Attached files

| file | filename |

|---|---|

| EX-12 - EXHIBIT 21 - HuntMountain Resources | ex21.htm |

| EX-10.1 - EXHIBIT 10.1 - HuntMountain Resources | ex10-1.htm |

| EX-31.1 - EXHIBIT 31.1 - HuntMountain Resources | ex31-1.htm |

| EX-31.2 - EXHIBIT 31.2 - HuntMountain Resources | ex31-2.htm |

| EX-32.1 - EXHIBIT 32.1 - HuntMountain Resources | ex32-1.htm |

| EX-32.2 - EXHIBIT 32.2 - HuntMountain Resources | ex32-2.htm |

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

FORM 10-K

|

x

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

For the fiscal year ended December 31, 2009

|

Commission file number 001-01428

HUNTMOUNTAIN RESOURCES LTD.

(Exact name of registrant as specified in its charter)

Washington

(State or other jurisdiction of incorporation or organization)

1611 N. Molter Road

Suite 201

Liberty Lake, Washington 99019

(Address of principal executive offices, including zip code.)

(509) 892-5287

(Registrant’s telephone number, including area code)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. o Yes No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act: o Yes No x

Indicate by check mark whether the registrant(1) has filed all reports required by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 day.

o Yes x No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulations S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 if the Exchange Act.

|

Large Accelerated filer

|

o

|

Accelerated filer

|

o

|

|

|

Non-accelerated filer

|

o

|

Smaller reporting company

|

x

|

|

|

(Do not check if a smaller reporting company)

|

||||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). o Yes x No

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was sold, or the average bid and asked price of such common equity, as of December 31, 2009: $997,063. As of November 4, 2010 there were 76,251,362 shares of this registrant’s common stock outstanding.

PART I

|

ITEM 1.

|

DESCRIPTION OF BUSINESS

|

References made in this Annual Report on Form 10-K to “we,” “our”, “us”, “the Company”, or “HuntMountain” refer to HuntMountain Resources Ltd. and our subsidiaries.

References made to “C$” are to Canadian dollars. References to “$” are to United States dollars. Certain financial information relating to the Company originated in C$ and were converted into $ based on prevailing and average exchange rates for the fiscal period ended December 31, 2009. The rate of exchange at December 31, 2009 for C$ to $ was .9532 and the average rate of exchange for the twelve month period ending December 31, 2009 was .8803.

The accompanying consolidated financial statements include the accounts of HuntMountain, a Washington corporation, its wholly-owned Canadian subsidiary HuntMountain Resources LTD (“HMR LTD”), HuntMountain’s wholly owned Mexican subsidiary, Cerro Cazador Mexico S.E. (“CCM”), HuntMountain’s wholly-owned subsidiary HuntMountain Investments, LLC (“HMI”), its majority owned subsidiary, Hunt Mining Corp. formerly known as Sinomar Capital Corp. (“Hunt Mining”), Hunt Mining’s wholly owned Canadian Subsidiary Hunt Gold USA, LLC (Hunt Gold), Hunt Mining’s wholly owned Canadian Subsidiary 1494716 Alberta, Ltd. (Alberta) and Cerro Cazador S.A. (“CCSA”), Hunt Mining’s Argentine subsidiary 95% owned by Hunt Mining and 5% owned by Alberta,

Proposed Dissolution of the Company

On February 18, 2010, the Company’s board of directors recommended and authorized a shareholder meeting to consider and vote upon a proposal to approve the voluntary dissolution and liquidation of the Company pursuant to a plan of complete dissolution and liquidation dissolution. On July 16, 2010, the Company filed with the Securities and Exchange Commission (“SEC”), a preliminary schedule 14A proxy statement to submit the vote to the Company’s shareholders. As of the date of the filing of this form 10-K, the preliminary 14A proxy statement has not yet been approved by the SEC and the vote has yet to go before the shareholders. The dissolution of the Company, if approved by the shareholders, will not affect the operations of Hunt Mining which will continue in existence along with its subsidiary companies.

(a) Business Development

Currently all exploration activities are being pursued by our majority owned subsidiary, Hunt Mining through its wholly owned subsidiary, CCSA which on December 23, 2009 the company exchanged 100% of its shares of CCSA, which were acquired by Hunt Mining as part of a reverse takeover transaction. Hunt Mining is a mineral exploration company incorporated on January 10, 2006 under the laws of Alberta, Canada which trades on the TSX Venture Exchange under the ticker symbol HMX. Prior to December 23, 2009 Hunt Mining was a Capital Pool Company within the meaning ascribed by Policy 2.4 of the TSX Venture Exchange. Hunt Mining issued 29,118,507 common shares and 20,881,493 non-voting convertible preferred shares to the Company at a deemed price of C$0.30 per Common Share and C$0.30 per convertible preferred share in consideration for the acquisition of all of the common shares of CCSA. Each convertible preferred share shall be convertible into one Common Share of Hunt Mining for no additional consideration at any time as long as the public float is not less than 20%. This transaction gave the Company controlling interest in Hunt Mining, 65% owned by the Company and 4% owned by the Company’s wholly-owned subsidiary HMI.

On February 18, 2010, the board of directors, believing it to be in the best interest of the Company to eliminate some of the debt owed to the Hunt Family Limited Partnership (“HFLP”), a related party controlled by the Company’s President, Chief Executive Officer and Chairman, Tim Hunt, decided to sell its stock in Black Hawk Exploration and its interest in the Dun Glen property and all of its Mexican assets in consideration of cancelling $600,000 of the debt owed to HFLP. See “Note 16, Subsequent Events” to our consolidated financial statements for further details.

Our predecessor, Metaline Mining and Leasing Company (“MMLC”) was incorporated in the State of Washington in 1927. Historically, MMLC was engaged in the mineral exploration business. The Company was dormant for a number of years during which time management did not think that the business climate for successfully financing mineral exploration was a viable option. In 2005, given the increase in precious metals prices and a more favorable environment for financing mineral exploration MMLC embarked on a business plan to again become active in mineral exploration. In March 2005 MMLC completed two private placements with net proceeds of approximately $650,000. In August, 2005, the shareholders of MMLC voted to merge MMLC with and into a wholly-owned subsidiary, HuntMountain. As a result, HuntMountain was the surviving entity. The stock symbol was changed to ‘HNTM’ and due to the fact that we were delisted from the OTC Bulletin Board as a result of our failure to timely file this form 10-K for the period ended December 31, 2009, the Company’s stock currently trades on the Pink Sheets.

2

In March 2006, we acquired interests in exploration properties in Pershing County, Nevada, Santa Cruz province of Argentina, and Québec Canada. In March, 2007 the Company, through its Argentine subsidiary, CCSA, was awarded the exploration and development rights to the La Josefina Project from Fomento Minero de Santa Cruz Sociedad del Estado (“Fomicruz”). The legal agreement granting our rights to the La Josefina property was finalized in July, 2007.

In August, 2007 the Company incorporated a Mexican Subsidiary, CCM and began looking at properties for acquisition in the State of Chihuahua. In January, 2008 the Company signed a purchase agreement for 100% ownership of an exploration concession totaling approximately 9,000 hectares in Chihuahua, Mexico. On November 12, 2008 the Company announced the acquisition of an additional 100 hectares in Chihuahua, Mexico. On February 18, 2010 the Company transferred all of its Mexican assets to the Hunt Family Limited Partnership (“HFLP”), a related party, along with all its stock in Black Hawk and its interest in the Dun Glen property in consideration of cancelling $600,000 of the debt that the Company owed to HFLP on an outstanding note payable. See “Note 16, subsequent events” to our consolidated financial statements for further information.

(b) Business of Issuer

We, through our majority owned subsidiary Hunt Mining, are engaged in the business of acquiring, exploring and developing mineral properties, primarily those containing gold, silver and associated base metals.

Competition

With the increased value of gold, the mining exploration industry has become very competitive in the identification and acquisition of properties that may have commercial potential. We compete for the opportunity to participate in exploration projects with other entities, many of which have greater financial and human resources. In addition, we compete with others in efforts to obtain financing to explore and develop mineral properties.

Employees

At the end of 2009, we had 4 employees located in Liberty Lake, Washington, responsible for the management and oversight of our exploration, administration, financing, and marketing activities. Our employees are not subject to a union labor contract or a collective bargaining agreement. On February 2, 2010, all of our employees resigned. For the foreseeable future we intend to supplement our workforce by utilizing the services of consultants and contractors.

Regulation

The Company’s planned mineral exploration activities in all operating areas are subject to various federal, state, and local laws and regulations governing prospecting, development, production, labor standards, occupational health and mine safety, control of toxic substances, and other matters involving environmental protection and taxation. It is possible that future changes in these laws or regulations could have a significant impact on the Company’s business, causing those activities to be economically reevaluated at that time.

Available Information

We are subject to the reporting requirements of the Securities Exchange Act of 1934, as amended (the Exchange Act), and therefore file periodic reports and other information with the Securities and Exchange Commission (SEC). These reports may be obtained by visiting the Public Reference Room of the SEC at 100 F Street, NE, Washington, D.C. 20549, or by calling the SEC at 1-800-SEC-0330. In addition, the SEC maintains an Internet web site at www.sec.gov that contains reports, proxy information statements and other information regarding issuers that file electronically.

We are a Washington corporation with our principal executive offices located at 1611 N. Molter Road, Suite 201, Liberty Lake, Washington 99019. Our telephone number is (509) 892-5287. Our filings under the Exchange Act (including annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and all amendments to these reports) are also available at our principal executive offices free of charge. Our Code of Business Conduct and Ethics for Directors, Officers and Employees is also available at the executive offices free of charge. We will provide copies of these materials to shareholders upon request using the above-listed contact information, directed to the attention of Mr. Tim Hunt.

We have included the Principal Executive Officer and Principal Financial Officer certifications regarding our public disclosure required by Section 302 of the Sarbanes-Oxley Act of 2002 as Exhibits 31.1 and 31.2 to this report.

Item 1A. Risk Factors

As a smaller reporting company, we have elected not to provide the disclosure required by this item.

Item 1B. Unresolved Staff Comments – None.

3

|

ITEM 2.

|

DESCRIPTION OF PROPERTY

|

Santa Cruz Province, Argentina

The properties held in the Santa Cruz Province, Argentina, are operated through our majority owned subsidiary Hunt Mining through their wholly owned subsidiary, CCSA. The proposed dissolution of the Company will not affect the operations of Hunt Mining which will continue in existence along with its subsidiary companies.

La Josefina Property

Overview

In March, 2007, CCSA, a wholly owned Argentine subsidiary of Hunt Mining, was awarded the exploration and development rights to the La Josefina Project from Fomicruz. Fomicruz is owned by the government of the Santa Cruz province in Argentina. The legal agreement granting our rights to the La Josefina property was finalized in July, 2007. Pursuant to this agreement, CCSA is obligated to spend $6 million in exploration and complete pre-feasibility and feasibility studies during a 4 exploration season period commencing in October, 2007 at La Josefina in order to earn mining and production rights for a 40-year period in a joint venture partnership (“JV”) with Fomicruz. CCSA may terminate this agreement at the end of each exploration stage if results are negative. With the successful completion of positive pre-feasibility and feasibility studies at the end of the 4th year, a new company will be formed which will be 91%-owned by CCSA and 9%-owned by Fomicruz. Once commercial production starts, Fomicruz has a one-time election to increase its interest in the Company to either 19%, 29% or 49% by reimbursing CCSA 10%, 20% or 40%, respectively, of CCSA’s total investment in the project. The royalty prescribed by Federal (Argentina) mining code will be a 1% mine-mouth royalty if the operation produces doré bullion within the province, which is required in the agreement. Also, because La Josefina is a Provincial Mining Reserve with the mineral rights belonging to the province, the project will carry an additional 5% mine-mouth royalty.

In February 2008 CCSA purchased the “La Josefina Estancia”, a 92 square kilometer parcel of land within the La Josefina project area. CCSA plans to use the La Josefina Estancia as a base of operations for Santa Cruz exploration. The purchase price for the La Josefina Estancia was $710,000.

4

Location

The La Josefina property is located in north central Santa Cruz Province, about 160 kilometers NW of the coastal town of Puerto San Julian and 120 kilometers NE of the town of Gobernador Gregores.

Infrastructure present on the project includes a ranch house and several out-buildings that are currently being used as camp headquarters and core storage facilities.

Climate and Physiography

The Patagonia region is classified as a continental steppe-like climate. It is arid, very windy and has two distinct seasons; a cold season and a warm season. The area is sparsely vegetated, consisting mostly of scattered low bushes and grass. Because Patagonia is in the southern hemisphere, the seasons are opposite to North America. The cold winter months are from May to September and warmer summer is from November to March. The average annual precipitation averages only 200 mm, much of which occurs as winter snow; average monthly temperatures range from 3°C to 14°C, but vary widely depending on elevation. The winds are persistent, cool, dry and gusty, averaging about 36 km/hour and directed predominantly to the east-southeast off the Andean Cordillera. All of the Company’s Santa Cruz province projects are characterized by subdued hilly terrain with internal drainages and playa lakes. Elevations range from 300 meters to 800 meters above sea level. Hill slopes are not steep; they are usually less than 10°. Rock exposures on these hillsides are typically excellent. Almost all of the mineralization and significant geochemical and geophysical anomalies are on the crests or the flanks of these subdued hills.

Mining claim detail

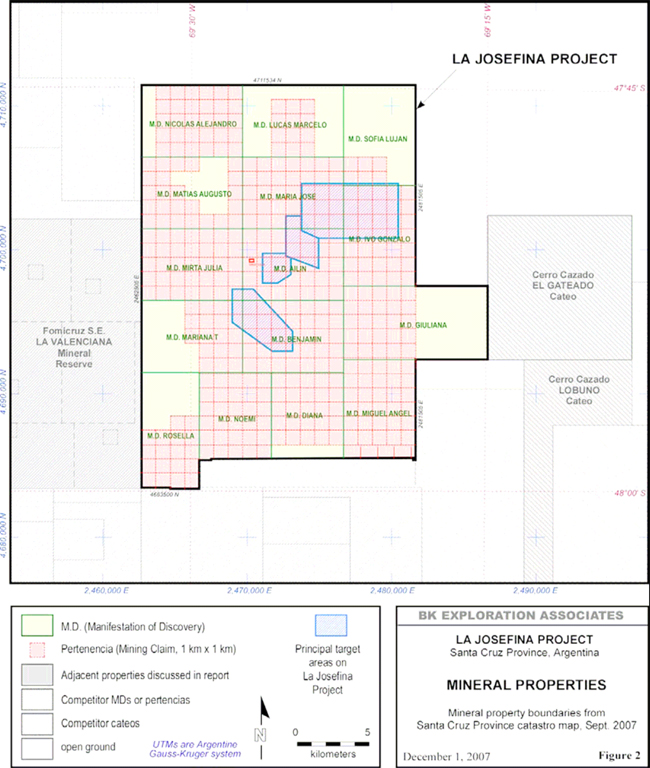

The La Josefina Project includes 15 Manifestations of Discovery (Manifestacións de Descubrimiento, or simply “MDs”) totaling 52,776 hectares which are partially covered by 399 mining claims (minas or pertenencias), as shown in Figure 2 and listed in the following table:

| Mineral Properties of the La Josefina Project | ||||||||||||

|

M.D.

|

Expediente

|

Hectares

|

No. of Perts

|

|||||||||

|

Nicolás Alejandro

|

409.072/F/98 | 3500 | 30 | |||||||||

|

Lucas Marcelo

|

409.071/F/98

|

3500 | 12 | |||||||||

|

Sofia Luján

|

409.070/F/98

|

3500 | 6 | |||||||||

|

Matiao Augusto

|

409.069/F/98

|

3500 | 24 | |||||||||

|

Maria José

|

409.068/F/68

|

3500 | 35 | |||||||||

|

Ivo Gonzalo

|

409.067/F/98

|

3500 | 35 | |||||||||

|

Mirta Julia

|

409.066/F/98

|

3500 | 35 | |||||||||

|

Ailin

|

409.065/F/98

|

3500 | 35 | |||||||||

|

Mariana T.

|

409.064/F/98

|

3500 | 18 | |||||||||

|

Benjamin

|

409.063/F/98

|

3500 | 35 | |||||||||

|

Giuliana

|

409.062/F/98

|

5100 | 25 | |||||||||

|

Rosella

|

409.061F/98 | 3227 | 18 | |||||||||

|

Noemi

|

409.060/F/98

|

3013 | 30 | |||||||||

|

Diana

|

409.059/F/98

|

2995 | 25 | |||||||||

|

Miguel Ángel

|

409.058/F/98

|

3435 | 35 | |||||||||

|

Julia

|

409.048/F/98

|

6 | 1 | |||||||||

| 52,776 | 399 | |||||||||||

5

Required property payments

CCSA must maintain the La Josefina mining rights by paying the annual canons due the province on the project’s 399 pertenencias. This currently amounts to 318,400 Argentine pesos per year (approximately $93,647) that can be deducted from the $6,000,000 work commitment.

Accessibility

The La Josefina Project is located in the north-central part of Santa Cruz Province, the southernmost of the several Argentine provinces comprising a vast, sparsely-populated, steppe-like region of southern South America known as Patagonia. The nearest town to the project is Gobernador Gregores (population 2,500), about 110 kilometers southwest, and the nearest Atlantic coastal town is Puerto San Julián (population 6,200), approximately 190 kilometers southeast. The project is accessible via automobile by driving east from Gobernador Gregores for 40 km on gravel Provincial Road 25 – or west from Puerto San Julián for 170 km on the same road – and then north on gravel Provincial Road 12 for 110 km. Provincial Road 12 crosses the edge of the project and continues another 240 kilometers north of Pico Truncado (population 15,000) in the northeastern part of the province. The provincial roads are generally accessible via two-wheel drive vehicles in dry weather but can become slippery to impassable for short periods when wet. Gobernador Gregores and Puerto San Julián are both served by weekly “commuter” flights to/from Comodoro Rivadavia (population 137,000), an important industrial center and port city, 428 kilometers north of Puerto San Julián via paved highway Ruta 3. Comodoro Rivadavia serves as the region’s major supply center for the booming petroleum and mining industries and is served by several airline flights daily to Buenos Aires and other major cities in Argentina. Ruta 3, Argentina’s major coastal highway, runs from Buenos Aires on the north to Ushuaia at the southernmost tip of the continent and offers all-weather access to a number of sea ports.

6

Geologic Setting

The La Josefina Project is located near the center of a large non-deformed stable platform known as the Deseado Massif, which covers an area of approximately 100,000 square kilometers in the northern third of Santa Cruz Province. The Deseado Massif is similar to the Somun Cura Massif encompassing parts of the adjacent provinces to the north. The two massifs are major metallotectonic features of the Patagonia region and represent the products of massive continental volcanism formed in the wake of extensional rifting caused by the breakup of the South American and African continents in Jurassic time.

The Deseado Massif is dominated by felsic volcanic and volcaniclastic rock units belonging to a few major regional sequences deposited in middle- to late-Jurassic time. The rocks are broken into a series of regional fractures that probably represent reactivated basement fracture zones. Faults active during the period of intense Jurassic extension and volcanism trend mostly NNW-SSE and form a series of grabens, half-grabens and horst blocks which are tilted slightly to the east. Since Jurassic time, the rocks have been cut by normal faults of several different orientations, mainly NW-SE and ENE-WSW but have undergone only a moderate amount of compression. In general, the Jurassic rocks remain relatively undeformed and generally flat to gently dipping, except locally where close to faults, volcanic domes or similar features.

The geology of the La Josefina Project Area was mapped in detail by Moreira (2005). The project geology is essentially a scaled version of the Deseado Massif geology described above. Specifically:

|

●

|

The project area is dominated by Jurassic-age rhyolitic volcanic units belonging to the Chon Aike Formation

|

|

●

|

There is one inlier of metamorphic basement rocks belonging to the Paleozoic age La Modesta Formation;

|

|

●

|

There are several small inliers of andesitic volcanics belonging to the Bajo Pobre Formation which is slightly older than the Chon Aike;

|

|

●

|

About half of the area is covered by thin Quaternary basalt flows; and

|

|

●

|

The project is crossed by a number of conjugate NNW-SSE and NE-SW sets of strong fault lineaments which are similar to those occurring throughout the Deseado Massif region.

|

Missing or unrecognized are the Jurassic-age sedimentary and volcaniclastic units of the Roca Blanca and La Matilde formations that are present at many other places in the region. Rhyolitic ignimbrites, lavas and tuffs of the Chon Aike Formation are intermittently exposed over about half of the La Josefina Project area with the remainder of the area largely concealed beneath the veneer of Quaternary basalts. Moreira (2005) subdivided the Chon Aike of the project area into nine members, each representing a separate volcanic event with generally similar sequences consisting of basal surge breccia followed by pyroclastic flows (ignimbrites), ash-fall tuffs and finally by re-worked volcaniclastic detritus. According to Moreira, the volcanism responsible for these nine episodic eruptions reached its climax over a relatively short 4-million year period in upper Jurassic time and is responsible for epithermal events that emplaced the gold-silver mineralization found in the La Josefina Project Area.

Nearly all of the hundreds of gold-silver and base metals occurrences in the Deseado Massif region of southern Argentina are categorized as “low-sulfidation type epithermal vein deposits.” “Epithermal” deposits are high-level hydrothermal systems which usually form within one kilometer of the surface at relatively low temperatures, generally in the range of 50°C to 200°C. They often represent deeper parts of fossil geothermal systems with some forming hot-springs at or near the surface. The modifier “low-sulfidation” denotes a variety of epithermal deposits characteristically deficient in sulfide minerals and often called “quartz-adularia” vein systems after the two most common gangue (non-valuable) minerals in the veins. Well-known examples of low-sulfidation type epithermal deposits include Comstock (Nevada, USA), McLaughlin (California, USA), Creede (Colorado, USA), Ladolam (Lihir, Papua New Guinea), El Peñon (Chile), Guanajuato (Mexico), Hishikari (Japan) and – in the Deseado Massif region of Argentina – Mina Martha and Cerro Vanguardia.

7

The many low-sulfidation epithermal occurrences of the Deseado Massif are products of episodic rhyolitic volcanism spread widely over a 50-million year time period and a 100,000 square kilometer area. Despite differences in space and time, they are all remarkably similar in style and origin and they closely fit the classic low-sulfidation epithermal vein model. The region’s premier deposit example and flagship operation is the Cerro Vanguardia mine, operated jointly by AngloGold Ashanti and Fomicruz, which opened in 1998. The Cerro Vanguardia mine has produced continuously at the approximate rate of 250,000 ounces gold and 2.5 million ounces silver per year at average cash costs of $133 to $232 per ounce of gold (AngloGold Annual Reports, 2001-2006). The deposits are fissure vein systems localized by structures, often a meter or more wide and hundreds of meters to several kilometers long. They are comprised of quartz veins, stockworks and breccias that carry gold, silver, electrum and some sulfides, mainly pyrite, with variable, but usually small, amounts of base metal sulfides. The richest mineralization commonly occurs in dilational zones caused by structural irregularities along or down the vein. The thickening and thinning along and down the structure, often referred to as “pinch-and-swell,” is responsible for rod-like high-grade ore shoots that are hallmarks of these systems.

History

In 1975 the first occurrence of metals known in the La Josefina area was publicly mentioned by the Patagonia delegation of the National Ministry of Mining who reported the presence of an old lead-zinc mine in veins very near Estancia La Josefina (Viera and Marquez, 1975). This received no further attention until 1994 when a research project by the Institute of Mineral Resources of the UNLP and the geology department of the University of Patagonia San Juan Bosco examined the occurrence. The investigation corroborated not only the presence of base metals but also found significant amounts of previously unknown precious metals (1 to 3 g/t Au and 5 to 21 g/t Ag).

In 1994, immediately after the La Josefina gold-silver discovery, Fomicruz claimed the area as a Provincial Mineral Reserve and subsequently explored the project in collaboration with the Instituto de Recursos Minerales (INREMI) of La Plata University. The geology and alteration of the project area was mapped at a scale of 1:20,000, mineralized structures and zones of sinter were mapped at 1:2,500, trenches across the structures were continuously sampled and mapped at scales of 1:100 and ground geophysical surveys consisting of 6,000 metres of inverse polarization resistivity and 5,750 meters of magnetic surveys were completed over sectors of greatest interest (INREMI, 1996). In 1998, after four years of exploring and advancing interest in the project, Fomicruz offered La Josefina for public bidding by international mining companies. In accordance with provincial law, the winner would continue exploring the project to earn the right to share production with Fomicruz of any commercial discoveries. The bid was awarded to Minamérica S. A., a small private Argentine mining company. Minamérica S.A. dug a limited number of new trenches, initiated a program of systematic surface geochemical sampling, completed several new IP-Resistivity geophysical survey lines and drilled the first exploration holes on the project – 12 diamond core holes (HQ-size, 63.5mm diameter) totaling 800 meters in length. Minamerica S.A. ceased exploration activity and the property reverted back to Fomicruz in 1999.

In 2000, Fomicruz resumed exploration of the project and continued their efforts until 2006. Pits were dug to bedrock on 100-meter grids over some of the target areas, 3,900 meters of new trenches were dug and sampled, more than 8,000 float, soil and outcrop samples were collected for geochemical analyses, some new IP-Resistivity surveys were completed and 59 diamond core holes (total 3,680 meters) were drilled to average shallow depth below surface of 55 meters. Of these holes, 37 were NQ-size core (47.6mm diameter) and 22 were HQ-size core (63.5mm). Fomicruz reports spending more than $2.8 million in exploring and improving infrastructure on the La Josefina Project from 1994 to 2006.

Exploration

The 4-year exploration period contained in the La Josefina/Fomicruz agreement was originally planned to proceed in the following three stages:

|

Year 1

|

Year 2

|

Years 3 & 4

|

||||||||||||||

|

Target Area

|

To July 2008

|

July 2008 to July 2009

|

July 2009 to July 2011

|

Totals

|

||||||||||||

|

Noreste Area

|

$

|

300,000

|

$

|

400,000

|

$

|

500,000

|

$

|

1,200,000

|

||||||||

|

Veta Norte

|

500,000

|

800,000

|

800,000

|

2,100,000

|

||||||||||||

|

Central Area

|

500,000

|

800,000

|

900,000

|

2,200,000

|

||||||||||||

|

Piedra Labrada

|

200,000

|

100,000

|

200,000

|

500,000

|

||||||||||||

|

Grand Total

|

$

|

1,500,000

|

$

|

2,100,000

|

$

|

2,400,000

|

$

|

6,000,000

|

||||||||

Between November of 2007 and December of 2008 CCSA completed a 37,605 meter drilling program on the La Josefina property. In 2009 CCSA incurred $521,782 in exploration expenses on the La Josefina property. In 2008 CCSA incurred $4,551,394 in exploration expenses on the La Josefina property. To date, we have exceeded the $6,000,000 work commitment.

8

Legal Framework for Exploration in Argentina

In Argentina, minerals are owned by the provinces, even when they are generally regulated by the national Mining Code. The Mining Code establishes that private property of mines is determined by legal concession.

The provinces can impose a maximum 3% mine-mouth royalty on mineral production. In the case of Santa Cruz Province, if most of the mining processes are performed in the state with doré bar as the final product the mine-mouth royalty can drop to 1%.

In addition, in 1993 the Argentine Congress approved “The Mining Investment Law” which covers all mining stages: prospecting, exploration, extraction, milling, leaching and smelting, when this industrialization is performed by the same economic unit in the region of origin of the mineral. Mining companies need to file paper work with the National Mining Office in order to get an official certificate which gives several advantages. These advantages include 30 years of tax stability on new mines development, capital investment depreciation rights, advantages on provincial and municipal taxes, deduction of 100% on income taxes for the cost of investment done during prospecting and exploration studies, a special regime for amortizing investment in infrastructure machinery and equipment, exemption from income tax of profits resulting from mines and mineral rights; and certain import and export benefits alleviating taxes. By virtue of the mining code, new mine developments can claim a five-year federal tax holiday on production income in Argentina.

Exploration stages:

a) Cateos: The first step in acquiring mining rights is filing a cateo, which gives exclusive prospecting rights for the requested area for a period of time, according with the size of the obtained surface. The maximum size of each cateo is 10,000 hectares, which gives one thousand days to explore the area. A maximum of 20 cateos can be held by a single entity (individual or company) in any one province.

b) Manifestation of Discoveries: The holder of a cateo has exclusive right to establish a Manifestation of Discovery (MD) on that cateo, but MDs can also be set without a cateo on any land not covered by another entity’s cateo. MDs are filed as either a vein or a disseminated discovery. A square protection zone can be declared around the discovery – up to 840 hectares for a vein MD or up to 7,000 hectares for a disseminated MD. The protection zone grants the discoverer exclusive rights for an indefinite period, during which the discoverer must provide an annual report presenting a program of exploration work and investments related to the protection zone.

c) Minas (Mining claims): An MD can later be upgraded to a Mina (mine claim), which gives the holder the right to begin commercial extraction of minerals.

A period not less than sixty (60) days must elapse between the publication of the expiration of the time for exclusive exploration rights belonging to a person and the request of a Cateo by another person (Article 28, amended by Law 22259). During this period of 60 days (as amended by Law 24468), it is allowed that the owner of the Cateo makes its Manifestation of Discoveries. An additional period to make the required “formal work” up to 150 days is obtained and the exploration area is reduced to 70 zones or mining claims of 6 hectares each for vein type deposits or 35 zones of mining claims of 100 hectares each for disseminated type deposits.

The Mines Notary is the officer attesting in the discovery statement to the delivery date and hour, certifying after the Mining Authorities find out whether there is or not another petition in the zone. The certification is made after the Graphic Department verifies on a map the location of the announced discovery.

When the permission has been granted, the claims are to be defined. Once the discovery has been verified and the mine deposit confirmed, the petitioner will request the formal concession for the mine.

The explorer must compensate the surface owner for any damage incurred during the exploration activities.

Mining Property:

The mine concession is unlimited in time, and only ends when the exploration ceases. It can be transferred by any of the means used for transfers of common property, and as in common real state, mining properties are subject to mortgages.

The payment of an annual Lease or Mining Right of 80 Argentinean pesos for each claim in vein deposit and 800 Argentinean pesos for each disseminated deposit, is required. The lease must be paid in advance and in two equal semi-annual installments (June 30 and December 31).

9

The miner shall have to invest in the mine equipment, camps, building, roads, power plants, within the term of 5 years for a minimum amount of 500 times the annual Lease.

Provinces that decide to collect royalties may not receive a percentage exceeding three per cent over the “mine’s exit value” of the extracted ore.

Bajo Pobré Property

Overview

In January, 2006 CCSA signed a Letter of Intent with FK Minera S.A. to acquire a 100% interest in the Bajo Pobré gold property located in Santa Cruz Province, Argentina. In March, 2007 CCSA signed a final contract to acquire the Bajo Pobré property. Pursuant to this agreement, CCSA can earn up to a 100% equity interest in the Bajo Pobré property by making cash payments and exploration expenditures over a five-year earn-in period. The required expenditures and ownership levels upon meeting those requirements are:

|

Year of the Agreement

|

Payment to FK Minera S.A.

|

Exploration Expenditures

|

Ownership

|

|||||||||

|

First Year -2007

|

$ | 50,000 | $ | 250,000 | 0 | % | ||||||

|

Second Year-2008

|

$ | 50,000 | $ | 250,000 | 0 | % | ||||||

|

Third Year -2009

|

$ | 75,000 | $ | 0 | 51 | % | ||||||

|

Fourth Year -2010

|

$ | 75,000 | $ | 0 | 60 | % | ||||||

|

Fifth Year -2011

|

$ | 75,000 | $ | 0 | 100 | % | ||||||

After the fifth year, CCSA shall pay FK Minera the greater of a 1% NSR royalty on commercial production or $100,000 per year. CCSA has the option to purchase the NSR Royalty for a lump sum payment of $1,000,000 less the sum of all royalty payments made to FK Minera to that point. CCSA has the right to conduct exploration on these properties for a period of at least 1,000 days and retains 100% ownership of any mineral deposit found within. Should a mineral deposit be discovered, the Company has the exclusive option to file for mining rights of said deposit.

CCSA paid approximately half of its required payment to FK Minera S.A. in the second year of the agreement and all of its required payment to FK Minera S.A. in the first year of the agreement. As of December 31, 2009, CCSA has not engaged in any exploration activity on the Bajo Pobré property. CCSA has not fulfilled any of our exploration obligations relative to the Bajo Pobré property. Further, CCSA has not received any form of formal relief from the contract terms relating to the Bajo Pobré property. CCSA’s ability to retain rights to explore the Bajo Pobré property is uncertain at this time.

On November 5, 2009 the Company received notification from the Santa Cruz Province Mining Authority that FK Minera S.A. and Arturo Canero, its principal, have been inhibited in the disposal of its assets, including the Bajo Pobre property. They orally stated that such inhibition would be released since it would submit other assets in replacement; however, to date there is no evidence of such replacement of assets.

Filed with the Santa Cruz provincial mining authority, the Bajo Pobré property is comprised of one “Manifestation of Discovery” type mining claim designated “MD Joanna Belem 409162/S/94 and 32 covering “pertenencia” type mining claims. The property covers an area of approximately 120 square kilometers.

Location and Accessibility

The Bajo Pobré Property is located in north-central Santa Cruz province near 47 18’ 04” south latitude and 69 11’ 28” west longitude, 90 kilometers south of the town of Las Heras. It can be accessed by driving west from Las Heras on provincial route 43 for 53 kilometers then south on route 39 for 85 kilometers crossing estancias Laguna grande, El Mirasol, La Herradura and Cumbres Blancas. From there, turning south-east on the access road to Estancia Santa Cruz and traveling an additional 82 kilometers to the property boundary. The total distance of 220 kilometers can be traveled in the summer by two wheel drive vehicles and normally in the winter by four wheel drive vehicles.

Climate and Physiography

The Patagonia region is classified as a continental steppe-like climate. It is arid, very windy and has two distinct seasons; a cold season and a warm season. The area is sparsely vegetated, consisting mostly of scattered low bushes and grass. Because Patagonia is in the southern hemisphere, the seasons are opposite to North America. The cold winter months are from May to September and warmer summer is from November to March. The average annual precipitation averages only 200 mm, much of which occurs as winter snow; average monthly temperatures range from 3°C to 14°C, but vary widely depending on elevation. The winds are persistent, cool, dry and gusty, averaging about 36 km/hour and directed predominantly to the east-southeast off the Andean Cordillera. All of the Company’s Santa Cruz province projects are characterized by subdued hilly terrain with internal drainages and playa lakes. Elevations range from 300 meters to 800 meters above sea level. Hill slopes are not steep; usually less than 10° and the rock exposures on these hillsides are typically excellent. Almost all of the mineralization and significant geochemical and geophysical anomalies are on the crests or the flanks of these subdued hills.

10

History

The Bajo Pobré property was discovered in 1970 and has been worked intermittently by several government entities and private companies. Exploration began in the 1990’s with geologic mapping and surface sampling. Assays from this sampling yielded values from nil to 40 grams per ton gold. Drill targets identified from surface sampling were augmented in 2002 with additional targets derived from a geophysical survey. In 2003 and 2004, the property saw a limited amount of exploration drilling which tested a small portion of these targets.

Geology

The project is located within the Deseado Massif which is dominated by felsic volcanic and volcaniclastic rock units belonging to a few major regional sequences deposited in middle- to late-Jurassic time. The rocks are broken into a series of regional fractures that probably represent reactivated basement fracture zones. Faults active during the period of intense Jurassic extension and volcanism trend mostly NNWSSE and form a series of grabens, half-grabens and horst blocks which are tilted slightly to the east. Since Jurassic time, the rocks have been cut by normal faults of several different orientations, mainly NW-SE and ENE-WSW but have undergone only a moderate amount of compression. In general, the Jurassic rocks remain relatively undeformed and generally flat to gently dipping, except locally where close to faults, volcanic domes or similar features.

The geology of the project area is dominated by Jurassic-aged, volcanic rocks of the Bajo Pobré formation. Mineralization is characterized as epithermal in nature, comprised of numerous zones of quartz veining, vein breccias, and stock works with a cumulative strike length of more than 9 kilometers. Individual veins range from 0.5 meters to 6 meters in width.

Exploration Program

We have not engaged in any exploration activity on the Bajo Pobré property. We have not fulfilled any of our exploration obligations relative to the Bajo Pobré property and presently have no current plans to conduct exploration activities on the Bajo Pobré property.

El Gateado Property

Overview

In March, 2006 CCSA acquired the right to conduct exploration on El Gateado for a period of at least 1,000 days, commencing after the Argentine Government issues a formal claim notice, and retain 100% ownership of any mineral deposit found within. CCSA has not yet received a formal claim notice pertaining to the El Gateado property. Should a mineral deposit be discovered, we have the exclusive option to file for mining rights on the deposit. As of the date of this report, the Argentine Government has yet to issue a formal claim notice.

Location and Accessibility

El Gateado is a 10,000 hectare exploration concession filed with the Santa Cruz Provincial mining authority The El Gateado Project is located in the north-central part of Santa Cruz Province, the southernmost of the several Argentine provinces comprising a vast, sparsely-populated, steppe-like region of southern South America known as Patagonia (Figure 1). The nearest town to the project is Gobernador Gregores (population 2,500), about 110 kilometers southwest, and the nearest Atlantic coastal town is Puerto San Julián (population 6,200), 190 kilometers southeast. The project is accessible via automobile by driving east from Gobernador Gregores for 40 km on gravel Provincial Road 25 – or west from Puerto San Julián for 170 km on the same road – and then north on gravel Provincial Road 12 for 110 km. Provincial Road 12 crosses the edge of the project and continues another 240 kilometers north to the oil town of Pico Truncado (population 15,000) in the northeastern part of the province. The provincial roads are generally accessible via two-wheel drive vehicles in dry weather but can become slippery to impassable for short periods when wet. Gobernador Gregores and Puerto San Julián are both served by weekly “commuter” flights to/from Comodoro Rivadavia (population 137,000), an important industrial center and port city, 428 kilometers north of Puerto San Julián via paved highway Ruta 3. Comodoro Rivadavia serves as the region’s major supply center for the booming petroleum and mining industries and is served by several airline flights daily to Buenos Aires and other major cities in Argentina. Ruta 3, Argentina’s major coastal highway, runs from Buenos Aires on the north to Ushuaia at the southernmost tip of the continent and offers all-weather access to a number of sea ports.

11

Climate and Physiography

The Patagonia region is classified as a continental steppe-like climate. It is arid, very windy and has two distinct seasons; a cold season and a warm season. The area is sparsely vegetated, consisting mostly of scattered low bushes and grass. Because Patagonia is in the southern hemisphere, the seasons are opposite to North America. The cold winter months are from May to September and warmer summer is from November to March. The average annual precipitation averages only 200 mm, much of which occurs as winter snow; average monthly temperatures range from 3°C to 14°C, but vary widely depending on elevation. The winds are persistent, cool, dry and gusty, averaging about 36 km/hour and directed predominantly to the east-southeast off the Andean Cordillera. All of the Company’s Santa Cruz province projects are characterized with subdued hilly terrain with internal drainages and playa lakes. Elevations range from 300 meters to 800 meters above sea level. Hill slopes are not steep; usually less than 10° and the rock exposures on these hillsides are typically excellent. Almost all of the mineralization and significant geochemical and geophysical anomalies are on the crests or the flanks of these subdued hills.

History

No known exploration has taken place at El Gateado prior to the work completed by CCSA in 2006 and 2007 (See below). During that time CCSA conducted a program consisting of surface channel outcrop sampling, geological mapping, topographic surveying and 1,500 meters of diamond core drilling.

Geology

The project is located within the Deseado Massif which is dominated by felsic volcanic and volcaniclastic rock units belonging to a few major regional sequences deposited in middle- to late-Jurassic time. The rocks are broken into a series of regional fractures that probably represent reactivated basement fracture zones. Faults active during the period of intense Jurassic extension and volcanism trend mostly NNW-SSE and form a series of grabens, half-grabens and horst blocks which are tilted slightly to the east. Since Jurassic time, the rocks have been cut by normal faults of several different orientations, mainly NW-SE and ENE-WSW but have undergone only a moderate amount of compression. In general, the Jurassic rocks remain relatively undeformed and generally flat to gently dipping, except locally where close to faults, volcanic domes or similar features.

Mineralization on the property is localized within the volcanic and volcanoclastic Jurassic-aged Chon Aike Formation. The precious metal occurrences are generally characterized as epithermal systems manifested in quartz vein and stockwork exposures.

Exploration Program

We began field reconnaissance work in February 2006 with the completion of a topographic survey, base map generation, and a staked grid. In late 2006 and early 2007 we drilled 13 holes on the El Gateado property. Results of our drilling program, based on assay results over 1 g/t Au, were as follows:

|

Hole

|

From (m)

|

To (m)

|

Length (m)

|

Au (g/t)

|

||||||||||||

|

GAT-DDH06 001

|

146.6 | 147.4 | 0.80 | 11.7 | ||||||||||||

|

GAT-DDH06 001

|

140.2 | 140.8 | 0.60 | 8.24 | ||||||||||||

|

GAT-DDH06 001

|

142.5 | 143.2 | 0.70 | 6.5 | ||||||||||||

|

GAT-DDH06 001

|

144 | 145 | 1.00 | 4.78 | ||||||||||||

|

GAT-DDH06 001

|

141.4 | 142 | 0.60 | 3.92 | ||||||||||||

|

GAT-DDH06 001

|

145 | 145.8 | 0.80 | 3.82 | ||||||||||||

|

GAT-DDH06 001

|

139.7 | 140.2 | 0.50 | 3.76 | ||||||||||||

|

GAT-DDH06-006

|

21 | 22.5 | 1.50 | 3.64 | ||||||||||||

|

GAT-DDH06 001

|

139.2 | 139.7 | 0.50 | 3.03 | ||||||||||||

|

GAT-DDH06 001

|

143.2 | 144 | 0.80 | 2.92 | ||||||||||||

|

GAT-DDH07-007

|

33 | 33.5 | 0.50 | 2.61 | ||||||||||||

|

GAT-DDH06 001

|

140.8 | 141.4 | 0.60 | 2.52 | ||||||||||||

|

GAT-DDH06 001

|

137.7 | 138.7 | 1.00 | 2.39 | ||||||||||||

12

|

Hole

|

From (m)

|

To (m)

|

Length (m)

|

Au (g/t)

|

||||||||||||

|

GAT-DDH07-008

|

58.6 | 59.5 | 0.90 | 2.33 | ||||||||||||

|

GAT-DDH06 001

|

145.8 | 146.6 | 0.80 | 1.89 | ||||||||||||

|

GAT-DDH07-008

|

55.4 | 55.9 | 0.50 | 1.77 | ||||||||||||

|

GAT-DDH07-008

|

57.2 | 58 | 0.80 | 1.34 | ||||||||||||

|

GAT-DDH07-012

|

9 | 9.5 | 0.50 | 1.32 | ||||||||||||

|

GAT-DDH06-003

|

36.74 | 37.5 | 0.76 | 1.3 | ||||||||||||

|

GAT-DDH07-013

|

10 | 11 | 1.00 | 1.29 | ||||||||||||

|

GAT-DDH07-012

|

35 | 36 | 1.00 | 1.08 | ||||||||||||

|

GAT-DDH06-004

|

67 | 68 | 1.00 | 1.07 | ||||||||||||

|

GAT-DDH07-007

|

32.1 | 32.6 | 0.50 | 1.07 | ||||||||||||

|

GAT-DDH06-004

|

16 | 17 | 1.00 | 1.01 | ||||||||||||

CCSA incurred approximately $706,000 in exploration expenses on the initial El Gateado drilling program. CCSA did not conduct any exploration activity on the El Gateado property in 2008 or 2009 nor do they have any immediate plans to conduct exploration activity on the property.

Other Santa Cruz Properties

Overview

In 2006, CCSA was granted exclusive rights to explore three properties known as El Overo, El Alazan, and El Tordillo in Santa Cruz province of Argentina. We have the right to conduct exploration on these properties for a period of at least 1,000 days, commencing after the Argentine Government issues a formal claim notice, and retain 100% ownership of any mineral deposit found within. Should a mineral deposit be discovered, we have the exclusive option to file for mining rights on the deposit. As of the date of this report, the Argentine Government has yet to issue a formal claim notice.

Location and Accessibility

The “El Alazan”, “El Overo”, and “El Tordillo” properties form a contiguous land block located 220 kilometers NW of the port town of Puerto San Julian and 100 kilometers north of the town of Gobernador Gregores. This entire property package covers an area approximately 300 square kilometers in size. The projects are accessible via automobile by driving east from Gobernador Gregores for 40 km on gravel Provincial Road 25 – or west from Puerto San Julián for 170 km on the same road – and then north on gravel Provincial Road 12 for 50 km. Then turning northwest on provincial route 74 for 65 km The provincial roads are generally accessible via two-wheel drive vehicles in dry weather but can become slippery to impassable for short periods when wet. Gobernador Gregores and Puerto San Julián are both served by weekly “commuter” flights to/from Comodoro Rivadavia (population 137,000), an important industrial center and port city, 428 kilometers north of Puerto San Julián via paved highway Ruta 3. Comodoro Rivadavia serves as the region’s major supply center for the booming petroleum and mining industries and is served by several airline flights daily to Buenos Aires and other major cities in Argentina. Ruta 3, Argentina’s major coastal highway, runs from Buenos Aires on the north to Ushuaia at the southernmost tip of the continent and offers all-weather access to a number of sea ports.

Climate and Physiography

The Patagonia region is classified as a continental steppe-like climate. It is arid, very windy and has two distinct seasons; a cold season and a warm season. The area is sparsely vegetated, consisting mostly of scattered low bushes and grass. Because Patagonia is in the southern hemisphere, the seasons are opposite to North America. The cold winter months are from May to September and warmer summer is from November to March. The average annual precipitation averages only 200 mm, much of which occurs as winter snow; average monthly temperatures range from 3°C to 14°C, but vary widely depending on elevation. The winds are persistent, cool, dry and gusty, averaging about 36 km/hour and directed predominantly to the east-southeast off the Andean Cordillera. All of the Company’s Santa Cruz province projects are characterized by subdued hilly terrain with internal drainages and playa lakes. Elevations range from 300 meters to 800 meters above sea level. Hill slopes are not steep; usually less than 10° and the rock exposures on these hillsides are typically excellent. Almost all of the mineralization and significant geochemical and geophysical anomalies are on the crests or the flanks of these subdued hills.

13

History

To date, there has been no known historic precious metal exploration conducted on these three properties. However, they cover areas of strong hydrothermal alteration and structural complexity conducive to precious metal discovery that have been indicated by satellite images. They are also located adjacent to several known gold and silver occurrences.

Geology

The project is located within the Deseado Massif which is dominated by felsic volcanic and volcaniclastic rock units belonging to a few major regional sequences deposited in middle- to late-Jurassic time. The rocks are broken into a series of regional fractures that probably represent reactivated basement fracture zones. Faults active during the period of intense Jurassic extension and volcanism trend mostly NNW-SSE and form a series of grabens, half-grabens and horst blocks which are tilted slightly to the east. Since Jurassic time, the rocks have been cut by normal faults of several different orientations, mainly NW-SE and ENE-WSW but have undergone only a moderate amount of compression. In general, the Jurassic rocks remain relatively undeformed and generally flat to gently dipping, except locally where close to faults, volcanic domes or similar features.

Mineralization on the properties is localized within the volcanic and volcanoclastic Jurassic-aged Chon Aike Formation. These precious metal occurrences are generally characterized as low-sulfidation epithermal systems manifested in quartz vein and stockwork exposures.

Exploration Program

We have not conducted any exploration work on the El Overo, El Alazan, and El Tordillo properties. We plan to conduct exploration work on these properties pending the outcome of exploration work on our other Santa Cruz properties.

On March 24, 2010 the Company announced that CCSA filed for control of 17 new mineral concessions totaling 139,000 hectares in Santa Cruz province, Argentina. With this addition the Company became the second largest public company landholder in Santa Cruz province.

United States

Dun Glen Gold Project, Nevada USA

On February 18, 2010 the Company transferred its stock in Black Hawk and its interest in the Dun Glen property to the Hunt Family Limited Partnership (“HFLP”), a related party, along with all its Mexican assets in consideration of cancelling $600,000 of the debt that the Company owed to HFLP on an outstanding note payable. See “Note 16, subsequent events” to our consolidated financial statements for further information. Below is a brief narrative about the history of the property up until the point it was sold.

Overview

In early 2006 we entered into agreements to lease, with an option to purchase, the properties comprising the Dun Glen Project. The initial lease/option term of the agreements is 10 years, renewable for an additional 10 years. As of December 31, 2009, the Company has made lease payments totaling $137,500. Future lease payments are as follows:

|

|

●

|

4th Anniversary $60,000

|

|

|

●

|

5th (and each anniversary thereafter) $72,500

|

During the term of the agreement, we have the option to purchase 86% of the claims for $5,000 upon delivery of a copy of an approved mine plan of operations or a final feasibility study. The seller will retain a 3% net smelter return (“NSR”) royalty of which we may purchase up to 2 percentage points for $1,000,000 per percentage point. NSR is generally defined as the gross value of the metals less the costs of smelting, refining and transportation. We also have the option to purchase the remaining two claim blocks (or 14% of the claims) for $250,000 per block at any time during the term of the agreements. The sellers will retain a 3% NSR royalty on production from their respective claim blocks. We may purchase up to 2 percentage points for $875,000 per percentage point. We must maintain all of the claims referenced within the agreement in good standing during the lease period. We may terminate the lease at any time upon 60 days notice.

On December 10, 2009, the Company entered into a Property Interest Purchase Option Agreement (“Black Hawk Agreement”) with Black Hawk Exploration, Inc. (“Black Hawk”) to transfer 75% of the company’s economic interest in the Dun Glen Project. In return, the Company received a one-time payment of $50,000 at signing, and is due to receive further payments of $25,000 on or before each of December 10, 2010, and December 10, 2011. Black Hawk also issued to the company 250,000 restricted common shares of Black Hawk Exploration and will issue a further 100,000 restricted common shares on or before December 10, 2010.

14

The terms of the Black Hawk Agreement state that Black Hawk has the responsibility to maintain the property in good standing at their expense, including the timely filing or payment of all claims maintenance fees or taxes and all the underlying future lease payments owed by the Company as noted above.

Black Hawk has agreed to expend at least $700,000 before December 10, 2013 as a work commitment on the Property in order to earn a 75% interest in the property. The Company and Black Hawk also agreed that any revenue generated from tailings, dumps or stockpiles on the Property will be allocated 75% to Black Hawk and 25% to the Company.

The Black Hawk Agreement states that with a 90 day advance written notice from Black Hawk to the Company, Black Hawk can elect not to proceed with the acquisition of any property, or any further interest in the property without further obligation to the Company.

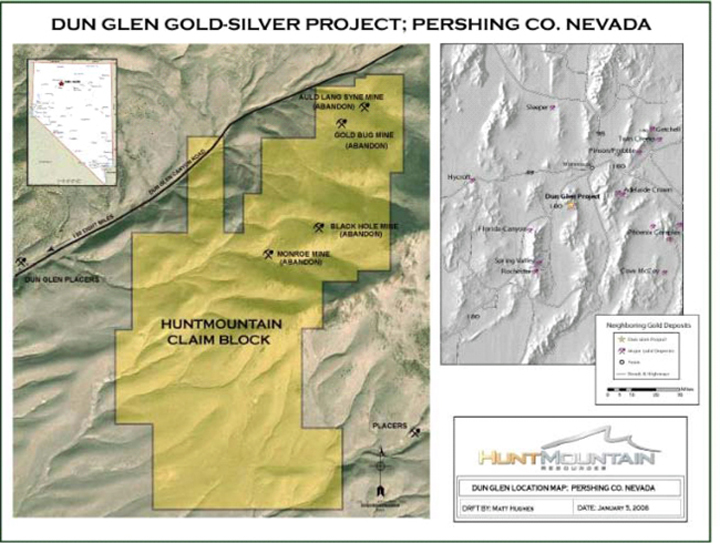

Location

The Dun Glen Gold Project is a precious metal exploration property located in the historic Sierra district in Dun Glen Canyon on the west flank of the East Range in northern Pershing County, Nevada. The project area consists of 94 contiguous unpatented lode mining claims covering approximately 1,700 acres within the Sierra Mining District. It lies approximately 25 miles southwest of Winnemucca and 21 miles north of the Florida Canyon Mine and is accessible via 2 wheel drive vehicle year round. The Dun Glen property can be accessed by driving 21 miles south of Winnemucca on U.S. Interstate 80, taking the Mill City exit and following a county-maintained 8-mile long dirt road.

15

Canada

Abitibi Properties, Quebec

Overview

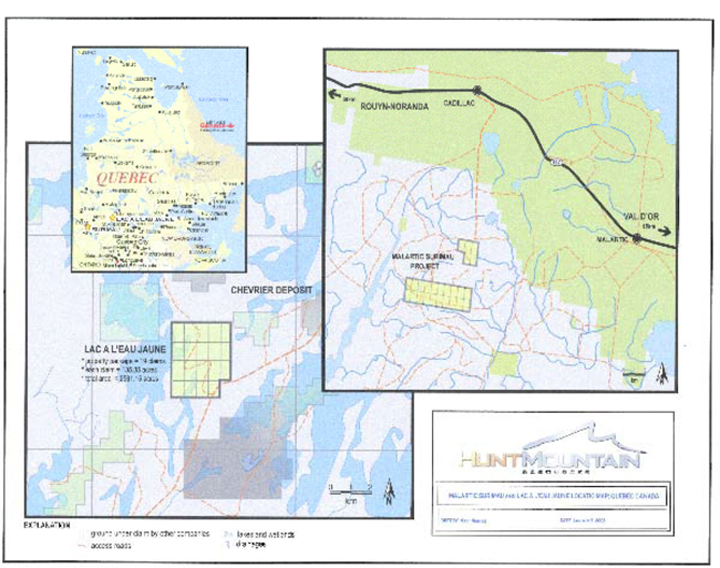

In June 2006, the Company entered into an agreement with Diagnos, Inc., (“Diagnos”) obtaining an exclusive option to acquire a 100 percent interest in two prospective gold properties known as the Lac à l’Eau Jaune and Malartic Surimau Projects located in the Abitibi region of Québec, Canada. The Company paid Diagnos $70,000 for the two Properties and will acquire a 100% interest by conducting an initial exploration program comprised of at least three drill holes on each property. Upon completion of the initial drilling programs, the Company will have the option to select up to an additional seven properties in which it may acquire a 100% interest by paying Diagnos a sum of $40,000 and completing an initial three-hole exploration drilling program for each property. The option will expire if the initial drill program is not drilled by March 31, 2010.

For each economic discovery made on any of the acquired Properties, the Company will pay Diagnos a bonus of $500,000. The Company will also grant Diagnos a 2% Net Smelter Royalty (“NSR”) for economic discoveries made on the initial or additional properties, but will retain the option to acquire 1% of the NSR upon payment of $1 million to Diagnos within five years of making the economic discovery. An economic discovery is defined in the agreement as being the production of a positive feasibility study for a given project in compliance with Canada’s National Instrument 43-101.

The Quebec properties consist of 46 provincial mining claims, each of which requires a renewal payment of $50 per year and a minimum work commitment of $1,250 per year to maintain.

As of December 31, 2009, management of the Company determined that the $70,000 carrying value of the property purchase option had been impaired based on the fact that a drilling program would most likely not be completed by the expiration date of March 31, 2010. The Company therefore recorded a write a write-down of $70,000 which was recognized as an impairment of mineral property purchase option in the fourth quarter of 2009 leaving a carrying value of zero.

Location

The Lac à l’Eau Jaune Project is located approximately eighteen miles southwest of the Chibougamau mining camp and is comprised of 21 claims totaling 2,900 acres. The project area is accessible from Chibougamau via Road 167 south and Road 113 west toward the Chibougamau airport. The Malartic Surimau Project covers 25 claims totaling 3,554 acres approximately 25 miles west of the Town of Val D’or and ten miles south of the Town of Cadillac and is accessible from Highway 117 by a maintained dirt road. The property is separated into two blocks, with five claims lying directly north of the property’s main body.

16

Geology

Malartic Surimau Property:

The Archaean Malartic gold mines are located along the Larder Lake-Cadillac Fault zone, in the Abitibi sub-province of the Superior Province, some 20 km west of Val d’Or in Quebec, Canada. Historically the main mines of the district known as its East Canadian, Barnat, Sladen and Canadian Malartic properties produced over 162 tonnes of gold to 2000.

The district straddles the faulted contact between the mafic to ultramafic volcanics of the Piché Group to the north and the greywacke-mudstone sequence of the Pontiac Group to the south. The majority of the gold mineralization is found within the sediments where it is spatially associated with small monzonite porphyry bodies, younger diorite intrusives and crosscutting brittle (silicified) faults. The host succession has been subjected to NE trending F1 folds, asymmetric F2 folds with a SE striking penetrative S2 cleavage which is in turn paralleled by brittle faults. The monzodiorite intrusives predate F2, while a series of significant ESE trending brittle faults occur near the volcanic-sediment boundary. Two main styles of mineralization are observed, which consist of elongate zones of disseminated auriferous pyrite in fractured and silicified greywacke and adjacent monzodiorite porphyry along ESE striking and S2 parallel faults, and stockwork zones of quartz-albite-K feldspar veinlets and intervening disseminated pyrite in intensely fractured and altered porphyritic monzodiorite and diorite adjacent to faults.

The alteration includes K (potassium) and Na (sodium) feldspar addition, carbonization and silicification in the sediments and by biotite development in the intrusives. Pyrite constitutes 5 to 10% of the altered greywackes and monzodiorites, and 5 to 20% of the mineralized diorite which also contains abundant magnetite.

17

Lac à l’Eau Jaune property:

The Chibougamau District of northern Quebec, some 350 km to the north-east of Val d’Or, has produced in excess of 1,050 tonnes (33.75 million ounces) of gold to date from a variety of styles of ore, but is mostly characterized by copper-gold vein deposits distinct from typical greenstone hosted quartz-carbonate veins. The deposits of the district range from volcanogenic massive sulfides with copper, zinc and silver to gold bearing sulfide veins with associated silver, zinc, lead arsenic & antimony; to copper-gold and gold-copper veins with varying amounts of sulfides; and auriferous quartz veins with minor chalcopyrite. Most of the copper-gold deposits are localized in southeast trending ductile shear zones and are within meta-anorthosite and gabbroic hosts.

Exploration Program

In October of 2007, the Company entered into an agreement with Diagnos to conduct a phased exploration program at both the Lac a l’Eau Jaune (“LEJ”) and Malartic Surimaum properties. Diagnos conducted site visits and exploration work on the LEJ claim block in November of 2007, collecting 26 rock samples that were sent to ALS Chemex in Val d’Or, Québec for assay analysis. In the spring of 2008, Diagnos conducted compilation work followed by a field exploration program on the LEJ project. Fieldwork was carried out from May 19th to the 1st of June and included geological mapping, prospecting, rock sampling and soil sampling. During this period a Mobile Metal Ion (MMI) orientation survey was carried out. The purpose of the orientation survey was to test the usefulness of the method in the project area. A total of 152 rock samples, mostly from outcrop, were collected and delivered for analysis to ALS Chemex in Val d’Or, Québec. A total of 72 soil samples were collected and sent for MMI analysis to SGS Minerals Services, Toronto. Rock samples collected on the LEJ property were analyzed for a multi-element suite including gold and copper. Diagnos conducted site visits and exploration work on the Malartic claim block in September of 2008 and collected 145 rock samples which were sent to ALS Chemex in Val d’Or, Québec.

Mineralization was observed in the ultramafic volcanic and quartzite units. Highest grades were obtained at the quartzite/ultramafic contact which was found in both the northern and southern claim block. The “quartzite” may also be described as a heavily silicified sheared horizon with areas containing clasts of semi-massive to massive sulfides (Cpy, Py, Sp) and abundant mineralization within the schistosity. The ultramafic volcanic rocks show up to 5% disseminated/clasts Py and Cpy in the northern block while the southern block showed the ultramafic to be either moderately mineralized or with large (5-10 cm) massive sulfide pouches.

The Company incurred $27,982 and $227,880 in 2009 and 2008, respectively, in exploration expenses relating to the Quebec properties.

El Milagro/El Capitan Property

On February 18, 2010 the Company transferred all of its Mexican assets to the Hunt Family Limited Partnership (“HFLP”), a related party, along with all its stock in Black Hawk and its interest in the Dun Glen property in consideration of cancelling $600,000 of the debt that the Company owed to HFLP on an outstanding note payable. See “Note 16, subsequent events” to our consolidated financial statements for further information. Below is a brief narrative about the history of the property up until the point it was sold.

Overview

In 2008 the company purchased a 100% interest in the “El Capitan” and “El Milagro” mineral exploration and mining concessions from a Mexican Particular; Jesus Guadelupe Morales. The El Capitan exploration concession was purchased for $110,000 with no underlying royalties. The El Milagro mining concession was purchased for $150,000 and retains a 2% net profit royalty which must be paid to a previous owner should a mine be put into production.

18

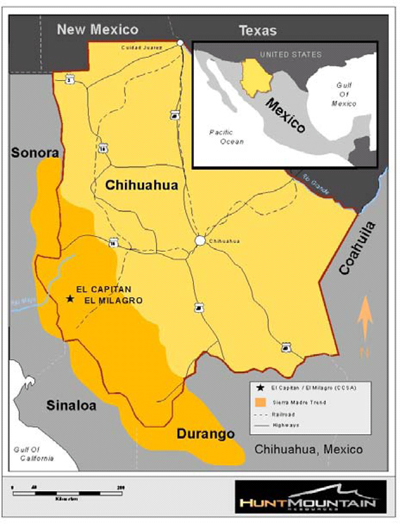

Location

The El Capitan and El Milagro property package is located in the northern Mexican state of Chihuahua.

CCSA Mexico and the Company incurred $21,826 and $30,104 in exploration expenses on the El Milagro/El Capitan property in 2009 and 2008, respectively.

|

ITEM 3.

|

LEGAL PROCEEDINGS

|

There are no material pending legal proceedings to which the “Registrant” is a party or of which any of its property is subject.

|

ITEM 4.

|

SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS

|

Not Applicable

19

PART II

|

ITEM 5.

|

MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

|

|

(a)

|

Market Information

|

The Common Stock of the Company is currently quoted on the Pink Sheets under the symbol “HNTM”. The following table shows the high and low closing sales prices for the Common Stock for each quarter since January 1, 2008. The quotations reflect inter-dealer prices, without retail mark-up, mark-down or commission and may not represent actual transactions.

|

High Closing

|

Low Closing

|

|||||||

|

Year Ended 12/31/2008

|

||||||||

|

First Quarter

|

.93 | .50 | ||||||

|

Second Quarter

|

.85 | .73 | ||||||

|

Third Quarter

|

.77 | .59 | ||||||

|

Fourth Quarter

|

.69 | .26 | ||||||

|

Year Ended 12/31/2009

|

||||||||

|

First Quarter

|

.50 | .18 | ||||||

|

Second Quarter

|

.28 | .16 | ||||||

|

Third Quarter

|

.22 | .16 | ||||||

|

Fourth Quarter

|

.20 | .06 | ||||||

|

(b)

|

Holders

|

There are approximately 1,421 holders of the Registrant’s common equity at the date hereof

|

(c)

|

Dividends

|

We have never paid a dividend. There is no plan to pay dividends for the foreseeable future.

|

(d)

|

Securities Authorized for Issuance Under Equity Compensation Plans

|

Securities Authorized for Issuance Under Equity Compensation Plans.

|

Plan Category

|

Number of securities to be issued upon exercise of outstanding options, warrants and rights (1)

(a)

|

Weighted-average exercise price of outstanding options, warrants and rights

(b)

|

Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a))

(c)

|

|||||||||

|

Equity compensation plans approved by shareholders

|

2,245,000 | $ | 0.44 | 755,000 | ||||||||

|

Equity compensation plans not approved by shareholders

|

-0- | -0- | -0- | |||||||||

|

Total

|

2,245,000 | $ | 0.44 | 755,000 | ||||||||

|

(e)

|

Unregistered Sales

|

The Company had no unregistered sales of shares for the year ended December 31, 2009.

The following are the transactions which occurred during the year ended December 31, 2008.

In January, 2008 the Company issued 408,000 shares and 408,000 warrants pursuant to the conversion of principal of a convertible note. The warrants issued have a $0.40 exercise price and an expiration date of five years from the date of issuance. The private placement was made pursuant to section 4(2) and a Regulation D Rule 506 exemptions from registration under the Act.

In March, 2008 the Company issued 4,000 shares and 4,000 warrants pursuant to the conversion of principal of a convertible note. The warrants issued have a $0.40 exercise price and an expiration date of five years from the date of issuance. The private placement was made pursuant to section 4(2) and a Regulation D Rule 506 exemptions from registration under the Act.

On April 9, 2008 the Company issued 40,000 shares and 40,000 warrants pursuant to the conversion of principal of a convertible note. The warrants issued have a $0.40 exercise price and an expiration date of five years from the date of issuance. The private placement was made pursuant to section 4(2) and a Regulation D Rule 506 exemptions from registration under the Act.

20

On April 16, 2008 the Company issued 20,200,056 shares and 20,200,056 warrants pursuant to the conversion of principal and accrued interest of a convertible note. The warrants issued have a $0.40 exercise price and an expiration date of five years from the date of issuance. The private placement was made pursuant to section 4(2) and a Regulation D Rule 506 exemptions from registration under the Act.

In July, 2008 the Company issued 22,394,192 shares and 22,394,192 warrants pursuant to the conversion of principal and accrued interest of a convertible note. The warrants issued have a $0.40 exercise price and an expiration date of five years from the date of issuance. The private placement was made pursuant to section 4(2) and a Regulation D Rule 506 exemptions from registration under the Act.

|

ITEM 6.

|

SELECTED FINANCIAL DATA – We are a smaller reporting company as defined by Rule 12b-2 of the Exchange Act and are not required to provide the information under this item.

|

|

ITEM 7.

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

|

FORWARD-LOOKING STATEMENTS

This Annual Report and other documents we file with the Securities and Exchange Commission (“SEC”) contain forward-looking statements that are based on current expectations, estimates, forecasts and projections about us, our future performance, our business, our beliefs and our management’s assumptions. All statements other than statements of historical facts are forward-looking statements, including any statements of the plans and objectives of management for future operations, projections of revenue earnings or other financial items, any statements regarding future economic conditions or performance, and any statement of assumptions underlying any of the foregoing. Some of these forward-looking statements may be identified by the use of words in the statements such as “anticipate,” “estimate,” “could,” “would,” “expect,” “project,” “intend,” “plan,” “believe,” “seek,” “should,” “may,” “assume,” “continue,” variations of such words and similar expressions. These statements are not guarantees of future performance and involve certain risks, uncertainties, and assumptions that are difficult to predict. We caution you that our performance and results could differ materially from what is expressed, implied, or forecast by our forward-looking statements due to general financial, economic, regulatory and political conditions affecting the economy and markets, as well as more specific risks and uncertainties affecting the Company. The Company operates in a rapidly changing environment that involves a number of risks, some of which are beyond the Company’s control. Future operating results and the Company’s stock price may be affected by a number of factors. Factors that could cause or contribute to such differences include, but are not limited to, those discussed in the section entitled “ITEM 1. BUSINESS,” and all subsections therein, including, without limitation, the subsection entitled, “FACTORS THAT MAY AFFECT THE COMPANY,” and the section entitled “MARKET FOR REGISTRANT’S COMMON STOCK AND RELATED STOCKHOLDER MATTERS,” all contained in this Annual Report on Form 10-K. Given these risks and uncertainties, any or all of these forward-looking statements may prove to be incorrect. Therefore, you should not rely on any such forward-looking statements. Furthermore, we do not intend (and we are not obligated) to update publicly any forward-looking statements. You are advised, however, to consult any further disclosures we make on related subjects in our reports to the Securities and Exchange Commission.

Year ended December 31, 2009 compared to year ended December 31, 2008

Result of Operations

Dividend and interest income increased to $17,617 in 2009, up from $8,211 in 2008.

Total expenses decreased from approximately $40.7 million in 2008 to $11.2 million in 2009. The change is primarily due to reduced exploration activity and the costs associated with the completion of the drilling campaign on the La Josefina property in 2008. As a result, the Company recorded a net loss of $11.2 million in 2009, compared to a net loss of $40.7 million in 2008.

Liquidity and Capital Resources

Working Capital, Cash and Cash Equivalents

The Company’s working capital deficit at December 31, 2009 was $3.6 million compared to $3.6 million at December 31, 2008. The ratio of current assets to current liabilities was 0.50 to 1 at December 31, 2009 compared to 0.23 to 1 at December 31, 2008. The increase in the ratio is primarily due to the increase in cash and cash equivalents which was $3,040,744 at December 31, 2009 versus only $250,484 at December 31, 2008. The other primary reason for the increased ratio is due to the increase in short term note payable and shareholder loan which was approximately $5.2 million at December 31, 2009 versus approximately $1.9 million at December 31, 2008.