Attached files

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K /A

Amendment #1

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended July 31, 2009

OR

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from __________ to __________

Commission File Number 000-49961

MAGNUS INTERNATIONAL RESOURCES INC.

(Exact Name of Registrant as Specified in its Charter)

|

Nevada

|

98-0351859

|

|

(State or other Jurisdiction of Incorporation

or Organization)

|

(IRS Employer

Identification Number)

|

|

115 – 280 Nelson Street,

|

|

| Vancouver, BC Canada |

V6B 2E2

|

|

(Address of Principal Executive Offices)

|

(Zip Code)

|

|

1-604-694-1432

(Registrant's Telephone Number, Including Area Code)

|

|

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act: Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act: Yes o No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports); and (2) has been subject to the filing requirements for the past 90 days: Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K: Yes o No x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | o | Accelerated filer | o |

| Non-accelerated filer | o (Do not check if a smaller reporting company) | Smaller reporting company | x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

State issuer’s revenues for its most recent fiscal year. July 31, 2009: $-0-

Aggregate market value of outstanding Common Stock held by non-affiliates: As of October 29, 2009, the aggregate market value of outstanding Common Stock of the registrant held by non-affiliates was approximately $958,435.

Outstanding Common Stock: As of October 29, 2009, the Company had 54,470,740 shares of Common Stock outstanding.

In this report, the terms “Magnus”, the “Company”, “we” or “us”, unless the context otherwise requires, mean Magnus International Resources Inc. and its subsidiaries.

Unless otherwise specified, all dollar amounts in this report are expressed in United States dollars.

|

To Convert Imperial Measurement Units

|

To Metric Measurement Units

|

Multiply by

|

||

|

Acres

|

Hectares

|

0.4047

|

||

|

Feet

|

Meters

|

0.3048

|

||

|

Miles

|

Kilometers

|

1.6093

|

||

|

Tons (short)

|

Tonnes

|

0.9071

|

||

|

Gallons

|

Liters

|

3.7850

|

||

|

Ounces (troy)

|

Grams

|

31.103

|

||

|

Ounces (troy) per ton (short)

|

Grams per tonne

|

34.286

|

This document, including any documents that are incorporated by reference, contains forward-looking statements concerning, among other things, mineralized material, proven or probable reserves and cash operating costs. Such statements are typically punctuated by words or phrases such as “anticipates”, “estimates”, “projects”, “foresees”, “management believes”, “believes” and words or phrases of similar import. Such statements are subject to certain risks, uncertainties or assumptions. If one or more of these risks or uncertainties materialize, or if underlying assumptions prove incorrect, actual results may vary materially from those anticipated, estimated or projected. Important factors that could cause actual results to differ materially from those in such forward-looking statements are identified in this document under “Part I—Item 1. Description of the Business and Risk Factors”. Magnus assumes no obligation to update these forward-looking statements to reflect actual results, changes in assumptions, or changes in other factors affecting such statements.

ITEM 1. DESCRIPTION OF BUSINESS

General Overview

Magnus is a mineral exploration company that specializes in identifying, acquiring and developing precious and base metal properties. The Company has been active in Uganda since 2007 where it has a 100% interest in eight mineral properties: Mubende, Mwerusandu, Lugazi, Mitoma, Rubindi, Kigumba, Kidera and Nyanga. The Company has previously been focused on gold projects in China from 2004 to 2006 with its key mineral project being the Huidong Property. The Huidong project has been sold.

The Company was incorporated under the laws of the State of Nevada, USA on April 4, 2001 and has a July 31st fiscal year end.

The current addresses, telephone and facsimile numbers of the offices of the Company are:

|

Canadian Office

|

Uganda Office

|

|

280 Nelson Street

Suite 115

Vancouver, BC

Canada V6B 2E2

Tel: (604) 694-1432

|

Plot 1A

Mugwanya Road

Entebbe, Uganda

Tel: +256(0) 7734 63095

|

The price of the Company’s common stock was quoted for trading on the over-the-counter bulletin board (“OTCBB”) since March 25, 2003. On November 14, 2007, the Company received notice of the suspension of the quotation of its shares on the OTCBB for one year for late filing of annual and/or quarterly reports, and on December 6, 2007 the Company’s shares were removed from quotation on the OTCBB. The Company’s shares are now quoted for trading on the Pink Sheets over-the-counter quotation system under the symbol “MGNU”.

Property Agreements

Property Agreements - Africa

In Africa, the Company, through its indirect wholly-owned subsidiaries, African Mineral Fields Limited and AB Mining Ltd. (each of which are wholly-owned by the Company’s wholly-owned subsidiary, African Mineral Fields Inc. (“AMF”)), has a 100% interest in eight mineral properties (comprising 25 mineral exploration licenses) in Uganda: Mubende, Mwerusandu, Lugazi, Mitoma, Buhweju East, Kigumba, Kidera and Nyanga. The Company also had a right, to earn a 60% interest in the Mashonga Property, and a right to earn an 80% interest in the Ibanda Property. The Company withdrew from both of these joint venture agreements at Mashonga and Ibanda in December 2008. Magnus intends to transfer 10 of its mineral exploration licenses to Kamu Kamu Drilling Experts Ltd. (“Kamu Kamu”) as part of an agreement to settle a legal action brought against the Company by Kamu Kamu in December 2008.

Mwerusandu Property

On November 8, 2007, Magnus entered into a license transfer agreement (the “License Transfer Agreement”) with Flemish Investments Limited (“Flemish”) under which Flemish agreed to transfer 100% of the right, title and interest to the licenses comprising the Mwerusandu Property (comprised of three mineral exploration licenses covering a total of 57.7 square kilometers of land in Uganda) and the Mitoma Property (described below) to Magnus. Flemish is a third party property vendor in relation to Magnus. The Ugandan Department of Geological Survey and Mines ratified the transfer of the licenses on December 20, 2007, and accordingly Magnus now holds a 100% interest in the Mwerusandu Property. Flemish is entitled to receive from Magnus a net smelter returns royalty on the Mwerusandu Property on a sliding scale between 0.5% (if the gold price is below $250/oz.) and 2.1% (if the gold price is above $1,200/oz.), depending on the price of gold when the NSR is being paid.

In addition to the licenses transferred to Magnus under the License Transfer Agreement, Magnus received an additional exploration license covering 147.63 sq. km. During fiscal year 2008, three licenses were renewed for a period of two years, each with a 50% reduction in area, so that the Mwerusandu Property comprised of four exploration licenses covering 175.43 sq. km.

Mitoma Property

Under the License Transfer Agreement, Flemish also agreed to transfer 100% of the right, title and interest to the licenses comprising the Mitoma Property (comprised of six mineral exploration licenses for a total of 279.0 square kilometers of land in Uganda) to Magnus. The Ugandan Department of Geological Survey and Mines ratified the transfer of the licenses on December 20, 2007, and accordingly Magnus now holds a 100% interest in the Mitoma

Property. Flemish is entitled to receive from Magnus a net smelter returns royalty on the Mitoma Property on a sliding scale between 0.5% (if the gold price is below $250/oz.) and 2.1% (if the gold price is above $1,200/oz.), depending on the price of gold when the NSR is being paid.

In addition to the licenses transferred to Magnus under the License Transfer Agreement, Magnus received an additional two exploration licenses covering 159.49 sq. km. In fiscal year 2008, four licenses were renewed for a period of two years with a 50% reduction in area and one license was relinquished. The Mitoma Property is comprised of seven exploration licenses covering 359.49 sq. km.

During fiscal year 2008, a limited infill soil survey was completed at the Kabira license on the Mitoma Property. Some 43 soil samples were collected to test previous anomalies delineated in previous exploration. The results do not indicate an extensive zone of anomalous soil values.

Mubende Property

On September 1, 2006, AMF entered into an agreement (the “Mubende Agreement”) with Flemish Investments Limited (“Flemish”) under which AMF purchased a 100% right, title and interest in and to the mineral exploration licenses respecting 780 square kilometers of land in central Uganda (the “Mubende Property”). The purchase price paid by AMF for the Mubende Property was US$25,000 and the issuance of 250,000 common shares of AMF (since exchanged for Magnus shares). In addition, under the Mubende Agreement AMF was required to issue additional AMF common shares, to a maximum of 300,000 additional shares, to Flemish for each economically mineable ounce of gold on the Mubende Property that is proven to be a measured and indicated resource. To date, there is not a measured or indicated resource on the Mubende Property, and accordingly no additional shares have been issued to Flemish.

The Mubende Property comprises three exploration licenses covering 780 sq. km. One exploration licence, EL0121 with an area of 71.2 sq. km expired in fiscal 2009 and was relinquished.

During the fiscal year 2008, a total of 1,001 soil samples and 46 rock grab samples were collected on the Mubende Property along regional lines to test the edges of a large granite batholith. The Company believes that the numerous gold and tungsten occurrences on the Property as well as alluvial mining operations to the west of the Property have a source from the edges of this granite body.

Lugazi Property

AMF acquired a 100% right, title and interest in and to a mineral exploration license covering 261 square kilometers of land in central Uganda (the “Lugazi Property”) on September 1, 2006 under an agreement (the “Lugazi Agreement”) with Flemish. The terms of the Lugazi Agreement are the same as those of the Mubende Agreement, and to date there is not a measured or indicated resource on the Lugazi Property and no additional shares have been issued to Flemish. Since acquiring the Lugazi Property, AMF has received four additional exploration licenses covering 1,359.17 sq. km. During fiscal year 2008, one license was renewed for a period of two years, with a 50% reduction in area, so that the Lugazi Property is now comprised of five exploration licenses covering 1,487.69 sq. km.

A reverse circulation drilling program was completed on the Lugazi Property in 2008 which tested three prominent gold-in-soil geochemical anomalies. The 31 hole, 2,037m program tested these three anomalous zones which were co-incident with magnetic rich horizons along lithological strike. The RC holes were drilled at about 50m intervals along a fence across the soil anomaly, and were designed to investigate the nature of the weathered profile to an average depth of some 65m. As no previous gold mineralisation has been reported from this belt the Company sought to understand the source of the anomalous gold in soils and attempt to identify possible structures that could be followed up during subsequent phases of exploration. This drilling is the culmination of early stage exploration at Lugazi which commenced in May 2006.

The most significant RC drill results include:

|

|

§

|

4m at 0.98 g/t gold from 18m in LUG006 at the Kiyola target (incl. 2m at 1.3g/t)

|

|

|

§

|

2m at 0.50 g/t gold from 64m in LUG007 at the Kiyola target

|

|

|

§

|

2m at 1.50 g/t gold from 2m in LUG017 at the Nantula target

|

|

|

§

|

2m at 1.20 g/t gold from 9m in LUG028 at the Katente target

|

On a more regional scale, a total of 1,456 soil samples were collected along regional lines, planned to investigate additional gold, as well as base metal rich horizons. The results of these soils have not demonstrated an anomalous gold trend. A zone of low level gold was indicated on a single north-south line, with values between 20 and 30 ppb. Infill sampling did not extend this zone to the west or east. The nickel and chromium values of these samples did not show anomalism related to a buried source for base metals.

Mashonga Property

On August 30, 2007, AMF entered into a joint venture agreement (the “Mashonga Agreement”) with a consortium of Ugandan businessmen respecting two mineral exploration licenses and three location licenses covering 460.87 square km of land partially contiguous to AMF’s Mitoma Property in Uganda (the “Mashonga Property”). Under the Mashonga Agreement, Magnus had the right to earn a 60% interest in the Mashonga Property by making aggregate cash payments of US$650,000 to its joint venture partners, making a minimum US$4 million in property exploration expenditures and completing a pre-feasibility study on the property by August 30, 2012. Magnus’ joint venture partners had the right to accept common shares of Magnus in lieu of the cash payments. As of December 1, 2008, Magnus had paid US$70,000 to its joint venture partners.

At the Mashonga Property a preliminary soil sample program was completed over targets with high-grade trench and rock sample values from previous exploration activities, as well as from regional soil lines, to investigate additional targets. In total, 127 soil samples were collected; results were mixed, showing good anomalous values over one target while having inconsistent values over the other target. The Company also conducted an alteration mapping survey using PIMA analysis of surface rock samples. The alteration pattern indicated an important transition from acidic to alkaline regime along a prominent northwest structure. An RC drill program was conducted at the Mashonga small-scale mine site during the summer 2008. A total of 667m was completed in 7 holes beneath the Mashonga mine.

The RC drill holes intersected a sequence of sericite schist in contact with a mafic schist and granite-pegmatite-quartz veining. Sulphide mineralisation in the form of disseminated pyrite was noted within each of the holes.

The drilling conditions at Mashonga proved to be very difficult and as a result none of the 7 holes reached the planned depth. Hole MA-7 was abandoned after 25m, without reaching the targeted mineralised zone. The assay results show that gold mineralization is confined to the extents of the mine workings, but gold values are lower than previous grab samples from the targeted shear zone. As previously reported, gold values up to 874 g/t were reported from a grab sample underground and trench intersections reported 4.6m at 24.7 g/t and 2.4m at 59.6 g/t gold. There is a broad east-west correlation in peak copper values with highs often close to pegmatite mafic boundaries.

There are several other targets that Company management intended to drill at Mashonga but was unable to due to the difficulties experienced by the drilling contractor at the Mashonga mine target area. The Company is also cognizant, that the discontinuous, podiform nature of mineralization associated with shear zones can be difficult to intersect in limited drill programs such as the one just completed.

The most significant RC drill results include:

|

§

|

1m at 0.51 g/t gold from 37m in MA-1 beneath the mine workings

|

|

|

§

|

2m at 0.10 g/t gold from 111m in MA-1 beneath the mine workings

|

|

|

§

|

3m at 0.12 g/t gold from 54m in MA-2 beneath the mine workings

|

|

|

§

|

3m at 1.12 g/t gold from 81m in MA-2 beneath the mine workings

|

|

|

§

|

3m at 3.22 g/t gold from 96m in MA-2 beneath the mine workings

|

|

|

§

|

3m at 2.55 g/t gold from 114m in MA-2 beneath the mine workings

|

|

|

§

|

3m at 0.40 g/t gold from 0m in MA-6 west of the mine workings

|

|

|

§

|

3m at 0.11 g/t gold from 66m in MA-6 west of the mine working

|

The Company withdrew from the Mashonga joint venture in December 2008.

Ibanda Property

On May 1, 2008, the Company entered into an earn-in agreement (the “Ibanda Agreement”) with Canmin-Gold Limited, a subsidiary of IBI Corporation, respecting a mineral exploration license covering 332.70 square kilometers of land contiguous in southwest Uganda, northeast of the Mashonga Property (the “Ibanda Property”). Under the Ibanda Agreement, Magnus has the right to earn a 5% interest in the Ibanda Property for each $150,000 of expenditures that it makes and may earn up to an 80% interest by making an aggregate of $2 million in expenditures on the property within five years. Upon Magnus earning an 80% interest in the Property, the parties may form a joint venture under which each party will be required to contribute its proportionate share of further expenditures or have its interest be diluted.

Exploration at Ibanda commenced during 2008 with soil samples and rock samples being collected over previous gold-in-soil anomalies defined by a previous explorer in the late 1990’s. The sampling at Ibanda was completed at two locations in the central and western parts of the licence. A total of 685 soil samples at 25m sampling intervals were collected at 500m line spacing. These samples were taken at 30cm depth, dried and sieved to -80 mesh fraction and submitted to SGS labs in Mwanza for low level gold determination by aqua regia.

The results of the soil sampling showed no continuous gold anomalism. The results did show one point low-level anomalies, with values reaching a maximum of 50 ppb gold. Based on the results of this sampling, the results reported by Roraima need to be taken into context. They reported very high soil values (up to 11,170 ppb) but these values were not repeated during the Company’s soil program.

The Company withdrew from the Ibanda joint venture in December 2008.

Other Projects

On May 12, 2008, a mineral exploration license covering 363 square kilometers of land in western Uganda (the “Kigumba Property”) was granted to the Company. A 20km long uranium anomaly on the license was picked up by processing the data from the airborne geophysical survey which is being flown over 80% of Uganda. Since acquiring this licence, three additional licences totalling 1402.55 square kilometers were also acquired.

On May 12, 2008, a mineral exploration license covering 291 square kilometers of land in southwestern Uganda (the “Rubindi Property”) was granted to the Company. Since acquiring this licence, an additional licence covering 429 square kilometers was also acquired.

On June 30, 2008, a mineral exploration license covering 485 square kilometers of land in central Uganda (the “Kidera Property”) was granted to the Company. The Company intends to evaluate this project for tantalum, rare earth metals and diamonds.

On June 30, 2008, a mineral exploration license covering 23.28 square kilometers of land in central Uganada (the “Nyanga Property”) was granted to the Company. The Company intends to evaluate the tantalum potential at this project.

Property Agreements – China

Through its joint venture agreements described below, the Company previously had interests, or contingent interests, in two properties in China: the Huidong Property, comprising 83.29 square kilometers in Sichuan Province; and the Mangshi Property, comprising 113.96 square kilometers in Yunnan Province.

Yunnan Long Teng Mining Ltd. – Huidong Property

On July 6, 2004, the Company signed a formal cooperative joint venture contract (the “Huidong Agreement”) with Geological Brigade Team 209 of the Nuclear Industry of Yunnan Province (“Team 209”) to form a new cooperative joint venture company, Yunnan Long Teng Mining Ltd. (“Long Teng Mining”), a Sino-foreign Chinese corporation, to carry out minerals exploration and development in an 83.29 square kilometer area of Huidong County in Sichuan Province.

On May 12, 2008, the Company entered into an Agreement for Modification of Joint Venture Rights & Interests (the “Modification Agreement”) with Team 209. Under the Modification Agreement, the Company, which held a 90% interest in Long Teng Mining and a 90% interest in Yunnan Western Mining Co., Ltd. (“Western”, which holds the mineral rights to the Mangshi Property, described below), would obtain the remaining 10% interest in Long Teng Mining from Team 209 in exchange for transferring the Company’s 90% interest in Western to Team 209. Magnus was also required to pay 1 million RMB (approximately US$130,000) to Team 209 for previous services provided by Team 209 to Long Teng Mining and Western and payment of all the liabilities of Western within 10 days after all documents submitted to governmental departments receive approval.

On May 28, 2008, Magnus executed an agreement (the “Transfer Agreement”) with Mr. Jinzang Lai (“Lai”) under which Magnus agreed to sell its 90% interest in Yunnan Long Teng Mining Ltd., which owns the exploration license underlying the Huidong gold exploration property in Sichuan Province, China to Lai. Under the Transfer Agreement, Magnus was to receive; (i) 7,000,000 RmB (approximately US $1,000.000) within seven days of the execution of the Transfer Agreement; (ii) a further 7,000,000 RmB within seven days of the successful renewal of the exploration license underlying the Huidong property; (iii) a further 4,900,000 RmB within seven days of the transfer of Magnus’ 90% interest in Yunnan Long Teng Mining Ltd. to Lai; and (iv) a further 2,100,000 RmB within seven days of the transfer of the remaining 10% interest in Yunnan Long Teng Mining Ltd. held by Team 209 to Lai, whether directly from Team 209 or indirectly from Team 209 to Magnus and then to Lai. In addition, Magnus was to retain a 3% net smelter royalty on any minerals produced from the Huidong property under the exploration license in the future, which were to be paid quarterly. In late May 2008, Lai forwarded the first payment of 7,000,000 RmB to Magnus. 100% of the ownership interest in the company that possesses the license, Long Teng Mining Ltd., was transferred to Lai in July 2008. The exploration license underlying the property was successfully renewed by the relevant Chinese authorities in September 2008.

On November 12, 2008 the Company collected a further RMB 1,000,000 (approximately $146,000) of the proceeds of sale of Long Teng from Lai. On November 16, 2008, the Company signed an amending agreement with Lai to amend the due dates of the remaining outstanding proceeds. Under the amendment, RMB 1,000,000 (approximately $146,000) was due for payment by November 30, 2008, RMB 4,000,000 (approximately $584,000) was due for payment by December 31, 2008, RMB 4,000,000 was due for payment by January 31, 2009 and RMB 4,000,000 was due for payment by February 28, 2009. The amendment also made Magnus liable for RMB 300,000 (approximately $44,000) of additional costs incurred by Lai to settle pre-existing liabilities of Long Teng. The additional liability would be paid by reduction of the final payment under the agreement. On November 21, 2008 the Company collected RMB 420,000 (approximately $61,000) of the amount that was due by November 30. The Company did not receive the rest of the payment due by November 30 or the payments that were due on December 31, 2009, January 31, 2009 and February 28, 2009.

As of 17 June 2009, Magnus had received a total of RMB 8.42 million out of the 21 million RMB Long Teng sale price originally agreed to on May 28, 2008. On 17 June 2009, Magnus signed a new amended sale agreement requiring the Lai group to pay Magnus RMB 13.5 million within 10 days of the signing of the agreement. Magnus agreed to waive its right to a previously agreed 3% NSR on mineral production and late payments due according to the November 2008 contract in return for an additional 1.38 million RmB payment that was included in the 13.5 million RmB total payment.According to the new agreement, if the Lai group were not to pay Magnus the 13.5 million RmB then Magnus would have the right to take back its ownership of Long Teng Mining Ltd. without refunding any payments received previously from the Lai group or Magnus may elect to continue to accrue a 10% penalty, RMB 1,228,000, per month until the Company is paid by the Lai group. The Company did not receive the RMB 13.5 million within 10 days of the signing of the agreement.

On May 9, 2009 the Lai group entered into an agreement with a new buyer, Mr. Peijan He, under which the Lai group would transfer its interest in Yunnan Long Teng Mining Ltd. to Mr. He for RMB 24.8 million. As the Lai group still owed Magnus RMB 13.5 million for acquiring its interest in Long Teng, Mr. He verbally agreed to pay RMB 13,500,000 of the purchase price it owes to the Lai group to Magnus instead. As at July 31, 2009 no formal written agreement had been consummated by Magnus and Mr. He. A formal agreement was signed on September 3, 2009. See subsequent events section.

As at July 31, 2009, Magnus had received a total of RMB 8.42 million (about $1,234,000) in proceeds from the sale of Long Teng and was still owed 13.5 million RMB (about $1,976,000).

Yunnan Western Mining Co., Ltd. – Mangshi Property

Under the Modification Agreement (described above), Magnus agreed to transfer its interest in Western Mining to Team 209 in exchange for Team 209’s interest in Long Teng Mining. The Modification Agreement was consummated and accordingly Magnus has no ownership interest in the Mangshi Property or Western Mining.

On November 25, 2005, Magnus acquired 100% of the issued and outstanding shares of Golden River Resources Corp., a private British Columbia company (“Golden River”), which was owned by First Fortune Investments Inc. Golden River was a party to a co-operative joint venture agreement dated August 29, 2003 (the “Mangshi Agreement”) with Team 209. Under the Mangshi Agreement, Golden River and Team 209 formed Western, a sino-foreign joint venture company which held the rights to the Mangshi Property, a mineral exploration property comprising approximately 113.96 square kilometres in Yunnan Province. Golden River had the right to earn a 90% interest in Western Mining, with Team 209 retaining the other 10%.

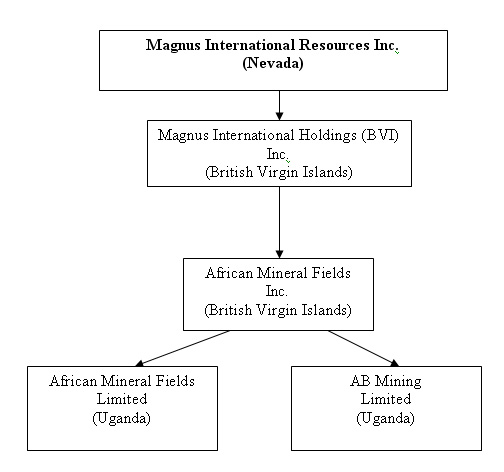

Corporate Structure

The Company has one wholly owned subsidiary, African Mineral Fields Inc. (incorporated under the laws of the British Virgin Islands), which in turn has incorporated two subsidiaries, African Mineral Fields Limited and AB Mining Limited (both incorporated under the laws of Uganda).

The following chart describes the Company’s corporate structure and material subsidiaries:

Notes:

Employees

As of November 1, 2009, the Company had no employees (over and above its directors, officers and consultants) employed in Vancouver, British Columbia.

The Company’s operating subsidiary in Uganda, African Mineral Fields Limited, employs three persons: one accountant and two housekeepers.

The Company employs one person in China who continues to assist in dealing with matters relating to Long Teng and further payments due to Magnus for the sale of its equity interest in Long Teng.

The Company uses consultants with specific skills to assist with various aspects of its exploration, project evaluation, due diligence, acquisition initiatives, corporate governance, property management, and with accounting and legal matters.

Other Property Interests and Mining Claims

The Company currently only has interests in the above-noted properties in Uganda.

Government Regulation

Mining operations and exploration activities are subject to various national, state, provincial and local laws and regulations in the United States, Canada, and Uganda as well as other jurisdictions, which govern prospecting, development, mining, production, exports, taxes, labor standards, occupational health, waste disposal, protection of the environment, mine safety, hazardous substances and other matters.

The Company believes that it is and will continue to be in compliance in all material respects with applicable statutes and the regulations passed in the United States, Canada and Uganda. There are no current orders or directions relating to the Company with respect to the foregoing laws and regulations.

Environmental Regulation

The Company's exploration projects are subject to various federal, state and local laws and regulations governing protection of the environment in North America and Uganda. These laws often change and, as a general matter, are becoming more restrictive. The Company's policy is to conduct business in a way that safeguards public health and the environment. The Company believes that its operations are conducted in material compliance with applicable laws and regulations.

Changes to current local, state or federal laws and regulations in the jurisdictions where the Company operates or may operate in the future could require additional capital expenditures and increased operating costs. Although the Company is unable to predict what additional legislation, if any, might be proposed or enacted, additional regulatory requirements could impact the economics of its projects.

In the preceding year, there were no material environmental incidents or non-compliance with any applicable environmental regulations. The Company estimates that it will not incur material capital expenditures for environmental control facilities during the current fiscal year.

Competition

Magnus is a grassroots mineral exploration company. The mineral exploration industry is competitive, with many companies competing for the limited number of precious and base metals acquisition and exploration opportunities that are economic under current or foreseeable metals prices, as well as for available investment funds. With metal prices at their current levels, activity in the industry has increased dramatically, and competition is also high for the recruitment of qualified personnel and equipment.

The Company believes no single company has sufficient market power to affect the price or supply of gold or other minerals in the world market.

Subsequent Events

On May 9, 2009 the Lai group entered into an agreement with a new buyer for Long Teng Minging, Mr. Peijan He, under which the Lai group would transfer its interest in Yunnan Long Teng Mining Ltd. to Mr. He for RMB 24.8 million. As the Lai group still owed Magnus RMB 13.5 million for acquiring its interest in Long Teng, on September 3, 2009, Magnus entered into an agreement with the Lai group and Mr. He under which Mr. He agreed to pay RMB 13,500,000 of the purchase price it owes to the Lai group to Magnus instead. This RMB 13,500,000 is payable to Magnus under the agreement as follows: RMB 5,000,000 is payable upon issuance of a new business license of Long Teng to Mr. He or his designee; RMB 4,865,000 is payable to Magnus and 135,000 is payable to Yunnan Beichuan Law firm on or before September 28, 2009; and RMB 3,500,000 is payable on or before October 28, 2009. Under the agreement, Magnus is required to pay a commission of RMB 135,000 and legal fees to Yunnan Beichuan Law firm which is acting as a trust agent for the funds. As at the 10 November 2009, a new business license has been issued reflecting that ownership of Long Teng has been transferred to Mr. He. Consequently, Magnus has received RMB 10,000,000 (approximately $1.466 million) pursuant to the agreement and has paid RMB 135,000 in commission and 50,000 in legal fees to Yunnan Beichuan Law firm. As at November 12, 2009, the remaining 3.5 million RmB (approximately $510,000) related to the sale of Long Teng Mining in China has not been received by Magnus.

On December 11, 2008, the Company's indirect wholly-owned subsidiary, African Mineral Fields Limited, received notice that a legal action had been instituted against it in Uganda by Kamu Kamu Drilling Experts Limited, a drill contractor used by the Company in Uganda. Kamu Kamu was seeking special damages in the amount of US$306,595, general damages, interest and costs of the action for the alleged breach by African Mineral Fields Limited of a reverse circulation drilling agreement dated April 29, 2008 between Kamu Kamu and African Mineral Fields Limited. On November 11, 2009, African Mineral Fields entered into a settlement agreement with Kamu Kamu under which Kamu Kamu agreed to deliver to African Mineral Fields a full and final release of its claim in exchange for: (1) US$50,000; and (2) the transfer by African Mineral Fields to Kamu Kamu of 10 mineral properties in Uganda representing 1,706 square kilometers. If any of the properties cannot be transferred then African Mineral Fields will pay an additional US$2,000 to Kamu Kamu for each property that cannot be transferred. The mineral properties are in the process of being transferred, and the Company does not foresee any difficulties in transferring all of the properties to Kamu Kamu.

Magnus intends to transfer the following ten licenses to Kamu Kamu as part of the settlement: EL0005, EL0020, EL0022, EL0023, EL0167, EL0187, EL0188, EL0196, EL0199 and EL0200. One of the licenses is part of the Mwerusandu Project (EL0022). Four of the licenses are part of the Mitoma Property (EL0005, EL0023, EL0187 and EL0188). Five of the licenses comprise the Lugazi Property (EL0020, EL0167, EL0196, EL0199 and EL0200).

Between July 31, 2009 and November 12, 2009, 1,091,374 warrants have expired. 2,134,517 warrants remain outstanding and exercisable at November 12, 2009.

Three of the Company’s exploration licenses in Uganda expired in August 2009: EL0116, EL0122 and EL0123. The Company has reapplied for EL0122 and EL0123.

ITEM 1A. Risk Factors

The following risk factors should be considered in connection with an evaluation of the business of the Company:

THE COMPANY'S LIMITED OPERATING HISTORY MAKES IT DIFFICULT FOR YOU TO JUDGE ITS PROSPECTS.

The Company has a limited operating history upon which an evaluation of the Company, its current business and its prospects can be based. You should consider any purchase of the Company's shares in light of the risks, expenses and problems frequently encountered by all companies in the early stages of its corporate development.

LIQUIDITY AND CAPITAL RESOURCES ARE UNCERTAIN.

For the year ended July 31, 2009, the Company had an operating loss of $795,511. At July 31, 2009, the Company had a working capital deficiency of $2,485,548. Magnus needs to raise additional capital by way of an offering of equity securities, an offering of debt securities, or by obtaining financing through a bank or other entity.

The Company has not established a limit as to the amount of debt it may incur nor has it adopted a ratio of its equity to debt allowance. If the Company needs to obtain additional financing, there is no assurance that financing will be available from any source, that it will be available on terms acceptable to us, or that any future offering of securities will be successful. If additional funds are raised through the issuance of equity securities, there may be a significant dilution in the value of the Company’s outstanding common stock. The Company could suffer adverse consequences if it is unable to obtain additional capital which would cast substantial doubt on its ability to continue its operations and growth.

We have a going concern opinion from our auditors, indicating the possibility that we may not be able to continue to operate.

We anticipate generating losses for the next 12 months. Therefore, we may be unable to continue operations in the future as a going concern. No adjustment has been made in the accompanying financial statements to the amounts and classification of assets and liabilities which could result should we be unable to continue as a going concern. If we cannot continue as a viable entity, our shareholders may lose some or all of their investment in the Company.

There can be no assurance that we will be capable of raising the additional funding that we need to carry out our development and exploration objectives.

The further development and exploration of our mineral properties depends upon our ability to collect on monies owed to the Company or obtain financing through capital markets, or other means. There is no assurance that we will be successful in obtaining financing as and when needed. Unfavorable market conditions may make it difficult or impossible for us to obtain debt financing or equity financing on acceptable terms or at all. Failure to collect monies owed to the Company or to obtain additional financing on a timely basis may cause us to postpone our development plans, forfeit rights in some or all of our properties or reduce or terminate some or all of our operations.

We do not have experience in placing properties into production.

We have no experience in placing mineral properties into production, and our ability to do so will be dependent upon using the services of appropriately experienced personnel or entering into agreements with other major resource companies that can provide such expertise. There can be no assurance that we will have available to us the necessary expertise to take a mineral deposit into production.

THE VALUE AND TRANSFERABILITY OF THE COMPANY'S SHARES MAY BE ADVERSELY IMPACTED BY THE LIMITED TRADING MARKET FOR ITS SHARES AND THE PENNY STOCK RULES.

There is only a limited trading market for the Company’s shares. The Company’s common stock is quoted for trading on the Pink Sheets quotation market and “bid” and “asked” quotations regularly appear on the Pink Sheets quotation market under the symbol “MGNU”. There can be no assurance that the Company’s common stock will trade at prices at or above its present level, and an inactive or illiquid trading market may have an adverse impact on the market price. In addition, holders of the Company’s common stock may experience substantial difficulty in selling their securities as a result of the “penny stock rules”, which restrict the ability of brokers to sell certain securities of companies whose assets or revenues fall below the thresholds established by those rules.

Our stock is a penny stock. Trading of our shares may be restricted by the SEC’s penny stock regulations and FINRA’s sales practice requirements, which may limit a shareholder’s ability to buy and sell our shares.

The Securities and Exchange Commission has defined “penny stock” under Rule 3a51-1 and as such our stock is penny stock. Our securities are covered by the penny stock rules, Rule 15g-9, which imposes additional sales practice requirements, including disclosure requirements, on broker-dealers who sell to persons other than established customers and “accredited investors”. The disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for stock that is subject to the penny stock rules. The penny stock rules may affect the ability of broker-dealers to trade our securities. We believe that the penny stock rules discourage investor interest in, and limit the marketability of, our common stock.

In addition, the Financial Industry Regulatory Authority has adopted rules that require a broker/dealer, when recommending an investment to a customer, to have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low priced securities to their non-institutional customers, broker/dealers must make reasonable efforts to obtain information about the customer’s financial status, tax status, investment objectives and other information. Interpretations of these rules suggest that there is a high probability that speculative low-priced securities will not be suitable for some customers. The Financial Industry Regulatory Authority requirements make it more difficult for broker/dealers to recommend that their customers buy our common stock, which may limit your ability to buy and sell our stock.

Because we do not intend to pay any cash dividends on our shares of common stock, our stockholders will not be able to receive a return on their shares unless they sell them.

We intend to retain any future earnings to finance the development and expansion of our business. We do not anticipate paying any cash dividends on our common stock in the foreseeable future. Unless we pay dividends, our stockholders will not be able to receive a return on their shares unless they sell them.

FUTURE SALES OF SHARES MAY ADVERSELY IMPACT THE VALUE OF THE COMPANY'S STOCK.

If required, the Company may seek to raise additional capital through the sale of common stock. Future sales of shares by the Company or its stockholders could cause the market price of its common stock to decline.

MINERAL EXPLORATION AND DEVELOPMENT ACTIVITIES ARE SPECULATIVE IN NATURE.

Resource exploration and development is a speculative business, characterized by a number of significant risks including, among other things, unprofitable efforts resulting not only from the failure to discover mineral deposits but from finding mineral deposits which, though present, are insufficient in quantity and quality to return a profit from production. The marketability of minerals acquired or discovered by the Company may be affected by numerous factors which are beyond the control of the Company and which cannot be accurately predicted, such as market fluctuations, the proximity and capacity of milling facilities, mineral markets and processing equipment and such other factors as government regulations, including regulations relating to royalties, allowable production, importing and exporting of minerals and environmental protection, the combination of which factors may result in the Company not receiving an adequate return of investment capital.

Substantial expenditures are required to establish ore reserves through drilling, to develop metallurgical processes to extract the metal from the ore and, in the case of new properties, to develop the mining and processing facilities and infrastructure at any site chosen for mining. Although substantial benefits may be derived from the discovery of a major mineralized deposit, no assurance can be given that minerals will be discovered in sufficient quantities and grades to justify commercial operations or that funds required for development can be obtained on a timely basis. Estimates of reserves, mineral deposits and production costs can also be affected by such factors as environmental permitting regulations and requirements, weather, environmental factors, unforeseen technical difficulties, unusual or unexpected geological formations and work interruptions. In addition, the grade of ore ultimately mined may differ from that indicated by drilling results. Short term factors relating to reserves, such as the need for orderly development of ore bodies or the processing of new or different grades, may also have an adverse effect on mining operations and on the results of operations. Material changes in ore reserves, grades, stripping ratios or recovery rates may affect the economic viability of any project.

THE COMPANY WILL BE SUBJECT TO OPERATING HAZARDS AND RISKS WHICH MAY ADVERSELY AFFECT THE COMPANY'S FINANCIAL CONDITION.

Mineral exploration involves many risks, which even a combination of experience, knowledge and careful evaluation may not be able to overcome. The Company's operations will be subject to all the hazards and risks normally incidental to exploration, development and production of metals, such as unusual or unexpected formations, cave-ins or pollution, all of which could result in work stoppages, damage to property and possible environmental damage. The Company does not have general liability insurance covering its operations and does not presently intend to obtain liability insurance as to such hazards and liabilities. Payment of any liabilities as a result could have a materially adverse effect upon the Company's financial condition

THE COMPANY'S ACTIVITIES WILL BE SUBJECT TO ENVIRONMENTAL AND OTHER INDUSTRY REGULATIONS WHICH COULD HAVE AN ADVERSE EFFECT ON THE FINANCIAL CONDITION OF THE COMPANY.

The Company's activities are subject to environmental regulations promulgated by government agencies from time to time. Environmental legislation generally provides for restrictions and prohibitions on spills, releases or emissions of various substances produced in association with certain mining industry operations, such as seepage from tailing disposal areas, which would result in environmental pollution. A breach of such legislation may result in imposition of fines and penalties. In addition, certain types of operations require the submission and approval of environmental impact assessments. Environmental legislation is evolving in a manner which means stricter standards and enforcement, fines and penalties for non-compliance are more stringent. Environmental assessments of proposed projects carry a heightened degree of responsibility for companies and directors, officers and employees. The cost of compliance with changes in governmental regulations could have an adverse effect on the financial condition of the Company.

The operations of the Company including exploration and development activities and commencement of production on its properties, require permits from various federal, state, provincial and local governmental authorities and such operations are and will be governed by laws and regulations governing prospecting, development, mining, production, exports, taxes, labor standards, occupational health, waste disposal, toxic substances, land use, environmental protection, mine safety and other matters. Companies engaged in the development and operation of mines and related facilities generally experience increased costs and delays in production and other schedules as a result of the need to comply with applicable laws, regulations and permits.

Failure to comply with applicable laws, regulations, and permitting requirements may result in enforcement actions thereunder, including orders issued by regulatory or judicial authorities causing operations to cease or be curtailed, and may include corrective measures requiring capital expenditures, installation of additional equipment, or remedial actions. Parties engaged in mining operations may be required to compensate those suffering loss or damage by reason of the mining activities and may have civil or criminal fines or penalties imposed for violations of applicable laws or regulations and, in particular, environmental laws.

THE COMPANY’S PROPERTIES ARE LOCATED IN UGANDA, A DEVELOPING COUNTRY WHICH HAS HISTORICALLY EXPERIENCED PERIODS OF CIVIL UNREST AND POLITICAL AND ECONOMIC INSTABILITY.

All of the Company’s African properties are located in Uganda, a developing country which has historically experienced periods of civil unrest and political and economic instability. Although the political and economic climate in Uganda is currently stable, any negative changes in governmental laws, regulations, economic conditions, or political attitudes in Uganda are beyond the control of the Company and may adversely affect its business.

The Company’s operations may be affected in varying degrees by government regulations, policies or directives with respect to restrictions on production or sales, price controls, export controls, repatriation of income, income taxes, carried interests for the state, expropriation of property and environmental legislation. Magnus may also be required to negotiate property agreements with the Ugandan government, which may impose conditions that will affect the viability of the project such as providing the government with free carried interests or providing subsidies for the development of the local infrastructure or other social assistance. There can be no assurance that Magnus will be successful in concluding such agreements on commercially acceptable terms or that these agreements will be successfully enforced in Uganda.

As a result of the limited but improving infrastructure present in Uganda, land titles systems are not developed to the extent found in many developed nations. Although Magnus believes that it has good title to its mineral properties in Uganda, there is little it can do to control this risk. Magnus holds rights to explore its mineral properties in Uganda, but no assurance can be given that the Ugandan government will not revoke or significantly alter the conditions of the applicable licenses and that such licenses will not be challenged or impugned by third parties. There is no certainty that such rights or additional rights applied for will be granted or renewed on terms satisfactory to Magnus. There can be no assurance that claims by third parties against the Company’s properties will not be asserted at a future date.

We may be unable to enforce our legal rights in certain circumstances.

In the event of a dispute arising at or in respect of our foreign operations, we may be subject to the exclusive jurisdiction of foreign courts or may not be successful in subjecting foreign persons to the jurisdiction of courts in the United States, Canada or other jurisdictions. We may also be hindered or prevented from enforcing our rights with respect to a governmental entity or instrumentality because of the doctrine of sovereign immunity.

COMPETITION MAY HAVE AN IMPACT ON THE COMPANY'S ABILITY TO ACQUIRE ATTRACTIVE MINERAL PROPERTIES, WHICH MAY HAVE AN ADVERSE IMPACT ON THE COMPANY'S OPERATIONS.

Significant and increasing competition exists for the limited number of mineral acquisition opportunities available. As a result of this competition, some of which is with large established mining companies with substantial capabilities and greater financial and technical resources than the Company, the Company may be unable to acquire attractive mineral properties on terms it considers acceptable. Accordingly, there can be no assurance that any exploration program intended by the Company on properties it intends to acquire will yield any reserves or result in any commercial mining operation.

DOWNWARD FLUCTUATIONS IN METAL PRICES MAY SEVERELY REDUCE THE VALUE OF THE COMPANY.

The Company has no control over the fluctuations in the prices of the metals for which it is exploring. A significant decline in such prices would severely reduce the value of the Company.

THE COMPANY CURRENTLY RELIES ON CERTAIN KEY INDIVIDUALS AND THE LOSS OF ONE OF THESE CERTAIN KEY INDIVIDUALS COULD HAVE AN ADVERSE EFFECT ON THE COMPANY.

The Company’s success depends to a certain degree upon certain key members of the management. These individuals are a significant factor in the Company's growth and success. The loss of the service of members of the management and certain key employees could have a material adverse effect on the Company. In particular, the success of the Company is highly dependant upon the efforts of the President, Treasurer, Secretary, CEO and director of the Company, Graham Taylor, the loss of whose services would have a material adverse effect on the success and development of the Company.

THE COMPANY DOES NOT MAINTAIN KEY MAN INSURANCE TO COMPENSATE THE COMPANY FOR THE LOSS OF CERTAIN KEY INDIVIDUALS.

The Company does not anticipate having key man insurance in place in respect of any of its senior officers or personnel, although the Board has discussed and investigated the prospect of obtaining key man insurance for Graham Taylor.

THE COMPANY’S PRESIDENT AND CHIEF EXECUTIVE OFFICER, GRAHAM TAYLOR, ALSO SERVES AS PRESIDENT, CHIEF EXECUTIVE OFFICER AND/OR DIRECTOR FOR SOME OTHER ACTIVE COMPANIES.

Mr. Taylor also serves as president, chief executive officer and/or director for Arcview Entertainment Inc. (a motion picture distribution company). This list may also expand in the future.

Mr. Taylor currently devotes 90% of his time to Magnus and 10% to Arcview Entertainment. As Mr. Taylor focuses part of his time on other companies, this may have a material adverse effect on the success and development of the Company.

WE ARE AN EXPLORATION STAGE COMPANY, AND THERE IS NO ASSURANCE THAT A COMMERCIALLY VIABLE DEPOSIT OR "RESERVE" EXISTS ON ANY PROPERTIES FOR WHICH THE COMPANY HAS, OR MIGHT OBTAIN, AN INTEREST.

The Company is an exploration stage company and cannot give assurance that a commercially viable deposit, or “reserve,” exists on any properties for which the Company currently has (through a joint venture agreement) or may have (through potential future joint venture agreements or acquisitions) an interest. Therefore, determination of the existence of a reserve depends on appropriate and sufficient exploration work and the evaluation of legal, economic, and environmental factors. If the Company fails to find a commercially viable deposit on any of its properties, its financial condition and results of operations will be materially adversely affected.

WE REQUIRE SUBSTANTIAL FUNDS MERELY TO DETERMINE WHETHER COMMERCIAL MINERAL DEPOSITS EXIST ON OUR PROPERTIES.

Any potential development and production of the Company’s exploration properties depends upon the results of exploration programs and/or feasibility studies and the recommendations of duly qualified engineers and geologists. Such programs require substantial additional funds. Any decision to further expand the Company’s operations on these exploration properties is anticipated to involve consideration and evaluation of several significant factors including, but not limited to:

|

▪

|

Costs of bringing each property into production, including exploration work, preparation of production feasibility studies, and construction of production facilities;

|

|

▪

|

Availability and costs of financing;

|

|

▪

|

Ongoing costs of production;

|

|

▪

|

Market prices for the minerals to be produced;

|

|

▪

|

Environmental compliance regulations and restraints; and

|

|

▪

|

Political climate and/or governmental regulation and control.

|

GENERAL MINING RISKS

Factors beyond the control of Magnus may affect the marketability of any substances discovered from any resource properties the Company may acquire. Metal prices, in particular gold and copper prices, have fluctuated widely in recent years. Government regulations relating to price, royalties, allowable production and importing and exporting of minerals can adversely affect the Company. There can be no certainty that the Company will be able to obtain all necessary licenses and permits that may be required to carry out exploration, development and operations on any projects it may acquire and environmental concerns about mining in general continue to be a significant challenge for all mining companies.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

ITEM 2. DESCRIPTION OF PROPERTIES.

Summary

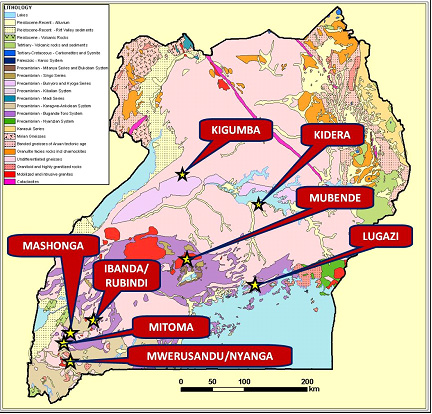

Magnus is a mineral exploration company that specializes in identifying, acquiring and developing precious and base metal properties. Magnus’ objective is to develop a balanced portfolio of early-to-advanced stage projects and is currently focused on gold, uranium and rare earth mineral projects in Uganda. The Company has a 100% interest in eight mineral properties in Uganda at Mubende, Lugazi, Mitoma, Mwerusandu, Rubindi, Kigumba, Kidera and Nyanga. In December 2008, the Company relinquished both its right to earn a 60% interest in a ninth property, Mashonga, and its right to earn an 80% interest in a tenth property, Ibanda.

Properties in Uganda

Geological Map of Uganda Identifying the Company’s Properties

The following disclosure with respect to the Lugazi, Mubende, Mitoma and Mwerusandu Properties is based on a technical report dated May 15, 2007 (the “Uganda Technical Report 1”) prepared by Martin Taylor, an independent consulting geologist hired to complete Canadian NI-43101 compliant reports on behalf of Magnus . The following disclosure with respect to Mashonga is based on the report dated October 10, 2007 (the “Uganda Technical Report 2”) prepared by Martin Taylor. The report is filed at www.sedar.com.

Property Description and Location

The Lugazi, Mubende, Mitoma, Mwerusandu, Rubindi, Kigumba, Kidera and Nyanga Properties comprising approximately 5,796.44 sq. km. are located in central, southern and southwestern Uganda in East Africa. The properties are covered by valid exploration licenses, 26 in total.

Lugazi Property

The Lugazi Property is located some 50 km east of the capital Kampala in the Mukono district of southern Uganda, and is approximately centred at Latitude 0° 18’N and Longitude 32° 52’E. The Property consists of five exploration licenses covering an area of approximately 1,487.69 sq. km.

Mubende Property

The Mubende Property is located some 100 km west-northwest of the capital Kampala in the Mubende and Kiboga administrative districts of south-central Uganda. The Property is approximately centred at Latitude 0° 34’N and Longitude 31° 46’E, and consists of two exploration licenses covering approximately 780 sq. km.

Mitoma Property

The Mitoma Property is located some 320 km southwest of the capital Kampala in the Bushenyi district of south-western Uganda. The Property is approximately centred at Latitude 0° 35’S and Longitude 30° 05’E. The property consists of seven exploration licenses covering an area of 359.49 sq. km.

Mwerusandu Property

The Mwerusandu Property is located some 380 km southwest of the capital Kampala in the Ntungamo district of south-western Uganda. The Property is approximately centred at Latitude 1° 00’S and Longitude 30° 10’E. The property consists of four exploration licenses covering an area of 175.43 sq. km.

Mashonga Property

The Mashonga Property is located some 400 km southwest of the capital Kampala in the Bushenyi district of south-western Uganda. The Property is approximately centred at Latitude 0° 23’S and Longitude 30° 09’E. The property consists of two exploration licenses and three location licences covering an area of 460.87 sq. km.

Ibanda Property

The Ibanda Property is located some 300 km southwest of the capital Kampala in the Bushenyi district of south-western Uganda. The Property is approximately centred at Latitude 0° 08’S and Longitude 30° 32’E. The property consists of one exploration license covering an area of 332.70 sq. km.

Rubindi Property

The Rubindi Property is located some 300 km southwest of the capital Kampala in the Bushenyi and Mbarara districts of south-western Uganda. The Property is approximately centred at Latitude 0° 20’S and Longitude 30° 32’E. The property consists of two exploration licenses covering an area of 720.00 sq. km.

Kigumba Property

The Kigumba Property is located some 200 km north-northwest of the capital Kampala in the Masindi district of western Uganda. The Property is approximately centred at Latitude 1° 53’N and Longitude 31° 50’E. The property consists of four exploration licenses covering an area of 1,765.55 sq. km.

Kidera Property

The Kidera Property is located some 120 km north of the capital Kampala in the Kamuli and Kayunga districts of central Uganda. The Property is approximately centred at Latitude 1° 20’N and Longitude 32° 53’E. The property consists of one exploration license covering an area of 485.00 sq. km.

Nyanga Property

The Nyanga Property is located some 380 km southwest of the capital Kampala in the Ntungamo district of south-western Uganda. The Property is approximately centred at Latitude 0° 57’S and Longitude 30° 11’E. The property consists of one exploration license covering an area of 23.28 sq. km.

Regional Geology

The Archaean Ugandan Craton is part of the African Plate, a large area of continental crust consisting of the accretion of small cratons (e.g. Uganda, Tanzania) welded together by Proterozoic mobile belts. Much of northern and central Uganda is underlain by Archaean basement gneisses. The southwest part of the country, including the exploration licenses of Magnus, is largely underlain by Proterozoic sediments, minor volcanics and intrusive granites. Major rift faulting commenced in the Tertiary and continued to the present. Tertiary volcanism of mafic to intermediate composition and minor carbonatites also occurred. This includes the formation of large shield volcanoes, the most prominent in Uganda being Mt. Elgon on the Kenyan border. Great thicknesses of Tertiary to Recent sediments fill the fault valleys, especially along the Western, or Albertine, Rift in western Uganda.

Precambrian rocks underlie two-thirds of Uganda. Archaean rocks are exposed in the southeast where they are part of the extensive granite-greenstone terrane of the Tanzanian Craton. Three major Proterozoic belts underlie central and west Uganda: the Paleoproterozoic Buganda-Toro metasediments, the Mesoproterozoic Karagwe-Ankolean (Kibaran) Belt in the southwest of the country and Neoproterozoic Pan-African rocks. The Neoproterozoic includes the Bunyoro Series with tillites and argillites, and the undeformed shallow water sediments of the Bukoban Supergroup. Tertiary to Recent sediments have filled parts of the down-faulted Western Rift. Tertiary carbonatites and Cenozoic volcanics are related to rift activities and occur along the eastern and western borders of the country.

The Mashonga region is largely underlain by Igara Group quartz-muscovite schists, quartzites and phyllites of the PalaeoProterozoic Buganda-Toro System. Younger granitic intrusions occur and there is evidence of mafic-ultramafic igneous intrusive bodies (gabbroic or diorite). North of the Mashonga Mine the Igara rocks are covered unconformably by Buhweju Group quartzites and conglomerates of the MesoProterozoic Karagwe-Ankolean System. North-south trending fold axes from isoclinal folded sequences are reported as well as N-S and E-W trending structures. The drainages in the mine area trend southeast, suggesting there is a regional structure parallel to this.

The Buganda-Toro and Karagwe-Ankolean systems have been extensively folded into tight synclines and anticlines, with upright axial planes and, in the southern and central Mashonga area, the former has been intruded by synorogenic porphyritic gneissic adamellites to post-orogenic biotite-bearing alkaline granites and leucocratic, sub-alkaline, per-aluminous granites (“tin granites”). Historical economic Sn, tungsten (“W”), beryllium (“Be”), niobium (“Nb”)/tantalum (“Ta”) deposits occur in similar rocks to the south of the Mashonga Property, hosted within the metasediments on the periphery of the granites. The presence of abundant quartz veining, several gold occurrences and the Sn-W-Be-Ta mineralization in this environment support the typical hydrothermal and epithermal activity of the Intrusive-Related Gold model driving the exploration.

Informal gold production from the Mashonga Mine is reported to come from an east-west trending sheared quartz-vein zone. The mineralized shear appears to be hosted by quartz-muscovite schist, at the contact between the schist and granitic rock. The wallrock of the mine pit, much of which is now filled by slumped material, is comprised of schist and kaolinitized granite with pegmatitic veins and quartz stockwork veining.

Mineralization

Lugazi Property

The style of gold mineralization at the Lugazi area is associated with a belt of sedimentary rocks comprising the Paleoproterozoic Buganda-Toro system, and surrounding granite gneisses. A thermal aureole granite (“TAG”) model is being used in an attempt to understand the mineralization where an Intrusion Related Gold system is expected along with skarn and pegmatite host rocks.

Mubende Property

The style of gold mineralization at the Mubende area is interpreted by the Company as being associated with the roof zones of large batholiths such as the Singo Granite. Greisen alteration has been identified by reconnaissance exploration and an Intrusion Related Gold (“IRG”) system is being modeled, with gold mineralization in disseminated and quartz stockwork styles in the upper roof zones of granites, or in large scale fault zones along the flanks of the intrusions. Tungsten and gold occurrences have been identified on the Singo granites and in surrounding meta-sediments.

Mitoma Property

The Mitoma area is characterized by the presence of historically economic tin, tungsten, beryllium and niobium-tantalum deposits hosted within the Mesoproterozoic metasediments located on the periphery of Proterozoic circular porphyritic granite intrusives. A TAG model is being used by the Company as a guide to the mineralization where an Intrusion Related Gold system is expected along with skarn and pegmatite host rocks. Disseminated sulphides have been observed in some quartzite and schistose lithologies on the property, supported by the numerous gold, tin, tantalum workings with alluvial gold panning has taken place on the license in the past.

Mwerusandu Property

The style of gold mineralization at the Mwerusandu area is associated with sedimentary rocks located in antiforms within the Karagwe-Ankolean system and in conjugate fracture sets in quartzites close to the contact with large granite batholiths termed arena granites. Disseminated sulphides have been observed in some quartzite and schistose lithologies on the property, supported by numerous past gold, tin, tantalum and tungsten alluvial workings within the property. A light green, arsenic rich alteration phase identified as scorodite is also associated with gold mineralization at the Nyamulindira license. A TAG model is being used in an attempt to understand the mineralization where an Intrusion Related Gold system is expected along with skarn and pegmatite host rocks.

Mashonga Property

The style of gold mineralization at the Mashonga area is associated with shear zones hosted by early-Proterozoic schists which are adjacent to late tin-bearing granite intrusions. An unconformity related gold system is used to model the style of mineralisation, with the younger, mid-Proterozoic Karagwe-Ankolean system forming an unconformable relationaship with the older Buganda Toro system. In the basement schists and granites, a TAG model was being used in an attempt to understand the mineralization where an Intrusion Related Gold system is expected along with skarn and pegmatite host rocks.

Artisanal gold production from the Mashonga Mine is reported to come from an east-west trending sheared-quartz vein zone, tentatively interpreted by Magnus to be a splay off a northwest-trending regional structure. The mineralized shear appears to be hosted by quartz-muscovite schist, or at the contact between the schist and granitic rock. Parts of the open cast wallrock are kaolinitized granite with pegmatitic veins and a quartz stockwork.

The presence of anomalous platinum group elements (“PGE”) values in rock samples from the mine area and possibly anomalous Terra Leach soils from further east suggest the gold mineralization in the Buganda-Toro sediments may have a significant PGE association.

In the Mashonga area the Company believes there is an IRG style of mineralization. This model takes into account both large veins which occur on the margins of granite bodies as well as granite hosted sheeted, stockwork or pegmatitic veins. In the larger veins such as mined at Mashonga, high gold grades can be expected. Any potential economic deposit, however, is more likely to be a lower grade, granite hosted system which calls for alternative exploration techniques (multi-element geochemistry, IP to detect zones of silicification, magnetic halo anomalies, recognition of metal/element assemblages and unique features such as unidirectional solidification textures, greisens and pegmatites).

Ibanda Property

The style of gold mineralization at the Ibanda area is similar to Mashonga, and is also associated with shear zones hosted by early-Proterozoic schists which are adjacent to late tin-bearing granite intrusions. An unconformity related gold system is used to model the style of mineralisation, with the younger, mid-Proterozoic karagwe Ankolean system forming an unconformable relationaship with the older Buganda Toro system. In the basement schists and granites, a TAG model is being used in an attempt to understand the mineralization where an Intrusion Related Gold system is expected along with skarn and pegmatite host rocks.

Rubindi Property

The style of gold mineralization at the Rubindi area is similar to Mashonga, and is also associated with shear zones hosted by early-Proterozoic schists which are adjacent to late tin-bearing granite intrusions. An unconformity related gold system is used to model the style of mineralisation, with the younger, mid-Proterozoic karagwe Ankolean system forming an unconformable relationaship with the older Buganda Toro system. In the basement schists and granites, a TAG model is being used in an attempt to understand the mineralization where an Intrusion Related Gold system is expected along with skarn and pegmatite host rocks.

Kigumba Property

The style of mineralization at the Kigumba area is expected to be related to a large 22km long by up to 4km wide radiometrics anomaly, which was identified from the airborne geophysical survey covering 80% of the country. The uranium response is particularly strong, so the area will be tested initially for uranium potential associated with the sheared limb of a folded sequence.

Kidera Property

The style of mineralization at the Kidera area is expected to be related to a large 7km by 5km circular radiometrics anomaly, which was identified from the airborne geophysical survey covering 80% of the country. This radiometrics anomaly has a similarity in size to the carbonatite complexes such as Tororo and Sukulu Hills, located in the southeastern part of Uganda. The large anomaly will be examined for vermiculite, phosphate and rare earth metals, commonly associated with carbonatite rocks. In addition, a field of distinct magnetic bullseyes, will be tested for diamond potential, as they resemble kimberlite pipes.

Nyanga Property

The style of mineralization at the Nyanga area is tantalum which is associated with large pegmatite bodies that are hosted by metasedimentary rocks of Karagwe-Ankolean age. Mining operations at three locations at Nyanga occurred during the 1930 – 1960’s producing a total of 130,000t tantalum. These operations were suspended in 1960. The Nyanga deposit is hosted by a pegmatite body measuring 370m and with a width of approximately 54m.

Exploration

Lugazi Property

A detailed soil sampling program comprising over 1500 soil samples delineated a strong 300 – 700m wide gold-in-soil anomaly over a length of 3.5 km. The anomaly is offset to the east, and there are indications that the anomaly is open ended in this direction. A fixed wing, high resolution airborne magnetic and radiometric survey was flown on the Lugazi licence and covered 574.5 sq km at 200m line spacing. The results from the survey show a close correlation between the gold-in-soil anomaly and magnetic rich stratigraphic horizons as well as elevated potassic levels.

A Reverse Circulation (RC) drill program comprising a total of 31 holes for 2,037m was completed in February 2008, along three lines at the Kiyola, Nantula and Katente targets. The RC holes were drilled at about 50m intervals along a fence across the soil anomaly, and were designed to investigate the nature of the weathered profile to an average depth of some 65m. As no previous gold mineralisation has been reported from this belt the Company thought it

would be important to understand the source of the anomalous gold in soils and attempt to identify possible structures that could be followed up during subsequent phases of exploration. This drilling is the culmination of early stage exploration at Lugazi which commenced in May 2006.

The most significant RC drill results include:

|

|

§

|

4m at 0.98 g/t gold from 18m in LUG006 at the Kiyola target (incl. 2m at 1.3g/t)

|

|

|

§

|

2m at 0.50 g/t gold from 64m in LUG007 at the Kiyola target

|

|

|

§

|

2m at 1.50 g/t gold from 2m in LUG017 at the Nantula target

|

|

|

§

|

2m at 1.20 g/t gold from 9m in LUG028 at the Katente target

|

On a more regional scale, a total of 1,456 soil samples were collected along regional lines, planned to investigate additional gold, as well as base metal rich horizons. The results of these soils have not demonstrated an anomalous gold trend. A zone of low level gold was indicated on a single north-south line, with values between 20 and 30 ppb. Infill sampling did not extend this zone to the west or east. The nickel and chromium values of these samples did not show anomalism related to a buried source for base metals.

Mubende Property

A regional alteration and structural interpretation over Mubende has been completed. This information together with the historical airborne geophysical data indicates that the eastern end of the Singo batholith could be prospective for granite related gold systems. A follow-up soil geochemical program was completed, which targeted the northern and southern boundaries of the granite batholith. In total 1,001 soil samples were collected along lines on elevated topography to avoid the wide swampy drainages in this region. The samples were sieved to -80 mesh fraction and analyzed for gold by means of aqua regia and AAS finish. Prior to these soil samples, a program of low level terra leach soil sampling was completed over the southwestern portions of the licence. A total of 554 terra leach samples were collected. The results of the soil sampling have not delineated any clear targets to follow up.

Mitoma Property

2,546 soil samples have been collected over different areas of the property in seven phases. The samples were analyzed with the Terra Leach partial digest method and have delineated gold-in-soil anomalies at the Kahungye (EL 0023), Rugoma (EL 0025) and Rutaka (EL 0024) exploration licenses. The assay results were received from soil samples analysed by Agua Regia together with Pits at Kayhunge. The results from agua regia confirm anomalous gold within the surface profile with levels between 20-30 ppb gold with one value of 50 ppb. The results of pitting confirm low level gold (0.14 g/t) in the uppermost 30 cm in Pit 2. The gold tenors in the bedrock schist vary between 0.02 g/t and 0.05 g/t. The surface soil values in the 20-30 ppb range therefore appear to be reflecting values in schist of 0.02-0.05 g/t Au. i.e. the magnitude of the soil anomaly corresponds with values occurring in bedrock.

Exploration at the southern licences, called Kabira (EL 0005, 0117, 0187, 0188), has included the collection of 957 soil samples, which were analysed for low level gold by means of terra leach method. The results show very low levels of gold associated with the metasediments of the Karagwe-Ankolean system. The main anomalous area is located in the south-eastern portion of EL0005 where gold shows a clear correlation with copper. During fiscal year 2008, a limited infill soil survey was completed at the Kabira license on the Mitoma Property. Some 43 soil samples were collected to test previous anomalies delineated in previous exploration. The results do not indicate an extensive zone of anomalous soil values.

Mwerusandu Property

Exploration activity at the Mwerusandu Property has included: soil sampling over the Nyamulindira and Kiana Mine licences and preparation was made for a planned 500m RC drill program which has not been executed. A total of 1,016 terra leach soil samples have been collected, mostly in the northern part of the area, which has defined a clear gold in soil anomaly hosted by quartzites and schist’s of the mid-Proterozoic Karagwe-Ankolean system, parallel to the contact with a granitoid body, referred to as ‘arena’ granites. The northern part of the soil anomaly is 200m in length and covers a silica-scorodite altered rock outcrop, while further to the south a 1km long anomaly is situated in