Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CTI BIOPHARMA CORP | d8k.htm |

| EX-99.2 - NOTICE, DATED DECEMBER 3, 2010 - CTI BIOPHARMA CORP | dex992.htm |

Exhibit 99.1

REGISTRATION DOCUMENT

ISSUER

CELL THERAPEUTICS INC.

Registration Document filed with CONSOB on December 2, 2010 following authorization to the publication thereof

communicated by means of CONSOB note no. 10098480 of December 1, 2010

The fulfillment of the publication of this Registration Document does not entail any opinion of CONSOB as to the opportunity of the proposed investment and the merit of the data and information related thereto.

1

WARNINGS TO INVESTORS

THE SCOPE OF THESE WARNINGS IS TO ALLOW THE INVESTORS TO IMMEDIATELY CATCH THE ISSUES CONNECTED TO THE CAPACITY OF THE ISSUER TO REGULARLY CARRY ON ITS ACTIVITIES IN THE TWELVE MONTHS FOLLOWING THE DATE OF THIS REGISTRATION DOCUMENT. IN PARTICULAR, BELOW IS A SUMMARY OF THE MAIN RISKS AND UNCERTAINTIES WHICH MIGHT RAISE MATERIAL DOUBTS CONCERNING THE CAPABILITY OF THE ISSUER TO CONTINUE TO CARRY ON ITS ACTIVITIES AS AN ONGOING CONCERN.

| • | THE COMPANY DOES NOT EXPECT THAT ITS EXISTING CASH AND CASH EQUIVALENTS, INCLUDING THE CASH RECEIVED FROM THE ISSUANCE OF ITS SERIES 7 PREFERRED STOCK AND WARRANTS IN OCTOBER 2010, WILL BE SUFFICIENT TO FUND ITS PRESENTLY ANTICIPATED OPERATIONS BEYOND THE FIRST QUARTER OF 2011. THIS RAISES SUBSTANTIAL DOUBT ABOUT THE COMPANY’S ABILITY TO CONTINUE AS A GOING CONCERN. PLEASE REFER TO RISK FACTOR 4.1.1 FOR MORE INFORMATION. |

| • | THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING AUDITOR HAS INCLUDED AN EXPLANATORY PARAGRAPH IN ITS AUDIT REPORTS ON THE COMPANY’S DECEMBER 31, 2007, 2008 AND 2009 CONSOLIDATED FINANCIAL STATEMENTS AND IN ITS LIMITED REVIEW REPORT ON THE COMPANY’S FINANCIAL STATEMENTS CONCERNING THE SIX-MONTH PERIOD ENDED JUNE 30, 2010 WHERE, TAKEN INTO CONSIDERATION WHAT HAS BEEN REPORTED BY THE DIRECTORS IN THE RELEVANT ACCOUNTING DOCUMENTS AND THE COMPANY’S INABILITY TO DEMONSTRATE ITS ABILITY TO SATISFY THE MONETARY LIABILITIES DUE, IT RAISED SUBSTANTIAL DOUBT AS TO THE COMPANY’S ABILITY TO CONTINUE AS A GOING CONCERN. THIS MAY HAVE A NEGATIVE IMPACT ON THE TRADING PRICE OF THE COMPANY’S COMMON STOCK AND AS A RESULT, THE COMPANY MAY HAVE A DIFFICULT TIME OBTAINING NECESSARY FINANCING. |

| • | THE COMPANY HAS INCURRED A NET OPERATING LOSS EVERY YEAR SINCE ITS INCORPORATION IN 1991. AS OF SEPTEMBER 30, 2010, THE COMPANY HAD AN ACCUMULATED DEFICIT OF APPROXIMATELY $1.5 BILLION. THE COMPANY HAS NOT DECLARED OR PAID ANY DIVIDENDS ON SHARES OF ITS COMMON STOCK AND DOES NOT CURRENTLY EXPECT TO DO SO IN THE FUTURE. THE COMPANY MAY CONTINUE TO INCUR NET LOSSES, AND IT MAY NEVER ACHIEVE PROFITABILITY. PLEASE REFER TO RISK FACTOR 4.1.1 FOR MORE INFORMATION. |

| • | THE COMPANY DOES NOT HAVE ANY APPROVED DRUGS ON THE MARKET AND DOES NOT GENERATE REVENUES FROM ITS PRODUCTS AND THE COMPANY MAY NOT BE ABLE TO REPAY THE COMPANY’S DEBT OR THE RELEVANT INTEREST, LIQUIDATED DAMAGES OR OTHER PAYMENTS WITH RESPECT TO ITS DEBT. PLEASE REFER TO RISK FACTOR 4.1.1 FOR MORE INFORMATION. |

| • | THE COMPANY HAS A SUBSTANTIAL AMOUNT OF DEBT OUTSTANDING, AND ITS ANNUAL INTEREST EXPENSE WITH RESPECT TO ITS DEBT IS SIGNIFICANT. THE AGGREGATE PRINCIPAL BALANCE OF THE COMPANY’S CONVERTIBLE NOTES AS OF SEPTEMBER 30, 2010 IS APPROXIMATELY $21.1 MILLION, CORRESPONDING TO APPROXIMATELY $10.2 MILLION IN THE 7.5% CONVERTIBLE SENIOR NOTES DUE IN APRIL 2011 (THEREFORE WITHIN THE NEXT 12 |

2

| MONTHS) AND TO APPROXIMATELY $10.9 MILLION IN THE 5.75% CONVERTIBLE SENIOR NOTES DUE IN DECEMBER 2011. PLEASE REFER TO THE FOLLOWING PARAGRAPH 10.3.3 FOR MORE INFORMATION. AS OF SEPTEMBER 30, 2010 THE TOTAL ESTIMATED AND UNAUDITED NET FINANCIAL POSITION OF THE COMPANYWAS APPROXIMATELY NEGATIVE $6.7 MILLION. |

| • | THE COMPANY ESTIMATES ITS AVERAGE CASH BURN-RATE (CORRESPONDING TO ITS MONTHLY FINANCIAL NEED) FOR THE REMAINDER OF 2010 AND THE FIRST QUARTER OF 2011 TO BE ABOUT $5 MILLION PER MONTH. THE COMPANY IS REVIEWING WAYS TO REDUCE ITS BURN RATE. |

| • | WITH RESPECT TO THE PERIODS TO WHICH THE HISTORIC FINANCIAL INFORMATION REPORTED IN THIS REGISTRATION DOCUMENT REFERS, THE COMPANY BORE THE FOLLOWING TOTAL NET LOSS ATTRIBUTABLE TO CTI COMMON SHAREHOLDERS: $148.3 MILLION IN THE YEAR 2007, $202.9 MILLION IN THE YEAR 2008, AND $116.8 MILLION IN THE YEAR 2009. WITH RESPECT TO SUCH AMOUNT OF TOTAL NET LOSS ATTRIBUTABLE TO CTI COMMON SHAREHOLDERS, THE PERCENTAGE OF REMUNERATIONS AND BENEFITS TO DIRECTORS AND THE NAMED EXECUTIVE OFFICERS (AS DEFINED IN THE FOLLOWING GLOSSARY) IS RESPECTIVELY: 3% FOR THE YEAR 2007, 2% FOR THE YEAR 2008, AND 36% FOR THE YEAR 2009. THE TOTAL AMOUNT OF RENUMERATION AND BENEFITS TO DIRECTORS AND THE NAMED EXECUTIVE OFFICERS IS DERIVED FROM INFORMATION PROVIDED IN OUR PROXY STATEMENTS PREPARED IN ACCORDANCE WITH THE APPLICABLE RULES AND REGULATIONS OF THE U.S. SECURITIES AND EXCHANGE COMMISSION AND IS NOT NECESSARILY INDICATIVE OF THE AMOUNT OF COMPENSATION AND BENEFITS RECORDED IN THE FINANCIAL STATEMENTS FOR SUCH PERIODS. PLEASE REFER TO THE FOLLOWING PARAGRAPH 15.1 FOR MORE INFORMATION. |

| • | DURING THE LAST THREE YEAR PERIOD AND THE NINE-MONTH PERIOD ENDING IN SEPTEMBER 30, 2010, THE COMPANY HAS DECREASED ITS RESEARCH AND DEVELOPMENT EXPENSES AS FOLLOWS, SPECIFICALLY FROM $72.019 MILLION IN THE FINANCIAL YEAR 2007 TO $51.614 MILLION IN THE FINANCIAL YEAR 2008, $30.179 IN THE FINANCIAL YEAR 2009 AND, LASTLY, TO $19.375 MILLION IN THE NINE-MONTH PERIOD FROM DECEMBER 31, 2009 TO SEPTEMBER 30, 2010. PLEASE REFER TO THE FOLLOWING PARAGRAPHS 9.2.1, 9.2.3 AND 20.1 FOR MORE INFORMATION. |

| • | OBTAINING REGULATORY APPROVAL TO MARKET DRUGS TO TREAT CANCER IS EXPENSIVE, DIFFICULT AND RISKY. ON APRIL 9, 2010, THE FOOD AND DRUG ADMINISTRATION (FDA) INFORMED THE COMPANY ABOUT THE REJECTION OF THE NEW DRUG APPLICATION (NDA) FOR THE MARKETING OF PIXANTRONE (THAT IS THE PRODUCT IN THE MOST ADVANCED PHASE OF THE MARKETING AUTHORIZATION PROCESS AMONG THE CANDIDATE DRUGS OF CTI) IN THE USA AND RECOMMENDED THAT THE COMPANY CONDUCT AN ADDITIONAL TRIAL TO DEMONSTRATE THE SAFETY AND EFFECTIVENESS OF PIXANTRONE. THE COMPANY DOES NOT KNOW WHAT THIS TRIAL WILL COST OR WHETHER THE FDA WILL ACCEPT THE COMPANY’S DESIGN FOR THIS TRIAL. PLEASE REFER TO THE FOLLOWING PARAGRAPH 6.1 FOR MORE INFORMATION. |

| • | ON NOVEMBER 1, 2010, THE COMPANY SUBMITTED A MARKETING AUTHORIZATION APPLICATION (MAA) TO THE EUROPEAN MEDICINES AGENCY (EMA) FOR PIXUVRI(R) (PIXANTRONE DIMALEATE) AS MONOTHERAPY FOR THE TREATMENT OF ADULT PATIENTS WITH MULTIPLY RELAPSED OR REFRACTORY AGGRESSIVE NON-HODGKIN’S LYMPHOMA |

3

| (NHL). THE APPLICATION SUBMISSION FOLLOWS A POSITIVE OPINION FROM THE EMA’S PEDIATRIC COMMITTEE (PDCO), WHERE PDCO AGREED TO CTI’S PEDIATRIC INVESTIGATION PLAN (PIP) FOR PIXUVRI. MOREOVER ON NOVEMBER 17, 2010 THE EMA APPROVED THE AFORESAID PIP. AS OF THE DATE OF THIS REGISTRATION DOCUMENT THE COMPANY CAN NOT ANTICIPATE THE DURATION OF SUCH MARKETING AUTHORIZATION PROCEEDINGS OR WHETHER THE MAA WILL RECEIVE APPROVAL IN THE NEXT 12 MONTHS. PLEASE REFER TO THE FOLLOWING PARAGRAPH 6.1 FOR MORE INFORMATION. |

| • | THE COMPANY IS NOT YET PURSUING OBTAINING MARKETING APPROVAL FOR ITS DRUG CANDIDATE OPAXIO. THE COMPANY PLANS TO MEET WITH THE FDA TO EXPLORE A POTENTIAL PHASE III REGISTRATION STUDY UTILIZING OPAXIO AS A RADIATION SENSITIZER IN THE TREATMENT OF ESOPHAGEAL CANCER AND HAS ENTERED INTO A CLINICAL TRIALS AGREEMENT WITH THE GYNECOLOGIC ONCOLOGY GROUP, TO PERFORM A PHASE III TRIAL OF OPAXIO AS MAINTENANCE THERAPY IN PATIENTS WITH OVARIAN CANCER. AS OF THE DATE OF THIS REGISTRATION DOCUMENT THE COMPANY CAN NOT ANTICIPATE IF IT WILL BE ABLE TO FILE A NDA IN THE USA OR A MAA IN THE EUROPEAN UNION IN THE NEXT 12 MONTHS. PLEASE REFER TO THE FOLLOWING PARAGRAPH 6.1 FOR MORE INFORMATION. |

4

INDEX

| INDEX |

5 | |||||

| GLOSSARY |

C-1 | |||||

| SECTION I |

REGISTRATION DOCUMENT | C-13 | ||||

| CHAPTER 1 |

PERSONS RESPONSIBLE FOR THIS PROSPECTUS | C-13 | ||||

| CHAPTER 2 |

AUDITORS | C-14 | ||||

| CHAPTER 3 |

SELECTED FINANCIAL INFORMATION | C-15 | ||||

| CHAPTER 4 |

RISK FACTORS | C-20 | ||||

| CHAPTER 5 |

COMPANY INFORMATION | C-53 | ||||

| CHAPTER 6 |

BUSINESS OVERVIEW | C-66 | ||||

| CHAPTER 7 |

ORGANIZATIONAL STRUCTURE | C-98 | ||||

| CHAPTER 8 |

PROPERTY, PLANT AND EQUIPMENT | C-100 | ||||

| CHAPTER 9 |

OPERATING AND FINANCIAL REVIEW | C-102 | ||||

| CHAPTER 10 |

CAPITAL RESOURCES | C-112 | ||||

| CHAPTER 11 |

RESEARCH AND DEVELOPMENT, PATENTS AND LICENSES | C-134 | ||||

| CHAPTER 12 |

TREND INFORMATION | C-136 | ||||

| CHAPTER 13 |

PROFIT FORECASTS OR ESTIMATES | C-140 | ||||

| CHAPTER 14 |

ADMINISTRATIVE, MANAGEMENT, AND SUPERVISORY BODIES AND SENIOR MANAGEMENT | C-141 | ||||

| CHAPTER 15 |

REMUNERATION AND BENEFIT | C-152 | ||||

| CHAPTER 16 |

PRACTICES OF THE BOARD OF DIRECTORS | C-163 | ||||

| CHAPTER 17 |

EMPLOYEES | C-169 | ||||

| CHAPTER 18 |

MAJOR SHAREHOLDERS | C-173 | ||||

| CHAPTER 19 |

RELATED PARTY TRANSACTIONS | C-174 | ||||

| CHAPTER 20 |

FINANCIAL INFORMATION CONCERNING THE ISSUER’S ASSETS AND LIABILITIES, FINANCIAL POSITION AND PROFITS AND LOSSES | C-177 | ||||

| CHAPTER 21 |

ADDITIONAL INFORMATION | C-266 | ||||

| CHAPTER 22 |

MATERIAL CONTRACTS | C-304 | ||||

| CHAPTER 23 |

THIRD PARTY INFORMATION AND STATEMENT BY EXPERTS AND DECLARATIONS OF ANY INTEREST | C-314 | ||||

| CHAPTER 24 |

DOCUMENTS AVAILABLE TO THE PUBLIC | C-315 | ||||

| CHAPTER 25 |

INFORMATION ON HOLDING | C-316 | ||||

5

DEFINITIONS

The important terms and definitions used in this Registration Document are listed below. These definitions and terms shall have the meaning set out below unless otherwise provided.

| Auditors: | Stonefield Josephson, Inc., a company with its registered office in Los Angeles, California. | |

| Authorized Common Shares: | The total number of shares of the Common Stock that the Company is permitted to issue (1,200,000,000 as of the date of the Registration Document, including the issued and outstanding Common Shares) without obtaining stockholder approval (except as may be required by the NASDAQ Marketplace Rules). | |

| Authorized Preferred Shares: | The total number of shares of the Company’s preferred stock that the Company is permitted to issue (10,000,000 as of the date of the Registration Document, including the issued and outstanding Preferred Shares) without obtaining stockholder approval (except as may be required by the NASDAQ Marketplace Rules). The Board of Directors may determine the terms of the preferred shares in its sole discretion. | |

| Borsa Instructions: | The Istruzioni al Regolamento dei Mercati organizzati e gestiti da Borsa Italiana S.p.A. effective as of August 9, 2010. | |

| Borsa Italiana: | Borsa Italiana S.p.A. with registered office in Milan, Piazza Affari 6. | |

| Borsa Regulation: | The Regolamento dei Mercati organizzati e gestiti da Borsa Italiana S.p.A. effective as of June 28, 2010. | |

| Business Day: | Each day between Monday and Friday, inclusive, of any given week in which banks are open and stock exchanges are open for trading in Italy and the United States. | |

| Common Stock: | The shares of common stock of the Company (ISIN Code US1509345039), no par value per share, listed on the NASDAQ Capital Market and on MTA. | |

| CONSOB: | Commissione Nazionale per le Societa e la Borsa (Italian National Commission for Companies and the Stock Exchange). | |

| CONSOB Regulation: | Regulations implementing Italian Legislative Decree No 58 of February 24, 1998, regarding issuers regulation (adopted by CONSOB with resolution No 11971 dated May 14, 1999 as subsequently amended). | |

| CTI Europe: | The Company’s branch in Italy (formerly known as Cell Therapeutics Europe S.r.l., which was merged into the Company in November 2007) with registered office in Via Valentino Mazzola n. 18, Rome (before the registered office was in Bresso). | |

| CTI or the Issuer or the Company: | Cell Therapeutics, Inc. having its registered office located in the State of Washington at 501 Elliott Avenue West, Suite 400, Seattle, Washington 98119 (U.S.). | |

C-1

| Date of the Registration Document: | The date on which the Registration Document has been published. | |

| EBITDA: | Earnings before interest, taxes, depreciation and amortization (EBITDA) is a non-GAAP metric that can be used to evaluate a company’s profitability. | |

| Exchange Act: | The U.S. Securities Exchange Act of 1934, as amended. | |

| Group: | The Company and the Company’s Subsidiaries. | |

| Italian Shareholders | The Company’s shareholders who hold shares in Italy through Monte Titoli. | |

| Issuance: | Any issuance, from time to time, which will be authorized by the Board of Directors prior to the commencement thereof and which will be described in detail in one more securities notes to be disclosed to the public, together with the relevant summaries and the possible updated information, according to the applicable laws and regulations. | |

| Monte Titoli: | Monte Titoli S.p.A., having its registered office in Milan, via Mantegna, 6. | |

| MTA: | MTA, Standard 1, organized and managed by Borsa Italiana. | |

| NASDAQ: | National Association of Securities Dealers Automated Quotations system and the NASDAQ Capital Market (the U.S. exchange on which the Company’s stock is listed). | |

| Named Executive Officers: | Means the Chief Executive Officer (the “CEO”), the Chief Financial Officer (the “CFO”) and the Company’s next three most highly compensated executive officers for fiscal year 2009. | |

| New Common Shares: | The newly issued Common Shares pursuant to the Share Capital Increase. | |

| NASDAQ Marketplace Rules: | The rules of the NASDAQ Capital Market. | |

| Preferred Shares: | Shares of 3% Convertible Preferred Series A, Series B and Series C Stock, shares of 7% Convertible Preferred Series D Stock, shares of Convertible Preferred Series F Stock, shares of Series 1 Preferred Stock, shares of Series 2 Preferred Stock, shares of Series 3 Preferred Stock, shares of Series 4 Preferred Stock, shares of Series 5 Preferred Stock, shares of Convertible Preferred Series 6 Stock and shares of Convertible Preferred Series 7 Stock. As of the date of this Registration Document there were no shares of any series of the Company’s Preferred Stock remaining outstanding. | |

| RIT Oncology: | RIT Oncology, LLC, a joint venture formed by the Company and Spectrum Pharmaceuticals, Inc. in December 2008 for the marketing and commercialization of Zevalin; all Zevalin-specific assets owned by | |

C-2

| the Company (including the supplemental biologics license application submitted on October 2, 2008 for the use of Zevalin as consolidation therapy after remission induction in previously untreated patients with follicular non-Hodgkin’s lymphoma) were transferred to RIT Oncology in connection with this formation. The Company subsequently sold its interest in RIT Oncology to Spectrum Pharmaceuticals, Inc. in March 2009, although it will continue to perform transition services for Zevalin through May 31, 2009. | ||

| Share Capital Increase: | The share capital increase resolved upon for the purposes of the Issuances that may be made under this Registration Document. | |

| SEC: | The U.S. Securities and Exchange Commission. | |

| Subscriber: | A single purchaser, a limited number of purchasers, underwriters or dealers of the Offer. | |

| 2003 Listing Prospectus: | Listing Prospectus filed by the Company with CONSOB in 2003. | |

| Unified Financial Act or TUF: | Italian Legislative Decree No 58 of February 24, 1998, as amended and supplemented. | |

| US GAAP: | U.S. generally accepted accounting principles. | |

GLOSSARY OF THE MEDICAL AND TECHNICAL TERMS USED IN THIS REGISTRATION DOCUMENT

In consideration of the activity that the Company carries out in the biotechnology sector, it has been deemed convenient to prepare the following glossary of the technical terms which will be most frequently used in this Registration Document.

| Anthracyclines | Antibiotics which act to inhibit tumor growth by causing damage to DNA. | |

| Biologic Products | Biologic products, like other drugs, are used for the treatment, prevention or cure of disease in humans. In contrast to chemically synthesized small molecular weight drugs, which have a well-defined structure and can be thoroughly characterized, biological products are generally derived from living material – human, animal, or microorganism – are complex in structure, and thus are usually not fully characterized. | |

| Bisplatinates | Bisplatinates are new analogues of the dinuclear-platinum complex that is more potent than cisplatin. Cisplatin is a platinum-based chemotherapy drug used to treat a wide variety of cancers. The Company is currently researching bisplatinates. | |

C-3

| BLA | Biologics License Application, the method by which the FDA reviews and approves biological products for marketing in the U.S. | |

| Chemotherapy | The treatment of a tumor through the use of various chemical compounds, especially cytotoxic agents, which prevent cellular proliferation and reduce tumor growth. | |

| CHOP-R | A chemotherapy regimen used in the treatment of non-Hodgkin’s lymphoma. CHOP-R stands for cyclophosphamide, doxorubicin, vincristine, prednisone, rituximab. | |

| CPOP-R | CPOP-R is the acronym for a chemotherapy regimen. CPOP-R stands for cyclophosphamide, pixantrone, vincristine, prednisone, rituximab and differs from the standard regimen as pixantrone is substituted for doxorubicin. | |

| cGMP/GLP/GCP (current good manufacturing practice/good laboratory practice/ good clinical practice) |

International rules aimed at ensuring the quality of, respectively: (i) the pharmaceutical production processes; (ii) the carrying out of non-clinical trials for regulatory purposes; and (iii) the trials on humans and the definition of trial guidelines. | |

| Clinical data | Patient and other information collected and recorded during and as part of an ongoing clinical trial. | |

| Clinical development (or clinical experimentation) | Series of consequential studies regulated by the regulatory health authorities involving the trials of experimental drugs on humans with the aim of their possible introduction to the market. Clinical trials are typically conducted in three sequential phases, but the phases may overlap or be combined. Phase I usually involves the initial introduction of the investigational drug into people to evaluate its short-term safety, dosage tolerance, metabolism, pharmacokinetics and pharmacologic actions, and, if possible, to gain an early indication of its effectiveness. Phase II usually involves trials in a limited patient population to (i) evaluate dosage tolerance and appropriate dosage, (ii) identify possible adverse effects and safety risks, and (iii) evaluate preliminarily the efficacy of the drug for specific indications. Phase III trials usually further evaluate clinical efficacy and test further for safety by using the drug in its final form in an expanded patient population. | |

C-4

| Confirmed Complete Remission (CR) | The total disappearance of all evidence of disease using physical examination, laboratory studies and radiologic imaging and a criterion for evaluating the efficacy of a particular anti-cancer therapy. | |

| Corporate Integrity Agreement | An agreement with the federal government whereby the Company’s actions with respect to promotion and sales practices are reviewed and reported to the federal government for a period of time. | |

| Cytotoxic agents | Chemicals or compounds that are directly toxic to cells, preventing their reproduction or growth. | |

| Data Safety Monitoring Board, or DSMB | The Data Safety Monitoring Board, or DSMB, is a group consisting of external investigators and company personnel which periodically reviews safety data from an ongoing clinical trial. The DSMB may make recommendations with regard to an ongoing study based on their review of the safety data and their knowledge of treatment of the disease. | |

| Data Monitoring Committee | See Data Safety Monitoring Board | |

| EMA | European Medicines Agency. The inter-governmental agency responsible for approving drug candidates for marketing in the European Union. | |

| Endpoint | In a clinical research trial, a clinical endpoint refers to occurrence of a disease, symptom, sign or laboratory abnormality that constitutes one of the target outcomes of the trial. The results of a clinical trial generally indicate the number of people enrolled who reached the pre-determined clinical endpoint during the study interval, compared with the overall number of people who were enrolled. | |

| EORTC | European Organization for Research and Treatment of Cancer. | |

| Fast Track | Fast track designation is granted to expedite the review process of applications for approval of new drugs intended to treat serious or life-threatening conditions where potential to address an unmet medical need is demonstrated. | |

| FDA | U.S. Food and Drug Administration, the governmental agency in the United States responsible for approving new drug applications. | |

| First-line | Preferred treatment for the diagnosed illness. | |

C-5

| Formulation | Pharmaceutical preparation which enables the administration of a drug’s active principles (i.e., of the components of a drug with pharmacological activity) in the desired manner, due to the use of excipients; the final preparation is ready for clinical use. | |

| GOG | The Gynecologic Oncology Group is a non-profit organization with the purpose of promoting excellence in the quality and integrity of clinical and basic scientific research in the field of gynecologic malignancies. | |

| Hazard ratio | The relative likelihood of experiencing a particular event. In a survival study, this is the relative likelihood of death. A hazard ratio (HR) of 0.5 indicates that one group has half the risk of the other group. | |

| HIF-1/P300 | HIF-1 (hypoxia-inducible factor 1) is a transcription factor that senses the low oxygen concentration and activates a series of genes which helps the tumor survive these conditions | |

| “Intent to treat” analysis | Intent to treat analysis means including all patients randomized to an arm of a clinical trial, regardless of their adherence to the entry criteria, regardless of the treatment they actually received, and regardless of the subsequent withdrawal from treatment or deviation from the protocol. | |

| Investigational New Drug | An application that a drug sponsor must submit to FDA before beginning tests of a new drug on humans. The IND contains the plan for the study and is supposed to give a complete picture of the drug, including its structural formula, animal test results, and manufacturing information. | |

| In vitro | Activities performed outside the living body and in an artificial environment. | |

| In vivo | Experimentation carried out on animals or humans, (meaning, “in the living body”). | |

| Leucopenia | A low white blood cell count, or leucopenia, is a decrease in disease-fighting cells (leukocytes) circulating in your blood. | |

C-6

| Log rank | Log rank describes a standard statistical method for testing the null hypothesis that there is no difference between the populations in the probability of an event at any given time point. A log rank test is most likely to detect a difference between groups when the risk of an event is consistently greater for one group than another. | |

| Marker | Indicator of the presence of a specific kind of tumor, identifiable by means of specific laboratory tests. | |

| Metastatic | Spread of a tumor by cells migrating from a primary site (primary tumor) to a secondary site where a new tumor develops (metastatic secondary tumor). | |

| Mitoxantrone | Intercalating cancer drug with a high level of activity on leukemia and lymphoma, but also used in the combined treatment of breast, prostate and ovarian cancer. | |

| Milestone | A scheduled event that is used to measure progress toward a final set target. | |

| MAA or Marketing authorization application | An application submitted to the EMA for review and approval to begin marketing a drug in Europe. An MAA is similar to the NDA in the U.S. | |

| NDA or New drug application | When the sponsor of a new drug believes that enough evidence on the drug’s safety and effectiveness has been obtained to meet FDA’s requirements for marketing approval, the sponsor submits to FDA a new drug application (NDA). The application must contain data from specific technical viewpoints for review, including chemistry, pharmacology, medical, biopharmaceutics, and statistics. If the NDA is approved, the product may be marketed in the United States. | |

| Neutropenia | An abnormally low count of neutrophils, white blood cells that protect your body from bacteria and fungi. Neutrophils usually constitute about 45 to 75% of all white blood cells in the bloodstream. | |

| Non-Hodgkin’s lymphoma, or NHL | A particular type of malignant tumor that starts in the lymphoid tissue (also called lymph or lymphatic tissue). | |

C-7

| Non-small cell lung cancer, or NSCLC | Non-small cell lung cancer, or NSCLC, is one of two main types of lung cancer. There are three sub-types of NSCLC. The cells in these sub-types differ in size, shape, and chemical make-up.

• squamous cell carcinoma: linked to smoking and tend to be found near the bronchus.

• adenocarcinoma: usually found in the outer part of the lung.

• large-cell undifferentiated carcinoma: tends to grow and spread quickly. | |

| NSCLC | Non-small cell lung cancer. | |

| Off-label | Use of a drug for a disease or condition other than the indication for which it was approved by a regulatory authority, such as the FDA or EMA. | |

| Oncology | Branch of medicine which studies the characteristics of tumors, their classification, diagnosis and therapy. | |

| OPAXIO™ | Paclitaxel poliglumex, previously referred as XYOTAX. In May 2008 the European Medecines Agency (EMA) expressed a positive opinion for the brand name OPAXIO which replaces XYOTAX as the brand name. | |

| Partial Remission (PR) | A decrease in the size of a tumor, or in the extent of cancer in the body, in response to treatment. | |

| Pivotal study or Pivotal trial | Clinical trial on which a drug’s safety and efficacy is based and which provides the data that the FDA uses to decide whether or not to approve a drug. A pivotal study will generally be a phase III, well-controlled, randomized trial. | |

| Pixantrone or Pixuvri™ | A novel anthracycline derivative, BBR 2778, for the treatment of non-Hodgkin’s lymphoma, or NHL, and various other hematologic malignancies, solid tumors and immunological disorders. | |

| Pharmacokinetics | Branch of pharmacology which studies the behavior of compounds in living organisms by means of the evaluation of ADME (absorption, distribution, metabolism and elimination) of the drug in a living organism. If the tests are carried out using toxic doses, the appropriate term is toxicokinetics. | |

C-8

| Pharmacology | Science of the study of drugs, their preparation, their effects and their action mechanisms. | |

| Phase I, Phase II, Phase III | See “Clinical Development”. | |

| PolaRx | PolaRx, a single product company that owned the rights to TRISENOX. | |

| Polyglutamate | A biodegradable polymer of glutamic acid, a naturally occurring amino acid. | |

| Pooled analysis | Pooled analysis means combining analyses from more than one clinical trial. | |

| Preclinical data | Data collected from studies performed in the laboratory or in animals, which is used to predict the potential safety, tolerability, and activity of a potential drug before it has entered clinical trials in humans. (See also preclinical development). | |

| Preclinical development | Laboratory tests (in vitro and in vivo) before testing on humans. This phase involves in vitro and in vivo experimentation to evaluate the activity and toxicity of the compounds and the first stages in the study of the formulation. | |

| Product | Depending on the context, (i) a pharmaceutical or biopharmaceutical substance which is already on the market; or (ii) a pharmaceutical or biopharmaceutical substance which is potentially marketable (potential product or product in clinical development). | |

| Product candidate | A pharmaceutical or biopharmaceutical substance in any phase of research and development between initial research and the completion of the clinical trials and market approval. | |

| Progression-free survival | The time interval during which a patient’s disease is determined to be stable until the time when the disease is determined to be progressing. | |

C-9

| PS2 Patient | A poor performance status patient. Performance status (PS) is a measure of disease symptoms defined by the Eastern Cooperative Oncology Group. It is rated on a scale from PS0 to PS5. Patients who are considered “good performance status” or PS0 or PS1 have minimal or no symptoms of disease and are able to maintain their activities of daily living. Patients with performance status 2 or greater are considered “poor performance status.” PS2 patients are ambulatory and capable of self care and up and about more than 50% of their waking hours, but are unable to carry out work activities. | |

| Radiopharmaceutical | A radioactive compound used in radiotherapy or diagnosis. | |

| Randomized study | A clinical trial, typically conducted at several different centers, in which patients have been randomly assigned to receive either the study drug or control drug. | |

| Refractory | Not responsive to the relevant treatment. | |

| Regulatory health authorities | The authorities which regulate the various stages of experimentation (pre-clinical and clinical) of potential pharmaceutical products and grant/revoke the relative authorization for marketing and sale of the products. In Italy the relevant authority is the Ministry of Health (Ministero della Sanità) and the Superior Institute of Health (Istituto Superiore della Sanità), in Europe, the European Medicines Agency (Agenzia Europea per i Medicinali) (EMA) and, in the U.S., the Food and Drug Administration (FDA). | |

| Resistance (to anti-tumor compounds) | Capability of cancer cells to become less sensitive to the effect of compounds which are intended to weaken them. | |

| sBLA | Supplemental Biologics License Application; the process for approval by the FDA of additional marketed uses for a biologic product which already has an approved BLA from the FDA for another indication. | |

| Second-line | Treatment following first-line treatment; used if the initial treatment is unsuccessful or if the disease re-occurs. | |

C-10

| Shelf registration statement | A registration statement that allows an issuer in the United States to offer securities from time to time, provided that the securities have been described in the registration statement and the registration statement has been declared effective by the SEC. | |

| Special Protocol Assessment, or SPA | The SPA process allows for an agreement between companies and the FDA on the design of a study, including clinical drug supply, pivotal trial design, clinical endpoints, conduct, data analysis, and other clinical trial issues, and is intended to provide assurance that if pre-specified trial results are achieved, they may serve as the primary basis for an efficacy claim in support of an NDA. | |

| STELLAR clinical trials 2, 3, and 4 | Clinical studies for OPAXIO. | |

| Taxol | Anti-cancer agent very effective on numerous forms of solid tumors such as breast, ovarian and lung cancers. | |

| TRISENOX | Arsenic trioxide, a commercial product the Company divested in 2005. | |

| Unconfirmed complete remission (CRu) | The patient has achieved a complete remission, but may not have a completely clean bone marrow test. | |

| United States Attorney’s Office or USAO | The principal litigators of the United States, under the U.S. Attorney General. | |

| United States Public Company Accounting Oversight Board | A private-sector, non-profit corporation, created by the U.S. Sarbanes-Oxley Act of 2002, to oversee the auditors of U.S. public companies in order to protect the interests of investors and further the public interest in the preparation of informative, fair, and independent audit reports. | |

C-11

| Zevalin | Ibritumomab Tiuxetan, a CD20-directed, radiotherapeutic antibody indicated as part of the therapeutic regimen for treatment of relapsed or refractory, low-grade or follicular B-cell non-Hodgkin’s lymphoma. The Company acquired the U.S. sales, marketing and development rights to Zevalin from Biogen Idec in December 2007 and subsequently transferred those rights, along with all assets owned or licensed to the Company specific to Zevalin (including the supplemental biologics license application submitted on October 2, 2008 for the use of Zevalin as consolidation therapy after remission induction in previously untreated patients with follicular non-Hodgkin’s lymphoma), to RIT Oncology in December 2008. As of the date of this Registration Document the Company no longer owns any interest, directly or indirectly, in Zevalin. |

C-12

CHAPTER 1 PERSONS RESPONSIBLE FOR THIS REGISTRATION DOCUMENT

| 1.1 | Persons responsible for this Registration Document |

Cell Therapeutics Inc, a company incorporated in 1991 under the laws of the State of Washington (U.S.), with its registered office located in the State of Washington at 501 Elliott Avenue West, Suite 400, Seattle, Washington 98119 (U.S.) (the “Company”), is responsible, in its quality as the issuer, for the completeness and truthfulness of the information contained in this Registration Document.

| 1.2 | Statement of responsibility for this Registration Document |

The Company declares that this Registration Document is consistent with the copy filed with CONSOB on December 2, 2010, following the communication of the release of the relevant authorization by means of notice no. 10098480 of December 1, 2010.

Having adopted all reasonable diligence for such purposes, the Company declares that the information contained herein is–so far as it is aware–in accordance with the facts and there is no omission that may change the import hereof.

C-13

CHAPTER 2 AUDITORS

| 2.1 | Auditors appointed by the Company to audit the financial statements contained in this Registration Document |

The Company’s financial statements for the years ended December 31, 2007, December 31, 2008 and December, 31 2009 were audited by Stonefield Josephson, Inc., a company with its registered office in Los Angeles, California (U.S.) and a certified independent public accounting firm registered with the United States Public Company Accounting Oversight Board (the “Auditors”). Moreover the Auditor performed a review of the unaudited condensed consolidated financial statements of the Company for the six-month period ended June 30, 2010.

| • | The external auditor opinions for the financial statements for the years ended December 31, 2007 is included in the Company’s Annual Report on Form 10-K, as amended and filed with the SEC on March 26, 2008; |

| • | the external auditor opinions for the financial statements for the years ended December 31, 2008 is included in the Company’s Annual Report on Form 10-K, as amended and filed with the SEC on March 16, 2009; |

| • | the external auditor opinion for the financial statements for the year ended December 31, 2009 is included in the Company’s Annual Report on Form 10-K filed with the SEC on February 26, 2010; |

| • | the external auditor limited review report for the financial information regarding the six-month period ended June 30, 2010 is included in the Company’s Quarterly Report on Form 10-Q as filed with the SEC on August 5, 2010. |

The aforesaid Reports can be found on the Company’s website at http://investors.celltherapeutics.com. The external auditor opinions for the Company’s 2007, 2008 and 2009 financial statements and the external auditor interim review report for the financial information regarding the six-month period ended June 30, 2010 are also attached to this Registration Document as Appendix A.

Stonefield Josephson, Inc.’s address is 2049 Century Park East, Suite 400, Los Angeles, CA 90067.

C-14

CHAPTER 3 SELECTED FINANCIAL INFORMATION

| 3.1 | Introduction |

The selected financial information contained in this Chapter 3 is taken from the Company’s financial statements for the periods ended December 31, 2009, 2008 and 2007 as well as the Company’s reports for the six-months periods ended June 30, 2010 and 2009 and for the nine-month periods ended September 30, 2010 and 2009.

The information in this Chapter must be read alongside the information provided in other parts of this Prospectus and in the documents incorporated by reference.

| 3.2 | Financial information selected from the condensed consolidated balance sheets for the years ended December 31, 2009, 2008 and 2007, for the six-month period ended June 30, 2010 and for the nine-month period ended September 30, 2010 |

| Year ended December 31, 2007 |

Year ended December 31, 2008 |

Year ended December 31, 2009 |

Six-month period ended June 30, 2010 |

Nine- month period ended September 30, 2010 |

||||||||||||||||

| (in thousands of U.S. dollars) |

||||||||||||||||||||

| ASSETS |

||||||||||||||||||||

| Current assets |

22,637 | 28,161 | 42,165 | 67,943 | 20,081 | |||||||||||||||

| Property and equipment, net |

6,025 | 4,324 | 3,430 | 3,507 | 3,114 | |||||||||||||||

| Goodwill |

17,064 | 17,064 | 17,064 | 17,064 | 17,064 | |||||||||||||||

| Other intangibles, net |

15,957 | — | — | — | — | |||||||||||||||

| Investment in joint venture |

— | 5,830 | — | — | — | |||||||||||||||

| Other assets |

11,830 | 8,864 | 6,936 | 6,064 | 6,354 | |||||||||||||||

| Total assets |

$ | 73,513 | $ | 64,243 | $ | 69,595 | $ | 94,578 | $ | 46,613 | ||||||||||

| LIABILITIES AND SHAREHOLDERS’ DEFICIT |

||||||||||||||||||||

| Current liabilities |

53,546 | 42,302 | 63,859 | 64,648 | 25,873 | |||||||||||||||

| Deferred revenue, less current portion |

398 | 319 | 239 | — | — | |||||||||||||||

| Long-term obligations, less current portion |

9,879 | 2,907 | 1,861 | 1,179 | 1,010 | |||||||||||||||

| Convertible notes |

117,579 | 142,373 | 21,779 | 11,880 | 11,985 | |||||||||||||||

| Preferred stock, no par value |

26,236 | 8,403 | — | — | — | |||||||||||||||

| Common stock purchase warrants |

— | — | 626 | 12,255 | 13,461 | |||||||||||||||

| Shareholders’ deficit: |

||||||||||||||||||||

| Series F preferred stock, no par value |

— | — | — | — | — | |||||||||||||||

| Common Stock, no par value |

979,295 | 1,188,071 | 1,418,931 | 1,539,510 | 1,545,324 | |||||||||||||||

| Accumulated other comprehensive income (loss) |

(4,007 | ) | (7,812 | ) | (8,412 | ) | (7,667 | ) | (8,159 | ) | ||||||||||

| Accumulated deficit |

(1,109,413 | ) | (1,312,320 | ) | (1,429,083 | ) | (1,526,919 | ) | (1,542,526 | ) | ||||||||||

| Total CTI shareholders’ deficit |

(134,125 | ) | (132,061 | ) | (18,564 | ) | 4,924 | (5,361 | ) | |||||||||||

| Noncontrolling interest |

— | — | (205 | ) | (308 | ) | (355 | ) | ||||||||||||

| Total shareholders’ deficit |

(134,125 | ) | (132,061 | ) | (18,769 | ) | 4,616 | (5,716 | ) | |||||||||||

| Total liabilities and shareholders’ deficit |

$ | 73,513 | $ | 64,243 | $ | 69,595 | $ | 94,578 | $ | 46,613 | ||||||||||

C-15

| 3.3 | Financial information selected from the condensed consolidated statements of operations for the years ended December 31, 2009, 2008 and 2007, for the six-month periods ended June 30, 2009 and 2010 and for the nine-month periods ended September 30, 2009 and 2010, including the disclosure of the EBITDA for the relevant financial periods |

| Year

ended December 31, 2007 (1) |

Year

ended December 31, 2008 (1) |

Year

ended December 31, 2009 (1) |

Six-month period ended June 30, 2009 (1) |

Six-month period ended June 30, 2010 (1) |

Nine-month period ended September 30, 2009 (1) |

Nine-month period ended September 30, 2010 (1) |

||||||||||||||||||||||

| (in thousands of U.S. dollars) | ||||||||||||||||||||||||||||

| Net Revenue |

$ | 127 | $ | 11,432 | $ | 80 | $ | 40 | $ | 319 | $ | 60 | $ | 319 | ||||||||||||||

| Operating expense (excl. depreciation and amortization) |

128,158 | 83,487 | 79,868 | 27,358 | 44,793 | 53,973 | 57,340 | |||||||||||||||||||||

| Loss from operations (excl. depreciation and amortization) |

(128,031 | ) | (72,055 | ) | (79,788 | ) | (27,318 | ) | (44,474 | ) | (53,913 | ) | (57,021 | ) | ||||||||||||||

| Other income (expenses), net |

9,627 | 42,460 | 2,851 | 10,013 | (3,068 | ) | 3,060 | (2,091 | ) | |||||||||||||||||||

| Preferred Stock: |

||||||||||||||||||||||||||||

| Gain on restructuring of Preferred Stock |

— | — | 2,116 | 2,116 | — | 2,116 | — | |||||||||||||||||||||

| - Beneficial conversion feature |

(9,549 | ) | (1,067 | ) | — | — | — | — | — | |||||||||||||||||||

| - Dividend |

(648 | ) | (662 | ) | (24 | ) | (24 | ) | — | (24 | ) | — | ||||||||||||||||

| - Deemed Dividends on Conversion of Preferred Stock |

— | (21,149 | ) | (23,460 | ) | (9,648 | ) | (47,434 | ) | (23,460 | ) | (50,519 | ) | |||||||||||||||

| EBITDA (2) |

(128,601 | ) | (52,473 | ) | (98,305 | ) | (24,861 | ) | (94,976 | ) | (72,221 | ) | (109,631 | ) | ||||||||||||||

| Depreciation and amortization |

(4,955 | ) | (5,228 | ) | (1,771 | ) | (948 | ) | (966 | ) | (1,424 | ) | (1,413 | ) | ||||||||||||||

| Make-whole interest expense |

(2,310 | ) | (70,243 | ) | (6,345 | ) | (6,345 | ) | — | (6,345 | ) | — | ||||||||||||||||

C-16

| Amortization of debt discount and issuance costs |

(4,280 | ) | (66,530 | ) | (5,788 | ) | (5,348 | ) | (434 | ) | (5,575 | ) | (600 | ) | ||||||||||||||

| Interest expense |

(8,237 | ) | (8,559 | ) | (4,806 | ) | (3,200 | ) | (1,563 | ) | (4,026 | ) | (1,948 | ) | ||||||||||||||

| Non controlling interest |

78 | 126 | 252 | 152 | 103 | 205 | 149 | |||||||||||||||||||||

| Net loss attributable to CTI common shareholders |

$ | (148,305 | ) | $ | (202,907 | ) | $ | (116,763 | ) | $ | (40,550 | ) | $ | (97,836 | ) | $ | (89,386 | ) | $ | (113,443 | ) | |||||||

| Basic and diluted net loss per common share |

$ | (32.75 | ) | $ | (7.00 | ) | $ | (0.25 | ) | $ | (0.11 | ) | $ | (0.15 | ) | $ | (0.21 | ) | $ | (0.17 | ) | |||||||

| Shares used in calculation of basic and diluted net loss per common share |

4,529 | 28,967 | 458,356 | 366,293 | 632,658 | 420,520 | 659,244 |

| (1) | The Company’s financial information was retroactively restated to reflect a one-for-four reverse stock split that occurred on April 15, 2007 and a one-for-ten reverse stock split that occurred on August 31, 2008. Shares outstanding and per share information has been adjusted to reflect these reverse stock splits. |

| (2) | Earnings before interest, taxes, depreciation and amortization (EBITDA) is a non-GAAP metric that can be used to evaluate a company’s profitability. EBITDA differs from the operating cash flow in a cash flow statement primarily by excluding payments for taxes or interest as well as changes in working capital. EBITDA also differs from free cash flow because it excludes cash requirements for replacing capital assets. |

| 3.4 | Net financial standing for the years ended December 31, 2009, 2008 and 2007, for the six-month period ended June 30, 2010 and for the nine-month period ended September 30, 2010 (3) |

| Net Financial Standing |

Year

ended December 31, 2007 |

Year

ended December 31, 2008 |

Year

ended December 31, 2009 |

Six-month period ended June 30, 2010 |

Nine-month period ended September 30, 2010 |

|||||||||||||||

| (in thousands of U.S. dollars) | ||||||||||||||||||||

| Cash and cash equivalents |

(15,798 | ) | (10,072 | ) | (37,811 | ) | (64,534 | ) | (17,268 | ) | ||||||||||

| Restricted cash |

— | (6,640 | ) | — | — | — | ||||||||||||||

| Securities available-for-sale (4) |

(2,548 | ) | (599 | ) | — | — | — | |||||||||||||

| Long term obligations, current portion |

1,020 | 757 | 1,312 | 784 | 812 | |||||||||||||||

| Convertible senior notes, |

10,158 | 10,187 | ||||||||||||||||||

| Convertible senior subordinate notes, current portion |

16,907 | — | 40,363 | 38,515 | ||||||||||||||||

| Convertible subordinate notes, current portion |

2,910 | — | — | — | — | |||||||||||||||

C-17

| Net Financial Standing, current portion |

2,491 | (16,554 | ) | 3,864 | (15,077 | ) | (6,269 | ) | ||||||||||||

| Convertible senior subordinated notes |

55,150 | 55,150 | — | — | — | |||||||||||||||

| Long term obligations, less current portion |

9,879 | 2,907 | 1,861 | 1,179 | 1,010 | |||||||||||||||

| Convertible senior notes, less current portion |

62,429 | 87,223 | 21,779 | 11,880 | 11,985 | |||||||||||||||

| Net Financial Standing, less current portion |

127,458 | 145,280 | 23,640 | 13,059 | 12,995 | |||||||||||||||

| Net Financial Indebtedness |

129,949 | 128,726 | 27,504 | (2,018 | ) | 6,726 | ||||||||||||||

| (3) | Not reviewed by the Company’s auditors. |

| (4) | Securities available-for-sale consist of the following debt securities (in thousands of U.S. dollars): |

| Year ended December 31, 2007 |

Year ended December 31, 2008 |

Year ended December 31, 2009 |

Six period ended June 30, 2010 |

Nine-month period ended September 30, 2010 |

||||||||||||||||

| Type of Security |

||||||||||||||||||||

| Corporate obligations |

1,000 | 599 | — | — | — | |||||||||||||||

| U.S.government obligations |

746 | — | — | — | — | |||||||||||||||

| Municipal obligations |

802 | — | — | — | — | |||||||||||||||

| Total |

2,548 | 599 | — | — | — | |||||||||||||||

As of December 31, 2008 and 2007, all securities available-for-sale had contractual maturities of less than one year. Gross realized gains and losses to date were not material. As of these dates there were no impairment provisions on securities available-for-sale and all securities available-for-sale were held in the United States and were denominated in U.S. dollars.

There were no securities outstanding as of December 31, 2009, as of June 30, 2010 and as of September 30, 2010. As of December 31, 2008, the securities outstanding had a fixed interest rate of 7.5%. As of December 31, 2007, the securities outstanding had fixed interest rates ranging from 2.3% to 7.0%.

C-18

| 3.5 | Financial information selected from the consolidated statements of cash flows for the years ended December 31, 2009, 2008 and 2007, for the six-month periods ended June 30, 2010 and 2009 and for the nine-month periods ended September 30, 2010 and 2009 |

| (in thousands of U.S. Dollars) |

Year

ended December 31, 2007 |

Year

ended December 31, 2008 |

Year

ended December 31, 2009 |

Six-month period ended June 30, 2009 |

Six-month period ended June 30, 2010 |

Nine-month period ended September 30, 2009 |

Nine-month period ended September 30, 2010 |

|||||||||||||||||||||

| Net cash used in operating activities |

(103,618 | ) | (80,207 | ) | (88,186 | ) | (50,705 | ) | (39,281 | ) | (70,644 | ) | (50,356 | ) | ||||||||||||||

| Net cash provided by (used in) investing activities |

21,477 | 4,408 | 21,840 | 22,244 | (1,042 | ) | 22,176 | (1,150 | ) | |||||||||||||||||||

| Net cash provided by financing activities |

84,700 | 73,726 | 94,775 | 30,707 | 65,707 | 94,202 | 30,616 | |||||||||||||||||||||

| Effect of exchange rate changes on cash and cash equivalents |

(3,890 | ) | (3,653 | ) | (690 | ) | (338 | ) | 1,339 | (814 | ) | 347 | ||||||||||||||||

| Net increase (decrease) in cash and cash equivalents |

(1,331 | ) | (5,726 | ) | 27,739 | 1,908 | 26,723 | 44,920 | (20,543 | ) | ||||||||||||||||||

C-19

CHAPTER 4 RISK FACTORS

| 4.1 | RISK FACTORS RELATING TO THE ISSUER AND ITS GROUP |

THE REGISTRATION DOCUMENT DISCLOSES RISKS AND ESSENTIAL CHARACTERISTICS CONNECTED TO THE COMPANY. THE INVESTMENT IN FINANCIAL INSTRUMENTS OF THE COMPANY IMPLIES THE TYPICAL RISKS OF AN INVESTMENT IN FINANCIAL INSTRUMENTS. POTENTIAL INVESTORS SHOULD READ THE WHOLE REGISTRATION DOCUMENT AND THE SECURITIES NOTE FROM TIME TO TIME PUBLISHED.

FOR THE PURPOSES OF A CORRECT ASSESSMENT OF THE INVESTMENTS, INVESTORS ARE INVITED TO EVALUATE THE SPECIFIC RISK FACTORS RELATING TO THE COMPANY, TO ITS GROUP, TO THE INDUSTRY IN WHICH IT CARRIES OUT ITS ACTIVITIES AND TO THE ISSUANCE. THE RISK FACTORS BELOW SHOULD BE READ TOGETHER WITH THE OTHER INFORMATION INCLUDED IN THIS REGISTRATION DOCUMENT.

ANY REFERENCE TO CHAPTER AND PARAGRAPH SHALL BE UNDERSTOOD AS REFERENCE TO CHAPTERS AND PARAGRAPHS OF THIS REGISTRATION DOCUMENT.

| 4.1.1 | RISKS RELATED TO THE COMPANY’S ABILITY TO CONTINUE ITS OPERATIONS, TO ITS FINANCIAL SITUATION, TO FUTURE LOSSES AND TO HIGH COSTS FOR RAISING ADDITIONAL FUNDS |

THE COMPANY EXPECTS THAT ITS EXISTING CASH AND CASH EQUIVALENTS, SECURITIES AVAILABLE-FOR-SALE, INTEREST RECEIVABLE AS WELL AS PROCEEDS RECEIVED FROM THE COMPANY’S OFFERINGS TO DATE, INCLUDING THE ISSUANCE OF SHARES OF PREFERRED STOCK OF SERIES 7 AND RELATED WARRANTS, WILL NOT BE SUFFICIENT TO FUND THE COMPANY’S PRESENTLY ANTICIPATED OPERATIONS BEYOND FIRST QUARTER OF 2011.

THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING AUDITOR HAS INCLUDED AN EXPLANATORY PARAGRAPH IN ITS AUDIT REPORTS ON THE COMPANY’S DECEMBER 31, 2007, 2008 AND 2009 CONSOLIDATED FINANCIAL STATEMENTS AND IN ITS LIMITED REVIEW REPORT ON THE COMPANY’S FINANCIAL STATEMENTS CONCERNING THE SIX-MONTH PERIOD ENDED JUNE 30, 2010 WHERE, TAKEN INTO CONSIDERATION WHAT HAS BEEN REPORTED BY THE DIRECTORS IN THE RELEVANT ACCOUNTING DOCUMENTS AND THE COMPANY’S INABILITY TO DEMONSTRATE ITS ABILITY TO SATISFY THE MONETARY LIABILITIES DUE, IT RAISED SUBSTANTIAL DOUBT AS TO THE COMPANY’S ABILITY TO CONTINUE AS A GOING CONCERN. THIS MAY HAVE A NEGATIVE IMPACT ON THE TRADING PRICE OF THE COMPANY’S COMMON STOCK AND AS A RESULT, THE COMPANY MAY HAVE A DIFFICULT TIME OBTAINING NECESSARY FINANCING.

C-20

LOSSES, REVENUES AND DIVIDENDS

THE COMPANY WAS INCORPORATED IN 1991 AND HAS INCURRED A NET OPERATING LOSS EVERY YEAR. AS OF SEPTEMBER 30, 2010, THE COMPANY HAD AN ACCUMULATED NET DEFICIT OF APPROXIMATELY $1.543 BILLION1.

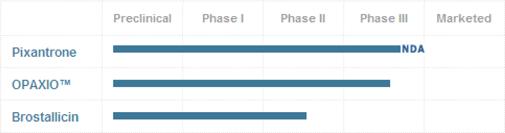

WITH RESPECT TO THE PERIODS TO WHICH THE HISTORIC FINANCIAL INFORMATION REPORTED IN THIS REGISTRATION DOCUMENT REFERS, THE COMPANY BORE THE FOLLOWING TOTAL NET LOSS ATTRIBUTABLE TO CTI COMMON SHAREHOLDERS: $148.3 MILLION IN THE YEAR 2007, $202.9 MILLION IN THE YEAR 2008, AND $116.8 MILLION IN THE YEAR 2009. WITH RESPECT TO SUCH AMOUNT OF TOTAL NET LOSS ATTRIBUTABLE TO CTI COMMON SHAREHOLDERS, THE PERCENTAGE OF REMUNERATIONS AND BENEFITS TO DIRECTORS AND THE NAMED EXECUTIVE OFFICERS (AS DEFINED IN THE FOLLOWING GLOSSARY) IS RESPECTIVELY: 3% FOR THE YEAR 2007, 2% FOR THE YEAR 2008, AND 36% FOR THE YEAR 2009. THE TOTAL AMOUNT OF REMUNERATION AND BENEFITS TO DIRECTORS AND THE NAMED EXECUTIVE OFFICERS IS DERIVED FROM INFORMATION PROVIDED IN OUR PROXY STATEMENTS PREPARED IN ACCORDANCE WITH THE APPLICABLE RULES AND REGULATIONS OF THE U.S. SECURITIES AND EXCHANGE COMMISSION AND IS NOT NECESSARILY INDICATIVE OF THE AMOUNT OF COMPENSATION AND BENEFITS RECORDED IN THE FINANCIAL STATEMENTS FOR SUCH PERIODS. PLEASE REFER TO THE FOLLOWING PARAGRAPH 15.1 FOR MORE INFORMATION.THE COMPANY IS PURSUING REGULATORY APPROVAL FOR PIXANTRONE, OPAXIO AND BROSTALLICIN. THE COMPANY WILL NEED TO CONDUCT RESEARCH, DEVELOPMENT, TESTING AND REGULATORY COMPLIANCE ACTIVITIES AND UNDERTAKE MANUFACTURING AND DRUG SUPPLY ACTIVITIES, EXPENSES WHICH, TOGETHER WITH PROJECTED GENERAL AND ADMINISTRATIVE EXPENSES, WILL RESULT IN OPERATING LOSSES FOR THE FORESEEABLE FUTURE. THE COMPANY’S ABILITY TO REACH PROFITABILITY IS DEPENDENT UPON ALL OF THESE FACTORS, AND THE COMPANY CANNOT PREDICT WHEN IT MAY REACH PROFITABILITY. FURTHER, THE COMPANY MAY NEVER BECOME PROFITABLE, EVEN IF IT IS ABLE TO COMMERCIALIZE PRODUCTS CURRENTLY IN DEVELOPMENT OR OTHERWISE.

THE COMPANY, FOLLOWING THE TRANSFER TO SPECTRUM PHARMACEUTICAL OF ITS INTEREST IN THE JOINT VENTURE RIT ONCOLOGY RELATED TO THE DRUG PHARMACEUTICAL PRODUCT ZEVALIN, OCCURRED IN MARCH 2009, DOES NOT CURRENTLY HAVE ANY PRODUCTS APPROVED FOR SALE IN THE MARKET. MOREOVER, THE COMPANY DOES NOT GENERATE REVENUES FROM ITS PRODUCTS AND MAY NOT BE ABLE TO REPAY ITS DEBT OR THE RELEVANT INTEREST, LIQUIDATED DAMAGES OR OTHER PAYMENTS WITH RESPECT TO ITS DEBT.

1 It is noted that, as of September 30, 2010, the negative accumulated deficit balance of $1.543 billion is offset by the positive value of the capital stock of the Company since inception of its business amounting to $1.545 billion as it can be observed in the table Consolidated balance sheets as of September 30, 2010 reported under subsequent Paragraph 20.6.2. Moreover, the aforesaid value of the capital stock of the Company (i.e. $1.545 billion) represents historical costs of capital stock transactions as they occurred since inception of its business.

C-21

THE COMPANY HAS NOT DECLARED OR PAID ANY DIVIDENDS ON SHARES OF COMMON STOCK AND DOES NOT CURRENTLY EXPECT TO DO SO IN THE FUTURE. FOR FURTHER INFORMATION ABOUT THE DIVIDEND POLICY PLEASE REFER TO CHAPTER 20, PARAGRAPH 20.7 OF THIS REGISTRATION DOCUMENT.

OVERALL FACE VALUE OF OUTSTANDING NOTES OF THE COMPANY

THE COMPANY HAS A SUBSTANTIAL AMOUNT OF DEBT OUTSTANDING. THE AGGREGATE PRINCIPAL BALANCE OF THE COMPANY’S CONVERTIBLE NOTES AS OF SEPTEMBER 30, 2010 IS APPROXIMATELY $21 MILLION IN CONVERTIBLE NOTES WITH INTEREST RATES RANGING FROM 5.75% TO 7.5%. FOR FURTHER INFORMATION ABOUT THE CONVERTIBLE NOTES OF THE COMPANY PLEASE REFER TO CHAPTER 10, PARAGRAPH 10.3.3 OF THIS REGISTRATION DOCUMENT.

COMPANY BURN RATE

THE COMPANY ESTIMATES ITS AVERAGE CASH BURN-RATE FOR THE REMAINDER OF 2010 TO BE ABOUT $5 MILLION PER MONTH. NEVERTHELESS, THE COMPANY IS REVIEWING ALTERNATIVE OPTIONS TO REDUCE ITS BURN RATE.

COMPANY’S ABILITY TO RAISE ADDITIONAL FUNDS

CTI HAS SUBSTANTIAL OPERATING EXPENSES ASSOCIATED WITH THE DEVELOPMENT OF ITS PRODUCT CANDIDATES AND AS OF SEPTEMBER 30, 2010 CTI HAD APPROXIMATELY $17.3 MILLION IN CASH AND CASH EQUIVALENTS AND ITS TOTAL CURRENT LIABILITIES WERE APPROXIMATELY $25.9 MILLION.

TO CONTINUE ITS OPERATIONS THE COMPANY NEEDS TO RAISE ADDITIONAL FUNDS AND EXPECTS THAT IT WILL NEED TO CONTINUE TO RAISE FUNDS IN THE FUTURE, AND ADDITIONAL FUNDS MAY NOT BE AVAILABLE ON ACCEPTABLE TERMS, OR AT ALL; THE FAILURE TO RAISE SIGNIFICANT ADDITIONAL FUNDS MAY CAUSE THE COMPANY TO CEASE DEVELOPMENT OF OUR PRODUCTS AND OPERATIONS.

SINCE THE COMPANY CURRENTLY DOES NOT HAVE FINANCIAL RESOURCES SUFFICIENT TO FUND ITS OPERATIONS BEYOND FIRST QUARTER OF 2011, IT NEEDS TO RAISE ADDITIONAL CAPITAL. THE COMPANY MAY SEEK TO RAISE SUCH CAPITAL THROUGH PUBLIC OR PRIVATE EQUITY FINANCINGS, PARTNERSHIPS, JOINT VENTURES, DISPOSITIONS OF ASSETS, DEBT FINANCINGS OR RESTRUCTURINGS, BANK BORROWINGS OR OTHER SOURCES. HOWEVER, ADDITIONAL FUNDING MAY NOT BE AVAILABLE ON FAVORABLE TERMS OR AT ALL. IF ADEQUATE FUNDS ARE NOT OTHERWISE AVAILABLE, THE COMPANY WILL FURTHER CURTAIL OPERATIONS SIGNIFICANTLY, INCLUDING THE DELAY, MODIFICATION OR CANCELLATION OF OPERATIONS AND PLANS RELATED TO PIXANTRONE, OPAXIO AND BROSTALLICIN, AND MAY BE FORCED TO CEASE OPERATIONS, LIQUIDATE OUR ASSETS AND POSSIBLY SEEK BANKRUPTCY PROTECTION. A BANKRUPCY MAY RESULT IN THE TERMINATION OF THE AGREEMENTS PURSUANT TO WHICH THE COMPANY LICENSE CERTAIN INTELLECTUAL PROPERTY RIGHTS, INCLUDING THE RIGHTS TO PIXANTRONE, OPAXIO AND BROSTALLICIN. TO OBTAIN ADDITIONAL FUNDING, THE COMPANY MAY NEED TO ENTER INTO ARRANGEMENTS THAT REQUIRE THE COMPANY TO RELINQUISH RIGHTS TO CERTAIN TECHNOLOGIES, DRUG CANDIDATES, PRODUCTS AND/OR POTENTIAL MARKETS, SUCH AS

C-22

THE COMPANY’S TRANSFER OF ZEVALIN ASSETS TO RIT ONCOLOGY AND ITS SUBSEQUENT SALE OF OUR 50% INTEREST IN RIT ONCOLOGY. IN ADDITION, SOME FINANCING ALTERNATIVES MAY REQUIRE THE COMPANY TO MEET ADDITIONAL REGULATORY REQUIREMENTS IN ITALY AND THE UNITED STATES, WHICH MAY INCREASE THE COMPANY’S COSTS AND ADVERSELY AFFECT ITS ABILITY TO OBTAIN FINANCING. TO THE EXTENT THAT ADDITIONAL CAPITAL IS RAISED THROUGH THE SALE OF EQUITY, OR SECURITIES CONVERTIBLE INTO EQUITY, SHAREHOLDERS MAY EXPERIENCE DILUTION OF THEIR PROPORTIONATE OWNERSHIP OF THE COMPANY.

MAIN PRODUCTS, CONNECTED REGULATORY APPROVALS FOR THEIRMANUFACTURE AND MARKETING AND RESEARCH AND DEVELOPMENT EXPENSES

OBTAINING REGULATORY APPROVAL TO MARKET DRUGS TO TREAT CANCER IS EXPENSIVE, DIFFICULT AND RISKY, AS FURTHER DESCRIBED IN RISK FACTOR 4.2.5 BELOW. IF CTI’S PRODUCTS ARE NOT APPROVED QUICKLY ENOUGH TO PROVIDE NET REVENUES TO DEFRAY ITS DEBT AND OPERATING EXPENSES, ITS BUSINESS AND FINANCIAL CONDITION MAY BE ADVERSELY AFFECTED.

C-23

WITH RESPECT TO OPAXIO, THE COMPANY ON THE ONE HAND ON SEPTEMBER 21, 2009, NOTIFIED THE EMA ITS DECISION TO WITHDRAW ITS MARKETING AUTHORIZATION APPLICATION (MAA) FOR A NON-INFERIORITY INDICATION IN NON-SMALL CELL LUNG CANCER (NSCLC), ON THE OTHER HAND, (AS REPORTED IN THE SCHEDULE “CTI’S ONGOING CLINICAL TRIALS” THAT CAN BE CONSULTED UNDER PARAGRAPH 6.1.1 OF THIS REGISTRATION DOCUMENT) IS PRESENTLY CARRYING ON PHASE III TRIALS FOR THE TREATMENT OF OVARIAN CANCER FOR WOMEN WHO HAVE PRE-MENOPAUSAL ESTROGEN LEVELS.

WITH RESPECT TO PIXANTRONE:

(I) ON APRIL 9, 2010, THE FDA GAVE NOTICE TO THE COMPANY OF THE REJECTION OF THE NDA FOR PIXANTRONE AND RECOMMENDED THAT THE COMPANY CONDUCT AN ADDITIONAL CLINICAL TRIAL TO DEMONSTRATE THE SAFETY AND EFFECTIVENESS OF PIXANTRONE. THE COMPANY DOES NOT KNOW WHAT THIS TRIAL WILL COST OR WHETHER THE FDA WILL ACCEPT OUR SPA FOR THIS TRIAL;

(II) ON NOVEMBER 1, 2010 THE COMPANY SUBMITTED A MARKETING AUTHORIZATION APPLICATION (MAA) TO THE EUROPEAN MEDICINES AGENCY (EMA) FOR PIXUVRI (PIXANTRONE DIMALEATE) AS MONOTHERAPY FOR THE TREATMENT OF ADULT PATIENTS WITH MULTIPLE RELAPSED OR REFRACTORY AGGRESSIVE NON-HODGKIN’S LYMPHOMA (NHL). THE APPLICATION SUBMISSION FOLLOWED A POSITIVE OPINION FROM THE EMA’S PEDIATRIC COMMITTEE (PDCO), WHERE PDCO AGREED TO THE COMPANY’S PEDIATRIC INVESTIGATION PLAN (PIP) FOR PIXUVRI. MOREOVER ON NOVEMBER 17, 2010 THE EMA APPROVED THE AFORESAID PIP. AS OF THE DATE OF THIS REGISTRATION DOCUMENT THE COMPANY CAN NOT ANTICIPATE THE DURATION OF SUCH MARKETING AUTHORIZATION PROCEEDINGS OR WHETHER THE MAA WILL RECEIVE APPROVAL IN THE NEXT 12 MONTHS.

FOR FURTHER INFORMATION WITH RESPECT TO THE RESEARCH AND DEVELOPMENT PHASES AND THE AUTHORIZATION PROCEEDINGS OF THE CANDIDATE PRODUCTS OF THE COMPANY, PLEASE REFER TO CHAPTER 6.1 OF THIS REGISTRATION DOCUMENT.

DURING THE LAST THREE YEAR PERIOD AND THE NINE-MONTH PERIOD ENDING IN SEPTEMBER 30, 2010, THE COMPANY HAS DECREASED ITS RESEARCH AND DEVELOPMENT EXPENSES AS FOLLOWS, SPECIFICALLY FROM $72.019 MILLION IN THE FINANCIAL YEAR 2007 TO $51.614 MILLION IN THE FINANCIAL YEAR 2008, $30.179 MILLION IN THE FINANCIAL YEAR 2009 AND LASTLY, TO $19.375 MILLION IN THE NINE-MONTH PERIOD FROM DECEMBER 31, 2009 TO SEPTEMBER 30, 2010.

FOR MORE INFORMATION, PLEASE REFER TO CHAPTERS 6, 9, 10, 20 AND 22 OF THIS REGISTRATION DOCUMENT. PLEASE ALSO REFER TO RISK FACTORS 4.1.5 OF THIS REGISTRATION DOCUMENT.

| 4.1.2 | RISKS RELATED TO A SUBSTANTIAL AMOUNT OF DEBT AND SHAREHOLDER DEFICIT |

THE COMPANY HAS A SUBSTANTIAL AMOUNT OF DEBT OUTSTANDING, AND ITS ANNUAL INTEREST EXPENSE WITH RESPECT TO ITS DEBT IS SIGNIFICANT. THE COMPANY NEEDS TO RAISE SUBSTANTIAL ADDITIONAL CAPITAL TO CONTINUE TO FUND ITS OPERATIONS AS ITS CURRENT CASH RESOURCES, INCLUDING THE PROCEEDINGS RELATED TO THE ISSUANCE OF SHARES OF PREFERRED STOCK OF SERIES 7 AND RELATED WARRANTS, WOULD NOT FUND

C-24

THE COMPANY BEYOND FIRST QUARTER OF 2011. UNLESS THE COMPANY RAISES SUBSTANTIAL ADDITIONAL CAPITAL AND REDUCES ITS OPERATING EXPENSES, IT WILL NOT BE ABLE TO PAY ITS OPERATING EXPENSES OR REPAY ITS DEBT OR THE INTEREST, LIQUIDATED DAMAGES OR OTHER PAYMENTS WITH RESPECT TO ITS DEBT.

THE CONSOLIDATED NET FINANCIAL STANDING OF THE GROUP AS OF SEPTEMBER 30, 2010 IS NEGATIVE $6.726 MILLION AS COMPARED TO THE CONSOLIDATED ASSETS AND LIABILITIES OF THE GROUP OF $46.6 MILLION AND $38.9 MILLION, RESPECTIVELY, AS OF SEPTEMBER 30, 2010.

THE CONSOLIDATED NET FINANCIAL STANDING OF THE GROUP AS OF DECEMBER 31, 2009 AND THE NINE MONTHS ENDED SEPTEMBER 30, 2010 AMOUNTS TO A NEGATIVE VALUE OF RESPECTIVELY 27,504 AND 6,726 THOUSANDS OF US DOLLARS.

AS OF DECEMBER 31, 2009 AND SEPTEMBER 30, 2010, CTI HAD A TOTAL SHAREHOLDER DEFICIT OF APPROXIMATELY $18.769 MILLION AND $5.716 MILLION RESPECTIVELY. THERE ARE NO PROVISIONS UNDER US LAW THAT GOVERN THE INTEGRITY OF THE COMPANY’S SHARE CAPITAL AND THEREFORE, THE COMPANY’S SHAREHOLDER DEFICIT MAY CONTINUE AND MAY INCREASE WITHOUT THE NEED FOR SHARE CAPITAL TO BE ADJUSTED.

AS INDICATED IN 4.1.1, CTI WAS INCORPORATED IN 1991 AND HAS INCURRED A NET OPERATING LOSS EVERY YEAR. AS OF SEPTEMBER 30, 2010, CTI HAD AN ACCUMULATED NET DEFICIT OF APPROXIMATELY $1.5 BILLION. REVENUES FOR THE NINE MONTH PERIOD ENDED SEPTEMBER 30, 2010 AND 2009 IN THE AMOUNTS OF 319 AND 60 THOUSANDS OF US DOLLARS, RESPECTIVELY, WHILE INTEREST EXPENSE FOR THE SAME PERIODS WAS 1,948 AND 4,026 THOUSANDS OF US DOLLARS, RESPECTIVELY.

FOR MORE INFORMATION, PLEASE REFER TO CHAPTERS 10 AND 20 OF THIS REGISTRATION DOCUMENT.

| 4.1.3 | RISKS RELATED TO THE NEED TO REDUCE EXPENSES |

THE COMPANY NEEDS TO RAISE SUBSTANTIAL ADDITIONAL CAPITAL TO FUND ITS OPERATIONS. IF THE COMPANY IS UNABLE TO SECURE ADDITIONAL FINANCING ON ACCEPTABLE TERMS IN THE NEAR FUTURE, THE COMPANY EXPECTS TO IMPLEMENT A NUMBER OF COST REDUCTION INITIATIVES, SUCH AS FURTHER REDUCTIONS IN THE COST OF THE COMPANY’S WORKFORCE AND THE DISCONTINUATION OF A NUMBER OF BUSINESS INITIATIVES TO FURTHER REDUCE ITS RATE OF CASH UTILIZATION AND EXTEND THE COMPANY’S EXISTING CASH BALANCES. THE COMPANY BELIEVES THAT THESE ADDITIONAL COST REDUCTION INITIATIVES, IF UNDERTAKEN, WILL PROVIDE IT WITH ADDITIONAL TIME TO CONTINUE ITS PURSUIT OF ADDITIONAL FINANCING SOURCES AND STRATEGIC ALTERNATIVES. IN THE EVENT THE COMPANY IS UNABLE TO OBTAIN FINANCING ON ACCEPTABLE TERMS AND REDUCE ITS EXPENSES, IT MAY BE REQUIRED TO LIMIT OR CEASE OPERATIONS, PURSUE A PLAN TO SELL ITS OPERATING ASSETS OR OTHERWISE MODIFY ITS BUSINESS STRATEGY, WHICH COULD MATERIALLY HARM ITS FUTURE BUSINESS PROSPECTS.

C-25

| 4.1.4 | RISKS RELATING TO EXECUTIVE COMPENSATION |

THE FOLLOWING TABLE SETS FORTH INFORMATION CONCERNING COMPENSATION EARNED FOR SERVICES RENDERED TO THE COMPANY BY THE CHIEF EXECUTIVE OFFICER, THE CHIEF FINANCIAL OFFICER, AND THE COMPANY’S NEXT FOUR MOST HIGHLY COMPENSATED EXECUTIVE OFFICERS FOR FISCAL YEAR 2009, 2008 AND 2007, INCLUDING MR. STROMATT WHO WAS NOT SERVING AS AN EXECUTIVE OFFICER OF THE COMPANY AS OF DECEMBER 31, 2008, NOTWITHSTANDING THE LACK OF ANY POSITIVE ECONOMICAL OUTCOME OBTAINED BY THE COMPANY FROM THE DATE OF ITS INCORPORATION TO THE DATE OF THIS REGISTRATION DOCUMENT.

| Name |

Principal position |

Fiscal Year |

Total compensation($) | |||

| James A. Bianco, M.D. |

Chief Executive Officer | 2009 2008 2007 |

12,592,030 1,506,156 2,197,804 | |||

| Louis A. Bianco |

Chief Financial Officer | 2009 2008 2007 |

5,059,961 539,972 757,816 | |||

| Dan Eramian |

Executive Vice President | 2009 2008 2007 |

3,879,210 485,768 697,793 | |||

| Craig W. Philips |

President of the Company | 2009 2008 |

7,423,518 405,147 | |||

| Jack W. Singer, M.D. |

Executive Vice President | 2009 2008 2007 |

5,011,602 568,248 811,063 | |||

| Scott Stromatt, M.D. |

Executive Vice President | 2008 2007 |

435,711 532,802 | |||

THE TOTAL COMPENSATION AMOUNTS DISCLOSED IN THE ABOVE TABLE FOR EACH FISCAL YEAR INCLUDES CASH COMPENSATION AND EQUITY COMPENSATION FOR EACH EXECUTIVE. FOR THESE PURPOSES, EQUITY COMPENSATION IS INCLUDED USING THE GRANT DATE FAIR VALUE OF EQUITY AWARDS GRANTED TO THE EXECUTIVE IN THE FISCAL YEAR AS DETERMINED IN ACCORDANCE WITH UNITED STATES GENERALLY ACCEPTED ACCOUNTING PRINCIPLES USED TO CALCULATE THE VALUE OF EQUITY AWARDS FOR PURPOSES OF THE COMPANY’S FINANCIAL STATEMENTS.

C-26

WITH SPECIFIC REFERENCE TO FISCAL YEAR 2009, IT IS NOTED THAT THE PERCENTAGE OF TOTAL COMPENSATION AND BENEFITS PAID TO THE COMPANY’S DIRECTORS AND THE NAMED EXECUTIVE OFFICERS (AS DEFINED IN THE GLOSSARY OF THIS REGISTRATION DOCUMENT) WITH RESPECT TO THE TOTAL NET LOSS ATTRIBUTABLE TO CTI COMMON SHAREHOLDERS RECORDED IN SUCH FISCAL YEAR (AMOUNTING TO $116.8 MILLION) IS EQUAL TO 36%. IN THIS REGARD IT IS SPECIFIED THAT THE AFORESAID TOTAL AMOUNT OF COMPENSATION AND BENEFITS PAID TO DIRECTORS AND THE NAMED EXECUTIVE OFFICERS FOR THE FISCAL YEAR 2009 IS DERIVED FROM INFORMATION PROVIDED IN THE COMPANY’S PROXY STATEMENTS PREPARED IN ACCORDANCE WITH THE APPLICABLE RULES AND REGULATIONS OF THE U.S. SECURITIES AND EXCHANGE COMMISSION AND IS NOT NECESSARILY INDICATIVE OF THE AMOUNT OF COMPENSATION AND BENEFITS RECORDED IN THE FINANCIAL STATEMENTS FOR SUCH PERIOD OR, IN THE CASE OF EQUITY COMPENSATION, THE VALUE THAT WILL ACTUALLY BE REALIZED BY THE DIRECTOR OR EXECUTIVE OFFICER (DUE TO THE VESTING REQUIREMENTS OF AWARDS THAT MAY RESULT IN THEIR BEING FORFEITED OR FLUCTUATIONS IN STOCK PRICE THAT MAY AFFECT THE ULTIMATE VALUE OF THE AWARD).

THE COMPANY HAS HISTORICALLY ATTRACTED AND RETAINED, AND CONTINUES TO ATTRACT AND RETAIN, KEY EMPLOYEES THROUGH COMPENSATION ARRANGEMENTS AS APPROVED AS DESCRIBED IN CHAPTER 15 OF THIS REGISTRATION DOCUMENT, WHICH ALSO INCLUDES A DESCRIPTION OF THE COMPANY’S COMPENSATION ARRANGEMENTS WITH SENIOR MANAGEMENT IN THE PAST THREE YEARS. IN PARTICULAR, THE COMPANY INTERNALLY ESTABLISHED A COMPENSATION COMMITTEE COMPOSED BY THREE INDEPENDENT DIRECTORS THAT EVALUATE AND APPROVE THE COMPENSATION ARRANGEMENTS FOR THE EXECUTIVE OFFICERS AFTER (I) RETAINING EXTERNAL CONSULTANTS TO PROVIDE RECOMMENDATIONS ABOUT COMPARABLE MARKET PRACTICES; (II) EVALUATING, ALSO WITH THE ASSISTANCE OF SUCH CONSULTANTS, THE COMPENSATION GRANTED TO THE MANAGERS OF COMPANIES COMPARABLE TO CTI; AND (III) CONSIDERING SPECIFIC PARAMETERS SUCH AS THE PERFORMANCE OF THE COMPANY.

WITH SPECIFIC RESPECT TO THIS LAST PARAMETER, IT HAS TO BE CONSIDERED THAT ANNUAL CASH INCENTIVES FOR OUR EXECUTIVE OFFICERS ARE DESIGNED TO REWARD PERFORMANCE FOR ACHIEVING KEY CORPORATE GOALS, WHICH THE COMPANY BELIEVES IN TURN SHOULD INCREASE SHAREHOLDER VALUE. THE MAIN PERFORMANCE METRICS AGAINST WHICH THE EXECUTIVES ARE EVALUATED BY THE COMPENSATION COMMITTEE ARE (I) THE FINANCIAL PERFORMANCE OF THE COMPANY, (II) THE DRUG DEVELOPMENT AND (III) THE INDIVIDUAL EXECUTIVE’S PERFORMANCE.

MORE IN PARTICULAR AND AT AN ANALYTICAL LEVEL, IT IS NOTED THAT THE MAIN PARAMETERS TAKEN INTO ACCOUNT BY THE COMPENSATION COMMITTEE FOR THE DETERMINATION OF CASH INCENTIVES PAID TO THE COMPANY’S EXECUTIVE OFFICERS IN 2010 (FOR THE ACTIVITIES PERFORMED IN 2009) WERE: (I) THE POSSIBLE EXECUTION OF A LICENSE AGREEMENT FOR PIXANTRONE; (II) THE COMPLETENESS OF THE NEW DRUG APPLICATION (NDA) SUBMISSION FOR THE SAME DRUG; (III) THE RAISING OF OPERATING CAPITAL; AND (IV) THE PERCENTAGE OF THE COMPANY’S THEN-OUTSTANDING NOTES DUE IN 2010-2011 THAT WERE TENDERED IN THE COMPANY’S PUBLICLY-REGISTERED TENDER OFFERS DESCRIBED UNDER SUBSEQUENT PARAGRAPH 21.1.4. MOREOVER IT IS NOTED THAT A

C-27

LOWER SIGNIFICANCE WAS ASSUMED BY THE PARAMETERS LINKED TO THE INDIVIDUAL PERFORMANCE AND THE P&L RESULTS OF THE COMPANY

IN LIGHT OF THE GENERAL CURRENT ECONOMIC CLIMATE, THE COMPANY’S COMPENSATION PHILOSOPHY AND OBJECTIVES FOR FISCAL 2009 CONTINUED TO FOCUS HEAVILY ON RETENTION OF THE COMPANY’S SENIOR MANAGEMENT TEAM THROUGH THIS CHALLENGING TIME WHILE FURTHER LINKING MANAGEMENT’S POTENTIAL REWARDS WITH SHAREHOLDER VALUE. IN 2010, THE COMPANY’S SHAREHOLDERS AND BOARD OF DIRECTORS APPROVED AN AMENDMENT TO THE COMPANY’S 2007 EQUITY INCENTIVE PLAN, AS AMENDED AND RESTATED (THE “2007 EQUITY PLAN”) THAT INCREASED THE NUMBER OF SHARES OF THE COMPANY’S COMMON STOCK THAT MAY BE DELIVERED PURSUANT TO AWARDS GRANTED UNDER THE 2007 EQUITY PLAN BY AN ADDITIONAL 40,000,000 SHARES.

MOREOVER IT IS OBSERVED THAT THE COMPANY’S PROFITABILITY AND FINANCIAL PERFORMANCE COULD DECREASE DUE TO SEVERANCE PAYMENTS THE COMPANY MAY OWE SUCH MANAGEMENT PERSONNEL, NOTWITHSTANDING THE LACK OF ANY POSITIVE ECONOMICAL OUTCOME OBTAINED BY THE COMPANY FROM THE DATE OF ITS INCORPORATION TO THE DATE OF THIS REGISTRATION DOCUMENT, UPON THE EMPLOYEES TERMINATION OR EXIT FROM THE COMPANY PURSUANT TO THE COMPANY’S EMPLOYMENT CONTRACTS.

NOTE THAT THE COMPANY, ITS BOARD OF DIRECTORS, AND THE COMPENSATION COMMITTEE OF ITS BOARD OF DIRECTORS HAVE THE DISCRETION TO, AND MAY, CHANGE THE COMPANY’S COMPENSATION PRACTICES IN THE FUTURE. THESE CHANGES MAY RELATE TO CHANGES IN THE COMPANY’S PERFORMANCE, CHANGES IN LAW, RULES OR REGULATIONS, CHANGES IN COMPENSATION PRACTICES GENERALLY OR AT COMPANIES THAT COMPETE WITH THE COMPANY (GENERALLY OR WITH RESPECT TO HIRING AND RETAINING DIRECTORS, OFFICERS, AND EMPLOYEES), CHANGES IN COMPANY FOCUS OR GOALS, THE TERMINATION OR EXPIRATION OF EXISTING COMPENSATION ARRANGEMENTS, THE NEED TO HIRE NEW OR RETAIN EXISTING DIRECTORS, OFFICERS OR EMPLOYEES, OR ANY OTHER FACTS OR CIRCUMSTANCES THAT THE COMPANY, ITS BOARD OF DIRECTORS OR THE COMPENSATION COMMITTEE OF ITS BOARD OF DIRECTORS MAY DETERMINE TO BE APPROPRIATE.

FOR FURTHER INFORMATION PLEASE REFER TO CHAPTER 15, PARAGRAPH 15.1, OF THIS REGISTRATION DOCUMENT.

| 4.1.5 | RISKS RELATED TO THE LICENSE AND CO-DEVELOPMENT AGREEMENT ENTERED INTO WITH NOVARTIS PHARMACEUTICAL COMPANY LTD. |

ON SEPTEMBER 15, 2006, THE COMPANY ENTERED INTO A LICENSE AND CO-DEVELOPMENT AGREEMENT RELATED TO OPAXIO AND PIXANTRONE WITH NOVARTIS PURSUANT TO WHICH THE COMPANY GRANTED TO NOVARTIS AN EXCLUSIVE WORLDWIDE LICENSE FOR THE DEVELOPMENT AND COMMERCIALIZATION OF OPAXIO AND AN OPTION TO ENTER INTO AN EXCLUSIVE WORLDWIDE LICENCE TO DEVELOP AND COMMERCIALIZE PIXATRONE ON AGREED UPON TERMS.

IF NOVARTIS DOES NOT ELECT TO EXERCISE ITS OPTION WITH REGARD TO PIXANTRONE OR TO PARTICIPATE IN THE DEVELOPMENT AND COMMERCIALIZATION OF OPAXIO (AS

C-28

DESCRIBED IN RISK FACTOR 4.1.6 OF THIS REGISTRATION DOCUMENT), THE COMPANY MAY NOT BE ABLE TO FIND ANOTHER SUITABLE PARTNER FOR THE COMMERCIALIZATION AND DEVELOPMENT OF THOSE PRODUCTS, WHICH MAY HAVE AN ADVERSE EFFECT ON THE COMPANY’S ABILITY TO BRING THOSE DRUGS TO MARKET. IN ADDITION, THE COMPANY WOULD NEED TO OBTAIN A RELEASE FROM NOVARTIS PRIOR TO ENTERING INTO ANY AGREEMENT TO DEVELOP AND COMMERCIALIZE PIXANTRONE OR OPAXIO WITH A THIRD PARTY. THE COMPANY MAY NEVER RECEIVE THE NECESSARY REGULATORY APPROVALS AND THE COMPANY’S PRODUCTS MAY NOT REACH THE NECESSARY SALES LEVELS TO GENERATE ROYALTY OR MILESTONE PAYMENTS EVEN IF NOVARTIS ELECTS TO EXERCISE ITS OPTION WITH REGARD TO PIXANTRONE OR TO PARTICIPATE IN THE DEVELOPMENT AND COMMERCIALIZATION OF OPAXIO.

FOR MORE INFORMATION CONCERNING THE ABOVE MENTIONED AGREEMENT, PLEASE REFER TO CHAPTER 22, PARAGRAPH 22.1.1 OF THIS REGISTRATION DOCUMENT.

| 4.1.6 | RISKS RELATED TO DILUTION RESULTING FROM ISSUANCES OF NEW COMMON SHARES PURSUANT TO THE SECURITIES NOTES WHICH WILL BE DRAFTED, TOGETHER WITH THE RELEVANT SUMMARIES AND THE POSSIBLE UPDATED INFORMATION, ACCORDING TO THIS REGISTRATION DOCUMENT |

TO THE EXTENT THAT THE COMPANY RAISES ADDITIONAL CAPITAL THROUGH THE SALE OF NEW COMMON SHARES PURSUANT TO AN ISSUANCE IN CONNECTION WITH THE SECURITIES NOTES WHICH WILL BE DRAFTED, TOGETHER WITH THE RELEVANT SUMMARIES AND THE POSSIBLE UPDATED INFORMATION, ACCORDING TO THIS REGISTRATION DOCUMENT, THE OWNERSHIP INTEREST OF THE EXISTING COMPANY’S SHAREHOLDERS MAY BE DILUTED, AS THE CURRENT SHAREHOLDERS OF THE COMPANY DO NOT POSSESS ANY RIGHT TO SUBSCRIBE TO NEW SHARES ISSUANCES THAT MAY BE OFFERED TO OTHER INVESTORS, AND THE PRICE OF THE NEW COMMON SHARES SOLD TO SUBSCRIBERS IN SUCH AN ISSUANCE MAY BE AT A PRICE THAT IS DISCOUNTED COMPARED TO THE MARKET VALUE OF THE STOCK.

| 4.1.7 | RISKS RELATED TO MAINTAINING THE LISTING OF THE COMPANY’S COMMON STOCK ON THE NASDAQ CAPITAL MARKET |

EFFECTIVE WITH THE OPENING OF TRADING ON JANUARY 8, 2009, THE U.S. LISTING OF CTI’S COMMON STOCK WAS TRANSFERRED TO THE NASDAQ CAPITAL MARKET. ON MAY 3, 2010 THE COMPANY RECEVEID NOTICE FROM NASDAQ INDICATING THAT FOR THE LAST 30 CONSECUTIVE BUSINESS DAYS THE CLOSING BID PRICE OF COMPANY’S COMMON STOCK WAS BELOW THE MINIMUM $1.00 PER SHARE REQUIREMENT FOR CONTINUED LISTING OF THE COMPANY’S COMMON STOCK ON THE NASDAQ CAPITAL MARKET. THIS NOTIFICATION HAS NO IMMEDIATE EFFECT ON THE LISTING OF OR THE ABILITY TO TRADE THE COMPANY’S COMMON STOCK ON THE NASDAQ CAPITAL MARKET. IN ACCORDANCE WITH NASDAQ MARKETPLACE RULE 5810(C)(3)(A), THE COMPANY WAS PROVIDED A GRACE PERIOD OF 180 CALENDAR DAYS, OR UNTIL NOVEMBER 1, 2010, TO REGAIN COMPLIANCE. ALTHOUGH THE COMPANY DID NOT REGAIN COMPLIANCE WITHIN THE NOVEMBER 1, 2010, ON NOVEMBER 3, 2010 THE NASDAQ GRANTED A FURTHER GRACE PERIOD OF 180 CALENDAR DAYS. THE COMPANY WILL THEREFORE ACHIEVE COMPLIANCE IF THE BID PRICE OF OUR COMMON STOCK CLOSES AT $1.00 PER SHARE OR MORE FOR A MINIMUM OF TEN CONSECUTIVE TRADING DAYS BEFORE MAY 2, 2011. IF THE COMPANY IS UNABLE TO ATTAIN COMPLIANCE

C-29

WITH THE MINIMUM BID PRICE, WHETHER BY EFFECTING A REVERSE STOCK SPLIT OF OUR COMMON STOCK OR OTHERWISE, THE COMPANY MAY BE DELISTED.

IN ADDITION, EVEN THOUGH THE COMPANY CONTINUES TO BE LISTED ON THE NASDAQ CAPITAL MARKET, TRADING IN ITS COMMON STOCK MAY BE HALTED OR SUSPENDED DUE TO MARKET CONDITIONS OR IF NASDAQ, CONSOB OR THE BORSA ITALIANA DETERMINES THAT TRADING IN ITS COMMON STOCK IS INADVISABLE (FOR EXAMPLE, THE TRADING OF THE COMPANY’S STOCK WAS HALTED BOTH BY BORSA ITALIANA AND NASDAQ ON FEBRUARY 10,2009 AND MARCH 23, 2009).

IF CTI’S COMMON STOCK CEASES TO BE LISTED FOR TRADING ON NASDAQ, THE MTA, OR BOTH FOR ANY REASON OR IF TRADING IN CTI’S STOCK IS HALTED OR SUSPENDED ON NASDAQ CAPITAL MARKET, THE MTA, OR BOTH, IT MAY HARM CTI’S STOCK PRICE, INCREASE THE VOLATILITY OF ITS STOCK PRICE AND MAKE IT MORE DIFFICULT FOR INVESTORS TO BUY OR SELL SHARES OF THE COMPANY COMMON STOCK. MOREOVER, IF THE COMPANY’S COMMON STOCK CEASES TO BE LISTED FOR TRADING ON NASDAQ OR IF TRADING IN ITS STOCK IS HALTED OR SUSPENDED ON NASDAQ, THE COMPANY MAY BECOME SUBJECT TO OBLIGATIONS TO REDEEM CERTAIN SHARES OF PREFERRED STOCK AT A PREMIUM AND/OR REPAY ON AN ACCELERATED BASIS CERTAIN CONVERTIBLE NOTES. IN ADDITION, IF THE COMPANY IS NOT LISTED ON NASDAQ AND/OR IF ITS PUBLIC FLOAT FALLS BELOW $75 MILLION (THAT IS THE AMOUNT ESTABLISHED BY SEC RULES FOR A COMPANY TO BE ELIGIBLE TO FILE SHELF REGISTRATION STATEMENTS ON SEC FORM S-3), THE COMPANY WILL BE LIMITED IN ITS ABILITY TO FILE NEW SHELF REGISTRATION STATEMENTS ON SEC FORM S-3 AND/OR TO FULLY USE ONE OR MORE REGISTRATION STATEMENTS ON SEC FORM S-3. THE COMPANY HAS RELIED SIGNIFICANTLY ON SHELF REGISTRATION STATEMENTS ON SEC FORM S-3 FOR MOST OF ITS FINANCINGS IN RECENT YEARS, SO ANY SUCH LIMITATIONS MAY HAVE A MATERIAL ADVERSE EFFECT ON THE COMPANY’S ABILITY TO RAISE THE CAPITAL IT NEEDS.

FOR FURTHER INFORMATION ABOUT THE REQUIREMENTS FOR CONTINUED LISTING OF THE COMPANY’S COMMON STOCK ON THE NASDAQ CAPITAL MARKET PLEASE REFER TO CHAPTER 5, PARAGRAPH 5.1.5, SUBPARAGRAPH D OF THIS REGISTRATION DOCUMENT.

| 4.1.8 | RISKS RELATED TO THE GLOBAL FINANCIAL CRISIS |

THE ONGOING CREDIT CRISIS AND RELATED TURMOIL IN THE GLOBAL FINANCIAL SYSTEM HAS HAD AND MAY CONTINUE TO HAVE AN IMPACT ON THE COMPANY’S BUSINESS AND FINANCIAL CONDITION. THE COMPANY MAY FACE SIGNIFICANT CHALLENGES IF CONDITIONS IN THE FINANCIAL MARKETS DO NOT IMPROVE OR CONTINUE TO WORSEN. IN PARTICULAR, THE COMPANY’S ABILITY TO ACCESS THE CAPITAL MARKETS AND RAISE FUNDS REQUIRED FOR ITS OPERATIONS MAY BE SEVERELY RESTRICTED AT A TIME WHEN THE COMPANY WOULD LIKE, OR NEED, TO DO SO. SUCH RESTRICTION COULD HAVE AN ADVERSE EFFECT ON OUR ABILITY TO MEET OUR CURRENT AND FUTURE FUNDING REQUIREMENTS AND ON OUR FLEXIBILITY TO REACT TO CHANGING ECONOMIC AND BUSINESS CONDITIONS.

C-30

| 4.1.9 | RISKS RELATED TO THE EXERCISE OF THE VOTING RIGHTS AND DELIVERY OF THE MEETING DOCUMENTATION |

DUE TO CERTAIN RESTRICTIONS UNDER ITALIAN LAW WHICH PROHIBIT IDENTIFYING INDIVIDUAL THE COMPANY SHAREHOLDERS WHO HOLD SHARES IN ITALY THROUGH MONTE TITOLI (THE “ITALIAN SHAREHOLDERS”), THE ITALIAN SHAREHOLDERS MAY BE LIMITED IN THEIR ABILITY TO RECEIVE INFORMATION ABOUT THE COMPANY (FOR INSTANCE, ITALIAN SHAREHOLDERS ARE GENERALLY NOT ABLE TO RECEIVE THE SHAREHOLDER MEETING DOCUMENTATION AT THEIR OWN ADDRESS) AND TO AVAIL THEMSELVES OF CERTAIN VOTING MODALITIES SUCH AS INTERNET AND PHONE. THESE LIMITATIONS DO NOT APPLY TO SHAREHOLDERS WHO HOLD THEIR SHARES IN THE COMPANY DIRECTLY OR THROUGH A U.S. INTERMEDIARY.

FOR DETAILED INFORMATION ABOUT THE SHAREHOLDERS’ MEETING DOCUMENTATION AND THE VOTING PROCEDURES, PLEASE REFER TO CHAPTER 21, PARAGRAPH 21.2.5 OF THIS REGISTRATION DOCUMENT.

| 4.1.10 | RISKS RELATED TO THE COMPANY’S NEED TO OBTAIN A QUORUM FOR ITS MEETINGS OF SHAREHOLDERS |