Table of Contents

As filed with the Securities and Exchange Commission on October 26, 2010

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

iShares® Copper Trust

(Exact name of registrant as specified in its charter)

| New York | 6799 | [ ] | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

c/o BlackRock Asset Management International Inc.

400 Howard Street

San Francisco, CA 94105

Attn: Product Management Team,

Intermediary Investor and Exchange-Traded Products Department

(415) 670-2000

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

c/o BlackRock Asset Management International Inc.

400 Howard Street

San Francisco, CA 94105

Attn: Product Management Team,

Intermediary Investor and Exchange-Traded Products Department

(415) 670-2000

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| David Yeres, Esq. Clifford Chance US LLP 31 West 52nd Street New York, NY 10019 |

Deepa Damre, Esq. BlackRock Institutional Trust Company, N.A. 400 Howard Street San Francisco, CA 94105 |

Approximate date of commencement of proposed sale to the public: As soon as practical after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: þ

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ¨ |

Accelerated filer ¨ | |

|

Non-accelerated filer þ (Do not check if a smaller reporting company) |

Smaller reporting company ¨ |

Calculation of Registration Fee

| Title of Each Class of Securities to be Registered |

Amount to be Registered |

Proposed Maximum Offering Price Per Unit |

Proposed Maximum Aggregate Offering Price(1) |

Amount of Registration Fee | ||||

| Shares |

12,120,000 | 82.50 | $999,900,000 | $71,293 | ||||

| (1) | The proposed maximum aggregate offering price has been calculated assuming that all Shares are sold at a price of $82.50 per Share (determined on the basis of the price of $8,250 per metric tonne of copper announced by the London Metal Exchange on October 20, 2010 and taking into account that, on the day of creation of the registrant trust, each Share is expected to represent 10 kilograms of copper). The amount of the registration fee of the Shares is calculated in reliance upon Rule 457(d) under the Securities Act. |

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said section 8(a), may determine.

Table of Contents

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to completion, dated [ ], 20[ ]

12,120,000 Shares

iShares® Copper Trust

The iShares® Copper Trust issues shares (“Shares”) representing fractional undivided beneficial interests in its net assets. The objective of the trust is for the Shares to reflect, at any given time, the value of the assets owned by the trust less the trust’s expenses and liabilities at that time. The assets of the trust consist primarily of copper held by a custodian on behalf of the trust. The Shares are listed and traded on [ ] under the symbol “[ ]”. Market prices for the Shares may be different from the net asset value per Share. BlackRock Asset Management International Inc. is the sponsor of the trust, The Bank of New York Mellon is the trustee of the trust, and Metro International Trade Services LLC is the custodian of the trust. The trust is not an investment company registered under the Investment Company Act of 1940. The trust is not a commodity pool for purposes of the Commodity Exchange Act, and its sponsor is not subject to regulation by the Commodity Futures Trading Commission as a commodity pool operator or a commodity trading advisor.

Copper owned by the trust will be held by the custodian in the United States, [ ], and other locations that may be authorized in the future.

The trust intends to issue Shares on a continuous basis. A block of 2,500 Shares is called a “Basket”. The trust issues and redeems Shares only in blocks of [ ] or more Baskets. The trust issues Baskets in exchange for copper in physical form. Generally, redemptions take place in exchange for warehouse warrants (called “Warrants”) issued by the custodian of the trust’s copper in compliance with applicable rules of the London Metal Exchange (the “LME”). Because, in compliance with LME rules, Warrants can only be issued in amounts of 25 metric tonnes (plus or minus 2%), redemptions of Baskets may require delivery of an amount of cash sufficient to adjust for the value of the copper not susceptible to be delivered in Warrant form. Redemptions will take place in exchange for physical copper only when Warrants are not available to the trust (for example, because the copper held by the trust does not meet the LME specifications to be placed on Warrant). Only registered broker-dealers that become authorized participants by entering into a contract with the sponsor and the trustee may purchase or redeem Baskets. Shares will be offered to the public from time to time at prices that will reflect the price of copper and the trading price of the Shares on [ ] at the time of the offer.

Except when aggregated in Baskets, Shares are not redeemable securities.

Investing in the Shares involves significant risks. See “Risk Factors” starting on page 13.

Neither the Securities and Exchange Commission (SEC) nor any state securities commission has approved or disapproved of the securities offered in this prospectus, or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The Shares are not interests in or obligations of the sponsor or the trustee. The Shares are not insured by the Federal Deposit Insurance Corporation or any other governmental agency.

“iShares” is a registered trademark of BlackRock Institutional Trust Company, N.A.

The date of this prospectus is [ ], 20[ ].

Table of Contents

| Page | ||||

| 1 | ||||

| 2 | ||||

| 5 | ||||

| 5 | ||||

| 6 | ||||

| 7 | ||||

| 8 | ||||

| 12 | ||||

| 13 | ||||

| 13 | ||||

| 14 | ||||

| 16 | ||||

| 18 | ||||

| 21 | ||||

| 22 | ||||

| 22 | ||||

| 22 | ||||

| 23 | ||||

| 25 | ||||

| 29 | ||||

| 29 | ||||

| 29 | ||||

| 31 | ||||

| 32 | ||||

| 32 | ||||

| 33 | ||||

| 33 | ||||

| 34 | ||||

| 34 | ||||

| 36 | ||||

| 36 | ||||

| 37 | ||||

| 37 | ||||

| 38 | ||||

| 38 | ||||

| 38 | ||||

| 38 | ||||

| 39 | ||||

| 39 | ||||

i

Table of Contents

| 37 | ||||

| 38 | ||||

| 38 | ||||

| THE SECURITIES DEPOSITORY; BOOK-ENTRY-ONLY SYSTEM; GLOBAL SECURITY |

39 | |||

| 40 | ||||

| 40 | ||||

| 40 | ||||

| 41 | ||||

| 41 | ||||

| 42 | ||||

| 42 | ||||

| 42 | ||||

| 44 | ||||

| 44 | ||||

| 45 | ||||

| Maximum 28% Long-Term Capital Gains Tax Rate for U.S. Shareholders Who Are Individuals |

46 | |||

| 46 | ||||

| 46 | ||||

| 47 | ||||

| 47 | ||||

| 47 | ||||

| 47 | ||||

| 48 | ||||

| 48 | ||||

| 49 | ||||

| 49 | ||||

| 49 |

ii

Table of Contents

STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This prospectus includes statements which relate to future events or future performance. In some cases, you can identify such forward-looking statements by terminology such as “may,” “should,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “potential” or the negative of these terms or other comparable terminology. All statements (other than statements of historical fact) included in this prospectus that address activities, events or developments that may occur in the future, including such matters as changes in market conditions (for copper and the Shares), the trust’s operations, the sponsor’s plans and references to the trust’s future success and other similar matters are forward-looking statements. These statements are only predictions. Actual events or results may differ materially. These statements are based upon certain assumptions and analyses made by the sponsor on the basis of its perception of historical trends, current conditions and expected future developments, as well as other factors it believes are appropriate in the circumstances. Whether actual results and developments will conform to the sponsor’s expectations and predictions, however, is subject to a number of risks and uncertainties, including the special considerations discussed in this prospectus, general economic, market and business conditions, changes in laws or regulations, including those concerning taxes, made by governmental authorities or regulatory bodies, and other world economic and political developments. See “Risk Factors.” Consequently, all the forward-looking statements made in this prospectus are qualified by these cautionary statements, and there can be no assurance that the actual results or developments the sponsor anticipates will be realized or, even if substantially realized, that they will result in the expected consequences to, or have the expected effects on, the trust’s operations or the value of the Shares. Moreover, neither the sponsor, nor any other person assumes responsibility for the accuracy or completeness of the forward-looking statements. Neither the trust nor the sponsor is under a duty to update any of the forward-looking statements to conform such statements to actual results or to a change in the sponsor’s expectations or predictions.

1

Table of Contents

In this prospectus, each of the following terms has the meaning set forth below:

“Allocated”—Copper is said to be held in “allocated” form when specific pieces of copper held by the custodian are identified as the property of the person holding the “allocated” account.

“Authorized Participant”—A person who, at the time of submitting to the trustee an order to create or redeem one or more Baskets (1) is a registered broker-dealer, (2) is a DTC Participant or an Indirect Participant, and (3) has in effect a valid Authorized Participant Agreement.

“Authorized Participant Agreement”—An agreement entered into by each Authorized Participant, the sponsor and the trustee which provides the procedures for the creation and redemption of Baskets.

“Basket”—A block of 2,500 Shares or such number of Shares as the trustee, in consultation with the sponsor, may from time to time determine.

“Basket Copper Amount”—The amount of copper (measured in metric tonnes and fractions thereof), determined on each Business Day by the trustee, which Authorized Participants must transfer to the trust in exchange for a Basket, or are entitled to receive in exchange for each Basket surrendered for redemption .

“Business Day”—Any day other than (i) a Saturday or a Sunday, or (ii) a day on which [ ] is closed for regular trading.

“CFTC”—Commodity Futures Trading Commission, an independent agency with the mandate to regulate commodity futures and option markets in the United States.

“Code”—The United States Internal Revenue Code of 1986, as amended.

“COMEX”—The exchange market on copper futures contracts operated by Commodity Exchange, Inc., a subsidiary of New York Mercantile Exchange, Inc.

“Commodity Exchange Act”—The United States Commodity Exchange Act of 1936, as amended.

“Copper”—Copper that, at the time it is delivered to the Trust, meets the specifications (with respect to chemical composition, brand, shape, size and identifying markings) of copper eligible to be placed on Warrant and delivered pursuant to a copper futures contract traded on the LME.

“Custodian”—The warehousing company retained by the Trustee to be responsible for the safekeeping of the copper owned by the Trust.

“Custodian Agreement”—The agreement between the trustee and the custodian regarding the custody of the trust’s copper.

“DTC”—The Depository Trust Company, a limited purpose trust company organized under the New York Banking Law, a “banking organization” within the meaning of the New York Banking Law, a member of the United States Federal Reserve System, a “clearing corporation” within the meaning of the New York Uniform Commercial Code and a “clearing agency” registered pursuant to the provisions of Section 17A of the Securities Exchange Act of 1934.

“DTC Participant”—An entity which, pursuant to DTC’s governing documents, is entitled to deposit securities with DTC in its capacity as a “participant”.

2

Table of Contents

“ERISA”—The Employee Retirement Income Security Act of 1974, as amended.

“Exchange Act”—The United States Securities Exchange Act of 1934, as amended.

“FINRA”—The Financial Industry Regulatory Authority.

“FSA”—The Financial Services Authority, an independent non-governmental body which exercises statutory regulatory power under the FSM Act.

“FSM Act”—The United Kingdom Financial Services and Markets Act 2000.

“Indirect Participant”—An entity which has access to the DTC clearing system by clearing securities through, or maintaining a custodial relationship with, a DTC Participant.

“IRA”—Individual retirement account.

“IRS”—Internal Revenue Service.

“LME”—The London Metal Exchange.

“LME Settlement Price”—On any day, the official price (cash, seller) for copper announced by the LME on such day.

“LME Rulebook”—The Rules and Regulations of the London Metal Exchange, as from time to time in effect.

“NAV”—Net asset value per Share. See “Business of the Trust—Valuation of Copper; Computation of Net Asset Value” for a description of how the net asset value of the trust and the NAV are calculated.

“Non-U.S. Shareholder”—A shareholder that is not a U.S. Shareholder.

“OTC”—The global Over-the-Counter market for the trading of copper which consists of transactions in spot, forwards, and options and other derivatives.

“Plans”—Employee benefit plans and certain other plans and arrangements, including individual retirement accounts and annuities, Keogh plans, and certain collective investment funds or insurance company general or separate accounts in which such plans or arrangements are invested, that are subject to Title I of ERISA and/or Section 4975 of the Code.

“SEC”—The Securities and Exchange Commission.

“Securities Act”—The United States Securities Act of 1933, as amended.

“Shareholders”—Owners of beneficial interests in the Shares.

“Shares”—Units of fractional undivided beneficial interest in the net assets of the trust which are issued by the trust.

“Sponsor”—BlackRock Asset Management International Inc., an indirect subsidiary of BlackRock, Inc.

“Trust”—The iShares® Copper Trust, a New York trust formed pursuant to the Trust Agreement.

3

Table of Contents

“Trust Agreement”—The Depositary Trust Agreement dated [ ], 201[ ] among the sponsor, the trustee, the registered and beneficial owners from time to time of Shares and all persons that deposit copper for creation of Shares.

“Trustee”—The Bank of New York Mellon, a banking corporation organized under the laws of the State of New York with trust powers.

“U.S. Shareholder”—A Shareholder that is (1) an individual who is treated as a citizen or resident of the United States for United States federal income tax purposes; (2) a corporation or partnership created or organized in or under the laws of the United States or any political subdivision thereof; (3) an estate, the income of which is includible in gross income for United States federal income tax purposes regardless of its source; or (4) a trust, if a court within the United States is able to exercise primary supervision over the administration of the trust and one or more United States persons have the authority to control all substantial decisions of the trust, or a trust that has made a valid election under applicable Treasury Regulations to be treated as a domestic trust.

“Warrant”—a warehouse warrant representing Copper issued in compliance with the LME Rulebook.

4

Table of Contents

Although the sponsor believes that this summary is materially complete, you should read the entire prospectus, including “Risk Factors” beginning on page 13, before making an investment decision about the Shares.

A glossary of defined terms appears beginning on page 2 above.

Trust Structure, the Sponsor, the Trustee and the Custodian

The trust was formed on [ ], 20[ ] when the sponsor and The Bank of New York Mellon (the “Trustee”) signed the Depositary Trust Agreement (“Trust Agreement”) and an initial deposit of copper was made in exchange for the issuance of [ ] Baskets. The purpose of the trust is to own copper transferred to the trust in exchange for shares issued by the trust (“Shares”). Each Share represents a fractional undivided beneficial interest in the net assets of the trust. The assets of the trust consist primarily of copper held by the custodian on behalf of the trust. However, there may be situations where the trust will unexpectedly hold cash. For example, a claim may arise against a third party, which is settled in cash. In situations where the trust unexpectedly receives cash or other assets, no new Shares will be issued until after the record date for the distribution of such cash or other property has passed.

The trust issues and redeems Shares only in blocks of [ ] or more Baskets. A Basket consists of 2,500 Shares. The trust issues Baskets in exchange for copper in physical form. Generally, redemptions take place in exchange for warehouse warrants (called “Warrants”) issued by the custodian of the trust’s copper in compliance with applicable rules of the London Metal Exchange (the “LME”). Because, in compliance with LME rules, Warrants can only be issued in amounts of 25 metric tonnes (plus or minus 2%), redemptions of Baskets may require delivery of an amount of cash sufficient to adjust for the value of the copper not susceptible to be delivered in Warrant form. Redemptions will take place in exchange for physical copper only when Warrants are not available to the trust (for example, because the copper held by the trust does not meet the LME specifications to be placed on Warrant). Individual Shares will not be redeemed by the trust, but will be listed and traded on [ ] under the symbol “[ ]”. The objective of the trust is for the value of the Shares to reflect, at any given time, the value of copper owned by the trust at that time less the trust’s expenses and liabilities. The material terms of the trust are discussed in greater detail under the section “Description of the Shares and the Trust Agreement”. The trust is not a registered investment company under the Investment Company Act of 1940 and is not required to register under such act.

The trust’s sponsor is BlackRock Asset Management International Inc., a Delaware corporation and a subsidiary of BlackRock, Inc. The Shares are not obligations of, and are not guaranteed by, BlackRock Asset Management International Inc. or any of its subsidiaries or affiliates.

The sponsor arranged for the creation of the trust, the registration of the Shares for their public offering in the United States and the listing of the Shares on [ ]. The sponsor has agreed to assume the following administrative and marketing expenses incurred by the trust: the trustee’s fee, [ ]’s listing fees, SEC registration fees, printing and mailing costs, audit fees and expenses and up to $100,000 per annum in legal fees and expenses. The trust will be responsible for (and, therefore, the Shareholders will bear the burden of) trust expenses not assumed by the Sponsor. These expenses include, primarily, the warehousing fees owed to the custodian and the sponsor’s fee.

The sponsor will not exercise day-to-day oversight over the trustee or the custodian. The sponsor may remove the trustee and appoint a successor trustee if the trustee ceases to meet certain objective

5

Table of Contents

requirements (including the requirement that it have capital, surplus and undivided profits of at least $150 million) or if, having received written notice of a material breach of its obligations under the Trust Agreement, the trustee has not cured the breach within thirty days. The sponsor also has the right to replace the trustee during the ninety days following any merger, consolidation or conversion in which the trustee is not the surviving entity or, in its discretion, on the fifth anniversary of the creation of the trust or on any subsequent third anniversary thereafter. The sponsor also has the right to approve any new or additional custodian that the trustee may wish to appoint.

The trustee is The Bank of New York Mellon and the custodian is Metro International Trade Services LLC (the “Custodian”).

The trustee is responsible for the day-to-day administration of the trust. The responsibilities of the trustee include (1) processing orders for the creation and redemption of Baskets; (2) coordinating with the custodian the receipt and delivery of copper transferred to, or by, the trust in connection with each issuance and redemption of Baskets; (3) calculating the net asset value and the adjusted net asset value of the trust on each business day; and (4) selling the trust’s copper as needed to cover the trust’s expenses or pay amounts due by the trust in connection with a redemption of Baskets. For a more detailed description of the role and responsibilities of the trustee see “Description of the Shares and the Trust Agreement” and “The Trustee.”

The custodian is responsible for safekeeping the copper owned by the trust. The custodian is appointed by the trustee and is responsible for any loss of copper to the trustee only. The general role and responsibilities of the custodian are further described in “The Custodian.” Because the holders of Shares are not parties to the custodian agreement, their claims against the custodian may be limited. The custodian has no obligation to accept any additional delivery on behalf of the trust if, after giving effect to such delivery, the total weight of the trust’s copper held by the custodian exceeds [ ] metric tonnes. If this limit is exceeded, it is anticipated that the trustee, with the consent of the sponsor, will retain an additional custodian. If an additional custodian becomes necessary, the trustee will seek to hire the additional custodian under terms and conditions similar to those in the agreement with the custodian. However, because the agreement with the additional custodian will only be negotiated when the need for the additional custodian arises, it may not be possible for the trustee to locate at that time an additional custodian that agrees to exactly the same terms of the agreement with the custodian. As a result, the new agreement may differ from the current one with the custodian, with respect to issues like duration, fees, maximum amount of copper that the additional custodian will hold on behalf of the trust, scope of the additional custodian’s liability and the additional custodian’s standard of care.

The objective of the trust is for the value of the Shares to reflect, at any given time, the value of copper owned by the trust at that time, less the trust’s expenses and liabilities. The trust is not actively managed. It does not engage in any activities designed to obtain a profit from, or to ameliorate losses caused by, changes in the price of copper. The trust receives copper deposited with it in exchange for the creation of Baskets, sells copper as necessary to cover the trust expenses and other liabilities (including in respect of redemptions of Baskets) and delivers copper in exchange for Baskets surrendered to it for redemption.

The Shares are intended to constitute a simple and cost-effective means of making an investment similar to an investment in copper. Although the Shares are not the exact equivalent of an investment in

6

Table of Contents

copper, they provide investors with an alternative that allows a level of participation in the copper market through the securities market. An investment in Shares is:

Backed by copper held by the custodian on behalf of the trust.

The Shares are backed by copper held by the custodian on behalf of the trust in the United States, [ ], and other locations that may be authorized in the future.

As accessible and easy to handle as any other investment in shares.

Retail investors may purchase and sell Shares through traditional brokerage accounts at prices expected to be less than the amount required for currently existing means of investing in physical copper. Shares are eligible for margin accounts.

Listed.

Although there can be no assurance that an actively traded market in the Shares will develop or be maintained, the Shares are listed and traded on [ ] under the symbol “[ ]”.

Relatively cost efficient.

Because the expenses involved in an investment in physical copper will be dispersed among all holders of Shares, an investment in Shares may represent a cost-efficient alternative to investments in copper for investors not otherwise in a position to participate directly in the market for physical copper. See “Business of the Trust—Trust Objective”.

The sponsor’s office is located at 400 Howard Street, San Francisco, CA 94105; telephone number (415) 670-2000. The trustee has a trust office at 101 Barclay Street, Floor 6E, New York, New York 10286, telephone number (212) 815-6250. The custodian’s registered office is located at [ ]; its telephone number is [ ].

7

Table of Contents

| Offering |

The Shares represent units of fractional undivided beneficial interest in the net assets of the trust. |

| Use of proceeds |

Proceeds received by the trust from the issuance of Baskets consist of copper deposits. Such deposits are held by the custodian on behalf of the trust until (i) delivered to Authorized Participants in connection with a redemption of Baskets or (ii) sold to pay the fee due to the sponsor and trust expenses or liabilities not assumed by the sponsor. |

| [ ] symbol |

[ ] |

| CUSIP |

[ ] |

| Creation and redemption |

The trust issues and redeems Baskets on a continuous basis (a Basket equals 2,500 Shares). Baskets are only issued or redeemed in exchange for an amount of copper (generally represented by Warrants, in the case of redemptions) determined by the trustee on each day that [ ] is open for regular trading. No Shares are issued unless the custodian has allocated to the trust’s account the corresponding amount of copper. On the day of creation of the trust, a Basket required delivery of 25 metric tonnes of copper. The amount of copper necessary for the creation of a Basket, or to be received (generally in the form of Warrants) upon redemption of a Basket, will decrease over the life of the trust, due to the payment or accrual of fees and other expenses or liabilities payable by the trust. Baskets may be created or redeemed only by Authorized Participants, who must pay the trustee a transaction fee in connection with each order to create or redeem Baskets. See “Description of the Shares and the Trust Agreement” for more details. |

| Net Asset Value |

The net asset value of the trust is obtained by subtracting the trust’s expenses and liabilities on any day from the value of the copper owned by the trust on that day; the net asset value per Share, or NAV, is obtained by dividing the net asset value of the trust on a given day by the number of Shares outstanding on that date. On each day on which [ ] is open for regular trading, the trustee determines the NAV as promptly as practicable after 4:00 p.m. (New York time). The trustee values the trust’s copper on the basis of that day’s announced LME Settlement Price. If there is no LME Settlement Price on that day, the trustee is authorized to use the most recently announced LME Settlement Price unless the trustee, in consultation with the sponsor, determines that such price is inappropriate as a basis for evaluation. See “Business of the Trust—Valuation of Copper; Computation of Net Asset Value.” |

8

Table of Contents

| Trust expenses |

The trust’s main recurring expenses are expected to be the remuneration due to the sponsor (the “sponsor’s fee”) and the fees due to the custodian (the “custodian’s fee”). In exchange for the sponsor’s fee, the sponsor has agreed to assume the following administrative and marketing expenses of the trust: the trustee’s fee, [ ] listing fees, SEC registration fees, printing and mailing costs, audit fees and expenses and up to $100,000 per annum in legal fees and expenses. The sponsor also paid the costs of the trust’s organization and the initial sale of the Shares, including the applicable SEC registration fees. |

The sponsor’s fee is accrued daily and paid monthly in arrears at an annualized rate equal to[ ]% of the adjusted net asset value of the trust. The trustee will from time to time sell copper in such quantity as may be necessary to permit payment of the sponsor’s fee, the custodian’s fee and of other trust expenses and liabilities not assumed by the sponsor. The trustee is authorized to sell copper at such times and in the smallest amounts required to permit such payments as they become due, it being the intention to avoid or minimize the trust’s holdings of assets other than copper. Accordingly, the amount of copper to be sold will vary from time to time depending on the level of the trust’s expenses and liabilities and the market price of copper. See “Business of the Trust—Trust Expenses” and “Description of the Shares and the Trust Agreement—Trust Expenses and Copper Sales.”

| Tax Considerations |

Owners of Shares will be treated, for U.S. federal income tax purposes, as if they owned a corresponding share of the assets of the trust. They will also be viewed as if they directly received a corresponding share of any income of the trust, or as if they had incurred a corresponding share of the expenses of the trust. Consequently, each sale of copper by the trust will be a taxable event to Shareholders. See “United States Federal Tax Consequences—Taxation of U.S. Shareholders” and “ERISA and Related Considerations.” |

| Voting Rights |

Owners of Shares do not have any voting rights. See “Description of the Shares and the Trust Agreement—Voting Rights.” |

| Suspension of Issuance, Transfers and Redemptions |

The trustee may suspend the delivery or registration of transfers of Shares, or may refuse a particular deposit or transfer at any time, if the trustee or the sponsor think it advisable for any reason. Redemptions may be suspended only (i) during any period in which regular trading on [ ] is suspended or restricted, or the exchange is closed, (ii) during an emergency as a result of which delivery, disposal or evaluation of Warrants is not reasonably practicable, or (iii) at any time when Warrants are not available to the trust, during an emergency as a result of which delivery, disposal or evaluation of copper is not reasonably |

9

Table of Contents

| practicable. See “Description of the Shares and the Trust Agreement—Requirements for Trustee Actions.” |

| Limitation on Liability |

The sponsor and the trustee: |

| • | are only obligated to take the actions specifically set forth in the Trust Agreement without negligence or bad faith; |

| • | are not liable for the exercise of discretion permitted under the Trust Agreement; and |

| • | have no obligation to prosecute any lawsuit or other proceeding on behalf of the Shareholders or any other person. |

See “Description of the Shares and the Trust Agreement—Limitations on Obligations and Liability.”

| Termination events |

The trustee will terminate the Trust Agreement if: |

| • | the trustee is notified that the Shares are delisted from [ ] and are not approved for listing on another national securities exchange within five business days of their delisting; |

| • | holders of at least 75% of the outstanding Shares notify the trustee that they elect to terminate the trust; |

| • | 60 days have elapsed since the trustee notified the sponsor of the trustee’s election to resign and a successor trustee has not been appointed and accepted its appointment; |

| • | the SEC determines that the trust is an investment company under the Investment Company Act of 1940, as amended, and the trustee has actual knowledge of that determination; |

| • | the aggregate market capitalization of the trust, based on the closing price for the Shares, was less than $350 million for five consecutive trading days and the trustee receives, within six months from the last of those trading days, notice that the sponsor has decided to terminate the trust; |

| • | the CFTC determines that the trust is a commodity pool under the Commodity Exchange Act and the trustee has actual knowledge of that determination; or |

| • | the trust fails to qualify for treatment, or ceases to be treated, as a grantor trust for United States federal income tax purposes and the trustee receives notice that the sponsor has determined that the termination of the trust is advisable. |

[If not terminated earlier by the trustee, the trust will terminate in [ ], on the [ ] anniversary of its creation. See “Description of the Shares and the Trust Agreement—Amendment and Termination.”] After termination of the trust, the trustee will

10

Table of Contents

| deliver trust property upon surrender and cancellation of Shares and, ninety days after termination, may sell any remaining trust property in a private or public sale, and hold the proceeds, uninvested and in a non-interest bearing account, for the benefit of the holders who have not surrounded their Shares for cancellation. See “Description of the Shares and the Trust Agreement— Amendment and Termination.” |

| Authorized Participants |

Baskets may be created or redeemed only by Authorized Participants. Each Authorized Participant must be a registered broker-dealer, a participant in DTC, have entered into an agreement with the trustee (the Authorized Participant Agreement) and be in a position to transfer copper to, and take delivery of copper from, the custodian through one or more copper accounts. The Authorized Participant Agreement provides the procedures for the creation and redemption of Baskets and for the delivery of copper in connection with such creations or redemptions. A list of the current Authorized Participants can be obtained from the trustee or the sponsor. |

| Clearance and settlement |

The Shares are issued in book-entry form only. Transactions in Shares clear through the facilities of DTC. Investors may hold their Shares through DTC, if they are participants in DTC, or indirectly through entities that are participants in DTC. |

11

Table of Contents

12

Table of Contents

Before making an investment decision, you should consider carefully the risks described below, as well as the other information included in this prospectus.

Risks Related to the Copper Markets

Because the Shares are created to reflect the price of the copper held by the trust, the market price of the Shares will be as unpredictable as the price of copper has historically been. This creates the potential for losses, regardless of whether you hold Shares for a short-, mid- or long-term.

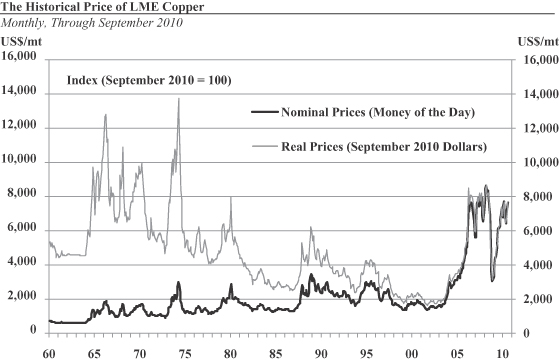

Shares are created to reflect, at any given time, the value of the copper owned by the trust at that time less the trust’s expenses and liabilities. Because the value of Shares depends on the price of copper, it is subject to fluctuations similar to those affecting copper prices. The price of copper has fluctuated widely over the past several years. If copper markets continue to be characterized by the wide fluctuations that they have shown in the past several years, the price of the Shares will change widely and in an unpredictable manner. This exposes your investment in Shares to potential losses if you need to sell your Shares at a time when the price of copper is lower than it was when you made your investment in Shares. Even if you are able to hold Shares for the mid- or long-term you may never realize a profit, because copper markets have historically experienced extended periods of flat or declining prices.

Following an investment in Shares, several factors may have the effect of causing a decline in the prices of copper and a corresponding decline in the price of Shares. Among them:

| • | A change in economic conditions, such as a recession, can adversely affect the price of copper. In recent years, demand from China has been a significant factor in the overall market for copper and, therefore, copper price levels. Were such demand to decline due to a reduction in the rate of growth of the Chinese economy, or for other reasons, copper prices and, consequently, the price of the Shares could decline as well. |

| • | Copper is used in a wide range of industrial applications. Technological changes and the substitution of other materials in lieu of copper (for example, aluminum in copper transition lines, PVCs in copper tubing, and optical fibers for copper cable in telecommunications lines) could have a negative impact on its demand and, consequently, its price and the price of the Shares. |

| • | A change in the attitude of speculators and investors towards copper. Should the speculative community take a negative view towards copper, a decline in world copper prices could occur, negatively impacting the price of the Shares. |

| • | A significant increase in copper price hedging activity by copper producers or industrial users. Should there be an increase in the level of hedge activity of copper mining companies or industrial users of copper, it could cause a decline in world copper prices, adversely affecting the price of the Shares. |

Conversely, several factors may trigger a temporary increase in the price of copper prior to your investment in the Shares. If that is the case, you will be buying Shares at prices affected by the temporarily high prices of copper, and you may incur losses when the causes for the temporary increase disappear. One of the causes for a temporary increase of this type would be a very enthusiastic reception of the Shares by the market. If a rush to acquire Shares results in large purchases of copper to be deposited in the trust, the price of copper may see an increase that will subside after the initial rush comes to an end.

13

Table of Contents

Neither the sponsor nor the trustee has experience with a trust the only assets of which are copper. Their experience may be inadequate or unsuitable to manage the trust.

None of the sponsor, the trustee or their respective management have experience with an investment vehicle such as the trust that only invests in copper. While there have been other similar exchange traded investment vehicles that invest in precious metals and with which the sponsor and the trustee have been involved, none of them invested in copper. If this lack of experience with a copper-based investment vehicle like the trust results in losses or operational difficulties, the value of the Shares may be adversely affected. In addition, the trust is the first investment vehicle the shares of which seek to track the price of a base metal such as copper. Although the trust relies on the same structural principles that have proved successful for the tracking of the price of precious metals by other investment vehicles, there is no assurance that the different nature of the markets for base metals will not adversely affect the ability of the Shares to track the price of copper. If that were to be the case, the price of the Shares may fluctuate erratically, and you may sustain a loss in your investment.

The trust is a passive investment vehicle. This means that the value of your Shares may be adversely affected by trust losses that, if the trust had been actively managed, it might have been possible to avoid.

The trustee does not actively manage the copper held by the trust. This means that the trustee does not sell copper at times when its price is high, or acquire copper at low prices in the expectation of future price increases. It also means that the trustee does not make use of any of the hedging techniques available to professional copper investors to attempt to reduce the risks of losses resulting from price decreases or high price volatility. Any losses sustained by the trust will adversely affect the value of your Shares.

The performance of your Shares will be adversely affected by an increase in the expenses of the trust.

The trust will be responsible for the payment of the sponsor’s fee and all other expenses not assumed by the sponsor. While most of the anticipated ordinary expenses of the trust have been assumed by the sponsor, warehousing fees are the responsibility of the trust. The amount of the warehousing fess at the time of effectiveness of the registration statement that includes this prospectus are set forth under “The Custodian—The Custodian Fees”. The benefit of these fees, however, will only last for as long as the agreement with the custodian is in place and the custodian is required to provide services thereunder. By its terms, the custodian agreement will terminate on [ ]. In addition, the custodian has no obligation to accept any additional delivery on behalf of the trust if, after giving effect to such delivery, the total weight of the trust’s copper held by the custodian exceeds [ ] metric tonnes. If the custodian agreement terminates and the trust needs to negotiate a new agreement with a different custodian, or if the trust is required to obtain the services of additional warehousing companies to store copper in excess of the amount that the custodian is required to warehouse, the amount of the fees to be paid by the trust in connection with such new arrangements is impossible to predict. It will depend on the market conditions prevailing at the time, the relative strength of the trust’s bargaining position and other factors outside of the trust’s or the sponsor’s control. In any event, an increase in warehousing fees will require additional sales of copper to cover such fees and will result in a corresponding decrease in the return, if any, of your investment in the Shares.

Copper warehousing fees are usually structured in terms of a fixed dollar amount per metric tonne per day, irrespective of the market value of the copper. Accordingly, in times of depressed copper prices, the trust will need to sell higher amounts of copper to cover periodic storage fees. This will result in a more accelerated decrease of the amount of copper represented by each Share and a corresponding decrease in the value of the Share.

14

Table of Contents

A determination by the taxing authorities in one or more of the several relevant jurisdictions that transfers of copper to or from the trust, in connection with issuances and redemptions of Baskets, is subject to sales or other taxes could have an adverse effect on the trust and the value of your Shares.

Transfers of copper to the trust, in exchange for newly issued Baskets, and delivery of Warrants representing copper in exchange for Baskets surrendered for redemption, take place in different jurisdictions, each with its own tax laws and regulations. While the Sponsor intends to obtain advice regarding any applicable transfer, sales or other taxes in connection with such transactions, and the Authorized Participants have agreed to assume any such taxes, it is possible that a final determination by the relevant tax authorities as to the application of a tax may not occur until some time after the transaction with the relevant Authorized Participant has been concluded. Should any such final determination be inconsistent with the advice previously received by the Sponsor, and the relevant Authorized Participant unwilling or unable to cover the amount of any unpaid taxes in respect of past transactions, the trust may be left with a tax liability for which it may not be able to seek recovery from any person. In such circumstances, the value of the assets of the trust will decrease to reflect any sales of copper needed to pay the past due taxes, and the value of the Shares will be adversely affected.

The liquidation of the trust may occur at a time when the disposition of the trust’s copper will result in losses to investors in Shares.

The trust will have limited duration. If certain events occur, at any time, the trustee will have to terminate the trust. [Otherwise, the trust will terminate automatically after forty years.] See “Description of the Shares and the Trust Agreement—Amendment and Termination” for more information about the termination of the trust, including when events outside the control of the sponsor, the trustee or the Shareholders may prompt the trust’s termination.

Upon termination of the trust, the trustee will sell copper in the amount necessary to cover all expenses of liquidation, and to pay any outstanding liabilities of the trust. The remaining copper will be distributed among investors surrendering Shares. Any copper remaining in the possession of the trustee after 90 days may be sold by the trustee and the proceeds of the sale will be held by the trustee until claimed by any remaining holders of Shares. Sales of copper in connection with the liquidation of the trust at a time of low prices will likely result in losses, or adversely affect your gains, on your investment in Shares.

Investors with large holdings may choose to terminate the trust.

Holders of 75% of the Shares have the power to terminate the trust. This power may be exercised by a relatively small number of holders. If it is so exercised, investors who wished to continue to invest in copper through the vehicle of the trust will have to find another vehicle, and may not be able to find another vehicle that offers the same features as the trust.

The value of the Shares will be adversely affected if copper owned by the trust is lost or damaged in circumstances in which the trust is not in a position to recover the corresponding loss.

Copper owned by the trust will not be insured against any kind of risks. In addition, the custodian is responsible to the trust for loss or damage to the trust’s copper only under limited circumstances and, when it is so responsible, the custodian has no obligation to replace any copper lost. The custodian’s liability to the trust, if any, will be limited to the value of any copper lost at the time of the custodian’s acts or omissions giving rise to the claim for indemnification. Accordingly, even when the custodian is liable to the trust and has paid indemnification for any losses attributable to it, there is no assurance that such indemnification will suffice to place the trust and its shareholders in the same situation as they would have been in the absence of the circumstances giving rise to such losses.

15

Table of Contents

Any loss of copper owned by the trust will result in a corresponding loss in the NAV and it is reasonable to expect that such loss will also result in a decrease in the value at which the Shares are traded on [ ].

Copper transferred to the trust in connection with the creation of Baskets may not be of the quality required under the Trust Agreement. The trust will sustain a loss if the trustee issues Shares in exchange for copper of inferior quality and that loss will adversely affect the value of all existing Shares.

The procedures agreed to with the custodian contemplate that the custodian must undertake certain tasks in connection with the inspection of copper delivered by Authorized Participants in exchange for Baskets. The custodian’s inspection includes procedures that the Sponsor believes are consistent with industry practice, but does not include any chemical or other tests designed to verify that the copper received does, in fact, meet the requirements referred to in the Trust Agreement. Accordingly, such inspection procedures may not prevent the deposit of copper that fails to meet these standards. Each person that deposits copper in the trust is liable to the trust if that copper does not meet the requirements of the Trust Agreement. The custodian will not be responsible or liable to the trust or to any investor in the event any copper otherwise properly inspected by it does not meet the requirements contained in the Trust Agreement. To the extent that Baskets are issued in exchange for copper of inferior quality and the trust is not able to recover damages from the person that deposited that copper, the total value of the assets of the trust will be adversely affected and, with it, the NAV. In these circumstances, it is reasonable to expect that the value at which the Shares trade on [ ] will also be adversely affected.

The value of the Shares will be adversely affected if the trust is required to indemnify the sponsor and certain related parties or the custodian as contemplated in the Trust Agreement and the custodian agreement.

Under the Trust Agreement, the sponsor and certain parties related to the sponsor (such as its shareholders, officers or directors) have a right to be indemnified from the trust for any liability or expense incurred in connection with the discharge of their obligation under the Trust Agreement and without negligence, bad faith, willful misconduct or reckless disregard on their part. Similarly, under the custodian agreement the custodian has a right to be indemnified from the trust for certain losses. This means that it may be necessary to sell assets of the trust in order to cover losses or liability suffered by the persons entitled to indemnification pursuant to the foregoing provisions. Any sale of that kind would reduce the net asset value of the trust and the value of the Shares.

Sponsor and its affiliates may engage in activities that present conflicts with the interests of the trust and holders of the Shares.

The sponsor may, from time to time, have conflicting demands in respect of its obligations to the trust. In addition, the sponsor or any of its affiliates may engage in trading activities relating to copper that are not for the account of, or on behalf of, the trust or the Shareholders. These activities may present a conflict between the Shareholders’ interest in the Shares and the interest of the sponsor and its affiliates in their proprietary accounts and could be adverse to the interests of the Shareholders.

Risks Related to The London Metal Exchange

Although the trust is not affiliated with, or endorsed or in any way supported by, The London Metal Exchange, it relies on prices and standards disseminated by the LME that are widely accepted in the copper world markets and, in connection with the delivery of Warrants due upon a redemption of Baskets, on the availability of certain systems and arrangements developed and put in place by the LME. As a result, several actions or omission of the LME, over which none of the trust, the sponsor or the trustee will have

16

Table of Contents

any control, may have an adverse effect on the value of the Shares and may result in losses in your investment in Shares. For example:

A failure of the systems or procedures developed by the LME for the transfer of Warrants may delay or impede timely redemptions of Baskets and prevent the trading price of the Shares from converging with the price of copper .

As explained elsewhere in this prospectus, redemptions generally take place in exchange for warehouse warrants called “Warrants” that are issued by the custodian of the trust’s copper in compliance with applicable rules of the LME, together with (if necessary) an amount of cash sufficient to adjust for the value of copper not susceptible to be delivered in Warrant form. Pursuant to the LME Rulebook, Warrants are transferred via an electronic system called the LMEsword System, operated by the LME. None of the trust, the trustee, the custodian or any of their affiliates has any control over the operation or availability of the LMEsword System. Should the LMEsword System become unavailable at the time a redemption is expected to occur, the custodian will not be able to deliver on behalf of the trust the corresponding Warrants. In that situation, while it may be possible for the trust to arrange for a physical delivery of copper in lieu of Warrants, there is no assurance that such delivery could take place at the time anticipated by the redeeming authorized participant, and a delay in the redemption may result.

To the extent that the delays described in the paragraph above occur at a time when the trading price of the Shares has deviated from the price of copper, they may result in authorized participants not being able or willing to take advantage of the arbitrage opportunities that would otherwise operate to close the disparity and cause both prices to converge. If that is the case, the price of your Shares may fall or fluctuate erratically and you may sustain a loss in your investment. See “Risk Factors—Risks Relating to the Shares—If the process of creation and redemption of Baskets encounters any unanticipated difficulties or is materially restricted due to any illiquidity in the market for physical copper, or for other reasons, the possibility for arbitrage transactions by Authorized Participants, intended to keep the price of the Shares closely linked to the price of copper, may not exist and, as a result, the price of the Shares may fall or otherwise diverge from NAV.”

The copper held by the trust may cease to be eligible under applicable standards of The London Metal Exchange and such change may adversely affect the value of your investment in the Shares.

According to the Trust Agreement, only copper that meets the requirements to be delivered in settlement of copper futures contracts traded on the LME may be delivered to the trust in exchange for Baskets. This requirements seeks to ensure that the trust owns copper of such quality and specifications as are widely acceptable in the market. There is no assurance, however, that the LME will not change its specifications, or that copper held by the custodian will not cease to meet the specifications required to be delivered in settlement of copper futures contracts traded on the LME. As a result, copper owned by the trust may become less marketable and lose value. If that were the case, the value of your investment in the Shares would be adversely affected.

Errors or omissions in information disseminated by The London Metal Exchange may have an adverse effect on the value of your Shares.

The trust values its assets using the Official Price (cash seller) announced by the LME on the date on which the valuation takes place. Should the LME fail to announce an Official Price (cash seller) on a date when such announcement is expected, the trustee is authorized to use the most recently announced LME Official Price (cash seller) unless the trustee, in consultation with the sponsor, determines that such a price is inappropriate as a basis for evaluation. Similarly, the LME may announce on a date as Official Price (cash seller) an erroneous price. It is not possible to anticipate the effect, if any, that such a change in the price used in the valuation of the trust’s assets, or the announcement of an erroneous price (even if

17

Table of Contents

subsequently corrected by the LME) may have on the price of the Shares, but it is conceivable that such impact could be negative and material. If that is the case and you were to sell your Shares at a time while such negative impact is still affecting their market price, you may sustain a loss in your investment in the Shares.

The amount of copper represented by the Shares will decrease over the life of the trust due to the sales necessary to pay trust expenses. Without increases in the price of copper sufficient to compensate for that decrease, the price of the Shares will also decline and you will lose money on your investment in Shares.

Because the trust does not have any income, it needs to sell copper to cover the sponsor’s fee and expenses not assumed by the sponsor. Although the sponsor has agreed to assume all organizational and certain ordinary administrative and marketing expenses incurred by the trust, not all trust expenses have been assumed by the sponsor. For example, warehousing and any taxes and other governmental charges that may be imposed on the trust’s property will not be paid by the sponsor. Legal fees and expenses in excess of $100,000.00 per annum will be also be the responsibility of the trust.

The trust may also be subject to other liabilities (for example, as a result of litigation) which have also not been assumed by the sponsor. The only source of funds to cover those liabilities will be sales of copper held by the trust. Even if there were no expenses other than those assumed by the sponsor, and there were no other liabilities of the trust, the trustee would still need to sell copper to pay the warehousing fees and the sponsor’s fee. The result of these sales is a decrease in the amount of copper represented by each Share. New deposits of copper, received in exchange for new Shares issued by the trust, do not reverse this trend.

A decrease in the amount of copper represented by each Share results in a decrease in its price even if the price of copper has not changed. To retain the Share’s original price, the price of copper has to increase. Without that increase, the lower amount of copper represented by each Share will have a correspondingly lower price. If these increases do not occur, or are not sufficient to counter the lower amount of copper represented by each Share, you will sustain losses on your investment in Shares.

The price received upon the sale of Shares may be less that the value of the copper represented by them.

The result obtained by subtracting the trust’s expenses and liabilities on any day from the price of the copper owned by the trust on that day is the net asset value of the trust which, when divided by the number of Shares outstanding on that date, results in the net asset value per Share, or NAV.

Shares may trade at, above or below their NAV. The NAV of Shares will fluctuate with changes in the market value of the trust’s assets. The trading prices of Shares will fluctuate in accordance with changes in their NAVs as well as market supply and demand. The amount of the discount or premium in the trading price relative to the NAV per Share may be influenced by non-concurrent trading hours between the major copper markets and [ ]. While the Shares will trade on [ ] until [ ]:00 p.m. New York time, liquidity in the market for copper will be reduced after the close of the major world copper markets, including the LME and the COMEX. As a result, during this time, trading spreads, and the resulting premium or discount on Shares, may widen.

There may be situations where an Authorized Participant is unable to redeem a Basket. To the extent the value of copper decreases, these delays may result in a decrease in the value of the copper the Authorized Participant will receive when the redemption occurs, as well as a reduction in liquidity for all shareholders in the secondary market.

Although Shares surrendered by Authorized Participants in [ ] or more Basket aggregations are redeemable in exchange for Warrants representing the underlying amount of copper (together with, if

18

Table of Contents

necessary, an amount of cash sufficient to adjust for the value of amounts of copper not susceptible to be delivered in Warrant form), redemptions may be suspended during any period while regular trading on [ ] is suspended or restricted, or in which an emergency exists that makes it reasonably impracticable to deliver, dispose of, or evaluate copper. If any of these events occurs at a time when an Authorized Participant intends to redeem Shares, and the price of copper decreases before such Authorized Participant is able again to surrender for redemption Baskets, such Authorized Participant will sustain a loss with respect to the amount that it would have been able to obtain in exchange for the copper received from the trust upon the redemption of its Shares, had the redemption taken place when such Authorized Participant originally intended it to occur. As a consequence, Authorized Participants may reduce their trading in Shares during times when redemptions are suspended, decreasing the number of potential buyers of Shares in the secondary market and, therefore, the price a shareholder may receive upon sale.

The liquidity of the Shares may also be affected by the withdrawal from participation of Authorized Participants.

In the event that one of more Authorized Participants which have substantial interests in Shares withdraw from participation, the liquidity of the Shares will likely decrease which could adversely affect the market price of the Shares and result in your incurring a loss on your investment.

The lack of an active trading market for the Shares may result in losses on your investment at the time of disposition of your Shares.

Although Shares are listed for trading on [ ], you should not assume that an active trading market for the Shares will develop or be maintained. If you need to sell your Shares at a time when no active market for them exists, such lack of an active market will most likely adversely affect the price you receive for your Shares (assuming you are able to sell them).

If the process of creation and redemption of Baskets encounters any unanticipated difficulties or is materially restricted due to any illiquidity in the market for physical copper, or for other reasons, the possibility for arbitrage transactions by Authorized Participants, intended to keep the price of the Shares closely linked to the price of copper, may not exist and, as a result, the price of the Shares may fall or otherwise diverge from NAV.

The ability of Authorized Participants to create and redeem Baskets in a predictable and timely manner is intended to ensure that they will stand ready to take advantage of any arbitrage opportunities arising from temporary discrepancies between the trading price of the Shares and the price of the copper represented by the Shares. At times when the Shares are trading at a premium (that is, they can be sold at a price higher than the price of the amount of copper represented by them), Authorized Participants will have an incentive to purchase and deposit copper into the trust in exchange for new Baskets that can then be sold at a profit. That purchase of copper and sale of Shares should cause their trading prices to converge. Conversely, when the Shares are trading at a discount (that is, they can be purchased at a price lower than the price of the amount of copper represented by them), Authorized Participants will have an incentive to purchase Shares and redeem them in exchange for the corresponding amounts of copper that can then be sold at a profit. The purchase of Shares and sale of copper should cause their trading prices to converge. In either case, the activities of the Authorized Participants should have the effect of ensuring that the price of the Shares reflect the price of the copper they represent.

If the processes of creation and redemption of Shares encounter any unanticipated difficulties, Authorized Participants and their customers, who would otherwise be willing to purchase or redeem Baskets to take advantage of any arbitrage opportunities described above, may not take the risk that, as a result of those difficulties, they may not be able to realize the profit they expect. Such difficulties may

19

Table of Contents

arise, for example, due to shortages in the availability of physical copper to be delivered in connection with a creation of new Baskets, if such copper is only available at locations from which it would not be cost-efficient for the Authorized Participant to transfer it to the trust’s account at the custodian, or if limitations in the custodian’s ability to promptly take or make delivery of copper were to dissuade Authorized Participants or their customers from attempting to capitalize on otherwise available arbitrage opportunities. If this is the case, the liquidity of the Shares may decline and the price of the Shares may fluctuate independently of the price of copper and may fall.

As an owner of Shares, you will not have the rights normally associated with ownership of other types of shares.

Shares are not entitled to the same rights as shares issued by a corporation. By acquiring Shares, you are not acquiring the right to elect directors, to receive dividends, to vote on certain matters regarding the issuer of your Shares or to take other actions normally associated with the ownership of shares. You will only have the limited rights described under “Description of the Shares and the Trust Agreement”.

As an owner of Shares, you will not have the protections normally associated with ownership of shares in an investment company registered under the Investment Company Act of 1940, or the protections afforded by the Commodity Exchange Act.

The trust is not registered as an investment company for purposes of United States federal securities laws, and is not subject to regulation by the SEC as an investment company. Consequently, the owners of Shares do not have the regulatory protections provided to investors in investment companies. For example, the provisions of the Investment Company Act that limit transactions with affiliates, prohibit the suspension of redemptions (except under certain limited circumstances) or limit sales loads do not apply to the trust.

The trust does not hold or trade in commodity futures contracts regulated by the Commodity Exchange Act (CEA), as administered by the Commodity Futures Trading Commission (CFTC). Furthermore, the trust is not a commodity pool for purposes of the CEA, and neither the sponsor nor the trustee is subject to regulation by the CFTC as a commodity pool operator, or a commodity trading advisor. Consequently, the owner of Shares does not have the regulatory protections provided to investors in CEA-regulated instruments or commodity pools, and does not receive the disclosure document and certified annual report required to be delivered by a commodity pool operator.

20

Table of Contents

Proceeds received by the trust from the issuance and sale of Baskets consist of copper deposits. Such deposits are held by the custodian on behalf of the trust until (i) delivered to Authorized Participants in connection with redemptions of Baskets or (ii) sold to pay fees due to the sponsor and trust expenses and liabilities not assumed by the sponsor. See “Business of the Trust—Trust Expenses”.

21

Table of Contents

Copper is a major base metal. It has been one of the largest commodities markets for centuries, and the copper market is the third largest metals market in terms of physical volume. Much of the copper traded in the world is traded across organized exchanges, with the major exchanges located in London, Shanghai, and New York. There also is an active dealer market that trades physical and forward copper off of the exchanges, as well as non-exchange traded options. The price of copper generally reflects copper supply and demand, underlying production costs, cumulative levels of copper inventories, and investor sentiment toward copper market prospects and broader economic trends, as well as actual economic conditions such as industrial production, real manufacturing output, inflation, and exchange rates.

Copper mine supplies are concentrated on a regional basis, while demand is more geographically dispersed, as is typical in extractive industries. The copper supply chain—from raw copper concentrated ore from mines to upgraded copper products—is highly dependent on global trade. According to CPM Group, a commodities market research firm, the majority of copper mine production is in the Americas, accounting for roughly 57% of global output in 2009, while roughly 44% and 38% of refined and semi-manufactured production is performed in Asia, respectively. Final end use varies regionally. Copper is ductile, corrosion resistant, malleable and an excellent conductor of heat and electricity. In fact, copper is considered the best non-precious metal conductor of electricity, encountering much less resistance compared to other commonly used metals. As such, copper is widely employed in cable, wire, and electrical products for both the electrical and building industries. Globally, CPM Group estimates that in 2008, prior to the decline in construction activity during the recession, the building construction and infrastructure sectors were the largest consumers of refined copper, demanding roughly 40% of world supplies. The electrical and electronic sector comprised approximately 20% of total usage, while the industrial machinery and equipment (19%), transportation equipment (13%), and consumer and general products (8%) sectors accounted for the remainder of demand. Geographically, according to CPM Group research, China is the largest consumer (38%) of refined copper, followed by the European Union and United States, which consume roughly 17% and 9% of global refined copper supplies, respectively. It should be noted that the products made in these manufacturing locations using copper then are exported, sold, and used worldwide, so that while manufacturing demand for copper is distributed along these lines, the demand for copper is distributed more broadly by end-user demand in many countries around the world.

The copper market includes a diversified group of market participants. Both the physical and financial copper markets consist of primary and secondary producers, fabricators, manufacturers and end-use consumers, physical traders and merchants, the banking sector, and the investment community.

Primary and Secondary Producers

Primary and secondary producers are generally the market participants that bring new and recovered (i.e., copper recycled from scrap) physical copper supplies to the market. This sector is primarily comprised of mining companies, metal processors, such as refiners and smelters, and scrap recyclers. Primary producers refers to mining companies that produce copper from ore, while secondary producers include smelters and refiners that recover copper from end-of-life products ranging from electronic equipment to old wires, cars, trains, and other products containing copper. The copper production industry includes many companies that integrate copper sourced from both primary mines and secondary recovery from scrap.

22

Table of Contents

Fabricators, Manufacturers and End-use Consumers

Consumption of extracted resources typically occurs in two phases. Refined copper supplies in various grades and forms are initially demanded by fabricators that convert unwrought metals to salable products such as wire, tubing, and plates. These semi-manufactured products are available for consumption by other fabricators and/or manufacturers to further upgrade the copper product until the material is ultimately converted into a final saleable product.

Physical Traders, Merchants and Banks

Physical traders and merchants generally facilitate the domestic and international trade of copper supplies along the value chain and support the distribution of supplies to consumers.

Banking institutions may provide market participants an assortment of services to assist copper market transactions. On the producer level, the banking sector may facilitate project financing, offtake agreements (agreements to purchase/sell all or a portion of a producers output), over-the-counter transactions, hedging services, and price risk management. In addition to these and other services, consumers may seek guidance from the banking sector on commodity supply management.

Starting in the late 1970s, changes in bank regulation in many industrialized nations allowed banks to assume many of the functions traditionally fulfilled by traders and commodities merchants. Non-banking merchants continue to operate side by side with banks that have either acquired or developed internal copper trading capacity.

The Investment Community

The investment community is composed of non-commercial market participants engaged in the investment in copper or speculation about copper prices. This may range from large-scale institutional investors to hedge funds to small-scale retail investors. In addition, the investment community includes sovereign wealth funds as well as other governmental bodies that stockpile metal for strategic purposes.

Global Copper Supply and Demand

Primary copper supplies are typically sourced from two basic methods of copper mining: open-pit and underground mining. Open-pit mining refers to a method of extracting rock or minerals from the earth by their removal from an open pit or borrow pit. Underground mining is a mineral extraction technique consisting of subsurface excavation with minimal disturbance of the ground surface. Mined ore is then upgraded to a refined product through conventional smelting and refining practices or the solvent extraction/electro winning process. Historically (based on approximately 60 years of data), the tonnage of mined copper is less than total demand for refined copper. However, this should not imply that there is a shortage of copper ore. According to the United States Geological Survey, in 2009 there were roughly 540 million metric tonnes of global copper reserves or roughly 30 years of supply at 2009 consumption levels. Reserves are defined as metal that is economical to extract at the time of determination. If long-term copper prices increase, producers may recalculate reserves to include copper that is economically extractable at the higher price. Secondary supplies from new scrap (metal waste generated in the fabrication of semi-manufactured goods or the finished product manufacturing processes) and old scrap (obsolete or end-of-life products) recovery and/or primary metal stored in inventories helps to fill the on-going gap between copper mine supply and refined copper demand. Copper scrap that undergoes a refining process is called secondary output. This supply has accounted for approximately 15% of total refined copper supplies over the past five years, according to CPM Group. The direct use of scrap is not included in total refined copper supply. The recovery of copper from scrap is more profitable at higher copper prices, as such the volume of scrap available is related to the price of copper. Surplus copper inventories are generally held by commercial market participants throughout the downstream and

23

Table of Contents

upstream processes as well as the non-commercial investment community. Both commercial and non-commercial market participants may build copper stocks during surplus supply years. For example, in 2001 and 2002 when the market was in a surplus, the excess copper could have been stockpiled in producer warehouses, consumer stocks, and/or in investor warehouse stocks.

Inventories