Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - NAVISTAR INTERNATIONAL CORP | d8k.htm |

NYSE:

NAV Exhibit 99.1

34

Annual

Gabelli

&

Co.

Automotive Aftermarket Symposium

November 1, 2010

th |

2

NYSE: NAV

Safe Harbor

Statement

Information provided and statements contained in this presentation that are not

purely historical are forward-looking statements within the meaning of

Section 27A of the Securities Act of 1933, as

amended, Section

21E of the Securities Exchange Act of 1934, as amended, and the Private Securities

Litigation Reform Act of 1995. Such forward-looking statements only

speak as of the date of this presentation and the Company assumes no

obligation to update the information included in this

presentation. Such forward-looking statements include information concerning

our possible or assumed future results of operations, including descriptions

of our business strategy. These statements often include words such as

“believe,” “expect,”

“anticipate,”

“intend,”

“plan,”

“estimate,”

or similar

expressions. These statements are not guarantees of performance or results and they

involve risks, uncertainties, and assumptions. For a further description of

these factors, see Item 1A, Risk Factors,

included within our Form 10-K for the year ended October

31, 2009, which was filed on

December 21, 2009. Although we believe that these forward-looking

statements are based on reasonable assumptions, there are many factors that

could affect our actual financial results or results

of operations and could cause actual results to differ materially from those in the

forward-looking statements. All future written and oral

forward-looking statements by us or persons acting on our behalf are

expressly qualified in their entirety by the cautionary statements contained or referred to above.

Except for our ongoing obligations to disclose material information as required by

the federal securities laws, we do not have any obligations or intention to

release publicly any revisions to any forward- looking statements to

reflect events or circumstances in the future or to reflect the occurrence of

unanticipated events. |

3

NYSE: NAV

Other Cautionary Notes

•

The financial information herein contains audited and unaudited

information and has been prepared by management in good faith

and based on data currently available to the Company.

•

Certain Non-GAAP measures are used in this presentation to assist

the reader in understanding our core manufacturing business.

We

believe this information is useful and relevant to assess and

measure the performance of our core manufacturing business as it

illustrates manufacturing performance without regard to selected

historical legacy costs (i.e. pension and other postretirement costs).

It also excludes financial services and other expenses that may not

be related to the core manufacturing business. Management often

uses this information to assess and measure the performance of our

operating segments.

A reconciliation to the most appropriate GAAP

number is included in the appendix of this presentation.

|

4

NYSE: NAV

Company Overview

Truck Group

North American market share leader

with regional and long-haul class 8

trucks, recreational vehicles, class 6-7

trucks, buses, military vehicles and

severe service trucks

Products, parts and services sold

through an extensive dealer network in

North America, Brazil and more than

90 other countries globally

Engine Group

Engine manufacturer of mid-range and

heavy-duty diesel engines

Products sold directly to major global OEMs

Manufacturing locations in U.S. and Brazil

Industries and applications include:

agriculture, industrial, buses, commercial on-

highway trucks, consumer vehicles, military,

marine vessels and commercial off-highway

vehicles

Parts Group

Distribution business that provides high-margin and

non-cyclical earnings

Strong growth in revenue and earnings

Most extensive distribution channel in truck and mid-

range diesel

Navistar Financial

Provide wholesale, retail and account financing

Manage / facilitate alliance finance partners providing

wholesale, retail and account financing

Consolidated 2009 Revenues

Truck

Engine

Parts

Financial Services

Founded over 100 years ago, Navistar’s 2009 revenues were $11.6 billion, $8.8 billion July 2010 YTD

|

5

NYSE: NAV

•

Postretirement

•

Capital structure

•

Labor legacy

Navistar Strategy to Create

Shareholder Value

Navistar Environment

Navistar Environment

Current 2010

Forecast

Industry

FY99

FY00

FY01

FY02

FY03

FY04

FY 05

FY06

FY 07

FY08

FY09

FY 10

School Bus

33,800

33,900

27,900

27,400

29,200

26,200

26,800

28,200

24,500

24,400

22,600

20,000

Class 6-7 - Medium

126,000

129,600

96,000

72,700

74,900

99,200

104,600

110,400

88,500

59,600

39,800

46,000

Combined Class 8 (Heavy & Severe Service)

286,000

258,300

163,700

163,300

159,300

219,300

282,900

316,100

206,000

160,100

119,400

126,500

Total Industry Demand

445,800

421,800

287,600

263,400

263,400

344,700

414,300

454,700

319,000

244,100

181,800

192,500

Actual

United States and Canadian Class 6-8 Truck Industry - Retail Sales Volume

Historical Information

Industry Environment

Industry Environment

100,000

200,000

300,000

400,000

500,000

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

Fcst

U.S. and Canada Class 6-8 Retail

Industry |

6

NYSE: NAV

Strategy

Notes:

* 2008 excludes Impairment

** 2009 excludes Ford and 1-time items

*** Assumes attainment of mature global growth by end of calendar year

2013 $(10.00)

$(5.00)

$-

$5.00

$10.00

$15.00

$20.00

150

200

250

300

350

400

450

500

Traditional Industry Volume (Thousands of Units)

2010

Guidance

Midpoint

Original $1.6B Segment

Profit Goal

@ 415kunits

$1.8B Segment Profit

Goal

@ 350kunits***

2008

Actual*

2009

Actual**

Note: This is not meant for updated guidance, it is for illustrative purposes only. This

slide contains non-GAAP information, please see the Reg G in appendix for detailed reconciliation. |

Strategic Framework Remains Intact

DIFFERENTIATION &

LEADERSHIP

7

NYSE: NAV |

8

NYSE: NAV

Medium

Truck

Great Products –

Market Share

52% Market Share

3Q10

Severe

Service

Truck

Heavy

Truck

FY07

60%

FY08

55%

FY09

61%

Sep YTD10

58%

FY07

36%

FY08

36%

FY09

35%

Sep YTD10

37%

FY07

25%

FY08

27%

FY09

34%

Sep YTD10

34%

FY07

15%

FY08

19%

FY09

25%

Sep YTD10

25%

Class 8

School

Bus

(U.S. & Canada)

Note: Market share based on brand and Severe Service Truck market share excludes military and

stripped chassis 36% Market Share

3Q10

35% Market Share

3Q10

30% Market Share

3Q10

31% Market Share

3Q10

School Bus & Combined Class 6-8 Market Share –

Sep YTD08: 27%; Sep YTD09: 35% Sep YTD10: 33% |

9

NYSE: NAV

Game Changers

Fully

vertically

integrated

“Motorhome

of

the

Future”

4.5% Fuel Economy Improvement

Disruptive

Thinking

–

Reshaping

the

Standards

Fuel

Fuel

economy

economy

improvement

improvement

vs.

vs.

2009

2009

ProStar

ProStar

Most aerodynamic, ergonomic and fuel efficient

Most aerodynamic, ergonomic and fuel efficient

®

® |

NYSE:

NAV 10

MaxxForce

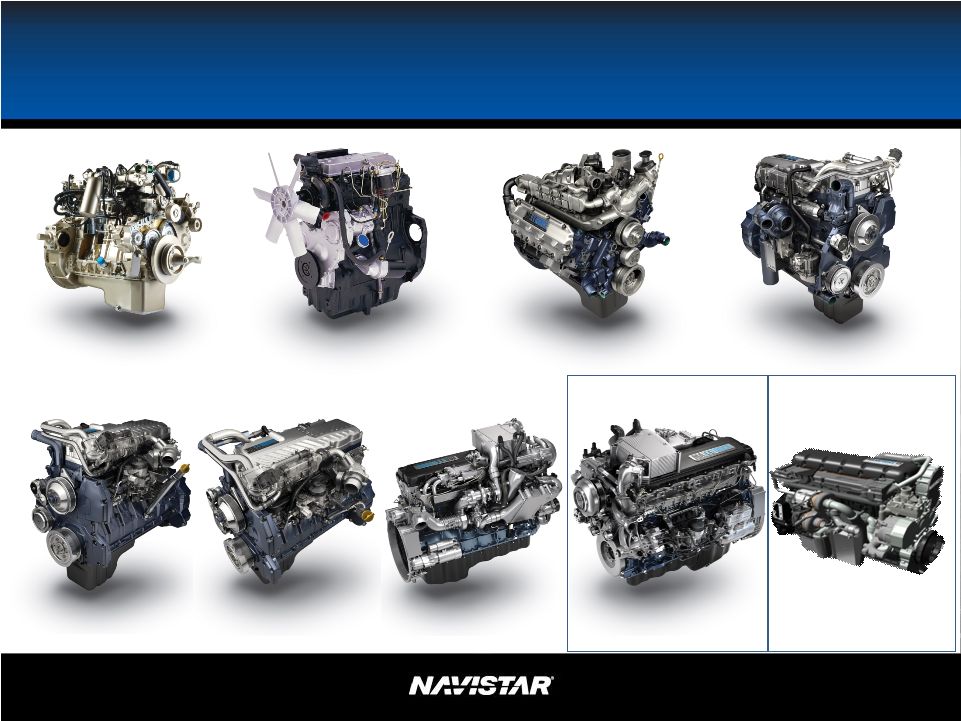

MaxxForce

DT

DT

MaxxForce

MaxxForce

9

9

MaxxForce

MaxxForce

10

10

MaxxForce

MaxxForce

11

11

MaxxForce

MaxxForce

13

13

Engine Differentiation -

Integration

MaxxForce

MaxxForce

15

15

Acteon

Acteon

3.0L

3.0L

Sprint 4.1L

Sprint 4.1L

MaxxForce

MaxxForce

7

7

Regional Haul 2008

Line Haul 2010

4

Quarter

2010

th |

11

NYSE: NAV

2010 U.S. and Canada Heavy Strategy

2010 and 2011 Strategy

•Convert

•Convert

customers to the 13L

•Drive customer –

pre/post buy |

Product Leadership

•

Approximately 28,000

2010 orders

•

Shipments on track

12

NYSE: NAV |

Navistar Differentiation –

LEADING

Ease for Customer

•

Easy for operators

•

Easy to understand

•

Easy to maintain

•

Dealer and customer friendly

Navistar’s enhanced EGR 2010 solution

The competitor’s 2010 urea-based solution

Nothing new

–

just turn the

key

Class 4/5

13

NYSE: NAV |

14

NYSE: NAV

Conventional

Conventional with improved aero devices

On-off fans

Visco-electric fans

Smaller, higher performance engines

Fixed fans

Turbo-charging

Evolutionary Path of Operational

Efficiency

1980’s

2010

2014

2017

Today

9670

ProStar

ProStar

with

Enhancements

SuperTruck

Biased ply with

tubes Tubeless

radials Gear fast/run slow, cruise control, automated manuals, etc.

Engines

Controls

Aerodynamics

Cooling

1990’s

9900i

Tires

Electronic Controls

Charged-air-Cooling

Viscous fans

Cab-Over-Engine |

15

NYSE: NAV

Military Differentiation –

Commercial Expertise

SUSTAINMENT

•

1,100 locations worldwide

•

80 plus locations in 70

countries

MANUFACTURING

•

Extremely flexible assembly

facilities to meet urgent

requirements

ENGINEERING

•

3,000 Engineers

•

Designed for assembly

•

Rapid response

•

Global resources/capabilities

–

Suppliers integrated into

design

ENABLERS FOR OUR SUCCESS

ENABLERS FOR OUR SUCCESS |

16

NYSE: NAV

School Bus

Class 6 and 7

Combined

Class 8

Engines

Class 4 and 5

Existing Platforms + Survivability Solutions = Success

Existing Platforms + Survivability Solutions = Success

Navistar Defense

Leveraging Platforms |

17

NYSE: NAV

COTS

MilCOTS

True Tactical Vehicles

Field Service Reps

Integrated Logistics

Services

Parts Support Reset,

Refurbish, Repower

Independent

Suspension

Emergency

Egress Windows

MXT Limited Slip

Differential

Upgrade

Navistar Defense Business Model

“Leveraging what we have and what others have built.”

Leveraging what we have and what others have built.” |

18

NYSE: NAV

Canada DND

TACOM

Navistar Defense Overview

Diversification and Global Expansion

U.K. MoD

DoD Program Cost

Distribution

Program Spend

Program Years

System Acquisition

Support and Sustainment

28%

72%

28%

72%

Life Cycle Cost

JPO

U.S. and Allies |

19

NYSE: NAV

Next In

Rank

International Market

GLOBAL DEFENSE BUDGETS

Iran

Colombia

Israel

Netherlands

Poland

Taiwan

Greece

Singapore

United Arab

Emirates

Sweden

Norway

Pakistan

Egypt

Algeria

Belgium

Thailand

Switzerland

Oman

Chile

Denmark

50 Countries (Including US) Define 87% of the Global Defense Marketplace;

13 of top 15 Accessible to US Defense Companies

Copyright ©

Jane’s

Information Group Inc., 2010.

All rights reserved.

1.

China

2.

United Kingdom

3.

France

4.

Japan

5.

Saudi Arabia

6.

Germany

7.

India

8.

Italy

9.

Russia

10.

S. Korea

11.

Brazil

12.

Canada

13.

Australia

14.

Spain

15.

Turkey

Domestic US Markets

Accessible International Markets

Excluded International Markets

Top 15

Countries |

20

NYSE: NAV

Navistar Defense

Sustainable Revenue

2008

2009

2010

2011

> $2B

> $2B

> $2B

$1.5-$2.0B

•

U.S. and FMS

$1.2B

Continue at lower rate (-)

•

Foreign Direct

$0.3B

U.K./Canada/26 countries (+/-)

•

Parts & Services

$0.5B

Continue w/more vehicles (+/-)

•

Capability Insertion

$0.1B

Increasing (+)

•

Total

$2.1B

Opportunity

•Tactical vehicles –

urgent need & new

variants

•Capability insertion –

rolling chassis &

upgrades

•Programs / products

—

HMMWV Recap

—

FHTV

—

JLTV

—

Tatra

•Program of record label

2011 Recurring Business

•

U.S. and FMS

$0.4 -

$0.5B

•

Foreign Direct

$0.2B

•

Parts & Services*

$0.5B

•

Capability Insertion

$0.2 -

$0.3B

Total

$1.3 -

$1.5B

*The Services portion of this business is recorded in the Truck segment revenues

|

21

NYSE: NAV

•

Moving from focused facilities to

flexible manufacturing to maximize

logistics cost

•

School bus: All assembly in Tulsa

•

Huntsville –

ability to produce

V8/I6/DT engines on same line

What’s next?

Engineering consolidation

Competitive Cost Structure |

22

NYSE: NAV

Global Truck Market Demand &

Near Term Opportunities

North America

(U.S. and Canada)

2008: 389K

2015: 485K

China

2008: 754K

2015: 1.2M

India

2008: 229K

2015: 361K

Western Europe

2008: 341K

2015: 366K

Mercosur

2008: 138K

2015: 158K

Latin America

(Other)

2008: 39K

2015: 40K

Mexico

2008: 36K

2015: 34K

Russia

2008: 136K

2015: 193K

Australia

2008: 25K

2015: 29K

South Africa

2008: 22K

2015: 24K

Middle East

2008: 87K

2015: 105K

Turkey

2008: 21K

2015: 41K

Significant Future

Growth Opportunities, High GDP Growth

Sustaining

Markets,

Modest

Growth

Areas,

Lower

GDP

Growth |

23

NYSE: NAV

Access to Global Markets

NC

2

& IC Bus Growth

China & India Joint Ventures

JAC JV pending government approval

Neobus

is currently in concept stage |

NYSE:

NAV 24

Global Truck Operations

2010

Profitable

Exports and

Investing

2011

Expanded Exports

and Continuing

Investment

2012

Growth and

Profitability

2015

Global

Vision |

NYSE:

NAV Parts Segment |

26

NYSE: NAV

Parts Business –

Gaining Market Share

Approx. $14B U.S. Retail Market

2010

2011

2012

2013+

Year over year

3% commercial

margin

percentage

increase

Realize benefits of Truck and Engine

Strategy

Parts Segment: Double digit top

line growth with excellent return

on assets

Market Size: Navistar vs. Overall Parts Market

YOY Change %

Total Industry

-4.3%

-13.9%

2.5%

Navistar U.S.

Net Sales

2.2%

-11.2%

14.4% |

27

NYSE: NAV

Parts Business

Grow with Truck and Engine

•

MaxxForce

®

11L/13L/15L

($400-500M

revenue at maturity)

•

OEM engine growth

(150,000-200,000 units

by end of 2013)

•

Global truck

(100,000 units by end of 2013)

•

Market share growth in core business |

28

NYSE: NAV

2007 Product Offerings

2011 Product Offerings

Well Positioned for Future

NGV Platform

Purchased Engines

NGV Platform

4.8L

7.2L

9.3L

Global Powertrain |

29

NYSE: NAV

Navistar Well Positioned for

Industry Recovery

Note:

This

is

not

meant

for

updated

guidance,

it

is

for

illustrative

purposes

only.

This

slide

contains

non-GAAP

information,

please

see

the

Reg

G

in

appendix

for

detailed

reconciliation.

FY2009

Actual

3Q2010

R&D

$433M

$338M

$(10.00)

$(5.00)

$-

$5.00

$10.00

$15.00

$20.00

150

200

250

300

350

400

450

500

Traditional Industry Volume (Thousands of Units)

2010

Guidance

Midpoint

Original $1.6B Segment

Profit Goal@ 415k

units

$1.8B Segment Profit

Goal

@ 350k

units***

2008

Actual*

2009

Actual**

Notes:

* 2008 excludes Impairment

** 2009 excludes Ford and 1-time items

*** Assumes attainment of mature global growth by end of calendar year

2013 |

30

NYSE: NAV

Frequently Asked Questions

Q1:

What should we assume for capital expenditures in 2010?

A:

For

2010,

excluding

our

NFC

and

Dealcor

acquisition

of

vehicles

for

leasing,

we

expect

our

capital

expenditures to be at our normal $250 million to $350 million range. We continue to

fund our strategic programs.

Q2:

What is in your Dealcor

debt?

A:

Dealcor

debt is comprised of wholesale (floor plan) financing and also retail financing on

lease and rental fleets for company owned dealers.

Q3:

How many Dealcor

dealers did you have as of July 31, 2010?

A:

Of

our

278

primary

NAFTA

dealers,

we

have

ownership

interest

in

11

DealCor

dealers

as

of

September

30,

2010.

We

expect

to

further

reduce

our

number

of

Dealcor

dealers

before

calendar year end.

Q4:

When is the next refinancing due at NFC?

A:

Our TRAC facility, which funds fleets and national accounts, matures in January of

2011. Q5:

Are there any requirements for NFC leverage?

A:

NFC is compliant with our revolver leverage covenant of 6 to 1. This ratio

calculation excludes qualified retail and lease securitization debt.

|

31

NYSE: NAV

Frequently Asked Questions

Q6:

How do you fund your wholesale business?

A:

We primarily finance our wholesale portfolio in traditional private or public

securitizations, and through our bank facility.

Q7:

How are your dealers doing?

A:

We think our dealers, which have always been one of our strengths, are well

positioned. We traditionally have not had any significant dealer

losses and expect that trend to continue in the future. Q8:

What kind of rates do you charge your dealers and customers?

A:

Generally, our rates vary (those with higher credit risk have always had to pay

higher interest rates) and are usually in line with the market.

Q9:

How is your NFC portfolio performing?

A:

NFC portfolio performance is improving, which has resulted in a lower provision for

losses.

Repossessions, past due accounts and losses peaked in 2008 and have continued to

show improvement, with considerable improvement lately.

Q10:

What is your total amount of capacity at NFC?

A:

Total availability in our funding facilities is more than $750 million as of July

31, 2010. Q11:

What is the status of the retail financing alliance with GE Capital in the United

States? A:

Navistar

Capital

–

the

alliance

we

formed

with

GE

Capital

to

support

the

sale

of

Navistar

products

–

is

off to a great start and progressing consistent with expectations.

|

32

NYSE: NAV

Frequently Asked Questions

Q12:

Why have NFC’s wholesale receivables and debt moved onto the balance sheet?

A:

NFC amended its wholesale securitization trust to allow NFC some control over receivables

transferred to the trust, which is a variable interest entity of which NFC is the primary

beneficiary. Under current accounting rules, the amendment requires NFC to consolidate

the assets and liabilities of the wholesale securitization trust onto the balance sheet.

Q13:

What is the current Joint Light Tactical Vehicle (JLTV) program status?

A:

As part of the Technology Development (TD) phase, Navistar and BAE delivered right-hand drive

prototypes to Australia on June 21 following delivery of prototypes to the U.S. in May.

A:

At this time, we stand ready to support any needs from the military should they choose to retrofit the

remainder of the MaxxPro fleet with DXM™ independent suspension. Navistar has

produced 1,130 MaxxPro Dash units with DXM independent suspension and will retrofit another

1,222 Dash units in theater with the capability.

Q15:

What are your margins for military vehicles?

A:

We do not break margins out specific to our military vehicles. These numbers are reported as part of

our Truck Group financials.

Q16:

What funding is available in the DoD FY 2011 budget for the MRAP program?

A:

Funding has not yet been approved, but a proposed budget includes $3.4B for the MRAP program. In

the past, the MRAP program has been financed with supplemental war funding.

Q14:

What

is

the

status

of

any

MaxxPro®

Dash

rolling

chassis

orders? |

33

NYSE: NAV

Frequently Asked Questions

Q17:

What

will

Navistar

do

to

meet

the

0.2

NOx

emissions

when

its

credits

are

depleted?

A:

Navistar remains committed to its strategy of providing solutions that let

customers focus on their business, not emissions regulations.

Solutions under development are multi-pronged and include our

prime

path

of

in-cylinder

solutions

along

with

application-specific

solutions

such

as

the

Amminex

metal

ammine-based NOx

reductant

delivery system which Navistar announced in December 2009.

Q18:

What are the 2010 emissions requirements?

A:

The

rules

allow

manufacturers

to

go

to

0.5

NOx

if

they

cleaned

up

the

environment

earlier

with

advanced

technology;

manufacturers

need

to

be

at

0.2

NOx

if

they

chose

not

to

introduce

advanced

technologies earlier.

Q19:

Why do parts margins fluctuate year to year?

A:

In 2009 and 2008 the Parts business benefitted from substantial fielding orders to

support the MRAP launch in the field with higher margins than the commercial

business. In 2009 the Military business

was

38%

percent

of

the

total

Parts

Revenue.

We

expect

2010

to

be

down

to

17%

of

the

total

with

margins closer to commercial as more of the military business was in lower margin

sustainment orders.

Our commercial business is performing well with 14% top line sales growth and

improving ROS % from cost reductions and

leveraging SG&A. |

34

NYSE: NAV

Frequently Asked Questions

Q20:

How much net operating losses remain, and why is there still a valuation allowance

against deferred tax assets?

A:

The Company has approximately $288 million of U.S. federal net operating losses

available as of October 31, 2009 to offset future taxable income.

Applying a federal tax rate of 35%, these losses have an undiscounted cash

value of $101 million. In addition, the value of our state and foreign NOLs

are $82 million and $102 million, respectively, for a total value of

tax-effected, undiscounted cash of $285 million. (The difference

from the reported balance is attributed to stock option accounting.) A

substantial portion of these NOL assets are subject to a valuation allowance. In addition to the

deferred tax assets attributable to the NOLs, we have other deferred tax assets

arising from temporary book-tax differences subject to a valuation

allowance of $1.7 billion, for a total balance of deferred tax assets

subject to a valuation allowance of $2 billion. Under U.S. GAAP rules, when the Company is

able to demonstrate sufficient earnings (both historically and in the future) to

absorb these future deductions, the Company would release its valuation

allowances. Based on evidence to date, we believe it is reasonably possible

that the Company may release all or a portion of its U.S. valuation

allowance in the next twelve months. When the full valuation allowance is

released, $72 million would favorably impact shareowner’s equity and the

balance would favorably impact net income. |

35

NYSE: NAV

Frequently Asked Questions

Q21: How has recent tax legislation affected Navistar?

A:

The Worker, Homeownership, and Business Assistance Act of 2009 provides an opportunity to carry

back alternative minimum tax net operating losses from the Company’s 2010 fiscal year and to

receive a refund of alternative minimum tax payments made in the prior five fiscal years.

The Company intends to take advantage of this opportunity to the fullest extent allowable by

law. Other recent international legislation would not have a material impact on our financial statements in

the near term, due to the fact that we currently have a full valuation allowance against our

U.S. deferred tax assets and are still utilizing U.S. net operating losses. We

continually monitor legislative changes to address adverse tax implications that may occur in

the future. Q22: What makes up our consolidated tax expense?

A:

Our pre-tax operating profits reflect our worldwide operations; similarly our consolidated tax

expense reflects the impact of differing tax positions throughout the world. In general, we

currently have full valuation allowances against the deferred tax assets of our U.S. and

Canadian operations. Consequently, our tax expense in those jurisdictions is generally

limited to current state or local taxes and the impact of alternative minimum taxes. Our

Brazilian and Mexican operations are profitable and as a result we accrue taxes in those

jurisdictions. This combination of factors causes our overall consolidated effective tax

rate to be fairly low. |

36

NYSE: NAV

Frequently Asked Questions

Q23:

Your tax footnote in the 10K discloses gross deferred tax assets of $2.2 billion. How will

those assets be used to offset future taxable income?

A:

Simply put, deferred tax assets represent the value of future tax deductions attributable to items

that have already been expensed or deducted for book purposes. The most commonly

understood component of deferred tax assets is the value of our net operating losses, which

will serve to reduce taxable income in the future. In addition, we have several other

major components of deferred taxes which will reduce taxable income in the future. For

example, the Company has accrued significant OPEB, pension and other employee benefit expenses

during prior years based on expected payments to be made in the future. As these payments

are made, the Company will realize tax deductions to the extent of its future taxable income. Q24: What causes the variance between manufacturing cash interest payments and GAAP

interest expense?

A:

The main variance between cash and GAAP interest results from the recent issuance of new manufacturing

debt. In October 2009, we issued $1 billion of senior unsecured high yield notes and $570

million of senior subordinated convertible notes. As a result of this issuance, future

manufacturing interest expense will be higher than cash interest payments due to the

amortization of debt issuance costs which are amortized over the life of each note ($36

million), amortization of the original issue discount of the high yield notes ($37 million) and

amortization of the embedded call option in the convertible notes ($114 million). In FY 2010, this

variance will be much larger due to the timing of interest payments on the high yield notes.

Interest payment dates are in May and November starting in May 2010. Therefore, we will

only have one cash payment this fiscal year even though expense will show the full year

amount. As a result of this and other non-cash interest expense, FY 2010 may show a

variance of approximately $66 million between cash and GAAP interest. |

37

NYSE: NAV

Frequently Asked Questions

Q25:

What are the $225 million of Recovery Zone Facility Revenue Bonds (RZB) Series 2010 due

October 15, 2040 being used for?

A:

We are using the proceeds to invest in our product development strategy. Great products are a key

pillar of our three pronged strategy. Streamlining and improving our product development

processes will continue to provide competitive advantages for us in the marketplace. The

funding from RZFB will allow us to consolidate many facilities into a new facility and make

necessary renovations to that facility. Additionally we will invest in an existing

facility, which includes investments in equipment and technology that will help us create and

improve our product development process and thus shareholder value.

Q26:

Why did you use RZB financing?

A:

The recovery zone facility bonds are a cost effective, long-term form of capital that is

complementary to our capital structure. The bonds have a 30 year maturity and a fixed rate

coupon of 6.50% per annum. They are callable at par any time after 10 years (October 15,

2020). Issuing bonds in the tax-exempt market gave us exposure to a new source of

investors that we wouldn’t otherwise have access to if not for the Recovery Zone Facility

Bond program. |

38

NYSE: NAV

Frequently Asked Questions

Q27:

What are the benefits of an integrated product development organization?

A:

Great Products is one of the three pillars of our strategy.

Product development is therefore a

foundation of our strategy.

We believe that by consolidating our Truck and Engine product

development organizations we will leverage the capabilities of both organizations

and obtain benefits and cost savings that would not be possible by

maintaining separate Truck and Engine development groups.

We believe those benefits/savings will come in several areas including:

Engineering

–

improved Truck and Engine engineering collaboration will produce better product

designs resulting in

enhanced materials savings and faster time to market

Quality

–

centralizing the quality function with a singular focus will improve

end-to-end accountability and result in lower warranty costs

Customer

Service

–

consolidating

disparate

customer

service

functions

and

field

and

technical

services

will improve the customer experience and reduce repair time

Purchasing

–

Consolidating the Truck, Engine and Parts procurement will improve collaboration

and reduce transactional activity

Beyond the benefits of an integrated product development organization, we believe

the HQ consolidation will also result in

benefits and cost savings in:

Human

Resources

–

consolidating

HR

activity

around

core

service

offerings

such

as

compensation

&

benefits, talent management and strategic services will build global and M&A

competencies to support future growth

Finance

–

centralizing core functions and shifting transactional activities to shared or

outsourced services will improve finance efficiencies

|

39

NYSE: NAV

SEC Regulation G |

40

NYSE: NAV

SEC Regulation G –

Fiscal Year Comparison

Future

2009

U.S. and Canada Industry

414,500

350,000

($billions)

Sales and revenues, net

$ 15 +

$ 20 +

($millions)

Manufacturing segment profit*

$ 1,600

Below the line items

Income excluding income tax

Income tax expense

(298)

Net Income attributable to Navistar International Corporation (NIC)

Diluted earnings per share ($'s) attributable to NIC

$12.31

Weighted average shares outstanding: diluted (millions)

Original Target

@ 414.5k Industry

Revised Target

@ 350k Industry

$ 1,780

(590)

~ 72.5

$892

~ 72.5

(500)

1,100

(275)

$825

$11.46

1,190

Manufacturing Segment Profit is not in accordance with, or an alternative for, U.S. generally accepted

accounting principles (GAAP). The non-GAAP financial information presented herein should be

considered supplemental to, and not as a substitute for, or superior to, financial measures calculated in accordance with GAAP. However, we believe that non-GAAP reporting,

giving effect to the adjustments shown in the reconciliation above, provides meaningful information

and therefore we use it to supplement our GAAP reporting by identifying items that may not be

related to the core manufacturing business. Management often uses this information to assess and measure the performance of our operating segments. We have chosen to

provide this supplemental information to investors, analysts and other interested parties to enable

them to perform additional analyses of operating results, to illustrate the results of

operations giving effect to the non-GAAP adjustments shown in the above reconciliations and to

provide an additional measure of performance. |

41

NYSE: NAV

SEC Regulation G –

Fiscal Year Comparison

2009

2008

Non GAAP

Non GAAP

As Reported

Non GAAP

Non GAAP

As Reported

Without

Impacts

Impacts

With Impacts

Without

Impacts

Impacts

With Impacts

U.S. and Canada Industry

181,800

244,100

($billions)

Sales and revenues, net

11.6

$

14.7

$

($millions)

Manufacturing segment profit

(excluding items listed below)

707

$

-

$

707

$

1,088

$

-

$

1,088

$

Ford settlement net of related charges

160

160

(37)

(37)

Impairment of property, plant and equipment

(31)

(31)

(358)

(358)

Manufacturing segment profit

707

129

836

1,088

(395)

693

Below the line items

(excluding items listed below)

(468)

(468)

(502)

(502)

Write-off of debt issuance cost

(11)

(11)

-

Below the line items

(468)

(11)

(479)

(502)

-

(502)

Income (loss) excluding income tax

239

118

357

586

(395)

191

Income tax benefit (expense)

(34)

(3)

(37)

(58)

1

(57)

Net Income (loss)

205

$

115

$

320

$

528

$

(394)

$

134

$

Diluted earnings (loss) per share ($'s)

2.86

$

1.60

$

4.46

$

7.21

$

(5.39)

$

1.82

$

Weighted average shares outstanding: diluted (millions)

71.8

71.8

73.2

73.2

This presentation is not in accordance with, or an alternative for, U.S. generally accepted

accounting principles (GAAP). The non-GAAP financial information presented herein should be considered

supplemental to, and not as a substitute for, or superior to, financial measures calculated in

accordance with GAAP. However, we believe that non-GAAP reporting, giving effect to the adjustments shown in

the reconciliation above, provides meaningful information and therefore we use it to supplement our

GAAP reporting by identifying items that may not be related to the core manufacturing business.

Management often uses this information to assess and measure the performance of our operating segments.

We have chosen to provide this supplemental information to investors, analysts and other

interested parties to enable them to perform additional analyses of operating results, to illustrate

the results of operations giving effect to the non-GAAP adjustments shown in the above reconciliations and to

provide an additional measure of performance. |

42

NYSE: NAV

SEC Regulation G –

Quarterly Comparison

This presentation is not in accordance with, or an alternative for, U.S. generally

accepted accounting principles (GAAP). The non-GAAP financial information presented herein should be

considered supplemental to, and not as a substitute for, or superior to, financial measures calculated

in accordance with GAAP. However, we believe that non-GAAP reporting, giving effect to

the adjustments shown in the reconciliation above, provides meaningful information and therefore we use it to supplement our GAAP reporting by identifying items that may not be related

to the core manufacturing business. Management often uses this information to assess and measure

the performance of our operating segments. We have chosen to provide this supplemental

information to investors, analysts and other interested parties to enable them to perform additional analyses of operating results, to illustrate the results of operations giving

effect to the non-GAAP adjustments shown in the above reconciliations and to provide an additional

measure of performance. 2010 Q3

2009 Q3

2010 Nine Months

2009 Nine Months

As Reported

As Reported

As Reported

As Reported

Sales and revenues, net

3.2

$

2.5

$

8.8

$

8.3

$

($ millions)

Manufacturing segment profit

278

110

595

604

Below the line items

(122)

(92)

(394)

(338)

Income (loss) excluding income tax

156

18

201

266

Income tax benefit (expense)

(19)

(30)

(17)

(32)

Net

Income

(loss)

attributable

to

navistar

International

Corporation

137

$

(12)

$

184

$

234

$

Diluted

earnings

(loss)

per

share

($'s)

attributable

to

Navistar

International

Corporation

1.83

$

(0.16)

$

2.51

$

3.27

$

Weighted average shares outstanding: diluted

(millions) 74.3

70.8

73.1

71.7

Note: In the third quarter 2010, related to the ratification of a new collective

bargaining agreement at ICC, we incurred $10 million of restructuring benefits offset by $6 million

of charges in costs of products sold for supplemental unemployment and healthcare

benefits. |