Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

_____________________

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

______________________

| CURAXIS PHARMACEUTICAL CORPORATION |

| (Exact name of registrant as specified in its charter) |

|

Nevada

|

2834

|

26-1919261

|

||

|

(State or other jurisdiction of

|

(Primary Standard Industrial

|

(I.R.S. Employer Identification Number)

|

||

|

incorporation or organization)

|

|

Classification Code Number)

|

|

_______________________

4819 Emperor Blvd., Suite 400

Durham, NC 27703

(888) 919-2873

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices) ________________________

Business Filings Incorporated

6100 Neil Road, Suite 500

Reno, NV 89511

(608) 827-5300

(Name, address, including zip code, and telephone number, including area code, of agent for service)

_________________________

Copies to:

Anslow & Jaclin, LLP

195 Route 9 South, 2nd Floor

Manalapan, NJ 07726

(732) 409-1212

__________________________

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box: þ

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If delivery of the prospectus is expected to be made pursuant to Rule 434, please check the following box. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

¨

|

Accelerated filer

|

¨

|

|

Non-accelerated filer

|

¨

|

Smaller reporting company

|

þ

|

CALCULATION OF REGISTRATION FEE

|

Title of Each Class Of Securities to be Registered

|

Amount to be

Registered (1)

|

Proposed

Maximum

Aggregate

Offering Price

per share

|

Proposed

Maximum

Aggregate

Offering Price

|

Amount of

Registration fee

|

||||||||||||

|

Common Stock, $0.0001 par value per share, issuable pursuant to the Equity Credit Agreement

|

14,500,000

|

$

|

$0.74

|

(2)

|

$

|

10,730,000

|

(3)

|

$

|

$765.05

|

|||||||

|

(1)

|

We are registering 14,500,000 shares of our common stock (the “Put Shares”) that we will put to Southridge Partners II, LP (“Southridge” or “Selling Security Holder”) pursuant to a private equity credit agreement (the “Equity Credit Agreement”) between Selling Security Holder and the registrant entered into on September 16, 2010 and subsequently amended on December 6, 2010. In the event of stock splits, stock dividends, or similar transactions involving the common stock, the number of common shares registered shall, unless otherwise expressly provided, automatically be deemed to cover the additional securities to be offered or issued pursuant to Rule 416 promulgated under the Securities Act of 1933, as amended (the “Securities Act”). In the event that adjustment provisions of the Equity Credit Agreement require the registrant to issue more shares than are being registered in this registration statement, for reasons other than those stated in Rule 416 of the Securities Act, the registrant will file a new registration statement to register those additional shares.

|

|

(2)

|

The offering price has been estimated solely for the purpose of computing the amount of the registration fee in accordance with Rule 457(c) of the Securities Act on the basis of the closing bid price of common stock of the registrant as reported on the Over-the-Counter BB (the “OTCBB”) on December 7, 2010.

|

|

(3)

|

This amount represents the maximum aggregate value of common stock, which may be put to Southridge by the registrant pursuant to the terms and conditions of the Equity Credit Agreement between Southridge and the registrant.

|

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(a) OF THE SECURITIES ACT OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE COMMISSION, ACTING PURSUANT TO SUCH SECTION 8(a), MAY DETERMINE.

PRELIMINARY PROSPECTUS, SUBJECT TO COMPLETION DATED DECEMBER 8, 2010

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the U.S. Securities and Exchange Commission (“SEC”) is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

PROSPECTUS

CURAXIS PHARMACEUTICAL CORPORATION

14,500,000 Shares of Common Stock

This prospectus relates to the resale of up to 14,500,000 shares of our common stock, par value $0.0001 per share, by Southridge Partners II, LP (“Southridge” or “Selling Security Holder”), which are Put Shares that we will put to Southridge pursuant to the Equity Credit Agreement.

The Equity Credit Agreement with Southridge provides that Southridge is committed to purchase up to $25 million of our common stock. We may draw on the facility from time to time, as and when we determine appropriate in accordance with the terms and conditions of the Equity Credit Agreement.

Southridge is an “underwriter” within the meaning of the Securities Act in connection with the resale of our common stock under the Equity Credit Agreement. No other underwriter or person has been engaged to facilitate the sale of shares of our common stock in this offering. This offering will terminate thirty-six (36) months after the registration statement to which this prospectus is made a part is declared effective by the SEC. Southridge will pay us 95% of the average of the lowest closing bid price of our common stock reported by Bloomberg, LP in any three trading days, consecutive or inconsecutive, of the five consecutive trading day period commencing the date a put notice is delivered.

We will not receive any proceeds from the sale of these shares of common stock offered by Selling Security Holder. However, we will receive proceeds from the sale of our Put Shares under the Equity Credit Agreement. The proceeds will be used for working capital or general corporate purposes. We will bear all costs associated with this registration.

Our common stock is quoted on the OTC Bulletin Board under the symbol “CURX.OB.” The shares of our common stock registered hereunder are being offered for sale by Selling Security Holder at prices established on the OTC Bulletin Board during the term of this offering. On December 7, 2010, the closing bid price of our common stock was $0.74 per share. These prices will fluctuate based on the demand for our common stock.

This investment involves a high degree of risk. You should purchase shares only if you can afford a complete loss. See “Risk Factors” beginning on page 5.

Neither the SEC nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is________, 2010

|

TABLE OF CONTENTS

|

Page

|

|

PROSPECTUS SUMMARY

|

1 |

|

RISK FACTORS

|

5 |

|

FORWARD LOOKING STATEMENTS

|

25 |

|

USE OF PROCEEDS

|

25 |

|

DIVIDEND POLICY

|

25 |

|

MARKET FOR OUR COMMON STOCK

|

25 |

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OR PLAN OF OPERATION

|

27 |

|

BUSINESS

|

41 |

|

MANAGEMENT

|

64 |

|

BENEFICIAL OWNERSHIP OF CURAXIS SHARES

|

71 |

|

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

|

73 |

|

DESCRIPTION OF SECURITIES

|

73 |

|

SELLING SECURITY HOLDER

|

74 |

|

PLAN OF DISTRIBUTION

|

76 |

|

LEGAL MATTERS

|

78 |

|

EXPERTS

|

78 |

|

AVAILABLE INFORMATION

|

78 |

|

INTERIM CONDENSED FINANCIAL STATEMENTS

|

F-1 |

| AUDITED FINANCIAL STATEMENTS | F-15 |

You should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with information different from that which is contained in this prospectus. This prospectus may be used only where it is legal to sell these securities. The information in this prospectus may only be accurate on the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of securities. This prospectus contains important information about us that you should read and consider carefully before you decide whether to invest in our common stock. If you have any questions regarding the information in this prospectus, please contact Patrick S. Smith, our President and Chief Executive Officer, at: Curaxis Pharmaceutical Corporation, 4819 Emperor Blvd., Suite 400, Durham, NC 27703 or by phone at (888) 919-2873.

All dealers that effect transactions in these securities whether or not participating in this offering may be required to deliver a prospectus. This is in addition to the dealer’s obligation to deliver a prospectus when acting as underwriters.

i

PROSPECTUS SUMMARY

This summary highlights selected information contained elsewhere in this prospectus. This summary does not contain all the information that a person should consider before investing in the Company’s securities. A potential investor should carefully read the entire prospectus, including “Risk Factors” and the Consolidated Financial Statements, before making an investment decision.

In this prospectus, “CURX,” “Curaxis,” the “Company,” “our Company,” “we,” “us” and “our” refers to Curaxis Pharmaceutical Corporation.

The Company

We are an emerging specialty pharmaceutical company with a hormone drug product candidate for the treatment of Alzheimer’s disease and multiple cancers. Our therapeutic platform is based on the hypothesis that many diseases of aging may be caused by age-related changes in the function of the hypothalamic-pituitary-gonadal (HPG) axis. The HPG axis is a hormonal endocrine feedback loop that controls development, reproduction and aging in animals. This drug development platform is built on the premise that hormones associated with this feedback loop are beneficial early in life, when they promote growth and development, but are harmful later in life when the mechanism for feedback is compromised, thereby leading to disease processes, including pathologies associated with Alzheimer’s disease and various cancers. We believe our discovery of similar hormonal signaling mechanisms at the cellular level in brain tissue from Alzheimer’s patients and in multiple tumors will enable us to develop significant new treatments for Alzheimer’s disease as well as many cancers.

Corporate History

We were incorporated in Nevada on February 1, 2008 under the name Auto Search Cars, Inc. We engaged in the development of a web-based e-commerce site platform to provide information for the sale of vehicles and vehicle financing and warranties. By providing such platform, we believed that we could be a price leader in the online vehicle sales and service market and bring vehicle sellers and other industry participants (such as vendors of automotive services and advertisers) together with consumers actively engaged in a search for a vehicle or vehicle-related products. Despite offering free listings on our website as an incentive for consumers to use our product, there had been no significant activities related to our website development. Our executive offices were located at 164 Eleven Levels Road, Ridgefield, Connecticut 06877.

On February 8, 2010, we entered into a merger agreement (as amended on July 29, 2010, the “Merger Agreement”) by and among Auto Search Cars, Inc., Auto Search Cars Acquisition Corp., a Delaware Corporation (“Acquisition Corp.”), and Curaxis Pharmaceutical Corporation, a corporation incorporated in Delaware on February 27, 2001 (“Curaxis”) (the “Merger”).

On July 29, 2010 (the “Closing Date”), pursuant to the Merger Agreement, (i) the common stock of Curaxis (the “Curaxis Common Stock”) became no longer outstanding and existing, and was cancelled and retired, and (ii) each holder of Curaxis Common Stock ceased to have any rights with respect to their shares of Curaxis Common Stock, except the right to receive shares of our common stock. Each holder of Curaxis Common Stock received one (1) share of Auto Search common stock for each share of Curaxis Common Stock they own immediately prior to completion of the Merger. Each share of the Auto Search Common Stock issued to the Curaxis stockholders pursuant to the Merger Agreement was restricted from trading or resale for a period of one (1) year commencing at the effective date of the Merger. Auto Search stockholders continued to own their existing shares, which were not affected by the Merger.

On the Closing Date, Curaxis and Acquisition Corp. merged with and into one another, with the surviving corporation being Curaxis. Simultaneously with the filing of a Certificate of Merger with the State of Delaware, Curaxis amended its Certificate of Incorporation in order to change its name to Curaxis Pharma Corp. On the Closing Date, Curaxis Pharma Corp. became our subsidiary.

1

On July 30, 2010, we entered into an agreement and plan of merger with Curaxis Pharmaceutical Corporation, a Nevada corporation formed solely for the purpose of a name change (the “Short-Form Merger”). Pursuant to the Short-Form Merger, we changed our name to Curaxis Pharmaceutical Corporation.

Our principal business offices are located at 4819 Emperor Blvd., Suite 400, Durham, NC 27703, and our telephone number at that address is (888) 919-2873.

The Offering

|

Common stock offered by Selling Security Holder

|

14,500,000 shares of common stock.

|

|

Common stock outstanding before the offering

|

72,216,489 as of November 30, 2010

|

|

Common stock outstanding after the offering

|

86,716,489 shares.

|

|

Terms of the Offering

|

Selling Security Holder will determine when and how it will sell the common stock offered in this prospectus.

|

|

Termination of the Offering

|

Pursuant to the Equity Credit Agreement, this offering will terminate thirty six (36) months after the registration statement to which this prospectus is made a part is declared effective by the SEC.

|

|

Use of proceeds

|

We will not receive any proceeds from the sale of the shares of common stock offered by Selling Security Holder. However, we will receive proceeds from sale of our common stock under the Equity Credit Agreement. The proceeds from the offering will be used for the clinical development of our drug candidate, Memryte, for the treatment of mild to moderate Alzheimer’s disease and general corporate purposes. See “Use of Proceeds.”

|

|

Risk Factors

|

The common stock offered hereby involves a high degree of risk and should not be purchased by investors who cannot afford the loss of their entire investment. See “Risk Factors” beginning on page 5.

|

|

OTC Bulletin Board Symbol

|

CURX.OB

|

This offering relates to the resale of up to 14,500,000 shares of our common stock, par value $0.0001 per share, by Selling Security Holder, which are the Put Shares that we will put to Southridge pursuant to the Equity Credit Agreement. Assuming the resale of all of the shares being registered in this Registration Statement, such shares would constitute approximately 17% of our outstanding common stock.

On September 16, 2010, our Company and Southridge entered into the Equity Credit Agreement pursuant to which we have the opportunity, for a three -year period, commencing on the date on which the SEC first declares effective this registration statement, to which this prospectus is made a part registering the resale of our common shares by Southridge, to resell shares of our common stock purchased under the Equity Credit Agreement. For each share of our common stock purchased under the Equity Credit Agreement, Southridge will pay 95% of the average of the three lowest closing bid price (the “Bid Price”) of any three applicable trading days, consecutive or inconsecutive, during the five (5) trading day period (the “Valuation Period”), commencing on the date a put notice (the “Put Notice”) is delivered to Southridge (the “Put Date”) in the manner prescribed in the Equity Credit Agreement. Subject to the limitations and floor price reductions outlined below, we may, at our sole discretion, issue a Put Notice to Southridge, after which Southridge will be irrevocably bound to acquire such shares. The Company and Southridge subsequently amended certain terms of the Equity Credit Agreement on December 6, 2010.

2

We must specify a floor price in each Put Notice, which shall not be less than sixty percent (60%) of the average of the closing Bid Prices for the three (3) trading days ending immediately prior to the Put Date (the “Floor Price”). In the event that during a Valuation Period for any Put Notice, the closing Bid Price on any trading day falls below the Floor Price specified in such Put Notice, then for each such trading day we shall be under no obligation to sell and Selling Security Holder shall be under no obligation to purchase one fifth (1/5th) of the amount specified in the Put Notice, and the Investment Amount shall accordingly be deemed reduced by such amount. In the event that during a Valuation Period the closing Bid Price falls below the Floor Price for any three (3) trading days - not necessarily consecutive – then the balance of each party’s rights and obligations to purchase and sell the Investment Amount under such Put Notice shall terminate on such third trading day (“Put Termination Day”), and the Investment Amount shall be adjusted to include only one-fifth (1/5) of the initial Investment Amount for each trading day during the Valuation Period prior to the Put Termination Day that the closing Bid Price equals or exceeds the Floor Price.

Furthermore, subject to the terms and conditions of the Equity Credit Agreement, at any time or from time to time after the effectiveness of this registration statement, we can notify Southridge in writing of the existence of a potential material event based upon the good faith determination of our board of directors (the “Blackout Notice”), and Southridge shall not offer or sell any of our securities acquired under the Equity Credit Agreement from the time the Blackout Notice was provided to Southridge until Southridge receives our written notice that such potential material event has either been disclosed to the public or no longer constitutes a potential material event. If we deliver a Blackout Notice within fifteen trading days, commencing the sixth day following a Put Date (the “Closing Date”), and the Bid Price immediately preceding the applicable Blackout Period (the “Old Bid Price”) is greater than the Bid Price on the first trading day immediately following such Blackout Period (the “New Bid Price”), then we are obligated to issue to Southridge a number of additional common shares (the “Blackout Shares”) equal to the difference between (i) the product of (X) the shares that were issued to the Southridge on the most recent Closing Date and held by the Southridge immediately prior to the Blackout Period (the “Remaining Put Shares”), multiplied by (Y) the Old Bid Price, and divided by (Z) the New Bid Price, and (ii) the Remaining Put Shares.

We are relying on an exemption from the registration requirements of the Securities Act of 1933, as amended (the “Securities Act”), and/or Rule 506 of Regulation D promulgated thereunder. The transaction does involve a private offering, Southridge is an “accredited investor” and/or qualified institutional buyer and Southridge has access to information about our Company and its investment.

At the assumed offering price of $.74 per share, we will be able to receive up to $10,193,500 in gross proceeds, assuming the sale of the entire 14,500,000 shares of our common stock being registered hereunder pursuant to the Equity Credit Agreement. We would be required to register additional shares to obtain the balance of $25,000,000 under the Equity Credit Agreement if the market price of the stock remains stable or falls below the assumed offering price of $.74. Neither the Equity Credit Agreement nor any rights or obligations of the parties under the Equity Credit Agreement may be assigned by either party to any other person.

There are substantial risks to investors as a result of the issuance of shares of our common stock under the Equity Credit Agreement. These risks include dilution of stockholders, significant decline in our stock price and our inability to draw sufficient funds when needed.

Southridge will periodically purchase our common stock under the Equity Credit Agreement and will, in turn, sell such shares to investors in the market at the market price. This may cause our stock price to decline, which will require us to issue increasing numbers of common shares to Southridge to raise the same amount of funds, as our stock price declines.

3

SUMMARY FINANCIAL AND OPERATING INFORMATION

The following selected financial information is derived from our Financial Statements appearing elsewhere in this prospectus and should be read in conjunction with the Company’s Financial Statements, including the notes thereto, appearing elsewhere in this prospectus. (Except as noted, all numbers are reported in thousands)

Summary of Operations

For the Nine Months Ended September 30,

|

2010

|

2009

|

|||||||

|

Total Revenue

|

$

|

0

|

$

|

0

|

||||

|

Loss from operations

|

$

|

(1,555

|

)

|

$

|

(525

|

)

|

||

|

Other expense

|

$

|

(133

|

)

|

$

|

(299

|

)

|

||

|

Gain on debt restructuring

|

$

|

204

|

$

|

6,562

|

||||

|

Interest from derivative conversion feature

|

$

|

(2,586

|

)

|

$

|

0

|

|||

|

Change in fair value of derivatives

|

$

|

429

|

$

|

0

|

||||

|

Net Income (loss)

|

$

|

(3,641

|

)

|

$

|

5,738

|

|||

|

Net income (loss) per common share (basic)

|

$

|

(0.06

|

)

|

$

|

0.10

|

|||

|

Net income (loss) per common share (diluted)

|

$

|

(0.06

|

)

|

0.10

|

||||

|

Weighted average common shares outstanding (basic)

|

65,690

|

56,134

|

||||||

|

Weighted average common shares outstanding (diluted)

|

65,690

|

59,016

|

||||||

For the Years Ended December 31,

|

2009

|

2008

|

|||||||

|

Total Revenue

|

$

|

0

|

$

|

0

|

||||

|

Loss from operations

|

$

|

(1,209

|

)

|

$

|

(1,508

|

)

|

||

|

Other expense

|

$

|

(366

|

)

|

$

|

(478

|

)

|

||

|

Gain on debt restructuring

|

$

|

6,562

|

$

|

0

|

||||

|

Net income (loss)

|

$

|

4,987

|

$

|

(1,986

|

)

|

|||

|

Net income (loss) per common share (basic)

|

$

|

0.09

|

$

|

(0.04

|

)

|

|||

|

Net income (loss) per common share (diluted)

|

$

|

0.08

|

$

|

(0.04

|

)

|

|||

|

Weighted average common shares outstanding (basic)

|

57,699

|

54,070

|

||||||

|

Weighted average common shares outstanding (diluted)

|

60,701

|

54,070

|

||||||

For the Cumulative period from February 27, 2001 (Inception) to:

|

September 30,

2010

|

December 31,

2009

|

|||||||

|

Total Revenue

|

$

|

0

|

$

|

0

|

||||

|

Loss from operations

|

$

|

(94,750

|

)

|

$

|

(93,195

|

)

|

||

|

Other expense

|

$

|

(1,050

|

)

|

$

|

(917

|

)

|

||

|

Gain on debt restructuring

|

$

|

6,766

|

$

|

6,562

|

||||

|

Interest from derivative conversion feature

|

$

|

(2,586

|

)

|

$

|

0

|

|||

|

Change in fair value of derivatives

|

$

|

429

|

$

|

0

|

||||

|

Net loss

|

$

|

(91,191

|

)

|

$

|

(87,550

|

)

|

||

Statement of Financial Position

|

September 30,

2010

|

December 31,

2009

|

|||||||

|

Cash and cash equivalents

|

$

|

273

|

$

|

631

|

||||

|

Total assets

|

$

|

1,195

|

$

|

781

|

||||

|

Total Liabilities

|

$

|

13,193

|

$

|

10,371

|

||||

|

Stockholders’ equity ( deficit )

|

$

|

(11,998

|

)

|

$

|

(9,590)

|

|||

4

RISK FACTORS

The shares of our common stock being offered for resale by Selling Security Holder are highly speculative in nature, involve a high degree of risk and should be purchased only by persons who can afford to lose the entire amount invested therein. Before purchasing any of these securities, you should carefully consider the following factors relating to our business and prospects. If any of the following risks actually occurs, our business, financial condition or operating results could be materially adversely affected. In such case, the trading price of our common stock could decline, and you may lose all or part of your investment.

RISKS RELATED TO OUR BUSINESS

We expect to incur losses at least for the foreseeable future and may never achieve or maintain profitability.

We expect to incur operating losses at least for the foreseeable future. If we are unable to raise the funds necessary to pay our expenses, including expenses accumulated in our clinical trial activities to date, we may be unable to continue operations.

To become and remain profitable, we must succeed in developing and commercializing drugs with significant market potential. This will require us to be successful in a range of challenging activities for which we are only in the preliminary stages: developing drugs, obtaining regulatory approval for them, and manufacturing, marketing and selling them. We may never succeed in these activities and may never generate revenues that are significant or large enough to achieve profitability. Even if we do achieve profitability, we may not be able to sustain or increase profitability on a quarterly or annual basis. Our failure to become and remain profitable could impair our ability to raise capital, expand our business, diversify our product offerings or continue out operations.

Due to a lack of financial resources, we have been unable to advance the clinical development of our lead product candidate since 2006.

Our lead product candidate is a hormone for the treatment of Alzheimer’s disease. We have previously conducted several clinical trials for this indication, the most recent of which we were forced to terminate in 2006 due to financial constraints. Since terminating those trials, we have been unable to advance the clinical development of our Alzheimer’s disease candidate due to a lack of financial resources. We anticipate that we will be able to raise the funds necessary to restart the clinical development of our Alzheimer’s disease candidate, but there can be no assurance that we will be able to do so. Furthermore, even if we are successful in raising the funds necessary to restart the clinical development of our Alzheimer’s disease candidate, there can be no assurance that we will be able to successfully complete all phases of such clinical development. Drug development is extremely costly and complex and requires multiple clinical trials and we may be unable to obtain suitable financing for all such trials and, even if we are successful in obtaining suitable financing, we may be unable to complete all required clinical trials due to an inability to recruit an adequate number of clinical trial sites or an adequate number of patients to participate in those trials or other reasons.

We will need substantial additional funding and may be unable to raise capital when needed, which would force us to delay, reduce or eliminate our product development programs or commercialization efforts.

We expect our research and development expenses to increase in connection with our ongoing activities, particularly as we conduct clinical trials for our candidate for the treatment of mild to moderate Alzheimer’s disease. In addition, subject to regulatory approval of any of our product candidates, we expect to incur significant commercialization expenses for product sales, marketing, securing commercial quantities of product from our manufacturers and distribution. We will need substantial additional funding to complete clinical trials and fund initial commercialization costs of our therapeutic candidates and to advance our earlier stage preclinical programs, and may be unable to raise capital when needed or on attractive terms, which would force us to delay, reduce or eliminate our research and development programs or commercialization efforts. Our management believes that it has sufficient funds to continue operations through December 31, 2010.

5

Our future capital requirements will depend on many factors, including:

|

·

|

the progress and results of clinical trials of our lead candidate, VP4896, for mild to moderate Alzheimer’s disease;

|

|

·

|

the costs of establishing sales and marketing functions, outsourcing manufacturing needs and obtaining pre-launch inventory of VP4896;

|

|

·

|

the scope, progress, results and cost of pre-clinical development and laboratory testing and clinical trials for our other product candidates;

|

|

·

|

the costs, timing and outcome of regulatory review of VP4896 for mild to moderate Alzheimer’s disease and of our other product candidates;

|

|

·

|

the number and development requirements of other product candidates;

|

|

·

|

the costs of preparing, filing and prosecuting patent applications and maintaining, enforcing and defending intellectual property-related claims;

|

|

·

|

our success in entering into collaboration agreements with leading pharmaceutical and biotechnology companies to assist in furthering the development of product candidates; and

|

|

·

|

the timing, receipt and amount of sales or royalties, if any, from VP4896 and other potential products.

|

Until such time, if ever, when we can generate substantial product revenues, we expect to finance our cash needs through public or private equity offerings, debt financings and possibly corporate collaboration and licensing arrangements. If we raise additional funds by issuing equity securities, our stockholders may experience dilution. Debt financing, if available, may involve agreements that include covenants limiting or restricting our ability to take specific actions, such as incurring additional debt, making capital expenditures or declaring dividends. Any debt financing or additional equity that we raise may contain terms, such as liquidation and other preferences that are not favorable to our Company or our stockholders. If we raise additional funds through collaboration and licensing arrangements with third parties, it may be necessary to relinquish valuable rights to our technologies, future revenue streams, research programs or product candidates or to grant licenses on terms that may not be favorable to us.

We are still in the initial stages of our business plan, which may make it difficult for you to evaluate the success of our business to date and to assess our future viability.

Our operations have been limited to organizing and staffing our Company, acquiring, developing and securing our technology and undertaking pre-clinical studies and limited clinical trials of our most advanced product candidate, VP4896. We have not yet demonstrated our ability to successfully complete large-scale, pivotal clinical trials, obtain regulatory approval, manufacture a commercial scale product or arrange for a third party to do so on our behalf or conduct sales and marketing activities necessary for successful product commercialization.

In addition, we may encounter unforeseen expenses, difficulties, complications, delays and other known and unknown factors. We will need to transition from our research focus to supporting commercial activities, and we may not be successful in such transition.

6

We depend heavily on the success of our most advanced product candidate, VP4896 for mild to moderate Alzheimer’s disease, which is still in clinical development. If we are unable to commercialize VP4896 for this indication, or experiences significant delays in doing so, our business will be materially harmed.

We have invested a significant portion of our efforts and financial resources in the development of our most advanced product candidate, VP4896, for mild to moderate Alzheimer’s disease. The success of our VP4896 Alzheimer’s disease program will depend on several factors, including the following:

|

·

|

successful patient enrollment in, and completion of, clinical trials;

|

|

·

|

receipt of marketing approvals from the FDA and similar foreign regulatory authorities;

|

|

·

|

obtaining commercial quantities of leuprolide acetate, the active ingredient of VP4896;

|

|

·

|

obtaining commercial quantities of VP4896 from our supplier, Durect Corporation;

|

|

·

|

establishing a sales and marketing infrastructure to market and sell VP4896 in the United States and internationally, whether alone or in collaboration with others; and

|

|

·

|

acceptance of the product by patients, the medical community and third party payors.

|

Our ability to generate product revenues, which we do not expect will occur for at least the next several years, if ever, will depend heavily on the successful development and commercialization of VP4896. If we are unable to commercialize VP4896 for mild to moderate Alzheimer’s disease, or experience significant delays in doing so, our business will be materially harmed.

If we are unable to achieve statistical significance on the primary efficacy endpoints in clinical trials of VP4896 for the treatment of mild to moderate Alzheimer’s disease, we may not be successful in obtaining FDA approval for VP4896, which would materially harm our business.

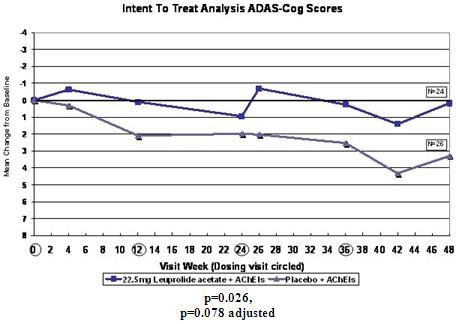

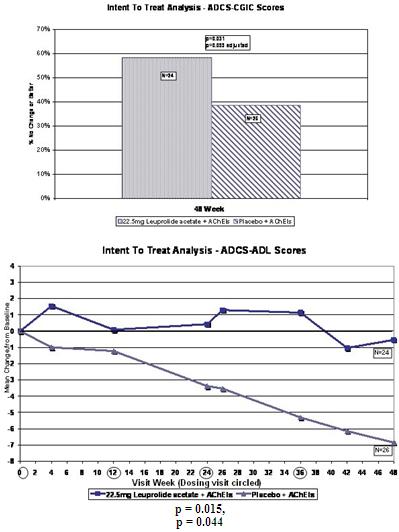

In ALADDIN I, our Phase II clinical trial for women with mild to moderate Alzheimer’s disease involving an injectable formulation of leuprolide acetate, we identified a trend in favor of the high dose leuprolide acetate group versus placebo, but we did not achieve statistical significance on the primary efficacy endpoints or any of the secondary efficacy endpoints in this clinical trial. The primary efficacy endpoints of the trial were a patient’s score on each of the ADAS-cog, a test of memory and cognition, and the ADCS-CGIC, a global measure of a subject’s change in condition, at 48 weeks compared to baseline. There were various secondary efficacy endpoints, including a patient’s score on the ADCS-ADL, a measurement of a patient’s capacity to perform activities of daily living, at 48 weeks compared to baseline. Analysis of the same primary efficacy endpoints at the completion of the 48-week men’s Phase II study, ALADDIN II, also did not demonstrate statistical significance.

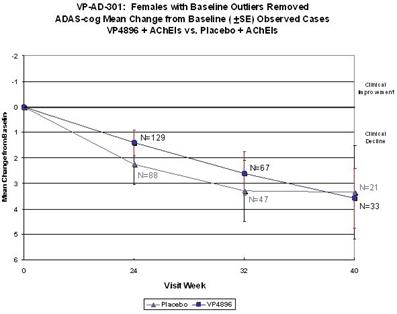

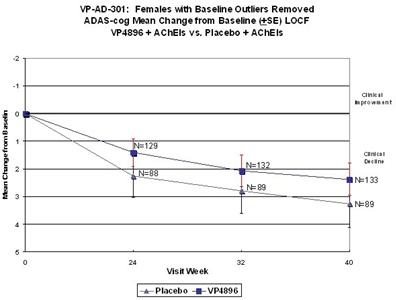

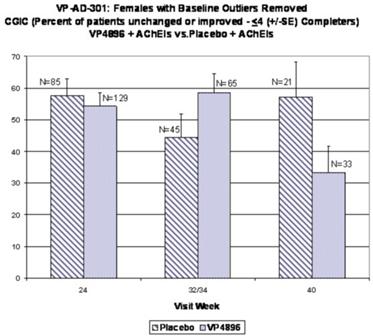

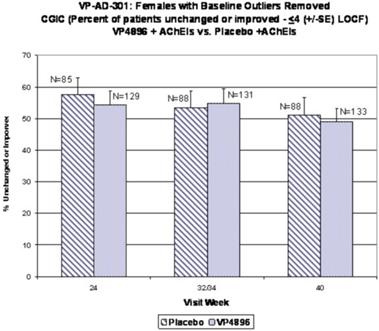

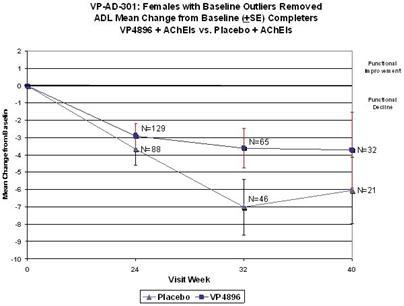

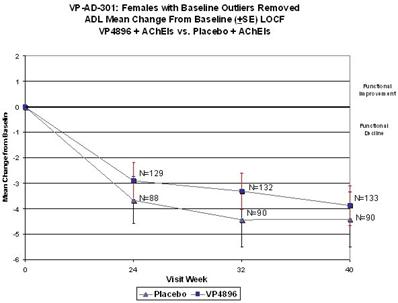

We performed a preplanned subgroup analysis of 78 women out of the 108 women who participated in ALADDIN I, the Phase II clinical trial in women. Of this subgroup of 78 women, which included all of the patients who were taking an acetylcholinesterase inhibitor (AChEI) and excluded the 30 patients who were not taking an AChEI, 28 patients were taking an AChEI plus 11.25 mg of leuprolide acetate, 24 patients were taking an AChEI plus 22.5 mg of leuprolide acetate and 26 patients were taking an AChEI plus placebo. The results for the group of 28 patients that received an AChEI plus the 11.25 mg dose of leuprolide acetate were not statistically significantly different from the results for the group that received an AChEI plus placebo. The results for the group of 24 patients that received an AChEI plus the 22.5 mg of leuprolide acetate compared to the group of 26 patients that received an AChEI plus placebo were statistically significant with respect to the patients’ scores on both primary endpoints, the ADAS-cog and ADCS-CGIC as well as on the ADCS-ADL, a secondary endpoint, prior to applying any statistical adjustment. However, because we performed several comparisons, we were required to adjust the p-values (a mathematical calculation used to determine the likelihood that the measured result was obtained by chance) of the results to account for multiple comparisons. This was done by using what is referred to as the Bonferroni correction, which applies an estimated statistical penalty to account for the number of comparisons made. Specifically, the unadjusted p-values for this subgroup were 0.026 for the ADAS-cog, 0.031 for the ADCS-CGIC and 0.015 for ADCS-ADL. The adjusted p-values for this subgroup were 0.078 for the ADAS-cog, 0.093 for the ADCS-CGIC and 0.044 for ADCS-ADL. Therefore, after applying the Bonferroni correction, we were only able to demonstrate statistical significance with respect to the ADCS-ADL.

7

We likewise performed an analysis of 90 men out of 119 men who participated in ALADDIN II, the Phase II clinical trial in men. Of this subgroup of 90 men, which included all of the patients who were taking an AChEI and excluded the 29 patients who were not taking an AChEI, 27 patients were taking an AChEI plus a 22.5 mg dose of leuprolide acetate, 34 patients were taking an AChEI plus a 33.75 mg dose of leuprolide acetate and 29 patients were taking an AChEI plus placebo. The results for both leuprolide-treated groups were not significantly different from the results for the group that received an AChEI plus placebo. The treated groups of 27 and 34 patients given 22.5 mg and 33.75 mg of leuprolide acetate, respectively, demonstrated a slight positive signal on the ADAS-cog assessment compared to placebo at 48 weeks. Results on the ADCS-CGIC rating demonstrated that 44% of the men who received 22.5 mg of leuprolide acetate plus AChEIs, and 47% of the men who received 33.75 mg of leuprolide acetate plus AChEIs, were either improved or showed no change compared to 31% of the men who received placebo plus AChEIs.

In addition, we used a commercially available formulation of leuprolide acetate administered by injection in its Phase II trials for the treatment of mild to moderate Alzheimer’s disease, while our planned clinical trials will test VP4896, a biodegradable polymeric implant formulation of leuprolide acetate, for this indication. Leuprolide acetate administered through an implant may not have the same effect as leuprolide acetate injections had in our earlier Phase II clinical trials and may cause side effects not seen in those Phase II clinical trials. ALADDIN 105 was a Phase I trial performed by us to test the safety and tolerability of the VP4896 implant and the implantation procedure as well as the pharmacokinetics (absorption, distribution, metabolism, and elimination), of leuprolide delivery from the implant. The results of that study suggest that the VP4896 implant is safe and well tolerated. ALADDIN 105 also demonstrated that the VP4896 implant releases leuprolide acetate in a steady and sustained way over the 8-week dosing period. In addition, our planned clinical trials may be at dosing levels that are higher than the doses of leuprolide acetate used in ALADDIN I and ALADDIN II.

The differences in dosing levels and methods of administration, as well as other factors, may have unexpected effects on the outcome of our clinical trials. If we are unable to achieve statistical significance on the primary efficacy endpoints in pivotal Phase III clinical trials, we may not be successful in obtaining FDA approval for VP4896, which would materially harm our business.

Our program for VP4896 is based on the LH Hypothesis, which is not viewed as the predominant hypothesis regarding the possible causes of Alzheimer’s disease. This adds to the risk of our development effort and may affect physician and patient acceptance and use of VP4896 and the willingness of third parties to provide reimbursement.

Our program for VP4896 is based on the LH hypothesis, which is not the predominant view regarding the possible causes of Alzheimer’s disease. The LH hypothesis proposes that the known neurological and biochemical changes associated with Alzheimer’s disease are caused by elevated levels of the pituitary hormone, leuteinizing hormone (LH). This hypothesis suggests that when LH levels increase as the body ages, the neurological changes seen in Alzheimer’s disease result. The beta amyloid hypothesis, however, proposes that amyloid beta protein, which makes up the plaques present in the brains of Alzheimer’s disease patients, is toxic, and is the causative agent of the disease. Under this hypothesis, inhibiting the production of, and enhancing the clearance of, amyloid beta protein plaques may prevent or treat Alzheimer’s disease. The beta amyloid hypothesis is the predominant view. While preclinical data now support the notion that the LH hypothesis may be interrelated with the amyloid hypothesis and other hypotheses of Alzheimer’s disease pathology, the unproven nature of the LH hypothesis adds to the risk that our development effort may not be successful. In particular, no drugs for the treatment of Alzheimer’s disease have been successfully developed based on the LH hypothesis. Moreover, the predominant status of the beta amyloid hypothesis may impede our development and commercialization efforts. For example, the predominant status of the beta amyloid hypothesis in the medical community may adversely affect our ability to recruit patients for our clinical trials or, if we successfully complete clinical development of this product candidate and obtain regulatory approval, may adversely affect our ability to recruit sales and marketing personnel, may affect physician and patient acceptance and use of the product and the willingness of third parties to provide reimbursement, any of which could materially harm our business.

8

If Curaxis’ preclinical studies do not produce successful results or its clinical trials do not demonstrate safety and efficacy in humans, Curaxis will not be able to commercialize its product candidates.

Before obtaining regulatory approval for the sale of its product candidates, Curaxis must conduct, at its own expense, extensive preclinical tests and clinical trials to demonstrate the safety and efficacy in humans of its product candidates. Preclinical and clinical testing is expensive, difficult to design and implement, can take many years to complete and is uncertain as to outcome. Success in preclinical testing and early clinical trials does not ensure that later clinical trials will be successful, and interim results of a clinical trial do not necessarily predict final results. Specifically, the results of Curaxis’ Phase II trials were collected from a limited number of subjects and may not be indicative of results that it will obtain in later studies which are expected to be of greater size and scope.

A failure of one or more of our clinical trials can occur at any stage of testing. We may experience numerous unforeseen events during, or as a result of, the clinical trial process that could delay or prevent our ability to receive regulatory approval or commercialize VP4896 or our other product candidates, including:

|

·

|

regulatory authorities, institutional review boards, or ethics committees may not authorize us to commence a clinical trial or conduct a clinical trial at a prospective trial site;

|

|

·

|

our clinical trials may produce negative or inconclusive results, and we may decide, or regulatory authorities may require us, to conduct additional clinical trials or we may abandon projects that we expect to be promising;

|

|

·

|

enrollment in our clinical trials may be slower than we currently anticipate, resulting in significant delays. Additionally, participants may drop out of our clinical trials at a higher rate than we anticipate;

|

|

·

|

our third party contractors may fail to comply with regulatory requirements or meet their contractual obligations to us in a timely manner;

|

|

·

|

we might have to suspend or terminate our clinical trials if the participants are being exposed to unacceptable health risks;

|

|

·

|

regulatory authorities, institutional review boards, or ethics committees may require that we hold, suspend or terminate clinical research for various reasons, including noncompliance with regulatory requirements;

|

|

·

|

the cost of our clinical trials may be greater than we anticipate;

|

|

·

|

the supply or quality of our product candidates or other materials necessary to conduct our clinical trials may be insufficient or inadequate; and

|

|

·

|

the effects of our product candidates may not achieve the desired effects or may include undesirable side effects or the product candidates may have other unexpected characteristics.

|

If we are required to conduct additional clinical trials or other testing of VP4896 or our other product candidates beyond those that we currently contemplate, if we are unable to successfully complete our clinical trials or other testing, or if the results of these trials or tests are not positive or are only modestly positive, we may:

|

·

|

be delayed in obtaining marketing approval for our product candidates;

|

9

|

·

|

not be able to obtain marketing approval; or

|

|

·

|

obtain approval for indications that are not as broad as we intended.

|

Our product development costs will also increase if we experience delays in testing or approvals. We do not know whether any clinical trials will begin as planned, need to be restructured or will be completed on schedule, if at all. Significant clinical trial delays could also shorten the patent protection period during which we may have the exclusive right to commercialize our product candidates or allow our competitors to bring products to market before we do and impair our ability to commercialize our products or product candidates.

Use of third parties to manufacture our product candidates, including VP4896, may increase the risk that we will not have sufficient quantities of our product candidates or such quantities at an acceptable cost, and clinical development and commercialization of our product candidates could be delayed, prevented or impaired.

We do not own or operate manufacturing facilities for clinical or commercial production of our product candidates. We have limited personnel with experience in drug manufacturing and we lack the resources and the capabilities to manufacture any of our product candidates on a clinical or commercial scale. Our strategy is to outsource all manufacturing of our product candidates and products, including VP4896, to third parties.

Reliance on third party manufacturers entails risks to which we would not be subject if we manufactured product candidates or products ourselves, including:

|

·

|

reliance on the third party for regulatory compliance and quality assurance;

|

|

·

|

the possible breach of the manufacturing agreement by the third party because of factors beyond our control; and

|

|

·

|

the possible termination or non-renewal of the agreement by the third party, based on its own business priorities, at a time that is costly or inconvenient for us.

|

Our manufacturers may not be able to comply with current Good Manufacturing Practice, or cGMP, regulations or other regulatory requirements or similar regulatory requirements outside the United States. Our failure, or the failure of our third party manufacturers to comply with applicable regulations could result in sanctions being imposed on us, including fines, injunctions, civil penalties, failure of regulatory authorities to grant marketing approval of our product candidates, delays, suspension or withdrawal of approvals, license revocation, seizures or recalls of product candidates or products, operating restrictions and criminal prosecutions, any of which could significantly and adversely affect supplies of our product candidates.

Our product candidates and any products that we may develop may compete with other product candidates with respect to the availability of manufacturing facilities. There are a limited number of manufacturers that operate under cGMP regulations that are both capable of manufacturing for us and willing to do so. If the third parties that we engage to manufacture product for our clinical trials should cease to continue to do so for any reason, we likely would experience delays in advancing these trials while we identify and qualify replacement suppliers and we may be unable to obtain replacement supplies on terms that are favorable to us. In addition, if we are not able to obtain adequate supplies of our product candidates or the drug substances used to manufacture them, it will be more difficult for us to develop our product candidates and compete effectively.

Our current and anticipated future dependence upon others for the manufacture of our product candidates may adversely affect our future profit margins and our ability to develop product candidates and commercialize any products that receive regulatory approval on a timely and competitive basis.

10

We rely on Durect Corporation, our sole source provider of VP4896, to produce VP4896 for our clinical trials and will rely on Durect to produce commercial drug supplies of VP4896. Durect has limited experience producing biodegradable implants and may not be able to provide VP4896 to satisfy our requirements.

We rely on Durect Corporation, or Durect, as our sole source provider of VP4896 for use in our clinical trials and, if we receive marketing approval, will rely on Durect as our sole source provider for commercial supply of VP4896. VP4896 requires precise, high quality manufacturing. Durect’s failure to achieve and maintain satisfactory standards could result in patient injury or death, product recalls or withdrawals, delays or failures in product testing or delivery, cost overruns or other problems that could materially harm our business. Durect may encounter manufacturing difficulties involving production yields, quality control and quality assurance. Durect is subject to ongoing periodic unannounced inspection by the FDA and corresponding state and foreign agencies to ensure strict compliance with cGMP and other government regulations and corresponding foreign standards. We do not control Durect’s compliance with these regulations and standards.

To date, Durect has not produced commercial supply of a biodegradable implant for any drug approved for human use. If we receive marketing approval for and commercially launch VP4896, we anticipate that Durect will need to expand its manufacturing capacity for this drug, possibly materially. Durect may not be able to increase its manufacturing capacity for VP4896 in a timely or economic manner, or at all. Moreover, significant scale up of manufacturing may require additional validation studies, which the FDA must review and approve.

If Durect is unable to successfully increase the manufacturing capacity for VP4896 and we are unable to establish alternative manufacturing capabilities, the commercial launch of VP4896 may be delayed or there may be a shortage in supply. If Durect is unable to successfully increase manufacturing capacity for VP4896 at an acceptable cost, our commercialization of VP4896 could be delayed, prevented or impaired, including through a reduction of our gross margins on product sales.

We could lose supply of VP4896 from Durect if Durect elects to discontinue supply to us pursuant to Durect’s right to do so beginning two years after the first commercial sale or use of VP4896 or if Durect simply fails to or is unable to supply us at the levels required under the agreement. If we lose supply of VP4896 from Durect, we will need to establish an alternative source of supply. The loss of supply and need to establish alternative supply could result in lengthy delays in clinical trials, significant interruption of commercial supplies and substantial additional costs. Switching manufacturers may be difficult because, among other reasons, the number of potential manufacturers is limited, and the FDA must approve any replacement manufacturer. Such approval would require new clinical trials and compliance inspections. If we are able to transfer Durect’s manufacturing technology and process to a new manufacturer, which we have the right to do in circumstances specified in our agreement with Durect, to receive FDA approval would require bioequivalence or similar clinical trials, which are generally simpler and less costly than pivotal clinical trials. If we are not able to obtain such transfer, including as a result of Durect’s refusal to adhere to its contractual obligations, such approval would require new pivotal clinical trials. Accordingly, it may be difficult or impossible for us to find a replacement manufacturer for Durect on acceptable terms, in a manner that avoids supply interruption or possibly at all.

We could also lose our supply of VP4896 from Durect if our agreement with Durect terminates for any reason. In that case, in addition to the risks and consequences associated with having to secure alternative supply arrangements for VP4896 described above, we would be subject to the risks and consequences associated with losing our license to the Durect technology that is included in VP4896, and having to find and test alternative sustained release technology, as described in detail in the risk factor below entitled “If we fail to comply with our obligations in our intellectual property agreements with Durect or other third parties, we could lose license rights that are important to our business.”

11

We rely on third parties to conduct our clinical trials and those third parties may not perform satisfactorily, including failing to meet established deadlines for the completion of such trials.

We do not have the ability to independently conduct clinical trials for our product candidates and we rely on third parties, such as contract research organizations, clinical data management organizations, medical institutions, and clinical investigators, to perform this function. Our reliance on these third parties for clinical development activities reduces our control over these activities. Furthermore, these third parties may also have relationships with other entities, some of which may be our competitors. If these third parties do not successfully carry out their contractual duties or meet expected deadlines, we will not be able to obtain, or may be delayed in obtaining, regulatory approvals for our product candidates and will not be able to, or may be delayed in our efforts to, successfully commercialize our product candidates.

We also rely on other third parties to store and distribute drug supplies for our clinical trials for VP4896. Any performance failure on the part of our existing or future distributors could delay clinical development or regulatory approval of our product candidates or commercialization of our products, producing additional losses and depriving us of potential product revenue.

We may not be successful in establishing collaborations, which could adversely affect our ability to discover, develop and, particularly in international markets, commercialize products.

We intend to selectively enter into collaboration agreements with leading pharmaceutical and biotechnology companies to assist us in furthering the development of our product candidates. In particular, we intend to enter into these third-party arrangements for target indications in which our potential collaborator has particular expertise or that involve a large, primary care market that must be served by large sales and marketing organizations. In entering into these collaboration agreements, our goal will be to maintain co-promotion or co-commercialization rights in the United States and, in some cases, other markets. If we are unable to reach agreements with suitable collaborators, we may fail to meet our business objectives for the affected product or program. We face, and will continue to face, significant competition in seeking appropriate collaborators. Moreover, collaboration arrangements are complex and time consuming to negotiate, document and implement. We may not be successful in our efforts to establish and implement collaborations or other alternative arrangements. The terms of any additional collaborations or other arrangements that we establish may not be favorable to us. Moreover, these collaborations or other arrangements may not be successful.

If we are unable to obtain and enforce patent protection for our discoveries, our ability to successfully commercialize our product candidates will be harmed and we may not be able to operate our business profitably.

Our success depends, in part, on our ability to protect proprietary methods and technologies that we develop under the patent and other intellectual property laws of the United States and other countries, so that we can prevent others from using our inventions and proprietary information. However, we may not hold proprietary rights to some patents related to our current and/or future products and technologies. Because patent applications in the United States and many foreign jurisdictions are typically not published until 18 months after filing, or in some cases not at all, and because publications of discoveries in scientific literature lag behind actual discoveries, we cannot be certain that we were the first to make the inventions claimed in our issued patent or pending patent applications, or that we were the first to file for protection of the inventions set forth in our patent applications. As a result, we may be required to obtain licenses under third-party patents to market our proposed products. If licenses are not available to us on acceptable terms, or at all, we will not be able to market the affected products.

Our strategy depends on our ability to rapidly identify and seek patent protection for our discoveries. This process is expensive and time consuming, and we may not be able to file and prosecute all necessary or desirable patent applications at a reasonable cost or in a timely manner. Despite our efforts to protect our proprietary rights, unauthorized parties may be able to obtain and use information that we regard as proprietary. The issuance of a patent does not guarantee that it is valid or enforceable, so even if we obtain patents, they may not be valid or enforceable against third parties. In addition, the issuance of a patent does not guarantee that we have the right to practice the patented invention. Third parties may have blocking patents that could be used to prevent us from marketing our own patented-product or method and practicing our own patented technology.

12

Our pending patent applications and the pending patent applications of Durect that we have licensed may not result in issued patents. If patents do not issue with respect to such patent applications or if the claims allowed are too narrow, our business may be harmed. The patent position of pharmaceutical or biotechnology companies, including ours, is generally uncertain and involves complex legal and factual considerations. The standards that the United States Patent and Trademark Office and its foreign counterparts use to grant patents are not always applied predictably or uniformly and can change. There is also no uniform, worldwide policy regarding the subject matter and scope of claims granted or allowable in pharmaceutical or biotechnology patents. The laws of some foreign countries do not protect proprietary information to the same extent as the laws of the United States, and many companies have encountered significant problems and costs in protecting their proprietary information in those foreign countries. Accordingly, we do not know the degree of future protection for our proprietary rights or the breadth of claims allowed in any patents issued to us or to others. The allowance of broader claims may increase the incidence and cost of patent interference proceedings and/or opposition proceedings, and the risk of infringement litigation. On the other hand, the allowance of narrower claims may limit the value of our proprietary rights.

Our issued patent and any future patents that we may own or license may not contain claims sufficiently broad to protect us against third parties with similar technologies or products, or provide us with any competitive advantage. Moreover, our patents and any patent for which we have licensed rights may be challenged, narrowed, invalidated or circumvented. For example, we are aware of one issued third party U.S. patent, filed after our issued U.S. patent was filed, which may nonetheless be prior art to our patent and which might form the basis of an interference proceeding or invalidity challenge. We believe that our claimed methods of treatment for Alzheimer’s disease are patentably distinct over the third party patent, that the third party patent does not enable our methods of treatment and, therefore, that our patent claims should be found valid and enforceable. However, the patent office or a court might disagree with us. An interference or invalidity challenge to our issued patent could result in the narrowing or loss of our patent claims.

If the patents that we own or license are invalidated or otherwise limited, other companies will be better able to develop products and technologies that compete with ours, which could adversely affect our competitive business position, business prospects and financial condition.

There are limitations on our patent rights relating to our product candidates and technologies, including with respect to the use of VP4896 to treat Alzheimer’s disease, that may affect our ability to exclude third parties from competing against us if we receive approval to market these product candidates or technologies.

Our proprietary rights relating to our product candidates and technologies, including with respect to the use of VP4896 to treat Alzheimer’s disease, are limited in ways that may affect our ability to exclude third parties from competing against us if we receive regulatory approval to market these product candidates and technologies. In particular:

|

·

|

We do not own or license composition of matter patents covering leuprolide acetate, the active pharmaceutical ingredient of VP4896, or methods of making leuprolide acetate. Moreover, the active ingredient that we are testing in our most advanced preclinical programs is also leuprolide acetate. Leuprolide acetate is currently marketed for a number of other indications. As a result, competitors can offer and sell leuprolide acetate products so long as they do not infringe, or contribute to the infringement of, or actively induce infringement of, any patents or other proprietary rights that we or others may have the rights to enforce;

|

|

·

|

The principal patent protection that covers, or that we expect will cover, the use of VP4896 to treat Alzheimer’s disease and leuprolide acetate to treat other indications stems from a method of use patent and patent applications. This type of patent only protects specified methods of using specified products according to the patent claims. This type of patent does not limit a competitor from making and marketing a product that is identical to our product for an indication that is outside of the patented method. Moreover, physicians may prescribe such a competitive identical product for off label indications that are covered by the applicable patents. In particular, leuprolide acetate, the active pharmaceutical ingredient in VP4896 and the drug being tested by us in our most advanced preclinical programs, is currently marketed for a number of other indications. Although off label prescriptions may infringe or contribute to or actively induce infringement of method of use patents, the practice is common and such infringement is difficult to prevent or prosecute. Consequently, VP4896, if approved, could face competition from leuprolide acetate products that are already on the market, or may later be approved, through off label usage of these products to treat Alzheimer’s disease that may be difficult or impossible for us to prevent because our primary patent protection is limited to method of use claims; and

|

13

|

·

|

We have not applied for method of use patent protection outside of the United States and Canada for use of VP4896 to treat Alzheimer’s disease. As a result, there is a significant risk that we will face early generic competition for VP4896 for the treatment of Alzheimer’s disease in international markets. This risk may be increased if competitors are able to develop formulations of leuprolide acetate, such as other polymeric implants, that are as effective as VP4896 may prove to be or if competitors can demonstrate that commercially available leuprolide acetate can be administered by injection in a manner that is as effective as VP4896 may prove to be.

|

These limitations on our patent rights may result in competitors taking product sales away from us, which would reduce our revenues and harm our business.

If we fail to comply with our obligations in our intellectual property agreements with Durect or other third parties, we could lose license rights that are important to our business.

We are a party to a license agreement with Durect pursuant to which Durect grants to us a worldwide, royalty-bearing exclusive license relating to Durect’s polymeric implant technology to develop and commercialize VP4896 for the treatment of Alzheimer’s disease. This technology includes patent applications covering the VP4896 formulation and the method of making VP4896. If we fail to perform our obligations under our agreement with Durect, Durect may terminate the agreement and our license to its patents and its manufacturing know-how. If this happened, we would be required to develop or license an alternative sustained release technology for VP4896. This would likely involve reformulating or otherwise changing VP4896. As a result, the FDA would likely require us to perform new pivotal clinical trials of the reformulated or otherwise changed version of VP4896. This could result in lengthy delays in clinical trials, significant interruption of commercial supplies and substantial additional costs. This would substantially harm our business. Furthermore, acceptable alternative technology may not exist, may not be something we are able to develop and may not be available to us on reasonable terms or possibly at all.

In addition to clinically developing VP4896 for mild to moderate Alzheimer’s disease, we also are working on the pre-clinical development of leuprolide acetate for the treatment of various cancers. We may determine to develop an implantable formulation of leuprolide acetate for these additional indications. However, because our license from Durect is limited to the field of Alzheimer’s disease, we will not be able to develop a leuprolide acetate implant based on Durect’s technology for these additional indications without obtaining an appropriate amendment of our license from Durect. If Durect will not agree to such an amendment, we could seek to develop other polymeric implants of leuprolide acetate that are outside of Durect’s patents and know-how. However, it might be time consuming and expensive for us to do so and might deprive us of the clinical and regulatory benefits that we believe will be available to us from developing a leuprolide acetate implant based on Durect’s technology for additional indications.

We may also enter into additional licenses in the future. Our existing license with Durect imposes, and we expect future licenses with third parties will impose, various diligence, milestone payment, royalty, insurance and other obligations on us. If we fail to comply with these obligations, the licensor may have the right to terminate the license, in which event we might not be able to market any product that is covered by the licensed patents.

14

If we are unable to protect the confidentiality of our proprietary information and know-how, the value of our technology and products could be adversely affected.

In addition to patented technology, we rely upon unpatented proprietary technology, processes and know-how, including particularly Durect’s manufacturing know-how relating to the production of VP4896. We seek to protect our unpatented proprietary information in part by confidentiality agreements with our employees, consultants and third parties. These agreements may be breached and we may not have adequate remedies for any such breach. In addition, our trade secrets may otherwise become known or be independently developed by competitors. If we are unable to protect the confidentiality of our proprietary information and know-how, competitors may be able to use this information to develop products that compete with our products, which could adversely impact our business. We could be similarly harmed if Durect’s confidential know-how relating to the production of VP4896 becomes known to our competitors.

If we infringe or are alleged to infringe intellectual property rights of third parties, it will adversely affect our business.

Our research, development and commercialization activities, as well as any product candidates or products resulting from these activities, may infringe or be claimed to infringe patents or patent applications under which we do not hold licenses or other rights. Third parties may own or control these patents and patent applications in the United States and abroad. These third parties could bring claims against us or our collaborators that would cause us to incur substantial expenses and, if successful against us, could cause us to pay substantial damages. Further, if a patent infringement suit were brought against us or our collaborators, we or they could be forced to stop or delay research, development, manufacturing or sales of the product or product candidate that is the subject of the suit.

As a result of patent infringement claims, or in order to avoid potential claims, we or our current or future collaborators may choose or be required to seek a license from the third party and be required to pay license fees or royalties or both. These licenses may not be available on acceptable terms, or at all. Even if we or our collaborators were able to obtain a license, the rights may be nonexclusive, which could result in our competitors gaining access to the same intellectual property. Ultimately, we could be prevented from commercializing a product, or be forced to cease some aspect of our business operations, if, as a result of actual or threatened patent infringement claims, we or our collaborators are unable to enter into licenses on acceptable terms. This could harm our business significantly.

For example, we are aware of one issued third party U.S. patent, filed after our issued patent was filed, which includes a claim directed to a method for the treatment of a neurodegenerative disorder which could form the basis of an infringement claim. We believe that if this patent were asserted against us in an infringement action relating to VP4896 for the treatment of mild to moderate Alzheimer’s disease, the claims should be held invalid. An issued U.S. patent, however, is entitled to a presumption of validity as a matter of law. If the claims of this third party patent were found valid and interpreted to cover the use of VP4896 for the treatment for Alzheimer’s disease, we would be liable for past damages for infringement and might be required to obtain a license under the patent to manufacture and market VP4896. If a license were not available to us on acceptable terms, or at all, we might not be able to market VP4896.

Moreover, the field of polymeric implants for sustained drug release is highly competitive, and we are aware of third party patents directed to technologies similar to that of Durect. Although we are not aware of any third party patents that would be literally infringed by the commercial development of the VP4896 implant, we are aware of third party patents which include claims directed to implants containing a copolymer of lactic acid and glycolic acid, that could be asserted against our product in the United States under the doctrine of equivalents. Even if a U.S. patent claim is not literally infringed, the doctrine of equivalents permits a court to find infringement if the differences between the accused product or process and the patent claims are insubstantial. If a court were to find a third party patent infringed under the doctrine of equivalents, the consequences could be the same as those of a finding of literal infringement, including liability for past damages and the possibility of being enjoined from commercializing the affected product or process. In the event of an injunction, we would be required to cease marketing VP4896, but could develop an alternative sustained release formulation which would not infringe any third party patents. Development of an alternative sustained release formulation would require substantial additional time and expense, including additional regulatory review, all of which could harm our business significantly.

15