Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Mastercard Inc | d8k.htm |

| EX-99.1 - PRESS RELEASE - Mastercard Inc | dex991.htm |

Exhibit 99.2

MasterCard’s Acquisition of Travelex’s

Prepaid Card Program Management

Conference Call December 9, 2010

Forward-Looking Statements

Statements in this presentation that are not historical facts, including statements about MasterCard’s proposed acquisition of the Card Program Management operations of Travelex as well as plans about strategies, beliefs and expectations, are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements are based on reasonable assumptions, plans, estimates and expectations, and are not guarantees of future performance. They are based on management’s expectations that involve a number of business risks and uncertainties, any of which could cause actual results to differ materially from those expressed in or implied by the forward-looking statements.

MasterCard undertakes no obligation to publicly update or revise any forward-looking statement. The risks and uncertainties relating to the forward-looking statements in this presentation include those described under the caption “Risk Factors” and “Forward-Looking Statements” in the Company’s most recent Form 10-K, Form 10-Qs and/or any Form 8-Ks filed or furnished with the U.S. Securities and Exchange Commission.

2

Acquisition of Prepaid Card Program Management

• Acquisition of the card program management operations from Travelex

– Global footprint

– Leading cardholder services

– Specialized expertise

• Agreement expands and extends our previous relationship with Travelex

– Now offers prepaid program management for the Travelex retail operations

– MasterCard gains brand exclusivity

• Acquisition price of £290 million in cash, with an earn-out of up to an additional £35 million if certain performance targets are met

• Expected to close in the first half of 2011

3

The Strategic Opportunity

Advances MasterCard’s leadership position in the prepaid segment – Projected to grow at 20+% CAGR to $840 billion by 2017*

Provides MasterCard the ability to provide customers and partners end-to-end or modular solutions to augment their capabilities

The prepaid card program management business operates in 20 countries and is launching in several other countries in 2011

* Source: Boston Consulting Group

| 4 |

|

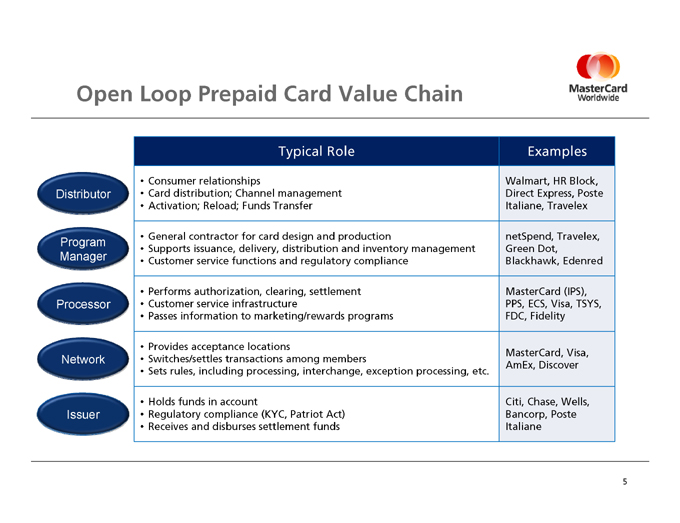

Open Loop Prepaid Card Value Chain

Typical Role Examples

• Consumer relationships Walmart, HR Block,

Distributor • Card distribution; Channel management Direct Express, Poste

• Activation; Reload; Funds Transfer Italiane, Travelex

Program • General contractor for card design and production netSpend, Travelex,

• Supports issuance, delivery, distribution and inventory management Green Dot,

Manager • Customer service functions and regulatory compliance Blackhawk, Edenred

• Performs authorization, clearing, settlement MasterCard (IPS),

Processor • Customer service infrastructure PPS, ECS, Visa, TSYS,

• Passes information to marketing/rewards programs FDC, Fidelity

• Provides acceptance locations

Network • Switches/settles transactions among members MasterCard, Visa,

• Sets rules, including processing, interchange, exception processing, etc. AmEx, Discover

• Holds funds in account Citi, Chase, Wells,

Issuer • Regulatory compliance (KYC, Patriot Act) Bancorp, Poste

• Receives and disburses settlement funds Italiane

5

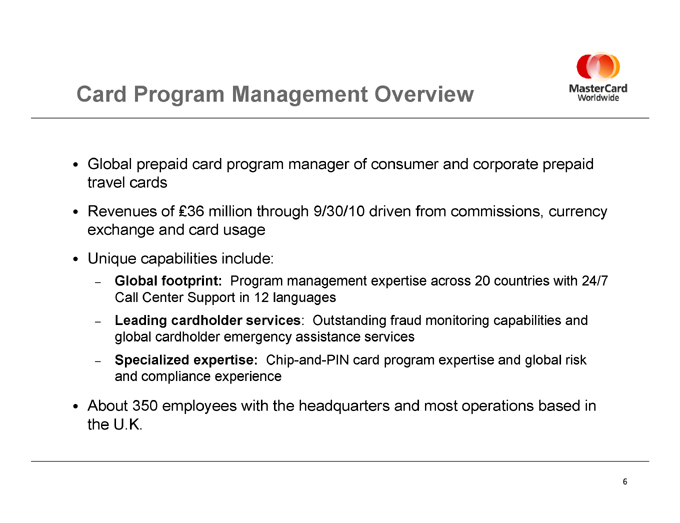

Card Program Management Overview

Global prepaid card program manager of consumer and corporate prepaid travel cards

Revenues of €36 million through 9/30/10 driven from commissions, currency exchange and card usage

Unique capabilities include:

Global footprint: Program management expertise across 20 countries with 24/7 Call Center Support in 12 languages

Leading cardholder services: Outstanding fraud monitoring capabilities and global cardholder emergency assistance services

Specialized expertise: Chip-and-PIN card program expertise and global risk and compliance experience

About 350 employees with the headquarters and most operations based in the U.K.

6

A Good Strategic Fit

Advances MasterCard’s vision to be the global leader in prepaid, especially within the high-growth cross-border segment

Provides multi-country infrastructure to accelerate prepaid market entry and growth in emerging markets

Flexibility to provide modular assets to support existing prepaid partners or end-to-end services to accelerate growth in select markets

Existing relationship with Travelex facilitates technical and operational integration

7

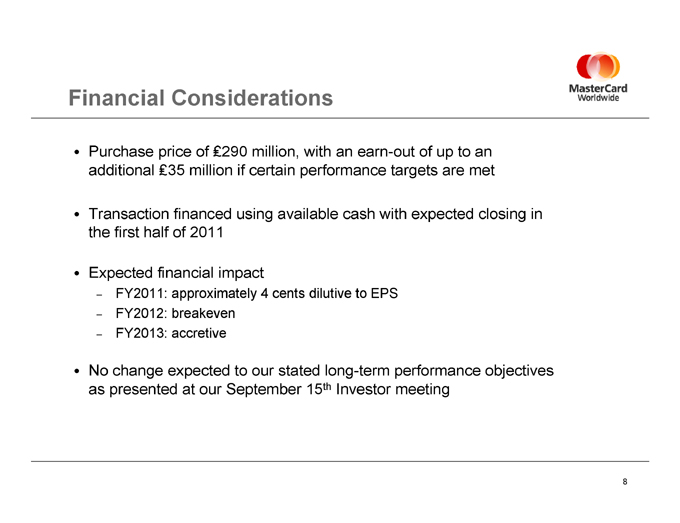

Financial Considerations

Purchase price of €290 million, with an earn-out of up to an additional €35 million if certain performance targets are met

Transaction financed using available cash with expected closing in the first half of 2011

Expected financial impact

FY2011: approximately 4 cents dilutive to EPS

FY2012: breakeven

FY2013: accretive

No change expected to our stated long-term performance objectives as presented at our September 15th Investor meeting

8

Master Card Worldwide

The Heart of Commerce TM