Attached files

| file | filename |

|---|---|

| EX-10.3 - EXHIBIT 10.3 - Golden Matrix Group, Inc. | ex10_3.htm |

| EX-10.5 - EXHIBIT 10.5 - Golden Matrix Group, Inc. | ex10_5.htm |

| EX-31.1 - EXHIBIT 31.1 - Golden Matrix Group, Inc. | ex31_1.htm |

| EX-10.1 - EXHIBIT 10.1 - Golden Matrix Group, Inc. | ex10_1.htm |

| EX-10.4 - EXHIBIT 10.4 - Golden Matrix Group, Inc. | ex10_4.htm |

| EX-10.2 - EXHIBIT 10.2 - Golden Matrix Group, Inc. | ex10_2.htm |

| EX-32.1 - EXHIBIT 32.1 - Golden Matrix Group, Inc. | ex32_1.htm |

| EX-31.2 - EXHIBIT 31.2 - Golden Matrix Group, Inc. | ex31_2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

|

[X]

|

ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

For the fiscal year ended July 31, 2010

|

|

|

[ ]

|

TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT

|

|

For the transition period from _________ to ________

|

|

|

Commission file number: 333-153881

|

|

Source Gold Corp.

|

|

|

(Exact name of registrant as specified in its charter)

|

|

|

Nevada

|

N/A

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

|

2 Toronto Street, Suite 234

Toronto, Ontario, Canada

|

M5C 2B5

|

|

(Address of principal executive offices)

|

(Zip Code)

|

|

Registrant’s telephone number: 289-208-6664

|

|

|

Securities registered under Section 12(b) of the Exchange Act:

|

|

|

Title of each class

|

Name of each exchange on which registered

|

|

None

|

not applicable

|

|

Securities registered under Section 12(g) of the Exchange Act:

|

|

|

Title of each class

|

|

|

None

|

|

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [ ] No [X]

Indicate by checkmark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the proceeding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [ ] No [X]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. Yes [X] No [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. [ ]

Large accelerated filer [ ] Accelerated filer [ ] Non-accelerated filer [ ] Smaller reporting company [X]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [ ] No [X]

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter. Approx. $13,994,400 as of February 28, 2010.

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date. 49,159,265 as of October 18, 2010.

TABLE OF CONTENTS

PART I

Item 1. Business

Business of Company

We are an exploration stage company that intends to engage in the exploration of mineral properties. We have acquired four mineral claims through our wholly owned subsidiaries Northern Bonanza, Inc., an Ontario corporation, (“Northern Bonanza”) and Source Bonanza, LLC, a Nevada limited liability company, (“Source Bonanza”). None of these properties possesses known mineral reserves. Exploration of these mineral claims is required before a final determination as to their viability can be made.

Northern Bonanza holds or possesses an option to acquire a partial interest in the following claims in Ontario, Canada:

|

·

|

Southern Beardmore Claims

|

|

o

|

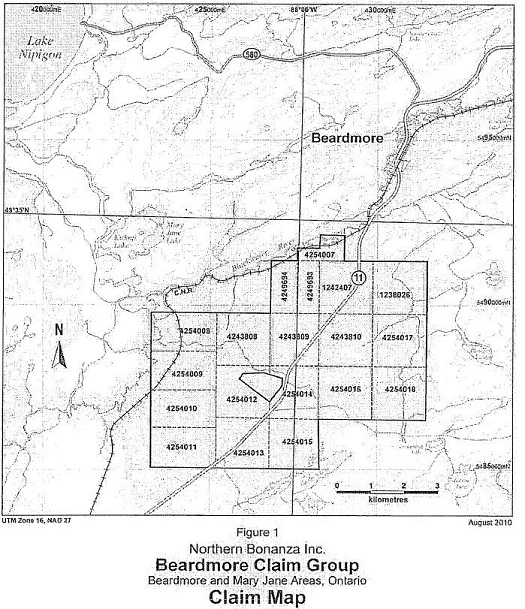

A group of 21 mineral claims in Beardmore Area and Mary Jane Lake Area, 3 km south of Beardmore, Ontario, Canada.

|

|

·

|

KRK West Claims

|

|

o

|

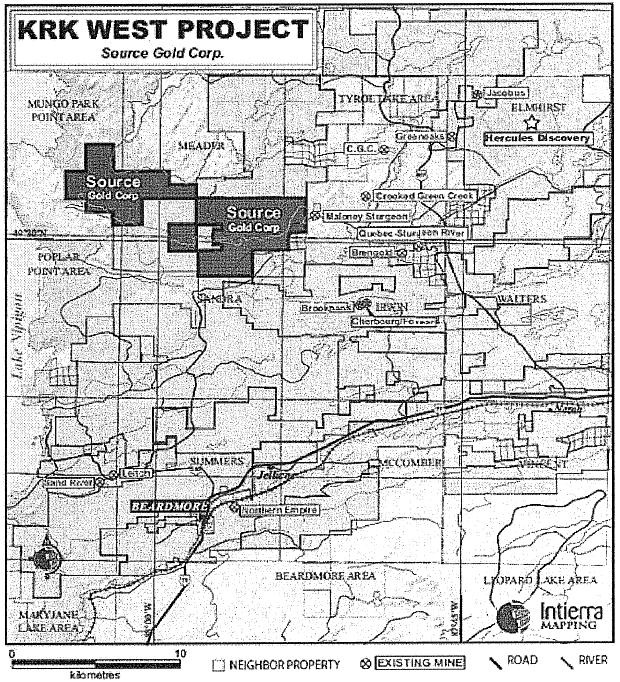

Northern Bonanza either possesses, or holds an option to acquire an undivided 50% interest, in 16 mineral claims known as the KRK West Claims, located north of Thunder Bay, Ontario, Canada.

|

Source Bonanza owns a 100% membership interest in Vulture Gold, LLC, a Nevada limited liability company. Vulture Gold is the owner of the mineral rights to 27 unpatented mineral claims located in Maricopa County Arizona.

Description of Business.

Northern Bonanza, Inc.

Southern Beardmore Claims.

On May 4, 2010, we acquired a group of 21 contiguous mineral claims in the Beardmore Area and Mary Jane Lake Area, near Beardmore, Ontario for $51,800 (CDN).

Location and Means of Access to Southern Beardmore Claims.

The property consists of nineteen contiguous mineral claims. The area of the property is 269 hectares. The northern boundary of the property is 3 kilometers south of Beardmore, Ontario on Highway11. Highway 11 transects the property. Old logging roads also cross the property.

Title to Southern Beardmore Claims.

We only hold the mineral rights to the Southern Beardmore Claims. We do not possess surface rights to the property. The claims all expire in May of 2012, subject to proper renewal. There are no royalties, back-in rights payments or other agreements and encumbrances to which the property is subject. Additionally, there are no environmental liabilities to which the property is subject or permits that must be acquired to conduct the work proposed.

Previous Operations on the Southern Beardmore Claims.

There have been no prior operations on these claims.

Present Condition of Southern Beardmore Claims.

At the moment there are no established mineralized zones, mineral resources, mineral reserves and mine workings, tailing ponds, waste deposits and important natural features and improvements, relative to the outside property boundaries.

Work Completed on the Southern Beardmore Claims.

No work has been completed on the claims with the exception of certain airborne survey work, discussed below.

Proposed and Current State of Exploration and Development on the Southern Beardmore Claims.

There is not currently any exploration on the property. We retained a geologist to conduct a study and produce a report on the exploration potential of the property. He had the following recommendation:

|

·

|

A fixed-wing airborne survey should be flown over the property. An airborne electromagnetic signal should be sourced by VLF-EM signals. Magnetic and radiometric surveys should he flown on the same platform. The survey should be flown on E-W lines spaced at 50m intervals. The results of the survey would receive professional evaluation, which would guide ground follow-up prospecting, sampling and assaying in an attempt to isolate quartz-gold silver + sulphide veins.

|

The total recommended budget estimate for the foregoing is:

| · | Fixed wing airborne survey | $40,000 |

| · | Evaluation, prospecting, sampling and assaying | $20,000 |

| · | Total | $60,000 |

In addition to the purchase price paid, we have incurred $17,436 in staking costs in relation to these claims. During the year ended July 31, 2010 we advanced exploration totaling $47,086. As of July 31, 2010, exploration expenditures totaled $20,118 resulting in net exploration advances having been made at July 31, 2010 of $26,968. Our exploration expenditures during the year ended July 31, 2010 were focused on the recommended airborne survey of the Southern Beardmore property and on the preparation of a geological report on the property.

No Known Presence of Reserves on the Southern Beardmore Claims.

The proposed program is exploratory in nature and there are no known reserves on the property.

Rock Formations and Mineralization of Existing or Potential Economic Significance on the Southern Beardmore Claims.

Regionally a swath of metavolcanic-metasedimentary rocks runs from Geraldton to Beardmore. The metavolcanic rocks are host to numerous showings and former producers of gold and silver. A metasedimentary sequence consists of both clastic and chemical metasediments. These are rocks from two northeast trenching belts and occur to the northwest and southeast of the central volcanic belt. The northern belt is about 3.4 km thick; the southern belt is in excess of 5.4 km. The Northern Bonanza claim group lies entirely within the southern belt. The clastic melasediments are wackes with minor intercalated siltstone and mudstone. The chemical metasediments comprise ironstone units 1-2 m thick bedded in the metavolcanics. The metavolcanies comprise mafic to intermediate flows in a belt 2.0 to 2.5 km wide and trend northeasterly between the two metasedimentary units. The metavolcanic flows are dark green to greenish black in color and typically consist of a massive medium grained basal part, a finer middle portion and a fine-grained to aphanitic upper part, which may be pillowed, amygdaloidal and/or variolitic. Proterozoic rocks comprise diabase sills of medium grain size and massive texture and form topographic highs in outcrop. Precious metals occur (i) in quartz and quartz-carbonate veins almost exclusively in metavolcacanics but also in metasediments and (ii) in quartz veins in chert-hematite-magnelite-grunerite ironstone units interlaycled with the mafic metavolcanies.

The KRK West Claims

Location and Means of Access to KRK West Claims. The property consists of 16 claims covering 15 square miles. It is located north of Thunder Bay in the Beardmore area of Northwestern Ontario, Canada. The nearest townships to the property are Pifher, Sandra, and Meade. The property can be accessed Access via Hwy 11 through the Village of Beardmore to Hwy 801.

Title to KRK West Claims.

Option Agreement

On October 26, 2009, we entered into an agreement with Thunder Bay Minerals, Inc. (“Thunder Bay”) under which were granted an option to acquire an undivided 50% interest in 16 mineral claims known as the KRK West Claim, located north of Thunder Bay, Ontario, Canada. We are currently in a dispute with Thunder Bay regarding the ownership of the claims. The dispute is discussed more fully in the following section titled “Separate Purchase of KRK West Claims”.

Detailed below are the payments we have made to date and the payments we will be obligated to make in the future if the dispute with Thunder Bay is not resolved in our favor.

|

|

o Pay $110,000 (CDN) to Thunder Bay with $50,000 (CDN) of that amount due upon execution of the Agreement before commencing due diligence of the claims (paid) and the balance of $60,000 (CDN) on or before December 1, 2009 (paid);

|

|

|

o Incur $500,000 (CDN) in expenditures on the claims before December 31, 2010 and $500,000 in expenditures on the claims before December 31, 2011; and

|

|

o Issue 2,000,000 shares of our common stock to the shareholders of Thunder Bay within 30 days of closing the transaction.

|

On November 26, 2009 and December 7, 2009, we made payments of $31,785 (CDN) and $28,215 (CDN) respectively.

Under the agreement, Thunder Bay will act as operator and define the nature of and execute all exploration programs and subsequent phases of development on the claims.

If we are able to pay the consideration for the claims (as set forth above), we will be entitled to a 50% interest in the claims, which are currently subject to a 3% Net Smelter Royalty in favor of James Wheeler, President of Thunder Bay. In the event we acquire an interest in the claims, we and Thunder Bay have further agreed to enter into a joint venture agreement for further exploration and development of the claims.

Separate Purchase of KRK West Claims.

During the year, we learned that the optionor had allowed the KRK West Claims to lapse, and therefore the option agreement was null and void. All 19 of the KRK West Claims were re-staked by a third party. Together with our President, Lauren Notar, we were able to purchase 13 of the 19 KRK West Claims from the third party who re-staked the claims. Ms. Notar contributed $20,000 toward the purchase and we contributed $7,578 in cash. The 13 claims were initially transferred to Ms. Notar. Then, on June 30, 2010, Ms. Notar transferred the 13 claims to us in exchange for an unsecured non-interest bearing promissory note for $20,000 which falls due on November 30, 2010. Our total purchase price for the 13 re-staked claims was therefore $27,578. We also incurred exploration expenditures of $555 in relation to these claims. Subsequent to our acquisition of the claims, they were transferred to our subsidiary Northern Bonanza.

The original optionor currently maintains that control of the KRK West Claims remains with the optionor and that we have no right to further explore the property. We disagree with this assertion and accordingly ownership to the claims is in dispute. On January 7, 2011 the Ministry of Northern Development, Mines and Forestry, Canada, will adjudicate upon the ownership of the claims.

Previous Operations on the KRK West Claims.

The KRK West property encompasses many previous prospects and occurrences that, since 1930, have been the subject of many prospecting, geophysics, and diamond drilling as well as high grading conducted by operators dating back between 1930-1950 where copper and gold mineralization was identified.

Present Condition of KRK West Claims.

At the moment there are no established mineralized zones, mineral resources, mineral reserves and mine workings, tailing ponds, waste deposits and important natural features and improvements, relative to the outside property boundaries.

Work Completed on the Claims and Proposed and Current State of Exploration and Development on the Claims.

We have undertaken an initial trenching, sampling, and geological mapping program on the KRK West Claims. The samples are being assayed by Accurassay Laboratories in Thunder Bay, Ontario, Canada.

Based upon the initial exploration program of trenching, channel sampling, geological mapping and a TEM survey covering our claim group on over 15 square miles of the KRK West Property, we have identified three main areas of interest.

The first area of interest is the Little Brother Claim Group, where a number of samples were taken from an area along a northern grandiorite with intermediate volcanics, which yielded visible gold occurrences.

The second area of interest is close to the eastern portion of the property east of Peddle Lake. This area is the most active on the property where a number of drill collars belonging to a previous operator were drilled during the 1970's. The ground observations in the trenches and historical assessment have indicated a large disrupted zone carrying the potential for significant gold and silver values.

The third area of interest is the most westerly area of the property near Musca Lake, along a continuous shear zone. The Musca Lake zone consists of a quartz flooded shear which pinches and swells along its strike length.

Although we have no established an overall exploration budget for the KRK West claims at this time, we intend to continue with an exploration program centered on the major fault lines and areas of interest which traverse the KRK West mineral claims. Accurassay Laboratories is currently processing more than 250 trench samples from our three main areas of interest on the KRK West Property.

No Known Presence of Reserves on the KRK West Claims.

The proposed program is exploratory in nature and there are no established reserves on the property.

Rock Formations and Mineralization of Existing or Potential Economic Significance on the KRK West Claims.

The property is located within the Northern Felsic Metavolcanic Belt. Intermediate crystal-lithic tuff is the dominant rock type and underlies most of the property. These tuffs consist of intermixed units of crystal tuffs containing feldspar crystals and lithic tuffs containing fragments of felsic to intermediate composition. Felsic crystal tuffs are easily identified by the presence of quartz-eyes within a light gray crystal tuff. The rock weathers to a very distinctive porcellaneous buff-white color. The felsic crystal tuff forms two prominent east-west trending horizons within the intermediate crystal-lithic tuff in the southern half of the western portion of the property and can be traced to the western boundary. The felsic horizons vary in width from 25 to 120 meters, and can be traced for a length of 2.8 kilometers.

Gold occurs on the property associated with white quartz veins and pyritic horizons within felsic crystal tuffs and quartz-feldspar porphyry. Earlier exploration identified quartz veins and mineralized shear zones within felsic and mafic intrusions. Base and precious metals are found all over the property. The KRK West property encompasses many previous well known prospects and occurrences that since 1930 have been the subject of many prospecting, geophysics, and diamond drilling as well as high grading conducted by operators dating back between 1930-1950 where copper and gold mineralization was identified.

Source Bonanza, LLC.

Vulture Peak Property and Gold Point Claim Group.

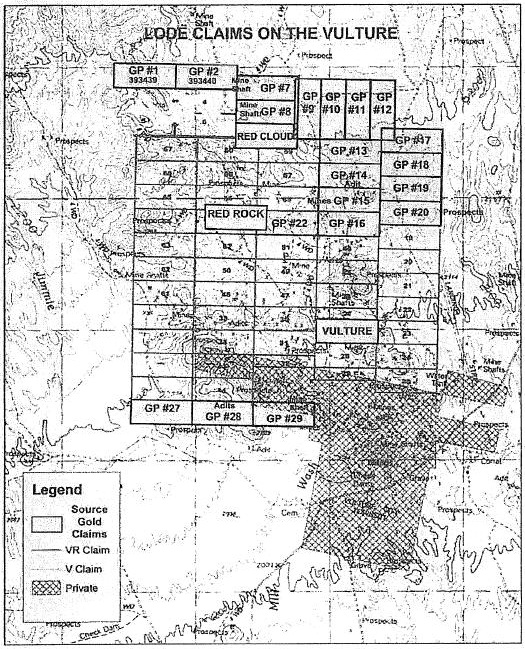

On August 7, 2010, we entered into an agreement with Vulture Gold LLC (“Vulture”), to purchase 100% of Vulture’s outstanding membership interests in consideration for 4 million shares of our common stock. Vulture is the owner of the mineral rights to unpatented mineral claims located in Maricopa County Arizona known collectively as the Vulture Claims.

Location and Means of Access to Vulture Claims.

The property is located approximately 15 km to 17 km southwest of Wickenburg in Maricopa County, Arizona. It consists of 27 claims located in Section(s) 23, 24, 25, 26, 35 and 36, T.6N., R.GW., and in Section(s) 3D, T.6N., R.5W., Maricopa County, Arizona. Each claim is approximately 20.7 acres with a total property area of 476.1 acres, configured in three separate blocks.

The property can be accessed from Wickenburg through Vulture Mine Road south from State Highway 60. Wickenburg is located 85 km (53 miles) NW of Phoenix; 98 km (61 miles) S of Prescott; and 206 km (128 miles) SE of Kingman. Wickenburg is connected with Phoenix through State Highway 60 south; and to Prescott and Kingman through State Highways 89 and 93 respectively. Wickenburg is one of the railway stations for Prescott- Phoenix branch of Santa Fe Railway. From Vulture Mine Road various gravel roads traverse through different areas of the property providing access to almost all the mineral claims.

Title to Vulture Claims.

The Vulture Claims are owned by Vulture Gold, LLC, which is owned 100% by Source Bonanza. The following claim maintenance fees are applicable for the property:

|

o

|

Bureau of Land Management Claim Maintenance Fee = $ 125 per claim per year ($3,625 each year, due on or before September 1)

|

|

o

|

Maricopa County Recorder "Notice of Intent to Hold" Fee = $104 per year (due on or before November 1).

|

A "Mineral Exploration Permit" application will be required to get a permit for the proposed exploration work to be carried out on the property. A minimum bond required is $3,000 but the actual bond amount is based upon the type of exploration and the degree of disturbance. The department responsible for issuing this is the Minerals Section of the Arizona State Land Department. Additionally, the Arizona State Land Commissioner, at his discretion, may also change the amount of the damage and restoration bond when warranted by any changes in the Plan of Operation.

Previous Operations on the Vulture Claims.

The Vulture Claims were part of the historical Red Cloud Mine, Vulture Mine, Vulture Mine Extension, and Mohawk Mines. The first prospecting party to explore the mountains of north-central Arizona was guided by Pauline Veaver, a pioneer trapper and Indian Scout of the period. Henry Wickenburg, one of the party members, while prospecting south of Wickenburg located the Vulture lode in 1863. He established a camp on the Hassayampa River six miles east of the location, and for the next three years worked the richer parts of the outcrop ore. No records are available for his production.

In November 1, 1866, the Vulture Claims and adjoining area was acquired from Wickenburg by the Vulture Company of New York. This company established a camp at the mine, and built a forty stamp amalgamation and concentration mill at Wickenburg. This pioneer company operated steadily from 1867 to July 1872. Chinese Miners were employed. Concentrates were stored, and the production was in gold bullion saved on the plates. The property was closed due to excessive transportation costs and to the apparent pinching of the ore at water level.

In 1870 a new corporation was formed to operate the Vulture and Vulture Extension of Taylor and Smith. This company was known as the Arizona Central Mining Company. Vulture Extension property was reportedly located to the north of the Vulture Mine and is believed to be located on claim 1127 and 28, an area staked by Gold Point LLC. An 80 stamp mill was built at the mine, and water was pumped from Hassayampa at Seymour, through a seven mile pipe line. Power was supplied by woodburning boilers. Work was continued by this company for nine years on a large scale. A great deal of very low grade ore was treated. No exact figures are available on the production but scattered estimates of the Art one Daily Star and U.S. Mint reports indicate a probable gross of 3,000,000 ounces. The mine was worked down about 300 feet to a fault which cut off the ore body.

In 1908 the property was acquired by the Vulture Mines Company. This company at first used 20 stamps of the Arizona Central Company mill. In 1910 a new 20 stamp mill was erected driven by gasoline engine, which treated from 100 to 120 tons a day of ore. This company operated the mine up to 1917. The gross output of this company which worked on the faulted segment of ore was $1,839,375, 30 percent of which was concentrates and 70 percent bullion.

In 1927 D.R. Finlayson acquired the property and organized the Vulture Mining and Milling Company. A 5-stamp amalgamation mill was built at the mine using water pumped from the mine, power being supplied by Diesel engine. Old pillars were treated.

In 1929, a diamond drill campaign was started, after a careful geological study, to prospect for the second faulted segment of the ore. Vein matter carrying free gold was encountered. Financial help was enlisted from the United Verde Extension Mining Company of Jerome. In 1930 and 1931 an 800 foot shaft was sunk to prospect the ground cut by the drill. A large vein was encountered. After six months lateral work and a little drilling, work was abandoned.

Present Condition of Vulture Claims.

There are several areas of past producing mines and old workings located on the property. Detailed below are some of the old workings on the property.

|

·

|

Red Cloud Mine

|

|

o

|

This shaft is located at 0329733 E, 3745506 N at an elevation of 2,222 ft (692 m). The shaft area is fenced. Mine dump material is lying in the immediate surrounding area. Groundwater was observed in the shaft by throwing a piece of rock in the shaft and is estimated to be at a depth of 60 to 80 m below ground surface. Three old trenches were observed; two on the west and one on the east side along strike of this shaft.

|

|

·

|

Red Cloud Mill and Shaft

|

|

o

|

An old shaft, foundations of a stamp mill and an approximately 30 m long trench was observed at this location. A small dump of old milling material was also observed.

|

|

·

|

Vulture Mine Extension

|

|

o

|

This area is marked by the presence of a shaft, an abandoned mill site with remnants of hoist, head frame, ball mills, generator, etc. This area is located on Vulture claim at 0330263 E, 3744219 N with an elevation of 2162 ft (659 m). The shaft is fenced and was observed to be plugged with rock material at 6 to 7 m depth.

|

|

·

|

Mohawk

|

|

o

|

Gold Point claims 27-29 located immediately to the west of Vulture Mine private property were historically called Mohawk group of claims reportedly located 2 miles (3 km) to the west of historical Vulture and Black Hawk mines. Historical work done in this area included a shaft down to about 48 feet which passed through 24 feet of ledge matter.

|

10

Work Completed on the Vulture Claims.

We have not performed any work on the claims.

Proposed and Current State of Exploration and Development on the Vulture Claims. We have not carried out any exploration work on the property. However, on March 13, 2008 Gold Point LLC, the party that staked the current Vulture Claims, contracted Fred B. Brost, P.E. to carry out rock sampling on Red Cloud, Red Rock, and Vulture claims. A total of six samples were collected during this work at various locations. The samples were analyzed at Jacobs Assay Office in Tucson. Following receipt of the assay results, we retained a geologist to conduct a study and produce a report on the exploration potential of the property. He recommended the following two stage exploration program:

Phase 1- Data Compilation, Geological Mapping, Trenching and Sampling

|

o

|

This work should be completed in two stages. The first stage should include compilation of all the historical geological data available for property and putting it into a data base to generate several layers of maps in GIS format for further interpretation. This work will also include geo-referencing historical geological maps, sampling and trenching data, and collecting available historical production records from shafts and mines.

|

|

o

|

In the second stage, the geological fieldwork program should be carried out. This program should include, geological mapping 1:5,000 scale, conducting systematic rock sampling on each claim, and trenching at selected locations. All the accessible old shafts should be studied and sampled in detail to understand the local mineralization trend and to get an insight into the type of ore historically mined. The intent of this work should be to define ground geophysical surveying targets for Phase 2 work Program.

|

The estimated cost of this program is $132,500, which would be expended as follows:

PHASE 1 BUDGET – GEOLOGICAL MAPPING, TRENCHING AND SAMPLING

|

Item

|

No. of Units

|

Rate

|

Total

|

|

Bonds and Permitting

|

1

|

$5,000

|

$5,000

|

|

Data Compilation

|

10

|

$500

|

$5,000

|

|

Maps production

|

1

|

$1,000

|

$1,000

|

|

Geological mapping (2 geologists)

|

21

|

$1,100

|

$23,100

|

|

Prospecting (Prospectors 2)

|

21

|

$900

|

$18,900

|

|

Assaying rock samples

|

500

|

$40

|

$20,000

|

|

Soil Samples

|

300

|

$40

|

$12,000

|

|

Excavator

|

10

|

$1,500

|

$15,000

|

|

Accommodation and Meals

|

50 Man days

|

$200

|

$10,000

|

|

Vehicles: 1

|

25

|

$100

|

$2,500

|

|

Supplies, Blasting Equipment and Rentals

|

Lump Sum

|

$10,000

|

$10,000

|

|

Reports

|

Lump Sum

|

$10,000

|

$10,000

|

|

TOTAL (CANADIAN DOLLARS)

|

$132,500

|

Phase 2 - Ground Geophysical Surveying, Diamond Drilling

Based on the results of Phase 1 program, the following ground geophysical surveys should be carried out at suitable locations: 3D Induced Polarization (IP), Magnetometer Survey and Electromagnetic (EM) - VLF Survey

|

o

|

The IP technique will help in measuring the amount of disseminated metallic sulphides in the underlying porphyritic rocks and quartz veins. This technique energizes the ground surface with an alternating square wave pulsar via a pair of current electrodes and the IP effect is measured as a time diminishing voltage at the receiver electrodes.

|

|

o

|

The very-low frequency (VLF) EM method will help to detect any subsurface conducting zone by utilizing radio signals in the 15 to 30 kilohertz (kH) range that are used for military communications.

|

|

o

|

Magnetometer survey measures the earth's magnetic field which can be influenced due to presence of magnetic or relatively non-magnetic rocks in the survey area. This survey will be helpful in identifying gold bearing zones associated with pyrrhotite or magnetite depleted porphyry type copper-gold mineralization. In some property areas with potential for porphyry copper-gold type ore bodies the mineralizing fluids might have destroyed the magnetite associated with the original intrusive or volcanic rocks. Magnetic surveys would outline positive magnetic anomalies over the unaltered rock formations. The exploration target would be the relatively magnetic lows within these formations where magnetite has altered to a non-magnetic mineral, such as pyrite.

|

|

o

|

The geophysical survey is initially recommended to be carried out at 50 m x 50 m grid on selected areas within the following claim blocks: Red Cloud, Vulture Extension Mohawk.

|

|

o

|

The type of geophysical survey on each claim would depend on the style of mineralization. This work will help to define the trends and continuity of the anomalous surface mineralization and locate targets for drilling. A 10 to 15 drill hole program for up to 2,000 m diamond drilling is proposed which will be contingent upon the findings of Phase 1 program and geophysical surveys.

|

Estimated cost of Phase 2 work program is $522,000, which would be expended as follows:

PHASE 2 BUDGET – GROUND GEOPHYSICAL SURVEYING, DIAMOND DRILLING

|

Item

|

No. of Units

|

Rate

|

Total

|

|

Bond and permitting

|

1

|

$10,000

|

$10,000

|

|

Geologist

|

10

|

$600

|

$6,000

|

|

Geophysical Survey Induced Polarization

|

42

|

$2,000

|

$84,000

|

|

Magnetometer, EM-VLF Survey Crew

|

28

|

$1,200

|

$33,600

|

|

Diamond Core Drilling (m), if warranted

|

2,000

|

$150

|

$300,000

|

|

Accommodation and Meals

|

200

|

$200

|

$40,000

|

|

Vehicles: 2 – 4x4 truck

|

20

|

$200

|

$4,000

|

|

Supplies and Rentals

|

Lump Sum

|

$10,000

|

$10,000

|

|

Data Interpretation

|

Lump Sum

|

$20,000

|

$20,000

|

|

Reports

|

Lump Sum

|

$15,000

|

$15,000

|

|

TOTAL (CANADIAN DOLLARS)

|

$522,600

|

No Known Presence of Reserves on the Vulture Claims. The proposed program is exploratory in nature and there are no known reserves on the property.

Rock Formations and Mineralization of Existing or Potential Economic Significance on the Vulture Claims. Mineralization on the claims and adjoining areas can be classified into three types: i) mineralized veins, ii) porphyritic masses of rock, iii) mixed deposits In which veins and porphyry are both present.

Mineralized Veins. Fractures filled with quartz and other veining material was observed at places on the claims but no strong or regular veins were located. Most of the veins are at the contact of volcanics and metasediments. Gold, silver and other metals may concentrate in quartz veins and in silicified and altered rocks. Some irregular quartz veins were observed in schistose rocks where vein filling occur mainly along the cleavage of schist.

Porphyritic Masses of Rock. At many places quartz monzonite volcanic dykes were observed containing pyrite in disseminated crystalline grains with in porphyritic masses of rocks. The distribution of this sulphide looks like independent of fractures or fracture filling. Moderate to severe alteration of dykes and wall rocks has converted feldspar and mafic minerals to a fine grained sericite, hematite, and clay minerals. Altered dyke rocks commonly consist of quartz "eyes" in a fine-grained matrix of alteration minerals. Conceptual restoration of the rocks of the Vulture mine area to their pre-rotations orientation reveals that the mineralization and alteration originally occurred along a north-northeast-trending subvertical dyke that projected upward from the structural top of a Cretaceous granitoid pluton. The association of gold with dyke and gradation of the dyke into the granitic rocks of the pluton indicate that gold mineralization was intimately related to Cretaceous magmatism and dyke emplacement. Later erosion and subsequent burial by lower Miocene volcanic rocks was followed by structural dismemberment and tilting and eventual uncovering by late Cenozoic erosion.

Mixed Mineralization. Combined veining and porphyritic style of mineralization was observed to be a common feature especially on Gold Point Vulture claim and Gold Point claims 27-29 located in the southwestern part of the property. Granitoid rocks are intersected by porphyritic volcanic rocks in these areas. Hematitic alteration is common and covers large areas at the contact of granite and volcanic dykes.

Competition

The mineral exploration industry, in general, is intensely competitive and even if commercial quantities of reserves are discovered, a ready market may not exist for the sale of the reserves.

Most companies operating in this industry are more established and have greater resources to engage in the production of mineral claims. We were incorporated on June 4, 2008 and our operations are not well-established. Our resources at the present time are limited. We may exhaust all of our resources and be unable to complete full exploration of our various claims. There is also significant competition to retain qualified personnel to assist in conducting mineral exploration activities. If a commercially viable deposit is found to exist and we are unable to retain additional qualified personnel, we may be unable to enter into production and achieve profitable operations. These factors set forth above could inhibit our ability to compete with other companies in the industry and enter into production of the mineral claim if a commercial viable deposit is found to exist.

Numerous factors beyond our control may affect the marketability of any substances discovered. These factors include market fluctuations, the proximity and capacity of natural resource markets and processing equipment, government regulations, including regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting of minerals and environmental protection. The exact effect of these factors cannot be accurately predicted, but the combination of these factors may result in not receiving an adequate return on invested capital.

Compliance with Government Regulation

Canada.

The main agency that governs the exploration of minerals in the Province of Ontario is the Ontario Ministry of Northern Development, Mines and Forestry.

The Ontario Ministry of Northern Development, Mines and Forestry manages the development of Ontario’s mineral resources, and implements policies and programs respecting their development while protecting the environment. In addition, the Ministry regulates and inspects the exploration and mineral production industries in Ontario to protect workers, the public and the environment.

The material legislation applicable to us is the Ontario Mining Act. In order to prospect on Crown lands in Ontario or stake out, record or apply to record the staking of a mining claim, a person must be a holder of a prospector's license issued under the Ontario Mining Act. In order to obtain a license an application is made to the nearest Mining Lands office or other offices offering Mining Lands services of the Ministry of Northern Development, Mines and Forestry. Although a license is required for prospecting, unlicensed parties can perform pre-exploration activities including: geophysical/geochemical surveys, airborne geophysical surveys, limited stripping and trenching, limited bulk sampling and various forms of drilling can be conducted without a license.

Prospecting or preliminary exploration may require the following permits and approvals:

|

o

|

Provincial permits associated with use of Crown land for road building, water crossings, tree cutting, burning of materials or approach to a Provincial highway. In addition, some of the permits required for activity on Crown land may require a limited Environmental Assessment;

|

|

o

|

Federal approvals for crossing a watercourse designated as navigable; work near or within waters that are fish habitat; exploration on First Nation Reserve land; or purchase and possession of explosives; and

|

|

o

|

Municipal approvals for potential changes in land use, and sometimes for burning of materials.

|

If we progress past the exploration stage then the next three main stages in the development of a mining project are advanced exploration, development, operations and closures. At such point in time as we move closer towards realizing each stage we will provide the major regulatory and permitting requirements to be taken into consideration

In order to hold a claim in good standing or to apply for a lease, exploration work (referred to as assessment work) must be performed and reported to the Crown for approval, within specified time limits. Qualifying assessment activities fall into two categories, those performed with 12 months prior to the recording of mining claims and those performed after the recording of mining claims. Activities in the former category are regional surveys such as airborne geophysics and regional or reconnaissance ground exploration and prospecting by a holder of a valid prospector’s license. Activities in the latter category include prospecting and physical work such as manual, mechanical overburden stripping and bedrock trenching and shaft sinking, driving adits and open cuttings.

We have a total of 19 claims scheduled to expire in April 2012, including the 13 KRK West claims which we have re-purchased and the additional 6 claims which remain in dispute. We estimate that a total of $104,400 in assessment work must be conducted before that date in order to maintain the claims in good standing. In addition, we have a total of 19 claims scheduled to expire in May of 2012. We estimate that a total of $107,600 in assessment work must be conducted before that date in order to maintain the claims in good standing.

United States.

The exploration, drilling and mining industries in the United States operate in a legal environment that requires permits to conduct virtually all operations. A Mineral Exploration Permit application will be required to get a permit for the proposed exploration work to be carried out on the Vulture Claims. The department responsible for issuing this is the Minerals Section of the Arizona State Land Department (the “ALSD”).

An exploration permit is valid for one (1) year, renewable up to five (5) years. An Exploration Plan of Operation must be submitted annually and approved by the ASLD prior to startup of exploration activities. A minimum bond required is $3,000 but the actual bond amount is based upon the type of exploration and the degree of disturbance. The State Land Commissioner, an Arizona official, at his discretion, may also change the amount of the damage and restoration bond when warranted by any changes in the Plan of Operation.

Once a permit is issued then there are minimum expenditure requirements. If no work was completed on-site, the applicant can pay the equal amount to the department. An exploration permit does not permit its holder to conduct mining operations. If discovery of a valuable mineral deposit is made, then the permitee must apply for a mineral lease before actual mining activities can begin.

Employees

We have no employees as of the date of this report other than our president and CEO, Ms. Notar. We conduct our business largely through agreements with consultants and other independent third party vendors. We do not anticipate hiring additional employees over the next twelve months.

Research and Development Expenditures

We have not incurred any research or development expenditures since our incorporation.

Environmental Laws

With the exception of the regulations discussed above, we have not incurred and do not anticipate incurring any expenses associated with environmental laws during the currently planned exploratory phases of our operations.

Subsidiaries

We do not have any subsidiaries other than Northern Bonanza, Inc., an Ontario corporation, and Source Bonanza, LLC, a Nevada limited liability company and IRC Exploration, Ltd., an Alberta Corporation.

Patents and Trademarks

We do not own, either legally or beneficially, any patent or trademark.

Item 1A. Risk Factors.

If we do not obtain additional financing, our planned exploration activities will be delayed and we may be unable to implement our business plan.

We currently have cash in the amount of $52,147 and a working capital deficit of $21,938. We will require significant additional cash to complete the proposed exploration programs on our various mining properties. Our business plan calls for ongoing expenses in connection with exploring and developing our mineral properties. Accordingly, we must seek additional financing to fund our planned operations. Such additional funds may be raised through the issuance of equity, debt, convertible debt or similar securities that may have rights or preferences senior to those of our common stock. If financing adequate to fund our planned exploration activities cannot be secured, we will be required to limit our operations and the execution of our business plan will be significantly delayed. There can be no assurance that such additional financing, when and if necessary, will be available to us on acceptable terms, or at all.

Because our auditor has issued a going concern opinion regarding our company, there is an increased risk associated with an investment in our company

We have earned $0 of revenue since our inception, which makes it difficult to evaluate whether we will operate profitably. Operating expenses for the period from June 4, 2008 (date of inception) to July 31, 2010, totaled $5,579,313. We have not attained profitable operations and are dependent upon obtaining financing or generating revenue from operations to continue operations for the next twelve months. As of July 31, 2010, we had $52,147 in cash.

Our future is dependent upon our ability to obtain financing or upon future profitable operations. We reserve the right to seek additional funds through private placements of our common stock and/or through debt financing. Our ability to raise additional financing is unknown. We do not have any formal commitments or arrangements for the advancement or loan of funds. For these reasons, our auditors stated in their report that they have substantial doubt we will be able to continue as a going concern. As a result, there is an increased risk that you could lose the entire amount of your investment in our company.

Because we have only a limited operating history, we face a high risk of business failure.

We have not completed exploration on any of our mining claims. As a result, we have no way to evaluate the likelihood that we will be able to operate the business successfully. We were incorporated on June 4, 2008, and to date have been involved primarily in early stage exploration of the aforementioned mining claims. A significant amount of additional exploration is necessary prior to determining the viability of the claims. We have not earned any revenues as of the date of this prospectus, and thus face a high risk of business failure.

Because our executive officers do not have any training specific to the technicalities of mineral exploration, there is a higher risk our business will fail.

Ms. Lauren Notar, our president and director, does not have any training as a geologist or an engineer. As a result, our management may lack certain skills that are advantageous in managing an exploration company. In addition, Ms. Notar’s decisions and choices may not take into account standard engineering or managerial approaches mineral exploration companies commonly use. Consequently, our operations, earnings, and ultimate financial success could suffer irreparable harm due to management’s lack of experience in geology and engineering.

Because we conduct our business through verbal agreements with consultants and arms-length third parties, there is a substantial risk that such persons may not be readily available to us and the implementation of our business plan could be impaired.

We have verbal agreements with our consulting geologists on the respective properties that require them to review all of the results from the exploration work performed on such properties and then make recommendations based upon those results. In addition, we have a verbal agreement with our accountants to perform requested financial accounting services and a written agreement with our outside auditors to perform auditing functions. Each of these functions requires the services of persons in high demand and these persons may not always be available. The implementation of our business plan may be impaired if these parties do not perform in accordance with our verbal agreement. In addition, it may be difficult to enforce a verbal agreement in the event that any of these parties fail to perform.

Because of the unique difficulties and uncertainties inherent in the mineral exploration business, we face a high risk of business failure.

Potential investors should be aware of the difficulties normally encountered by new mineral exploration companies and the high rate of failure of such enterprises. The likelihood of success must be considered in light of the problems, expenses, difficulties, complications and delays encountered in connection with the exploration of the mineral properties that we plan to undertake. These potential problems include, but are not limited to, unanticipated problems relating to exploration, and additional costs and expenses that may exceed current estimates. The search for valuable minerals also involves numerous hazards. As a result, we may become subject to liability for such hazards, including pollution, cave-ins and other hazards against which we cannot insure or against which we may elect not to insure. At the present time, we have no coverage to insure against these hazards. The payment of such liabilities may have a material adverse effect on our financial position. In addition, there is no assurance that the expenditures to be made by us in the exploration of the mineral claims will result in the discovery of mineral deposits. Problems such as unusual or unexpected formations and other conditions are involved in mineral exploration and often result in unsuccessful exploration efforts.

Because we anticipate our operating expenses will increase prior to our earning revenues, we may never achieve profitability.

Prior to completion of our exploration stage, we anticipate that we will incur increased operating expenses without realizing any revenues. We expect to incur continuing and significant losses into the foreseeable future. As a result of continuing losses, we may exhaust all of our resources and be unable to complete the exploration of all the claims that we own. Our accumulated deficit will continue to increase as we continue to incur losses. We may not be able to earn profits or continue operations if we are unable to generate significant revenues from the exploration of the mineral claims if we exercise our option. There is no history upon which to base any assumption as to the likelihood that we will be successful, and we may not be able to generate any operating revenues or ever achieve profitable operations. If we are unsuccessful in addressing these risks, our business will most likely fail.

Because, Ms Lauren Notar holds an option to purchase 40.68% of our outstanding common stock, investors may find that corporate decisions influenced by Ms. Notar are inconsistent with the best interests of other stockholders.

Ms. Notar holds an option to purchase 44.29% of the Company’s outstanding stock from our former president and CEO, Mr. Harry Bygdnes. If Ms. Notar exercises this option and purchases all of the stock thereunder, she will have a significant influence in determining the outcome of all corporate transactions or other matters, including mergers, consolidations and the sale of all or substantially all of our assets, and also the power to prevent or cause a change in control. While we have no current plans with regard to any merger, consolidation or sale of substantially all of its assets, the interests of Ms. Notar may still differ from the interests of the other stockholders.

Because our sole officer and director, Ms Lauren Notar, holds an option to purchase 44.29% of our outstanding common stock, the market price of our shares would most likely decline if she exercised the option to purchase 40.68% of the outstanding stock and then were to sell a substantial number of those shares all at once or in large blocks.

Our sole officer and director, Ms Lauren Notar holds an option to purchase 20,000,000 shares of our common stock which equates to approximately 40.68% of our outstanding common stock. Our common stock is currently quoted on the OTC Bulletin Board (“OTCBB”), which is sponsored by FINRA. The OTCBB is a network of security dealers who buy and sell stock. The dealers are connected by a computer network that provides information on current "bids" and "asks", as well as volume information. Our shares are quoted on the OTCBB under the symbol “SRGL.” The offer or sale of a large number of shares at any price may cause the market price to fall. Sales of substantial amounts of common stock or the perception that such transactions could occur, may materially and adversely affect prevailing markets prices for our common stock.

If we are unable to successfully compete within the mineral exploration business, we will not be able to achieve profitable operations.

The mineral exploration business is highly competitive. This industry has a multitude of competitors and no small number of competitors dominates this industry with respect to any of the large volume metallic minerals. Our exploration activities will be focused on attempting to locate commercially viable mineral deposits on our current claims. Many of our competitors have greater financial resources than us. As a result, we may experience difficulty competing with other businesses when conducting mineral exploration activities on the claims. If we are unable to retain qualified personnel to assist us in conducting mineral exploration activities on our claims, even if a commercially viable deposit is found to exist, we may be unable to enter into production and achieve profitable operations.

Because of factors beyond our control which could affect the marketability of any substances found, we may be difficulty selling any substances we discover.

Even if commercial quantities of reserves are discovered, a ready market may not exist for the sale of the reserves. Numerous factors beyond our control may affect the marketability of any substances discovered. These factors include market fluctuations, the proximity and capacity of natural resource markets and processing equipment, and government regulations, including regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting of minerals, and environmental protection. These factors could inhibit our ability to sell minerals in the event that commercial amounts of minerals are found.

Risks Related To Legal Uncertainty

Because we will be subject to compliance with government regulation which may change, the anticipated costs of our exploration program may increase.

There are several governmental regulations that materially restrict mineral exploration or exploitation. We may be required to obtain work permits, post bonds and perform remediation work for any physical disturbance to the land in order to comply with these regulations. Currently, we have not experienced any difficulty with compliance of any laws or regulations which affect our business. While our planned exploration program budgets for regulatory compliance, there is a risk that new regulations could increase our costs of doing business, prevent us from carrying out our exploration program, and make compliance with new regulations unduly burdensome.

If Native land claims affect the title to our mineral claims, our ability to prospect the mineral claims may be lost.

We are unaware of any outstanding native land claims on our Canadian claims. Notwithstanding, it is possible that a native land claim could be made in the future. The federal and provincial government policy is at this time is to consult with all potentially affected native bands and other stakeholders in the area of any potential commercial production. In the event that we encounter a situation where a native person or group claims an interest in one of our Canadian claims, we may be unable to provide compensation to the affected party in order to continue with our exploration work, or if such an option is not available, we may have to relinquish any interest that we may have in this claim. The Supreme Court of Canada has ruled that both the federal and provincial governments in Canada are obliged to negotiate these matters in good faith with native groups and at no cost to us. Notwithstanding, the costs and/or losses could be greater than our financial capacity and our business would fail.

Because legislation, including the Sarbanes-Oxley Act of 2002, increases the cost of compliance with federal securities regulations as well as the risks of liability to officers and directors, we may find it more difficult for us to retain or attract officers and directors.

The Sarbanes-Oxley Act of 2002 was enacted in response to public concerns regarding corporate accountability in connection with recent accounting scandals. The stated goals of the Sarbanes-Oxley Act are to increase corporate responsibility, to provide for enhanced penalties for accounting and auditing improprieties at publicly traded companies, and to protect investors by improving the accuracy and reliability of corporate disclosures pursuant to the securities laws. The Sarbanes-Oxley Act generally applies to all companies that file or are required to file periodic reports with the SEC, under the Securities Exchange Act of 1934. Upon becoming a public company, we will be required to comply with the Sarbanes-Oxley Act and it is costly to remain in compliance with the federal securities regulations. Additionally, we may be unable to attract and retain qualified officers, directors and members of board committees required to provide for our effective management as a result of Sarbanes-Oxley Act of 2002. The enactment of the Sarbanes-Oxley Act of 2002 has resulted in a series of rules and regulations by the SEC that increase responsibilities and liabilities of directors and executive officers. The perceived increased personal risk associated with these recent changes may make it more costly or deter qualified individuals from accepting these roles. Significant costs incurred as a result of becoming a public company could divert the use of finances from our operations resulting in our inability to achieve profitability.

Risks Related To Our Common Stock

Because the market may respond to our business operations and that of our competitors, our stock price will likely be volatile.

Our common stock is currently quoted on the OTC Bulletin Board (“OTCBB”), which is sponsored by FINRA. The OTCBB is a network of security dealers who buy and sell stock. The dealers are connected by a computer network that provides information on current "bids" and "asks", as well as volume information. Our shares are quoted on the OTCBB under the symbol “SRGL.” We anticipate that the market price of our Common Stock will be subject to wide fluctuations in response to several factors, including: our ability to develop projects successfully; increased competition from competitors; and our financial condition and results of our operations.

Because we are subject to the “Penny Stock” rules, the level of trading activity in our stock may be reduced.

Broker-dealer practices in connection with transactions in "penny stocks" are regulated by penny stock rules adopted by the Securities and Exchange Commission. Penny stocks generally are equity securities with a price of less than $5.00 (other than securities registered on some national securities exchanges or quoted on Nasdaq). The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document that provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction, and, if the broker-dealer is the sole market maker, the broker-dealer must disclose this fact and the broker-dealer's presumed control over the market, and monthly account statements showing the market value of each penny stock held in the customer's account. In addition, broker-dealers who sell these securities to persons other than established customers and "accredited investors" must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser's written agreement to the transaction. Consequently, these requirements may have the effect of reducing the level of trading activity, if any, in the secondary market for a security subject to the penny stock rules, and investors in our common stock may find it difficult to sell their shares.

As our shares are quoted on the over-the-counter bulletin board, we are required to remain current in our filings with the SEC and our securities will not be eligible for quotation if we are not current in our filings with the SEC.

Because our shares are quoted on the over-the-counter bulletin board, we are required to remain current in our filings with the SEC in order for shares of our common stock to be eligible for quotation on the over-the-counter bulletin board. In the event that we become delinquent in our required filings with the SEC, quotation of our common stock will be terminated following a 30 day grace period if we do not make our required filing during that time. If our shares are not eligible for quotation on the over-the-counter bulletin board, investors in our common stock may find it difficult to sell their shares.

Item 1B. Unresolved Staff Comments

A smaller reporting company is not required to provide the information required by this Item.

Item 2. Properties

We do not lease or own any real property other than our mineral claims. Our executive and head office is located at 2 Toronto Street, Suite 234, Toronto, Ontario, Canada M5C 2B5. We believe our current premises are adequate for our current operations and we do not anticipate that we will require any additional premises in the foreseeable future. When and if we require additional space, we intend to move at that time.

Southern Beardmore Claims

The Southern Beardmore property consists of a group of 21 contiguous mineral claims in the Beardmore Area and Mary Jane Lake Area, near Beardmore, Ontario The area of the property is 269 hectares. The northern boundary of the property is 3 kilometers south of Beardmore, Ontario on Highway11.

KRK West Claims

The KRK West property consists of 19 claims covering 15 square miles. It is located north of Thunder Bay in the Beardmore area of Northwestern Ontario, Canada.

Vulture Peak Claims

The Vulture Peak property is located approximately 15 km to 17 km southwest of Wickenburg in Maricopa County, Arizona. It consists of 23 claims located in Section(s) 23, 24, 25, 26, 35 and 36, T.6N., R.GW., and in Section(s) 3D, T.6N., R.5W., Maricopa County, Arizona. Each claim is approximately 20.7 acres with a total property area of 476.1 acres, configured in three separate blocks.

Item 3. Legal Proceedings

On October 26, 2009, we entered into an agreement with Thunder Bay Minerals, Inc. (“Thunder Bay”) under which we were granted an option to acquire an undivided 50% interest in 19 mineral claims known as the KRK West Claim, located north of Thunder Bay, Ontario, Canada. During the year we learned that Thunder Bay had allowed the KRK West Claims to lapse, and therefore the option agreement was null and void. As discussed above, we were able to re-purchase 13 of the 19 KRK West Claims from persons who re-staked the claims for an aggregate amount of $27,578. We also incurred exploration expenditures of $555 in relation to these claims. Subsequent to acquisition of the claims they were transferred to our wholly owned subsidiary, Northern Bonanza, Inc.

Thunder Bay currently maintains that control of the KRK West Claims remains with it and that we have no right to further explore the property. We disagree with this assertion and accordingly ownership to the claims is in dispute. On January 7, 2011 the Ministry of Northern Development, Mines and Forestry, Canada, will adjudicate upon the ownership of the claims.

Other than the foregoing, we are not a party to any pending legal proceeding. We are not aware of any pending legal proceeding to which any of our officers, directors, or any beneficial holders of 5% or more of our voting securities are adverse to us or have a material interest adverse to us.

Item 4. (Removed and Reserved)

PART II

Item 5. Market for Registrant’s Common Equity and Related Stockholder Matters and Issuer Purchases of Equity Securities

Market Information

Our common stock is currently quoted on the OTC Bulletin Board (“OTCBB”), which is sponsored by FINRA. The OTCBB is a network of security dealers who buy and sell stock. The dealers are connected by a computer network that provides information on current "bids" and "asks", as well as volume information. Our shares are quoted on the OTCBB under the symbol “SRGL.OB.”

The following table sets forth the range of high and low bid quotations for our common stock for each of the periods indicated as reported by the OTCBB. These quotations reflect inter-dealer prices, without retail mark-up, mark-down or commission and may not necessarily represent actual transactions.

|

Fiscal Year Ending July 31, 2010

|

||||

|

Quarter Ended

|

High $

|

Low $

|

||

|

July 31, 2010

|

1.87

|

0.44

|

||

|

April 30, 2010

|

2.0

|

0.60

|

||

|

February 28, 2010

|

1.24

|

0.51

|

||

|

October 31, 2009

|

0.55

|

0.0

|

||

|

Fiscal Year Ending July 31, 2009

|

||||

|

Quarter Ended

|

High $

|

Low $

|

||

|

July 31, 2009

|

0.0

|

0.0

|

||

|

April 30, 2009

|

0.0

|

0.0

|

||

|

February 28, 2009

|

0.0

|

0.0

|

||

|

October 31, 2008

|

0.0

|

0.0

|

||

Penny Stock

The SEC has adopted rules that regulate broker-dealer practices in connection with transactions in penny stocks. Penny stocks are generally equity securities with a market price of less than $5.00, other than securities registered on certain national securities exchanges or quoted on the NASDAQ system, provided that current price and volume information with respect to transactions in such securities is provided by the exchange or system. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock, to deliver a standardized risk disclosure document prepared by the SEC, that: (a) contains a description of the nature and level of risk in the market for penny stocks in both public offerings and secondary trading; (b) contains a description of the broker's or dealer's duties to the customer and of the rights and remedies available to the customer with respect to a violation of such duties or other requirements of the securities laws; (c) contains a brief, clear, narrative description of a dealer market, including bid and ask prices for penny stocks and the significance of the spread between the bid and ask price; (d) contains a toll-free telephone number for inquiries on disciplinary actions; (e) defines significant terms in the disclosure document or in the conduct of trading in penny stocks; and (f) contains such other information and is in such form, including language, type size and format, as the SEC shall require by rule or regulation.

The broker-dealer also must provide, prior to effecting any transaction in a penny stock, the customer with (a) bid and offer quotations for the penny stock; (b) the compensation of the broker-dealer and its salesperson in the transaction; (c) the number of shares to which such bid and ask prices apply, or other comparable information relating to the depth and liquidity of the market for such stock; and (d) a monthly account statement showing the market value of each penny stock held in the customer's account.

In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from those rules, the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser's written acknowledgment of the receipt of a risk disclosure statement, a written agreement as to transactions involving penny stocks, and a signed and dated copy of a written suitability statement.

These disclosure requirements may have the effect of reducing the trading activity for our common stock. Therefore, stockholders may have difficulty selling our securities.

Holders of Our Common Stock

As of October 18, 2010, we had 49,159,265 shares of our common stock issued and outstanding, held by 48 shareholders of record.

Common Stock

Our authorized capital stock consists of 180,000,000 shares of common stock, with a par value of $0.001 per share, and 20,000,000 shares of preferred stock, with a par value of $0.001 per share. As of October 18, 2010 there were 49,159,265 shares of our common stock issued and outstanding. We have not issued any shares of preferred stock.

Voting Rights

Holders of common stock have the right to cast one vote for each share of stock in his or her own name on the books of the corporation, whether represented in person or by proxy, on all matters submitted to a vote of holders of common stock, including the election of directors. There is no right to cumulative voting in the election of directors. Except where a greater requirement is provided by statute or by the Articles of Incorporation, or by the Bylaws, the presence, in person or by proxy duly authorized, of the holder or holders of a majority of the outstanding shares of the our common voting stock shall constitute a quorum for the transaction of business. The vote by the holders of a majority of such outstanding shares is also required to effect certain fundamental corporate changes such as liquidation, merger or amendment of the Company's Articles of Incorporation.

Dividends

There are no restrictions in our articles of incorporation or bylaws that prevent us from declaring dividends. The Nevada Revised Statutes, however, do prohibit us from declaring dividends where after giving effect to the distribution of the dividend:

1. we would not be able to pay our debts as they become due in the usual course of business, or;

2. our total assets would be less than the sum of our total liabilities plus the amount that would be needed to satisfy the rights of shareholders who have preferential rights superior to those receiving the distribution.

We have not declared or paid any dividends and we do not plan to declare any dividends in the foreseeable future.

Pre-emptive Rights

Holders of common stock are not entitled to pre-emptive or subscription or conversion rights, and there are no redemption or sinking fund provisions applicable to the Common Stock. All outstanding shares of common stock are, and the shares of common stock offered hereby will be when issued, fully paid and non-assessable.

Share Purchase Warrants

We have not issued and do not have outstanding any warrants to purchase shares of our common stock.

Options

We have not issued and do not have outstanding any options to purchase shares of our common stock.

Convertible Securities

We have not issued and do not have outstanding any securities convertible into shares of our common stock or any rights convertible or exchangeable into shares of our common stock.

Transfer Agent

Our transfer agent is Empire Stock Transfer Inc., 1859 Whitney Mesa Drive, Henderson, Nevada 89014.

Nevada Anti-Takeover Laws

Nevada Revised Statutes sections 78.378 to 78.379 provide state regulation over the acquisition of a controlling interest in certain Nevada corporations unless the articles of incorporation or bylaws of the corporation provide that the provisions of these sections do not apply. Our articles of incorporation and bylaws do not state that these provisions do not apply. The statute creates a number of restrictions on the ability of a person or entity to acquire control of a Nevada company by setting down certain rules of conduct and voting restrictions in any acquisition attempt, among other things. The statute is limited to corporations that are organized in the state of Nevada and that have 200 or more stockholders, at least 100 of whom are stockholders of record and residents of the State of Nevada; and does business in the State of Nevada directly or through an affiliated corporation. Because of these conditions, the statute currently does not apply to our company.

Recent Sales of Unregistered Securities

During the quarter and year ended July 31, 2010, we had the following sale of unregistered securities:

|

o

|

On June 16, 2010, the Company issued 105,932 common shares at $1.18 per share to Greenshoe Investment Ltd. for total proceeds of $125,000 pursuant to a private placement. We completed this offering pursuant Regulation S of the Securities Act of 1933.

|

Subsequent to the quarter and year ended July 31, 2010, we had the following sale of unregistered securities:

|

o

|

On August 7, 2010, we entered into an agreement with Vulture Gold LLC, a Nevada limited liability company (“Vulture”), to purchase One Hundred percent (100%) of Vulture’s outstanding membership interests in consideration for 4,000,000 shares of our common stock. The sellers of the membership interests in Vulture were Aravis Investments, Ltd., and Somerset Management, Ltd. Each of the selling parties sold a 50% membership interest in Vulture in exchange for 2,000,000 shares of our common stock. We completed this offering pursuant Regulation S of the Securities Act of 1933.

|

In addition to the foregoing sales, since our inception, we have had the following previously reported sale of unregistered securities:

|

o

|

On June 16, 2008, the Company issued 24,000,000 common shares to the Company’s former president, Mr. Harry Bygdnes, at $0.002 per share for total proceeds of $48,000. These shares were issued pursuant to Section 4(2) of the Securities Act of 1933 and are restricted shares as defined in the Securities Act.

|

|

o

|

On July 31, 2008, the Company issued 20,400,000 common shares at $0.0035 per share for total proceeds of $71,400 pursuant to a private placement. The Company paid commissions of $7,025 for net proceeds of $64,375. We completed this offering pursuant Regulation S of the Securities Act of 1933. The identity of the purchasers from this offering was included in the selling shareholder table set forth on Form S-1 filed by us on October 7, 2008.

|

|

o

|

On October 26, 2009, the Company issued 200,000 common shares to Somerset Management at $0.25 per share for total proceeds of $50,000 pursuant to a private placement. We completed this offering pursuant Regulation S of the Securities Act of 1933.

|

|

o

|

On October 30, 2009, the Company issued 200,000 common shares to Murrayfield Limited at $0.25 per share for total proceeds of $50,000 pursuant to a private placement. We completed this offering pursuant Regulation S of the Securities Act of 1933.

|

|

o

|

On November 26, 2009, the Company issued 100,000 common shares at $1.00 per share to Valcorine Capital for total proceeds of $100,000 pursuant to a private placement. We completed this offering pursuant Regulation S of the Securities Act of 1933.

|

|

o

|

On March 5, 2010, the Company issued 120,000 common shares at $1.00 per share for total proceeds of $120,000 pursuant to a private placement. We completed this offering pursuant Regulation S of the Securities Act of 1933.

|

|

o

|

On April 30, 2010, the Company issued 33,333 common shares at $1.50 per share to Greenshoe Investment Ltd. for total proceeds of $50,000 pursuant to a private placement. We completed this offering pursuant Regulation S of the Securities Act of 1933.

|

Securities Authorized for Issuance under Equity Compensation Plans

We do not have any equity compensation plans.

Item 6. Selected Financial Data

A smaller reporting company is not required to provide the information required by this Item.

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Forward-Looking Statements