Attached files

| file | filename |

|---|---|

| 8-K - STONEMOR PARTNERS L.P. - STONEMOR PARTNERS LP | d8k.htm |

Bank

of America Merrill Lynch Credit Conference

November 2010

Exhibit 99.1 |

Private and Confidential

2

Confidential

This presentation contains certain statements that may be deemed to be forward-looking

statements within the meaning of the Securities Acts. All statements, other than statements

of historical facts, that address activities, events or developments that the Partnership

expects, projects, believes or anticipates will or may occur in the future, including, without

limitation, the outlook for population growth and death rates, general industry conditions

including future operating results of the Partnerships properties, capital expenditures, asset

sales, expansion and growth opportunities, bank borrowings, financing activities and other

such matters, are forward-looking statements. Although the Partnership believes that

its expectations stated in this presentation are based on reasonable assumptions, actual

results may differ from those projected in the forward-looking statements. For a more

detailed discussion of risk factors, please refer to the annual Report on Form 10-K and

quarterly reports on form 10-Q filed with the SEC and the prospectus and the

prospectus supplement relating to this offering.

In addition, the projected impact of acquisitions reflect managements projections as to

possible future results based on a number of assumptions that are inherently uncertain,

including without limitation the organic growth of the Partnership, the availability of

acquisition targets, the purchase prices for the targets, the availability of debt or equity

financing from either third parties or the targets and the Partnership’s ability to integrate and

manage such acquisitions. The assumptions involve significant elements of subjective

judgment and analysis, and no representation is made as to their or the projections

attainability.

|

Private and Confidential

3

Today’s Participants

William Shane

Chief Financial Officer and Executive Vice President

Paul Waimberg

Vice

President

–

Finance

and

Corporate

Development |

Private and Confidential

4

4

StoneMor

Partners L.P.

StoneMor

is the second largest owner and operator of cemeteries in the US

–

The Company currently operates 257 cemeteries and 64 funeral homes, diversely

located across 26 states and Puerto Rico

–

As of 12/31/2009, over 9,800 acres of land, equivalent to an aggregate weighted

average sales life of 226 years

StoneMor

has demonstrated a consistent track record of growth and financial

performance

–

134 cemeteries and 60 funeral homes acquired since inception

–

Revenue

has

increased

from

$145

million

in

2007

to

$181

million

in

2009

•

12% ’07-’09 CAGR

–

Adjusted operating profits have increased from $26 million in 2007 to $35 million

in 2009

•

16% ’07-’09 CAGR

StoneMor’s mission is to help families memorialize each life with dignity

|

Private and Confidential

5

Business Strategy

Enhance

existing

cemetery

operations

Optimize real

estate portfolio

Actively manage

trust fund

assets

Execute

disciplined

acquisition

strategy |

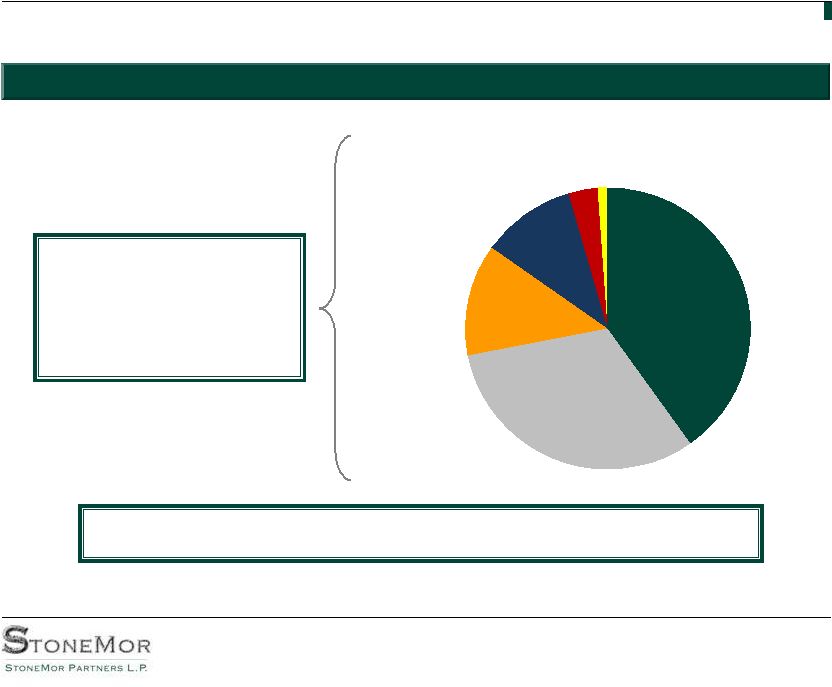

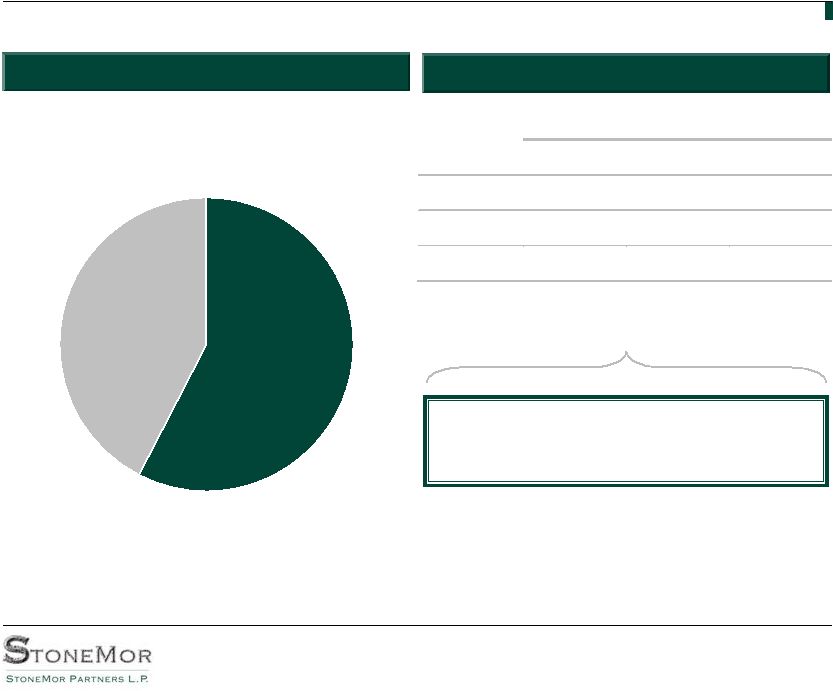

Private and Confidential

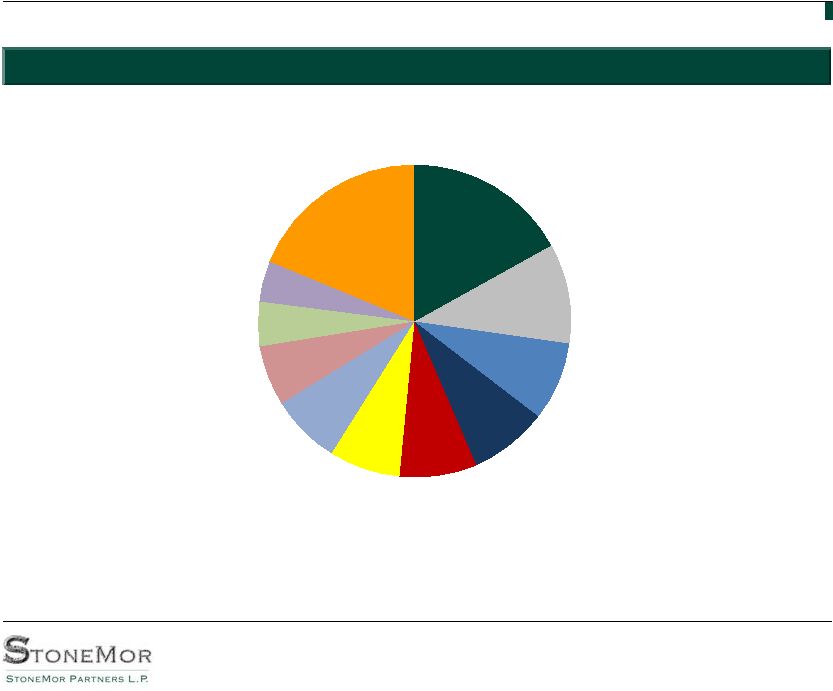

Pre-need sales

40.2%

At-need sales

31.7%

Funeral homes

12.9%

Investment

Income

10.8%

Interest

3.2%

Other

0.9%

6

Diversified Revenue Streams

STONEMOR BUSINESS MIX BY REVENUE –

TWELVE MONTHS ENDED DECEMBER 31, 2009

StoneMor’s +700 person sales team creates an unparalleled advantage

in pre-need sales performance

~45% of StoneMor’s

revenue is generated

through highly

predictable at-need

business |

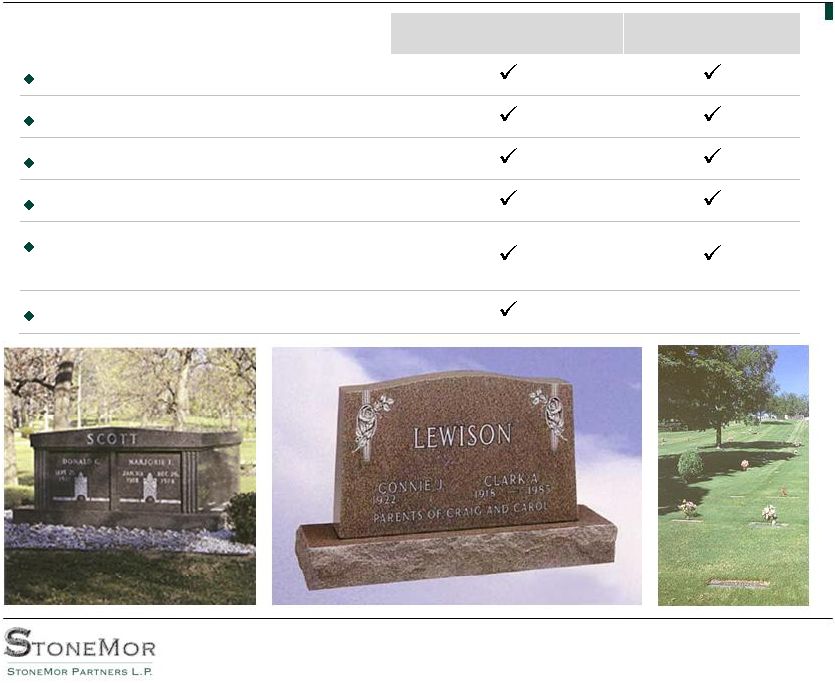

7

Cemetery Revenues –

Major Products Sold

Pre-need

At-need

Burial Lots

Mausoleums

Burial Vaults and Crypts

Grave Markers

Grave Opening and Closing

Fees

Caskets

(Funeral Homes

only) Private and Confidential |

Private and Confidential

8

Cemetery Revenues –

How Are Pre-Need Sales Generated?

Leads are generated and appointments made

–

40% of leads result in a presentation

20-25% of all presentations result in a sale

Pre-need sale is usually financed on terms averaging 36 months

–

22% of all sales are cash at the time of the sale

Customers make monthly payments, including interest, on

financed sales

–

Down payments average 12%

–

Finance charges range from 7% to 12% |

Private and Confidential

9

StoneMor’s Master Limited Partnership Structure

StoneMor

makes distributions to its unitholders

on a quarterly

basis

–

Paid from available cash after debt service and other expenses

MLP

MLP

Overview

Overview

Tax Status

Tax Status

MLP structure is predominantly tax free

At least 90% of gross income must be “qualifying income”

–

Qualifying income comprised of sale of real property (burial

lots, lawn and mausoleum crypts), cremation niches, interest

and dividends

Non-qualifying income, such as caskets, markers and funeral

home sales, are operated through tax-subject subsidiaries

Tax-free structure helps optimize cash flow

for debt service and distributions |

Private and Confidential

10

2010 Growth Events

SCI Acquisition

SCI Acquisition

Nelms

Nelms

Acquisition

Acquisition

Catholic Archdiocese of Detroit

Catholic Archdiocese of Detroit

Completed end of Q1 2010

9 cemeteries in Michigan that conducted

2,400 burials in 2009

Aggregate cash purchase price of $14 million

Received merchandise trusts of $46 million

and perpetual trusts of $15 million, while

assuming $23 million in merchandise

liabilities

First Year

Projected

Accrual

EBITDA

-

$6.4

Million

Leverage

Ratio

at

Acquisition

–

2.98

Completed end of Q2 2010

8 cemeteries

5 funeral homes

Located in Indiana, Michigan and Ohio

Purchased out of receiverships

2,500 burials and 900 funeral services in the

previous 12 months

Aggregate purchase price of $19.8 million in

cash and units

First Year Projected

Accrual

EBITDA

-

$6.7

Million

Leverage

Ratio

at

Acquisition

–

3.6

Completed in July 2010

StoneMor

will

manage

and

operate

the

3

large

cemeteries

owned

by

the

Archdiocese

Properties conduct approximately 2,200 interments annually

No “purchase price”; StoneMor

steps into Archdiocese P&L

First

Year

Projected

Accrual

EBITDA

-

$1.1

Million |

Private and Confidential

11

Highly Fragmented Industry…

Cemeteries,

9,600

Funeral

Homes,

22,000

$11 billion

$6 billion

___________________________

Source: National Directory of Morticians; Public Filings.

___________________________

Source: ABN Amro

Research; Public Filings.

(1) Includes StoneMor, SCI, Stewart, Carriage and Loewen.

$17 Billion Market

LARGE DEATH CARE INDUSTRY

LARGE DEATH CARE INDUSTRY

HIGHLY FRAGMENTED INDUSTRY REVENUE

HIGHLY FRAGMENTED INDUSTRY REVENUE

Independent

Operators

80%

Owned by

Consolidators

20%

(1) |

Private and Confidential

12

12

Cemeteries

Funeral

Homes

Ratio

SCI

382

1,412

1:3.7

StoneMor

257

64

4:1

Stewart

140

218

1:1.5

Carriage

33

145

1:4.4

…Creates Significant Competitive Advantages

For Profit,

9,600

Municipal,

Military,

Religious,

Non-Profit,

13,000

22,600 U.S. CEMETERIES

22,600 U.S. CEMETERIES

LARGEST FOR-PROFIT CEMETERY OPERATORS

StoneMor

has a unique focus on

ownership and operation of

cemetery assets |

Private and Confidential

13

Investment Highlights

Proven acquisition track record

High barriers to entry

Expertise in Cemetery Operations generates significant value

Favorable demographic trends

Secure, stable asset profile

–

Diversely located properties

–

Land, Accounts Receivable, and Trust Assets (Merchandise Trust Assets excess of

approximately $188 million)

Experienced management

–

Averages over 27 years of industry experience

Conservative financial profile

–

No significant near-term debt maturities

–

Consistent growth in cash flows

–

Tax free structure and minimal capital expenditures |

Private and Confidential

14

14

Proven Acquisition Track Record

Growth primarily driven by acquisitions

Never-break-the-model discipline in selecting acquisition targets

Focus on acquisitions that generate incremental cash flow in excess of

financing costs

Accretive from day one

DISIPLINED ACQUISITION PHILOSOPHY

DISIPLINED ACQUISITION PHILOSOPHY

PROVEN TRACK RECORD

PROVEN TRACK RECORD

Acquired 134 cemeteries and 60 funeral homes since inception

Leading sector consolidator

–

Public competitors have largely curtailed cemetery acquisitions since 1999

–

Post-acquisition, improved operating performance through:

–

Centralization of many functions

–

Purchasing leverage

–

Professional maintenance techniques

–

Sophisticated pre-need sales programs employed |

Private and Confidential

15

Substantial Industry and Financial Barriers to Entry

Scarcity and cost of real estate near densely populated

areas

Zoning restrictions

Initial capital requirements

Strength of family tradition and heritage

Administratively complex business for new entrants

Deferred revenue accounting (SAB 101) makes cemetery

acquisitions

unattractive

to

“C-corps”

valued

on

EPS

and

EBITDA, keeping consolidators out of the market

BARRIERS TO ENTRY

BARRIERS TO ENTRY

Because of the barriers to entry, there are few new cemeteries built. The only way to

enter the industry is to buy an existing cemetery |

Private and Confidential

16

Value Enhancing Strategy in the Cemetery Business

We are experts at operating and growing a cemetery-focused deathcare

business

–

Best practices in pre-need marketing

–

Extensive and highly driven commission-based sales force

–

Volume purchasing lowers costs for cemetery and funeral home merchandise

–

Centralized administrative functions lower operating expenses

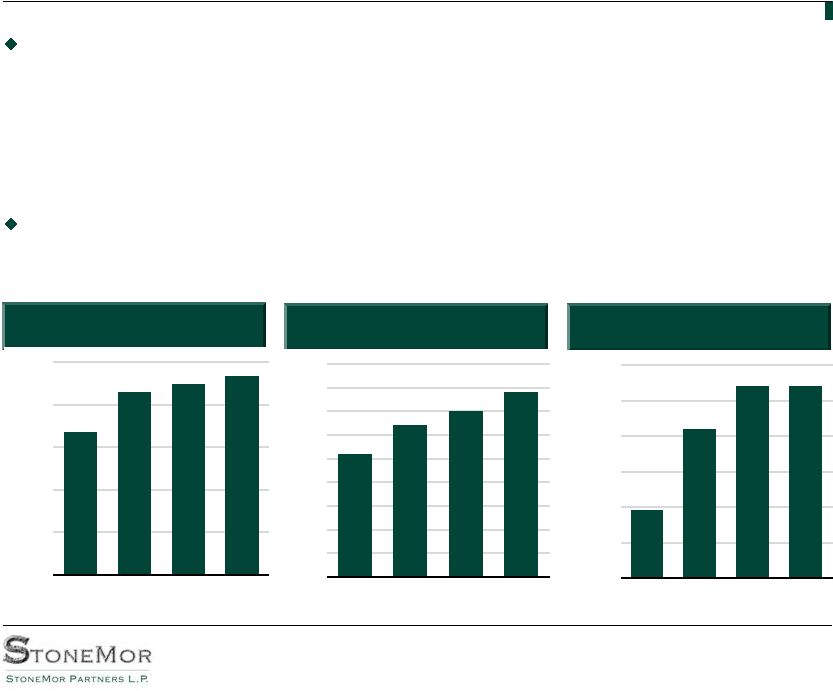

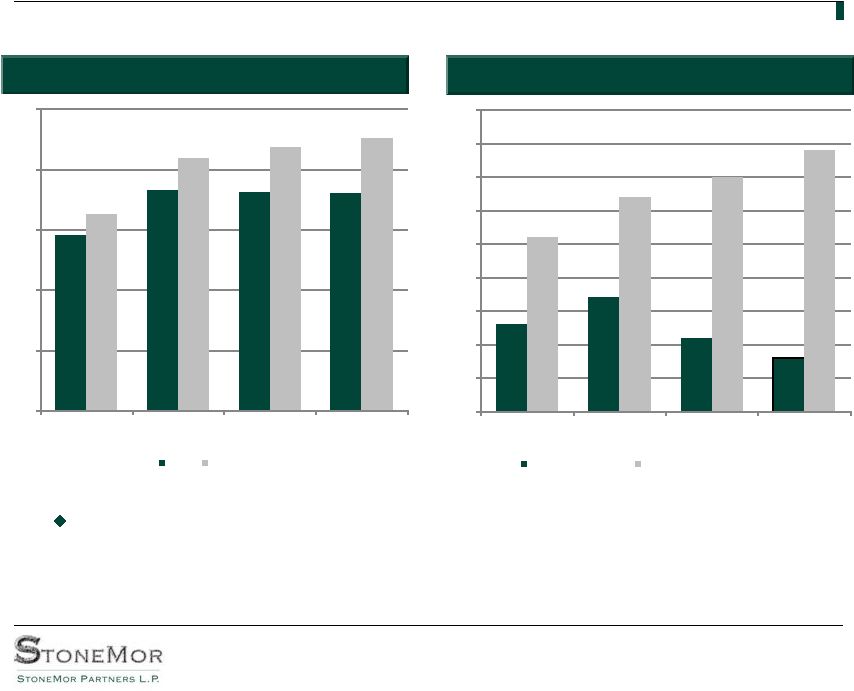

Our strategy leverages our existing asset base to drive revenues, adjusted

operating profit and cash flow available for distributions to common

unitholders ACCRUAL REVENUES

ACCRUAL REVENUES

ADJUSTED OPERATING

ADJUSTED OPERATING

PROFIT

PROFIT

DISTRIBUTION PER UNIT

DISTRIBUTION PER UNIT

($ in millions)

$163

$209

$218

$236

$0

$50

$100

$150

$200

$250

2007

2008

2009

LTM

$26

$32

$35

$40

$0

$5

$10

$15

$20

$25

$30

$35

$40

$45

2007

2008

2009

LTM

$2.05

$2.16

$2.22

$2.23

$1.95

$2.00

$2.05

$2.10

$2.15

$2.20

$2.25

2007

2008

2009

LTM |

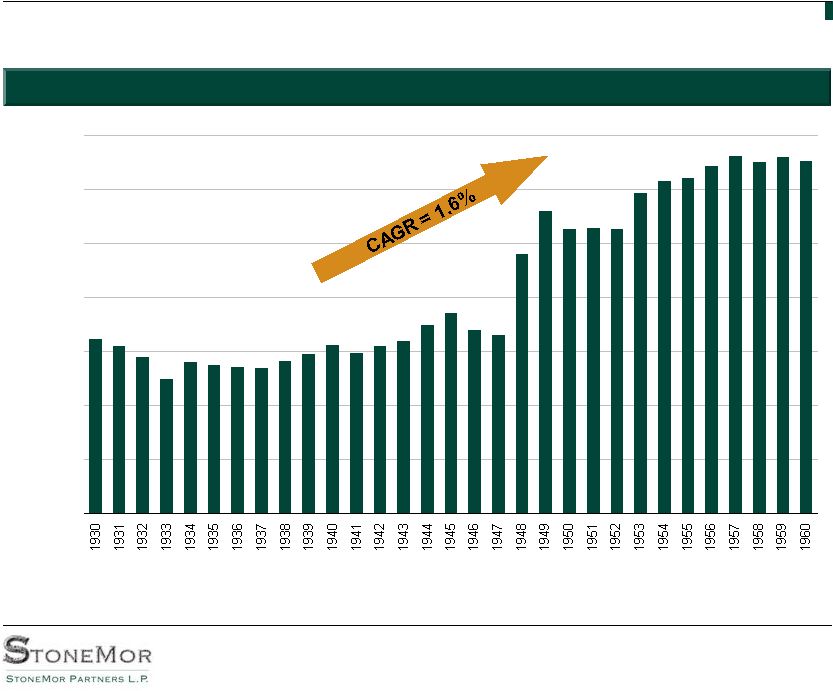

Private and Confidential

17

1,000,000

1,500,000

2,000,000

2,500,000

3,000,000

3,500,000

4,000,000

4,500,000

Favorable Demographics

Aging

of

the

Baby

Boom

Generation

will

accelerate

the

death

rate

and

expand

our target pre-need market

___________________________

Source: Department of Health and Human Services.

ANNUAL BIRTHS IN THE UNITED STATES 1930-1960 |

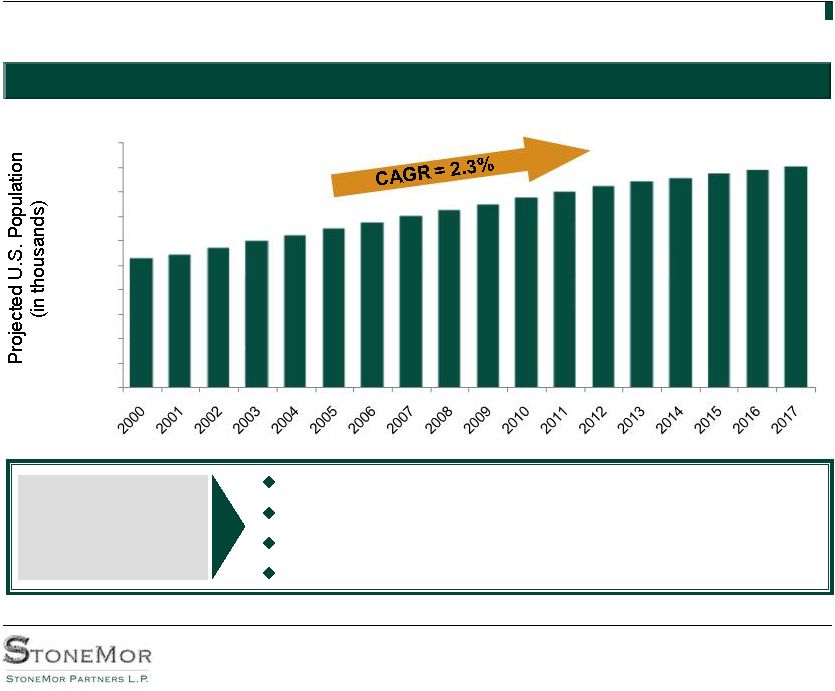

Private and Confidential

18

Favorable Demographics

Sharply increasing population in our target pre-need market

___________________________

Source: U.S. Department of Commerce Census Bureau.

PROJECTED U.S. POPULATION IN 55-65 YEAR OLD CATEGORY

Target Market

More Resilient to

Economic

Downturns

Target 55 to 65 age range

Near

retirement

–

low

unemployment

risk

Mortgage

paid-off

(or

almost)

–

minimal

debt

obligations

Adult

children

–

no

tuition

costs

0

5,000

10,000

15,000

20,000

25,000

30,000

35,000

40,000

45,000

50,000 |

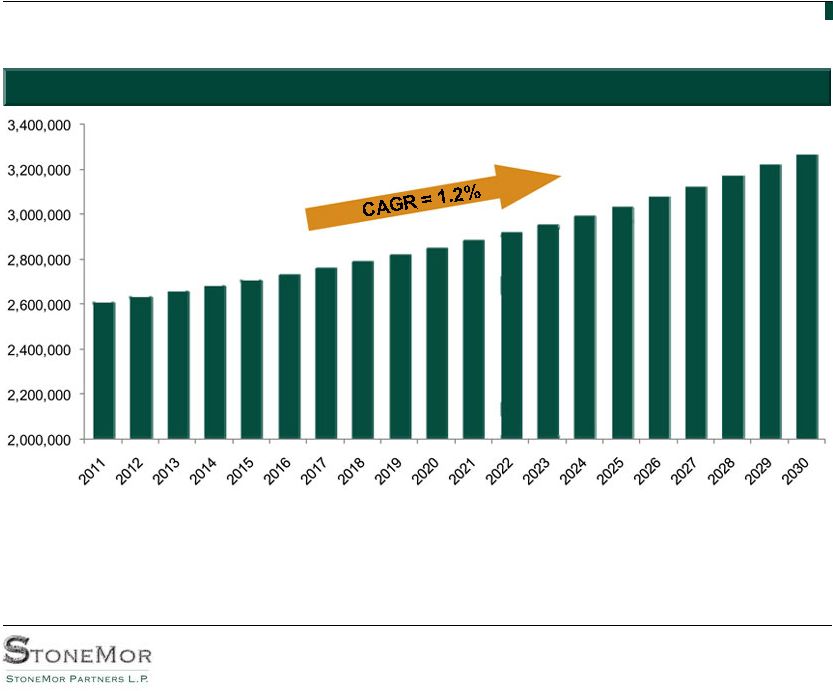

Private and Confidential

19

Favorable Demographics

Steady

increase

in

projected

mortality

rate

in

the

U.S.

over

the

next

20

years

PROJECTED ANNUAL DEATHS IN THE UNITED STATES

PROJECTED ANNUAL DEATHS IN THE UNITED STATES

___________________________

Source: U.S. Department of Commerce Census Bureau. |

Private and Confidential

20

Significant Underlying Assets

Cemetery Land

–

Approximately 10,000 Acres

–

Weighed Average Estimated Sales life of over 225 years

–

Book Value of approximately $304.0 million as of September 30, 2010.

Accounts Receivable

–

Gross

balance

of

approximately

$123.0

million,

including

approximately

$15.0

million

in

Unearned Interest as of September 30, 2010.

Perpetual Care Trust

–

Approximately $242 MM as of September 30, 2010

–

10 to

15%

of

the

lot

selling

price

is

deposited

into

a

perpetual

care

fund

–

Gains

and

losses

stay

in

fund

–

no

impact

on

earnings

–

Income from Perpetual Care Trust used to offset cemetery maintenance costs

Merchandise Trust

–

Approximately $293 MM as of September 30, 2010

–

Various percentages of merchandise selling price deposited into trust as cash is

received and redeemed once merchandise is delivered

–

Gains and losses and income to Company

–

Includes approximately $188 MM in

assets in excess of the amount required to fund all merchandise

liabilities |

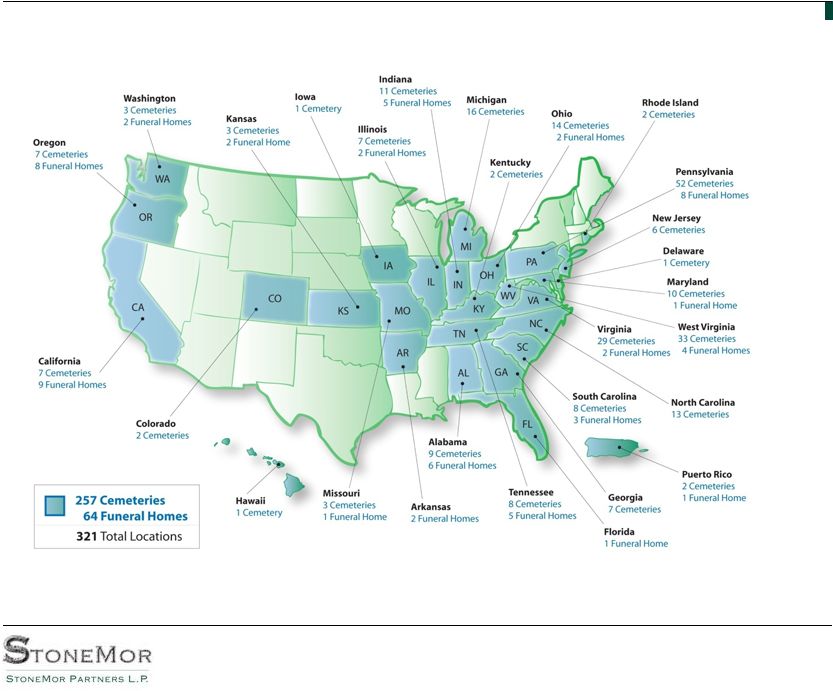

Private and Confidential

21

21

Diverse Geographic Exposure

as of November 12, 2010… |

Private and Confidential

22

22

Geographic Diversification

SALES BY STATE –

YEAR ENDED DECEMBER 31, 2009

Pennsylvania

17.0%

California

10.3%

Ohio

8.2%

Virginia 8.1%

New Jersey

8.0%

West Virginia

7.3%

Maryland 7.3%

North Carolina

6.3%

Alabama

4.6%

Oregon

4.2%

All Others

18.8% |

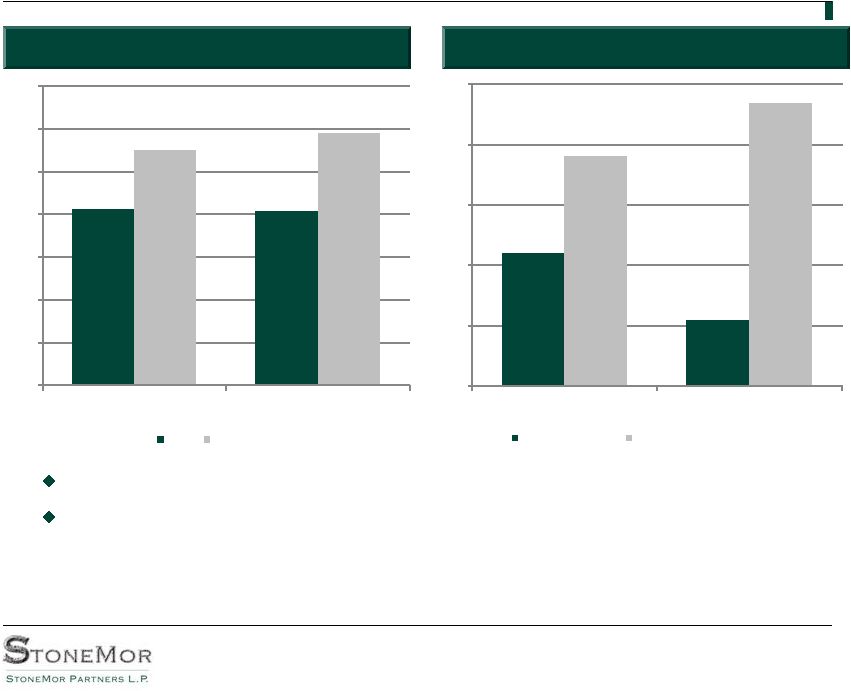

Private and Confidential

23

Historical Performance

($ in millions)

($ in millions)

REVENUE

REVENUE

OPERATING PROFIT

OPERATING PROFIT

Solid performance amid challenging economic conditions

$145

$183

$181

$185

$163

$209

$218

$236

$0

$50

$100

$150

$200

$250

2007

2008

2009

LTM 9/30/10

SAB

Accrual

$13

$17

$11

$5

$26

$32

$35

$40

$0

$5

$10

$15

$20

$25

$30

$35

$40

$45

2007

2008

2009

LTM 9/30/10

Operating Profit

Adjusted Operating Profit |

Private and Confidential

24

Year-to-Date 2010 Performance

Solid year-over-year performance amid challenging economic conditions

A decline in death rates in 2009, and a corresponding reduction in

at-need sales and withdrawals from the merchandise trust, has tempered

results on a GAAP basis YEAR-OVER-YEAR REVENUE

YEAR-OVER-YEAR OPERATING PROFIT

($ in millions)

($ in millions)

$137

$142

$165

$177

$0

$80

$100

$120

$140

$160

$180

$200

9 Months 2009

9 Months 2010

SAB

Accrual

$11

$4

$29

$34

$0

$5

$10

$20

$30

$40

9 Months 2009

9 Months 2010

Operating Profit

Adjusted Operating Profit |

Private and Confidential

25

Operating Metrics

2007

2008

2009

2009

2010

Operating Data:

Interments performed

29,380

38,863

37,782

28,226

29,852

Interment rights sold (1):

Lots

17,509

22,552

22,637

17,587

18,155

Mausoleum crypts (including pre-construction)

2,314

1,881

2,316

1,756

1,836

Niches

602

864

889

683

765

Net interment rights sold (1)

20,425

25,297

25,842

20,026

20,756

Number of contracts written

63,026

80,144

83,043

62,963

68,319

Aggregate contract amount, in thousands (excluding

interest)

$138,588

$187,093

$197,787

$150,673

$164,433

Average amount per contract (excluding interest)

$2,199

$2,334

$2,382

$2,384

$2,407

Number of pre-need contracts written

29,546

35,599

39,043

29,679

33,440

Aggregate pre-need contract amount, in thousands

(excluding interest)

$89,486

$115,024

$124,997

$95,100

$106,309

Average amount per pre-need contract (excluding interest)

$3,029

$3,231

$3,202

$3,204

$3,179

Number of at-need contracts written

33,480

44,545

44,000

33,284

34,879

Aggregate at-need contract amount, in thousands

$49,102

$72,068

$72,790

$54,973

$58,124

Average amount per at-need contract

$1,467

$1,618

$1,654

$1,652

$1,666

Year Ended December 31,

(1) Net of cancellations. Sales of double-depth burial lots are counted

as two sales. Nine Months Ended

September 30, |

Private and Confidential

26

Appendix |

Private and Confidential

27

Cemetery Accounting –

GAAP vs. Accrual

GAAP requires that cemetery product revenue be deferred until (i) the product is

purchased, (ii) the product is specifically identified to the customer, and

(iii) title is transferred

Management uses “accrual”

accounting to monitor its performance, recognizing

revenue at the time a contract is finalized

The

timing

differences

between

GAAP

criteria

for

recognition

and

the

time

sales

are

made create significant disparities in financial results across the two

methods Cemetery operations are particularly affected due to the high level

of pre-need sales

SEC now requires the Company to show both accrual and GAAP-based MD&A in

its filings |

Private and Confidential

rd

rd

28

Cemetery Revenue –

Accounting Recognition

There are significant timing differences for cemetery product revenue recognition

between GAAP and accrual accounting

Cemetery Product

GAAP Revenue Recognition

Accrual Revenue Recognition

Burial Lots

10% of selling price collected

Recognized when the

customer and StoneMor

finalize a contract for a

particular product or

service

Revenue is recorded less

a 10% bad debt reserve

(historically 8.8%)

Expenses are accrued

Receivables are booked

Mausoleums

(Pre-Constructed)

%

of

completion

basis,

once

10%

of selling price collected

Mausoleums

(Existing)

10% of selling price collected

Burial Vaults and

Crypts

When installed in the ground

(0 to 18 months)

Grave Markers

When stored in a warehouse

owned

by

a

3

party

(~18 months)

Caskets

When stored in a warehouse

owned

by

a

3

party

(~18 months)

Grave

Opening

(initial)

When vault is installed

(0 to 18 months)

Grave Opening (final)

When

customer

is

dead

&

buried

(~25 years) |

Private and Confidential

29

Cash Flows of a Typical Contract

Represents a typical contract in which the customer signs a contract for a number

of products, which will be delivered at various times, and pays over a 36

month term Assumes the customer purchases a burial lot, vault, grave marker,

casket and the initial and final opening & closing of the grave site

totaling $5,300 The customer makes a ~10% down payment of $600 at the time of

sale Approximately 8% interest on accounts receivable

Cash Inflows

Time of

Time of

Sale

Year 1

Year 2

Year 3

Death

Total

Merchandise Trust Fund Earnings

$0

$25

$53

$0

$78

Perpetual Care Trust Fund Earnings

-

3

5

8

15

Interest on Accounts Receivable

-

300

200

50

550

Principle Payments from Customer

600

1,450

1,550

1,700

5,300

Total Cash Inflows

$600

$1,778

$1,808

$1,758

$5,943

Cash Outflows

Time of

Time of

Sale

Year 1

Year 2

Year 3

Death

Total

Deposit to Perpetual Care Trust

($17)

($41)

($44)

($48)

(150)

Deposit to Merchandise Trust

(500)

(550)

(1,050)

Merchandise Trust Withdrawals

1,050

1,050

Merchandise Purchase / Service Delivery

(948)

(13)

(960)

Vault, Marker, Casket & Initial Opening & Closing

(948)

(948)

Final Opening & Closing

(13)

(13)

Total Cost

($948)

($13)

($960)

Total Cash Outflows

($541)

($491)

($48)

($13)

($1,093) |

Private and Confidential

30

GAAP vs. Accrual Revenue Recognition

GAAP Accounting Recognition

Time of

Time of

Sale

Year 1

Year 2

Year 3

Death

Total

Merchandise Trust Fund Earnings

$0

$0

$78

$0

$78

Perpetual Care Trust Fund Earnings

-

3

5

8

15

Interest on Accounts Receivable

-

300

200

50

550

Revenue Recognized from Products / Services

1,035

-

3,600

-

135

4,770

Perpetual Care Trust Requirement

135

135

Burial Lots

900

900

Burial Vault

540

540

Grave Marker

720

720

Casket

1,845

1,845

Initial Opening & Closing

495

495

Final Opening & Closing

135

135

Total Revenue

$1,035

$3,600

$135

$4,770

Total Revenue Recognized

$1,035

$303

$3,883

$58

$135

$5,413

Accrual Accounting Recognition

Time of

Time of

Sale

Year 1

Year 2

Year 3

Death

Total

Merchandise Trust Fund Earnings

$0

$25

$53

$0

$78

Perpetual Care Trust Fund Earnings

-

3

5

8

15

Interest on Accounts Receivable

-

300

200

50

550

Revenue Recognized from Products / Services

4,770

-

-

-

-

4,770

Perpetual Care Trust Requirement

135

135

Burial Lots

900

900

Burial Vault

540

540

Grave Marker

720

720

Casket

1,845

1,845

Initial Opening & Closing

495

495

Final Opening & Closing

135

135

Total Revenue

4,770

4,770

Total Revenue Recognized

$4,770

$328

$258

$58

$5,413

Note: Accrual revenue recognition includes a 10% reserve for prospective cancellations.

|