Attached files

Exhibit 10.1

CONSENT, WAIVER AND FIFTH AMENDMENT TO

FOURTH AMENDED AND RESTATED CREDIT AGREEMENT

This CONSENT, WAIVER AND FIFTH AMENDMENT TO FOURTH AMENDED AND RESTATED CREDIT AGREEMENT (this “Amendment”) is dated as of October 25, 2010, but effective as of the Effective Date (hereinafter defined), among THE VAIL CORPORATION, a Colorado corporation doing business as “Vail Associates, Inc.” (the “Company”), the LENDERS (as defined in the Credit Agreement referenced below) party hereto, and BANK OF AMERICA, N.A., as Administrative Agent (hereinafter defined).

R E C I T A L S

A. The Company has entered into that certain Fourth Amended and Restated Credit Agreement dated as of January 28, 2005, with Bank of America, N.A., as Administrative Agent (in such capacity, the “Administrative Agent”), and certain other agents and lenders party thereto, as amended by that certain First Amendment to Fourth Amended and Restated Credit Agreement dated as of June 29, 2005, that certain Second Amendment to Fourth Amended and Restated Credit Agreement dated as of February 17, 2006, that certain Limited Waiver, Release, and Third Amendment to Fourth Amended and Restated Credit Agreement dated as of March 13, 2007, and that certain Fourth Amendment to Fourth Amended and Restated Credit Agreement dated as of April 30, 2008 (as previously amended, as amended hereby, and as further amended, restated, or modified from time to time, the “Credit Agreement”), providing for revolving credit loans, letters of credit, and swing line loans.

B. The Company has notified the Administrative Agent that a to be formed wholly-owned Subsidiary of the Company (“Northstar Parent”), will enter into a Purchase and Sale Agreement (the “Purchase and Sale Agreement”) with Booth Creek Resort Properties, LLC and the other parties named therein, as sellers (collectively, the “Sellers”), pursuant to which Northstar Parent will acquire all of the Equity Interests of BCRP, Inc. and Northstar Group Commercial Property LLC (collectively with their respective Subsidiaries, the “Acquired Subsidiaries”; the Acquired Subsidiaries and Northstar Parent are collectively, the “Northstar Subsidiaries”) from Sellers (the “Northstar Acquisition”).

C. The Company is required, pursuant to Section 10.11(c)(iv) of the Credit Agreement, to deliver to the Administrative Agent, at least 15 days prior to the closing date of any acquisition for which the Purchase Price exceeds $50,000,000, (i) a written description of the acquisition, including the funding sources, Purchase Price, and calculations demonstrating pro forma compliance with the terms and conditions of the Loan Papers after giving effect thereto (including compliance with applicable financial covenants), and (ii) a copy of the executed purchase agreement relating to the acquisition (and, to the extent available, all schedules and exhibits thereto) (collectively, the “Permitted Acquisition Delivery Requirements”). The Company has requested that the Lenders consent to the Northstar Acquisition, notwithstanding the Company’s inability to deliver the Permitted Acquisition Delivery Requirements 15 days prior to the closing date of the Northstar Acquisition.

D. The Acquired Subsidiaries lease all of their real property and substantially all of their personal property from CNL Income Northstar, LLC, CNL Income Northstar Commercial, LLC, and CNL Income Northstar TRS Corp. pursuant to (i) that certain Lease Agreement, dated as of January 20, 2007, by and between CNL Income Northstar, LLC, as lessor, and Trimont Land Company, a California corporation, as lessee, as amended by that certain First Amendment to Lease Agreement, dated as of June 10, 2007, that certain Second Amendment to Lease Agreement, dated as of November 15, 2007, that certain Third Amendment to Lease Agreement, dated as of November 15, 2007, that certain Fourth Amendment to Lease Agreement, dated as of November 1, 2008, and that certain Fifth Amendment to Lease Agreement, dated as of August 1, 2009, (ii) that certain Personal Property Lease Agreement by and

between CNL Income Northstar TRS Corp., a Delaware corporation, as lessor, and Trimont Land Company, a California corporation, as lessee, dated as of January 20, 2007, as amended by that certain First Amendment to Personal Property Lease, dated as of November 1, 2008, and that certain Second Amendment to Personal Property Lease Agreement, dated as of August 1, 2009, and (iii) that certain Lease Agreement, dated as of October 2, 2007, by and between CNL Income Northstar Commercial, LLC, a Delaware limited liability company, as lessor, and Northstar Group Commercial Properties, LLC, a Delaware limited liability company, as lessee, as amended by that certain First Amendment to Lease Agreement, dated as of November 15, 2007, that certain Second Amendment to Lease Agreement dated as of April 8, 2009, that certain Third Amendment to Lease Agreement, dated as of July 30, 2009, and that certain Fourth Amendment to Lease Agreement, dated as of August 1, 2009 (collectively, the “Northstar Leases”).

E. The Company intends to designate the Northstar Subsidiaries as “Restricted Subsidiaries” under the Credit Agreement, and has requested that the Lenders (i) include the Northstar Leases in the definition of “Permitted Debt”, but exclude the Northstar Leases from the definition of “Funded Debt”, in each case solely to the extent the Northstar Leases constitute Capital Leases, (ii) waive the provisions in Section 9.10(b) of the Credit Agreement requiring the pledge of Equity Interests in the Northstar Subsidiaries to the Administrative Agent for the benefit of the Lenders, and (iii) exclude the Northstar Leases from the restrictions in Section 10.16 of the Credit Agreement related to Burdensome Agreements.

Subject to the terms and conditions set forth herein, the Company, the Required Lenders party hereto, the Guarantors (by execution of the attached Guarantors’ Consent and Agreement), and the Administrative Agent agree as follows:

1. Amendments.

(a) New Definitions. Section 1.1 of the Credit Agreement (Definitions) is amended by inserting the following new definitions alphabetically to read as follows:

Northstar Acquisition means the acquisition consummated in connection with that certain Purchase and Sale Agreement, dated as of the Effective Date, between Northstar Parent and Booth Creek Resort Properties, LLC and the other entities party thereto as sellers (collectively, the “Northstar Sellers”), pursuant to which Northstar Parent acquired all of the interests of BCRP, Inc. and Northstar Group Commercial Property LLC from the Northstar Sellers.

Northstar Leases means, collectively, (a) that certain Lease Agreement, dated as of January 20, 2007, by and between CNL Income Northstar, LLC, as lessor, and Trimont Land Company, a California corporation, as lessee, as amended by that certain First Amendment to Lease Agreement, dated as of June 10, 2007, that certain Second Amendment to Lease Agreement, dated as of November 15, 2007, that certain Third Amendment to Lease Agreement, dated as of November 15, 2007, that certain Fourth Amendment to Lease Agreement, dated as of November 1, 2008, and that certain Fifth Amendment to Lease Agreement, dated as of August 1, 2009, (b) that certain Personal Property Lease Agreement by and between CNL Income Northstar TRS Corp., a Delaware corporation, as lessor, and Trimont Land Company, a California corporation, as lessee, dated as of January 20, 2007, as amended by that certain First Amendment to Personal Property Lease, dated as of November 1, 2008, and that certain Second Amendment to Personal Property Lease Agreement, dated as of August 1, 2009, and (c) that certain Lease Agreement, dated as of October 2, 2007, by and between CNL Income Northstar Commercial, LLC, a Delaware limited liability company, as lessor, and Northstar Group Commercial Properties, LLC, a Delaware limited liability company, as lessee, as amended by that certain First Amendment to Lease Agreement, dated as of November 15, 2007, that certain Second Amendment to Lease Agreement dated as of April 8, 2009, that certain Third Amendment to Lease Agreement, dated as of July 30, 2009, and that certain Fourth Amendment to Lease Agreement, dated as of August 1, 2009, each as amended from time to time.

Northstar Parent means a Restricted Company that is the owner of 100% of the direct or indirect Equity Interests of the Northstar Subsidiaries.

Northstar Subsidiaries means, collectively, Northstar Parent and each direct and indirect Subsidiary thereof.

(b) Modification of the Definition of “Adjusted EBITDA”. Section 1.1 of the Credit Agreement (Definitions) is amended by modifying the definition of “Adjusted EBITDA” to replace the period at the end of the first sentence thereof with a comma and insert the following thereafter:

“minus (d) for any payments by the Northstar Subsidiaries in respect of the portion of the Northstar Leases, if any, that is classified as a Capital Lease, the amount of such payment that would have been recorded as operating lease expense had such portion of the Northstar Leases been classified as an operating lease.”

(c) Modification of the Definition of “Funded Debt”. Section 1.1 of the Credit Agreement (Definitions) is amended by revising clause (b) of the definition of “Funded Debt” to read as follows:

“(b) all Capital Lease obligations (other than (x) the interest component of such obligations and (y) obligations under the Northstar Leases (to the extent such leases constitute Capital Leases)) of SSI or any Restricted Company, plus”

(d) Modification of the Definition of “Permitted Debt”. Section 1.1 of the Credit Agreement (Definitions) is amended by renumbering clause (e)(v) of the definition of “Permitted Debt” as clause (e)(vi), and adding the following new clause (e)(v) thereto to read as follows:

“(v) if the Northstar Leases are Capital Leases, obligations of the Northstar Subsidiaries thereunder;”

(e) Modification of Limits on Burdensome Agreements. Section 10.16 (Burdensome Agreements) is amended by replacing the period at the end thereof with a semi-colon and inserting the following thereafter:

“and (iii) the foregoing clauses (a) and (b) shall not apply to the Northstar Leases.”

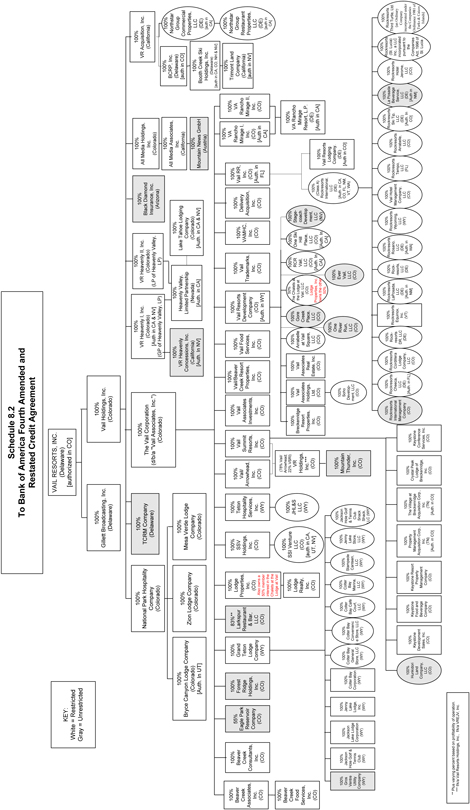

(f) Modification of Schedule 8.2. Schedule 8.2 of the Credit Agreement (Corporate Organization and Structure) is revised as set forth on Annex A attached hereto.

(g) Modification of Compliance Certificate. The Compliance Certificate is modified by revising Annex A thereto in its entirety as set forth on Annex B hereto.

2. Additional Agreements.

(a) Restricted Subsidiaries. Each of the Northstar Subsidiaries is hereby designated a “Restricted Subsidiary” under the Credit Agreement.

(b) Purchase Price. If the Northstar Leases constitute Capital Leases, then the Purchase Price for the Northstar Acquisition shall not include any Debt attributable to such leases.

3. Consent and Waiver. Required Lenders hereby (a) consent to the Northstar Acquisition, so long as (i) no Default or Potential Default exists or occurs as a result of, or after giving effect to, the Northstar Acquisition, and (ii) after giving effect to this Amendment, the Company is in compliance with Section 10.11(c) of the Credit Agreement, and (b) waive the provisions in Section 9.10(b) of the Credit Agreement requiring the pledge of Equity Interests in the Northstar Subsidiaries to the Administrative Agent for the benefit of the Lenders.

4. Representations and Warranties. As a material inducement to the Lenders and the Administrative Agent to execute and deliver this Amendment, the Company represents and warrants to the Lenders and the Administrative Agent (with the knowledge and intent that Lenders are relying upon the same in entering into this Amendment) that: (a) the Company and the Guarantors have all requisite authority and power to execute, deliver, and perform their respective obligations under this Amendment and the Guarantors’ Consent and Agreement, as the case may be, which execution, delivery, and performance have been duly authorized by all necessary action, require no Governmental Approvals, and do not violate the respective certificates of incorporation or organization, bylaws, or operating agreement, or other organizational or formation documents of such Companies; (b) upon execution and delivery by the Company, the Guarantors, the Administrative Agent, and the Lenders party hereto, this Amendment will constitute the legal and binding obligation of the Company and each Guarantor, enforceable against such entities in accordance with the terms of this Amendment, except as that enforceability may be limited by general principles of equity or by bankruptcy or insolvency laws or similar laws affecting creditors’ rights generally; (c) all representations and warranties in the Loan Papers are true and correct in all material respects as though made on the date hereof, except to the extent that any of them speak to a specific date or the facts on which any of them are based have been changed by transactions contemplated or permitted by the Credit Agreement; and (d) no Default or Potential Default has occurred and is continuing.

5. Conditions Precedent to Effectiveness. This Amendment shall be effective on the date (the “Effective Date”) upon which the Administrative Agent receives each of the following items:

(a) counterparts of this Amendment executed by the Company, the Administrative Agent, and Required Lenders;

(b) the Guarantors’ Consent and Agreement executed by each Guarantor;

(c) evidence satisfactory to the Administrative Agent and the Lenders that Northstar Parent has acquired the Acquired Subsidiaries from the Sellers in accordance with the Purchase and Sale Agreement and on terms and conditions reasonably satisfactory to the Administrative Agent and the Lenders;

(d) an agreement executed by CNL Income Northstar, LLC, CNL Income Northstar Commercial, LLC, and CNL Income Northstar TRS Corp., in form and substance satisfactory to the Administrative Agent and the Lenders, consenting to the Northstar Acquisition;

(e) the Permitted Acquisition Delivery Requirements, including, without limitation, a written description of the Northstar Acquisition (including the funding sources, the Purchase Price, and calculations demonstrating pro forma compliance with the terms and conditions of the Loan Papers after giving effect to the Northstar Acquisition (including compliance with the applicable financial covenants)), and a copy of the fully-executed Purchase and Sale Agreement;

(f) Officers’ Certificates for the Restricted Companies (i) attaching resolutions authorizing the transactions contemplated hereby, (ii) certifying that no changes have been made to the Restricted Companies’ respective articles of incorporation or organization, bylaws, or operating agreements since the date such documents were previously provided to the Administrative Agent, as applicable, (iii) listing the names and titles of the Responsible Officers, and (iv) providing specimen signatures for such Responsible Officers; and

(g) a certificate signed by a Responsible Officer certifying (i) that as of the Effective Date (A) all of the representations and warranties of the Companies in the Loan Papers are true and correct in all material respects (unless they specifically refer to an earlier date, in which case they shall be true and correct as of such earlier date, or are based on facts which have changed by transactions contemplated or permitted by the Credit Agreement), and (B) no Default or Potential Default exists under the Credit Agreement or would result from the execution and delivery of this Amendment, and (ii) the aggregate purchase price of the Northstar Acquisition.

6. Expenses. The Company shall pay all reasonable out-of-pocket fees and expenses paid or incurred by the Administrative Agent incident to this Amendment, including, without limitation, the reasonable fees and expenses of the Administrative Agent’s counsel in connection with the negotiation, preparation, delivery, and execution of this Amendment and any related documents.

7. Ratifications. The Company and each Guarantor (by executing the Guarantors’ Consent and Agreement attached hereto) (a) ratifies and confirms all provisions of the Loan Papers, (b) ratifies and confirms that all Guaranties, assurances, and Liens granted, conveyed, or assigned to Administrative Agent, for the benefit of the Lenders, under the Loan Papers are not released, reduced, or otherwise adversely affected by this Amendment and continue to guarantee, assure, and secure full payment and performance of Company’s present and future obligations to Administrative Agent and the Lenders, and (c) agrees to perform such acts and duly authorize, execute, acknowledge, deliver, file, and record such additional documents, and certificates as Administrative Agent may reasonably request in order to create, perfect, preserve, and protect those guaranties, assurances, and liens.

8. Miscellaneous. Unless stated otherwise herein, (a) the singular number includes the plural, and vice versa, and words of any gender include each other gender, in each case, as appropriate, (b) headings and captions shall not be construed in interpreting provisions of this Amendment, (c) this Amendment shall be governed by and construed in accordance with the laws of the State of New York, (d) if any part of this Amendment is for any reason found to be unenforceable, all other portions of it shall nevertheless remain enforceable, (e) this Amendment may be executed in any number of counterparts with the same effect as if all signatories had signed the same document, and all of those counterparts shall be construed together to constitute the same document, (f) this Amendment is a “Loan Paper” referred to in the Credit Agreement, and the provisions relating to Loan Papers in Section 15 of the Credit Agreement are incorporated herein by reference, (g) this Amendment, the Credit Agreement, as amended by this Amendment, and the other Loan Papers constitute the entire agreement and understanding among the parties hereto and supercede any and all prior agreements and understandings, oral or written, relating to the subject matter hereof, and (h) except as provided in this Amendment, the Credit Agreement, the Notes, and the other Loan Papers are unchanged and are ratified and confirmed.

9. Parties. This Amendment binds and inures to the benefit of the Company, the Guarantors, the Administrative Agent, the Lenders, and their respective successors and assigns.

The parties hereto have executed this Amendment in multiple counterparts as of the date first above written.

Remainder of Page Intentionally Blank.

Signature Pages to Follow.

| THE VAIL CORPORATION (D/B/A “VAIL ASSOCIATES, INC.”), as the Company | ||

| By: | /S/ JEFFREY W. JONES | |

| Name: | Jeffrey W. Jones | |

| Title: | Senior Executive Vice President, | |

| and Chief Executive Officer | ||

Signature Page to

Consent and Fifth Amendment to Fourth Amended and Restated Credit Agreement

| BANK OF AMERICA, N.A., as Administrative Agent | ||

| By: | /S/ RONALDO NAVAL | |

| Name: | Ronaldo Naval | |

| Title: | Vice President | |

Signature Page to

Consent and Fifth Amendment to Fourth Amended and Restated Credit Agreement

| BANK OF AMERICA, N.A., as a Lender | ||

| By: | /S/ DAVID MCCAULEY | |

| Name: | David McCauley | |

| Title: | Senior Vice President | |

Signature Page to

Consent and Fifth Amendment to Fourth Amended and Restated Credit Agreement

| U.S. BANK NATIONAL ASSOCIATION, as a Lender | ||

| By: | /S/ GREG BLANCHARD | |

| Name: | Greg Blanchard | |

| Title: | Vice President | |

Signature Page to

Consent and Fifth Amendment to Fourth Amended and Restated Credit Agreement

| WELLS FARGO BANK, NATIONAL ASSOCIATION, as a Lender | ||

| By: | /S/ CATHERINE M. JONES | |

| Name: | Catherine M. Jones | |

| Title: | Senior Vice President | |

Signature Page to

Consent and Fifth Amendment to Fourth Amended and Restated Credit Agreement

| DEUTSCHE BANK TRUST COMPANY AMERICAS, as a Lender | ||

| By: | /S/ JAMES ROLISON | |

| Name: | James Rolison | |

| Title: | Managing Director | |

| By: | /S/ PERRY FORMAN | |

| Name: | Perry Forman | |

| Title: | Director | |

Signature Page to

Consent and Fifth Amendment to Fourth Amended and Restated Credit Agreement

| JPMORGAN CHASE BANK, NA, as a Lender | ||

| By: | /S/ BRIAN MCDOUGAL | |

| Name: | Brian McDougal | |

| Title: | Senior Vice President | |

Signature Page to

Consent and Fifth Amendment to Fourth Amended and Restated Credit Agreement

| COMPASS BANK, as a Lender | ||

| By: | /S/ ERIC R. LONG | |

| Name: | Eric R. Long | |

| Title: | Senior Vice President | |

Signature Page to

Consent and Fifth Amendment to Fourth Amended and Restated Credit Agreement

| COLORADO STATE BANK & TRUST, as a Lender | ||

| By: | /S/ KENT MUSTARI | |

| Name: | Kent Mustari | |

| Title: | Senior Vice President | |

Signature Page to

Consent and Fifth Amendment to Fourth Amended and Restated Credit Agreement

| COMERICA WEST INCORPORATED, as a Lender | ||

| By: | /S/ FATIMA ARSHAD | |

| Name: | Fatima Arshad | |

| Title: | Vice President | |

Signature Page to

Consent and Fifth Amendment to Fourth Amended and Restated Credit Agreement

GUARANTORS’ CONSENT AND AGREEMENT

As an inducement to Administrative Agent and Required Lenders to execute, and in consideration of and as a condition to Administrative Agent’s and Required Lenders’ execution of the foregoing Consent, Waiver and Fifth Amendment to Fourth Amended and Restated Credit Agreement (the “Fifth Amendment”), the undersigned hereby consent to the Fifth Amendment, and agree that (a) the Fifth Amendment shall in no way release, diminish, impair, reduce or otherwise adversely affect the respective obligations and liabilities of each of the undersigned under each Guaranty described in the Credit Agreement, or any agreements, documents or instruments executed by any of the undersigned to create liens, security interests or charges to secure any of the indebtedness under the Loan Papers, all of which obligations and liabilities are, and shall continue to be, in full force and effect, and (b) the Guaranty executed by each Guarantor is ratified, and the “Guaranteed Indebtedness” includes, without limitation, the “Obligation” (as defined in the Credit Agreement). This consent and agreement shall be binding upon the undersigned, and the respective successors and assigns of each, shall inure to the benefit of Administrative Agent and Lenders, and the respective successors and assigns of each, and shall be governed by and construed in accordance with the laws of the State of New York.

| Vail Resorts, Inc. |

| Vail Holdings, Inc. |

| All Media Associates, Inc. |

| All Media Holdings, Inc. |

| Arrabelle at Vail Square, LLC |

| Beaver Creek Associates, Inc. |

| Beaver Creek Consultants, Inc. |

| Beaver Creek Food Services, Inc. |

| Breckenridge Resort Properties, Inc. |

| Bryce Canyon Lodge Company |

| Colter Bay Café Court, LLC |

| Colter Bay Convenience Store, LLC |

| Colter Bay Corporation |

| Colter Bay General Store, LLC |

| Colter Bay Marina, LLC |

| Crystal Peak Lodge of Breckenridge, Inc. |

| Delivery Acquisition, Inc. |

| Gillett Broadcasting, Inc. |

| Grand Teton Lodge Company |

| Heavenly Valley, Limited Partnership |

| Jackson Hole Golf and Tennis Club, Inc. |

| Jackson Hole Golf and Tennis Club Snack Shack, LLC |

| Jackson Lake Lodge Corporation |

| Jenny Lake Lodge, Inc. |

| Jenny Lake Store, LLC |

| JHL&S LLC |

| Keystone Conference Services, Inc. |

| Keystone Development Sales, Inc. |

| Keystone Food and Beverage Company |

| Keystone Resort Property Management Company |

| Lodge Properties, Inc. |

| Lodge Realty, Inc. |

| Mesa Verde Lodge Company |

| National Park Hospitality Company |

| One Ski Hill Place, LLC |

| Property Management Acquisition Corp., Inc. |

| RCR Vail, LLC |

| Rockresorts Arrabelle, LLC |

| Rockresorts Cheeca, LLC |

| Rockresorts Cordillera Lodge Company, LLC |

| Rockresorts DR, LLC |

| Rockresorts Equinox, Inc. |

| Rockresorts Hotel Jerome, LLC |

| Rockresorts International, LLC |

| Rockresorts LaPosada, LLC |

| Rockresorts LLC |

| Rockresorts Rosario, LLC |

| Rockresorts Ski Tip, LLC |

| Rockresorts (St. Lucia) Inc. |

| Rockresorts Tempo, LLC |

| Rockresorts Third Turtle, Ltd. |

| Rockresorts Wyoming, LLC |

| SOHO Development, LLC |

| SSI Venture LLC |

| SSV Holdings, Inc. |

| Stampede Canteen, LLC |

| Teton Hospitality Services, Inc. |

| The Chalets at the Lodge at Vail, LLC |

| The Village at Breckenridge Acquisition Corp., Inc. |

| VA Rancho Mirage I, Inc. |

| VA Rancho Mirage II, Inc. |

| VA Rancho Mirage Resort, L.P. |

| Vail/Arrowhead, Inc. |

| Vail Associates Holdings, Ltd. |

| Vail Associates Investments, Inc. |

| Vail Associates Real Estate, Inc. |

| Vail/Beaver Creek Resort Properties, Inc. |

| Vail Food Services, Inc. |

| Vail Hotel Management Company, LLC |

| Vail Resorts Development Company |

| Vail Resorts Lodging Company |

| Vail RR, Inc. |

| Vail Summit Resorts, Inc. |

| Vail Trademarks, Inc. |

| VAMHC, Inc. |

| VR Heavenly I, Inc. |

| VR Heavenly II, Inc. |

| VR Holdings, Inc. |

| Zion Lodge Company |

| By: | /S/ JEFFREY W. JONES | |

| Name: | Jeffrey W. Jones | |

| Title: | Senior Executive Vice President and | |

| Chief Financial Officer |

ANNEX A

Schedule 8.2

ANNEX B

Annex A to Exhibit D of Compliance Certificate

Annex A to Exhibit D

CREDIT FACILITY COVENANTS CALCULATIONS

Subject Period: , 200

| Months Ended |

||||||||

| 10.8(m) |

INVESTMENTS IN PERSONS |

|||||||

| (i) | Investments during Subject Period in Unrestricted Subsidiaries, Housing Districts and Metro Districts not otherwise permitted under Section 10.8(j)(ii), and other Persons (other than Restricted Subsidiaries) involved in Similar Businesses: | $ | ||||||

| (ii) | Investments during prior Subject Periods in Unrestricted Subsidiaries, Housing Districts and Metro Districts not otherwise permitted under Section 10.8(j)(ii), and other Persons (other than Restricted Subsidiaries) involved in Similar Businesses: | $ | ||||||

| (iii) | Investments set forth on part (b) of Schedule 10.8: | $ | ||||||

| (iv) | (10.8(m)(i) plus 10.8(m)(ii) plus 10.8(m)(iii)): | $ | ||||||

| (v) | $75,000,000: | $75,000,000 | ||||||

| (vi) | Book value of Total Assets: | $ | ||||||

| (vii) | 10% of 10.8(m)(vi): | $ | ||||||

| (viii) | Investment Limit (10.8(m)(v) plus 10.8(m)(vii)): | $ | ||||||

| (ix) | Net reductions in investments permitted under Section 10.8(m) in an aggregate amount not to exceed 10.8(m)(viii): | $ | ||||||

| (x) | Maximum permitted investments in Unrestricted Subsidiaries, Housing Districts and Metro Districts not otherwise permitted under Section 10.8(j)(ii), and other Persons (other than Restricted Subsidiaries) involved in Similar Businesses permitted after the Closing Date, and investments set forth on part (b) of Schedule 10.8 (10.8(m)(viii) plus 10.8(m)(ix)): | $ | ||||||

| (xi) | Fair market value of all assets owned by Restricted Subsidiaries on the Closing Date which have been contributed to Unrestricted Subsidiaries: | $ | ||||||

| (xii) | Is 10.8(m)(xi) less than $75,000,000? | Yes/No | ||||||

| Months Ended |

||||||||

| (xiii) | Are investments in Unrestricted Subsidiaries, Housing Districts and Metro Districts not otherwise permitted under Section 10.8(j)(ii), and other Persons (other than Restricted Subsidiaries) involved in Similar Businesses, and investments set forth on part (b) of Schedule 10.8 (10.8(m)(iv)), less than or equal to the maximum amount permitted (10.8(m)(x))? | Yes/No | ||||||

| 10.9(d) |

DISTRIBUTIONS, LOANS, ADVANCES, AND INVESTMENTS |

|||||||

| (i) | Distributions under Section 10.9(d), and loans, advances, and investments made, which are not otherwise permitted under Section 10.8 during Subject Period: | $ | ||||||

| (ii) | Distributions under Section 10.9(d), and loans, advances, and investments made, which are not otherwise permitted under Section 10.8 during prior Subject Periods: | $ | ||||||

| (iii) | Aggregate Distributions under Section 10.9(d), and loans, advances, and investments made, which are not otherwise permitted under Section 10.8 (the sum of 10.9(d)(i) plus 10.9(d)(ii)): | $ | ||||||

| (iv) | Aggregate amount of Restricted Payments (as defined in the VRI Indenture) that VRI and its Restricted Subsidiaries are permitted to make under, and in accordance with, Section 4.10 of the VRI Indenture, as set forth in detail on Schedule I attached hereto: | $ | ||||||

| (v) | Are aggregate Distributions under Section 10.9(d), and loans, advances, and investments made, which are not otherwise permitted under Section 10.8 (10.9(d)(iii)) less than the maximum amount of Restricted Payments permitted (10.9(d)(iv))? | Yes/No | ||||||

| 11.1 |

RATIO OF NET FUNDED DEBT TO ADJUSTED EBITDA: | |||||||

| (i) | All obligations of the Companies for borrowed money: | $ | ||||||

| (ii) | Minus all obligations of the Unrestricted Subsidiaries for borrowed money (the sum of items 11.1(ii)(A) through 11.1(ii)(Z) below): | ($ ) | ||||||

| (A) Colter Bay Café Court, LLC |

($ ) | |||||||

| (B) Colter Bay Convenience Store, LLC |

($ ) | |||||||

| (C) Colter Bay Corporation |

($ ) | |||||||

| (D) Colter Bay General Store, LLC |

($ ) | |||||||

| (E) Colter Bay Marina, LLC |

($ ) | |||||||

| (F) Crystal Peak Lodge of Breckenridge, Inc. |

($ ) | |||||||

| (G) Gross Ventre Utility Company |

($ ) | |||||||

| (H) Jackson Hole Golf & Tennis Club Snack Shack, LLC |

($ ) | |||||||

| (I) Jackson Lake Lodge Corporation |

($ ) | |||||||

| (J) Jenny Lake Lodge, Inc. |

($ ) | |||||||

| Months Ended |

||||||||

| (K) Jenny Lake Store, LLC |

($ ) | |||||||

| (L) Stampede Canteen, LLC |

($ ) | |||||||

| (M) Eagle Park Reservoir Company |

($ ) | |||||||

| (N) Rockresorts International Management Company |

($ ) | |||||||

| (O) Forest Ridge Holdings, Inc. |

($ ) | |||||||

| (P) Arrabelle at Vail Square, LLC |

($ ) | |||||||

| (Q) Gore Creek Place, LLC |

($ ) | |||||||

| (R) The Chalets at the Lodge at Vail, LLC |

($ ) | |||||||

| (S) RCR Vail, LLC |

($ ) | |||||||

| (T) Hunkidori Land Company, LLC |

($ ) | |||||||

| (U) TCRM Company |

($ ) | |||||||

| (V) VR Heavenly Concessions, Inc. |

($ ) | |||||||

| (W) Stagecoach Development, LLC |

($ ) | |||||||

| (X) Vail Resorts Lodging Company |

($ ) | |||||||

| (Y) La Posada Beverage Service, LLC |

($ ) | |||||||

| (Z) Other Unrestricted Subsidiaries not listed above |

($ ) | |||||||

| (iii) |

Plus the principal portion of all Capital Lease obligations of the Companies (other than obligations under the Northstar Leases (to the extent such leases constitute Capital Leases)): | $ | ||||||

| (iv) |

Minus the principal portion of the Capital Lease obligations for the following Unrestricted Subsidiaries (the sum of items 11.1(iv)(A) through 11.1(iv)(Z) below): | ($ ) | ||||||

| (A) Colter Bay Café Court, LLC |

($ ) | |||||||

| (B) Colter Bay Convenience Store, LLC |

($ ) | |||||||

| (C) Colter Bay Corporation |

($ ) | |||||||

| (D) Colter Bay General Store, LLC |

($ ) | |||||||

| (E) Colter Bay Marina, LLC |

($ ) | |||||||

| (F) Crystal Peak Lodge of Breckenridge, Inc. |

($ ) | |||||||

| (G) Gross Ventre Utility Company |

($ ) | |||||||

| (H) Jackson Hole Golf & Tennis Club Snack Shack, LLC |

($ ) | |||||||

| (I) Jackson Lake Lodge Corporation |

($ ) | |||||||

| (J) Jenny Lake Lodge, Inc. |

($ ) | |||||||

| (K) Jenny Lake Store, LLC |

($ ) | |||||||

| (L) Stampede Canteen, LLC |

($ ) | |||||||

| (M) Eagle Park Reservoir Company |

($ ) | |||||||

| (N) Rockresorts International Management Company |

($ ) | |||||||

| (O) Forest Ridge Holdings, Inc. |

($ ) | |||||||

| (P) Arrabelle at Vail Square, LLC |

($ ) | |||||||

| (Q) Gore Creek Place, LLC |

($ ) | |||||||

| (R) The Chalets at the Lodge at Vail, LLC |

($ ) | |||||||

| (S) RCR Vail, LLC |

($ ) | |||||||

| (T) Hunkidori Land Company, LLC |

($ ) | |||||||

| (U) TCRM Company |

($ ) | |||||||

| (V) VR Heavenly Concessions, Inc. |

($ ) | |||||||

| (W) Stagecoach Development, LLC |

($ ) | |||||||

| Months Ended |

||||||||

| (X) Vail Resorts Lodging Company | ($ ) | |||||||

| (Y) La Posada Beverage Service, LLC | ($ ) | |||||||

| (Z) Other Unrestricted Subsidiaries not listed above | ($ ) | |||||||

| (v) |

Plus reimbursement obligations and undrawn amounts under Bond L/Cs supporting Bonds (other than Existing Housing Bonds) issued by Unrestricted Subsidiaries: | $ | ||||||

| (vi) |

Minus Debt under Existing Housing Bonds: | $ | ||||||

| (vii) |

Funded Debt of the Restricted Companies (11.1(i) minus 11.1(ii) plus 11.1(iii) minus 11.1(iv) plus 11.1(v) minus 11.1(vi)): | $ | ||||||

| (viii) |

Cash of the Companies: | $ | ||||||

| (ix) |

Minus cash of the Unrestricted Subsidiaries (the sum of items 11.1(ix)(A) through 11.1(ix)(Z) below): | ($ ) | ||||||

| (A) Colter Bay Café Court, LLC |

($ ) | |||||||

| (B) Colter Bay Convenience Store, LLC |

($ ) | |||||||

| (C) Colter Bay Corporation |

($ ) | |||||||

| (D) Colter Bay General Store, LLC |

($ ) | |||||||

| (E) Colter Bay Marina, LLC |

($ ) | |||||||

| (F) Crystal Peak Lodge of Breckenridge, Inc. |

($ ) | |||||||

| (G) Gross Ventre Utility Company |

($ ) | |||||||

| (H) Jackson Hole Golf & Tennis Club Snack Shack, LLC |

($ ) | |||||||

| (I) Jackson Lake Lodge Corporation |

($ ) | |||||||

| (J) Jenny Lake Lodge, Inc. |

($ ) | |||||||

| (K) Jenny Lake Store, LLC |

($ ) | |||||||

| (L) Stampede Canteen, LLC |

($ ) | |||||||

| (M) Eagle Park Reservoir Company |

($ ) | |||||||

| (N) Rockresorts International Management Company |

($ ) | |||||||

| (O) Forest Ridge Holdings, Inc. |

($ ) | |||||||

| (P) Arrabelle at Vail Square, LLC |

($ ) | |||||||

| (Q) Gore Creek Place, LLC |

($ ) | |||||||

| (R) The Chalets at the Lodge at Vail, LLC |

($ ) | |||||||

| (S) RCR Vail, LLC |

($ ) | |||||||

| (T) Hunkidori Land Company, LLC |

($ ) | |||||||

| (U) TCRM Company |

($ ) | |||||||

| (V) VR Heavenly Concessions, Inc. |

($ ) | |||||||

| (W) Stagecoach Development, LLC |

($ ) | |||||||

| (X) Vail Resorts Lodging Company |

($ ) | |||||||

| (Y) La Posada Beverage Service, LLC |

($ ) | |||||||

| (Z) Other Unrestricted Subsidiaries not listed above |

($ ) | |||||||

| Months Ended |

||||||||

| (x) |

Investments of the Companies in marketable obligations issued or unconditionally guaranteed by the U.S. or issued by any of its agencies and backed by the full faith and credit of the U.S., in each case maturing within one year from the date of acquisition: | $ | ||||||

| (xi) |

Investments of the Companies in short-term investment grade domestic and eurodollar certificates of deposit or time deposits that are fully insured by the Federal Deposit Insurance Corporation or are issued by commercial banks organized under the Laws of the U.S. or any of its states having combined capital, surplus, and undivided profits of not less than $100,000,000 (as shown on its most recently published statement of condition): | $ | ||||||

| (xii) |

Investments of the Companies in commercial paper and similar obligations rated “P-1” by Moody’s or “A-1” by S&P: | $ | ||||||

| (xiii) |

Investments of the Companies in readily marketable Tax-free municipal bonds of a domestic issuer rated “A-2” or better by Moody’s or “A” or better by S&P, and maturing within one year from the date of issuance: | $ | ||||||

| (xiv) |

Investments of the Companies in mutual funds or money market accounts investing primarily in items described in items 11.1(x) through (xiii) above: | $ | ||||||

| (xv) |

Investments of the Companies in demand deposit accounts maintained in the ordinary course of business: | $ | ||||||

| (xvi) |

Investments of the Companies in short-term repurchase agreements with major banks and authorized dealers, fully collateralized to at least 100% of market value by marketable obligations issued or unconditionally guaranteed by the U.S. or issued by any of its agencies and backed by the full faith and credit of the U.S.: | $ | ||||||

| (xvii) |

Investments of the Companies in short-term variable rate demand notes that invest in tax-free municipal bonds of domestic issuers rated “A-2” or better by Moody’s or “A” or better by S&P that are supported by irrevocable letters of credit issued by commercial banks organized under the laws of the U.S. or any of its states having combined capital, surplus, and undivided profits of not less than $100,000,000: | $ | ||||||

| (xviii) |

Temporary Cash Investments of the Companies (11.1(x) plus 11.1(xi) plus 11.1(xii) plus 11.1(xiii) plus 11.1(xiv) plus 11.1(xv) plus 11.1(xvi) plus 11.1(xvii)): | $ | ||||||

| Months Ended |

||||||||

| (xix) | Minus Temporary Cash Investments of the Unrestricted Subsidiaries (the sum of items 11.1(xix)(A) through 11.1(xix)(Z) below): | ($ ) | ||||||

| (A) Colter Bay Café Court, LLC |

($ ) | |||||||

| (B) Colter Bay Convenience Store, LLC |

($ ) | |||||||

| (C) Colter Bay Corporation |

($ ) | |||||||

| (D) Colter Bay General Store, LLC |

($ ) | |||||||

| (E) Colter Bay Marina, LLC |

($ ) | |||||||

| (F) Crystal Peak Lodge of Breckenridge, Inc. |

($ ) | |||||||

| (G) Gross Ventre Utility Company |

($ ) | |||||||

| (H) Jackson Hole Golf & Tennis Club Snack Shack, LLC |

($ ) | |||||||

| (I) Jackson Lake Lodge Corporation |

($ ) | |||||||

| (J) Jenny Lake Lodge, Inc. |

($ ) | |||||||

| (K) Jenny Lake Store, LLC |

($ ) | |||||||

| (L) Stampede Canteen, LLC |

($ ) | |||||||

| (M) Eagle Park Reservoir Company |

($ ) | |||||||

| (N) Rockresorts International Management Company |

($ ) | |||||||

| (O) Forest Ridge Holdings, Inc. |

($ ) | |||||||

| (P) Arrabelle at Vail Square, LLC |

($ ) | |||||||

| (Q) Gore Creek Place, LLC |

($ ) | |||||||

| (R) The Chalets at the Lodge at Vail, LLC |

($ ) | |||||||

| (S) RCR Vail, LLC |

($ ) | |||||||

| (T) Hunkidori Land Company, LLC |

($ ) | |||||||

| (U) TCRM Company |

($ ) | |||||||

| (V) VR Heavenly Concessions, Inc. |

($ ) | |||||||

| (W) Stagecoach Development, LLC |

($ ) | |||||||

| (X) Vail Resorts Lodging Company |

($ ) | |||||||

| (Y) La Posada Beverage Service, LLC |

($ ) | |||||||

| (Z) Other Unrestricted Subsidiaries not listed above |

($ ) | |||||||

| (xx) | Unrestricted Cash of the Restricted Companies (11.1(viii) minus 11.1(ix) plus 11.1(xviii) minus 11.1(xix)): | $ | ||||||

| (xxi) | Unrestricted Cash of the Restricted Companies in excess of $10,000,000: | $ | ||||||

| (xxii) | Net Funded Debt (11.1(vii) minus 11.1(xxi)): | $ | ||||||

| (xxiii) | EBITDA of the Companies for the last four fiscal quarters: | $ | ||||||

| (xxiv) | Plus insurance proceeds (up to a maximum of $10,000,000 in the aggregate for any fiscal year) received by the Restricted Companies under policies of business interruption insurance (or under policies of insurance which cover losses or claims of the same character or type): | $ | ||||||

| Months Ended |

||||||||

| (xxv) |

Plus pro forma EBITDA of the Restricted Companies for assets acquired during such period (excluding EBITDA of Restricted Companies from cash distributions from Real Estate Joint Ventures that are Unrestricted Subsidiaries, to the extent such amounts are included in 11.1 (xxii)): | $ | ||||||

| (xxvi) |

Minus for any payments by the Northstar Subsidiaries in respect of the portion of the Northstar Leases, if any, that is classified as a Capital Lease, the amount of such payment that would have been recorded as operating lease expense had such portion of the Northstar Leases been classified as an operating lease: | $ | ||||||

| (xxvii) |

Minus pro forma EBITDA of the Restricted Companies for assets disposed of during such period: | ($ ) | ||||||

| (xxviii) |

Minus EBITDA for such period attributable to the following Unrestricted Subsidiaries (sum of items 11.1(xxviii)(A) through 11.1(xxviii)(Z) below): | ($ ) | ||||||

| (A) Colter Bay Café Court, LLC |

($ ) | |||||||

| (B) Colter Bay Convenience Store, LLC |

($ ) | |||||||

| (C) Colter Bay Corporation |

($ ) | |||||||

| (D) Colter Bay General Store, LLC |

($ ) | |||||||

| (E) Colter Bay Marina, LLC |

($ ) | |||||||

| (F) Crystal Peak Lodge of Breckenridge, Inc. |

($ ) | |||||||

| (G) Gross Ventre Utility Company |

($ ) | |||||||

| (H) Jackson Hole Golf & Tennis Club Snack Shack, LLC |

($ ) | |||||||

| (I) Jackson Lake Lodge Corporation |

($ ) | |||||||

| (J) Jenny Lake Lodge, Inc. |

($ ) | |||||||

| (K) Jenny Lake Store, LLC |

($ ) | |||||||

| (L) Stampede Canteen, LLC |

($ ) | |||||||

| (M) Eagle Park Reservoir Company |

($ ) | |||||||

| (N) Rockresorts International Management Company |

($ ) | |||||||

| (O) Forest Ridge Holdings, Inc. |

($ ) | |||||||

| (P) Arrabelle at Vail Square, LLC |

($ ) | |||||||

| (Q) Gore Creek Place, LLC |

($ ) | |||||||

| (R) The Chalets at the Lodge at Vail, LLC |

($ ) | |||||||

| (S) RCR Vail, LLC |

($ ) | |||||||

| (T) Hunkidori Land Company, LLC |

($ ) | |||||||

| (U) TCRM Company |

($ ) | |||||||

| (V) VR Heavenly Concessions, Inc. |

($ ) | |||||||

| (W) Stagecoach Development, LLC |

($ ) | |||||||

| (X) Vail Resorts Lodging Company |

($ ) | |||||||

| (Y) La Posada Beverage Service, LLC |

($ ) | |||||||

| (Z) Other Unrestricted Subsidiaries not listed above |

($ ) | |||||||

| Months Ended |

||||||||

| (xxix) |

Adjusted EBITDA (11.1(xxiii) plus 11.1(xxiv) plus 11.1(xxv) minus 11.1(xxvi) minus 11.1(xxvii) minus 11.1(xxviii)): | $ | ||||||

| (xxx) |

Ratio of Net Funded Debt to Adjusted EBITDA (Ratio of 11.1(xxii) to 11.1(xxix)): |

|||||||

| (xxxi) |

Maximum ratio of Net Funded Debt to Adjusted EBITDA permitted: | 4.50 : 1.00 | ||||||

| (xxxii) |

Is the ratio of Net Funded Debt to Adjusted EBITDA less than the maximum ratio permitted? | Yes/No | ||||||

| 11.2 | [RESERVED] | |||||||

| 11.3 | MINIMUM NET WORTH: | |||||||

| (a) |

Shareholders’ Equity determined in accordance with GAAP: | $ | ||||||

| (b) |

$414,505,800: | $414,505,800 | ||||||

| (c) |

Restricted Companies’ Net Income, if positive, for each fiscal year completed after October 31, 2004: | $ | ||||||

| (d) |

75% of the total from 11.3(c): | $ | ||||||

| (e) |

Net Proceeds received by any Restricted Company from the offering, issuance, or sale of equity securities of a Restricted Company after October 31, 2004 (other than Net Proceeds received from another Company or from the exercise of employee stock options): | $ | ||||||

| (f) |

Minimum shareholders’ equity permitted (11.3(b) plus 11.3(d) plus 11.3(e)): |

$ | ||||||

| (g) |

Does Shareholders’ Equity exceed the minimum permitted? | Yes/No | ||||||

| 11.4 | INTEREST COVERAGE RATIO | |||||||

| (a) |

Adjusted EBITDA for the last four fiscal quarters (11.1(xxviii)): | $ | ||||||

| (b) |

Interest expense on Funded Debt for the last four fiscal quarters: | $ | ||||||

| (c) |

Amortization of deferred financing costs and original issue discounts: | $ | ||||||

| (d) |

11.4(b) minus 11.4(c): | $ | ||||||

| Months Ended |

||||||||

| (e) | Interest Coverage Ratio (Ratio of 11.4(a) to 11.4(d)): | |||||||

| (f) | Minimum Interest Coverage Ratio permitted: |

2.50 : 1.00 | ||||||

| (g) | Does the Interest Coverage Ratio exceed the minimum ratio permitted? |

Yes/No | ||||||

| 11.5 | CAPITAL EXPENDITURES | |||||||

| (a) | Aggregate capital expenditures of the Restricted Companies in the ordinary course of the business during each fiscal year (excluding (i) normal replacements and maintenance which are properly charged to current operations, and (ii) expenditures relating to real estate held for resale): | $ | ||||||

| (b) | Total Assets of the Restricted Companies (and, if SSI is not a Restricted Company, Borrower’s Ownership Percentage of the total assets of SSI) as of the last day of the fiscal year: | $ | ||||||

| (c) | Maximum capital expenditures permitted (15% of Total Assets of the Restricted Companies (and, if SSI is not a Restricted Company, Borrower’s Ownership Percentage of the total assets of SSI) set forth in 11.5(b)): | $ | ||||||

| (d) | Are aggregate capital expenditures less than the maximum amount permitted? |

Yes/No | ||||||

| LETTERS OF CREDIT | ||||||||

| Set forth on Schedule 1 attached hereto is a list of all issued and outstanding letters of credit issued for the account of any of the Companies, and the drawn and undrawn amounts thereunder | ||||||||