Attached files

| file | filename |

|---|---|

| EX-31.2 - BLUEGREEN VACATIONS CORP | i00502_ex31-2.htm |

| EX-32.2 - BLUEGREEN VACATIONS CORP | i00502_ex32-2.htm |

| EX-32.1 - BLUEGREEN VACATIONS CORP | i00502_ex32-1.htm |

| EX-31.1 - BLUEGREEN VACATIONS CORP | i00502_ex31-1.htm |

| EX-10.102 - BLUEGREEN VACATIONS CORP | i00502_ex10-102.htm |

| EX-10.103 - BLUEGREEN VACATIONS CORP | i00502_ex10-103.htm |

| EX-10.106 - BLUEGREEN VACATIONS CORP | i00502_ex10-106.htm |

| EX-10.107 - BLUEGREEN VACATIONS CORP | i00502_ex10-107.htm |

| EX-10.105 - BLUEGREEN VACATIONS CORP | i00502_ex10-105.htm |

| EX-10.104 - BLUEGREEN VACATIONS CORP | i00502_ex10-104.htm |

| EX-10.101 - BLUEGREEN VACATIONS CORP | i00502_ex10-101.htm |

| 10-Q - BLUEGREEN VACATIONS CORP | i00502_bxg-10q.htm |

FINAL EXECUTION COPY

LOAN AND SECURITY AGREEMENT

By and Between

NATIONAL BANK OF ARIZONA

and

BLUEGREEN/BIG CEDAR VACATIONS, LLC

Dated: September 30, 2010

_________________________________

| 6284.98.499412.15 | 9/30/2010 |

TABLE OF CONTENTS

|

|

|

|

|

Page |

|

1. |

DEFINITIONS |

2 |

||

|

|

1.1 |

CERTAIN DEFINED TERMS |

2 |

|

|

|

1.2 |

OTHER DEFINITIONAL PROVISIONS |

21 |

|

|

2. |

LOAN COMMITMENT; USE OF PROCEEDS |

22 |

||

|

|

2.1 |

LOAN COMMITMENT |

22 |

|

|

|

|

(a) |

Determination of Advance Amounts |

22 |

|

|

|

(b) |

Nonrevolving Nature of Loan |

22 |

|

|

2.2 |

CONTINUATION OF OBLIGATIONS THROUGHOUT TERM |

22 |

|

|

|

2.3 |

USE OF ADVANCE |

22 |

|

|

|

2.4 |

REPAYMENT OF LOAN |

22 |

|

|

|

2.5 |

INTEREST |

22 |

|

|

|

2.6 |

PAYMENTS |

22 |

|

|

|

2.7 |

MINIMUM REQUIRED PAYMENTS |

23 |

|

|

|

|

(a) |

Periodic Loan Payments |

23 |

|

|

|

(b) |

Borrowing Base Step-Down |

23 |

|

|

|

(c) |

Borrowing Base Maintenance |

24 |

|

|

|

(d) |

Upgrades |

25 |

|

|

2.8 |

PREPAYMENT |

25 |

|

|

|

|

(a) |

Prohibitions on Prepayment; Prepayment Premium |

25 |

|

|

|

(b) |

Exceptions to Prepayment Prohibitions |

26 |

|

|

|

(c) |

Prepayment Premium Payable for Involuntary Prepayments |

26 |

|

|

2.9 |

LOAN FEE |

26 |

|

|

|

2.10 |

APPLICATION OF PROCEEDS OF COLLATERAL AND PAYMENTS |

26 |

|

|

|

2.11 |

BORROWER'S UNCONDITIONAL OBLIGATION TO MAKE PAYMENTS |

27 |

|

|

3. |

SECURITY |

27 |

||

|

|

3.1 |

GRANT OF SECURITY INTEREST IN COLLATERAL |

27 |

|

|

|

|

(a) |

Grant |

27 |

|

|

|

(b) |

Assigned Notes Receivable |

27 |

|

|

3.2 |

LOCKBOX COLLECTIONS AND SERVICING; RECONCILIATION REPORTS |

27 |

|

|

|

|

(a) |

Collections |

27 |

|

|

|

(b) |

Reports |

28 |

|

|

|

(c) |

Notice to Purchasers |

28 |

|

|

3.3 |

CUSTODIAL AGENT; BACKUP SERVICING AGENT |

29 |

|

|

|

3.4 |

REPLACEMENT OF AGENTS |

29 |

|

|

|

3.5 |

MAINTENANCE OF SECURITY |

30 |

|

|

|

3.6 |

LIABILITY OF GUARANTOR |

30 |

|

|

4. |

CONDITIONS PRECEDENT TO ADVANCE; METHOD OF DISBURSEMENT |

30 |

||

|

|

4.1 |

CLOSING CONDITIONS |

30 |

|

|

|

|

(a) |

Loan Documents |

30 |

|

|

|

(b) |

Opinions |

30 |

|

|

|

(c) |

Organizational Documents |

30 |

|

|

|

(d) |

Credit Reports; Search Reports |

30 |

|

|

|

(e) |

Timeshare Project Due Diligence |

31 |

|

|

|

(f) |

Site Inspection and Due Diligence |

33 |

|

|

|

(g) |

Subordinate Debt |

33 |

|

|

|

(h) |

Exchange Affiliation |

33 |

|

|

|

(i) |

Existing Indebtedness |

33 |

|

|

|

(j) |

Payment of Expenses |

33 |

|

|

|

(k) |

Budget and Financial Information |

33 |

| 6284.98.499412.15 | 9/30/2010 |

TABLE OF CONTENTS

(Continued)

|

|

|

(l) |

First Right of Refusal |

33 |

|

|

|

(m) |

Collateral Releases |

33 |

|

|

4.2 |

CONDITIONS PRECEDENT TO ADVANCE |

33 |

|

|

|

|

(a) |

Request for Advance |

34 |

|

|

|

(b) |

Timeshare Documents |

34 |

|

|

|

(c) |

Receivables Schedules |

34 |

|

|

|

(d) |

Assignment |

34 |

|

|

|

(e) |

Promised Improvements |

34 |

|

|

|

(f) |

Servicing Agent Confirmation |

34 |

|

|

|

(g) |

Title Policy |

35 |

|

|

|

(h) |

Report from Custodial Agent |

35 |

|

|

|

(i) |

Documents Received and Recorded |

35 |

|

|

|

(j) |

Title Policy |

35 |

|

|

|

(k) |

Event of Default |

35 |

|

|

|

(l) |

Representations and Warranties |

35 |

|

|

|

(m) |

No Violation of Usury Law |

35 |

|

|

|

(n) |

Payment of Fees |

35 |

|

|

|

(o) |

Condemnation or Litigation |

35 |

|

|

|

(p) |

Other Items |

36 |

|

|

4.3 |

CONDITIONS SATISFIED AT BORROWER'S EXPENSE |

36 |

|

|

|

4.4 |

DISBURSEMENT OF ADVANCE |

36 |

|

|

|

4.5 |

NO WAIVER |

36 |

|

|

5. |

REPRESENTATIONS AND WARRANTIES |

36 |

||

|

|

5.1 |

GOOD STANDING |

36 |

|

|

|

5.2 |

POWER AND AUTHORITY; ENFORCEABILITY |

36 |

|

|

|

5.3 |

BORROWER'S PRINCIPAL PLACE OF BUSINESS |

37 |

|

|

|

5.4 |

COMPLIANCE WITH LEGAL REQUIREMENTS |

37 |

|

|

|

5.5 |

NO MISREPRESENTATIONS |

38 |

|

|

|

5.6 |

NO DEFAULT FOR THIRD PARTY OBLIGATIONS |

38 |

|

|

|

5.7 |

PAYMENT OF TAXES AND OTHER IMPOSITIONS |

38 |

|

|

|

5.8 |

GOVERNMENTAL REGULATIONS |

38 |

|

|

|

5.9 |

EMPLOYEE BENEFIT PLANS |

38 |

|

|

|

5.10 |

SECURITIES ACTIVITIES |

39 |

|

|

|

5.11 |

SALES ACTIVITIES |

39 |

|

|

|

5.12 |

TIMESHARE INTEREST NOT A SECURITY |

39 |

|

|

|

5.13 |

REPRESENTATIONS AS TO EACH TIMESHARE PROJECT |

40 |

|

|

|

|

(a) |

Title; Prior Liens |

40 |

|

|

|

(b) |

Timeshare Plan |

40 |

|

|

|

(c) |

Access |

40 |

|

|

|

(d) |

Utilities |

40 |

|

|

|

(e) |

Amenities |

40 |

|

|

|

(f) |

Improvements |

40 |

|

|

|

(g) |

Sale of Intervals |

40 |

|

|

|

(h) |

Zoning Laws, Building Codes, Etc. |

41 |

|

|

|

(i) |

Units Ready for Use |

41 |

|

|

5.14 |

ELIGIBLE NOTES RECEIVABLE |

41 |

|

|

|

5.15 |

ASSOCIATION; ASSESSMENTS AND RESERVES |

41 |

|

|

|

5.16 |

TITLE TO AND MAINTENANCE OF COMMON AREAS AND AMENITIES |

42 |

|

|

|

5.17 |

RESERVATION SYSTEM |

42 |

|

|

|

5.18 |

LITIGATION AND PROCEEDINGS |

42 |

|

|

|

5.19 |

OPERATING CONTRACTS |

43 |

|

|

|

5.20 |

SUBSIDIARIES, AFFILIATES AND CAPITAL STRUCTURE |

43 |

|

|

|

5.21 |

TIMESHARE PROGRAM CONSUMER DOCUMENTS |

43 |

|

|

5.22 |

PUBLIC REPORTS |

43 |

|

|

5.23 |

SOLVENCY |

43 |

| 6284.98.499412.15 | ii | 9/30/2010 |

|

|

5.24 |

NO MATERIAL ADVERSE CHANGE IN FINANCIAL CONDITION |

44 |

||

|

|

5.25 |

TIMESHARE PROGRAM GOVERNING DOCUMENTS |

44 |

||

|

|

5.26 |

MARKETING ACTIVITIES |

44 |

||

|

|

5.27 |

BROKERS; PAYMENT OF COMMISSIONS |

44 |

||

|

|

5.28 |

RESERVED |

44 |

||

|

|

5.29 |

FOREIGN ASSETS CONTROL REGULATIONS |

44 |

||

|

|

5.30 |

SURVIVAL AND ADDITIONAL REPRESENTATIONS AND WARRANTIES |

46 |

||

|

6. |

COVENANTS |

46 |

|||

|

|

6.1 |

AFFIRMATIVE COVENANTS |

46 |

||

|

|

|

(a) |

Good Standing |

46 |

|

|

|

|

(b) |

Compliance with Legal Requirements |

46 |

|

|

|

|

(c) |

Insurance, Casualty and Condemnation |

46 |

|

|

|

|

(d) |

Reports |

49 |

|

|

|

|

(e) |

Subordination of Indebtedness Owing to Affiliates |

52 |

|

|

|

|

(f) |

Payment of Taxes |

53 |

|

|

|

|

(g) |

Payment of Impositions |

53 |

|

|

|

|

(h) |

Further Assurance |

53 |

|

|

|

|

(i) |

Fulfillment of Obligations Under Project and Consumer Documents |

53 |

|

|

|

|

(j) |

Material Increases to Assessments |

53 |

|

|

|

|

(k) |

Maintenance of Timeshare Project and Other Property |

53 |

|

|

|

|

(l) |

Maintenance of Larger Tract |

54 |

|

|

|

|

(m) |

Collection of Receivables Collateral |

54 |

|

|

|

|

(n) |

Loan File |

54 |

|

|

|

|

(o) |

Financial Covenants |

54 |

|

|

|

|

(p) |

Exchange Affiliation |

55 |

|

|

|

|

(q) |

Right to Inspect |

55 |

|

|

|

|

(r) |

Management and Marketing |

56 |

|

|

|

6.2 |

NEGATIVE COVENANTS |

56 |

||

|

|

|

(a) |

Change in Borrower's Name, Principal Place of Business, Jurisdiction of Organization or Business |

56 |

|

|

|

|

(b) |

Restrictions on Additional Indebtedness |

56 |

|

|

|

|

(c) |

Ownership and Control |

56 |

|

|

|

|

(d) |

No Sales Activities Prior to Approval |

57 |

|

|

|

|

(e) |

No Modification of Receivables Collateral or Payments by Borrower |

57 |

|

|

|

|

(f) |

No Modification of Timeshare Documents |

57 |

|

|

|

|

(g) |

Maintenance of Larger Tract |

57 |

|

|

|

|

(h) |

Making Loans |

57 |

|

|

|

|

(j) |

Distributions |

58 |

|

|

|

|

(k) |

Negative Pledge |

58 |

|

|

|

6.3 |

SURVIVAL OF COVENANTS |

58 |

||

|

7. |

DEFAULT |

58 |

|||

|

|

7.1 |

EVENTS OF DEFAULT |

58 |

||

|

|

|

(a) |

Payments |

58 |

|

|

|

|

(b) |

Covenant Defaults |

59 |

|

|

|

|

(c) |

Cross-Default |

59 |

|

|

|

|

(d) |

Environmental Default |

59 |

|

|

|

|

(e) |

Default by Borrower in Other Agreements |

59 |

|

|

|

|

(f) |

Warranties or Representations |

59 |

|

|

|

|

(g) |

Termination of Borrower |

59 |

|

|

|

|

(h) |

Enforceability of Liens |

60 |

|

|

|

|

(i) |

Creditor or Forfeiture Proceedings |

60 |

|

|

|

|

(j) |

Guaranty |

60 |

|

|

|

|

(l) |

Bankruptcy |

60 |

|

|

|

|

(m) |

Attachment, Judgment, Tax Liens |

60 |

|

| 6284.98.499412.15 | iii | 9/30/2010 |

|

|

|

(n) |

Material Adverse Change |

60 |

|

|

|

|

(o) |

Criminal Proceedings |

60 |

|

|

|

|

(p) |

Loss of License |

60 |

|

|

|

|

(q) |

Suspension of Sales |

61 |

|

|

|

|

(r) |

Management, Marketing, Administration |

61 |

|

|

|

|

(s) |

Timeshare Documents |

61 |

|

|

|

|

(t) |

Removal of Collateral |

61 |

|

|

|

|

(u) |

Operating Contracts |

61 |

|

|

|

|

(v) |

Vacation Club |

61 |

|

|

|

|

(x) |

Other Defaults |

62 |

|

|

|

7.2 |

EFFECT OF AN EVENT OF DEFAULT; REMEDIES |

62 |

||

|

|

7.3 |

APPLICATION OF PROCEEDS DURING AN EVENT OF DEFAULT |

64 |

||

|

|

7.4 |

UNIFORM COMMERCIAL REMEDIES; SALE; ASSEMBLY OF RECEIVABLES COLLATERAL |

64 |

||

|

|

|

(a) |

UCC Remedies; Sale of Collateral |

64 |

|

|

|

|

(b) |

Lender's Right to Execute Conveyances |

64 |

|

|

|

|

(c) |

Obligation to Assemble Receivables Collateral |

64 |

|

|

|

|

(d) |

Registration |

64 |

|

|

|

7.5 |

APPLICATION OF PROCEEDS |

65 |

||

|

|

7.6 |

LENDER'S RIGHT TO PERFORM |

65 |

||

|

|

7.7 |

WAIVER OF MARSHALLING |

65 |

||

|

|

7.8 |

WAIVER IN LEGAL ACTIONS |

65 |

||

|

|

7.9 |

SET-OFF |

66 |

||

|

8. |

COSTS AND EXPENSES; INDEMNIFICATION; DUTIES OF LENDER |

66 |

|||

|

|

8.1 |

COSTS AND EXPENSES |

66 |

||

|

|

8.2 |

INDEMNIFICATION |

67 |

||

|

|

8.3 |

DUTIES OF LENDER |

67 |

||

|

|

8.4 |

DELEGATION OF DUTIES AND RIGHTS |

67 |

||

|

|

8.5 |

FOREIGN ASSETS CONTROL |

67 |

||

|

9. |

CONSTRUCTION AND GENERAL TERMS |

68 |

|||

|

|

9.1 |

PAYMENT LOCATION |

68 |

||

|

|

9.2 |

ENTIRE AGREEMENT |

68 |

||

|

|

9.3 |

POWERS COUPLED WITH AN INTEREST |

68 |

||

|

|

9.4 |

COUNTERPARTS; FACSIMILE SIGNATURES |

68 |

||

|

|

9.5 |

NOTICES |

68 |

||

|

|

9.6 |

BORROWER'S REPRESENTATIVE |

70 |

||

|

|

9.7 |

GENERAL SUBMISSION REQUIREMENTS |

70 |

||

|

|

9.8 |

LOAN PARTICIPANTS |

71 |

||

|

|

9.9 |

SUCCESSORS AND ASSIGNS |

71 |

||

|

|

9.10 |

SEVERABILITY |

71 |

||

|

|

9.11 |

TIME OF ESSENCE |

71 |

||

|

|

9.12 |

MISCELLANEOUS |

71 |

||

|

|

9.13 |

FORUM SELECTION; JURISDICTION; CHOICE OF LAW |

72 |

||

|

|

9.14 |

DISPUTE RESOLUTION |

72 |

|

|

9.15 |

INTERPRETATION |

74 |

|

|

9.16 |

DESTRUCTION OF NOTE; SUBSTITUTE NOTE |

74 |

|

|

9.17 |

COMPLIANCE WITH APPLICABLE USURY LAW |

75 |

|

|

9.18 |

NO RELATIONSHIP WITH PURCHASERS |

75 |

|

|

9.19 |

NO JOINT VENTURE |

75 |

|

|

9.20 |

SCOPE OF REIMBURSABLE ATTORNEY'S FEES |

75 |

|

|

9.21 |

CONFIDENTIALITY |

76 |

|

|

9.22 |

RELIEF FROM AUTOMATIC STAY, ETC |

76 |

|

|

9.23 |

RELIANCE |

76 |

|

|

9.24 |

LIMITATION OF DAMAGES |

76 |

| 6284.98.499412.15 | iv | 9/30/2010 |

|

|

9.25 |

WAIVER OF RIGHT OF FIRST REFUSAL |

77 |

|

|

9.26 |

CONSENTS, APPROVALS AND DISCRETION |

77 |

|

|

9.27 |

USA PATRIOT ACT NOTICE |

77 |

|

|

9.28 |

ERRORS AND OMISSIONS |

77 |

|

|

9.29 |

BACKGROUND STATEMENTS |

77 |

|

|

9.30 |

WAIVER OF DEFENSES AND RELEASE OF CLAIMS |

78 |

| 6284.98.499412.15 | v | 9/30/2010 |

LOAN AND SECURITY AGREEMENT

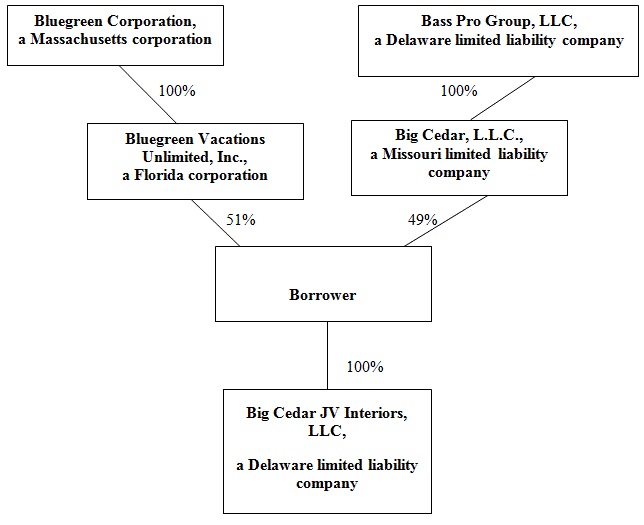

THIS LOAN AND SECURITY AGREEMENT is made as of September 30, 2010 by and between BLUEGREEN/BIG CEDAR VACATIONS, LLC, a Delaware limited liability company ("Borrower") and NATIONAL BANK OF ARIZONA, a national banking association ("Lender").

BACKGROUND

A. The Bluegreen Vacation Club (the "Vacation Club") is a multi-site timeshare plan established by Bluegreen Vacations Unlimited, Inc. pursuant to the Vacation Club Trust Agreement and entitles Purchasers who become Owner Beneficiaries under the Vacation Club Trust Agreement to use any component site within the Vacation Club, subject to the Vacation Club Trust Agreement and the rules and regulations governing such occupancy, including, without limitation, its reservation procedures.

B. Borrower is the developer of the Long Creek Project and the Big Cedar Project. In addition to other component site resorts, each of the Long Creek Project and the Big Cedar Project are component site resorts within the Bluegreen Vacation Club.

C. When a Purchaser purchases a Timeshare Interest in either of the Timeshare Projects, the purchased Timeshare Interest is conveyed by the Borrower to the Vacation Club Trustee at the Purchaser's direction as set forth in the Purchase Contract to be held under the terms of the Vacation Club Trust Agreement. The Purchaser thereby is designated an Owner Beneficiary and receives Owner Beneficiary Rights and appurtenant Vacation Points and is entitled to all the benefits accruing to Owner Beneficiaries under the Vacation Club Trust Agreement.

D. If the Borrower provides purchase money financing to the Purchaser, the Vacation Club Trustee (as the title holder of the purchased Timeshare Interest), at the direction of the Purchaser, executes the Purchaser Mortgage in favor of the Borrower to secure such financing. To the extent that the Purchaser Mortgage is assigned to Lender in consideration for an Advance, the Lender becomes an Interest Holder Beneficiary under the Vacation Club Trust Agreement and is thereby entitled to all of the benefits accruing under the Vacation Club Trust Agreement to Interest Holder Beneficiaries.

E. Borrower has applied to Lender for a loan in the maximum principal amount of $20,000,000.00 to be secured by timeshare receivables arising from the financed sale of Timeshare Interests in each of the Long Creek Project and the Big Cedar Project and other collateral as set forth herein pledged to Lender from time to time.

F. Lender is willing to make the foregoing loan upon and subject to the terms and conditions set forth in this Agreement.

| 6284.98.499412.15 | 9/30/2010 |

AGREEMENT

NOW, THEREFORE, in consideration of the mutual covenants and agreements contained in this Agreement and the other Loan Documents, and for other good and valuable consideration, the receipt and adequacy of which are acknowledged, the parties to this Agreement agree as follows:

1. DEFINITIONS

1.1 Certain Defined Terms. As used in this Agreement (including any Exhibits attached hereto) and the other Loan Documents unless otherwise expressly indicated in this Agreement or the other Loan Documents, the following terms shall have the following meanings (such meanings to be applicable equally both to the singular and plural terms defined).

620/575 FICO Score Notes Receivable: those Notes Receivable under which the Purchaser thereof has a FICO Score of less than 620 but equal to or greater than 575.

Advance: an advance of the proceeds of the Loan by Lender to, or on behalf of, Borrower in accordance with the terms and conditions of this Agreement.

Affiliate: Any Person: (a) which directly or indirectly controls, or is controlled by, or is under common control with such Person; (b) which directly or indirectly beneficially owns or holds five percent (5%) or more of the voting stock of such Person; or (c) for which five percent (5%) or more of the voting stock of which is directly or indirectly beneficially owned or held by such Person; provided, however, that under no circumstances shall Guarantor be deemed an Affiliate of any 5% or greater shareholder of Guarantor or any Affiliate of such shareholder who is not a Direct Affiliate (as defined herein) of Guarantor, nor shall any such shareholder be deemed to be an Affiliate of Guarantor. The term "control" means the possession, directly or indirectly, of the power to direct or cause the direction of the management and policies of a Person, whether through the ownership of voting securities, by contract or otherwise. For purposes of this definition, (i) any entity included in Guarantor’s GAAP consolidated financial statements shall be an Affiliate of Guarantor (a "Direct Affiliate"), (ii) Guarantor shall be deemed to be an Affiliate of Borrower and (iii) each of Bluegreen Vacations Unlimited, Inc. and Big Cedar, L.L.C. shall be deemed an Affiliate of Borrower.

Agents: the Servicing Agent, the Lockbox Agent and the Custodial Agent. "Agent" means, as the context requires, any one of the Agents.

Agreement: this Loan and Security Agreement, as it may from time to time be amended, supplemented or restated.

Applicable Usury Law: the usury law chosen by the parties pursuant to the terms of Section 9.13 or such other usury law which is applicable if such usury law is not.

Articles of Organization: the charter, articles of incorporation, articles of organization, operating agreement, joint venture agreement, partnership agreement, by-laws and any other written documents evidencing the formation, organization, governance and continuing existence of an entity.

| 6284.98.499412.15 | 2 | 9/30/2010 |

Assignment: a written Collateral Assignment of Notes Receivable and Purchaser Mortgages and their proceeds, executed by Borrower substantially in the form and substance of Exhibits A-1 and A-2, attached hereto.

Backup Servicing Agent: Concord Servicing Corporation, an Arizona corporation, as the Backup Servicing Agent, or its successor as Backup Servicing Agent, under the Backup Servicing Agreement.

Backup Servicing Agreement: the agreement dated as of the Effective Date among Lender, Servicing Agent, Borrower and Backup Servicing Agent which provides for Backup Servicing Agent to perform for the benefit of Lender backup accounting, reporting and other servicing functions as set forth therein with respect to the Receivables Collateral, as it may from time to time be amended, supplemented or restated.

Bankruptcy Code: as defined in Section 9.22 hereof.

Base Rate: the rates per annum quoted by Lender as Lender's 30 day LIBOR rate based upon quotes from the London Interbank Offered Rate from the British Bankers Association Interest Settlement Rates, as quoted for U.S. Dollars by Bloomberg, or other comparable services selected by the Lender. The Index is not necessarily the lowest rate charged by Lender on its loans. If the foregoing 30 day LIBOR rate becomes unavailable during the Term, Lender may designate a substitute index after notifying Borrower. The 30 day LIBOR rate is to be strictly interpreted and is not intended to serve any purpose other than providing an index to determine the interest rate used herein. The LIBOR rate selected by Lender may not necessarily be the same as the quoted "offer" side in the Eurodollar time deposit market by any particular institution or service applicable to any interest period.

Base Rate Determination Date: two Business Days prior to the last Business Day of each calendar month. Notwithstanding the foregoing, the initial Base Rate Determination Date shall be two Business Days prior to the Effective Date.

Basic Interest: as defined in Section 2.5 hereof.

Basic Interest Rate: the variable interest rate per annum, adjusted as of each Base Rate Determination Date, equal to the Base Rate in effect as of each Base Rate Determination Date plus 525 basis points, but in no event shall the Basic Interest Rate exceed the rate permitted by the Applicable Usury Law or fall below 6.75% per annum.

Big Cedar Project: that certain vacation ownership project, commonly known as Bluegreen Wilderness Club at Big Cedar, located in Ridgedale, Missouri.

Big Cedar Timeshare Association: Big Cedar Wilderness Club Condominium Association, Inc., a Missouri corporation not-for-profit, which is the association established in accordance with the Big Cedar Timeshare Declaration to manage the Big Cedar Timeshare Program and in which all owners of Timeshare Interests at the Big Cedar Project will be members.

| 6284.98.499412.15 | 3 | 9/30/2010 |

Big Cedar Timeshare Declaration: that declaration of covenants, conditions and restrictions which has been executed by Borrower, recorded in the real estate records of the county where the Big Cedar Project is located, and has established the Big Cedar Timeshare Program.

Big Cedar Timeshare Program: the program created within the Big Cedar Project under the Big Cedar Timeshare Declaration by which Persons may own Timeshare Interests, enjoy their respective Timeshare Interests on a recurring basis, and share the expenses associated with the operation and management of such program.

Bluegreen: Bluegreen Corporation, a Massachusetts corporation.

Bluegreen Inc.: Bluegreen Vacation Club, Inc., a Florida nonprofit corporation, and its successors and assigns, which was organized and formed to manage and operate the Vacation Club and with respect to which each Purchaser becomes a Class A Member thereof upon the purchase of a Timeshare Interest.

Borrower: the entity named as Borrower in the introductory paragraph of this Agreement and, subject to the restrictions on assignment and transfer contained in the Loan Documents, its successors and assigns.

Borrower Bank Accounts: as defined in Section 7.2(g) hereof.

Borrowing Base: with respect to an Eligible Note Receivable, an amount that is initially equal to 85% of the unpaid principal balance of such Eligible Note Receivable, subject to the step-down provisions in Section 2.7(b) hereof.

Borrowing Base Certificate a certificate prepared by Borrower substantially in the form and substance of Exhibit S, attached hereto.

Borrowing Base Shortfall: at any time, the amount by which the unpaid principal balance of the Loan exceeds the aggregate then applicable Borrowing Base of all Eligible Notes Receivable assigned to Lender.

Business Day: every day on which Lender's offices in the state of Arizona are open to the public for carrying on substantially all its business functions or any day which is not a Saturday or Sunday or a legal holiday under the laws of the State of Missouri, State of Florida or the United States.

Collateral: the Receivables Collateral and the collateral pledged to Lender pursuant to the Security Documents.

Custodial Agent: US Bank National Association or any other Person approved by Lender in writing as Custodial Agent under the Custodial Agreement.

Custodial Agreement: an agreement dated as of the Effective Date to be made among Lender, Borrower and Custodial Agent pursuant to which the Custodial Agent is providing custodial

| 6284.98.499412.15 | 4 | 9/30/2010 |

and other services to the benefit of Lender with respect to Notes Receivable pledged to Lender and other items of Receivables Collateral, as such agreement may from time to time be amended, supplemented or restated.

Debtor Relief Laws: any applicable liquidation, conservatorship, bankruptcy, moratorium, rearrangement, insolvency, reorganization or similar law, proceeding or device providing for the relief of debtors from time to time in effect and generally affecting the rights of creditors.

Default Rate: The lesser of (a) the maximum per annum rate permitted by Applicable Usury Law, and (b) five percent (5%) per annum in excess of the applicable Basic Interest Rate not to exceed a maximum per annum rate of eighteen percent (18%).

Effective Date: the date of this Agreement.

Eligible Note Receivable: a Note Receivable which satisfies the criteria set forth below as of the Effective Date (unless another date is specified, in which case such Note Receivable shall satisfy such criteria as of such other date):

(a) The Note Receivable was created in connection with the credit purchase and sale of a Timeshare Interest (thereby entitling the Purchaser to Owner Beneficiary Rights under the Vacation Club Trust Agreement) pursuant to the applicable Timeshare Program Consumer Documents in the forms attached hereto as Exhibits C-1 and C-2 and under the Timeshare Program Governing Documents approved by Lender.

(b) A down payment by cash, check or credit card has been received from the Purchaser in an amount equal to at least 10% of the original purchase price for the purchased Timeshare Interest, which down payment may (i) in the case of an upgrade sale, be represented in whole or in part by the down payment made and principal payments paid in respect of the related original loan and (ii) in the case of a sampler converted loan, be represented in whole or in part by the principal payments and down payment made on the related sampler loan since its date of origination;

(c) The Note Receivable has an original maturity date of 120 months or less, payable in equal monthly installments of principal and interest;

(d) The annual rate of interest applied to the unpaid principal balance of the applicable Note Receivable is at least equal to a fixed rate of 12.9% per annum and the weighted average interest rate for all of the Notes Receivable collaterally assigned to Lender is at least equal to 15.0% per annum;

(e) Other than as to 620/575 FICO Score Notes Receivable, No Fico Score Notes Receivable and Non-Resident Notes Receivable for which no FICO Score is available, the Purchaser's FICO Score shall not be less than 620;

(f) The minimum weighted average FICO Score of all Eligible Notes Receivable assigned to Lender shall be at least 690. In no event shall a particular Note Receivable qualify as an Eligible Note Receivable in the event the FICO Score of the Purchaser related thereto is less than

| 6284.98.499412.15 | 5 | 9/30/2010 |

575. In calculating the minimum weighted average FICO Score, 620/575 FICO Score Notes Receivable shall be included in such calculation; however, No FICO Score Notes Receivable and Non-Resident Notes Receivable shall not be included;

(g) At the time of assignment, the principal balance outstanding of any Note Receivable assigned to Lender hereunder shall not exceed $35,000, provided, however, that, at any one time 5% or less of the then-outstanding principal balance of all Eligible Notes Receivable assigned to Lender and against which Lender has made or is making an advance may consist of Jumbo Notes Receivable;

(h) At the time of assignment, the principal balance outstanding of all Notes Receivable to any one Purchaser or Affiliates of such Purchaser (and assigned to Lender hereunder) shall not exceed $50,000 in the aggregate;

(i) The Purchaser is not subject to any bankruptcy proceedings, whether voluntary or involuntary;

(j) At the time of the advance against such Note Receivable (or at the time of delivery of such Note Receivable to Lender in the case of a Borrowing Base Shortfall or in the case of an upgrade, pursuant to Sections 2.7(c)and2.7(d), respectively), no installment payment thereunder is more than 30 days contractually past due at the time of the advance against (or at the time of delivery of such Note Receivable to Lender in the case of a Borrowing Base Shortfall or in the case of an upgrade, pursuant to Sections 2.7(c)and2.7(d), respectively of) such Note Receivable and after the advance or such delivery, no installment payment thereunder shall become more than 60 days contractually past due;

(k) Except for the Non-Resident Notes Receivable, the Purchaser is a resident of the United States of America;

(l) The payment to be received is payable in United States dollars;

(m) Reserved;

(n) The Purchaser has no claim of any defense, setoff or counterclaim under the applicable Note Receivable;

(o) The Note Receivable represents the balance of the sales price of a Timeshare Interest entitling a Purchaser to Owner Beneficiary Rights under the Vacation Club Trust Agreement, and the Purchaser of such Timeshare Interest is not, and no payment of a sum due under the Note Receivable has been made by, Borrower, an Affiliate, or an officer, director, agent, employee, principal, broker, creditor (or relative thereof) of Borrower or of any other Person related to or an Affiliate of Borrower or Guarantor;

(p) The Timeshare Program Consumer Documents executed by the applicable Purchaser and all other aspects of the related transaction comply with all applicable Legal Requirements;

| 6284.98.499412.15 | 6 | 9/30/2010 |

(q) Each Note Receivable, and related Timeshare Program Consumer Document (other than, for example, the Purchaser Mortgage) to which the related Purchaser is a party and which requires the signature of such Purchaser has been duly executed by such Purchaser. The Purchaser Mortgage has been executed by the Vacation Club Trustee;

(r) The Unit in which the applicable Timeshare Interest financed by the Note Receivable is situate and to which the Purchaser has access: (i) has been completed in compliance with all Legal Requirements, is currently served by all required utilities, is fully furnished and ready for use, subject to renovations for improvements from time to time in the ordinary course of maintaining the Unit; (ii) is covered by a valid permanent and unconditional certificate of occupancy (or its equivalent) duly issued; (iii) is subject to the terms of the Timeshare Declaration for the applicable Timeshare Project; and (iv) has been developed to the specifications provided for in the applicable Purchase Contract. All furnishings (including appliances) within the Unit(s) to which the Purchaser has access have been or will timely be fully paid for and are free and clear of any lien or other interest by any third party, except for any furniture leases which contain non-disturbance provisions acceptable to Lender;

(s) The Unit in which the applicable Timeshare Interest financed by the Note Receivable is situate has had all taxes, maintenance, special and other assessments, penalties and fees related thereto paid when due;

(t) Any and all applicable rescission periods relating to the purchase by the applicable Purchaser of a Timeshare Interest have expired;

(u) Reserved;

(v) The lien of the Purchaser Mortgage securing the Note Receivable is a perfected first priority purchase money mortgage which has been executed by the Vacation Club Trustee, has been collaterally assigned of record to Lender and is fully insured by a Title Policy in the amount of the Note Receivable, which Title Policy has been endorsed in the manner specified in the Confirmation of Recording;

(w) All representations, warranties and covenants regarding such Note Receivable and the Timeshare Program Consumer Documents related thereto and the matters related thereto as set forth in this Agreement are accurate and Borrower shall have performed all of its obligations with respect thereto;

(x) Lender has a valid, perfected first priority lien against and security interest in the Note Receivable and the related Timeshare Program Consumer Documents and all payments to be made thereunder;

(y) The payment terms of such Note Receivable have not been amended in any way, including any revisions to the payment provisions to cure any defaults or delinquencies or a revision that would constitute a downgrade in the type or quality of the Timeshare Interest purchased by the Purchaser, except in the case of a Permitted Modification;

| 6284.98.499412.15 | 7 | 9/30/2010 |

(z) There has been no increase to the applicable interest rate payable on the Note Receivable as the result of the termination of any automatic payment option, unless all disclosures required under Regulation Z for such increase have been properly given by Borrower to Purchaser;

(aa) The Purchaser is not a "blocked person", as defined in the Patriot Act Certificate and Agreement;

(bb) A No FICO Score Notes Receivable shall be considered Eligible Notes Receivable, provided that: (a) not more than 1% of the principal balance of all Eligible Notes Receivable assigned to Lender and against which Lender has made an advance may be comprised of such No FICO Score Notes Receivable; (b) the Purchaser has made at least eight (8) monthly installment payments thereon; and (c) such Note Receivable is otherwise an Eligible Note Receivable;

(cc) Non-Resident Notes Receivable shall be considered Eligible Notes Receivable, provided that: (a) not more than 10% of the principal balance of all Eligible Notes Receivable assigned to Lender and against which Lender has made an advance may be comprised of such Non-Resident Notes Receivable; (b) the Purchaser has made at least eight (8) monthly installment payments thereon; and (c) such Note Receivable is otherwise an Eligible Note Receivable;

(dd) 620/575 FICO Score Notes Receivable shall be considered Eligible Notes Receivable, provided that: (a) not more than 5% of the principal balance of all Eligible Notes Receivable assigned to Lender and against which Lender has made an advance may be comprised of such 620/575 FICO Score Notes Receivable; (b) the Purchaser has made at least eight (8) monthly installment payments thereon; and (c) such Note Receivable is otherwise an Eligible Note Receivable;

(ee) The Purchaser is personally liable under its Purchase Contract;

(ff) The Purchaser has become an Owner Beneficiary under the Vacation Club Trust Agreement; and

(gg) The purchased Timeshare Interest has been conveyed to the Vacation Club Trustee to be held under the terms of the Vacation Club Trust Agreement.

Environmental Indemnity: a Hazardous Substance Remediation and Indemnification Agreement dated as of the Effective Date executed and delivered by Borrower, Guarantor and any other Persons as Lender may require and containing representations, warranties and covenants regarding the environmental condition of each Timeshare Project and the Collateral, as it may from time to time be amended, supplemented or restated.

Event of Default: as defined in Section 7.1 hereof.

Executive Order: as defined in Section 5.29 hereof.

| 6284.98.499412.15 | 8 | 9/30/2010 |

Existing Indebtedness: collectively, Borrower's existing indebtedness owed to GE Capital and to Residential Funding.

FICO Score: a credit risk score determined by the Fair Isaac Company for a consumer borrower through the analysis of individual credit files. In the event that such credit risk scoring program ceases to exist, Lender may select a successor credit risk scoring program in Lender's discretion.

For Purchasers related to Notes Receivable collaterally assigned to Lender under this Agreement and which were originated on and after December 15, 2008, the FICO Score was determined at the point of sale. In the event that a Purchaser consists of more than one individual (e.g., husband and wife) (a "Purchaser Group"), the FICO Score for such Purchaser Group shall be based on the highest of the FICO Scores for all individuals who have a FICO Score in such Purchaser Group. If all individuals in a Purchaser Group have no FICO Score, then the Purchaser Group shall be considered to have no FICO Score.

Notwithstanding the foregoing, for Purchasers related to Notes Receivable collaterally assigned to Lender under this Agreement and which were originated prior to December 15, 2008, the FICO Score was determined by an Experian Quest project run in May 2010 and was based on the primary obligor in respect of the related Note Receivable.

Foreign Assets Control Regulations: as defined in Section 5.29 hereof.

GAAP: generally accepted accounting principles, applied on a consistent basis, as described in Opinions of the Accounting Principles Board of the American Institute of Certified Public Accountants and/or in statements of the Financial Accounting Standards Board which are applicable in the circumstances as of the date in question.

GE Capital: General Electric Capital Corporation, a Delaware corporation, and its successors and assigns.

Guarantor: Bluegreen, and, subject to any restrictions on assignment and transfer contained in the Loan Documents, its successors and assigns.

Guaranty: a primary, joint and several guaranty agreement made by a Guarantor with respect to all or any part of the Obligations, as it may be from time to time amended, supplemented or restated.

Impositions: all present and future real estate, personal property, excise, privilege, transaction, documentary stamp and other taxes, charges, assessments and levies (including non-governmental assessments and levies such as maintenance charges, association dues and assessments under private covenants, conditions and restrictions) and any interest, costs, fines or penalties with respect thereto, general and special, ordinary and extraordinary, foreseen and unforeseen, of any kind and nature whatsoever which at any time prior to or after the execution hereof may be assessed, levied or imposed. Impositions shall include any and all taxes, withholding obligations, deductions,

| 6284.98.499412.15 | 9 | 9/30/2010 |

license or other fees, assessments, charges, fines, duties, imposts, penalties, or any property, privilege, excise, real estate or other taxes, charges or assessments currently or hereafter levied or imposed by any local, state, or federal governmental authority of the United States upon or in connection with or measured by the Loan Documents, the Collateral, or the principal or accrued interest under the Loan, the Prepayment Premium, Loan Fee, servicing fees, custodial fees, lockbox fees, collection fees or other amounts payable by Borrower to Lender or to Servicing Agent, Backup Servicing Agent, Custodial Agent or Lockbox Agent under the Loan Documents or by Purchasers to Borrower or Lender under the Timeshare Program Consumer Documents.

Incipient Default: an event or condition, the occurrence of which would, with a lapse of time or the giving of notice or both, become an Event of Default.

Indebtedness: for any Person, without duplication, the sum of the following:

(a) indebtedness for borrowed money;

(b) obligations evidenced by bonds, debentures, notes or other similar instruments;

(c) obligations to pay the deferred purchase price of property or services;

(d) obligations as lessee under leases which have been or should be, in accordance with GAAP, recorded as capital leases;

(e) obligations of such Person to purchase securities (or other property) which arise out of or in connection with the sale of the same or substantially similar securities or property;

(f) obligations of such Person to reimburse any bank or other Person in respect of amounts actually paid under a letter of credit or similar instrument;

(g) indebtedness or obligations of others secured by a lien on any asset of such Person, whether or not such indebtedness or obligations are assumed by such Person (to the extent of the value of the asset);

(h) obligations under direct or indirect guaranties in respect of, and obligations (contingent or otherwise) to purchase or otherwise acquire, or otherwise to assure a creditor against loss in respect of, indebtedness or obligations of others of the kinds referred to in clauses (a) though (g) above; and

(i) liabilities in respect to unfunded vested benefits under plans covered by Title IV of the Employee Retirement Income Security Act of 1974, as amended.

Insurance Policies: the insurance policies that Borrower is required to maintain and deliver pursuant to Section 6.1(c) hereof.

| 6284.98.499412.15 | 10 | 9/30/2010 |

Intangible Asset. A nonphysical, noncurrent right that gives Guarantor or any of its subsidiaries an exclusive or preferred position in the marketplace including but not limited to a copyright, patent, trademark, goodwill, organization costs, capitalized advertising cost, computer programs, licenses for any of the preceding, governmental licenses (e.g., broadcasting or the right to sell liquor), leases, franchises, mailing lists, exploration permits, import and export permits, construction permits, and marketing quotas.

Interest Holder Beneficiary: as defined in the Vacation Club Trust Agreement.

Jumbo Notes Receivable: a Note Receivable (a) with a balance that exceeds $35,000 but is less than $50,000; and (b) on which the Purchaser has made at least twelve (12) monthly installment payments thereon.

Legal Requirements: (a) all present and future judicial decisions, statutes, regulations, permits, approvals, registrations and licenses or certificates of any governmental authority (including from any state regulatory agency, department or division in any jurisdiction in which a Timeshare Project is located which has the power and authority to regulate timeshare projects in such jurisdiction) in any way applicable to Borrower or its property, including any applicable state statute or other law in any jurisdiction where a Timeshare Project is located which governs the creation and regulation of condominiums in such jurisdiction, as the same may be amended from time to time, and (b) all contracts or agreements (written or oral) by which Borrower or its property is bound or, if compliance therewith would otherwise be in conflict with any of the Loan Documents, by which Borrower or its property becomes bound with Lender's prior written consent.

Lender: National Bank of Arizona, a national banking association, and its successors and assigns.

Loan: the nonrevolving loan made pursuant to Section 2.1 hereof.

Loan Documents: this Agreement, the Note, any and all Guaranties, any and all Subordination Agreements, the Lockbox Agreement, the Servicing Agreement, the Backup Servicing Agreement, the Custodial Agreement, the Environmental Indemnity, the Security Documents, the Patriot Act Certificate and Agreement, and all other documents now or hereafter executed in connection with the Loan, as they may from time to time be amended, modified, supplemented or otherwise restated.

Loan Fee: a one-time fee in the amount of $300,000.00, which is equal to 1.5% of the Maximum Loan Amount less a credit in the amount of $25,000 which represents a portion of the amounts previously paid by Borrower to Lender as a good faith deposit.

Loan File: with respect to each of the Notes Receivable, all the Timeshare Program Consumer Documents relating thereto, each duly executed, as applicable, plus:

(a) All guaranties, if any, for the payment of the Notes Receivable and

(b) The Title Policy insuring the lien of the Purchaser Mortgage.

| 6284.98.499412.15 | 11 | 9/30/2010 |

Lockbox Agent: Initially, National Bank of Arizona, a national banking association, as the Lockbox Agent, or its successor as Lockbox Agent, under the Lockbox Agreement.

Lockbox Agreement: an agreement dated as of the Effective Date to be made among Lender, Borrower and Lockbox Agent, which provides for Lockbox Agent to collect, through a lockbox, payments under Notes Receivable constituting part of the Receivables Collateral and to remit them to Lender, as it may from time to time be amended, supplemented or restated.

Long Creek Project: that certain vacation ownership project, commonly known as Long Creek Ranch at Big Cedar, located in Ridgedale, Missouri.

Long Creek Timeshare Association: Bluegreen Wilderness Club at Long Creek Ranch Condominium Association, Inc., a Missouri corporation not-for-profit, which is the association established in accordance with the Long Creek Timeshare Declaration to manage the Long Creek Timeshare Program and in which all owners of Timeshare Interests at the Long Creek Project will be members.

Long Creek Timeshare Declaration: that declaration of covenants, conditions and restrictions which has been executed by Borrower, recorded in the real estate records of the county where the Long Creek Project is located, and has established the Long Creek Timeshare Program.

Long Creek Timeshare Management Agreement: the management agreement from time to time entered into between the Long Creek Timeshare Association and the Timeshare Manager for the management of the Long Creek Timeshare Program.

Long Creek Timeshare Program: the program created within the Long Creek Project under the applicable Timeshare Declaration by which Persons may own Timeshare Interests, enjoy their respective Timeshare Interests on a recurring basis, and share the expenses associated with the operation and management of such program.

Material Adverse Change: any material and adverse change in, or a change which has a material adverse effect upon, any of:

(a) the business, properties, operations or condition (financial or otherwise) of Borrower or of Guarantor, which, with the giving of notice or the passage of time, or both, could reasonably be expected to result in either (i) Borrower or Guarantor failing to comply with any of the financial covenants contained in Section 6.1(o) or (ii) Borrower's or Guarantor's inability to perform its or their respective obligations pursuant to the terms of the Loan Documents; or

(b) the legal or financial ability of Borrower or Guarantor to perform its or their respective obligations under the Loan Documents and to avoid any Incipient Default or Event of Default; or

(c) the legality, validity, binding effect or enforceability against Borrower or Guarantor of any Loan Document.

| 6284.98.499412.15 | 12 | 9/30/2010 |

Maturity Date: the first to occur of (a) September 30, 2017 or (b) the date on which the Loan is required to be repaid pursuant to the terms of this Agreement.

Maximum Loan Amount: $20,000,000.00.

Minimum Required Timeshare Approvals: all approvals, registrations and licenses required from governmental authorities in order to sell and finance Timeshare Interests and offer them for sale, including a copy of the registrations/consents to sell, the final subdivision public reports/public offering statements and/or prospectuses (including the Public Report) and approvals thereof required to be issued by or used in the jurisdiction where the applicable Timeshare Project is located and other jurisdictions where Timeshare Interests have been offered for sale or sold.

No FICO Score Notes Receivable: a Note Receivable from a Purchaser who is a resident of the United States of America but for whom no FICO Score is available from Fair Isaac Company.

Non-Resident Notes Receivable: a Note Receivable from a Purchaser who is a resident of Canada.

Note: the Promissory Note to be made and delivered by Borrower to Lender having a face amount equal to $20,000,000, dated as of the Effective Date and made payable to Lender to evidence the Loan, as it may from time to time be amended, supplemented or restated.

Note Receivable: a purchase money promissory note which has arisen out of a sale of a Timeshare Interest by Borrower to a Purchaser, is made payable by such Purchaser solely to Borrower, and is secured by a Purchaser Mortgage.

Notice to Purchasers: as defined in Section 3.2(c) hereof.

Obligations: all obligations, agreements, duties, covenants and conditions of Borrower to Lender which Borrower is now or hereafter required to Perform under the Loan Documents. Without in any way limiting the foregoing, the term Obligations includes (i) any and all obligations of Borrower to Lender with respect to the Loan and (ii) any and all obligations of Borrower to Lender arising under or in connection with any transaction hereafter entered into between Borrower and Lender which is a rate swap, basis swap, forward rate transaction, commodity swap, commodity option, equity or equity index swap, equity or equity index option, bond option, interest rate option, foreign exchange transaction, cap transaction, floor transaction, collar transaction, forward transaction, currency swap transaction, cross-currency rate swap transaction, currency option or any other similar transaction (including any option with respect to any of these transactions) or any combination thereof, whether linked to one or more interest rates, foreign currencies, commodity prices, equity prices or other financial measures, as applicable.

Opening Prepayment Date: the date which occurs one year following the Advance.

Operating Contracts: as defined in Section 5.19 hereof.

| 6284.98.499412.15 | 13 | 9/30/2010 |

Owner Beneficiary: the Purchaser under the Purchase Contract who purchases a Timeshare Interest in a Timeshare Project pursuant to such Purchase Contract and is thereby designated an Owner Beneficiary under the terms of the Vacation Club Trust Agreement and entitled to exercise Owner Beneficiary Rights with appurtenant Vacation Points.

Owner Beneficiary Rights: the beneficial rights provided to a Purchaser under the Vacation Club Trust Agreement, which rights shall specifically include the rights of performance provided to Owner Beneficiaries by the Vacation Club Trustee under the Vacation Club Trust Agreement and related documents, which Owner Beneficiary Rights shall specifically include as an appurtenance thereto Vacation Points.

Participant(s): as defined in Section 9.8 hereof.

Participation Agreement: as defined in Section 9.8 hereof.

Patriot Act Certificate and Agreement: the Patriot Act Certificate and Agreement by and among Borrower, Guarantor and Lender, dated of even date herewith.

Performance or Perform: full, timely and faithful payment and performance.

Permitted Debt: the meaning given to it in Section 6.2(b) hereof.

Permitted Encumbrances: with respect to each Timeshare Project (i) real estate taxes and assessments not yet due and payable, (ii) exceptions to title which are approved in writing by Lender (including such easements, dedications and covenants which Lender consents to in writing after the date of this Agreement) and (iii) those exceptions listed on the attached Exhibits B-1 and B-2.

Permitted Modification means an amendment or other modification to the terms and conditions of a Note Receivable (a) as a result of the Servicemembers Civil Relief Act, (b) with respect to a one percent (1%) increase or decrease in the related Note Receivable’s interest rate related to a voluntary or involuntary election to commence or cease using an automatic payment option, as applicable, or (c) in connection with an Upgraded Note Receivable.

Person: an individual, general partnership, limited partnership, corporation (including a business trust), limited liability company, joint stock company, trust, unincorporated association, joint venture or other entity, or a government or any political subdivision or agency thereof.

Prepayment Premium: an amount to be paid pursuant to Section 2.8 upon a prepayment of the Loan.

Public Report: the approved public report, permit or public offering statement for the Vacation Club and for the applicable Timeshare Project and the approvals or registrations for such Timeshare Project, in the jurisdiction in which such Timeshare Project is located and in each other jurisdiction in which sales of Timeshare Interests are made or such Timeshare Project is otherwise required to be registered.

| 6284.98.499412.15 | 14 | 9/30/2010 |

Purchase Contract: a purchase contract by and between a Purchaser, Bluegreen Vacations Unlimited Inc. (as "Club Developer"), and Borrower (as "Facilitator") pursuant to which Borrower has agreed to sell and a Purchaser has agreed to purchase a Timeshare Interest in connection with such Purchaser's designation as an Owner Beneficiary under the Vacation Club Trust Agreement, commonly known as a Bluegreen Owner Beneficiary Agreement.

Purchaser: a person who has executed a Purchase Contract as a purchaser.

Purchaser Mortgage: the purchase money deed of trust given to secure a Note Receivable.

Receivables Collateral: (a) the Notes Receivable which are now or hereafter assigned, endorsed or delivered to Lender pursuant to this Agreement or against which an Advance has been made, all payments due to become due thereunder, in whatever form, including cash, checks, notes, drafts and other instruments for the payment of money; (b) all rights under all documents evidencing, securing, guaranteeing or otherwise pertaining to such Notes Receivable, including the Owner Beneficiary Rights under the Vacation Club Trust Agreement and pertaining to the purchased Timeshare Interest, Title Policies, Purchaser Mortgages and Purchase Contracts including all rights of foreclosure, termination, dispossession and repossession thereunder, all documents, instruments, contracts, liens and security interests related to such Notes Receivable, all collateral and other security securing the obligations of any Person under such Note Receivable and all rights and remedies of whatever kind or nature Borrower may hold or acquire for purpose of securing or enforcing such Notes Receivable and related Timeshare Program Consumer Documents (expressly excluding any rights as developer or declarant under the applicable Timeshare Declaration, the Timeshare Program Consumer Documents or the Timeshare Program Governing Documents); (c) all deposits, accounts, instruments, contract rights, general intangibles, chattel paper, documents, instruments, pre-authorization account-debit agreements, claims and judgments pertaining to or arising out of any of the foregoing; (d) all proceeds, property, property rights, privileges and other benefits arising out of the enforcement of such Notes Receivable or the related Purchaser Mortgages, Purchase Contracts and other Timeshare Program Consumer Documents, including all property returned by and reclaimed by or repossessed from Purchasers thereunder; (e) any lockbox agreements and the funds contained in any accounts established pursuant thereto, relating to such Notes Receivable, except amounts deposited in error; (f) all rights, now or hereafter existing under any payment authorization agreements signed or delivered by or on behalf of a Purchaser under a Note Receivable described in clause (a) above and all accounts and other proceeds derived therefrom; (g) any rights inuring to Borrower as an "institutional mortgagee," an "institutional lender" or a "mortgagee" as provided in the Timeshare Declaration in connection with any Notes Receivable described in clause (a) above and the related Purchaser Mortgages pledged to Lender; (h) all rights of the Borrower to exercise, at any meeting of the Timeshare Association, the voting rights of a Purchaser whose Note Receivable has been assigned or delivered to Lender; (i) all of Borrower's rights to any insurance policies related to a Timeshare Project, to the extent pertaining to a Note Receivable assigned to Lender or to the Timeshare Interest securing such Note Receivable; (j) all computer software, files, books and records of Borrower pertaining to any of the foregoing clauses (a) through (i), subject to any licensing limitations; (k) all rights of the Borrower as an Interest Holder Beneficiary as to the foregoing; (l) the cash and non-cash proceeds of all of the foregoing, including (whether or not acquired with cash proceeds), all accounts, chattel paper, contract rights, documents, general intangibles, instruments, fixtures, and equipment, inventory and

| 6284.98.499412.15 | 15 | 9/30/2010 |

other goods; and (m) all extensions, additions, improvements, betterments, renewals, substitutions, amendments of any of the foregoing and the products and proceeds thereof.

Reservation System: the method, arrangement or procedure including any computer network and software employed for the purpose of enabling or facilitating the operation of the system which enables each Purchaser to utilize such Purchaser's right to reserve a use period in a Timeshare Project in accordance with the provisions and conditions set forth therein.

Reservation System License: a non-exclusive license granted by Bluegreen Resorts Management, Inc. to Lender as of the date of this Agreement entitling Lender to the non-exclusive license to use the Reservation System upon the terms and conditions described therein.

Residential Funding: Residential Funding Corporation, a Delaware corporation, and its successors and assigns.

Resolution: a resolution of a corporation certified as true and correct by an authorized officer of such corporation, a certificate signed by such members, the manager or managers and/or the authorized officers of a limited liability company as may be required by applicable law and by the Articles of Organization of such limited liability company, or a partnership certificate signed by all of the general partners of such partnership and such other partners whose approval is required.

Sampler Loan means a loan made to a purchaser pursuant to the terms of a Sampler Program Agreement.

Sampler Program Agreement means a Bluegreen Vacation Club Sampler Program Agreement, pursuant to which a purchaser thereunder obtains those certain benefits set forth therein which comprise the “Sampler Membership” and, subject to the terms and conditions thereof, has the opportunity to convert such Sampler Membership into full ownership in the Vacation Club.

Security Documents: the Assignments, this Agreement, the Reservation System License, and all other documents now or hereafter securing the Obligations, as they may be from time to time be amended, supplemented or restated.

Servicing Agent: Bluegreen, as the Servicing Agent, or its successor as Servicing Agent, under the Servicing Agreement.

Servicing Agreement: the agreement dated as of the Effective Date among Lender, Borrower and Servicing Agent which provides for Servicing Agent to perform for the benefit of Lender accounting, reporting and other servicing functions with respect to the Receivables Collateral, as it may from time to time be amended, supplemented or restated.

Subordination Agreement: such subordination agreement from a Subordinator subordinating Indebtedness owed to it by Borrower to all or a part of the Obligations, whether delivered on or before the Effective Date or thereafter, as the same may from time to time be amended, supplemented or restated.

| 6284.98.499412.15 | 16 | 9/30/2010 |

Subordinated Indebtedness. Indebtedness represented by Guarantor's junior subordinated debentures or such other Indebtedness incurred by Guarantor which is treated as subordinated indebtedness in accordance with GAAP.

Subordinator: at any time, a Person (including Big Cedar, L.L.C., a Missouri limited liability company, Bluegreen Vacations Unlimited, Inc., a Florida corporation and Guarantor) then required under the terms of this Agreement to subordinate Indebtedness owed to it by Borrower or a Guarantor to all or any part of the Obligations in accordance with the terms of a Subordination Agreement.

Tangible Net Worth: On a consolidated basis for Guarantor and its subsidiaries, at any date, (i) the sum of (a) capital stock taken at par or stated value plus (b) capital of Guarantor in excess of par or stated value relating to capital stock plus (c) retained earnings (or minus any retained earning deficit) of Guarantor plus (d) other comprehensive income plus (e) non-controlling interest plus (f) Subordinated Indebtedness plus (g) an amount not in excess of $600,000,000 of non-recourse receivables-backed notes payable as reported on the consolidated balance sheet of Guarantor, minus (ii) the sum of Intangible Assets, treasury stock, capital stock subscribed for and unissued and other contra-equity accounts, all determined and in accordance with GAAP.

Term: the duration of this Agreement, commencing on the Effective Date and ending when all of the payment Obligations have been Performed.

Timeshare Association: individually and collectively, as the context requires, the Big Cedar Timeshare Association and the Long Creek Timeshare Association.

Timeshare Declaration: individually and collectively, as the context requires, the Big Cedar Timeshare Declaration and the Long Creek Timeshare Declaration.

Timeshare Interest: a timeshare fee simple estate in the relevant Timeshare Project as established and provided in the applicable Timeshare Declaration, which consists of an undivided interest as tenant in common with other owners in the relevant Timeshare Program, including the appurtenant exclusive right to occupy and use a Unit for one or more periods per calendar year or per second calendar year of one "Unit Week", and subject to the then existing reservation rules and regulations of the applicable Timeshare Association, together with all appurtenant rights and interests, including without limitation, the right to make reservations pursuant to the reservation system pertaining thereto, and appurtenant use rights in and to common elements at the relevant Timeshare Project, easements, licenses, access and use rights in and to all of the facilities at the relevant Timeshare Project, all of which the Purchaser thereof directs Borrower to immediately convey to the Vacation Club Trustee and which the Vacation Club Trustee holds pursuant to the provisions of the Vacation Club Trust Agreement, at which time, the Purchaser becomes a member and Owner Beneficiary of the Vacation Club, is identified in a schedule attached to the Vacation Club Trust Agreement, as amended from time to time to include new Owner Beneficiaries, and is entitled to certain Owner Beneficiary Rights under the Vacation Club Trust Agreement and a specific number of Vacation Points corresponding to such rights, which Vacation Points may be used by the Owner Beneficiary for lodging for varying lengths of time at various Vacation Club resorts.

| 6284.98.499412.15 | 17 | 9/30/2010 |

Timeshare Management Agreement: individually and collectively, as the context requires, the Big Cedar Timeshare Management Agreement and the Long Creek Timeshare Management Agreement.

Timeshare Manager: individually and collectively, as the context requires, the Person from time to time employed by (i) the Big Cedar Timeshare Association to manage the Big Cedar Timeshare Program; and (ii) the Long Creek Timeshare Association to manage the Long Creek Timeshare Program, in each case, as of the Effective Date, being Bluegreen Resorts Management, Inc., a Delaware corporation.

Timeshare Program: individually and collectively, as the context requires, the Big Cedar Timeshare Program and the Long Creek Timeshare Program.

Timeshare Program Consumer Documents: the following documents used by Borrower in connection with the credit sale of Timeshare Interests at a Timeshare Project:

|

|

(a) |

Note Receivable (original duly endorsed to Lender's order with recourse pursuant to the form of endorsement attached hereto as Exhibit J); |

|

(b) |

Deed of Trust (recorded original, if available, otherwise recorded Deed of Trust to be provided promptly after receipt); |

|

|

(c) |

General Warranty Deed (original or copy); |

|

|

(d) |

Service Disclosure Statement (original or copy); |

|

|

(e) |

Good Faith Estimate of Settlement Charges (original or copy); |

|

|

(f) |

HUD-1 Settlement Statement (original or copy); |

|

|

(g) |

Truth-in-Lending Disclosure Statement (original or copy); |

|

|

(h) |

Bluegreen Owner Beneficiary Agreement (original or copy); |

|

|

|

(1) |

California Addendum to Owner Beneficiary Agreement (if Purchaser is a resident of California) (original or copy), if any; |

|

(2) |

Nebraska Addendum to Owner Beneficiary Agreement (if Purchaser is a resident of Nebraska) (original or copy), if any; |

|

(i) |

Assent to Execution of Documents (original or copy), if applicable; |

|

|

(j) |

Certificate of Purchase of Owner Beneficiary Rights (if such purchase occurred after January 31, 2006) (original or copy); |

|

|

(k) |

Owner Confirmation Interview (or Biennial Owner Confirmation Interview) (original or copy); |

| 6284.98.499412.15 | 18 | 9/30/2010 |

|

(l) |

Receipt for Timeshare Documents (original or copy); |

|

|

(m) |

Compliance Agreement (original or copy); |

|

|

(n) |

Credit Application (original or copy); |

|

|

(o) |

Evidence of FICO Score (original or copy) in the form set forth in Exhibit E to the Custodial Agreement; |

|

|

(p) |

Illinois Public Offering Statement receipt (original or copy), if any; and |

|

|

(q) |

Iowa Public Offering Statement receipt (original or copy), if any. |

A sample form of each Timeshare Program Consumer Document in connection with the credit sale of Timeshare Interests at a Timeshare Project is attached hereto as Exhibits C-1 and C-2;

Timeshare Program Governing Documents: the Public Report, the Timeshare Declaration, any condominium declarations pertaining to a Timeshare Project, the Articles of Organization and bylaws for each Timeshare Association and for Bluegreen Inc., any and all rules and regulations from time to time adopted by each Timeshare Association and Bluegreen Inc., the Timeshare Management Agreement, the Vacation Club Trust Agreement, the Vacation Club Management Agreement, any subsidy agreement by which Borrower is obligated to subsidize shortfalls in the budget of the Timeshare Program in lieu of paying assessments, any affiliation agreements, any amenity agreements and any other existing and future contracts, agreements or other documents relating to the establishment, use, occupancy, operation, management, marketing, sale and maintenance of a Timeshare Project.

Timeshare Project: individually and collectively, as the context requires, the Big Cedar Project and the Long Creek Project.

Title Insurer: a title company which is acceptable to Lender and issues a Title Policy, including without limitation, First American Title Insurance Company.

Title Policy: in connection with each Purchaser Mortgage which is a part of the Receivables Collateral, an ALTA lender's policy of title insurance in an amount not less than the Borrowing Base of the Note Receivable secured by the Purchaser Mortgage, insuring Borrower's and its successors' and assigns' interest in the Purchaser Mortgage as a perfected, direct, first and exclusive lien on the Timeshare Interest(s) encumbered thereby, subject only to the Permitted Encumbrances, issued by Title Insurer and in form and substance attached hereto as Exhibits D-1 and D-2.

Trading With The Enemy Act: as defined in Section 5.29 hereof.

Unit: a dwelling unit in a Timeshare Project.

Upgraded Note Receivable: a new Eligible Note Receivable made by the Purchaser under an existing Note Receivable (i) who has elected to terminate such Purchaser’s interest in an existing Timeshare Interest and related Owner Beneficiary Rights and Vacation Points (if any) in exchange

| 6284.98.499412.15 | 19 | 9/30/2010 |

for purchasing an upgraded Timeshare Interest of higher value than the existing Timeshare Interest and related Owner Beneficiary Rights and Vacation Points (if any) and (ii) whereby the Borrower releases the Purchaser from Purchaser’s obligations in respect of the existing Timeshare Interest and all related Owner Beneficiary Rights and Vacation Points (if any) in exchange for receiving (in substantially all cases) the new Eligible Note Receivable from the Purchaser secured by the upgraded Timeshare Interest and related Owner Beneficiary Rights and Vacation Points (if any).

Vacation Club: defined in the Background Statements.

Vacation Club Management Agreement: the management agreement from time to time entered into between the Vacation Club Trustee and the Vacation Club Manager for the management of the Vacation Club.

Vacation Club Manager: Bluegreen Resorts Management, Inc., a Delaware corporation, and such other Person from time to time employed by the Vacation Club Trustee to manage the Vacation Club.

Vacation Club Trust: the trust established pursuant to the Vacation Club Trust Agreement and in accordance with F.S. Ch. 721 (the Florida Vacation Plans and Timesharing Act).

Vacation Club Trust Agreement: means, collectively, that certain Bluegreen Vacation Club Amended and Restated Trust Agreement, dated as of May 18, 1994, by and among Bluegreen Vacations Unlimited, Inc., the Vacation Club Trustee, Bluegreen Resorts Management, Inc. and Bluegreen Vacation Club, Inc., as amended, restated or otherwise modified from time to time, together with all other agreements, documents and instruments governing the operation of the Vacation Club.

Vacation Club Trustee: Vacation Trust, Inc., a Florida corporation, in its capacity as trustee under the Vacation Club Trust Agreement, and its permitted successors and assigns.

Vacation Points: the value placed upon a nightly or weekly occupancy of a timeshare unit pursuant to the terms of the Purchase Contract, which value may be set forth within the Demand Balancing Standard (as defined in the Vacation Club Trust Agreement).

Ward Financial: Ward Financial Company, a Pennsylvania corporation.

1.2 Other Definitional Provisions.

Capitalized terms used in this Agreement or in any Loan Document which are defined herein shall have the meanings set forth herein. Capitalized terms defined in the Preliminary Statements or elsewhere in this Agreement shall have the meanings assigned to them at the place first defined. As used herein, the term "this Agreement" shall include all exhibits, schedules and addenda attached hereto, all of which shall be deemed incorporated herein and made a part hereof. The definitions include the singular and plural forms of the terms defined. Any defined term which relates to a document, instrument or agreement shall include within its definition any amendments, modifications, supplements, renewals, restatements, extensions, or substitutions which may have

| 6284.98.499412.15 | 20 | 9/30/2010 |

been heretofore or may be hereafter executed in accordance with the terms hereof and thereof. Unless otherwise specified, references to particular section numbers shall mean the respective sections of this Agreement.