Attached files

| file | filename |

|---|---|

| EX-99.2 - MEMORANDUM IN SUPPORT OF MOTION TO DISMISS - Yellow Corp | dex992.htm |

| 8-K - FORM 8-K - Yellow Corp | d8k.htm |

Investor

Presentation November 2010

Exhibit 99.1 |

2

Overview

Overview

•

Opening Comments

•

Strategy

•

Stakeholder Support

•

New Labor Contract

•

Operating Improvements and Key Milestones

•

Liquidity

•

Summary |

3

Business Segments

Business Segments

•

The company’s National and Regional networks provide the most comprehensive North

American network and flexible solutions to meet its customers’

diverse transportation needs

•

Sale of YRC Logistics allows YRCW to focus on its core businesses

•

Customers maintain access to logistics services via commercial services agreement

Transportation & Logistics

Transportation & Logistics

North American LTL & TL

North American LTL & TL

U.S. National LTL

Inter/Intra-Canada LTL

Truckload

Regional LTL

Regional LTL

Global Logistics

Global Logistics

Western U.S. & Canada

Central U.S. & Canada

Northeast U.S. & Canada

China Ground, Global Forwarding

Jiayu

Jing Jiang

73%

$1.3 Billion 27%

YRC Worldwide Inc. 2009 Revenue: $4.9 Billion

(1)

(1)

Adjusted to exclude $.4 billion revenue from YRC Logistics segment reported as

discontinued operations effective 2Q 2010. $3.6 Billion

$40 million / $265 million |

4

National and Regional Networks

National and Regional Networks

4

Strategy:

Achieve competitive cost base and enhanced customer mix

management, resulting in improved earnings and cash flows |

Stakeholder Support

Stakeholder Support

5

•

Stakeholders alignment to ensure

future success

•

Liquidity programs

•

Sale of assets

•

Deferral of pension contributions

•

Lender flexibility

•

Addressed 2010 bond obligations

•

Converted $470 million of bonds to

equity

•

Refinanced remaining bonds with

$70 million of new 6% notes

•

Competitive cost base

•

Customer confidence |

6

Labor Contract Overview

Labor Contract Overview

•

Extended by two years from 2013 to March 31, 2015

•

Re-entry of YRCW companies into multi-employer pension plans in

June 2011, at a more affordable level of contribution

•

Sustains the current competitive cost structure and improves future

operating leverage, as work rule

changes drive cost efficiencies to

more than offset returning pension contributions and to promote

service enhancements

•

Addresses the long-term market competitiveness of YRCW, which is

designed to protect jobs, enable long-term growth and generate

financial returns to its stakeholders

•

ABF lawsuit update |

7

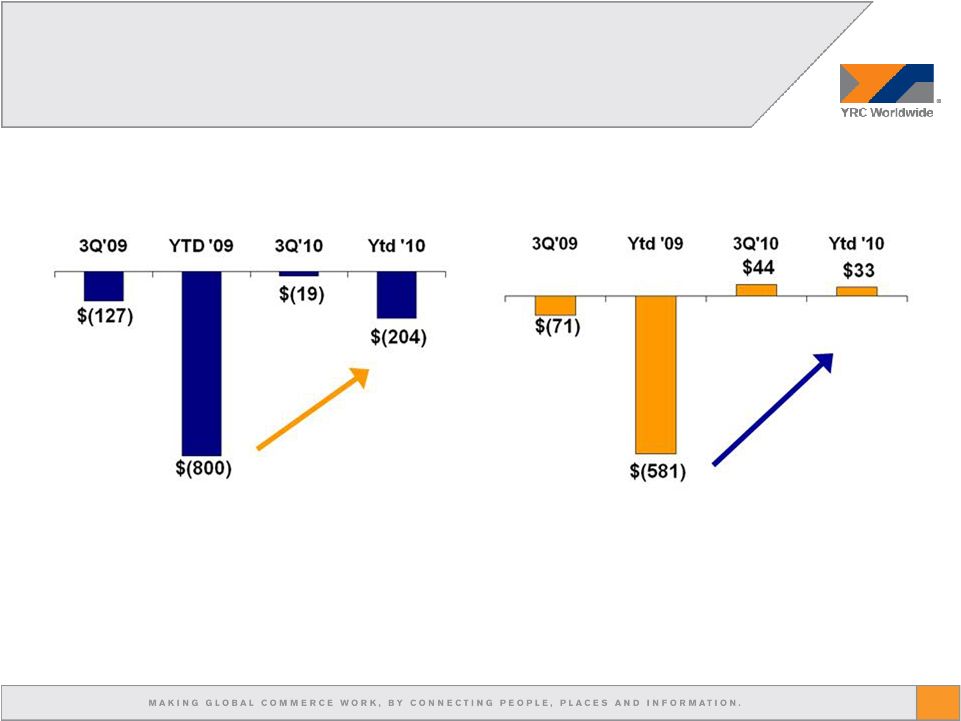

Key Financial Recovery Milestones…to Date

Key Financial Recovery Milestones…to Date

•

2Q and 3Q 2009 –

sequential improvement in adjusted EBITDA

•

4Q 2009 –

sequential and year-over-year improvement in

adjusted EBITDA

•

March 2010 –

volume growth returns

•

April 2010 –

breakeven adjusted EBITDA

•

2Q 2010 –

positive adjusted EBITDA quarter, first since 3Q 2008

•

3Q 2010:

•

Second consecutive quarter of positive adjusted EBITDA

•

Positive cash flow from operating activities

•

Regional operating ratio 97.6

•

National operating ratio 102.9

•

YRCW operating ratio improved 8.8 year-over-year |

Year-Over-Year Operating Improvement

Year-Over-Year Operating Improvement

•

Cost actions, price discipline, and customer mix management

•

Expect YRCW to be adjusted EBITDA positive in 4Q 2010

Adjusted EBITDA is a non-GAAP measure that reflects the company’s earnings

before interest, taxes, depreciation, and amortization expense, and further

adjusted for letter of credit fees, professional restructure fees, discontinued

operations, and other items as defined in the company’s Credit Agreement. Adjusted

EBITDA is used for internal management purposes as a financial measure that reflect

the company’s core operating performance and is used by management to

measure compliance with financial covenants in the company’s Credit Agreement. This financial measure should not be construed as a better measurement

than operating income as defined by generally accepted accounting principles. See

Pages15 and16 for reconciliations of GAAP measures to non-GAAP financial

measures. 8

Operating Loss

(in millions)

Adjusted EBITDA

(in millions) |

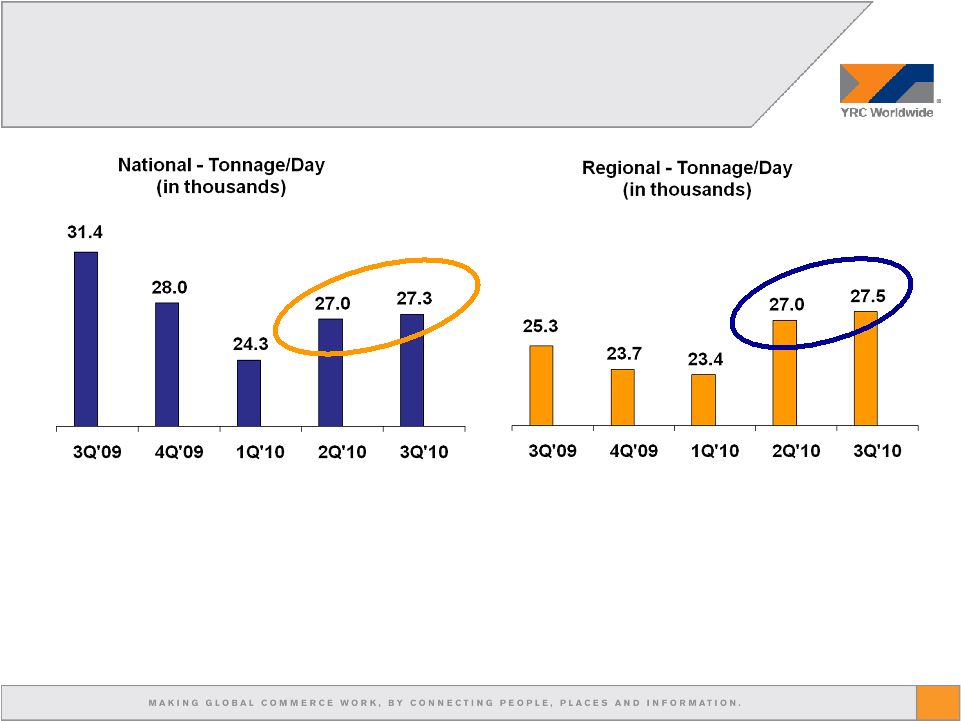

Tonnage Per Day Trends

•

Sequential volume improvement trends

•

National up 1.2% from 2Q 2010; second consecutive sequential increase

•

Regional up 2.1% from 2Q 2010; year-over-year up 9%

•

Market share stabilized during 2Q & 3Q; now positioned for future profitable

growth 9 |

10

Liquidity

Liquidity

•

Stable liquidity position

•

Proactive actions to fund working capital for revenue growth

•

DSO improvement 3 days year-over-year

•

Renewal of $325 million asset-backed securitization through October 2011

Note: Revolver reserves are subject to the terms of the company’s

credit agreement with its lenders. |

11

Summary

Summary

•

Strategic focus on core business

•

Improving operational performance

•

Stakeholder alignment

•

Customer confidence |

12

Appendix |

2010

Expectations 2010 Expectations

•

YRCW positive adjusted EBITDA and be well within credit

agreement financial covenants in 4Q 2010

•

Gross capital expenditures of $20 to $30 million

•

Excess property sales of $70 to $80 million

•

Sale and financing leasebacks approximately $50 million

•

Effective income tax rate of 3%

13 |

Common

Share Recap Pre-Split and Post-Split Common Share Recap Pre-Split and

Post-Split 14

Authorized

Outstanding

(1)

6% Notes

(2)

Options/RSU’s

(3)

Available

Jun 30

2 billion

1.124 billion

202 million/

$70M

350 million

324 million

Post 1:25 Split

Jun 30

(pro forma)

80 million

45 million

8 million

14 million

13 million

Sep 30

80 million

47.5 million

5.5 million/

$69.410M

14 million

13 million

1)

Per third quarter 2010 10-Q

2)

Pro

forma

amounts,

assuming

$70m

notes

are

fully

converted

into

shares,

inclusive

of

interest

and

make-whole

amounts

paid

in

shares;

represents

an

‘all-in’

conversion

rate

of

approximately $8.67/share ($0.35/share pre-split)

a)

In August 2010, the company temporarily modified the conversion ratio to $0.25/share

($0.01/share pre-split) and issued 2.4m shares (59m pre-split) in conversion of

$590,000 of notes. In addition, the company issued 0.2 m shares (5.5m pre-split)

for semi-annual interest due August 15, 2010. b)

Remaining

5.5m

shares

relate

to

outstanding

notes

of

$69.41m

or

an

‘all-in’

conversion

ratio

of

approximately

$12.61

per

share

for

future

conversions

(approximately

$.50/share pre-split).

3)

Includes June 2010 Teamster option awards of 10.5m (264m pre-split) with a strike

price of $12/share ($0.48/share pre-split), June 2010 shareholder approval of 2.7m shares (67m

pre-split) for the non-union equity plan which are available for future equity

awards and 2009 employee awards (union and non-union) of 0.6m (15m pre-split). |

Consolidated Adjusted EBITDA

Consolidated Adjusted EBITDA

15

For the Three and Nine Months Ended September 30

2010

2009

2010

2009

Operating revenue

1,136,836

$

1,203,977

$

3,243,081

$

3,820,916

$

Operating Ratio, as adjusted

101.7%

110.5%

105.5%

120.4%

Reconciliation of operating loss to adjusted EBITDA:

Operating loss

(18,836)

$

(126,648)

$

(203,726)

$

(799,556)

$

Union equity awards

-

-

24,995

20,639

Operating loss, as adjusted

(18,836)

(126,648)

(178,731)

(778,917)

(Gains) losses on property disposals, net

(3,429)

(11,138)

3,183

(10,579)

Impairment charges

-

-

5,281

-

Depreciation and amortization

49,785

58,346

150,491

181,173

Equity based compensation expense

2,211

2,032

5,545

8,147

Letter of credit expense

8,321

8,838

24,943

23,301

Restructuring professional fees

6,594

n/a

15,936

n/a

Reimer Finance Co. dissolution (foreign exchange)

n/a

n/a

5,540

n/a

Other nonoperating, net

(312)

(2,018)

1,029

(4,495)

Adjusted EBITDA

44,334

$

(70,588)

$

33,217

$

(581,370)

$

Operating Ratio, as adjusted is calculated as 100 minus the result of dividing operating income,

as adjusted by operating revenue or plus the result of dividing operating loss, as adjusted by

operating revenue, and expressed as a percentage. Three Months

Nine Months

SUPPLEMENTAL FINANCIAL INFORMATION

YRC Worldwide Inc. and Subsidiaries

(Amounts in thousands)

(Unaudited) |

2010

Consolidated Operating Cash Flows 2010 Consolidated Operating Cash Flows

16

YRC Worldwide Inc. and Subsidiaries

(Amounts in thousands)

(Unaudited)

1Q 2010

2Q 2010

3Q 2010

Reconciliation of Adjusted EBITDA to net cash

from (used in) operating activities:

Adjusted EBITDA

(51,034)

$

39,917

$

44,334

$

Add back amounts included in Adjusted EBITDA:

Restructuring professional fees

n/a

(9,342)

(6,594)

Discontinued operations and permitted dispositions

(2,135)

(7,421)

1,347

Cash interest

(10,876)

(10,062)

(11,009)

Working capital cash flows, net

1,063

(47,870)

(22,678)

Net cash used in operating activities before income taxes

(62,982)

(34,778)

5,400

Cash income tax refunds, net

81,272

2,016

(253)

Net cash (used in) provided by operating activities

18,290

$

(32,762)

$

5,147

$ |

17

Forward-Looking Statements

Forward-Looking Statements

This

presentation

contains

forward-looking

statements

within

the

meaning

of

Section

27A

of

the

Securities

Act

of

1933,

as

amended,

and

Section

21E

of

the

Securities

Exchange

Act

of

1934,

as

amended.

The

words

“believe,”

“expect,”

“continue,”

and

similar

expressions

are

intended

to

identify

forward-looking

statements.

It

is

important

to

note

that

the

company’s

actual

future

results

could

differ

materially

from

those

projected

in

such

forward-looking

statements

because

of

a

number

of

factors,

including

(among

others)

our

ability

to

generate

sufficient

cash

flows

and

liquidity

to

fund

operations,

which

raises

substantial

doubt

about

our

ability

to

continue

as

a

going

concern,

inflation,

inclement

weather,

price

and

availability

of

fuel,

sudden

changes

in

the

cost

of

fuel

or

the

index

upon

which

the

company

bases

its

fuel

surcharge,

competitor

pricing

activity,

expense

volatility,

including

(without

limitation)

expense

volatility

due

to

changes

in

rail

service

or

pricing

for

rail

service,

ability

to

capture

cost

reductions,

changes

in

equity

and

debt

markets,

a

downturn

in

general

or

regional

economic

activity,

effects

of

a

terrorist

attack,

labor

relations,

including

(without

limitation)

the

impact

of

work

rules,

work

stoppages,

strikes

or

other

disruptions,

any

obligations

to

multi-employer

health,

welfare

and

pension

plans,

wage

requirements

and

employee

satisfaction,

and

the

risk

factors

that

are

from

time

to

time

included

in

the

company’s

reports

filed

with

the

SEC.

The

company’s

expectations

regarding

the

rate

and

timing

of

pricing

and

revenue

mix

improvements

are

only

its

expectations

regarding

these

matters.

Actual

rate

and

timing

of

pricing

and

revenue

mix

improvements

could

differ

based

on

a

number

of

factors

including

(among

others)

general

economic

trends

and

excess

capacity

within

the

industry,

and

the

factors

that

affect

revenue

results

(including

the

risk

factors

that

are

from

time

to

time

included

in

the

company’s

reports

filed

with

the

SEC).

The

company’s

expectations

regarding

the

timing

and

degree

of

market

share

growth

are

only

its

expectations

regarding

these

matters.

Actual

timing

and

degree

of

market

share

growth

could

differ

based

on

a

number

of

factors

including

(among

others)

the

company’s

ability

to

persuade

existing

customers

to

increase

shipments

with

the

company

and

to

attract

new

customers,

and

the

factors

that

affect

revenue

results

(including

the

risk

factors

that

are

from

time

to

time

included

in

the

company’s

reports

filed

with

the

SEC).

The

company’s

expectations

regarding

the

impact

of,

and

the

service

and

operational

improvements

and

collateral

and

cost

reductions

due

to,

the

integration

of

Yellow

Transportation

and

Roadway,

improved

safety

performance,

right-sizing

the

network,

consolidation

of

support

functions,

the

company’s

credit

ratings

and

the

timing

of

achieving

the

improvements

and

cost

reductions

could

differ

materially

from

actual

improvements

and

cost

reductions

based

on

a

number

of

factors,

including

(among

others)

the

factors

identified

in

the

preceding

and

following

paragraphs,

the

ability

to

identify

and

implement

cost

reductions

in

the

time

frame

needed

to

achieve

these

expectations,

the

success

of

the

company’s

operating

plans

and

programs,

the

company’s

ability

to

successfully

reduce

collateral

requirements

for

its

insurance

programs,

which

in

turn

is

dependent

upon

the

company’s

safety

performance,

ability

to

reduce

the

cost

of

claims

through

claims

management,

the

company’s

credit

ratings

and

the

requirements

of

state

workers’

compensation

agencies

and

insurers

for

collateral

for

self-

insured

portions

of

workers’

compensation

programs,

the

need

to

spend

additional

capital

to

implement

cost

reduction

opportunities,

including

(without |

Forward-Looking Statements

Forward-Looking Statements

18

limitation)

to

terminate,

amend

or

renegotiate

prior

contractual

commitments,

the

accuracy

of

the

company’s

estimates

of

its

spending

requirements,

changes

in

the

company’s

strategic

direction,

the

need

to

replace

any

unanticipated

losses

in

capital

assets,

approval

of

the

affected

unionized

employees

of

changes

needed

to

complete

the

integration

under

the

company’s

union

agreements,

the

readiness

of

employees

to

utilize

new

combined

processes,

the

effectiveness

of

deploying

existing

technology

necessary

to

facilitate

the

combination

of

processes,

the

ability

of

the

company

to

receive

expected

price

for

its

services

from

the

combined

network

and

customer

acceptance

of

those

services.

The

company's

expectations

regarding

the

lawsuit

filed

by

ABF

are

only

its

expectations

regarding

this

matter.

The

actual

outcome

of

ABF

lawsuit

is

dependent

on

final

resolution

of

the

claims

through

the

courts

or

grievance

process

under

the

company's

labor

agreement.

The

company's

expectations

regarding

the

amount

and

timing

of

receipt

of

a

working

capital

adjustment

in

connection

with

the

sale

of

a

majority

of

its

Logistics

business

are

only

its

expectations

regarding

these

matters.

The

actual

amount

and

timing

of

receipt

of

a

working

capital

adjustment

is

dependent

on

final

resolution

of

the

amount

with

the

buyer

of

the

Logistics

business

in

accordance

with

the

related

purchase

agreement.

The

company’s

expectations

regarding

re-entry

into

multi-employer

pension

funds

to

which

it

contributes

are

only

its

expectations

regarding

this

matter.

Whether

multi-employer

pension

funds

to

which

the

company

contributes

approve

the

company’s

re-entry

into

the

funds

and

the

timing

and

terms

and

conditions

of

any

re-entry

is

dependent

upon

approval

by

the

affected

funds.

Actual

contributions

to

multi-employer

pension

funds

are

also

affected

by

levels

of

employment.

The

company’s

expectations

regarding

the

benefits

from

the

new

labor

contract

are

only

its

expectations

regarding

this

matter.

The

wage,

benefit

and

work

rule

concessions

in

the

new

labor

contract

may

cease

if

a

committee

representing

the

Teamsters

(“TNFINC”)

exercises

its

rights

in

the

new

labor

contract

described

below.

•

TNFINC

was

given

the

right

to

approve

certain

changes

of

control

applicable

to

the

company.

If

TNFINC

approval

is

not

received,

TNFINC

may

declare

the

wage,

benefit

and

work

rule

concessions

null

and

void

on

a

prospective

basis.

•

In

the

event

of

a

bankruptcy

of

the

company,

TNFINC

may

declare

the

wage,

benefit

and

work

rule

concessions

null

and

void. |

Forward-Looking Statements

Forward-Looking Statements

19

•

The

company

expects

to

begin

discussions

to

restructure

the

debt

under

its

credit

agreement,

which

may

include

additional

capital

investment

(debt

and/or

equity)

by

third

parties

in

a

recapitalization.

The

new

labor

contract

provides

the

following:

o

TNFINC

would

have

the

right

to

approve

the

various

transactions

comprising

the

restructuring/recapitalization.

o

If

TNFINC’s

approval

is

not

obtained,

TNFINC

may

declare

the

wage,

benefit

and

work

rule

concessions

null

and

void

on

a

prospective

basis,

and

the

company

would

owe

its

Teamster

employees

an

amount

equal

to

the

concessions

that

in

fact

benefited

the

company

prior

to

the

termination.

o

TNFINC

would

have

significant

rights

to

participate

in

the

restructuring/recapitalization

discussions.

o

In

deciding

whether

to

give

its

approval

to

a

restructuring/recapitalization,

TNFINC

could

demand

on

behalf

of

Teamster

represented

employees

of

the

company’s

subsidiaries

additional

compensation

if

negotiated

performance

triggers

are

met,

equity

participation,

specified

terms

in

the

restructuring,

specified

indebtedness

levels

resulting

from

the

transactions,

governance

rights

and

financial

viability

criteria.

o

The

company

is

required

to

enter

into

definitive

agreements

to

effect

the

restructuring/recapitalization

by

December

31,

2010

and

close

those

transactions

by

March

31,

2011,

or

in

each

case,

such

later

date

as

TNFINC

would

agree

and,

in

each

case,

on

terms

and

conditions

that

TNFINC

approves.

The

company’s

expectations

regarding

ratification

of

a

new

labor

agreement

for

Reddaway

and

the

timing

of

any

ratification

are

only

its

expectations

regarding

this

matter.

Ratification

of

a

new

labor

agreement

for

Reddaway

is

dependent

on

a

majority

of

Reddaway's

union

employees

who

are

eligible

to

vote

to

approve

the

new

labor

agreement.

The

company’s

expectations

regarding

its

ability

to

replace

the

ABS

with

a

new

facility

are

only

its

expectations

regarding

this

matter.

Whether

the

company

is

able

to

replace

the

ABS

and

the

terms

of

any

replacement

facility

are

dependent

upon

a

number

of

factors

including

(among

others)

the

company

reaching

agreement

with

interested

lenders

and

closing

such

transaction

on

negotiated

terms

and

conditions.

The

company’s

expectations

regarding

multi-employer

pension

plan

reform

are

only

its

expectations

regarding

this

matter.

The

impact

to

the

company

and

the

multi-employer

pension

plans

to

which

it

contributes

of

such

reform

is

subject

to

a

number

of

conditions,

including

(among

others)

whether

Congress

passes

legislation

to

reform

multi-employer

pension

plans

and

the

timing

of,

and

provisions

included

in,

such

legislation. |

Forward-Looking Statements

Forward-Looking Statements

20

The

company’s

expectations

regarding

the

continued

support

of

its

stakeholders

are

only

its

expectations

regarding

this

matter.

Whether

the

company’s

stakeholders

continue

to

support

the

company

including

(among

other

things)

to

continue

deferral

arrangements

in

2011

or

to

restructure

obligations

owed

to

such

stakeholders

is

subject

to

a

number

of

conditions

including

(among

other

things)

the

outcome

of

discussions

with

such

stakeholders,

whether

requested

support

meets

their

requirements

and

the

factors

identified

in

the

preceding

paragraphs.

The

company’s

expectations

regarding

future

asset

dispositions

and

sale

and

financing

leasebacks

of

real

estate

are

only

its

expectations

regarding

these

matters.

Actual

dispositions

and

sale

and

financing

leasebacks

will

be

determined

by

the

availability

of

capital

and

willing

buyers

and

counterparties

in

the

market

and

the

outcome

of

discussions

to

enter

into

and

close

any

such

transactions

on

negotiated

terms

and

conditions,

including

(without

limitation)

usual

and

ordinary

closing

conditions

such

as

favorable

title

reports

or

opinions

and

favorable

environmental

assessments

of

specific

properties.

The

company’s

expectations

regarding

liquidity,

working

capital

and

cash

flow

are

only

its

expectations

regarding

these

matters.

Actual

liquidity,

working

capital

and

cash

flow

will

depend

upon

(among

other

things)

the

company’s

operating

results,

the

timing

of

its

receipts

and

disbursements,

the

company’s

access

to

credit

facilities

or

credit

markets,

the

company’s

ability

to

continue

to

defer

interest

and

fees

under

the

company’s

credit

agreement

and

ABS

facility

and

interest

and

principal

under

the

company’s

contribution

deferral

agreement,

the

continuation

of

the

wage,

benefit

and

work

rule

concessions

under

the

company's

modified

labor

agreement

and

temporary

cessation

of

pension

contributions,

and

the

factors

identified

in

the

preceding

paragraphs.

The

company’s

expectations

regarding

its

capital

expenditures

are

only

its

expectations

regarding

this

matter.

Actual

expenditures

could

differ

materially

based

on

a

number

of

factors,

including

(among

others)

the

factors

identified

in

the

preceding

paragraphs.

The

company’s

expectations

regarding

its

compliance

with

its

credit

agreement

covenants

are

only

its

expectations

regarding

these

matters.

Whether

the

company

satisfies

the

covenants

under

its

credit

agreement

is

subject

to

a

number

of

factors,

including

(among

others)

the

factors

identified

in

the

preceding

paragraphs.

The

company’s

expectations

regarding

its

effective

tax

rate

are

only

its

expectations

regarding

this

rate.

The

actual

rate

could

differ

materially

based

on

a

number

of

factors,

including

(among

others)

variances

in

pre-tax

earnings

on

both

a

consolidated

and

business

unit

basis,

variance

in

pre-tax

earnings

by

jurisdiction,

impacts

on

our

business

from

the

factors

described

above,

variances

in

estimates

on

non-deductible

expenses,

tax

authority

audit

adjustments,

change

in

tax

rates

and

availability

of

tax

credits.

The

company’s

expectations

regarding

its

ability

to

complete

its

comprehensive

recovery

plan

are

only

its

expectations

regarding

these

matters.

Whether

the

company

is

able

to

complete

its

comprehensive

recovery

plan

is

dependent

upon

a

number

of

factors

including

(among

others)

the

company

reaching

agreement

with

its

stakeholders

and

interested

investors

and

closing

transactions

on

negotiated

terms

and

conditions,

including

(without

limitation)

any

closing

conditions

that

the

company’s

stakeholders

and

investors

may

require. |