Attached files

| file | filename |

|---|---|

| EX-23.1 - EXHIBIT 23.1 - SafeNet Holding Corp | dex231.htm |

Table of Contents

As filed with the Securities and Exchange Commission on November 2, 2010

Registration No. 333-168067

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 3

to

FORM S-1

REGISTRATION STATEMENT

Under

The Securities Act of 1933

SAFENET HOLDING CORPORATION

(Exact name of Registrant as specified in its charter)

| Delaware | 3577 | 27-2808598 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

4690 Millennium Drive

Belcamp, Maryland 21017

(410) 931-7500

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Mark A. Floyd

Chief Executive Officer

SafeNet Holding Corporation

4690 Millennium Drive

Belcamp, Maryland 21017

(410) 931-7500

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| David J. Segre, Esq. Wilson Sonsini Goodrich & Rosati, Professional Corporation 650 Page Mill Road Palo Alto, California 94304

Mark R. Fitzgerald, Esq. Michael C. Labriola, Esq. Wilson Sonsini Goodrich & Rosati, Professional Corporation 1700 K Street, N.W., Fifth Floor Washington, D.C. 20006 Telephone: (202) 973-8800 Facsimile: (202) 973-8899 |

Kenneth M. Siegel, Esq. Senior Vice President and General Counsel SafeNet Holding Corporation 4690 Millennium Drive Belcamp, Maryland 21017 Telephone: (410) 931-7500 Facsimile: (410) 931-7524 |

Richard D. Truesdell, Jr., Esq. Davis Polk & Wardwell LLP 450 Lexington Avenue New York, New York 10017 Telephone: (212) 450-4674 Facsimile: (212) 701-5674 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | x (Do not check if a smaller reporting company) | Smaller reporting company | ¨ |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a) may determine.

Table of Contents

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

PROSPECTUS (Subject to completion)

Issued November 2, 2010

Shares

This is an initial public offering of shares of common stock of SafeNet Holding Corporation. No public market currently exists for our common stock. We anticipate the initial public offering price per share will be between $ and $ per share.

We are selling shares of common stock and the selling stockholder is selling shares of common stock. We will not receive any of the proceeds from the shares of common stock sold by the selling stockholder.

We have applied to list our common stock on the NASDAQ Global Market under the symbol “SAFE.”

Investing in our common stock involves risks. See “Risk Factors” beginning on page 16.

Price $ Per Share

| Price to Public | Underwriting Discounts and Commissions |

Proceeds to SafeNet |

Proceeds to Selling Stockholder |

|||||||||||||

| Per Share |

$ | $ | $ | $ | ||||||||||||

| Total |

$ | $ | $ | $ | ||||||||||||

The underwriters have a 30-day option to purchase up to an aggregate of additional shares of common stock from on the same terms set forth above.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares of common stock to purchasers on or about , 2010.

| Morgan Stanley | Goldman, Sachs & Co. | J.P. Morgan |

| BofA Merrill Lynch | Deutsche Bank Securities |

| Wells Fargo Securities | ||||||

| Lazard Capital Markets | ||||||

| Pacific Crest Securities | ||||||

| RBC Capital Markets |

, 2010

Table of Contents

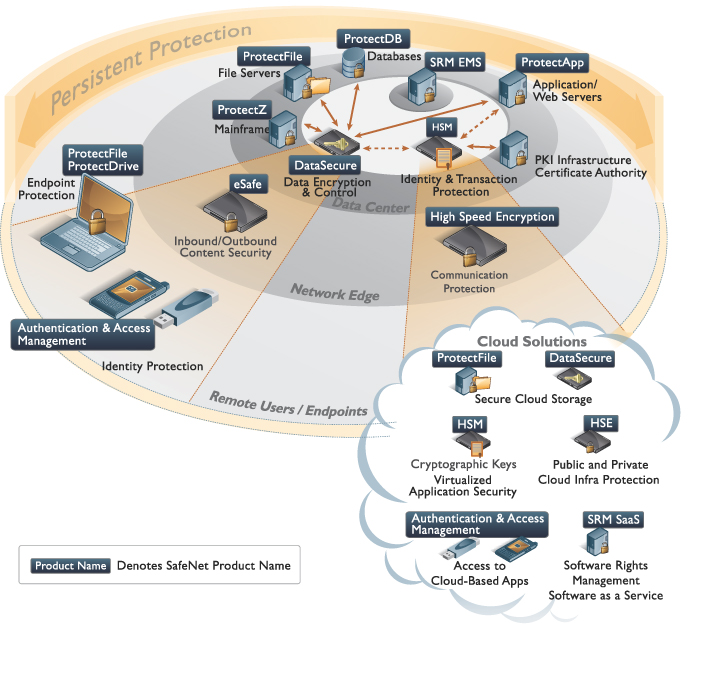

Our products provide persistent data-centric protection throughout the data lifecycle. The diagram below graphically depicts the nature of information networks and where the SafeNet data protection solution applies products that protect the phases of the data’s lifecycle. In the center of the diagram is a typical data center, comprised of a combination of storage resources, application and web servers, mainframe computers and other core transactional functions. The concentric rings around the data center represent the network edge and the remote users and endpoints that sit beyond the network edge. Also beyond the edge are cloud computing environments and the SafeNet products that extend data protection from the data center into the cloud. Persistent data protection is provided by protecting data regardless of where it sits in, or beyond the edge of, the data network.

Table of Contents

| Page | ||||

| 1 | ||||

| 16 | ||||

| Cautionary Note Regarding Forward-Looking Statements and Industry Data |

42 | |||

| 43 | ||||

| 44 | ||||

| 45 | ||||

| 46 | ||||

| Unaudited Pro Forma Condensed Consolidated Financial Information |

48 | |||

| 50 | ||||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

53 | |||

| 108 | ||||

| 132 | ||||

| 142 | ||||

| 149 | ||||

| 168 | ||||

| 172 | ||||

| 174 | ||||

| 177 | ||||

| Material United States Federal Income Tax and Estate Tax Consequences to Non-U.S. Holders |

179 | |||

| 183 | ||||

| 190 | ||||

| 190 | ||||

| 190 | ||||

| F-1 | ||||

We have not authorized anyone to provide any information other than that contained in this prospectus or in any free writing prospectus prepared by or on behalf of us or to which we have referred you. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We, the underwriters and the selling stockholder are offering to sell, and seeking offers to buy, shares of our common stock only in jurisdictions where offers and sales are permitted. The information in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of shares of our common stock.

Neither we, the selling stockholder, nor any of the underwriters have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the shares of common stock and the distribution of this prospectus outside of the United States.

Until , 2010 (25 days after the commencement of this offering), all dealers that buy, sell or trade shares of our common stock, whether or not participating in this offering, may be required to deliver a prospectus. This delivery requirement is in addition to the obligation of dealers to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

We have registered the “SafeNet,” “Aladdin,” “DataSecure,” “eSafe,” “HASP,” “Luna,” and “Sentinel” trademarks in the U.S. in certain classes of goods and services applicable to our business and, in some cases, in certain other countries. Other of our unregistered trademarks and service marks in the U.S. include: “eToken,” “ProtectApp,” “ProtectDatabase,” “ProtectDrive,” “ProtectFile,” “Sentinel HASP,” “Sentinel RMS,” and “Sentinel EMS,” which are protected under common law. Third parties may use trademarks similar to our trademarks in other fields of use. This prospectus also contains trademarks of other persons.

i

Table of Contents

(This page left intentionally blank)

ii

Table of Contents

This summary highlights information contained elsewhere in this prospectus. This summary does not contain all of the information you should consider before buying shares in this offering. Therefore, you should read this entire prospectus carefully, including the “Risk Factors” section beginning on page 16 and our consolidated financial statements and the related notes. As described below in the sections entitled “—Company Information” and “—Corporate Reorganization,” we were incorporated in June 2010 as a Delaware corporation to become a holding company for SafeNet, Inc., which was founded in 1983. The reorganization was completed on June 30, 2010. Prior to and following the reorganization, our operations were and will continue to be conducted through SafeNet, Inc. and its consolidated subsidiaries. Unless the context requires otherwise, the words “we,” “us,” “our” and “SafeNet” refer to SafeNet, Inc. and its consolidated subsidiaries prior to the reorganization and refer to SafeNet Holding Corporation and its consolidated subsidiaries following the reorganization.

SAFENET HOLDING CORPORATION

Overview

SafeNet is a leading provider of high-end data protection solutions to both commercial enterprises and government agencies. Customers trust our comprehensive and flexible solutions to protect their most valuable information assets, including electronic banking transfers, personally identifiable information, electronic medical records, software and intellectual property assets and classified information that is critical for national security. We combine leading-edge commercial technologies with the expertise and credibility developed through our long-standing leadership in the government sector. We offer a lifecycle approach to data protection that:

| • | protects the identities of users, applications and machines; |

| • | secures transactions that are performed by authenticated users; |

| • | encrypts data when it is created and while it is accessed, shared, stored and moved; |

| • | encrypts the communications channels through which data travels; |

| • | controls users’ rights to access software and digital assets; and |

| • | includes management solutions that enable our products to work together. |

We were founded in 1983 and have developed our core encryption and data protection technology into comprehensive and integrated solutions focused on the protection of high-value information assets. Many of our products are certified to the highest security standards. We have established a global channel of resellers, original equipment manufacturers, or OEMs, value-added resellers, or VARs, systems integrators and application and solution providers that provide us extensive geographic reach across multiple commercial verticals.

In 2007 (Predecessor Period)*, 2007 (Successor Period)*, 2008, 2009 and the first nine months of 2010, our total revenue was $73.8 million*, $226.4 million*, $329.0 million, $403.7 million and $334.1 million; our net loss was $50.8 million*, $37.3 million*, $126.5 million, $49.7 million and $8.7 million and our adjusted EBITDA was $(1.0) million*, $41.4 million*, $57.5 million, $85.9 million and $69.3 million. Adjusted EBITDA is not a recognized presentation under accounting principles generally accepted in the United States, or GAAP. For an explanation of the elements of adjusted EBITDA and a full reconciliation of adjusted EBITDA to net loss, the most directly comparable GAAP measure, see “—Summary Historical Financial Data—Definition of Adjusted EBITDA” and “—Summary Historical Financial Data—Definition of Adjusted EBITDA—Reconciliation of Adjusted EBITDA to Net Loss.”

| * | Our consolidated statement of operations data for the calendar year ended December 31, 2007 reflects our activity in both the Predecessor Period during the year (January 1, 2007 to April 11, 2007) and Successor Period during that year (April 12, 2007 to December 31, 2007). For further information on this presentation, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Presentation of Financial Statements—Predecessor and Successor Entities.” |

1

Table of Contents

Industry Background

Several key trends are driving the need for high-end data protection solutions.

Proliferation of digital data and increase in high-value digital assets and transactions. Organizations are experiencing an unprecedented and sustained growth in digital assets and electronic transactions, which involves increasingly valuable information such as financial transactions, corporate, state and national security secrets, intellectual property and personal information.

Organizational deployment of new technologies has led to increased vulnerabilities. Innovations in technology have changed the ways in which organizations create, use, store and move their valuable information assets. As organizations deploy new technologies to increase productivity, they also introduce additional security and compliance risks and increase the vulnerability of valuable digital information and assets. Several examples include the increased use of:

| • | collaboration within and across organizations; |

| • | extended enterprise and workforce mobility resources; |

| • | virtualization and cloud computing; |

| • | consumer technologies and personal devices in information technology environments; and |

| • | software-as-a-service, or SaaS. |

Security threats are becoming more frequent, sophisticated and severe. There has been a significant increase in frequency, sophistication and severity of threats, originating inside and beyond an organization’s perimeter, that can compromise national security and lead to severe reputational and financial loss for organizations.

Cyber security has become a top government priority. Cyber security has become a top priority of the U.S. government as cyber attacks on the federal government have increased in volume and sophistication. Such attacks could be catastrophic to national security, defense, financial systems and critical infrastructure.

Government regulations, industry standards and internal risk management policies mandate increased protection of data. Governments are enacting legislation to ensure that individuals and organizations are informed of and protected from losses due to data breaches. In addition, organizations are increasingly implementing internal compliance policies to ensure that their data and underlying information technology, or IT, infrastructure remain protected yet available to authorized users.

The market opportunity for protecting digital assets is large. As organizations continue to increase their spending to protect their high-value digital assets, a large market opportunity has developed for high-end data security solutions. This opportunity includes portions of the broader IT, security, software rights management and government cyber security markets.

Traditional approaches are insufficient for comprehensive data protection. As a result of these trends, there is an increasing need to protect data throughout its lifecycle, which includes establishing the identities of users, applications and machines, verifying electronic transactions, and securing the access, storage, sharing and movement of data. As protection evolves, there is also an increasing need for integrated management systems to coordinate protection across these lifecycle processes. Current solutions are a combination of network perimeter defenses that do not provide comprehensive security and control and point security solutions that do not protect high-value information throughout its lifecycle.

2

Table of Contents

Our Competitive Strengths

We believe our products and services address the increased security challenges that organizations face with respect to their digital assets and the limitations associated with existing security solutions. Our product families provide persistent protection with integrated, centralized management designed to protect the digital information throughout its lifecycle. Our competitive strengths include:

| • | Comprehensive lifecycle approach to data security. Our products provide persistent data-centric protection throughout the data lifecycle. We protect the identities of users, applications and machines, the transactions they perform and the data as it is created, accessed, shared, stored, moved and used, both within and beyond the organization’s network. We believe that this comprehensive lifecycle approach to data security differentiates us from our competitors. |

| • | Proven solutions trusted by customers to protect their most valuable information assets. We have highly sophisticated customers that trust us to protect their most valuable information assets, such as classified information that is critical for national security, electronic banking transfers, proprietary corporate data, personally identifiable information, electronic medical records, software and intellectual property assets. Many of our products have achieved global certifications such as Common Criteria and governmental certifications such as those under the U.S. Federal Information Processing Standard, or FIPS, and National Security Agency Type 1, or Type 1. |

| • | Security solutions engineered to evolve with business needs. Our data-centric security solutions are based on an extensible data protection architecture that is engineered to be adaptable to changing security threats, technologies, business requirements and compliance mandates. Our solutions are modular and integrate with other products and applications in heterogeneous IT environments. This enables customers to leverage existing infrastructure and increase their data security, starting with a single product for a specific use-case and expanding to incorporate additional products and solutions as their security needs evolve. |

| • | Combining the best in commercial and government security. Due to our significant presence in both commercial enterprises and the government sector, we are well positioned to combine leading-edge commercial technologies with the expertise and credibility that we have developed through our leadership in the government sector. |

| • | Highly experienced team with significant security expertise. Our management team has 300 years of combined security and technology industry experience; our sales teams are comprised of subject matter experts; our products are engineered by a world-class research and development organization of over 550 security engineers; and over 300 of our employees hold security clearances. |

We believe that the combination of these strengths creates a significant competitive advantage.

Our Growth Strategy

Our objective is to be the leading provider of comprehensive data protection solutions that protect high-value information throughout its lifecycle. The following are key elements of our strategy:

| • | Continue to develop innovative high-end data protection solutions. We intend to leverage our proven development capabilities and expertise from government and commercial sectors to develop new security technologies that broaden our protection footprint by creating more secure, adaptive and comprehensive solutions. |

| • | Broaden our global distribution by continuing to expand our channel networks and other relationships. We intend to strengthen our existing channel by establishing new product reseller and distribution partnerships that will enable us to extend our customer reach and to target new verticals and geographic regions. |

3

Table of Contents

| • | Continue to increase our sales to new commercial and government customers. We plan to continue to invest in our direct sales force and to leverage our existing global solution partners and channel sales organizations to drive additional sales to new customers. |

| • | Further expand sales into our existing large customer base. We intend to extend our leadership within the U.S. government and the commercial sector by advancing new use cases to our existing customer base and selling new products. |

| • | Capture near term opportunities related to government cyber security initiatives and cloud computing deployments. We intend to continue to focus our resources on capturing increases in spending by our government customers on cyber security related projects and new and existing customers on evolving their IT infrastructure to shared computing environments. |

| • | Pursue selective acquisitions. We have a successful track record of making and integrating acquisitions over time, and intend to continue to pursue selective acquisitions that we expect will enhance our competitive position and financial performance. |

Our Products and Solutions

Our comprehensive and flexible data protection solutions include the following product family portfolios:

| • | Identity protection. We offer our customers identity protection tools that enable them to manage access rights to sensitive information. Our products in this area include USB authenticators, smart cards, one-time-password authenticators and software/mobile authenticators. |

| • | Transaction protection. Our transaction protection solutions provide our commercial enterprise and government customers with a fast, secure and easy way to integrate application and transaction security. Our products in this area include our Luna family of hardware security modules, or HSMs. |

| • | Data encryption and control. Our data encryption and control solutions provide our customers with a unified platform that delivers adaptive data protection and control for information assets. Our products in this area include our DataSecure data center and endpoint product suites. |

| • | Communication protection. We offer high-speed encryptor solutions that combine the highest levels of performance and integrated management capability. Our products in this area include our ethernet and synchronous optical networking encryptors. |

| • | Software rights management. We offer an integrated enforcement and management platform for software licenses and entitlements that has been designed to support a variety of deployment and licensing models. Our products in this area include our Sentinel line of products. |

Finally, each of our comprehensive data protection solutions has a management product through which an authorized administrator provisions, manages and controls deployments across the respective product families.

Our Customers

We serve more than 25,000 customers across both commercial enterprises and government agencies and in over 100 countries. Examples of customer uses of our products and solutions include:

| • | a major global interbank network using our HSMs, authenticators and high-speed encryptors to protect its communications and financial transactions; |

| • | a large government agency using our data encryption product suites to share data with other agencies and outside parties; |

4

Table of Contents

| • | a prominent global airline using our DataSecure family of products to enable compliance with standards for protecting its customers’ personally identifiable information; and |

| • | a leading European-based software provider using our Sentinel solutions to manage licenses for its solutions. |

Risks Related to Our Business

Investing in our common stock involves risk. You should carefully consider all the information in this prospectus prior to investing in our common stock. These risks are discussed more fully in the section entitled “Risk Factors” immediately following this prospectus summary. These risks and uncertainties include, but are not limited to, the following:

| • | our business depends in significant part on sales to U.S. government agencies and changes in U.S. government fiscal policies and appropriations could have a material adverse effect on our business; |

| • | losses, delays or reductions in scope of our primary customer relationships will materially reduce our revenue and profitability; |

| • | we face intense competition in our market, both from larger, better-known companies and more targeted competitors; |

| • | if functionality similar to that offered by our products is incorporated into existing infrastructure products, organizations may decide against adding our solutions to their IT networks; |

| • | defects or vulnerabilities in our products or the failure of our products to adequately prevent a security breach or protect software assets could harm our reputation and divert resources; and |

| • | if we do not accurately predict, prepare for and respond promptly to technological and market developments and changing end-customer needs and develop corresponding products, our competitive position and prospects will be harmed. |

Recent Developments

Acquisition by an Affiliate of Vector Capital

Prior to April 2007, our predecessor entity was a publicly traded company on the Nasdaq Global Market. In April 2007, we were acquired by Vector Stealth Holdings II, L.L.C., or Vector Stealth, a Delaware limited liability company and an affiliate of Vector Capital, a San Francisco-based private equity investment firm specializing in the technology sector. We were acquired through a tender offer consisting principally of $613.2 million paid to purchase all outstanding shares of the common stock of our predecessor entity, $23.4 million paid to the holders of stock options and $1.5 million in equity interests in Vector Stealth issued in lieu of cash for certain outstanding stock options. The transaction was funded by $225.0 million in cash from Vector Stealth as well as through our incurrence of $375.0 million in debt financing in addition to cash on hand. Upon completion of the tender offer, we became a wholly-owned subsidiary of Vector Stealth, and the acquired shares of our predecessor entity were cancelled. As a result of this going private transaction, we ceased to be a public reporting company in 2007.

As a private company, we began a series of steps to improve our growth, profitability and internal controls. Included in these actions were changes in our board of directors and management personnel, including reconstituting our board such that all of our board members have joined our board since 2007, and the appointment of a new chief executive officer in July 2009, a new chief financial officer in October 2009, and a new senior vice president and general counsel in February 2010. In 2009, we began implementation of a new enterprise resource planning system to further improve our efficiency and internal controls.

5

Table of Contents

Strategic Repositioning

As a private company, we made a series of strategic acquisitions and divestitures that enhanced our competitive position. In 2008, we acquired Ingrian Networks, Inc., an enterprise data protection and privacy solutions provider. In 2009, we acquired Assured Decisions, LLC, a cyber security consultancy and provider of high-value solutions for securely sharing confidential information across government agencies.

Most notable among our recent activity was the acquisition on March 24, 2009 of Aladdin Knowledge Systems Ltd., or Aladdin, a developer of data security and software rights management solutions, by an entity affiliated with Vector Capital. Vector Capital placed Aladdin under common control with us at that time. On March 31, 2010, we formally acquired the entity that had acquired Aladdin, which resulted in Aladdin becoming a wholly owned subsidiary of SafeNet, Inc. Combining the two companies enhanced our presence in our target markets, increased our geographic diversity, expanded our reseller and distribution channels and improved operating efficiencies through the reduction or elimination of overlapping products and functions.

In 2009, we divested MediaSentry, which provided network monitoring for copyright enforcement. In 2010, we divested assets of our Embedded Solutions Division product line that we marketed to network equipment manufacturers, ASIC vendors and mobile device providers.

Through these acquisitions and divestitures, we have focused our business on providing integrated high-end data protection solutions that address data security throughout its lifecycle. We unified our marketing and sales focus and targeted our development efforts on the most valuable assets in our portfolio.

Company Information

We were incorporated in 2010 as a Delaware corporation and on June 30, 2010 became a holding company for SafeNet, Inc., a company that was formed in 1983 as a Delaware corporation. As of October 1, 2010, SafeNet, Inc. employed 1,707 people in 24 countries. Our headquarters are located at 4690 Millennium Drive, Belcamp, Maryland 21017 and our telephone number is (410) 931-7500. You can access our Web site at www.safenet-inc.com. Information contained on our Web site is not part of this prospectus and is not incorporated in this prospectus by reference.

Corporate Reorganization

Prior to and following June 30, 2010, we have conducted our business through SafeNet, Inc. and its subsidiaries. SafeNet, Inc. was most recently a wholly owned subsidiary of Vector Stealth, a Delaware limited liability company and an affiliate of Vector Capital. Vector Stealth held no material assets other than SafeNet, Inc. and does not engage in any business operations. Pursuant to the terms of our recent corporate reorganization that was completed on June 30, 2010. Vector Stealth exchanged all of its ownership interest in SafeNet, Inc. for a 100% interest in SafeNet Holding Corporation. As a result of this reorganization, SafeNet, Inc. is wholly owned by SafeNet Holding Corporation, and SafeNet Holding Corporation is wholly owned by Vector Stealth. Certain of our executive officers hold economic interests in Vector Stealth. See “Certain Relationships and Related Person Transactions—Vector Stealth Unit Award Agreements.”

The corporate reorganization does not affect our operations, which we continue to conduct through SafeNet, Inc. and its consolidated subsidiaries, including Aladdin.

6

Table of Contents

Effects of the Proposed Public Offering

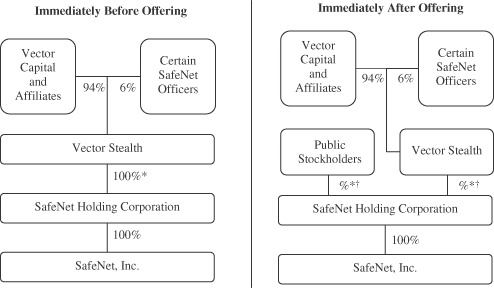

The following diagram provides a summary illustration of our ownership and organizational structure immediately before and after giving effect to this offering:

| * | Percentages calculated excluding the effects of outstanding compensatory stock options to purchase shares of our common stock, which will amount to approximately % of our fully diluted shares following this offering. |

| † | Percentages give effect to the sale of shares of common stock by us and the selling stockholder in this offering based on the amount of shares expected to be sold by us and the selling stockholder as indicated on the front cover of this prospectus (excluding the exercise of any over allotment option held by the underwriters). |

As indicated in the diagram above, immediately prior to this offering, Vector Capital and its affiliates hold approximately 94% of the total equity interests of Vector Stealth, which entity in turn holds all of the outstanding common stock in SafeNet Holding Corporation. After this offering, assuming the sale of shares of common stock by us and Vector Stealth in this offering based on the amount of shares expected to be sold as indicated on the front cover of this prospectus (excluding the exercise of any over allotment option held by the underwriters), Vector Stealth will own approximately shares, or approximately %, of our outstanding common stock. As the selling stockholder, Vector Stealth will receive net proceeds of approximately $ million from the sale of shares offered by it in this offering (excluding the exercise of any over allotment option held by the underwriters), after deducting the underwriting discounts and commissions and estimated offering expenses and based on an assumed initial public offering price of $ per share, the mid-point of the range on the front cover of this prospectus.

In addition, prior to the completion of this offering, we and Vector Stealth will enter into a stockholders’ agreement related to a number of board of director, stockholder and related governance matters. Such stockholders’ agreement will provide that Vector Stealth will have the right to designate a majority of the director nominees to our board of directors, subject to their beneficial ownership of at least 40% or more of the total outstanding shares of our capital stock. Vector will continue to have a right to designate director nominees to our board of directors to a lesser degree if their ownership percentage is between 7.5% and 40% of the total outstanding shares of our capital stock. In addition, stockholders will only be allowed to remove directors for

7

Table of Contents

cause, and our board of directors shall designate appointees to fill vacancies (subject to Vector Stealth’s rights to designate members of our board of directors). Furthermore, such stockholders’ agreement will also provide that the following actions by us or any of our subsidiaries require the approval of Vector Stealth for so long as Vector Stealth owns at least 30% or more of our outstanding shares of common stock: (1) termination of our chief executive officer; (2) consummation of a change of control transaction; (3) entering into any agreement providing for acquisitions or divestitures for aggregate consideration in excess of the greater of (i) $50.0 million or (ii) 7.5% of our market capitalization (as determined at the end of each fiscal quarter); and (4) the incurrence of debt (excluding working capital revolvers and the refinancing of any then existing debt) of greater than $50.0 million in excess of our existing indebtedness following the application of proceeds from this offering to the repayment of all or a portion of our debt.

As further described in the section titled “Certain Relationships and Related Person Transactions—Transactions and Relationships with Directors, Officers and 5% Stockholders—Transactions and Relationships with Vector Stealth and its Affiliates—Management Services Agreement,” we are subject to a management services agreement with Vector Capital. Such agreement will terminate upon completion of this offering, and we will be required to pay a termination fee of up to $12 million in connection with the termination.

Finally, as more fully described in “Use of Proceeds,” upon consummation of the offering, we currently intend to use a portion of the net proceeds of the offering to repay a portion of the amounts outstanding under our senior secured credit facilities. Upon the consummation of the offering and application of the net proceeds as described above, we currently intend to repay a portion of our outstanding borrowings under the term loan portion of our first lien credit agreement and to repay in full all of our outstanding borrowings under our second lien credit agreement and to terminate the second lien credit agreement. As more fully described in “Certain Relationships and Related Person Transactions—Transactions and Relationships with Directors, Officers and 5% Stockholders—Transactions and Relationships with Vector Stealth and its Affiliates—Term Loan,” an affiliate of Vector Stealth holds approximately $2.5 million in face value of the second lien debt, of which a total of approximately $131.0 million was outstanding on September 30, 2010. Upon consummation of the offering and application of the net proceeds as described above, we currently intend for the portion of the second lien debt held by such affiliate of Vector Stealth to be repaid in full together with the other second lien debt.

About Vector Capital

Vector Capital is a leading global private equity firm specializing in spinouts, buyouts and recapitalizations of established technology businesses in both the private and public capital markets. Vector Capital strives to actively partner with management teams to develop and execute new financial and business strategies designed to materially improve the competitive standing of those businesses and enhance value for employees, customers and stockholders.

8

Table of Contents

THE OFFERING

| Common stock offered by us |

shares |

| Common stock offered by the selling stockholder |

shares |

| Total common stock offered |

shares |

| Common stock outstanding after this offering |

shares |

| Use of proceeds |

We estimate that we will receive net proceeds of approximately $ million from the sale of the shares offered by us in this offering, after deducting the underwriting discounts and commissions and estimated offering expenses payable by us. We intend to use the net proceeds received by us in connection with this offering for the following purposes and in the following amounts: |

| • | approximately $ million will be used to repay a portion of the amount outstanding under our senior secured credit arrangements, a portion of which is held by an affiliate of Vector Stealth; however, the selection of which indebtedness obligations, the amounts to be repaid with respect to these specific indebtedness obligations, the timing of repayment and the particular method by which we effect repayment, have not yet been determined and will depend, among other things, on market conditions; |

| • | approximately $ million will be paid to Vector Capital Partners III, L.P., an affiliate of Vector Stealth, in connection with the termination of our management services agreement pursuant to its terms; and |

| • | the remainder for general corporate purposes, including working capital and capital expenditures. We may also use a portion of the proceeds for expansion of our current business through acquisitions or investments in other complementary businesses, products or technologies; however, we do not have commitments for any acquisitions at this time. |

We will not receive any proceeds from the sale of shares by the selling stockholder, including from sales of its shares in the event that the underwriters exercise their option to purchase an additional shares of our common stock from the selling stockholder. See “Use of Proceeds” and “Certain Relationships and Related Person Transactions—Transactions and Relationships with Vector Stealth and its Affiliates.”

| Proposed NASDAQ Global Market symbol |

SAFE |

| Risk factors |

See “Risk Factors” and other information included in this prospectus for a discussion of factors you should carefully consider before deciding to invest in shares of our common stock. |

9

Table of Contents

The number of shares of common stock that will be outstanding after this offering is based on the number of shares outstanding as of , 2010. This number:

| • | assumes that the underwriters will not exercise their option to purchase additional shares; |

| • | excludes shares of common stock issuable upon exercise of options outstanding at a weighted-average exercise price of $ per share under our 2007 Equity Plan; and |

| • | excludes shares of common stock reserved for future issuance under our 2010 Equity Incentive Plan. |

Unless otherwise indicated, all information in this prospectus assumes no exercise by the underwriters of their option in this offering to purchase additional shares to cover over-allotments.

10

Table of Contents

SUMMARY HISTORICAL FINANCIAL DATA

You should read the summary historical financial data set forth below in conjunction with our consolidated financial statements, the notes to our consolidated financial statements and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” contained elsewhere in this prospectus.

Pursuant to our acquisition on April 12, 2007 by Vector Stealth, our consolidated financial statements and notes included elsewhere and referenced in this prospectus present information relating to both a “Successor” and “Predecessor” entity. We refer to the period prior to April 12, 2007 as the “Predecessor Period” and the period from April 12, 2007 as the “Successor Period.” The historical financial data for the years ended December 31, 2007, 2008 and 2009 have been derived from our audited consolidated financial statements that are included elsewhere in this prospectus. The historical financial data as of September 30, 2010 and for the nine months ended September 30, 2009 and 2010 have been derived from our unaudited interim consolidated financial statements included elsewhere in this prospectus. We have prepared this unaudited financial information on the same basis as the audited consolidated financial statements and have included all adjustments, consisting only of normal recurring adjustments, that we consider necessary for a fair presentation of our financial position and operating results for such period. Our historical results are not necessarily indicative of results to be expected for future periods. Results for the nine months ended September 30, 2010 are not necessarily indicative of results expected for the full year.

11

Table of Contents

| Predecessor Period | Successor Period | |||||||||||||||||||||||||||

| Period from January 1, 2007 to April 11, 2007 |

Period from April 12, 2007 to December 31, 2007 |

Year Ended December 31, |

Nine Months Ended September 30, |

|||||||||||||||||||||||||

| 2008 | 2009 | 2009 | 2010 | |||||||||||||||||||||||||

| (unaudited) | ||||||||||||||||||||||||||||

| (dollars in millions, except per share data) | ||||||||||||||||||||||||||||

| Consolidated Statement of Operations Data: |

||||||||||||||||||||||||||||

| Revenues: |

||||||||||||||||||||||||||||

| Products |

$ | 63.7 | $ | 197.2 | $ | 283.6 | $ | 348.7 | $ | 254.6 | $ | 283.9 | ||||||||||||||||

| Service and maintenance |

10.1 | 29.2 | 45.4 | 55.0 | 39.3 | 50.2 | ||||||||||||||||||||||

| Total revenues |

73.8 | 226.4 | 329.0 | 403.7 | 293.9 | 334.1 | ||||||||||||||||||||||

| Costs of revenues: |

||||||||||||||||||||||||||||

| Products (excluding amortization and impairment of intangible assets) |

34.1 | 91.1 | 128.7 | 141.9 | 105.5 | 117.6 | ||||||||||||||||||||||

| Service and maintenance (excluding amortization and impairment of intangible assets) |

2.5 | 7.1 | 11.5 | 10.4 | 7.7 | 10.3 | ||||||||||||||||||||||

| Amortization and impairment of intangible assets |

3.7 | 26.4 | 117.2 | 31.9 | 23.7 | 24.6 | ||||||||||||||||||||||

| Total cost of revenues |

40.3 | 124.6 | 257.4 | 184.2 | 136.9 | 152.5 | ||||||||||||||||||||||

| Gross profit |

33.5 | 101.8 | 71.6 | 219.5 | 157.0 | 181.6 | ||||||||||||||||||||||

| Operating expenses: |

||||||||||||||||||||||||||||

| Research and development expenses |

19.3 | 34.0 | 47.9 | 60.6 | 47.5 | 45.4 | ||||||||||||||||||||||

| Sales and marketing expenses |

21.6 | 35.3 | 56.6 | 81.5 | 57.5 | 70.9 | ||||||||||||||||||||||

| General and administrative expenses |

41.1 | 33.8 | 47.2 | 56.0 | 42.7 | 40.3 | ||||||||||||||||||||||

| Class action settlement |

— | — | — | 25.0 | — | — | ||||||||||||||||||||||

| Amortization of intangible assets |

1.9 | 5.1 | 6.8 | 10.4 | 7.6 | 7.5 | ||||||||||||||||||||||

| Impairment of goodwill |

— | — | 42.9 | — | — | — | ||||||||||||||||||||||

| Loss on sale of business and net assets held for sale |

— | — | — | 2.5 | 1.5 | 0.7 | ||||||||||||||||||||||

| Restructuring expenses |

— | — | — | 5.5 | 3.1 | 0.2 | ||||||||||||||||||||||

| Operating (loss) income |

(50.4 | ) | (6.4 | ) | (129.8 | ) | (22.0 | ) | (2.9 | ) | 16.6 | |||||||||||||||||

| Foreign exchange (loss) gain |

(0.3 | ) | — | (2.5 | ) | (0.9 | ) | (0.8 | ) | 0.6 | ||||||||||||||||||

| Interest income (expense), net |

0.9 | (24.1 | ) | (34.2 | ) | (30.3 | ) | (23.0 | ) | (21.9 | ) | |||||||||||||||||

| Other income (expense), net |

— | 0.2 | 0.8 | 2.6 | 2.5 | (0.4 | ) | |||||||||||||||||||||

| (Loss) before income taxes |

(49.8 | ) | (30.3 | ) | (165.7 | ) | (50.6 | ) | (24.2 | ) | (5.1 | ) | ||||||||||||||||

| Income tax expense (benefit) |

1.0 | 7.0 | (39.2 | ) | (0.9 | ) | 0.1 | 3.6 | ||||||||||||||||||||

| Net (loss) |

$ | (50.8 | ) | $ | (37.3 | ) | $ | (126.5 | ) | $ | (49.7 | ) | $ | (24.3 | ) | $ | (8.7 | ) | ||||||||||

| Net loss per common share: |

||||||||||||||||||||||||||||

| Basic and diluted |

$ | (2.41 | ) | $ | (0.41 | ) | $ | (1.10 | ) | $ | (0.34 | ) | $ | (0.16 | ) | $ | (0.06 | ) | ||||||||||

| Weighted average common shares outstanding (in thousands): |

||||||||||||||||||||||||||||

| Basic and diluted |

21,107 | 90,505 | 115,233 | 147,877 | 147,877 | 150,991 | ||||||||||||||||||||||

12

Table of Contents

The following table sets forth summary unaudited consolidated balance sheet data as of September 30, 2010 and as adjusted to give effect to the issuance of common stock in this offering at an assumed initial public offering price of $ per share, the midpoint of the range on the front cover of this prospectus, and application of proceeds from the offering as described in “Use of Proceeds.” The unaudited as adjusted consolidated balance sheet data is presented for informational purposes only and does not purport to represent what our consolidated financial position actually would have been had the transactions reflected occurred on the date indicated or to project our financial condition as of any future date or results of operations for any future period.

| September 30, 2010 | ||||||||

| Actual | As Adjusted(1) |

|||||||

| (unaudited) | ||||||||

| (in millions) | ||||||||

| Consolidated Balance Sheet Data: |

||||||||

| Cash and cash equivalents |

$ | 43.5 | $ | |||||

| Total current assets |

179.9 | |||||||

| Total assets |

726.8 | |||||||

| Total current liabilities |

157.4 | |||||||

| Long-term obligations |

370.4 | |||||||

| Total stockholder’s equity |

127.9 | |||||||

| (1) | Each $1.00 increase or decrease in the assumed initial public offering price of $ per share, the midpoint of the price range set forth on the front cover of this prospectus, would increase or decrease, as applicable, our as adjusted cash, cash equivalents and short-term investments, total current assets, total assets and stockholders’ equity by approximately $ million, assuming that the number of shares offered by us, as set forth on the cover page of this prospectus, remains the same and after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us. |

The following table sets forth a number of key financial metrics that we believe are helpful in evaluating growth trends, measuring the effectiveness and efficiency of our operations and gauging our cash generation.

| Predecessor Period* |

Successor Period* | |||||||||||||||||||||||

| Period from January 1, 2007 to April 11, 2007 |

Period from April 12, 2007 to December 31, 2007 |

Year Ended December 31, |

Nine Months Ended September 30, |

|||||||||||||||||||||

| 2008 | 2009 | 2009 | 2010 | |||||||||||||||||||||

| (unaudited) | ||||||||||||||||||||||||

| (dollars in millions) | ||||||||||||||||||||||||

| Products revenues |

$ | 63.7 | $ | 197.2 | $ | 283.6 | $ | 348.7 | $ | 254.6 | $ | 283.9 | ||||||||||||

| Service and maintenance revenues |

$ | 10.1 | $ | 29.2 | $ | 45.4 | $ | 55.0 | $ | 39.3 | $ | 50.2 | ||||||||||||

| Total revenue |

$ | 73.8 | $ | 226.4 | $ | 329.0 | $ | 403.7 | $ | 293.9 | $ | 334.1 | ||||||||||||

| Gross profit margin of products revenues (excluding amortization and impairment of intangible assets)† |

46.4 | % | 53.8 | % | 54.6 | % | 59.3 | % | 58.5 | % | 58.6 | % | ||||||||||||

| Gross profit margin of service and maintenance revenues (excluding amortization and impairment of intangible assets)† |

75.2 | % | 75.9 | % | 74.7 | % | 81.1 | % | 80.4 | % | 79.5 | % | ||||||||||||

| Total gross profit margin |

45.4 | % | 45.0 | % | 21.8 | % | 54.4 | % | 53.4 | % | 54.3 | % | ||||||||||||

| Operating expenses |

$ | 83.9 | 108.2 | $ | 201.4 | $ | 241.5 | $ | 159.9 | $ | 165.0 | |||||||||||||

| Operating (loss) income |

$ | (50.4 | ) | $ | (6.4 | ) | $ | (129.8 | ) | $ | (22.0 | ) | $ | (2.9 | ) | $ | 16.6 | |||||||

| Net cash provided by (used in) operating activities |

$ | 1.4 | 18.2 | $ | 8.0 | $ | 17.5 | $ | 2.9 | $ | 38.5 | |||||||||||||

| Adjusted EBITDA |

$ | (1.0 | ) | $ | 41.4 | $ | 57.5 | $ | 85.9 | $ | 58.4 | $ | 69.3 | |||||||||||

13

Table of Contents

| * | Key financial metrics for the calendar year ended December 31, 2007 reflect our activity in both the Predecessor Period and Successor Period during that year. For further information on this presentation, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Presentation of Financial Statements—Predecessor and Successor Entities.” |

| † | For further discussion of our presentation of gross profit margin, including by products revenues (excluding amortization and impairment of intangible assets) and service and maintenance revenues (excluding amortization and impairment of intangible assets), see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Components of Operations—Gross Profit and Gross Profit Margins.” |

Definition of Adjusted EBITDA

We define adjusted EBITDA as net income (loss), calculated in accordance with GAAP, plus: (i) interest (income) expense, net; (ii) income tax (benefit) expense; (iii) depreciation; (iv) amortization of acquired intangible assets; (v) impairment of acquired intangible assets and goodwill; (vi) stock-based compensation expense; (vii) transaction costs related to acquisitions; (viii) purchase accounting adjustments; (ix) restructuring expenses; (x) principal stockholder management fees; (xi) investigation and restatement related charges; and (xii) costs and benefits of litigation settlements.

Adjusted EBITDA is a performance measure that is not calculated in accordance with GAAP. The table immediately following this discussion provides a reconciliation of this non-GAAP measure to net loss, the most directly comparable measure calculated and presented in accordance with GAAP. Adjusted EBITDA should not be considered as an alternative to net income, income from operations or any other measure of financial performance calculated and presented in accordance with GAAP. Our adjusted EBITDA may not be comparable to similarly titled measures of other companies because other companies may not calculate adjusted EBITDA or similarly titled measures in the same manner as we do. We prepare adjusted EBITDA to eliminate the impact of items that we do not consider indicative of our core operating performance. We encourage you to evaluate these adjustments, the reasons we consider them appropriate and the material limitations of adjusted EBITDA as described in “Management’s Discussion and Analysis of Results of Operations and Financial Condition—Key Metrics—Definition of Adjusted EBITDA—Material Limitations of Adjusted EBITDA.”

Our management uses adjusted EBITDA:

| • | as a measure of operating performance; |

| • | as a factor when determining management’s compensation; |

| • | for planning purposes, including the preparation of our annual operating budget; |

| • | to allocate resources of our business; and |

| • | to evaluate the effectiveness of our business strategies. |

We believe that the use of adjusted EBITDA provides consistency and comparability with our past financial performance and facilitates period to period comparisons of our operating results by management and investors. Although calculation of adjusted EBITDA may vary from company to company, our detailed presentation may facilitate analysis and comparison of our operating results by management and investors with other peer companies, many of which use similar non-GAAP financial measures to supplement their GAAP results in their public disclosures.

14

Table of Contents

Reconciliation of Adjusted EBITDA to Net Loss

The following table presents a reconciliation of adjusted EBITDA to net loss, the most comparable GAAP measure, for each of the periods identified.

| (in millions, unaudited*) | ||||||||||||||||||||||||

| Predecessor Period** |

Successor Period** | |||||||||||||||||||||||

| Period from January 1, 2007 to April 11, 2007 |

Period from April 12, 2007 to December 31, 2007 |

Year Ended December 31, |

Nine Months Ended September 30, |

|||||||||||||||||||||

| 2008 | 2009 | 2009 | 2010 | |||||||||||||||||||||

| Net (loss) |

$ | (50.8 | ) | $ | (37.3 | ) | $ | (126.5 | ) | $ | (49.7 | ) | $ | (24.3 | ) | $ | (8.7 | ) | ||||||

| Interest (income) expense, net |

(0.9 | ) | |

24.1 |

|

34.2 | 30.3 | |

23.0 |

|

|

21.9 |

| |||||||||||

| Income tax expense (benefit) |

1.0 | |

7.0 |

|

(39.2 | ) | (0.9 | ) | |

0.1 |

|

|

3.6 |

| ||||||||||

| Depreciation expense |

1.9 | |

5.0 |

|

6.9 | 8.5 | |

6.2 |

|

|

6.9 |

| ||||||||||||

| Amortization of acquired intangibles |

5.6 | |

31.5 |

|

41.9 | 42.3 | |

31.2 |

|

|

32.1 |

| ||||||||||||

| Impairment of acquired intangibles and goodwill |

— | — | 125.0 | — | |

— |

|

|

— |

| ||||||||||||||

| Stock-based compensation expense |

23.8 | |

0.1 |

|

2.4 | 1.2 | |

0.9 |

|

|

2.9 |

| ||||||||||||

| Transaction costs related to acquisitions and divestitures |

14.0 | 1.2 | 3.9 | 6.1 | |

5.2 |

|

|

1.3 |

| ||||||||||||||

| Purchase accounting adjustments |

— | |

3.6 |

|

1.7 | 9.1 | |

6.6 |

|

|

2.5 |

| ||||||||||||

| Restructuring expense |

— | — | — | 5.5 | |

3.1 |

|

|

0.2 |

| ||||||||||||||

| Management fees |

— | |

1.4 |

|

2.0 | 2.5 | |

1.8 |

|

|

1.8 |

| ||||||||||||

| Investigation and restatement related charges |

4.4 | |

3.6 |

|

5.2 | 6.0 | |

4.6 |

|

|

6.0 |

| ||||||||||||

| Costs (benefits) of litigation settlements |

— | |

1.2 |

|

— | 25.0 | |

— |

|

|

(1.2 |

) | ||||||||||||

| Adjusted EBITDA |

$ | (1.0 | ) | $ | 41.4 | $ | 57.5 | $ | 85.9 | $ | 58.4 | $ | 69.3 | |||||||||||

| * | The amounts indicated are unaudited other than the net loss for the Predecessor Period of 2007, Successor Period of 2007 and years ended December 31, 2008 and 2009. |

| ** | Our results of operations for the calendar year ended December 31, 2007 reflect our activity in both the Predecessor Period and Successor Period during that year. For further information on this presentation, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Presentation of Financial Statements—Predecessor and Successor Entities.” |

15

Table of Contents

An investment in our common stock offered by this prospectus involves a substantial risk of loss. You should carefully consider these risk factors, together with all of the other information included in this prospectus, before you decide to purchase shares of our common stock. The occurrence of any of the following risks could materially adversely affect our business, financial condition or operating results. In that case, the trading price of our common stock could decline, and you may lose part or all of your investment.

Risks Related to Our Business and Our Technologies

Our business depends in significant part on sales to U.S. government agencies, and changes in U.S. government fiscal policies could have a material adverse effect on our business.

We have historically derived, and expect to continue to derive, a significant portion of our revenues from sales to agencies of the U.S. federal government, either directly by us or through systems integrators and other resellers, and we believe that the success and growth of our business will continue to depend on successful procurement of government business. For example, approximately 50%, 43% and 39% of our revenue in the years ended December 31, 2008 and 2009 and the nine months ended September 30, 2010 was derived from our direct or indirect sales to agencies, offices and departments of the U.S. federal government, of which the substantial majority was to the Department of Defense. Some or all of the following could cause government agencies to delay or refrain from purchasing products and services that we offer in the future or otherwise have an adverse effect on our business, financial condition and results of operations:

| • | changes in fiscal or contracting policies or decreases in available government funding; |

| • | changes in government programs or applicable requirements; |

| • | changes in the competitive landscape for government contracting; |

| • | the adoption of new laws or regulations or changes to existing laws or regulations; |

| • | potential delays or changes in the government appropriations process; and |

| • | changes with respect to policies and spending for commercial-off-the-shelf, or COTS, solutions. |

Even though some of our U.S. government transactions may involve fixed minimum commitments, other commitments are subject to annual Congressional appropriations and, as a result, U.S. government agencies may not continue to fund these contracts at current or anticipated levels. For example, in fourth quarter 2009, we experienced general delays in U.S. government purchasing following the delay of the approval of the U.S. federal budget appropriations bills until December 2009. As of September 30, 2010, the U.S. Congress had not yet approved several key appropriations bills for the 2011 federal fiscal year. These delays may result in delays in U.S. government purchasing of our solutions and products. In addition, although we anticipate that the U.S. government agencies will continue to purchase from us in the future or after the expiration of any existing contracts, the vast majority of our business with the U.S. government is conducted on a purchase order basis and not under fixed minimum contracts. As such, we cannot assure you that those purchases will continue at historic levels or at all, or that there will not be gaps between the expiration of a prior agreement and entry into any new agreement. If U.S. government agencies terminate, significantly reduce in scope or suspend any of their business with us, or change their policies, priorities, or funding levels, our business, financial condition and results of operations would be materially and adversely affected.

Losses, delays or reductions in scope of our primary customer relationships will materially reduce our revenue and profitability.

We depend on a small number of key customer relationships for a significant portion of our revenues. Our top twenty customers represented over half of our total revenue for the year ended December 31, 2009. In addition, approximately 50%, 43% and 39% of our revenue in the years ended December 31, 2008 and 2009 and the nine months ended September 30, 2010 was derived from our direct or indirect sales to agencies, offices and departments of the U.S. federal government, of which the substantial majority was to the Department of Defense.

16

Table of Contents

An important part of our growth strategy is to increase sales of our products to existing and new large enterprises, service providers and government entities. Sales to enterprises, service providers and government entities involve risks that may not be present (or that are present to a lesser extent) with sales to small-to-mid-sized entities. These risks include:

| • | increased competition from larger competitors that traditionally target enterprises, service providers and government entities and that may already have purchase commitments from those end-customers; |

| • | increased purchasing power and leverage held by large end-customers in negotiating contractual arrangements with us; |

| • | more stringent requirements in our support service contracts, including increased penalties for any failure to meet support requirements; and |

| • | longer sales cycles and the associated risk that substantial time and resources may be spent on a potential end-customer who elects not to purchase our products and services. |

Large enterprises, service providers and government entities often undertake significant evaluation processes that result in lengthy sales cycles, in some cases over twelve months. Due to the lengthy nature, the size and scope, and stringent requirements of these evaluations, we may spend substantial time, effort and money in our sales efforts without being successful in producing any sales. If we are unsuccessful in converting these evaluations into sales, we may experience an increased inventory of used products and potential increased write-offs. In addition, product purchases by enterprises, service providers and government entities are frequently subject to budget constraints, multiple approvals, and unplanned administrative, processing and other delays. Finally, enterprise, service providers and government entities typically have longer implementation cycles; require greater product functionality and scalability and a broader range of services, including design services; demand that vendors take on a larger share of risks; sometimes require acceptance provisions that can lead to a delay in revenue recognition; and expect greater payment flexibility from vendors. All these factors can add further risk to business conducted with these customers. If sales expected from a large end-customer for a particular quarter are not realized in that quarter or at all, our business, operating results and financial condition could be materially and adversely affected.

We face intense competition in our market, both from larger, better-known companies and from more targeted competitors; we may lack sufficient financial or other resources to maintain or improve our competitive position.

The market for high-end data protection solutions is intensely competitive, and we expect competition to intensify in the future. Although we are not aware of a competitor that offers the same array of solutions that we provide, we compete with several companies in various areas of our business. Many competitors that specialize in providing protection from a narrow variety of security threats are often able to deliver specialized security products to the market more quickly than we can.

In addition, large, more established competitors in similar markets with our own competitive space, such as RSA (a division of EMC), Intel, McAfee and Symantec may attempt to further expand their presence in the high-end data protection solutions market and compete more directly against more of our solutions.

Many of these existing and potential competitors enjoy substantial competitive advantages such as:

| • | greater name recognition and longer operating histories; |

| • | larger sales and marketing budgets and resources; |

| • | broader distribution and established relationships with distribution partners and end-customers; |

| • | access to larger customer bases; |

| • | greater customer support resources; |

| • | greater resources to make acquisitions; |

17

Table of Contents

| • | lower labor and development costs or increased economies of scale; and |

| • | substantially greater financial, technical and other resources. |

Some of our competitors have substantially larger installed customer bases beyond the high-end data protection solutions market and leverage their relationships based on other products or incorporate functionality into existing products in a manner that may discourage users from purchasing our products. These larger competitors may also have more diversified businesses that allow them to better withstand significant reduction in capital spending by end-customers in a number of markets.

Conditions in our markets could change rapidly and significantly as a result of technological advancements or continuing market consolidation. Our current and potential competitors may also establish cooperative relationships among themselves or with third parties that may further enhance their resources and product offerings in the markets we address. In addition, current or potential competitors may be acquired by third parties with greater available resources. As a result of such acquisitions, our current or potential competitors might be able to adapt more quickly to new technologies and customer needs, devote greater resources to the promotion or sale of their products and services, initiate or withstand substantial price competition, and more readily develop and expand their product and service offerings. These competitive pressures in our market or our failure to compete effectively may adversely affect our operating results and market share.

If functionality similar to that offered by our products is incorporated into existing infrastructure products, organizations may decide against adding our solutions to their network, which would have an adverse effect on our business.

Providers of services and products outside the data protection market may bundle products and services competitive with ours with existing products and services. For example, large, well-established providers of network and storage equipment, such as Cisco Systems or Hewlett-Packard Company, offer and may continue to introduce, security features that compete with our products, either in stand-alone security products or as additional features in their network infrastructure products. The inclusion of, or the announcement of an intent to include, functionality perceived to be similar to that offered by our data protection and security solutions in existing products that are already generally accepted as necessary components of network architecture may have an adverse effect on our ability to market and sell our products. Furthermore, even if the functionality offered by infrastructure providers is more limited than our products, a significant number of customers may elect to accept such functionality in lieu of adding solutions from an additional vendor. Many organizations have invested substantial personnel and financial resources to design and operate their networks and have established deep relationships with providers of networking products, which may make them reluctant to add new components to their networks, particularly from other vendors such as us. In addition, an organization’s existing vendors or new vendors with a broad product offering may be able to offer sales concessions that we are not able to match due to our product offering or more limited resources. If organizations are reluctant to add additional data protection and security solutions from new vendors or otherwise decide to work with their existing vendors, our business, financial condition and results of operations will be adversely affected.

Defects or vulnerabilities in our products or the failure of our products to adequately prevent a security breach or protect software assets could harm our reputation and divert resources.

Because our products are complex, they have contained and may contain defects, errors or vulnerabilities that are not detected until after their release and deployment by our customers despite our efforts to test those products prior to release. Defects, errors or vulnerabilities may make our products susceptible to hacking or electronic break-ins or otherwise cause them to fail to help secure data. Because the techniques used by attackers to access or sabotage data change frequently and generally are not recognized until launched against a target, we may be unable to anticipate all of these techniques. Our products may also experience technical failures and downtime or fail to meet the increased requirements of a growing customer base. Any such technical failure, downtime, or failures in general may temporarily or permanently expose our end-customers’ data, leaving their data unprotected against the latest security threats.

18

Table of Contents

Our products must also successfully interoperate with products from other vendors. As a result, it may be difficult to identify the sources of problems that may arise through operation. The occurrence of hardware and software errors, whether or not caused by our products, could delay or reduce market acceptance of our products, and have an adverse effect on our business and financial performance, and any necessary revisions may cause us to incur significant expenses.

An actual or perceived security breach of the data of one of our end-customers or our own systems, regardless of whether the breach is attributable to the failure of our products to prevent the security breach, could adversely affect the market’s perception of our security products. We may not be able to correct defects, errors or vulnerabilities promptly, or at all. Any defects, errors or vulnerabilities in our products could result in:

| • | expenditure of significant financial and product development resources in efforts to analyze, correct, eliminate or work-around errors or defects or to address and eliminate vulnerabilities; |

| • | loss of existing or potential end-customers or channel partners; |

| • | loss and/or disclosure of confidential information or our proprietary technology; |

| • | delayed or lost revenue; |

| • | delay or failure to attain market acceptance; |

| • | lost market share; |

| • | negative publicity, which will harm our reputation; and |

| • | litigation, regulatory inquiries or investigations that may be costly and harm our reputation. |

Although we have limitation of liability provisions in our standard terms and conditions of sale, they may not fully or effectively protect us from claims as a result of federal, state or local laws or ordinances or unfavorable judicial decisions in the United States or other countries. In addition, some of our customer agreements may require us to indemnify our customers for any claims or losses resulting from defects, errors or vulnerabilities in our products. The sale and support of our products also entail the risk of product liability claims. We maintain insurance to protect against certain claims associated with the use of our products, but our insurance coverage may not adequately cover any claim asserted against us. In addition, even claims that ultimately are unsuccessful could result in our expenditure of funds in litigation and divert management’s time and other resources.

The data security market is rapidly evolving and the complex technology incorporated in our products makes them difficult to develop. If we do not accurately predict, prepare for and respond promptly to technological and market developments and changing end-customer needs and develop corresponding products, our competitive position and prospects will be harmed.

Our future success depends on our ability to respond to the rapidly changing needs of our customers by developing or introducing new products, product upgrades, and services in a timely manner. We have in the past incurred, and will continue to incur, significant research and development expenses as we strive to remain competitive. New product development and introduction involves a significant commitment of time and resources and is subject to a number of risks and challenges including:

| • | managing the length of the development cycle for new products and product enhancements; |

| • | adapting to emerging and evolving industry standards and to technological developments by our competitors and customers; |

| • | extending the operation of our products and services to new and evolving platforms, operating systems and hardware products, such as virtualization and cloud computing; |

| • | entering into new or unproven markets with which we have limited experience; |

| • | managing new product and service strategies; |

19

Table of Contents

| • | incorporating acquired products and technologies; |

| • | trade compliance issues affecting our ability to ship new or acquired products; |

| • | protecting our intellectual property and other proprietary rights; |

| • | developing or expanding efficient sales channels; and |

| • | obtaining sufficient licenses to technology and technical access from operating system software vendors on reasonable terms to enable the development and deployment of interoperable products, including source code licenses for certain products with deep technical integration into operating systems. |

In addition, the data security market has evolved and is expected to continue to evolve rapidly. Many of our end-customers operate in dynamic and rapidly changing markets that require them to continuously evolve their IT infrastructure, including add numerous network access points and adapt increasingly complex enterprise networks, incorporating a variety of hardware, software applications, operating systems and networking protocols. In addition to the rapidly changing network environments, computer hackers and others who try to attack networks are employing increasingly sophisticated techniques to gain access to and attack systems and networks. In order to remain competitive, we need to accurately anticipate changes in IT infrastructure that our end-customers will deploy, the security vulnerabilities of such infrastructure as well as likely attack techniques, and to continue to develop and introduce solutions that successfully address the evolving threats while minimizing the impact on IT infrastructure performance.

Although the market expects rapid development and commercial introduction of new products or product enhancements to respond to changing infrastructure and evolving threats, the development of these products is difficult and the timeline for their release and availability can be uncertain. Additionally, some of our new products and enhancements may require us to develop new hardware architectures and application-specific integrated circuits, or ASICs, that involve complex, expensive and time consuming research and development processes. We have in the past and may in the future experience unanticipated delays in the availability of new products and services and fail to meet previously announced timetables for such availability. If we do not quickly respond to the rapidly changing and rigorous needs of our end-customers by timely developing and releasing new products and services or enhancements that can respond adequately to new security threats, our competitive position and business prospects will be harmed.

In addition, for certain customers and environments we must obtain certifications for our products such as U.S. Federal Information Processing Standard, or FIPS, or Common Criteria. While we have successfully obtained the requisite certifications for our products in the past, there can be no assurance that we will be able to obtain such certifications on a timely basis or at all for new products. The failure to obtain certifications would preclude us from selling our products to certain customers or for certain applications which could harm our competitive position and our business.

Failure to comply with laws or regulations applicable to our business could cause us to lose U.S. government customers or our ability to contract with the U.S. government