Attached files

| file | filename |

|---|---|

| EX-99.1 - PDF OF CONFERENCE SLIDES - NORTHERN TRUST CORP | dex9911.pdf |

| 8-K - FORM 8-K - NORTHERN TRUST CORP | d8k.htm |

©

2010 Northern Trust Corporation

Service

Expertise

Integrity

Frederick H. Waddell

Chairman

& Chief Executive Officer

Goldman Sachs US Financial Services Conference

Goldman Sachs Conference Center

New York, New York

December 7, 2010

Northern Trust

Corporation

Exhibit 99.1 |

Integrity

Expertise

Service

2

Forward Looking Statement

This presentation may include forward-looking statements such as statements

that relate to Northern Trust’s financial goals, capital adequacy,

dividend policy, expansion and business development

plans,

risk

management

policies,

anticipated

expense

levels

and

projected

profit

improvements,

business

prospects

and

positioning

with

respect

to

market,

demographic

and

pricing

trends, strategic initiatives, re-engineering and outsourcing activities, new

business results and outlook, changes in securities market prices, credit

quality including reserve levels, planned capital expenditures and

technology spending, anticipated tax benefits and expenses, and the effects of

any extraordinary events and various other matters (including developments with

respect to litigation, other contingent liabilities and obligations, and

regulation involving Northern Trust and changes in accounting policies,

standards and interpretations) on Northern Trust’s business and

results. These statements speak of Northern Trust’s plans, goals, targets,

strategies, beliefs, and expectations, and refer to estimates or use similar

terms. Actual results could differ materially from those indicated by these

statements because the realization of those results is subject to many risks

and uncertainties. Our 2009 annual report and periodic reports to the SEC

contain information about specific factors that could cause actual results

to differ, and you are urged to read them. Northern Trust disclaims any

continuing accuracy of the information provided in this presentation after today. |

Integrity

Expertise

Service

3

Agenda

Northern Trust Corporation

Excellent Strategic Positioning

Spotlight on:

Wealth Advisory

Australasia

Investment Program Solutions |

©

2010 Northern Trust Corporation

Service

Expertise

Integrity

Excellent Strategic

Positioning |

Integrity

Expertise

Service

5

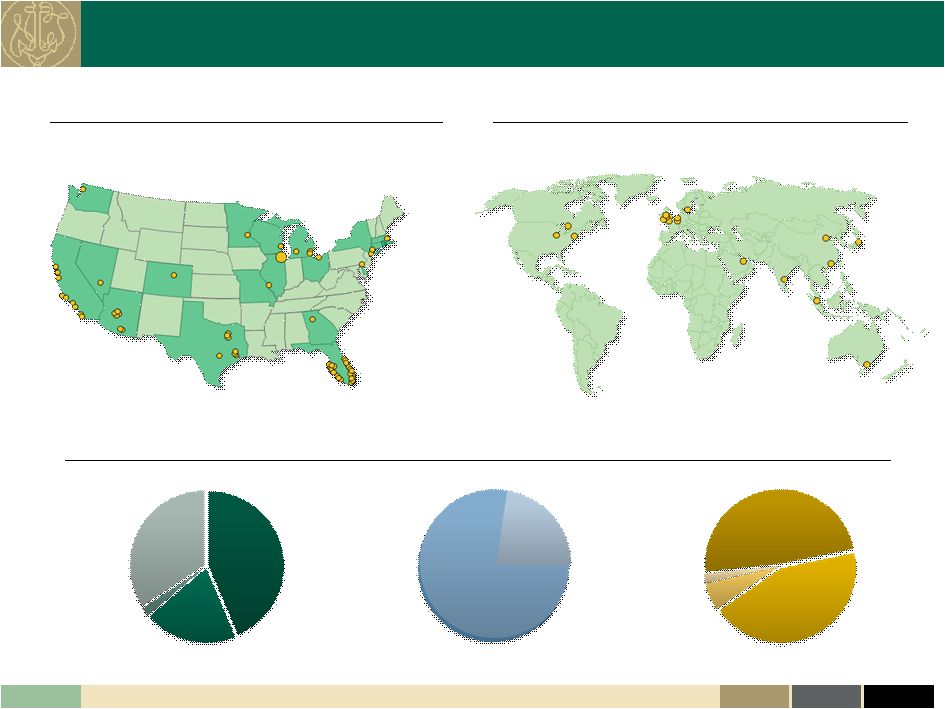

Founded in 1889, Northern Trust Corporation is a global leader in asset

management and asset servicing for institutional and personal clients.

Operations & Technology:

Integrated global operating platform

Serving personal and

institutional clients

$1.3 billion in technology

spending, 2007-2009

Personal Financial Services:

Leading advisor to affluent market

$149 billion AUM

$349 billion AUC

Corporate & Institutional Services:

Leading global custodian

$3.6 trillion AUC

$508 billion AUM

Northern Trust Global Investments:

Leading asset manager for

personal & institutional clients

$657 billion AUM

As of September 30, 2010

Client Centric, Highly Focused Business Model

Personal

Clients

Institutional

Clients

Integrated Operations & Technology Platform

Asset

Servicing

Asset

Management

$3.9T Assets

Under Custody

$657B Assets

Under Mgmt. |

Integrity

Expertise

Service

6

Excellent strategic positioning

Outstanding client base

Strong and supportive

demographic trends

Continued globalization

fueling international growth

Attractive profitability dynamics

The strategic businesses that Northern Trust has focused on –

consistently for many years –

continue to offer compelling and attractive growth opportunities

As of September 30, 2010

Client Centric, Highly Focused Business Model

Personal

Clients

Institutional

Clients

Integrated Operations & Technology Platform

Asset

Servicing

Asset

Management

$3.9T Assets

Under Custody

$657B Assets

Under Mgmt. |

Integrity

Expertise

Service

7

Northern Trust Global Investments

Diversified, World Class Investment Manager

Corporate & Institutional Services

Strategically Positioned in Three Dynamic Regions

Positioned Globally for Growth

Personal Financial Services

Extensive Reach in Affluent Market

$318 Billion

(48%)

Active

$287 Billion

(44%)

Index

$39 Billion

(6%)

Manager of

Managers

Across Asset Classes

Across Client Segments

$508 Billion

Institutional

$149 Billion

Personal

Across Styles

Equities

$287 Billion

(44%)

Fixed Income

$132 Billion

(20%)

Short

Duration

$225 Billion

(34%)

Other

$13 Billion

(2%)

Network of PFS Offices in 18 States

Over 50% of the U.S. millionaire market resides within

a 45-minute drive of Northern Trust offices.

Other

$13 Billion

(2%)

Europe, Middle

East & Africa

North America

Asia Pacific

As of September 30, 2010 |

©

2010 Northern Trust Corporation

Service

Expertise

Integrity

Client Spotlight |

Integrity

Expertise

Service

9

Personal Financial Services

Spotlight on: Wealth Advisory

Northern Trust provides comprehensive financial advice and solutions delivered by a

dedicated team of multi-disciplinary professionals.

Asset

Servicing

Financial

Planning

Investment

Management

Bank A

Broker B

Asset

Manager C

Banking

Services

Trust

Services

Retired

East Coast

Executive |

Integrity

Expertise

Service

10

Corporate & Institutional Services

Spotlight on: Australasia

Recent success in Australia and New Zealand

exhibits Northern Trust’s ability to expand

globally into strategically important markets. |

Integrity

Expertise

Service

11

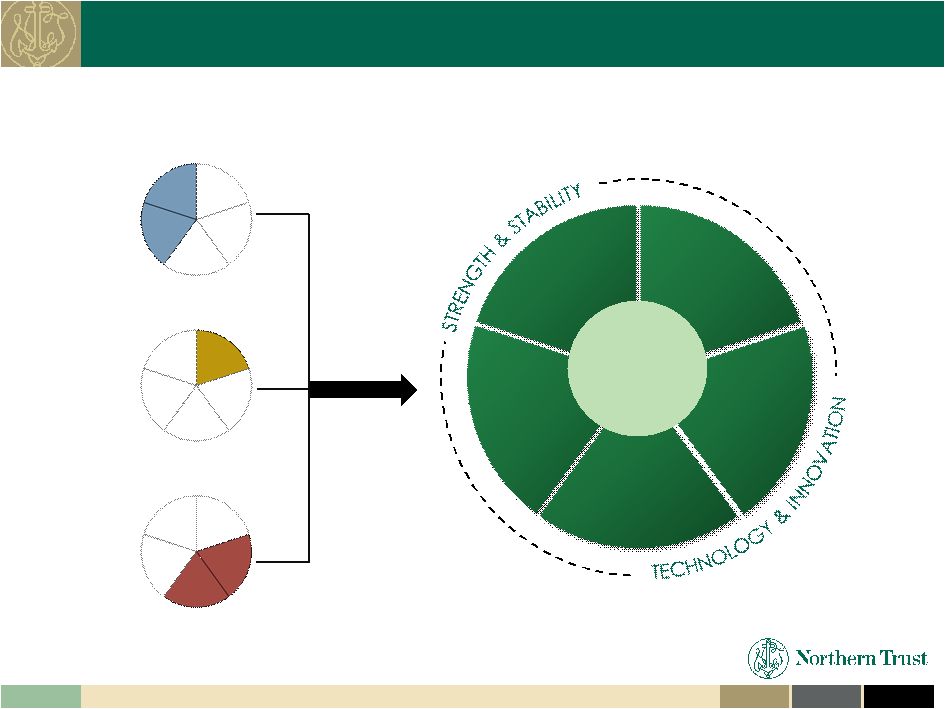

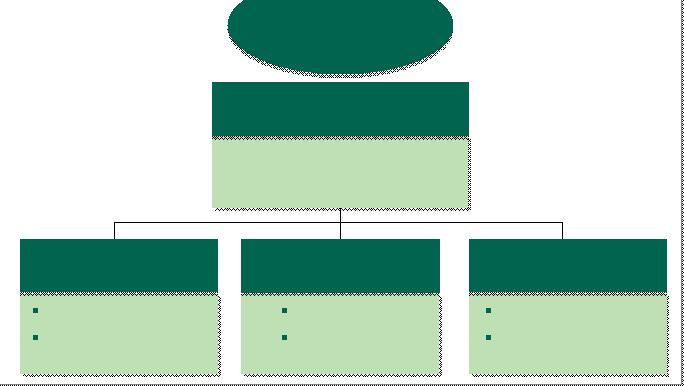

Northern Trust Global Investments

Spotlight on: Investment Program Solutions

$4.0 Billion

3,800 Plans

39,000 Participants

Northern Trust -

Trustee

Open architecture

Broad set of

implementation options

Investment Program

Development and Oversight

Manager Selection

Fund Construction

Performance Measurement

Custody

Fund

Administration

Investment

Management

Asset servicing

Reporting

Fund accounting

Regulatory reporting

As of September 30, 2010 |

©

2010 Northern Trust Corporation

Service

Expertise

Integrity

Concluding Thoughts |

Integrity

Expertise

Service

13

Strategically Positioned for Growth

Market Leader in Focused Businesses

Largest Personal Trust provider in the United States

Best Private Bank in North America (Financial Times, November 2010 and

2009) Best Global Investor Services House (Euromoney, July

2010) One of the largest Fund Administrators in Ireland and Guernsey

11

th

largest manager of worldwide institutional assets (Pensions &

Investments, May 2010) Strong History of Organic Growth

Global

custody

assets

CAGR

of

20%

1999

-

3Q2010

Net new business up 18% year-to-date versus prior year

Continuing to invest in the business

Distinctive Financial Strength

87% of securities portfolio rated triple A

NPAs

to loans relatively low at 1.35%

Tier 1 Common Equity ratio of 12.7%

96% of total Tier 1 Capital is Tier 1 Common Equity

Invested & Experienced Management Team

Combined service at Northern Trust of 189 years

As of September 30, 2010 |

©

2010 Northern Trust Corporation

Service

Expertise

Integrity

Goldman Sachs US Financial Services Conference

Northern Trust

Corporation

Questions?

Frederick H. Waddell

Chairman

& Chief Executive Officer |