal year 2009. Due to consolidation of airlines combined with continued efforts in the airline industry to cut costs, airline net revenues may continue to decrease in future periods. For fiscal year 2010, the airline category as a percentage of net revenues decreased to 4.1% from 5.3% as we continue our transition to opportunities outside of this category.

Gross Profit. Gross profit for fiscal year 2010 decreased $1.9 million (7.4%) to $23.7 million from $25.6 million for fiscal year 2009. Gross margin remained unchanged at 12.2% for fiscal years 2010 and 2009 due to increased efficiencies and yields and favorable commodity prices offset by increased investment spending in the plants to achieve certification under the new global Food Safety Management Systems standard FSSC 22000 and brokerage paid to Safeway Inc. of $262,000 as a reduction to net revenues. During the latter part of the third quarter of fiscal year 2010, Safeway Inc. ended its brokerage agreement and took the function in-house, so the brokerage we pay to Safeway Inc. is now recorded as a reduction of revenue.

Selling, General and Administrative Expenses. SG&A expenses decreased $241,000 (2.4%) to $9.7 million for fiscal year 2010 from $10.0 million for fiscal year 2009. SG&A expenses as a percentage of net revenues increased slightly to 5.0% for fiscal year 2010 from 4.8% for fiscal year 2009 due to the year-over-year decrease in net revenues. The decrease in SG&A expenses resulted from a decrease in brokerage fees ($315,000) stemming primarily from the change in recording of brokerage expense for Safeway Inc. as described above and a decrease in personnel related expenses ($146,000). These reductions were partially offset by an increase in professional service fees ($178,000) relating primarily to litigation described in item 3 of this report. We expect to incur increased legal fees during FY 2011 as we continue to vigorously contest the claims and grievances described in Item 3 of this report.

Operating Income. Operating income decreased $1.7 million (10.9%) to $13.9 million for fiscal year 2010 from $15.6 million for fiscal year 2009. The decrease in operating income was the result of the decrease in gross profit as noted above.

Interest and Other (Income) Expense, net. Interest expense decreased $611,000 (26.6%) to $1.7 million for fiscal year 2010 from $2.3 million for fiscal year 2009 due to lower debt balances and lower variable interest rates offset by an increase of $301,000 in debt extinguishment expenses stemming from the refinancing of the GCF credit facility.

Income Tax Provision. Income tax expense was $4.7 million for fiscal year 2010 compared to $5.0 million for fiscal year 2009. The difference was a result of income before taxes decreasing $1.0 million from $13.3 million for fiscal year 2009 to $12.3 million during fiscal year 2010. The effective tax rates were 38.2% and 37.6% for fiscal years 2010 and 2009, respectively.

Net Income. Net income for fiscal year 2010 was $7.6 million, or $0.48 per basic share and $0.47 per diluted share, compared to net income of $8.3 million, or $0.52 per basic and diluted share for fiscal year 2009.

We currently expect to continue profitable operations primarily through (a) growing revenues from profitable product lines, increasing our customer base and replacing lower margin accounts; (b) improving gross margins by increasing prices to customers where appropriate, streamlining additional costs and continuing to leverage our manufacturing and storage facilities to improve manufacturing efficiency; and (c) reducing future interest costs on outstanding debt through pre-payments on our debt. However, no assurance can be given that we will be successful in any of these initiatives. As discussed in “Risk Factors” contained in Item 1A of this report, we may be unable to improve our operating results if we suffer a decline in our manufacturing efficiency, the loss of major customers, continued cost-cutting measures in the airline industry, adverse changes in our operating costs or raw materials costs or other adverse changes to our business.

Fiscal Year Ended September 27, 2009 Compared to Fiscal Year Ended September 28, 2008

|

Fiscal Year Ended

|

Change 2009 vs 2008

|

|||||||||||||||||||||||

|

September 27, 2009

|

September 28, 2008

|

Dollar Variance

|

% Variance

|

|||||||||||||||||||||

|

Dollars

|

% of Net Revenues

|

Dollars

|

% of Net Revenues

|

Favorable (Unfavorable)

|

Favorable (Unfavorable)

|

|||||||||||||||||||

|

(Dollars in thousands)

|

||||||||||||||||||||||||

|

Net revenues

|

$ | 209,877 | 100.0 | % | $ | 238,780 | 100.0 | % | $ | (28,903 | ) | (12.1 | )% | |||||||||||

|

Cost of sales

|

184,326 | 87.8 | 209,517 | 87.7 | 25,191 | 12.0 | ||||||||||||||||||

|

Gross profit

|

25,551 | 12.2 | 29,263 | 12.3 | (3,712 | ) | (12.7 | ) | ||||||||||||||||

|

Selling, general and administrative expenses

|

9,972 | 4.8 | 8,647 | 3.6 | (1,325 | ) | (15.3 | ) | ||||||||||||||||

|

Operating income

|

15,579 | 7.4 | 20,616 | 8.6 | (5,037 | ) | (24.4 | ) | ||||||||||||||||

|

Interest and other (income) expense, net

|

2,279 | 1.1 | 3,663 | 1.5 | 1,384 | 37.8 | ||||||||||||||||||

|

Income before income taxes

|

13,300 | 6.3 | 16,953 | 7.1 | (3,653 | ) | (21.5 | ) | ||||||||||||||||

|

Income tax provision

|

4,999 | 2.4 | 6,632 | 2.8 | 1,634 | 24.6 | ||||||||||||||||||

|

Net income

|

$ | 8,301 | 4.0 | % | $ | 10,321 | 4.3 | % | $ | (2,020 | ) | (19.6 | )% | |||||||||||

Net Revenues. Net revenues for fiscal year 2009 decreased $28.9 million (12.1%) (13.1% of the decrease was attributed to volume/mix offset by a 1.0% pricing increase) to $209.9 million from $238.8 million for fiscal year 2008, due to decreases in airline and retail net revenues as discussed below.

Retail net revenues decreased $27.6 million (15.9%) to $146.4 million for fiscal year 2009 from $174.0 million for fiscal year 2008. The decrease in retail net revenues was largely due to the previously disclosed reduced volume from H. J. Heinz Company. This reduction in volume resulted in a decrease in net revenues of approximately $19.1 million. The remaining decrease in retail net revenues is attributable to a $5.8 million decline in sales to Jenny Craig, Inc. due to the economic downturn and their inventory management plans. For fiscal year 2009, the retail category as a percentage of net revenues decreased to 69.7% from 72.9%.

Foodservice net revenues increased $8.2 million (18.6%) to $52.3 million for fiscal year 2009 from $44.1 million for fiscal year 2008 due to the anticipated increased sales to an existing customer as well as sales to a new customer. For fiscal year 2009, the foodservice category as a percentage of net revenues increased to 24.9% from 18.5%.

Airline net revenues decreased $9.6 million (46.4%) to $11.1 million for fiscal year 2009 from $20.7 million for fiscal year 2008. Due to continued efforts in the airline industry to cut costs, airline net revenues may continue to decrease in future periods. For fiscal year 2009, the airline category as a percentage of net revenues decreased to 5.3% from 8.7%.

Gross Profit. Gross profit for fiscal year 2009 decreased by $3.7 million (12.6%) to $25.6 million from $29.3 million for fiscal year 2008. Gross margin decreased slightly to 12.2% for fiscal year 2009 from 12.3% for fiscal year 2008 due primarily to higher overhead costs as a percentage of net revenues on lower sales volume in the fourth quarter of fiscal year 2009 as well as minor price reductions to some of our largest customers. Prior to our fourth quarter, our gross margin was higher than fiscal year 2008 due largely to a more favorable sales mix along with increased efficiencies and yields, favorable commodity prices, lower freight charges, lower product development costs and modest increases in sales prices to several customers, offset partially by higher overhead costs as a percentage of net revenues on lower sales volume. In addition, in order to improve our gross margins, we continue to analyze our lower margin accounts and expect to move away from some of the accounts that do not meet our profit objectives towards higher margin business currently available to us.

Selling, General and Administrative Expenses. SG&A expenses increased $1.3 million (15.3%) to $10.0 million for fiscal year 2009 from $8.6 million for fiscal year 2008. SG&A expenses increased as a percentage of net revenues from 3.6% in fiscal year 2008 to 4.8% in fiscal year 2009. The increases were driven by higher brokerage and licensing fees ($461,000) stemming predominately from higher sales to Safeway Inc. and higher professional and legal fees relating primarily to litigation ($878,000) described in Item 3 of this report.

Operating Income. Operating income decreased $5.0 million (24.4%) to $15.6 million for fiscal year 2009 from $20.6 million for fiscal year 2008. The decrease in operating income was the result of the decrease in gross profit and an increase in SG&A expenses as noted above.

Interest and Other (Income) Expense, net. Interest expense decreased $1.4 million (37.8%) for fiscal year 2009 to $2.3 million from $3.7 million for fiscal year 2008 due to lower debt balances and lower variable interest rates.

Income Tax Provision. Income tax expense was $5.0 million for fiscal year 2009 compared to $6.6 million for fiscal year 2008. The difference was a result of income before taxes decreasing $3.7 million from $17.0 million for fiscal year 2008 to $13.3 million during fiscal year 2009. The effective tax rates were 37.6% and 39.1% for fiscal years 2009 and 2008, respectively.

Net Income. Net income for fiscal year 2009 was $8.3 million, or $0.52 per basic and diluted share, compared to net income of $10.3 million, or $0.66 per basic share and $0.65 per diluted share for fiscal year 2008.

Liquidity and Capital Resources

For fiscal years ended 2010 and 2009, our operating activities provided cash of $16.9 million and $14.7 million, respectively. Cash generated from operations before working capital changes for fiscal year 2010 was $11.4 million. Cash generated by changes in working capital was $5.5 million for fiscal year 2010 and resulted from decreases in accounts receivable, inventory and prepaid expenses and other assets of $4.3 million, $2.2 million and $376,000, respectively. This was partially offset by a decrease in accounts payable and accrued liabilities of $1.1 million and $191,000, respectively. At September 26, 2010, we had working capital of $24.4 million compared to working capital of $23.6 million at September 27, 2009. We were able to fund our operations during fiscal year 2010 internally, without increasing our external debt, by executing the cash management procedures noted above.

During fiscal year 2010, our investing activities, consisting primarily of capital expenditures of $1.8 million, resulted in a net use of cash of approximately $1.8 million, compared to a net use of cash of approximately $3.1 million during fiscal year 2009. The property and equipment additions were made to accommodate additional business opportunities, meet anticipated growth and improve operating efficiency, as well as achieve certification under the new global Food Safety Management Systems standard FSSC 22000. We believe the short-term cash outlay for this certification will allow us future growth opportunities as we will now be able to compete for new customers and products. We anticipate that cash generated from operating activities and borrowing availability under our existing credit facility will fund revenue growth and working capital needs in the near term.

During fiscal year 2010, our financing activities used cash of $14.6 million, compared to cash used by financing activities of $12.9 million during fiscal year 2009. The net use of cash consisted primarily of $14.1 million of principal payments that reduced our outstanding debt. Financing activities during fiscal year 2010 also included principal payment on equipment loans of $423,000 and cash paid in association with new financing arrangements of $71,000. Subsequent to fiscal year 2010, we paid off an additional $5.5 million on our debt leaving us with a balance of $7.7 million.

We executed a senior secured credit agreement with Bank of America on September 24, 2010. The facility is structured as a $30 million three-year senior secured revolving credit facility, secured by a first priority lien on substantially all of our assets. We made an initial loan drawdown of $13.2 million, which was used to pay off our prior credit facility. Under the Bank of America facility we have the ability to increase the aggregate amount of the financing by $20 million under certain conditions.

The Bank of America facility bears annual interest at the British Bankers Association LIBOR Rate, or LIBOR, plus an applicable margin (listed below). The Margin is initially 1.75% and beginning no later than December 25, 2010, and adjusted quarterly thereafter, shall be calculated as follows:

|

Ratio of aggregate outstanding funded commitments under the facility (including letter of credit obligations) to EBITDA for the preceding four quarters

|

Applicable Margin

|

|

|

Greater than or equal to 1.50:1

|

2.00%

|

|

|

Greater than or equal to 0.50:1 but less than 1.50:1

|

1.75%

|

|

|

Less than 0.50:1

|

1.50%

|

At September 26, 2010, there was $13.2 million outstanding under the Bank of America facility with an applicable interest rate of 2.01%. In addition, the Company will pay an unused fee equal to 0.25% per annum. Initial proceeds from the Bank of America facility, received September 24, 2010, were used to repay approximately $13.2 million in existing debt in connection with the termination of our former financing arrangements. We recorded a pretax charge of approximately $301,000 in connection with the termination of the former financing arrangements in the fourth quarter of fiscal year 2010. As of September 26, 2010, we had $16.8 million available to borrow under the new credit facility.

The Bank of America facility contains covenants whereby, among other things, we are required to maintain compliance with agreed levels of fixed charge coverage and total leverage. The facility also contains customary restrictions on incurring indebtedness and liens, making investments and paying dividends.