Attached files

| file | filename |

|---|---|

| 8-K - TELESTONE TECHNOLOGIES CORP | v204542_8k.htm |

(to

Prospectus dated March 17, 2010)

1,675,000

Shares

TELESTONE

TECHNOLOGIES CORPORATION

Common

Stock

$12.00 per

share

We are

offering 1,675,000 shares of our common stock.

Our

common stock is listed on the NASDAQ Global Select Market under the symbol

“TSTC.” On November 22, 2010, the last

reported sale price of our common stock on the NASDAQ Global Select Market was

$14.96.

This

investment involves a high degree of risk. You should review carefully the risks

and uncertainties described under the heading “Risk Factors” on page S-9 of

this prospectus supplement, on page 4 of the accompanying prospectus and in our

Annual Report on Form 10-K, as amended, for the year ended December 31,

2009.

|

Per Share

|

Total

|

|||||||

|

Public

offering price

|

$ | 12.00 | $ | 20,100,000 | ||||

|

Underwriting

discounts and commissions

|

$ | 0.72 | $ | 1,206,000 | ||||

|

Offering

price and proceeds, before expenses, to Telestone Technologies

Corporation

|

$ | 11.28 | $ | 18,894,000 | ||||

We have

granted the underwriters a 30-day option to purchase up to an

additional 251,250 shares of our common stock at the public offering price

from us to cover over-allotments, if any. If the underwriters exercise this

option in full, the total underwriting discounts and commissions will be

$1,386,900, and our gross proceeds, before expenses, will be

$21,728,100.

The

underwriters expect to deliver the shares of our common stock on or

about November 30, 2010.

Neither

the Securities and Exchange Commission nor any state securities commission has

approved or disapproved of these securities or determined if this prospectus

supplement or the accompanying prospectus is truthful or complete. Any

representation to the contrary is a criminal offense.

Roth

Capital Partners

JMP

Securities

The date

of this prospectus supplement is November 24, 2010.

TABLE

OF CONTENTS

|

|

Page

|

|

|

|

||

|

|

S-1

|

|

|

|

S-2

|

|

|

|

S-4

|

|

|

|

S-9

|

|

|

|

S-27

|

|

|

|

S-30

|

|

|

|

S-34

|

|

|

S-34

|

||

| Where You Can Find More Information | S-34 | |

|

|

S-35

|

|

|

|

||

|

|

2

|

|

|

|

3

|

|

|

|

12

|

|

|

|

13

|

|

|

|

20

|

|

| General Description of the Securities We May Offer |

20

|

|

|

|

21

|

|

|

|

21

|

|

|

|

29

|

|

|

|

31

|

|

|

|

31

|

|

| Ratio of Earnings to Fixed Charges |

33

|

|

|

|

33

|

|

|

|

33

|

|

|

|

33

|

|

|

|

34

|

This

document is in two parts. The first part is the prospectus supplement, including

the documents incorporated by reference, which describes the specific terms of

this offering. The second part, the accompanying prospectus, including the

documents incorporated by reference, provides more general information.

Generally, when we refer to this prospectus, we are referring to both parts of

this document combined. We urge you to carefully read this prospectus supplement

and the accompanying prospectus, and the documents incorporated herein and

therein by reference, before buying any of the securities being offered under

this prospectus supplement. This prospectus supplement may add, update or change

information contained in the accompanying prospectus. To the extent that any

statement that we make in this prospectus supplement is inconsistent with

statements made in the accompanying prospectus or any documents incorporated by

reference therein, the statements made in this prospectus supplement will be

deemed to modify or supersede those made in the accompanying prospectus and such

documents incorporated by reference therein.

You

should rely only on the information contained, or incorporated herein by

reference, in this prospectus supplement and contained, or incorporated therein

by reference, in the accompanying prospectus. We have not authorized anyone to

provide you with different information. No dealer, salesperson or other person

is authorized to give any information or to represent anything not contained in

this prospectus supplement and the accompanying prospectus. You should not rely

on any unauthorized information or representation. This prospectus supplement is

an offer to sell only the securities offered hereby, and only under

circumstances and in jurisdictions where it is lawful to do so. You should

assume that the information in this prospectus supplement and the accompanying

prospectus is accurate only as of the date on the front of the applicable

document and that any document incorporated by reference herein or therein is

accurate only as of the date of the document incorporated by reference,

regardless of the time of delivery of this prospectus supplement or the

accompanying prospectus, or any sale of a security. Our business, financial

condition, results of operations and prospects may have changed since these

dates.

Unless

otherwise mentioned or the context requires otherwise, all references in this

prospectus supplement to “Telestone,” “the Company,” “we,” “us,” “our” or

similar references mean Telestone Technologies Corporation and its

subsidiaries.

S-1

Many

statements made in this prospectus supplement, the accompanying prospectus, and

the documents incorporated or deemed to be incorporated by reference herein or

therein relating to a particular offering of securities are forward-looking

statements within the meaning of Section 27A of the Securities Act of 1933,

as amended, or the Securities Act, and Section 21E of the Securities

Exchange Act of 1934, as amended, or Exchange Act. Such forward-looking

statements reflect our current expectations and views of future events. We

generally identify forward-looking statements by words such as “anticipate,” “believe,” “expect,”

“can,” “continue,” “could,” “estimate,” “intend,” “may,” “plan,” “potential,”

“predict,” “should” or “will” or the negative of these terms or other comparable

terminology but the absence of these words or comparable terminology does not

necessarily mean that a statement is not forward-looking. These statements are

only predictions based upon our management’s current intentions, expectations

and assumptions, some of which are based upon estimates, data and other

information from third party sources and may be subject to revision. For such

statements, we claim the protection of the safe harbor for forward-looking

statements contained in the Private Securities Litigation Reform Act of

1995. Uncertainties and other factors, including the risks outlined in the

section entitled “Risk Factors” in this prospectus supplement, the accompanying

prospectus and in our Annual Report on Form 10-K, as amended, for the year ended

December 31, 2009, may cause our actual results, levels of activity, performance

or achievements to be materially different from any future results, levels or

activity, performance or achievements expressed or implied by these

forward-looking statements.

A variety

of factors, some of which are outside our control, may cause our operating

results to fluctuate significantly. They include, without limitation, the

following:

|

|

·

|

our ability to enter into and renew key corporate

and strategic relationships with our customers, suppliers and

manufacturers;

|

|

|

·

|

the availability, cost and quality of products

from our suppliers incorporated into

our customized module design

solutions;

|

|

|

·

|

changes in end-user demand for the products and

services offered manufactured and sold by our

customers;

|

|

|

·

|

general and cyclical economic and business

conditions, domestic or foreign, and, in particular, those in China’s mobile

handset, telecom equipment and digital media

industries;

|

|

|

·

|

our ability to collect on our accounts receivable

in a timely manner;

|

|

|

·

|

the rate of introduction of new products or

services by our customers;

|

|

|

·

|

changes in our pricing policies or the pricing policies of our competitors or

suppliers;

|

|

|

·

|

the success of our new engineering services

business;

|

|

|

·

|

our ability to compete effectively with our

current and future

competitors;

|

|

|

·

|

our ability to manage our growth effectively,

including possible growth internationally and through strategic alliances

and acquisitions;

|

|

|

·

|

our ability to enter into and renew key corporate

and strategic relationships with our customers and

suppliers;

|

|

|

·

|

our implementation of stock-based compensation

plans;

|

S-2

|

|

·

|

changes in the favorable tax incentives enjoyed by our PRC operating

companies as well as how recent changes in PRC enterprise income tax laws

generally will be interpreted and enforced by the PRC tax

authorities;

|

|

|

·

|

foreign currency exchange rates

fluctuations;

|

|

|

·

|

adverse changes in the securities markets;

and

|

|

|

·

|

legislative or regulatory changes in

China.

|

Developments

in any of these areas, which are more fully described elsewhere in this

prospectus supplement, the accompanying prospectus and the documents

incorporated or deemed to be incorporated by reference herein or therein could

cause our results to differ materially from results that have been or may be

projected by or on our behalf.

We

caution that the foregoing list of important factors is not exclusive. We urge

you not to unduly rely on forward-looking statements contained in this

prospectus supplement, the accompanying prospectus, and the documents

incorporated by reference herein and therein.

Although

we believe that the expectations reflected in the forward-looking statements are

reasonable, we cannot guarantee future results, levels of activity, performance

or achievements. Our expectations are as of the date this prospectus supplement,

and we do not intend to update any of the forward-looking statements to conform

these statements to actual results, unless required by law. You should, however,

review the factors and risks we describe in this prospectus supplement, the

accompanying prospectus, and the documents incorporated by reference herein and

therein and in the reports we file from time to time with the Securities and

Exchange Commission, or the SEC, after the date of this prospectus supplement.

For additional details, please see “Where You Can Find More

Information.”

S-3

|

You

should read the following summary together with the more detailed

information concerning us, the common stock being sold in this offering

and our financial statements appearing in this prospectus supplement and

the accompanying prospectus and in the documents incorporated by reference

in this prospectus supplement and the accompanying prospectus. Because

this is only a summary, you should read the rest of this prospectus

supplement and the accompanying prospectus, including all documents

incorporated by reference, before you invest in our common stock. Read

this entire prospectus supplement and the accompanying prospectus

carefully, especially the risks described under “Risk Factors” and the

financial statements and related notes, before making an investment

decision.

Our

Company

We

are a leading supplier of local access network solutions for

communications networks in China. We design, engineer and sell RF-based

local access network solutions for indoor and outdoor wireless coverage,

IP-based products for Internet access, and unified local access network,

or ULAN, solutions based on our Wireless and Fiber-Optics Distribution

System, or WFDS, technology. Our local access network solutions

integrate and enhance communication coverage and improve the signal quality of reception for wireless,

Internet, wireline, cable television and other end user

applications. These solutions are used in a variety of indoor

and outdoor environments, such as hotels, residential estates, office

buildings, airports, exhibition centers, underground stations, highways,

tunnels and rural areas. As part of our comprehensive network

solution, we provide professional services, including upfront system

design, implementation and network maintenance. Our primary

customers are China Mobile, China Unicom and China Telecom, or the Big 3,

and commercial and residential property owners in China. We

have 30 branches throughout China and

six international sales offices. We believe our solutions offer

a compelling value proposition to our customers as our solutions offer

lower costs of ownership and increase overall efficiency.

With our industry-leading technologies, close

relationships with the Big 3 and strong management team, we believe that

we will continue to demonstrate strong growth in the future as we have

done historically.

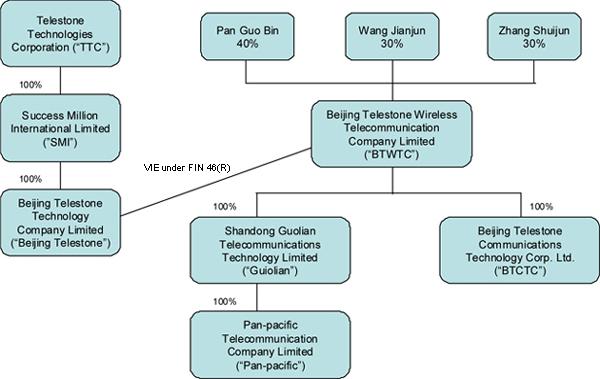

We carry on our

business through our indirect

wholly-owned operating subsidiary in the PRC, Beijing Telestone

Technologies Co., Ltd. (“Beijing Telestone”), and our variable interest

entity (“VIE”), Beijing Telestone Wireless Telecommunication

Company Limited (“BTWTC”) and its

subsidiaries Shandong Guolian Telecommunication Technology Limited

(“Guolian”), Pan-pacific Telecommunication Company Limited

(“Pan-pacific”), and Beijing Telestone Communication Technology

Corp. Ltd. (“BTCTC”).

Our Competitive Strengths

We believe the following competitive strengths enable us to

compete effectively and to capitalize on growth opportunities in our

markets:

Leading Local Access Network Solution Provider

Poised to Benefit from Chinese Government Initiatives

As an innovative local access network solution provider, we are uniquely

positioned to benefit from the various Chinese government-sponsored

initiatives. In addition, we maintain good relations with the

Ministry of Science and Technology, the Ministry of Industry and

Information Technology, the Beijing municipal government and the

Administrative Committee of Z-Park. These relationships provide

us with timely information regarding opportunities to receive financing

support, research and development reimbursement, and tax incentives,

thereby enabling us to plan our activities

timely. We intend to leverage our existing government support

to build our technology leadership position and to continue to pioneer

industry firsts.

|

S-4

|

State-of-the-Art Unified Local Access Network WFDS

Solution

We believe

our industry leading WFDS solution is the only commercially available

solution that is fully compatible with the Big 3’s respective

technology requirements and can offer integrated services in a single

platform. Our WFDS systems can be deployed in various

types of properties. We currently have received 60 patents for

WFDS, and have an additional 40 filed patent applications for WFDS under

review. In September 2009, WFDS technology successfully passed

all United States Federal Communications Commission, or

FCC, testing procedures. The FCC certification will not only

apply to the U.S. market, but also to our WFDS products in Central and

South America. We expect to gain significant traction in the

indoor wireless coverage market through our first mover

advantage.

Leading

Research and Development Capabilities

We have leading research and development

capabilities in China, and we have won awards from the Ministry of Science

and Technology. We have more than 60 research

and development specialists of which

over 40% have at least a master’s

degree. Our research and development staff includes specialists

in RF and WFDS technology. These

employees are comparatively difficult to recruit and we believe our

experienced staff provides us with a competitive advantage. Our research and development

laboratory has state-of-the-art equipment intended to give our personnel

the tools to make significant advances in wireless coverage

technologies. In addition, we provide our employees with

continuing education administered through internal

programs.

Long-Term, Established Customer

Relationships

We have maintained long-term relationships with

the Big 3 as customers for thirteen years. Given the

conservative nature of the Big 3, we believe that our long-term

relationship with them provides us

with a competitive advantage over new entrants or less mature Chinese

companies in selling wireless infrastructure in

China. Additionally, with the significant ownership the Chinese

government has over the Big 3 and the protected nature of

the wireless equipment infrastructure market in China, we believe that it

would be difficult for international competitors to gain traction with the

Big 3.

Extensive Branch Network Providing Strong Sales

Network and Customer Service

We employ a

group of experienced and technologically savvy sales and marketing staff

in China. Selling local access network solutions is a

relationship driven business and therefore requires extensive touch

points. As our business is based on a direct sales

model, and covers a broad and diverse customer base, we

have 30 branches across all but one province in China. Through

this branch network, we have a strong sales effort and can deliver timely

customer service.

Experienced Management Team with a Proven Track

Record

Our management team has a track record of success

at both public and private companies, including extensive experience

within the Chinese wireless communications market. Mr. Daqing

Han, our founder, Chairman and President, has extensive knowledge

of the telecommunications industry in

China through over 25 years of experience. Mr. Han and most of

our senior management have worked together as a team for over 13 years and

have successfully built our business and increased revenue from $21.7

million in 2006 to $71.0 million in

2009.

Our Growth Strategy

Our strategic focus is to build on our position as

a leading provider of local access network solutions in China and

to increase our international market

presence. Key elements of our growth strategy include:

Increase Market Share in China

We have uniquely positioned ourselves to be a

major benefactor of various Chinese government-sponsored

initiatives. We have built trust and earned validation from the

Big 3 and from the Chinese government, which continues to exercise substantial control over

virtually every sector of the Chinese economy through regulation and state

ownership. We plan on leveraging our industry-leading local

access network solutions, our track record of successful deployment of our

solutions in projects in various geographical regions

in China, and our strong relationships to increase our market share in

China.

|

S-5

|

Leverage First Mover Advantage for

WFDS

The Chinese government recently issued a directive

to integrate 2G and 3G wireless signal coverage, Internet, TV and radio, and voice

and data services into a single platform. To help encourage the

integration, the Chinese government has committed to provide financial

incentives in order to increase competition and meet its projected

timetable, which is expected to be completed over

the next five years. We believe our WFDS product is currently

the only solution in the market that can deliver an integrated

service.

Continue to Explore and Capitalize on WFDS Leasing Model

We have recently pioneered a new WFDS leasing

model. As opposed to selling our WFDS equipment to carriers, we

are testing a leasing model in which we maintain ownership of the

equipment installed on the property premise. The Big 3 pays us

a monthly fee to “lease” bandwidth on the

WFDS solution in order to deliver integrated services to the property

tenants. We would in turn share a portion of the monthly

leasing fee with the property owners in return for them providing us with

space on the property to install our equipment. The Big 3 benefit as well as they

will no longer need to pay upfront for the equipment.

The leasing model would not only provide a steady

revenue stream, it would also yield higher gross margins, and we expect it

will be attractive to property owners

and the Big 3.

Extend Our Research and Development Leadership and

Product Development

We plan to continue to invest in research and

development and product development for our solutions to enhance our

leadership position for unified local access network solutions. We have a dedicated team of over

60 research and development specialists to continue

the development of solutions and we expect to maintain meaningful

investments in research and development on a going-forward

basis.

Seek Selective Acquisitions and Strategic Investments

We have in-depth knowledge of smaller equipment

vendors or solutions providers in the Chinese local access network

market. We may selectively acquire smaller participants in the

sector to expand our product offering or market presence. Potential targets are

companies that have strong traction with the Big 3 in their local markets

or have technologies to bolster our product offering.

Strengthen International Market

Presence

We intend to increase our international presence

over the next few

years. We have already established partnerships with, and will

continue to find and train value-added resellers and systems integrators

in international markets to sell our solutions. We currently

have six sales offices outside of China and intend to

increase this number in the near-term. While we currently

generate less than 5% of our revenue from sources outside of China, we

expect the international market, especially the U.S., will represent a

significant growth opportunity for us in the

future.

Recent Developments

On November 22, 2010, Beijing Telestone signed new

VIE agreements with BTWTC to replace the existing

agreement. Various regulations in China currently

restrict or prevent foreign-invested entities from engaging in certain

sectors. Because of these restrictions, certain of our operations in the

PRC, namely the wireless telecommunication networking and system

integration businesses, are conducted through our VIE, BTWTC, a PRC

company that is owned by PRC citizens, but which is effectively controlled

by our subsidiary, Beijing Telestone, through a series of contractual

arrangements. These contracts are summarized below.

|

S-6

|

Exclusive

Business Cooperation Agreement

Under

the Exclusive Business Cooperation Agreement between Beijing Telestone,

BTWTC, and the shareholders of BTWTC (the “VIE Shareholders”), Beijing

Telestone provides technical and consulting services to the VIE in

exchange for service fees of a certain percentage of the VIE’s operational

income. During the term of the agreement, the VIE may not contract with

any other party to provide services that are the same or similar to the

services to be provided by Beijing Telestone pursuant to the

agreement.

|

|

Exclusive

Purchase Option Agreement

Under

the Exclusive Purchase Option Agreement, the VIE Shareholders, who

collectively own 100% of the equity interest in the VIE, granted Beijing

Telestone an exclusive, irrevocable option to purchase all or part of

their equity interests in the VIE, exercisable at any time and from time

to time, to the extent permitted under PRC law. In addition, the VIE

granted Beijing Telestone an exclusive, irrevocable option to purchase all

or part of its assets to the extent permitted under PRC law. The purchase

price of the equity interest will be the lowest price permitted under PRC

law, and in the event any transfer occurs, the VIE Shareholders or the VIE

will pay to Beijing Telestone any after-tax consideration or profits

accrued from the consideration of such transfer.

|

|

Equity

Pledge Agreement

The

VIE Shareholders have pledged their entire equity interest in the VIE to

Beijing Telestone pursuant to the Equity Pledge Agreement. The equity

interests are pledged as collateral to secure the obligations of the VIE

and the VIE Shareholders under the Exclusive Business Cooperation

Agreement, the Exclusive Purchase Option Agreement and the Loan

Agreement.

|

|

Loan

Agreement

Pursuant

to the Loan Agreement, the VIE Shareholders confirmed that they had

borrowed an aggregate of RMB 10,000,000, the amount Messrs. Han Daqing and

Luo Zhengbin provided in capital contribution to the VIE pursuant to a

Proxy Agreement dated June 12, 2005, from Beijing Telestone in an interest

free loan. The loan will be repaid upon receipt of written

notice from Beijing Telestone to the VIE, and the terms of repayment will

be based equity or asset transfers in accordance with the provisions of

the Exclusive Purchase Option Agreement.

|

|

Corporate Information

Set forth below is a chart exhibiting our current

corporate structure:

Our principal executive

offices are located at Floor 10, China Ruida Plaza, No. 74 Lugu Road, Shi

Jingshan District, Beijing, People’s Republic of China

100040. Our telephone number is +86-10-6860-8335.

|

S-7

|

The

Offering

The

following is a brief summary of some of the terms of this offering. For a

more complete description of our common stock being offered in this

offering, see “Description of Share Capital” in the accompanying

prospectus.

|

|

Common

stock offered(1)

|

1,675,000 shares

of common stock

|

|

|

Common

stock outstanding after this offering(1)

|

12,233,264 shares

of common stock(1)

|

|

|

Option

to purchase additional shares of common stock

|

We

have granted the underwriters a 30-day option to purchase, from time to

time, up to an additional 251,250 shares of our common stock at the

public offering price to cover over-allotments, if any.

|

|

|

Public

offering price

|

$12.00

per share

|

|

|

Use

of proceeds

|

We

estimate that the net proceeds from this offering, after deducting

underwriting discounts and commissions and before offering expenses

payable by us, will be approximately $18.9 million. We intend to use the

net proceeds from this offering for the construction and set up of a

manufacturing and research and development center, mergers and

acquisitions and other working capital requirements. See “Use of Proceeds”

on page S-28 of this prospectus supplement.

|

|

|

NASDAQ

Global Select Market symbol

|

TSTC

|

|

|

Risk

factors

|

This

investment involves a high degree of risk. See “Risk Factors” beginning on

page S-9 of this prospectus supplement, page 4 of the accompanying

prospectus and in our Annual Report on Form 10-K, as amended, for the year

ended December 31, 2009.

|

|

|

Lock-up

|

We,

our directors and officers, have agreed with the underwriters to a lock-up

of shares beneficially owned by them for a period of 90 days after the

date of this prospectus supplement. See “Underwriting” section on

page S-31.

|

|

|

(1) Based on the number of shares outstanding

as of November 22, 2010, excluding

125,666 shares of common stock

issuable upon exercise of the Company’s warrants

and shares underlying the underwriters’ over-allotment

option.

|

||

S-8

An

investment in our securities is speculative and involves a high degree of risk.

You should carefully consider the risks described below and the other

information in this prospectus supplement and accompanying prospectus, and in

our other filings with the SEC before purchasing any of our securities. The

risks and uncertainties described below are not the only ones facing us.

Additional risks and uncertainties may also adversely impair our business

operations. If any of the events described in the risk factors below actually

occur, our business, financial condition or results of operations could suffer

significantly. In such case, the value of your investment could decline and you

may lose all or part of the money you paid to buy our securities.

In addition to other matters

identified or described by us from time to time in filings with the SEC, there

are a number

of important factors that could cause

our future results to differ materially from historical results or trends,

results anticipated or planned by us, or results that are reflected from time to

time in any forward-looking statement. Some of these important factors include

the following:

RISKS RELATED TO OUR BUSINESS AND

OPERATIONS

We

rely on a small number of significant customers.

Our

success depends substantially upon retaining our significant clients, such as

China Unicom, China Mobile and China Telecom. We cannot guarantee that we will

be able to retain long-term relationships or secure renewals of short-term

relationships with our significant clients in the future. If we were to lose

such customers, it is unclear if we would be able to replace them or how long it

would take to do so. Accordingly, our revenues and profitability would be

negatively impacted.

We

typically enter into contracts with individual local affiliates of our major

customers and treat these local affiliates as separate customers. Although it

has been our business practice to interact with each local affiliate

individually, they are under the common control of their parent company.

Procurement decisions for equipment are now made by the parent company and its

local affiliates through a centralized bidding process, which has led to

intensified industry-wide pricing pressure.

During

the ordinary course of our business, we also experience delays in payments from

China Unicom, China Mobile and China Telecom. As explained in the next risk

factor, these delays are largely due to our limited bargaining leverage and the

resulting lack of a specific timetable in our sale and purchase contracts to

require our customers to issue completion certificates and to perform

preliminary inspections, which are pre-conditions to their initiation of

payments. Despite our constant attempts, we have not been able to significantly

change this prevalent practice in our industry due to our limited bargaining

leverage, and we expect this practice to continue in coming

periods.

Because

we have limited bargaining leverage with China Unicom, China Mobile and China

Telecom, some contractual terms and market practices are materially adverse to

our interests.

China

Unicom, China Mobile and China Telecom, or the Big 3, award contracts through

competitive bidding. As China Unicom and China Mobile were the two major

licensed wireless operators in China prior to the industry restructuring which

was completed in 2008 and even after the restructuring they remain major

industry participants, we have limited negotiating leverage with these key

clients in the bidding process. As a result, many proposed contractual terms and

market practices subject to bidding are materially adverse to our interest. For

example, most of our contracts, in the form contained in the bidding materials,

do not specify a timetable for our customers to perform the inspection of

products we install. This affects our revenues as the inspection by our wireless

operator customers is a condition to our recognition of service

revenue. Any worsening of these terms and conditions could have a

material adverse effect on our liquidity and cash flows from

operations.

S-9

We

have long accounts receivable cycles and long collection periods, and our

liquidity and cash flows from operations will deteriorate if our accounts

receivable cycles or collection periods continue to lengthen.

As is

customary in our industry in China, we experience relatively long accounts

receivable cycles and long collection periods of up to approximately 358 days in

2009. These extended accounts receivable cycles and collection

periods may adversely affect our cash flow and our ability to fund our

operations from operating cash flow. In addition, if our customers

experience sales slowdowns or other adverse effects to their business, they may

not make payment in a timely fashion, despite our extended accounts receivable cycles and

long collection periods. Failure of our customers to pay us in a

timely manner would negatively affect our working capital, which would in turn

adversely affect our cash flow, revenues and operating results in subsequent

periods.

We have not entered into any long term

contracts with our

customers.

All of our agreements with our customers are for short

term projects or sales of equipment. While we believe that our significant

relationships with the Big 3 will likely provide additional sales agreements in

the future, none of our customers are

contractually bound to purchase any products or services from us in the future.

If our customers do not continue to purchase products or services from us in the

future, our business, financial condition and results of operations could be

adversely affected.

We depend on a limited number of

suppliers.

We rely on certain third-party suppliers to provide us

various pieces of telecommunications equipment. If we were to lose our

relationship with those suppliers, we may experience difficulties finding a suitable replacement for our equipment needs,

and our business and operations could be adversely affected. In

addition, if any of our major suppliers fails to deliver our required materials

in time for our production, and we are unable to find the required

materials from other suppliers in a timely manner and on acceptable terms, there

will be a delay in our provision of products and services to our customers. Such

delays would damage our relationship with our customers and may materially and

adversely affect our business

operations.

We

utilize a third party production center for the manufacture of the products we

sell to our customers. Although we are parties to a memorandum of cooperation

regarding such manufacturing arrangement, we cannot be assured that such

cooperation will continue indefinitely. Should we be required to utilize a

different source for our manufactured products our costs could be adversely

affected. We hire third parties to carry out some of the initial installation of

our wireless coverage products. We are

liable for the failure or inadequacy of their services. If their performance is inadequate, we will liable for any remedial

measures. We may also be vulnerable to the loss and

unavailability of their services.

If

the wireless communication sector in China does not maintain its current pace of

growth, or if the telecommunications operators reduce their investments for

network coverage in the near future, the profitability and future prospects of

our business and our liquidity could be materially and adversely

affected.

We

generate most of our revenues from the provision of wireless coverage products

and services to telecommunications operators in China. Our future success

depends on the continued growth of the PRC wireless communication industry. Any

slowdown in the development of the wireless communication industry in China or

reduction in our customers’ expenditure on wireless coverage products and

services may reduce market demand for our products and services. 3G

network deployment requires significant capital investment by PRC

telecommunications operators, including investments in wireless coverage

products and services and RF parts and components. Therefore, we believe that

issuance of 3G licenses will in general have a positive impact on the growth of

our business. Although telecommunications operators have been increasing their

capital expenditure for 3G network construction in China, it is uncertain how

long this investment trend would continue, and any reduction of the capital

expenditure for 3G network development will negatively impact our business

growth and liquidity.

S-10

We historically recognized

significantly lower revenues in the first quarter, which sometimes resulted in

net losses in the first quarter, and our revenues may fluctuate significantly

from quarter to quarter in the future, resulting in quarterly net

losses.

Our customers typically set their annual budgets at the

beginning for each year. Once the annual budget is set, the customers will

commence the bidding process for specific

projects. As a result, the amount of revenues we could recognize is typically

lower during the earlier part of the year, especially during the first quarter.

In addition, for our standalone service contracts and bundled sale

contracts, our customers generally use the same team to

manage different aspects of a project, including bidding, contracting and

payment. Their work is performed in accordance with their internal annual and

semi-annual project management process. As a result, our customers

prefer to perform completion and preliminary inspections and sign contracts for

each batch of installed projects at the same time. Under our revenue recognition

policies, we recognize revenue after we receive the preliminary inspection

certificate for our standalone service contracts and for the

portion attributable to the provision of integrated services for our bundled

sale contracts. Accordingly, we typically recognize higher levels of revenue

during the second and third quarter than that of the first

quarter, because more wireless coverage products are installed and inspected,

and for which completion and preliminary inspection certificates are issued,

during the second and the third quarter. During the fourth quarter, especially

in December, our major customers, being public companies and

influenced by their semi-annual reporting obligations, usually perform

completion and preliminary inspections, issue completion and preliminary

inspection certificates and sign contracts for a majority of our standalone

service contracts and bundled sale contracts. Therefore, we typically recognize the

highest level of revenue during the fourth quarter. Nevertheless, as we

recognize our revenue from the sale of equipment when delivery has occurred and

the customer has signed a contract with us and issued a delivery certificate to

us under our standalone equipment contracts, our increased

sales of equipment on a standalone basis following the implementation of the

centralized billing process has slightly reduced the effect of seasonality on

our business.

Whether

we continue to have fluctuations in revenues, gross profit margins and earnings

in the future will depend largely upon our customers, over which we have very

little control. Past quarterly results, therefore, may not provide an accurate

indication of future performance or fluctuation. Such fluctuation may have an

adverse effect on our liquidity and financial condition.

We

may fail to offer products that meet industry standards or our customers’

specific requirements, and as a result we may lose customers or orders or incur

significant warranty or other costs, and our revenue growth may be materially

and adversely affected.

The

development of our products is based upon a complex technology, and requires

significant time and expertise in order to meet industry standards and

customers’ specifications. Our customers often have their own sets of standards

and criteria relating to their requirements for wireless coverage products,

including standards and criteria issued by the relevant governmental

authorities. We must satisfy these standards and criteria in order to be

eligible to supply our products and services to those customers. If we are

unable to continue to meet these standards and criteria, we may become

ineligible to provide our products and services that have in the past generated

most of our revenues and profitability. Furthermore, quality and performance

problems could damage our reputation and our relationships with existing and

prospective customers and could have a material and adverse effect on our

revenue growth.

We

customarily provide our customers with one to three years of warranty

protection, under which we agree to repair or replace defectively installed

wireless coverage products at no additional cost to our customers. Our contracts

generally do not contain disclaimers or limitations on product liabilities for

special, consequential and incidental damages, nor do we typically cap the

amounts our customers may recover for damages. In addition, we do not currently

maintain any insurance for product liability or warranty claims. Our failure to

offer products and services that meet our customers’ specific requirements could

give rise to substantial liabilities under our warranties and

otherwise.

Our

research and development efforts may not lead to successful development of

commercially viable or acceptable products, which could cause a decline in

customer use of our products.

The

markets in which we compete are characterized by:

• Rapidly changing technology;

• Evolving industry

standards and transmission protocols;

S-11

• Frequent improvements in products and

services; and

• Intense competition from well-funded and

technologically advanced companies.

To

succeed, we must continually improve our current products and develop and

introduce new or enhanced products that adequately address the requirements of

our customers and are competitive in terms of functionality, performance,

quality and price. We expend considerable efforts in the development of new and

enhanced RF technology, WFDS technology and in their commercial applications,

including the development of 3G products and base station RF components.

Although we have successfully developed products that meet customers’

requirements in the past, there is no assurance that any of our research and

development efforts will necessarily lead to any new or enhanced products or

generate sufficient market share to justify commercialization. For example, 3G

is a new and evolving technology. Our

research and development efforts may not

yield new wireless coverage products that are readily deployable in 3G networks

and that our customers may not be satisfied with the performance of our

3G coverage products. Under those circumstances, we will not be able to recoup

our research and development costs and expenses, we may not be able to serve our

customers’ 3G needs, and customers may refuse to use our products.

We

face intense competition.

The

market for access network solutions services is intensely competitive in the

People’s Republic of China and is characterized by rapid technological

advancement, frequent development of new products, evolving industry standards

and a downward pricing trend over the life cycle of a product. There are

numerous other access network service providers with which we compete for

business. There are low barriers to entry for new competitors in our market and

our business may experience a negative impact as a result of increased

competition. In addition, our existing or potential competitors may in the

future achieve greater market acceptance and gain additional market share or may develop new technology that may make our product

less competitive, which in turn could reduce our revenues and

operations.

We

depend on key personnel for the success of our business.

Our

business may be severely disrupted if we lose the services of our key executives

and employees or fail to add new senior and middle managers to our management.

Our future success is heavily dependent upon the continued service of our key

executives, particularly Han Daqing, our Chief Executive Officer and President,

Yu Xiaoli, our Chief Financial Officer and Yong Shiqin, our Chief Operating

Officer. Our future success is also dependent upon our ability to attract and

retain qualified senior and middle managers to our management team. If one or

more of our current or future key executives and employees are unable or

unwilling to continue in their present positions, we may not be able to easily

replace them, and our business may be severely disrupted. In addition, if any of

these key executives or employees joins a competitor or forms a competing

company, we could lose customers and suppliers and incur additional expenses to

recruit and train personnel. Each of our executive officers has entered into an

employment agreement with us.

We also

rely on a number of key technology staff for the operation of our Company. The

wireless coverage industry is characterized by a high level of employee

mobility. Competition in China for experienced RF technology experts is intense.

There are few senior-level research and development or technical personnel

available for hire as the costs of hiring and retaining such individuals are

high, and such personnel may not remain with us once hired. If we are unable to

successfully attract or retain senior-level research and development employees,

our ability to develop new technologies and products and to effectively conduct

our operations could be compromised and our ability to carry on our research and

development and other efforts could be materially and adversely

affected.

Rapid

growth and a rapidly changing operating environment may strain our limited

resources.

We will

need to increase our investment in our technology infrastructure, facilities and

other areas of operations, in particular our product development, in order to

facilitate our growth. If we are unable to manage our growth and expansion

effectively, the quality of our products and services, and in turn, our customer

support, could deteriorate and our business and results of operations may

suffer. Our future success will depend on, among other things, our ability

to:

S-12

• continue to develop through our research

and development facilities new technologies acceptable to the PRC

market;

• continue training, motivating and retaining

our existing employees and attract and integrate new employees, including our

senior management;

• develop and improve our operational,

financial, accounting and other internal systems and controls; and

• maintain adequate controls and procedures

to ensure that our periodic public disclosure under applicable laws, including

U.S. securities laws, is complete and accurate.

Current economic conditions may adversely impact demand

for our products, reduce access to credit and cause our customers and others

with which we do business to suffer financial hardship, all of which could adversely impact our

business, results of operations, financial condition and cash

flows.

Our business, financial condition and results of

operations have and may continue to be affected by various economic factors. The

worldwide economy is undergoing a period of

slowdown and the future economic environment may continue to be less favorable

than that of recent years. This slowdown has, and could further lead to, reduced

consumer and business spending in the foreseeable future, including by our

customers. Reduced access to credit has and may continue to adversely affect the

ability of consumers to purchase our products and system solutions. In addition,

economic conditions, including decreased access to credit, may result in

financial difficulties leading to restructurings,

bankruptcies, liquidations and other unfavorable events for our customers,

suppliers and other service providers. If such conditions continue or further

deteriorate, our industry, business and results of operations may be

severely impacted.

We have limited experience in operating outside mainland

China, and failure to expand internationally may have an adverse effect on our

business growth in the future.

Our future growth primarily depends on our ability to

increase our market share domestically by

effectively utilizing our competitive advantages. However, we also intend to

increase our international presence and expand our customer base

internationally. We currently have six sales offices outside of China.

While

we currently generate less than 5% of our revenue from overseas, we expect the

international market, especially the U.S., will represent a significant growth

opportunity for us in the future. However, we have limited experience

in operating outside mainland China or with foreign regulatory environments and

market practices, and we may not be able to penetrate these international

markets. Our failure to grow in international markets may have an adverse effect

on our business growth in the future.

We may

not be able to adequately protect our intellectual property, and we may be

exposed to infringement claims by third parties.

We rely

primarily on a combination of intellectual

property laws and contractual restrictions to establish and protect our

intellectual property rights. Monitoring unauthorized use of our information

services is difficult and costly, and we cannot be certain that the steps we

take will effectively prevent misappropriation of our technology and content.

Our management may determine in the future to register for patents, copyrights, trademarks or trade secret

protection if management determines that such protection would be beneficial and

cost-effective.

From time

to time, we may have to resort to litigation to enforce our intellectual

property rights, which could result in substantial costs and diversion of our

resources and may ultimately be

unsuccessful. In addition, parties may initiate litigation against us for

alleged infringement of their proprietary rights. In the event of a successful

claim of infringement and our failure or inability to develop non-infringing

technology, content or license the infringed or similar technology or content on

a timely basis, our business could suffer. Moreover, even if we are able to

license the infringed or similar technology or content, license fees that we pay

to licensors could be substantial or uneconomical.

S-13

We

have limited business insurance coverage, and any significant product liability

claim could have a material and adverse effect on our financial

condition.

The

insurance industry in the PRC is still at an early stage of development. We

currently do not maintain any product liability insurance for our products and

services, nor do we carry any business interruption insurance, third-party

liability insurance for personal injuries, or environmental damage insurance for

environmental emissions or accidents on our properties or relating to our

operations. There is no assurance that there will not be any product liability

claims against us in relation to our products. Furthermore, we cannot assure you

that we will not experience any major accidents in the course of our operations,

which may cause significant property or

environmental damage or personal

injuries. Any business disruption, litigation or natural disaster might result

in substantial costs and diversion of resources.

If

we fail to develop and maintain an effective system of disclosure controls and

internal controls over financial reporting, we may not be able to accurately

report our financial results or prevent fraud; as a result, current and

potential shareholders could lose confidence in the integrity of our financial

reports, which could harm our business and the trading price of our common

stock.

Effective

internal controls are necessary for us to provide timely disclosure of material events affecting our

business and reliable financial reports and effectively prevent fraud.

Section 404 of the Sarbanes-Oxley Act of 2002.

Section 404 requires management to establish and maintain a system of internal control over financial reporting

and annual reports on Form 10-K filed under the

Exchange Act to contain a report from management assessing the effectiveness of

a company's internal control over financial reporting. Separately, under

Section 404, as amended by the Dodd-Frank

Wall Street Reform and Consumer Protection Act of 2010, public companies that

are large accelerated or accelerated filers must include in their annual reports

on Form 10-K an attestation report of their regular auditors attesting to and

reporting on management’s assessment of internal control over financial

reporting. Non-accelerated filers and smaller reporting companies are not

required to include an attestation report of their auditors in annual

reports.

The

process of strengthening our internal controls and complying with Section 404 is

expensive and time consuming, and requires significant management attention.

During the assessment of our internal controls over financial reporting for the

year ended December 31, 2009, our management concluded that our disclosure

controls and procedures were not effective due to control weaknesses and control

deficiencies in our internal control over financial reporting, including the

following:

• Our

internal audit team is currently understaffed. In addition, the scope and

effectiveness of the internal audit function have yet to be

developed.

• Currently, not all of our financial

and accounting staff are knowledgeable of U.S. GAAP accounting rules.

Specifically, certain positions in our accounting and finance departments at our

subsidiary level were staffed with individuals who primarily dealing

with PRC financial reporting and do not currently have adequate knowledge,

skills and training under U.S. GAAP.

• Our

financial department has internal control policies and procedures that are not

yet integrated with all of our operations.

• At

present, we have a whistle blower channel via manager’s email and telephone, but

no formal whistle blower policy.

S-14

Although

we have developed certain remediation plans, which we anticipate will be

completed during 2010, we cannot be certain that these measures we have

undertaken will ensure that we will maintain adequate controls over our

financial processes and reporting in the future. Furthermore, if we are able to

rapidly grow our business, the internal controls that we will need may become

more complex, and significantly more resources may be required to ensure our

internal controls remain effective. Failure to implement required controls, or

difficulties encountered in their implementation, could harm our operating

results or cause us to fail to meet our reporting obligations. If we fail to

execute our remediation plans, our stockholders and other potential investors

may lose confidence in our business operations and the integrity of our

financial statements, and may be discouraged from future investments in our

company, which may delay or hinder any future business development or expansion

plans if we are unable to raise funds in future financings, and our current

stockholders may choose to dispose of the shares of common stock they own in our

company, which could have a negative impact on our stock price. In the event we are unable to receive a positive

attestation from our independent auditors with respect to our internal controls, investors and others may

lose confidence in the reliability of our financial statements, which may also

lead to a decline in our stock price.

After this offering, we expect that we likely will

become an accelerated filer. Accordingly,

we expect that we will be required to include an attestation report of our

auditors in our annual report on Form 10-K for the fiscal year ending December

31, 2011. If and when we become subject to the auditor attestation requirements

under Section 404, we can provide no assurance that we will receive a

positive attestation from our independent auditors. In

addition, non-compliance with Section 404 could subject us to a variety of

administrative sanctions, including the suspension of trading of our stock on

the NASDAQ Select Global Market,

ineligibility for listing on other national securities exchanges, and the

inability of registered broker-dealers to make a market in our common stock,

which could further reduce our stock price.

We

must comply with the Foreign Corrupt Practices Act and Chinese anti-corruption

law.

Since we

are a Delaware corporation and a public company in the United States, we are

subject to the U.S. Foreign Corrupt Practices Act, or FCPA, which generally

prohibits U.S. companies from engaging in bribery or other prohibited payments

to foreign officials for the purpose of obtaining or retaining business. The PRC

also strictly prohibits bribery of government officials. Our principal

customers, the Big 3, are partially owned by the PRC government and our dealings

with them are likely to be considered to be with government officials for

purposes of these laws. We do not condone bribery on the part of our employees,

agents, representatives and consultants. Our employees, agents, representatives

and consultants may not always be subject to our control. If any of them

violates FCPA or other anti-corruption law, we might be held responsible. We

could suffer severe penalties in that event. In addition, the U.S. government

may seek to hold us liable for successor liability FCPA violations committed by

companies in which we invest or which we acquire. Non-U.S. companies, including

some that may compete with us, are not subject to these prohibitions. If these

competitors engage in these practices, they may receive preferential treatment

from some companies to our disadvantage.

RISKS RELATED TO DOING BUSINESS IN

CHINA

A

downturn in the Chinese economy may slow down our growth and

profitability.

The

growth of the Chinese economy has been uneven across geographic regions and

economic sectors. There can be no assurance that growth of the Chinese economy

will be steady or that any downturn will not have a negative effect on our

business. Our profitability will decrease if expenditures for wireless services

decrease due to a downturn in the Chinese economy. In addition, increased

penetration of wireless services in the less economically developed central and

western provinces of the PRC will depend on those provinces achieving certain

income levels, so that mobile phones and related services become affordable to a

significant portion of the population.

Government regulation of the

telecommunications industry may become more complex.

Government

regulation of the telecommunications industry is highly complex. New regulations

could increase our costs of doing business and prevent us from efficiently

delivering our services. These regulations may stop or slow down the expansion

of our user base and limit the access to our services.

S-15

Our

ability to generate revenues could suffer if the Chinese market for access

network solutions services does not develop as anticipated.

The

wireless services market in the PRC has evolved rapidly over the last four

years, with the introduction of new services, development of consumer

preferences, market entry by new competitors and adaptation of strategies by

existing competitors. We expect each of these trends to continue, and we must

continue to adapt our strategy to successfully compete in our

market.

In

particular, we currently offer a wide range of access network solutions services

for mobile phones using 2G technologies including GSM/CDMA/PHS/WLAN and are

developing access network solutions for 3G mobile phones. There can be no

assurance, however, that any of these 2G or 3G technologies and any services

compatible with them will be accepted by consumers or promoted by the mobile

operators. Accordingly, it is extremely difficult to accurately predict consumer

acceptance and demand for various existing and potential new offerings and

services, and the future size, composition and growth of this

market.

Our

ability to compete on a nationwide scale may be impaired due to state-owned

competitors.

Although

we believe our strongest competitors are other privately held Chinese companies,

we face direct competition with telecommunications companies which are either

state-owned or state-run. In certain circumstances, these state-owned

competitors may receive preferential treatment, particularly in the awarding of

governmental contracts.

The

uncertain legal environment in China could limit the legal protections available

to you.

The

Chinese legal system is a civil law system based on written

statutes. Unlike common law systems, it is a system in which precedents set

in earlier legal cases are not legally

binding. The overall effect of legislation enacted over the past 20

years has been to enhance the protections afforded to foreign invested

enterprises in China. However, these laws, regulations and legal

requirements are relatively recent and are evolving rapidly and their

interpretation and enforcement involves uncertainties. In addition, the PRC

legal system is based in part on government policies and internal rules (some of

which are not published on a timely basis or at all) that may have a retroactive

effect. As a result, we may not be aware of our violation of these policies

and rules until some time after the violation. These uncertainties could

limit the legal protections available to foreign investors, such as the right of

foreign invested enterprises to hold licenses and permits such as requisite

business licenses. In addition, all of our executive officers and our

directors are residents of China, and substantially all the assets of these

persons are located outside the U.S. As a result, it could be

difficult for investors to effect service of process in the U.S., or to enforce

a judgment obtained in the U.S. against us or any of these persons.

Moreover,

the enforceability of contracts in China, especially with governmental entities,

is relatively uncertain. If counterparties repudiated our contracts or defaulted

on their obligations, we might not have adequate remedies. Such uncertainties or

inability to enforce our contracts could materially and adversely affect our

revenues and earnings.

Adverse

changes in political and economic policies of the PRC government could impede

the overall economic growth of China, which could reduce the demand for our

products and damage our business.

We

conduct substantially all of our operations and generate most of our revenue in

China. Accordingly, our business, financial condition, results

of operations and prospects are affected significantly by economic, political

and legal developments in China. The PRC economy differs from the

economies of most developed countries in many respects, including:

• a

higher level of government involvement;

• an

early stage of development of the market-oriented sector of the

economy;

• a

rapid growth rate;

• a

higher level of control over foreign exchange; and

S-16

• the

control over the allocation of resources.

As the

PRC economy has been transitioning from a planned economy to a more

market-oriented economy, the PRC government has implemented various measures to

encourage economic growth and guide the allocation of resources. Although these

measures may benefit the overall PRC economy, they may also have a negative

effect on us.

Although

the PRC government has in recent years implemented measures emphasizing the

utilization of market forces for economic reform, the PRC government continues

to exercise significant control over economic growth in China through the

allocation of resources, controlling the payment of foreign currency-denominated

obligations, setting monetary policy and imposing policies that impact

particular industries or companies in different ways.

Any

adverse change in economic conditions or government policies in China could have

a material adverse effect on the overall economic growth in China, which in turn

could lead to a reduction in demand for our products and services and

consequently have a material adverse effect on our business and

prospects.

Restrictions

on currency exchange may limit our ability to receive and use our revenues

effectively or to pay dividends in U.S. dollars.

Because

almost all of our future revenues may be in the form of RMB, any future

restrictions on currency exchanges may limit our ability to use revenue

generated in RMB to fund any future business activities outside the PRC or to

make dividend or other payments in U.S. dollars. Under current PRC laws and regulations, payments of current account items, including profit

distributions, interest payments and operation-related expenditures, may be made

in foreign currencies without prior approval from SAFE, but are subject

to procedural requirements including

presenting relevant documentary evidence of such transactions and conducting

such transactions at designated foreign exchange banks within China that have

the licenses to carry out foreign exchange business. Strict foreign

exchange control continues to apply to capital account transactions. These

transactions must be approved by or registered with SAFE, and repayment of loan

principal, direct capital investment and investment in negotiable instruments are also subject to

restrictions. We cannot assure you that we

will be able to meet all of our foreign currency obligations or to remit profits

out of China. If future changes in relevant regulations were to place

restrictions on the ability of our PRC subsidiaries to remit dividend payments

to us, our liquidity and ability to satisfy our third-party payment obligations,

and our ability to distribute dividends, could be materially adversely affected.

Further, restrictions on the

convertibility of the Renminbi for capital

account transactions could also affect the

ability of our PRC subsidiaries to make investment overseas or to obtain foreign

exchange funds through debt or equity financing, including by means of loans or

capital contribution from us.

The

Chinese government exerts substantial influence over the manner in which we must

conduct our business activities.

The

Chinese government has exercised and continues to exercise substantial control

over virtually every sector of the Chinese economy through regulation and state

ownership. Our ability to operate in China may be harmed by changes in its laws

and regulations, including those relating to taxation, import and export

tariffs, environmental regulations, land use rights, property and other matters.

We believe that our operations in China are in material compliance with all

applicable legal and regulatory requirements. However, the central or local

governments of these jurisdictions may impose new, stricter regulations or

interpretations of existing regulations that would require additional

expenditures and efforts on our part to ensure our compliance with such

regulations or interpretations. Accordingly, government actions in the future,

including any decision not to continue to support recent economic reforms and to

return to a more centrally planned economy or regional or local variations in

the implementation of economic policies, could have a significant effect on

economic conditions in China or particular regions thereof, and could require us

to divest ourselves of any interest we then hold in Chinese

properties.

S-17

Future

inflation in China may inhibit our ability to conduct business in

China.

In recent

years, the Chinese economy has experienced periods of rapid expansion and high

rates of inflation. During the past ten years, the rate of inflation in China

has been as high as 20.7% and as low as -2.2%. These factors have led to the

adoption by Chinese government, from time to time, of various corrective

measures designed to restrict the availability of credit or regulate growth and

contain inflation. While inflation has been more moderate since 1995, high

inflation may in the future cause Chinese government to impose controls on

credit and/or prices, or to take other action, which could inhibit economic

activity in China, and thereby harm the market for our products.

Cessation

of the preferential treatment of income

tax may have an adverse impact on our net income.

China

passed a new PRC Enterprise Income Tax Law (the

“EIT Law”) and

its implementing rules, both of which became effective on January 1, 2008.

The EIT Law imposes a unified enterprise income

tax rate of25% on all domestic enterprises and foreign-invested enterprises

unless they qualify under certain limited exceptions. Under the EIT Law and it

implementing

rules, companies established before March 16, 2007 and had enjoyed preferential tax rates previously

shall gradually become subject to the 25%

rate over a five-year transition period, and

enterprises that were established before March 16, 2007 and were eligible for preferential tax exemptions or reductions

within the specified time under the then effective laws and regulations will

continue to enjoy the original preferential tax exemptions or reductions until

the expiration of the specified terms, except that the

relevant exemption or reduction shall start from the year of 2008 if the first

profitable year of the relevant enterprise is later than January 1, 2008.

Certain qualified high-technology enterprises may still enjoy a preferential tax rate of 15%. Currently, our PRC subsidiaries, Beijing Telestone and

BTWTC, are specified as “high-technology enterprises” are eligible for

the preferential tax rate of 15. If its PRC subsidiaries cease to qualify as

“high-technology enterprises,” our financial condition and results of operations

could be materially and adversely affected.

We

may be deemed as a PRC resident enterprise under the EIT Law and be subject us

to PRC income tax for our global income and withholding income tax for any

dividends we pay to our non-PRC shareholders on profits earned after

January 1, 2008.

Under the

EIT Law, enterprises established outside of China whose “de facto management

bodies” are located in China are considered “resident enterprises” and will

generally be subject to the uniform 25% enterprise income tax rate as to their

global income. Under the Implementation Rules for

the EIT Law, “de facto management bodies” is defined as the bodies that have material and overall management

control over the business operations,

personnel, accounts, and properties of the

an enterprise. In April 2009, the PRC State

Administration of Taxation (the “SAT”) promulgated a

circular to clarify the criteria to determine whether the “de facto management bodies” are located within the PRC for enterprises incorporated overseas with controlling

shareholders being PRC enterprises.

The EIT Law and its Implementation Rules are relatively

new and ambiguities exist with respect to the interpretation of the provisions

relating to resident enterprise issues. As

substantially all of our management is currently based in China and may remain

in China in the future, we may be treated as a PRC resident enterprise for PRC

enterprise income tax purposes. If we are deemed as a PRC resident enterprise,

we will be subject to PRC enterprise income tax at the rate of 25% on

our worldwide income. In that case, however, dividend income we receive from our

PRC subsidiaries may be exempt from PRC enterprise income tax because the EIT

Law and its Implementation Rules generally provide that

dividends received by a PRC resident enterprise from its directly invested

entity that is also a PRC resident enterprise is exempt from enterprise income

tax. However, as there is still uncertainty as to how the EIT Law and its