Attached files

| file | filename |

|---|---|

| EX-31.1 - CERTIFICATION OF CHIEF EXECUTIVE OFFICER - REXNORD LLC | ex31109302010.htm |

| EX-32.1 - CERTIFICATION OF CHIEF EXECUTIVE OFFICER AND CHIEF FINANCIAL OFFICER - REXNORD LLC | ex32109302010.htm |

| EX-31.2 - CERTIFICATION OF CHIEF FINANCIAL OFFICER - REXNORD LLC | ex31209302010.htm |

| 10-Q - FORM 10-Q - REXNORD LLC | rbsg0930201010q.htm |

Exhibit 10.1

REXNORD

MANAGEMENT

INCENTIVE

COMPENSATION PLAN

(“MICP”)

REVISED: July 29, 2010

Plan Name:

Rexnord Management Incentive Compensation Plan (MICP)

Plan Objectives:

Establish a meaningful variable compensation component of an attractive pay-for-performance total cash compensation program designed to support the achievement of Outstanding Strategic, Financial and Operational Performance

Plan Term:

The Plan commences on the first day of the fiscal year and ends on the last day of the fiscal year

Plan Eligibility:

As approved by the CEO, in consultation with the Chairman of the Board.

Target Bonus Levels:

Determined based on a mix of level-of-impact toward the achievement of Company objectives, and sound pay-for-performance total cash compensation guidelines

Performance Measures:

• | EBITDA |

• | Free Cash Flow (De-levered Free Cash Flow or Divisional Free Cash Flow) |

• | Non-financial Goals and Objectives (Personal Performance Factor) |

Plan Design:

Payout Determined by Formula:

Year End | Individual | Financial* | Personal | Bonus | ||||

Base | X | Target | X | Factor | X | Performance | = | Payout |

Salary | Bonus % | Factor |

* NOTE - Financial Factor may be determined by a “mix” of more than one Organizational Financial Factor (percentage weighted - example: 80% Division + 20% Corporate)

Performance Criteria:

Individual Achievements = “Personal Performance Factor”

TEAM Achievements = “Financial Factor”

Company Financial Factor based on:

• | EBITDA |

• | Free Cash Flow* |

* NOTES:

• | EBITDA & Free Cash Flow targets will be recommended by Management, reviewed/approved by the Chairman, and then approved by the Compensation Committee of the Board of Directors of RBS Global, Inc, (the “Compensation Committee”). |

• | % weighting of EBITDA and Free Cash Flow will normally be 50%/50% (variances from this weighting will be recommended by Management and reviewed/approved by the Chairman) |

Financial Thresholds

Minimum EBITDA or Minimum Free Cash Flow thresholds must be achieved in order to trigger a potential bonus payment under the plan (“The Cliff”)

"Cliff" = 80% - 90% of Target*

* NOTE: The CEO shall have the discretionary ability to determine the applicable cliff to be assigned to each plan (with the exception of the consolidated plan, which is set by the Compensation Committee) at the outset of each fiscal year. For Fiscal Year 2011, the cliff has been set to 90%.

Upper Limit = None (No Cap)

Performance Range:

• | See examples in Addendum A |

Financial Factor Calculation Example:

EBITDA as a % of the Financial Factor calculation | = | 50 | % | |

Free Cash Flow as a % of the Financial Factor calculation | = | 50 | % | |

Cliff | = | 90 | % | |

% of EBITDA Target Achieved | = | 110 | % | |

% of Free Cash Flow Achieved | = | 97 | % | |

Calculation: | 1.25 x .50 | = | 0.625 | |

.85 x .50 | = | 0.425 | ||

Company Financial Factor | = | 1.05 | ||

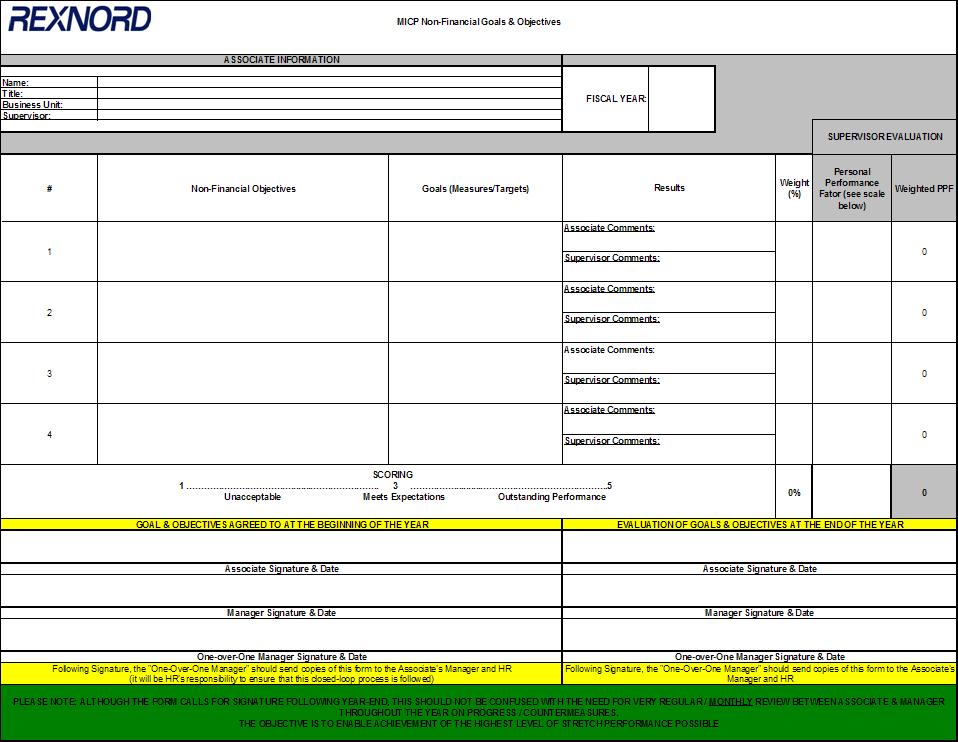

Personal Performance Factor

• | Based primarily on Individual Non-Financial Goals & Objectives |

◦ | Re-enforce Cross-Functional / Business Teamwork |

◦ | DIFFERENTIATE for Performance |

• | Range |

--------0---------------------------------------------1.0-------------------------------------1.5--------

Unacceptable Meets Expectations Outstanding

• | Focus - No More Than Five Personal Objectives Which: |

◦ | Generally Tie to Strategy Deployment Objectives |

◦ | Are Aggressive |

◦ | Are Measurable |

◦ | Are Critical to Business Success |

Personal Performance Factor (con't.)

• | Setting Objectives |

◦ | Common Format |

Annual Payout Calculation Example:

Year End Individual's Company Personal

Base X Target X Financial X Performance

Salary Bonus % Factor Factor

March 31st Base Salary = $115,000

Individual Target Bonus % / $ = 15% / $17,250

Company Financial Factor = 1.05

Personal Performance Factor = 1.15

Actual Payout = $115,000 x .15 x 1.05 x 1.15 = $20,829

Miscellaneous Plan Guidelines:

• | The Plan will be administered in accordance with the following guidelines: |

◦ | Plan Design & Continuation - to be determined by the Compensation Committee. |

◦ | Plan Participation - to be determined by the CEO, in consultation with the Chairman. |

◦ | Payout Calculations and Timing - the Compensation Committee shall approve the total annual payout, as well as specific payouts to the CEO and the other Named Executive Officers. The rest of the payouts shall be approved by the CEO, in consultation with the Chairman. |

◦ | The CEO shall apply discretionary management judgment, as appropriate, in administering all other aspects of the Plan, based on specific business situations or individual considerations. The CEO may delegate the daily administration of the Plan to other managers and associates, including payments of the amounts to be issued to participants under the Plan. |

• | Plan participants must be employed by the Company on the date of payment in order to qualify for payout (normally June) |

◦ | Exceptions due to retirement, disability, or death will be at the sole discretion of the CEO, in consultation with the Chairman. |

• | Promotions / Transfers |

◦ | Where a transfer from one organizational unit to another organizational unit occurs during the Plan year, the individual will receive a pro-rated award based on time and base salary / target MICP % in the multiple assignments |

◦ | When a promotion occurs and the associate remains in the same organizational unit, the base salary and target MICP % in effect @ year-end (3/31) will be used for the entire year |

• | Partial Year participants will normally be eligible for a payment on a pro rata amount calculated at a rate of 1/12 of the annual amount for each complete calendar month |

• | Each Plan Participant will receive individual written notification of the following plan details at the beginning of each fiscal year: |

◦ | Financial Factor “Mix” |

◦ | Applicable EBITDA and Free Cash Flow Targets |

◦ | % Weighting of EBITDA & Free Cash Flow in calculating Financial Factor |

◦ | Applicable plan “Cliff” |

◦ | Guidelines for Establishing Participant's Annual Personal Objectives |

Addendum A

(Performance Ranges by Cliff %)

• | For 90% Cliff |

Performance of EBITDA & Free Cash Flow / Modified Cash Target Achievement | 90% of Target | 100% of Target | 105% of Target | 110% of Target | 115% of Target | 120% of Target | 125% of Target | 130% or > of Target | |||||||

Financial Factor | 50 | % | 100 | % | 112.5 | % | 125 | % | 150 | % | 175 | % | 200 | % | 225% and >* |

*For each additional 5% increase in the percent of Target Bonus Plan Achievement above 115%, the financial factor will increase 25%.

• | For 80% Cliff |

Performance of EBITDA & Free Cash Flow / Modified Cash Target Achievement | 80% of Target | 90% of Target | 100% of Target | 105% of Target | 110% of Target | 115% of Target | 120% of Target | 125% of Target | 130% or > of Target | ||||||||

Financial Factor | 40 | % | 50 | % | 100 | % | 107.5 | % | 115.5 | % | 130.5 | % | 145.5 | % | 160.5 | % | 175.5% and >* |

*For each additional 5% increase in the percent of Target Bonus Plan Achievement above 115%, the financial factor will increase 15%.

NOTE: Regardless of Cliff %, any business segment with financial targets that are either negative or under a million dollars will be treated outside the payout matrix above. The payout methodology will be developed and agreed upon between the Management Team and Finance and will be approved by the CEO, in consultation with the Chairman.