Attached files

| file | filename |

|---|---|

| EX-32.1 - CERTIFICATION - Blox, Inc. | exhibit32-1.htm |

| EX-31.1 - CERTIFICATION - Blox, Inc. | exhibit31-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

[X] QUARTERLY REPORT UNDER SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended September 30, 2010

[ ] TRANSITION REPORT UNDER SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _________ to _________

Commission File Number: 000-53565

NAVA RESOURCES INC.

(Exact name of registrant as specified in its charter)

|

Nevada (State or other jurisdiction of incorporation or organization) |

20-8530914

(I.R.S. Employer Identification No.) |

|

Suite 303 - 11861 88th Avenue Delta, British Columbia, Canada (Address of principal executive offices) |

V4C 3C7 (Zip Code) |

|

778-218-9638 (Registrant's telephone number, including area code) |

Indicate by check mark whether the registrant (1) has filed all reports

required to be filed by Section 13 or 15(d) of the Exchange Act during the past

12 months (or for such shorter period that the registrant was required to file

such reports), and (2) has been subject to such filing requirements for the

past 90 days.

Yes [X] No [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer," "non-accelerated filer," and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer [ ] | Accelerated filer [ ] |

| Non-accelerated filer [ ] (Do not check if a smaller reporting company) | Smaller reporting company [X] |

Indicate by check mark whether the registrant is a shell company (as

defined in Rule 12b-2 of the Exchange Act).

Yes [ ] No [X]

State the number of shares outstanding of each of the issuer's classes of common equity, as of the latest practicable date: 12,288,604 shares of common stock as of October 25, 2010.

NAVA RESOURCES INC.

Quarterly Report On Form 10-Q

For The Quarterly Period Ended

September 30, 2010

INDEX

2

FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q contains forward-looking information. Forward-looking information includes statements relating to future actions, prospective products, future performance or results of current or anticipated products, sales and marketing efforts, costs and expenses, interest rates, outcome of contingencies, financial condition, results of operations, liquidity, business strategies, cost savings, objectives of management of the Company and other matters. The Private Securities Litigation Reform Act of 1995 provides a “safe harbor” for forward-looking information in order to encourage companies to provide prospective information about themselves without fear of litigation, so long as that information is identified as forward-looking and is accompanied by meaningful cautionary statements identifying important factors that could cause actual results to differ materially from those projected in the information. Forward-looking information may be included in this Quarterly Report on Form 10-Q or may be incorporated by reference from other documents filed with the Securities and Exchange Commission by the Company. You can find many of these statements by looking for words including, for example, “believes,” “expects,” “anticipates,” “estimates” or similar expressions in this Quarterly Report on Form 10-Q or in documents incorporated by reference in this Quarterly Report on Form 10-Q. Except as otherwise required by applicable law, the Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information or future events.

The Company has based the forward-looking statements relating to the Company’s operations on management’s current expectations, estimates and projections about the Company and the industry in which it operates. These statements are not guarantees of future performance and involve risks, uncertainties and assumptions that we cannot predict. In particular, we have based many of these forward-looking statements on assumptions about future events that may prove to be inaccurate. Accordingly, the Company’s actual results may differ materially from those contemplated by these forward-looking statements. Any differences could result from a variety of factors, including, but not limited to the following:

| • | strategies, outlook and growth prospects; |

| • | future plans and potential for future growth; |

| • | liquidity, capital resources and capital expenditures; |

| • | growth in demand for our products; |

| • | economic outlook and industry trends; |

| • | developments of our markets; |

| • | the impact of regulatory initiatives; and |

| • | the strength of our competitors |

3

PART I - FINANCIAL INFORMATION

Item 1. Financial Statements

The following unaudited interim financial statements of Nava Resources Inc.(sometimes referred to as "we", "us" or "our Company") are included in this quarterly report on Form 10-Q:

NAVA RESOURCES, INC.

(An Exploration Stage

Company)

September

30, 2010

Index

F-1

NAVA RESOURCES, INC.

(An

Exploration Stage Company)

INTERIM CONSOLIDATED BALANCE SHEETS

|

September 30, 2010 (Unaudited) |

June 30, 2010 |

|||||

| ASSETS | ||||||

| Current | ||||||

| Cash and cash equivalents | $ | 84,256 | $ | 89,581 | ||

| Equipment | 176 | 199 | ||||

| TOTAL ASSETS | $ | 84,432 | $ | 89,780 | ||

| LIABILITIES | ||||||

| Current | ||||||

| Accounts payable and accrued liabilities | $ | 10,685 | $ | 13,751 | ||

| Due to related party | 1,920 | 920 | ||||

| Total current liabilities | 12,605 | 14,671 | ||||

| Going concern contingency (Note 1) | ||||||

| STOCKHOLDERS’ EQUITY | ||||||

| Common stock | ||||||

| 400,000,000 common shares authorized, $0.00001 par value | ||||||

| 12,288,604 common shares issued and outstanding (June 30, 2010 – 12,263,604) | 123 | 123 | ||||

| Additional paid-in capital | 230,494 | 190,794 | ||||

| Deficit accumulated during the exploration stage | (158,790 | ) | (115,808 | ) | ||

| Total stockholders’ equity | 71,827 | 75,109 | ||||

| TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY | $ | 84,432 | $ | 89,780 | ||

The accompanying notes are an integral part of these interim consolidated financial statements.

F-2

NAVA RESOURCES, INC.

(An

Exploration Stage Company)

INTERIM CONSOLIDATED STATEMENTS OF OPERATIONS

|

Three months ended September 30, 2010 (Unaudited) |

Three months ended September 30, 2009 (Unaudited) |

Accumulated from July 21, 2005 (date of inception) to September 30, 2010 (Unaudited) |

|||||||

| EXPENSES | |||||||||

| Amortization | $ | 23 | $ | 36 | $ | 1,141 | |||

| Consulting | - | - | 16,000 | ||||||

| Consulting – stock based compensation | 39,450 | - | 42,248 | ||||||

| Exploration costs | - | - | 12,026 | ||||||

| Office and miscellaneous | 90 | 637 | 8,208 | ||||||

| Professional fees | 4,429 | 2,828 | 88,269 | ||||||

| Operating loss | (43,992 | ) | (3,501 | ) | (167,892 | ) | |||

| Other items | |||||||||

| Cost recovery | 1,000 | - | 1,000 | ||||||

| Interest income | 10 | 53 | 8,102 | ||||||

| 1,010 | 53 | 9,102 | |||||||

| NET AND COMPREHENSIVE LOSS | $ | (42,982 | ) | $ | (3,448 | ) | $ | (158,790 | ) |

| BASIC AND DILUTED LOSS PER SHARE | $ | (0.00 | ) | $ | (0.00 | ) | |||

| WEIGHTED AVERAGE NUMBER OF SHARES OUTSTANDING – BASIC AND DILUTED | 12,286,702 | 12,226,104 |

The accompanying notes are an integral part of these interim consolidated financial statements.

F-3

NAVA RESOURCES, INC.

(An

Exploration Stage Company)

INTERIM CONSOLIDATED STATEMENTS OF CASH FLOWS

|

Three months ended September 30, 2010 (Unaudited) |

Three months ended September 30, 2009 (Unaudited) |

Accumulated from July 21, 2005 (date of inception) to September 30, 2010 (Unaudited |

|||||||

| CASH FLOWS FROM OPERATING ACTIVITIES | |||||||||

| Net loss | $ | (42,982 | ) | $ | (3,448 | ) | $ | (158,790 | ) |

| Non-cash operating items: | |||||||||

| Amortization | 23 | 36 | 1,141 | ||||||

| Consulting – stock based compensation | 39,450 | - | 42,248 | ||||||

| Changes in non-cash working capital item: | |||||||||

| Accounts payable and accrued liabilities | (3,066 | ) | 497 | 10,685 | |||||

| Net cash provided by (used in) operating activities | (6,575) | (2,915) | (104,716 | ) | |||||

| CASH FLOWS FROM INVESTING ACTIVITY | |||||||||

| Acquisition of equipment | - | - | (1,318 | ) | |||||

| Net cash used in investing activity | - | - | (1,318 | ) | |||||

| CASH FLOWS FROM FINANCING ACTIVITIES | |||||||||

| Issuance of capital stock | 250 | - | 188,370 | ||||||

| Due to related party | 1,000 | - | 1,920 | ||||||

| Net cash provided by financing activities | 1,250 | - | 190,290 | ||||||

| Change in cash and cash equivalents | (5,325 | ) | (2,915 | ) | 84,256 | ||||

| Cash and cash equivalents, beginning | 89,581 | 108,629 | - | ||||||

| Cash and cash equivalents, ending | $ | 84,256 | $ | 105,714 | $ | 84,256 |

Supplemental disclosures with respect to cash flows:

| Cash paid during the Period for: | |||||||||

| Interest | $ | - | $ | - | $ | - | |||

| Income taxes | $ | - | $ | - | $ | - |

The accompanying notes are an integral part of these interim consolidated financial statements.

F-4

NAVA RESOURCES, INC.

(An

Exploration Stage Company)

INTERIM CONSOLIDATED STATEMENTS OF STOCKHOLDERS’

EQUITY

|

Common shares – number |

Common shares – paid-in capital |

Additional paid-in capital |

Subscriptions received in advance |

Deficit accumulated during the exploration stage |

Total | |||||||||||||

| July 21, 2005 (inception) | - | $ | - | $ | - | $ | - | $ | - | $ | - | |||||||

| July 21, 2005 | ||||||||||||||||||

| Issuance of capital stock ($0.001/share) | 200,000 | 2 | 198 | - | - | 200 | ||||||||||||

| June 30, 2006 | ||||||||||||||||||

| Subscriptions received | - | - | - | 14,000 | - | 14,000 | ||||||||||||

| Net loss | - | - | - | - | (1,750 | ) | (1,750 | ) | ||||||||||

| Balance, June 30, 2006 | 200,000 | 2 | 198 | 14,000 | (1,750 | ) | 12,450 | |||||||||||

| March 1, 2007 | ||||||||||||||||||

|

Issuance of capital stock ($0.00001/share) |

39,800,000 | 398 | - | - | - | 398 | ||||||||||||

| March 4, 2007 | ||||||||||||||||||

|

Cancellation of common stock

($0.00001/share) |

(18,000,000 | ) | (180 | ) | - | - | - | (180 | ) | |||||||||

| March 20, 2007 | - | - | - | - | - | |||||||||||||

| Issuance of capital stock ($0.15/share) | 874,104 | 9 | 131,107 | (14,000 | ) | - | 117,116 | |||||||||||

| April 18, 2007 | ||||||||||||||||||

|

Cancellation of common stock

($0.00001/share) |

(11,000,000 | ) | (110 | ) | - | - | - | (110 | ) | |||||||||

| June 1, 2007 | ||||||||||||||||||

| Issuance of capital stock ($0.16/share) | 352,000 | 4 | 56,316 | - | - | 56,320 | ||||||||||||

| Net loss | - | - | - | - | (16,103 | ) | (16,103 | ) | ||||||||||

| Balance, June 30, 2007 | 12,226,104 | 123 | 187,621 | - | (17,853 | ) | 169,891 | |||||||||||

| Net loss | - | - | - | - | (42,281 | ) | (42,281 | ) | ||||||||||

| Balance, June 30, 2008 | 12,226,104 | 123 | 187,621 | - | (60,134 | ) | 127,610 | |||||||||||

| Net loss | - | - | - | - | (30,388 | ) | (30,388 | ) | ||||||||||

| Balance, June 30, 2009 | 12,226,104 | 123 | 187,621 | - | (90,522 | ) | 97,222 | |||||||||||

| November 29, 2009 | ||||||||||||||||||

|

Issuance of capital stock ($0.01/share) and stock based compensation |

37,500 | - | 3,173 | - | - | 3,173 | ||||||||||||

| Net loss | - | - | - | - | (25,286 | ) | (25,286 | ) | ||||||||||

| Balance, June 30, 2010 | 12,263,604 | 123 | 190,794 | - | (115,808 | ) | 75,109 | |||||||||||

| July 7, 2010 | ||||||||||||||||||

| Issuance of capital stock ($0.01/share) | 25,000 | - | 250 | - | - | 250 | ||||||||||||

| Stock based compensation | - | - | 39,450 | - | - | 39,450 | ||||||||||||

| Net loss | - | - | - | - | (42,982 | ) | (42,982 | ) | ||||||||||

| Balance, September 30, 2010 | 12,288,604 | $ | 123 | $ | 230,494 | $ | - | $ | (158,790 | ) | $ | 71,827 |

The accompanying notes are an integral part of these interim consolidated financial statements.

F-5

NAVA RESOURCES, INC.

(An

Exploration Stage Company)

NOTES TO THE INTERIM CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2010

| 1. | NATURE AND CONTINUANCE OF OPERATIONS |

Nava Resources Inc. (the "Company") was incorporated on July 21, 2005 under the laws of the state of Nevada. The Company’s wholly owned subsidiary, Nava Resources, Canada Inc. (“Nava Resources, Canada”), was incorporated in Canada on August 9, 2005. The Company is an Exploration Stage Company. The Company’s principal business is the acquisition and exploration of mineral properties. The Company has not yet determined whether its properties contain mineral reserves that are economically recoverable. Going Concern These consolidated financial statements have been prepared on a going concern basis, which implies the Company will continue to realize its assets and discharge its liabilities in the normal course of business. The Company has not generated revenues since inception and has not paid any dividends and is unlikely to pay dividends or generate earnings in the immediate or foreseeable future. The continuation of the Company as a going concern is dependent upon the continued financial support from its shareholders, the ability of the Company to obtain necessary equity financing to continue operations and to determine the existence, discovery and successful exploitation of economically recoverable reserves in its resource properties, confirmation of the Company interest in the underlying properties, and the attainment of profitable operations. As at September 30, 2010, the Company has accumulated losses of $158,790 since inception. These consolidated financial statements do not include any adjustments to the recoverability and classification of recorded asset amounts and classification of liabilities that might be necessary should the Company be unable to continue as a going concern. Management of the Company has undertaken steps as part of a plan with the goal of sustaining Company operations for the next twelve months and beyond. These steps include: (a) continuing efforts to raise additional capital and/or other forms of financing; and (b) controlling overhead and expenses. There can be no assurance that any of these efforts will be successful. |

|

| 2. | BASIS OF PRESENTATION |

These interim financial statements have been prepared

in accordance with U.S. generally accepted accounting principles for financial

information and with the instructions to Form 10-Q and Item 310(b) of

Regulation S. In the opinion of management, all adjustments (consisting of

normal recurring accruals) considered necessary for a fair presentation have

been included. Operating results for the three months ended September 30, 2010

are not necessarily indicative of the results that may be expected for any

interim period or an entire year. The Company applies the same accounting

policies and methods in its interim financial statements as those in the most

recent audited annual financial statements, except as discussed in Note 3

below. |

|

| 3. | RECENTLY ADOPTED ACCOUNTING PRONOUNCEMENTS |

Statement of Financial Accounting Standards (“SFAS”)

No. 166 (ASC Topic 810), “Accounting for Transfers of Financial Assets—an

Amendment of FASB Statement No. 140”, SFAS No. 167 (ASC Topic 810), “Amendments

to FASB Interpretation No. 46(R)”, and SFAS No. 168 (ASC Topic 105), “The FASB

Accounting Standards Codification and the Hierarchy of Generally Accepted

Accounting Principles—a replacement of FASB Statement No. 162” were recently

issued. SFAS No. 166, 167, and 168 have no current applicability to the Company

or their effect on the financial statements would not have been significant. |

F-6

NAVA RESOURCES, INC.

(An

Exploration Stage Company)

NOTES TO THE INTERIM CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2010

| 3. | RECENTLY ADOPTED ACCOUNTING PRONOUNCEMENTS (cont’d) |

Accounting Standards Update (“ASU”) ASU No. 2009-05

(ASC Topic 820), which amends Fair Value Measurements and Disclosures –

Overall, ASU No. 2009-13 (ASC Topic 605), Multiple-Deliverable Revenue Arrangements,

ASU No. 2009-14 (ASC Topic 985), Certain Revenue Arrangements that include

Software Elements, and various other ASU’s No. 2009-2 through ASU No. 2010-13 which

contain technical corrections to existing guidance or affect guidance to

specialized industries or entities were recently issued. These updates have no

current applicability to the Company or their effect on the financial

statements would not have been significant. |

|

| 4. | CAPITAL STOCK |

The Company is authorized to issue up to 400,000,000 shares of common stock, with a par value of $0.00001. On July 7, 2010, the Company issued 25,000 common shares at a price of $0.01 for proceeds of $250 for exercise of stock options. |

|

| 5. | STOCK OPTIONS |

Stock Options The Company has adopted a Stock Incentive Plan (the “Plan”). The essential elements of the Plan provide that the total number of shares of stock reserved and available for distribution under the plan shall be 10,000,000 shares of common stock of the Company. The Options granted under the Plan shall have a maximum term of five years. During the current period, the Company granted 250,000 stock options to its director at an exercise price of $0.01, expiring August 31, 2015. The fair value of the options granted during the period was estimated at the grant date using the Black-Scholes option pricing model with the following weighted average assumptions: |

| Expected annual volatility | 161.58% | ||

| Risk free interest rate | 1.33% | ||

| Expected life | 5 years | ||

| Expected dividend yield | 0% | ||

| Exercise price | $ | 0.01 | |

| Closing price on the date of grant | $ | 0.16 |

| The fair value of the stock options granted and vested during the period is $39,450. |

F-7

NAVA RESOURCES, INC.

(An

Exploration Stage Company)

NOTES TO THE INTERIM CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2010

| 5. | STOCK OPTIONS (cont’d) |

| The Company has the following stock options outstanding: |

|

Expiry Date |

Exercise Price |

Number

of Options Outstanding |

Number of options Exercisable |

||||||

| November 17, 2014 | $ | 0.01 | 50,000 | - | |||||

| November 28, 2014 | $ | 0.01 | 12,500 | 12,500 | |||||

| August 31, 2015 | $ | 0.01 | 250,000 | 250,000 | |||||

| 312,500 | 262,500 |

A summary of the status of the Company’s stock options

as of September 30, 2010 and changes during the period are as follows: |

| Shares | Weighted average exercise price | |||||

| Options outstanding, June 30, 2010 | 87,500 | $ | 0.01 | |||

| Granted | 250,000 | 0.01 | ||||

| Exercised | (25,000 | ) | (0.01 | ) | ||

| Options outstanding, September 30, 2010 | 312,500 | $ | 0.01 |

| 6. | SUBSEQUENT EVENT |

The

Company has evaluated subsequent events according to ASC Topic 855 and has

determined that there are no events to disclose. |

F-8

Item 2. Management's Discussion and Analysis of Financial Condition and Results of Operations

The following discussion of our financial condition, changes in financial condition and results of operations for the three months ended September 30, 2010 and 2009 should be read in conjunction with our unaudited interim financial statements and related notes for the three months ended September 30, 2010 and 2009. The following discussion contains forward-looking statements that involve risks, uncertainties and assumptions. Our actual results may differ materially from those anticipated in these forward-looking statements as a result of many factors, including, but not limited to, those set forth below under the heading "Risk Factors".

Overview of our Business

We are an exploration stage company formed for the purposes of acquiring, exploring and, if warranted and feasible, developing natural resource properties.

Organization

On July 21, 2005, the Company was incorporated under the laws of the State of Nevada for the purpose of conducting mineral exploration activities. We were authorized to issue 400,000,000 shares of common stock, par value $.001 per share, and initially issued 100,000 shares of common stock to each of Jag Sandhu, our President, Chief Executive Officer and a director, and Johnny Astorino, our Chief Financial Officer. Said issuances were paid at a purchase price of the par value per share. Our wholly owned subsidiary, Nava Resources Canada Inc. (“Nava Canada”), was organized under the Federal laws of Canada on August 9, 2005.

On January 4, 2007, the Company obtained written consent from the shareholders to amend our Articles of Incorporation to change the par value of our common stock from $0.001 to $0.00001 per share. On February 28, 2007, the Board of Directors of the Company amended the Articles of Incorporation changing the par value of the Company’s common stock.

In March 2007 we issued 19,900,000 shares to each of Messrs. Sandhu and Astorino in consideration for the payment of par value per share. Mr. Astorino subsequently returned 18,000,000 shares to the Company’s treasury for cancellation.

On March 20, 2007, we accepted subscriptions for 874,104 shares of our common stock from 37 investors. The shares of common stock were sold at a purchase price of $0.15 per share, amounting in the aggregate to $131,116. The offering was made to non-U.S. persons in offshore transactions pursuant to the exemption from registration provided by Regulation S of the Securities Act of 1933, as amended (the “Securities Act”).

On April 18, 2007, Mr. Sandhu returned an aggregate of 10,000,000 shares and Mr. Astorino returned an aggregate of 1,000,000 shares of common stock to the Company’s treasury for cancellation.

On June 1, 2007, we accepted subscriptions for 352,000 units from 10 investors. The units were sold at a purchase price of $0.16 per unit, amounting in the aggregate to $56,320. Each unit was comprised of one share of our common stock and one warrant. Each warrant entitles the warrant holder to purchase one share of common stock at an exercise price of $0.20 per share. Each warrant expires on June 1, 2009. The offering was made to non-U.S. persons in offshore transactions pursuant to the exemption from registration provided by Regulation S of the Securities Act.

Exploratory Activities

In July 2005 we commenced our mineral exploration activities. On October 10, 2006, the Company entered into an agreement with Jag Sandhu, our President, Chief Executive Officer and Director, pursuant to which the Company obtained an option to acquire a 100% interest in and to the mineral claim located in Lillooett Mining Division called the Noel Creek Claim. On October 2, 2007, the option expired due to the Company not making the required payments as per the option agreement.

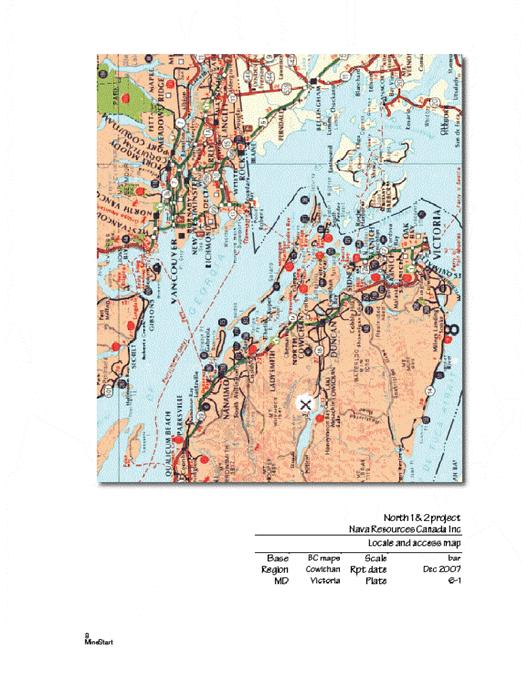

On August 28, 2007, Mr. Jag Sandhu, our President and Chief Executive Officer and a director, acquired two claims for a 637.39 hectare (approximately 1575.03 acres) mineral concession on Vancouver Island, in the Province of British Columbia, Canada through British Columbia’s online staking service. These mineral claims are known as the North 1 and North 2 Claims. On November 22, 2007, Mr. Sandhu transferred the claims to Nava Canada using British Columbia’s Mineral Title Online web site. We intend to conduct exploratory activities with respect to the claims, and if viable mineral deposits are discovered, develop and extract such minerals. In addition, as funding permits, we may acquire additional properties of interest and either abandon our existing properties or enter into agreements to sell all or a portion of those properties.

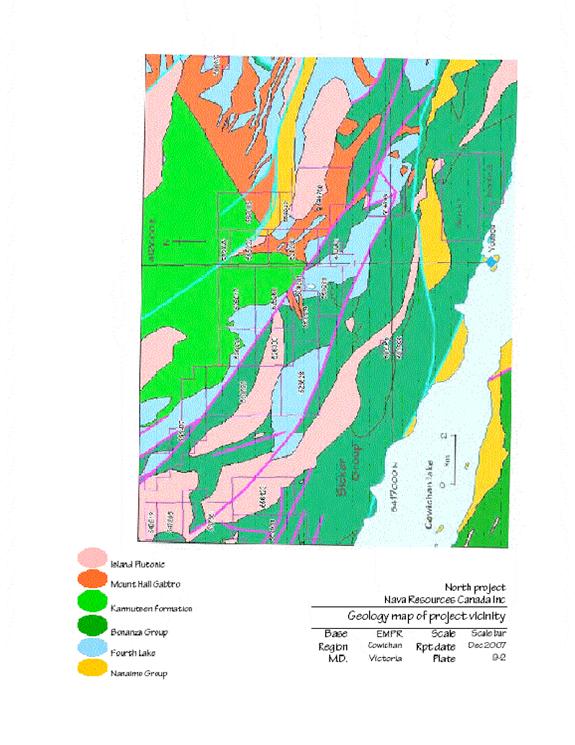

In October 2007, we engaged a professional mining engineering service and consulting firm, MineStart Management Inc. (“MineStart”), to review the geologic premise and information upon which the claim was staked, and to provide a technical report as to its merit as an exploration prospect, including recommendations on appropriate next steps. The report on the claims, entitled “North 1 and 2 Project – A VMS Investigation” and dated December 7, 2007, describes the mineral claim (tenures, location and access) and the regional, local and property geology. It also includes relevant information on targeted deposit types and mineralization, and recommendations with associated budgets, regarding the initial strategy that should be followed in exploring the claim.

We performed an exploration program on the North 1 and North 2 Claims in August 2008. This program involved a review of property geology based on government compilations, acquisition of relevant air photo coverage and a visit to the property by Jag Sandhu and Don Blackadar. The purpose of this visit was to become familiar with the general layout of the property and related road access, and to prospect and collect rock samples in readily accessible areas. Work was concentrated in the South West corner of the North 2 claim which was accessible just off of the highway, with foot access via an overgrown secondary road leading into the claim.

4

The North Claim is primarily underlain by felsic to intermediate volcanic and volcaniclastic rocks of the middle to upper Devonian Sicker Group (McLaughlin Ridge Formation), which is prospective for Kuroko-type massive sulphide deposits rich in copper, lead, zinc, gold and silver. Outcrop exposure in the area prospected was minimal due to overburden cover of bolder till with hardpan noted in some rock cuts. A total of 30 rock samples were taken for multi-element geochemical analysis. These samples were primarily float but several samples may have been from small outcrops visible in the road cut. All samples were of intermediate composition (andesite), ranging from fine to medium grained, and relatively massive in texture (weekly foliated in some cases), possibly representing intermediate tuffs with some intrusive equivalents. Samples were sent to Acme Labs in Vancouver, crushed to 200 mesh, and processed by Aqua Regia digestion CCP-MS analysis. Gold was also determined by fire assay fusion by ICP-ES. No significant anomalies were identified in the pathfinder suite. However, the first three samples demonstrate a weakly anomalous Cu-Pb-Zn-Ag-As-Ba signature, which may be of interest.

On October 20, 2010 The Molly1 claim was staked by Nava Resources Canada Ltd. The claim comprises 20 contiguous units totalling 424.96 hectares.

The claim is located in the Cowichan Lake area, Vancouver Island, British Columbia, about 30 kilometers west of the city of Duncan and about 5 kilometers northwest of the town of Lake Cowichan. It is accessible via the Meade Lake forestry road from Highway 18, which extends along the north shore of Lake Cowichan from Duncan.

Molly1 is underlain by the McLaughlin Ridge Formation, which is the uppermost member of the Devonian Age Sicker Group. The Sicker assemblage comprises three successive volcanic formations that are believed to represent an oceanic magmatic arc. The lower two members consist predominantly of mafic volcanics. Rocks of the McLaughlin Ridge Formation are more felsic in composition, with some intermediate assemblages and are thought to represent a more advanced stage of arc development. These rocks are related to major magmatic / volcanic centers, one of which is located in the Duncan / Saltspring Island area. The Sicker Group is exposed in four major structural uplifts in the south half of Vancouver Island: 1) the Buttle Lake Uplift west of Courtenay, 2) the Bedingfield Uplift near Tofino, 3) the Nanoose Uplift north of Nanaimo, and 4) the Cowichan Lake Uplift, substantially the largest of the four, which extends in and arcuate belt between Saltspring Island and Port Alberni, a distance of over 100 km.

The Sicker Group is considered to be highly prospective for Volcanogenic Massive Sulphide (VMS) deposits. Definite or potential VMS deposits have been identified within three of the four structural uplifts. Most known occurrences are Kuroko type deposits, which are rich in copper, lead and zinc, with important amounts of gold and silver. These deposits are hosted by felsic volcanic or volcaniclastic rocks of the McLaughlin Ridge Formation or its equivalent, the Myra Formation in the Buttle Lake area. Important Kuroko-type deposits include the Myra Falls mine in the Buttle Lake Uplift, and several deposits (e.g. Mount Sicker, Lara) at the southest end of the Cowichan Lake Uplift near Crofton (northeast of Molly1).

The Myra Falls deposit, located at the southeast end of Buttle Lake, has been in production since 1966. To the end of 2005, the deposit yielded 24 million Tonnes grading 1.8% copper, 5.0% zinc, 2 g/T gold and 52 g/T silver. Mineral reserves at December 31, 2009 were 18.5 million Tonnes grading 6.7% zinc. Deposits in the Crofton area are proximal to a major felsic volcanic center. The Mount Sicker deposits (Tyee, Lenora and Richard III) were mined from 1898 to 1909 and again between 1942 and 1952 as the Twin J. The Lara deposit, discovered in the mid-1980s, remains sub-economic, but has significant demonstrated potential (drill indicated resource of 528,839 Tonnes grading 1.01% copper, 1.22% lead, 5.87% zinc, 100.09 g/T silver and 4.74 g/T gold).

Molly1 lies in a panel of Sicker Group rocks, which is parallel to but separate from the assemblage that contains the Sicker and Lara deposits. While no VMS deposits have been discovered in this panel in the Cowichan Lake area and vicinity of the claim, the area is dominated by Sicker volcanics and contains a significant number of documented mineral showings. Many of these showings are in structurally-controlled epigenetic vein systems and some include significant gold and silver values. Significantly, in terms of VMS potential, some showings have a polymetallic signature that is representative of Kuroko-type deposits.

McLaughlin Ridge rocks in the Cowichan Lake area are described on government geological maps as thickly-bedded tuffite and lithic tuffite, feldspar-crystal tuff, lapilli tuff, rhyolite, dacite, laminated tuff and chert. On the Molly1 claim, the assemblage is well-exposed in a logging road cut over a distance of about 1 km. This assemblage consists predominantly of bedded tuffites, which are locally siliceous and cherty. A total of 46 grab samples have been taken across strike in this area and will be analyzed geochemically for a multi-element suite (37 elements) in order to accrue a foundation of geochemical data, and to test for the presence of copper, lead, zinc, silver, gold, barium and arsenic values which are potential indications of Kuroko-type environments.

5

History and Geological Setting

Vancouver Island is dominated by rocks of the Wrangellia Terrane, which is interpreted to represent a Paleozoic Island Arc assemblage, accreted to the North American content about 100 million years ago. Mid-Devonian volcanic rocks of the Sicker Group, representing the basement of this complex, are the oldest rocks on Vancouver Island and are exposed in four major structural uplifts – Buttle Lake, Beddington, Nanoose, and Cowichan Lake. The North Claims lie toward the southeast end of the Cowichan Lake Uplift, along the north shore of the east end of Cowichan Lake. In the Cowichan Lake Uplift, the Sicker comprises three distinct volcanic / volcaniclastic assemblages – the Duck Lake Formation as the oldest member and overlain by the Nitnat Formation, which in turn is overlain, possibly unconformably, by the McLaughlin Ridge Formation.

Volcanic rocks of the Sicker Group are highly prospective for economically viable volcanogenic massive sulphide (VMS) deposits, which are the primary exploration target on the North Claims. As a group, these deposits are rich in copper and zinc and also carry significant gold and silver values.

The most significant mineral deposit in the Sicker Group is the Myra Falls mine, a world class deposit located in the Buttle Lake Uplift. Other significant deposits, notably the Lara and Mount Sicker deposits, are located in the southeast part of the Cowichan Lake uplift, several kilometers northeast of the North Claims and separated from the property by a major geologic fault.

Massive sulphide mineralization was first discovered in the Sicker Group with the Mount Sicker discoveries in the late 1800s. Production was from one main ore body via three separate underground mines (Tyee, Lenora and Richard III), which operated for several years. These mines were subsequently amalgamated and re-operated as the Twin J mine from 1942 to 1952. Production from the Tyee mine (1901 – 09) totaled 5,840,593 kilograms copper and 13,725,069 grams silver, and 762,553 grams gold from 152,668 tonnes mined. The Buttle Lake mine, which has been in operation since 1966, currently produces approximately 1 millioncqui of ore per year. Over the 39 years to 2005, the mine yielded 24 million cqui with an average grade of 1.8% copper, 5.0% zinc, 2g/T gold and 52g/T silver. The Lara deposit, discovered in the mid-1980s, contains a drill indicated resource of 528,839 tonnes grading 1.01% copper, 1.22% lead, 5.87% zinc, 100.09 g/T sliver and 4.73 g/T gold.

Discovery of the Lara deposit and ongoing interest in the nearby Mount Sicker deposits, all of which are hosted in felsic volcanic rocks of the McLaughlin Ridge formation, stimulated significant interest and exploration activity in the Cowichan uplift during the mid-to late 1980s. During this period the Striker Property, comprising 31 contiguous mineral claims (528 units) and extending along virtually the entire north shore of Cowichan Lake, was explored by Utah Mines. This property is underlain predominantly by the Sicker Group, with Nitnat rocks dominant in the western part of the property and McLaughlin Ridge sediments and volcanics dominant in the east. Work on this property is documented in a number of BC government assessment reports, from which the following descriptions are derived. McLaughlin Ridge rocks, as mapped, divide grossly into 3 units, dominated by diverse sedimentary lithologies with volcanic members, particularly lower in the sequence. Volcanic rocks are described as interbedded lithic and crystal tuff, cherty dust tuff, chert and minor lapilli tuff. The lower unit consists of fine-grained andesitic lithic crystal tuffs and cherty tuffs with local coarse lapilli beds and dacitic tuff units.

6

Exploration on the Striker property included airborne geophysics, with ground follow-ups and grid work in selected areas in the eastern part of the property because of the distribution of geophysical and geochemical targets. While massive sulphides were not encountered, encouraging mineralization of various types was noted, including exhalative horizons, which occasionally contain anomalous molybdenum, copper and silver. Significant barium, silver, molybdenum and zinc values are also associated with syndepositional pyrite in argillite units and significant gold-silver-copper-zinc values are associated with several structures. Anomalous silt and heavy metal values (copper-lead-zinc-silver-gold) were also identified. The latest assessment report on the Striker property recommended further, more detailed work in the eastern part of the property including detailed mapping, sampling, trenching and limited drilling. The North Property occupies a portion of the eastern half of the old Striker property.

The Cowichan Lak e area generally, has been the subject of mineral exploration since the late 1800s and a large number and variety of mineral showings in the area are documented in B.C. government Minfile records. Massey and Friday (1986) grouped Cowichan area mineral showings into five categories:

1. Volcanogenic gold-bearing massive sulphides (Sicker Group Kuroko deposits).

2. Gold-bearing, pyrite-chalcopyrite-quart-carbonate veins along shears, which are quite common cutting Sicker Group and Karmutsen Formation sills north of Cowichan Lake.

3. Epithermal gold-silver deposits within Bonanza Group volcanics.

4. Copper skarns developed in limy sediments apparently interbedded with basalts of the Karmutsen formation.

5. Copper-molybdenum quarts veins in granodiorite and adjacent country rock on several properties. Chalcopyrite and pyrite, with or without molybdenite are the principle sulphides and minor sphalerite, galena and arsenopyrite are also reported.

Property and Claim Position

The North Claim site encompasses two adjoining mineral tenures which form one parcel. The North property is in the Victoria mining division of British Columbia and lies on the north shore of Cowhichan lake in southern Vancouver Island about 30km west of the town of Duncan and 10km west of the town of Lake cowichan.

7

8

Geology North of Cowichan Lake Including North Property

9

Conditions to Retain Title to the Claims

The mineral titles are subject to annual renewal and government permits for specific field work. The claims are valid until their next anniversary date of October 28, 2010 for the North claims and October 20, 2010 for the Molly 1 Claim. They can be renewed indefinitely by performance and recording of assessment work as defined in the Mineral Act (B.C.) or by payment of cash in lieu of work. Work or cash payment of the equivalent of CAN$4.00 per hectare or approximately $2,500 for each of the first, second and third anniversary years, and the equivalent of CAN$8.00 per hectare for each subsequent anniversary year is required for the North Claims and $1.700 for each of the first, second and third anniversary years for the Molly 1 claim. Contiguous claims may be grouped for purposes of applying the value of work from the site of work to other claims. Failure to perform and record valid exploration work or pay the equivalent sum to the Province of British Columbia on the anniversary dates will result in forfeiture of title to the claim.

Present Condition of the Claims

The North Claims were staked on August 28, 2007 by Mr. Jag Sandhu, our President, Chief Executive Officer and a director, on behalf of the Company. Mr. Sandhu subsequently transferred the claims to Nava Canada, the current claim holder. The Molly 1 claim was staked by Nava Resources Canada Inc. The Claims were staked to acquire a position in the Sicker Group, a sequence of volcanic rocks known to be very prospective for the occurrence of polymetallic volcanogenic massive sulphide deposits (VMS), commonly referred to as Kuroko type deposits.

Our objective is to conduct exploration activities on the North Claims to assess whether they possess evidence of mineralization sufficient to merit further exploration activities. The North Claims are without known reserves.

Competitive Conditions

The mineral exploration business is an extremely competitive industry. We are competing with many other exploration companies looking for minerals. We are a very early stage mineral exploration company and a very small participant in the mineral exploration business. Being a junior mineral exploration company, we compete with other companies like ours for financing and joint venture partners. Additionally, we compete for resources such as professional geologists, camp staff, helicopters and mineral exploration supplies.

Government Approvals and Recommendations

We will be required to comply with all regulations defined in the British Columbia Mineral Tenure Act for the Province of British Columbia (the “Act”). The Act sets forth rules for:

- locating claims

- posting claims

- working claims

- reporting work performed

10

We also have to comply with the British Columbia Mineral Exploration Code which dictates how and where we can explore for minerals. We must comply with these laws to operate our business. Compliance with these rules and regulations will not adversely affect our operations. In order to explore for minerals on our mineral claim we must submit our exploration plan for review. We believe that our exploration plan as described below will be accepted and an exploration permit will be issued to our agent or us. The exploration permit is the only permit or license we will need to explore for precious and base minerals on the mineral claim.

We will be required to obtain additional work permits from the British Columbia Ministry of Energy and Mines for any exploration work that results in a physical disturbance to the land. Accordingly, we may be required to obtain a work permit depending on the complexity and affect on the environment if we proceed beyond the exploration work contemplated by our proposed exploration programs. The time required to obtain a work permit is approximately four weeks. We will incur the expense of our consultants to prepare the required submissions to the Ministry of Energy and Mines. We will be required by the Mining Act to undertake remediation work on any work that results in physical disturbance to the land. The cost of remediation work will vary according to the degree of physical disturbance. No remediation work is anticipated as a result of completion of Stage One and Stage Two of our exploration program.

We have budgeted for regulatory compliance costs in the proposed exploration program recommended by the MineStart report. As mentioned above, we will have to sustain the cost of reclamation and environmental remediation for all exploration and other work undertaken. The amount of reclamation and environmental remediation costs are not known at this time as we do not know the extent of the exploration program that will be undertaken beyond completion of the recommended exploration program. Because there is no information on the size, tenor, or quality of any mineral resource at this time, it is impossible to assess the impact of any capital expenditures on earnings or our competitive position in the event a potential mineral deposit is discovered.

If we enter into substantial exploration, the cost of complying with permit and regulatory environment laws will be greater than in Stages One and Two because the impact on the project area is greater. Permits and regulations will control all aspects of any program if the project continues to that stage because of the potential impact on the environment. We may be required to conduct an environmental review process under the British Columbia Environmental Assessment Act if we determine to proceed with a substantial project. An environmental review is not required under the Environmental Assessment Act to proceed with the recommended Stage One and Two exploration programs on our North and Molly 1 Claims.

Costs and Effects of Compliance with Environmental Laws

We currently have no costs to comply with environmental laws concerning our exploration program.

We will have to sustain the cost of reclamation and environmental remediation for all work undertaken which causes sufficient surface disturbance to necessitate reclamation work. Both reclamation and environmental remediation refer to putting disturbed ground back as close to its original state as possible. Other potential pollution or damage must be cleaned-up and renewed along standard guidelines outlined in the usual permits. Reclamation is the process of bringing the land back to a natural state after completion of exploration activities. Environmental remediation refers to the physical activity of taking steps to remediate, or remedy, any environmental damage caused, i.e. refilling trenches after sampling or cleaning up fuel spills. Our initial programs do not require any reclamation or remediation other than minor clean up and removal of supplies because of minimal disturbance to the ground. The amount of these costs is not known at this time as we do not know the extent of the exploration program we will undertake, beyond completion of the recommended phases. Because there is presently no information on the size, tenor, or quality of any resource or reserve at this time, it is impossible to assess the impact of any capital expenditures on our earnings or competitive position in the event a potentially economic deposit is discovered.

11

Employees

We currently have no employees other than our officers and directors. We intend to retain the services of geologists, prospectors and consultants on a contract basis to conduct the exploration programs on our mineral claims and to assist with regulatory compliance and preparation of financial statements.

Research and Development Expenditures

We have not incurred any research or development expenditures since our incorporation.

Subsidiaries

Nava Resources Canada Inc. (“Nava Canada”) is a 100% owned subsidiary of Nava Resources Inc.

Patents and Trademarks

We do not own, either legally or beneficially, any patent or trademark.

Plan of Operation

Our plan of operation for the next twelve months is to complete the following objectives within the time periods specified, subject to our obtaining any additional funding necessary for the continued exploration of our mineral claims. We have enough funds to complete our Phase One exploration program and possibly Phase Two depending on scope and costs.

1. Since the next anniversary date of the Claims is October 28, 2010 we will need to arrange exploration work worth approximately CAN$2,500 or pay the Province of British Columbia CAN$2,517.69 in lieu of filing exploration expenses in order to keep the Claims in good standing.

2. As recommended by MineStart, we commenced the Phase One program starting in June 2008. Work performed consisted of a prospecting traverse of about 5.5 kilometers, primarily within North 2, but overlapping into the southwest corner of North 1. This represents an area of about 62 ha, broadly prospected. The area prospected is covered by an extensive layer of boulder till, best exposed locally along Youbou Road and in stream cuts. Outcrops in this area are probably minimal; none were located during the traverse. A total of 30 samples were taken for multi-element lithogeochemical analysis. These samples are from both sub-crop (along road cuts close to Youbou Road and drainage ways) and float. All samples are intermediate to possibly mafic in composition, weakly to moderately foliated, and fine to medium grained, probably representing a mix of fine pyroclastics and intrusive equivalents. Samples exhibited no visible signs of mineralization, veining or hydrothermal alteration.

12

Though not visibly mineralized samples were analyzed geochemically for a multi-element suite (37 elements) in order to accrue a foundation of lithogeochemical data in anticipation of more detailed work, and to test for the presence of anomalous Cu-Pb-Zn-Ag-Au-Ba-As, potential pathfinders for Kuroko type environments. Samples were sent to Acme Labs in Vancouver, crushed to 200 mesh, and processed by Aqua Regia digestion CCP-MS analysis. Gold was also determined by fire assay fusion by ICP-ES. No significant anomalies were identified in the pathfinder suite. However, the first three samples demonstrate a weakly anomalous Cu-Pb-Zn-Ag-As-Ba signature, which may be of interest.

3. We will further review the phase one results and decide if we will plan and conduct a Phase Two program beginning in November 2010. Timing of this program will to some extent be dependent on permitting requirements. This program, estimated to cost from $100,000 to $150,000 depending on scope, may include geological mapping, a geochemical survey, trenching, sampling and analysis.

4. In the case that the Phase Two exploration program takes place, we will review its results in December 2010. Further work on the property may be undertaken if justified by the results of Phase Two. A joint venture relationship may be explored at some future point as justified to offset the costs of continued exploration and drilling if warranted.

We may consider entering into a joint venture partnership by linking with a major resource company to provide the required funding to complete exploration beyond Phase Two. We have not undertaken any efforts to locate a joint venture partner at this point. If we enter into a joint venture arrangement, we will assign a percentage of our interest in our mineral claims to the joint venture partner.

5. We will also be evaluating other opportunities that might be brought to our attention.

13

Results of Operations

|

Three months ended September 30, 2010 (Unaudited) |

Three months ended September 30, 2009 (Unaudited) |

Accumulated from July 21, 2005 (date of inception) to September 30, 2010 (Unaudited) |

|||||||

| EXPENSES | |||||||||

| Amortization | $ | 23 | $ | 36 | $ | 1,141 | |||

| Consulting | - | - | 16,000 | ||||||

| Consulting – stock based compensation | 39,450 | - | 42,248 | ||||||

| Exploration costs | - | - | 12,026 | ||||||

| Office and miscellaneous | 90 | 637 | 8,208 | ||||||

| Professional fees | 4,429 | 2,828 | 88,269 | ||||||

| Operating loss | (43,992 | ) | (3,501 | ) | (167,892 | ) | |||

| Other items | |||||||||

| Cost recovery | 1,000 | - | 1,000 | ||||||

| Interest income | 10 | 53 | 8,102 | ||||||

| 1,010 | 53 | 9,102 | |||||||

| NET AND COMPREHENSIVE LOSS | $ | (42,982) | $ | (3,448) | $ | (158,790) | |||

Revenues

We have had no operating revenues since our inception on July 21, 2005 to September 30, 2010. We anticipate that we will not generate any revenues for so long as we are an exploration stage company.

General and Administrative Expenses

Our general and administrative expenses in the three months ended September 30, 2010 increased to $43,992 from $3,501 in the three months ended September 30, 2009, primarily as a result of stock based compensation.

14

Mineral Property Costs

In the three months ended September 30, 2010, we incurred nil mineral property costs compared to mineral property costs of $nil in the three months ended September 30, 2009.

Rent

Our office space is being provided free of charge. They can be no assurance that it will continue to be provided free of charge.

Net Loss

As a result of the above, our net loss for the three months ended September 30, 2010 was $42,982, as compared to $3,448 in the three months ended September 30, 2009.

Liquidity and Capital Resources

At September 30, 2010, we had cash of $84,256 and a working capital of $71,827. During the 12 month period following the date of this quarterly report, we anticipate that we will not generate any revenue. We believe that we have enough cash on hand to complete our Phase One exploration program and commence a fairly basic Phase Two program. If the results of the Phase One are particularly encouraging, we may wish to raise additional funds for a more in depth Phase Two program starting in March 2011. Additional funds will need to be raised to support work that may be undertaken subsequent to Phase Two.

If additional funds are required, the additional funding will likely come from equity financing from the sale of our common stock or sale of part of our interest in our mineral claims. If we are successful in completing an equity financing, existing shareholders will experience dilution of their interest in our Company. We do not have any financing arranged and we cannot provide investors with any assurance that we will be able to raise sufficient funding from the sale of our common stock to fund our exploration activities. In the absence of such financing, our business will likely fail.

Going Concern

We have not generated any revenues since inception. As of September 30, 2010, the Company had accumulated losses of $158,790. Our independent auditors included an explanatory paragraph in their report on the accompanying financial statements regarding concerns about our ability to continue as a going concern. Our financial statements contain additional note disclosures describing the circumstances that lead to this disclosure by our independent auditors. Our financial statements do not include any adjustments related to the recoverability or classification of asset-carrying amounts or the amounts and classifications of liabilities that may result should the Company be unable to continue as a going concern.

15

Off-Balance Sheet Arrangements

We have no off-balance sheet arrangements including arrangements that would affect our liquidity, capital resources, market risk support and credit risk support or other benefits.

Critical Accounting Policies

Our financial statements and accompanying notes have been prepared in accordance with United States generally accepted accounting principles and are expressed in U.S. dollars. For a change in accounting policies, please see Note 3 to our financial statements for our quarter ended September 30, 2010, which are included in this quarterly report.

Item 3. Quantitative and Qualitative Disclosures About Market Risk

A smaller reporting company, as defined by Item 10 of Regulation S-K, is not required to provide the information required by this item.

Item 4. Controls and Procedures

Under the supervision and with the participation of our management, including our Chief Executive Officer and Chief Financial Officer, we evaluated the effectiveness of our disclosure controls and procedures (as defined in Rules 13a-15(e) and 15d-15(e) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”)) as of September 30, 2010. Based upon that evaluation, our Chief Executive Officer and Chief Financial Officer concluded that our disclosure controls and procedures were effective as of September 30, 2010.

Management report on Internal Control over Financial Reporting

Our management is responsible for establishing and maintaining adequate internal control over financial reporting. Internal control over financial reporting is defined in Rule 13a-15(f) and 15d-15(f) under the Exchange Act as a process designed by, or under the supervision of, a company’s principal executive and principal financial officers and effected by the company’s board of directors, management and other personnel to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles and includes those policies and procedures that:

- pertain to the maintenance of records that in reasonable detail accurately and fairly reflect the transactions and dispositions of the assets of the Company;

- provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that receipts and expenditures of the Company are being made only in accordance with authorizations of management and directors of the Company; and

- provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of the Company’s assets that could have a material effect on the financial statements.

Management acknowledges its responsibility for establishing and maintaining adequate internal controls over financial reporting. We are not in compliance with Section 404 of the Sarbanes-Oxley Act of 2002, but intend to commence shortly the system and process of documentation and evaluation needed to comply with Section 404.

16

This quarterly report does not include an attestation report of the Company’s registered public accounting firm regarding internal control over financial reporting. Management’s report was not subject to attestation by the Company’s registered public accounting firm pursuant to temporary rules of the Securities and Exchange Commission that permit the Company to provide only management’s report in this quarterly report

There has not been any change in our internal control over financial reporting (as defined in Rules 13a-15(f) and 15d-15(f) under the Exchange Act) during the quarter ended September 30, 2008 that has materially affected, or is reasonably likely to materially affect, our internal control over financial reporting.

PART II - OTHER INFORMATION

Item 1. Legal Proceedings

We currently are not a party to any material legal proceedings and, to our knowledge, no such proceedings are threatened or contemplated.

Item 1A. Risk Factors

There have been no material changes to the risks to our business described in our Annual Report on Form 10-K for the year ended June 30, 2010 filed with the SEC on September 27, 2010.

Item 2. Unregistered Sales of Equity Securities and Use of Proceeds

Unregistered Sales of Equity Securities

None

Purchases of equity securities by the issuer and affiliated purchasers

None.

Item 3. Defaults Upon Senior Securities

None.

Item 4. Submission of Matters to a Vote of Securities Holders

None.

Item 5. Other Information

On October 26, 2009, the Board of Directors of the Company adopted the Nava Resources, Inc. 2009 Stock Incentive Plan (the “Stock Plan”) and reserved 10,000,000 shares to be issued under the Stock Plan.

17

Item 6. Exhibits

| Exhibit | Description |

| 3.1 | Articles of Incorporation of Registrant* |

| 3.2 | Bylaws of the Registrant* |

| 3.3 | Articles of Incorporation of Nava Resources Canada, Inc.* |

| 3.4 | Certificate of Amendment to Articles of Incorporation of Registrant* |

| 4.0 | Stock Plan |

| 4.1 | Specimen Common Stock Certificate* |

| 4.2 | Form of Regulation S Subscription Agreement for Shares of Common Stock* |

| 4.3 | Form of Regulation S Subscription Agreement for Units* |

| 4.4 | Form of Warrant Certificate* |

| 10.1 | Bill of Sale of North Claim 1 to Jag dated August 22, 2007* |

| 10.2 | Bill of Sale of North Claim 2 to Jag dated August 22, 2007* |

| 10.3 | Mineral Tenure Bill of Sale Completion for North Claim 1 dated November 22, 2007* |

| 10.4 | Mineral Tenure Bill of Sale Completion for North Claim 2 dated November 22, 2007* |

| 21.1 | Subsidiaries of Registrant |

| 31. | Rule 13a-14(a)/15d14(a) Certifications |

| 32. | Section 1350 Certifications |

| 99.1 | Report of MineStart Management Inc. dated December 7, 2007* |

* Incorporated by reference to the registration statement on Form S-1, as filed by the Company with the Securities and Exchange Commission on May 1, 2008.

18

SIGNATURES

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the Company has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

NAVA RESOURCES, INC. By: /s/ Jag Sandhu |

In accordance with the Exchange Act, this report has been signed below by the following persons on behalf of the Registrant and in the capacities and on the dates indicated.

|

Signature /s/

Jag Sandhu |

Title President,

Chief Executive Officer |

Date October 25, 2010 |

|

/s/

Don Blackadar Don Blackadar |

Director | October 25, 2010 |