Attached files

Table of Contents

As filed with the Securities and Exchange Commission on November 9, 2010

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

Express, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 5600 | 26-2828128 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

1 Express Drive

Columbus, Ohio 43230

(614) 474-4001

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Matthew C. Moellering

Executive Vice President, Chief Administrative Officer, Chief Financial Officer, Treasurer and Secretary

Express, Inc.

1 Express Drive

Columbus, Ohio 43230

(614) 474-4001

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies of all communications, including communications sent to agent for service, should be sent to:

| Robert M. Hayward, P.C. William R. Burke Kirkland & Ellis LLP 300 North LaSalle Chicago, Illinois 60654 (312) 862-2000 |

Marc D. Jaffe Latham & Watkins LLP 885 Third Avenue Suite 1000 New York, New York 10022 (212) 906-1200 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box: ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ¨ | Accelerated filer ¨ | Non-accelerated filer x | Smaller reporting company ¨ | |||

| (Do not check if a smaller reporting company) | ||||||

CALCULATION OF REGISTRATION FEE

| Title of Each Class of Securities to be Registered |

Amount to be Registered(1) |

Proposed Maximum Offering Price Per Share(2) |

Proposed Maximum Aggregate Offering Price(1)(2) |

Amount of Registration Fee(1) | ||||

| Common Stock, $0.01 par value per share |

13,225,000 |

$14.01 | $185,282,250 | $13,211 | ||||

| (1) | Includes shares of common stock that the underwriters may purchase from the selling stockholders pursuant to the option to purchase additional shares. |

| (2) | Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(c) under the Securities Act of 1933, as amended, on the basis of the average high and low prices of the Registrant’s common stock on November 3, 2010, as reported by the New York Stock Exchange. |

| The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine. |

Table of Contents

The information in this prospectus is not complete and may be changed. The selling stockholders may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion.

Preliminary Prospectus dated November 9, 2010.

PROSPECTUS

11,500,000 Shares

Express, Inc.

Common Stock

The selling stockholders identified in this prospectus are offering 11,500,000 shares of our common stock. We will not receive any proceeds from the sale of shares offered by the selling stockholders.

Our common stock is traded on the New York Stock Exchange under the symbol “EXPR.” The last reported sale price of our common stock on the New York Stock Exchange on November 8, 2010 was $14.57 per share.

Investing in the common stock involves risks that are described in the “Risk Factors” section beginning on page 12 of this prospectus.

| Per Share |

Total | |||

| Public offering price |

$ | $ | ||

| Underwriting discount |

$ | $ | ||

| Proceeds, before expenses, to the selling stockholders |

$ | $ |

The underwriters have the option to purchase up to 1,725,000 additional shares from the selling stockholders at the public offering price less the underwriting discount for 30 days after the date of this prospectus to cover any overallotments, if any.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

The shares will be ready for delivery on or about , 2010.

| BofA Merrill Lynch | Morgan Stanley |

| Goldman, Sachs & Co.

| ||||

| Piper Jaffray | Stifel Nicolaus Weisel | UBS Investment Bank | ||

The date of this prospectus is , 2010.

Table of Contents

| Page | ||||

| ii | ||||

| iii | ||||

| iii | ||||

| 1 | ||||

| 12 | ||||

| 28 | ||||

| 30 | ||||

| 31 | ||||

| 32 | ||||

| 33 | ||||

| Selected Historical Consolidated Financial and Operating Data |

34 | |||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

36 | |||

| 67 | ||||

| 79 | ||||

| 86 | ||||

| 109 | ||||

| 111 | ||||

| 121 | ||||

| 126 | ||||

| 130 | ||||

| Material U.S. Federal Income Tax Considerations for Non-U.S. Holders |

132 | |||

| 135 | ||||

| 141 | ||||

| 142 | ||||

| 143 | ||||

| F-1 | ||||

No dealer, salesperson or other person is authorized to give any information or to represent anything not contained in this prospectus. You must not rely on any unauthorized information or representations. This prospectus is an offer to sell only the shares offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus is current only as of its date.

i

Table of Contents

Unless otherwise indicated, all of the financial data presented in this prospectus is presented on a consolidated basis for Express, Inc. and its subsidiaries.

We use a 52-53 week fiscal year ending on the Saturday closest to January 31. Fiscal years are identified in this prospectus according to the calendar year prior to the calendar year in which they end. For example, references to “2010,” “fiscal 2010,” “fiscal year 2010” or similar references refer to the fiscal year ending January 29, 2011 and references to “2009,” “fiscal 2009,” “fiscal year 2009” or similar references refer to the fiscal year ended January 30, 2010. References to the “second quarter of 2010” and the “second quarter of 2009” refer to the thirteen weeks ended July 31, 2010 and August 1, 2009, respectively.

On July 6, 2007, investment funds managed by Golden Gate Private Equity, Inc. (“Golden Gate”) acquired 75% of the equity interests in our business from Limited Brands, Inc. (“Limited Brands”). As a result of the acquisition (the “Golden Gate Acquisition”), a new basis of accounting was created beginning July 7, 2007. The periods prior to the Golden Gate Acquisition are referred to as the “Predecessor” periods and the periods after the Golden Gate Acquisition are referred to as the “Successor” periods in this prospectus. The Predecessor periods presented in this prospectus include the period from February 4, 2007 through July 6, 2007, reflecting 22 weeks of operations, and the Successor periods presented in this prospectus include the period from July 7, 2007 through February 2, 2008, reflecting 30 weeks of operations. Due to the Golden Gate Acquisition, the financial statements for all Successor periods are not comparable to those of the Predecessor periods presented in this prospectus. Prior to the Golden Gate Acquisition, our consolidated financial statements were prepared on a carve-out basis from Limited Brands. The carve-out consolidated financial statements include allocations of certain costs of Limited Brands. In the Successor periods we no longer incur these charges, but do incur certain expenses as a standalone company for similar functions, including for certain support services provided by Limited Brands under the Limited Brands Transition Services Agreements, which are discussed further in the section entitled “Certain Relationships and Related Party Transactions.” These allocated costs were based upon various assumptions and estimates and actual results may differ from these allocated costs, assumptions and estimates. Accordingly, the carve-out consolidated financial statements may not provide a comparable presentation of our financial position or results of operations as if we had operated as a standalone entity during the Predecessor periods. See “Risk Factors—Risks Related to Our Business—We have a limited operating history as a standalone company, which may make it difficult to compare our current operating results to prior periods.”

In the section entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” we have presented pro forma consolidated financial data for the fiscal year ended February 2, 2008, which gives effect to the Golden Gate Acquisition as if such transaction had occurred on February 4, 2007, in addition to the Predecessor and Successor periods. We believe that presenting the discussion and analysis of the results of operations in this manner promotes the overall usefulness of the comparison given the complexities involved with comparing two significantly different periods.

On May 12, 2010, in connection with our initial public offering (the “IPO”), we converted from a Delaware limited liability company into a Delaware corporation and changed our name from Express Parent LLC (“Express Parent”) to Express, Inc. See “Certain Relationships and Related Party Transactions—Reorganization as a Corporation.” In connection with this conversion, all of our equity interests, which consisted of Class L, Class A and Class C units, were converted into shares of our common stock at a ratio of 0.702, 0.649, and 0.442, respectively. All share and per share information in the accompanying consolidated financial statements and the related notes has been retrospectively recast to reflect this conversion. Throughout this prospectus, the term “Express Parent” refers, prior to the Reorganization, to Express Parent LLC and, after the Reorganization, to Express, Inc. The term “Express Topco” refers to Express Topco LLC and “Express Holding” refers to Express Holding, LLC (each of which is one of our wholly-owned subsidiaries) and in each case not to any of their subsidiaries.

ii

Table of Contents

Prior to our registration statement on Form S-1 (File No. 333-164906) for the IPO being declared effective on May 12, 2010, (i) Express Investment Corp. (“EIC”), the holding company that held 67.3% of our equity interests on behalf of certain investment funds managed by Golden Gate and (ii) the holding companies that directly or indirectly held 6.1% of our equity interests on behalf of certain members of management (the “Management Holding Companies”) merged with and into us. EIC did not have any independent operations or any significant assets or liabilities and did not comprise a business. Accordingly, this legal merger represented in substance a reorganization and transfer of EIC’s income tax payables or receivables between entities under common control. Accordingly, for financial reporting purposes, the transaction was reflected as a contribution of certain of EIC’s income tax payables or receivables to us, in exchange for a net receivable or payable of equal amount with an affiliate of Golden Gate. In this prospectus, we refer to all of these events that occurred in connection with the IPO as the “Reorganization.” See “Certain Relationships and Related Party Transactions—Reorganization as a Corporation.”

We obtained the industry, market and competitive position data throughout this prospectus from our own internal estimates and research as well as from industry and general publications and research, surveys and studies conducted by third parties. Industry publications, studies and surveys generally state that they have been obtained from sources believed to be reliable, although they do not guarantee the accuracy or completeness of such information. While we believe that each of these studies and publications is reliable, we have not independently verified market and industry data from third-party sources. While we believe our internal company research is reliable and the definitions of our market and industry are appropriate, neither such research nor these definitions have been verified by any independent source. Certain industry, market and competitive position data presented in this prospectus was obtained from a survey conducted by e-Rewards, Inc. in April 2007 that was commissioned by Golden Gate prior to the Golden Gate Acquisition in connection with their evaluation of our business. We refer to this survey throughout this prospectus as the “2007 Market Survey.”

This prospectus includes our trademarks such as “Express,” which are protected under applicable intellectual property laws and are the property of Express, Inc. or its subsidiaries. This prospectus also contains trademarks, service marks, trade names and copyrights of other companies, which are the property of their respective owners. Solely for convenience, trademarks and trade names referred to in this prospectus may appear without the ® or TM symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the right of the applicable licensor to these trademarks and trade names.

iii

Table of Contents

This summary highlights information contained elsewhere in this prospectus. This summary does not contain all of the information that you should consider in making your investment decision. You should read the following summary together with the entire prospectus, including the more detailed information regarding our company, the common stock being sold in this offering and our consolidated financial statements and the related notes included elsewhere in this prospectus. You should carefully consider, among other things, our consolidated financial statements and the related notes included elsewhere in this prospectus and the matters discussed in the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in this prospectus before deciding to invest in our common stock. Some of the statements in this prospectus constitute forward-looking statements. See “Forward-Looking Statements.”

Except where the context otherwise requires or where otherwise indicated, the terms “Express,” “we,” “us,” “our,” “our company” and “our business” refer to Express, Inc. together with its predecessors and its consolidated subsidiaries as a combined entity.

Company Overview

Express is the sixth largest specialty retail apparel brand in the United States. With 30 years of experience offering a distinct combination of style and quality at an attractive value, we believe we are a core shopping destination for our customers and that we have developed strong brand awareness and credibility with them. We target an attractive and growing demographic of women and men between 20 and 30 years old. We offer our customers an edited assortment of fashionable apparel and accessories to address fashion needs across multiple aspects of their lifestyles, including work, casual and going-out occasions. Since we became an independent company in 2007, we have made several significant changes to our business model, including completing the conversion of our stores to a dual-gender format, re-designing our go-to-market strategy and launching our e-commerce platform, all of which we believe have improved our operating profits and positioned us well for future growth and profitability.

As of July 31, 2010, we operated 577 stores. Our stores are located primarily in high-traffic shopping malls, lifestyle centers and street locations across the United States and in Puerto Rico, and average approximately 8,700 square feet. We also sell our products through our e-commerce website, express.com. Our stores and website are designed to create an exciting shopping environment that reflects the sexy, sophisticated and social brand image that we seek to project. Our product offering includes both women’s and men’s apparel and accessories, of which women’s represented 66% of our net sales and men’s represented 34% of our net sales for the twenty-six weeks ended July 31, 2010. Our product assortment is a mix of core styles balanced with the latest fashions, a combination we believe our customers look for and value in our brand. For fiscal 2009, we generated net sales, net income and Adjusted EBITDA of $1,721.1, $75.3 and $229.8 million, respectively. Our Adjusted EBITDA increased 168% from $85.9 million in fiscal 2006 to $229.8 million in fiscal 2009. For the twenty-six weeks ended July 31, 2010, we generated net sales, net income and Adjusted EBITDA of $833.7, $52.7 and $122.2 million, respectively. Our Adjusted EBITDA increased 55% from $78.7 million in the twenty-six weeks ended August 1, 2009 to $122.2 million in the twenty-six weeks ended July 31, 2010. See “—Summary Historical Consolidated Financial and Operating Data” for a discussion of Adjusted EBITDA, an accompanying presentation of the most directly comparable GAAP financial measure and a reconciliation of the differences between Adjusted EBITDA and the most directly comparable GAAP financial measure, net income.

1

Table of Contents

Company History and Recent Accomplishments

We opened our first store in 1980, in Chicago, Illinois as a division of Limited Brands, Inc., and launched our men’s apparel line in 1987, which we rebranded under the name Structure in 1989. In the mid 1990s, we experienced a period of rapid expansion, resulting in our operation of over 1,000 stores by 2000, including in many cases a women’s and men’s store in the same shopping center. In 2001, we began to consolidate our separate women’s and men’s stores into combined dual-gender stores under the Express brand. In 2007, we began to operate as a standalone company and have since implemented and completed numerous initiatives to strengthen our business, including:

| • | Transitioned to Standalone Company. As a standalone company, we have made a number of changes to improve our organization, reinvest in our business and align incentives with our performance. Among these, we rehired Michael Weiss as our President and Chief Executive Officer in July 2007. We have also worked to build depth in our organization, including strengthening our merchandising and design teams and improving the processes by which we make product decisions. |

| • | Completed Dual-Gender Store Conversion. During the last nine years, we have significantly improved the efficiency of our store base by consolidating separate women’s and men’s stores that were located in the same shopping center into combined dual-gender stores. Over this time period, this conversion has allowed us to reduce our total gross square footage by approximately 30%. We believe our converted store model has resulted in higher store productivity and lower store expenses, leading to increased profitability. |

| • | Redesigned Go-To-Market Strategy. Since 2007, we have revised the process by which we design, source and merchandise our product assortment. We now design a greater number of styles, colors and fits of key items for each season and test approximately three-quarters of our product early in each season at a select group of stores before ordering for our broader store base. We believe the results of these changes are higher product margins from reduced markdowns, lower inventory risk and a more relevant product offering for our customers. |

| • | Reinvested in Our Business to Support Growth. Over the past three years, we have expanded several of our key functional departments and shifted our marketing focus to better position our company for long-term growth. In addition, we have placed increased focus on long-term brand-building initiatives. |

| • | Launched Express.com. We launched our e-commerce website, express.com, in July 2008, offering our customers a new channel to access our products. We believe our e-commerce platform has improved the efficiency of our business by allowing us to monitor real-time customer feedback, enhancing our product testing capabilities, expanding our advertising reach and providing us with a merchandise clearance channel. |

Competitive Strengths

We attribute our success to the following competitive strengths:

Established Lifestyle Brand. With 30 years of brand heritage, we have developed a distinct and widely recognized brand that we believe fosters loyalty and credibility among our customers who look to us to provide the latest fashions and quality at an attractive value. We are the sixth largest specialty retail apparel brand in the United States in terms of 2009 sales and we believe we are the largest specialty lifestyle brand focused on the 20 to 30 year old customer demographic.

Attractive Market and Customer Demographic. According to The NPD Group (“NPD Group”), in the twelve months ended September 30, 2010, our brand represented approximately 5% of the $19 billion specialty apparel market for 18 to 30 year old women and men in the United States. Our customer demographic is a growing segment of the United States population, and we believe that the Express brand appeals to a particularly attractive subset of this group.

2

Table of Contents

Sophisticated Design, Sourcing and Merchandising Model. We believe that we have an efficient, diversified and flexible supply chain that allows us to quickly identify and respond to trends and to bring a tested assortment of products to our stores. We believe our model allows us to better meet customer needs and enables us to reduce inventory risk and improve product margins from reduced markdowns. Our product testing processes early in the season allow us to test approximately three-quarters of our merchandise in select stores before placing orders for our broader store base. In addition, we assess sales data and new product development on a weekly basis in order to make in-season inventory adjustments where possible and to allow us to respond to the latest trends.

Optimized Real Estate Portfolio. During the last nine years we have completed the conversion of our store base into dual-gender stores from separate women’s and men’s stores, which has reduced our total square footage by approximately 30%. We believe that over this period, this conversion has brought our average store size in-line with other specialty retailers, has contributed to improved per store sales and profitability and has positioned us to drive improvement in store sales and margins.

Proven and Experienced Team. Michael Weiss, our President and Chief Executive Officer, has more than 40 years of experience in the fashion industry and has served as our President for over 20 years. In addition, our senior management team has an average of 25 years of experience across a broad range of disciplines in the specialty retail industry, including design, sourcing, merchandising and real estate. Experience and tenure with Express extends deep into our organization. For example, our district managers and store managers have been with Express for an average of ten years and seven years, respectively.

Business Strategy

Key elements of our business and growth strategies include the following:

Improve Productivity of Our Retail Stores. We believe that the efforts we have taken over the last several years to optimize our store base through conversion to dual-gender stores and to improve our go-to-market strategy have positioned us well for future growth. We seek to grow our comparable store sales and operating margins by executing the following initiatives:

| • | Continue to Refine Our Go-to-Market Strategy. As we increase testing and refine our go-to-market strategy, we believe our in-store product assortment will be more appealing to our customers and will help us to decrease markdowns and to increase sales and product margins; |

| • | Recapture Market Share in Our Core Product Categories. Approximately five years ago we shifted our product mix, which included a high percentage of tops, casual bottoms and denim, to increase our focus on a more premium wear-to-work assortment. Based on our historical peak sales levels across product categories, we believe there is opportunity for us to recapture sales as our customers re-discover Express in certain product categories, specifically in casual and party tops, dresses and denim; and |

| • | Improve Profit Margins. We believe we have the opportunity to continue to improve margins through further efficiencies in sourcing and continued refinement of our merchandising strategy. We plan to leverage our infrastructure, corporate overhead and fixed costs through our converted dual-gender store format. |

Expand Our Store Base. While there has been significant growth in retail shopping centers during the last decade, we have focused on converting our existing store base to a dual-gender format and have opened few new stores over this time period. As a result, we believe there are numerous attractive, high-traffic locations that present opportunities for us to expand our store base. We currently plan to open an average of 30 stores across the United States and Canada over each of the next five years, which represents annual store growth of approximately 5%, with slightly less than 30 stores in the earlier years and slightly more than 30 stores in the latter years.

3

Table of Contents

Expand Our e-Commerce Platform. In July 2008, we launched our e-commerce platform at express.com, providing us with a direct-to-consumer sales channel. In fiscal 2009, our e-commerce sales increased 231% relative to fiscal 2008 but still only represented approximately 5% of our net sales in fiscal 2009. In the twenty-six weeks ended July 31, 2010, our e-commerce sales increased 59% over the twenty-six weeks ended August 1, 2009, but still only represented approximately 7% of our net sales through the first twenty-six weeks of fiscal 2010.

Expand Internationally with Development Partners. We believe Express has the potential to be a successful global brand. As of July 31, 2010, there were six Express stores in the Middle East, which were constructed through a development agreement with Alshaya Trading Co. Over the next five years, we believe there are additional opportunities to expand the Express brand internationally through additional low capital development arrangements.

Summary Risk Factors

We are subject to a number of risks, including risks that may prevent us from achieving our business objectives or may materially and adversely affect our business, financial condition, results of operations, cash flows and prospects. You should carefully consider these risks, including the risks discussed in the section entitled “Risk Factors,” before investing in our common stock. Risks related to our business include, among others:

| • | our business is sensitive to consumer spending and general economic conditions, and therefore a continued or further economic slowdown could adversely affect our financial performance; |

| • | our business is highly dependent upon our ability to identify and respond to new and changing fashion trends, customer preferences and other related factors; |

| • | our sales and results of operations fluctuate quarterly and are affected by a variety of factors, including fashion trends, changes in our merchandise mix, the effectiveness of our inventory management, actions of competitors or mall anchor tenants, holiday or seasonal periods, changes in general economic conditions and consumer spending patterns, the timing of promotional events and weather conditions; |

| • | the clothing retail market in the United States is highly competitive, and we face substantial competition from numerous retailers, including major specialty retailers, department stores, regional retail chains, web-based retail stores and other direct retailers; |

| • | our ability to attract customers to our stores that are located in malls or other shopping centers depends heavily on the success of these malls and shopping centers; |

| • | we depend upon third parties to manufacture all of the products that we sell, the transportation of these products to and from all of our stores and the operation of our distribution facilities; |

| • | we may not be able to carry out our growth strategy in a manner that is profitable, and the expansion of our business will place increased demands on our financial, operational, managerial and administrative resources; and |

| • | as of July 31, 2010, we had $367.9 million of outstanding indebtedness and minimum annual rental obligations under long-term leases of $75.4 million for the remainder of 2010, and this substantial indebtedness and these lease obligations have significant effects on our business. |

4

Table of Contents

Our Equity Sponsor

Golden Gate Private Equity, Inc. is a San Francisco-based private equity investment firm with approximately $8 billion of assets under management. Golden Gate is dedicated to partnering with world class management teams and targets investments in situations where there is a demonstrable opportunity to significantly enhance a company’s value. The principals of Golden Gate have a long history of investing with management partners across a wide range of industries and transaction types, including leveraged buyouts and recapitalizations, corporate divestitures and spin-offs, build-ups and venture stage investing. Over the last five years, Golden Gate has invested in numerous brands in the specialty retail and apparel sectors, including Eddie Bauer, J. Jill and Orchard Brands, a multi-brand direct marketer which owns brands such as Appleseed’s, Blair, Draper’s and Damon’s, Haband and Norm Thompson.

Golden Gate acquired a 75% interest in our business from an affiliate of Limited Brands on July 6, 2007 for aggregate cash payments of $484.9 million. In addition, on the closing of the Golden Gate Acquisition, we distributed to an affiliate of Limited Brands $117.0 million in loan proceeds (which amount includes an expense reimbursement paid to Limited Brands) from a $125.0 million term loan facility that was entered into in connection with the Golden Gate Acquisition. See “Certain Relationships and Related Party Transactions—Golden Gate Acquisition—Purchase Agreement.” As a result of our reorganization, the IPO and its sale of shares in connection with the IPO, Golden Gate beneficially owned approximately 55.0% of our common stock as of November 3, 2010.

Corporate Information

We are a Delaware corporation. Our corporate headquarters is located at 1 Express Drive, Columbus, Ohio 43230. Our telephone number is (614) 474-4001. Our website address is express.com. The information on our website is not deemed to be part of this prospectus.

5

Table of Contents

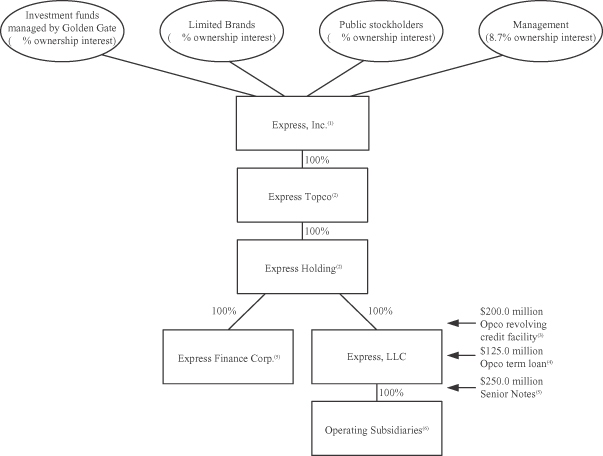

Corporate Structure

The following chart summarizes our corporate structure and principal indebtedness on a pro forma basis as of the completion of this offering, assuming no exercise by the underwriters of their option to purchase additional shares.

| (1) | We reorganized our corporate structure prior to the IPO such that the issuer of our common stock became a Delaware corporation named Express, Inc., and certain entities through which our equity holders held their equity in Express Parent were merged with and into Express Parent so that those equity holders directly held their equity interests immediately prior to the IPO. See “Basis of Presentation.” |

| (2) | Express Topco and Express Holding are holding companies. Express Holding is a guarantor of the $200.0 million secured Asset-Based Loan Credit Agreement entered into by Express Holding and Express, LLC with Wells Fargo Retail Finance, LLC, as administrative agent, and certain other lenders (the “Opco revolving credit facility”) and the $125.0 million secured term loan entered into by Express Holding and Express, LLC on July 6, 2007 (the “Opco term loan”). |

| (3) | As of October 2, 2010, Express, LLC had $195.4 million available for borrowing under the Opco revolving credit facility and no borrowings were then outstanding. |

| (4) | As of October 30, 2010, there was $120.9 million outstanding under the Opco term loan. |

| (5) | Express Finance Corp. is a guarantor of our credit facilities and a co-issuer, together with Express, LLC, of $250.0 million of 8 3/4% senior notes due 2018 (the “Senior Notes”). See “Description of Certain Indebtedness—Senior Notes.” Express Finance Corp. conducts no other business operations. |

| (6) | Includes Express GC, LLC, a guarantor of the Senior Notes, and Express Fashion Apparel Canada Inc., which is a non-U.S. subsidiary. |

6

Table of Contents

The Offering

| Common stock offered by the selling stockholders |

11,500,000 shares |

| Selling stockholders |

The selling stockholders in this transaction are Golden Gate and Limited Brands. See “Principal and Selling Stockholders.” |

| Common stock outstanding |

88,735,895 shares |

| Option to purchase additional shares |

The underwriters have the option to purchase up to 1,725,000 additional shares from the selling stockholders. The underwriters can exercise this option at any time within 30 days from the date of this prospectus. |

| Use of proceeds |

We will not receive any proceeds from this offering. See “Use of Proceeds.” |

| Dividend policy |

Any determination to pay dividends in the future will be at the discretion of our board of directors. In addition, because we are a holding company, our ability to pay dividends on our common stock is limited by restrictions on the ability of our subsidiaries to pay dividends or make distributions to us, including restrictions under the terms of the agreements governing our indebtedness. See “Dividend Policy” and “Description of Certain Indebtedness.” |

| Risk factors |

Investing in our common stock involves a high degree of risk. See “Risk Factors” beginning on page 11 of this prospectus for a discussion of factors you should carefully consider before deciding to invest in our common stock. |

| New York Stock Exchange symbol |

“EXPR” |

Unless otherwise indicated, all information in this prospectus excludes:

| • | 1,303,500 shares of our common stock issuable upon the exercise of options; |

| • | 12,500 shares of common stock subject to restricted stock units; and |

| • | 13,684,000 shares of our common stock reserved for future issuance under our 2010 Incentive Compensation Plan, excluding the option grant and restricted stock unit issuance described above. |

Unless otherwise indicated, all information in this prospectus assumes no exercise by the underwriters of their option to purchase additional shares.

7

Table of Contents

Summary Historical Consolidated Financial and Operating Data

The following tables summarize our consolidated financial and operating data as of the dates and for the periods indicated. We have derived the summary consolidated financial and operating data for the periods ended July 6, 2007 and February 2, 2008 from our consolidated financial statements for such periods, which were audited by Ernst & Young LLP, an independent registered public accounting firm. We have derived the summary consolidated financial and operating data as of January 30, 2010 and for the fiscal years ended January 31, 2009 and January 30, 2010 from our consolidated financial statements as of and for such fiscal years, which were audited by PricewaterhouseCoopers LLP, an independent registered public accounting firm. Our audited consolidated financial statements as of January 31, 2009 and January 30, 2010 and for the fiscal years or periods, as applicable, ended July 6, 2007, February 2, 2008, January 31, 2009 and January 30, 2010 are included elsewhere in this prospectus. We have derived the summary consolidated financial and operating data as of and for the twenty-six weeks ended August 1, 2009 and July 31, 2010 from our unaudited consolidated financial statements, which include all adjustments, consisting of normal and recurring adjustments, that we consider necessary for a fair presentation of our financial position and results of operations for such periods. Operating results for the twenty-six week periods are not necessarily indicative of results for a full fiscal year, or for any other period. Our unaudited consolidated financial statements as of July 31, 2010 and for the twenty-six week periods ended August 1, 2009 and July 31, 2010 are included elsewhere in this prospectus.

On July 6, 2007, investment funds managed by Golden Gate acquired 75% of the equity interests in our business from Limited Brands. As a result of the Golden Gate Acquisition, a new basis of accounting was created beginning July 7, 2007 for the Successor periods ending after such date. Prior to the Golden Gate Acquisition, our consolidated financial statements were prepared on a carve-out basis from Limited Brands. The carve-out consolidated financial statements include allocations of certain costs of Limited Brands. In the Successor periods we no longer incur these charges, but do incur certain expenses as a standalone company for similar functions, including for certain support services provided by Limited Brands under the Limited Brands Transition Services Agreements, which are discussed further in the section entitled “Certain Relationships and Related Party Transactions.” These allocated costs were based upon various assumptions and estimates and actual results may differ from these allocated costs, assumptions and estimates. Accordingly, the carve-out consolidated financial statements may not provide a comparable presentation of our financial position or results of operations as if we had operated as a standalone entity during the Predecessor period from February 4, 2007 through July 6, 2007. See “Risk Factors—Risks Related to Our Business—We have a limited operating history as a standalone company, which may make it difficult to compare our current operating results to prior periods.”

On May 12, 2010, in connection with the IPO, we converted from a Delaware limited liability company into a Delaware corporation and changed our name to Express, Inc. See “Certain Relationships and Related Party Transactions—Reorganization as a Corporation.” In connection with this conversion, all of our equity interests, which consisted of Class L, Class A, and Class C units, were converted into shares of our common stock at a ratio of 0.702, 0.649 and 0.442, respectively. All share and per share information in the accompanying consolidated financial statements and the related notes has been retrospectively recast to reflect this conversion.

8

Table of Contents

The summary historical consolidated data presented below should be read in conjunction with the sections entitled “Risk Factors,” “Selected Historical Consolidated Financial and Operating Data,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and the related notes and other financial data included elsewhere in this prospectus.

| Predecessor | Successor | |||||||||||||||||||||||||||

| Period from February 4, 2007 through July 6, 2007 |

Period from July 7, 2007 through February 2, 2008 |

Year Ended | Twenty-Six Weeks Ended |

|||||||||||||||||||||||||

| January 31, 2009 |

January 30, 2010 |

August 1, 2009 |

July 31, 2010 |

|||||||||||||||||||||||||

| (unaudited) | ||||||||||||||||||||||||||||

| (dollars in thousands, excluding net sales per gross square foot data) | ||||||||||||||||||||||||||||

| Statement of Operations Data: |

||||||||||||||||||||||||||||

| Net sales |

$ | 659,019 | $ | 1,137,327 | $ | 1,737,010 | $ | 1,721,066 | $ | 748,181 | $ | 833,739 | ||||||||||||||||

| Cost of goods sold, buying and occupancy costs |

451,514 | 890,063 | 1,280,018 | 1,175,088 | 533,298 | 546,516 | ||||||||||||||||||||||

| Gross profit |

207,505 | 247,264 | 456,992 | 545,978 | 214,883 | 287,223 | ||||||||||||||||||||||

| General, administrative, and store operating expenses |

170,100 | 275,150 | 447,071 | 409,198 | 184,240 | 213,846 | ||||||||||||||||||||||

| Other operating expense, net |

302 | 5,526 | 6,007 | 9,943 | 3,444 | 17,045 | ||||||||||||||||||||||

| Operating income (loss) |

37,103 | (33,412 | ) | 3,914 | 126,837 | 27,199 | 56,332 | |||||||||||||||||||||

| Interest expense |

— | 6,978 | 36,531 | 53,222 | 26,847 | 44,129 | ||||||||||||||||||||||

| Interest income |

— | (5,190 | ) | (3,527 | ) | (484 | ) | (174 | ) | (11 | ) | |||||||||||||||||

| Other expense (income), net |

— | 4,712 | (300 | ) | (2,444 | ) | (910 | ) | (1,906 | ) | ||||||||||||||||||

| Income (loss) before income taxes |

37,103 | (39,912 | ) | (28,790 | ) | 76,543 | 1,436 | 14,120 | ||||||||||||||||||||

| Provision for income taxes |

7,161 | 487 | 246 | 1,236 | 593 | (38,555 | ) | |||||||||||||||||||||

| Net income (loss) |

$ | 29,942 | $ | (40,399 | ) | $ | (29,036 | ) | $ | 75,307 | $ | 843 | $ | 52,675 | ||||||||||||||

| Statement of Cash Flows Data: |

||||||||||||||||||||||||||||

| Net cash provided by (used in): |

||||||||||||||||||||||||||||

| Operating activities |

$ | 45,912 | $ | 282,192 | $ | 35,234 | $ | 200,721 | $ | 40,199 | $ | 41,789 | ||||||||||||||||

| Investing activities |

(22,888 | ) | (15,258 | ) | (51,801 | ) | (26,873 | ) | (16,678 | ) | (28,181 | ) | ||||||||||||||||

| Financing activities |

(29,939 | ) | 39,361 | (127,347 | ) | (115,559 | ) | (75,625 | ) | (161,080 | ) | |||||||||||||||||

| Other Financial and Operating Data: |

||||||||||||||||||||||||||||

| Comparable store sales change(1) |

6 | % | 12 | % | (3 | )% | (6 | )% | (14 | )% | 9 | % | ||||||||||||||||

| Net sales per gross square foot(2) |

$ | 118 | $ | 213 | $ | 337 | $ | 321 | $ | 141 | $ | 155 | ||||||||||||||||

| Total gross square feet (in thousands) (average) |

5,604 | 5,348 | 5,060 | 5,033 | 5,030 | 5,007 | ||||||||||||||||||||||

| Number of stores (at period end) |

622 | 587 | 581 | 573 | 580 | 577 | ||||||||||||||||||||||

| Capital expenditures |

$ | 22,888 | $ | 15,258 | $ | 50,551 | $ | 26,853 | $ | 16,678 | $ | 28,181 | ||||||||||||||||

| EBITDA(3) |

62,154 | 10,071 | 83,514 | 198,949 | 65,260 | 90,916 | ||||||||||||||||||||||

| Adjusted EBITDA(3) |

62,154 | 115,272 | 137,198 | 229,750 | 78,714 | 122,186 | ||||||||||||||||||||||

| July 31, 2010 |

||||||||||||||||||||||||||||

| (unaudited) | ||||||||||||||||||||||||||||

| Balance Sheet Data (at end of period): |

|

|||||||||||||||||||||||||||

| Cash and cash equivalents |

|

$ | 86,932 | |||||||||||||||||||||||||

| Working capital (excluding cash and cash equivalents)(4) |

|

(28,860 | ) | |||||||||||||||||||||||||

| Total assets |

|

784,192 | ||||||||||||||||||||||||||

| Total debt (including current portion) |

|

367,873 | ||||||||||||||||||||||||||

| Total stockholders’ equity |

|

103,237 | ||||||||||||||||||||||||||

9

Table of Contents

| (1) | Comparable store sales have been calculated based upon stores that were open at least thirteen full fiscal months as of the end of the reporting period. |

| (2) | Net sales per gross square foot is calculated by dividing net sales for the applicable period by the average gross square footage during such period. For the purpose of calculating net sales per gross square foot, e-commerce sales and other revenues are excluded from net sales. |

| (3) | EBITDA and Adjusted EBITDA have been presented in this prospectus and are supplemental measures of financial performance that are not required by, or presented in accordance with, generally accepted accounting principles in the United States (“GAAP”). EBITDA is defined as consolidated net income (loss) before depreciation and amortization, interest expense (net) and amortization of debt issuance costs and discounts and provision for income taxes. Adjusted EBITDA is calculated in accordance with our existing credit agreements, and is defined as EBITDA adjusted to exclude the items set forth in the table below. |

| EBITDA is included in this prospectus because it is a key metric used by management to assess our operating performance. Adjusted EBITDA is included in this prospectus because it is a measure by which our lenders evaluate our covenant compliance. The Opco term loan contains a leverage ratio covenant and the Opco revolving credit facility contains a fixed charge coverage ratio covenant that we must meet if we do not meet the excess availability requirement under the Opco revolving credit facility, and are calculated based on Adjusted EBITDA, without the adjustment for management bonuses paid in connection with our distribution to equity holders in 2008. See “Certain Relationships and Related Party Transactions—2008 Corporate Reorganization.” Non-compliance with the financial ratio covenants contained in the Opco term loan and the Opco revolving credit facility could result in the acceleration of our obligations to repay all amounts outstanding under those agreements. The applicable interest rates on the Opco term loan and the Opco revolving credit facility are also based in part on our leverage ratio and excess availability, respectively. In addition, the Opco term loan, the Opco revolving credit facility and the indenture governing the Senior Notes contain covenants that restrict, subject to certain exceptions, our ability to incur additional indebtedness or make restricted payments, such as dividends, based, in some cases, on our ability to meet leverage ratios or fixed charge coverage ratios. Adjusted EBITDA is a material component of these ratios. |

| EBITDA and Adjusted EBITDA are not measures of our financial performance or liquidity under GAAP and should not be considered as alternatives to net income as a measure of operating performance, cash flows from operating activities as a measure of liquidity, or any other performance measure derived in accordance with GAAP. Additionally, EBITDA and Adjusted EBITDA are not intended to be measures of free cash flow for management’s discretionary use, as they do not consider certain cash requirements such as interest payments, tax payments and debt service requirements. EBITDA and Adjusted EBITDA contain certain other limitations, including the failure to reflect our cash expenditures, cash requirements for working capital needs and cash costs to replace assets being depreciated and amortized, and exclude certain non-recurring charges that may recur in the future. Management compensates for these limitations by relying primarily on our GAAP results and by using EBITDA and Adjusted EBITDA only supplementally. |

10

Table of Contents

| Our measures of EBITDA and Adjusted EBITDA are not necessarily comparable to other similarly titled captions of other companies due to potential inconsistencies in the methods of calculation. |

| The following table sets forth a reconciliation of net income (loss), the most directly comparable GAAP financial measure, to EBITDA and Adjusted EBITDA. |

| Predecessor | Successor | |||||||||||||||||||||||||||

| Period from February 4, 2007 through July 6, 2007 |

Period from July 7, 2007 through February 2, 2008 |

Year Ended | Twenty-Six Weeks Ended | |||||||||||||||||||||||||

| January 31, 2009 |

January 30, 2010 |

August 1, 2009 |

July 31, 2010 |

|||||||||||||||||||||||||

| (unaudited) | ||||||||||||||||||||||||||||

| (dollars in thousands) | ||||||||||||||||||||||||||||

| Net income (loss) |

$ | 29,942 | $ | (40,399 | ) | $ | (29,036 | ) | $ | 75,307 | $ | 843 | $ | 52,675 | ||||||||||||||

| Depreciation and amortization |

25,051 | 48,195 | 79,105 | 69,668 | 37,152 | 32,668 | ||||||||||||||||||||||

| Interest expense, net(a) |

— | 1,788 | 33,199 | 52,738 | 26,672 | 44,128 | ||||||||||||||||||||||

| Provision for income taxes |

7,161 | 487 | 246 | 1,236 | 593 | (38,555 | ) | |||||||||||||||||||||

| EBITDA |

62,154 | 10,071 | 83,514 | 198,949 | 65,260 | 90,916 | ||||||||||||||||||||||

| Non-cash deductions, losses, charges(b) |

9,780 | 21,112 | 12,128 | 4,569 | 5,754 | |||||||||||||||||||||||

| Non-recurring expenses(c) |

86,886 | 18,660 | 5,908 | 2,680 | 2,090 | |||||||||||||||||||||||

| Transaction expenses(d) |

766 | 3,596 | 1,656 | 1,207 | 2,628 | |||||||||||||||||||||||

| Permitted Advisory Agreement fees and expenses(e) |

3,882 | 4,238 | 7,153 | 2,446 | 12,752 | |||||||||||||||||||||||

| Non-cash expense related to equity incentives |

1,233 | 2,069 | 2,052 | 1,004 | 3,570 | |||||||||||||||||||||||

| Other adjustments allowable under our existing credit agreements(f) |

2,654 | 4,009 | 1,904 | 1,548 | 4,476 | |||||||||||||||||||||||

| Adjusted EBITDA |

$ | 62,154 | $ | 115,272 | $ | 137,198 | $ | 229,750 | $ | 78,714 | $ | 122,186 | ||||||||||||||||

| (a) | Includes interest income and also includes the amortization of debt issuance costs, amortization of debt discount and debt extinguishment costs. |

| (b) | Adjustments made to reflect the net impact of non-cash expense items such as non-cash rent and expense associated with the change in the fair value of our interest rate swap. |

| (c) | Primarily includes an $86.9 million non-cash cost of goods sold charge associated with the allocation of purchase price adjustments to inventory in the 30 weeks ended February 2, 2008, a one-time management bonus paid in the first quarter of fiscal 2008 and expenses related to the development of standalone information technology systems in anticipation of the termination of our transition services agreement with Limited Brands. |

| (d) | Represents costs incurred related to items such as the issuance of stock, recapitalizations and the incurrence of permitted indebtedness. |

| (e) | Prior to the IPO, Golden Gate provided us with consulting and management services pursuant to the advisory agreement entered into in connection with the Golden Gate Acquisition (“Advisory Agreement”). The Advisory Agreement was terminated in connection with the IPO. See “Certain Relationships and Related Party Transactions—Golden Gate Acquisition—Golden Gate Advisory Agreement.” |

| (f) | Reflects adjustments permitted under our existing credit agreements, including advisory fees paid to Limited Brands pursuant to the Express Parent Limited Liability Company Agreement (the “LLC Agreement”). The LLC Agreement, including the advisory arrangement with Limited Brands, was terminated in connection with the IPO. |

| (4) | Working capital is defined as current assets, less cash and cash equivalents, less current liabilities excluding the current portion of long-term debt. |

11

Table of Contents

This offering and an investment in our common stock involve a high degree of risk. You should carefully consider the risks described below, together with the financial and other information contained in this prospectus, before you decide to purchase shares of our common stock. If any of the following risks actually occurs, our business, financial condition, results of operations, cash flows and prospects could be materially and adversely affected. As a result, the trading price of our common stock could decline and you could lose all or part of your investment in our common stock.

Risks Related to Our Business

Our business is sensitive to consumer spending and general economic conditions, and a continued or further economic slowdown could adversely affect our financial performance.

Consumer purchases of discretionary retail items, including our products, generally decline during recessionary periods and other periods where disposable income is adversely affected. Our performance is subject to factors that affect domestic and worldwide economic conditions, including employment, consumer debt, reductions in net worth based on recent severe market declines, residential real estate and mortgage markets, taxation, fuel and energy prices, interest rates, consumer confidence, value of the United States dollar versus foreign currencies and other macroeconomic factors. For example, our net sales declined by 1% in fiscal 2009 compared to fiscal 2008, primarily due to the global economic recession. Further deterioration in economic conditions or increasing unemployment levels may continue to reduce the level of consumer spending and inhibit consumers’ use of credit, which may continue to adversely affect our revenues and profits. In recessionary periods, we may have to increase the number of promotional sales or otherwise dispose of inventory for which we have previously paid to manufacture, which could further adversely affect our profitability. Our financial performance is particularly susceptible to economic and other conditions in regions or states where we have a significant number of stores. Current economic conditions and further slowdown in the economy could further adversely affect shopping center traffic and new shopping center development and could materially adversely affect us.

In addition, the current economic environment and future recessionary periods may exacerbate some of the risks noted below, including consumer demand, strain on available resources, store growth, interruption of the flow of merchandise from key vendors and foreign exchange rate fluctuations. The risks could be exacerbated individually or collectively.

Our business is highly dependent upon our ability to identify and respond to new and changing fashion trends, customer preferences and other related factors, and our inability to identify and respond to these new trends may lead to inventory markdowns and write-offs, which could adversely affect us and our brand image.

Our focus on fashion-conscious young women and men means that we have a target market of customers whose preferences cannot be predicted with certainty and are subject to change. Our success depends in large part upon our ability to effectively identify and respond to changing fashion trends and consumer demands, and to translate market trends into appropriate, saleable product offerings. Our failure to identify and react appropriately to new and changing fashion trends or tastes or to accurately forecast demand for certain product offerings could lead to, among other things, excess inventories, markdowns and write-offs, which could materially adversely affect our business and our brand image. Because our success depends significantly on our brand image, damage to our brand image as a result of our failure to respond to changing fashion trends could have a negative impact on us.

We often enter into agreements for the manufacture and purchase of merchandise well ahead of the season in which that merchandise will be sold. Therefore we are vulnerable to changes in consumer preference and demand between the time we design and order our merchandise and the season in which this merchandise will

12

Table of Contents

be sold. There can be no assurance that our new product offerings will have the same level of acceptance as our product offerings in the past or that we will be able to adequately and timely respond to the preferences of our customers. The failure of any new product offerings to appeal to our customers could have a material adverse effect on our business, results of operations and financial condition.

Our sales and profitability fluctuate on a seasonal basis and are affected by a variety of other factors.

Our sales and results of operations are affected by a variety of factors, including fashion trends, changes in our merchandise mix, the effectiveness of our inventory management, actions of competitors or mall anchor tenants, holiday or seasonal periods, changes in general economic conditions and consumer spending patterns, the timing of promotional events and weather conditions. As a result, our results of operations fluctuate on a quarterly basis and relative to corresponding periods in prior years, and any of these factors could adversely affect our business and could cause our results of operations to decline. For example, our third and fourth quarter net sales are impacted by early Fall shopping trends and the holiday season. Likewise, we typically experience lower net sales in the first fiscal quarter relative to other quarters. Any significant decrease in net sales during the early Fall selling period or the holiday season would have a material adverse effect on us. In addition, in order to prepare for these seasons, we must order and keep in stock significantly more merchandise than we carry during other parts of the year. This inventory build-up may require us to expend cash faster than we generate it by our operations during this period. Any unanticipated decrease in demand for our products during these peak shopping seasons could require us to sell excess inventory at a substantial markdown, which could have a material adverse effect on our business, profitability, ability to repay indebtedness and our brand image with customers.

We could face increased competition from other retailers that could adversely affect our ability to generate higher net sales and our ability to obtain favorable store locations.

We face substantial competition in the specialty retail apparel industry. We compete on the basis of a combination of factors, including, among others, price, breadth, quality and style of merchandise offered, in-store experience, level of customer service, ability to identify and offer new and emerging fashion trends and brand image. We compete with a wide variety of large and small retailers for customers, vendors, suitable store locations and personnel. We face competition from major specialty retailers that offer their own private label assortment, department stores, regional retail chains, web-based retail stores and other direct retailers that engage in the retail sale of apparel accessories, footwear and similar merchandise to fashion-conscious young women and men.

Some of our competitors have greater financial, marketing and other resources available. In many cases, our competitors sell their products in stores that are located in the same shopping malls or lifestyle centers as our stores. In addition to competing for sales, we compete for favorable site locations and lease terms in shopping malls and lifestyle centers and our competitors may be able to secure more favorable locations than us as a result of their relationships with, or appeal to, landlords. Our competitors may also sell substantially similar products at reduced prices through the Internet or through outlet centers or discount stores, increasing the competitive pricing pressure for those products. We cannot assure you that we will continue to be able to compete successfully against existing or future competitors. Our expansion into markets served by our competitors and entry of new competitors or expansion of existing competitors into our markets could have a material adverse effect on us.

Our ability to attract customers to our stores that are located in malls or other shopping centers depends heavily on the success of these malls and shopping centers, and any decrease in customer traffic in these malls or shopping centers could cause our net sales to be less than expected.

A significant number of our stores are located in malls and other shopping centers. Sales at these stores are dependent, to a significant degree, upon the volume of traffic in those shopping centers and the surrounding area. Our stores benefit from the ability of a shopping center’s other tenants, particularly anchor stores, such as department stores, to generate consumer traffic in the vicinity of our stores and the continuing popularity of the shopping center as a shopping destination. Our sales volume and traffic generally may be adversely affected by,

13

Table of Contents

among other things, a decrease in popularity of malls or other shopping centers in which our stores are located, the closing of anchor stores important to our business, a decline in popularity of other stores in the malls or other shopping centers, in which our stores are located or a deterioration in the financial condition of shopping center operators or developers which could, for example, limit their ability to finance tenant improvements for us and other retailers. A reduction in consumer traffic as a result of these or any other factors, or our inability to obtain or maintain favorable store locations within malls or other shopping centers, could have a material adverse effect on us. Although we do not have specific information with respect to the malls and other shopping centers in which we locate or plan to locate our stores, we believe mall and other shopping center vacancy rates have been rising, and mall and other shopping center traffic has been decreasing nationally, as a result of the current economic downturn which could reduce traffic to our stores.

We do not own or operate any manufacturing facilities and therefore depend upon independent third parties for the manufacture of all of our merchandise, and any inability of a manufacturer to ship goods to our specifications or to operate in compliance with applicable laws could negatively impact our business.

We do not own or operate any manufacturing facilities. As a result, we are dependent upon our timely receipt of quality merchandise from third-party manufacturers. A manufacturer’s inability to ship orders to us in a timely manner or meet our quality standards could cause delays in responding to consumer demands and negatively affect consumer confidence in the quality and value of our brand or negatively impact our competitive position, all of which could have a material adverse effect on our financial condition or results of operations. Furthermore, we are susceptible to increases in sourcing costs, which we may not be able to pass on to customers, and changes in payment terms from manufacturers, which could adversely affect our financial condition or results of operations.

Failure by our manufacturers to comply with our guidelines also exposes us to various risks, including with respect to use of acceptable labor practices and compliance with applicable laws. We do not independently investigate whether our vendors and manufacturers use acceptable labor practices and comply with applicable laws, such as child labor and other labor laws, and instead rely on audits performed by several unrelated third-party auditors. Our business may be negatively impacted should any of our manufacturers experience an interruption in operations, including due to labor disputes and failure to comply with laws, and our business may suffer from negative publicity for using manufacturers that do not engage in acceptable labor practices and comply with applicable laws. Any of these results could harm our brand image and have a material adverse effect on our business and growth.

The interruption of the flow of merchandise from international manufacturers could disrupt our supply chain.

We purchase the majority of our merchandise outside of the United States through arrangements with approximately 90 vendors, utilizing approximately 350 foreign manufacturing facilities located throughout the world, primarily in Asia and Central and South America. Political, social or economic instability in Asia, Central or South America, or in other regions in which our manufacturers are located, could cause disruptions in trade, including exports to the United States. Other events that could also cause disruptions to exports to the United States include:

| • | the imposition of additional trade law provisions or regulations; |

| • | the imposition of additional duties, tariffs and other charges on imports and exports; |

| • | quotas imposed by bilateral textile agreements; |

| • | foreign currency fluctuations; |

| • | restrictions on the transfer of funds; |

| • | the financial instability or bankruptcy of manufacturers; and |

| • | significant labor disputes, such as dock strikes. |

14

Table of Contents

We cannot predict whether the countries in which our merchandise is manufactured, or may be manufactured in the future, will be subject to new or additional trade restrictions imposed by the United States or other foreign governments, including the likelihood, type or effect of any such restrictions. Trade restrictions, including new or increased tariffs or quotas, embargos, safeguards and customs restrictions against apparel items, as well as United States or foreign labor strikes and work stoppages or boycotts, could increase the cost or reduce the supply of apparel available to us and adversely affect our business, financial condition or results of operations.

If we encounter difficulties associated with distribution facilities or if they were to shut down for any reason, we could face shortages of inventory, delayed shipments to our online customers and harm to our reputation. Any of these issues could have a material adverse effect on our business operations.

Our distribution facilities are operated by third parties. Our Columbus, Ohio facility operates as our central distribution facility and supports our entire business, as all of our merchandise is shipped to the central distribution facility from our vendors, and is then packaged and shipped to our stores or the e-commerce distribution facility in Groveport, Ohio for further distribution to our online customers. The success of our stores and the satisfaction of our online customers depend on their timely receipt of merchandise. The efficient flow of our merchandise requires that the third parties who operate the distribution facilities have adequate capacity in both distribution facilities to support our current level of operations, and any anticipated increased levels that may follow from the growth of our business. If we encounter difficulties with the distribution facilities or in our relationships with the third parties who operate the facilities or if either facility were to shut down for any reason, including as a result of fire or other natural disaster, we could face shortages of inventory, resulting in “out of stock” conditions in our stores, incur significantly higher costs and longer lead times associated with distributing our products to both our stores and online customers and experience dissatisfaction from our customers. Any of these issues could have a material adverse effect on our business and harm our reputation.

We rely upon independent third-party transportation providers for substantially all of our product shipments and are subject to increased shipping costs as well as the potential inability of our third-party transportation providers to deliver on a timely basis.

We currently rely upon independent third-party transportation providers for substantially all of our product shipments, including shipments to and from all of our stores. Our utilization of these delivery services for shipments is subject to risks, including increases in fuel prices, which would increase our shipping costs, and employee strikes and inclement weather which may impact a shipping company’s ability to provide delivery services that adequately meet our shipping needs. If we change the shipping companies we use, we could face logistical difficulties that could adversely affect deliveries and we would incur costs and expend resources in connection with such change. Moreover, we may not be able to obtain terms as favorable as those received from independent third-party transportation providers which in turn would increase our costs.

Our growth strategy, including our international expansion plan, is dependent on a number of factors, any of which could strain our resources or delay or prevent the successful penetration into new markets.

Our growth strategy is partially dependent on opening new stores across North America, remodeling existing stores in a timely manner and operating them profitably. Additional factors required for the successful implementation of our growth strategy include, but are not limited to, obtaining desirable store locations, negotiating acceptable leases, completing projects on budget, supplying proper levels of merchandise and successfully hiring and training store managers and sales associates. In order to optimize profitability for new stores, we must secure desirable retail lease space when opening stores in new and existing markets. We must choose store sites, execute favorable real estate transactions on terms that are acceptable to us, hire competent personnel and effectively open and operate these new stores. We historically have received landlord allowances for store build outs, which offset certain capital expenditures we must make to open a new store. If landlord allowances cease to be available to us in the future or are decreased, opening new stores would require more capital outlay, which could adversely affect our ability to continue opening new stores.

15

Table of Contents

To the extent we open new stores in markets where we have existing stores, our existing stores in those markets may experience reduced net sales. Our planned growth will also require additional infrastructure for the development, maintenance and monitoring of those stores. In addition, if our current management systems and information systems are insufficient to support this expansion, our ability to open new stores and to manage our existing stores would be adversely affected. If we fail to continue to improve our infrastructure, we may be unable to implement our growth strategy or maintain current levels of operating performance in our existing stores.

Additionally, we plan to expand outside of North America through development agreements with third parties and these plans could be negatively impacted by a variety of factors. We may be unable to find acceptable partners with whom we can enter into joint development agreements, negotiate acceptable terms for franchise and development agreements and gain acceptance from consumers outside of North America. Our planned usage of development agreements outside of North America also creates the inherent risk as to whether such third parties are able to both effectively operate the businesses and appropriately project our brand image in their respective markets. Ineffective or inappropriate operation of our partners’ businesses or projection of our brand image could create difficulties in the execution of our international expansion plan.

Our domestic growth plans and our international expansion plan will place increased demands on our financial, operational, managerial and administrative resources. These increased demands may cause us to operate our business less efficiently, which in turn could cause deterioration in the performance of our existing stores. Furthermore, relating to our international expansion, our ability to conduct business in international markets may be affected by legal, regulatory, political and economic risks, including our unfamiliarity with local business and legal environments in other areas of the world. Our international expansion strategy and success could also be adversely impacted by the global economy, as well as by fluctuations in the value of the dollar against foreign currencies.

Our business depends in part on a strong brand image, and if we are not able to maintain and enhance our brand, particularly in new markets where we have limited brand recognition, we may be unable to attract sufficient numbers of customers to our stores or sell sufficient quantities of our products.

Our ability to maintain our reputation is critical to our brand image. Our reputation could be jeopardized if we fail to maintain high standards for merchandise quality and integrity. Any negative publicity about these types of concerns may reduce demand for our merchandise. Failure to maintain high ethical, social and environmental standards for all of our operations and activities or adverse publicity regarding our responses to these concerns could also jeopardize our reputation. Failure to comply with local laws and regulations, to maintain an effective system of internal controls or to provide accurate and timely financial statement information could also hurt our reputation. Damage to our reputation or loss of consumer confidence for any of these reasons could have a material adverse effect on our business, financial condition and results of operations, as well as require additional resources to rebuild our reputation.

We are subject to risks associated with leasing substantial amounts of space, including future increases in occupancy costs.

We lease all of our store locations, our corporate headquarters and our central distribution facility. We typically occupy our stores under operating leases with terms of ten years, with options to renew for additional multi-year periods thereafter. In the future, we may not be able to negotiate favorable lease terms. Our inability to do so may cause our occupancy costs to be higher in future years or may force us to close stores in desirable locations.

Some of our leases have early cancellation clauses, which permit the lease to be terminated by us or the landlord if certain sales levels are not met in specific periods or if the center does not meet specified occupancy standards. In addition to future minimum lease payments, some of our store leases provide for additional rental payments based on a percentage of net sales, or “percentage rent,” if sales at the respective stores exceed

16

Table of Contents

specified levels, as well as the payment of common area maintenance charges, real property insurance and real estate taxes. Many of our lease agreements have defined escalating rent provisions over the initial term and any extensions. As we expand our store base, our lease expense and our cash outlays for rent under the lease terms will increase.

We depend on cash flow from operations to pay our lease expenses. If our business does not generate sufficient cash flow from operating activities to fund these expenses, we may not be able to service our lease expenses, which could materially harm our business.

If an existing or future store is not profitable, and we decide to close it, we may nonetheless be committed to perform our obligations under the applicable lease including, among other things, paying the base rent for the balance of the lease term. Moreover, even if a lease has an early cancellation clause, we may not satisfy the contractual requirements for early cancellation under that lease. Our inability to enter into new leases or renew existing leases on terms acceptable to us or be released from our obligations under leases for stores that we close could materially adversely affect us.

Our failure to find store employees who reflect our brand image and embody our culture could adversely affect our business.