Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - RURAL/METRO CORP /DE/ | d8k.htm |

Annual Meeting of Stockholders

December 8, 2010

EXHIBIT 99.1 |

2

Annual

Meeting

of

Stockholders –

12/8/10

Forward-Looking Statements

Nothing contained in this presentation is, or should be relied upon as, a

promise or representation as to the future. Any projections contained

herein or otherwise made available are based on management’s analysis

of information available at the time this presentation was prepared

and on

assumptions and perspectives that may be unique to Rural/Metro

management, which may or may not prove to be correct. There can

be no

representation, warranty or other assurance as to the accuracy or

completeness of such projections or that any such projections will be

realized. Recipients of this presentation should conduct their own

investigation and analysis of the business, data and property described.

|

3

Annual

Meeting

of

Stockholders –

12/8/10

Management Introduction

Michael DiMino, President & CEO

•

Mr.

DiMino

was

named

President

&

Chief

Executive

Officer

in

June

2010.

•

From 2001 to 2005, Mr. DiMino was President, Chief Executive Officer and Director

of LESCO, Inc. (NASDAQ: LSCO), a $585 million public company that was the

nation’s largest distributor of landscape and lawn care products to

lawn care professionals (now an operating company of John Deere).

•

Mr. DiMino received his Bachelor of Arts, Liberal Arts, Economics Major, from

Marquette University.

Bryan Gibson, Executive Vice President & COO

•

Mr. Gibson was named Executive Vice President & Chief Operating Officer in

June 2010. •

Mr. Gibson joined the Company in 1997 as Director of Business Development for the

Southern region prior to his appointments in 2001 as Division General

Manager and in 2005 as President of the South segment.

•

Mr. Gibson founded Priority EMS, a 911 and non-emergency ambulance service in

Northern Mississippi

and

Western

Tennessee

that

became

the

largest

private

ambulance

service

in

the

Mid-South and was acquired in 1997 by Rural/Metro Corporation.

Kristi

Ponczak, Senior Vice President & CFO

•

Mrs. Ponczak has served as Senior Vice President, Chief Financial Officer,

Treasurer and Secretary since 2006.

•

She

joined

Rural/Metro

in

1998

as

Director

of

Financial

Planning

until

2004

when

she

was

promoted to Vice President and Treasurer.

•

Mrs.

Ponczak

is

a

certified

public

accountant

and

has

a

Bachelor

of

Science

degree

in

Accounting from Arizona State University. |

4

Annual

Meeting

of

Stockholders –

12/8/10

Management Introduction

Christopher Kevane, Senior Vice President & General Counsel

•

Mr. Kevane was promoted to Senior Vice President and General Counsel in March

2010. Previously he served as Managing Director and General Council

since 2006. •

Prior to joining Rural/Metro, Mr. Kevane was an attorney with the international

law firm of Squire, Sanders and Dempsey L.L.P.

•

He holds a Juris

Doctor from Arizona State University’s Sandra Day O’Connor College of

Law and a Bachelor of Science in Finance from ASU’s W.P. Carey School

of Business. Jeffrey Perry, Senior Vice President & Chief Information

Officer •

Mr.

Perry

was

promoted

to

Senior

Vice

President

and

Chief

Information

Officer

in

Jule

2010.

Prior to that, he served as Chief Information Officer since 2007.

•

From

2005-2007,

Mr.

Perry

was

Vice

President/Chief

Information

Officer

for

Giant

Industries.

•

Mr. Perry holds a Bachelor of Science in Organizational Management from Colorado

Christian University and a Masters Degree in Information Technology from

American Intercontinental University.

Maureen Thompson, Vice President of Human Resources

•

Ms. Thompson joined Rural/Metro in July 2010 as Vice President of Human Resources

to lead strategic and corporate human resources throughout the

enterprise. •

Prior to joining Rural/Metro, Ms. Thompson was Retail HR Strategic Business

Partner for The Goodyear Tire and Rubber Company.

•

Ms. Thompson holds a Bachelor of Arts in Business Administration/Marketing from

Michigan State University. |

5

Annual

Meeting

of

Stockholders –

12/8/10

Company Overview

Since 1948, grown into leading national provider of ground ambulance and

private fire protection services.

Serving more than 400 communities in 20 states.

8,150 employees and 1,800 vehicles

Since 2008, annual net revenue has increased at a compounded annual growth

rate of 4%.

From $482 million in ‘08 to $540.4 million at 9/30/10 (LTM)

Since

2008,

annual

adjusted

EBITDA

has

increased

at

a

compounded

annual

growth rate of 14.2%.

Fiscal 2011 EBITDA guidance is $74.0 million to $76.0 million.

Represents 45% increase over the last 3 years.

Fiscal 2011 capital expenditures expected to be $18M-$20M.

|

6

Annual

Meeting

of

Stockholders –

12/8/10

Investor Highlights

Multi-year, overlapping contracts and strong retention rates.

Capacity to increase utilization and drive margin expansion.

Organic & strategic growth opportunities due to highly fragmented

market. Commitment to technology to standardize processes and improve

operating efficiencies.

Strong EBITDA and cash-flow generation.

Population of Americans 65+ projected to increase 5x faster than

younger population in next 10 years.

Nearly 40M seniors in U.S.; by 2030, number is expected to double

as Boomers reach age 65.

43%

of

Rural/Metro’s

patients

are

age

65+

--

trending

upward.

Strong Business Model

Demographics Support

Demand for Services

Customer Acceptance

Outsourced ambulance services provide viable and economical

option to municipal and hospital-based EMS systems.

Increased demand for non-emergency ambulance services.

Trend: Hospital CEOs choosing to outsource.

Reimbursement

Environment

Favorable impact related to healthcare reform, as more Americans

have access to healthcare insurance.

All payers are a “wait and see”on specific impact and administration

of healthcare dollars under federal reform programs.

Continuing to request commercial rate increases to meet rising

costs of providing services. |

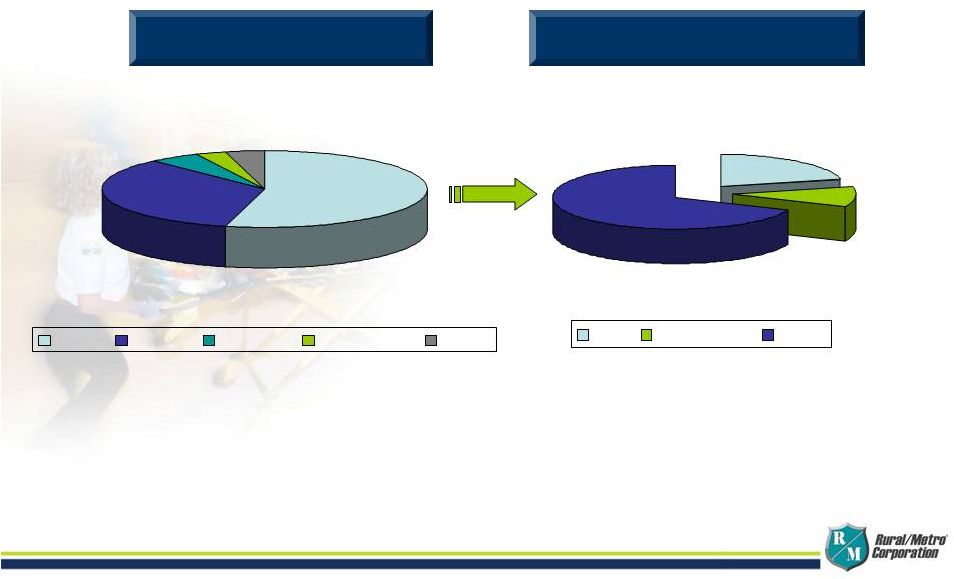

U.S.

Ambulance Spending Private

Provider

Market Share

$14.0 Billion –

All Transports

$4.8 Billion –

Private Sector Transports

Sources: U.S. Census Bureau; Coalition of Advanced Emergency Medical Systems;

Centers for Medicare and Medicaid Services; American Ambulance Association;

Journal of Emergency Medical Services 200 City Survey. Partnerships With

Municipal Departments & Hospital-Based Services Provide Market

Expansion Opportunities 54%

34%

5%

3%

4%

Gov't.

Private

Hospital

Pub. Utility

Other

21%

10%

69%

AMR

Rural/Metro

Other

7

Annual

Meeting

of

Stockholders –

12/8/10 |

8

Annual

Meeting

of

Stockholders –

12/8/10

Ambulance Utilization by Age

6%

10%

12%

19%

36%

41%

0%

5%

10%

15%

20%

25%

30%

35%

40%

45%

<15 Years

15-24 Years

25-44 Years

45-64 Years

>65 Years

>75 Years

Source: GAO

More than 43% of R/M Patients are Over 65 |

9

Annual

Meeting

of

Stockholders –

12/8/10

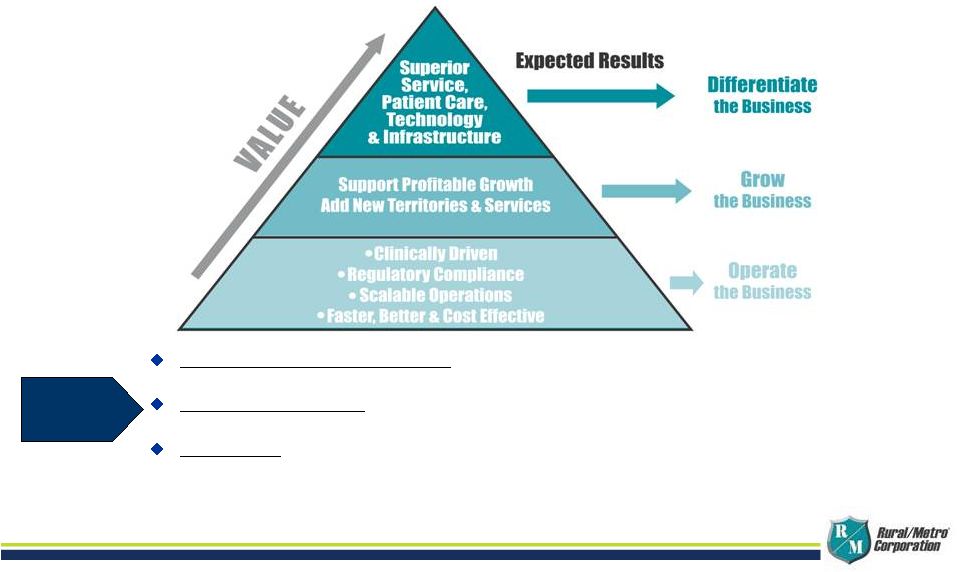

Rural/Metro Strategic Model

Best-in-Class

Operations

Superior

Service

&

Infrastructure

–

Standardization

of

key

systems,

including

billing, purchasing and contract compliance.

Advanced

Technology

–

Dispatch,

electronic

patient

care

reporting

(ePCR)

platform and proprietary billing system.

Best

People

–

Highly

experienced

executive

and

operational

management

team, along with

finest

paramedics,

EMTs

and

fire

professionals. |

10

Annual

Meeting

of

Stockholders –

12/8/10

Rural/Metro Operating Zones |

11

Annual

Meeting

of

Stockholders –

12/8/10

Organic & Strategic Growth Tactics

911 RFPs

Identify 911 emergency contracts with municipalities that meet

our profit guidelines.

Seek opportunities in new and existing markets

Complete detailed financial evaluation prior to bid response.

General Transport

Facility-based non-emergency transports that do not require an

RFP.

Opportunities for growth in contiguous and new geographies

initiated as a result of favorable market data.

Acquisitions

Disciplined approach to identifying, selecting and purchasing

highly accretive, existing ambulance operating companies.

Evaluate transformative new lines of business, including fire

protection, home health services, etc. |

Growth Opportunities/ Revenue Pipeline

$200 M

12

Annual

Meeting

of

Stockholders –

12/8/10

Active

Acquisitions

$89 M

Target

Acquisitions

$410 M

Startups

$66 M

RFP’s

$126 M |

13

Annual

Meeting

of

Stockholders –

12/8/10

Proprietary Billing & Process Technology

Computer-Aided Dispatch

System:

Electronic, real-time

dispatching to optimize contractual

response time performance

Paperless, electronic patient record.

Artificial intelligence prompts

paramedic based on medical

protocols to accurately document

medical necessity.

Ensures higher rate of

reimbursement

Accuracy, completeness, proof of medical

necessity.

Translates into: Reduced uncompensated

care, decreased DSO.

Core operating strength

Automated Vehicle Location

(AVL):

Knowing vehicle locations

creates dispatching efficiencies.

Electronic Patient Care

Report System (ePCR)

Proprietary Billing System

DISPATCH

& LOGISTICS

MEDICAL NECESSITY |

14

Annual

Meeting

of

Stockholders –

12/8/10

Debt Structure

Total Leverage

6.7x

4.7x

3.9x

3.6x

5.3x

0.0x

1.0x

2.0x

3.0x

4.0x

5.0x

6.0x

7.0x

2007

2008

2009

2010

Est. FY '11

* Based on FY ’11 Guidance

*

Company remains

focused on deleveraging

through debt repayment

and EBITDA creation.

Description

Term

Balance

Term Loan

6 yr through 2016

LIBOR +

4.25%

(1.75% LIBOR floor

)

$270M

Revolver

5 yr through 2015

$85M Undrawn

*Letter of Credit Sub-Line

$60M |