Attached files

Table of Contents

Index to Financial Statements

As filed with the Securities and Exchange Commission on October 25, 2010

Registration No. 333-168736

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1

to

Form S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Triangle Petroleum Corporation

(Exact name of registrant as specified in its charter)

| Nevada | 1311 | 98-0430762 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

1625 Broadway, Suite 780

Denver, CO 80202

(303) 260-7125

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Peter J. Hill

President and Chief Executive Officer

Triangle Petroleum Corporation

1625 Broadway, Suite 780

Denver, CO 80202

(303) 260-7125

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Richard B. Aftanas, Esq. Skadden, Arps, Slate, Meagher & Flom LLP Four Times Square New York, NY 10036 Telephone: (212) 735-3000 Facsimile: (212) 735-2000 |

Robert G. Reedy Porter & Hedges LLP 1000 Main Street, 36th floor Houston, TX 77002 Telephone: (713) 226-6000 Facsimile: (713) 228-1331 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||||||

| Non-accelerated filer | ¨ | (Do not check if a smaller reporting company) | Smaller reporting company | x | ||||||

Table of Contents

Index to Financial Statements

CALCULATION OF REGISTRATION FEE

| Title of each class of securities to be registered |

Proposed maximum aggregate offering price(1)(2) |

Amount of fee(3) | ||

| Common Stock, par value $0.00001 per share |

$56,925,000 | $4,059 | ||

| (1) | Includes common stock to be sold upon exercise of the underwriters’ option. See “Underwriting.” |

| (2) | Estimated solely for the purpose of calculating the amount of the registration fee pursuant to Rule 457(o) under the Securities Act. |

| (3) | $3,565 of this amount was paid with the filing of the original registration statement on August 10, 2010. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission acting pursuant to said Section 8(a), may determine.

Table of Contents

Index to Financial Statements

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED OCTOBER 25, 2010

PROSPECTUS

9,000,000 Shares

Triangle Petroleum Corporation

COMMON STOCK

Triangle Petroleum Corporation is offering 9,000,000 shares of its common stock.

Our common stock is traded on the OTC Bulletin Board under the symbol “TPLM.” We have received conditional approval to list our common stock on the NYSE Amex under the symbol “TPLM.” On October 22, 2010, the last reported sale price of our common stock on the OTC Bulletin Board was $5.40 per share (after giving effect to a 1-for-10 reverse stock split). Concurrently with the pricing of this offering, we will effectuate a 1-for-10 reverse stock split. After the reverse stock split and this offering, the market price of our common stock may be different from its current price.

Investing in our common stock involves significant risks. See “Risk Factors” beginning on page 9.

| Price

to Public |

Underwriting Discounts and Commissions |

Proceeds, Before Expenses, to Us |

||||||||||

| Per Share |

$ | $ | $ | |||||||||

| Total |

$ | $ | $ | |||||||||

The underwriters may also purchase up to an additional 1,350,000 shares of common stock from us at the public offering price above, less the underwriting discounts and commissions, within 30 days of the date of this prospectus to cover any over-allotments.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities, or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares of common stock to purchasers on or before , 2010.

Sole Book-Running Manager

Johnson Rice & Company L.L.C.

Co-Managers

| Canaccord Genuity | Rodman & Renshaw, LLC |

, 2010

Table of Contents

Index to Financial Statements

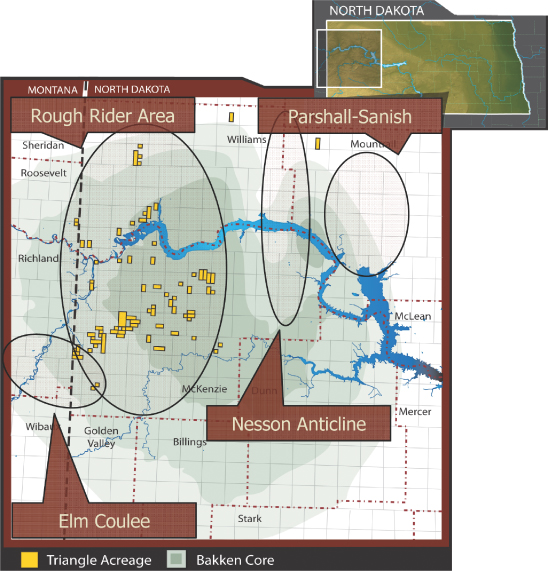

Triangle’s acreage position in the Williston Basin, including the planned Williston Purchase.

Table of Contents

Index to Financial Statements

| 1 | ||||

| 9 | ||||

| 24 | ||||

| 25 | ||||

| 27 | ||||

| 28 | ||||

| 29 | ||||

| 30 | ||||

| 32 | ||||

| 33 | ||||

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

34 | |||

| 46 | ||||

| 58 | ||||

| 63 | ||||

| 67 | ||||

| 69 | ||||

| 70 | ||||

| 73 | ||||

| 76 | ||||

| 76 | ||||

| 76 | ||||

| F-1 | ||||

| A-1 | ||||

You should rely only on the information contained in this prospectus or in any free writing prospectus we may authorize to be delivered to you. Neither we nor the underwriters have authorized anyone to provide you with additional or different information. If anyone provides you with additional, different or inconsistent information, you should not rely on it. We and the underwriters are offering to sell, and seeking offers to buy, these securities only in jurisdictions where offers and sales are permitted. The information in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of our common stock.

i

Table of Contents

Index to Financial Statements

This summary provides a brief overview of information contained elsewhere in this prospectus. Because it is abbreviated, this summary does not contain all of the information that you should consider before investing in our common stock. You should read the entire prospectus carefully before making an investment decision, including the information presented under the headings “Risk Factors,” “Cautionary Note Regarding Forward-Looking Statements” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the historical consolidated financial statements and related notes thereto included elsewhere in this prospectus. Unless otherwise indicated, information presented in this prospectus assumes that the underwriters’ option to purchase additional shares of common stock is not exercised. We have provided definitions for certain oil and natural gas terms used in this prospectus in the “Glossary of Oil and Natural Gas Terms” beginning on page A-1 of this prospectus.

Except where otherwise indicated, all information regarding share amounts and prices assume the consummation of the 1-for-10 reverse stock split to be effected prior to the closing of this offering. All dollar amounts are in U.S. dollars unless otherwise indicated. In this prospectus, unless the context otherwise requires, the terms “we,” “us” and “our” refer to Triangle Petroleum Corporation and its subsidiaries. Our fiscal year-end is January 31.

Overview

We are an oil and natural gas exploration and development company currently focused on the acquisition and development of unconventional shale oil resources. In late 2009, we adopted a new investment strategy shifting our area of focus from the Maritimes Basin in the Province of Nova Scotia to the Bakken Shale and Three Forks formations in the Williston Basin of North Dakota and Montana. In furtherance of our new strategy, to date, we have acquired, or committed to acquire, approximately 13,000 net acres primarily in McKenzie and Williams Counties of North Dakota. Having identified an area of focus in the Bakken Shale that we believe will generate attractive returns on invested capital, we are continuing to explore further opportunities in the region with a goal of reaching 30,000 net acres by the end of 2011.

In the Maritimes Basin, we hold over 400,000 net acres with numerous conventional and unconventional prospective reservoirs, including the Windsor and Horton Shales. As a result of the processing and interpretation of our proprietary 2D seismic data, we have identified a conventional exploration opportunity that we believe could hold significant natural gas reserves. We are currently marketing the prospect to industry partners as a farm-out opportunity and propose to enter into an agreement whereby we would maintain a working interest position and potential partners would agree to cover 100% of the capital costs of an initial exploration well.

Williston Basin

We have operated and non-operated leasehold positions in the Williston Basin. The operations of our non-operated leasehold positions are primarily conducted through agreements with Slawson Exploration, Inc., or Slawson, one of the largest private operators in the Williston Basin, and Kodiak Oil & Gas Corp., or Kodiak, a publicly traded oil and natural gas independent exploration and production company. Both companies are experienced operators in the development of the Bakken Shale and Three Forks formations. As of October 22, 2010, we have acquired, or committed to acquire, an aggregate of approximately 13,000 net acres in the Williston Basin in North Dakota. We are seeking to acquire new operated and non-operated acreage within these formations with additional experienced operators. In 2011, we also plan to drill our first operated well on the acreage that we expect to acquire as part of the Williston Purchase. See “—Recent Developments.” In addition, we have successfully recruited a new land staff and brokerage and title team, which in the past month has successfully acquired over 1,200 net acres, including approximately 700 net acres in the same township as the Williston Purchase.

1

Table of Contents

Index to Financial Statements

The Slawson participation agreement, or the Slawson Agreement, is confined to an agreed upon AMI within the Rough Rider area of McKenzie and Williams Counties in North Dakota. We have acquired approximately 6,000 net acres to date under the Slawson Agreement and have identified numerous drilling locations. We will spud our first well in October 2010 and plan to continue to drill additional wells through the end of 2011. Under the terms of the Slawson Agreement, we pay 33% of the gross well costs and between a 20% and 60% premium of our pro rata share of leasehold acquisition costs to earn a 30% working interest in all wells drilled within the AMI through January 15, 2012. We believe the terms of the Slawson Agreement are consistent with industry practice and will result in net costs to us that are substantially lower than we could achieve during the early phase of our development.

In May 2010, we entered into an agreement with Kodiak pursuant to which we have the opportunity to acquire approximately 2,600 net acres in an area of McKenzie County, or the Grizzly Project, located north and east of the Elm Coulee field. Under the terms of the agreement, we agreed to pay approximately $3.2 million to Kodiak in the form of future drilling carry for a 30% working interest in the Grizzly Project area. After the $3.2 million has been expended, we will have earned our approximately 2,600 net acres, with all future wells to be drilled according to our working interest position. As described below, we have drilled three gross wells in the Grizzly Project, two of which are awaiting completion and one of which has been production tested and is being prepared for production. We anticipate drilling an additional well by fiscal year-end.

Using industry accepted well-spacing parameters and a combination of short and long laterals, we believe that there could be over 100 unrisked drilling locations for the Bakken Shale and Three Forks formations on our acreage in the Williston Basin. Based on current industry expectations, we believe we can drill up to eight 9,500 foot lateral wells on 1,280 acre spacing units within our acreage. Consistent with leading field operators, we plan to perform multi-stage fracs with 25 to 30 stages on each lateral well. We also plan to drill shorter laterals on smaller units as dictated by our leasehold position.

In May 2010, we announced our plans to participate in the Roedeske Federal #12-21H well in McKenzie County with an approximate 15% working interest. The 9,000 foot lateral well was drilled on a 1,280 acre spacing unit and is awaiting completion with a 22-stage frac job. The well is operated by XTO Energy Inc.

In June 2010, we commenced a two well drilling program in the Grizzly Project with Kodiak as operator. The first well, the Grizzly #13-6H, is a 4,000 foot lateral re-entry of an existing wellbore. The estimated gross costs are $3.2 million and we have an approximate 26% working interest in this well. We anticipate that this well will be completed late in October 2010. The second well, the Grizzly #1-27H, is a 9,000 foot lateral well that was drilled on a 1,280 acre spacing unit. This well experienced mechanical difficulties during completion resulting in only 10 of 24 initially planned stages being completed, reducing the estimated cost of the well. The well produced 507 Boe during its initial 24 hour test and is currently being prepared for production. The gross estimated costs are $5.7 million and we have an approximate 26% working interest in this well.

We recently announced that Slawson will spud the first well of its joint venture with us on approximately October 30, 2010, the Bonanza #1-21-16H, located in the Rough Rider area in McKenzie County. We currently anticipate that Slawson will drill an additional nine wells in the Rough Rider area during the remainder of 2010 and 2011.

Maritimes Basin

We have an 87% working interest in approximately 474,625 gross acres (approximately 412,924 net acres) in the Windsor Sub-Basin of the Maritimes Basin located in the Province of Nova Scotia, Canada, or the Windsor Block. In October 2009, we completed an approximately 30-square kilometer 2D seismic shoot on the Windsor Block and completed processing and interpreting the data in the fiscal quarter ending January 31, 2010. We believe

2

Table of Contents

Index to Financial Statements

that this seismic program, combined with the completion operations on three previously drilled vertical exploration wells, satisfied the first-year requirements of our 10-year production lease. See “Business—Operations and Oil and Natural Gas Properties—Maritimes Basin” for a description of the terms of the lease. We have completed our interpretation of the seismic data on the Windsor Block and we are currently seeking partners to participate in the drilling of the test well and to participate in a joint venture to further evaluate the potential of the Windsor Block.

Our Strategy

Our goal is to increase stockholder value by increasing our Williston Basin leasehold position and converting such leasehold position into proven reserves, production and cash flow at attractive returns on invested capital. We are seeking to achieve this goal through the following strategies:

| • | Focus on the Williston Basin. We believe the Bakken Shale and Three Forks formations in the Williston Basin represent one of the largest oil deposits in North America. A report issued by the United States Geological Survey, or USGS, in April 2008 classified these formations as the largest continuous oil accumulation ever assessed by it in the contiguous United States. We expect to continue to aggressively pursue additional leasehold positions where our geologic model suggests the Bakken Shale and/or the Three Forks formations are believed to be prospective. We believe horizontal wells drilled on our acreage will generate attractive returns on invested capital given our outlook for the price of oil and the finding and development costs associated with converting the acreage from resource potential to proven and producing reserves. |

| • | Continue to pursue leasehold acquisitions at attractive costs. We believe significant additional acreage in the Williston Basin, prospective for the Bakken Shale and Three Forks formations, is and will be available for acquisition allowing us to reach our goal of 30,000 net acres by the end of 2011. We believe many of the active operators in the area have assembled sizeable leasehold positions and have shifted from a leasehold acquisition strategy to a development strategy, reducing the competition for additional leasehold acreage. We plan to explore various techniques to add acreage, including participating in state and federal lease sales, pursuing leasehold acquisitions, farm-in agreements with existing operators and farm-in opportunities on lease positions that are about to expire. We believe many operators will choose to farm-out lease positions rather than allow leases to expire, giving us an opportunity to add significant leasehold at attractive costs. |

| • | Maintain a balanced mix of operated and non-operated leasehold positions. Through our non-operated positions with Slawson and Kodiak, we plan to leverage our currently low overhead while broadening our operating experience by teaming with two of the most active and knowledgeable operators in the Williston Basin. We believe that Slawson’s and Kodiak’s long histories in the Williston Basin will also provide significant opportunities to expand our collective acreage position. We believe that the operations of Slawson and Kodiak will have lower costs resulting in higher returns than we can achieve on a stand-alone basis during the early phase of our development. With the majority of primary term leases extending three to five years from inception, we expect to build our operational capabilities and develop our operated acreage position prior to lease expiration. |

| • | Capture upside value in Nova Scotia. We hold approximately 412,924 net acres in the province of Nova Scotia in Canada that we believe contains multiple conventional and unconventional targets. Increased industry activity in the Maritimes Basin, along with other factors such as more restrictive permitting procedures in the Gulf of Mexico, has increased industry interest in this area. Recently, Southwestern Energy Company, a mid-cap independent exploration company, leased a large undeveloped acreage position in the province of New Brunswick and committed to spend $47 million on the development of such acreage. Additionally, Apache Corporation recently spudded the B-41 Green Road and the G-59 Will deMille wells pursuant to its December 2009 farm-out agreement with Corridor Resources Inc. We are currently seeking a farm-out arrangement whereby a partner will fund 100% of the cost of the first well drilled on our acreage. |

3

Table of Contents

Index to Financial Statements

| • | Maintain conservative leverage position to enhance financial flexibility. Acquisitions and farm-in opportunities will require us to move rapidly in many instances. As such, we expect to maintain excess cash balances and a conservative leverage position while we focus on leasehold acquisitions. Between now and the end of 2011, we expect to primarily use equity capital to fund our leasehold expansion and only add leverage where cash flow and reserve growth allow. |

Our Competitive Strengths

We have the following competitive strengths that we believe will help us to successfully execute our business strategies:

| • | We benefit from the increasing activity in the Bakken Shale and Three Forks formations acreage. Activity levels in the Williston Basin continue to increase with a drilling rig count of 134 at October 15, 2010 versus 65 at January 1, 2010. We benefit from the increasing number of wells drilled and the corresponding data available from public sources and the North Dakota Industrial Commission. This activity and data has begun to define the geographic extent of the Bakken Shale and Three Forks formations which we believe reduces the amount of risk we face on future leasehold acquisitions and development operations. In addition, the leading operators in the Williston Basin have developed drilling and completion technologies that have significantly reduced production risk, decreased per unit drilling and completion costs and enhanced returns. |

| • | Relatively small size allows us to make meaningful acquisitions. Our relatively small size provides us with the opportunity to acquire smaller acreage blocks that may be less attractive to larger operators inside and outside of the Williston Basin. These smaller blocks in aggregate will have a meaningful impact on our overall acreage position and should allow us to meet our goal of 30,000 net acres by year-end 2011. |

| • | Experienced management team with proven acquisition and operating capabilities. Peter Hill, our Chief Executive Officer, has over 37 years of oil and natural gas experience, including over 20 years with British Petroleum in a variety of roles including Chief Geologist, Chief of Staff for BP Exploration, President of BP Venezuela and Regional Director for Central and South America. He currently serves as the non-executive Chairman for Toreador Resources, a public company currently developing an oil shale prospect in the Paris Basin in France. He is complemented by Jonathan Samuels, our Chief Financial Officer, who spent over five years as a member of an energy focused investment management firm. |

| • | We have no outstanding indebtedness and following the offering we will have $44.7 million in cash. We expect to have approximately $44.7 million in cash after we close this offering. We will use this cash to meet our drilling commitments in 2010 and 2011 and pursue additional leasehold acquisitions, including under our recent agreement with Williston Exploration LLC. See “—Recent Developments.” |

Recent Developments

Williston Purchase—On October 5, 2010, we entered into a purchase and sale agreement with Williston Exploration LLC to acquire approximately 1,732 net acres in Williams County, North Dakota, or the Williston Purchase. These undeveloped acres are in contiguous blocks in three separate 1,280 acre drilling units and will provide our first operated drilling locations. The addition of this acreage will give us an opportunity to operate on a large portion of the acreage and we plan to drill up to two wells that we will operate by the end of 2011. The aggregate purchase price consists of up to approximately $2.2 million in cash and up to 433,500 shares of our common stock (after giving effect to the reverse stock split). We expect to close on a portion of the acres in December 2010 and on the remainder in February 2011.

4

Table of Contents

Index to Financial Statements

Oppenheimer Joint Venture—On October 22, we entered into an exploration and development agreement, or the Oppenheimer Agreement, with Oppenheimer Global Resource Private Equity Fund I and a related co-investment fund, or OGR, each a New York based investment fund managed by an affiliate of Oppenheimer & Co, Inc. Under the Oppenheimer Agreement, OGR has made a $25 million capital commitment to co-invest with us in our future acquisition and development of assets in the Williston Basin. $10 million of OGR’s initial capital, which OGR has the right to increase up to $19 million, is allocated for leasehold acquisition with the remainder available for well development. Further, OGR has the right to participate in up to 25% of our future activity in the Williston Basin. OGR will pay its share of leasehold costs in all leases in which it participates, plus a premium to us equal to an additional percentage of lease acquisition costs which is designed to remunerate us for our services in sourcing and managing the acreage activity in the Williston Basin. The acreage premium varies depending upon the level of lease acquisition costs. OGR will also bear 25% of all of our brokerage costs in the region. In addition, OGR will pay its proportional share of all drilling and completion costs, plus a 10% premium thereof to us for our services associated with well development. We will also earn an annual management fee as general and administrative expense reimbursement. Our current leasehold position, including the Grizzly Project, and any future leasehold acquisition pursuant to the Slawson Agreement, is excluded from the Oppenheimer Agreement.

Exploration and Development Activity—Beginning in the fourth quarter of 2010, we believe we will participate in the drilling of up to 20 gross (5.3 net) wells by the end of 2011. We anticipate participating in two gross (1.25 net) wells in the acreage being acquired from Williston Exploration LLC, 10 gross (2.0 net) wells on our Slawson AMI, two to four gross (0.7 to 1.40 net) wells in the Grizzly Project and up to four gross (0.6 net) wells in our other non-operated areas. With an average drilling and completion cost of $7.0 million per well, we have budgeted a range of anticipated drilling capital costs of $30 to $40 million over this period.

Reverse Stock Split and NYSE Amex Listing

Prior to the closing of this offering, we will complete a 1-for-10 reverse stock split, or the reverse stock split, which is intended to increase our ability to meet the minimum share price requirement of the NYSE Amex LLC, or AMEX. Although we have already received conditional approval to list our common stock on AMEX, such listing is conditioned upon completion of the reverse stock split and final approval of AMEX.

We received stockholder approval at our 2010 annual meeting of stockholders held on September 16, 2010 granting discretionary authority to our board of directors, or the Board, to effect the reverse stock split. In connection with the reverse stock split, we also received stockholder approval to amend our articles of incorporation to decrease the number of shares of authorized common stock from 150,000,000 shares to 70,000,000 shares. Such decrease is conditioned upon effecting the reverse stock split. We intend to amend our articles of incorporation to decrease the number of authorized shares simultaneously with the reverse stock split.

Corporate Information

We were incorporated in the State of Nevada on December 11, 2003 under the name Peloton Resources Inc. On May 10, 2005, we changed our name to Triangle Petroleum Corporation. Our principal executive office is located at 1625 Broadway, Suite 780, Denver, Colorado 80202 and our telephone number at that address is (303) 260-7125. Our website is www.trianglepetroleum.com. The information on our website is not part of this prospectus.

5

Table of Contents

Index to Financial Statements

THE OFFERING

| Issuer |

Triangle Petroleum Corporation |

| Common stock offered by us |

9,000,000 shares |

| Common stock outstanding immediately after this offering |

19,539,084 shares |

| Over-allotment option |

We have granted the underwriters a 30-day option to purchase up to an aggregate of 1,350,000 additional shares of our common stock to cover any over-allotments. |

| Use of proceeds |

We estimate that our net proceeds from this offering will be approximately $44 million after deducting the underwriting discounts and commissions and estimated offering expenses. |

We intend to use the net proceeds from this offering to fund our drilling and development expenditures, leasehold acquisitions, including the Williston Purchase, and general corporate purposes, including working capital.

| Dividend policy |

We have not and do not expect to declare or pay any cash or other dividends in the foreseeable future on our common stock. See “Dividend Policy.” |

| Risk factors |

You should carefully read and consider the information beginning on page 9 of this prospectus set forth under the heading “Risk Factors” and all other information set forth in this prospectus before deciding to invest in our common stock. |

| Proposed AMEX symbol |

“TPLM” |

The number of shares to be outstanding after this offering is based on (i) 10,105,584 shares of our common stock outstanding as of October 22, 2010 (after giving effect to the reverse stock split), (ii) up to 433,500 shares of our common stock that may be issued in connection with the Williston Purchase (after giving effect to the reverse stock split) and (iii) excludes 1,010,559 additional shares (after giving effect to the reverse stock split) that are authorized for future issuance under our equity incentive plans, of which 340,000 shares (after giving effect to the reverse stock split) may be issued pursuant to outstanding stock options.

Unless otherwise indicated, the information in this prospectus assumes that the underwriters will not exercise their over-allotment option.

6

Table of Contents

Index to Financial Statements

SUMMARY HISTORICAL CONSOLIDATED FINANCIAL DATA

The following table presents our summary historical consolidated financial data as of the dates and for the periods as indicated. The consolidated income statement and other consolidated financial data for each of the fiscal years in the three years ended January 31, 2010, and the consolidated balance sheet data as of each of such periods, have been derived from our consolidated financial statements, which have been audited by our independent registered public accounting firm. The consolidated income statement and other consolidated financial data for the fiscal six months ended July 31, 2009 and July 31, 2010, and the consolidated balance sheet data as of July 31, 2010, have been derived from our unaudited interim consolidated financial statements included elsewhere in this prospectus. The unaudited interim consolidated financial statements have been prepared on a basis consistent with the audited consolidated financial statements and, in the opinion of our management, include all adjustments (including normal recurring accruals) necessary for a fair presentation of such data. Our results for the interim period are not necessarily indicative of results for a full year. Our historical consolidated financial data should be read in conjunction with our historical consolidated financial statements and the accompanying notes and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included elsewhere in this prospectus.

| Years ended January 31, | Six months ended July 31, | |||||||||||||||||||

| 2008 | 2009 | 2010 | 2009 | 2010 | ||||||||||||||||

| (unaudited) | ||||||||||||||||||||

| INCOME STATEMENT |

||||||||||||||||||||

| Revenue, net of royalties |

$ | 586,804 | $ | 386,892 | $ | 131,245 | $ | 63,087 | $ | 41,722 | ||||||||||

| Operating Expenses |

||||||||||||||||||||

| Oil and gas production |

$ | 304,537 | $ | 125,777 | $ | 95,852 | $ | 52,576 | $ | 13,495 | ||||||||||

| Depletion and accretion |

441,881 | 200,050 | 188,788 | 91,477 | 131,795 | |||||||||||||||

| Depreciation—property and equipment |

40,429 | 39,448 | 26,198 | 11,674 | 13,864 | |||||||||||||||

| General and administrative |

5,800,116 | 4,045,906 | 3,987,012 | 1,675,148 | 1,655,125 | |||||||||||||||

| Foreign exchange (gain) loss |

317,656 | 2,682,873 | (753,950 | ) | (707,654 | ) | (30,141 | ) | ||||||||||||

| Gain on sale of assets |

— | (126,314 | ) | (1,266,294 | ) | (124,621 | ) | (976,900 | ) | |||||||||||

| Ceiling test write-down on oil and gas properties |

19,598,916 | 8,308,229 | — | — | — | |||||||||||||||

| Total Operating Expenses |

$ | 26,503,535 | $ | 15,275,969 | $ | 2,277,606 | $ | 998,600 | $ | 807,238 | ||||||||||

| Total Other Income (Expense) |

$ | (3,684,016 | ) | $ | 1,118,592 | $ | 6,260 | $ | 6,213 | $ | 373 | |||||||||

| Net Income (Loss) for the Period |

$ | (29,600,747 | ) | $ | (13,770,485 | ) | $ | (2,140,101 | ) | $ | (929,300 | ) | $ | (765,516 | ) | |||||

| STATEMENT OF CASH FLOWS |

||||||||||||||||||||

| Net Cash Used In Operating Activities |

$ | (4,246,258 | ) | $ | (3,898,095 | ) | $ | (2,099,940 | ) | $ | (890,162 | ) | $ | (1,640,608 | ) | |||||

| Net Cash Used In Investing Activities |

$ | (22,279,141 | ) | $ | (1,190,231 | ) | $ | (2,192,365 | ) | $ | (2,712,803 | ) | $ | (9,898,918 | ) | |||||

| Net Cash Provided By Financing Activities |

$ | 25,308,006 | $ | 12,002,541 | $ | — | $ | — | $ | 8,699,426 | ||||||||||

7

Table of Contents

Index to Financial Statements

| As of January 31, | As of July

31, 2010 |

|||||||||||

| 2009 | 2010 | |||||||||||

| (unaudited) | ||||||||||||

| BALANCE SHEET |

||||||||||||

| ASSETS |

||||||||||||

| Cash |

$ | 8,449,471 | $ | 4,878,601 | $ | 2,050,357 | ||||||

| Total Current Assets |

$ | 9,787,821 | $ | 5,535,021 | $ | 4,425,062 | ||||||

| Property and Equipment |

39,765 | 39,296 | 25,432 | |||||||||

| Oil and Gas Properties |

16,942,864 | 18,783,375 | 27,995,018 | |||||||||

| Total Assets |

$ | 26,770,450 | $ | 24,357,692 | $ | 32,445,512 | ||||||

| STOCKHOLDERS’ EQUITY |

||||||||||||

| Common Stock |

$ | 699 | $ | 699 | $ | 990 | ||||||

| Additional Paid-In Capital |

81,155,715 | 81,950,076 | 95,370,116 | |||||||||

| Warrants |

4,237,100 | 4,237,100 | — | |||||||||

| Deficit |

(61,564,544 | ) | (63,704,645 | ) | (64,469,788 | ) | ||||||

| Total Stockholders’ Equity |

$ | 23,828,970 | $ | 22,483,230 | $ | 30,901,318 | ||||||

8

Table of Contents

Index to Financial Statements

You should carefully consider the following risk factors and all other information contained in this prospectus in evaluating our business and prospects. The risks and uncertainties described below are not the only ones we face. Additional risks and uncertainties, other than those we describe below, that are not presently known to us or that we currently believe are immaterial, may also impair our business operations. If any of the following risks occur, our business, financial condition and results of operations could be harmed.

Risks Relating to Our Business

We have a history of losses which may continue and negatively impact our ability to achieve our business objectives.

We incurred net losses of $13,770,485 and $2,140,101 for the fiscal years ended January 31, 2009 and 2010, respectively, and a net loss of $765,516 for the fiscal six months ended July 31, 2010. We cannot assure you that we can achieve or sustain profitability on a quarterly or annual basis in the future. Our operations are subject to the risks and competition inherent in the oil and natural gas industry. We cannot assure you that future operations will be profitable. Revenues and profits, if any, will depend upon various factors, including whether we will be able to expand our revenues. We may not achieve our business objectives and the failure to achieve such goals would have an adverse impact on our business, financial condition and result of operations.

Oil and natural gas drilling is a speculative activity and involves numerous risks and substantial and uncertain costs that could adversely affect us.

An investment in us should be considered speculative due to the nature of our involvement in the exploration for, and the acquisition, development and production of, oil and natural gas. Oil and natural gas operations involve many risks, which even a combination of experience and knowledge and careful evaluation may not be able to overcome. There is no assurance that commercial quantities of oil and natural gas will be discovered or acquired by us.

We have substantial capital requirements that, if not met, may hinder our operations.

We anticipate that we will make substantial capital expenditures for the acquisition, exploration, development and production of oil and natural gas reserves in the future and for future drilling programs, including our obligations under the Slawson Agreement, the Kodiak Agreement and the Oppenheimer Agreement. If we have insufficient revenues, we may have a limited ability to expend the capital necessary to undertake or complete future drilling programs. We cannot assure you that debt or equity financing, or cash generated by operations, will be available or sufficient to meet these requirements or for other corporate purposes, or if debt or equity financing is available, that it will be on terms acceptable to us. Moreover, future activities may require us to alter our capitalization significantly. Our inability to access sufficient capital for our operations could have a material adverse effect on our business, financial condition, results of operations or prospects.

The termination of our agreements with Slawson, Kodiak or OGR could have a material adverse effect on our business, financial condition and results of operations.

Our agreements with Slawson, Kodiak and OGR are essential to us and our future development. Our agreement with Slawson remains in effect as long as there is a producing well and for a period of 90 days thereafter, but may be continued if another well is being drilled or reworked at the end of this period. Our agreement with OGR remains in effect until the third anniversary of its effective date unless either OGR achieves certain acquisition thresholds before that date and elects to extend the term of the agreement, or OGR fails to achieve certain thresholds and we elect to terminate the agreement. Also, OGR may terminate the agreement if our net worth falls below a certain level or OGR determines that changes in our executive management team or financial prospects are not satisfactory. Termination of any of these agreements would require us to seek another collaborative relationship in that territory. We cannot assure you that a suitable alternative third party would be

9

Table of Contents

Index to Financial Statements

identified, and even if identified, we cannot assure you that the terms of any new relationship would be commercially acceptable to us, and as a result, any such termination could have a material adverse effect on our business, financial condition and results of operations.

Our agreements with Slawson, Kodiak and OGR and other agreements that we may enter into, present a number of challenges that could have a material adverse effect on our business, financial condition and results of operations.

Our agreements with Slawson, Kodiak and OGR represent a significant portion of our business in the near future. In addition, as part of our business strategy, we plan to enter into other similar transactions, some of which may be material. These transactions typically involve a number of risks and present financial, managerial and operational challenges, including the existence of unknown potential disputes, liabilities or contingencies that arise after entering into these arrangements related to the counterparties to such arrangements. We could experience financial or other setbacks if such transactions encounter unanticipated problems due to challenges, including problems related to execution or integration. Any of these risks could reduce our revenues or increase our expenses, which could adversely affect our business, financial condition or results of operations.

We depend on successful exploration, development and acquisitions to develop any future reserves and grow production and revenue in the future.

Acquisitions of oil and natural gas acreage, reserves and assets are typically based on engineering and economic assessments made by independent engineers and our own assessments. These assessments will include a series of assumptions regarding such factors as recoverability and marketability of oil and natural gas, future prices of oil and natural gas and operating costs, future capital expenditures and royalties and other government levies which will be imposed over the producing life of the reserves. Many of these factors are subject to change and are beyond our control. In particular, the prices of and markets for oil and natural gas products may change from those anticipated at the time of making such assessment. In addition, all such assessments involve a measure of geologic and engineering uncertainty that could result in lower production and reserves than anticipated. Initial assessments of acquisitions may be based on reports by a firm of independent engineers that are not the same as the firm that we have used. Because each firm may have different evaluation methods and approaches, these initial assessments may differ significantly from the assessments of the firm used by us.

Properties we acquire may be in an unexpected condition and may subject us to increased costs and liabilities, including environmental liabilities. Although we review acquired properties prior to acquisition in a manner consistent with industry practices, such reviews are not capable of identifying all potential conditions. Generally, it is not feasible to review in depth every individual property involved in each acquisition. Ordinarily, we will focus our review efforts on the higher value properties or properties with known adverse conditions and will sample the remainder. However, even a detailed review of records and properties may not necessarily reveal existing or potential problems or permit a buyer to become sufficiently familiar with the properties to assess fully their condition or any deficiencies. Inspections may not always be performed on every well, and environmental problems, such as ground water contamination, are not necessarily observable even when an inspection is undertaken. As a result, we may not acquire good title to some of our acquired properties and we may assume unknown liabilities that could have a material adverse effect on our business, financial condition and results of operations.

We may have difficulty managing growth in our business, which could adversely affect our business plan, financial condition and results of operations.

Growth in accordance with our business plan, if achieved, will place a significant strain on our financial, technical, operational and management resources. As we expand our activities and increase the number of projects we are evaluating or in which we participate, there will be additional demands on these resources. The failure to continue to upgrade our technical, administrative, operating and financial control systems or the occurrences of unexpected expansion difficulties, including the failure to recruit and retain experienced

10

Table of Contents

Index to Financial Statements

managers, geologists, engineers and other professionals in the oil and natural gas industry, could have a material adverse effect on our business, financial condition and results of operations and our ability to timely execute our business plan.

Substantially all of our net leasehold acreage is undeveloped, and that acreage may not ultimately be developed or become commercially productive, which could have a material adverse effect on our future oil and natural gas reserves and production and, therefore, our future cash flow and income.

Substantially all of our net leasehold acreage is undeveloped, or acreage on which wells have not been drilled or completed to a point that would permit the production of commercial quantities of oil and natural gas. In addition, many of our oil and natural gas leases require us to drill wells that are commercially productive, and if we are unsuccessful in drilling such wells, we could lose our rights under such leases. We intend to use some of the proceeds from this offering to develop our leasehold acreage by funding our exploration, exploitation and development activities. Our future oil and natural gas reserves and production and, therefore, our future cash flow and income are highly dependent on successfully developing our undeveloped leasehold acreage.

We may be unable to successfully acquire additional leasehold interests or other oil and natural gas properties, which may inhibit our ability to grow our production.

Acquisitions of leasehold interests or other oil and natural gas properties have been an important element of our business, and we will continue to pursue acquisitions in the future. In the last several years, we have pursued and consummated leasehold or other property acquisitions that have provided us opportunities to expand our acreage position and, to a lesser extent, grow our production. Although we regularly engage in discussions and submit proposals regarding leasehold interests or other properties, suitable acquisitions may not be available in the future on reasonable terms.

As most of our properties are in the exploration stage, we cannot assure you that we will establish commercial discoveries on our properties.

Exploration for economically recoverable reserves of oil and natural gas is subject to a number of risks. Few properties that are explored are ultimately developed into producing oil and/or natural gas wells. Most of our properties are only in the exploration stage and we have only limited revenues from operations. While we do have a limited amount of production of natural gas, we may not establish commercial discoveries on any of our properties. Failure to do so would have a material adverse effect on our business, financial condition and results of operations.

We have a limited operating history in the Bakken Shale and Three Forks formations in North Dakota and if we are not successful in continuing to grow our business, then we may have to scale back or even cease our ongoing business operations.

We have a limited operating history in the Bakken Shale and Three Forks formations in North Dakota. Our success is significantly dependent on a successful acquisition, drilling, completion and production program. Our operations in the Bakken Shale and Three Forks formations will be subject to all the risks inherent in the establishment of a developing enterprise and the uncertainties arising from the absence of a significant operating history. We may be unable to locate recoverable reserves or operate on a profitable basis. We are in the early stage of the exploration and development phase of our plan and potential investors should be aware of the difficulties normally encountered by enterprises in this stage. If our business plan is not successful and we are not able to operate profitably, investors may lose some or all of their investment.

Our method of accounting for investments in oil and natural gas properties may result in impairment of asset value.

We follow the full cost method of accounting for oil and natural gas properties. Accordingly, all costs associated with the acquisition, exploration and development of oil and natural gas properties, including costs of

11

Table of Contents

Index to Financial Statements

undeveloped leasehold, geological and geophysical expenses, dry holes, leasehold equipment and legal due diligence costs directly related to acquisition, exploration and development activities, are capitalized. Capitalized costs of oil and natural gas properties also include estimated asset retirement costs recorded based on the fair value of the asset retirement obligation when incurred. The capitalized costs plus future development and dismantlement costs are depleted and charged to operations using the equivalent unit-of-production method based on proved oil and natural gas reserves as determined by our independent petroleum engineers. To the extent that such capitalized costs, net of depletion and amortization, exceed the present value of estimated future net revenues, discounted at 10%, from proved oil and natural gas reserves, after income tax effects, such excess costs are charged to operations, which may have a material adverse effect on our business, financial condition and results of operations. Once incurred, a write down of oil and natural gas properties is not reversible at a later date, even if oil or natural gas prices increase. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Critical Accounting Policies—Investment in Oil and Natural Gas Properties” for a more detailed description of our method of accounting.

We cannot control the activities on the properties we do not operate and are unable to ensure their proper operation and profitability.

We currently do not operate substantially all of the properties in which we have an interest, including all of our acreage in the Bakken Shale and Three Forks formations; however, we currently control and intend to operate 10% to 15% of the acreage from the Williston Purchase. As a result, we have limited ability to exercise influence over, and control the risks associated with, operations of these properties. The failure of an operator of our wells to adequately perform operations, an operator’s breach of the applicable agreements or an operator’s failure to act in our best interests could reduce our production and revenues. The success and timing of our drilling and development activities on properties operated by others therefore depends upon a number of factors outside of our control, including the operator’s timing and amount of capital expenditures, expertise and financial resources, inclusion of other participants in drilling wells and use of technology.

Our lack of diversification will increase the risk of an investment in us.

Our current business focus is on the oil and natural gas industry in a limited number of properties, primarily in North Dakota. Larger companies have the ability to manage their risk by diversification. However, we currently lack diversification, in terms of both the nature and geographic scope of our business. As a result, we will likely be impacted more acutely by factors affecting our industry or the regions in which we operate, such as the Bakken Shale and Three Forks formations, than we would if our business were more diversified, increasing our risk profile.

Because we have a small asset base and have limited access to additional capital, we may have to limit our exploration activity, which may result in a loss of investment.

We have a small asset base and limited access to additional capital. Due to our brief operating history and historical operating losses, our operations have not been a source of liquidity and we expect to raise additional capital through equity financings. We presently do not have any available credit or bank financing sources of liquidity. We expect significant capital expenditures during the next 12 months for land acquisitions and drilling programs on our U.S. oil shale program and for overhead and working capital purposes. We cannot assure you that we will be successful in obtaining additional funding. In that event, we may not be able to complete our planned exploration programs. If additional financing is not available or is not available on acceptable terms, we will have to curtail our operations and investors may lose their investment.

If we are unable to raise additional funds or secure a new joint operating partner in the Windsor Block, we may be required to surrender the Windsor Block lease.

On April 15, 2009, we entered into a 10-year production lease for approximately 474,625 gross acres (approximately 412,924 net acres) of land. In April 2011, we are required to provide a technical report and the Nova Scotia government may request the surrender of certain lands they deem not adequately evaluated. At the

12

Table of Contents

Index to Financial Statements

end of the fifth year of the lease, areas of the land block not adequately drilled or otherwise evaluated may be subject to surrender. Since April 15, 2009, we have completed three exploration wells and acquired seismic data towards the production lease commitments. There is a risk that our joint venture partner in the Windsor Block will not be able to pay for their portion (13%) of the well costs, which could also slow down or stop exploration on the Windsor Block.

We will have to raise additional funds or secure a new joint operating partner in the Windsor Block to complete the exploration and development phase of our Windsor Block programs and we cannot assure you that we will be able to do so. There is a risk that we may not obtain the necessary additional funds or a new partner to continue operations and to determine the existence, discovery and successful exploitation of economically recoverable reserves and the attainment of profitable operations on our Windsor Block. If we do not obtain additional funds or secure a new partner, we may be required to surrender the lease.

We face strong competition from other oil and natural gas companies.

We encounter competition from other oil and natural gas companies in all areas of our operations, including the acquisition of exploratory prospects and proven properties. Our competitors include major oil and natural gas companies and numerous independent oil and natural gas companies, individuals and drilling and income programs. Many of our competitors have been engaged in the oil and natural gas business much longer than we have and possess substantially larger operating staffs and greater capital resources than us. These companies may be able to pay more for exploratory projects and productive oil and natural gas properties and may be able to define, evaluate, bid for and purchase a greater number of properties and prospects than our financial or human resources permit. In addition, these companies may be able to expend greater resources on the existing and changing technologies that we believe are and will be increasingly important to attaining success in the industry. Such competitors may also be in a better position to secure oilfield services and equipment on a timely basis or on more favorable terms. We may not be able to conduct our operations, evaluate and select suitable properties and consummate transactions successfully in this highly competitive environment.

Current global financial conditions have been characterized by increased volatility which could have a material adverse effect on our business, prospects, liquidity, financial condition and results of operations.

Current global financial conditions and recent market events have been characterized by increased volatility and the resulting tightening of the credit and capital markets has reduced the amount of available liquidity and overall economic activity. We cannot assure you that debt or equity financing, the ability to borrow funds or cash generated by operations will be available or sufficient to meet or satisfy our initiatives, objectives or requirements. Our inability to access sufficient amounts of capital on terms acceptable to us for our operations could have a material adverse effect on our business, prospects, liquidity, financial condition and results of operations.

The potential profitability of oil and natural gas properties depends upon factors beyond our control.

The potential profitability of oil and natural gas properties is dependent upon many factors beyond our control. For instance, world prices and markets for oil and natural gas are unpredictable, highly volatile, potentially subject to governmental fixing, pegging, controls or any combination of these and other factors, and respond to changes in domestic, international, political, social and economic environments. Additionally, due to worldwide economic uncertainty, the availability and cost of funds for production and other expenses have become increasingly difficult, if not impossible, to project. These changes and events may materially affect our financial performance. In addition, a productive well may become commercially unproductive in the event that water or other deleterious substances are encountered which impair or prevent the production of oil and/or natural gas from the well. In addition, production from any well may be unmarketable if it is impregnated with water or other deleterious substances. These factors cannot be accurately predicted and the combination of these factors may result in us not receiving an adequate return on invested capital.

13

Table of Contents

Index to Financial Statements

Seasonal weather conditions and other factors could adversely affect our ability to conduct drilling activities.

Our operations could be adversely affected by weather conditions and wildlife restrictions on federal leases. In the Williston Basin and in Canada, drilling and other oil and natural gas activities cannot be conducted as effectively during the winter months. Winter and severe weather conditions limit and may temporarily halt the ability to operate during such conditions. These constraints and the resulting shortages or high costs could delay or temporarily halt our oil and natural gas operations and materially increase our operating and capital costs, which could have a material adverse effect on our business, financial condition and results of operations.

If we are unable to retain the services of Dr. Hill and Mr. Samuels, or if we are unable to successfully recruit qualified managerial and field personnel having experience in oil and natural gas exploration, we may not be able to continue our operations.

Our success depends to a significant extent upon the continued services of our directors and officers and, in particular, Peter Hill, our Chief Executive Officer, and Jonathan Samuels, our Chief Financial Officer. Loss of the services of Dr. Hill or Mr. Samuels could have a material adverse effect on our growth, revenues and prospective business. We have not and do not expect to obtain key man insurance on our management. In addition, in order to successfully implement and manage our business plan, we will be dependent upon, among other things, successfully recruiting qualified managerial and field personnel having experience in the oil and natural gas exploration business. Competition for qualified individuals is intense. We cannot assure you that we will be able to retain existing employees or that we will be able to find, attract and retain qualified personnel on acceptable terms.

The marketability of natural resources will be affected by numerous factors beyond our control.

The markets and prices for oil and natural gas depend on numerous factors beyond our control. These factors include demand for oil and natural gas, which fluctuate with changes in market and economic conditions, and other factors, including:

| • | worldwide and domestic supplies of oil and natural gas; |

| • | actions taken by foreign oil and natural gas producing nations; |

| • | political conditions and events (including instability or armed conflict) in oil-producing or natural gas-producing regions; |

| • | the level of global and domestic oil and natural gas inventories; |

| • | the price and level of foreign imports; |

| • | the level of consumer demand; |

| • | the price and availability of alternative fuels; |

| • | the availability of pipeline or other takeaway capacity; |

| • | weather conditions; |

| • | terrorist activity; |

| • | domestic and foreign governmental regulations and taxes; and |

| • | the overall worldwide and domestic economic environment. |

Significant declines in oil and natural gas prices for an extended period may have the following effects on our business:

| • | adversely affect our financial condition, liquidity, ability to finance planned capital expenditures and results of operations; |

14

Table of Contents

Index to Financial Statements

| • | cause us to delay or postpone some of our capital projects; |

| • | reduce our revenues, operating income and cash flow; and |

| • | limit our access to sources of capital. |

We may have difficulty distributing our oil and natural gas production, which could harm our financial condition.

In order to sell the oil and natural gas that we are able to produce from the Williston Basin and the Maritimes Basin, we may have to make arrangements for storage and distribution to the market. We will rely on local infrastructure and the availability of transportation for storage and shipment of our products, but infrastructure development and storage and transportation facilities may be insufficient for our needs at commercially acceptable terms in the localities in which we operate. This situation could be exacerbated to the extent that our operations are conducted in remote areas that are difficult to access, such as areas that are distant from shipping and/or pipeline facilities. These factors may affect our ability to explore and develop properties and to store and transport our oil and natural gas production, which may increase our expenses.

Furthermore, weather conditions or natural disasters, actions by companies doing business in one or more of the areas in which we will operate or labor disputes may impair the distribution of oil and/or natural gas and in turn diminish our financial condition or ability to maintain our operations.

Our significant stockholders may have substantial influence over our business and affairs.

As of October 22, 2010, Cambrian Capital L.P. and Palo Alto Investors, LLC each own greater than 10% of our issued and outstanding shares of common stock. As a result, each of these investors currently has substantial influence over the outcome of certain matters requiring stockholder approval, including the power to, among other things:

| • | amend our articles of incorporation, other than with respect to the reverse stock split that has already been approved by our stockholders; |

| • | elect and remove our directors and control the appointment of our senior management; and |

| • | prevent our ability to be acquired and complete other significant corporate transactions. |

Oil and natural gas operations are subject to comprehensive regulation which may cause substantial delays or require capital outlays in excess of those anticipated, causing an adverse effect on us.

Oil and natural gas operations are subject to federal, state, provincial and local laws relating to the protection of the environment, including laws regulating removal of natural resources from the ground and the discharge of materials into the environment. Oil and natural gas operations are also subject to federal, state, provincial and local laws and regulations which seek to maintain health and safety standards by regulating the design and use of drilling methods and equipment. Various permits from government authorities are required for drilling operations to be conducted and no assurance can be given that such permits will be received. The failure or delay in obtaining the requisite approvals or permits may adversely affect our business, financial condition and results of operations.

Hydraulic fracturing, the process used for releasing oil and natural gas from shale rock, has recently come under increased scrutiny and could be the subject of further regulation that could impact the timing and cost of development.

The Environmental Protection Agency, or EPA, recently amended the Underground Injection Control, or UIC, provisions of the federal Safe Drinking Water Act, or the SDWA, to exclude hydraulic fracturing from the

15

Table of Contents

Index to Financial Statements

definition of “underground injection.” However, the U.S. Senate and House of Representatives are currently considering bills entitled the Fracturing Responsibility and Awareness of Chemicals Act, or the FRAC Act, to amend the SDWA to repeal this exemption. If enacted, the FRAC Act would amend the definition of “underground injection” in the SDWA to encompass hydraulic fracturing activities, which could require hydraulic fracturing operations to meet permitting and financial assurance requirements, adhere to certain construction specifications, fulfill monitoring, reporting, and recordkeeping obligations, and meet plugging and abandonment requirements. The FRAC Act also proposes to require the reporting and public disclosure of chemicals used in the fracturing process, which could make it easier for third parties opposing the hydraulic fracturing process to initiate legal proceedings based on allegations that specific chemicals used in the fracturing process could adversely affect groundwater.

Hydraulic fracturing is the primary production method used to produce reserves located in the Bakken Shale and Three Forks formations. Depending on the legislation that may ultimately be enacted or the regulations that may be adopted at the federal, state and/or provincial levels, exploration and production activities that entail hydraulic fracturing could be subject to additional regulation and permitting requirements. Individually or collectively, such new legislation or regulation could lead to operational delays or increased operating costs and could result in additional burdens that could increase the costs and delay the development of unconventional oil and natural gas resources from shale formations which are not commercial without the use of hydraulic fracturing. This could have an adverse effect on our business, financial condition and results of operations.

Exploration activities are subject to certain environmental regulations which may prevent or delay the commencement or continuance of our operations.

In general, our exploration activities are subject to certain federal, state, provincial and local laws and regulations relating to environmental quality and pollution control. Specifically, we are subject to legislation regarding emissions into the environment, water discharges and storage and disposition of hazardous wastes. These laws and regulations may require the acquisition of permits before drilling commences; restrict the types, quantities and concentration of various substances that can be released into the environment from drilling and production activities; limit or prohibit drilling activities on certain lands lying within wilderness, wetlands and other protected areas; require remedial measures to mitigate pollution from former operations, such as plugging abandoned wells; and impose substantial liabilities for pollution resulting from our operations. Such laws and regulations increase the costs of our exploration activities and may prevent or delay the commencement or continuance of a given operation. In addition, legislation has been enacted which requires well and facility sites to be abandoned and reclaimed to the satisfaction of state or provincial authorities. Such laws and regulations are frequently changed and we are unable to predict the ultimate cost of compliance.

With the introduction of the Kyoto Protocol, oil and natural gas producers may be required to reduce greenhouse gas emissions. This could result in, among other things, increased operating and capital expenditures for those producers. This could also make certain production of oil or natural gas by those producers uneconomic, resulting in reductions in such production. The Kyoto Protocol was ratified by the Canadian government in December of 2002 and commits Canada to reducing its greenhouse gas emissions levels to 6% below 1990 “business-as-usual” levels by 2012. It officially came into force on February 16, 2005. Since that date the Canadian government has indicated it will be unable to meet its Kyoto Protocol commitments. We are unable to predict the effect on our business, financial condition and results of operations of the ratification of the Kyoto Protocol by the Canadian federal government or its subsequent position that Canada cannot meet its commitments thereunder.

The first commitment period under the Kyoto Protocol ends in 2012. Government leaders and representatives from approximately 170 countries met in Copenhagen, Denmark from December 7 through 18, 2009, or the Copenhagen Conference, to attempt to negotiate a successor to the Kyoto Protocol. The Copenhagen Conference resulted in a broad political consensus rather than a binding international treaty, or the Copenhagen Accord, that has not been endorsed by all participating countries. The Copenhagen Accord reinforces the commitment to reducing the emissions of greenhouse gas, or GHGs, contained in the Kyoto Protocol and

16

Table of Contents

Index to Financial Statements

promises funding to help developing countries mitigate and adapt to climate change. In response to the Copenhagen Accord, the Canadian government indicated on January 29, 2010 that it will seek to achieve a 17% reduction in GHG emissions from its 2005 levels by 2020. We are unable to predict the effect that compliance with the Copenhagen Accord by the Canadian federal government will have on our business, financial condition and results of operation.

Climate change laws and regulations restricting emissions of greenhouse gases could result in increased operating costs and reduced demand for the oil and natural gas that we produce while the physical effects of climate change could disrupt our production and cause us to incur significant costs in preparing for, or responding to, those effects.

On December 15, 2009, the EPA published its findings that emissions of carbon dioxide, methane and other greenhouse gases present an endangerment to human health and the environment because emissions of such gases are, according to the EPA, contributing to the warming of the earth’s atmosphere and other climatic changes. These findings by the EPA allowed the agency to proceed with the adoption and implementation of regulations that would restrict emissions of greenhouse gases under existing provisions of the federal Clean Air Act. Consequently, the EPA proposed two sets of regulations that would require a reduction in emissions of greenhouse gases from motor vehicles and, also, could trigger permit review for greenhouse gas emissions from certain stationary sources. In addition, on October 30, 2009, the EPA published a final rule requiring the reporting of greenhouse gas emissions from specified large greenhouse gas emission sources in the United States beginning in 2011 for emissions occurring in 2010. The adoption and implementation of any regulations imposing reporting obligations on, or limiting emissions of greenhouse gases from, our equipment and operations could require us to incur costs to reduce emissions of greenhouse gases associated with our operations or could adversely affect demand for the oil and natural gas we produce.

Also, on June 26, 2009, the U.S. House of Representatives passed the American Clean Energy and Security Act of 2009, or ACESA, which would establish an economy-wide cap-and-trade program to reduce United States emissions of greenhouse gases including carbon dioxide and methane that may contribute to the warming of the Earth’s atmosphere and other climatic changes. If it becomes law, ACESA would require a 17% reduction in greenhouse gas emissions from 2005 levels by 2020 and just over an 80% reduction of such emissions by 2050. Under this legislation, the EPA would issue a capped and steadily declining number of tradable emissions allowances to certain major sources of greenhouse gas emissions so that such sources could continue to emit greenhouse gases into the atmosphere. These allowances would be expected to escalate significantly in cost over time. The net effect of ACESA will be to impose increasing costs on the combustion of carbon-based fuels such as oil, refined petroleum products and natural gas. The U.S. Senate has begun work on its own legislation for restricting domestic greenhouse gas emissions and President Obama has indicated his support of legislation to reduce greenhouse gas emissions through an emission allowance system. Although it is not possible at this time to predict when the Senate may act on climate change legislation or how any bill passed by the Senate would be reconciled with ACESA, any future federal laws or implementing regulations that may be adopted to address greenhouse gas emissions could require us to incur increased operating costs and could adversely affect demand for the oil and natural gas we produce.

Finally, it should be noted that some scientists have concluded that increasing concentrations of greenhouse gases in the Earth’s atmosphere may produce climate changes that have significant physical effects, such as increased frequency and severity of storms, floods and other climatic events. If any such effects were to occur, they could have an adverse effect on our exploration and production operations. Significant physical effects of climate change could also have an indirect effect on our financing and operations by disrupting the transportation or process-related services provided by midstream companies, service companies or suppliers with whom we have a business relationship. We may not be able to recover through insurance some or any of the damages, losses or costs that may result from potential physical effects of climate change and as a result, this could have a material adverse effect on our business, financial condition and results of operations.

17

Table of Contents

Index to Financial Statements

Exploratory drilling involves many risks and we may become liable for pollution or other liabilities which may have an adverse effect on our financial position and results of operations.

Drilling operations generally involve a high degree of risk. Hazards such as unusual or unexpected geological formations, power outages, labor disruptions, blow-outs, sour gas leakage, fire, inability to obtain suitable or adequate machinery, equipment or labor and other risks are involved. We may become subject to liability for pollution or hazards against which we cannot adequately insure or for which we may elect not to insure. Incurring any such liability may have a material adverse effect on our financial position and results of operations.

Any change in government regulation and/or administrative practices may have a negative impact on our ability to operate and on our profitability.

The laws, regulations, policies or current administrative practices of any government body, organization or regulatory agency in the United States or Canada or any other jurisdiction may be changed, applied or interpreted in a manner which will fundamentally alter our ability to carry on our business. The actions, policies or regulations, or changes thereto, of any government body or regulatory agency, or other special interest groups, may have a detrimental effect on us. Any or all of these situations may have a negative impact on our ability to operate and/or our profitability.

Aboriginal claims could have an adverse effect on us and our operations.

Aboriginal peoples have claimed aboriginal title and rights to portions of Canada where we operate, including in Nova Scotia, where our Windsor Block acreage is located. We are not aware that any claims have been made in respect of our property and assets. However, if a claim arose and was successful, it could have an adverse effect on us and our operations.

We do not plan to insure against all potential operating risks. We might incur substantial losses from, and be subject to substantial liability claims for, uninsured or underinsured risks related to our oil and natural gas operations.

We do not intend to insure against all risks. Our oil and natural gas exploration and production activities will be subject to hazards and risks associated with drilling for, producing and transporting oil and natural gas, and any of these risks can cause substantial losses resulting from:

| • | environmental hazards, such as uncontrollable flows of oil, natural gas, brine, well fluids, toxic gas or other pollution into the environment, including groundwater and shoreline contamination; |

| • | abnormally pressured formations; |

| • | mechanical difficulties, such as stuck oil field drilling and service tools and casing collapse; |

| • | fires and explosions; |

| • | personal injuries and death; |

| • | regulatory investigations and penalties; and |

| • | natural disasters. |