Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - OMNICARE INC | form8k-oppenheimer.htm |

Exhibit 99.1

Forward-Looking Statements

Except for historical information discussed, the statements made today

are forward-looking statements that involve risks and uncertainties.

Investors are cautioned that such statements are only predictions and that

actual events or results may differ materially.

are forward-looking statements that involve risks and uncertainties.

Investors are cautioned that such statements are only predictions and that

actual events or results may differ materially.

These forward-looking statements speak only as of this date. We

undertake no obligation to publicly release the results of any revisions to

the forward-looking statements made today, to reflect events or

circumstances after today or to reflect the occurrence of unanticipated

events.

undertake no obligation to publicly release the results of any revisions to

the forward-looking statements made today, to reflect events or

circumstances after today or to reflect the occurrence of unanticipated

events.

To facilitate comparisons and enhance understanding of core operating

performance, certain financial measures have been adjusted from the

comparable amount under Generally Accepted Accounting Principles

(GAAP). A detailed reconciliation of adjusted numbers to GAAP is posted

the Investor Relations section of our Web site at http://ir.omnicare.com.

performance, certain financial measures have been adjusted from the

comparable amount under Generally Accepted Accounting Principles

(GAAP). A detailed reconciliation of adjusted numbers to GAAP is posted

the Investor Relations section of our Web site at http://ir.omnicare.com.

2

3

Omnicare Today…

A Senior Care Pharmacy Services Company

A Senior Care Pharmacy Services Company

• Industry leader

– 47 states, District of Columbia and Canada

– 120 million prescriptions dispensed per year

• Nation’s largest provider of hospice

pharmacy

pharmacy

• Global contract research organization

Omnicare Growth Drivers

• Demographic trends

• Pharmaceutical market trends

• Strategic objectives

4

Demographic Trends

Aging Population Shaping Healthcare

Aging Population Shaping Healthcare

• Life expectancy continues to lengthen

• Significant population mix shift towards seniors

Source: U.S. Census Bureau

5

Pharmaceutical Market

Trends

Trends

• Branded drugs

• Major market shift to generic drugs

• Development and use of biologics

increasing

increasing

6

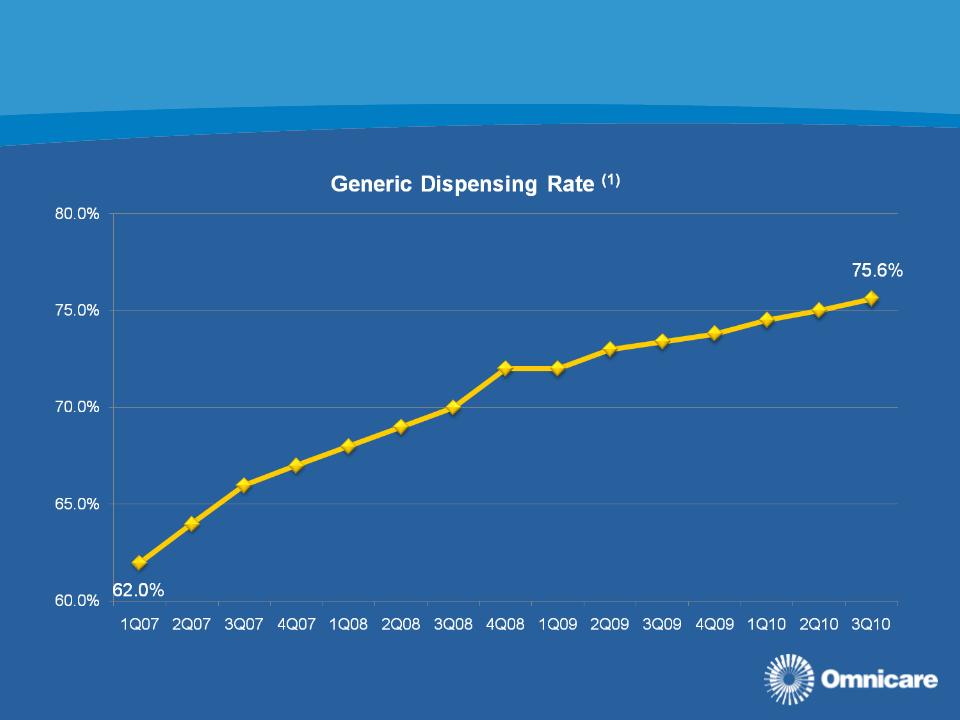

Brand to Generic Drugs

Increasing Utilization of Generics

Increasing Utilization of Generics

(1) Generic prescriptions dispensed as a percent of total scripts

7

Major Shift to Generic Drugs

Benefits

Benefits

• Buy-side margin

• Favorable impact on working capital

• Top 100 generic drug analysis

8

Generic Drugs

Long-Term Trends

Long-Term Trends

• Top 100 generics based on revenue

• 94% of these older generics providing

positive contribution relative to brand

positive contribution relative to brand

9

(1) All generic launches are subject to change due to litigation or pediatric exclusivity.

(2) Drugs already launched shown in gray and italics

|

2010

|

2011

|

2012

|

2013

|

|

Arimidex

|

Fazaclo

|

Actos

|

Aciphex

|

|

Cozaar

|

Femara

|

Diovan

|

Asacol

|

|

Effexor ER

|

Gabitril

|

Exelon Patch

|

Avodart

|

|

Exelon Caps

|

Levaquin

|

Geodon

|

Cymbalta

|

|

Flomax

|

Lipitor

|

Invega

|

Humalog

|

|

Lovenox

|

Plavix

|

Lexapro

|

Lupron Depot

|

|

Merrem Inj.

|

Tricor

|

Lidoderm

|

Niaspan SR

|

|

Mirapex

|

Uroxatrol

|

Seroquel

|

Oxycontin

|

|

Prevacid Soltabs

|

Xalatan

|

Singulair

|

Renagel

|

|

Aricept

|

Zyprexa

|

Xopenex

|

Travatan

|

2010-2013 Potential Patent Expirations(1)(2)

Geriatric Market

Geriatric Market

10

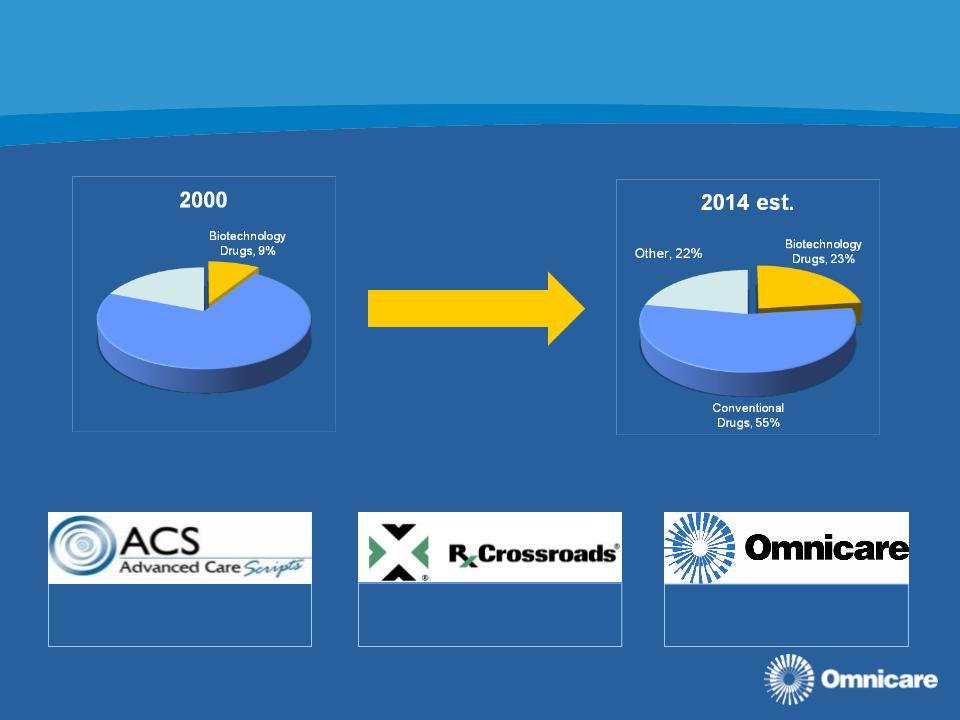

Specialty Pharmaceuticals

A Growth Industry

A Growth Industry

(1) Source: EvaluatePharma

Pharmaceutical Market Share(1) by Drug Type

11

• Mail order

• Oncology and multiple sclerosis

• Outsourced services for

biotechnology firms

biotechnology firms

• Omnicare’s institutional

pharmacies

pharmacies

Conventional

Drugs, 72%

Drugs, 72%

Other, 19%

Omnicare’s Positioning Within Specialty Pharmaceuticals…

Strategic Objectives

• Productivity improvements

– Cost-reduction initiatives

• Customer growth

– Skilled nursing facilities (SNFs)

– Assisted living facilities (ALFs)

– Other institutional settings

• Specialty pharmacy

12

Productivity Improvements

Transitioning to an Operations-Driven Company

Transitioning to an Operations-Driven Company

• Cultural transformation

– Instill collaborative environment,

encourage employee innovation

encourage employee innovation

– Revamp budgeting process

– Reinforce a commitment to compliance

• Reallocation of resources

– Align employee interests

– Reshape the organization, bringing it

closer to the customer

closer to the customer

– Improve accountability with regional

realignment

realignment

13

Productivity Improvements

Cost-Reduction Initiatives

Cost-Reduction Initiatives

• Drug purchasing

– Leveraging brand and generic drug

purchasing power

purchasing power

• Strategic sourcing

– Capitalizing on scale with non-drug

purchases

purchases

• Operating initiatives

– Hub-and-spoke network, new

technologies, best practices

technologies, best practices

14

(1) P&L savings realized for trailing four quarters through the third quarter of 2010.

15

Customer Growth

Initiatives Focused on Organic Growth

Initiatives Focused on Organic Growth

• Enhance the customer experience

– Align customer retention with incentive programs

– Proactive vs. reactive approach to customer service

– Reposition leading technology offering

• Improve selling effectiveness

– Re-engage sales consulting group

– Improve coordination of selling process

– Revamped incentive programs

– Redeploy marketing resources

Customer Growth

Broadening Markets

Broadening Markets

• Assisted living market

• CCRCs, independent living

• Mental health market, rural hospitals,

prisons

prisons

16

Customer Growth

Focus on Assisted Living Opportunity

Focus on Assisted Living Opportunity

17

Assisted Living:

Three-Pronged Growth Opportunity

Specialty Pharmacy

Growth Outside Institutional Setting

Growth Outside Institutional Setting

18

• Omnicare specialty pharmacy growth rates have outpaced

robust industry growth rates…but opportunities exist to

further accelerate growth through:

robust industry growth rates…but opportunities exist to

further accelerate growth through:

– Addition of new leadership

– Tighter coordination of efforts

– Penetrate additional disease states (for ACS)

– Primary disease states currently multiple sclerosis and oncology

– Potential additional acquisitions to fill-out portfolio

Two-year CAGR(1) for Omnicare’s specialty pharmacy businesses = 43.8%

(1) Quarterly revenues based on third quarter 2010 results (as compared with third quarter 2008 results)

Third Quarter 2010 Highlights

• Scripts dispensed increased 1.3% sequentially

– One additional calendar day in 3Q 2010 as compared with 2Q 2010

– Number of beds served up sequentially

– Utilization stable

– Census was lower, although rate of decline improved from 2Q 2010

• Qtr. ending number of beds served(1) up 32,000 sequentially

– Increases in additions; bed adds benefitted from CCRx acquisition

– 25% sequential reduction in losses

• Net sales, gross profit higher sequentially

• Adjusted EBITDA(2),(3) slightly lower at $140.7 million

• Adjusted EPS(2),(3) up 8.3% sequentially to $0.52

• $37.4 million returned to shareholders through dividends and share

repurchases

repurchases

19

(1) Includes patients served under patient assistance programs

(2) Excludes discontinued operations

(3) Excludes special items. A reconciliation of this non-GAAP information has been attached to our press release and

is also available on our Web site under ‘Supplemental Financial Information’ from the ‘Investors’ page.

Capital Returned to Shareholders

20

(1) Cumulative % Returned = (YTD Dividends Paid + YTD Share Repurchases) / 12/31/09 Market Capitalization of $2,908.4 million.

Omnicare’s Fundamental Value Drivers

• Favorable industry dynamics

• Industry leading position

• Scale business

• Solid financial position

• Substantial cash flow generator

• Enhancing efficiency of operations

• Opportunities to leverage core business

21