Attached files

Exhibit 10.32

STANDARD OFFICE LEASE

This Standard Office Lease (“Lease”) is made and entered into as of this 20th day of July, 2010, by and between GATEWAY TEMPE LLC, a Washington limited liability company (“Landlord”), and LIMELIGHT NETWORKS, INC., a Delaware corporation (“Tenant”).

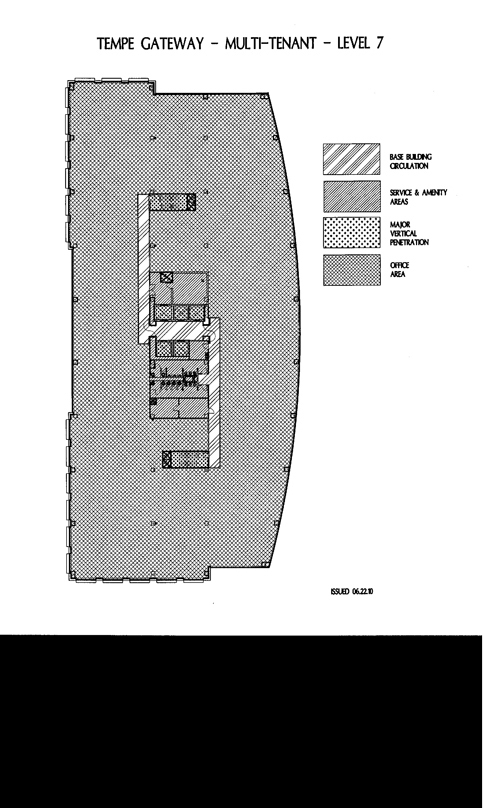

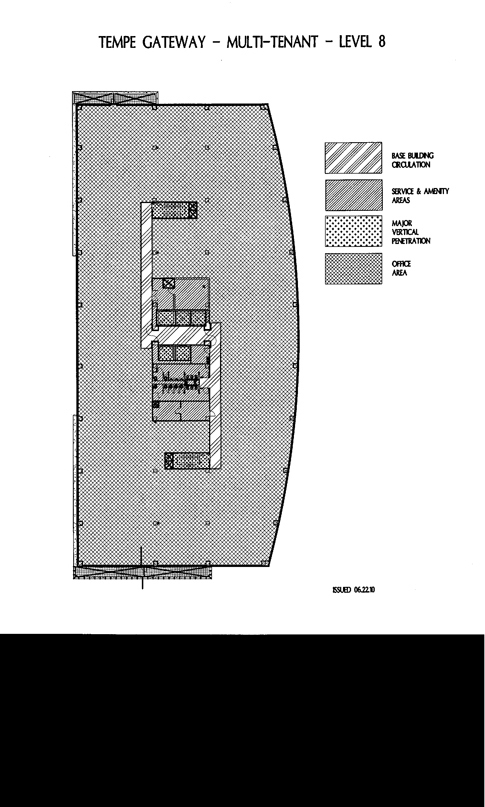

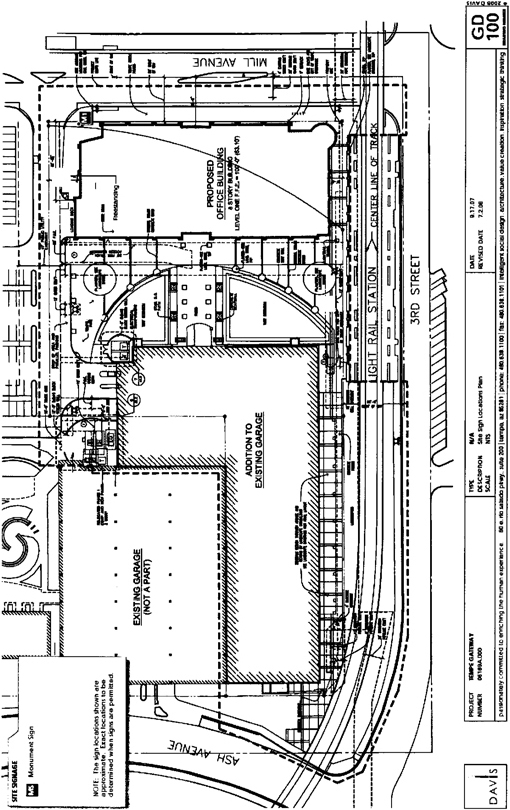

Landlord hereby leases to Tenant and Tenant hereby leases from Landlord the premises described as the entire seventh and eighth floors of the Project (as defined below), as designated on the plan attached hereto and incorporated herein as Exhibit “A” (“Premises”), of the project (“Project”) commonly known as Tempe Gateway whose address is 222 South Mill Avenue, Tempe, Arizona 85281, as legally described on Exhibit “A-1” attached hereto, for the Term and upon the terms and conditions hereinafter set forth, and Landlord and Tenant hereby agree as follows:

ARTICLE 1

BASIC LEASE PROVISIONS

| A. Initial Term: | Eight (8) years | |

| Estimated Commencement Date: | March 15, 2011 | |

| Estimated Expiration Date: | March 31, 2019 | |

| B. Square Footage: | 64,411 rentable square feet, subject to the terms of Article 2 below. | |

| C. Basic Rental: | ||

| Period In Lease Years* |

Annual Basic Rental |

Monthly Basic Rental |

Annual Basic Rental Per Rentable Square Foot |

|||||||||

| 1 |

$ | 0.00 | $ | 0.00 | $ | 0.00 | ||||||

| 2 |

$ | 1,375,000.00 | $ | 114,583.33 | $ | 25.00 | ** | |||||

| 3 |

$ | 1,610,275.00 | $ | 134,189.58 | $ | 25.00 | ||||||

| 4-6 |

$ | 1,706,891.50 | $ | 142,240.95 | $ | 26.50 | ||||||

| 7-8 |

$ | 1,803,508.00 | $ | 150,292.33 | $ | 28.00 | ||||||

| * | For purposes of this Lease, the term “Lease Year” shall mean each successive twelve (12) month period with the First Lease Year commencing on the Commencement Date and expiring on the last day of the twelfth (12th) full calendar month thereafter. |

| ** | Basic Rental for the Second Lease Year will be calculated using 55,000 rentable square feet, notwithstanding the actual size of the Premises. The first month’s Monthly Basic Rental for the Second Lease year shall be $0. |

| D. Expense Stop: | $6.50 | |

| E. Tenant’s Proportionate Share: | 24.40% | |

| F. Security Deposit: | None | |

| G. Permitted Use: | General office, data center, and network operations center (“NOC”), consistent with the nature of the Project as a first-class office project. | |

| H. Brokers: | CB Richard Ellis, Inc. on behalf of Landlord;

Ross Brown Partners on behalf of Tenant. | |

-1-

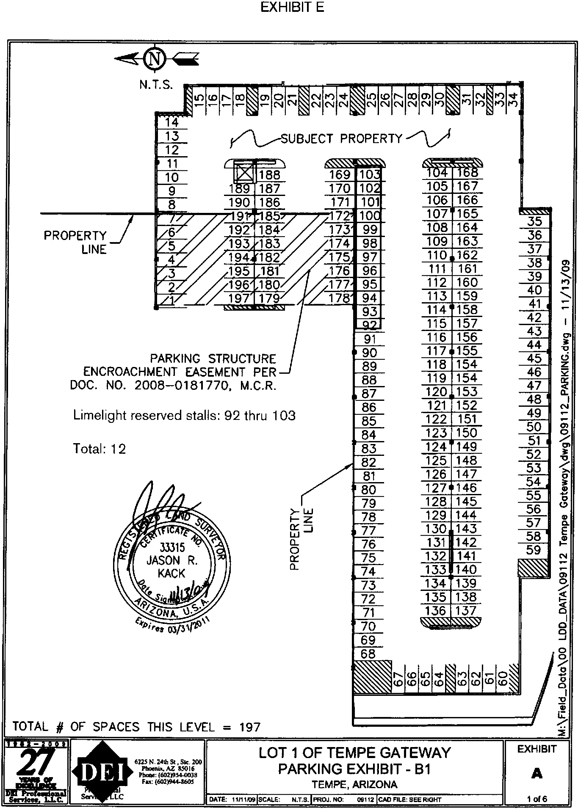

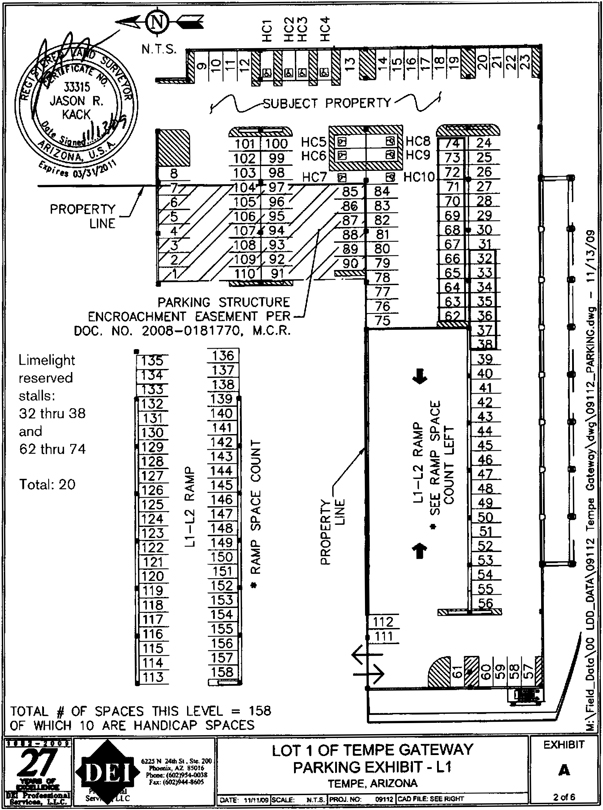

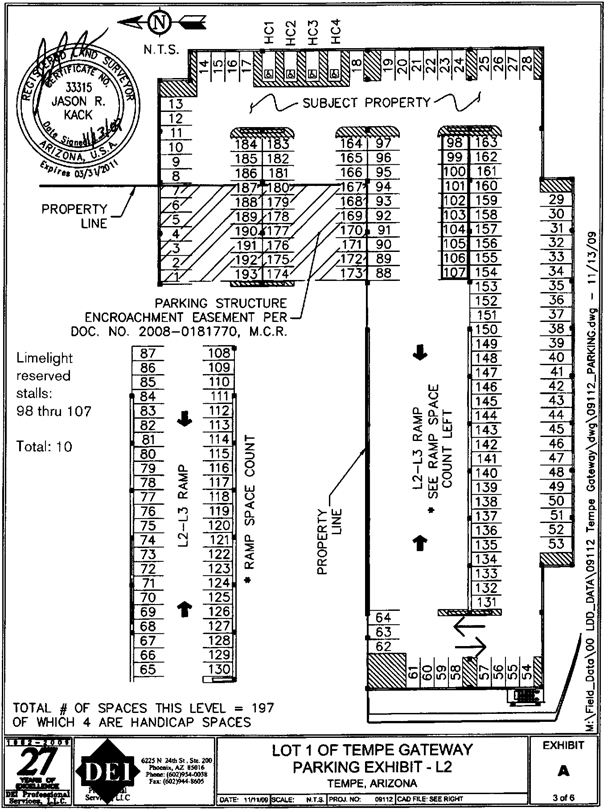

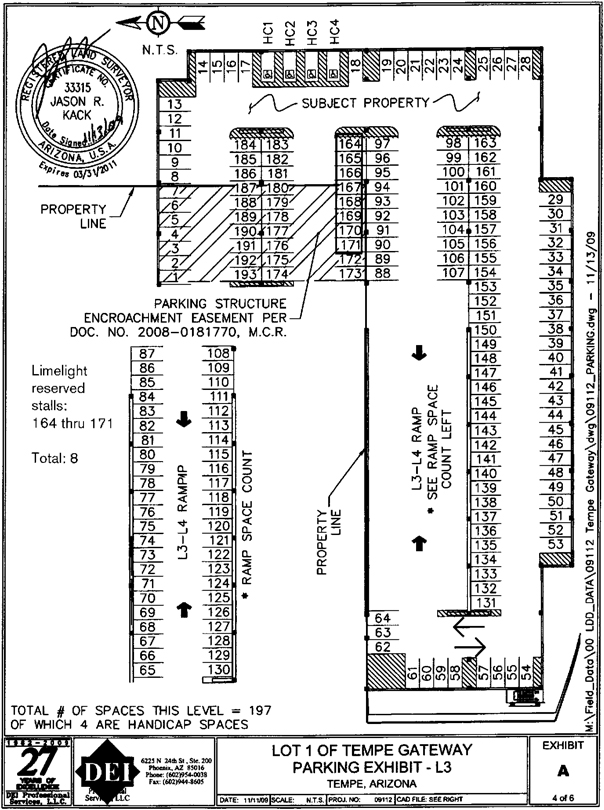

| I. Parking: | Tenant shall rent four (4) parking spaces for each 1,000 rentable square feet contained in the Premises, upon the terms and conditions and at the rate provided in Article 23 hereof. | |

| J. Initial Installment of Basic Rental: | The first full month’s Basic Rental plus applicable Rental Tax shall be due and payable by Tenant to Landlord upon the full execution hereof, which installment shall be credited to the 14th month of the Term hereof. | |

ARTICLE 2

TERM/PREMISES

The Term of this Lease shall commence on the Commencement Date and shall end on the last day of the month in which the eighth (8th) anniversary of the Commencement Date occurs. The term “Commencement Date” shall mean the date when all of the following have occurred: (i) all of the Tenant Improvements to be constructed by Landlord have been substantially completed in accordance with the provisions of the Work Letter attached hereto as Exhibit “D” (the “Work Letter”), subject only to the completion of minor punch list items that will not materially interfere with Tenant’s use and operation of the Premises for Tenant’s Permitted Use, (ii) a certificate of occupancy and/or a conditional use permit or other such document has been issued for the Premises by the applicable governing authority, if required, and (iii) Landlord has delivered the Premises to Tenant. If Landlord does not deliver possession of the Premises to Tenant on or before the Estimated Commencement Date (as set forth in Article 1.A, above), Landlord shall not be subject to any liability for its failure to do so, and such failure shall not affect the validity of this Lease nor the obligations of Tenant hereunder. Notwithstanding the foregoing, if the Commencement Date has not occurred on or before May 1, 2011 (subject to delay by Force Majeure (not to exceed 60 days) and any Tenant Delay) (the “Outside Date”), Tenant, as its sole remedy, shall have the right to terminate this Lease by written notice to Landlord at any time prior to the occurrence of the Commencement Date. If Tenant so terminates the Lease, any amounts previously paid by Tenant to Landlord shall be returned to Tenant and the parties shall have no further obligations hereunder. For purposes of this Lease, the term “Tenant Delay” shall mean any delay resulting from (i) Tenant’s failure to meet any time deadlines established herein, (ii) submission by Tenant of a request for any change order(s), or (iii) any other delay arising from the act or omission of Tenant. In the event of any Tenant Delay, the Commencement Date shall be deemed to have occurred on the day it would otherwise have occurred absent a Tenant Delay, and the Outside Date shall be postponed on a day-for-day basis. The rentable area of the Premises has been determined in accordance with “American National Standard ASNI/BOMA Z65.1-2010: Standard Method for Measuring Floor Area in Office Buildings” issued by the Building Owners and Managers Association International (“BOMA Standard”) to be 64,411 rentable square feet. If Landlord converts a portion of the first floor to a great room, meeting room, or other similar tenant amenity, the Premises and Building shall be re-measured pursuant to the BOMA Standard and the Premises size and Proportionate Share shall be adjusted. Landlord may deliver to Tenant a Commencement Letter in a form substantially similar to that attached hereto as Exhibit “C”, which Tenant shall execute and return to Landlord within ten (10) business days after receipt thereof. Failure of Tenant to timely execute and deliver the Commencement Letter shall constitute acknowledgment by Tenant that the statements included in such notice are true and correct, without exception. In addition to the Premises, Tenant shall have the right to use, in common with all other tenants of the Project, all portions of the Project not designated for the exclusive use of Tenants, including, without limitation, entrances and exits, hallways, stairways, elevators, restrooms, and parking areas (collectively, the “Common Areas”).

ARTICLE 3

RENTAL

(a) Basic Rental. Tenant agrees to pay to Landlord during the Term hereof, at Landlord’s office or to such other person or at such other place as directed from time to time by written notice to Tenant from Landlord, the monthly and annual sums as set forth in Article 1.C.

-2-

of the Basic Lease Provisions, plus applicable Rental Tax, which amounts are payable in advance on the first (1st) day of each calendar month, without demand, setoff or deduction. Notwithstanding the foregoing, Basic Rental and applicable Rental Tax for the fourteenth month of the Term shall be paid to Landlord in accordance with Article 1.J. of the Basic Lease Provisions upon execution of this Lease by Tenant.

(b) Increase in Direct Costs. The term “Expense Stop” means the dollar amount per rentable square foot in the Premises set forth in Article 1.D. of the Basic Lease Provisions. If, in any calendar year during the Term of this Lease, the “Direct Costs” (as hereinafter defined) paid or incurred by Landlord shall be higher than the Expense Stop, Tenant shall pay an additional sum for each such calendar year equal to the number of rentable square feet in the Premises multiplied by such increased amount of “Direct Costs.” In the event this Lease shall terminate on any date other than the last day of a calendar year, the additional sum payable hereunder by Tenant during the calendar year in which this Lease terminates shall be prorated on the basis of the relationship which the number of days which have elapsed from the commencement of said calendar year to and including said date on which this Lease terminates bears to three hundred sixty five (365). Any and all amounts due and payable by Tenant pursuant to this Lease (other than Basic Rental), except for any amounts paid by Tenant to Landlord under the Work Letter, shall be deemed “Additional Rent” and Landlord shall be entitled to exercise the same rights and remedies upon default in these payments as Landlord is entitled to exercise with respect to defaults in monthly Basic Rental payments. Basic Rental and Additional Rent may be collectively referred to herein as “Rent”. At the same time as any payment of Rent is to be made by Tenant hereunder, Tenant shall also pay any and all rental taxes, gross receipts taxes, transaction privilege taxes, sales taxes, and/or similar taxes levied currently or in the future on the Rent amount then due or otherwise assessed in connection with the rental activity then occurring (collectively, “Rental Tax”).

(c) Definitions. As used herein the term “Direct Costs” shall mean the sum of the following:

(i) “Tax Costs”, which shall mean any and all real estate taxes, lease excise taxes, payments in lieu of taxes, and other similar charges on real property or improvements, assessments, water and sewer charges, and all other charges assessed, reassessed or levied upon the Project and appurtenances thereto and the parking or other facilities thereof, or the real property thereunder (collectively the “Real Property”) or attributable thereto or on the rents, issues, profits or income received or derived therefrom which are assessed, reassessed or levied by the United States, the State of Arizona, any applicable county within the State of Arizona, any applicable city, town or other local government authority within the State of Arizona, and/or any other agency or political subdivision of the State of Arizona, and shall include Landlord’s reasonable legal fees, costs and disbursements incurred in connection with proceedings for reduction of Tax Costs or any part thereof; provided, however, if at any time after the date of this Lease the methods of taxation now prevailing shall be altered so that in lieu of or as a supplement to or a substitute for the whole or any part of any Tax Costs, there shall be assessed, reassessed or levied (a) a tax, assessment, reassessment, levy, imposition or charge wholly or partially as a net income, capital or franchise levy or otherwise on the rents, issues, profits or income derived therefrom, or (b) a tax, assessment, reassessment, levy (including but not limited to any municipal, state or federal levy), imposition or charge measured by or based in whole or in part upon the Real Property and imposed upon Landlord, then except to the extent such items are payable by Tenant under Article 6 below, such taxes, assessments, reassessments or levies or the part thereof so measured or based, shall be deemed to be included in the term “Direct Costs.” Notwithstanding the foregoing, if the Prime Lease (as defined below) is terminated due to failure of Landlord to comply with the Prime Lease, and the termination causes the Tax Costs to increase over the amount of the Tax Costs immediately prior to such termination, the Expense Stop shall be increased to reflect the increase in Tax Costs in the first calendar year or portion thereof affected by such increase. Further, if the Prime Lease is terminated due to a reason other than Landlord’s failure to comply with the Prime Lease (or expiration of the Prime Lease term), and the termination causes the Tax Costs to increase over the amount of the Tax Costs immediately prior to such termination, the Expense Stop shall be increased to reflect 50% of the increase in Tax Costs in the first calendar year or portion thereof affected by such increase.

(ii) “Operating Costs”, which shall mean all costs and expenses incurred by Landlord in connection with the maintenance, operation, replacement, ownership and repair of the Project, the equipment, the intrabuilding cabling and wiring, adjacent walks, malls and

-3-

landscaped and Common Areas and the parking structure, areas and facilities of the Project. Operating Costs shall include but not be limited to, city permit fees, parking management, salaries, wages, medical, surgical and general welfare benefits and pension payments, payroll taxes, fringe benefits, employment taxes, workers’ compensation, uniforms and dry cleaning thereof for all employees, independent contractors, agents, invitees or guests who perform duties connected with the operation, maintenance and repair of the Project, its equipment, the intrabuilding cabling and wiring and the adjacent walks and landscaped areas, including janitorial, gardening, security, operating, engineering, painting, plumbing, electrical, carpentry, heating, ventilation, air conditioning and window washing; hired services; a reasonable allowance for depreciation of the cost of acquiring or the rental expense of personal property used in the maintenance, operation and repair of the Project; accountant’s fees incurred in the preparation of rent adjustment statements; legal fees; real estate tax consulting fees; personal property taxes on property used in the maintenance and operation of the Project; fees, costs, expenses or dues payable pursuant to the terms of any covenants, conditions or restrictions or owners’ association pertaining to the Project; capital expenditures incurred to effect economies of operation of, or stability of services to, the Project and capital expenditures required due to changes in any Applicable Laws (as defined below), whether by enactment, repeal or change in interpretation, after the Commencement Date provided, however, that capital expenditure included in Operating Costs shall be amortized (with interest at the rate of the lesser of (1) U.S. Bank National Association Prime Rate plus two percent (2%) per annum, or (2) ten percent (10%) per annum) over its useful life; costs incurred (capital or otherwise) on a regular recurring basis every three (3) or more years for certain maintenance projects (e.g., parking lot slurry coat or replacement of lobby and elevator cab carpeting); costs incurred (capital or otherwise) in order for the Project, or any portion thereof, to maintain its current certification pursuant to the Green Globe certification standards promulgated by Green Globe International, Inc. (“Green Globe”), including, without limitation, costs of managing, reporting and commissioning the Project or any part thereof that was designed and/or built to be compliant with Green Globe standards; the cost of all charges for electricity, gas, water and other utilities furnished to the Project, and any taxes thereon; the cost of all charges for fire and extended coverage, liability and all other reasonable insurance coverages in connection with the Project carried by Landlord; the cost of all building and cleaning supplies and materials; the commercially reasonable cost of all charges for cleaning, maintenance and service contracts and other services with independent contractors and administration fees; a commercially reasonable property management fee (which fee may be imputed if Landlord has internalized management or otherwise acts as its own property manager) and license, permit and inspection fees relating to the Project. In the event, during any calendar year, the Project is less than ninety-five percent (95%) occupied, Operating Costs shall be adjusted to reflect the Operating Costs of the Project as though ninety-five percent (95%) were occupied, and the increase or decrease in the sums owed hereunder shall be based upon such Operating Costs as so adjusted. Notwithstanding the foregoing, Operating Costs shall not include the following:

| (1) | Any costs or expenses for which Landlord is reimbursed or indemnified (whether by an insurer, condemnor, tenant or otherwise); |

| (2) | Overhead and administrative costs of Landlord not directly incurred in the operation and maintenance of the Project; |

| (3) | Depreciation or amortization of the Project or its contents or components; |

| (4) | Contributions to Operating Cost reserves; |

| (5) | Capital expenditures including rentals and any other related expenses incurred in leasing capital items, except to the extent permitted above in this Section 3(c)(ii); |

| (6) | Expenses for the preparation of space or other work which Landlord performs for any tenant or prospective tenant of the Project; |

| (7) | Expenses for repairs or other work which is caused by fire, windstorm, casualty or any other insurable occurrence, including costs subject to Landlord’s insurance deductible, to the extent such deductible exceeds $50,000.00; |

-4-

| (8) | Expenses incurred in leasing or obtaining new tenants or retaining existing tenants, including leasing commissions, legal expenses, advertising, entertaining or promotion; |

| (9) | Interest, amortization or other costs, including legal fees, associated with any mortgage, loan or refinancing of the Project or any Common Areas, transfer or recordation taxes and other charges in connection with the transfer of ownership in the Project, land trust fees, and rental due under any ground lease relating to the property on which the Project is located; |

| (10) | Expenses incurred for any necessary replacement of any item to the extent that it is covered under warranty, and the cost of correcting defects in the construction of the Project or any Common Areas; provided, however, that repairs resulting from ordinary wear and tear shall not be deemed to be defects; |

| (11) | The cost of any item or service which Tenant separately reimburses Landlord or pays to third parties, or which Landlord provides selectively to one or more tenants of the Project, other than Tenant, whether or not Landlord is reimbursed by such other tenant(s). This category shall include the actual cost of any special electrical, heating, ventilation or air conditioning required by any tenant that exceeds normal building standards or is required during times other than the standard business hours stated in this Lease; |

| (12) | Accounting and legal fees relating to the ownership, construction, leasing, sale of or relating to any litigation in any way involving the Project, or any Common Areas, or to the enforcement of the terms of any lease; |

| (13) | Any interest or penalty incurred due to the late payment of any Operating Cost and/or Tax Cost; |

| (14) | The cost of correcting any applicable building or fire code violation(s) or violations of any other Applicable Law relating to the Project, or any Common Areas, and/or the cost of any penalty or fine incurred for noncompliance with the same, and any costs incurred to test, survey, cleanup, contain, abate or remove any environmental or Hazardous Materials or materials, including asbestos containing materials from the Project or any Common Areas or to remedy any breach or violation of any Environmental Laws. To the extent any of the foregoing are the result of any act or omission of any of the Tenant Parties or any of their agents, guests, invitees or contractors (“Tenant Responsible Parties”), such costs shall be governed by Article 28 hereof; |

| (15) | Any personal property taxes of the Landlord for equipment or items not used directly in the operation or maintenance of the Project, nor connected therewith; |

| (16) | Any costs or expenses for sculpture, paintings, or other works of art, including costs incurred with respect to the purchase, ownership, leasing, repair, and/or maintenance of such works of art; |

| (17) | All expenses to the extent resulting from the negligence or willful misconduct of the Landlord, its agents, servants or other employees; |

| (18) | All bad debt loss, rent loss, or reserve for bad debt or rent loss; |

| (19) | Payroll and payroll related expenses for any employees in commercial concessions operated by the Landlord; |

| (20) | The cost of installing, operating, and maintaining any building amenity or special facility such as a health club; and |

| (21) | Any expenditures made more than eighteen (18) months prior to submission of demand. |

(iii) Notwithstanding anything to the contrary contained herein, the aggregate Controllable Operating Costs, as that term is defined below, shall not increase more than five

-5-

percent (5%) in any calendar year over the amount of Controllable Operating Costs chargeable for the immediately preceding calendar year, on a non-cumulative basis. “Controllable Operating Costs” shall mean all Direct Costs except Tax Costs, utility charges, insurance charges, costs of services provided under a union contract, payments under any parking agreement, CC&R’s or to an owners’ association, and costs associated with repairs due to casualty, vandalism or other damage outside of Landlord’s reasonable control.

(d) Determination of Payment.

(i) If for any calendar year ending or commencing within the Term, Tenant’s Proportionate Share of the actual cost of the Direct Costs for such calendar year exceeds the Expense Stop, then Tenant shall pay to Landlord, in the manner set forth in Sections 3(d)(ii) and (iii), below, and as Additional Rent, an amount equal to Tenant’s Proportionate Share of the excess (the “Excess”).

(ii) Landlord shall give Tenant a yearly expense estimate statement (the “Estimate Statement”), which shall set forth Landlord’s reasonable estimate (the “Estimate”) of the total amount of Direct Costs for the then-current calendar year. The estimated Excess (the “Estimated Excess”) shall be calculated by comparing Tenant’s Proportionate Share of the actual cost of the Direct Costs for such calendar year, which shall be based upon the Estimate, to the Expense Stop. Any delay by Landlord in furnishing the Estimate Statement for any calendar year shall not preclude Landlord from subsequently enforcing its rights to collect any Estimated Excess under this Article 3, once such Estimated Excess has been determined by Landlord. If pursuant to the Estimate Statement an Estimated Excess is calculated for the then-current calendar year, Tenant shall pay, with its next installment of Monthly Basic Rental due, a fraction of the Estimated Excess for the then-current calendar year (reduced by any amounts paid pursuant to the last sentence of this Section 3(d)(ii)). Such fraction shall have as its numerator the number of months which have elapsed in such current calendar year to the month of such payment, both months inclusive, and shall have twelve (12) as its denominator. Until a new Estimate Statement is furnished, Tenant shall pay monthly, with the Monthly Basic Rental installments, an amount equal to one-twelfth (1/12) of the total Estimated Excess set forth in the previous Estimate Statement delivered by Landlord to Tenant.

(iii) In addition, Landlord shall give to Tenant following the end of each calendar year, a statement (the “Statement”) which shall include (a) the amount, if any, by which the Direct Costs for the subject year exceed the Direct Costs for the prior year, (b) a reconciliation of Tenant’s impound accounts of monies collected in advance by Landlord based Landlord’s estimate of Tenant’s Proportionate Share, and (c) the actual Direct Costs for the subject year broken down by component expenses. Upon receipt of the Statement for each calendar year during the Term, if amounts paid by Tenant as Estimated Excess are less than the actual Excess as specified on the Statement, Tenant shall pay, within ten (10) business days, the full amount of the Excess for such calendar year, less the amounts, if any, paid during such calendar year as Estimated Excess. If, however, the Statement indicates that amounts paid by Tenant as Estimated Excess are greater than the actual Excess as specified on the Statement, such overpayment shall be credited against Tenant’s next installments of Estimated Excess or paid by Landlord to Tenant at the time of delivery of the Statement if the Lease is then terminated or expired. Any delay by Landlord in furnishing the Statement for any calendar year shall not prejudice Landlord from enforcing its rights under this Article 3, once such Statement has been delivered. Even though the Term has expired and Tenant has vacated the Premises, when the final determination is made of Tenant’s Proportionate Share of the Direct Costs for the calendar year in which this Lease terminates, if an Excess is present, Tenant shall pay to Landlord within ten (10) business days an amount as calculated pursuant to the provisions of this Section 3(d). The provisions of this Section 3(d)(iii) shall survive the expiration or earlier termination of the Term.

(iv) Landlord shall maintain books and records of all Direct Costs. If requested by Tenant within ninety (90) days after Tenant’s receipt of a Statement, Landlord shall permit Tenant to audit Landlord’s Statement for the annual period covered by such Statement. If Tenant elects to audit such books and records, Tenant shall perform such audit using an employee of a certified public accounting firm or an employee of Tenant. Landlord shall reasonably cooperate with Tenant, and any deficiency or overpayment disclosed by such audit shall be paid or refunded, as the case may be, within thirty (30) days after completion of the audit. If any such audit discloses that the Direct Costs reflected on Landlord’s Statement were overstated by more than five percent (5%) of the actual Direct Costs for the subject year, Landlord shall reimburse Tenant for the reasonable costs of such audit.

-6-

ARTICLE 4

SECURITY DEPOSIT

Tenant has deposited or concurrently herewith is depositing with Landlord the sum set forth in Article 1.F. of the Basic Lease Provisions as security for the full and faithful performance of every provision of this Lease to be performed by Tenant. If Tenant breaches any provision of this Lease, including but not limited to the payment of rent, Landlord may use all or any part of this security deposit for the payment of any rent or any other sums in default, or to compensate Landlord for any other loss or damage which Landlord may suffer by reason of Tenant’s default. If any portion of said deposit is so used or applied, Tenant shall, within five (5) days after written demand therefor, deposit cash with Landlord in an amount sufficient to restore the security deposit to its full amount. Tenant agrees that Landlord shall not be required to keep the security deposit in trust, segregate it or keep it separate from Landlord’s general funds, but Landlord may commingle the security deposit with its general funds and Tenant shall not be entitled to interest on such deposit. At the expiration of the Term, and provided there exists no default by Tenant hereunder, the security deposit or any balance thereof shall be returned to Tenant (or, at Landlord’s option, to Tenant’s “Transferee”, as such term is defined in Article 15 below), provided that subsequent to the expiration of this Lease, Landlord may retain from said security deposit (i) an amount reasonably estimated by Landlord to cover potential Direct Cost reconciliation payments due with respect to the calendar year in which this Lease terminates or expires, (ii) any and all amounts reasonably estimated by Landlord to cover the anticipated costs to be incurred by Landlord to remove any signage provided to Tenant under this Lease, to remove cabling and other items required to be removed by Tenant under Section 29(b) below and to repair any damage caused by such removal (in which case any excess amount so retained by Landlord shall be returned to Tenant within thirty (30) days after such removal and repair), (iii) amounts required to cure defaults or make Landlord whole, or (iv) any and all amounts permitted by law or this Article 4. Tenant hereby waives any provisions of law, now or hereafter in effect, which provide that Landlord may claim from a security deposit only those sums reasonably necessary to remedy defaults in the payment of rent, to repair damage caused by Tenant or to clean the Premises, it being agreed that Landlord may, in addition, claim those sums specified in this Article 4 above, and all of Landlord’s damages under this Lease and Arizona law including, but not limited to, any damages accruing upon termination of this Lease and/or those sums reasonably necessary to compensate Landlord for any other loss or damage, foreseeable or unforeseeable, caused by the acts or omissions of Tenant or any officer, employee, agent, contractor or invitee of Tenant.

ARTICLE 5

HOLDING OVER

Should Tenant, without Landlord’s written consent, hold over after termination of this Lease, Tenant shall, at Landlord’s option, become a month-to-month tenant upon each and all of the terms herein provided as may be applicable to such a tenancy and any such holding over shall not constitute an extension of this Lease. During such holding over, Tenant shall pay in advance, monthly, Basic Rental at a rate equal to one and one-half times the rate in effect for the last month of the Term of this Lease, in addition to, and not in lieu of, all other payments required to be made by Tenant hereunder including but not limited to the Excess over the Expense Stop. Notwithstanding the foregoing, Tenant shall be permitted to hold over in the Premises for a period not to exceed ninety (90) days, on a month-to-month basis and at a Base Rental equal to that payable for the last month of the term prior to the holdover period. Nothing contained in this Article 5 shall be construed as consent by Landlord to any holding over of the Premises by Tenant, and Landlord expressly reserves the right to require Tenant to surrender possession of the Premises to Landlord as provided in this Lease upon the expiration or earlier termination of the Term. If Tenant fails to surrender the Premises upon the expiration or termination of this Lease, Tenant agrees to indemnify, defend and hold Landlord harmless from and against all costs, loss, expense or liability, including without limitation, claims made by any succeeding tenant and real estate brokers claims and attorneys’ fees and costs.

-7-

ARTICLE 6

OTHER TAXES

Tenant shall pay, prior to delinquency, all taxes assessed against or levied upon trade fixtures, furnishings, equipment and all other personal property of Tenant located in the Premises. In the event any or all of Tenant’s trade fixtures, furnishings, equipment and other personal property shall be assessed and taxed with property of Landlord, or if the cost or value of any leasehold improvements in the Premises exceeds the cost or value of a Project-standard buildout as determined by Landlord and, as a result, real property taxes for the Project are increased, Tenant shall pay to Landlord, within ten (10) business days after delivery to Tenant by Landlord of a written statement setting forth such amount, the amount of such taxes applicable to Tenant’s property or above-standard improvements. Tenant shall assume and pay to Landlord at the time Basic Rental next becomes due (or if assessed after the expiration of the Term, then within ten (10) business days), any excise, sales, use, rent, occupancy, garage, parking, gross receipts or other taxes (other than net income taxes) which may be assessed against or levied upon Landlord on account of the letting of the Premises or the payment of Basic Rental or any other sums due or payable hereunder, and which Landlord may be required to pay or collect under any law now in effect or hereafter enacted, whether or not currently contemplated. In addition to Tenant’s obligation pursuant to the immediately preceding sentence, Tenant shall pay directly to the party or entity entitled thereto all business license fees, gross receipts taxes and similar taxes and impositions which may from time to time be assessed against or levied upon Tenant, as and when the same become due and at least twenty (20) days before delinquency. Notwithstanding anything to the contrary contained herein, any sums payable by Tenant under this Article 6 shall not be included in the computation of “Tax Costs.”

ARTICLE 7

USE

Tenant shall use and occupy the Premises only for the uses set forth in Article 1.G. of the Basic Lease Provisions and shall not use or occupy the Premises or permit the same to be used or occupied for any other purpose without the prior written consent of Landlord, which consent shall not be unreasonably withheld or delayed, and Tenant agrees that it will use the Premises in such a manner so as not to interfere with or infringe upon the rights of other tenants or occupants in the Project. Tenant shall, at its sole cost and expense, promptly comply with all laws, statutes, ordinances, governmental regulations or requirements now in force or which may hereafter be in force relating to or affecting (i) the condition, use or occupancy of the Premises or the Project (excluding structural changes to the Project not related to Tenant’s particular use of the Premises), and (ii) improvements installed or constructed in the Premises by or for the benefit of Tenant. Tenant shall not permit more than six and one-half (6.5) people per one thousand (1,000) rentable square feet of the Premises to occupy the Premises at any time. Tenant may use a portion of the Premises as a lunchroom for Tenant’s employees only (and not the general public), provided that Tenant shall obtain Landlord’s prior approval to all electronic kitchen equipment to be used in the Premises (which approval shall not be unreasonably withheld or delayed), shall comply with Landlord’s insurers requirements with respect to the use and operation of such lunchroom, and shall not generate unreasonable or offensive odors from the Premises. Notwithstanding the foregoing, Tenant may use one or more food and beverage refrigerators or coolers, microwave ovens, soup warmers, toasters, toaster ovens, Panini presses, meat slicers and George Foreman™ type grills without the consent of Landlord. In addition, the kitchen equipment included in the Tenant Improvements shall be deemed approved by Landlord. Tenant shall be prohibited from using or installing deep fryers, commercial ovens, open flame or similar cooktops or any other kitchen equipment that would necessitate the use of a grease trap or hood in the Premises or generate odors inconsistent with a first-class office building. All use of kitchen equipment shall be consistent with food safety regulations. Tenant shall not do or permit to be done anything in violation of this Lease which would invalidate or increase the cost of any fire and extended coverage insurance policy covering the Project and/or the property located therein and Tenant shall comply with all rules, orders, regulations and requirements of any organization which sets out standards, requirements or recommendations commonly referred to by major fire insurance underwriters, and Tenant shall, upon demand reimburse Landlord for any additional premium charges for any such insurance policy assessed or increased by reason of Tenant’s failure to comply with the provisions of this Article 7.

-8-

ARTICLE 8

CONDITION OF PREMISES; LANDLORD’S REPRESENTATIONS

(a) Except as otherwise provided herein or in the Work Letter, Tenant hereby agrees that the Premises shall be taken “as is”, “with all faults”, “without any representations or warranties”, and Tenant hereby agrees and warrants that it has investigated and inspected the condition of the Premises and the suitability of same for Tenant’s purposes, and Tenant does hereby waive and disclaim any objection to, cause of action based upon, or claim that its obligations hereunder should be reduced or limited because of the condition of the Premises or the Project or the suitability of same for Tenant’s purposes. Tenant acknowledges that, except as otherwise provided herein, neither Landlord nor any agent nor any employee of Landlord has made any representations or warranty with respect to the Premises or the Project or with respect to the suitability of either for the conduct of Tenant’s business and Tenant expressly warrants and represents that Tenant has relied solely on its own investigation and inspection of the Premises and the Project in its decision to enter into this Lease and let the Premises in the above-described condition. Nothing contained herein is intended to, nor shall, obligate Landlord to implement sustainability practices for the Project or to seek certification under, or make modifications in order to obtain, a certification from LEED or any other comparable certification,

(b) Landlord represents and warrants to and covenants with Tenant as follows:

(i) Landlord has received no notice that the Project (inclusive of the Premises) currently is not in compliance with all applicable laws, rules, regulations, ordinances and local codes, including, without limitation, O.S.H.A. rules and regulations governing asbestos and asbestos containing materials and the Americans with Disabilities Act and/or any comparable state statute (“Applicable Laws”). Landlord has received no notice that the Project violates any private covenants, conditions and restrictions affecting the Project (the “Deed Restrictions”), copies of which have been given to Tenant.

(ii) Following the date of this Lease, Landlord will not record against the Project or the Premises, or otherwise subject the Project or the Premises to, any restrictions, agreements, encumbrances, liens, easements or rights which are reasonably expected to (i) prevent or impair the use of the Premises for the purposes permitted in this Lease or (ii) materially conflict with or diminish the rights herein granted to Tenant.

(iii) To the extent the Project, as of the date of this Lease, is not in compliance with current Applicable Laws or the Deed Restrictions, Landlord shall be responsible for bringing the Project into compliance with such Applicable Laws and Deed Restrictions at Landlord’s sole cost. In the event of a change in Applicable Laws after the Commencement Date that requires Landlord perform any alterations in or about the Project, Landlord shall perform such alterations and the cost thereof shall be an Operating Cost to the extent permitted in Article 3 above.

ARTICLE 9

REPAIRS AND ALTERATIONS

(a) Landlord’s Obligations. Landlord shall maintain, in first-class condition and repair, the structural portions of the Project, including the foundation, floor/ceiling slabs, roof, curtain wall, exterior glass, columns, beams, shafts, stairs, stairwells, elevator cabs and Common Areas, and shall also maintain and repair the basic mechanical, electrical, life safety, plumbing, sprinkler systems and heating, ventilating and air-conditioning systems; provided, however, that Landlord’s obligation with respect to any such systems shall be to repair and maintain those portions of the systems located in the core of the Project or in other areas outside of the Premises, but Tenant shall be responsible to repair and maintain any distribution of such systems throughout the Premises.

(b) Tenant’s Obligations. Except as expressly provided as Landlord’s obligation in this Article 9, Tenant shall keep the Premises in first-class condition and repair and in compliance with Landlord’s sustainability practices including, without limitation, compliance with the Green Globe rating system applicable to the Project. All damage or injury to the Premises or the Project resulting from the act or negligence of Tenant, its employees, agents or

-9-

visitors, guests, invitees or licensees or by the use of the Premises, shall be promptly repaired by Tenant at its sole cost and expense, to the reasonable satisfaction of Landlord; provided, however, that for damage to the Project as a result of casualty or for any repairs that may impact the mechanical, electrical, plumbing, heating, ventilation or air-conditioning systems of the Project, Landlord shall have the right (but not the obligation) to select the contractor and oversee all such repairs. Landlord may make any repairs which are not promptly made by Tenant after any applicable notice and cure period and charge Tenant for the cost thereof, plus ten percent (10%) to defray Landlord’s administrative costs, which costs shall be paid by Tenant within ten (10) business days from invoice from Landlord. Tenant shall be responsible for the design and function of all non-standard improvements of the Premises, whether or not installed by Landlord at Tenant’s request. Tenant waives all rights to make repairs at the expense of Landlord, or to deduct the cost thereof from the Rent.

(c) Alterations. Tenant shall make no alterations, installations, changes or additions in or to the Premises or the Project that affect the building systems (including, without limitation, the mechanical, electrical, structural, plumbing or roofing systems) (collectively, “Alterations”) without Landlord’s prior written consent, which consent shall not be unreasonably withheld, conditioned or delayed. Tenant may, upon prior notice to Landlord but without the requirement of obtaining Landlord consent, perform alterations in the Premises that do not affect any of the building systems (“Permitted Alterations”). It is mutually agreed that Tenant may install a security system serving the Premises, but that such system impacts the other building systems and is therefore subject to Landlord’s reasonable approval. Any Alterations approved by Landlord must be performed in accordance with the terms hereof, using only contractors or mechanics reasonably approved by Landlord in writing and upon the approval by Landlord in writing of fully detailed and dimensioned plans and specifications pertaining to the Alterations in question, to be prepared and submitted by Tenant at its sole cost and expense. Tenant shall at its sole cost and expense obtain all necessary approvals and permits pertaining to any Alterations approved by Landlord. Tenant shall cause all Alterations and Permitted Alterations to be performed in a good and workmanlike manner, in conformance with all applicable federal, state, county and municipal laws, rules and regulations, pursuant to a valid building permit, and in conformance with Landlord’s construction rules and regulations. If Landlord, in approving any Alterations, specifies a commencement date therefor, Tenant shall not commence any work with respect to such Alterations prior to such date. Tenant hereby agrees to indemnify, defend, and hold Landlord free and harmless from all liens and claims of lien, and all other liability, claims and demands arising out of any work done or material supplied to the Premises by or at the request of Tenant in connection with any Alterations or Permitted Alterations.

(d) Insurance; Liens. Prior to the commencement of any Alterations, Tenant shall provide Landlord with evidence that Tenant carries “Builder’s All Risk” insurance in an amount approved by Landlord covering the construction of such Alterations, and such other insurance as Landlord may reasonably require, it being understood that all such Alterations shall be insured by Tenant pursuant to Article 14 of this Lease immediately upon completion thereof. In addition, Landlord may, in its discretion, require Tenant to obtain a letter of credit, or some other evidence demonstrating Tenant’s ability to pay for such Alterations, satisfactory to Landlord in an amount sufficient to ensure the lien free completion of such Alterations and naming Landlord as a co-obligee. Notwithstanding the foregoing, no such letter of credit (or other evidence) shall be required for Permitted Alterations or Alterations which are estimated to cost less than $250,000.00 on a per project basis.

(e) Costs and Fees; Removal. If permitted Alterations are made, they shall be made at Tenant’s sole cost and expense and shall be and become the property of Landlord, except that Landlord may, if requested by Tenant and by written notice to Tenant given at the time such consent is granted, or if no consent is required, within twenty (20) days after Landlord receives notice of such Alterations, require Tenant at Tenant’s expense to remove such Alterations from the Premises, and to repair any damage to the Premises and the Project caused by such removal. Any and all costs attributable to or related to the applicable building codes of the city in which the Project is located (or any other authority having jurisdiction over the Project) arising from Tenant’s plans, specifications, improvements, Alterations or otherwise shall be paid by Tenant at its sole cost and expense. With regard to repairs, Alterations or any other work arising from or related to this Article 9, Landlord shall be entitled to receive an administrative/coordination fee (which fee shall vary depending upon whether or not Tenant orders the work directly from Landlord) sufficient to compensate Landlord for all overhead, general conditions, fees and other costs and expenses arising from Landlord’s involvement with such work, which fee shall be the

-10-

greater of (i) five percent (5%) of the total cost of the subject Alterations, repairs or other work or (ii) Landlord’s actual cost paid to third parties in connection with the subject Alterations, repairs or other work. In no event shall Tenant be required to pay the fee referred to in the prior sentence with respect to Permitted Alterations consisting solely of painting, carpeting and millwork.

ARTICLE 10

LIENS

Tenant shall keep the Premises and the Project free from any mechanics’ liens, vendors liens or any other liens arising out of any work performed, materials furnished or obligations incurred by Tenant, and Tenant agrees to defend, indemnify and hold Landlord harmless from and against any such lien or claim or action thereon, together with costs of suit and reasonable attorneys’ fees and costs incurred by Landlord in connection with any such claim or action. Before commencing any work or alteration, addition or improvement to the Premises, Tenant shall give Landlord at least ten (10) days’ written notice of the proposed commencement of such work (to afford Landlord an opportunity to post appropriate notices of non-responsibility). In the event that there shall be recorded against the Premises or the Project or the property of which the Premises is a part any claim or lien arising out of any such work performed, materials furnished or obligations incurred by Tenant and such claim or lien shall be removed or discharged within ten (10) days of filing; provided, however, that if Tenant is engaged in a good faith contest over such lien, Tenant need not discharge the same but shall post a bond to assure the payment of said lien with Landlord in an amount and reasonably satisfactory to Landlord. If Tenant fails to discharge or bond over such lien (if bonding over is permitted hereunder), Landlord shall have the right but not the obligation to pay and discharge said lien without regard to whether such lien shall be lawful or correct (in which case Tenant shall reimburse Landlord for any such payment made by Landlord within ten (10) business days following written demand), or to require that Tenant promptly deposit with Landlord in cash, and in lawful money of the United States, one hundred fifty percent (150%) of the amount of such claim, which sum may be retained by Landlord until such claim shall have been removed of record or until judgment shall have been rendered on such claim and such judgment shall have become final, at which time Landlord shall have the right to apply such deposit in discharge of the judgment on said claim and any costs, including attorneys’ fees and costs incurred by Landlord, and shall remit the balance thereof to Tenant, if any.

ARTICLE 11

PROJECT SERVICES

(a) Basic Services. Landlord agrees to furnish to the Premises, at a cost to be included in Operating Costs, from 7:00 a.m. to 6:00 p.m. Mondays through Fridays and 9:00 a.m. to 1:00 p.m. on Saturdays (the “Building Standard Hours”) excepting New Year’s Day, Memorial Day, Independence Day, Labor Day, Thanksgiving Day and Christmas Day (collectively, the “Building Holidays”), air conditioning and heat in a manner consistent with the operation of a first-class office building in the Phoenix, Arizona metropolitan area and in accordance with Schedule 1 to the Work Letter. In addition, Landlord shall provide electric current for normal lighting and normal office machines, elevator service and water on the same floor as the Premises for lavatory and drinking purposes in such reasonable quantities as in the judgment of Landlord is reasonably necessary for general office use and in compliance with applicable codes. Janitorial and maintenance services shall be furnished five (5) days per week, excepting Building Holidays. Tenant shall comply with all rules and regulations which Landlord may establish for the proper functioning and protection of the Common Area air conditioning, heating, elevator, electrical, intrabuilding cabling and wiring and plumbing systems. Landlord shall not be liable for, and there shall be no rent abatement as a result of, any stoppage, reduction or interruption of any such services caused by governmental rules, regulations or ordinances, riot, strike, labor disputes, breakdowns, accidents, necessary repairs or other cause. Except as specifically provided in this Article 11, Tenant agrees to pay for all utilities and other services utilized by Tenant and any additional building services furnished to Tenant which are not uniformly furnished to all tenants of the Project, at the rate generally charged by Landlord to tenants of the Project for such utilities or services.

-11-

(b) Excess Usage. Tenant will not, without the prior written consent of Landlord, use any apparatus or device in the Premises which will in any way increase the amount of electricity or water usually furnished or supplied for use of the Premises as permitted hereunder; nor shall Tenant connect any apparatus, machine or device with water pipes or electric current (except through existing electrical outlets in the Premises), for the purpose of using electric current or water except with respect to Tenant’s operation of the NOC (to the extent expressly approved by Landlord in connection with the Tenant Improvements) or as otherwise expressly approved by Landlord in connection with the Tenant Improvements.

(c) Additional Service. Electrical service and HVAC shall be available to the Premises, 24 hours a day, 7 days a week. If Tenant shall require electric current and HVAC outside of Building Standard Hours, Tenant shall pay Landlord for the actual out-of-pocket cost associated with such services. Landlord may, at Landlord’s option and at Tenant’s expense, cause an electric current meter or submeter to be installed in or about the Premises to measure the amount of any such excess electric current consumed by Tenant in the Premises, either as a part of the Tenant Improvements (in which case the cost thereof shall be deducted from the Allowance) or during the Term hereof (in which case the cost thereof shall be paid by Tenant as Additional Rent). Zoning for the Premises shall be reasonably determined by Landlord and Tenant in connection with the design of the Tenant Improvements. Landlord shall accommodate Tenant’s request to provide a separate HVAC unit (which shall be at Tenant’s cost and shall be separately metered) for the NOC, provided that such unit shall be on the roof or within Tenant’s Premises, and subject to Landlord’s requirements regarding structural reinforcement (if necessary), roof top screening, and compliance with applicable permitting requirements.

(d) HVAC Balance. If any lights, machines or equipment (including but not limited to computers and computer systems and appurtenances) are used by Tenant in the Premises in excess of those required for general office use and such excess materially affect the temperature otherwise maintained by the air conditioning system, or generate substantially more heat in the Premises than would be generated by the building standard lights and usual office equipment, Landlord shall have the right to install any machinery and equipment which Landlord reasonably deems necessary to restore temperature balance, including but not limited to modifications to the standard air conditioning equipment, and the cost thereof, including the cost of installation and any additional cost of operation and maintenance occasioned thereby, shall be paid by Tenant to Landlord upon demand by Landlord.

(e) Telecommunications. Upon request from Tenant from time to time, Landlord will provide Tenant with a listing of telecommunications and media service providers serving the Project, and Tenant shall have the right to contract directly with the providers of its choice. If Tenant wishes to contract with or obtain service from any provider which does not currently serve the Project or wishes to obtain from an existing carrier services which will require the installation of additional equipment, such provider must, prior to providing service, enter into a written agreement with Landlord setting forth the terms and conditions of the access to be granted to such provider, in form and substance satisfactory to Landlord, in its sole discretion. In considering the installation of any new or additional telecommunications cabling or equipment at the Project, Landlord will consider all relevant factors in a reasonable and non-discriminatory manner, including, without limitation, the existing availability of services at the Project, the impact of the proposed installations upon the Project and its operations and the available space and capacity for the proposed installations. Landlord may also consider whether the proposed service may result in interference with or interruption of other services at the Project or the business operations of other tenants or occupants of the Project. In no event shall Landlord be obligated to incur any costs or liabilities (other than de minimis costs) in connection with the installation or delivery of telecommunication services or facilities at the Project. All such installations shall be subject to Landlord’s prior reasonable approval and shall be performed in accordance with the terms of Article 9. If Landlord approves the proposed installations in accordance with the foregoing, Landlord will deliver its standard form agreement upon request and will use commercially reasonable efforts to promptly enter into an agreement on reasonable and non-discriminatory terms with a qualified, licensed and reputable carrier confirming the terms of installation and operation. of telecommunications equipment consistent with the foregoing.

(f) After-Hours Use. If Tenant requires heating, ventilation and/or air conditioning during times other than Building Standard Hours, Tenant shall control such use via an automated system activated by wall mounted controls and shall pay the actual costs for such after-hours use. Tenant may request that Landlord provide 24/7 HVAC to certain areas in the Premises.

-12-

(g) Generator. Landlord grants to Tenant the non-exclusive right to purchase the right to use the currently existing exterior generator for the Building (the “Generator”) for the purpose of providing back-up power for the NOC and a non-exclusive license over and across the area surrounding the Generator for such purpose. Such right may be purchased by payment of Tenant’s proportionate share of the cost of the Generator; if Tenant exercises such right, Tenant shall thereafter pay Tenant’s proportionate share of the cost to maintain and repair the Generator. If Tenant reasonably requires a separate generator for its own use, Landlord shall work with Tenant to find an appropriate location for such generator. If space is not available, Tenant may use a parking stall within the garage (in a location selected by Landlord), and Tenant’s reserved parking stalls shall be reduced by one (and Tenant shall continue to pay the reserved parking rate for such stall dedicated to generator use). Landlord grants to Tenant a license (i) (A) to use currently existing excess conduit to connect a Tenant installed generator to the Building, or (B) if the existing excess conduit is not adequate, to install a new conduit to connect a Tenant installed generator to the Building in a location mutually reasonably acceptable to Landlord and Tenant, and (ii) over and across the area surrounding the Generator for such purpose in connection with Tenant’s installation and operation of its own generator. Such licenses are subject to availability of excess conduit, availability of space for Tenant’s generator in the vicinity of the Generator, and permitting requirements. Tenant shall be solely responsible for all costs to design, permit and install such a generator.

(h) Reasonable Charges. Landlord may charge Tenant for Landlord’s actual out of pocket costs for any utilities or services (other than electric current and heating, ventilation and/or air conditioning which shall be governed by Section 11(c) above) utilized by Tenant in excess of the amount or type that is reasonably necessary for general office use.

(i) Interruption of Services. In the event of any interruption of HVAC, utility and other services, Landlord shall use its best efforts to promptly restore the same. If any failure to provide services or utilities continues for more than seventy-two (72) hours and materially interferes with Tenant’s conduct of business in or use and operation of the Premises, Tenant shall be entitled to an equitable abatement of rent for such period of time as the interruption is in effect.

ARTICLE 12

RIGHTS OF LANDLORD

(a) Right of Entry. Landlord and its agents shall have the right to enter the Premises at all reasonable times for the purpose of cleaning the Premises, examining or inspecting the same, serving or posting and keeping posted thereon notices as provided by law, or protecting Landlord or the Project, showing the same to prospective tenants (during the last twelve (12) months of the Term), lenders or purchasers of the Project, in the case of an emergency, and for making such alterations, repairs, improvements or additions to the Premises or to the Project as Landlord may deem necessary or desirable. An employee of Tenant shall accompany Landlord in connection with its entry into the Premises, and Tenant shall make such employee reasonably available upon request from Landlord. In the event of an emergency, if Tenant shall not be personally present to open and permit an entry into the Premises at any time when such an entry by Landlord is necessary or permitted hereunder, Landlord may enter by means of a master key, or may forcibly enter in the case of an emergency, in each event without liability to Tenant and without affecting this Lease.

(b) Maintenance Work. Landlord reserves the right from time to time, but subject to payment by and/or reimbursement from Tenant as otherwise provided herein: (i) to install, use, maintain, repair, replace, relocate and control for service to the Premises and/or other parts of the Project pipes, ducts, conduits, wires, cabling, appurtenant fixtures, equipment spaces and mechanical systems, wherever located in the Premises or the Project, (ii) to alter, close or relocate any facility in the Premises or the Common Areas or otherwise conduct any of the above activities for the purpose of complying with a general plan for fire/life safety for the Project or otherwise, and (iii) to comply with any Applicable Law, but in no event shall Tenant be permitted to withhold or reduce Basic Rental or other charges due hereunder as a result of same, make any claim for constructive eviction or otherwise make any claim against Landlord for interruption or interference with Tenant’s business or operations, so long as Landlord uses commercially reasonable efforts to minimize any interference with Tenant’s business.

-13-

(c) Communication Equipment. If Tenant desires to use the roof of the Project to install communication equipment to be used from the Premises, Tenant may so notify Landlord in writing (“Communication Equipment Notice”), which Communication Equipment Notice shall generally describe the specifications for the equipment desired by Tenant. If at the time of Landlord’s receipt of the Communication Equipment Notice, Landlord reasonably determines that space is available on the roof of the Project for such equipment, then subject to all governmental laws, rules and regulations, Tenant and Tenant’s contractors (which shall first be reasonably approved by Landlord) shall have the right and access to install, repair, replace, remove, operate and maintain five (5) so-called “satellite dishes” or other similar devices, such as antennae (the “Communication Equipment”), which Communication Equipment the combined size of which shall be no greater than one (1) meter in diameter, together with aesthetic screening designated by Landlord and all cable, wiring, conduits and related equipment, for the purpose of receiving and sending radio, television, computer, telephone or other communication signals, at a location on the roof of the Project designated by Landlord. Landlord shall have the right to require Tenant to relocate the Communication Equipment at any time to another location on the roof of the Project. Tenant shall retain Landlord’s designated roofing contractor to make any necessary penetrations and associated repairs to the roof in order to preserve Landlord’s roof warranty. Tenant’s installation and operation of the Communication Equipment shall be governed by the following terms and conditions:

(i) Tenant’s right to install, replace, repair, remove, operate and maintain the Communication Equipment shall be subject to all Applicable Laws, and Landlord makes no representation that such Applicable Laws permit such installation and operation.

(ii) All plans and specifications for the Communication Equipment shall be subject to Landlord’s reasonable approval.

(iii) All costs of installation, operation and maintenance of the Communication Equipment and any necessary related equipment (including, without limitation, costs of obtaining any necessary permits and connections to the Project’s electrical system) shall be borne by Tenant.

(iv) It is expressly understood that Landlord retains the right to use the roof of the Project for any purpose whatsoever.

(v) Tenant shall use the Communication Equipment so as not to cause any unreasonable interference to other tenants in the Project or with any other tenant’s Communication Equipment, and not to damage the Project or interfere with the normal operation of the Project.

(vi) Landlord shall not have any obligations with respect to the Communication Equipment. Landlord makes no representation that the Communication Equipment will be able to receive or transmit communication signals without interference or disturbance (whether or not by reason of the installation or use of similar equipment by others on the roof of the Project) and Tenant agrees that Landlord shall not be liable to Tenant therefor. Tenant shall not lease or otherwise make the Communication Equipment available to any third party (other than Tenant’s customers and clients, which may use the Communication Equipment while at the Premises for business purposes only) and the Communication Equipment shall be only for Tenant’s use in connection with the conduct of Tenant’s business in the Premises.

(vii) Tenant shall (i) be solely responsible for any damage caused as a result of the Communication Equipment, (ii) promptly pay any tax, license or permit fees charged pursuant to any Applicable Laws in connection with the installation, maintenance or use of the Communication Equipment and comply with all precautions and safeguards recommended by all governmental authorities, and (iii) pay for all necessary repairs, replacements to or maintenance of the Communication Equipment.

(viii) The Communication Equipment shall remain the sole property of Tenant. Tenant shall remove the Communication Equipment and related equipment at Tenant’s sole cost and expense upon the expiration or sooner termination of this Lease or upon the imposition of

-14-

any Applicable Law which may require removal, and shall repair the Project upon such removal to the condition it existed prior to the installation of the Communication Equipment. If Tenant fails to remove the Communication Equipment and repair the Project within fifteen (15) days after the expiration or earlier termination of this Lease, Landlord may do so at Tenant’s expense. The provisions of this Section 12(d)(viii) shall survive the expiration or earlier termination of this Lease.

(ix) The Communication Equipment shall be deemed to constitute a portion of the Premises for purposes of Article 13 of this Lease.

(x) Upon request from Landlord, Tenant agrees to execute a license agreement with Landlord or Landlord’s rooftop management company regarding Tenant’s installation, use and operation of the Communication Equipment, which license agreement shall be in commercially reasonable form and shall incorporate the terms and conditions of this Section 12.

(d) Tenant’s Rights in Landlord’s Entry. Except in the event of a Tenant default, Landlord shall have access to the Premises for the purposes described in this Article, provided that (a) Landlord’s activities hereunder will not unreasonably interfere with or adversely affect Tenant’s use of the Premises, (b) when practicable under the circumstances, Landlord will provide to Tenant reasonable advance notice of any entry to the Premises, and (c) nothing will be done hereunder that would permanently alter the aesthetics or the utility of the Premises for regular office use without Tenant’s prior written consent, which consent shall not be unreasonably withheld, conditioned or delayed. In the event of Landlord’s entry into the Premises following Tenant’s default hereunder, such entry shall be governed by Articles 19 and 20 of this Lease. In the event of entry pursuant to this Article 12, Landlord shall use commercially reasonable efforts to minimize any material interference with or disruption of Tenant’s operations. Notwithstanding anything in this Lease to the contrary, if Landlord’s entry onto the Premises or other exercise of its rights under this Lease interferes with Tenant and such interference causes a material adverse impact on Tenant’s operations at, use or enjoyment of the Premises and such impact continues beyond forty-eight (48) hours, Tenant shall be entitled to an equitable abatement of rent for such period of time as the interference continues, based on the portion of the Premises that Tenant actually stops using. If such interference continues beyond a period of thirty (30) consecutive days and such interference does not arise as a result of the performance of reasonably necessary repairs or in connection with the delivery of services to be provided by Landlord hereunder, Tenant shall be entitled to terminate this Lease upon 60 days written notice to Landlord.

ARTICLE 13

INDEMNITY; EXEMPTION OF LANDLORD FROM LIABILITY

(a) Indemnity. Tenant shall indemnify, defend and hold Landlord, its subsidiaries, partners, parents or other affiliates and their respective members, shareholders, officers, directors, employees and contractors (collectively, “Landlord Parties”) harmless from and against any and all claims arising from Tenant’s use of the Premises or the Project or from the conduct of its business or from any activity, work or thing which may be permitted, suffered or caused by Tenant in or about the Premises or the Project and shall further indemnify, defend and hold Landlord and the Landlord Parties harmless from and against any and all claims arising from any breach or default in the performance of any obligation on Tenant’s part to be performed under this Lease or arising from any negligence or willful misconduct of Tenant or any of its agents, contractors, employees or invitees, patrons, customers or members in or about the Project and from any and all costs, attorneys’ fees and costs, expenses and liabilities incurred in the defense of any claim or any action or proceeding brought thereon, including negotiations in connection therewith. Tenant hereby assumes all risk of damage to property or injury to persons in or about the Premises from any cause except for the negligence or willful misconduct of Landlord or the Landlord Parties and Tenant hereby waives all claims in respect thereof against Landlord and the Landlord Parties. Landlord shall indemnify, defend and hold Tenant and its subsidiaries, partners, parents or other affiliates and their respective members, shareholders, officers, directors, employees and contractors (collectively, “Tenant Parties”) harmless from and against any and all claims arising from Landlord’s operation of the Project or from any activity, work or thing which may be permitted or suffered by Landlord in or about the Project (but exclusive of the Premises) and shall further indemnify, defend and hold Tenant and the

-15-

Tenant Parties harmless from and against any and all claims arising from any breach or default in the performance of any obligation on Landlord’s part to be performed under this Lease or arising from any negligence or willful misconduct of Landlord or any of its agents, contractors, employees or invitees, patrons, customers or members in or about the Project and from any and all costs, attorneys’ fees and costs, expenses and liabilities incurred in the defense of any claim or any action or proceeding brought thereon, including negotiations in connection therewith.

(b) Exemption of Landlord from Liability. Except as otherwise provided herein, Landlord and the Landlord Parties shall not be liable for injury to Tenant’s business, or loss of income therefrom, however occurring (including, without limitation, from any failure or interruption of services or utilities or as a result of Landlord’s negligence), or, for damage that may be sustained by the person, goods, wares, merchandise or property of Tenant, its employees, invitees, customers, agents, or contractors, or any other person in, on or about the Premises directly or indirectly caused by or resulting from any cause whatsoever, including, but not limited to, fire, steam, electricity, gas, water, or rain which may leak or flow from or into any part of the Premises, or from the breakage, leakage, obstruction or other defects of the pipes, sprinklers, wires, appliances, plumbing, air conditioning, light fixtures, or mechanical or electrical systems, or from intrabuilding cabling or wiring, whether such damage or injury results from conditions arising upon the Premises or upon other portions of the Project or from other sources or places and regardless of whether the cause of such damage or injury or the means of repairing the same is inaccessible to Tenant. Landlord and the Landlord Parties shall not be liable to Tenant for any damages arising from any willful or negligent action or inaction of any other tenant of the Project.

(c) Security. Landlord shall provide security cameras or other surveillance equipment in the parking areas, lobby and elevators of the Building and the elevators shall be designed to provide that access to the 7th floor of the Premises may only be accessed by use of a key card. Tenant acknowledges that Landlord’s election whether or not to provide any type of additional mechanical surveillance or security personnel whatsoever in the Project is solely within Landlord’s discretion; Landlord and the Landlord Parties shall have no liability in connection with the provision, or lack, of such services, and Tenant hereby agrees to hold Landlord and the Landlord Parties harmless with regard to any such potential claim, whether or not such services are provided. Landlord and the Landlord Parties shall not be liable for losses due to theft, vandalism, or like causes. Tenant shall defend, indemnify, and hold Landlord and the Landlord Parties harmless from and against any such claims made by any employee, licensee, invitee, contractor, agent or other person whose presence in, on or about the Premises or the Project is attendant to the business of Tenant. Tenant shall be permitted to install a security system serving the Premises, subject to Landlord’s approval of the same.

ARTICLE 14

INSURANCE

(a) Tenant’s Insurance. Tenant, shall at all times during the Term of this Lease, and at its own cost and expense, procure and continue in force the following insurance coverage: (i) Commercial General Liability Insurance, written on an occurrence basis, with a combined single limit for bodily injury and property damages of not less than Two Million Dollars ($2,000,000) per occurrence and Three Million Dollars ($3,000,000) in the annual aggregate, including products liability coverage if applicable, owners and contractors protective coverage, blanket contractual coverage including both oral and written contracts, and personal injury coverage, covering the insuring provisions of this Lease and the performance of Tenant of the indemnity and exemption of Landlord from liability agreements set forth in Article 13 hereof; (ii) a policy of standard fire, extended coverage and special extended coverage insurance (all risks), including a vandalism and malicious mischief endorsement, sprinkler leakage coverage and earthquake sprinkler leakage where sprinklers are provided in an amount equal to the full replacement value new without deduction for depreciation of all (A) Tenant Improvements, Alterations, fixtures and other improvements in the Premises, including but not limited to all mechanical, plumbing, heating, ventilating, air conditioning, electrical, telecommunication and other equipment, systems and facilities, and (B) trade fixtures, furniture, equipment and other personal property installed by or at the expense of Tenant; (iii) Worker’s Compensation coverage as required by law; and (iv) business interruption, loss of income and extra expense insurance covering any failure or interruption of Tenant’s business equipment (including, without limitation, telecommunications equipment) and covering all other perils, failures or interruptions sufficient

-16-

to cover a period of interruption of not less than twelve (12) months. Tenant shall carry and maintain during the entire Term (including any option periods, if applicable), at Tenant’s sole cost and expense, increased amounts of the insurance required to be carried by Tenant pursuant to this Article 14 and such other reasonable types of insurance coverage and in such reasonable amounts covering the Premises and Tenant’s operations therein, as may be reasonably required by Landlord.

(b) Form of Policies. The aforementioned minimum limits of policies and Tenant’s procurement and maintenance thereof shall in no event limit the liability of Tenant hereunder. The Commercial General Liability Insurance policy shall name Landlord, Landlord’s property manager, Landlord’s lender(s) and such other entities, persons or firms as Landlord specifies from time to time in writing to Tenant, as additional insureds with an appropriate endorsement to the policy(s). All such insurance policies carried by Tenant shall be with companies having a rating of not less than A-VI in Best’s Insurance Guide. Tenant shall furnish to Landlord, from the insurance companies, or cause the insurance companies to furnish, certificates of coverage. The deductible under each policy shall be reasonably acceptable to Landlord. No such policy shall be cancelable or subject to reduction of coverage or other modification or cancellation except after thirty (30) days prior written notice to Landlord by the insurer. All such policies shall be endorsed to agree that Tenant’s policy is primary and that any insurance carried by Landlord is excess and not contributing with any Tenant insurance requirement hereunder and shall name Landlord as an additional insured. Tenant shall, within ten (10) days of the expiration of such policies, furnish Landlord with renewals or binders. Tenant agrees that if Tenant does not take out and maintain such insurance or furnish Landlord with renewals or binders in a timely manner, Landlord may (but shall not be required to), procure said insurance on Tenant’s behalf and charge Tenant the cost thereof, which amount shall be payable by Tenant within ten (10) business days of demand with interest (at the rate set forth in Section 20(e) below) from the date such sums are expended.

(c) Landlord’s Insurance. Landlord, as a cost to be included in Operating Costs to the extent permitted hereunder, agrees to carry during the entire Lease term and any extensions thereof casualty and liability insurance equivalent to or in excess of the coverage typically carried by owners of other comparable office buildings in the Phoenix, Arizona metropolitan area with insurers rated A-VI or better in Best’s Insurance Guide, but in no event less than:

(i) Property insurance on the Project in the form of an All Risk, Special Form or Direct Damage policy and Boiler & Machinery coverage, both in the amount of at least $50,000,000. Coverage shall also include Demolition and Increased Cost of Construction coverage with a limit of not less than $100,000; and

(ii) Commercial General Liability Insurance utilizing ISO form CG0001 (or its equivalent) in an amount not less than $1,000,000 per occurrence, $1,000,000 Personal Injury and Advertising injury, $2,000,000 Products and Completed Operations Aggregate and $2,000,000 General Aggregate. There shall be no exclusions deleting or limiting the above coverages from the CG0001 form (or its equivalent). Coverage shall include, but shall not be limited to, coverage for bodily injury, loss of life or property damage occurring in or about the Building.

(iii) Umbrella policy with limits of not less than $5,000,000 per occurrence.