| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

| ______________________ |

| FORM 8-K |

| CURRENT REPORT |

| Pursuant to Section 13 or 15(d) of the |

| Securities Exchange Act of 1934 |

| Date of Report: November 1, 2010 |

| (Date of earliest event reported) |

| PRINCIPAL FINANCIAL GROUP, INC. |

| (Exact name of registrant as specified in its charter) |

| Delaware | 1-16725 | 42-1520346 |

| (State or other jurisdiction | (Commission file number) | (I.R.S. Employer |

| of incorporation) | Identification Number) |

| 711 High Street, Des Moines, Iowa 50392 | |

| (Address of principal executive offices) | |

| (515) 247-5111 | |

| (Registrant’s telephone number, including area code) | |

| Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the | |

| registrant under any of the following provisions: | |

| [ ] | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| [ ] | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| [ ] | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR |

| 240.14d-2(b)) | |

| [ ] | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR |

|

240.13e-4(c)) __________________ | |

| Page 2 | ||

| Item 2.02. Results of Operations and Financial Condition | ||

| On November 1, 2010, Principal Financial Group, Inc. publicly announced information regarding its | ||

| results of operations and financial condition for the quarter ended September 30, 2010. The text of the | ||

| announcement is included herewith as Exhibit 99. | ||

| Item 9.01 Financial Statements and Exhibits | ||

| 99 | Third Quarter 2010 Earnings Release | |

| SIGNATURE | ||

| Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly | ||

| caused this report to be signed on its behalf by the undersigned thereunto duly authorized. | ||

| PRINCIPAL FINANCIAL GROUP, INC. | ||

| By: /s/ Terrance J. Lillis ___________________ | ||

| Name: Terrance J. Lillis | ||

| Title: Senior Vice President and Chief Financial Officer | ||

| Date: November 2, 2010 | ||

| Page 3 | |

| EXHIBIT 99 | |

| Release: | On receipt, November 1, 2010 |

| Media contact: | Susan Houser, 515-248-2268, mail to: houser.susan@principal.com |

| Investor contact: | John Egan, 515-235-9500, mail to: egan.john@principal.com |

| Principal Financial Group, Inc. Announces Third Quarter 2010 Results | |

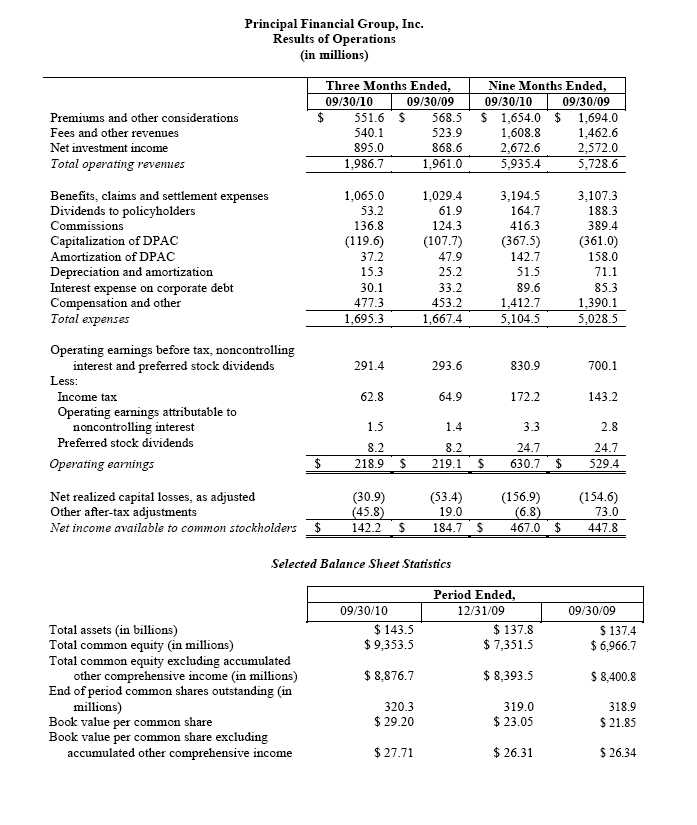

- Third quarter 2010 operating earnings1 of $218.9 million, net income available to common stockholders of $142.2 million

- Assets under management of $305.7 billion increased 9 percent compared to third quarter 2009

- Book value per share, excluding AOCI2 increased to a record high of $27.71, up 5 percent over third quarter 2009 and 1 percent sequentially

- Operating revenues increased 1 percent to $1,986.7 million, compared to third quarter 2009

| (Des Moines, Iowa) – Principal Financial Group, Inc. (NYSE: PFG) today announced results for third quarter |

| 2010. The company reported operating earnings of $218.9 million for third quarter 2010, compared to $219.1 |

| million for third quarter 2009. Operating earnings per diluted share (EPS) were $0.68 for the third quarter 2010 and |

| 2009. The company reported net income available to common stockholders of $142.2 million, or $0.44 per diluted |

| share for the three months ended Sept. 30, 2010, compared to $184.7 million, or $0.57 per diluted share for the |

| three months ended Sept. 30, 2009. Operating revenues for third quarter 2010 were $1,986.7 million compared to |

| $1,961.0 million for the same period last year. |

| “The Principal® continued to deliver strong financial results during the third quarter. Compared to 2009, |

| on a year-to-date basis, operating earnings are up 19 percent while average assets under management are up 12 |

| percent. This reflects strong execution in an economic environment that is improving slowly. Importantly, we’re |

| seeing increasing signs of growth across our businesses. Highlights for the quarter include strong net cash flow |

| in Principal Funds, Principal Global Investors and Principal International,” said Larry D. Zimpleman, chairman, |

| president and chief executive officer of Principal Financial Group, Inc. “Our hybrid business model of asset |

| management and risk-based products, combined with our leadership position in the U.S. and strong presence in |

| select international markets, uniquely positions The Principal to help a growing middle income customer base |

| achieve financial security and success.” |

| “Despite the choppy economic recovery, our results in the third quarter demonstrate that our businesses |

| continue to grow and we are excited about our prospects going forward,” said Terry Lillis, senior vice president and |

| chief financial officer. “During the third quarter and now early into our second month of the fourth quarter, we are |

| seeing positive sales momentum and are confident we will finish 2010 with Full Service Accumulation sales 15-20 |

| percent higher than 2009 year-end sales, resulting in positive cash flows. Overall, our diversified businesses and |

| geography mix, strong balance sheet and continued expense management have and will continue to serve us well.” |

| ________________________ |

| 1 Use of non-GAAP financial measures is discussed in this release after Segment Highlights |

| 2 Accumulated Other Comprehensive Income |

| Page 4 |

| Key Highlights |

- Principal International had record assets under management as of Sept. 30, 2010 of $42.3 billion and $1.0 billion in net positive cash flow in the third quarter.

- Solid sales of the company’s three key U.S. retirement and investment products in the third quarter, with $864 million for Full Service Accumulation, $2.5 billion for Principal Funds and $364 million for Individual Annuities.

- Record net cash flow in Principal Funds of $790 million in the third quarter.

- Principal Global Investors had unaffiliated net cash flow of $800 million in third quarter.

- Continued strong operating leverage, reflected in a 19 percent growth in operating earnings through nine months compared to 12 percent growth in average assets under management.

- Strong capital and liquidity, with an estimated risk based capital ratio of 450 percent at quarter-end and $2.2 billion of excess capital.3

| Net Income |

| Net income available to common stockholders of $142.2 million for third quarter 2010 reflects net realized |

| capital losses of $30.9 million, which include: |

- $29.1 million of losses related to credit gains and losses on sales and permanent impairments of fixed maturity securities, including $19.9 million of losses on commercial mortgage backed securities;

- $7.2 million of losses on commercial mortgage whole loans;

- $5.6 million of losses on residential mortgage loans; and

- $7.7 million of gains from the appreciation of fixed maturities designated as trading.

| Net income also reflects $48.5 million of one-time after-tax losses from planned severance and goodwill write- |

| off as a result of our exit from the medical insurance business. |

| Segment Highlights |

| U.S. Asset Accumulation |

| Segment operating earnings for third quarter 2010 were $147.4 million, compared to $154.6 million for |

| the same period in 2009, as higher earnings from the Full Service Accumulation business were more than offset by |

| lower earnings from the Investment Only and Individual Annuities Businesses. Full Service Accumulation |

| earnings increased 14 percent from a year ago to $80.3 million, reflecting a 9 percent increase in average account |

| values. Principal Funds earnings increased 20 percent from a year ago to $8.5 million, primarily due to a 12 percent |

| increase in average account values. Individual Annuities earnings were $31.9 million compared to $36.1 million |

| for third quarter 2009, mostly due to relatively less favorable DPAC4 amortization equity market true-ups in the |

| current quarter. Investment Only earnings were $13.9 million for third quarter 2010, compared to $26.0 million for |

| the same period a year ago. The decline is primarily due to a 19 percent drop in average account values, reflecting |

| the company’s scale back of its Investment Only business. In the third quarter 2009, earnings benefitted by $10.8 |

| million from the opportunistic early redemption of medium-term notes and an increase in the market value of a |

| receivable. |

| _________________________ |

| 3 Excess capital includes cash at the holding company and capital at the life company above that needed to maintain a 350 |

| percent NAIC risk based capital ratio for the life company. |

| 4 Deferred Policy Acquisition Costs |

| Page 5 |

| Operating revenues for the third quarter 2010 were $997.0 million compared to $1,025.6 million for |

| the same period in 2009. Higher revenues for the accumulation businesses5 , which improved $14.9 million, or 2 |

| percent increase from a year ago, were more than offset by a $43.1 million decline in revenues for the Investment |

| Only business. |

| Segment assets under management were $168.8 billion as of Sept. 30, 2010, compared to $158.8 |

| billion as of Sept. 30, 2009. |

| Principal Global Investors |

| Segment operating earnings for third quarter 2010 were $15.0 million, compared to $10.5 million in the |

| prior year quarter, primarily due to increased transaction fees and an increase in assets under management. |

| Operating revenues for third quarter were $118.0 million, compared to $111.3 million for the same |

| period in 2009, mostly due to higher management fees and a significant increase in transaction fees. |

| Unaffiliated assets under management were $76.2 billion as of Sept. 30, 2010, compared to $73.2 billion |

| as of Sept. 30, 2009. |

| Principal International |

| Segment operating earnings were $33.1 million in third quarter 2010 and 2009, as the increase in fees |

| on higher assets under management and improved macroeconomic conditions offset lower earnings resulting from |

| our reduced economic interest in the Brazilian joint venture. |

| Operating revenues were $200.1 million for third quarter, compared to $156.1 million for the same period |

| last year, primarily due to higher net investment income from inflation-linked investments in Latin America, the |

| impact of foreign currency movements, and an increase in fees on higher assets under management. |

| Segment assets under management were a record $42.3 billion as of Sept. 30, 2010, compared to |

| $31.4 billion as of Sept. 30, 2009. This includes a record $3.8 billion of net cash flows over the trailing twelve |

| months, or 12 percent of beginning of period assets under management. |

| 5 Full Service Accumulation, Principal Funds, Individual Annuities and Bank and Trust Services |

| Page 6 |

| U.S. Insurance Solutions6 |

| Segment operating earnings for third quarter 2010 were $47.3 million, compared to $56.2 million for |

| the same period in 2009. Individual Life earnings of $22.6 million were down compared to $29.8 million in |

| third quarter 2009, primarily due to updates to the DPAC model and assumptions. Specialty Benefits earnings |

| were $24.7 million in third quarter 2010, compared to $26.4 million in the same period a year ago, which is in |

| line with membership declines from a year ago. |

| Operating revenues for third quarter were $690.7 million, compared to $701.4 million for the same |

| period a year ago. |

| Corporate |

| Operating losses for third quarter 2010 were $23.9 million compared to operating losses of $35.3 million |

| in third quarter 2009. Results reflect higher investment returns on excess capital, which were partially offset by the |

| allocation of overhead expenses to Corporate from the medical insurance exit. |

| 6 Prior to third quarter 2010, amounts now reported in the U.S. Insurance Solutions segment and amounts for our group |

| medical business now reported in the Corporate segment were reported together in the Life and Health Insurance |

| segment. This change was made due to our decision to exit the group medical insurance business (insured and |

| administrative services only). Our segment results for 2009 have been restated to conform to the current segment |

| presentation. |

| Page 7 |

| Forward looking and cautionary statements |

| This press release contains forward-looking statements, including, without limitation, statements as to operating |

| earnings, net income available to common stockholders, net cash flows, realized and unrealized losses, capital |

| and liquidity positions, sales and earnings trends, and management's beliefs, expectations, goals and opinions. |

| The company does not undertake to update or revise these statements, which are based on a number of |

| assumptions concerning future conditions that may ultimately prove to be inaccurate. Future events and their |

| effects on the company may not be those anticipated, and actual results may differ materially from the results |

| anticipated in these forward-looking statements. The risks, uncertainties and factors that could cause or |

| contribute to such material differences are discussed in the company's annual report on Form 10-K for the year |

| ended December 31, 2009, and in the company’s quarterly report on Form 10-Q for the quarter ended June 30, |

| 2010, filed by the company with the Securities and Exchange Commission, as updated or supplemented from |

| time to time in subsequent filings. These risks and uncertainties include, without limitation: adverse capital and |

| credit market conditions that may significantly affect the company’s ability to meet liquidity needs, access to |

| capital and cost of capital; a continuation of difficult conditions in the global capital markets and the general |

| economy that may materially adversely affect the company’s business and results of operations; the actions of |

| the U.S. government, Federal Reserve and other governmental and regulatory bodies for purposes of stabilizing |

| the financial markets might not achieve the intended effect; the risk from acquiring new businesses, which could |

| result in the impairment of goodwill and/or intangible assets recognized at the time of acquisition; impairment of |

| other financial institutions that could adversely affect the company; investment risks which may diminish the |

| value of the company’s invested assets and the investment returns credited to customers, which could reduce |

| sales, revenues, assets under management and net income; requirements to post collateral or make payments |

| related to declines in market value of specified assets may adversely affect company liquidity and expose the |

| company to counterparty credit risk; changes in laws, regulations or accounting standards that may reduce |

| company profitability; fluctuations in foreign currency exchange rates that could reduce company profitability; |

| Principal Financial Group, Inc.’s primary reliance, as a holding company, on dividends from its subsidiaries to |

| meet debt payment obligations and regulatory restrictions on the ability of subsidiaries to pay such dividends; |

| competitive factors; volatility of financial markets; decrease in ratings; interest rate changes; inability to attract |

| and retain sales representatives; international business risks; a pandemic, terrorist attack or other catastrophic |

| event; and default of the company’s re-insurers. |

| Use of Non-GAAP Financial Measures |

| The company uses a number of non-GAAP financial measures that management believes are useful to investors |

| because they illustrate the performance of normal, ongoing operations, which is important in understanding and |

| evaluating the company’s financial condition and results of operations. They are not, however, a substitute for U.S. |

| GAAP financial measures. Therefore, the company has provided reconciliations of the non-GAAP measures to the |

| most directly comparable U.S. GAAP measure at the end of the release. The company adjusts U.S. GAAP |

| measures for items not directly related to ongoing operations. However, it is possible these adjusting items have |

| occurred in the past and could recur in the future reporting periods. Management also uses non-GAAP measures |

| for goal setting, as a basis for determining employee and senior management awards and compensation, and |

| evaluating performance on a basis comparable to that used by investors and securities analysts. |

| Earnings Conference Call |

| On Tuesday, Nov. 2, 2010 at 10:00 a.m. (ET), Chairman, President and Chief Executive Officer Larry |

| Zimpleman and Senior Vice President and Chief Financial Officer Terry Lillis will lead a discussion of results, |

| asset quality and capital adequacy during a live conference call, which can be accessed as follows: |

- Via live Internet webcast. Please go to www.principal.com/investor at least 10-15 minutes prior to the start of the call to register, and to download and install any necessary audio software.

- Via telephone by dialing 800-374-1609 (U.S. and Canadian callers) or 706-643-7701 (International callers) approximately 10 minutes prior to the start of the call. The access code is 16027050.

| Page 8 |

| Replay of the earnings call via telephone is available by dialing 800-642-1687 (U.S. and Canadian callers) or | ||

| 706-645-9291 (International callers). The access code is 16027050. This replay will be available | ||

| approximately two hours after the completion of the live earnings call through the end of day Nov. 9, 2010. | ||

| Replay of the earnings call via webcast as well as a transcript of the call is available after the call at: | ||

| www.principal.com/investor. | ||

| The company's financial supplement and additional investment portfolio detail for third quarter 2010 is |

| currently available at www.principal.com/investor, and may be referred to during the call. |

| 2010 Investor Day and 2011 EPS guidance |

| The Principal will hold its Investor Day on Dec. 9, 2010 in New York. Details can be found at |

| www.principal.com/investor. In addition, The Principal plans to announce guidance prior to Investor Day |

| through a press release and a conference call. |

| About the Principal Financial Group |

| The Principal Financial GroupÒ (The Principal ® )7 is a leader in offering businesses, individuals and institutional |

| clients a wide range of financial products and services, including retirement and investment services, life and |

| health insurance, and banking through its diverse family of financial services companies. A member of the |

| Fortune 500, the Principal Financial Group has $305.7 billion in assets under management8 and serves some 18.9 |

| million customers worldwide from offices in Asia, Australia, Europe, Latin America and the United States. |

| Principal Financial Group, Inc. is traded on the New York Stock Exchange under the ticker symbol PFG. For |

| more information, visit www.principal.com. |

| ### |

| 7 “The Principal Financial Group” and “The Principal” are registered service marks of Principal Financial Services, |

| Inc., a member of the Principal Financial Group. |

| 8 As of Sept 30, 2010 |

| Page 9 |

| *Operating earnings versus U.S. GAAP (GAAP) net income available to common stockholders |

| Management uses operating earnings, which excludes the effect of net realized capital gains and losses, as adjusted, and other after-tax |

| adjustments, for goal setting, as a basis for determining employee compensation, and evaluating performance on a basis comparable to |

| that used by investors and securities analysts. Segment operating earnings are determined by adjusting U.S. GAAP net income available |

| to common stockholders for net realized capital gains and losses, as adjusted, and other after-tax adjustments the company believes are |

| not indicative of overall operating trends. Note: it is possible these adjusting items have occurred in the past and could recur in future |

| reporting periods. While these items may be significant components in understanding and assessing our consolidated financial |

| performance, management believes the presentation of segment operating earnings enhances the understanding of results of operations |

| by highlighting earnings attributable to the normal, ongoing operations of the company’s businesses. |

| Page 10 |

| Page 11 |