Attached files

| file | filename |

|---|---|

| EX-31.1 - CERTIFICATION - PARAMOUNT GOLD & SILVER CORP. | pzg_ex311.htm |

| EX-32.2 - CERTIFICATION - PARAMOUNT GOLD & SILVER CORP. | pzg_ex322.htm |

| EX-32.1 - CERTIFICATION - PARAMOUNT GOLD & SILVER CORP. | pzg_ex321.htm |

| EX-31.2 - CERTIFICATION - PARAMOUNT GOLD & SILVER CORP. | pzg_ex312.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

———————

FORM 10-Q

———————

(Mark One)

|

þ

|

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

|

|

For the quarterly period ended September 30, 2010

|

|

|

Or |

|

| o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

|

|

For the transition period from: _______ to _______

|

|

PARAMOUNT GOLD AND SILVER CORP.

|

Delaware

|

0-51600

|

20-3690109

|

||

|

(State or Other Jurisdiction

|

(Commission

|

(I.R.S. Employer

|

||

|

of Incorporation)

|

File Number)

|

Identification No.)

|

665 Anderson Street, Winnemucca, Nevada 89445

(Address of Principal Executive Office) (Zip Code)

(775) 625-3600

(Issuer’s telephone number, including area code)

N/A

(Former name, former address and former fiscal year, if changed since last report)

Indicate by a check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15 (d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to the filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

o |

Accelerated filer

|

þ

|

||

|

Non-accelerated filer

|

o |

Smaller reporting company

|

o |

(Do not check if smaller reporting company)

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act) Yes ¨ No þ

APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY

PROCEEDINGS DURING THE PRECEDING FIVE YEARS

Indicate by check mark whether the Registrant has filed all documents and reports required to be filed by Section 12, 13, or 15 (d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Yes ¨ No ¨

APPLICABLE ONLY TO CORPORATE ISSUERS:

Indicate the number of shares outstanding of each of the issuer’s classes of Common Stock as of the latest practicable date: 132,077,034 shares of Common Stock, $.001 par value as of October 31, 2010.

PARAMOUNT GOLD AND SILVER CORP.

INDEX

| PART I. – FINANCIAL INFORMATION | |||||

| Item 1. | Financial Statements | 1 | |||

| Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operation | 24 | |||

| Item 3. | Quantitative and Qualitative Disclosure About Market Risk | 32 | |||

| Item 4. | Controls and Procedures | 32 | |||

| PART II. – OTHER INFORMATION | |||||

| Item 1. | Legal Proceedings | 33 | |||

| Item 1A | Risk Factors | 33 | |||

| Item 2. | Unregistered Sales of Equity Securities and Use of Proceeds | 33 | |||

| Item 3. | Defaults upon senior securities | 33 | |||

| Item 4. | Removed and Reserved | 33 | |||

| Item 5. | Other information | 33 | |||

| Item 6. | Exhibits | 34 | |||

i

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

This Quarterly Report on Form 10-Q for the quarterly period ended September 30, 2010 contains “forward-looking statements”. Generally, the words “believes”, “anticipates,” “may,” “will,” “should,” “expect,” “intend,” “estimate,” “continue,” and similar expressions or the negative thereof or comparable terminology are intended to identify forward-looking statements which include, but are not limited to, statements concerning the Company’s expectations regarding its working capital requirements, financing requirements, business prospects, and other statements of expectations, beliefs, future plans and strategies, anticipated events or trends, and similar expressions concerning matters that are not historical facts. Such statements are subject to certain risks and uncertainties, including the matters set forth in this Quarterly Report or other reports or documents the Company files with the Securities and Exchange Commission from time to time, which could cause actual results or outcomes to differ materially from those projected.

These forward-looking statements were based on various factors and were derived utilizing numerous assumptions and other factors that could cause our actual results to differ materially from those in the forward-looking statements. These factors include, but are not limited to, economic, political and market conditions and fluctuations, government and industry regulation, interest rate risk, U.S. and global competition, and other factors. Most of these factors are difficult to predict accurately and are generally beyond our control. You should consider the areas of risk described in connection with any forward-looking statements that may be made herein.

Undue reliance should not be placed on these forward-looking statements which speak only as of the date hereof. Except for our ongoing obligations to disclose material information under the Federal securities laws, we undertake no obligation to release publicly any revisions to any forward-looking statements, to report events or to report the occurrence of unanticipated events. For any forward-looking statements contained in any document, we claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995.

OTHER PERTINENT INFORMATION

When used in this report, the terms "Paramount," the "Company," “we," "our," and "us" refers to Paramount Gold and Silver Corp., a Delaware corporation.

PART I. – FINANCIAL INFORMATION

|

ITEM 1.

|

FINANCIAL STATEMENTS

|

PARAMOUNT GOLD AND SILVER CORP.

(An Exploration Stage Mining Company)

Consolidated Financial Statements

(Unaudited)

Period ended September 30, 2010 and 2009

1

PARAMOUNT GOLD AND SILVER CORP.

(An Exploration Stage Mining Company)

Consolidated Balance Sheets

As at September 30, 2010(Unaudited) and June 30, 2010 (Audited)

(Expressed in United States dollars, unless otherwise stated)

|

As at

September 30, |

As at

June 30, |

|||||||

|

2010

(Unaudited)

|

2010

(Audited)

|

|||||||

|

Assets

|

||||||||

|

Current Assets

|

||||||||

|

Cash and cash equivalents

|

$ | 18,773,785 | $ | 21,380,505 | ||||

|

Amounts receivable

|

1,788,012 | 1,511,619 | ||||||

|

Equity conversion right (Note 13)

|

413,773 | 516,545 | ||||||

|

Loan advance (Note 9 and 16)

|

- | 243,495 | ||||||

|

Prepaid and deposits

|

122,310 | 45,368 | ||||||

|

Prepaid Insurance (Note 11)

|

1,042,163 | - | ||||||

|

Marketable Sercurities

|

2,700 | - | ||||||

| 22,142,743 | 23,697,532 | |||||||

|

Long Term Assets

|

||||||||

|

Mineral properties (Note 7)

|

48,516,487 | 22,111,203 | ||||||

|

Fixed assets (Note 8)

|

535,015 | 519,446 | ||||||

|

Reclamation bond

|

2,828,416 | - | ||||||

| 51,879,918 | 22,630,649 | |||||||

| $ | 74,022,661 | $ | 46,328,181 | |||||

|

Liabilities and Shareholder’s Equity

|

||||||||

|

Liabilities

|

||||||||

|

Current Liabilities

|

||||||||

|

Accounts payable

|

$ | 882,347 | $ | 430,323 | ||||

|

Warrant Liability (Note 2)

|

6,347,877 | 5,979,767 | ||||||

| 7,230,224 | 6,410,090 | |||||||

|

Long Term Liabilities

|

||||||||

|

Reclamation and Enviromental Obligation

|

1,122,305 | - | ||||||

| 1,122,305 | - | |||||||

|

Shareholder’s Equity

|

||||||||

|

Capital stock (Note 5)

|

132,247 | 110,069 | ||||||

|

Additional paid in capital

|

119,567,952 | 90,613,573 | ||||||

|

Contributed surplus

|

11,026,828 | 10,825,222 | ||||||

|

Deficit accumulated during the exploration stage

|

(65,048,327 | ) | (61,187,098 | ) | ||||

|

Cumulative translation adjustment

|

(8,568 | ) | (443,675 | ) | ||||

| 65,670,132 | 39,918,091 | |||||||

| $ | 74,022,661 | $ | 46,328,181 | |||||

Commitments and Contingencies (Note 13)

The accompanying notes are an integral part of the consolidated financial statements

2

PARAMOUNT GOLD AND SILVER CORP.

(An Exploration Stage Mining Company)

Consolidated Statements of Operations (Unaudited)

(Expressed in United States dollars, unless otherwise stated)

| Cumulative | ||||||||||||

|

Since Inception

|

||||||||||||

|

Period Ended

|

Period Ended

|

March 29, 2005 to

|

||||||||||

| September 30, |

September 30,

|

September 30, | ||||||||||

| 2010 | 2009 | 2010 | ||||||||||

|

Revenue

|

||||||||||||

|

Interest Income

|

$ | 20,937 | $ | 54,514 | $ | 1,038,899 | ||||||

|

Expenses:

|

||||||||||||

|

Incorporation Costs

|

- | - | 1,773 | |||||||||

|

Exploration

|

1,802,256 | 1,078,499 | 25,599,520 | |||||||||

|

Professional Fees

|

167,735 | 239,932 | 6,392,789 | |||||||||

|

Directors Compensation

|

50,546 | - | 191,770 | |||||||||

|

Travel & Lodging

|

55,283 | 22,124 | 1,104,531 | |||||||||

|

Corporate Communications

|

27,045 | 39,626 | 3,144,143 | |||||||||

|

Consulting Fees

|

74,368 | 234,182 | 13,879,188 | |||||||||

|

Office & Administration

|

80,623 | 80,938 | 2,436,456 | |||||||||

|

Interest & Service Charges

|

2,830 | 6,438 | 99,672 | |||||||||

|

Loss on disposal of Fixed Assets

|

- | - | 44,669 | |||||||||

|

Insurance

|

42,319 | 14,144 | 318,191 | |||||||||

|

Depreciation

|

17,752 | 14,651 | 314,031 | |||||||||

|

Accretion

|

14,254 | - | 14,254 | |||||||||

|

Miscellaneous

|

- | 5,014 | 203,097 | |||||||||

|

Financing & Listing Fees

|

- | - | (22,024 | ) | ||||||||

|

Acquisition Expenses

|

1,076,273 | 364,458 | 2,318,843 | |||||||||

|

Income and other taxes

|

- | - | 51,732 | |||||||||

|

Write Down of Mineral Property

|

- | - | 1,746,049 | |||||||||

|

Total Expense

|

3,411,284 | 2,100,006 | 57,838,684 | |||||||||

|

Net Loss before other item

|

3,390,347 | 2,045,492 | 56,799,785 | |||||||||

|

Other item

|

||||||||||||

|

Change in fair value of Equity Conversion Right

|

102,772 | - | 923,927 | |||||||||

|

Change in fair value of warrant liability

|

368,110 | (3,088,287 | ) | 7,324,615 | ||||||||

|

Net Loss (Gain)

|

$ | 3,861,229 | $ | (1,042,795 | ) | $ | 65,048,327 | |||||

|

Other comprehensive loss

|

||||||||||||

|

Foreign Currency Translation Adjustment

|

(435,107 | ) | (10,663 | ) | 8,568 | |||||||

|

Total Comprehensive Loss for the Period

|

$ | 3,426,122 | $ | (1,053,458 | ) | $ | 65,056,895 | |||||

|

Loss (Gain) per Common share

|

$ | 0.03 | $ | (0.01 | ) | |||||||

|

Basic and Diluted

|

||||||||||||

|

Weighted Average Number of Common

|

119,165,219 | 78,023,648 | ||||||||||

|

Shares Used in Per Share Calculations

|

||||||||||||

|

Basic

|

||||||||||||

|

Diluted

|

119,165,219 | 83,023,648 | ||||||||||

The accompanying notes are an integral part of the consolidated financial statements

3

PARAMOUNT GOLD AND SILVER CORP.

(An Exploration Stage Mining Company)

Consolidated Statements of Cash Flows (Unaudited)

(Expressed in United States dollars, unless otherwise stated)

|

For the

Period Ended September 30, 2010 |

For the

Period Ended September 30, 2009 |

Cummulative

Since

Inception to September 30, 2010 |

||||||||||

|

Operating Activities

|

||||||||||||

|

Net Gain (Loss)

|

$ | (3,861,229 | ) | 1,042,795 | (65,048,327 | ) | ||||||

|

Adjustment for:

|

||||||||||||

|

Depreciation

|

17,752 | 14,651 | 314,031 | |||||||||

|

Loss on disposal of assets

|

- | - | 44,669 | |||||||||

|

Stock based compensation

|

33,611 | 161,975 | 16,491,135 | |||||||||

|

Accrued interest

|

- | - | (58,875 | ) | ||||||||

|

Write-down of mineral properties

|

- | - | 1,746,049 | |||||||||

|

Accretion Expense

|

14,254 | - | 14,254 | |||||||||

|

Change in fair value of equity conversion right

|

102,772 | - | 923,927 | |||||||||

|

Change in fair value of warrant liability

|

368,110 | (3,088,287 | ) | 7,324,615 | ||||||||

|

(Increase) Decrease in accounts receivable

|

(276,393 | ) | (147,344 | ) | (1,788,012 | ) | ||||||

|

(Increase) Decrease in prepaid expenses

|

(102,902 | ) | (87,342 | ) | (148,270 | ) | ||||||

|

Increase (Decrease) in accounts payable

|

452,024 | 589,941 | 882,348 | |||||||||

|

Cash used in Operating Activities

|

(3,252,001 | ) | (1,513,611 | ) | (39,302,456 | ) | ||||||

|

Purchase of GIC receivable

|

- | - | 58,875 | |||||||||

|

Notes receivable issued

|

243,495 | - | 21,365 | |||||||||

|

Purchase of Equity conversion right

|

- | - | (1,337,700 | ) | ||||||||

|

Purchase of Mineral Properities

|

- | (3,701,751 | ) | (6,918,809 | ) | |||||||

|

Purchase of Equipment

|

(33,321 | ) | (3,067 | ) | (924,194 | ) | ||||||

|

Cash used in Investing Activities

|

210,174 | (3,704,818 | ) | (9,100,463 | ) | |||||||

|

Demand notes payable issued

|

- | - | 105,580 | |||||||||

|

Issuance of capital Stock

|

- | - | 67,124,640 | |||||||||

|

Cash used in Financing Activities

|

- | - | 67,230,220 | |||||||||

|

Effect of echange rate changes on Cash

|

435,107 | 28,819 | (53,516 | ) | ||||||||

|

Change in cash during period

|

(2,606,720 | ) | (5,189,610 | ) | 18,773,785 | |||||||

|

Cash at beginning of period

|

21,380,505 | 7,040,999 | - | |||||||||

|

Cash at end of period

|

$ | 18,773,785 | $ | 1,851,389 | $ | 18,773,785 | ||||||

|

Supplemental Cash Flow Disclosure

|

||||||||||||

|

Interest Received

|

$ | 20,937 | $ | - | ||||||||

|

Cash

|

2,243,119 | - | ||||||||||

|

Short-term investments

|

16,530,666 | - | ||||||||||

The accompanying notes are an integral part of the consolidated financial statements

4

PARAMOUNT GOLD AND SILVER CORP.

(An Exploration Stage Mining Company)

Consolidated Statements of Stockholders’ Equity (Unaudited)

For the Period Ended September 30, 2010

(Expressed in United States dollars, unless otherwise stated)

|

Shares

|

Par

Value

|

Capital in

Excess of

Par Value

|

Deficit

|

Contributed

Surplus

|

Cumulative

Translation

Adjustment

|

Total

Stockholders

Equity

|

||||||||||||||||||||||

|

Balance at September 30, 2005

|

11,267,726 | $ | 11,268 | $ | 1,755 | $ | (1,773 | ) | $ | — | $ | — | $ | 11,250 | ||||||||||||||

|

Forward split

|

45,267,726 | 45,267 | (45,267 | ) | — | — | — | — | ||||||||||||||||||||

|

Returned to treasury

|

(61,660,000 | ) | (61,660 | ) | 61,660 | — | ||||||||||||||||||||||

|

Capital issued for financing

|

48,289,835 | 48,291 | 20,320,683 | — | — | — | 20,368,974 | |||||||||||||||||||||

|

Capital issued for services

|

4,157,500 | 4,157 | 9,477,295 | — | — | — | 9,481,452 | |||||||||||||||||||||

|

Capital issued for mineral properties

|

1,178,519 | 1,179 | 2,682,617 | — | — | — | 2,683,796 | |||||||||||||||||||||

|

Capital issued on settlement of notes payable

|

39,691 | 39 | 105,541 | — | — | — | 105,580 | |||||||||||||||||||||

|

Fair Value of warrants

|

— | — | — | — | 8,460,682 | 8,460,682 | ||||||||||||||||||||||

|

Stock based compensation

|

— | — | — | — | 5,080,263 | — | 5,080,263 | |||||||||||||||||||||

|

Foreign currency translation

|

— | — | — | — | — | (19,977 | ) | (19,977 | ) | |||||||||||||||||||

|

Net Income (Loss)

|

— | — | — | (35,954,312 | ) | — | — | (35,954,312 | ) | |||||||||||||||||||

|

Balance at June 30, 2008

|

48,540,997 | 48,541 | 32,604,284 | (35,956,085 | ) | 13,540,945 | (19,977 | ) | 10,217,708 | |||||||||||||||||||

|

Capital issued for financing

|

16,707,791 | 16,707 | 5,828,684 | — | — | — | 5,845,391 | |||||||||||||||||||||

|

Capital issued for services

|

1,184,804 | 1,185 | 683,437 | — | — | — | 684,622 | |||||||||||||||||||||

|

Capital issued from stock options exercised

|

384,627 | 385 | 249,623 | — | (237,008 | ) | — | 13,000 | ||||||||||||||||||||

|

Capital issued for mineral properties

|

16,200,000 | 16,200 | 13,140,250 | — | — | — | 13,156,450 | |||||||||||||||||||||

|

Fair Value of warrants

|

— | — | — | — | 3,612,864 | — | 3,612,864 | |||||||||||||||||||||

|

Stock based compensation

|

— | — | — | — | 1,052,709 | — | 1,052,709 | |||||||||||||||||||||

|

Foreign currency translation

|

— | — | — | — | — | (267,215 | ) | (267,215 | ) | |||||||||||||||||||

|

Net Income (Loss)

|

— | — | — | (7,241,179 | ) | — | — | (7,241,179 | ) | |||||||||||||||||||

|

Balance at June 30, 2009

|

83,018,219 | $ | 83,018 | $ | 52,506,278 | $ | (43,197,264 | ) | $ | 17,969,510 | $ | (287,192 | ) | $ | 27,074,350 | |||||||||||||

The accompanying notes are an integral part of the consolidated financial statements

5

PARAMOUNT GOLD AND SILVER CORP.

(An Exploration Stage Mining Company)

Consolidated Statements of Stockholders’ Equity (Unaudited)

For the Period Ended September 30, 2010

(Expressed in United States dollars, unless otherwise stated)

|

Shares

|

Par

Value

|

Capital in

Excess of

Par Value

|

Deficit

|

Contributed

Surplus

|

Cumulative

Translation

Adjustment

|

Total

Stockholders

Equity

|

||||||||||||||||||||||

|

Balance at June 30, 2009

|

83,018,219 | $ | 83,018 | $ | 52,506,278 | $ | (43,197,264 | ) | $ | 17,969,510 | $ | (287,192 | ) | $ | 27,074,350 | |||||||||||||

|

Capital issued for financing

|

18,400,000 | 18,400 | 21,371,043 | — | — | — | 21,389,443 | |||||||||||||||||||||

|

Capital issued from stock options and warrants exercised

|

835,136,060 | 8,351 | 12,830,936 | — | (4,900,251 | ) | 7,939,036 | |||||||||||||||||||||

|

Capital issued for mineral properties

|

300,000 | 300 | 374,700 | — | — | — | 375,000 | |||||||||||||||||||||

|

Fair Value of warrants

|

— | — | — | — | ||||||||||||||||||||||||

|

Stock based compensation

|

— | — | — | — | 309,840 | — | 309,840 | |||||||||||||||||||||

|

Transition Adjustment (Note 2)

|

— | — | 3,530,616 | (12,637,875 | ) | (2,553,878 | ) | — | (11,661,137 | ) | ||||||||||||||||||

|

Foreign currency translation

|

— | — | — | — | — | (156,483 | ) | (156,483 | ) | |||||||||||||||||||

|

Net Income (Loss)

|

— | — | — | (5,351,958 | ) | — | — | (5,351,908 | ) | |||||||||||||||||||

|

Balance at June 30, 2010

|

110,069,579 | 110,069 | 90,613,573 | (61,187,098 | ) | 10,825,222 | (443,675 | ) | 39,918,091 | |||||||||||||||||||

|

Capital issued for financing

|

— | — | — | — | — | — | — | |||||||||||||||||||||

|

Capital issued from stock options and warrants exercised

|

170,690 | 171 | 146,623 | — | (146,794 | ) | — | — | ||||||||||||||||||||

|

Capital issued for acquisition

|

22,007,453 | 22,007 | 28,807,756 | — | 314,790 | — | 29,144,553 | |||||||||||||||||||||

|

Stock based compensation

|

— | — | — | — | 33,611 | — | 33,611 | |||||||||||||||||||||

|

Foreign currency translation

|

— | — | — | — | — | 435,107 | 435,107 | |||||||||||||||||||||

|

Net Income (Loss)

|

— | — | — | (3,861,229 | ) | — | — | (3,861,229 | ) | |||||||||||||||||||

|

Balance at September 30, 2010

|

132,247,722 | 132,247 | 119,567,952 | (65,048,327 | ) | 11,026,829 | (8,568 | ) | 65,670,133 | |||||||||||||||||||

The accompanying notes are an integral part of the consolidated financial statements

6

PARAMOUNT GOLD AND SILVER CORP.

(An Exploration Stage Mining Company)

Notes to Consolidated Financial Statements (Unaudited)

For the Period Ended September 30, 2010

(Expressed in United States dollars, unless otherwise stated)

|

1.

|

Organization and Business Activity:

|

Paramount Gold and Silver Corp. (‘the Company’), incorporated under the General Corporation Law of the State of Delaware, is a natural resource company engaged in the acquisition, exploration and development of gold, silver and precious metal properties. The Company’s wholly owned subsidiaries include Paramount Gold de Mexico S.A. de C.V., Magnetic Resources Ltd, Minera Gama SA de CV, Compania Minera Paramount SAC and X-Cal Resources Ltd. The Company is an exploration stage company in the process of exploring its mineral properties, and has not yet determined whether these properties contain reserves that are economically recoverable.

|

2.

|

Principal Accounting Policies:

|

Basis of Presentation

The consolidated financial statements are prepared by management in accordance with U.S generally accepted accounting principles (“U.S. GAAP”). The consolidated financial statements include the accounts of the Company and its wholly owned subsidiaries. All significant intercompany accounts and transactions are eliminated in consolidation.

Use of Estimates

The preparation of consolidated financial statements in conformity with United States generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, disclosure of contingent assets and liabilities at the date of the consolidated financial statements, and the reported amounts of revenue and expenses during the reporting period. Actual results could differ from those estimates.

Cash and Cash Equivalents

All highly liquid investments with maturities of three months or less at the date of purchase are classified as cash and cash equivalents.

Fair Value Measurements

The Company has adopted FASB ASC 820, Fair Value Measurements and Disclosures, which defines fair value, establishes guidelines for measuring fair value and expands disclosures regarding fair value measurements. The company applies fair value accounting for all financial assets and liabilities and non – financial assets and liabilities that are recognized or disclosed at fair value in the financial statements on a recurring basis. The Company defines fair value as the price that would be received from selling an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date.

The Company has adopted FASB ASC 825, Financial Instruments, which allows companies to choose to measure eligible financial instruments and certain other items at fair value that are not required to be measured at fair value. The Company has not elected the fair value option for any eligible financial instruments.

Notes Receivable

Notes receivable are classified as available-for-sale or held-to-maturity, depending on our intent with respect to holding such investments. If it is readily determinable, notes receivable classified as available-for-sale is accounted for at fair value. Unrealized gains and losses on available-for-sale securities are excluded from earnings and reported net of tax as a component of other comprehensive income within shareholders’ equity. Interest income is recognized when earned.

7

PARAMOUNT GOLD AND SILVER CORP.

(An Exploration Stage Mining Company)

Notes to Consolidated Financial Statements (Unaudited)

For the Period Ended September 30, 2010

(Expressed in United States dollars, unless otherwise stated)

|

2.

|

Principal Accounting Policies (Continued):

|

Stock Based Compensation

The Company has adopted the provisions of FASB ASC 718, “Stock Compensation” (“ASC 718”), which establishes accounting for equity instruments exchanged for employee services. Under the provisions of ASC 718, stock-based compensation cost is measured at the grant date, based on the calculated fair value of the award, and is recognized as an expense over the employees’ requisite service period (generally the vesting period of the equity grant).

Comprehensive Income

FASB ASC 220“Reporting Comprehensive Income” establishes standards for the reporting and display of comprehensive income and its components in the financial statements. As of June 30, 2010 and June 30 2009, the Company’s only component of comprehensive income is foreign currency translation adjustments.

Long Term Assets

Mineral Properties

Mineral property acquisition costs are capitalized when incurred and will be amortized using the units –of – production method over the estimated life of the probable reserve following the commencement of production. If a mineral property is subsequently abandoned or impaired, any capitalized costs will be expensed in the period of abandonment or impairment.

Acquisition costs include cash consideration and the fair market value of shares issued on the acquisition of mineral properties.

Exploration Costs

Exploration costs, which include maintenance, development and exploration of mineral claims, are expensed as incurred. When it is determined that a mineral deposit can be economically developed as a result of establishing proven and probable reserves, the costs incurred after such determination will be capitalized and amortized over their useful lives. To date, the Company has not established the commercial feasibility of its exploration prospects; therefore, all exploration costs are being expensed.

Fixed Assets

Equipment is recorded at cost less accumulated depreciation. All equipment is amortized over its estimated useful life at the following annual rates, with half the rate being applied in the period of acquisition:

|

Computer equipment

|

30% declining balance

|

|

Equipment

|

20% declining balance

|

|

Furniture and fixtures

|

20% declining balance

|

|

Exploration equipment

|

20% declining balance

|

8

PARAMOUNT GOLD AND SILVER CORP.

(An Exploration Stage Mining Company)

Notes to Consolidated Financial Statements (Unaudited)

For the Period Ended September 30, 2010

(Expressed in United States dollars, unless otherwise stated)

|

2.

|

Principal Accounting Policies (Continued):

|

Income Taxes

Potential benefits of income tax losses are not recognized in the accounts until realization is more likely than not. The Company has adopted FASB ASC 740 as of its inception. Pursuant to FASB ASC 740 the Company is required to compute tax asset benefits for net operating losses carried forward. Potential benefits of net operating losses have not been recognized in these financial statements because the Company cannot be assured it is more likely than not it will utilize the net operating losses carried forward in future periods; and accordingly is offset by a valuation allowance. FIN No.48 prescribes a recognition threshold and measurement attribute for financial statement recognition and measurement of tax positions taken into in tax returns.

To the extent interest and penalties may be assessed by taxing authorities on any underpayment of income tax, such amounts would be accrued and classified as a component of income tax expense in our Consolidated Statements of Operations. The Company elected this accounting policy, which is a continuation of our historical policy, in connection with our adoption of FIN 48.

Foreign Currency Translation

The parent company’s functional currency is the United States dollar. The consolidated financial statements of the Company are translated to United States dollars in accordance with FASB ASC 830 “Foreign Currency Translation” (“ASC 830”). Monetary assets and liabilities denominated in foreign currencies are translated using the exchange rate prevailing at the consolidated balance sheet date. Gains and losses arising on translation or settlement of foreign currency denominated transactions or balances are included in the determination of income. Foreign currency transactions are primarily undertaken in Mexican pesos and Canadian Dollars. The Company has not, to the date of these financial statements, entered into derivative instruments to offset the impact of foreign currency fluctuations.

The functional currencies of the Company’s wholly-owned subsidiaries are the U.S. Dollar and the Canadian Dollar. The financial statements of the subsidiaries are translated to United States dollars in accordance with ASC 830 using period-end rates of exchange for assets and liabilities, and average rates of exchange for the period for revenues and expenses. Translation gains (losses) are recorded in accumulated other comprehensive income (loss) as a component of stockholders’ equity. Foreign currency transaction gains and losses are included in the statement of operations.

Asset Retirement Obligation

The Company has adopted ASC 410-20 “Accounting for Asset Retirement Obligations”, which requires that an asset retirement obligation (“ARO”) associated with the retirement of a tangible long-lived asset be recognized as a liability in the period in which it is incurred and becomes determinable, with an offsetting increase in the carrying amount of the associated asset. The cost of the tangible asset, including the initially recognized ARO, is depleted such that the cost of the ARO is recognized over the useful life of the asset. The ARO is recorded at fair value, and accretion expense is recognizable over time as the discounted liability is accreted to its expected settlement value. The fair value of the ARO is measured using expected future cash flows, discounted at the Company’s credit-adjusted-risk-free interest rate.

9

PARAMOUNT GOLD AND SILVER CORP.

(An Exploration Stage Mining Company)

Notes to Consolidated Financial Statements (Unaudited)

For the Period Ended September 30, 2010

(Expressed in United States dollars, unless otherwise stated)

|

2.

|

Principal Accounting Policies (Continued):

|

Environmental Protection and Reclamation Costs

The operations of the Company have been, and may in the future be affected from time to time in varying degrees by changes in environmental regulations, including those for future removal and site restoration costs. Both the likelihood of new regulations and their overall effect upon the Company may vary from region to region and are not predictable.

Environmental expenditures that relate to ongoing environmental and reclamation programs are charged against statements of operations as incurred or capitalized and amortized depending upon their future economic benefits.

Loss per Share

The Company computes net income (loss) per share in accordance with FASB ASC 260, “Earnings per Share”. FASB ASC 260 requires presentation of both basic and diluted earnings per share (EPS) on the face of the income statement. Basic EPS is computed by dividing net income (loss) available to common shareholders (numerator) by the weighted average number of shares outstanding (denominator) during the period. Diluted EPS give effect to all dilutive potential common shares outstanding during the period using the treasury stock method. In computing Diluted EPS, the average stock price for the period is used in determining the number of shares assumed to be purchased from the exercise of stock options or warrants. Diluted EPS excludes all dilutive potential shares if their effect is anti dilutive. The basic and diluted EPS has been retroactively restated to take into effect the 2 for 1 stock split that occurred on July 11, 2005.

Concentration of Credit and Foreign Exchange Rate Risk

Financial instruments that potentially subject the Company to credit and foreign exchange risk consist principally of cash, deposited with a high quality credit institution and amounts receivable, mainly representing value added tax recoverable from a foreign government. Management does not believe that the Company is subject to significant credit or foreign exchange risk from these financial instruments.

Fair Value Measurements

On July 1, 2008, the Company adopted FASB ASC 820, Fair Value Measurements as it relates to financial assets and financial liabilities. In February 2008, the FASB staff issued ASC 845, Effective Date of ASC 820 (“ASC 820”). ASC 845 delayed the effective date of ASC 820 for nonfinancial assets and nonfinancial liabilities, except for items that are recognized or disclosed at fair value in the financial statements on a recurring basis (at least annually). The provisions of ASC 845 are effective for the Company’s fiscal year beginning July 1, 2009.

ASC 820 defines fair value, establishes a framework for measuring fair value in generally accepted accounting principles, and expands disclosures about fair value measurements. ASC 820 defines fair value as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. This standard is now the single source in GAAP for the definition of fair value, except for the fair value of leased property as defined in ASC 820. ASC 820 establishes a fair value hierarchy that distinguishes between (1) market participant assumptions developed, based on market data obtained from independent sources (observable inputs) and (2) an entity’s own assumptions about market participant assumptions developed, based on the best information available in the circumstances (unobservable inputs). The fair value hierarchy consists of three broad levels, which gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1) and the lowest priority to unobservable inputs (Level 3).

10

PARAMOUNT GOLD AND SILVER CORP.

(An Exploration Stage Mining Company)

Notes to Consolidated Financial Statements (Unaudited)

For the Period Ended September 30, 2010

(Expressed in United States dollars, unless otherwise stated)

|

2.

|

Principal Accounting Policies (Continued):

|

Fair Value Measurements (Continued)

The three levels of the fair value hierarchy under ASC 820 are described below:

|

Level 1

|

|

Unadjusted quoted prices in active markets that are accessible at the measurement date for identical, unrestricted assets or liabilities.

|

|

Level 2

|

Inputs other than quoted prices included within Level 1 that are observable for the asset or liability, either directly or indirectly, including quoted prices for similar assets or liabilities in active markets; quoted prices for identical or similar assets or liabilities in markets that are not active; inputs other than quoted prices that are observable for the asset or liability (e.g., interest rates); and inputs that are derived principally from or corroborated by observable market data by correlation or other means.

|

|

|

Level 3

|

Inputs that are both significant to the fair value measurement and unobservable.

|

The following table sets forth the Company’s financial assets and liabilities measured at fair value by level within the fair value hierarchy. As required by ASC 820, assets and liabilities are classified in their entirety based on the lowest level of input that is significant to the fair value measurement.

|

Fair Value at September 30, 2010

|

June 30, 2010

|

|||||||||||||||||||

|

Assets

|

Total

|

Level 1

|

Level 2

|

Level 3

|

Total

|

|||||||||||||||

| $ | $ | $ | $ | $ | ||||||||||||||||

|

Cash equivalents

|

18,773,785 | 18,773,785 | - | - | 21,380,505 | |||||||||||||||

|

Accounts receivable

|

1,788,012 | 1,788,012 | - | - | 1,511,619 | |||||||||||||||

|

Loan Advance

|

- | - | - | - | 243,495 | |||||||||||||||

|

Equity Conversion Right

|

413,773 | 413,773 | - | - | 516,545 | |||||||||||||||

|

Marketable Securities

|

2,700 | 2,700 | - | - | - | |||||||||||||||

|

Liabilities

|

||||||||||||||||||||

|

Warrant liability

|

6,347,877 | - | - | 6,347,877 | 5,979,767 | |||||||||||||||

The Company’s cash equivalents and GIC are classified within Level 1 of the fair value hierarchy because they are valued using quoted market prices. The cash equivalents that are valued based on quoted market prices in active markets are primarily comprised of commercial paper, short-term certificates of deposit and U.S. Treasury securities. The accounts receivable represent amounts due from a national government regarding refund of taxes. The notes receivable is classified within Level 2 of the fair value hierarchy.

The Equity Conversion Right is accounted for as an asset and is classified within Level 1 because the underlying security has a published and observable market. The Company uses the published closing stock price of the underlying security at the end of the financial reporting period to determine the fair value of the asset. The change in fair value is recorded in the statement of operations as a loss (gain).

The changes in fair value of the Equity Conversion Right during the period ended September 30, 2010 was as follows:

|

Balance at June 30, 2010

|

516,545

|

|

Change in fair value recorded in earnings

|

(102,772)

|

|

Balance at September 30, 2010

|

413,773

|

11

PARAMOUNT GOLD AND SILVER CORP.

(An Exploration Stage Mining Company)

Notes to Consolidated Financial Statements (Unaudited)

For the Period Ended September 30, 2010

(Expressed in United States dollars, unless otherwise stated)

|

2.

|

Principal Accounting Policies (Continued):

|

Fair Value Measurements (Continued)

The estimated fair value of warrants and options accounted for as liabilities was determined on the date of closing and marked to market at each financial reporting period. The change in fair value of the warrants is recorded in the statement of operations as a gain (loss) and is estimated using the Black-Scholes option-pricing model with the following inputs:

|

September 30, 2010

|

|

|

Risk free interest rate

|

0.26%

|

|

Expected life of warrants and options

|

1 to 2 years

|

|

Expected stock price volatility

|

59.72%

|

|

Expected dividend yield

|

0%

|

The changes in fair value of the warrants during the year ended September 30, 2010 were as follows:

|

Balance at June 30, 2010

|

5,979,767

|

|

Issuance of warrants and options

|

-

|

|

Change in fair value recorded in earnings

|

368,110

|

|

Transferred to equity upon exercise

|

-

|

|

Balance at September 30, 2010

|

6,347,877

|

Accounting Standards Adopted

(i) Derivatives

In March 2008, the FASB issued ASC 815, “Disclosures about Derivative Instruments and Hedging Activities” (“ASC 815”). ASC 815 requires qualitative disclosures about objectives and strategies for using derivatives, quantitative disclosures about fair value amounts of gains and losses on derivative instruments, and disclosures about credit-risk-related contingent features in derivative agreements. This statement is effective for financial statements issued for fiscal periods beginning after November 15, 2008.

Effective July 1, 2009, we adopted the amended provisions of ASC 815 on determining what types of instruments or embedded features in an instrument held by a reporting entity can be considered indexed to its own stock for the

purpose of evaluating the first criteria of the scope exception in ASC 815. Warrants and options issued in prior periods with exercise prices denominated in Canadian dollars are no longer considered indexed to our stock, as their exercise price is not in the Company’s functional currency of the US dollar, and therefore no longer qualify for the scope exception and must be accounted for as a derivative. These warrants and options are reclassified as liabilities under the caption “Warrant liability” and recorded at estimated fair value at each reporting date, computed using the Black-Scholes valuation method. Changes in the liability from period to period are recorded in the Statements of Operations under the caption “Change in fair value of warrant liability.” On July 1, 2010, we recorded a cumulative effect adjustment based on the grant date fair value of warrants issued during the year ended June 30, 2009 that were outstanding at July 1, 2009 and the change in fair value of the warrant liability from the issuance date through to July 1, 2009.

We have elected to record the change in fair value of the warrant liability as a component of other income and expense on the statement of operations as we believe the amounts recorded relate to financing activities and not as a result of our operations.

12

PARAMOUNT GOLD AND SILVER CORP.

(An Exploration Stage Mining Company)

Notes to Consolidated Financial Statements (Unaudited)

For the Period Ended September 30, 2010

(Expressed in United States dollars, unless otherwise stated)

|

2.

|

Principal Accounting Policies (Continued):

|

Accounting Standards Adopted (Continued)

(i) Derivatives (Continued)

We recorded the following cumulative effect of change in accounting principal pursuant to its adoption of the amendment as of July 1, 2009:

|

Contributed surplus

|

Warrant liability

|

Accumulated deficit

|

||||||||||

|

Grant date fair value of previously issued warrants outstanding as of July 1, 2009

|

3,612,865 | (3,612,865 | ) | — | ||||||||

|

Change in fair value of previously issued warrants outstanding as of July 1, 2009

|

— | (12,637,875 | ) | 12,637,875 | ||||||||

|

Cumulative effect of change in accounting principal

|

3,612,865 | (16,250,740 | ) | 12,637,875 | ||||||||

In addition, we have recorded a gain related to the change in fair value of the warrant liability of $5,681,370 on the Consolidated Statements of Operations for the year ended June 30, 2010.

(ii) Business Combinations

In December 2007, the FASB issued FASB ASC 805 (revised 2007), “Business Combinations” (“ASC 805”). ASC 805 significantly changes the accounting for business combinations in a number of areas including the treatment of contingent consideration, pre acquisition contingencies, transaction costs, in-process research and development, and restructuring costs. In addition, under ASC 805, changes in an acquired entity's deferred tax assets and uncertain tax positions after the measurement period will impact income tax expense. ASC 805 is effective for fiscal periods beginning after December 15, 2008. The Company has adopted ASC 805 on July 1, 2009. This standard will change the accounting treatment for business combinations on a prospective basis.

In December 2007, the FASB issued ASC 810, “No controlling Interests in Consolidated Financial Statements – an amendment of Accounting Research Bulletin No. 51” (“ASC 810”), which establishes accounting and reporting standards for ownership interests in subsidiaries held by parties other than the parent, the amount of consolidated net income attributable to the parent and to the non controlling interest, changes in a parent’s ownership interest and the valuation of retained non-controlling equity investments when a subsidiary is deconsolidated. The Statement also establishes reporting requirements that clearly identify and distinguish between the interests of the parent and the interests of the non-controlling owners. ASC 810 is effective for fiscal periods beginning after December 15, 2008. The Company has adopted ASC 810 on July 1, 2009. Adoption of this standard did not have a material impact on the Company’s financial position, results of operations, or cash flows.

(iii) Accounting Standards Codification

In July 2009, the FASB issued ASC 105-20-05, "FASB Accounting Standards Codification" ("ASC 105-10-05"), as the single source of authoritative nongovernmental U.S. generally accepted accounting principles (GAAP). The Codification is effective for interim and annual periods ending after September 15, 2009. All existing accounting standards are superseded as described in ASC 105- 10-05. All other accounting literature not included in the Codification is non-authoritative. Management is currently evaluating the impact of the adoption of ASC 105-10-05 but does not expect the adoption of ASC 105-10-05 to impact the Company's results of operations, financial position, or cash flows.

13

|

2.

|

Principal Accounting Policies (Continued):

|

Accounting Standards Adopted (Continued)

(iv) Financial Guarantee Insurance Contracts

In May 2008, the FASB issued ASC 460, "Accounting for Financial Guarantee Insurance Contracts - an interpretation of FASB Statement No. 60." ASC 460 requires that an insurance enterprise recognize a claim liability prior to an event of default (insured event) when there is evidence that credit deterioration has occurred in an insured financial obligation. This Statement also clarifies how Statement 60 applies to financial guarantee insurance contracts, including the recognition and measurement to be used to account for premium revenue and claim liabilities. Those clarifications will increase comparability in financial reporting of financial guarantee insurance contracts by insurance enterprises. This Statement requires expanded disclosures about financial guarantee insurance contracts. The accounting and disclosure requirements of the Statement will improve the quality of information provided to users of financial statements. ASC 460 will be effective for financial statements issued for fiscal years beginning after December 15, 2008. Adoption of this standard did not have an impact on the Company’s results of operations, financial position, or cash flows.

(v) Subsequent Events

In May 2009, the FASB issued ASC 855, "Subsequent Events," which establishes general standards for accounting for, and disclosures of, events that occur after the balance sheet date, but before the financial statements are issued or are available to be issued. The pronouncement requires the disclosure of the date through which an entity has evaluated subsequent events and the basis for that date and whether that date represents the date the financial statements were issued or were available to be issued. ASC 855 is effective with interim and annual financial periods ending after June 15, 2009. The Company adopted ASC 855 on July 1, 2009. Adoption of this standard did not have an impact on the Company's results of operations, financial position, or cash flows.

(vi) Convertible Debt Instruments

In May 2008, the FASB issued FSP No. APB 14-1, “Accounting for Convertible Debt Instruments That May Be Settled in Cash upon Conversion (Including Partial Cash Settlement)” (“FSP 14-1”). FSP 14-1 applies to convertible debt instruments that, by their stated terms, may be settled in cash (or other assets) upon conversion, including partial cash settlement, unless the embedded conversion option is required to be separately accounted for as a derivative under FASB Statement No. 133. Convertible debt instruments within the scope of FSP 14-1 are not addressed by the existing APB 14. FSP 14-1 would require that the liability and equity components of convertible debt instruments within the scope of FSP 14-1 be separately accounted for in a manner that reflects the entity’s nonconvertible debt borrowing rate. This will require an allocation of the convertible debt proceeds between the liability component and the embedded conversion option (i.e., the equity component). The difference between the principal amount of the debt and the amount of the proceeds allocated to the liability component would be reported as a debt discount and subsequently amortized to earnings over the instrument’s expected life using the effective interest method. FSP APB 14-1 is effective for the Company’s fiscal year beginning July 1, 2009 and will be applied retrospectively to all periods presented. Adoption of this standard is not expected to have a material impact on the Company’s financial position, results of operations or cash flows.

14

PARAMOUNT GOLD AND SILVER CORP.

(An Exploration Stage Mining Company)

Notes to Consolidated Financial Statements (Unaudited)

For the Period Ended September 30, 2010

(Expressed in United States dollars, unless otherwise stated)

|

2.

|

Principal Accounting Policies (Continued):

|

Accounting Standards Adopted (Continued)

(vii) ASC 820-10-65

During the second quarter of 2009, the FASB issued FASB ASC 820-10-65, (Determining Fair Value When the Volume and Level of Activity for the Asset or Liability Have Significantly Decreased and Identifying Transactions That Are Not Orderly). FASB ASC 820-10-65:

● Affirms that the objective of fair value when the market for an asset is not active is the price that would be received to sell the asset in an orderly transaction.

● Clarifies and includes additional factors for determining whether there has been a significant decrease in market activity for an asset when the market for that asset is not active.

● Eliminates the proposed presumption that all transactions are distressed (not orderly) unless proven otherwise. FASB ASC 820-10-65 instead requires an entity to base its conclusion about whether a transaction was not orderly on the weight of the evidence.

● Includes an example that provides additional explanation on estimating fair value when the market activity for an asset has declined significantly.

● Requires an entity to disclose a change in valuation technique (and the related inputs) resulting from the application of FASB ASC 820-10-65 and to quantify its effects, if practicable.

● Applies to all fair value measurements when appropriate.

FASB ASC 820-10-65 must be applied prospectively and retrospective application is not permitted. FASB ASC 820-10-65 is effective for interim and annual periods ending after June 15, 2009, with early adoption permitted for periods ending after March 15, 2009. An entity early adopting FASB ASC 820-10-65 must also early adopt FASB ASC 320-10-65, Recognition and Presentation of Other-Than-Temporary Impairments. The adoption of FASB ASC 820-10-65 had no impact on the company‘s consolidated operating results, financial position, or cash flows.

3. Recent Accounting Pronouncements:

ASC 860

In June 2009, the FASB issued ASC 860, “Accounting for Transfers of Financial Assets—an amendment of FASB Statement” (“ASC 860”). ASC 860 is intended to establish standards of financial reporting for the transfer of assets to improve the relevance, representational faithfulness, and comparability. ASC 860 is effective for financial statements issued for fiscal years and interim periods beginning after November 15, 2009. The Company will adopt ASC 860 on July 1, 2010. The Company has determined that the adoption of ASC 860 will have no impact on its consolidated financial statements.

15

PARAMOUNT GOLD AND SILVER CORP.

(An Exploration Stage Mining Company)

Notes to Consolidated Financial Statements (Unaudited)

For the Period Ended September 30, 2010

(Expressed in United States dollars, unless otherwise stated)

ASC 810

In June 2009, the FASB issued ASC 810, “Amendments to FASB Interpretation No. 46(R)” (“ASC 810”). ASC 810 eliminates the exception to consolidate a qualifying special-purpose entity, changes the approach to determining the primary beneficiary of a variable interest entity, and requires companies to more frequently re-assess whether they must consolidate variable interest entities. Under the new guidance, the primary beneficiary of a variable interest entity is identified qualitatively as the enterprise that has both (a) the power to direct the activities of a variable interest entity that most significantly impact the entity’s economic performance, and (b) the obligation to absorb losses of the entity that could potentially be significant to the variable interest entity or the right to receive benefits from the entity that could potentially be significant to the variable interest entity. ASC 810 becomes effective for the Company’s fiscal 2011 year-end and interim reporting periods thereafter. The Company does not expect ASC 810 to have a material impact on its financial statements.

4. Non-Cash Transactions:

During the period ended September 30, 2010 and 2009, the Company entered into certain non-cash activities as follows:

|

2010

|

2009

|

|||||||

|

Operating and Financing Activities

|

||||||||

|

From issuance of shares for acquisitions

|

$ | 28,829,763 | $ | - | ||||

|

From issuance of shares for cashless exercise of options

|

$ | 146,793 | $ | 3,529 | ||||

|

From issuance of shares for mineral property

|

$ | - | $ | - | ||||

5. Capital Stock:

a) Share issuances:

Authorized capital stock consists of 200,000,000 common shares with par value of $0.001 each.

During the period ended September 30, 2010, the Company issued a total of 22,178,143 common shares which are summarized as follows:

|

Common Shares

|

||||||||

|

2010

|

2009

|

|||||||

|

Financing

|

- | - | ||||||

|

Acquisition of mineral properties

|

- | - | ||||||

|

For exercise of warrants and options

|

170,690 | - | ||||||

|

For acquisition of companies

|

22,007,453 | - | ||||||

|

For services

|

- | 5,429 | ||||||

| 22,178,143 | 5,429 | |||||||

During the three month period ended September 30, 2010, the company issued 22,007,453 shares in exchange for all the outstanding and issued shares of X-Cal Resources Ltd. The Company also issued 170,690 common shares pursuant to the cashless exercise of 300,000 options at an exercise price of $0.65.

16

PARAMOUNT GOLD AND SILVER CORP.

(An Exploration Stage Mining Company)

Notes to Consolidated Financial Statements (Unaudited)

For the Period Ended September 30, 2010

(Expressed in United States dollars, unless otherwise stated)

b) Warrants:

The following share purchase warrants and agent compensation warrants were outstanding at September 30, 2010:

|

Exercise price in

CAD

|

Exercise price in

USD at June 30,

2010

|

Number of

warrants

|

Remaining contractual life

(years)

|

|

|

Warrants *

|

$1.05

|

$1.02

|

9,000,000

|

2.41

|

|

Agent compensation warrants *

|

$1.05

|

$1.02

|

840,000

|

2.41

|

|

Outstanding and exercisable at September 30, 2010

|

9,840,000

|

5. Capital Stock (Continued):

|

September 30, 2010

|

September 30, 2009

|

|

|

Risk free interest rate

|

.26%

|

0.93%

|

|

Expected life of warrants

|

1.2 years

|

.3 – 2 years

|

|

Expected stock price volatility

|

59.72%

|

77.67% to 106.62%

|

|

Expected dividend yield

|

0%

|

0%

|

c) Stock options:

On August 23, 2007, the board and stockholders approved the 2007/2008 Stock Incentive & Compensation Plan thereby reserving an additional 4,000,000 common shares for issuance to employees, directors and consultants.

On February 24, 2009 the stockholders approved the 2008/2009 Stock Incentive & Equity Compensation Plan thereby reserving an additional 3,000,000 common shares for future issuance. The stockholders also approved the re-pricing of the exercise price of all outstanding stock options to $0.65 per share.

Stock Based Compensation

The Company uses the Black-Scholes option valuation model to value stock options granted. The Black-Scholes model was developed for use in estimating the fair value of traded options that have no vesting restrictions and are fully transferable. The model requires management to make estimates which are subjective and may not be representative of actual results. Changes in assumptions can materially affect estimates of fair values. For purposes of the calculation, the following assumptions were used:

|

September 30, 2010

|

September 30, 2009

|

|

|

Risk free interest rate

|

0.26%-0.98%

|

0.50%-0.91%

|

|

Expected dividend yield

|

0%

|

0%

|

|

Expected stock price volatility

|

61%-85%

|

121%-123%

|

|

Expected life of options

|

1 to 2 years

|

1 to 2 years

|

17

PARAMOUNT GOLD AND SILVER CORP.

(An Exploration Stage Mining Company)

Notes to Consolidated Financial Statements (Unaudited)

For the Period Ended September 30, 2010

(Expressed in United States dollars, unless otherwise stated)

Changes in the Company’s stock options for the year ended September 30, 2010 are summarized below:

|

Options

|

Number

|

Weighted Avg. Exercise Price

|

Weighted-Average

Remaining

Contractual Term

|

Aggregate Intrinsic Value

|

|

Balance, beginning of period

|

2,785,000

|

$0.91

|

2.4

|

1,261,750

|

|

Issued

|

1,339,375

|

1.80

|

||

|

Cancelled / Expired

|

150,000

|

1.60

|

||

|

Exercised

|

300,000

|

0.65

|

||

|

Outstanding at September 30, 2010

|

3,674,375

|

1.23

|

1.72

|

1,840,781

|

|

Exercisable at September 30, 2010

|

2,180,625

|

$0.72

|

1.59

|

1,761,281

|

At September 30, 2010, there were 3,674,375 options outstanding. Options outstanding above that have not been vested at period end are 850,000 which have a maximum service term of 1- 4 years. The vesting of these options is dependent on market conditions which have yet to be met.

For the period ended September 30, 2010 the Company recognized stock based compensation expense in the amount of $33,611 (2009 - $161,975).

|

6.

|

Related Party Transactions:

|

During the period ended September 30, 2010, directors received payments in the amount of $98,000 (2009: $87,157).

During the period ended September 30, 2010 the Company made payments of $22,201 (2009: $19,765) pursuant to a premises lease agreement to a corporation with a shareholder in common with the Company.

All transactions with related parties are made in the normal course of operations and measured at exchange value.

18

PARAMOUNT GOLD AND SILVER CORP.

(An Exploration Stage Mining Company)

Notes to Consolidated Financial Statements (Unaudited)

For the Period Ended September 30, 2010

(Expressed in United States dollars, unless otherwise stated)

|

7.

|

Mineral Properties:

|

The Company has capitalized acquisition costs on mineral properties as follows:

|

September 30,

2010 |

June 30,

2010 |

|||||

|

Temoris

|

4,074,754 | 4,074,754 | ||||

|

Iris Royalty

|

50,000 | 50,000 | ||||

|

Morelos

|

100,000 | 100,000 | ||||

|

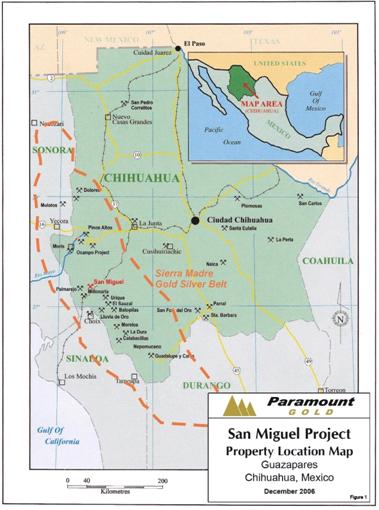

San Miguel Project

|

17,855,824 | 17,855,824 | ||||

|

Andrea

|

20,625 | 20,625 | ||||

|

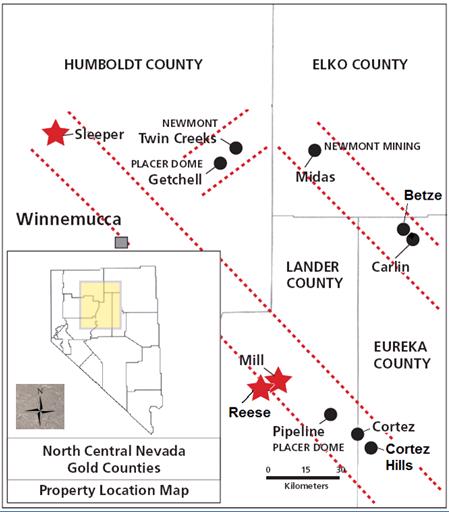

Sleeper

|

23,859,179 | − | ||||

|

Mill Creek

|

2,096,616 | − | ||||

|

Spring Valley

|

385,429 | − | ||||

|

Reese River

|

64,061 | − | ||||

|

Peru

|

10,000 | 10,000 | ||||

| $ | 48,516,487 | $ | 22,111,203 | |||

|

8.

|

Fixed Assets:

|

|

Net Book Value

|

||||||||||||||||

|

Cost

|

Accumulated

Amortization |

September 30,

2010

|

June 30,

2010

|

|||||||||||||

|

Property and Equipment

|

$ | 799,661 | $ | 264,646 | $ | 535,015 | $ | 519,446 | ||||||||

During the period ended September 30, 2010, total additions to property, plant and equipment were $33,321 (2009- $3,068). During the period ended September 30, 2010 the Company recorded depreciation of $17,752.

|

9.

|

Investments:

|

Mexoro Minerals Ltd.

The Company holds 250,000 shares of common stock of Mexoro Minerals Ltd. It has not recorded these shares in its financial statements because the shares as of the date of this report were restricted from sale and the Company cannot determine if there is any net realizable value until the shares have been liquidated.

Gaibaldi Resources Corp.

The Company also holds 400,000 shares of common stock of Garibaldi Resources Corp. It has not recorded these shares in its financial statements because it cannot determine if there is any net realizable value until the shares have been liquidated.

19

PARAMOUNT GOLD AND SILVER CORP.

(An Exploration Stage Mining Company)

Notes to Consolidated Financial Statements (Unaudited)

For the Period Ended September 30, 2010

(Expressed in United States dollars, unless otherwise stated)

|

10.

|

Segmented Information:

|

Segmented information has been compiled based on the geographic regions in which the Company has acquired mineral properties and performs exploration activities.

Loss for the period by geographical segment for the period ended September 30, 2010:

|

United

States

|

Mexico /

Latin America

|

Total

|

||||||||||

|

Interest income

|

$ | 20,936 | $ | 1 | $ | 20,937 | ||||||

|

Expenses:

|

||||||||||||

|

Exploration

|

362,394 | 1,439,862 | 1,802,256 | |||||||||

|

Professional fees

|

167,735 | - | 167,735 | |||||||||

|

Directors compensation

|

50,546 | - | 50,546 | |||||||||

|

Travel and lodging

|

55,283 | - | 55,283 | |||||||||

|

Corporate communications

|

27,045 | - | 27,045 | |||||||||

|

Consulting fees

|

74,368 | - | 74,368 | |||||||||

|

Office and administration

|

65,471 | 15,152 | 80,623 | |||||||||

|

Interest and service charges

|

1,926 | 905 | 2,831 | |||||||||

|

Loss on Disposal of Assets

|

- | - | - | |||||||||

|

Insurance

|

42,319 | - | 42,319 | |||||||||

|

Amortization

|

3,348 | 14,404 | 17,752 | |||||||||

|

Accretion

|

14,254 | - | 14,254 | |||||||||

|

Acquisition Expenses

|

1,076,273 | - | 1,076,273 | |||||||||

|

Miscellaneous

|

- | - | - | |||||||||

|

Write off of mineral property

|

- | - | - | |||||||||

|

Income and other taxes

|

- | - | - | |||||||||

|

Total Expenses

|

1,940,962 | 1,470,323 | 3,411,285 | |||||||||

|

Net loss before other items

|

$ | 1,920,026 | $ | 1,470,322 | $ | 3,390,348 | ||||||

20

PARAMOUNT GOLD AND SILVER CORP.

(An Exploration Stage Mining Company)

Notes to Consolidated Financial Statements (Unaudited)

For the Period Ended September 30, 2010

(Expressed in United States dollars, unless otherwise stated)

|

10.

|

Segmented Information (Continued):

|

Loss for the period by geographical segment for the period ended September 30, 2009:

|

United States

|

Peru

|

Mexico

|

Total

|

|||||||||||||

|

Interest income

|

$ | 54,448 | $ | - | $ | 65 | $ | 54,514 | ||||||||

|

Expenses:

|

||||||||||||||||

|

Exploration

|

(316,571 | ) | (8,037 | ) | 1,183,819 | 859,211 | ||||||||||

|

Professional fees

|

239,932 | - | - | 239,932 | ||||||||||||

|

Travel and lodging

|

22,124 | - | - | 22,124 | ||||||||||||

|

Geologist fees and expenses

|

190,171 | - | 29,117 | 219,288 | ||||||||||||

|

Corporate communications

|

39,626 | - | - | 39,626 | ||||||||||||

|

Consulting fees

|

72,207 | - | - | 72,207 | ||||||||||||

|

Office and administration

|

38,221 | - | 21,960 | 60,181 | ||||||||||||

|

Interest and service charges

|

5,163 | - | 1,275 | 6,438 | ||||||||||||

|

Loss on Disposal of Assets

|

- | - | - | - | ||||||||||||

|

Insurance

|

14,144 | - | - | 14,144- | ||||||||||||

|

Amortization

|

5,664 | - | 8,987 | 14,651 | ||||||||||||

|

Office

|

20,757 | - | - | 20,757 | ||||||||||||

|

Acquisition Expenses

|

365,458 | - | - | 365,458 | ||||||||||||

|

Miscellaneous

|

5,013 | - | 1 | 5,014 | ||||||||||||

|

Stock based compensation

|

161,975 | - | - | 161,975 | ||||||||||||

|

Total Expenses

|

862,884 | (8,037 | ) | 1,245,158 | 2,100,006 | |||||||||||

|

Net loss

|

$ | 808,436 | $ | (8,037 | ) | $ | 1,245,093 | $ | 2,045,492 | |||||||

Assets by geographical segment:

|

United

States

|

Mexico /

Latin America

|

Total

|

||||||||||

|

September 30, 2010

|

||||||||||||

|

Mineral properties

|

$ | 26,405,284 | $ | 22,111,203 | $ | 48,516,487 | ||||||

|

Equipment

|

153,722 | 381,293 | 535,015 | |||||||||

|

June 30, 2010

|

||||||||||||

|

Mineral properties

|

- | 22,111,203 | 22,111,203 | |||||||||

|

Equipment

|

$ | 125,825 | $ | 393,621 | $ | 519,446 | ||||||

21

PARAMOUNT GOLD AND SILVER CORP.

(An Exploration Stage Mining Company)

Notes to Consolidated Financial Statements (Unaudited)

For the Period Ended September 30, 2010

(Expressed in United States dollars, unless otherwise stated)

|

11.

|

Reclamation and Environmental

|

The Company holds an insurance policy related to its Sleeper Gold Project that covers reclamation costs in the event the Company defaults on payments of its reclamation costs up to an aggregate of $25 million. The insurance premium is being amortized over ten years and the prepaid insurance balance at September 30, 2010 is $1,042,163. As a part of the policy, the Company has funds in a commutation account which is used to reimburse reclamation costs and indemnity claims. The balance of the commutation account at September 30, 2010 is $2,828,416.

Reclamation and environmental costs are based principally on legal requirements. Management estimates costs associated with reclamation of mineral properties. On an ongoing basis the Company evaluates its estimates and assumptions; however, actual amounts could differ from those based on estimates and assumptions.

Changes to the Company’s asset retirement obligations are as follows:

|

Balance, beginning of the period

|

$ | 0 | ||

|

Asset retirement obligations acquired

|

1,121,150 | |||

|

Accretion expense

|

14,254 | |||

|

Payments

|

(13,099 | ) | ||

|

Balance, end of period

|

$ | 1,122,305 |

|

12.

|

Equity Conversion Right |

On December 4, 2009, the Company entered into an Earn-In Agreement with SNS Silver Corp (“SNS”) of Vancouver BC wherein the Company has acquired the right and option to earn up to 30% of SNS’s interest in and to the Claims of the Northern Nickel Agreement that SNS holds by incurring Exploration Expenditures of CAD $1,400,000 by December 31, 2009. SNS has confirmed that said expenditures of CAD $1,400,000 were incurred by the Company by December 31, 2009 and that the Company now holds an option to acquire a 30% interest in the Northern Nickel claims.

Under terms of the Agreement with SNS, the Company has the option to convert the “Equity Conversion Right” on any and all sums spent on the Exploration Program into shares of SNS at a price of CAD $0.23 per share.

At September 30, 2010, the fair value of the Equity Conversion Right was $413,773. As a result, the Company recorded a loss related to the change in fair value of the Equity Conversion Right of $102,772 on the Consolidated Statements of Operations for the period ended September 30, 2010.

|

13.

|

Commitments and Contingencies

|

Litigation

In April 2010, the Company learned that Danny Sims and Sims Geological and Geotechnical Services LLC, a former contractor for the company, filed an action against the Company in the United States District Court for the District of Arizona on the date of February 22, 2010. The Company believes the amount of the claim is indeterminable and believes there is no basis for the claim or allegations made by the plaintiff and will defend itself to the fullest possible extent.

22

PARAMOUNT GOLD AND SILVER CORP.

(An Exploration Stage Mining Company)

Notes to Consolidated Financial Statements (Unaudited)

For the Period Ended September 30, 2010

(Expressed in United States dollars, unless otherwise stated)

|

14.

|

X-Cal Resources Ltd.

|

On August 23, 2010, the Company acquired all the issued and outstanding shares of common stock of X-Cal Resources Ltd. X-Cal Resources Ltd. is an exploration stage mining company with advanced projects in the state of Nevada. The transaction was structured as a statutory Plan of Arrangement under the Business Corporations Act of British Columbia, Canada. Under the terms of the Plan of Arrangement, X-Cal shareholders received one (1) share of Paramount common stock for every eight (8) common shares of X-Cal.

At the Closing Date, X-Cal Resources Ltd. had 176,059,978 issued and outstanding shares of common stock. Holders of these shares received a total of 22,007,453 shares of Paramount common stock. All options to purchase common shares of X-Cal were terminated prior to the Closing Date, and 1,264,375 options to purchase shares of Paramount common stock were granted to those persons under Paramount’s existing stock option plans.

The Company recorded acquisition related costs for the period ended September 30, 2010 of $1,076,273.

The amounts of X-Cal Resources Ltd. revenue and Net Loss included in the Company’s consolidated income statement for the period ended September 30, 2010, and the revenue and earnings of the combined entity had the acquisition date been July 1, 2010, or July 1, 2009, are as follows:

|

Revenue

|

Net Loss (Gain)

|

|

|

Actual from August 23, 2010 to September 30, 2010

|

$0

|

$1,188,675

|

|

Supplemental pro forma

For three month period ended September 30, 2010

|

$20,937

|

$4,423,728

|

|

Supplemental pro forma

For three month period ending September 30, 2009

|

$54,514

|

$(290,970)

|

The following is the allocation of cost of acquisition of X-Cal Resources Ltd.:

|

Shares eligible for conversion

|

176,059,978 | |||

|

Common stock exchange ratio per share

|

0.125 | |||

|

Equivalent new shares to be issued (par value $0.01)

|

22,007,497 | |||

|

Total fractional shares in exchange not issued

|

(44 | ) | ||

|

Shares issued

|

22,007,453 | |||

|

Paramount common stock price on August 20, 2010

|

1.31 | |||

|

Total preliminary purchase price (common stock)

|

$ | 28,829,764 | ||

|

Estimated fair value of options issued

|

314,790 | |||

|

Total purchase price

|

$ | 29,144,554 |

23

|

ITEM 2.

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATION

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations (“MD&A”) is designed to provide a reader of our financial statements with a narrative from management’s perspective on our liquidity financial condition, results of operations and other factors that may affect our future results. This MD&A should be read in conjunction with the accompanying interim financial statements and related notes. We also believe it is important to read our MD&A in conjunction with our Annual Report on Form 10-K for the year ended June 30, 2010, as well as other publicly available information.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION