Attached files

| file | filename |

|---|---|

| 8-K - SUNPOWER CORPORATION 8-K 11-11-2010 - SUNPOWER CORP | form8k.htm |

| EX-99.2 - EXHIBIT 99.2 - SUNPOWER CORP | ex99-2.htm |

| EX-99.4 - EXHIBIT 99.4 - SUNPOWER CORP | ex99-4.htm |

| EX-99.1 - EXHIBIT 99.1 - SUNPOWER CORP | ex99-1.htm |

Exhibit 99.3

Third Quarter 2010 Earnings Supplementary Slides

November 11, 2010

Safe Harbor Statement

2

Strong Business Performance

§ Beat Q3 forecast in both segments

§ Met cost reduction plan in fab and field

§ Demand greater than supply - record backlog

§ Strong Q3 Execution

– Record cell outs, OEE, average efficiency and yields in Fabs 1 and 2

– 22+% Gen 2 cells on first production run in Fab 3

– Installed more than 70 MW* of power plants

– Closed sale of Montalto 28 MW ac solar park

3

* Power plant capacity in MW ac

Q4 Confidence / 2011 Visibility

§ High confidence in Q4 execution

– R&C: Fully booked

– UPP: On plan to monetize Italian solar parks

§ Strong growth and high visibility for 2011

– Volume and price established for Commercial business and UPP

– ~70% booked in Commercial for 2011

– 95% booked in North American UPP for 2011

– On plan for $1.08/W Q4 11 efficiency adjusted panel cost v. 14% panels

4

Vertical Integration Strategy

Poly

Ingot

Wafer

Cell

Panel

Upstream

§ World’s highest efficiency panels

§ Sustainable differentiated advantage

§ Drive for scale and cost reduction

Install

Services

Downstream

§ Adjust rapidly to market conditions

§ Integrated cost reduction

§ Premium brand / superior service

BOS

5

SPWR Downstream Strategy

§ World’s highest efficiency panels

§ Sustainable differentiated advantage

§ Drive for scale and cost reduction

§ Multi-year fixed price contracts

§ NA, EMEA, emerging markets

§ Integrated cost reduction

§ NAC: Multi-Qtr fixed price contracts

§ RLC: global dealer/partner network

§ Integrated cost reduction

EPC

Services

UPP Segment

BOS

Sales/

Install

Services

R&C Segment

BOS

Poly

Ingot

Wafer

Cell

Panel

Upstream

6

Diversified Channel / Portfolio

§R&C Market Position

− Global footprint, #1 in US

− Residential: 8 countries

− Commercial: Direct sales force

− #1 in NA, expanding to EU

− T5 driving wins: 3.5 MW Macy’s

§UPP Market Position

− Global reach / direct sales force

− 5 GW pipeline (~1/3 in EMEA)

− Customers buy energy (¢/kWh)

− High energy density = low LCOE

7

Italy Project Overview

|

|

2009

|

Q1 ’10

|

Q2 ’10

|

Q3 ’10

|

Q4 ’10

|

Q1 ’11

|

|

Montalto 20

Montalto 8

Montalto 44

Solare Roma 13

Permitting

Construction

Financing

Sale

* MW’s in chart are listed in ac

8

Note: Illustrative 100 GWh / year power plant, Phoenix, AZ

SunPower LCOE Advantages

|

|

SunPower

|

11% TF Fixed

|

|

GWh/yr

|

100

|

100

|

|

MW

|

37

|

46

|

|

Acres

|

191

|

351

|

|

Inverters

|

74

|

92

|

SunPower delivers

the same GWh using

far fewer acres and

less BOS leading to

lower O&M costs

the same GWh using

far fewer acres and

less BOS leading to

lower O&M costs

SunPower

Thin Film

9

SunPower LCOE Advantages

|

|

SunPower

|

11% TF Fixed

|

|

GWh/yr

|

100

|

100

|

|

Total $

|

$200 MM

|

$200 MM

|

|

$/Wp DC

|

$4.37

|

$3.50

|

SunPower delivers

the same LCOE with

a 25% $/Wp price

premium

the same LCOE with

a 25% $/Wp price

premium

SunPower

Thin Film

Economically equivalent to customer

10

Note: Illustrative 100 GWh / year power plant, Phoenix, AZ

Efficiency Adjusted Cost/Watt*

|

|

Q4’09

|

Q4’10

|

Q4’11

|

|

SunPower 19% Panel Cost / Watt**

|

$1.91

|

$1.71

|

$1.48

|

|

Efficiency Adjusted (vs. 14%)

|

$1.47

|

$1.36

|

$1.08

|

|

Efficiency Adjusted (vs. 11%)

|

$1.01

|

$0.92

|

$0.71

|

11

*Efficiency adjustments consider the BOS/tracking benefits of high efficiency panels.

**Base Cost/Watt excludes freight and pre-op expenses.

Comparison: 14% panel on T20 tracking system, 11% panel on fixed tilt.

§ Cost reduction drivers

− Fab 3 JV with AUO

− Leveraging R+D investments

− Improved manufacturing efficiency

− Increased ramp, yield and OEE

|

($ Millions except per share data)

|

Quarter

Ending 10/3/10

|

Quarter

Ending 9/27/09

|

Quarter

Ending 7/4/10

|

|

Non-GAAP Revenues

|

$553.8

|

$465.4

|

$392.1

|

|

R+C

|

$292.8

|

$270.2

|

$264.2

|

|

UPP

|

$261.0

|

$195.1

|

$127.9

|

|

Gross Margin % (Non-GAAP)

|

22.3%

|

23.1%

|

26.3%

|

|

R+C

|

24.3%

|

19.6%

|

26.5%

|

|

UPP

|

20.0%

|

27.9%

|

26.1%

|

|

Tax Rate (non-GAAP)

|

15.4%

|

25.3%

|

20.3%

|

|

Net Income (Loss) (GAAP)

|

$20.1

|

$19.5

|

($6.2)

|

|

Net Income (Loss) (Non-

GAAP) |

$26.3

|

$47.0

|

$14.4

|

|

Diluted Wtg. Avg. Shares Out.

|

105.6**

|

105.0**

|

96.8*

|

|

EPS (GAAP)

|

$0.21

|

$0.21

|

($0.07)

|

|

EPS (Non-GAAP)

|

$0.26

|

$0.46

|

$0.15

|

Note: Non-GAAP figures are reconciled to comparable GAAP figures in appendix on company website

*not converted method **if converted method

Current and historical figures reflect Q2’10 change to new business unit segmentation

12

Balance Sheet and Financial Outlook

§ Liquidity

– Ended Q310 with $438 million in cash and investments

– Repaid $177 million in convertible debt and bank loans

– $145 million of additional liquidity available

– Shares in Woongjin Energy ~$360 million market value

§ Capital Expenditures of $4.3 million in Q3; 2010 plan of $125-$150 million

§ Q3 Free Cash Flow* of $78 million

§ Q4 FX exposure fully hedged at $1.37 to 1 Euro

§ Q3 production of 152 MW; 2010 on track to exceed 550 MW

*Free Cash Flow is net cash provided by (used in) operating activities less net cash provided by (used in) investing activities.

13

Italian Projects Update

§ On track to assemble, finance and monetize Italian projects in Q4

– Expect to complete and sell more than 80 MW in 2010

§ Montalto 44 MW

– Currently marketing €200 million in debt financing

– Industry’s first solar bond

– Provisional investment grade rating on both tranches of debt

– Debt transfers to new owner on sale

– Equity sale in negotiation for Q4 close

– On schedule for connection to grid in mid-December 2010

§ Solare Roma - 13 MW

– On schedule to connect and monetize project in December 2010

14

2010 Guidance

|

|

Q4

|

FY 2010

|

|

Revenue $MM

|

$870-$970

|

$2,150-2,250

|

|

Gross Margin (Non-GAAP)

|

20-22%

|

22-23%

|

|

EPS $/Share (Non-GAAP)

|

$0.95-$1.15

|

$1.45-$1.65

|

|

EPS $/Share (GAAP)

|

$0.45-$0.60

|

$0.75-$0.90

|

15

Third Quarter 2010 Earnings Supplementary Slides

November 11, 2010

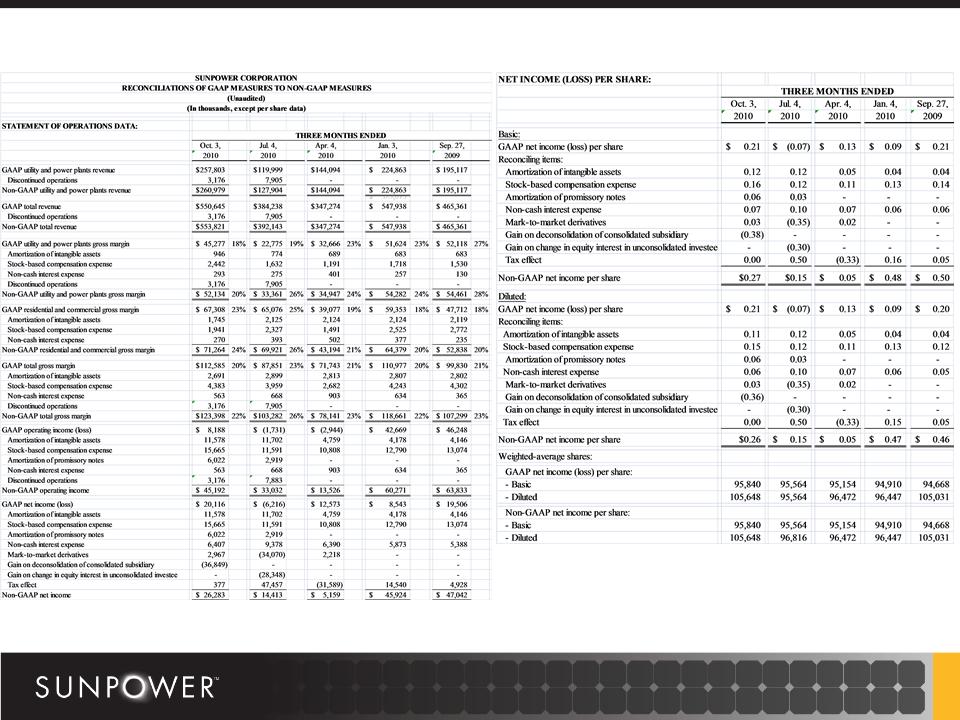

GAAP to Non-GAAP Reconciliation

17

18

Earnings Per Share Calculation

19

Three Months Ended October 3, 2010

GAAP

Non-GAAP

(in thousands)

If Converted Method

Not Converted

Method

Method

If Converted Method

Not Converted

Method

Method

Net income

$ 20,116

$ 20,116

$ 26,283

$ 26,283

Net income allocated to unvested restricted stock awards

(24)

(24)

(31)

(31)

Net income allocated to class A and class B common stock

20,092

20,092

26,252

26,252

Basic weighted-average shares

95,840

95,840

95,840

95,840

Net income per share - basic

$ 0.21

$ 0.21

$ 0.27

$ 0.27

Net income

$ 20,116

$ 20,116

$ 26,283

$ 26,283

(A)

Interest expense on 4.75% debentures, net of tax

1,666

-

1,666

-

Net income allocated to unvested restricted stock awards

(23)

(24)

(30)

(31)

Net income allocated to class A and class B common stock

21,759

20,092

27,919

26,252

Diluted weighted-average shares before consideration of 4.5% debentures

96,936

96,936

96,936

96,936

Shares issued if 100% of 4.5% Debentures are converted to equity

8,712

-

8,712

-

Diluted weighted-average shares

105,648

96,936

105,648

96,936

Net income per share - diluted

$ 0.21

$ 0.21

$ 0.26

$ 0.27

(A)

Under the "If Converted Method" we calculated diluted earnings per share using the more dilutive of the following two methods:

Method One:

Numerator = Income Available to Common Shareholders + Interest on 4.5% Debentures, Net of Tax

Denominator = Stock Outstanding + Common Shares Issued if 100% Coversion of 4.5% Debentures

Method Two:

Numerator = Income Available to Common Shareholders

Denominator = Stock Outstanding