Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

þ ANNUAL REPORT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended August 31, 2010

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ___________ to ___________.

Commission file number 000-53711

AMICO GAMES CORP.

(Exact name of registrant as specified in its charter)

|

Nevada

|

98-0579264

|

|

|

(State or Other Jurisdiction of Incorporation of Organization)

|

(I.R.S. Employer Identification No.)

|

Room North-02, 9th Floor, Flat A,

No. 89 Zhongshan Avenue West, Tianhe District,

Guangzhou, Canton Province, China 510630

(Address of principal executive offices) (ZIP Code)

+86 20 8556 2666

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section12(g) of the Act: Common Stock, $0.00001 par value

Indicate by check mark whether the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for shorter period that the registrant as required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark whether the registration has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that he registrant was required to submit and post such files). Yes o No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer o Accelerated filer o Non-accelerated filer o Smaller reporting company þ

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act) Yes o No þ

State the aggregate market value of voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and ask price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter.

The aggregate market value of Common Stock held by non-affiliates of the Registrant was $4,186,550 based on a $0.2263 closing price for the Common Stock on February 26, 2010. For purposes of this computation, all executive officers and directors have been deemed to be affiliates. Such determination should not be deemed to be an admission that such executive officers and directors are, in fact, affiliates of the Registrant.

Number of common shares outstanding at November 23, 2010: 219,000,000

TABLE OF CONTENTS

| 2 | |

| 2 | |

| 16 | |

| 16 | |

| 16 | |

| 16 | |

| 16 | |

| 17 | |

| 17 | |

| 18 | |

| 18 | |

| 18 | |

| 23 | |

| 23 | |

| 23 | |

| 24 | |

| 24 | |

| 28 | |

| 29 | |

| 31 | |

| 31 | |

| 32 | |

| 32 | |

| 32 | |

| 33 |

1

Forward-looking Statements

This annual report contains forward-looking statements. These statements relate to future events or our future financial performance. In some cases, you can identify forward-looking statements by terminology such as "may", "should", "expects", "plans", "anticipates", "believes", "estimates", "predicts", "potential" or "continue" or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors that may cause our or our industry's actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable laws, including the securities laws of the United States, we do not intend to update any of the forward-looking statements so as to conform these statements to actual results.

As used in this annual report, the terms "we", "us", "our", “our company”, and "Amico" mean Amico Games Corp. and all of our subsidiaries, unless otherwise indicated.

All dollar amounts refer to US dollars unless otherwise indicated.

Overview and Recent Business Developments

We were incorporated under the name Destiny Minerals Inc. on February 12, 2008 under the laws of the State of Nevada. On September 23, 2009 we filed an amendment to our articles of incorporation to change our name to Amico Games Corp., and on November 27, 2009 we entered into a share exchange agreement with Vodafun Limited (“Vodafun”), now our wholly owned subsidiary. The closing of the transactions contemplated by the share exchange agreement occurred on December 31, 2009, at which time we adopted the business of Vodafun. Our principal offices are located at Room North-02, 9th Floor, Flat A, No. 89, Zhongshan Avenue West, Tianhe District, Guangzhou, Canton Province, China 510630. Our telephone number is (8620) 85562666. Our fiscal year end is August 31.

Previous Business

Before we experienced the change of control and closed the transactions contemplated by the share exchange agreement with Vodafun, we were an exploration stage corporation. An exploration stage corporation is one engaged in the search for mineral deposits or reserves which are not in either the development or production stage. We intended to conduct exploration activities on one property located in the Province of Quebec, Canada. Record title to the property upon which we intended to conduct exploration activities was held in our name. The property consists of nine claims containing 503.79 hectares and is subject to a 1% net smelter royalty. We intended to explore for gold on the property. On September 25, 2009 we allowed the claim to this property to lapse. Our management made the decision that the property did not merit any additional expenditure based on limited exploration work

2

Share Exchange

On November 27, 2009 we entered into a share exchange agreement (the “Share Exchange Agreement”) with Vodafun Limited, a company incorporated under the laws of the British Virgin Islands (“Vodafun”) and Tian Yuan, the former sole shareholder of Vodafun. According to the terms of the Share Exchange Agreement, we agreed to acquire 100 common shares of Vodafun, which was and currently is all of the issued and outstanding common shares of Vodafun, from Tian Yuan in exchange for 54,500,000 shares of our common stock.

On December 31, 2009 we closed the transactions contemplated by the Share Exchange Agreement and acquired Vodafun as our wholly owned subsidiary. Vodafun has entered into a series of contractual obligations with Galaxy Software (Guangzhou) Limited (“Galaxy”), a company incorporated under the laws of the People’s Republic of China (“China”) that is engaged in the business of producing and distributing web-based video games played on mobile phones for the Chinese market, as well as the holders of 100% of the voting shares of Galaxy. A full description of these contractual arrangements is included under the heading “Organization”, below.

We had 48,000,000 shares of our common stock issued and outstanding before the closing of the transactions contemplated by the Share Exchange Agreement. Upon the closing of the transactions, we issued 54,500,000 shares of our common stock to Tian Yuan, the former sole shareholder of Vodafun and cancelled 29,800,000 shares of our common stock held by Emad Petro, our former director and officer, pursuant to an agreement with Mr. Petro. The 54,500,000 shares were issued in reliance upon an exemption from registration pursuant to Regulation S promulgated under the Securities Act of 1933, as amended (the “Securities Act”).

Prior to our entry into the Share Exchange Agreement, Tian Yuan was the sole officer, director and beneficial owner of Vodafun. Further details on the transactions contemplated by the Share Exchange Agreement can be found in our Current Report on Form 8-K filed with the Securities and Exchange Commission on November 30, 2009.

On April 16, 2010, our board of directors approved a dividend of our common stock pursuant to which all shareholders as of May 10, 2010 received 2 new shares of our common stock for each share then held. This resulted in the increase of our issued and outstanding shares to 219,000,000, which is the amount of shares issued and outstanding as of the date of this Annual Report on Form 10-K.

Organization

Our relationship with Galaxy and its shareholders is governed by a series of contractual arrangements between Vodafun, Galaxy and the holders of 100% of the share capital of Galaxy (the “Galaxy Shareholders”). Under the laws of China, the contractual arrangements constitute valid and binding obligations of the parties of such agreements. Each of the contractual arrangements and the rights and obligations of the parties thereto are enforceable and valid in accordance with the laws of China. Other than pursuant to the contractual arrangements between Vodafun and Galaxy described below, Galaxy cannot transfer 100% of the funds generated from their operations. The following diagram illustrates the organizational chart of our company:

The contractual arrangement refers to the following agreements signed on April 15, 2009 between Vodafun, Galaxy and the Galaxy Shareholders:

Consulting Services Agreement. Pursuant to this agreement between Vodafun and Galaxy, Vodafun has the exclusive right to provide Galaxy with consulting and daily operations services, including advice and strategic planning in relation to mobile phone game development, human resources, research and development and business growth. Galaxy agreed to pay an annual consulting service fee to Vodafun that is equal to 100% of Galaxy’s revenue for such year, based on Galaxy’s yearly financial statements. This agreement shall remain in force unless otherwise terminated. Vodafun is entitled to assign all the rights granted pursuant to this agreement to China Media.

Business Operating Agreement. Pursuant to this agreement among Vodafun, Galaxy and the Galaxy Shareholders, Vodafun has the right to appoint or remove Galaxy directors and executive officers. In addition, Vodafun agrees to guarantee Galaxy’s performance under any agreements or arrangements relating to its business arrangement with any third party. Upon the request of Galaxy, Vodafun agrees to provide loans to support Galaxy’s operational capital requirements and provide guarantees if Galaxy needs to apply for loan from any third parties. In return, Galaxy agrees to pledge its accounts receivable and all of its assets to Vodafun. The term of this agreement is ten years; and may be extended or terminated exclusively by Vodafun by providing 30-day written notice. Vodafun is entitled to assign all the rights granted pursuant to this agreement to any party designated by Vodafun.

3

Equity Pledge Agreement. Pursuant to this agreement among Vodafun, Galaxy and the Galaxy Shareholders, the Galaxy Shareholders pledged all of their equity interest in Galaxy to Vodafun to guarantee Galaxy’s performance of its obligations under the Business Operating Agreement. If Galaxy or its shareholders breach their respective contractual obligations, Vodafun, as the pledgee, will be entitled to certain rights, including the right to sell the pledged equity interests. The Galaxy Shareholders also agree that upon occurrence of any event of default, Vodafun shall be granted an exclusive, irrevocable power of attorney to take all actions in the place and stead of the Galaxy Shareholders to carry out the security provisions of the Equity Pledge Agreement and take any action and execute any instrument that Vodafun may deem necessary or advisable to accomplish the purposes of the Equity Pledge Agreement. The Galaxy Shareholders agreed not to dispose of the pledged equity interests or take any actions that would prejudice Vodafun’s interest in the pledged interest. This equity pledge agreement shall expire two years after Galaxy’s obligations under the Consulting Services Agreement have been fulfilled. Vodafun is entitled to assign all the rights granted pursuant to this agreement to any party designated by Vodafun..

Exclusive Option Agreement. Pursuant to this agreement among Vodafun, Galaxy and the Galaxy Shareholders, the Galaxy Shareholders irrevocably granted to Vodafun an exclusive option to purchase, to the extent permitted under Chinese law, all or part of the equity interests in Galaxy for the minimum amount of consideration permitted by applicable Chinese law. Vodafun has sole discretion to decide when to exercise the option, whether in part or in full. The term of this agreement is ten (10) years from April 15, 2009 and may be extended prior to its expiration by written agreement of the parties.

Voting Right Proxy Agreement. Pursuant to this agreement among Vodafun, Galaxy and the Galaxy Shareholders, the Galaxy Shareholders agreed to irrevocably grant Vodafun the right to exercise the Galaxy Shareholders’ voting rights and their other rights, including the attendance at and the voting of the all the shares held by the Galaxy Shareholders at shareholders’ meetings (or by written consent in lieu of such meetings) in accordance with applicable laws and Galaxy’s Articles of Association, including but not limited to the rights to sell or transfer all or any of their equity interests in Galaxy, and appoint and vote for the directors and Chairman as the authorized representative of the shareholders of Galaxy. This agreement may be terminated by joint consent of the parties or upon 30-day written notice from Vodafun.

Description of Business

Upon acquiring Vodafun pursuant to the share exchange, we adopted the business of Vodafun. We are now engaged in the development and distribution of mobile phone games for the Chinese market.

Principal Products

We are an information technology company specializing in developing and distributing mobile phone games for the Chinese market. Our games are delivered across JAVA and WAP platforms over third generation (“3G”) and second and a half generation (“2.5G”) mobile telecommunication networks in China. The term “mobile phone game” refers to video games which are played on mobile, or cellular, phones. This definition does not include games played on personal digital assistants, handheld computers or handheld video game system such as PlayStation Portable or Nintendo DS. The mobile phone games developed by Galaxy can be played on mobile phone devices that are commercially available in the retail market in China. The majority of our games are “networked” or “multiplayer” because they are played over the mobile internet network over 2.5G and 3G platform in China. This allows players to interact with each other in the game environment so that a number of players can be involved together in one game over the mobile internet. We believe this provides the game players with a more varied and interactive gaming experience.

We have developed over 10 mobile phone games since our inception. We are capable of providing interactive multiplayer mobile phone games through multiple technology platforms to mobile phone end users. Most of our games are delivered through the 2.5G and 3G technology platform, using the WAP and Java™ protocols, which offer high quality graphics, rich content and interactivity. In the past we have also offered games through the SMS platform on 2G network technology, but have stopped developing and distributing games on this network since March of 2008 as it is becoming antiquated with enhancements to the Chinese mobile telecommunications network. 2G, 2.5G and 3G are different variations of the mobile telecommunication systems and platforms carrying application services including wide-area wireless voice telephone, mobile internet access, video calls and/or mobile TV throughout China, with 2G being the earliest and least capable of the kind of data transmissions required by complex multiplayer games, and 3G being the newest and most capable.

The followings are the types of mobile phone games we currently develop and deliver over the 2.5G and 3G telecommunications network in China:

|

●

|

WAP games: Wireless Application Protocol (“WAP”) is an open standard for communication between mobile phones and the internet. WAP allows for the delivery of web data to mobile phones with relatively small screen displays as it compresses the data appropriately. It allows users to download color and animated pictures and other interactive game content on their mobile phones so that users can request and receive information in a manner similar to accessing information on Internet web sites using personal computers.

|

We began the testing of our first WAP game, Miracle Journey to the West, in January of 2006, but did not begin to receive revenues for from this game until our final ‘live’ testing carried out in May of 2006. We also launched two more WAP games: Miracle Jiutian in July of 2007 and Fantasy Wulin in October 2008. We have begun generating revenue from these two games as well.

|

●

|

Java™ games. Java™ is the software that has been specifically designed by Sun Microsystem to enable the development of applications on mobile devices; allowing mobile phone users to play interactive and multiplayer mobile phone games. Java™ is the most common application development platform for mobile games and allows for more advanced information and game play than WAP.

|

We started testing of its Java™ game, Journey to the West OL, in June of 2008, and has been receiving revenues for this game since final testing in May 2009.

4

The following are the names and details of the mobile phone games developed by us and which are currently available on the mobile internet of China through various mobile service providers:

|

Miracle Journey to the West

|

Miracle Jiutian

|

Fantasy Wulin

|

Journey to the West

OL

|

Journey to the West: déjà vu

|

|

|

Development Platform

|

WAP

|

WAP

|

WAP

|

Java ™

|

Java ™

|

|

Mobile Network

|

2.5G and 3G

|

2.5G and 3G

|

2.5G and 3G

|

2.5G and 3G

|

2.5G and 3G

|

|

Final Test Date

|

May 2006

|

September 2007

|

October 2008

|

May 2009

|

September 2010

|

|

●

|

Miracle Journey to the West is an adaptation of a famous Chinese novel: Journey to the West. The game incorporates many of the well known sites, scenes and characters from the classic novel. Miracle Journey to the West’s virtual game world was designed according to the novel’s story which revolves around the Tang Dynasty. The game provides players with real-time graphics mapping, real-time fighting effects and other WAP graphic technologies. The game also provides players with interactive game play functions such as fighting, upgrading characters, skill, task, various transactions, chatting, etc. To increase appeal of the game and enrich the users’ gaming experience we add new content by updating the game on a weekly basis.

|

5

|

●

|

Miracle Jiutian‘s theme is based on a famous, ancient Chinese martial arts story. The game environment is a highly stylized virtual world with eastern martial-arts characters, in which many famous Chinese factions and cities are presented.

|

6

|

●

|

Fantasy Wulin is a multiplayer mobile phone role playing game. It is an adaptation of traditional Chinese warrior stories and legends. Once a player downloads the game, they assume a fictional character of their choosing and interact with other players and challenge the game’s artificial intelligence to become a Wulin warrior. The game provides detailed scenarios and diversified interactive environments for extended and repeated gaming.

|

|

●

|

Journey to the West Online is a multiplayer mobile phone game on the Java™ platform. The virtual game world of Journey to the West Online is based on Chinese mythology, is presented in a popular cartoon design style, and provides a rich, personal computer-like, online game experience due to the flexibility of the Java™ platform. The game provides an environment which promotes extended game play recurring usage by providing the ability to build long term relationships with other users through interactions and opportunities within the game itself. The games allows players to upgrade and enhance their fictional character’s status and skills, as well as providing other extended gaming through access to secret communities, various country affiliations and even the ability to engage in virtual ‘marriage’ with other users.

|

7

|

●

|

Journey to the West: déjà vu is the second Java game of the Company and the third installment of its popular "Journey to the West" series. Based on the famous Chinese novel, Journey to the West, the game series introduces many sites, scenes and roles from this classic book set during the Tang Dynasty. Journey to the West: deja vu' has more powerful engines, content and enhanced graphics than our first Java game. It is the first game to be distributed through company portal E-Ge-Ge.

|

8

All of our games have exhibited success in the market with Miracle Journey to the West setting the standard with an 11.1% share of the multiplayer WAP game market with approximately 28,000,000 registered users as of August 31, 2010. Below is a graph depicting the growth of registered users for all of our games over the last two years:

We anticipate developing, or licensing, further games and technologies for distribution in our market over the next 12 months. Our current areas of focus are:

|

1.

|

Develop software to allow users to generate maps and game play scenarios for Journey to the West OL.

|

|

2.

|

Develop software that would allow users to operate our games on a larger number of platforms such as the iPhone and personal computers.

|

|

3.

|

Develop WAP 2.0 support for our WAP games to take advantage of the benefits offered by this newer standard.

|

|

4.

|

Develop additional Java™ games as the Chinese telecommunication network moves towards 3G compatibility. We hope our aggressive strategy in this area will establish us as a leader in this newly developing market.

|

|

5.

|

Create in-game ‘goods’ which may be purchased by the players to increase their game experience or enhance their status in the game. We anticipate this to provide us with additional revenue.

|

|

6.

|

Develop our own online mobile game platform and become not just a content provider, but a service provider by allowing players to access our games directly from our own websites.

|

|

7.

|

Investigate the possibility of licensing foreign developed games for use on the Chinese network in order to rapidly increase our game offerings and strengthen our position in the market.

|

|

8.

|

Develop games for Nokia's Symbian and Google's Android mobile operating systems.

|

Customer Service

We view the distributors of our games as well as the end users as our customers and believe that proper customer service is the key to building our brand and enhancing the attractiveness of our products. Accordingly, we have established a customer service call center comprised of 12 people at the moment. We train our customer services representatives with an emphasis on customer satisfaction. Our customer service department handles calls, faxes and e-mails from our end users and provides training materials to our customers to enhance their experience with our games.

9

Markets

In recent years, the telecommunications industry in China has been growing at a rapid pace, particularly in the mobile telecommunications market segment. China is now the largest mobile telecommunications market in the world. According to data announced by the Ministry of Industry and Information Technology of China (“MII”), over 60% of China’s population, that is amounted to over 830 million people, are mobile phone users as of September 2010. Of the entire mobile phone user population in China, approximately 35% or 277, million mobile phone users have been surfing the mobile internet on their cell phone, quoted from a reported published by China Internet Network Information Center in July 2010. Among the 277 million mobile internet users, about 21.1% are frequent mobile phone games players..

Mobile games are part of value-added services in telecommunication that include those services that are not part of the basic voice offer. Mobile value-added services allow mobile phone end users to receive and transmit text, images and other forms of digital data or voice content via their mobile handsets. Chinese mobile phone end users have been quick to adopt and use mobile value-added services as an alternative means of communication, as well as a source of information and entertainment. This has made mobile value-added services one of the fastest growing sectors within China’s rapidly evolving telecommunications industry.

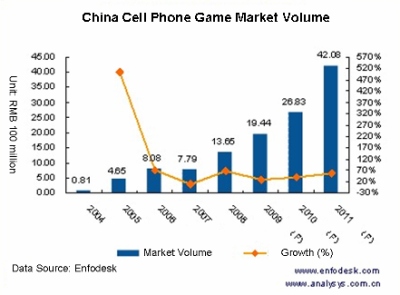

With respect to the aggregate market scale of mobile games in China, Analysys International forecasted that by 2011 the market size will reach $508.7 million (or RMB 4.208 billion yuan), up from $165 million (or RMB 1.365 billion yuan) in 2008 with a compound growth rate of 45.54% in the 2008-2010 period. The high growth is mainly based on the factors such as the rising demand for creation and entertainment services by users, the commercial use of 3G telecom network and the recent increase in the use of third party payment gateways and more efficient distribution models. The mobile phone game market volume is expected to experience steady and substantial growth in the future as well.

As of June 30, 2010, 25.2 million mobile phone users have subscribed China's 3G mobile phone services, according to announcement of MII. Our management expects that with the increase of 3G usage throughout China, mobile phone gaming usage will also increase as the 3G network will be able to provide a more user friendly and well developed game experience. Below is a graphical illustration of the Chinese mobile, or cell phone, game market as well as a forecast for continued growth developed by Enfodesk:

10

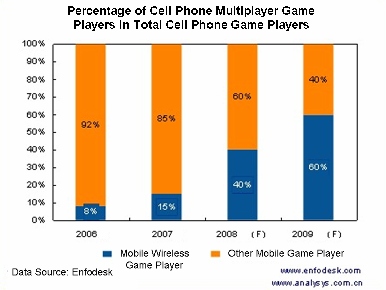

Below are charts illustrating the amount of game players and the amount of those players who will be focusing on multiplayer games such as the one primarily developed by us:

11

Distribution Methods and Customers

Through Distributors

We distribute our mobile phone games to our end customers through carefully selected distributors, or mobile value-added service providers, who work directly with the mobile telecommunications networks. These mobile value-added service providers take the role of distributors to enhance the visibility of our mobile phone games as they have an established market presence in providing services to mobile phone users. Our distributors set up WAP based internet sites which can be accessed by users of mobile internet features provided by telecommunication operations in China Mobile.

As of August 31, 2010, we had established cooperation arrangements with the following mobile value-added service providers in China:

|

●

|

Shenzhen Tencent Computer System Co., Ltd. (“Tencent”), a Chinese based company listed on the Hong Kong stock exchange. Tencent is the operator of QQ, the most popular free instant messaging computer program in China. According to statistics distributed by Tencent, at any time QQ had over 100,000,000 concurrent online users as of August 2010. Currently, Tencent provides 22 servers to host four of our mobile phone games. Tencent is our major distributor and key partner responsible for the distribution of the following games: Miracle Journey to the West, Fantasy Wulin and Journey to the West OL.

|

We have also maintained a strong distribution relationship directly with telecommunication operators including China Mobile and China Unicom. Our games use a third-party payment system provided by China Mobile for service providers who distribute their products through China Mobile, and our Miracle Jiutian game is expected to be operated in the game center of China Unicom and distributed directly by this operator. According to official statistics, China Mobile had 564 million users as of August 2010 and China Unicom had 320 million as of December 2009.

Direct Distribution

In August 2010, we started our direct distribution channel by launching our game portal, named "E-Ge-Ge" (which means "Big Brother" in Chinese). The game portal constitutes a consolidated platform to carry a number of mobile games and distribute directly to cell phone users in China. Cell phone users are able to access the game portal through the following domain names: <www.egege.com.cn> or <www.01234.com.cn>. Direct distribution allows us to receive a larger percentage from the revenue generated by our mobile games, without the need to share the revenue with distributors. The game portal operates on a membership basis and leverages on our strategic partners to attract a large and loyal user base.

Marketing

Our marketing programs include online advertising and customer referral, all leveraging on the mass community established by our distributors. Our sales and marketing groups work closely with our research and development and technology development department to coordinate our product development activities, product launches and ongoing demand and supply planning.

12

Competition

We face competition from various software production companies ranging from small, private businesses to large, state-sponsored enterprises. Some of our major competitors include Beijing Troodo Information Technology Co., Ltd. and Beijing Kongzhong Information Technology Co., Ltd. We compete with both mobile phone developers and personal computer game developers. We compete with these companies for market penetration, but also for favorable relationships with developers as well as experienced and talented employees.

Because there is a relatively low entry barrier, there are numerous mobile phone games developers in China. Some of the larger ones are as follows:

|

Competitor Name

|

Approximate Annual Sales Revenue

|

Product/Service

|

|

Beijing Pearl-in-Palm Information Co., Ltd.

|

$500,000

|

PC games and Java online games implementing multi-platform operation strategy. The games are free; revenue is generated through sale of virtual goods which are used in the games.

|

|

Beijing Kongzhong (China) Information Technology Co., Ltd.

|

$1,000,000

|

|

|

Beijing Lakoo Game Software Development Co., Ltd.

|

$400,000

|

|

|

Beijing Troodo Information Technology Co., Ltd.

|

$1,300,000

|

However, our management believes that our biggest competition are companies which develop personal computer games as they have greater access to capital, more technology resources, stronger marketing channels and more research and development capability. Though these companies have not yet entered the mobile phone game industry, our management expects them to do so some time in 2011.

Some of our competitors may have longer operating histories, better brand recognition and greater financial resources than we do. In order for us to successfully compete in our industry we will need to:

|

●

|

Continue developing new games to build our revenue stream and interest new customers in our products;

|

|

●

|

continue developing our relationships with distributors; and

|

|

●

|

increase our financial resources.

|

However, there can be no assurance that even if we do these things we will be able to compete effectively with the other companies in our industry.

Our management believes that we have certain strengths which will help us compete in our industry. Among these are:

|

1.

|

a good reputation and well known brand in the Chinese mobile phone game market;

|

|

2.

|

well established sales relationship with China’s largest telecommunication companies such as Tencent, China Telecom, China Unicom, and DownJoy;

|

|

3.

|

15,000,000 registered mobile phone multiplayer game users, occupying 10% market share;

|

|

4.

|

new technology to adjust its Java™ based games to fit different screen size of various models of mobile phones; and

|

|

5.

|

strong marketing structure developed through leveraging on our established partnerships with Shenzhen Tencent, China Mobile, and China Unicom.

|

13

Intellectual Property

We have not filed for any protection of our name or trademark. We do hold intellectual property rights in the mobile phone games which we have developed. The following is a list of intellectual property rights in mobile phone games which we have developed:

1. PC Software Copyright Registration Certificate of E-Love (2003);

2. PC Software Copyright Registration Certificate of Empire Times (2003);

3. PC Software Copyright Registration Certificate of Jianghu Domination (2003);

4. PC Software Copyright Registration Certificate of Tang Dynasty Journey to the West (2004);

5. PC Software Copyright Registration Certificate of Miracle Journey to the West (2007);

6. PC Software Copyright Registration Certificate of Miracle Jiutian (2007);

7. Software Product Registration Certificate of Tang Dynasty Journey to the West (2007);

8. PC Software Copyright Registration Certificate of Fantasy Wulin (2009);

9. PC Software Copyright Registration Certificate of Shuihu Heros Legend (2009);

10. PC Software Copyright Registration Certificate of Journey to the West OL (2009);

11. PC Software Copyright Registration Certificate of Empire Times (2009); and

12. PC Software Copyright Registration Certificate of Journey to the West: déjà vu (2010)

We also own the copyright of our logo and all of the contents of our website, <www.amicogames.com>.

Research and Development

We incurred approximately $137,173 in research and development expenses during the year ended August 31, 2009 and approximately $373,371 during the year ended August 31, 2010.

14

Reports to Security Holders

We are subject to the reporting and other requirements of the Exchange Act and we intend to furnish our shareholders with annual reports containing financial statements audited by our independent auditors and to make available quarterly reports containing unaudited financial statements for each of the first three quarters of each year.

The public may read and copy any materials that we file with the SEC at the SEC's Public Reference Room at 100 F Street, NE, Washington, D.C. 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC. The address of that site is www.sec.gov.

Government Regulations

Regulation on Software Product Management.

The Regulation on Software Product Management was enacted by the Ministry of Industry and Information on March 5, 2009. This law regulates that all domestic software producers shall apply for registration of their products and keep a copy of software which they have developed with the local industrial administrative department. Once software is deposited with the department it receives a registration number and a version number which is published on the software when it is sold. We submitted applications for registration for all of our software products and will register all of our future software product as well. The cost of compliance with these regulations is minimal.

Regulation on Telecommunication Business Operation License Management.

The Regulation on Telecommunication Business Operation License Management was enacted by the Ministry of Industry and Information on February 4, 2009. Under these regulations, companies involved in the sale of any product or service connected to telecommunications, must apply for and be granted specific operating licenses. These licenses include the Certificate for Value Added Telecommunication Service Provider and Certificate for Telecom and Information Service Operations, depending on the type of product or service the company is providing. We have acquired the Certificate for Value Added Telecommunication Service Provider, which is the required license for our operations and which will be examined by local telecommunication supervision department annually. We do not anticipate any problems with the renewal of our license and the costs are minimal.

Regulation on Foreign Investment in Telecommunication Enterprise.

The Regulation on Foreign Investment in Telecommunication Enterprise was enacted by the State Council on December 11, 2001. These regulations effect foreign investment in the Chinese telecommunication industry. The regulations statement that companies engaged in the business of value added telecommunication services, such as us, foreign investors cannot hold more than a 50% interest. This is why we have undertake the VIE structure with Galaxy. Compliance with these regulations has required the establishment of the VIE structure which has cost us approximately $20,000 and about $500 in annual upkeep.

Environmental Regulations

We are not aware of any material violations of environmental permits, licenses or approvals that have been issued with respect to our operations. We expect to comply with all applicable laws, rules and regulations relating to our business, and at this time, we do not anticipate incurring any material capital expenditures to comply with any environmental regulations or other requirements.

While our intended projects and business activities do not currently violate any laws, any regulatory changes that impose additional restrictions or requirements on us or on our potential customers could adversely affect us by increasing our operating costs or decreasing demand for our products or services, which could have a material adverse effect on our results of operations.

15

Employees

We currently have 86 employees with all being engaged on a full time basis

As a “smaller reporting company”, we are not required to provide the information required by this Item.

As a “smaller reporting company”, we are not required to provide the information required by this Item.

We currently rent two offices each of which serves a different business purpose:

(1) Our administrative, R&D, production center: Room South 01-07, 9/F South, Building A, Zhongshan Avenue No. 89, Tianhe District, Guangzhou, Canton Province, P.R. China, with area of 405 square meters;;

(2) Our customer service center:. Room North-02, 9/F North, Building A, Zhongshan Avenue No. 89, Tianhe District, Guangzhou, Canton Province, P.R. China, with area of 45 square meters.

Rent expense for the years ended August 31, 2009 and 2010 was $32,813 and $33,181, respectively.

We know of no other material, active or pending legal proceedings against us, our subsidiaries or our property, nor are we involved as a plaintiff in any material proceedings or pending litigation. There are no proceedings in which any of our directors, officers or affiliates, or any registered or beneficial shareholders are an adverse party or have a material interest adverse to us.

16

Market Information

There is a limited public market for our common shares. Our common shares are quoted for trading on the OTC Bulletin Board under the symbol “AMCG”. The market for our stock is highly volatile. We cannot assure you that there will be a market in the future for our common stock. OTC Bulletin Board securities are not listed and traded on the floor of an organized national or regional stock exchange. Instead, OTC Bulletin Board securities transactions are conducted through a telephone and computer network connecting dealers in stocks. OTC Bulletin Board stocks are traditionally smaller companies that do not meet the financial and other listing requirements of a regional or national stock exchange.

The following table shows the high and low prices of our common shares on the OTC Bulletin Board. The following quotations reflect inter-dealer prices, without retail mark-up, mark-down or commission and may not necessarily represent actual transactions:

|

Period

|

High

|

Low

|

||||||

|

June 1, 2010 – August 31, 2010

|

$ | 0.12 | $ | 0.039 | ||||

|

March 1, 2010 – May 30, 2010

|

$ | 0.213 | $ | 0.09 | ||||

|

December 1, 2009 – February 28, 2010

|

$ | 0.2787 | $ | 0.17 | ||||

|

September 1, 2009 – November 30, 2009

|

$ | 0.1667 | $ | 0.0633 | ||||

The first trade in our stock occurred on October 15, 2009

Holders

As of November 23, 2010, there were 23 holders of record of our common stock.

Dividends

Holders of our common stock are entitled to dividends if declared by the Board of Directors out of funds legally available therefore. Except for a dividend of $289,203 paid by our VIE to its shareholders during the year ended August 31, 2010, no cash dividends have been declared as of November 23, 2010.

We do not intend to issue any cash or stock dividends in the near future. We intend to retain earnings, if any, to finance the development and expansion of our business. Our future dividend policy will be subject to the discretion of the Board of Directors and will be contingent upon future earnings, if any, our financial condition, capital requirements, general business conditions and other factors.

Equity Compensation Plans

As of November 23, 2010, we did not have any equity compensation plans.

17

Recent Sales of Unregistered Securities

We have not made any previously unreported sales from September 1, 2008 to August 31, 2010.

Recent Purchases of Equity Securities by us and our Affiliated Purchases

We have not repurchased any of our common stock and have no publicly announced repurchase plans or programs as of November 23, 2010.

As a “smaller reporting company”, we are not required to provide the information required by this Item.

As a “smaller reporting company”, we are not required to provide the information required by this Item.

18

AMICO GAMES CORP. and SUBSIDIARIES

(A DEVELOPMENT STAGE COMPANY)

|

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

|

F-1

|

|

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

|

F-2

|

|

CONSOLIDATED BALANCE SHEETS

|

F-3

|

|

CONSOLIDATED STATEMENTS OF OPERATIONS

|

F-4

|

|

CONSOLIDATED STATEMENTS OF CASH FLOWS

|

F-5

|

|

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

|

F-6

|

|

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

|

F-7

|

19

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Board of Directors

Amico Games Corp.

We have audited the accompanying consolidated balance sheets of Amico Games Corp. as of August 31, 2010 and the related consolidated statements of operations, changes in stockholders’ equity and cash flows for each of the year ended August 31, 2010. These financial statements are the responsibility of the Company's management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company's internal control over financial reporting. Accordingly, we express no such opinion. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the consolidated financial position of Amico Games Corp. as of August 31, 2010 and the consolidated results of its operations and its cash flows for the year ended August 31, 2010 in conformity with accounting principles generally accepted in the in the United States of America.

/s/Yichien Yeh, CPA

Yichien Yeh, CPA

Forest Hills, New York

Nov. 15, 2010

F-1

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors

Vodafun Limited

Tortola, British Virgin Islands

We have audited the accompanying consolidated balance sheets of Vodafun Limited (the “Company”) as of August 31, 2009 and the related consolidated statements of operations, shareholders' equity and cash flows for the year then ended. These financial statements are the responsibility of the Company's management. Our responsibility is to express an opinion on these financial statements based on our audit.

We conducted our audit in accordance with standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company's internal control over financial reporting. Accordingly, we express no such opinion. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audit provides a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of Vodafun Limited as of August 31, 2009 and the results of its operations and cash flows for the periods described above in conformity with accounting principles generally accepted in the United States of America.

/s/ M&K CPAS, PLLC

www.mkacpas.com

Houston, Texas

December 17, 2009

F-2

AMICO GAMES CORP

Consolidated Balance Sheets

|

Aug. 31

|

Aug. 31

|

|||||||

|

2010

|

2009

|

|||||||

|

Current Assets

|

||||||||

|

Cash and cash equivalents

|

$ | 444,706 | $ | 191,470 | ||||

|

Accounts receivable, net

|

271,651 | 390,082 | ||||||

|

Prepaid expenses and other receivables

|

71,703 | 30,636 | ||||||

|

Total Current Assets

|

788,060 | 612,188 | ||||||

|

Property, plant and equipment, net

|

73,181 | 31,474 | ||||||

|

Intangible assets & deferred charges

|

488 | 517 | ||||||

|

Total Assets

|

$ | 861,729 | $ | 644,179 | ||||

|

Current Liabilities

|

||||||||

|

Payables and accrued liabilities

|

$ | 45,282 | $ | 10,592 | ||||

|

Dividend payable

|

- | 289,203 | ||||||

|

Due to related parties (short term)

|

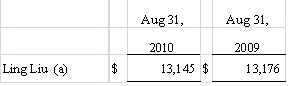

13,145 | 13,176 | ||||||

|

Income taxes payable

|

- | 52,322 | ||||||

|

Other taxes payable

|

11,124 | 5,500 | ||||||

|

Wages payable

|

64,329 | 72,178 | ||||||

|

Deferred tax liabilities

|

- | - | ||||||

|

Loan facility

|

30,158 | - | ||||||

|

Total Current Liabilities

|

164,038 | 442,971 | ||||||

|

Total Liabilities

|

$ | 164,038 | $ | 442,971 | ||||

|

Stockholders' Equity

|

||||||||

|

Preferred stock, 100,000,000 shares authorized, $0.00001 par value; none issued and outstanding

|

- | $ | - | |||||

| Common stock, 300,000,000* and 600,000,000 shares authorized, $0.00001 par value; 163,500,000* and 219,000,000 shares issued and outstanding at August 31, 2009 and August 31, 2010, respectively | 280,158 | 1,635 | ||||||

|

Additional paid in capital

|

280,158 | 106,713 | ||||||

| Accumulated other comprehensive income | 10,477 | 12,344 | ||||||

| Retained earnings | 404,866 | 80,516 | ||||||

|

Total Stockholders' Equity

|

697,691 | 201,208 | ||||||

|

Total Liabilities and Stockholders' Equity

|

$ | 861,729 | $ | 644,179 | ||||

* The amounts have been retroactively adjusted to reflect the three-for-one stock split in the form of a 200% stock dividend effected April 29, 2010

The accompanying notes are an integral part of these financial statements.

F-3

AMICO GAMES CORP

Consolidated Statements of Operations

|

For the Year Ended

Aug. 31,

|

||||||||

|

2010

|

2009

|

|||||||

|

Revenue

|

$ | 1,855,692 | $ | 1,258,765 | ||||

|

Operating Costs and Expenses:

|

||||||||

|

Selling expenses

|

497,528 | 389,906 | ||||||

|

A&G expenses

|

1,041,303 | 595,092 | ||||||

|

Depreciation of property, plant and equipment

|

16,349 | 14,836 | ||||||

|

Total operating costs and expenses

|

1,555,180 | 999,834 | ||||||

|

Income (Loss) From Operations

|

300,512 | 258,931 | ||||||

|

Interest income

|

(704 | ) | (675 | ) | ||||

|

Interest expenses

|

2,157 | 439 | ||||||

|

Income (Loss) Before Income Taxes

|

299,059 | 259,167 | ||||||

|

Income Tax Expense (Benefit)

|

||||||||

|

Current

|

(25,291 | ) | 52,289 | |||||

|

Defered

|

- | 9,383 | ||||||

| - | ||||||||

|

Net Income (Loss)

|

$ | 324,350 | $ | 197,495 | ||||

|

Other Comprehensive Income

|

||||||||

|

Foreign currency translation adjustment

|

(1,867 | ) | 534 | |||||

|

Comprehensive Income

|

$ | 322,483 | $ | 198,029 | ||||

|

Earnings Per Share, Basic and Diluted

|

$ | 0.00 | $ | 0.00 | ||||

|

Weighted Average Shares Outstanding

|

200,591,507 | 163,500,000 | ||||||

The accompanying notes are an integral part of these financial statements.

F-4

AMICO GAMES CORP

Consolidated Statements of Cash Flows

|

For the Year Ended

Aug 31,

|

||||||||

|

2010

|

2009

|

|||||||

|

Operating activities

|

||||||||

|

Net Income

|

$ | 324,350 | $ | 197,495 | ||||

|

Adjustments to reconcile net loss to net cash

|

||||||||

|

provided by (used in) operating activities:

|

||||||||

|

Depreciation expense

|

16,349 | 14,836 | ||||||

|

Amortization of intangible assets

|

117 | - | ||||||

|

Common stock issued for services

|

174,000 | - | ||||||

|

Changes in operating assets and liabilities:

|

||||||||

|

Accounts receivable, net

|

118,431 | (226,190 | ) | |||||

|

Prepaid expenses and other receivables

|

(41,067 | ) | 107,823 | |||||

|

Accounts payable and other current liabilities

|

(19,857 | ) | (130,361 | ) | ||||

|

Deferred tax

|

- | 9,376 | ||||||

|

Net cash provided by (used in) operating activities

|

$ | 572,323 | (27,021 | ) | ||||

|

Investing activities

|

||||||||

|

Property, plant and equipment additions

|

(58,056 | ) | (12,062 | ) | ||||

|

Intangible assets additions

|

(88 | ) | - | |||||

|

Net cash used in investing activities

|

$ | (58,144 | ) | (12,062 | ) | |||

|

Financing activities

|

||||||||

|

Repayament to related parties

|

(2,905 | ) | ||||||

|

Payment of dividend

|

(289,203 | ) | - | |||||

|

Proceeds from borrowings on loan facility

|

105,000 | - | ||||||

|

Principal payments on loan facility

|

(74,842 | ) | - | |||||

|

Principal payments on revolving line of credit

|

- | (64,884 | ) | |||||

|

Net cash used in financing activities

|

$ | (259,045 | ) | (67,789 | ) | |||

|

Effect of exchange rate changes on cash and cash equivalents

|

(1,898 | ) | 534 | |||||

|

Increase (decrease) in cash and cash equivalents

|

253,236 | (106,338 | ) | |||||

|

Cash and cash equivalents, beginning of year

|

191,470 | 297,808 | ||||||

|

Cash and cash equivalents, end of year

|

$ | 444,706 | $ | 191,470 | ||||

|

Supplemental Disclosures

|

||||||||

|

Interest paid

|

$ | 1,112 | $ | 236 | ||||

|

Income taxes paid

|

$ | 27,565 | $ | - | ||||

The accompanying notes are an integral part of these financial statements.

F-5

AMICO GAMES CORP

Consolidated Statements of Stockholders' Equity

For the Years Ended August 31, 2010 and 2009

|

Common Stock

|

Additional Paid-In

|

Accumulated

Other Comprehensive

|

Retained Earnings

|

Total

|

||||||||||||||||||||

|

Shares

|

Par ($0.00001)

|

Capital | Income | |||||||||||||||||||||

|

Balance as of August 31, 2008

|

163,500,000 | $ | 1,635 | $ | 395,916 | $ | 11,810 | $ | (116,979 | ) | $ | 292,382 | ||||||||||||

|

Net income for the year

|

197,495 | 197,495 | ||||||||||||||||||||||

|

Foreign currency translation adjustment

|

534 | 534 | ||||||||||||||||||||||

|

Dividend

|

(289,203 | ) | (289,203 | ) | ||||||||||||||||||||

|

Balance as of August 31, 2009

|

163,500,000 | $ | 1,635 | $ | 106,713 | $ | 12,344 | $ | 80,516 | $ | 201,208 | |||||||||||||

|

Effect of reverse merger

|

54,600,000 | 546 | (546 | ) | - | |||||||||||||||||||

|

Common shares issued for services

|

900,000 | 9 | 173,991 | 174,000 | ||||||||||||||||||||

|

Net income for the year ending

|

324,350 | 324,350 | ||||||||||||||||||||||

|

Foreign currency translation adjustment

|

(1,867 | ) | (1,867 | ) | ||||||||||||||||||||

|

Balance as of May 31, 2010

|

219,000,000 | $ | 2,190 | $ | 280,158 | $ | 10,477 | $ | 404,866 | $ | 697,691 | |||||||||||||

The accompanying notes are an integral part of these financial statements.

F-6

AMICO GAMES CROP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

August 31, 2010

NOTE 1 – ORGANIZATION, NATURE OF BUSINESS, and BASIS OF PRESENTATION

Organization and Nature of Business

The Company was incorporated under the name of Destiny Minerals Inc. on February 12, 2008 under the laws of the State of Nevada. On September 23, 2009, the Company filed an amendment to its articles of incorporation to change the name to Amico Games Corp. (“Amico Games” or “the Company”).

On December 31, 2009, the Company closed a reverse merger with Vodafun Limited (“Vodafun”). Vodafun has no other material operations except a series of contractual arrangements with Galaxy Software (Guangzhou) Limited (“Galaxy”), a private-owned company incorporated under the laws of the People’s Republic of China on November 15, 2001 with a registered capital of RMB 3,000,000 that was fully paid up.

On December 31, 2009, the Company closed the transactions contemplated by the Share Exchange Agreement and acquired Vodafun Limited (“Vodafun”), a company incorporated under the laws of British Virgin Islands on January 8, 2009, as its wholly owned subsidiary. Vodafun has entered into a series of contractual obligations with Galaxy Software (Guangzhou) Limited (“Galaxy”), a company incorporated under the laws of the People’s Republic of China (“China”) that is engaged in the business of developing and operating cellphone multiplayer games for the Chinese market, as well as the holders of 100% of the voting shares of Galaxy.

The Company’s relationship with Galaxy and its shareholders is governed by a series of contractual arrangements among Vodafun, Galaxy and the 100% holders of the share capital of Galaxy (the “Galaxy Shareholders”) entered on April 15, 2009. The contractual arrangements include Consulting Services Agreement, Business Operating Agreement, Equity Pledge Agreement, Exclusive Option Agreement, and Voting Right Proxy Agreement. Under the laws of China, the contractual arrangements constitute valid and binding obligations of the parties of such agreements. Each of the contractual arrangements and the rights and obligations of the parties thereto are enforceable and valid in accordance with the laws of China.

Galaxy is an information technology company primarily specialized in developing and operating cell phone multiplayer games in mainland China. Galaxy is a leading developer of cell phone games that are networked to serve a population of multiplayer users and delivered across JAVATM and WAP platforms over 3G and 2.5G mobile telecommunication network in China. Currently, Galaxy mainly distributes its mobile games on the QQ Game Platform in China and is developing its own game platform with as well as a separate platform with 3G compatibility.

Basis of Presentation

The accompanying consolidated financial statements of the Company have been prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”). The Company’s consolidated financial statements include the financial statements of Vodafun Limited and Galaxy Software (Guangzhou) Limited. All significant intercompany accounts and transactions have been eliminated in consolidation.

Galaxy is considered a variable interest entity (“VIE”), and Vodafun, the Company’s wholly owned subsidiary, is the primary beneficiary. The Company’s relationships with Galaxy and its shareholders are governed by a series of contractual arrangements between the Company and Galaxy, which is an operating company in the PRC. The contractual arrangements constitute valid and binding obligations of the parties of such agreements. Each of the contractual arrangements and the rights and obligations of the parties thereto are enforceable and valid in accordance with the laws of the PRC. On April 15, 2009, Vodafun entered into the following contractual arrangements with Galaxy:

F-7

|

(1)

|

Consulting Services Agreement. Pursuant to the consulting services agreement between Vodafun and Galaxy, dated April 15, 2009, Vodafun has the exclusive right to provide Galaxy with consulting services and daily operations, including general business operations in relation to the cell phone game development, human resources, research and development, and business growth, and support the daily operation costs and daily expenses. Galaxy pays an annual consulting service fee to Vodafun that is equal to 100% of Galaxy’s net revenue for such year, based on the annual financial statements. This agreement shall remain in force unless otherwise terminated. Vodafun is entitled to assign to a wholly-owned subsidiary, if one were set up in the future, all the rights to the Company as stipulated in this agreement. All intercompany transactions, including this service fee, have been eliminated in the consolidated financial statements presented.

|

|

(2)

|

Business Operating Agreement. Pursuant to the business operating agreement among Vodafun and Galaxy, dated April 15, 2009, Vodafun provides Galaxy guidance and instruction on Galaxy’s daily operations, financial management and employment issues. Vodafun has the right to appoint or remove Galaxy’s directors and executive officers. In addition, Vodafun agrees to guarantee Galaxy’s performance under any agreements or arrangements relating to its business arrangement with any third party. Upon the request of Galaxy, Vodafun agrees to provide loans to support its operation’s capital requirements and to provide guarantee if the Company needs to apply for loans from a third party. In return, Galaxy agrees to pledge its accounts receivable and all of its assets to Vodafun. The term of this agreement is ten years; and may be extended or terminated only by 30-day prior written notice served by Vodafun (or its designated party). Vodafun is entitled to assign to a wholly-owned subsidiary, if one were set up in the future, all the rights to the Company as stipulated in this agreement.

|

|

(3)

|

Equity Pledge Agreement. Under the equity pledge agreement between Vodafun and Galaxy, dated April 15, 2009, Galaxy’s 100% shareholders pledged all of their equity interests in Galaxy to Vodafun to guarantee its performance of its obligations under the Business Operating Agreement. If Galaxy or its shareholders breaches their respective contractual obligations, Vodafun, as Pledgee, will be entitled to certain rights, including the right to sell the pledged equity interests. The 100% shareholders of Galaxy also agreed that upon occurrence of any event of default, Vodafun shall be granted an exclusive, irrevocable power of attorney to take actions in the place and stead of the 100% shareholders of Galaxy to carry out the security provisions of the equity pledge agreement and take any action and execute any instrument that Vodafun may deem necessary or advisable to accomplish the purposes of the equity pledge agreement. The 100% shareholders of Galaxy agreed not to dispose of the pledged equity interests or take any actions that would prejudice Vodafun’s interest. This equity pledge agreement shall expire two years after Galaxy’s obligations under the Consulting Services Agreement have been fulfilled. Vodafun is entitled to assign to a wholly-owned subsidiary, if one were set up in the future, all the rights to the Company as stipulated in this agreement.

|

|

(4)

|

Exclusive Option Agreement. Under the exclusive option agreement between Vodafun and Galaxy, dated on April 15, 2009, all the shareholders of Galaxy irrevocably granted to Vodafun (or its designated person) an exclusive option to purchase, to the extent permitted under PRC law, all or part of the equity interests in Galaxy for the minimum amount of consideration permitted by applicable PRC law. Vodafun (or its designated person) has sole discretion to decide when to exercise the option, whether in part or in full. The term of this agreement is ten (10) years from April 15, 2009 and may be extended prior to its expiration by written agreement of the parties.

|

|

(5)

|

Voting Right Proxy Agreement. Under the voting right proxy agreement between Vodafun and Galaxy, dated on April 15, 2009, all shareholders of Galaxy agreed to irrevocably grant Vodafun with the right to exercise the 100% shareholders of Galaxy’s voting rights and their other rights, including the attendance at and the voting of the all the shares held by 100% shareholders of Galaxy at shareholders’ meetings (or by written consent in lieu of such meetings) in accordance with applicable laws and its Articles of Association, including but not limited to the rights to sell or transfer all or any of his equity interests of the Galaxy, and appoint and vote for the directors and Chairman as the authorized representative of the shareholders of the Galaxy. The proxy agreement may be terminated by joint consent of the parties or upon 30-day written notice from Vodafun.

|

The accounts of Galaxy are consolidated in the accompanying financial statements pursuant to generally accepted accounting standards pertaining to variable interest entities (“VIE”). As a VIE, Galaxy’s sales are included in the Company’s total sales, its income from operations is consolidated with the Company’s, and the Company’s net income includes all of Galaxy’s net income. The Company does not have any non-controlling interest and accordingly, did not subtract any net income in calculating the net income attributable to the Company. Because of the contractual arrangements, the Company had a pecuniary interest in Galaxy that requires consolidation of the Company’s and Galaxy’s financial statements.

F-8

NOTE 2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities as well as the reported amounts of revenues and expenses. The Company bases its estimates and assumptions on current facts, historical experience and various other factors that it believes to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities and the accrual of costs and expenses that are not readily apparent from other sources. The actual results experienced by the Company may differ materially and adversely from the Company’s estimates. To the extent there are material differences between the estimates and the actual results, future results of operations will be affected.

Stock Split

On April 29, 2010, the Company effected a three-for-one stock split in the form of a 200% stock dividend of common stock to stockholders of record as of May 10, 2010. All share and per share information referred to in the consolidated financial statements has been retroactively adjusted to reflect the stock split.

Reclassifications

Certain amounts in the prior period financial statements have been reclassified to conform to the current period presentation. These reclassifications had no effect on reported losses.

Cash and Cash Equivalents

Cash and cash equivalents include cash on hand, cash on deposit with various financial institutions in the PRC, and all highly-liquid investments with original maturities of three months or less at the time of purchase. The Company did not have any cash equivalents as of August 31, 2010 and 2009.

Accounts Receivable

Accounts receivable are carried at original invoice amount less an estimate made for doubtful accounts based on a review of all outstanding amounts on a monthly basis. Management judgment and estimates are made in connection with establishing the allowance for doubtful accounts. Specifically, the Company analyzes the aging of accounts receivable balances, historical bad debts, customer concentrations, customer credit-worthiness, current economic trends and changes in our customer payment terms. Significant changes in customer concentration or payment terms, deterioration of customer credit-worthiness or weakening in economic trends could have a significant impact on the collectability of receivables and the Company’s operating results. The company’s allowance for doubtful accounts is $0 at August 31, 2010 and 2009.

Property and Equipment

Property and equipment are recorded at cost and depreciated using the straight-line method, with an estimated 0% salvage value of original cost, over the estimated useful lives of the assets as follows:

|

Office equipment

|

5 years

|

|

Electronic equipment

|

5 years

|

|

Furniture

|

5 years

|

|

Automobiles

|

5 years

|

F-9

Expenditures for repairs and maintenance, which do not improve or extend the expected useful lives of the assets, are expensed as incurred while major replacements and improvements are capitalized.

When property or equipment is retired or disposed of, the cost and accumulated depreciation are removed from the accounts, with any resulting gains or losses being included in net income or loss in the year of disposition.

Intangible Assets and Long-Lived Assets

The Company has one category of intangible assets, application fee for the copyright of cell phone games, which is amortized using the straight-line method over approximately 10 years, which is the estimated economic life of the asset. The company evaluates long-lived assets for impairment annually.

Revenue Recognition

The Company generally recognizes revenue when its products are sold and splits the revenue earned with its partners that provide the platform for its software applications, the largest of which is Shenzhen Tencent Computer System Co., Ltd (“Tencent”). As of August 31, 2010, there were four cell phone games of the Company in operation, which are Miracle Journey to the West, Journey to the West Online, Fantasy Wulin, and Miracle Jiutian. These games are downloadable to the mobile hand set of the end users for free. Revenue is recognized when the end users purchase virtual in-game goods to enhance the competence of their game characters or send text messages to other game players. At the time of purchase of these virtual goods or the use of text messages, the following criteria of SAB 104 are met: 1) an arrangement exists, 2) the sales prices is fixed and determinable, 3) goods and services have been delivered, and 4) collectability is reasonably assured. At this point, the revenue earnings process is complete and revenue is recognized. There are no dual revenue components and their revenue process is complete and therefore no revenue deferral is necessary.

Comprehensive Income

The Company has adopted the standard issued by the FASB, “Reporting Comprehensive Income,” codified with ASC 220, which establishes standards for reporting and displaying comprehensive income, its components, and accumulated balances in a full-set of general-purpose financial statements. Accumulated other comprehensive income represents the accumulated balance of foreign currency translation adjustments.

Foreign Currency Translation

The functional currency of the Company is the Renminbi (“RMB”), the PRC’s currency. The Company maintains its financial statements using the functional currency. Monetary assets and liabilities denominated in currencies other than the functional currency are translated into the functional currency at rates of exchange prevailing at the balance sheet dates. Transactions denominated in currencies other than the functional currency are translated into the functional currency at the exchange rates prevailing at the dates of the transaction. Exchange gains or losses arising from foreign currency transactions are included in the determination of net income (loss) for the respective periods.

For financial reporting purposes, the financial statements of the Company, which are prepared using the RMB, are translated into the Company’s reporting currency, United States Dollars. Balance sheet accounts are translated using the closing exchange rate in effect at the balance sheet date and income and expense accounts are translated using the average exchange rate prevailing during the reporting period. Adjustments resulting from the translation, if any, are included in accumulated other comprehensive income (loss) in stockholder’s equity.

The exchange rates for the balance sheets in effect at August 31 2010 and August 31, 2009 were RMB 1 for $0.146051 and $0.146400, respectively.

F-10

Stock Options and Similar Equity Instruments

The Company is required to recognize expense of options or similar equity instruments issued to employees using the fair-value-based method of accounting for stock-based payments in compliance with the standard issued by the FASB "Share-Based Payment," codified with ASC 220. The standard covers a wide range of share-based compensation arrangements including share options, restricted share plans, performance-based awards, share appreciation rights, and employee share purchase plans. Application of this pronouncement requires significant judgment regarding the assumptions used in the selected option pricing model, including stock price volatility and employee exercise behavior. Most of these inputs are either highly dependent on the current economic environment at the date of grant or forward-looking over the expected term of the award. The Company does not have any instruments subject to compliance with this standard.

Income Taxes

The Company accounts for income taxes in accordance with the standard issued by the FASB, “Accounting for Income Taxes,” codified with ASC 740, and related FASB interpretation. In accordance with this standard, deferred tax assets and liabilities are determined based on differences between the financial statement and tax basis of assets and liabilities and net operating loss and credit carry forwards using enacted tax rates in effect for the year in which the differences are expected to impact taxable income. A valuation allowance is established, when necessary, to reduce deferred tax assets to the amount that is more likely than not to be realized.

Earnings Per Share

The Company has adopted the provisions of standard issued by the FASB, “Earnings Per Share,” codified with ASC 260, which provides for the calculation of basic and diluted earnings or loss per share. Basic loss per share includes no dilution and is computed by dividing income or loss available to common stockholders by the weighted average number of common shares outstanding for the period. Diluted loss per share reflects the potential dilution of securities that could share in the earnings or losses of the entity. The Company does not have any potentially issuable shares. For the year ended August 31, 2010 and 2009, basic and diluted earnings (loss) per share are $0.00 and $0.00, respectively.

Fair Value of Financial Instruments

The Company adopted the standard issued by the FASB, “Fair Value Measurements,” codified with ASC 820, which clarifies the definition of fair value, prescribes methods for measuring fair value, and establishes a fair value hierarchy to classify the inputs used in measuring fair value as follows:

Level 1-Inputs are unadjusted quoted prices in active markets for identical assets or liabilities available at the measurement date.

Level 2-Inputs are unadjusted quoted prices for similar assets and liabilities in active markets, quoted prices for identical or similar assets and liabilities in markets that are not active, inputs other then quoted prices that are observable, and inputs derived from or corroborated by observable market data.

Level 3-Inputs are unobservable inputs which reflect the reporting entity’s own assumptions on what assumptions the market participants would use in pricing the asset or liability based on the best available information.