Attached files

| file | filename |

|---|---|

| 8-K - JOINT FORM 8-K - KANSAS CITY POWER & LIGHT CO | f8keeideck.htm |

Great Plains Energy

Edison Electric Institute Financial Conference

November 2, 2010

2010 EEI Presentation

Michael J. Chesser

Chairman and CEO

Exhibit 99.1

Statements made in this presentation that are not based on historical facts are forward-looking, may involve risks and uncertainties, and are intended

to be as of the date when made. Forward-looking statements include, but are not limited to, the outcome of regulatory proceedings, cost estimates of the

Comprehensive Energy Plan and other matters affecting future operations. In connection with the safe harbor provisions of the Private Securities Litigation

Reform Act of 1995, Great Plains Energy and KCP&L are providing a number of important factors that could cause actual results to differ materially from the

provided forward-looking information. These important factors include: future economic conditions in regional, national and international markets and their

effects on sales, prices and costs, including but not limited to possible further deterioration in economic conditions and the timing and extent of any economic

recovery; prices and availability of electricity in regional and national wholesale markets; market perception of the energy industry, Great Plains Energy and

KCP&L; changes in business strategy, operations or development plans; effects of current or proposed state and federal legislative and regulatory actions or

developments, including, but not limited to, deregulation, re-regulation and restructuring of the electric utility industry; decisions of regulators regarding rates

the companies can charge for electricity; adverse changes in applicable laws, regulations, rules, principles or practices governing tax, accounting and

environmental matters including, but not limited to, air and water quality; financial market conditions and performance including, but not limited to, changes

in interest rates and credit spreads and in availability and cost of capital and the effects on nuclear decommissioning trust and pension plan assets and costs;

impairments of long-lived assets or goodwill; credit ratings; inflation rates; effectiveness of risk management policies and procedures and the ability of

counterparties to satisfy their contractual commitments; impact of terrorist acts; increased competition including, but not limited to, retail choice in the

electric utility industry and the entry of new competitors; ability to carry out marketing and sales plans; weather conditions including, but not limited to,

weather-related damage and their effects on sales, prices and costs; cost, availability, quality and deliverability of fuel; ability to achieve generation goals and

the occurrence and duration of planned and unplanned generation outages; delays in the anticipated in-service dates and cost increases of additional

generating capacity and environmental projects; nuclear operations; workforce risks, including, but not limited to, increased costs of retirement, health care

and other benefits; the timing and amount of resulting synergy savings from the GMO acquisition; and other risks and uncertainties.

to be as of the date when made. Forward-looking statements include, but are not limited to, the outcome of regulatory proceedings, cost estimates of the

Comprehensive Energy Plan and other matters affecting future operations. In connection with the safe harbor provisions of the Private Securities Litigation

Reform Act of 1995, Great Plains Energy and KCP&L are providing a number of important factors that could cause actual results to differ materially from the

provided forward-looking information. These important factors include: future economic conditions in regional, national and international markets and their

effects on sales, prices and costs, including but not limited to possible further deterioration in economic conditions and the timing and extent of any economic

recovery; prices and availability of electricity in regional and national wholesale markets; market perception of the energy industry, Great Plains Energy and

KCP&L; changes in business strategy, operations or development plans; effects of current or proposed state and federal legislative and regulatory actions or

developments, including, but not limited to, deregulation, re-regulation and restructuring of the electric utility industry; decisions of regulators regarding rates

the companies can charge for electricity; adverse changes in applicable laws, regulations, rules, principles or practices governing tax, accounting and

environmental matters including, but not limited to, air and water quality; financial market conditions and performance including, but not limited to, changes

in interest rates and credit spreads and in availability and cost of capital and the effects on nuclear decommissioning trust and pension plan assets and costs;

impairments of long-lived assets or goodwill; credit ratings; inflation rates; effectiveness of risk management policies and procedures and the ability of

counterparties to satisfy their contractual commitments; impact of terrorist acts; increased competition including, but not limited to, retail choice in the

electric utility industry and the entry of new competitors; ability to carry out marketing and sales plans; weather conditions including, but not limited to,

weather-related damage and their effects on sales, prices and costs; cost, availability, quality and deliverability of fuel; ability to achieve generation goals and

the occurrence and duration of planned and unplanned generation outages; delays in the anticipated in-service dates and cost increases of additional

generating capacity and environmental projects; nuclear operations; workforce risks, including, but not limited to, increased costs of retirement, health care

and other benefits; the timing and amount of resulting synergy savings from the GMO acquisition; and other risks and uncertainties.

This list of factors is not all-inclusive because it is not possible to predict all factors. Other risk factors are detailed from time to time in Great Plains

Energy’s and KCP&L’s quarterly reports on Form 10-Q and annual report on Form 10-K filed with the Securities and Exchange Commission. Each forward-

looking statement speaks only as of the date of the particular statement. Great Plains Energy and KCP&L undertake no obligation to publicly update or revise

any forward-looking statement, whether as a result of new information, future events or otherwise.

Energy’s and KCP&L’s quarterly reports on Form 10-Q and annual report on Form 10-K filed with the Securities and Exchange Commission. Each forward-

looking statement speaks only as of the date of the particular statement. Great Plains Energy and KCP&L undertake no obligation to publicly update or revise

any forward-looking statement, whether as a result of new information, future events or otherwise.

Forward Looking Statement

2

2010 EEI Presentation

• Solid Midwest electric utility operating under the KCP&L brand

• Transformational events in 2008 to focus business model on fully

regulated utility operations

regulated utility operations

– Sale of Strategic Energy

– Acquisition of Aquila (now KCP&L Greater Missouri Operations,

or “GMO”)

or “GMO”)

• Company attributes

– ~822,000 customers / 3,200+ employees

– ~6,600 MW of primarily low-cost coal baseload generation

– 5-year projected synergies post-GMO acquisition of ~$760M

– ~$8.5bn in assets and $4.4bn in rate base at 2009YE

Service Territories: KCP&L and GMO

Business Highlights

YTD MWh Sold by Customer Type

YTD MWh Sales by Jurisdiction

YTD MWh Generated by Fuel Type

Total: ~ 18,423 MWhs

Total: ~ 18,423 MWhs

Total: ~ 19,958 MWhs

2010 EEI Presentation

3

Note: Charts below reflect YTD 2010

3

Solid Vertically-Integrated Midwest Utility

4

Impressive Reliability

Solid Safety Record

Tier 1 Customer Service

Stewards of

the Environment

the Environment

Reliable, Economical, and

Safe Nuclear Generation

Safe Nuclear Generation

Strong Plant Performance

4

2010 EEI Presentation

Executing the Plan

2010 EEI Presentation

5

Strategic Overview

Terry Bassham

Executive Vice President, Utility

Operations

Operations

6

2010 EEI Presentation

7

2010 EEI Presentation

Steps to Completion of Iatan 2

1KCP&L’s initial request was subsequently adjusted to $50.9 million as the net result of updates to the case, most notably a reduction in the requested

ROE (see below footnote)

ROE (see below footnote)

2The requested ROE was adjusted by KCP&L to 10.75% with the potential for a 0.25% adder (to 11.00% ROE) if the KCC adopts a particular rate design

proposal by KCC Staff and other interveners

proposal by KCC Staff and other interveners

|

Jurisdiction

|

Requested

Increase |

Requested

ROE |

Rate Base

|

Rates

Effective |

Decision

|

|

KCP&L - KS

|

$55.21

|

11.25%2

|

1,794.8

|

12/1/2010

|

Fall 2010

|

|

KCP&L - MO

|

$92.1

|

11.00%

|

2,122.8

|

5/4/2011

|

Spring 2011

|

|

GMO - MPS

|

$75.8

|

11.00%

|

1,468.7

|

6/4/2011

|

Spring 2011

|

|

GMO - L&P

|

$22.1

|

11.00%

|

422.0

|

6/4/2011

|

Spring 2011

|

8

(in $ millions)

2010 EEI Presentation

Pending Rate Case Summary

Drivers of Change

Environmental

Rules

Natural Gas

Prices

Load Growth

Energy

Legislation

Financing

Emergent

Technologies

2010 EEI Presentation

9

Sustainable Resource Strategy

Change Creates Opportunity

Change Creates Opportunity

Transmission &

Distribution

Opportunities

Distribution

Opportunities

Opportunities

Resulting from

SmartGrid

Technologies

Resulting from

SmartGrid

Technologies

Generation Fleet

Optimization

Opportunities

Optimization

Opportunities

2010 EEI Presentation

10

Financial Overview

James C. Shay

Senior Vice President Finance &

Strategic Planning and CFO

Strategic Planning and CFO

11

2010 EEI Presentation

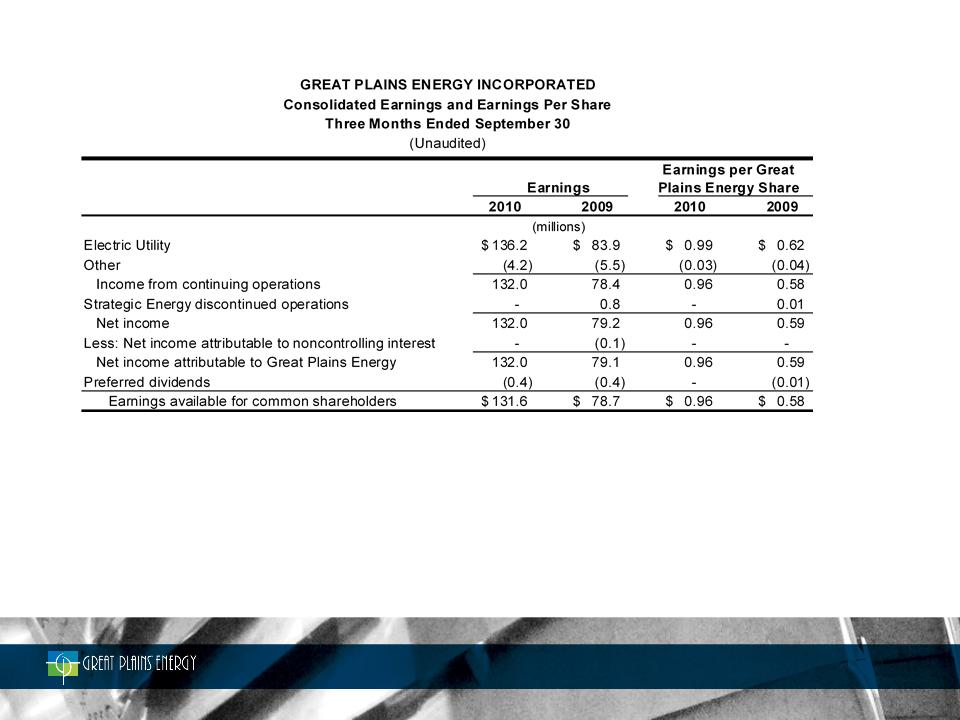

Electric Utility’s net income increased $52.3 million primarily driven by a $109.8 million increase in gross margin* due to

favorable impacts from weather and new retail rates

favorable impacts from weather and new retail rates

Increased number of shares outstanding primarily from the May 2009 equity offering resulted in dilution of $0.02 per

share

share

*Gross margin is defined and reconciled to GAAP operating revenues in the Appendix

12

2010 EEI Presentation

Electric Utility’s net income increased $98.7 million primarily driven by a $239.4 million increase in gross margin* due to

new retail rates and favorable impacts from weather

new retail rates and favorable impacts from weather

Other category earnings decreased $18.9 million primarily as a result of increased interest from the Equity Units issued in

2009 and a $16 million benefit in 2009 related to the settlement of GMO’s 2003 - 2004 federal tax audit

2009 and a $16 million benefit in 2009 related to the settlement of GMO’s 2003 - 2004 federal tax audit

Increased number of shares outstanding primarily from the May 2009 equity offering resulted in dilution of $0.12 per

share

share

*Gross margin is defined and reconciled to GAAP operating revenues in the Appendix

13

2010 EEI Presentation

Electric Utility Third Quarter

(millions except

where indicated)

Earnings

Earnings Per Share

14

Key Earnings Drivers:

+ Increased gross margin of $109.8 million primarily due to significantly warmer weather and full-quarter impact of

new retail rates which took effect in August and September 2009

new retail rates which took effect in August and September 2009

– Increased operating expense of $12.1 million primarily driven by $5.2 million increase in general taxes and $4.0

million Iatan 2 loss;

million Iatan 2 loss;

– Increased depreciation and amortization of $7.4 million, including $3.2 million of additional amortization pursuant

to KCP&L’s 2009 rate cases; and

to KCP&L’s 2009 rate cases; and

– Decrease in non-operating income and expenses of $7.0 million, including $4.2 million less AFUDC equity due to

lower CWIP balances

lower CWIP balances

2010 EEI Presentation

Key Earnings Drivers:

+ Increased gross margin of $239.4 million primarily due to new retail rates and favorable weather

– Increased operating expense of $40.7 million primarily due to planned plant outages, higher general taxes and

the Iatan 2 loss; and

the Iatan 2 loss; and

– Increased depreciation and amortization of $28.2 million; including $17.2 million of additional amortization

pursuant to KCP&L’s 2009 rate cases

pursuant to KCP&L’s 2009 rate cases

Earnings

Earnings Per Share

(millions except

where indicated)

15

2010 EEI Presentation

Electric Utility Year-to-Date

Electric Utility Segment

Retail MWh Sales by Customer Class - Third Quarter 2010

44%

12%

44%

16

2010 EEI Presentation

Debt and Capital Structure

as of September 30, 2010

as of September 30, 2010

Capital Structure

Great Plains Energy Debt ($ in millions)

17

2010 EEI Presentation

|

|

|

|

|

|

|

|

|

|

|

|

KCP&L

|

GMO (1)

|

GPE

|

Consolidated

|

||||

|

|

Amount

|

Rate (2)

|

Amount

|

Rate (2)

|

Amount

|

Rate (2)

|

Amount

|

Rate (2)

|

|

Short-term Debt

|

$304.5(3) |

0.80%

|

$0.0

|

0.00%

|

$22.0

|

3.06%

|

$326.5

|

0.95%

|

|

Long-term Debt(4)

|

$1,780.0

|

6.13%

|

$1,020.1

|

9.88%

|

$636.9

|

7.57%

|

$3,437.0

|

7.47%

|

|

Total

|

$2,084.5

|

5.35%

|

$1,020.1

|

9.88%

|

$658.9

|

7.42%

|

$3,763.5

|

6.89%

|

Secured debt = $862.3 (23%), Unsecured debt = $2,901.2 (77%)

(1) GPE guarantees substantially all of GMO’s debt

(2) Weighted Average Rates - excludes premium/discounts and fair market value adjustments; includes full Equity Units coupon (12%) for GPE

(3) Includes fully-drawn KCP&L A/R Securitization facility of $95 million

(4) Includes current maturities of long-term debt

18

2010 EEI Presentation

2010 EPS Guidance

• Increased to $1.52 - $1.62 from $1.30 - $1.50

• Key YTD drivers of new guidance include estimated

weather impact vs. normal, lower fuel cost at KCP&L -

Missouri, and lower transmission costs at GMO

weather impact vs. normal, lower fuel cost at KCP&L -

Missouri, and lower transmission costs at GMO

• Guidance assumes no regulatory disallowance for Iatan

beyond that already recognized

beyond that already recognized

Positioned for Long-term Earnings Growth

• Diligently pursue constructive outcomes in current rate cases

• Continue to deliver on GMO synergies and move toward Tier 1 costs

across the organization

across the organization

• Evaluate future opportunities through Sustainable Resource Strategy

and continue to advocate on behalf of our shareholders, customers,

and communities

and continue to advocate on behalf of our shareholders, customers,

and communities

19

2010 EEI Presentation

Great Plains Energy

Edison Electric Institute Financial Conference

November 2, 2010

2010 EEI Presentation

Appendix

3Q 2010

Gross Margin Reconciliation

2010 EEI Presentation

Gross margin is a financial measure that is not calculated in accordance with generally accepted accounting principles (GAAP). Gross

margin, as used by Great Plains Energy, is defined as operating revenues less fuel, purchased power and transmission of electricity by

others. The Company’s expense for fuel, purchased power and transmission of electricity by others, offset by wholesale sales margin, is

subject to recovery through cost adjustment mechanisms, except for KCP&L’s Missouri retail operations. As a result, operating revenues

increase or decrease in relation to a significant portion of these expenses. Management believes that gross margin provides a more

meaningful basis for evaluating the Electric Utility segment’s operations across periods than operating revenues because gross margin

excludes the revenue effect of fluctuations in these expenses. Gross margin is used internally to measure performance against budget and

in reports for management and the Board of Directors. The Company’s definition of gross margin may differ from similar terms used by

other companies. A reconciliation to GAAP operating revenues is provided in the table above.

margin, as used by Great Plains Energy, is defined as operating revenues less fuel, purchased power and transmission of electricity by

others. The Company’s expense for fuel, purchased power and transmission of electricity by others, offset by wholesale sales margin, is

subject to recovery through cost adjustment mechanisms, except for KCP&L’s Missouri retail operations. As a result, operating revenues

increase or decrease in relation to a significant portion of these expenses. Management believes that gross margin provides a more

meaningful basis for evaluating the Electric Utility segment’s operations across periods than operating revenues because gross margin

excludes the revenue effect of fluctuations in these expenses. Gross margin is used internally to measure performance against budget and

in reports for management and the Board of Directors. The Company’s definition of gross margin may differ from similar terms used by

other companies. A reconciliation to GAAP operating revenues is provided in the table above.

2010 EEI Presentation