Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - TESSERA TECHNOLOGIES INC | d8k.htm |

| EX-99.1 - PRESS RELEASE - TESSERA TECHNOLOGIES INC | dex991.htm |

Exhibit 99.2

Q3 2010 Earnings Prepared Remarks

Summary Results

The third quarter of 2010 was a record revenue quarter, excluding settlements, for Tessera. Total revenue for the third quarter of 2010 was $82.1 million, up 24% from the third quarter of 2009 and 10% from the second quarter of 2010. Micro-electronics revenue was $72.0 million and Imaging & Optics revenue was $10.1 million, of which $6.1 million was products and services.

GAAP net income for the third quarter of 2010 was $19.0 million, or $0.38 per share. Non-GAAP net income was $27.0 million, or $0.52 per share.

Cash, cash equivalents, and investments increased $36.2 million during the third quarter of 2010, resulting in $474.0 million at the end of the quarter.

Segment Review

Micro-electronics

In our Micro-electronics division, we develop, license and deliver advanced integrated circuit (IC) packaging solutions that are primarily used in the mobile wireless device and DRAM markets. Our chip scale packaging (CSP) and multi chip packaging (MCP) solutions play a significant role in these growing markets, which in turn creates growth in our Micro-electronics royalties. Gartner Dataquest forecasts mobile wireless devices, such as smart phones, are expected to grow approximately 45% in 2010 over 2009, in terms of units shipped. Gartner Dataquest also forecasts that the DRAM market will grow approximately 25% in 2010 over 2009. As a reminder, two major Tessera DRAM licensees have volume pricing adjustments that will cause our aggregate annual DRAM royalty revenue to grow less rapidly than DRAM shipments in the overall DRAM segment.

In the third quarter, Fujitsu, a long-standing Tessera licensee, renewed its agreement covering a broad range of CSPs and MCPs.

1

In order to protect our intellectual property, we recently filed two lawsuits. On September 30th, we filed a complaint in the United States District Court for the Northern District of California against UTAC (Taiwan) Corporation alleging breach of contract, breach of the covenant of good faith and fair dealing, and seeking declaratory relief. To avoid confusion, please note that UTAC (Taiwan) Corporation is not covered by the license agreement between Tessera and United Test and Assembly Center Ltd., also known as UTAC, which was announced on March 1, 2010.

On October 1st, we filed a patent infringement lawsuit against Sony and Renesas Electronics Corporation (the merged entity of NEC Electronics and Renesas Technology Corp.) in the United States District Court for the District of Delaware. We invest tens of millions of R&D dollars every year and believe strongly in protecting our inventions by filing patent applications and licensing the resulting patents to those who use our IP. We attempted to reach amicable renewals with these two licensees for their use of our patented technology. When they failed to renew, while continuing to ship the same products that incorporate our semiconductor packaging IP, we were forced to bring the matter to court.

A significant focus of our R&D resources is expanding our semiconductor packaging IP portfolio in the areas of flip chip, Through Silicon Via (TSV) and 3D packaging, for our served DRAM and mobile wireless device markets.

In addition to development efforts in advanced packaging, we are focused on thermal management, with development of our silent air cooling technology. OEMs in the ultra thin elite laptop market are working on devices that are thinner than many smart phones available to consumers today. This is our first target market due to the need for new forms of cooling for these very thin designs. We are pleased with the progress of our efforts as the interest in our silent air cooling technology continues to grow.

Imaging & Optics

Through internal development and acquisitions, we have created innovative Imaging & Optics technologies and core competencies, including the ability to design and deliver differentiated solutions using specialty optics design and image processing. Today, our primary market is camera phones, of which more than 1.3 billion units are expected to ship in 2010, according to Techno Systems Research. Camera phones and Digital Still Cameras capable of still as well as video image processing are gaining market share. We are positioned to benefit from this growth through our Video Tools technology. Yesterday, we announced that Fujitsu licensed our Video Tools hardware acceleration technology for use in its Milbeaut chipsets for both markets.

2

Near term, we have three differentiated solutions that are key growth drivers – Extended Depth of Field (EDOF), Zoom and Micro Electro Mechanical System (MEMS).

We began generating EDOF royalties in the first quarter of 2010. Our EDOF royalties will grow as EDOF technology is utilized in greater numbers of camera phones and additional devices such as tablets. We believe more than 120 million camera phones will feature EDOF in 2011, almost triple the market anticipated for 2010.

We are on track to sign our first Zoom licensee in the fourth quarter. Today, the two gating factors for adoption of optical zoom technology in camera phones is that traditional mechanical zoom is too thick for smart phone form factor and is also very expensive. Our innovative Zoom technology is approximately 1/3 the height and less than 20% of the cost of conventional mechanical zoom. We believe the size and cost benefits of our Zoom will increase the served available market opportunity to over 150 million units by 2013, compared to the 5 million unit optical zoom market predicted by industry analysts such as Techno Systems Research.

With regard to MEMS, we are commercializing our much improved Gen 2 Auto-Focus module. Our Gen 2 product is smaller and faster than our Gen 1 product, and has significant advantages over the widely used Voice Coil Motor (VCM) in terms of speed and power consumption, which is especially important for the increasing demand for mobile video applications. As compared to our licensing strategy with EDOF and Zoom, we plan to sell our MEMS products and outsource their manufacture. We believe our MEMS-based Auto-Focus and Auto-Focus plus Shutter modules will be significant revenue growth drivers starting in 2011. Our target market, namely camera phones, is expected to grow from approximately 300 million units in 2011 to more than 630 million units in 2013, according to Yole.

As we shared with you in our Second Quarter 2010 earnings report, our outlook for Wafer-Level Optics royalties has been negatively impacted by slower than anticipated market adoption due to pricing of competitive technology declining faster than expected. We believe continued investment in Wafer-Level Optics for camera modules is no longer justified given the diminished revenue opportunity for this technology under a license and royalty business model, and accordingly we are no longer pursuing further development of this Wafer-level Optics camera technology. We will continue to support, for a period of time, our two licensees, Nemotek and Q-Tech, in their commercialization of Wafer-Level Optics. We will, however, no longer pursue additional licensees for Wafer-Level Optics.

3

Patent Portfolio Review

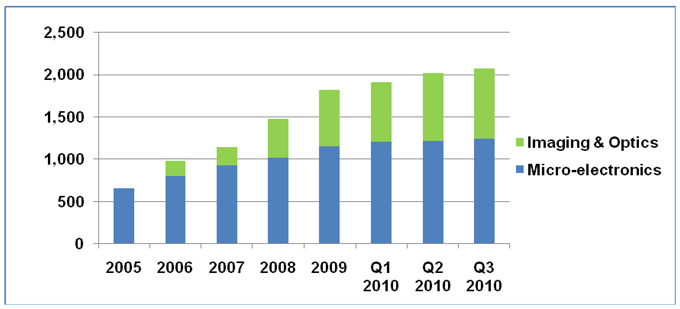

We continue to foster innovation and dedicate significant resources to inventing new technology. High-quality patents are the international currency of IP. As of September 30, 2010, our patent portfolio totaled over 2,075 domestic and international patents and patent applications. Roughly 1,240 of our patents and patent applications are for technologies in our Micro-electronics segment. Approximately 835 patents and patent applications are for technologies in our Imaging & Optics segment. We are committed to the continued growth of a high quality patent portfolio.

4

Financial Discussion

Revenue

| Q3 2010 | Q3 2009 | Y-o-Y % | Q2 2010 | Q-o-Q % | ||||||||||||||||

| Total Revenue |

$ | 82.1 | $ | 66.1 | 24 | % | $ | 74.6 | 10 | % | ||||||||||

| Micro-electronics |

$ | 72.0 | $ | 59.1 | 22 | % | $ | 65.1 | 11 | % | ||||||||||

| Imaging & Optics |

$ | 10.1 | $ | 7.0 | 42 | % | $ | 9.5 | 6 | % | ||||||||||

| Imaging & Optics - Royalties |

$ | 3.2 | $ | 1.1 | 202 | % | $ | 2.4 | 31 | % | ||||||||||

(in Millions, except %)

Total revenue for the third quarter of 2010 was $82.1 million, which was slightly above the high end of our $82 million guidance provided in our July 29, 2010 earnings report. Total Micro-electronics revenue, comprised of royalties and license fees, was $72.0 million for the third quarter of 2010, of which $6 million was received from UTAC as a result of our first quarter of 2010 settlement. This represents the best revenue quarter in the history of the company, excluding the effects of settlement amounts. Previously, the company's best revenue quarter was the second quarter of 2010, which totaled $74.6 million.

Imaging & Optics revenue, comprised of products and services, and royalties and license fees, was $10.1 million for the third quarter of 2010. Products and services revenue was $6.1 million, slightly above our guidance due to better than anticipated customer demand in the communications and lithographic markets. Additionally, Products and Services revenue was up 80% year-over-year. Royalties and license fees were $4.0 million, up 22% quarter-over-quarter, and 8% year-over-year. This was below our guidance of $4.5 million due to the timing of securing a Zoom license agreement. Royalties were $3.2 million, up 31% quarter-over-quarter and up 202% year-over-year. For reference, third quarter of 2009 royalties were $1.1 million and license fees were $2.6 million. The increase in royalties is primarily related to continued market adoption of our EDOF technology. As we have previously indicated, quarterly royalty and license fee revenue is expected to fluctuate due to the timing and amount of license fees, which can be significant relative to ongoing royalties.

Other Income Statement Metrics

Total GAAP operating expenses in the third quarter of 2010 were $50.0 million and included a full quarter of Siimpel operating expenses. As a reminder, we completed the acquisition of Siimpel during the second quarter of 2010. Total GAAP operating expenses are as follows:

| • | Cost of revenues: $5.4 million, |

5

| • | R&D: $20.8 million, |

| • | SG&A: $19.0 million, and |

| • | Litigation expense: $4.8 million. |

Third quarter total GAAP operating expenses were up 3% quarter-over-quarter and up 8% year-over-year. The sequential increase was mainly due to a $2.5 million increase in research and development related to advancements in our Silent Air Cooling and MEMS technologies. Selling, general and administrative expense decreased by $1.2 million sequentially primarily due to a decrease in stock-based compensation expense. In addition

| • | Stock based compensation expense was $6.9 million, |

| • | Amortization of acquired intangibles was $3.6 million, |

| • | Other income, net of expense, was $0.7 million, and |

| • | GAAP tax expense was $13.8 million, representing a 42 % estimated tax rate for the quarter. |

GAAP Net Income and EPS

| Q3 2010 | Q3 2009 | Y-o-Y % | Q2 2010 | Q-o-Q % | ||||||||||||||||

| GAAP Net Income |

$ | 19.0 | $ | 12.1 | 57 | % | $ | 15.0 | 27 | % | ||||||||||

| GAAP EPS |

$ | 0.38 | $ | 0.24 | $ | 0.30 | ||||||||||||||

| Fully Diluted Shares |

50.5 | 49.9 | 50.3 | |||||||||||||||||

(in Millions, except per share and %)

Non GAAP Results

Non-GAAP results exclude stock based compensation, charges for acquired in-process research and development, acquired intangibles amortization, impairment charges on long-lived assets, and related tax effects. We have included a detailed reconciliation between our GAAP and Non-GAAP net income in both our earnings release and on our web site for your convenient reference.

Total Non-GAAP operating expenses in the third quarter of 2010 were $39.5 million. Non-GAAP operating expenses are as follows:

| • | Cost of revenues was $3.5 million, |

| • | R&D was $17.1 million, |

| • | SG&A was $14.1 million, and |

| • | Litigation expense was $4.8 million. |

6

Third quarter total Non-GAAP operating expenses were up 5% quarter-over-quarter and up 9% year-over-year. Cost of revenues was down 8% sequentially due to product mix. R&D expense was up 13% sequentially, due to the impact of a full quarter of the Siimpel expenses supporting our MEMS technology as well as expenses related to advancements in Silent Air Cooling. SG&A expenses were down 1%. Litigation expense was up 9% sequentially as we filed complaints against UTAC (Taiwan) Corporation on September 30, 2010, and against Sony Corporation, Sony Electronics, Inc., and Renesas Electronics Corporation (the merged entity of NEC Electronics and Renesas Technology Corp.) on October 1, 2010. We also continued litigation in the Hynix antitrust action, the Amkor arbitration, and the appeals related to our International Trade Commission (ITC) 605 and 630 cases.

Non-GAAP Net Income and EPS

Tax adjustments in the third quarter of 2010 for Non-GAAP items were approximately $2.5 million.

| Q3 2010 | Q3 2009 | Y-0-Y % | Q2 2010 | Q-o-Q % | ||||||||||||||||

| Non-GAAP Net Income |

$ | 27.0 | $ | 19.2 | 41 | % | $ | 23.2 | 16 | % | ||||||||||

| Non-GAAP EPS |

$ | 0.52 | $ | 0.37 | $ | 0.45 | ||||||||||||||

| Fully Diluted Shares |

51.6 | 51.3 | 51.2 | |||||||||||||||||

(in Millions, except per share and EPS)

Balance Sheet Metrics

We ended the quarter with $474.0 million in cash, cash equivalents, and investments, which represents a $36.2 million increase over the prior quarter. Net cash provided from operations was $36.7 million. Major uses of cash in the quarter included $10.2 million for tax payments, $2.6 million for patent acquisitions, and $2.0 million for purchases of capital equipment.

Fourth Quarter 2010 Guidance

Total revenue for the fourth quarter 2010 will range between $76 million and $79 million, which represents an increase of approximately 35% to 40% over fourth quarter 2009 total revenues of $56.5 million. Micro-electronics revenue will range between $65 million and $68 million, all of which will be royalty and license related. Fourth quarter Micro-electronics revenue includes $6 million we expect to receive from UTAC as a result of the breach of contract litigation settlement in the first quarter of 2010. As a comparison, fourth quarter 2009 Micro-electronics royalties and license fees were $48.5 million.

7

As a reminder, two major DRAM manufacturers have volume pricing adjustments in their licenses that may cause, only for these two DRAM manufacturers when unit shipment volumes are high, our aggregate annual DRAM royalty revenue to grow less rapidly than annual growth in overall unit shipments in the DRAM market. An additional effect may include quarter-to-quarter fluctuations in growth of our revenues from DRAM, depending on the overall unit growth of the DRAM market and the relative DRAM market share enjoyed by these two DRAM manufacturers. As the unit growth of the DRAM market is occurring at a faster pace in 2010 than in 2009, we expect to see some impact from these volume pricing adjustments on our fourth quarter Micro-electronics revenue, which is reflected accordingly in the guidance.

Fourth quarter 2010 Imaging & Optics revenue, in total, is expected to be $11.0 million. This compares to fourth quarter of 2009 Imaging & Optics revenue of $8.0 million. Royalties and license fees are expected to be approximately $5 million as we anticipate continued increases in royalties from our EDOF licensees. Sequentially, royalties and license fees are expected to be up approximately $1 million or 25% from $4.0 million in the third quarter of 2010. For reference, royalties and license fees were $3.3 million in the fourth quarter of 2009, which included $1.8 million of license fees and $1.5 million of royalties.

Fourth quarter 2010 Products and services revenue is expected to be approximately $6 million. This is expected to be flat sequentially.

Fourth quarter 2010 Non-GAAP operating expenses, less litigation expense, are expected to range between $36 million and $37 million.

In connection with the cessation of development of our Wafer-Level Optics technology, we will recognize a charge of between $3 million and $4 million to write off the net carrying value of certain long-lived fixed assets.

Non-GAAP cost of revenues are expected be down approximately 25% to 30% sequentially related to product mix and the reallocation of our Wafer-Level Optics resources to development efforts.

Non-GAAP R&D is expected to be up approximately 10% to 12% sequentially as we anticipate additional costs to support the continued advancement of our MEMS technology, including non-recurring engineering and material cost related to establishing our outsourced manufacturing. In addition, we have repurposed our WLO resources to consumer Micro Optics development efforts.

8

Non-GAAP SG&A is expected to be up 6% to 7% sequentially in connection with our fourth quarter technology symposia and increased patent analysis.

We expect our litigation expense in the fourth quarter of 2010 to be up slightly in comparison to the third quarter of 2010. This expense is expected to increase due to the Hynix antitrust action, the Amkor arbitration, the UTAC (Taiwan) breach of contract case, the Sony and Renesas Electronics Corporation patent infringement case, and legal activity related to the appeals of the International Trade Commission (ITC) 605 and 630 cases, which are both pending in the U.S. Court of Appeals for the Federal Circuit. If a trial date is set in the Hynix antitrust action within the quarter, our litigation expense may further increase.

We expect fourth quarter 2010 stock based compensation to be approximately $7.1 million and amortization charges to be $4.0 million.

Our estimated tax rate for fiscal year 2010 is expected to be approximately 43%.

Litigation Review

Our two International Trade Commission actions are now on appeal before the U.S. Court of Appeals for the Federal Circuit. We await the Federal Circuit’s ruling in the appeal of the ITC 605 Wireless Action. In the ITC 630 DRAM Action, the Federal Circuit has not yet set a date for oral argument for the 630 case.

We continue to make progress in the pretrial phase of the antitrust case we filed against Hynix. A pretrial case management hearing will be held on Dec. 16, 2010. The Court has not yet set a trial date.

Similarly, we are making progress, albeit slowly, in the Amkor arbitration. The arbitration panel recently re-scheduled a hearing on a discrete part of the case, namely, certain issues arising from the previous arbitration, which is now scheduled to occur in December 2010. As a reminder, the previous Amkor arbitration took approximately three years before being resolved in Tessera’s favor.

9

Safe Harbor Statement

This document contains forward-looking statements, which are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements involve risks and uncertainties that could cause actual results to differ significantly from those projected, particularly with respect to the company’s financial results, the size of market opportunities, growth of the company’s served markets, industry and technology trends, use of the company’s technology in additional applications, impact of volume based pricing incentives in our Micro-electronics segment and revenue growth in our Imaging & Optics segment, future investment and development resources, the expansion of the company’s intellectual property portfolios, and the company’s IP protection efforts, including litigation. Material factors that may cause results to differ from the statements made include delays, setbacks or losses relating to our intellectual property or intellectual property litigations, or any invalidation or limitation of our key patents; fluctuations in our operating results due to the timing of new license agreements and royalties, or due to legal costs; changes in patent laws, regulation or enforcement, or other factors that might affect our ability to protect our intellectual property; the risk of a decline in demand for semiconductor products; failure by the industry to adopt our technologies; competing technologies; the future expiration of our patents; the future expiration of our license agreements and the cessation of related royalty income; the failure or refusal of licensees to pay royalties; failure to achieve the growth prospects and synergies expected from acquisition transactions; and delays and challenges associated with integrating acquired companies with our existing businesses. You are cautioned not to place undue reliance on the forward-looking statements, which speak only as of the date of this release. Tessera’s filings with the Securities and Exchange Commission, including its Annual Report on Form 10-K for the year ended Dec. 31, 2009, and Form 10-Q for the quarter ended June 30, 2010 include more information about factors that could affect the company's financial results. Tessera assumes no obligation to update information contained in this press release. Although this release may remain available on Tessera's website or elsewhere, its continued availability does not indicate that Tessera is reaffirming or confirming any of the information contained herein.

10

Non-GAAP Financial Measures

In addition to disclosing financial results calculated in accordance with U.S. generally accepted accounting principles (GAAP), this document contains non-GAAP financial measures adjusted for either one-time or ongoing non-cash acquired intangibles amortization charges, acquired in-process research and development, all forms of stock-based compensation, impairment charges on long-lived assets, and related tax effects. The non-GAAP financial measures also exclude the effects of FASB Accounting Standards Codification Topic 718 – Stock Compensation upon the number of diluted shares used in calculating non-GAAP earnings per share. Management believes that the non-GAAP measures used in this report provide investors with important perspectives into the company’s ongoing business performance. The non-GAAP financial measures disclosed by the company should not be considered a substitute for, or superior to, financial measures calculated in accordance with GAAP, and the financial results calculated in accordance with GAAP and reconciliations to those financial statements should be carefully evaluated. The non-GAAP financial measures used by the company may be calculated differently from, and therefore may not be comparable to, similarly titled measures used by other companies.

11