Washington, D.C. 20549

FORM 10-K/A

(Amendment No. 1)

|

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended May 30, 2010

Commission File Number: 1-6453

NATIONAL SEMICONDUCTOR CORPORATION

(Exact name of registrant as specified in its charter)

|

DELAWARE

|

95-2095071

|

|

(State of Incorporation)

|

(I.R.S. Employer

Identification Number)

|

2900 SEMICONDUCTOR DRIVE, P.O. BOX 58090

SANTA CLARA, CALIFORNIA 95052-8090

(Address of principal executive offices)

Registrant’s telephone number, including area code: (408) 721-5000

Securities registered pursuant to Section 12(b) of the Act:

|

Title of Each Class

|

Name of Each Exchange on Which Registered

|

|

|

Common stock, par value $0.50 per share

|

New York Stock Exchange

|

Securities registered pursuant to Section 12(g) of the Act:

|

None

|

||

|

(Title of class)

|

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

|

Yes S

|

No £

|

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

|

Yes £

|

No S

|

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

|

Yes S

|

No £

|

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

|

Yes £

|

No £

|

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. £

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act (check one):

|

Large Accelerated filer S

|

Non-accelerated filer £

|

||

|

Accelerated filer £

|

Smaller reporting company £

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

|

Yes £

|

No S

|

The aggregate market value of our common stock held by non-affiliates of the registrant as of November 29, 2009, was approximately $2,894,742,461 based on the last reported sale price on the last trading date prior to that date. Shares of common stock held by each officer and director and by each person who owns 5 percent or more of the outstanding common stock have been excluded because these persons may be considered to be affiliates. This determination of affiliate status for purposes of this calculation is not necessarily a conclusive determination for other purposes.

The number of shares outstanding of the registrant’s common stock, $0.50 par value, as of June 27, 2010 was 239,324,550 shares.

DOCUMENTS INCORPORATED BY REFERENCE

|

Document

|

Location in Form 10-K

|

|

|

Portions of the Proxy Statement for the Annual Meeting of Stockholders to be held on or about September 24, 2010

|

Part III

|

|

2

NATIONAL SEMICONDUCTOR CORPORATION

ANNUAL REPORT ON FORM 10-K/A

FISCAL YEAR ENDED MAY 30, 2010

TABLE OF CONTENTS

|

PART III

|

||

|

Item 11.

|

Executive Compensation

|

1

|

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

29

|

|

PART IV

|

|

|

|

Item 15.

|

Exhibits and Financial Statement Schedules

|

33

|

|

Signatures

|

EXPLANATORY NOTE

We are filing this Amendment No. 1 on Form 10-K/A to amend our Annual Report on Form 10-K for the fiscal year ended May 30, 2010, as filed with the Securities and Exchange Commission on July 20, 2010 (the “Original Form 10-K”). The purpose of this Amendment No. 1 is to add Suneil Parulekar, our Senior Vice President, Worldwide Marketing and Sales, as a named executive officer for purposes of Part III, Item 11 (“Executive Compensation”) and the “Security Ownership of Management” table in Item 12 (“Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters”). We have also corrected minor typographical and formatting errors. As required by Rule 12b-15 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), the complete text of Part III, Items 11 and 12 have been set forth in this Amendment No. 1, including those portions that have not been modified from the Original Form 10-K. Certain information required by these Items was incorporated by reference to our definitive Proxy Statement filed pursuant to Regulation 14A of the Exchange Act for our 2010 Annual Meeting of Stockholders, as filed with the Securities and Exchange Commission on August 11, 2010, in the Original Form 10-K. In addition, as required by Rule 12b-15, this Amendment No. 1 contains new certifications by our Principal Executive Officer and Principal Financial Officer, filed as exhibits hereto. Because this Amendment No. 1 includes no financial statements, we are not including certifications pursuant to Section 906 of the Sarbanes-Oxley Act of 2002.

Except as set forth above, we have not modified or updated disclosures presented in the Original Form 10-K to reflect events or developments that have occurred after the date of the Original Form 10-K. Among other things, forward-looking statements made in the Original Form 10-K have not been revised to reflect events, results, or developments that have occurred or facts that have become known to us after the date of the Original Form 10-K (other than as discussed above), and such forward-looking statements should be read in their historical context. Accordingly, this Amendment No. 1 should be read in conjunction with our filings made with the Securities and Exchange Commission subsequent to the filing of the Original Form 10-K.

i

ITEM 11. EXECUTIVE COMPENSATION

Compensation Committee Interlocks and Insider Participation

The members of the Compensation Committee are Mr. Frankenberg, Mr. Appleton, Dr. Maidique and Mr. McCracken. We do not have any Compensation Committee interlocks or insider participation we are required to report under SEC rules.

Director Compensation

We pay directors who are not employees of National an annual fee of $50,000, plus fees of $1,500 for each Audit, Compensation and Governance Committee meeting attended. We pay the Lead Independent Director, the Chairman of the Governance Committee and the Chairman of the Compensation Committee each an additional annual fee of $7,500, while the Chairman of the Audit Committee receives an additional annual fee of $12,500. Directors who are not employees are also reimbursed for actual expenses incurred on behalf of the Company. The annual and meeting fees appear in the Director Compensation Table under “Fees Earned or Paid in Cash”; totals in this column include the value of annual fees that the director elected to take in stock. Directors who are employees of National are not compensated for their services as directors.

We also pay a portion of director compensation in stock. Under the terms of the stockholder-approved National Semiconductor Corporation Director Stock Plan, as amended and restated effective August 13, 2005, which we refer to as the Director Stock Plan, each non-employee director receives 12,000 shares of stock when first elected or appointed to the Board of Directors and an additional 12,000 shares on the date of each subsequent re-election by the stockholders. Non-employee directors may also elect to take their annual retainer fee in stock. Restrictions on the stock issued in lieu of the annual retainer fee expire six months after issuance. Restrictions on the 12,000 shares issued at appointment, election or subsequent reelection automatically expire thirty-six months after issuance. During fiscal 2010, a total of 139,102 shares were issued to non-employee directors under the Director Stock Plan. The grant date fair value of shares issued during the 2010 fiscal year pursuant to the Director Stock Plan is shown in the Director Compensation Table under “Stock Awards.” Dividends paid on shares issued under the Director Stock Plan that were subject to forfeiture at the time the dividend was paid are shown in the Director Compensation Table under “All Other Compensation.”

Director Compensation

Below is a table showing the compensation received by our non-employee directors during fiscal 2010:

|

Name

|

Fees Earned or

Paid in Cash($)(1)

|

Stock

Awards($)(2)(3)

|

All Other

Compensation

(4)($)

|

Total

($)

|

|

|

William J. Amelio

|

$50,000(5)

|

$238,030

|

$0

|

$288,030

|

|

|

Steven R. Appleton

|

72,500

|

232,567

|

12,148

|

317,215

|

|

|

Gary P. Arnold

|

68,000

|

175,080

|

11,520

|

254,600

|

|

|

Richard J. Danzig

|

68,000

|

175,080

|

11,520

|

254,600

|

|

|

John T. Dickson

|

76,750

|

175,080

|

11,520

|

263,350

|

|

|

Robert J. Frankenberg

|

72,500

|

175,080

|

11,520

|

259,100

|

|

|

Modesto A. Maidique

|

65,000

|

175,080

|

11,520

|

237,600

|

|

|

Edward R. McCracken

|

51,000

|

175,080

|

11,520

|

251,600

|

|

|

Roderick C. McGeary

|

75,875

|

329,760(6)

|

4,800

|

410,435

|

|

|

William E. Mitchell(7)

|

6,528

|

188,040

|

0

|

194,568

|

|

|

(1)

|

Includes annual retainer fees, committee chairmanship fees and meeting fees, including fees paid at the election of a director in Company stock pursuant to the Director Stock Plan. The number of shares issued in lieu of the retainer fees and committee chairmanship fees were: Mr. Amelio: 3,178 shares having a fair market value per share of $15.73 on April 16, 2010 (the date of issuance); and Mr. Appleton: 3,924 shares having a fair market value of $14.65 per share on September 25, 2009 (the date of issuance).

|

|

(2)

|

Represents the grant date fair value determined in accordance with FASB ASC Topic 718 of shares issued under the Director Stock Plan during the fiscal year. Amounts vary depending on the date of issuance and whether the director has elected to take annual retainer fees in stock and do not reflect the actual amount that will be paid to or received by the director. Restrictions on the stock awards expire either 6 or 36 months after issuance depending on whether issued in lieu of the annual director fee or as part of the annual stock award, respectively.

|

1

|

(3)

|

Aggregate number of shares issued under the Director Stock Plan that are still subject to restriction at the end of fiscal 2010 (includes shares issued in prior fiscal years that are still subject to restriction at fiscal year end): Mr. Amelio: 15,178: Mr. Appleton: 36,000; Mr. Arnold: 36,000; Mr. Danzig: 36,000; Mr. Dickson: 36,000; Mr. Frankenberg: 36,000; Dr. Maidique: 36,000; Mr. McCracken: 36,000; Mr. McGeary: 24,000; and Mr. Mitchell: 12,000.

|

Aggregate number of options held by each of the directors at fiscal year end: Mr. Amelio: 0; Mr. Appleton: 30,000; Mr. Arnold: 0; Mr. Danzig: 90,000; Mr. Dickson: 0; Mr. Frankenberg: 90,000; Dr. Maidique: 0; Mr. McCracken: 50,000; Mr. McGeary: 0; and Mr. Mitchell: 0. We ceased granting options to directors in fiscal 2006.

|

(4)

|

This column represents dividends paid on shares issued under the Director Stock Plan, including shares issued in prior fiscal years that are subject to restriction at the time the dividend was paid during fiscal 2010. Dividends are not factored into the calculation of grant date fair value of shares issued under the Director Stock Plan. The incremental cost to the Company of perquisites in fiscal 2010 for each of the directors did not exceed $10,000.

|

|

(5)

|

Mr. Amelio was appointed to the Company’s Board of Directors on April 16, 2010 and chose to take his retainer fees in stock under the Director Stock Plan.

|

|

(6)

|

Consists of the sum of $154,680 (the grant date fair value of shares issued under the Director Stock Plan at the time of Mr. McGeary’s appointment in July 2009) and $175,080 (the grant date fair value of shares issued as part the annual stock award in September 2009).

|

|

(7)

|

Mr. Mitchell was appointed to the Company’s Board of Directors on April 16, 2010.

|

Director Retirement and Termination Benefits

Except as described below, we do not have any director termination or retirement benefits.

In 1994, the Board of Directors adopted a policy providing for a retirement benefit for directors consisting of the payment of the annual retainer fee (currently $50,000 per year) for a period of one half of the number of years the director served on the Board of Directors, with these payments limited to a maximum of twelve years. The retirement benefit has been terminated and no current directors other than Mr. Arnold are eligible to receive retirement benefits upon retirement, although we are currently paying retirement benefits to three retired directors.

Upon a termination of service as a director by reason of death, disability or retirement, the restrictions on the shares issued to directors under the Director Stock Plan expire provided the director has completed a minimum of six months of service. Directors are eligible for these retirement provisions once they have either completed at least five years of service or have reached the mandatory retirement age of 70.

2

EXECUTIVE COMPENSATION

Compensation Discussion & Analysis

Executive Summary

This Compensation Discussion and Analysis provides an overview of the Company’s compensation policies with respect to the compensation paid for the 2010 fiscal year to each of the executives of National Semiconductor listed in the Summary Compensation Table below.

The Compensation Committee determines each element of compensation paid to the CEO and approves all compensation paid to the Company’s other executive officers.

During fiscal 2010, on November 30, 2009, the Company’s then current chief executive officer, Brian L. Halla, retired and was replaced as chief executive officer by Donald Macleod, the Company’s current Chief Executive Officer. The data and discussion below details determinations made with respect to Mr. Halla at the start of fiscal 2010 and for Mr. Macleod, first as president and chief operating officer and then again in November 2009 at the time of his appointment as Chief Executive Officer.

The members of the Compensation Committee are selected by the Board of Directors. The members of the Compensation Committee for fiscal 2010 were Messrs. Frankenberg (Committee chair), Appleton, Maidique and McCracken. None of the Compensation Committee members has any interlocking relationships and each member is independent and qualifies as an “outside director” under Section 162(m) of the Internal Revenue Code.

The Compensation Committee oversees an executive compensation program designed to attract and retain talented executives in a cost effective manner. The Compensation Committee considers a wide range of technology companies with which the Company competes for talent, and also considers National’s pay-for-performance philosophy. This approach ensures that a significant amount of executives’ compensation is “at risk” and earned through superior company performance.

In determining the compensation to be paid to National’s executive officers, the Compensation Committee is guided by the following principles:

|

|

•

|

Pay for performance, structuring compensation so that high performing individuals are able to earn total compensation commensurate with Company performance relative to its company peers and with individual executive performance relative to executive peers, respectively;

|

|

|

•

|

Pay competitively, by establishing moderately attractive base salaries and comparable at market benefit plans with opportunities to achieve additional performance driven compensation at or near the 75th percentile for comparable companies for superior performance; and

|

|

|

•

|

Align compensation with stockholders’ interests through the use of stock options and performance share units as a significant portion of total compensation.

|

The executive compensation program consists of the following elements applicable to all executives:

|

Element

|

Description or role of element

|

|

|

Base salary

|

Fixed level of compensation for day-to-day responsibilities and achieving target goals and objectives

|

|

|

Executive Officer Incentive Plan

|

Annual cash incentive which is earned for achieving goals and objectives identified by the Compensation Committee

|

|

|

Long-term incentives

|

Equity awards designed to bridge short and long term goals and objectives and further align executive behavior and shareholder interests by rewarding executives for performance that results in increases in Company stock price

|

|

|

• Stock options

|

Each aligns executive behavior with shareholder interests

|

|

|

• Performance share units

|

Units convert to equivalent number of shares if performance goals are achieved

|

|

|

Benefits

|

Except as referenced below, executives participate in Company-wide benefit programs. Executives may choose to defer a portion of salary and annual incentive bonus under a deferred compensation program

|

|

|

Change-of-control

|

Provides incentive to executives to facilitate extraordinary opportunities to maximize shareholder value

|

|

3

How compensation determinations are made

The Compensation Committee annually reviews market trends in compensation, including the practices of identified competitors, and the alignment of the compensation program with the Company’s strategy. Specifically, for executive officers, the Compensation Committee:

|

|

•

|

establishes and approves target compensation levels for each executive officer;

|

|

|

•

|

approves individual executive and Company performance measures and goals;

|

|

|

•

|

determines the mix between cash and stock, short-term and long-term incentives and benefits;

|

|

|

•

|

verifies the achievement of previously established performance goals; and

|

|

|

•

|

approves the resulting cash or equity awards to executives.

|

In making determinations about total compensation for executives, the Compensation Committee takes into account a number of factors: the competitive market; Company performance; shareholder dilution; the particular executive’s role, responsibilities, experience, and performance; Company need; and retention. The Compensation Committee also considers other equitable factors such as the role, contribution and performance of an individual executive relative to the executive’s peers at the Company. The Compensation Committee does not assign specific weights to these factors, but rather makes a subjective judgment taking all of these factors into account. However, during the last fiscal year the Compensation Committee paid special consideration to issues of retention and the impact of the global economy on the Company’s business.

Each year, the Compensation Committee reviews the compensation of the CEO and conducts a performance assessment of the CEO. This assessment is presented to the full Board of Directors in executive session and is considered by the Compensation Committee along with market and other factors highlighted above to determine the CEO’s compensation.

Each year, the CEO makes compensation recommendations for all other executives and presents the Compensation Committee with his evaluation of the performance, development and potential future role for each executive. In determining an executive’s individual performance, the Compensation Committee discusses the CEO’s assessment and recommendations in addition to their own experience with the executive.

The Compensation Committee also utilizes the services of a compensation consultant, Frederic W. Cook & Co., Inc., as discussed more fully below under “Compensation Consultant.”

Pay for performance

The Company’s compensation philosophy is to, wherever practicable, link pay to performance and to emphasize performance-based incentives. To date, the Compensation Committee believes executive compensation has been commensurate with Company performance. Since fiscal 2005, the Compensation Committee has used return on invested capital (ROIC) as a performance metric for performance share units (as described below) granted to executives. From fiscal 2005 through fiscal 2008, the Company significantly outperformed the S&P 500 median by achieving ROIC in excess of 20%. During fiscal 2009, the global economic crisis and the devaluation of world equity markets and evaporation of consumer demand and the Company’s response to preserve and continue to generate cash and maintain positive earnings per share while investing in initiatives designed to enable the Company to take advantage of growth opportunities as the global economic environment improved resulted in the Company’s ROIC metrics to not be met (and incentive payouts eliminated accordingly). For fiscal 2010 ROIC metrics were established to incentivize improvement in ROIC and eventually return ROIC performance to historic levels in excess of 20%.

4

Market comparison

The Compensation Committee generally evaluates target total compensation for executives against the total compensation paid by competitive companies for like positions at between the 50th and 75th percentile of the competitive market. The Compensation Committee believes that the 50th - 75th percentile is a relevant reference in light of Company size, complexity, organizational structure, performance and retention needs.

For fiscal 2010, however, the Compensation Committee determined that retention concerns and market conditions required greater emphasis on long-term retention incentives tied to Company and Company stock performance which increased total target compensation for executives above the 50th - 75th percentile (where additional amounts would only be paid, however, if Company stock price or performance significantly improved).

The chart below shows the total compensation amounts attributable to the 50th - 75th percentile market reference point for each individual executive identified in the Summary Compensation Table as well as that executive’s total target compensation established by the Compensation Committee for fiscal 2010:

|

Executive

|

Market 50th

Percentile

|

Market 75th

Percentile

|

Fiscal 2010

Target Total

Compensation

|

Fiscal 2010

Actual

Compensation(1)

|

|

|

Mr. Halla(2)

|

$4,436,000

|

$5,657,000

|

$8,350,000

|

$10,061,095

|

|

|

Mr. Macleod(3)

|

3,256,000

|

3,968,000

|

5,950,000

|

NA

|

|

|

Mr. Macleod(4)

|

7,372,000

|

10,076,000

|

12,741,311

|

13,771,697

|

|

|

Mr. Chew

|

1,603,000

|

2,138,000

|

4,043,070

|

4,517,445

|

|

|

Mr. DuChene

|

1,258,000

|

1,892,000

|

3,342,256

|

3,592,343

|

|

|

Mr. Kunz

|

1,334,000

|

1,912,000

|

2,945,542

|

3,459,131

|

|

|

Mr. Parulekar

|

1,304,000

|

1,912,000

|

2,945,542

|

3,306,443

|

|

|

(1)

|

Fiscal 2010 Actual Compensation amounts taken from Summary Compensation Table.

|

|

(2)

|

Mr. Halla resigned as Chief Executive Officer of the Company on November 30, 2009 and as Chairman of the Company on May 30, 2010.

|

|

(3)

|

Mr. Macleod was appointed Chief Executive Officer on November 30, 2009. The referenced amounts were determined prior to Mr. Macleod’s appointment as Chief Executive Officer of the Company.

|

|

(4)

|

The referenced amounts were determined in connection with Mr. Macleod’s appointment as Chief Executive Officer of the Company.

|

The Compensation Committee will continue to evaluate the usefulness of the 50th - 75th percentile as a reference point for compensating specific executive positions and will continue to base individual compensation decisions on the factors identified above. The 50th - 75th percentile reference is not a target or a determinant of actual executive compensation and the Committee will adjust target total compensation only where competitive, retention, performance, succession, or other market factors require.

Actual compensation paid to an executive may be more or less than the 50th - 75th percentile reference point or the total target compensation established by the Compensation Committee for that executive. For example, aggregate fiscal 2009 total compensation was significantly below both the 50th - 75th percentile reference point and target total compensation because no incentive payments were made and performance shares earned were below targeted levels as a result of Company performance goals not being met, while aggregate fiscal 2010 total compensation exceeded the 50 - 75th percentile reference point and target compensation because incentive payments exceeded target levels as a result of Company performance goals being exceeded.

5

|

|

Market data

|

In defining the competitive market, the Compensation Committee considers two data sources: a peer group of semiconductor industry companies and published survey data. The Compensation Committee believes the companies identified in this data are appropriate because these companies compete with the Company for talent, face similar challenges in the semiconductor sector, are comparable to National in size, and the scope of responsibilities of the top executives is comparable to Company executives. For fiscal 2010, the peer group consisted of the following 18 companies:

Advanced Micro Devices, Inc

Altera Corporation

Analog Devices, Inc.

Atmel Corporation

Cypress Semiconductor Corporation

Fairchild Semiconductor International, Inc.

International Rectifier Corporation

Intersil Corporation

Linear Technology Corporation

LSI Corporation

Marvell Technology Group Ltd.

Maxim Integrated Products, Inc.

Microchip Technology Incorporated

Micron Technology Inc.

Nvidia Corporation

On Semiconductor Corporation

Skyworks Solutions, Inc.

Xilinx, Inc.

For fiscal 2010 the Compensation Committee modified this peer group list by deleting Conexant Systems, Inc. because it was no longer comparable to National in size and by adding International Rectifier Corporation, Marvell Technology Group Ltd., Microchip Technology Incorporated and Skyworks Solutions Inc. because they are comparable to National in size and scope. No changes to this list were made for fiscal 2011.

The specific surveys and competitive data used for fiscal 2010 are the Radford Executive Survey and the Equilar annual proxy data of 18 peer group companies. The information derived from the surveys provided the Compensation Committee with the ability to compare National to those companies with whom National competes for talent and jobs. While the Compensation Committee uses a composite of the peer group and survey data as a reference point for determining market pay levels and trends, the Compensation Committee does not set any executive’s compensation based solely on the market data.

Pay Mix

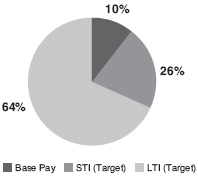

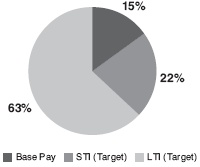

The Compensation Committee’s pay for performance philosophy requires that the majority of an executive’s total compensation should be at risk if performance goals are not achieved or the Company’s share price does not grow over time. National does not use a formulaic approach to the mix of compensation elements between cash and equity, short-term and long-term, or fixed (salary) and at risk (incentive awards), but in general, the more senior the executive, the more pay should be at risk. The following graphics show that for fiscal 2010, 90% of the CEO’s target compensation was at risk (95% in the case of Mr. Macleod after being appointed CEO), above the peer group median of 87% of CEO compensation at risk.

(In these graphics, “STI” refers to the short term incentive and “LTI” refers to the long term incentive.)

6

National Semiconductor Target Pay Mix: CEO (Halla)

Peer Group Median Target Pay Mix: CEO (Halla)

National Semiconductor Target Pay Mix: CEO (Macleod)

7

Peer Group Median Target Pay Mix: CEO (Macleod)

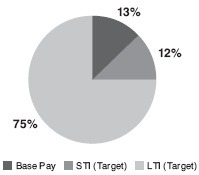

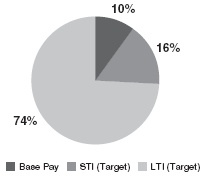

In addition, the following graphics show that for fiscal 2010, 90% of each of the CFO’s target compensation was at risk while the peer group median was at 76%.

National Semiconductor Target Pay Mix: CFO

8

Peer Group Median Target Pay Mix: CFO

National’s emphasis on pay at risk is reflected in annual and long-term incentives that are tied to performance based metrics that cliff rather than incentives that pay out proportionately at low performance levels or solely with the passage of time. The Compensation Committee continues to review this emphasis annually.

Base Salary

The Compensation Committee reviews executive salaries annually but does not make adjustments each year. During fiscal 2010, there were no base salary increases, except that of Mr. Macleod whose base salary was increased to $800,000 per year in connection with his appointment as Chief Executive Officer of the Company. During the fourth quarter of fiscal 2009 and the first quarter of fiscal 2010 the base salaries of all executive officers were temporarily reduced by 10% except for Brian Halla whose base salary was reduced by 25% and Donald Macleod whose base salary was reduced by 15%.

At Risk Compensation for Fiscal 2010

|

At Risk Compensation Element

|

Performance Period

|

Performance Measure

|

|

|

Executive Officer Incentive Plan

|

One year

|

Revenue

|

|

|

Stock options

|

Four-year vesting; six-year term

|

Value to the executive only if stock price appreciates

|

|

|

Performance share units

|

One year (and additional

one-year vesting)

|

Full year fiscal 2010 Return on Invested Capital (“ROIC”)

|

|

|

Performance share units

|

Two-year

|

Fiscal 2011 ROIC

|

|

|

|

Executive Officer Incentive Plan

|

The Executive Officer Incentive Plan is an annual cash based incentive plan. Cash incentives are payable if pre-determined Company and individual performance goals are achieved. The Compensation Committee sets each executive’s incentive opportunity as a percentage of base salary. The Compensation Committee reviews these opportunities each year based on market data and the desired pay mix.

The Compensation Committee establishes Company and individual performance metrics for the Executive Officer Incentive Plan at the beginning of each fiscal year. A table setting forth the incentive plan Company performance metrics is set forth below:

Percentage of Incentive Plan Payout

|

Fiscal 2010 Performance Metric

|

50%

|

100%

|

150%

|

200%

|

|

|

Fiscal 2010 Revenue

|

$1,260M

|

$1,300M

|

$1,380M

|

$1,460M

|

|

9

For fiscal 2010, performance at the 175% level was achieved and the commensurate percentage incentive payout was made to executive officers pursuant to the Executive Officer Incentive Plan.

The Compensation Committee established Mr. Halla’s annual incentive opportunity at 250% of salary and determined the annual incentive based on Company performance to the established Company metrics. For fiscal 2010, Mr. Halla received a bonus of $3,893,768 commensurate with the level of performance achieved. In connection with his appointment as Chief Executive Officer, the Compensation Committee established Mr. Macleod’s annual incentive opportunity at 200% of base salary, the same percentage opportunity established for him prior to being appointed Chief Executive Officer.

The chart below shows the actual incentives paid for fiscal 2010 compared to target:

|

Executive

|

Target EOIP

Award

|

Pool

Funding

|

Actual EOIP

Award for Fiscal

2010

|

|

|

Mr. Halla

|

$2,225,000

|

175%

|

$3,893,768

|

|

|

Mr. Macleod

|

1,400,000(1)

|

175%

|

2,450,000

|

|

|

Mr. Chew

|

637,500

|

175%

|

1,100,000

|

|

|

Mr. DuChene

|

350,000

|

175%

|

600,000

|

|

|

Mr. Kunz

|

435,500

|

175%

|

800,000

|

|

|

Mr. Parulekar

|

$455,000

|

175%

|

$770,000

|

|

|

(1)

|

Prorated for Mr. Macleod’s 2010 salary increase upon his appointment as Chief Executive Officer of the Company.

|

|

|

Long-term incentives

|

The Company uses stock options and performance share units as long-term incentives for executives. The Compensation Committee emphasizes performance share units over stock options, but may use both. The Compensation Committee also does not have a formulaic approach to determining grant levels for the executives but does take into account the factors described above, including the CEO’s recommendations, historical grant levels, retention concerns and the impact of the awards on the Company’s usage of shares. For fiscal 2010 the Compensation Committee determined that the CEO’s equity awards should be a combination of options and performance share units. The other executives also received a combination of options and performance share units. Upon his appointment as Chief Executive Officer Mr. Macleod received an award of options and restricted share units.

|

|

Performance share units

|

Performance share units are paid in Company stock (one unit is equivalent to one share); the number of units earned may vary between 0 and 150% of the target number of shares depending on how well the Company performs against the predetermined goal generally over a two-year performance period. Fiscal year 2010 marked the sixth year that the Company has aligned a portion of its long-term incentives with Company financial performance. Performance share unit targets established for the Fiscal 2010-2011 Performance Period are shown in the Grants of Plan-Based Award Table. Actual units earned depend on the Company’s achievement against the following predetermined goals:

|

|

Performance period fiscal 2009-2010

|

The performance share units granted for the two-year performance period fiscal 2009-2010 were tied to sustaining at least a 20% ROIC. For purposes of these metrics, ROIC is determined as operating profit before taxes, including stock compensation expenses, but excluding non-operating one time or expense items, divided by the average invested capital during the period. The percentage shares earned for performance at each of the threshold, target and outstanding levels are shown in the table below:

10

|

Measure

|

Threshold Level

of Achievement

|

Target Level

of Achievement

|

Outstanding Level

of Achievement

|

|

|

Return on Invested Capital (ROIC)

|

20%

|

22%

|

24%

|

|

|

Percentage of shares earned

|

50%

|

100%

|

150%

|

|

As a result of the economic crisis during fiscal 2009 and the resulting impact on the Company’s business, ROIC performance was severely impacted. As a result, none of the shares were earned and no shares were issued.

|

|

Performance period fiscal 2010-2011

|

A portion of the performance units granted for the performance period fiscal 2010-2011 were tied to sustaining at least a 10% ROIC for the full fiscal year 2010 and vesting at the end of fiscal 2011. For fiscal 2010, ROIC exceeded the established metric of 10% and the Compensation Committee determined that 100% of the shares were earned subject to the additional one-year vesting requirement.

The remaining portion of performance units granted for the two year performance period fiscal 2010-2011 are tied to sustaining at least an 18% ROIC for fiscal 2011. The percentage shares to be earned for performance at each of the threshold, target and outstanding levels are shown in the table below. For purposes of these metrics, ROIC is determined as net operating profit after taxes, divided by the average invested capital during the period.

|

Measure

|

Threshold Level

of Achievement

|

Target Level

of Achievement

|

Outstanding Level

of Achievement

|

|

|

Return on Invested Capital

|

18%

|

20%

|

22%

|

|

|

Percentage of shares earned

|

50%

|

100%

|

150%

|

|

|

|

Stock options

|

Stock options have long been a core component of the compensation program at the Company for a broad group of employees. The Compensation Committee believes that options are an appropriate vehicle to implement the Company’s pay for performance philosophy because executives benefit from options only if the Company’s stock appreciates. Stock options expire six years and one day after the date of grant. Fiscal 2010 grants to the executives are shown in the Grants of Plan Based Awards Table.

Special Retention Incentive Program

In fiscal 2009, as a result of the global economic crisis and its significant impact on the performance of the Company and its near term outlook, the Compensation Committee determined that despite management’s best efforts and through no fault of management, much of the Company’s near, medium and longer term incentive compensation metrics would not (and given the magnitude of the crisis, regardless of effort, action or turnaround, could not) be met and that under these circumstances the Compensation Committee’s reliance on at risk compensation resulted in too significant a departure between actual and target compensation. In addition, the Compensation Committee determined that because equity incentives no longer had any value, senior management had very little incentive to remain with the Company as the economic situation improved. As a result, the Compensation Committee approved a one-time cash payment to be paid at the end of the second quarter of fiscal 2011. To receive the payment the officer must be employed by the Company on the payment date and the amount of the payment depends in part on the closing price of the Company’s common stock during the immediately preceding fiscal quarter.

The amounts payable to the Company’s named executive officers under the terms of the approved retention plan are set forth below:

11

Estimated Retention Payment

Closing Price Per Share of Company Common Stock

|

Less than $10.00

|

$10.01—$12.50

|

$12.51—$15.00

|

$15.01—$17.50

|

Greater than $17.50

|

|

|

Brian L. Halla

|

$1,500,000

|

$2,250,000

|

$3,000,000

|

$3,750,000

|

$4,500,000

|

|

Donald Macleod

|

1,000,000

|

1,500,000

|

2,000,000

|

2,500,000

|

3,000,000

|

|

Lewis Chew

|

1,000,000

|

1,500,000

|

2,000,000

|

2,500,000

|

3,000,000

|

|

Todd M. DuChene

|

750,000

|

1,125,000

|

1,500,000

|

1,875,000

|

2,250,000

|

|

Detlev Kunz

|

500,000

|

750,000

|

1,000,000

|

1,250,000

|

1,500,000

|

|

Suneil Parulekar

|

500,000

|

750,000

|

1,000,000

|

1,250,000

|

1,500,000

|

Change-of-control benefits

Other than the change-of-control employment agreements discussed in the section of the proxy on Employment Contracts and Potential Payments Upon Termination of Employment or Change-of-Control, there are no specific employment agreements with the executive officers, as executive officers serve at the pleasure of the Board of Directors.

The change-of-control employment agreements are designed to ensure that Company stockholders receive full value for the Company in a change-of-control. The benefits and payments that the executive officers may become eligible to receive under the change-of-control agreement are intended to ensure that the management team is able to evaluate objectively whether a potential change-of-control of the Company is in the best interests of the Company and its stockholders and to ensure the continued services of the executive officers through a change-of-control transaction. The estimated amounts that may be due under the agreements in the event of a change-of-control are set forth in the section of the proxy relating to Employment Contracts and Potential Payments Upon Termination of Employment or Change-of-Control.

Other benefits

Executive officers participate in Company-wide employee benefit plans such as medical, dental, disability and 401k plans. In addition, Mr. Macleod is a participant in a life insurance program and a retiree medical program (which are discussed in the section of the proxy relating to Employment Contracts and Potential Payments Upon Termination of Employment or Change-of-Control).

Stock ownership guidelines

National has stock ownership guidelines for executive officers to ensure that they have a meaningful economic stake in the Company. The Compensation Committee reviews the guidelines regularly and monitors the executives’ progress toward meeting the guidelines. Stock held directly by the officer counts toward the requirements. Unexercised stock options and shares held in the Retirement and Savings Program and Deferred Compensation Plan do not count toward satisfying the guidelines. All of National’s executive officers included in the Summary Compensation Table satisfy the stock ownership guidelines (Mr. DuChene who joined the Company as an executive officer during fiscal 2008 has until 2012 to meet the applicable requirements). The guidelines and each executive’s ownership are shown in the following table:

|

Executive

|

Target #

of Shares

|

Actual Shares Owned

July 30, 2010

|

|

|

Mr. Halla

|

200,000

|

429,632

|

|

|

Mr. Macleod (as CEO)

|

200,000

|

259,085

|

|

|

Mr. Chew

|

20,000

|

103,774

|

|

|

Mr. DuChene

|

20,000

|

0

|

|

|

Mr. Kunz

|

20,000

|

43,193

|

|

|

Mr. Parulekar

|

20,000

|

43,277

|

|

12

Equity grant practices

During fiscal 2010, the Compensation Committee made equity grants to executive officers and set the performance goals for the performance share units at the meeting at which the Compensation Committee met to make its annual compensation determinations except with respect to awards made to Mr. Macleod in connection with his promotion to Chief Executive Officer.

“Clawback” policies

Under the 2009 Incentive Award Plan (the only equity plan from which we are currently permitted to issue awards to officers and key employees) (as well as our 2007 Employees Equity Plan, 2005 Executive Officer Equity Plan and the Executive Officer Incentive Plan) the Compensation Committee may cancel any outstanding plan award (regardless of whether it is vested or deferred and including any award under those plans held by an executive) and the “clawback” provisions also may require a participant to repay any gain realized through the previous exercise of an award granted under one of these plans in the event of a participant’s termination for cause; serious misconduct; or retirement and subsequent participation in any activity in competition with National. The Compensation Committee is solely responsible for determining, in good faith, whether a participant has engaged in serious misconduct or engaged in competition with the Company. The Compensation Committee believes these “clawback” provisions are appropriate in light of the significant value and importance it places on incentive and equity based compensation and its desire to ensure that all recipients of incentive and equity compensation awards abide by National’s reasonable standards of conduct and refrain from competitive activity.

Tax deductibility of compensation

The Internal Revenue Code imposes a $1 million limit on the amount that a public company may deduct for compensation paid to the Company’s CEO or the other executive officers. This limitation does not apply to compensation that meets the requirements of “qualifying performance-based” compensation. Consistent with the emphasis on performance based compensation, the Company’s policy is to qualify, to the extent deemed reasonable by the Compensation Committee, the compensation of executive officers for deductibility under the tax laws and the Company’s incentive and equity plans are designed accordingly.

Compensation Consultant

During fiscal 2010 the Compensation Committee retained Frederic W. Cook & Co. Inc. as its Compensation Consultant and to assist with executive compensation program design, calibration of the program to National’s performance and the competitive market, monitor program effectiveness and provide input with respect to compensation targets and performance metrics for fiscal 2010. The Compensation Committee’s Compensation Consultant attends Compensation Committee meetings, reviews compensation data and issues with the Compensation Committee and participates in discussions regarding executive compensation issues. While the Compensation Committee considers input from the Compensation Consultant, ultimately the Compensation Committee’s decisions reflect many factors and considerations. Personnel in the Company’s human resources department and the Senior Vice President, Human Resources at the direction of the Compensation Committee work with the Compensation Consultant so that the Compensation Consultant can develop materials, including competitive market assessments and summaries of current legal and regulatory developments, useful to the Compensation Committee in making its determinations and evaluations.

During fiscal 2010 Frederic W. Cook & Co. Inc. received $121,184 for its services as Compensation Consultant to the Compensation Committee.

Summary

We believe that the executive compensation program supports National’s business goals and objectives and aligns executive compensation to Company performance.

13

Summary Compensation Table

The following table shows information on compensation paid or accrued by National and our subsidiaries for our chief executive officer, our principal financial officer and the three other most highly compensated executive officers (collectively referred to in these compensation tables as the named executive officers) for the fiscal years ended May 30, 2010, May 31, 2009 and May 25, 2008:

|

Name and Principal Position

|

Year

|

Salary

($)

|

Stock

Awards(1)

($)

|

Option

Awards(2)

($)

|

Non-Equity

Incentive Plan

Compensation(3)

($)

|

Change in

Pension

Value and

Non-Qualified

Deferred

Compensation

Earnings(4)

($)

|

All Other

Compensation(5)

($)

|

Total

($)

|

|

|

Brian L. Halla

|

2010

|

911,407(6)

|

3,222,500

|

2,012,850

|

3,893,768

|

20,570

|

10,061,095

|

||

|

Former Chairman

|

2009

|

838,658

|

3,733,483(7)

|

0

|

0

|

—

|

13,475

|

4,585,616

|

|

|

and CEO

|

2008

|

879,735

|

4,036,200

|

0

|

1,112,500

|

—

|

14,248

|

6,042,683

|

|

|

Donald Macleod

|

2010

|

637,212

|

7,413,500(8)

|

3,227,811

|

2,450,000

|

43,174

|

13,771,697

|

||

|

Chairman and CEO

|

2009

|

559,154

|

2,764,722(7)

|

0

|

0

|

24,954

|

3,348,830

|

||

|

2008

|

593,077

|

2,883,000

|

0

|

600,000

|

—

|

29,464

|

4,105,541

|

||

|

Lewis Chew

|

2010

|

413,558

|

2,578,000

|

402,570

|

1,100,000

|

23,317

|

4,517,445

|

||

|

Senior Vice President,

|

2009

|

397,019

|

1,317,122(7)

|

622,870

|

0

|

9,770

|

2,346,781

|

||

|

Finance and Chief Financial Officer

|

2008

|

400,000

|

1,153,200

|

901,100

|

300,000

|

—

|

13,836

|

2,768,136

|

|

|

Todd M. DuChene(9)

|

2010

|

333,846

|

2,320,300

|

322,056

|

600,000

|

16,141

|

3,592,343

|

||

|

Senior Vice President,

|

2009

|

341,923

|

781,042(7)

|

280,292

|

0

|

—

|

14,417

|

1,417,674

|

|

|

General Counsel & Secretary

|

2008

|

137,308

|

0

|

645,410

|

69,038

|

—

|

7,563

|

859,319

|

|

|

Detlev Kunz

|

2010

|

314,322

|

1,933,500

|

241,542

|

800,000

|

146,524

|

23,243

|

3,459,131

|

|

|

Senior Vice President

|

2009

|

307,300

|

761,961(7)

|

311,435

|

0

|

7,782

|

9,701

|

1,398,179

|

|

|

And General Manager, Product Group

|

2008

|

335,004

|

576,600

|

450,550

|

175,000

|

81,042

|

13,781

|

1,631,977

|

|

|

Suneil Parulekar

|

2010

|

341,878

|

1,933,500

|

241,542

|

770,000

|

--

|

19,523

|

3,306,443

|

|

|

Senior Vice President,

|

2009

|

327,470

|

761,961(7)

|

311,435

|

0

|

--

|

8,254

|

1,409,120

|

|

|

Worldwide Marketing and Sales

|

2008

|

345,971

|

576,600

|

450,550

|

200,000

|

--

|

12,749

|

1,585,870

|

|

|

(1)

|

Except where indicated represents the grant date fair value determined in accordance with FASB ASC Topic 718 of performance share units granted during the fiscal year. The performance share units are subject to performance conditions, as described in the Compensation Discussion and Analysis. The amounts in this column do not reflect the actual value of the award to the executive, which depends solely on the achievement of specified performance objectives over the performance period.

|

|

(2)

|

This column represents the aggregate grant date fair value determined in accordance with FASB ASC Topic 718 of stock options granted during the applicable fiscal year to each of the named executives. For additional information on the valuation assumptions used for the option grants, refer to note 1 of the financial statements in our Form 10-K for the fiscal year ended May 30, 2010 as filed with the SEC. See the Grants of Plans-Based Awards Table for specific information on options granted in fiscal 2010. The amounts in this column do not reflect the actual value of the award to the executive.

|

|

(3)

|

The column represents incentives earned under the Executive Officer Incentive Plan for the fiscal year indicated.

|

|

(4)

|

This column represents the aggregate change in the actuarial present value for the defined benefit pension plan made available to Mr. Kunz in connection with his prior service with our German subsidiary. Amounts are based on the exchange rate used by the Company as of the applicable financial statement reporting dates. We do not have above market or preferential earnings on our non-qualified deferred compensation plan made available to our executive officers and other highly compensated employees.

|

14

|

(5)

|

Consists of the following:

|

|

|

(a)

|

Contributions and allocations to defined contribution retirement plans

|

|

2010

|

2009

|

2008

|

|

|

Mr. Halla

|

$19,869

|

$12,727

|

$13,500

|

|

Mr. Macleod

|

26,070

|

6,127

|

13,500

|

|

Mr. Chew

|

22,969

|

9,427

|

13,500

|

|

Mr. DuChene

|

15,854

|

14,123

|

7,269

|

|

Mr. Kunz

|

22,969

|

9,427

|

13,500

|

|

Mr. Parulekar

|

19,236

|

7,967

|

12,455

|

|

|

(b)

|

Value of life insurance premiums for term and whole life insurance

|

|

2010

|

2009

|

2008

|

|

|

Mr. Halla

|

$701

|

$748

|

$748

|

|

Mr. Macleod

|

17,104

|

18,827

|

15,964

|

|

Mr. Chew

|

348

|

343

|

336

|

|

Mr. DuChene

|

287

|

294

|

294

|

|

Mr. Kunz

|

274

|

274

|

281

|

|

Mr. Parulekar

|

287

|

287

|

294

|

Mr. Macleod has a whole life policy made available to executive officers under a grandfathered program; the other officers have term life insurance made available on the same terms as offered salaried employees.

The incremental cost to the Company of perquisites in fiscal 2010, fiscal 2009 and fiscal 2008 for each of the executive officers named in the table did not exceed $10,000.

|

(6)

|

Includes $64,192 of accrued vacation benefit paid in connection with Mr. Halla’s retirement.

|

|

(7)

|

Amounts for fiscal 2009 also include the grant date fair value determined in accordance with FASB ASC Topic 718 of the variable portion of the retention program implemented in fiscal 2009. The retention program pays a cash retention payment on or about November 30, 2010. The amount of the payment increases if the average daily closing price for the Company’s Common Stock for the fiscal quarter immediately prior to the payment date is between $10.01 and $17.50 per share.

|

|

(8)

|

Also includes for fiscal 2010 for Mr. Macleod the grant date fair value of restricted shares granted to Mr. Macleod in connection with his appointment as CEO. The amounts in this column do not reflect the actual value of the award to the executive, which depends solely on the achievement of specified performance objectives over the performance period.

|

|

(9)

|

Mr. DuChene joined the Company as an executive officer on January 3, 2008.

|

15

Grants of Plan-Based Awards

The following table shows information concerning plan-based awards in fiscal 2010 to the named executive officers:

|

Estimated Future Payouts

Under Non-Equity

Incentive Plan Awards(1)

|

Estimated Future Payouts

Under Equity Incentive

Plan Awards

|

All other

Stock

Awards:

Number

of

Shares

of

Stock

|

All other

Option

Awards:

Number of

Securities

Underlying

|

Exercise or

Base Price of

Option

|

Grant Date

Fair Value

of Stock

and Option

|

|||||||

|

Name

|

Grant

Date

|

Threshold

($)

|

Target

($)

|

Maximum

($)

|

Threshold

(#)

|

Target

(#)

|

Maximum

(#)

|

or Units

(#)

|

Options(2)

(#)

|

Awards(3)

($/sh)

|

Awards(4)

($)

|

|

|

Brian L. Halla

|

7/15/09(1)

|

$1,112,500

|

$2,225,000

|

$4,450,000

|

$—

|

|||||||

|

7/15/09(5)

|

125,000

|

125,000

|

125,000

|

1,611,250

|

||||||||

|

7/15/09(6)

|

62,500

|

125,000

|

187,500

|

1,611,250

|

||||||||

|

7/15/09(2)

|

500,000

|

12.89

|

2,012,850

|

|||||||||

|

Donald Macleod

|

7/15/09(1)

|

600,000

|

1,200,000

|

2,400,000

|

||||||||

|

7/15/09(5)

|

125,000

|

125,000

|

125,000

|

1,611,250

|

||||||||

|

7/15/09(6)

|

62,500

|

125,000

|

187,500

|

1,611,250

|

||||||||

|

7/15/09(2)

|

230,000

|

12.89

|

925,911

|

|||||||||

|

11/30/09(7)

|

300,000

|

4,191,000

|

||||||||||

|

11/30/09(8)

|

600,000

|

14.60

|

2,301,900

|

|||||||||

|

Lewis Chew

|

7/15/09(1)

|

318,750

|

637,500

|

1,275,000

|

||||||||

|

7/15/09(5)

|

100,000

|

100,000

|

100,000

|

1,289,000

|

||||||||

|

7/15/09(6)

|

50,000

|

100,000

|

150,000

|

1,289,000

|

||||||||

|

7/15/09(2)

|

100,000

|

12.89

|

402,570

|

|||||||||

|

Todd M. DuChene

|

7/15/09(1)

|

175,000

|

350,000

|

700,000

|

||||||||

|

7/15/09(5)

|

100,000

|

100,000

|

100,000

|

1,289,000

|

||||||||

|

7/15/09(6)

|

40,000

|

80,000

|

120,000

|

1,031,200

|

||||||||

|

7/15/09(2)

|

80,000

|

12.89

|

322,056

|

|||||||||

|

11/16/09(9)

|

22,333

|

0

|

||||||||||

|

Detlev Kunz

|

7/15/09(1)

|

217,750

|

435,500

|

871,000

|

||||||||

|

7/15/09(5)

|

75,000

|

75,000

|

75,000

|

966,750

|

||||||||

|

7/15/09(6)

|

37,500

|

75,000

|

112,500

|

966,750

|

||||||||

|

7/15/09(2)

|

60,000

|

12.89

|

241,542

|

|||||||||

|

Suneil Parulekar

|

7/15/09(1)

|

227,000

|

455,000

|

910,000

|

||||||||

|

7/15/09(5)

|

75,000

|

75,000

|

75,000

|

966,750

|

||||||||

|

7/15/09(6)

|

37,500

|

75,000

|

112,500

|

966,750

|

||||||||

|

7/15/09(2)

|

60,000

|

12.89

|

241,542

|

|||||||||

|

11/16/09(9)

|

7,000

|

|||||||||||

|

(1)

|

Represents target awards set on July 15, 2009 for fiscal 2010 under the Executive Officer Incentive Plan. Target awards are specifically set based on assigned incentive levels, assuming 100% achievement of goals. Under the performance metrics set for fiscal 2010, threshold represents goal achievement at the minimum performance level (50%) and maximum represents goal achievement at the maximum performance level (200%). Actual payout for fiscal 2010 was 175% and is shown in the Summary Compensation Table under “Non-Equity Incentive Plan Compensation.”

|

|

(2)

|

Options granted in July of fiscal 2010 were granted under the 2005 Executive Officer Equity Plan. Options granted after September 25, 2009 were granted under the 2009 Incentive Award Plan. The assumptions used to value these specific options are: risk-free rate of return of 1.88%, dividend yield of 2.33%, term of 3.78 years and volatility factor of 46.20%. For additional information on valuation assumptions used for financial statement reporting purposes, refer to note 1 of the financial statements in our Form 10-K for the fiscal year ended May 30, 2010 as filed with the SEC. The actual value that the executive officer will receive from stock option grants will depend on the future performance of the stock and the price of the stock at the time of exercise.

|

|

(3)

|

As required by the terms of the plans under which the options were granted, the exercise price is the closing price of the common stock on the date of grant.

|

|

(4)

|

For stock awards, represents the aggregate grant date fair value for the target number of performance share units set for each named executive officer during the fiscal year. The grant date fair value used in fiscal 2010 to determine expense associated with the performance share units is the product of the number of target units set and the closing price of the stock on the date the targets were set. The actual value that the executive officer will receive depends on performance achieved during the performance cycle. For option awards, represents the aggregate grant date fair value, using the Black-Scholes option pricing model. The valuation model and assumptions are the same as we use for financial statement reporting purposes. See Notes 2 and 8.

|

16

|

(5)

|

Represents restricted stock units for the two-year cycle fiscal 2010-2011 under the 2005 Executive Officer Equity Plan. Units are payable following fiscal 2011 at 100% if fiscal 2010 ROIC performance goals and vesting requirements are met.

|

|

(6)

|

Represents target levels set in fiscal 2010 for performance share units for the two year cycle fiscal 2010-2011 under the 2005 Executive Officer Equity Plan. Target levels are set based on 100% achievement of goals established for fiscal 2011. Threshold represents goal achievement at the minimum performance level (50%) at which awards can be paid and maximum represents goal achievement at the maximum performance (150%) level at which awards can be paid under this plan.

|

|

(7)

|

Represents RSUs that vest ratably in annual increments over a four-year period from the grant date and when vested convert into shares of common stock on a one-to-one basis.

|

|

(8)

|

Options granted to Mr. Macleod in connection with his appointment as Chief Executive Officer. The assumptions used to value these specific options are: risk-free rate of return of 1.75%, dividend yield of 2.17%, term of 3.91 years and volatility factor of 37.80%. For additional information on valuation assumptions used for financial statement reporting purposes, refer to note 1 of the financial statements in our Form 10-K for the fiscal year ended May 30, 2010 as filed with the SEC. The actual value that the executive officer will receive from stock option grants will depend on the future performance of the stock and the price of the stock at the time of exercise.

|

|

(9)

|

Represents RSUs that vest ratably over a four-year period and when vested convert into shares of common stock on a one-to-one basis. These RSUs were received in exchange for stock options cancelled pursuant to the Company’s underwater option exchange program approved by stockholders at the 2009 Annual Meeting of Stockholders.

|

Outstanding Equity Awards at Fiscal Year-End

The following table shows information concerning the equity awards held by the named executive officers that were outstanding as of the end of the 2010 fiscal year.

|

Option Awards

|

Stock Awards

|

||||||

|

Name

|

Number of

Securities

Underlying

Unexercised

Options (#)

Exercisable(1)

|

Number of

Securities

Underlying

Unexercised

Options (#)

Unexercisable(2)

|

Option

Exercise

Price ($)

|

Option

Expiration

Date

|

Equity

Incentive

Plan Awards:

Number of

Unearned

Shares, Units

or Other Rights

that Have Not

Vested

(#)(3)

|

Equity

Incentive

Plan Awards:

Market or

Payout Value of

Unearned

Shares, Units

or Other Rights

that Have Not

Vested

($)(4)

|

|

|

Brian Halla

|

395,000

|

5,549,750

|

|||||

|

1,200,000

|

0

|

12.975

|

4/17/11(5)

|

||||

|

1,600,000

|

0

|

17.10

|

4/16/12(5)

|

||||

|

500,000

|

0

|

19.10

|

7/13/10(6)

|

||||

|

143,750

|

6,250

|

23.01

|

7/18/12(6)

|

||||

|

400,000

|

0

|

8.025

|

8/6/12(5)

|

||||

|

400,000

|

0

|

6.30

|

10/17/12(5)

|

||||

|

240,000

|

0

|

6.545

|

2/11/13(5)

|

||||

|

240,000

|

0

|

8.375

|

4/15/13(5)

|

||||

|

0

|

500,000

|

12.89

|

7/15/15(6)

|

||||

|

Donald Macleod

|

600,000

|

0

|

12.975

|

4/17/11(5)

|

660,000

|

9,273,000

|

|

|

100,000

|

0

|

19.74

|

5/9/11(6)

|

||||

|

200,000

|

0

|

19.10

|

7/13/10(6)

|

||||

|

100,000

|

0

|

13.05

|

1/23/12(5)

|

||||

|

700,000

|

0

|

17.10

|

4/16/12(5)

|

||||

|

86,250

|

3,750

|

23.01

|

7/18/12(6)

|

||||

|

43,750

|

0

|

8.025

|

8/6/12(5)

|

||||

|

43,750

|

0

|

6.30

|

10/17/12(5)

|

||||

|

50,000

|

0

|

6.545

|

2/11/13(5)

|

||||

|

50,000

|

0

|

8.375

|

4/15/13(5)

|

||||

|

0

|

230,000

|

12.89

|

7/15/15(6)

|

||||

|

0

|

600,000

|

14.60

|

11/30/15(6)

|

||||

|

Lewis Chew

|

30,000

|

0

|

12.975

|

4/17/11(5)

|

240,000

|

3,372,000

|

|

|

100,000

|

0

|

13.875

|

6/19/11(5)

|

||||

|

60,000

|

0

|

13.05

|

1/23/12(5)

|

||||

|

360,000

|

0

|

17.10

|

4/16/12(5)

|

||||

|

125,000

|

0

|

19.10

|

7/13/10(6)

|

||||

|

57,500

|

2,500

|

23.01

|

7/18/12(6)

|

||||

|

90,000

|

0

|

8.025

|

8/6/12(5)

|

||||

|

38,000

|

0

|

6.30

|

10/17/12(5)

|

||||

|

60,000

|

0

|

6.545

|

2/11/13(5)

|

||||

|

80,000

|

0

|

8.375

|

4/15/13(5)

|

||||

|

70,833

|

29,167

|

28.83

|

7/17/13(6)

|

||||

|

45,833

|

54,167

|

20.68

|

7/15/14(6)

|

||||

|

0

|

100,000

|

12.89

|

7/15/15(6)

|

||||

|

Detlev Kunz

|

20,000

|

0

|

24.52

|

7/19/11(6)

|

175,000

|

2,458,750

|

|

|

125,000

|

0

|

19.10

|

7/13/10(6)

|

||||

|

225,000

|

0

|

17.10

|

4/16/12(5)

|

||||

|

38,333

|

1,667

|

23.01

|

7/18/12(6)

|

||||

|

18,750

|

0

|

8.025

|

8/6/12(5)

|

||||

|

18,750

|

0

|

6.30

|

10/17/12(5)

|

||||

|

20,000

|

0

|

6.545

|

2/11/13(5)

|

||||

|

30,000

|

0

|

8.375

|

4/15/13(5)

|

||||

|

35,416

|

14,584

|

28.83

|

7/17/13(6)

|

||||

|

22,916

|

27,084

|

20.68

|

7/15/14(6)

|

||||

|

0

|

60,000

|

12.89

|

7/15/15(6)

|

||||

|

Suneil Parulekar

|

75,000

|

0

|

18.10

|

7/13/10(6)

|

182,000

|

2,557,100

|

|

|

38,333

|

1,667

|

23.01

|

7/18/12(6)

|

||||

|

22,916

|

27,084

|

20.63

|

7/15/14(6)

|

||||

|

0

|

60,000

|

12.89

|

7/15/15(6)

|

||||

|

Todd M. DuChene

|

0

|

80,000

|

12.89

|

7/15/15(6)

|

222,333

|

3,123,779

|

|

17

|

(1)

|

All options that were exercisable at fiscal year end were vested at fiscal year end.

|

|

(2)

|

Options unexercisable at fiscal year end vest in increments. See notes (5) and (6) in the “Option Expiration Date” column for vesting detail.

|

|

(3)

|