Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Discover Financial Services | d8k.htm |

Roger Hochschild

President and

Chief Operating Officer

November 16, 2010

Bank of America / Merrill Lynch

Banking and Financial Services Conference

Exhibit 99.1 |

2

Notice

The

following

slides

are

part

of

a

presentation

by

Discover

Financial

Services

(the

"Company")

and

are

intended

to

be

viewed

as

part

of

that

presentation.

No

representation

is

made

that

the

information

in

these

slides

is

complete.

The

information

provided

herein

may

include

certain

non-GAAP

financial

measures.

The

reconciliations

of

such

measures

to

the

comparable

GAAP

figures

are

included

in

the

Company’s

Annual

Report

on

Form

10-K

for

the

year

ended

November

30,

2009

and

the

Company’s

Quarterly

Reports

on

Form

10-Q

for

the

quarters

ended

February

28,

2010,

May

31,

2010

and

August

31,

2010,

all

of

which

are on

file

with

the

SEC

and

available

on

the

Company’s

website

at

www.discoverfinancial.com.

Certain

reconciliations

are

also included

at

the

end

of

this

presentation.

The

presentation

contains

forward-looking

statements.

You

are

cautioned

not

to

place

undue

reliance

on

forward-looking

statements,

which

speak

only

as

of

the

date

on

which

they

are

made,

which

reflect

management’s

estimates,

projections,

expectations

or

beliefs

at

that

time

and

which

are

subject

to

risks

and

uncertainties

that

may

cause

actual

results

to

differ

materially.

For

a

discussion

of

certain

risks

and

uncertainties

that

may

affect

the

future

results

of

the

Company,

please

see

"Special

Note

Regarding

Forward-Looking

Statements,"

"Risk

Factors,"

"Business

–

Competition,"

"Business

–

Supervision

and

Regulation"

and

"Management’s

Discussion

and

Analysis

of

Financial

Condition

and

Results

of

Operations"

in

the

Company’s

Annual

Report

on

Form

10-K

for

the

year

ended

November

30,

2009

and

"Management’s

Discussion

and

Analysis

of

Financial

Condition

and

Results

of

Operations"

and

"Risk

Factors"

in

the

Company’s

Quarterly

Report

on

Form

10-Q

for

the

quarters

ended

February

28,

2010,

May

31,

2010

and

August

31,

2010,

which

are

on

file

with

the

SEC.

For

a

discussion

of

risks

associated

with

the

potential acquisition

of

The

Student

Loan

Corporation

discussed

herein,

please

see

Exhibit

No.

99.1

to

the

Company’s

Current

Report

on Form

8-K

dated

September

17,

2010,

which

is

on

file

with

the

SEC.

Certain

historical

financial

information

about

the

Company

that

we

have

included

in

this

presentation

has

been

derived

from

Morgan

Stanley’s

consolidated

financial

statements

and

does

not

necessarily

reflect

what

our

financial

condition,

results

of

operations

or

cash

flows

would

have

been

had

we

operated

as

a

separate,

stand-alone

company

during

the

periods

presented.

We

own

or

have

rights

to

use

the

trademarks,

trade

names

and

service

marks

that

we

use

in

conjunction

with

the

operation

of

our

business,

including,

but

not

limited

to:

Discover

®

,

PULSE

®

,

Cashback

Bonus

®

,

Discover

®

Network

and

Diners

Club

International

®

.

All

other

trademarks,

trade

names

and

service

marks

included

in

this

presentation

are

the

property

of

their

respective

owners. |

3

Become the Leading Direct Banking and Payments Company

Note: Balances as of August 31, 2010; volume based on the trailing four

quarters ending 3Q10 •

$45Bn in receivables

•

Leading cash rewards program

•

1 in 4 U.S. households

•

$19Bn consumer deposits

•

$2.6Bn personal loans and

private student loans

Deposits and Other Lending

Deposits and Other Lending

U.S. Card Issuing

U.S. Card Issuing

•

$112Bn volume

•

4,400 issuers

•

$101Bn volume

•

30+ issuers

•

$27Bn volume

•

50 franchises

•

185 countries/territories |

4

4

•

Achieve disciplined, profitable growth in Cards

•

Leverage Discover brand, service and rewards program

•

Broaden merchant acceptance to drive higher sales

•

Continue to grow direct-to-consumer banking business and expand other

attractive direct lending products

•

Increase global volume leveraging flexibility, multi-brand network alliances

and emerging payments technologies

•

Maintain focus on liquidity and strong capital base

Performance Priorities |

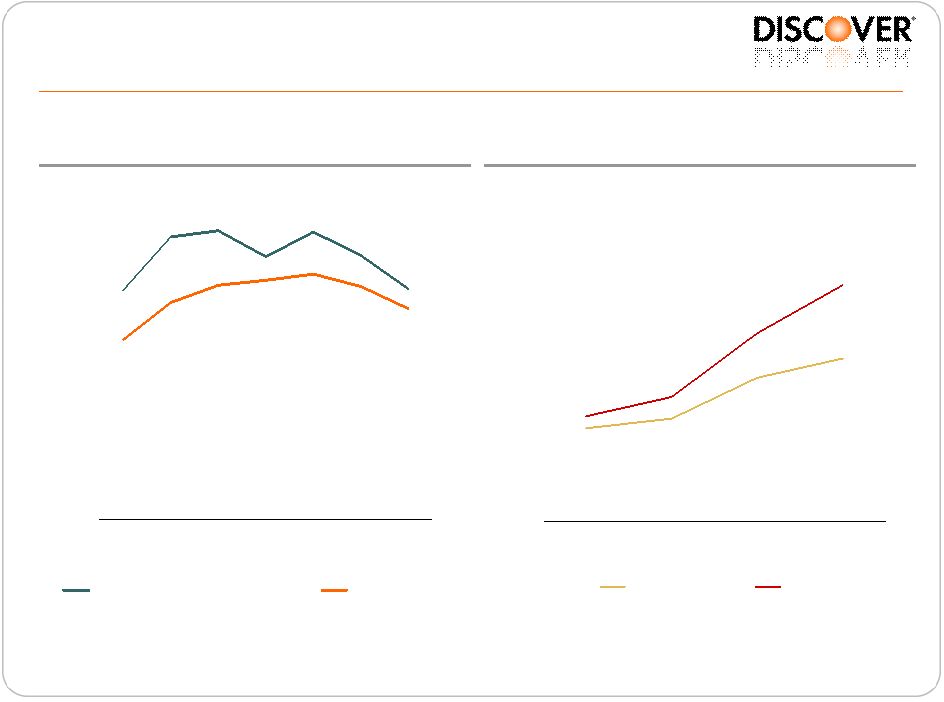

5

Achieve Disciplined, Profitable Growth in Cards

Source

Company Filings

0%

2%

4%

6%

8%

10%

12%

1Q09

2Q09

3Q09

4Q09

1Q10

2Q10

3Q10

Top 5 Bank Issuers (Avg)

Discover

Card Net Charge-off Rate (%)

(1)

Market Share Growth (%)

Source

Company

Filings,

Nilson

and DFS Estimates

5%

6%

7%

8%

2007

2008

2009

3Q10

Receivables

Sales

Note(s)

1. Includes: American Express (U.S. Card), Bank of America (U.S. Card), Capital One (U.S.

Card), Citi (N.A. Branded Cards) and JPM (Card Services) |

6

Discover Primary Card User Trends

4%

5%

7%

8%

-.2%

3Q09

4Q09

1Q10

2Q10

3Q10

-6%

3%

9%

13%

10%

3Q09

4Q09

1Q10

2Q10

3Q10

Account Growth

Sales Growth

Note(s):

Primary

card

users

(PCU)

are

cardholders

who

use

the

card

15

times

or

more

per

month.

Account

figures

are

based

on

average

number

of

PCU

accounts

during

the

quarter.

All

figures

are

shown

year-over-year. |

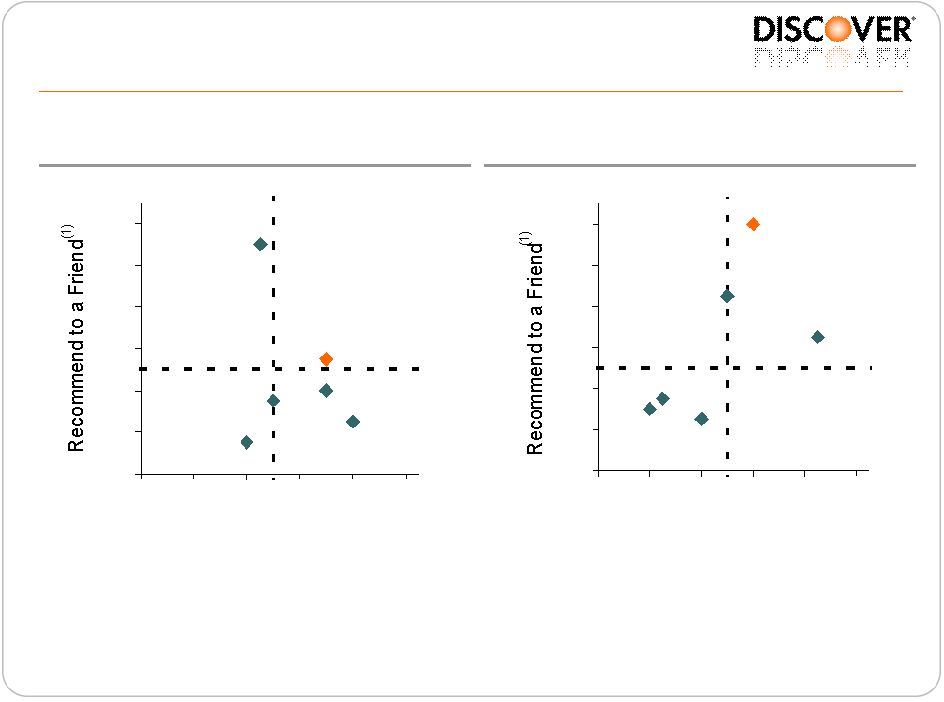

7

Leveraging Brand Progress

C

COF

DFS

JPM

BAC

AXP

65

69

73

77

81

85

89

27

31

35

39

43

47

Consideration

4Q08

Source

Millward Brown Brand & Ad Tracking Survey

C

COF

DFS

JPM

BAC

AXP

65

69

73

77

81

85

89

27

31

35

39

43

47

Consideration

3Q10

Note(s)

1. “Recommend to a Friend” among each respective brand’s primary cardmembers

2. “Consideration” defined as willingness of prospective customers among

general population to consider acquisition of each respective card (2)

(2) |

8

Discover Expanding Brand Presence

•

Increased investment in brand visibility |

9

Competitive Advantages

Cash Rewards Leadership Drives Loyalty

Cash

Rewards

Market

Share

(1)

Note(s)

1.

Household ownership of cash rewards cards; percentages add to more than 100% due to

household use of multiple brands Source

2009

TNS

Consumer

Card

Research

•

Highest household ownership of

cash reward cards

•

20+ years of cash rewards

experience and innovation

•

Focus on clarity and simplicity

•

Merchant funded rewards

43%

26%

18%

16%

8%

6%

DFS

JPM

AXP

C

BAC

COF |

10

Driving Sales Growth

3%

7%

2006

2010

Active Merchant

Outlet Growth

(1)

U.S. Merchant Acceptance

•

Building awareness via cost-

efficient targeted marketing

•

Investing for future growth

•

Agreements signed with top 100

merchant acquirers

•

Implementation continues with

focus on “last mile”

Note(s)

1.

Year-over-year growth in net active merchant outlets

|

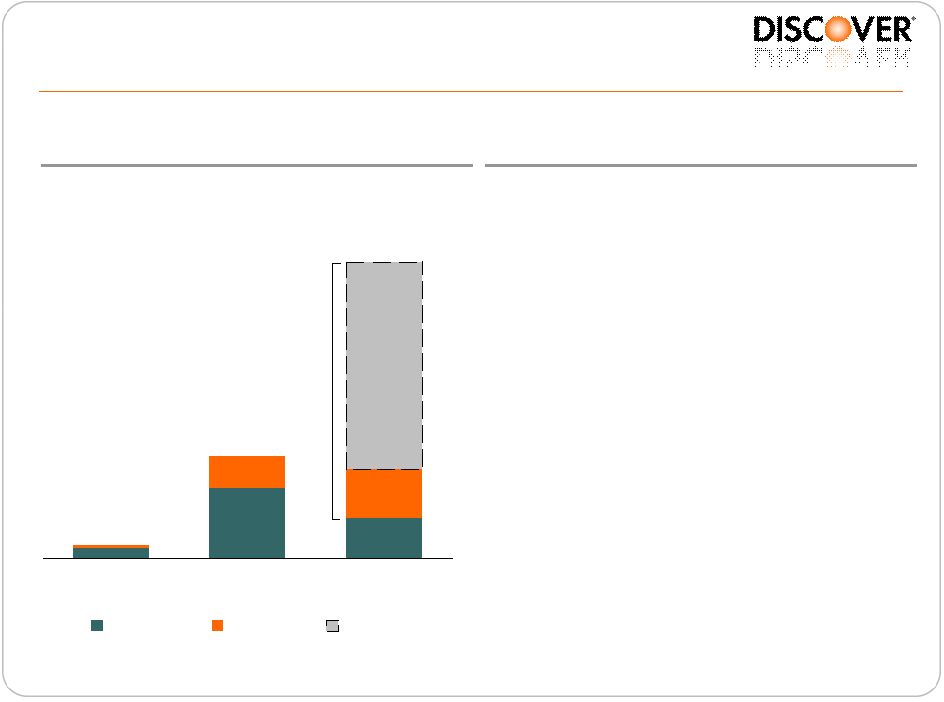

11

Update

Private Student Loan Growth

Note(s)

1.

Pro forma for the acquisition of SLC (expected to close before the calendar year

end) and the sale of $1.5Bn FFELP loans to the U.S. Department of Education in September

2010

Ending Receivables ($Bn)

$0.3

$1.9

2008

2009

8/31/10

Federal

Private

SLC

$5.5

(1)

Private

Student

Loans

•

Existing private student loans

–

On preferred lender list at ~800

schools

•

Underwriting approach

–

High co-signer rate

–

High avg. FICO

–

Only 4-year colleges and

graduate schools

•

Planned acquisition of The Student

Loan Corporation (“SLC”)

–

Top 3 originator of private

student loans

–

Over 70% of balances insured

against credit losses

–

Adds ~300k customers and

creates opportunity for cross-sell |

12

Update

Personal Loan Growth

Personal Loans (Bn)

$1.7

$1.4

$1.0

2008

2009

8/31/10

•

Superior alternative for consolidating

debt

–

Avg

loan size ~$15k

–

YTD 2010 67% from cross-sell

–

Average life of ~4 years

including prepayments

•

Recent vintages expected to drive

ROA’s superior to card |

13

Grow and Integrate our Networks

Discover cards accepted at DCI merchant locations:

-

Goal of 125 countries/territories enabled for acceptance by year-end 2010

-

Over 700,000 ATMs in 75+ countries and continuing expansion

Global POS Network

Global POS Network

Network Partners |

14

Position to lead the industry in emerging payments:

•

Building the most flexible network

•

Partnering with entrepreneurial companies to rapidly bring innovation

to the marketplace

•

Continuing to invest in alternative payments and prepaid

•

Embracing mobile commerce as the next big frontier

Priorities in Emerging Payments |

15

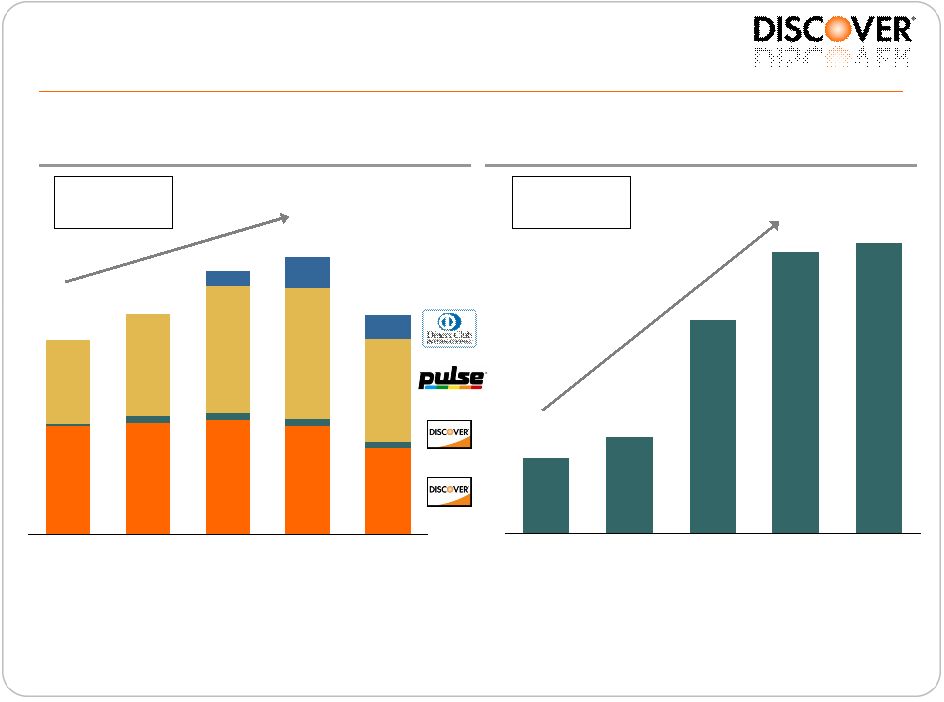

Strong Growth in Network Volume and Profits

$110

$107

$81

$37

$29

2006

2007

2008

2009

YTD

8/31/10

70

86

106

109

87

13

26

20

72

91

96

94

90

3

5

6

6

5

$163

$185

$221

$232

$183

2006

2007

2008

2009

YTD

8/31/10

Volume Growth by Business (Bn)

Strong Profit Growth (MM)

(TPI)

(Prop)

Note(s)

For fiscal years ending November 30

2006-2009

CAGR: 12%

YOY +6%

YOY +33%

2006-2009

CAGR: 55% |

16

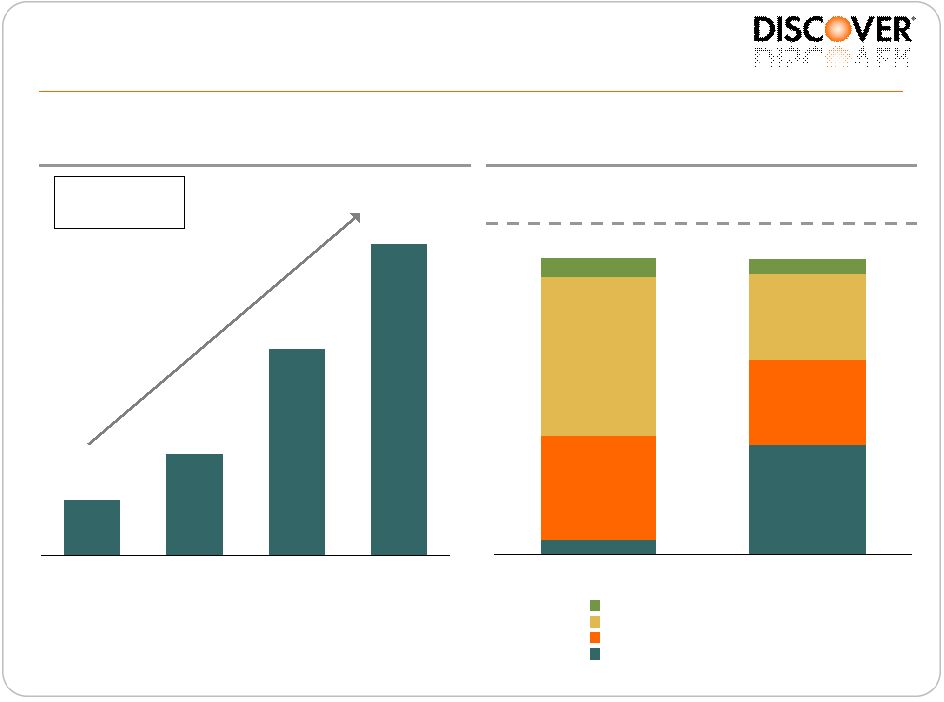

Funding and Liquidity

Liquidity and Funding Mix

35%

29%

54%

29%

37%

5%

5%

6%

Spin (6/30/07)

3Q10

Other

ABS / Conduits

Brokered Deposits

Direct-to-Consumer Deposits

100%

100%

Contingent

Liquidity

(2)

$9.4

$20.8

Direct-to-Consumer

Deposits

(1)

(Bn)

$19.1

$12.6

$6.2

$3.4

FYE 07

FYE 08

FYE 09

8/31/10

Note(s)

1.

Includes deposits originated through affinity relationships

2.

Includes cash, conduit capacity, bank credit facility and Fed discount window

access 2007-

YTD ’10

CAGR: 58% |

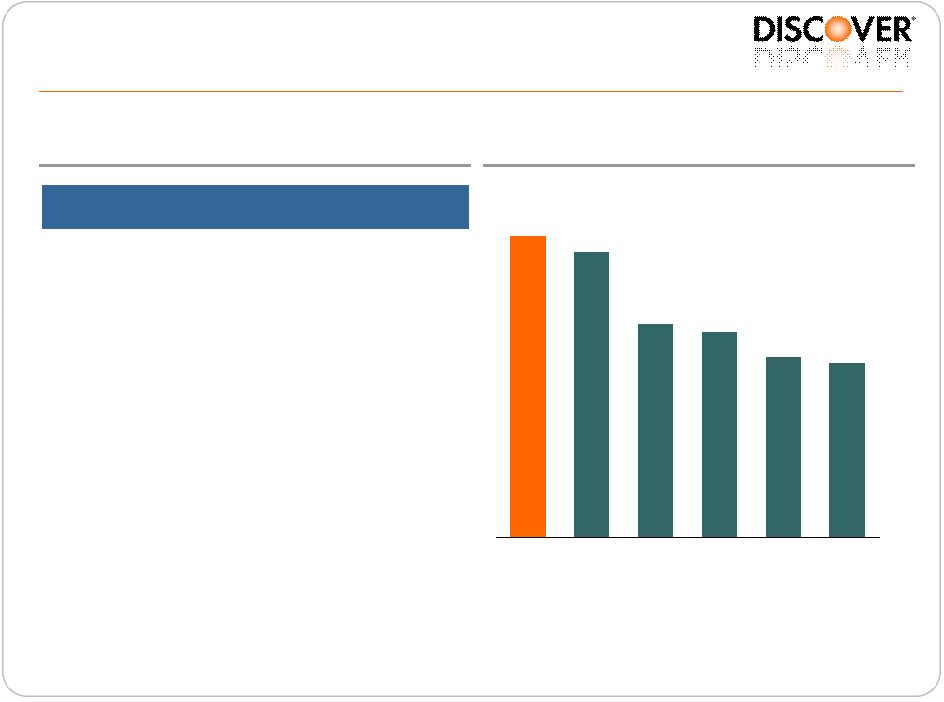

17

Basel

III

Estimates

(1)

Strong Capital

3Q10

TCE

/

TA

Ratio

(3)

9.4%

8.9%

6.6%

6.4%

5.6%

5.4%

DFS

AXP

C

COF

BAC

JPM

Source:

SNL

for

Competitors

Ratios

Proposed

Minimum Ratios

DFS

Consolidated

(2)

Tier 1 Common

7.0%

11.9%

Tier 1 RBC

8.5%

11.9%

Total RBC

10.5%

15.7%

Tier 1 Leverage

(3)

3.0%

7.5%

Note(s)

1.

Preliminary view based on 9/12/10 Basel Committee guidance, which is subject to change

2.

9/30/10 estimates; assumes that the portion of deferred tax assets (DTAs) realized as a result of

future profitability are capped at 10% of common equity 3.

Assets include 10% of the $166Bn undrawn credit lines

4.

Tangible common equity / tangible assets, as of 9/30/10; see appendix for Discover reconciliation

|

18

Summary

•

Leading unsecured lender, well positioned to leverage ongoing

improvement in consumer credit and economic environment

–

Disciplined, profitable growth in credit card, building on brand,

rewards and merchant acceptance

–

Selective expansion of other consumer lending products

•

Increasing contribution from payments businesses through global

expansion and network alliances |

Roger Hochschild

President and

Chief Operating Officer

November 16, 2010

Bank of America / Merrill Lynch

Banking and Financial Services Conference |

20

Appendix

3Q10

Tangible Common Equity Ratio ($MM)

Total Common Equity ("TCE")

6,160

Less: Goodwill and Intangibles

(446)

Tangible Common Equity

5,714

Total Assets

61,355

Less: Goodwill and Intangibles

(446)

Tangible Assets ("TA")

60,909

TCE/TA Ratio

9.4% |