Attached files

Exhibit 10.1

SECOND AMENDMENT TO OFFICE LEASE

This Second Amendment to Office Lease (the “Second Amendment”), dated as of September 1, 2010 (the “Renewal Effective Date”), is made by and between DOUGLAS EMMETT 2000, LLC, a Delaware limited liability company (“Landlord”), with offices at 808 Wilshire Boulevard, Suite 200, Santa Monica, California 90401, and REACHLOCAL, INC., a Delaware corporation (“Tenant”), with offices at 21700 Oxnard Street, Suite 1600, Woodland Hills, California 91367.

WHEREAS,

A. Landlord and Tenant are parties to a certain Office Lease dated August 30, 2006 (the “Original Lease”), as amended by a certain First Amendment to Office Lease dated January 31, 2008 (the “First Amendment”); a certain Memorandum of Lease Term Dates and Rent dated March 31, 2008; and a certain Memorandum of Lease Term Dates and Rent dated July 11, 2008 (collectively, the “Memoranda” and, collectively with the Original Lease and the First Amendment, the “Lease”) pursuant to which Tenant leases from Landlord and Landlord leases to Tenant space in the property located at 21700 Oxnard Street, Woodland Hills, California 91367 (the “Building”), commonly known as Suite 1500, Suite 1600 and Suite 1610 (collectively, the “Existing Premises”);

B. The Term of the Lease expires June 30, 2013, which Term Landlord and Tenant wish to hereby extend;

C. Tenant wishes to expand its occupancy within the Building in two (2) phases to include additional office space on the fifteenth (15th) and sixteenth (16th) floors in the Building as more particularly described below;

D. Landlord has agreed to permit such expansion, subject to Landlord first obtaining legal possession of each suite comprising the Expansion Premises (as hereinafter defined), all of which (except for suite 1680) are subject to leases in effect as of the date hereof; and

E. Landlord and Tenant, for their mutual benefit, wish to revise certain other covenants and provisions of the Lease.

NOW, THEREFORE, in consideration of the covenants and provisions contained herein, and other good and valuable consideration, the sufficiency of which Landlord and Tenant hereby acknowledge, Landlord and Tenant agree:

| 1. | Confirmation of Defined Terms. Unless modified herein, all terms previously defined and capitalized in the Lease shall hold the same meaning for the purposes of this Second Amendment. |

| 2. | Extension of Term. The scheduled expiration date of the Term of the Lease for the Existing Premises (June 30, 2013) shall be disregarded and the Term of the Lease of the Premises (as expanded under this Second Amendment to include the Existing Premises and the Expansion Premises) shall be extended through the Termination Date (as such term is defined below in Section 6(a)) (the “Extended Term”). Tenant’s obligation to pay Fixed Monthly Rent (as specified in the rent schedule set forth in Section 6(a) below) for the Extended Term shall commence on the Renewal Effective Date. |

| 3. | Contingency; Expansion Premises. The expansion of the Premises contemplated under this Second Amendment shall be subject to Landlord obtaining legal possession of all of the individual premises comprising the Expansion Premises (as hereinafter defined), except for suite 1680, which is not subject to any other lease or encumbrance. Landlord shall use commercially reasonable efforts to obtain legal possession of the Expansion Premises from the tenants currently occupying such premises on or before the dates contemplated in Section 4 below as the Phase I Delivery Date and the Phase II Delivery Date. The expansion shall occur in two (2) phases as follows: |

3.1 Phase I Expansion. The first phase of the expansion (“Phase I Expansion”) shall be comprised of the premises described below on the fifteenth (15th) floor of the Building and all such premises shall be referred to collectively in this Second Amendment as the “Phase I Expansion Premises”. Each of the suites comprising the Phase I Expansion Premises is depicted on Exhibit A-1 attached hereto and made a part hereof by this reference.

| Phase I Suites |

Square Feet of Rentable Area |

Square Feet of Usable Area |

Tenant’s Share |

Tenant’s Share of the Common Area | ||||

| 1520 |

2,634 | 2,192 | 0.56% | 0.37% | ||||

| 1530 |

1,739 | 1,447 | 0.37% | 0.25% | ||||

| TOTAL |

4,373 | 3,639 | 0.93% | 0.62% |

SECOND AMENDMENT TO OFFICE LEASE (continued)

3.2 Phase II Expansion. The second phase of the expansion (“Phase II Expansion”) shall be comprised of the premises described below on the sixteen (16th) floor of the Building and all such premises shall be referred to collectively in this Second Amendment as the “Phase II Expansion Premises”. Each of the suites comprising the Phase II Expansion Premises is depicted on Exhibit A-2 attached hereto and made a part hereof by this reference. The term “Expansion Premises” shall mean and refer to the Phase I Expansion Premises when used together with the Phase II Expansion Premises.

| Phase II Suites |

Square Feet of Rentable Area |

Square Feet of Usable Area* |

Tenant’s Share* |

Tenant’s Share of the Common Area* | ||||

| 1635 |

997 | 823 | 0.21% | 0.14% | ||||

| 1640 |

2,217 | 1,848 | 0.47% | 0.31% | ||||

| 1650 |

7,045 | 5,873 | 1.49% | 1.00% | ||||

| 1680 |

1,978 | 1,649 | 0.42% | 0.28% | ||||

| TOTAL |

12,237 | 10,193* | 2.59%* | 1.73%* |

(* The Usable Area of the 16th floor shall be subject to remeasurement, and the Tenant’s Share and Tenant’s Share of Common Area shall be adjusted, upon the conversion of the 16th floor from a multi-tenant floor to a single tenant floor.)

| 4. | Delivery of the Expansion Premises; Expansion Dates. Subject to the contingency referred to in Section 3, above, the expansion contemplated hereunder shall be effective and Tenant shall commence payment of Rent for the Expansion Premises as follows: |

4.1 Phase I Expansion Date. Landlord shall use commercially reasonable efforts to obtain legal possession of, and allow Tenant access to, the Phase I Expansion Premises, on or before December 1, 2010. The actual date such access is granted shall be referred to herein as the “Phase I Delivery Date”). The “Phase I Expansion Date” shall mean the date that is the ninety-first (91st) day after the Phase I Delivery Date. The anticipated Phase I Expansion Date is March 1, 2011. Landlord and Tenant agree that the Phase I Delivery Date shall not be deemed to have occurred until both suites comprising the Phase I Expansion Premises have been delivered to Tenant for commencement of the construction of the Improvements.

4.2 Phase II Expansion Date. Landlord shall use commercially reasonable efforts to obtain legal possession of, and allow Tenant access to, the Phase II Expansion Premises on or before January 1, 2011. The actual date such access is granted shall be referred to herein as the “Phase II Delivery Date”). The “Phase II Expansion Date” shall mean the date that is the ninety-first (91st) day after the Phase II Delivery Date. The anticipated Phase II Expansion Date is April 1, 2011. Landlord and Tenant agree that the Phase II Delivery Date shall not be deemed to have occurred until each of the suites comprising the Phase II Expansion Premises have been delivered to Tenant for commencement of the construction of the Improvements.

Tenant shall accept the Expansion Premises in their “as-is” condition and Tenant acknowledges that Landlord has made no representation or warranty, express or implied, except as are contained in this Second Amendment and its Exhibits, regarding the condition, suitability or usability of the Expansion Premises or the Building for the purposes intended by Tenant.

Landlord and Tenant shall promptly execute an amendment to this Second Amendment (the “Memorandum”) substantially in the form attached hereto as Exhibit D, confirming the finalized Phase I and Phase II Expansion Dates and the Usable Area of the 16th floor as soon as they are determined. Tenant shall execute the Memorandum and return it to Landlord within ten (10) business days after receipt thereof. Failure of Tenant to timely execute and deliver the Memorandum shall constitute an acknowledgement by Tenant that the statements included in such Memorandum are true and correct, without exception.

If for any reason Landlord is unable to deliver possession of the Expansion Premises to Tenant on the anticipated dates set forth above, this Second Amendment shall not be void or voidable, nor shall Landlord be liable to Tenant for any damage resulting from Landlord’s inability to deliver such possession. However, Tenant shall not be obligated to pay the Fixed Monthly Rent or Additional Rent that Tenant is required to pay for the Expansion Premises pursuant to this Second Amendment until the occurrence of the Phase I Expansion Date and the Phase II Expansion Date (as each date is defined above). Except for such delay in the commencement of Rent, Landlord’s failure to deliver possession of the Expansion Premises on the anticipated delivery dates in clauses (a) and (b) above shall in no way affect Tenant’s obligations hereunder.

Subject to the terms and conditions of this grammatical paragraph, the time period for the exercise by Tenant of its “Option to Terminate” the Lease of the Existing Premises set forth in Section 13 of the First Amendment shall be modified, subject to the terms of this grammatical paragraph, so that the “Notice Period” (as such term is defined in Section 13.1 of the First Amendment) shall mean and refer to the calendar month of August 2011; the “Early Termination Date” shall mean and refer to February 29, 2012; and the term “first calendar day of the twenty-eighth (28th) full calendar month” set forth in Section 13.4 of the First Amendment shall mean and refer to September 1, 2011. If possession of both the Phase I Expansion Premises and the Phase II Expansion Premises is not tendered by Landlord to Tenant on or before February 28, 2011, then

2

SECOND AMENDMENT TO OFFICE LEASE (continued)

Tenant shall have the right to (but shall not be obligated to) exercise its Option to Terminate pursuant to Section 13 of the First Amendment, as modified herein. If Tenant exercises its Option to Terminate, Tenant shall pay Landlord the Termination Consideration (as defined in Section 13.3 of the First Amendment) as and when required under Section 13.3. If Landlord delivers possession of the Expansion Premises on or before February 28, 2011, then upon the date of the delivery of the final premises comprising the Expansion Premises, Tenant’s Option to Terminate under the First Amendment shall be void and of no further force or effect, provided that the Option to Terminate set forth below in Section 11 shall remain in full force and effect in accordance with its terms.

| 5. | Rentable Area of the Premises Upon Expansion. As of the Phase I Expansion Date, the definition of the Premises shall be revised to include both the Existing Premises and the Phase I Expansion Premises, and wherever in the Lease the word “Premises” is found, it shall thereafter refer to both the Existing Premises and the Phase I Expansion Premises together, as if the same had been originally included in said Lease. Landlord and Tenant agree that the Usable Area of the Phase II Expansion Premises and Tenant’s Share and Tenant’s Common Area Share for the Phase II Expansion Premises shall be verified by Stevenson Systems, Inc., an independent planning firm, using the June, 1996 standards published by the Building Owners’ and Managers’ Association (“BOMA”), as a guideline. Landlord shall make a representative of Stevenson Systems available to meet and confer with an architect selected by Tenant to review Stevenson’s methodology for measurement of the Usable Area of the Phase II Expansion Premises. |

As of the Phase I Expansion Date, the Usable Area of the Premises shall increase from 18,313 square feet to 21,952 square feet and the Rentable Area of the Premises shall increase from 21,982 square feet to 26,355 square feet.

As of the Phase II Expansion Date, the definition of the Premises shall be revised to include both the Existing Premises, the Phase I Expansion Premises and the Phase II Expansion Premises, and wherever in the Lease the word “Premises” is found, it shall thereafter refer to both the Existing Premises, the Phase I Expansion Premises and the Phase II Expansion Premises together, as if the same had been originally included in said Lease.

As of the Phase II Expansion Date, the Usable Area of the Premises shall increase from 21,952 square feet to 33,423 square feet (subject to verification of the Usable Area on the 16th floor upon the conversion of the 16th floor from a multi-tenant floor to a single tenant floor) and the Rentable Area of the Premises shall increase from 26,355 square feet to 38,592 square feet.

| 6. | Fixed Monthly Rent; Rent Deferral |

(a) Fixed Monthly Rent for Existing Premises.

Commencing on the Renewal Effective Date, and continuing through the last calendar day of the twelfth (12th) full calendar following the Renewal Effective Date, the Fixed Monthly Rent payable by Tenant for the Existing Premises shall be $50,558.60 per month.

Commencing the first calendar day of the thirteenth (13th) full calendar month following the Renewal Effective Date, and continuing through the last calendar day of the twenty-fourth (24th) full calendar month following the Renewal Effective Date, the Fixed Monthly Rent payable by Tenant for the Existing Premises shall increase from $50,558.60 per month to $52,075.36 per month;

Commencing the first calendar day of the twenty-fifth (25th) full calendar month following the Renewal Effective Date, and continuing through last calendar day of the thirty-sixth (36th) full calendar month following the Renewal Effective Date, the Fixed Monthly Rent payable by Tenant for the Existing Premises shall increase from $52,075.36 per month to $53,637.62 per month;

Commencing the first calendar day of the thirty-seventh (37th) full calendar month following the Renewal Effective Date, and continuing through the last calendar day of the forty-eighth (48th) full calendar month following the Renewal Effective Date, the Fixed Monthly Rent payable by Tenant for the Existing Premises shall increase from $53,637.62 per month to $55,246.75 per month;

Commencing the first calendar day of the forty-ninth (49th) full calendar month following the Renewal Effective Date, and continuing through the last calendar day of the sixtieth (60th) full calendar month following the Renewal Effective Date, the Fixed Monthly Rent payable by Tenant for the Existing Premises shall increase from $55,246.75 per month to $56,904.15 per month;

Commencing the first calendar day of the sixty-first (61st) full calendar month following the Renewal Effective Date, and continuing through the last calendar day of the seventy-second (72nd) full calendar month following the Renewal Effective Date, the Fixed Monthly Rent payable by Tenant for the Existing Premises shall increase from $56,904.15 per month to $58,611.27 per month;

Commencing the first calendar day of the seventy-third (73rd) full calendar month following the Renewal Effective Date, and continuing through the last calendar day of the eighty-fourth (84th) full calendar month following the Renewal Effective Date, the Fixed Monthly Rent payable by Tenant for the Existing Premises shall increase from $58,611.27 per month to $60,369.61 per month;

3

SECOND AMENDMENT TO OFFICE LEASE (continued)

Commencing the first calendar day of the eighty-fifth (85th) full calendar month following the Renewal Effective Date, and continuing through the last calendar day of the ninety-sixth (96th) full calendar month following the Renewal Effective Date, the Fixed Monthly Rent payable by Tenant for the Existing Premises shall increase from $60,369.61 per month to $62,180.70 per month;

Commencing the first calendar day of the ninety-seventh (97th) full calendar month following the Renewal Effective Date, and continuing through the last calendar day of the one hundred eighth (108th) full calendar month following the Renewal Effective Date, the Fixed Monthly Rent payable by Tenant for the Existing Premises shall increase from $62,180.70 per month to $64,046.12 per month;

Commencing the first calendar day of the one hundred ninth (109th) full calendar month following the Renewal Effective Date, and continuing through the last calendar day of the one hundred twentieth (120th) full calendar month following the Renewal Effective Date, the Fixed Monthly Rent payable by Tenant for the Existing Premises shall increase from $64,046.12 per month to $65,967.51 per month; and

Commencing the first calendar day of the one hundred twenty-first (121st) full calendar month following the Renewal Effective Date, and continuing through the last day of the, one hundred twenty-ninth (129th) full calendar month following the Phase II Expansion Date (the “Termination Date”), the Fixed Monthly Rent payable by Tenant for the Existing Premises shall increase from $65,967.51 per month to $67,946.53 per month.

Notwithstanding the foregoing, or anything to the contrary contained in the Lease, Tenant shall be permitted to defer fifty percent (50%) of the Fixed Monthly Rent due for the Existing Premises for the period commencing with the Fixed Monthly Rent due in July 2013 and continuing each month for eighteen (18th) months through and including the full calendar month of December 2014 (collectively, the amount of Fixed Monthly Rent deferred shall be referred to herein as the “Rent Deferral Amount”). So long as Tenant has not committed a material default during the Term, which material default has not been cured following written notice and the applicable cure period, the entire Rent Deferral Amount shall be abated and forgiven as of the Termination Date; provided, however, that if Tenant does commit a material default during the Term, then (a) as part of Landlord’s damages recoverable upon a material default by Tenant Landlord may collect from Tenant the entire Rent Deferral Amount due for the months of the Term prior to the occurrence of such material default, including late charges and interest thereon at the rate of ten percent (10%) per annum, computed from the date of such deferral, as if the same had been due if the rent deferral had not occurred, and (b) Tenant shall not be entitled to any additional or future deferral of Fixed Monthly Rent.

(b) Fixed Monthly Rent for Phase I Expansion Premises.

Commencing on the Phase I Expansion Date and continuing through the last calendar day of the twelfth (12th) full calendar month following the Phase I Expansion Date, the Fixed Monthly Rent payable by Tenant for the Phase I Expansion Premises shall be $10,057.90 per month.

Commencing the first calendar day of the thirteenth (13th) full calendar month following the Phase I Expansion Date, and continuing through the last calendar day of the twenty-fourth (24th) full calendar month following the Phase I Expansion Date, the Fixed Monthly Rent payable by Tenant for the Phase I Expansion Premises shall increase from $10,057.90 per month to $10,359.64 per month.

Commencing the first calendar day of the twenty-fifth (25th) full calendar month following the Phase I Expansion Date, and continuing through the last calendar day of the thirty-sixth (36th) full calendar month following the Phase I Expansion Date, the Fixed Monthly Rent payable by Tenant for the Phase I Expansion Premises shall increase from $10,359.64 per month to $10,670.43 per month.

Commencing the first calendar day of the thirty-seventh (37th) full calendar month following the Phase I Expansion Date, and continuing through the last calendar day of the forty-eighth (48th) full calendar month following the Phase I Expansion Date, the Fixed Monthly Rent payable by Tenant for the Phase I Expansion Premises shall increase from $10,670.43 per month to $10,990.54 per month.

Commencing the first calendar day of the forty-ninth (49th) full calendar month following the Phase I Expansion Date, and continuing through the last calendar day of the sixtieth (60th) full calendar month following the Phase I Expansion Date, the Fixed Monthly Rent payable by Tenant for the Phase I Expansion Premises shall increase from $10,990.54 per month to $11,320.26 per month.

Commencing the first calendar day of the sixty-first (61st) full calendar month following the Phase I Expansion Date, and continuing through the last calendar day of the seventy-second (72nd) full calendar month of the Term, the Fixed Monthly Rent payable by Tenant for the Phase I Expansion Premises shall increase from $11,320.26 per month to $11,659.86 per month;

Commencing the first calendar day of the seventy-third (73rd) full calendar month following the Phase I Expansion Date, and continuing through the last calendar day of the eighty-fourth (84th) full calendar month following the Phase I Expansion Date, the Fixed Monthly Rent payable by Tenant for the Phase I Expansion Premises shall increase from $11,659.86 per month to $12,009.66 per month;

4

SECOND AMENDMENT TO OFFICE LEASE (continued)

Commencing the first calendar day of the eighty-fifth (85th) full calendar month following the Phase I Expansion Date, and continuing through the last calendar day of the ninety-sixth (96th) full calendar month following the Phase I Expansion Date, the Fixed Monthly Rent payable by Tenant for the Phase I Expansion Premises shall increase from $12,009.66 per month to $12,369.95 per month;

Commencing the first calendar day of the ninety-seventh (97th) full calendar month following the Phase I Expansion Date, and continuing through the last calendar day of the one hundred eighth (108th) full calendar month following the Phase I Expansion Date, the Fixed Monthly Rent payable by Tenant for the Phase I Expansion Premises shall increase from $12,369.95 per month to $12,741.05 per month;

Commencing the first calendar day of the one hundred ninth (109th) full calendar month following the Phase I Expansion Date, and continuing through the last calendar day of the one hundred twentieth (120th) full calendar month following the Phase I Expansion Date, the Fixed Monthly Rent payable by Tenant for the Phase I Expansion Premises shall increase from $12,741.05 per month to $13,123.28 per month; and

Commencing the first calendar day of the one hundred twenty-first (121st) full calendar month following the Phase I Expansion Date, and continuing throughout the remainder of the Extended Term, the Fixed Monthly Rent payable by Tenant for the Phase I Expansion Premises shall increase from $13,123.28 per month to $13,516.98 per month.

(c) Fixed Monthly Rent for Phase II Expansion Premises.

Commencing on the Phase II Expansion Date and continuing through the last calendar day of the twelfth (12th) full calendar month following the Phase II Expansion Date, the Fixed Monthly Rent payable by Tenant for the Phase II Expansion Premises shall be $28,145.10 per month.

Commencing the first calendar day of the thirteenth (13th) full calendar month following the Expansion Date, and continuing through the last calendar day of the twenty-fourth (24th) full calendar month following the Phase II Expansion Date, the Fixed Monthly Rent payable by Tenant for the Phase II Expansion Premises shall increase from $28,145.10 per month to $28,989.45 per month.

Commencing the first calendar day of the twenty-fifth (25th) full calendar month following the Phase II Expansion Date, and continuing through the last calendar day of the thirty-sixth (36th) full calendar month following the Phase II Expansion Date, the Fixed Monthly Rent payable by Tenant for the Phase II Expansion Premises shall increase from $28,989.45 per month to $29,859.14 per month.

Commencing the first calendar day of the thirty-seventh (37th) full calendar month following the Phase II Expansion Date, and continuing through the last calendar day of the forty-eighth (48th) full calendar month following the Phase II Expansion Date, the Fixed Monthly Rent payable by Tenant for the Phase II Expansion Premises shall increase from $29,859.14 per month to $30,754.91 per month.

Commencing the first calendar day of the forty-ninth (49th) full calendar month following the Phase II Expansion Date, and continuing through the last calendar day of the sixtieth (60th) full calendar month following the Phase II Expansion Date, the Fixed Monthly Rent payable by Tenant for the Phase II Expansion Premises shall increase from $30,754.91 per month to $31,677.56 per month.

Commencing the first calendar day of the sixty-first (61st) full calendar month following the Phase II Expansion Date, and continuing through the last calendar day of the seventy-second (72nd) full calendar month of the Term, the Fixed Monthly Rent payable by Tenant for the Phase II Expansion Premises shall increase from $31,677.56 per month to $32,627.88 per month;

Commencing the first calendar day of the seventy-third (73rd) full calendar month following the Phase II Expansion Date, and continuing through the last calendar day of the eighty-fourth (84th) full calendar month following the Phase II Expansion Date, the Fixed Monthly Rent payable by Tenant for the Phase II Expansion Premises shall increase from $32,627.88 per month to $33,606.72 per month;

Commencing the first calendar day of the eighty-fifth (85th) full calendar month following the Phase II Expansion Date, and continuing through the last calendar day of the ninety-sixth (96th) full calendar month following the Phase II Expansion Date, the Fixed Monthly Rent payable by Tenant for the Phase II Expansion Premises shall increase from $33,606.72 per month to $34,614.92 per month;

Commencing the first calendar day of the ninety-seventh (97th) full calendar month following the Phase II Expansion Date, and continuing through the last calendar day of the one hundred eighth (108th) full calendar month following the Phase II Expansion Date, the Fixed Monthly Rent payable by Tenant for the Phase II Expansion Premises shall increase from $34,614.92 per month to $35,653.37 per month;

5

SECOND AMENDMENT TO OFFICE LEASE (continued)

Commencing the first calendar day of the one hundred ninth (109th) full calendar month following the Phase II Expansion Date, and continuing through the last calendar day of the one hundred twentieth (120th) full calendar month following the Phase II Expansion Date, the Fixed Monthly Rent payable by Tenant for the Phase II Expansion Premises shall increase from $35,653.37 per month to $36,722.97 per month; and

Commencing the first calendar day of the one hundred twenty-first (121st) full calendar month following the Phase II Expansion Date, and continuing throughout the remainder of the Extended Term, the Fixed Monthly Rent payable by Tenant for the Phase II Expansion Premises shall increase from $36,722.97 per month to $37,824.66 per month.

Notwithstanding the foregoing, Tenant shall be permitted to defer fifty percent (50%) of the Fixed Monthly Rent due for the Phase I Expansion Premises for the first twenty (20) full calendar months following the Phase I Expansion Date and fifty percent (50%) of the Fixed Monthly Rent due for the Phase II Expansion Premises for the first twenty (20) full calendar months following the Phase II Expansion Date a the first twenty (20) calendar months (collectively, such amounts shall be added to the “Rent Deferral Amount” defined above in Section 6(a)).

| 7. | Revision to Tenant’s Share. As of the Phase I Expansion Date, Tenant’s Share, solely as it relates to the Phase I Expansion Premises, shall be 0.93%, and Tenant’s Share of the Common Area, solely as it relates to the Phase I Expansion Premises, shall be 0.62%. |

As of the Phase II Expansion Date, Tenant’s Share, solely as it relates to the Phase II Expansion Premises, shall be 2.74% %, and Tenant’s Share of the Common Area, solely as it relates to the Phase II Expansion Premises, shall be 1.83% %., subject to verification of the Usable Area

As of the Commencement Date, Tenant’s Share, solely as it relates to the Existing Premises, shall be 4.65%, and Tenant’s Share of the Common Area, solely as it relates to the Existing Premises, shall be 3.11%.

| 8. | Revision to Base Year. As of the Renewal Effective Date, the Base Year for Tenant’s payment of increases in Operating Expenses, solely as it relates to the Existing Premises, shall be calendar year 2011. The Base Year for the Expansion Premises shall be calendar year 2011., unless the Expansion Premises (or any portion thereof) is delivered after July 1, 2011, in which case the Base Year for the Expansion Premises (or that portion thereof) shall be calendar year 2012 |

| 9. | Modification to Security Deposit; Return of Letters of Credit. |

9.1 Security Deposit. Landlord acknowledges that it currently holds the sum of $75,332.32 as a Security Deposit under the Lease, which amount Landlord shall continue to hold throughout the Existing Premises Term and Expansion Term, unless otherwise applied pursuant to the provisions of the Lease. Concurrent with Tenant’s execution and tendering to Landlord of this Second Amendment, Tenant shall tender the sum of $43,955.85, which amount Landlord shall add to the Security Deposit already held by Landlord, so that thereafter, throughout the Existing Premises Term and Expansion Term, provided the same is not otherwise applied, Landlord shall hold a total of $119,288.17 as a Security Deposit on behalf of Tenant. Tenant hereby waives the provisions of Section 1950.7 of the California Civil Code, and all other laws, statutes, ordinances or other governmental rules, regulations or requirements now in force or which may hereafter be enacted or promulgated, which (i) establish the time frame by which Landlord must refund a security deposit under a lease, and/or (ii) provide that Landlord may claim from the Security Deposit only those sums reasonably necessary to remedy defaults in the payment of rent, to repair damage caused by Tenant or to clean the Premises, it being agreed that Landlord may, in addition, claim those sums specified in Lease Article 18, and/or those sums reasonably necessary to compensate Landlord for any loss or damage caused by Tenant’s breach of the Lease or the acts or omission of Tenant or any Tenant Party. As used in the Lease a “Tenant Party” shall mean Tenant, any employee of Tenant, or any agent, authorized representative, design consultant or construction manager engaged by or under the control of Tenant.

9.2 Letters of Credit. Pursuant to the terms of the Lease, and as security for Tenant’s obligations under the Lease, Landlord is the beneficiary under a certain Irrevocable Standby Letter of Credit No. SVBSF004327 dated September 12, 2006 in the original face amount of $300,000 and currently in the amount of $150,000 after reduction pursuant to the terms of the Lease, and a certain Irrevocable Standby Letter of Credit No. SVBSF005112 dated February 14, 2008 in the original face amount of $200,000 and currently in the amount of $125,000 after reduction pursuant to the terms of the Lease (collectively, the “Letters of Credit”). Within thirty (30) days after the mutual execution of this Second Amendment (and the delivery of the additional Security Deposit amount under Section 8.1 above), Landlord shall deliver the original Letters of Credit to Tenant or to the issuer of such Letters of Credit (at Tenant’s election and pursuant to Tenant’s instructions), and upon such delivery the Letters of Credit shall be void and of no further force or effect. Accordingly, Article 24 and all other provisions of the Lease regarding the Letters of Credit shall be terminated and of no further force and effect upon mutual execution of this Second Amendment and delivery of the additional Security Deposit amount under Section 8.1 above.

6

SECOND AMENDMENT TO OFFICE LEASE (continued)

| 10. | Parking. As of the Phase I Expansion Date, and thereafter during the Extended Term, Tenant shall have the right but not the obligation to purchase up to one hundred twenty-four (124) unreserved parking permits and up to an additional ten (10) reserved parking permits, for a total of up to one hundred thirty-four (134) parking permits at the current prevailing monthly Building parking rates in effect (which as of the date of this Second Amendment are $97.00 per single unreserved parking permit and $195.00 per single reserved parking permit), plus any and all applicable taxes, which monthly rates charged by Landlord shall increase by three percent (3%) on September 1 of each year during the Extended Term (with the subject increase being applied to the rate as discounted below in this Section 10) and Tenant shall continue to pay any and all applicable taxes without markup from the Landlord or Landlord’s parking vendor. Notwithstanding the foregoing, and anything to the contrary contained in the Lease, commencing on the Renewal Effective Date and continuing during the Extended Term, Tenant shall be granted a fifteen percent (15%) discount each month off the parking rates for up one hundred thirty-four (134) parking permits (provided that any unused amount of the discount (i.e., if Tenant purchase less than the maximum number of permits allotted to Tenant) may not be carried over to any other month. The parties acknowledge and agree that the first two paragraphs of Article 21 on page 31 of the Lease, and any discounts referenced therein (which discounts shall be superseded by the discount set forth above) and Paragraph 9 of the 1st Amendment regarding parking “must take” parking obligations and any discounts referenced or incorporated by reference therein are hereby deleted and of no force and effect during the Extended Term. |

| 11. | Option to Terminate Lease Early. |

11.1 Early Termination Date and Notice. Tenant may elect to terminate the Lease, as amended hereby, as of the last calendar day of the ninetieth (90th) full calendar month after the Phase II Expansion Date (the “Early Termination Date”) by giving Landlord written notice (the “Termination Notice”), accompanied by payment in full of the Termination Consideration (as defined below), during the eighty-first (81st) full calendar month after the Phase II Expansion Date (the “Notice Period”), with said notice being sent Certified Mail, Return Receipt Requested.

11.2. Contingencies to Early Termination. Provided that:

a) the Termination Notice is duly and timely received by Landlord;

b) Tenant is not in default under the Lease (following delivery of any required notice and expiration of any applicable cure period) as of the date the Termination Notice is received by Landlord and as of the Early Termination Date; and

c) Tenant complies with all the requirements contained in this Section 11,

then, as of the Early Termination Date, Landlord and Tenant shall be released from liability for any of their respective obligations under the Lease, as amended hereby, except for such obligations as specifically herein continue after the expiration or earlier termination of the Lease, as amended hereby. In the event Tenant fails to vacate the Premises and surrender legal possession thereof on or before the Early Termination Date, this Section 11 shall be null and void as of the Early Termination Date and this Lease shall remain in full force and effect in accordance with its terms. If Tenant fails to comply with the requirements of this Section 11 or fails to pay the Termination Consideration (as defined below) as specified in Section 11 below, which failure shall include but not be limited to Tenant’s check being returned by the bank for any reason whatsoever, such failure shall constitute a material default of this provision and shall serve to nullify the terms and conditions of this Section 11, in which case the Lease, as amended hereby, shall continue in full force and effect for the remainder of the Term.

11.3. Tenant’s Compensation to Landlord for Early Termination. The “Termination Consideration” shall mean the amount of $764,158.99.

11.4. Expiration of Option to Terminate Early. Provided that Tenant has not already delivered the Termination Notice specified hereinabove, then, effective the first calendar day of the ninety-first (91st) full calendar month after the Phase II Expansion Date, the provisions of this Section 13 shall be deemed null, void and of no further force or effect. If this early termination option has not expired on its terms herein and Tenant exercises the Right of First Offer pursuant to the terms of Section 13 below, Tenant acknowledges and agrees that the provisions of this Section 11 shall be deemed null, void and of no further force or effect upon the full execution of the expansion amendment contemplated upon the further expansion of the Premises under Section 13 below.

| 12. | Option to Extend Term. The Option to extend the Term of the Lease set forth in Article 23 of the Original Lease shall continue to apply during the Extended Term subject to the following: References in said Article 23 to “Term” shall mean and refer to the “Extended Term” and references to “Extended Term” shall mean and refer to a five (5) year period commencing on the first day after the Extended Term, is herein defined as the “Second Extended Term”. |

| 13. | Continuing Right of First Offer. |

| a) | Subject to the right to expand previously granted to the tenant currently occupying Suite 1590; and |

7

SECOND AMENDMENT TO OFFICE LEASE (continued)

| a) | Upon Landlord’s receipt of written notification (“Tenant’s Expansion Notice”) from Tenant that Tenant desires additional space in the Building on the fifteenth (15th) floor of the Building; and |

| b) | Provided Tenant is not in material uncured default after the expiration of time and the opportunity to cure as of the date or any time after Tenant tenders to Landlord Tenant’s Expansion Notice; and |

| c) | At least thirty-six (36) months remain before expiration of the Extended Term of this Lease, or Tenant is willing to enter into an extension of the Extended Term for a minimum of thirty-six (36) additional months; |

then, Landlord grants Tenant a continuing right of first offer to lease any contiguous space on the fifteenth (15th) floor of the Building in its then as-is condition (the “ROFO Premises”) that is vacated and thereafter becomes available for rent (or space that Landlord has knowledge will become available for lease in the reasonably near future) following delivery of Tenant’s Expansion Notice during the initial Term of this Lease, as follows:

If any space within the ROFO Premises is vacated and thereafter becomes available for lease at any time during the initial Term of this Lease (or if Landlord has knowledge that such space will become available for lease in the reasonably near future), Landlord shall give written notice thereof (the “Offer Notice”) to Tenant, specifying the terms and conditions upon which Landlord is willing to lease that portion of the ROFO Premises then available.

Landlord hereby confirms that as of the date hereof there are no superior rights to or encumbrances burdening any of the premises within the ROFO Premises except as stated above in clause a).

13.1 Tenant’s Acceptance. Tenant shall have ten (10) business days after receipt of the Offer Notice from Landlord to advise Landlord of Tenant’s election (the “Acceptance”) to lease the ROFO Premises on the same terms and conditions as Landlord has specified in its Offer Notice. If the Acceptance is so given, then within ten (10) business days thereafter, Landlord and Tenant shall sign an amendment to this Lease, adding the ROFO Premises to the Premises and incorporating all of the terms and conditions originally contained in Landlord’s Offer Notice.

13.2 Failure to Accept. If Tenant does not tender the Acceptance of Landlord’s Offer Notice, or if Tenant’s Acceptance is conditional or purports to modify any material term contained in Landlord’s Offer Notice, or if Tenant fails to execute the amendment to Lease called for above within the time period specified, then Landlord may lease the applicable ROFO Premises as is then available to any third party it chooses without liability to Tenant, provided that, in the event Landlord intends to enter into a lease for the applicable ROFO Premises on terms which are materially more favorable to the prospective tenant than those terms offered to Tenant, then Landlord must first offer the same revised terms to Tenant and Tenant shall have three (3) business days to agree to such terms in writing or waive its right to lease the applicable ROFO Premises pursuant to such new terms. If Tenant does not tender the Acceptance of Landlord’s revised Offer Notice, or if Tenant’s Acceptance is conditional or purports to modify any material term contained in Landlord’s revised Offer Notice, or if Tenant fails to execute the amendment to Lease called for above within the time period specified, then Landlord may lease such portion of the ROFO Premises as is then available to any third party it chooses without liability to Tenant. For purposes of this clause (c), “materially more favorable” shall mean, at a minimum, that the new terms include a net effective rent that is at least five percent (5%) less than the net effective rent offered to Tenant.

13.3 No Assignment of Right. This right is personal to the original Tenant signing the Lease, and shall be null, void and of no further force or effect as of the date that Tenant assigns the Lease to an entity that is not an Affiliate and/or subleases more than forty-nine percent (49%) of the total Rentable Area of the Premises to an entity that is not an Affiliate other than a permitted Transfer of a single full floor of the Premises.

| 14. | Proposition 13 Protection and Repurchase. |

14.1 Proposition 13 Protection. Notwithstanding any other provision of the Lease (as amended by this Second Amendment), if during the time period commencing on April 1, 2011 and expiring on March 31, 2017 (the “Protection Period”), any change of ownership of the Building is consummated (a “Transfer Event”) and, as a result thereof, the Building is reassessed (“Reassessment”) for real estate tax purposes by the appropriate government authority under the terms of Proposition 13, (as adopted by the voters of the State of California in the June 1978 election) the terms of this Section 14 shall apply to such Reassessment. In the event Proposition 13 is repealed or modified, the provisions of this Section 14 shall be applied as if no such repeal or modification was effective. As used herein, “Lease Year” shall mean each of the twelve (12) calendar month periods commencing on April 1 of each year during the Extended Term commencing on April 1, 2011.

(a) For purposes of this Section 14, the term “Tax Increase” shall mean that portion of real estate taxes and assessments (“Property Taxes”), as calculated immediately following any such the Reassessment that is attributable solely to the Reassessment. Accordingly, a Tax Increase shall not include any portion of the Property Taxes as calculated immediately following the Reassessment that is attributable to:

(i) the assessment value of the Building or Project, the base Building, or the tenant improvements located in the Building or Project prior to the Reassessment; or

8

SECOND AMENDMENT TO OFFICE LEASE (continued)

(ii) assessments pending immediately before the Reassessment that were conducted during, and included in, such Reassessment or that were otherwise rendered unnecessary following the Reassessment; or

(iii) the annual inflationary increase in real estate taxes (currently two percent (2%) per annum); or

(iv) any real property taxes and assessments incurred during the Base Year as determined under the Lease which are included in the calculation of Property Taxes for the Base Year (exclusive of the effects, if any, of any Proposition 8 reduction).

(b) During the Lease Years commencing on April 1, 2011 through March 31, 2014 Operating Expenses and Project Common Area Expenses shall not include, and Tenant shall not be obligated to pay any amount of Tenant’s Share or Tenant’s Common Area Share of the Tax Increase allocable to any Reassessment;

(c) During the Lease Year commencing on April 1, 2014 through March 31, 2015, Tenant shall be obligated to pay Tenant’s Share or Tenant’s Common Area Share of twenty-five percent (25%) of the Tax Increase relating to any Reassessment

(d) During the Lease Year commencing on April 1, 2015 through March 31, 2016, Tenant shall be obligated to pay Tenant’s Share and Tenant’s Common Area Share of fifty percent (50%) of the Tax Increase relating to any Reassessment.

(e) During the Lease Year commencing on April 1, 2016 through March 31, 2017 Tenant shall be obligated to pay Tenant’s Common Area Share of seventy-five percent (75%) of the Tax Increase relating to any Reassessment.

The Proposition 13 protection granted to Tenant hereunder shall be void and of no further force or effect after March 31, 2017, after which date Tenant shall pay all of Tenant’s Share of and Tenant’s Common Area Share of Property Taxes due under the Lease as a component of Operating Expenses in accordance with the provisions of the Lease.

14.2 Purchase of Proposition 13 Protection Amount. The amount of any Tax Increase which Tenant is not obligated to pay, if any, in connection with a particular Reassessment pursuant to the terms of Section 14.1 above shall be referred to hereinafter as a “Proposition 13 Protection Amount”. If, in connection with a change of ownership of the Building the occurrence of a Reassessment is reasonably foreseeable by Landlord and the Proposition 13 Protection Amount attributable to such Reassessment can be reasonably quantified or estimated for each calendar year of the Extended Term commencing with the year in which the Reassessment will occur, the terms of this Section 14.2 shall apply to each such Reassessment. Upon notice to Tenant, Landlord shall have the right to purchase the Proposition 13 Protection Amount relating to the applicable Reassessment (the “Applicable Reassessment”), within a reasonable period of time prior to the pending or anticipated change of ownership of the Building, by paying to Tenant an amount equal to the “Proposition 13 Purchase Price”, as that term is defined below. Landlord’s right to purchase the Proposition 13 Protection Amount with respect to each Transfer Event shall expire and terminate upon the change of ownership of the Building if prior thereto Landlord did not exercise the right of purchase, or upon Landlord’s failure to pay the Proposition 13 Purchase Price to Tenant on or before the closing of such or change of ownership.

As used herein, “Proposition 13 Purchase Price” shall mean the present value of the Proposition 13 Protection Amount (if any) remaining during the Extended Term, as of the date of payment of the Proposition 13 Purchase Price by Landlord. Such present value shall be calculated (i) by using the portion of the Proposition 13 Protection Amount attributable to each remaining calendar year of the Extended Term of the Lease (as though the portion of such Proposition 13 Protection Amount benefited Tenant in the middle of each such year), as the amounts to be discounted, and (ii) by using a five percent (5%) discount rate. . Upon such payment of the Proposition 13 Purchase Price, the provisions of Section 14.1 above, shall not apply to any Tax Increase attributable to the Applicable Reassessment. Since Landlord, if Landlord exercises its repurchase right hereunder, will be estimating the Proposition 13 Purchase Price because a Reassessment has not yet occurred, then when such Reassessment occurs, if Landlord has underestimated the Proposition 13 Purchase Price, then upon notice by Landlord to Tenant, Tenant’s Fixed Monthly Rent next due shall be credited with the amount of such underestimation, and if Landlord overestimates the Proposition 13 Purchase Price, then upon notice by Landlord (to be given promptly following Landlord’s receipt of notice of Reassessment) to Tenant, Monthly Rent next due following thirty (30) days after notice shall be increased by the amount of the overestimation. If in anticipation of the change of ownership of the Building, Landlord has paid Tenant the Proposition 13 Purchase Price but Tenant is notified in writing by Landlord that the change of ownership was not or will not be completed, Tenant shall have the right in its sole and absolute discretion to return the Proposition 13 Purchase Price to Landlord within ten (10) business days after receipt of such written notice

9

SECOND AMENDMENT TO OFFICE LEASE (continued)

| 15. | After Hours HVAC. The parties agree that Tenant shall continue to be entitled to use forty (40) hours of Excess HVAC during each twelve (12) month period of the Extended Term without charge, subject to the terms of Section 8.6 (including the prohibition on carrying forward unused hours allocated for free Excess HVAC from month to month). |

| 16. | Limitation on Landlord’s Liability to Provide Utilities and Services. The last paragraph of Section 8.9 of the Lease is hereby deleted and replaced with the following: |

“Notwithstanding the foregoing, if Tenant is prevented from using and does not use, the Premises or any portion thereof, as a result of (i) Landlord’s failure to provide services or utilities as required by this Lease, or (ii) any installation, maintenance, repair, replacement, construction, inspections, or other such activities required by this Lease to be provided by Landlord to the Premises or the Building (an “Abatement Event”), then Tenant shall give Landlord Notice of such Abatement Event and if such Abatement Event continues for five (5) consecutive business days or twenty (20) business days in any twelve (12) month period after Landlord’s receipt of any such Notice (the “Eligibility Period”), and such failure is in no way attributable to, or caused by, the acts or omissions of Tenant, then the Rent shall be abated or reduced, as the case may be, after expiration of the Eligibility Period for such time that Tenant continues to be so prevented from using, and does not use, the Premises, or a portion thereof, in the proportion that the rentable area of the portion of the Premises that Tenant is prevented from using, and does not use (“Unusable Area”), bears to the total rentable area of the Premises; provided, however, in the event that Tenant is prevented from using, and does not use, the Unusable Area for a period of time in excess of the Eligibility Period and the remaining portion of the Premises is not sufficient to allow Tenant to effectively conduct its business therein and if Tenant does not conduct its business from such remaining portion, then for such time after expiration of the Eligibility Period during which Tenant is so prevented from effectively conducting its business therein, the Fixed Monthly Rent and Additional Rent for the entire Premises shall be abated for such time as Tenant continues to be so prevented from using, and does not use, the Premises. If, however, Tenant reoccupies any portion of the Premises during such period, the Rent allocable to such reoccupied portion, based on the proportion that the rentable area of such reoccupied portion of the Premises bears to the total rentable area of the Premises, shall be payable by Tenant from the date Tenant reoccupies such portion of the Premises. Such right to abate Fixed Monthly Rent and Additional Rent shall be Tenant’s sole and exclusive remedy at law or in equity for an Abatement Event, but shall not relieve Landlord’s obligations hereunder.”

| 17. | Insurance. The parties agree that Section 19.2(a)(v) of the Lease is deleted and of force and effect during the Extended Term. |

| 18. | Reasonable Grounds for Denial of Assignment and/or Sublease. The parties agree that the final paragraph of Section 11.5 is hereby deleted and of no force and effect during the Extended Term. In lieu thereof, the parties agree to insert the following. |

If Landlord withholds or conditions its consent and Tenant believes that Landlord did so contrary to the terms of this Lease, Tenant may either seek an action in declaratory relief or injunction; or instead refer the matter to expedited arbitration (“Expedited ADR”) subject to the following terms and conditions:

| (a) | Landlord and Tenant shall refer the selection of an arbitrator to the American Arbitration Association Commercial Division on an expedited basis with the request that a selection be made at the earliest possible date. The sole issue shall be whether Landlord’s consent has been unreasonably conditioned or withheld. |

| (b) | To commence the Expedited ADR procedure, either party must send a “Notice of Commencement of ADR” to the arbitrator with a copy to the other party. Within three (3) business days after receipt of the Notice of Commencement of ADR, the arbitrator shall contact both parties to set a date within five (5) business days thereof to hold the Expedited ADR. If the parties and the arbitrator are unable to agree on a date within such five (5) day period, then the arbitrator shall select an appropriate date and time within such five (5) day period which shall be binding on the parties. |

| (c) | The Expedited ADR will be held on the date and time agreed upon by the parties or otherwise set by the arbitrator at the office of the arbitrator. Each party shall have two (2) hours to present its claim to the arbitrator (including the testimony of any live witnesses). The party initiating the Expedited ADR shall present its claim first followed by the party responding to the Expedited ADR. The arbitrator shall have the discretion to consider such other evidence as he or she deems relevant to the Expedited ADR. Following |

10

SECOND AMENDMENT TO OFFICE LEASE (continued)

| completion of the presentation of the claims by both parties, the arbitrator shall be permitted to request such further evidence as he or she deems necessary to render a decision. The arbitrator shall have the discretion to continue the Expedited ADR until the next business day, but in no event shall the Expedited ADR continue beyond the close of business on such second (2nd) business day. The arbitrator shall issue a written decision to both parties within two (2) business days of the completion of the Expedited ADR. The decision of the arbitrator shall be final and conclusive and non-appealable on the parties hereto. |

| (d) | The costs of the arbitrator shall initially be divided equally between the parties, it being understood and agreed that, upon judgment, the prevailing party shall be entitled to reimbursement from the other party of all costs of the Expedited ADR, including attorneys’ fees and the fees of the arbitrator. |

Tenant acknowledges and agrees that, notwithstanding the deletion of the final paragraph of Section 11, Tenant waives its right to terminate the Lease pursuant to California Civil Code Section 1995.310(b).

| 19. | SNDA. The Lease (as amended hereby) shall be subject and subordinate to the lien of each mortgage which may now or at any time hereafter affect Landlord’s interest in the real property, Building, parking facilities, Common Areas or portions thereof and/or the land thereunder (an “underlying mortgage”), regardless of the interest rate, the terms of repayment, the use of the proceeds or any other provision of any such mortgage. Landlord shall deliver to Tenant within ninety (90) days after this Second Amendment is mutually executed a non-disturbance agreement from EUROHYPO AG, New York Branch, as Administrative Agent on behalf of a syndicate of lenders (collectively, the “Lender”) which is the beneficiary under a first-lien deed of trust encumbering the Building, substantially in the form of Exhibit C attached hereto and made a part hereof (“SNDA”). Lender requires that Tenant and Landlord execute the SNDA prior to Lender’s execution thereof and upon execution by Landlord and Lender, Landlord shall return one (1) original of the SNDA to Tenant within said ninety-day period. Tenant shall pay all costs of Lender’s reasonable legal fees and costs associated with Lender’s review and processing of such SNDA, not to exceed the sum of $1,000. As a condition to the subordination of the Lease to any future mortgage, Landlord agrees to obtain for the benefit of Tenant a commercially reasonable form of subordination, non-disturbance and attornment agreement from every mortgagee. |

| 20. | Monument Signage. Subject to the terms and conditions set forth in this Section 20, Tenant shall, at Tenant’s sole expense, be entitled to affix Tenant’s name (but not Tenant’s logo) to one (1) dedicated monument sign, in a position selected by Landlord, fronting Oxnard Street (“Monument Signage”) on a non-exclusive basis. The Monument Signage shall be subject to the terms of Exhibit C attached hereto and made a part hereof. The Monument Signage shall be provided by the sign contractor designated by Landlord. The elevations, style, color, font, size and format and all other design elements and materials of the Monument Signage shall be acceptable to Landlord in Landlord’s sole and absolute discretion. The Monument Signage shall be consistent with Landlord’s current signage program (as may be modified from time to time in Landlord’s sole and absolute discretion). Concurrently with its execution of this Second Amendment, Tenant shall pay Landlord the sum of $500 as a signage deposit in accordance with Exhibit E. In addition, Tenant shall bear all expenses relating to the Monument Signage, including, without limitation: |

| a) | the cost of obtaining permits and approvals; |

| b) | the cost of maintaining, repairing, and replacing the Monument Signage; and |

| c) | if applicable, the cost of any electrical consumption illuminating the Monument Signage. |

Tenant shall pay to Landlord, within thirty (30) days after receipt of Landlord’s demand, any expenses incurred by Landlord with respect to the Monument Signage, except for those payable directly by Tenant to any third party. Tenant’s payment obligation under this Section 20 shall survive the expiration or earlier termination of the Lease Term. At the expiration, or earlier termination of the Term of the Lease, Tenant shall (or Landlord shall at Tenant’s expense), at Tenant’s sole expense remove the Monument Signage from the monument pylon and replace the vacancy created thereby with unlettered material reasonably acceptable to Landlord. The signage right granted hereunder is personal to the original Tenant signing this Second Amendment and shall be null, void and of no further force or effect as of the date (i) that Tenant assigns the Lease to an entity that is not an Affiliate (as “Affiliate” is defined in Section 11.2 of the Original Lease) and/or subleases more than forty-nine percent (49%) of the total rentable area of the Premises to an entity that is not an Affiliate; (ii) at any time Tenant is in material default of its obligations under the Lease (including without limitation Exhibit E) and such material default has continued after the expiration of any applicable notice and cure period; or (iii) at any time Tenant or any Affiliate does not occupy, operate its business and lease a full floor in the Project. Tenant acknowledges that if Tenant has not installed the Monument Signage on or before ninety (90) days after the Phase II Expansion Date, that Tenant’s right to install said signage shall expire as of the ninety-first (91st) day following the Phase II Expansion Date and Tenant’s right to install said signage shall thereafter be null and void.

11

SECOND AMENDMENT TO OFFICE LEASE (continued)

| 21. | Acceptance of Premises; Construction of the Improvements. Tenant acknowledges that to the best of Tenant’s actual knowledge, as of the date hereof, it has no claim against Landlord, in connection with the Existing Premises or the Lease. Tenant accepts the Expansion Premises in its “as-is” condition. Tenant further acknowledges that Landlord has made no currently effective representation or warranty, express or implied regarding the condition, suitability or usability of the Existing Premises, Expansion Premises or the Building for the purposes intended by Tenant. |

Tenant shall be entitled to construct certain improvements in the Existing Premises and the Expansion Premises in accordance with and subject to Exhibit B attached hereto and made a part hereof by this reference. Douglas Emmett Builders Inc. (“DEB”) shall be granted the bona fide opportunity to bid as general contractor.

| 22. | Deletion of Certain Provisions. Section 12 (Relocation) of the First Amendment and Section 6.2(b) of the Original Lease are hereby deleted in their entirety and is hereby no longer in force or effect |

| 22. | Warranty of Authority. If Landlord or Tenant signs as a corporation or limited liability company or a partnership, each of the persons executing this Second Amendment on behalf of Landlord or Tenant hereby covenants and warrants that the applicable entity executing herein below is a duly authorized and existing entity that is qualified to do business in California; that the person(s) signing on behalf of either Landlord or Tenant have full right and authority to enter into this Second Amendment; and that each and every person signing on behalf of either Landlord or Tenant are authorized in writing to do so. |

| 23. | Broker Representation. Landlord and Tenant represent to one another that it has dealt with no broker in connection with this Second Amendment other than Douglas Emmett Management, Inc. and Studley. Landlord and Tenant shall hold one another harmless from and against any and all liability, loss, damage, expense, claim, action, demand, suit or obligation arising out of or relating to a breach by the indemnifying party of such representation. Landlord agrees to pay all commissions due to the brokers listed above created by Tenant’s execution of this Second Amendment. |

| 24. | Confidentiality. Landlord and Tenant agree that the covenants and provisions of this Second Amendment shall not be divulged to anyone not directly involved in the management, administration, ownership, lending against, or subleasing of the Premises, other than Tenant’s or Landlord’s counsel-of-record or leasing or sub-leasing broker of record, accountants, or as required by any applicable law or regulatory body (such as the Securities and Exchange Commission). |

| 25. | Governing Law. The provisions of this Second Amendment shall be governed by the laws of the State of California. |

| 26. | Reaffirmation. Landlord and Tenant acknowledge and agree that the Lease, as amended herein, constitutes the entire agreement by and between Landlord and Tenant relating to the Premises, and supersedes any and all other agreements written or oral between the parties hereto. Furthermore, except as modified herein, all other covenants and provisions of the Lease shall remain unmodified and in full force and effect. |

| 27. | Submission of Document. No expanded contractual or other rights shall exist between Landlord and Tenant with respect to the Expansion Premises, as contemplated under this Second Amendment, until both Landlord and Tenant have executed and delivered this Second Amendment, whether or not any additional rental or security deposits have been received by Landlord, and notwithstanding that Landlord has delivered to Tenant an unexecuted copy of this Second Amendment. The submission of this Second Amendment to Tenant shall be for examination purposes only, and does not and shall not constitute a reservation of or an option for the Tenant to lease the Expansion Premises, or otherwise create any interest by Tenant in the Expansion Premises or any other portion of the Building other than the original Existing Premises currently occupied by Tenant. Execution of this Second Amendment by Tenant and its return to Landlord shall not be binding upon Landlord, notwithstanding any time interval, until Landlord has in fact executed and delivered this Second Amendment to Tenant. |

12

SECOND AMENDMENT TO OFFICE LEASE (continued)

IN WITNESS WHEREOF, Landlord and Tenant have duly executed this document, effective the later of the date(s) written below.

| LANDLORD: | TENANT: | |||||||||||

| DOUGLAS EMMETT 2000, LLC, a Delaware limited liability company |

REACHLOCAL, INC., a Delaware corporation | |||||||||||

|

By: |

Douglas Emmett Management, LLC, a Delaware limited liability company, its Agent |

By: Name: |

/s/ Ross G. Landsbaum Ross G. Landsbaum CFO | |||||||||

| By: | Douglas Emmett Management, Inc., a Delaware corporation, its Manager |

Dated: | August 31, 2010 | |||||||||

| By: | /s/ Michael J. Means |

By: |

| |||||||||

| Michael J. Means, Senior Vice President | Name: |

| ||||||||||

| Dated: | September 2, 2010 | Title: |

| |||||||||

| Dated: |

| |||||||||||

13

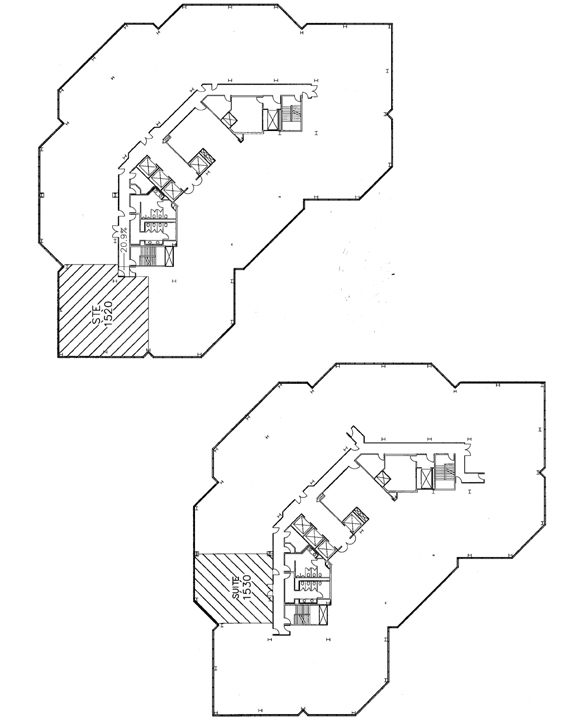

EXHIBIT A-1

PHASE I EXPANSION PREMISES PLANS

Suites 1520 and 1530

Total Rentable Area: approximately 4,373 square feet

Total Usable Area: approximately 3,639 square feet

A-1

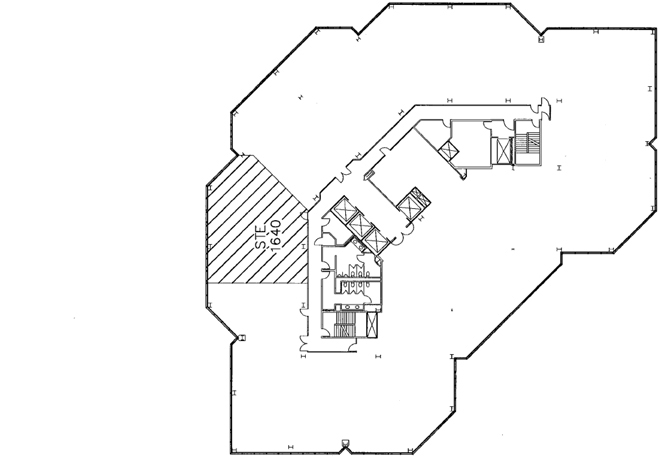

EXHIBIT A-2

PHASE II EXPANSION PREMISES PLANS

Suites 1635, 1640, 1650 and 1680

Total Rentable Area: approximately 12,237 square feet

A2-1

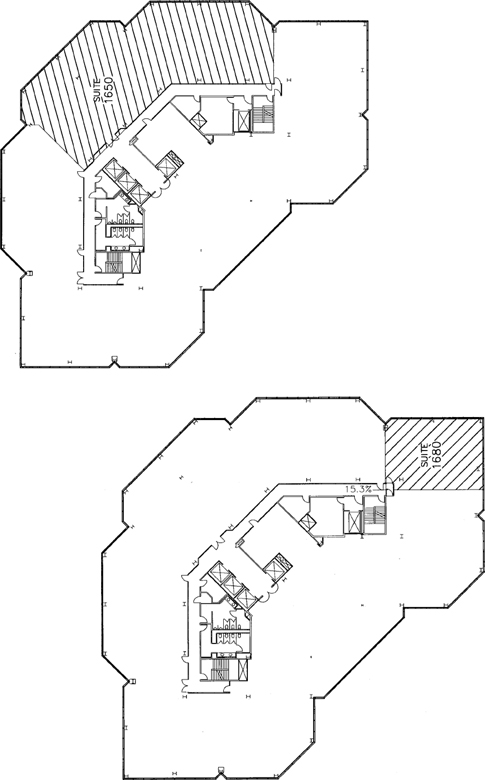

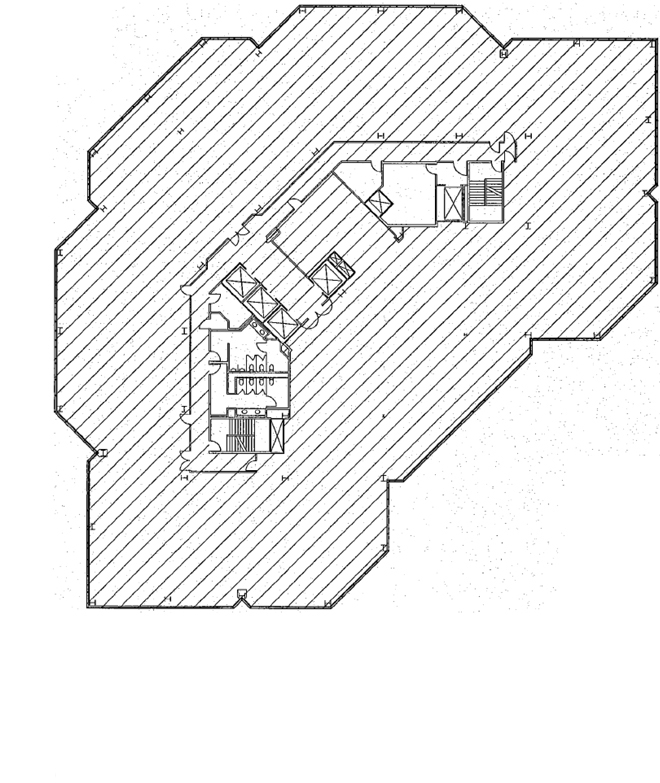

EXHIBIT B (Continued)

B-2

EXHIBIT B (Continued)

16th Floor

Usable Area: 22,856 square feet (subject to remeasurement after 16th floor corridor reconfiguration)

Rentable Area: 25,895 square feet

B-3

EXHIBIT B

CONSTRUCTION AGREEMENT

CONSTRUCTION PERFORMED BY TENANT

Section 1. Tenant to Complete Construction. Except as otherwise referenced herein, the term “Premises” shall mean and refer to the Premises, including collectively the Existing Premises and the Expansion Premises. Tenant shall accept the Premises in its “as-is” condition. Tenant’s general contractor (“Contractor”) shall furnish and install within the Premises those items of general construction (the “Improvements”), shown on the final Plans and Specifications approved by Landlord. The definition of “Improvements” shall include all costs associated with completing the Tenant Improvements, including but not limited to, space planning, design, architectural, and engineering fees, contracting, labor and material costs, municipal fees, plan check and permit costs, code upgrades, and document development and/or reproduction. The Improvements shall comply in all respects with the following: (i) all state, federal, city or quasi-governmental laws, codes, ordinances and regulations, as each may apply according to the rulings of the controlling public official, agent or other person; (ii) applicable standards of the American Insurance Association (formerly, the National Board of Fire Underwriters) and the National Electrical Code; (iii) building material manufacturer’s specifications and (iv) the Plans and Specifications. All Tenant selections of finishes shall be indicated in the Plans and Specifications and shall be equal to or better than the minimum Building standards and specifications. Any work not shown in the Plans and Specifications or included in the Improvements such as, but not limited to, telephone service, furnishings, or cabinetry, for which Tenant contracts separately shall be subject to Landlord’s policies and shall be conducted in such a way as to not unreasonably hinder or delay the work of Improvements.

Section 2. Tenant’s Payment of Costs. Subject to Landlord’s reimbursement as specified herein below, Tenant shall bear all costs of the Improvements, including any upgrades to the Premises required to comply with any applicable laws, and shall timely pay said costs directly to the Contractor. Subject to “Tenant’s Contribution” (as defined below) to any restroom upgrade required by the City of Los Angeles on the 16th floor, Landlord shall pay the cost of any renovations or revisions which Landlord is required to make to any Common Area or portion of the Building or Project, or Landlord shall otherwise cure any such deficiencies as permitted by applicable law, which such renovations, repairs or revisions arise out of or are required in connection with Tenant’s completion of the Improvements contemplated herein, including any renovations, repairs or revisions required by applicable law. Tenant hereby agrees that in the event the City of Los Angeles informs Tenant (e.g., at the plan check stage) that it requires modifications be made to the restrooms on the sixteenth (16th) floor to conform to applicable law, Tenant shall immediately notify Landlord. Upon receipt of such notice, if any, Landlord shall promptly cause its contractor, Douglas Emmett Builders, Inc. (“DEB”), to perform the work necessary to comply with the City of Los Angeles requirements for the restrooms. DEB shall prosecute such work continuously and diligently to completion and shall coordinate with Tenant’s contractor to minimize any interference with construction of the Improvements. Landlord may deduct out of the Allowance an amount not to exceed $10,700 (“Tenant’s Contribution”) to offset the cost of the restroom upgrade work. Landlord shall pay DEB for any other costs for the required 16th floor restrooms upgrades required by the City of Los Angeles in connection with the Improvements to be constructed by Tenant. Landlord shall provide Tenant an itemization of the costs for any amount of the Allowance (subject to the cap on Tenant’s Contribution) deducted by Landlord for the 16th floor restroom work. Landlord shall cause DEB to use commercially reasonable efforts to obtain competitive pricing for the work to be performed.

In addition, Tenant shall reimburse Landlord for any and all of Landlord’s reasonable third party out of pocket costs, if any, incurred in reviewing Tenant’s Space Plan, Plans and Specifications or Change reasonable third party out of pocket costs incurred in engaging any third party engineers or contractors. Landlord shall engage such third parties only if reasonably necessary and shall explain to Tenant in advance in reasonable detail the need to engage them prior to doing so. Landlord shall also provide a good faith estimate of the cost of such review, the name(s) of the proposed third-party to be engaged, and shall give Tenant a reasonable opportunity to respond and modify the plans that are the subject of the third-party’s work. Landlord shall use commercially reasonable efforts to engage the most cost-competitive qualified third parties. Tenant shall pay any of the costs required to be paid by Tenant under this Section 2 a) within thirty (30) days after Landlord’s delivery to Tenant of a copy of the invoice(s) for such work.

Section 3. Lien Waiver and Releases. During the course of construction Contractor shall provide Landlord with executed lien waiver and release forms as requested by Landlord (including any conditional or unconditional waiver and release forms in the form required under California Civil Code

B-1

EXHIBIT B (Continued)

Sections 3262(d), 3262(d)(3) or Section 3262(d)(4)) and confirmation that no liens have been filed against the Premises or the Building. If any liens arise against the Premises or the Building as a result of Tenant’s Improvements, Tenant shall immediately, at Tenant’s sole expense, remove such liens and provide Landlord evidence that the title to the Building and Premises have been cleared of such liens.

Section 4. Intentionally Omitted.

Section 5. Landlord’s Reimbursement for Costs.

5.1 Allowance. In accordance with the terms and procedures specified below, Landlord shall pay to Tenant for the Improvements, an allowance, not to exceed the sum of $25.00 per square foot of Rentable Area within the Expansion Premises to be applied solely to the construction of Improvements in the Expansion Premises and an allowance not to exceed the sum of $10.00 per square foot of Rentable Area within Existing Premises to be applied solely to the construction of Improvements in the Existing Premises (collectively, the “Allowance”). The Allowance shall be available for disbursement to the Tenant after January 1, 2011 and through July 31, 2011, subject to a day for day extension for any Landlord Caused Delay, Force Majeure event or in the event the Phase I Expansion Premises are delivered after December 1, 2010 or the Phase II Expansion Premises are delivered after January 1, 2010, and Landlord shall have no obligation to disburse the Allowance prior to January 1, 2011 or after July 31, 2011, subject to a day for day extension for any Landlord Caused Delay, Force Majeure event or in the event the Phase I Expansion Premises are delivered after December 1, 2010 or Phase II Expansion Premises are delivered after January 1, 2010 (provided that if Tenant has complied with all of the conditions precedent required for disbursement of the Allowance prior to July 31, 2011 but Landlord has not yet disbursed such the amount requested then, subject to Tenant’s compliance with the terms and conditions of this Exhibit B, Tenant shall be entitled to such disbursement).

5.2. Use of the Allowance.

5.2.1. Tenant Improvement Allowance Items. Except as otherwise set forth in this Exhibit B, the Allowance shall be disbursed by Landlord only for the following items and costs (collectively, the “Allowance Items”):

5.2.1.1 Payment of any space planning or architectural services fees and costs not to exceed an amount disbursed out of the Allowance (i.e., not in addition to the Allowance) of $3.50 per square feet of Rentable Area in the Premises;

5.2.1.2 The payment of plan check permit and license fees relating to construction of the Improvements;

5.2.1.3 The costs of construction of the Improvements, including without limitation, testing and inspection costs, installation of built-in work stations, floor loading reinforcement costs, hoisting and trash removal costs, and contractors’ fees and general conditions, provided that the Allowance may not be applied to the purchase of furniture or equipment or, provided that, Tenant may apply an amount of the Allowance up to $3.50 per square foot of Rentable Area toward the purchase and installation of data or telecom cabling or wiring;

5.2.1.4 The cost of any changes in the base, shell and core when such changes are required by the Plans and Specifications, including corridor construction, such cost to include all direct architectural and/or engineering fees and expenses incurred in connection therewith;

5.2.1.5 The cost of any changes to the Plans and Specifications or the Improvements required by all applicable building codes (the “Code”); and

5.2.1.6 Payment of any fees and costs to “Tenant’s Agents,” as defined below.

5.2.2 Disbursement of the Allowance. During the construction of the Improvements, Tenant may request and Landlord shall make monthly disbursements of the Allowance for the Allowance Items for the benefit of Tenant and shall authorize the release of monies for the benefit of Tenant as follows:

5.2.2.1 Disbursements. Tenant may request up to four (4) progress payments out of the Allowance in accordance with this Section 5.2.2.1. In connection with the foregoing, and not more than once each calendar month, Tenant shall deliver to Landlord: (i) a request for payment approved by Tenant detailing the work completed and paid for; (ii) paid invoices from the Contractor and its subcontractors and suppliers for labor rendered and materials delivered to the Premises; and (iii) executed conditional mechanic’s lien releases from all of Tenant’s Agents which shall comply with the appropriate provisions, as reasonably determined by Landlord, of California Civil Code Section 3262(d). Within thirty (30) days after Landlord has received all of the items in the foregoing clauses (i) through (iii), Landlord shall deliver a check to Tenant in payment of the lesser of: (A) the amounts so requested by Tenant, less an amount equal to the lesser of (i) a ten percent (10%) retention, or (ii) the retention provided for in the construction contract approved by Landlord (the aggregate amount of such retentions to be known as the “Final Retention”), and (B) the balance of any remaining available portion of the

B-2

EXHIBIT B (Continued)

Allowance, not including the Final Retention. Landlord’s payment of such amounts shall not be deemed Landlord’s approval or acceptance of the work furnished or materials supplied as set forth in Tenant’s payment request. Notwithstanding any contrary provision of this Section 5.2.2.1, it is expressly understood and agreed that there shall be no retention on the supervision fee (as specified in subparagraph (c) of Section 6 below), the architect’s fees, permit fees or the direct order items.

5.2.2.2 Final Retention. Subject to the provisions of this Exhibit B, a check for the Final Retention payable to Tenant shall be delivered by Landlord to Tenant following the completion of construction of the Improvements, provided that (i) Tenant delivers to Landlord properly executed mechanics lien releases in compliance with both California Civil Code Section 3262(d)(2) and either Section 3262(d)(3) or Section 3262(d)(4), (ii) Landlord has determined that no substandard work exists which materially adversely affects the mechanical, electrical, plumbing, heating, ventilating and air conditioning, life-safety or other systems of the Building, the curtain wall of the Building, the structure or exterior appearance of the Building, or any other tenant’s use of such other tenant’s leased premises in the Building, and (iii) Tenant delivers to Landlord a certificate, in a form reasonably acceptable to Landlord, certifying that the construction of the Improvements in the Premises has been substantially completed.