Attached files

Table of Contents

As filed with the Securities and Exchange Commission on October 29, 2010

Registration No. 333- 167601

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 3

TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Game Trading Technologies, Inc.

(Exact name of Registrant as specified in its charter)

| Delaware | 5734 | 20-5433090 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

Game Trading Technologies, Inc.

10957 McCormick Road

Hunt Valley, Maryland 21031

(410) 316-9900

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Todd Hays

Chief Executive Officer

Game Trading Technologies, Inc.

10957 McCormick Road

Hunt Valley, Maryland 21031

(410) 316-9900

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Gregory Sichenzia, Esq. Stephen A. Cohen, Esq. Sichenzia Ross Friedman Ference LLP 61 Broadway, 32nd Floor New York, New York 10006 Telephone: (212) 930-9700 Facsimile: (212) 930-9725 |

Steven M. Skolnick, Esq. Mathew B. Hoffman, Esq. Lowenstein Sandler PC 1251 Avenue of the Americas New York, New York 10020 Telephone: (212) 262-6700 Facsimile: (973) 422-6807 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Table of Contents

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ¨ | Accelerated filer ¨ | Non-accelerated filer ¨ | Smaller reporting company x |

| Title of each class of securities to be registered |

Amount to be registered |

Proposed maximum offering price per share |

Proposed maximum aggregate offering price |

Amount of registration fee | ||||

| Common Stock, $0.0001 par value (1)(2) |

2,300,000 | $7.70 | $17,710,000.00 | $1,262.72 | ||||

| Common Stock, $0.0001 par value (3)(4)(7) |

1,337,500 | $7.70 | $10,298,750.00 | $734.30 | ||||

| Common Stock, $0.0001 par value (3)(5)(7) |

1,923,750 | $7.70 | $14,812,875.00 | $1,056.16 | ||||

| Common Stock, $0.0001 par value (6) |

508,750 | $7.70 | $3,917,375.00 | $279.31 | ||||

| Total |

$46,739,000.00 | $3,332.49 (8) | ||||||

| (1) | Estimated solely for the purpose of calculating the amount of the registration fee pursuant to Rule 457(o) of the Securities Act of 1933, as amended. |

| (2) | Represents 2,300,000 shares of the Registrant’s common stock being offered pursuant to the Registrant’s public offering, including 300,000 shares of common stock that may be sold pursuant to the exercise of a 30-day option granted by the Registrant to the underwriters to cover over-allotments, if any. |

| (3) | Estimated solely for purposes of calculating the registration fee pursuant to Rule 457(c) of the Securities Act of 1933, as amended, based on the average of the high and low prices of the common stock of the Registrant as reported on the OTC Bulletin Board on October 28, 2010, and assumes a one for two reverse stock split to be effective on or prior to the effective date of the registration statement. |

| (4) | Represents shares of the Registrant’s common stock being registered for resale that are issuable to the selling stockholders named in the selling stockholders’ prospectus or a prospectus supplement thereto upon conversion of outstanding shares of series A convertible preferred stock. |

| (5) | Represents shares of the Registrant’s common stock being registered for resale that are issuable to the selling stockholders named in the selling stockholders’ prospectus or a prospectus supplement thereto upon exercise of outstanding warrants to purchase shares of common stock. |

| (6) | Represents shares of the Registrant’s common stock being registered for resale that are held by the selling stockholders named in the selling stockholders’ prospectus or a prospectus supplement thereto. |

| (7) | Pursuant to Rule 416 under the Securities Act of 1933, as amended, this Registration Statement shall be deemed to cover the additional securities (i) to be offered or issued in connection with any provision of any securities purported to be registered hereby to be offered pursuant to terms which provide for a change in the amount of securities being offered or issued to prevent dilution resulting from stock splits, stock dividends, or similar transactions and (ii) of the same class as the securities covered by this Registration Statement issued or issuable prior to completion of the distribution of the securities covered by this Registration Statement as a result of a split of, or a stock dividend on, the registered securities. |

| (8) | Previously paid. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall hereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

EXPLANATORY NOTE

This Registration Statement contains two forms of prospectuses: one to be used in connection with a public offering of up to 2,300,000 shares of our common stock (the “Prospectus”) and one to be used in connection with the potential resale by certain selling stockholders of an aggregate of 3,770,000 shares of our common stock (the “Selling Securityholder Prospectus”), consisting of (i) 1,337,500 shares of our common stock issuable upon conversion of our series A convertible preferred stock held by certain of the selling stockholders, (ii) 1,923,750 shares of our common stock issuable upon exercise of outstanding warrants held by certain of the selling stockholders and (iii) 508,750 shares of our common stock held by certain of the selling stockholders. The Prospectus and Selling Securityholder Prospectus will be identical in all respects except for the alternate pages for the Selling Securityholder Prospectus included herein which are labeled “Alternate Page for Selling Securityholder Prospectus.”

The Selling Securityholder Prospectus is substantively identical to the Prospectus, except for the following principal points:

| • | they contain different outside and inside front covers; |

| • | they contain different Offering sections in the Prospectus Summary section on page 7; |

| • | they contain different Use of Proceeds sections on page 27; |

| • | the Capitalization and Dilution sections are deleted from the Selling Securityholder Prospectus on page 28 and page 30, respectively; |

| • | a Selling Securityholder section is included in the Selling Securityholder Prospectus beginning on page 64; |

| • | the Underwriting section from the Prospectus on page 64 is deleted from the Selling Securityholder Prospectus and a Plan of Distribution is inserted in its place; and |

| • | the Legal Matters section in the Selling Securityholder Prospectus on page 66 deletes the reference to counsel for the underwriters; |

The Company has included in this Registration Statement, after the financial statements, a set of alternate pages to reflect the foregoing differences of the Selling Securityholder Prospectus as compared to the Prospectus.

Table of Contents

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED OCTOBER 29, 2010

Preliminary Prospectus

2,000,000 Shares of Common Stock

Game Trading Technologies, Inc.

We are offering 2,000,000 shares of our common stock.

We have applied to list our common stock on The NASDAQ Capital Market under the symbol “GTTI”. Our common stock is currently quoted on the OTC Bulletin Board, under the symbol “GMTD.OB.” As of October 28, 2010, the last reported sale price of our common stock was $3.85, which giving effect to a one for two reverse stock split, equates to $7.70. We will effect a reverse stock split of our outstanding shares of common stock prior to or upon the effective date of the registration statement of which this prospectus forms a part. However, following the stock split, our common stock may not trade at a price consistent with such reverse split ratio.

Investing in our common stock involves a high degree of risk. See “Risk Factors” beginning on page 10 of this prospectus.

| Price to Public | Underwriting Discounts and Commissions (1) |

Proceeds to Company |

||||||||||

| Per share |

$ | $ | $ | |||||||||

| Total |

$ | $ | $ | |||||||||

| (1) | Includes a non-accountable expense allowance of 1.5% of the gross proceeds, or $ per share ($ in total), payable to the underwriters. See “Underwriting.” |

We have granted the underwriters a 30-day option to purchase up to an additional 300,000 shares of our common stock at the public offering price, less the underwriting discounts and commissions, to cover over-allotments.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the common stock to purchasers on or about , 2010.

Joint Book-Running Managers

| Roth Capital Partners | Janney Montgomery Scott |

Prospectus dated , 2010.

Table of Contents

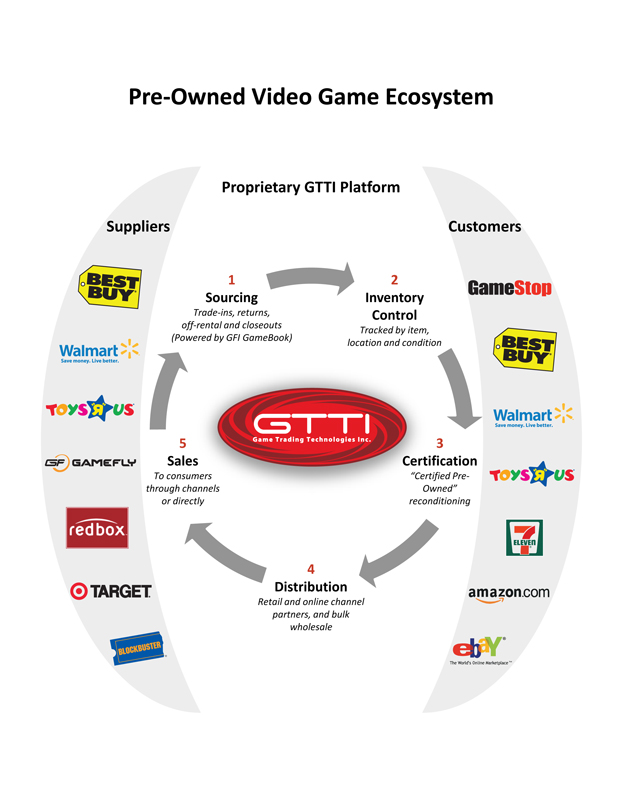

Pre-Owned Video Game Ecosystem

Suppliers

Best Buy®

Walmart Save money. Live better.SM

TOYS “R” US®

GF GAMEFLY

redbox

TARGET®

BLOCKBUSTER®

Proprietary GTTI Platform

1 Sourcing

Trade-ins, returns, off-rental and closeouts (Powered by GFI GameBook)

2 Inventory Control

Tracked by item, location and condition

3 Certification

“Certified Pre-Owned” reconditioning

4 Distribution

Retail and online channel partners, and bulk wholesale

5 Sales

GTTI Game Trading Technologies Inc.

To consumers through channels or directly

Customers

GameStop

BEST BUY®

Walmart Save money. Live better.SM

TOYS “R” US®

7ELEVEN®

amazon.com

ebay®

The World’s Online MarketplaceTM

Table of Contents

| Page | ||||

| 1 | ||||

| 10 | ||||

| Special Note Regarding Forward-Looking Statements and Information |

26 | |||

| 26 | ||||

| 27 | ||||

| 27 | ||||

| 28 | ||||

| 29 | ||||

| 30 | ||||

| 31 | ||||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

33 | |||

| 44 | ||||

| 51 | ||||

| Security Ownership of Certain Beneficial Owners and Management |

57 | |||

| 59 | ||||

| 60 | ||||

| 64 | ||||

| 66 | ||||

| 66 | ||||

| 66 | ||||

| F-1 | ||||

You should rely only on the information contained in this prospectus. We have not, and the underwriters have not, authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. We are not, and the underwriters are not, making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus is accurate only as of the date on the front cover of this prospectus or other date stated in this prospectus. Our business, financial condition, liquidity, results of operations, cash flows and prospects may have changed since that date.

We obtained statistical data, market data and other industry data and forecasts used throughout this prospectus from market research, publicly available information and industry publications. Industry publications generally state that they obtain their information from sources that they believe to be reliable, but they do not guarantee the accuracy and completeness of the information. Nevertheless, we are responsible for the accuracy and completeness of the historical information presented in this prospectus, as of the date of the prospectus.

Table of Contents

This summary highlights certain information described in greater detail elsewhere in this prospectus. Before deciding to invest in our common stock you should read the entire prospectus carefully, including “Risk Factors,” our consolidated financial statements and related notes, and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” in each case appearing elsewhere in this prospectus. References in this prospectus to “we”, “us”, “our” and “Company” refer to Game Trading Technologies, Inc., unless the context requires otherwise.

Business Overview

We are a leading provider of comprehensive trading solutions for video game retailers, publishers, rental companies, charities and consumers. Through our trading platform, we provide customers with value-added services including valuation, procurement, refurbishment, merchandising and distribution of pre-owned video games and related products. We offer these value-added services and customized solutions to leading specialty, mass, convenience, rental and online retailers, as well as directly to consumers through our website, www.gamersfactory.com. Our services allow retailers, including Wal-Mart, Best Buy and Toys ‘R’ Us to better serve those customers who are seeking to monetize their existing video game collections, as well as those looking to purchase pre-owned video games and related products. We believe we are the largest trading solutions provider and distributor of pre-owned video games and related products to retailers in North America, and the only company to offer a comprehensive set of solutions to the pre-owned video game industry.

We entered the video game wholesale and trading business in 2003 to meet the growing demand from retailers for high quality pre-owned video games. In response to this demand, we developed a proprietary algorithm and database, GFI GameBook, to categorize and efficiently value pre-owned video games. GFI GameBook provides daily price quotes for all pre-owned video games and related entertainment products released for use on North American game consoles. Retailers utilize GFI GameBook to determine daily market prices to facilitate the purchase of pre-owned video games from their customers in order to drive traffic and incremental storewide sales.

Our primary source of revenue is from the sale of pre-owned video games. We generate our supply of pre-owned video games and related products through four primary channels: trade-in, off-rental, consumer returns and closeout & overstock programs. Our multiple product sourcing channels enable us to acquire new releases, greatest hits and classic titles across all video game platforms. Once we source product, we categorize and, when needed, refurbish the video games at our facility in Hunt Valley, Maryland. We have the ability to refurbish video games for use on all major platforms including Nintendo, Sony and Microsoft. We then re-merchandise and distribute these products to various leading retailers as well as online directly to consumers. By utilizing GFI GameBook and leveraging our national customer reach, we have the ability to tailor the distribution and replenishment of video game products to maximize our operating performance.

For the fiscal year ended December 31, 2009, we recorded revenue of $36.7 million as compared to $17.1 million for the fiscal year ended December 31, 2008, representing a growth rate of 114.3%. For the nine months ended September 30, 2010, we reported revenues of $27.1 million as compared to revenues of $27.9 million for the nine months ended September 30, 2009, representing a decrease of 2.6%.

1

Table of Contents

Industry Overview

According to information published by NPD Group in May 2009, a leading market research firm specializing in consumer and retail sales information, nearly two out of every three Americans have played a video game in the past six months. Including the widely-used Sony PlayStation 2 and handheld devices such as the Nintendo DS, DS Lite, DSi and Sony PSP, we estimate a current total of more than 150 million consoles owned by U.S. households. The video game industry achieved $19.7 billion in sales for 2009 according to NPD, with $10.5 billion coming from software and the remainder in hardware and accessories. Based on revised estimates announced by NPD in June 2010, total software sales alone in 2009 exceeded $15.0 billion when factoring in estimates for used games, rentals, subscriptions, digital full game downloads, downloadable content, and mobile game apps.

In 2009, we estimate there were more than 1,000 new video game titles released for sale across all current generation consoles. Since 2000, we believe there have been more than 8,000 different titles released across all consoles. Today, we believe that U.S. consumers possess approximately 3.4 billion units of pre-owned video game products that are suitable for trading.

While new video game sales in the United States are concentrated in the hands of four national retailers, pre-owned video game sales are more heavily concentrated in the hands of one market leader, GameStop Corp. (“GameStop”). Despite the concentrated nature of the pre-owned video game market in the United States, we believe that the number of pre-owned video games sold by GameStop represents only a small fraction of the pre-owned video games that could potentially be traded-in due to the large, yet underpenetrated, nature of the pre-owned video game market.

We believe that many large video game and non-video game retailers are currently evaluating methods of entering the pre-owned video game market. Several challenges exist in successfully competing in this market, which include, among others:

| • | Supply. Currently, the demand from traditional retailers for pre-owned video games outpaces their ability to aggregate supply of the games, either directly from their customers or through other procurement channels. As consumers become more aware of the residual value of pre-owned video games, we believe they will become more active traders of their pre-owned video game collections. |

| • | Pricing. The value of a pre-owned video game can change very rapidly, based on a variety of factors. Since valuing pre-owned video games is outside the core expertise of most traditional retailers, they often undervalue trade-ins, which discourages consumers from monetizing their collections. |

| • | Merchandising. Given the reliance on consumers to trade-in games from their existing collections to create supply in the pre-owned market, it is difficult for retailers to plan their pre-owned merchandising strategies in the same manner they plan their new game merchandising strategies. |

| • | Refurbishment. Oftentimes, video games that are traded-in are in need of refurbishment, ranging from a light buffing of the disc to a complete resurfacing. Most traditional retailers lack this capability, limiting their ability to monetize damaged, but still repairable, pre-owned video games. |

| • | Repackaging. Many pre-owned video games are returned by consumers with the original packaging either damaged or missing. In order for these games to be effectively merchandised and resold, their packaging needs to be cleaned, repaired or entirely replaced. |

2

Table of Contents

Our Solution

Our platform provides our customers with an end-to-end solution including the valuation, procurement, refurbishment, merchandising and distribution of pre-owned video games and related products. Our services include, among other things:

Product Valuation and Services

| • | GFI GameBook. GFI GameBook provides daily price quotes for all pre-owned video games and related entertainment products released for use on North American game consoles. Our proprietary game trading database provides up-to-date pricing, which allows us to efficiently value product. |

| • | Store-based Solution. We provide retailers with access to a turn-key software application, which allows retailers to operate a game trading business, regardless of the capabilities of their internal systems. |

| • | Customized Services. In addition to our in-store solution, we offer our trading customers the ability to receive daily valuation data feeds customized to meet their specifications for use in their own trading operations. |

| • | Provider of e-Commerce and Interactive Marketing Services. We also offer website development and maintenance, providing retailers with an online channel to value and accept trade-ins of pre-owned video games. |

Product Procurement

We source product through four primary channels: trade-in, off-rental, consumer returns, and closeout & overstock programs:

| • | Trade-In Programs. We purchase pre-owned video games and related products from participating retailers. Participating retailers purchase pre-owned products, both in their retail stores and via their websites, and utilize our GFI GameBook to value these products. They purchase these trade-in products for either cash or store-credit, which we then repurchase from the retailer. Some of our retail trade-in partners include Wal-Mart, Best Buy and Toys ‘R’ Us. We also purchase pre-owned video games and related products directly from consumers through our website, www.gamersfactory.com, where consumers receive price quotes for their pre-owned merchandise, send the product directly to us, and receive payment from us once their products are received. |

| • | Off-Rental Programs. We source pre-owned video games from companies who offer video game rental programs. As these companies refresh their rental game inventory primarily with new releases, we purchase these off-rental video games. As a result, video game rental companies can efficiently monetize their off-rental inventory, while providing us with a supply of newer releases. Primary sources for these off-rental products include GameFly and Redbox. |

| • | Consumer Return Programs. Consumers return video games to retailers for a variety of reasons, and the retailer is often unable to restock these video games and sell them as new. We purchase these returned games from select national retailers. |

| • | Closeout & Overstock Programs. From time to time, we purchase new video games from retailers, distributors and publishers who have excess new game inventory that needs to be liquidated. We in-turn sell these new video games as pre-owned video games. Many publishers and distributors look to work with us due to our ability to distribute these excess games through a variety of channels. |

Product Refurbishment

A portion of the pre-owned video games that we source are in need of refurbishment before it can be sold. Our refurbishment process adds value by improving the games’ physical quality, extending its life and

3

Table of Contents

verifying its functionality. Once refurbished, we may shrink-wrap and/or label the video games according to specifications set by our retail customers. Historically, we have been able to repair approximately 97% of all acquired products; the approximately 3% of remaining products are outsourced or sold to refurbishment companies that have more extensive repair capabilities.

Product Distribution

We sell our video games and related products through three primary channels: retail ready, consumer direct and bulk.

| • | Retail Ready. Retail ready sales consist of pre-owned video games and related products sold to third party specialty, mass and convenience store retailers. In some instances, these retailers already sell new video games and use our services to help supply and merchandise dedicated pre-owned video game sections in their stores. Other retailers do not offer new video games, but utilize our solutions to sell pre-owned video games. Our retail customers include GameStop, Wal-Mart, Best Buy, Toys ‘R’ Us, 7-Eleven and others. |

| • | Consumer Direct. We sell pre-owned video games and related products directly to consumers through our proprietary channel, www.gamersfactory.com, which allows consumers to browse and purchase from our wide assortment of pre-owned video games and related products. We also sell pre-owned video games and related products directly to consumers through third party websites such as www.ebay.com and www.amazon.com. |

| • | Bulk. We provide “as-is” games and related products to video game retailers who possess their own refurbishment and store distribution capabilities. Our bulk sales help us efficiently manage our inventory position and working capital requirements by selling games in as-is condition, thereby eliminating refurbishment and accelerating the sales cycle. |

Growth Strategy

Our objective is to enhance our position as the leading provider of comprehensive trading solutions for the pre-owned video game market. Key elements of our growth strategy include:

| • | Capitalizing on the Large and Growing Market for Pre-Owned Games. Significant unmet demand exists from consumers seeking to purchase high quality pre-owned video games. We estimate that U.S. consumers possess more than 3.4 billion units of pre-owned video game products that are suitable for trading. We believe video game retailers are currently selling significantly more games than are being traded-in by consumers, which implies that the supply of pre-owned video games is growing. Utilizing GFI GameBook, we enable leading specialty, mass, convenience and online retailers, such as Best Buy and Toys ‘R’ Us, to accurately value and categorize pre-owned video games from consumers looking to monetize their existing video game collection. Our platform solution helps create a more consistent supply of pre-owned video games to sell through our various distribution channels. |

| • | Promoting the Concept of Game Trading to Casual Gamers. Over the past several years, game trading has become widely accepted within the core gamer market. These consumers understand that significant residual value exists in their video games after they have either beaten the game or lost interest in playing it further. Although casual gamers represent a large and growing portion of the overall market, they have yet to adopt game trading in the same manner as core gamers. By partnering with large, national retailers to promote the concept of game trading to casual gamers, we believe we can increase the awareness of game trading among casual gamers and by doing so, increase the overall size of the market as well as our market share in pre-owned video games. |

| • | Becoming the Foremost Buyer of Trade-in Video Games. Historically, our primary source of supply has been closeout and overstock programs and consumer returns. We believe the supply from retail trade-in |

4

Table of Contents

| and off-rental programs represents a much larger opportunity to acquire and ultimately resell higher margin products. As a result of our ability to accurately and competitively price products, we have become the pre-owned video game buyer of choice for many large retailers. |

| • | Expanding our Direct-To-Consumer Business. Our website, www.gamersfactory.com allows customers to trade-in and purchase pre-owned video games directly with us. Historically, we have not devoted a meaningful amount of our time to growing our direct-to-consumer business. We believe that there is a significant growth opportunity in the direct-to-consumer market, and we intend to allocate resources to expand our direct-to-consumer business in the future. |

| • | Evaluating International Expansion Opportunities. Many of our large participating retailers maintain a strong presence outside of the United States. We believe that as the concept of game trading becomes more widely accepted, there will be a significant opportunity for our products and services to be offered through our participating retailers’ locations as well as new retailers in other developed countries. We have, and will continue, to evaluate opportunities outside of the United States that we view as accretive to our core business. |

| • | Developing and Monetizing Complementary Products and Services. Our principals have an extensive operating history within the video game industry. We intend to leverage their experience and relationships in the industry to further develop products and services that are complementary to our core business. We are currently evaluating an opportunity to develop video game accessories under an exclusive license from a highly recognized developer of consumer electronic accessories, which would be sold primarily through our existing national retailer customer base. |

Proposed Changes to Our Capital Structure

Reverse Stock Split

We will effect a reverse stock split of our shares of common stock of 1-for-2 prior to, or upon, effectiveness of the registration statement of which this prospectus forms a part. No fractional shares will be issued in connection with the reverse stock split and all such fractional interests will be rounded up to the nearest whole number of shares of common stock. Issued and outstanding convertible securities, including shares of our series A convertible preferred stock, stock options and warrants will be split on the same basis and conversion and/or exercise prices will be adjusted accordingly. All information presented in this prospectus assumes a 1-for-2 reverse stock split of our outstanding shares of common stock, shares of series A convertible preferred stock, stock options and warrants, and unless otherwise indicated, all such amounts and corresponding conversion price and/or exercise price data set forth in this prospectus have been adjusted to give effect to the assumed reverse stock split.

Expected Conversion of Series A Preferred Stock

In connection with our February 2010 private placement, we issued shares of our series A convertible preferred stock. Upon the consummation of an underwritten public offering for gross proceeds of at least $10,000,000 at a per share price equal to at least $8.00 per share and provided all of the shares of common stock issuable upon conversion of our series A convertible preferred stock and upon exercise of the warrants to purchase shares of our common stock issued to the investors in our February 2010 private placement are registered or such registration requirement is waived, all outstanding shares of series A convertible preferred stock plus all accrued but unpaid dividends thereon shall automatically be converted into shares of our common stock at a conversion price of $4.00 per share. It is currently contemplated that all shares of our series A convertible preferred stock will convert into shares of our common stock as a part of this offering and, to the extent necessary, we will seek a waiver of the minimum per share requirement or any of the other conditions necessary to cause such automatic conversion to occur.

5

Table of Contents

Company History and Information

We were incorporated in the State of Delaware on August 28, 2006 under the name “City Language Exchange Incorporated.” In connection with a securities exchange agreement, or Exchange Agreement, on February 25, 2010, we changed our name to Game Trading Technologies, Inc. and acquired all of the issued and outstanding securities of Gamers Factory, Inc., a Maryland corporation (“Gamers”). As a result of the Exchange Agreement, Gamers became our wholly-owned subsidiary, with Gamers’ former stockholders acquiring a majority of the outstanding shares of our common stock. Gamers was incorporated in the State of Maryland on October 16, 2003 and remains our operating company.

Our principal executive offices are located at 10957 McCormick Road, Hunt Valley, Maryland 21031 and our telephone number is (410) 316-9900. Our website is www.gtti.com which contains a description of our company, but our website and the information contained on our website are not part of this prospectus. Please note that you should not view our website and the information contained on our website as part of this prospectus and should not rely on our website in making a decision to invest in our common stock.

6

Table of Contents

THE OFFERING

| Common stock offered by us in this offering |

2,000,000 shares (or 2,300,000 shares if the underwriters’ over-allotment option is exercised in full) |

| Common stock to be outstanding after this offering |

7,563,750 shares (or 7,863,750 shares if the underwriters’ over-allotment option is exercised in full) (1) |

| Use of proceeds |

Proceeds will be used primarily for working capital purposes in acquiring inventory, certain capital expenditures for automated warehouse operations and general corporate purposes. See “Use of Proceeds” below. |

| Risk factors |

An investment in our common stock involves a high degree of risk. You should carefully consider the information set forth in this prospectus and, in particular, the specific factors set forth in the “Risk Factors” section beginning on page 10 of this prospectus before deciding whether or not to invest in shares of our common stock. |

| Proposed NASDAQ Capital Market symbol |

“GTTI” |

| OTC Bulletin Board symbol |

“GMTD.OB” |

| (1) | Represents the number of shares of our common stock outstanding as of October 28, 2010, including 1,337,500 shares of our common stock issuable upon automatic conversion of our outstanding shares of series A convertible preferred stock and 81,250 shares of our common stock issued upon conversion of certain shares of our series A convertible preferred stock after September 30, 2010, but excludes: |

| • | Any shares of common stock that may be issuable in respect of any accrued but unpaid dividends upon the automatic conversion of our series A convertible preferred stock; |

| • | 1,418,750 shares of our common stock underlying outstanding warrants issued to the investors in our February 2010 private placement, which shares are being registered for resale under the Selling Securityholder Prospectus; |

| • | 505,000 shares of our common stock underlying other outstanding warrants at an exercise price between $1.30 and $5.00 per share that are being registered for resale under the Selling Securityholder Prospectus; |

| • | 75,000 shares of our common stock underlying outstanding warrants at an exercise price between $1.30 and $5.00 per share that are not being registered for resale under the Prospectus or the Selling Securityholder Prospectus; and |

| • | 717,000 shares of our common stock underlying outstanding options that are not being registered for resale under the Prospectus or the Selling Securityholder Prospectus. |

7

Table of Contents

SUMMARY CONSOLIDATED FINANCIAL DATA

The following tables set forth our summary statement of operations data for the fiscal years ended December 31, 2009 and 2008, for the nine months ended September 30, 2010 and 2009, and our summary balance sheet data as of September 30, 2010. Our statement of operations data for the fiscal years ended December 31, 2009 and 2008 were derived from our audited consolidated financial statements included elsewhere in this prospectus. Our statement of operations data for the nine months ended September 30, 2010 and 2009 and our balance sheet data as of September 30, 2010 were derived from our unaudited interim consolidated financial statements included elsewhere in this prospectus. In the opinion of management, the unaudited interim consolidated financial statements have been prepared on the same basis as the audited consolidated financial statements and include all adjustments, consisting of only normal recurring adjustments, necessary for a fair presentation of our operating results and financial position for those periods and as of such dates. The results for any interim period are not necessarily indicative of the results that may be expected for a full year.

The results indicated below and elsewhere in this prospectus are not necessarily indicative of our future performance. You should read this information together with “Description of Capital Stock”, “Management’s Discussion and Analysis of Financial Condition and Results of Operations”, our consolidated financial statements and related notes and our unaudited condensed consolidated financial statements and related notes included elsewhere in this prospectus.

| Year Ended December 31, | Nine Months Ended September 30, |

|||||||||||||||

| 2008 | 2009 | 2009 | 2010 | |||||||||||||

| Statement of Operations Data: |

||||||||||||||||

| Net sales |

$ | 17,122,540 | $ | 36,700,731 | $ | 27,867,603 | $ | 27,138,605 | ||||||||

| Cost of sales |

13,388,536 | 30,684,084 | 23,212,718 | 22,759,924 | ||||||||||||

| Gross profit |

3,734,004 | 6,016,647 | 4,654,885 | 4,378,681 | ||||||||||||

| Operating expenses |

3,253,423 | 4,290,550 | 2,383,364 | 6,855,347 | ||||||||||||

| Operating income (loss) |

480,581 | 1,726,097 | 2,271,520 | (2,476,666 | ) | |||||||||||

| Other income (expenses) |

— | 14,401 | (579,578 | ) | (59,981 | ) | ||||||||||

| Income tax |

10,254 | — | — | — | ||||||||||||

| Net income (loss) from continuing operations |

470,327 | 1,740,498 | 1,691,943 | (2,536,646 | ) | |||||||||||

| Discontinued operations: |

||||||||||||||||

| Loss from discontinued operation |

144,828 | — | 90,656 | — | ||||||||||||

| Net income (loss) |

$ | 325,499 | $ | 1,740,498 | $ | 1,601,287 | $ | (2,536,646 | ) | |||||||

| Earnings (loss) per share: |

||||||||||||||||

| Basic |

$ | 0.09 | $ | 0.49 | $ | 0.45 | $ | (0.63 | ) | |||||||

| Diluted |

$ | 0.09 | $ | 0.49 | $ | 0.45 | $ | (0.63 | ) | |||||||

| Adjusted EBITDA(1) |

$ | 1,149,702 | $ | 2,483,034 | $ | 2,325,343 | $ | 854,194 | ||||||||

| As of September 30, 2010 | ||||||||||||||||

| Actual | As Adjusted (2) | |||||||||||||||

| Balance Sheet Data: |

||||||||||||||||

| Cash and cash equivalents |

|

$ | 411,003 | $ | 14,268,003 | |||||||||||

| Working capital (deficit) |

|

4,441,478 | 18,298,478 | |||||||||||||

| Total assets |

|

14,162,519 | 28,019,519 | |||||||||||||

| Total liabilities |

|

9,390,542 | 9,390,542 | |||||||||||||

| Redeemable preferred stock, Series A |

|

674,839 | — | |||||||||||||

| Accumulated deficit |

|

(4,179,707 | ) | (4,179,707 | ) | |||||||||||

| Total shareholders’ equity (deficit) |

|

4,097,138 | 18,628,977 | |||||||||||||

| (1) | See description of “Adjusted EBITDA” below. |

8

Table of Contents

| (2) | Our consolidated as adjusted balance sheet data as of September 30, 2010 gives effect to the issuance and sale of 2,000,000 shares of common stock by us in this offering (excluding the underwriters’ over-allotment option), assuming an initial public offering price of $7.70 per share, the closing price of our common stock on the OTC Bulletin Board as of October 28, 2010 (after giving effect to the proposed reverse split), the issuance of 1,337,500 shares of our common stock issuable upon automatic conversion of our outstanding shares of series A convertible preferred stock upon completion of the offering, and 81,250 shares of our common stock issued upon conversion of certain shares of our series A convertible preferred stock after September 30, 2010, after deducting estimated underwriting discounts, commissions and estimated offering expenses payable by us. |

ADJUSTED EBITDA

Earnings Before Interest, Taxes, Depreciation and Amortization, or EBITDA, as adjusted in accordance with the table below, is a key indicator used by our management to evaluate operating performance of our company and to make decisions regarding compensation and other operational matters. While this adjusted EBITDA is not intended to replace any presentation included in these consolidated financial statements under generally accepted accounting principles, or GAAP, and should not be considered an alternative to operating performance or an alternative to cash flow as a measure of liquidity, we believe this measure is useful to investors in assessing our performance in comparison with other companies in our industry. This calculation may differ in method of calculation from similarly titled measures used by other companies. We compensate for these limitations by relying primarily on our GAAP results and using Adjusted EBITDA only as supplemental information.

| Twelve Months Ended December 31, |

Nine Months Ended September 30, |

|||||||||||||||

| 2008 | 2009 | 2009 | 2010 | |||||||||||||

| Net income (loss), as reported |

$ | 325,499 | $ | 1,740,498 | $ | 1,601,287 | $ | (2,536,646 | ) | |||||||

| Net income (loss) from discontinued operations |

$ | (144,828 | ) | $ | — | $ | (90,656 | ) | $ | — | ||||||

| Net income (loss) from continuing operations |

$ | 470,327 | $ | 1,740,498 | $ | 1,691,943 | $ | (2,536,646 | ) | |||||||

| Interest expense, net |

$ | 602,285 | $ | 669,746 | $ | 579,578 | $ | 106,473 | ||||||||

| Depreciation and amortization |

$ | 77,090 | $ | 72,790 | $ | 53,822 | $ | 59,800 | ||||||||

| EBITDA attributed to continuing operations |

||||||||||||||||

| Adjustments: |

||||||||||||||||

| Amortization of stock-based compensation |

$ | — | $ | — | $ | — | $ | 3,224,567 | ||||||||

| Adjusted EBITDA |

$ | 1,149,702 | $ | 2,483,034 | $ | 2,325,343 | $ | 854,194 | ||||||||

9

Table of Contents

Investing in our common stock involves a high degree of risk. Prospective investors should carefully consider the risks described below and other information contained in this prospectus before purchasing shares of our common stock. There are numerous and varied risks, including those described below, that may prevent us from achieving our goals. If any of the risks described below or any other risks actually occur, our business, financial condition, liquidity, results of operations, cash flow or prospects may be materially adversely affected. If this were to happen, the trading price of our common stock could decline significantly and investors in our common stock might lose all or a part of their investment.

Risks Relating to Our Business and Industry

Our limited operating history makes it difficult to evaluate our future business prospects and to make decisions based on our historical performance.

Although our management team has been engaged in the video game industry for an extended period of time, we did not begin focusing on the pre-owned video game wholesale and trading business until 2003 and we did not restrict our operations to this business until 2007. We have a limited operating history focusing on the pre-owned video game wholesale and trading business, which makes it difficult to evaluate our business on the basis of historical operations. As a consequence, it is difficult, if not impossible, to forecast our future results of operations and prospects based upon our historical data. Reliance on our historical results may not be representative of the operating results we will achieve. Because of the uncertainties relating to our lack of historical operations, we may be hindered in our ability to anticipate and timely adapt to increases or decreases in sales, product costs or expenses. If we make poor budgetary decisions as a result of unreliable historical data, we could be less profitable than planned or incur unexpected losses, which may result in a decline in our stock price.

We may not be able to grow our net sales and we may not be able to regain and maintain profitability.

We generated net sales and net income of $36.7 million and $1.7 million, respectively for the year ended December 31, 2009 compared to $17.1 million and $0.3 million for the year ended December 31, 2008. For the nine months ended September 30, 2010, we generated net sales of $27.1 million and incurred a net loss of $2.5 million compared to net sales of $27.9 million and net income $1.6 million for the nine months ended September 30, 2009. Our business plan is to grow both net sales and net income, however, we may not be successful in executing our business plan and even if we are able to implement our business plan, we may not be able to grow our business. As a result, we may not be able to sustain our recent net sales growth rate and you should not rely on the net sales and net income growth of any prior quarterly or annual period as an indication of our future performance. If we are unable to increase our net sales or if our net sales were to decline, it would adversely affect our business, profitability and financial condition. In addition, if our future growth fails to meet investor or analyst expectations, it could have a negative effect on our stock price.

A significant portion of our revenue is dependent upon a small number of customers, and in particular, GameStop, our largest customer. The loss of any one of these customers would negatively impact our revenues and our results of operations.

Our sales to our top five customers accounted for approximately 94% and 60% of our net sales for the years ended December 31, 2009 and December 31, 2008, respectively, and approximately 89% and 94% of our net sales for the nine months ended September 30, 2010 and 2009, respectively. Our sales to our largest customer, GameStop, accounted for approximately 78% and 3% of our net sales for the years ended December 31, 2009 and 2008, respectively, and approximately 69% and 75% of our net sales for the nine months ended September 30, 2010 and 2009, respectively. Contractual relationships with our major customers do not guarantee sales volumes or longevity. Consequently, our relationship with our major customers could change at any time. Our business, results of operations and financial condition would be materially and adversely affected if:

| • | we lose GameStop or any of our other major customers; |

10

Table of Contents

| • | GameStop or any of our other major customers purchase fewer of our products; or |

| • | we experience any other adverse change in our relationship with GameStop or any of our other major customers. |

Restrictions on our ability to take trade-ins of and sell pre-owned video game products could negatively affect our financial condition and results of operations.

Our financial results depend on our ability to take trade-ins of, and sell, pre-owned video game products. Actions by manufacturers or publishers of video game products or governmental authorities to limit our ability to take trade-ins or sell pre-owned video game products could have a negative impact on our sales and earnings. On September 10, 2010, the United States Court of Appeals, Ninth Circuit, held in Timothy S. Vernor v. Autodesk, Inc. that a software publisher can prohibit buyers of its software from reselling the software program to other users. If this ruling becomes accepted law and permits game publishers to require consent to resell their products, then we could have to stop selling certain video games or pay to have the right to do so, which could negatively impact our business.

If we are unable to obtain favorable terms from our suppliers, we may not be able to offer products at competitive prices and our financial results may be adversely affected.

We source our products, either pre-owned or new, from our four primary procurement channels, which consist of trade-in programs with participating retailers, off-rental programs, consumer return programs and closeout and overstock programs. Our financial results depend significantly upon the business terms we can obtain from suppliers within each of these procurement channels, primarily competitive prices and consistent availability. We do not have fixed or guaranteed contracts for these purchases. If our suppliers within these procurement channels do not provide us with favorable business terms, we may not be able to offer products to our customers at competitive prices and our financial results may be adversely affected.

Our guaranteed purchase contracts with retailers for trade-in programs could affect our liquidity.

We have certain contracts that require us, as part of a retail trade-in program, to purchase consumer trade-ins from such participating retailer based upon values we quote at the time of the transaction. The participating retailer generally offers the consumer a gift card or some other form of compensation, and books the transaction automatically as a receivable from us. We are obligated to purchase 100% of the items that are transacted at store level or via its website. If there is an unanticipated volume of trades that we are unable to mitigate through lower trade values or other mechanisms, we could incur trade payables that exceed our short-term cash resources, thus resulting in a default on payment to our retail customers.

If the products that we offer do not reflect our customers’ tastes and preferences, our net sales and profit margins could decrease.

Our success depends in part on our ability to offer products and services that reflect consumers’ tastes and preferences. Consumers’ tastes are subject to frequent, significant and sometimes unpredictable changes. Because the pre-owned video games and related products we sell are sourced from our four primary procurement channels, which include trade-ins from participating retailers, consumer returns and manufacturers’ and retailers’ excess inventory, we have limited control over the specific products that we offer for sale. If the merchandise we offer for sale fails to respond to changes in customer preferences, our sales could suffer and we could be required to mark down unsold inventory, which could depress profit margins, or we could be required to accept returned merchandise in exchange for full credit which could depress net sales and profit margins. In addition, any failure to offer products and services in line with customers’ preferences could allow competitors to gain market share, which could harm our business, results of operations and financial condition.

11

Table of Contents

We are heavily dependent on our senior management, and a loss of a member of our senior management team or our failure to attract, assimilate and retain other highly qualified personnel in the future, could harm our business.

If we lose members of our senior management, we may not be able to find appropriate replacements on a timely basis, and our business could be adversely affected. Our existing operations and continued future development depend to a significant extent upon the performance and active participation of certain key individuals, including Todd Hays, our Chief Executive Officer and President, Rodney Hillman, our Chief Operating Officer, and Richard Leimbach, our Chief Financial Officer. Although we have entered into three-year employment agreements with them, we cannot guarantee that we will be successful in retaining the services of these or other key personnel. If we were to lose any of these individuals, we may not be able to find appropriate replacements on a timely basis and our financial condition and results of operations could be materially adversely affected.

In addition, to execute our growth plan, we must attract and retain highly qualified personnel. Competition for these employees is intense, and we may not be successful in attracting and retaining qualified personnel. We could also experience difficulty in hiring and retaining highly skilled employees with appropriate qualifications. Many of the companies with which we compete for experienced personnel have greater resources than we have. In addition, in making employment decisions, particularly in the Internet and high-technology industries, job candidates often consider the value of the stock options they are to receive in connection with their employment. Accounting principles generally accepted in the United States relating to the expensing of stock options may discourage us from granting the size or type of stock option awards that job candidates may require to join our company. If we fail to attract new personnel, or fail to retain and motivate our current personnel, our business and future growth prospects could be severely harmed.

If we fail to keep pace with changing technology in the video game industry, we will be at a competitive disadvantage.

The video game industry is characterized by swiftly changing technology, evolving industry standards, frequent new and enhanced product introductions and product obsolescence. These characteristics require us to respond quickly to technological changes and to understand their impact on our customers’ preferences. If we fail to keep pace with these changes, our business may suffer.

The ability to download and play video games on the Internet could reduce the demand for pre-owned video games and thus result in lower net sales and reduced profitability.

While it is currently only possible to download a limited selection of video game content to current video game systems over the Internet, as technology advances, a broader selection of games may become available for purchase, download and/or play on the Internet. If advances in technology continue to expand consumers ability to access video games and incremental content through the Internet, the demand for purchasing video games for sale in our customers’ retail stores may decline, which could lead to lower net sales by us of pre-owned video games to our retail customers and thus reduce our profitability.

Shipment of pre-owned video games and other related products by us could be delayed or disrupted by factors beyond our control and we could lose suppliers and customers as a result.

We rely upon third party carriers such as United Parcel Services, or UPS, for timely delivery of our pre-owned video games and other related products. As a result, we are subject to carrier disruptions and increased costs due to factors that are beyond our control, including labor difficulties, inclement weather, terrorist activity and increased fuel costs. In addition, we do not have a long-term agreement with UPS or any other third party carrier, and we cannot be sure that our relationship with UPS will continue on terms favorable to us, if at all. If our relationship with UPS is terminated or impaired or if UPS is unable to deliver pre-owned video games and other related products for us, we would be required to use alternative carriers for the shipment of products to our

12

Table of Contents

customers. We may be unable to engage alternative carriers on a timely basis or on terms favorable to us, if at all. Potential adverse consequences include:

| • | reduced visibility of order status and package tracking; |

| • | delays in merchandise receipt and delivery; |

| • | increased cost of shipment; and |

| • | reduced shipment quality, which may result in damaged merchandise. |

Any failure to receive pre-owned video games and other related products purchased by us at our distribution center or to deliver such pre-owned video games and other related products to our customers in a timely and accurate manner could lead to client dissatisfaction and cause us to lose suppliers and customers.

If we fail to accurately predict our ability to sell pre-owned video games and other related products in which we take inventory risk, our margins may decline as a result of lower sale prices from such pre-owned video games and other related products.

We purchase pre-owned video games and other related products and assume the risk that the pre-owned video games and other related products purchased by us may sell for less than we paid for it. We assume general and physical inventory and credit risk. These risks are especially significant because some of the products we sell are subject to rapid technological change, obsolescence and price erosion, and because we sometimes make large purchases of particular types of inventory. In addition, we do not receive warranties on the products we purchase and, as a result, we may not be able to resell those products or may have to resell those products at a loss or dispose of those products. We may miscalculate customer demand and overpay for the acquired merchandise. In the event that merchandise is not attractive to our customer base, we may be required to take significant losses resulting from lower sale prices, which could reduce our revenue and margins. Occasionally, we are not able to sell our inventory for amounts above its cost and we may incur a loss.

If one or more states successfully assert that we should collect sales or other taxes on the sale of our pre-owned video games and other related products or the pre-owned video games and other related products of third parties that we offer for sale on our websites, our business could be harmed.

We pay sales or other similar taxes in respect of shipments of products into states in which we have a substantial presence. In addition, as we grow our business, any new operation in states in which we currently do not pay sales taxes could subject shipments into such states to state sales taxes under current or future laws.

In October 2007, the federal government extended until November 2014 a ban on state and local governments’ imposition of new taxes on Internet access or electronic commerce transactions. This ban does not prohibit federal, state or local authorities from collecting taxes on our income or from collecting taxes that are due under existing tax rules. Unless the ban is further extended, state and local governments may begin to levy additional taxes on Internet access and electronic commerce transactions upon the legislation’s expiration. An increase in taxes may make electronic commerce transactions less attractive for merchants and businesses, which could result in a decrease in the level of demand for our services.

Currently, decisions of the U.S. Supreme Court restrict the imposition of obligations to collect state and local sales and use taxes with respect to sales made over the Internet. However, a number of states, as well as the U.S. Congress, have been considering various initiatives that could limit or supersede the Supreme Court’s position regarding sales and use taxes on Internet sales. If any of these initiatives resulted in a reversal of the Supreme Court’s current positions, we could be required to collect sales and use taxes in states other than states in which we currently pay such taxes. A successful assertion by one or more local, state or foreign jurisdictions

13

Table of Contents

that the sale of merchandise by us is subject to sales or other taxes, could subject us to material liabilities and increase our costs of doing business. To the extent that we pass such costs on to our clients, doing so could harm our business and decrease our revenue.

Since all of our operations are housed in a single location, we are more susceptible to business interruption in the event of damage to or disruptions in our facility.

Our headquarters and distribution center are located in one building in Hunt Valley, Maryland, and all of our shipments of pre-owned video games and other related products to our customers are made from this sole distribution center. We have no present plans to establish any additional distribution centers or offices. Because we consolidate our operations in one location, we are more susceptible to power and equipment failures, and business interruptions in the event of fires, floods, and other natural disasters than if we had additional locations. We cannot assure you that we are adequately insured to cover the amount of any losses relating to any of these potential events, business interruptions resulting from damage to or destruction of our headquarters and distribution center, or power and equipment failures relating to our websites, or interruptions or disruptions to major transportation infrastructure, or other events that do not occur on our premises. The occurrence of one or more of these events could adversely impact our ability to generate revenues in future periods.

An adverse trend in sales during the holiday season could impact our financial results.

Our business is seasonal, with our most significant sales and operating profits realized during the first fiscal quarter (post-holiday season), which is when significant volumes of consumer returns become available for purchase and sale by us. Since our main customers are retailers which rely on the fourth quarter holiday selling season to generate their revenues, our operating results may be negatively impacted if our customers’ revenue during the fourth quarter is lower than expected, as that may result in our retail customers’ reducing, delaying or cancelling purchases of pre-owned video games and other related products.

If third parties do not continue developing new products and software, our business and operating results could be adversely affected.

Our business and operating results depend upon the continued development of new and enhanced video game platforms and video game software. Our business could suffer if manufacturers fail to develop new or enhanced video game platforms or the failure of software publishers to develop popular game and entertainment titles for current or future generation video game systems.

If our management information systems fail to perform or are inadequate, our ability to manage our business could be disrupted.

We rely on computerized inventory and management systems to coordinate and manage the activities in our distribution center, as well as to communicate daily pricing data to retailers and other customers with whom we work. We use our management information systems to track sales and inventory. Our ability to rapidly refurbish our products, process incoming inventory and deliver inventory to our customers, enables us to meet demand and replenish our customers timely and to move inventory efficiently. If our inventory or management information systems fail to adequately perform these functions, our business could be adversely affected. In addition, if operations in our distribution center were to shut down for a prolonged period of time or if our distribution center was unable to accommodate our continued growth, our business could suffer.

We rely heavily on our technology to refurbish games, hardware and accessories and to manage other aspects of our operations, and the failure of this technology to operate effectively could adversely affect our business.

We use proprietary and non-proprietary technologies to refurbish pre-owned video games and other related products to determine the price at which we purchase pre-owned video games and other related products and to

14

Table of Contents

price the sale of our pre-owned video games and other related products. Although we continually enhance and modify the technology used by us in our operations, we may not be able to achieve the intended results of such enhancements and modifications to our technologies. If we are unable to maintain and enhance our technologies to manage our operations in a timely and efficient manner, our business may be impaired.

If our intellectual property and technologies are not adequately protected to prevent use or misappropriation by our competitors, the value of our brand and other intangible assets may be diminished, and our business may be materially and adversely affected.

Our future success and competitive position depends in part on our ability to protect our proprietary technologies and intellectual property. We have generally not sought trademark, copyright or patent protection to protect our proprietary technology and intellectual property, with the exception of GFI GameBook, our proprietary algorithm and database. Instead, we have relied on a combination of trade secret laws and confidentiality arrangements to protect our proprietary technologies and intellectual property.

The steps we have taken or will take may not be adequate to protect our technologies and intellectual property. In addition, others may develop or patent similar or superior technologies, products or services, and our intellectual property may be challenged, invalidated or circumvented by others. Furthermore, the intellectual property laws of other countries in which we operate or may operate in the future may not protect our products and intellectual property rights to the same extent as the laws of the United States. The legal standards relating to the validity, enforceability and scope of protection of intellectual property rights in the video game industry are uncertain and still evolving, both in the United States and in other countries. In addition, third parties may knowingly or unknowingly infringe our intellectual property rights, and litigation may be necessary to protect and enforce our intellectual property rights. Any such litigation could be very costly, have an uncertain outcome and could divert management attention and resources. As a result of any dispute where we are alleged to have infringed or violated a third party’s intellectual property rights, we may have to develop non-infringing technology, pay damages, enter into royalty or licensing agreements, cease providing certain products or services, adjust our merchandizing or marketing and advertising activities or take other actions to resolve the claims. If the protection of our technologies and intellectual property is inadequate to prevent use or misappropriation by third parties, the value of our brand and other intangible assets may be diminished and competitors may be able to more effectively mimic our products and methods of operation. Any of these events may have a material adverse effect on our business, financial condition and results of operations.

We also expect that the more successful we are, the more likely it will become that competitors will try to develop services that are similar to ours, which may infringe on our proprietary rights. It may also become more likely that competitors will claim that our products infringe on their proprietary rights. If we are unable to protect our proprietary rights or if third parties independently develop or gain access to our or similar technologies, our business, revenue, reputation and competitive position could be harmed.

If we are unable to protect our domain name, our reputation and brand could be adversely affected.

We currently own registrations for various domain names relating to our brand, including www.gtti.com, www.gamersfactory.com and www.gametradingtechnologies.com. Failure to protect our domain names could adversely affect our reputation and brand and make it more difficult for users to find our website and our service. Domain names similar to ours have been registered in the United States and elsewhere. The acquisition and maintenance of domain names generally are regulated by various agencies and their designees. However, the relationship between regulations governing domain names and laws protecting trademarks and similar proprietary rights varies from jurisdiction to jurisdiction and is unclear in some jurisdictions. The regulation of domain names in the United States may change in the near future. Governing bodies may establish additional top-level domains, appoint additional domain name registrars or modify the requirements for holding domain names. As a result, we may be unable to acquire or maintain relevant domain names. We may be unable, without significant cost or at all, to prevent third parties from acquiring domain names that are similar to, infringe upon or otherwise decrease the value of our domain names.

15

Table of Contents

We may not adequately prevent disclosure of trade secrets and other proprietary information.

A substantial amount of our tools and technologies are protected by trade secret laws. In order to protect our proprietary technologies and processes, we rely in part on security measures. These measures may not effectively prevent disclosure of confidential information, including trade secrets, and may not provide an adequate remedy in the event of unauthorized disclosure of confidential information. We could potentially lose future trade secret protection if any unauthorized disclosure of such information occurs. In addition, others may independently discover our trade secrets and proprietary information, and in such cases we could not assert any trade secret rights against such parties. Laws regarding trade secret rights in certain markets in which we operate may afford little or no protection to our trade secrets. The loss of trade secret protection could make it easier for third parties to compete with our products by copying functionality. In addition, any changes in, or unexpected interpretations of trade secret and other intellectual property laws may compromise our ability to enforce our trade secret and intellectual property rights. Costly and time-consuming litigation could be necessary to enforce and determine the scope our proprietary rights, and failure to obtain or maintain trade secret protection could adversely affect our business, revenue, reputation and competitive position.

We must effectively manage the growth of our operations or our company will suffer.

Our ability to successfully implement our business plan requires an effective planning and management process. We intend to use a portion of the proceeds of this offering to increase the scope of our operations and may seek to acquire complimentary businesses or technologies. As we grow our operations, we will need to hire additional employees and make significant capital investments which could place a significant strain on our existing management and resources. In addition, we will need to improve our financial and managerial controls and reporting systems and procedures, and we will need to expand, train and manage our workforce. Any failure to manage any of the foregoing areas efficiently and effectively could cause our business and operations to suffer.

If we acquire any businesses or technologies in the future, they could prove difficult to integrate, disrupt our business, dilute stockholder value or have an adverse effect on our results of operations.

As part of our business strategy, we may engage in acquisitions of businesses, technologies or licenses involving complimentary businesses to augment our organic or internal growth. While our management team has some experience in acquiring businesses, we do not have extensive experience with integrating and managing acquired businesses or assets. Acquisitions involve challenges and risks in negotiation, execution, valuation and integration. Moreover, we may not be able to find suitable acquisition opportunities on terms that are acceptable to us. Even if successfully negotiated, closed and integrated, certain acquisitions or license arrangements may not advance our business strategy, may fall short of expected return-on-investment targets or may fail. Any future acquisition or license arrangements could involve numerous risks including:

| • | difficulty integrating the operations and products of the acquired business; |

| • | potential disruption of our ongoing business and distraction of management; |

| • | use of cash to fund the acquisition or for unanticipated expenses; |

| • | dilution to our current stockholders from the issuance of equity securities; |

| • | limited market experience in new businesses; |

| • | exposure to unknown liabilities, including litigation against the companies we may acquire; |

| • | potential loss of key employees or customers of the acquired company; |

16

Table of Contents

| • | additional costs due to differences in culture, geographic locations and duplication of key talent; and |

| • | acquisition-related accounting charges affecting our balance sheet and operations. |

In the event we enter into any agreements relating to acquisitions or licenses, closing of the transactions could be delayed or prevented by regulatory approval requirements, including antitrust review, or other conditions. We may not be successful in addressing these risks or any other problems encountered in connection with any attempted acquisitions or license arrangements, and we could assume the economic risks of such failed or unsuccessful acquisitions or license arrangements.

Our results of operations may fluctuate from quarter to quarter, which could affect our business, financial condition and results of operations.

Our quarterly operating results are tied to certain financial and operational metrics that have fluctuated in the past and may fluctuate significantly in the future. As a result, you should not rely upon our past quarterly operating results as indicators of future performance. Our operating results depend on numerous factors, many of which are outside of our control. In addition to the other risks described in this “Risk Factors” section, the following risks could cause our operating results to fluctuate:

| • | increases or decreases in purchases by our customers; |

| • | our ability to retain existing customers and attract new customers; |

| • | timing and cost of new and existing marketing and advertising efforts; |

| • | seasonal fluctuations; |

| • | timing and amount of operating costs and capital expenditures relating to expansion of our business, operations and infrastructure; |

| • | the cost and timing of the development and introduction of new product and service offerings by our competitors or by us; and |

| • | downward pressure on the pricing of our products. |

For these or other reasons, the results of any prior quarterly or annual periods should not be relied upon as indications of our future performance and our revenue and operating results in future quarters may differ materially from the expectations of our management or any analysts covering us.

Our sales and profitability may be affected by changes in economic, business and industry conditions.

If the economic climate in the United States or abroad deteriorates, existing or potential customers could reduce or delay purchases of video games, which would likely decrease our sales and profitability. In this type of economic environment, our customers may experience financial difficulty, cease operations and reduce budgets for the purchase of our products. This may lead to longer sales cycles, delays in purchase decisions, payment and collection, and can also result in downward price pressures, causing our sales and profitability to decline. In addition, general economic uncertainty and general declines in consumer spending in the video game industry make it difficult to predict changes in the purchasing requirements of our customers and in the markets we serve. There are many other factors which could affect our business, including:

| • | the introduction and market acceptance of new technologies, products and services, including an increased ability to access video games digitally or play video games online; |

| • | new competitors and new forms of competition; |

| • | the size and timing of customer orders; |

| • | adverse changes in the credit quality of our customers and suppliers; |

17

Table of Contents

| • | changes in the pricing policies of, or the introduction of, new products and services by us or our competitors; |

| • | changes in the terms of our contracts with our customers or suppliers; |

| • | the availability of products from our suppliers; and |

| • | variations in product costs and the mix of products sold. |

These trends and factors could adversely affect our business, profitability and financial condition and diminish our ability to achieve our strategic objectives.

We face competition from numerous sources and competition may increase, leading to a decline in revenues.