Attached files

| file | filename |

|---|---|

| 8-K - NOBEL LEARNING COMMUNITIES, INC. -- FORM 8-K - NOBEL LEARNING COMMUNITIES INC | d8k.htm |

Nobel Learning Communities, Inc.

December, 2010

Exhibit 99.1 |

2

Nobel Learning Communities –

Safe Harbor

Except for historical information contained in this presentation, the information in this

herein consists of forward-looking statements

pursuant

to

the

safe

harbor

provisions

of

the

Private

Securities

Litigation

Reform

Act

of

1995.

These

statements involve risks and uncertainties that could cause actual results to differ

materially from those in the forward- looking statements. Potential risks and

uncertainties include among others, the implementation and results of the

Company’s ongoing strategic initiatives; the Company’s ability to compete with new

or existing competitors; dependence on

senior

management

and

other

key

personnel;

changes

in

general

economic

conditions;

and

the

impact

on

our

business

and

the

price

of

our

common

stock

caused

by

the

concentration

of

ownership

of

our

common

stock.

Other

risks

and

uncertainties are discussed in the Company's filings with the SEC. These statements are

based only on management's knowledge and expectations on the date of this

presentation. The Company will not necessarily update these statements or other

information in this press release based on future events or circumstances. In this

presentation, financial measures are presented both in accordance with United States generally accepted

accounting principles ("GAAP") and also on a non-GAAP basis. Adjusted EBITDA is a

non-GAAP financial measure. Adjusted EBITDA is commonly presented as a

reconciliation starting with net income. Due to the number of non-operating related

items included in net income, we present Adjusted EBITDA. The Company believes that the use of certain non-

GAAP financial measures enables the Company and its investors and potential investors to

evaluate and compare the Company's

results

from

operations

generated

from

its

business

in

a

more

meaningful

and

consistent

manner

and

provides

an

analysis

of

operating

results

using

the

same

measures

used

by

the

Company's

chief

operating

decision

makers

to

measure

the

performance

of

the

Company.

Please

see

the

financial

summary

at

the

end

of

this

presentation

for

information reconciling non-GAAP financial measures to comparable GAAP financial

measures |

3

NLCI Business Summary

•

Leading education provider as an operator of 184 schools

–

#4 private preschool operator (units)

–

#1 private K12 operator (units)

•

Portfolio of schools

–

Preschools –

148

–

Elementary/Middle schools (29) and specialty schools (7)

–

Online K-12 Distance Learning School

•

Fully invested in people, curriculum, technology, real estate

•

Dual income families; high average household income

•

Primarily private pay customer

•

Revenue for fiscal year ended June 2010 increased 5.4% to $232mm

|

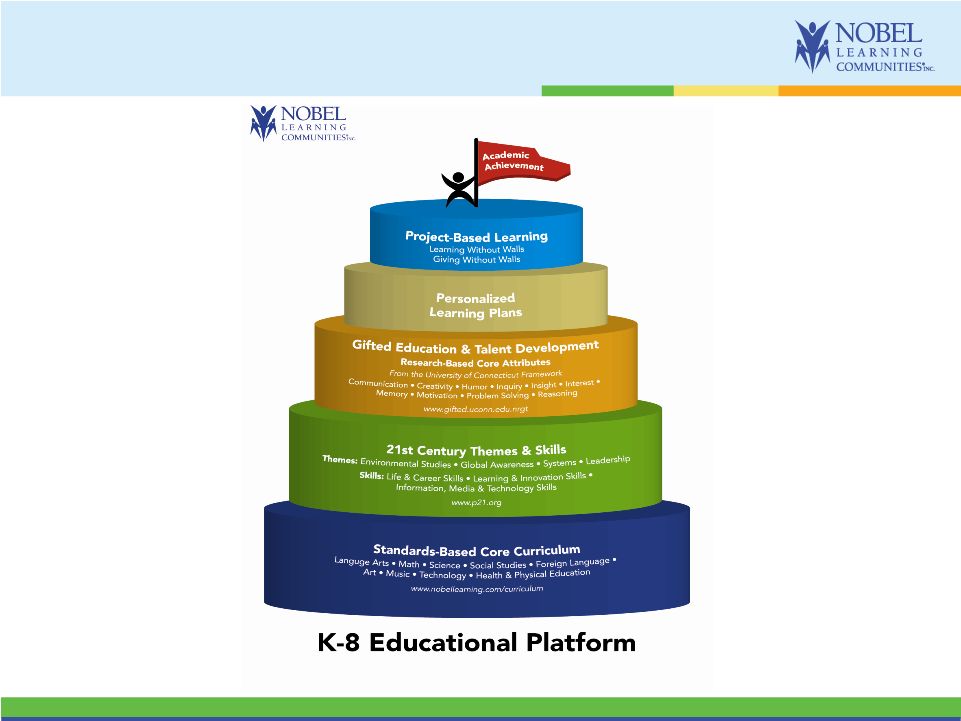

4

Program

Premier Portfolio

of Local Brands

Accreditations

National Curricula

Platform spans PreK-12 with proprietary

curriculum and accredited programs

21

st

Century Skills |

5

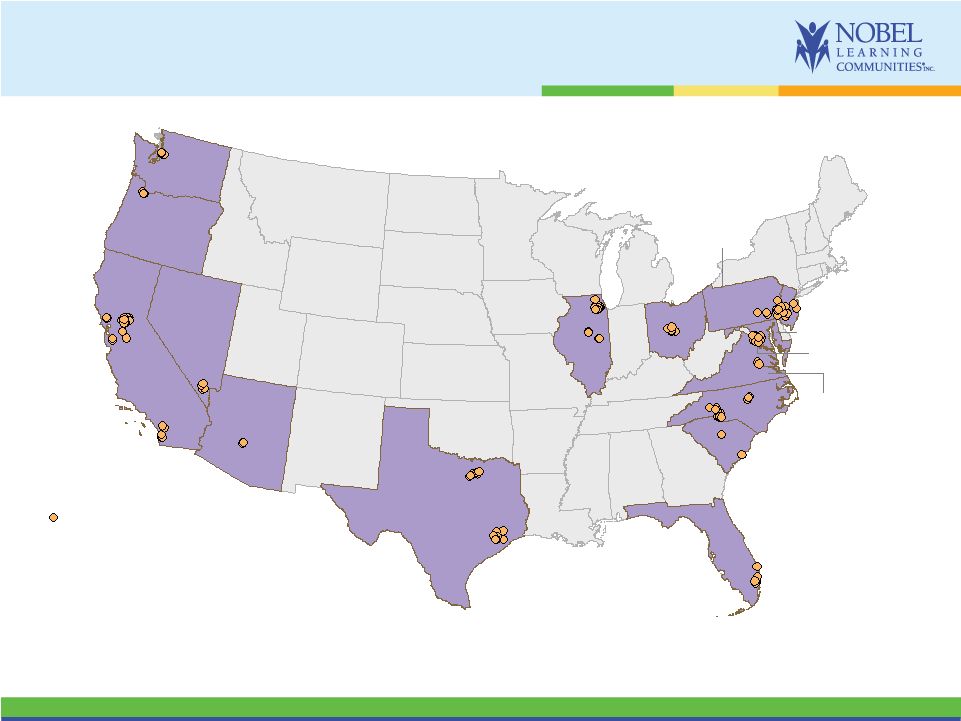

We operate 184 schools in 15 states

Note: As 12/2/2010

184 total schools

Arizona

1

California

37

Florida

8

Illinois

20

Maryland 1

Nevada

10

New Jersey 10

Oregon

3

Ohio

9

South Carolina 2

Texas

17

Virginia 19

Washington

5

District of

Columbia 1

North Carolina 17

Pennsylvania

24 |

6

NLCI has a multi-channel growth strategy

Organic Growth: Enrollment growth plus annual tuition

increases in existing schools; open new ones

Acquisition of K+ and Preschools

Expand online and distance learning presence into

new market segments; highly scalable |

7

Our platform strategy has dual tracks

•

Curriculum based preschools

•

Strong, Proprietary curriculum

•

Predictable cash flows

•

Opportunity for quick gains in economic recovery

•

Growth through new builds and acquisitions at attractive

multiples

Pure Play Preschool Track |

8

Preschool Operating Highlights

Average preschool

•

102 full-time equivalents

•

$1.25 million revenue

•

9,000 square feet

Staffing

•

23 people (2 admins, 20 teachers, 1 other)

Compensation

•

Principal salary range: $30,000 to $57,000

•

Teachers (infant to K): $9 to $27 per hour

Key operating metrics

•

Revenue, payroll, controllable expenses, contribution to fixed

•

Enrollment trends, occupancy, FTEs, inquiries, tours, sales

conversions

•

Parent satisfaction scores |

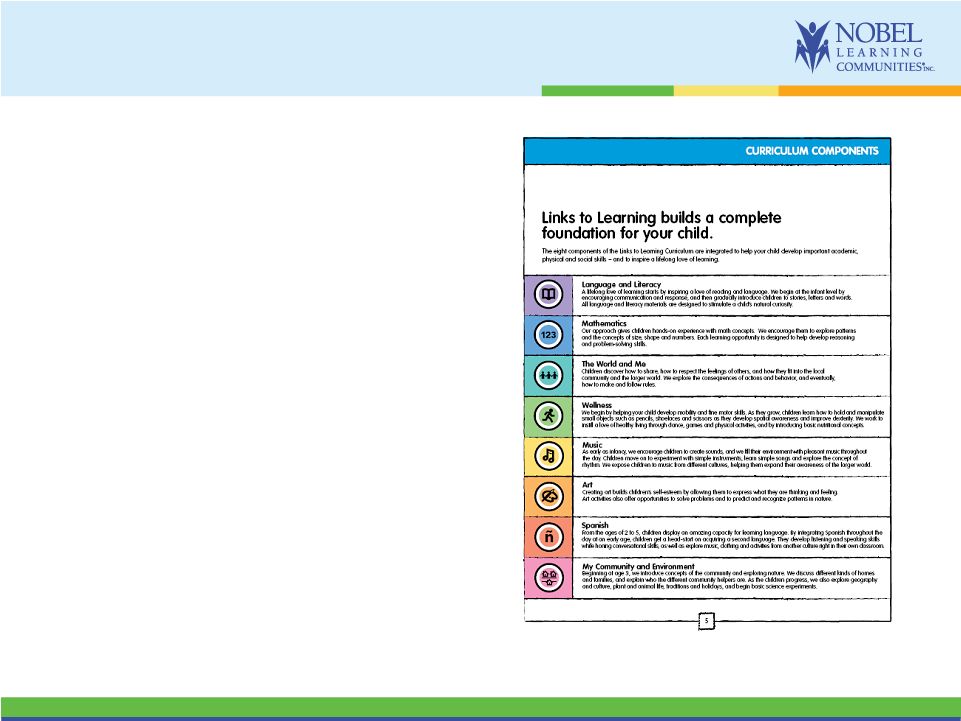

9

Links to Learning –

Preschool Product Overview

•

Preschool curriculum includes:

–

Teacher materials

–

Developmental Skills Sheet, Months at

a

Glance-

monthly pacing guides, Weeks at a

Glance-

weekly pacing guides Daily Skills

Sheet, LTL lesson plan template

–

Parent connections

–

Weekly lesson plans

–

Week-at-a-glance sheets

–

Parent friendly month-at-a-glance

–

Parent friendly Spanish poster with phonetic

pronunciation (Beginner-PreK)

–

Developmental skills sheet

–

What We Did Today

–

Monthly letters explaining how to link

learning from school with activities at home

–

End of Month folder |

10

•

K-8 onsite schools and K-12 distance learning school

•

Private pay

•

Capability for multiple delivery modalities

•

Bring online opportunities to onsite schools

•

Develop blended model schools and partnerships

•

Strong growth opportunity, including international

Integrated K-12 Track

Our platform strategy has dual tracks |

11

K+ Operating Highlights

Average K+ school

•

153 full-time students

•

$1.7 million revenue

•

4,000 to 40,000 square feet

Staffing

•

17 people (3 admins, 13 teachers, 1 other)

Compensation

•

Principal salary range: $55,000 to $121,000

•

Teacher salary range: $13 to $30 per hour

•

Teachers are contracted for 10 months

Key operating metrics

•

Revenue, payroll, controllable expenses, contribution to fixed

•

Enrollment trends, occupancy, inquiries, tours, sales

conversions

•

Educational outcomes and parent satisfaction scores |

12

Educational Platform: Curriculum and

Curriculum Delivery |

13

Laurel Springs Overview

•

A private, distance learning K-12 College Prep school founded in 1991

•

WASC accredited; NCAA approved; Univ. of CA A-G approved (non-lab

courses) •

Curriculum is combination of proprietary and licensed

•

Includes honors and AP courses

•

Gifted and Talented diploma program

•

Serves high-end, private pay markets focusing on college bound students

•

Excellent test scores (Terra Nova, AP, ACT, SAT, SATII)

•

Excellent placement record to selective universities

•

College planning and counseling services

•

Graduates receive over $1mm of scholarships annually

•

Mastery based

•

The most “high touch”

and high service online school, featuring:

•

Learning styles assessment

•

Enrollment counselors

•

Academic advisors and college prep coaches

•

On site Prom, Graduation and Year Book |

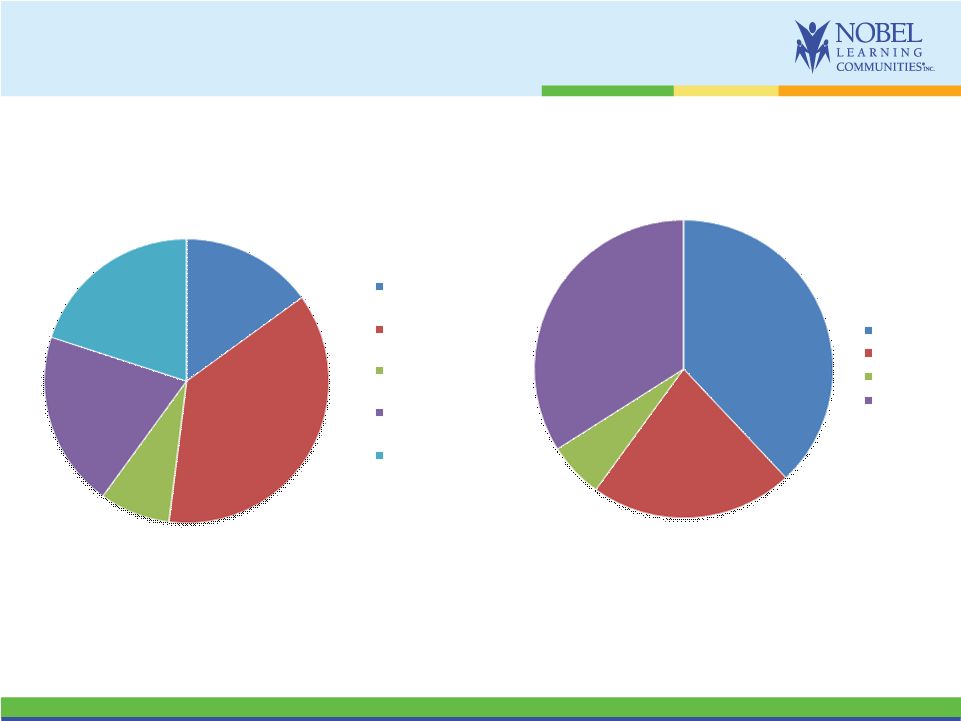

14

Laurel Springs serves students in several

profitable niche markets

15%

37%

8%

20%

20%

Student Population

Concurrent

Enrollments

"New" Home

Schoolers

International

Elite Athlete

Entertainment and

Performing Arts

38%

22%

6%

34%

Student Enrollment

FT 9-12

PT 9-12

PT K-8

FT K-8

FY 2010 student distribution |

15

Business model relationship to the

economy

Preschool

Track

K-12 Strategy Track

On –

site

On -

line

Relationship

to Economy

•

Lagging Indicator

•

Local Economy

•

Lagging indicator

•

Local economy

•

Slight lagging

indicator

•

National economy

Largest

Economic

Factor(s)

•

Unemployment

•

Unemployment

•

Local public school

funding

•

Local public school

funding

Growth

Drivers

•

Job creation

•

Program strength

versus competitors

•

Job creation

•

Trend to multiple

delivery modalities

•

Personalized

learning

•

Rapid penetration of

online education

•

International demand

for U.S. diplomas |

16

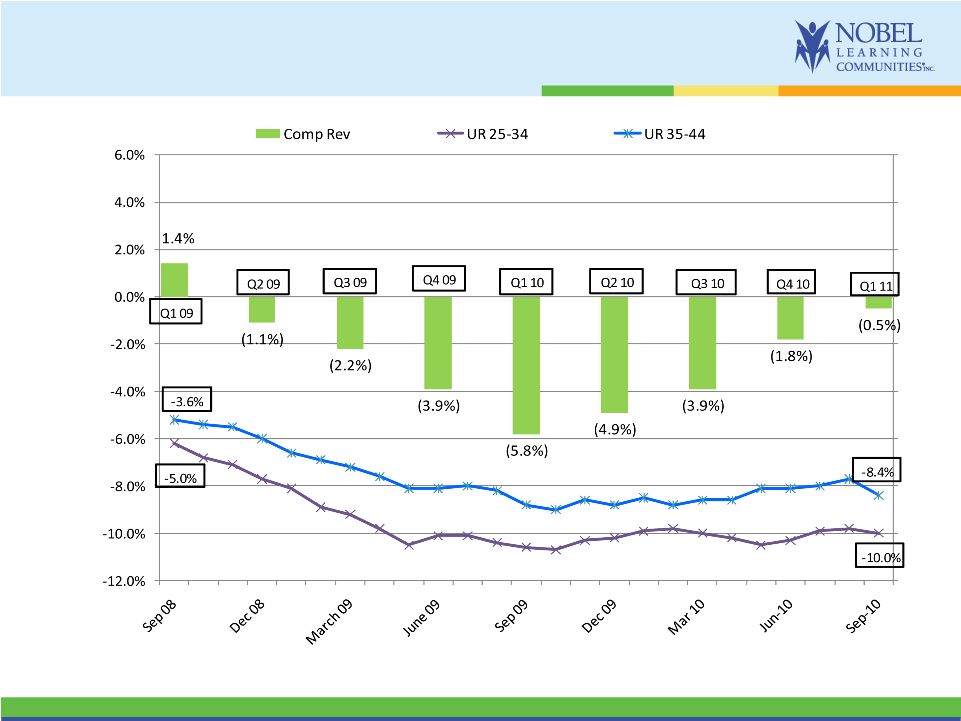

Comparable School Revenue Versus

Unemployment Rate

NOTE:

UR 25-34 and UR 35-44 data from BLS.gov |

17

October Achieved Positive Enrollments

•

September

–

1

st

month

of

positive

comp

school

Revenue

in

23

months

•

October

–

1

st

month

of

positive

comp

school

Enrollment

in

2

½

years

•

Positive comparable school revenue and enrollments in October

–

Both preschools and K+ schools had positive enrollments

|

18

Nobel Learning Communities, Inc.

Financial Information |

19

Key characteristics of our Model

•

Sources of Strength

–

Revenue growth –

tuition, enrollment, new facilities, acquisitions

–

Strong recurring revenues –

high student retention rate

–

Highly attractive private pay demographic target

–

Proven acquirer with successful integration track record

•

Margin and Earnings Leverage

–

Comparable school revenue growth = Margin expansion

–

Distance learning online school delivers leverage with scalable

platform

•

Attractive Cash Flow

–

Generate cash before services delivered

–

Modest capital requirements –

real estate leased, not owned

–

Dry powder -

$75mm revolving credit facility; over $50mm

available |

20

Most Recent Performance: Q1, FY 2011

•

Record Q1 revenue of $52.2mm, up 3.2%

•

Generated TTM adjusted EBITDA of $16.6 mm

•

EPS Q1 2011 = ($0.23) compared to Q1 2010 = ($0.14)

•

Q1 Performance Items

–

DOJ relate professional fees impacted EBITDA by ($275K) and EPS ($0.02)

–

Increased discounts (mostly retention oriented or agency related) over LY

($395K)

–

Controllable spend (bounceback, HVAC, new classrooms) ($500K) over LY

–

Comparable school payroll variance over LY ($300K)

•

Comparable school revenue and enrollment trending better in September and

continued into October |

21

$18

$20

$21

$18

2007

2008

2009

2010

$181

$204

$220

$232

2007

2008

2009

2010

$8

$8

$7

$6

$12

$21

$7

$12

2007

2008

2009

2010

Acquisition spend

Capex

Four year performance

Revenue

growth

12.9%

7.8%

$27

$31

$29

$29

2007

2008

2009

2010

%

margin

15.1%

15.0%

13.2%

EBITDA

margin

9.9%

9.8%

9.8%

5.4%

12.5%

7.9%

13.1%

Revenue ($ millions)

Gross profit ($ millions)

Adjusted EBITDA ($ millions)

Capex

and acquisition spend ($ millions) |

22

Non-GAAP information

Financial information should be read in conjunction with Financial Statements and

Notes thereto file with the SEC Trailing

Twelve

Months

October 2,

2010

September 26,

2009

October 2,

2010

Net (loss) income

(2,451)

$

(1,432)

$

853

$

Interest expense

417

267

1,721

Tax (benefit) expense

(1,602)

(771)

877

Depreciation and amortization expense

2,507

2,300

10,201

EBITDA

(1,129)

$

364

$

13,652

$

Net loss from discontinued operations - net of depreciation

85

189

705

Stock compensation expense

286

305

1,089

DOJ litigation costs

275

158

1,077

Non-capitalizable transaction costs from acquisitions

-

128

83

Adjusted EBITDA

(483)

$

1,144

$

16,606

$

Thirteen Weeks Ended

Reconciliation of Non-GAAP Financial Measures |