Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - PUBLIC SERVICE ELECTRIC & GAS CO | d8k.htm |

| EX-99 - PRESS RELEASE - PUBLIC SERVICE ELECTRIC & GAS CO | dex99.htm |

Public Service Enterprise Group

PSEG Earnings Conference Call

3

rd

Quarter 2010

October 27, 2010

Exhibit 99.1 |

| 1

Forward-Looking Statement

Readers are cautioned that statements contained in this presentation about our and

our subsidiaries' future performance, including future revenues, earnings,

strategies, prospects, consequences and all other statements that are not purely

historical, are forward-looking statements for purposes of the safe harbor

provisions

under

The

Private

Securities

Litigation

Reform

Act

of

1995.

When

used

herein,

the

words

“anticipate”,

“intend”,

“estimate”,

“believe”,

“expect”,

“plan”,

“should”, “hypothetical”, “potential”,

“forecast”, “project”, variations of such words and similar expressions are intended to identify forward-looking statements.

Although we believe that our expectations are based on reasonable assumptions, they

are subject to risks and uncertainties and we can give no assurance they

will be achieved. The results or developments projected or predicted in these

statements may differ materially from what may actually occur. Factors which could

cause results or events to differ from current expectations include, but are not

limited to: •

Adverse changes in energy industry law, policies and regulation, including market

structures, transmission planning and cost allocation rules, including rules

regarding

who

is

permitted

to

build

transmission

going

forward,

and

reliability

standards

•

Any inability of our transmission and distribution businesses to obtain adequate

and timely rate relief and regulatory approvals from federal and state regulators.

•

Changes in federal and state environmental regulations that could increase our

costs or limit operations of our generating units. •

Changes in nuclear regulation and/or developments in the nuclear power industry

generally that could limit operations of our nuclear generating units.

•

Actions

or

activities

at

one

of

our

nuclear

units

located

on

a

multi-unit

site

that

might

adversely

affect

our

ability

to

continue

to

operate

that

unit

or

other

units located at the same site.

•

Any inability to balance our energy obligations, available supply and trading

risks. •

Any deterioration in our credit quality.

•

Availability of capital and credit at commercially reasonable terms and conditions

and our ability to meet cash needs. •

Any inability to realize anticipated tax benefits or retain tax

credits.

•

Changes in the cost of, or interruption in the supply of, fuel and other

commodities necessary to the operation of our generating units. •

Delays in receipt of necessary permits and approvals for our construction and

development activities. •

Delays or unforeseen cost escalations in our construction and development

activities. •

Adverse changes in the demand for or price of the capacity and energy that we sell

into wholesale electricity markets, •

Increase in competition in energy markets in which we compete.

•

Adverse performance of our decommissioning and defined benefit plan trust fund

investments and changes in discount rates and funding requirements.

•

Changes in technology and customer usage patterns.

For further information, please refer to our Annual Report on Form 10-K,

including Item 1A. Risk Factors, and subsequent reports on Form 10-Q and Form 8-K filed

with the Securities and Exchange Commission. These documents address in

further detail our business, industry issues and other factors that could cause actual

results to differ materially from those indicated in this presentation. In

addition, any forward-looking statements included herein represent our estimates only as of

today and should not be relied upon as representing our estimates as of any

subsequent date. While we may elect to update forward-looking statements from time

to time, we specifically disclaim any obligation to do so, even if our internal

estimates change, unless otherwise required by applicable securities laws. |

| 2

GAAP Disclaimer

PSEG presents Operating Earnings in addition to its Net Income reported in

accordance with accounting principles generally accepted in the United

States (GAAP). Operating Earnings is a non-GAAP financial measure that

differs from Net Income because it excludes gains or losses associated with

Nuclear Decommissioning Trust (NDT), Mark-to-Market (MTM) accounting,

and other material one-time items. PSEG presents Operating Earnings

because management believes that it is appropriate for investors

to

consider results excluding these items in addition to the results reported in

accordance with GAAP. PSEG believes that the non-GAAP financial

measure of Operating Earnings provides a consistent and comparable

measure of performance of its businesses to help shareholders understand

performance trends.

This information is not

intended to be viewed as an

alternative to GAAP information. The last two slides in this presentation

include a list of items excluded from Income from Continuing Operations to

reconcile to Operating Earnings, with a reference to that slide included on

each of the slides where the non-GAAP information appears.

|

| PSEG

2010 Q3 Review

Ralph Izzo

Chairman, President and Chief Executive Officer

*

*

*

*

*

*

*

* |

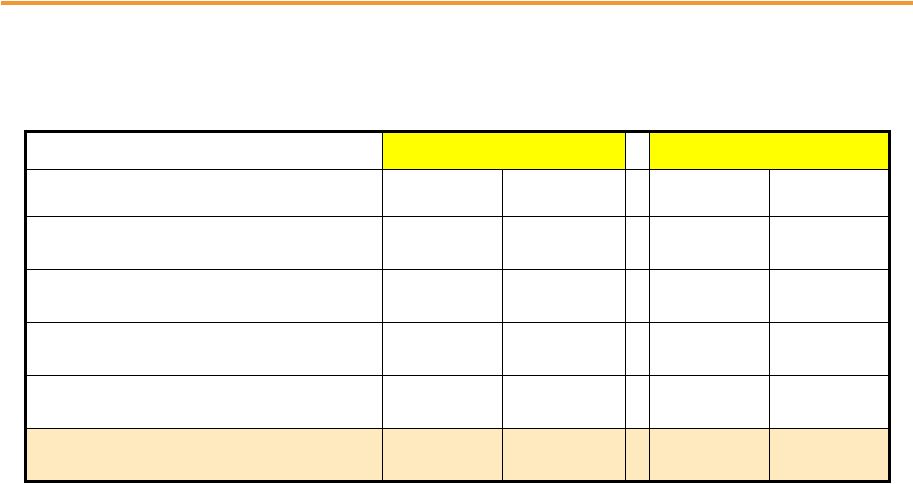

4

Q3 2010 Earnings Summary

-

-

Discontinued Operations, Net of Tax

$ 0.92

$ 1.06

EPS from Operating Earnings*

$ 488

$ 567

Net Income

488

567

Income from Continuing Operations

24

29

Reconciling Items, Net of Tax

$ 464

$ 538

Operating Earnings

2009

2010

$ millions (except EPS)

Quarter Ended September 30

* See page 36 for Items excluded from Income from Continuing Operations to

reconcile to Operating Earnings. |

5

YTD Earnings Summary

-

-

Discontinued Operations, Net of Tax

$ 2.50

$ 2.55

EPS from Operating Earnings*

$1,243

$1,282

Net Income

1,243

1,282

Income from Continuing Operations

(21)

(12)

Reconciling Items, Net of Tax

$ 1,264

$1,294

Operating Earnings

2009

2010

$ millions (except EPS)

Nine Months Ended September

30 * See page 36 for

Items excluded from Income from Continuing Operations to reconcile to Operating Earnings. |

6

PSEG –

Q3 2010: Company Execution Strong in Quarter

Q3 2010 results

Higher generation output

Cost control efforts aiding margins

New utility rates in effect

Hottest New Jersey summer on record

Challenging markets

Still weak economy

Weak natural gas price environment; customer migration

Sharpened business focus

Texas generating assets –

process continuing for potential sale

Revised capital spending forecast reflects updated Transmission projects

2 additional lease terminations; 1 cross border lease remaining

Company position continues to receive recognition

World Index -

Dow Jones Sustainability Index

Carbon Disclosure Project |

| PSEG

2010 Q3 Operating Company Review

Caroline Dorsa

Executive Vice President and Chief Financial Officer

*

*

*

*

*

*

*

* |

8

2008 Operating Earnings*

2009 Operating Earnings*

2010 Guidance

$3.00 -

$3.25

PSEG –

Maintaining 2010 Guidance

$3.03

* See page 37 for Items excluded from Income from Continuing Operations to

reconcile to Operating Earnings.

$3.12 |

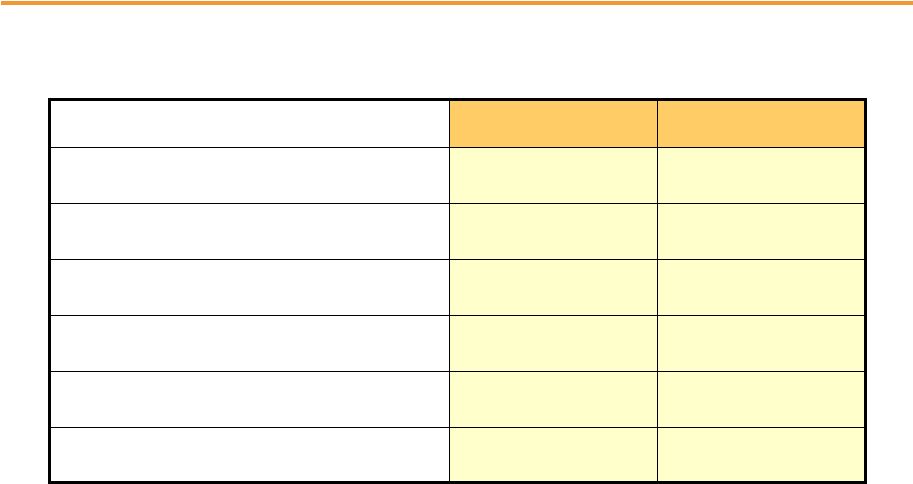

9

Q3 Operating Earnings by Subsidiary

$ 464

20

(1)

87

$ 358

2009

$ 538

4

24

155

$355

2010

Operating Earnings

Earnings per Share

0.04

0.01

Enterprise

$ 0.92

$ 1.06

Operating Earnings*

-

0.05

PSEG Energy Holdings

0.17

0.30

PSE&G

$ 0.71

$ 0.70

PSEG Power

2009

2010

$ millions (except EPS)

Quarter Ended September 30

* See page 36 for Items excluded from Income from Continuing Operations to

reconcile to Operating Earnings. |

10

YTD Operating Earnings by Subsidiary

$ 1,264

17

30

253

$ 964

2009

$1,294

12

43

347

$892

2010

Operating Earnings

Earnings per Share

0.03

0.02

Enterprise

$ 2.50

$ 2.55

Operating Earnings*

0.06

0.09

PSEG Energy Holdings

0.50

0.68

PSE&G

$ 1.91

$ 1.76

PSEG Power

2009

2010

$ millions (except EPS)

Nine Months Ended September 30

* See page 36 for Items excluded from Income from Continuing Operations to

reconcile to Operating Earnings. |

11

$1.06

(0.03)

0.05

0.13

(0.01)

$0.92

0.00

0.20

0.40

0.60

0.80

1.00

1.20

PSEG EPS Reconciliation –

Q3 2010 versus Q3 2009

Q3 2010

Operating

Earnings*

Q3 2009

Operating

Earnings*

Higher Generating

Volume

Offset by Lower

Prices .00

Nuclear (.03)

Weather .03

Migration (.01)

WPT (.02)

Other .02

PSEG Power

Electric & Gas

Margin (Including

Rate Increases) .06

Transmission Margin

.01

Weather .03

O&M .02

Other .01

PSE&G

PSEG Energy

Holdings

Enterprise

2009 Debt

Exchange Cost

Eliminated in

Consolidation

.04

Interest .01

•See page 36 for Items excluded from Income from Continuing Operations to

reconcile to Operating Earnings. 2009 Debt

Exchange

Benefit

Eliminated in

Consolidation

(.04)

Interest .01 |

12

$2.50

(0.15)

0.18

0.03

(0.01)

$2.55

1.00

1.25

1.50

1.75

2.00

2.25

2.50

2.75

PSEG EPS Reconciliation –

YTD 2010 versus YTD 2009

Nine Months

Ended

9/30/2010

Operating

Earnings*

Nine Months

Ended 9/30/2009

Operating

Earnings*

Interest .03

2009 Debt

Exchange Benefit

Eliminated in

Consolidation (.04)

Higher volume offset by

lower prices (.05)

Weather .05

Migration (.03)

Economy (.01)

Nuclear (.01)

WPT (.07) ; BGSS (.01)

O&M (.01); Other .03

SO

2

Impairment (.02)

Increase in effective tax

rate related to healthcare

legislation (.02)

PSEG Power

Electric & Gas

Margin (Including

Rate Increases) .07

Transmission .03

Other .02

Appliance

Service .01

Weather .02

O&M .01

Depreciation,

Taxes & Other .02

PSE&G

PSEG Energy

Holdings

Enterprise

2009 Lease Sales

& Other Investments

(.06)

Interest .03

Effective Tax Rate

and Other .02

2009 Debt Exchange

Cost Eliminated in

Consolidation .04

*

See

page

36

for

Items

excluded

from

Net

Income

to

reconcile

to

Operating

Earnings. |

| PSEG

Power 2010 Q3 Review

*

*

*

*

*

*

*

*

*

* |

14

PSEG Power –

Q3 2010 EPS Summary

2

17

19

Mark-to-Market, Net of Tax

3

7

10

NDT Funds Related

Activity,

Net of Tax

$ 99

$ 1,564

$1,663

Operating Revenues

$ (0.01)

$ 0.71

$ 0.70

EPS from Operating Earnings*

$ 2

$ 382

$ 384

Net Income

(3)

358

355

Operating Earnings

Variance

Q3 2009

Q3 2010

$ millions (except EPS)

* See page 36 for Items excluded from Income from Continuing Operations to

reconcile to Operating Earnings. |

15

$0.70

0.02

0.02

(0.05)

$0.71

0.00

0.25

0.50

0.75

1.00

Nuclear (.03)

WPT (.02)

PSEG Power EPS Reconciliation –

Q3 2010 versus Q3 2009

Q3 2010

Operating

Earnings*

Q3 2009

Operating

Earnings*

Weather .03

Higher Generation

Volumes Offset by

Lower Prices .00

Migration (.01)

* See page 36 for Items excluded from Income from Continuing Operations to

reconcile to Operating Earnings. Rabbi Trust Gains .01

Taxes .01 |

16

PSEG Power –

Generation Measures

7,309

7,738

3,131

2,241

7,409

6,253

0

10,000

20,000

2010

2009

Quarter Ended September 30

Total Nuclear

Total Coal*

Total Oil &

Natural Gas

* Includes figures for Pumped Storage.

PSEG Power –

Generation (GWh)

16,232

17,849

22,577

22,751

8,647

6,389

18,571

15,296

0

10,000

20,000

30,000

40,000

50,000

2010

2009

Nine Months Ended September 30

44,436

49,795 |

17

PSEG Power –

Generation Measures

45

51

18

14

25

13

22

12

0

50

100

2010

2009

Nine

Months

Ended

September

30

Total Nuclear

Total Coal*

Oil & Natural Gas

–

excluding

Texas

* Includes figures for Pumped Storage

PSEG Power –

% Generation Contribution

Oil & Natural Gas

-

Texas

PSEG Power –

Capacity Factors (%)

45%

47%

Texas

43%

56%

PJM and NY

Combined

Cycle

41%

86%

43%

93.1%

2010

25%

CT

79%

PA

23%

NJ

Coal

93.8%

Nuclear**

2009

Nine Months Ended

September 30

**Total

Nuclear

Fleet

-

PS

Share |

18

PSEG Power –

Fuel Costs

232

318

Oil & Gas

97

122

Coal

22.67

26.95

$ / MWh

16,232

17,849

Total Generation

(GWh)

368

481

Total Fuel Cost

39

41

Nuclear

Total Fossil

($ millions)

329

440

2009

2010

Quarter Ended September 30

PSEG Power –

Fuel Costs

641

817

Oil & Gas

240

336

Coal

22.30

25.65

$ / MWh

44,436

49,795

Total Generation

(GWh)

991

1,277

Total Fuel Cost

110

124

Nuclear

Total Fossil

($ millions)

881

1,153

2009

2010

Nine Months Ended

September 30 |

19

PSEG Power –

Gross Margin Performance

$0

$25

$50

$75

2010

2009

$0

$25

$50

$75

2010

2009

$64

$57

Quarter Ended

September 30

Nine Months Ended

September 30

$63

$55

In Q3, PJM total gross margin was sustained by strong weather-related demand,

with higher volumes offsetting lower realized prices

Salem Unit 1’s 17-day unplanned outage reduced nuclear generation and

earnings by $0.03 per share

Low spark spreads, partially offset by

increase in gas-fired generation.

$18

New York

Regional Performance

$41

$15

$856

Gross

Margin ($M)

Q3 2010 Performance

Region

Generation flat with year-ago levels.

Texas

Generation increased with strong

weather-related demand.

New

England

Q3 contribution to gross margin ($M)

flat versus year ago. A 10% increase

in generation offsetting lower realized

prices and the cost of the Salem

nuclear outage.

PJM

PSEG Power Gross Margin ($/MWh)*

*Excludes Texas. |

20

PSEG Power –

Q3 Operating Highlights

10% increase in total output

Weighted average combined cycle capacity factor of 59% vs. 52% in Q3 2009

Weighted average coal capacity factor of 60% vs

43% in Q3 2009

Q3 nuclear fleet capacity factor of 89.4%; Hope Creek refueling outage

underway in Q4 2010

Operations

Financial

Power markets affected by hottest summer on record in NJ, weak economic

growth, and an excess supply of gas

Actively managing coal inventory

Exploring the sale of Texas gas-fired assets (2,000 MW)

New, 5-year $100 million bilateral credit facility

Regulatory and Market

Environment |

| PSE&G

2010 Q3 Review

*

*

*

*

*

*

*

*

*

* |

22

PSE&G –

Q3 2010 Earnings Summary

(35)

1,717

1,682

Total Operating Expenses

1

30

31

Taxes Other than Income Taxes

Operating Expenses

(52)

1,167

1,115

Energy Costs

(24)

351

327

Operation & Maintenance

40

169

209

Depreciation & Amortization

$ 0.13

$ 0.17

$ 0.30

EPS from Operating Earnings*

$ 68

$ 87

$ 155

Operating Earnings / Net Income

$ 64

$ 1,943

$ 2,007

Operating Revenues

Variance

Q3 2009

Q3 2010

$ millions (except EPS)

* See page 36 for Items excluded from Income from Continuing Operations to

reconcile to Operating Earnings. |

23

$0.17

0.07

0.03

0.02

0.01

$0.30

0.00

0.10

0.20

0.30

PSE&G EPS Reconciliation –

Q3 2010

versus Q3 2009

Q3 2010

Operating

Earnings*

Q3 2009

Operating

Earnings*

Weather .03

O&M

* See page 36 for Items excluded from Income from Continuing Operations to

reconcile to Operating Earnings. Electric & Gas

Margin (Including

Rate Increases) .06

Transmission .01

Other

Rabbi Trust

Gains .02

Taxes .01

D&A (.01)

Interest (.01) |

24

56

33

38

27

5

147

55

0

50

100

150

200

250

2010

Normal

2009

July

August

September

Q3 2010 Was The Warmest Summer on Record in New Jersey

Third Quarter Number of Hours

Where

the

Temperature

was

Equal

or

Greater

than

90

o

F

40

230

93

…

with peak-producing hours up by over 4.5x 2009 levels

|

25

PSE&G Capital Spending: 2010-2013

PSE&G Capital Spending: 2010-2013

$6,130

$1,590

$1,490

$1,450

$1,600

Total

$890

$30

$190

$320

$350

Renewables/EMP

$2,170

$420

$390

$460

$900

Distribution

$3,070

$1,140

$910

$670

$350

Transmission

2010-2013E

2013E

2012E

2011E

2010E*

($ Millions)

Capital program provides growth in rate base of 9.5% per year from 2009

base of $7.3 Billion

Transmission investment represents 50% of planned capex over 2010-2013 and

is expected to comprise 31% of PSE&G rate base by 2013

Supportive regulatory treatment with contemporaneous recovery should align

earnings growth with investment

*Estimate |

26

PSE&G –

Q3 Operating Highlights

PSE&G

Electric

and

Gas

rate

increases

effective

in

June

and

July

2010,

respectively

B-R-H Transmission Line re-configured to a 230 KV project with

underground components; 2015 in-service date

Reliability projects related to the S-R Transmission in-service delay

identified EMP review underway; 2011 update expected

Updated PSE&G Capital Forecast for 2010-2013 calls for $6.1 Billion

investment program Rate Base Growth (CAGR) of 9.5% per year

Distribution’s

average

return

on

equity

for

the

12

months

ended

September

30,

2010

was

9.5%

Operations

Financial

Economic indicators have yet to point to sustained recovery

Electric sales skewed by the hottest summer on record in NJ

Temperature Humidity Index was 30% above normal and 68% above 2009’s mild

summer Regulatory and Market

Environment |

| PSEG

Energy Holdings 2010 Q3 Review

*

*

*

*

*

*

*

*

*

* |

28

PSEG Energy Holdings –

Q3 2010 Earnings Summary

-

-

-

Discontinued Operations, Net of Tax

-

-

-

Mark-to-Market, Net of Tax

$0.05

$ 0.00

$ 0.05

EPS from Operating Earnings*

$ 25

$ (1)

$ 24

Net Income

$ 25

$ (1)

$ 24

Operating Earnings

Variance

Q3 2009

Q3 2010

$ millions (except EPS)

* See page 36 for Items excluded from Income from Continuing Operations to

reconcile to Operating Earnings. |

29

$0.05

0.05

(0.01)

0.01

$0.0

0.00

0.01

0.02

0.03

0.04

0.05

0.06

PSEG Energy Holdings EPS Reconciliation –

Q3 2010 versus Q3 2009

Q3 2010

Operating

Earnings*

Q3 2009

Operating

Earnings*

G&A

Taxes

Other

* See page 36 for Items excluded from Income from Continuing Operations to

reconcile to Operating Earnings. Resources

Global

Holdings

Taxes

2009 Debt Exchange

Cost Eliminated in

Consolidation .04

Interest .01 |

30

PSEG Energy Holdings –

Q3 Operating Highlights

Financial

Termination of 2 additional leases in Q3 reduced net cash exposure at

quarter-end to $330 million; $320 million of cash on deposit at IRS

Solar projects in Ohio and Florida placed in-service; NJ solar project is

operating as planned

Continuing to review opportunities for additional investments in

solar

under PPA arrangements

In December 2010, Holdings will redeem the remaining $127 Million

of its 8.5% Senior Notes |

31

$660

~$1,200

~$10

~$330

$-

$500

$1,000

$1,500

2008

2009

2010

Cash Exposure Net

of $320M of IRS

Deposits

2009 Activities

Terminated 12

LILO/SILO

leases

2010 Activities

Terminated 4 LILO/SILO

leases to date

Pursue additional lease

termination opportunities

2008 Activities

Terminated 1

LILO/SILO lease

Exposure to our potential lease tax liability…

…was reduced with aggressive asset management.

1

5

17

# of LILO/SILO

Leases Remaining*

12/31/2008

12/31/2009

9/30/2010

*LILO/SILO leases are international leveraged leases.

|

| PSEG

*

*

*

*

*

*

*

*

*

* |

33

2010 Operating Earnings Guidance By Subsidiary

$ 3.12

$ 1,579

$ 10

$ 43

$ 321

$ 1,205

2009A*

$ 3.00 –

$ 3.25

$ 1,520 –

$ 1,645

$ 5 –

$15

$ 30 –

$ 40

$ 425 –

$ 455

$ 1,060 –

$ 1,135

2010E

Enterprise

Earnings per Share

Operating Earnings*

PSEG Energy Holdings

PSE&G

PSEG Power

$ millions (except EPS)

* See page 37 for Items excluded from Income from Continuing Operations to

reconcile to Operating Earnings. |

34

PSEG –

Q3 2010

Utility capital spending will result in 9.5%

rate base growth CAGR –

primarily driven

by transmission investment

Migration impacts are meeting expectations

but accelerating realization of current market

Forward price curve is weak and getting

weaker |

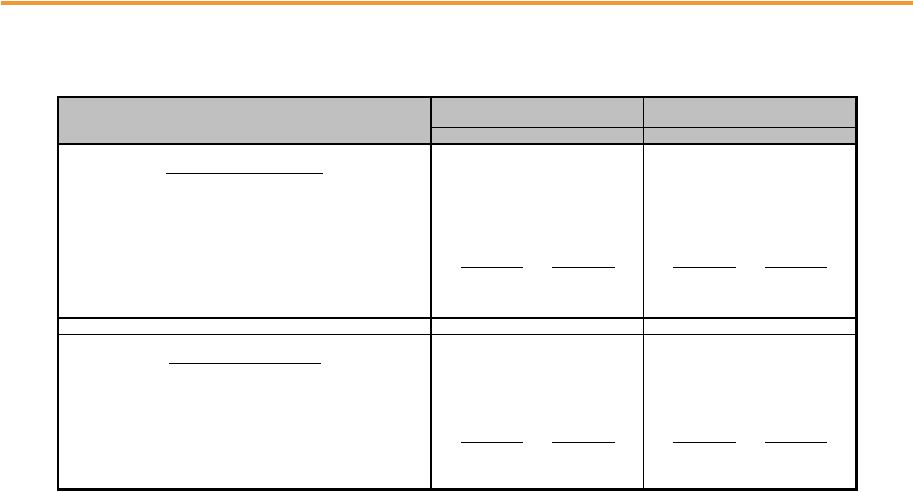

35

PSEG Liquidity as of October 20, 2010

PSEG Liquidity as of October 20, 2010

Expiration

Total

Available

Company

Facility

Date

Facility

Usage

Liquidity

5-Year Credit Facility (Power)

Dec-12

$1,600

1

$173

$1,427

5-Year Credit Facility (PSEG)

Dec-12

$1,000

2

$14

$986

5-Year Bilateral Facility (Power)

Sep-15

$100

$100

$0

2-Year Credit Facility (Power)

Jul-11

$350

$0

$350

PSE&G

5-Year Credit Facility

Jun-12

$600

3

$0

$600

Total

$3,650

$3,363

1

Power Facility reduces by $75 million in 12/2011

2

PSEG Facility reduces by $47 million in 12/2011

3

PSE&G Facility reduces by $28 million in 6/2011

PSEG /

Power

($Millions) |

36

Items Excluded from Income from Continuing Operations to

Reconcile to Operating Earnings

Please see Page 2 for an explanation of PSEG’s use of Operating Earnings as a

non-GAAP financial measure and how it differs from Net Income.

Pro-forma Adjustments, net of tax

2010

2009

2010

2009

Earnings Impact ($ Millions)

Gain (Loss) on Nuclear Decommissioning Trust (NDT)

10

$

7

$

30

$

1

$

Fund Related Activity (PSEG Power)

Gain (Loss) on Mark-to-Market (MTM) (PSEG Power)

19

17

30

(22)

Net Reversal of Lease Transaction Reserves (Energy Holdings)

-

-

-

-

Market Transition Charge Refund (PSE&G)

-

-

(72)

-

Total Pro-forma adjustments

29

$

24

$

(12)

$

(21)

$

Fully Diluted Average Shares Outstanding (in Millions)

507

507

507

507

Per Share Impact (Diluted)

Gain (Loss) on NDT Fund Related Activity (PSEG Power)

0.02

$

0.01

$

0.06

$

-

$

Gain (Loss) on MTM (PSEG Power)

0.04

0.03

0.06

(0.05)

Net Reversal of Lease Transaction Reserves (Energy Holdings)

-

-

-

-

Market Transition Charge Refund (PSE&G)

-

-

(0.14)

-

Total Pro-forma adjustments

0.06

$

0.04

$

(0.02)

$

(0.05)

$

(a) Income from Continuing Operations for the three and nine months ended September

30, 2010 and 2009. December 31, 2009 is equal to Net Income.

PUBLIC SERVICE ENTERPRISE GROUP INCORPORATED

Reconciling

Items

Excluded

from

Continuing

Operations

to

Compute

Operating

Earnings

(Unaudited)

For the Three Months Ended

For the Nine Months Ended

September 30,

September 30,

(a) |

37

Items Excluded from Income from Continuing Operations to

Reconcile to Operating Earnings

Please see Page 2 for an explanation of PSEG’s use of Operating Earnings as a

non-GAAP financial measure and how it differs from Net Income.

Pro-forma Adjustments, net of tax

2009

2008

Earnings Impact ($ Millions)

Gain (Loss) on Nuclear Decommissioning Trust (NDT) Fund

Related Activity (PSEG Power)

9

$

(71)

$

Gain (Loss) on Mark-to-Market (MTM) (PSEG Power)

(25)

16

Lease Transaction Reserves

-

(490)

Net Reversal of Lease Transaction Reserves

29

-

Asset Impairments

-

(13)

Premium on Bond Redemption

-

(1)

Total Pro-forma adjustments

13

$

(559)

$

Fully Diluted Average Shares Outstanding (in Millions)

507

508

Per Share Impact (Diluted)

Gain (Loss) on Nuclear Decommissioning Trust (NDT) Fund

Related Activity (PSEG Power)

0.02

$

(0.14)

$

Gain (Loss) on Mark-to-Market (MTM) (PSEG Power)

(0.05)

0.03

Lease Transaction Reserves

-

(0.96)

Net Reversal of Lease Transaction Reserves

0.05

-

Asset Impairments

-

(0.03)

Premium on Bond Redemption

-

-

Total Pro-forma adjustments

0.02

$

(1.10)

$

For the Twelve Months Ended

December 31, |