Attached files

| file | filename |

|---|---|

| EX-3.3 - EXHIBIT 3.3 - 8888 Acquisition CORP | exhibit3-3.htm |

| EX-2.1 - EXHIBIT 2.1 - 8888 Acquisition CORP | exhibit2-1.htm |

| EX-10.5 - EXHIBIT 10.5 - 8888 Acquisition CORP | exhibit10-5.htm |

| EX-10.3 - EXHIBIT 10.3 - 8888 Acquisition CORP | exhibit10-3.htm |

| EX-16.1 - EXHIBIT 16.1 - 8888 Acquisition CORP | exhibit16-1.htm |

| EX-10.7 - EXHIBIT 10.7 - 8888 Acquisition CORP | exhibit10-7.htm |

| EX-21.1 - EXHIBIT 21.1 - 8888 Acquisition CORP | exhibit21-1.htm |

| EX-10.2 - EXHIBIT 10.2 - 8888 Acquisition CORP | exhibit10-2.htm |

| EX-10.1 - EXHIBIT 10.1 - 8888 Acquisition CORP | exhibit10-1.htm |

| EX-10.8 - EXHIBIT 10.8 - 8888 Acquisition CORP | exhibit10-8.htm |

| EX-10.4 - EXHIBIT 10.4 - 8888 Acquisition CORP | exhibit10-4.htm |

| EX-10.6 - EXHIBIT 10.6 - 8888 Acquisition CORP | exhibit10-6.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the

Securities Exchange Act of 1934

Date of Report (Date of Earliest event Reported): October 25, 2010 (October 19, 2010)

8888 ACQUISITION

CORPORATION

(Exact name of registrant as specified in its charter)

| Nevada | 000-52251 | 59-2340247 |

| (State or other jurisdiction of | (Commission File Number) | (IRS Employer Identification No.) |

| incorporation or organization) |

Qingyanglianyu Industrial Area

Jinjiang City, Fujian

Province 362200

People’s Republic of China

(Address of principal

executive offices)

(86) 0595-82889862

(Registrant's telephone number, including

area code)

211 West Wall Street, Midland, TX 79701

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

SPECIAL NOTE REGARDING FORWARD LOOKING STATEMENTS

This report contains forward-looking statements. The forward-looking statements are contained principally in the sections entitled “Description of Business,” “Risk Factors,” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” These statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from any historical results and future results, performances or achievements expressed or implied by the forward-looking statements. These risks and uncertainties include, but are not limited to, the factors described in the section captioned “Risk Factors” above. In some cases, you can identify forward-looking statements by terms such as “anticipates,” “believes,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “projects,” “should,” “would” and similar expressions intended to identify forward-looking statements. Forward-looking statements reflect our current views with respect to future events and are based on assumptions and subject to risks and uncertainties. Given these uncertainties, you should not place undue reliance on these forward-looking statements. Also, forward-looking statements represent our estimates and assumptions only as of the date of this report. You should read this report and the documents that we reference and filed as exhibits to the report completely and with the understanding that our actual future results may be materially different from what we expect. Except as required by law, we assume no obligation to update any forward-looking statements publicly, or to update the reasons actual results could differ materially from those anticipated in any forward-looking statements, even if new information becomes available in the future.

USE OF CERTAIN DEFINED TERMS

Except as otherwise indicated by the context, references in this report to “we,” “us,” “our,” “our Company,” or the “Company” are to the combined business of 8888 Acquisition Corporation and its consolidated subsidiaries, Cheng Chang Shoes Industry Company Limited and Jinjiang Chengchang Shoes Co., Ltd.

In addition, unless the context otherwise requires and for the purposes of this report only, references to:

-

“Chengchang HK” refers to Cheng Chang Shoes Industry Company Limited, a Hong Kong limited company;

-

“Jinjiang Chengchang” refers to Jinjiang Chengchang Shoes Co., Ltd., a PRC limited company and the wholly- owned subsidiary of Chengchang HK;

-

“Hong Kong” refers to the Hong Kong Special Administrative Region of the People’s Republic of China;

-

“PRC,” “China,” and “Chinese,” refer to the People’s Republic of China;

-

“Renminbi” and “RMB” refer to the legal currency of China;

-

“U.S. dollars,” “dollars” and “$” refer to the legal currency of the United States;

-

“SEC” means the Securities and Exchange Commission;

-

“Exchange Act” means the Securities Exchange Act of 1934, as amended; and

-

“Securities Act” are to the Securities Act of 1933, as amended.

MARKET DATA AND FORECAST

Unless otherwise indicated, information in this current report on Form 8-K concerning economic conditions and our industry is based on information from independent industry analysts and publications, as well as our estimates. Except where otherwise noted, our estimates are derived from publicly available information released by third-party sources, as well as data from our internal research, and are based on such data and knowledge of our industry, which we believe to be reasonable. None of the independent industry publications used in this report was prepared on our or our affiliates’ behalf. We have not independently verified the underlying information in such publications and reports and you should not unduly rely upon it.

This report also contains data related to the footwear industry in China. These market data include estimates and projections that are based on a number of assumptions. If any one or more of the assumptions underlying the market data turn out to be incorrect, actual results may differ significantly from the projections. For example, the footwear market may not grow at the rate projected by market data, or at all. In addition, the rapidly changing nature of the footwear industry subjects any projections or estimates relating to the growth prospects or future condition of our market to significant uncertainties.

2

| ITEM 1.01 | ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT |

On October 19, 2010, we entered into a share exchange agreement, or the Share Exchange Agreement, with Chengchang HK, a Hong Kong limited company, and its shareholders, Mr. Guoqing Zhuang, Bai Cheng Investment Limited, Heng Feng Investment Limited, Kang Shi Investment Holdings Limited, River Tyne Ventures Inc., Zhao Kang Capital Resource Limited and Shiping Liu, pursuant to which we acquired 100% of the issued and outstanding capital stock of Chengchang HK in exchange for 31,059,267 shares of our common stock, par value $0.0001, which constituted 98.85% of our issued and outstanding capital stock on a fully-diluted basis as of and immediately after the consummation of the transactions contemplated by the Share Exchange Agreement. Under the Share Exchange Agreement, our former CEO and sole director Glenn A. Little also agreed to sell 100,000 shares of our common stock to the Company for $4,000. Chengchang HK is a holding company for a PRC-based operating subsidiary, Jinjiang Chengchang, which is engaged in the production of various sole products that are used to manufacture shoes. We refer to all shareholders of Chengchang HK before the closing of the Share Exchange Agreement as “Chengchang Shareholders” in this report.

Immediately following closing of the share exchange transaction, Mr. Zhuang and several other Chengchang Shareholders transferred an aggregate of 1,981,963 of the shares issued to them under the Share Exchange Agreement to other former shareholders of Chengchang HK and other persons who previously provided services to Chengchang HK and its subsidiary, pursuant to a side letter agreement, or the Side Letter, dated October 19, 2010. Taking into account this share transfer, our Chairman and CEO, Mr. Zhuang owns 24,707,353 shares of our common stock, constituting 72.74% of our issued and outstanding capital stock on a fully-diluted basis.

On October 19, 2010, we entered into a securities purchase agreement, or the Securities Purchase Agreement, with an investor whereby we issued 2,547,500 shares of our common stock for an aggregate purchase price of $4.5 million, or $1.77 per share. Under the Securities Purchase Agreement, we agreed to register the shares of our common stock issued to the investor within a pre-defined period.

In connection with the Securities Purchase Agreement, our Chairman and CEO Mr. Zhuang entered into a make good escrow agreement, or the Make Good Escrow Agreement, whereby Mr. Zhuang pledged to several other parties, including the investor, 7,492,154 shares of our common stock owned by him in support of the Company’s obligation to satisfy a pre-established after tax net income level. All or a portion of the shares pledged pursuant to the Make Good Escrow Agreement will be transferred to the beneficiaries of the make good arrangement if the Company does not satisfy the after tax net income threshold. The shares will be returned to Mr. Zhuang if the threshold is met. See Item 2.01 of this report below for more details.

The foregoing description of the terms of the Share Exchange Agreement, Side Letter, Securities Purchase Agreement, and Make Good Escrow Agreement is qualified in its entirety by reference to the provisions of the agreements filed as Exhibits 2.1, 10.1, 10.2, and 10.3 to this report, which are incorporated by reference herein.

| ITEM 2.01 | COMPLETION OF ACQUISITION OR DISPOSITION OF ASSETS |

On October 19, 2010, we completed the acquisition of Chengchang HK pursuant to the Share Exchange Agreement described in Item 1.01 above. The acquisition was accounted for as a recapitalization effected by a share exchange, wherein Chengchang HK is considered the acquirer for accounting and financial reporting purposes. The assets and liabilities of the acquired entity have been brought forward at their book value and no goodwill has been recognized.

FORM 10 DISCLOSURE

As disclosed elsewhere in this report, on October 19, 2010, we acquired Chengchang HK in a reverse acquisition transaction. Item 2.01(f) of Form 8-K states that if the registrant was a shell company, as we were immediately before the reverse acquisition transaction disclosed under Item 2.01, then the registrant must disclose the information that would be required if the registrant were filing a general form for registration of securities on Form 10.

Accordingly, we are providing below the information that would be included in a Form 10 if we were to file a Form 10. Please note that the information provided below relates to the combined enterprises after our acquisition of Chengchang HK, except that information relating to periods prior to the date of the reverse acquisition only relate to Chengchang HK unless otherwise specifically indicated.

3

DESCRIPTION OF BUSINESS

Business Overview

Through our indirect Chinese subsidiary, Jinjiang Chengchang, we engage in the business of designing, producing and selling high quality soles used to manufacture athletic and leisure shoes.

Since 1996, we have been a vertically integrated manufacturer of athletic and leisure shoes. In recent years, we shifted our strategic focus to concentrate on developing and producing specialized soles.

In our manufacturing operations, we process basic chemicals and other raw materials to make our sole products. Currently, we categorize our sole products into three primary product lines: (i) EVA, or ethylene vinyl acetate, sole products which are made from a viscous and elastic foam material containing tiny bubbles for shock absorption and cushioning abilities; (ii) RB, or synthetic rubber, sole products processed mainly from polybutadiene rubber, which is highly resistant to wear and abrasion and used mostly commonly in the production of outsoles; and (iii) EVO, or EVO outsole, products which are an outgrowth of our EVA product line that is designed to be more abrasive resistance and lighter and softer than our EVA product line.

We sell our products to footwear manufacturers that are based primarily in China. Our customers use our sole products as components in the athletic and leisure shoes that they sell to end consumers, athletic wear companies and global shoe distributors. As of June 30, 2010, we had over 30 customers which include a number of well-known companies in China’s athletic wear market, such as Adidas, 361º, Exceed, Erke, Xtep and Qiaodan.

Our manufacturing facilities in China are located in Jinjiang, Fujian Province, which has a high concentration of footwear industry participants. According to estimates by the PRC government contained in the People’s Daily Online, Jinjiang-based shoe manufacturing plants produce approximately 950 million pairs of athletic shoes each year, constituting approximately 40% of China’s aggregate athletic shoe output. Most of our customers are also either headquartered or have significant operations in the greater Jinjiang area, which reduces our logistic costs and provides us with an excellent marketing channel and better in person communication with our customers.

We continually strive to leverage our product quality and operational skills and recently qualified as the sole supplier of sole products in the Jinjiang area for Taiwan Ching Lu Footwear, which is one of the largest OEM footwear manufacturers for Adidas in Asia. We have separate production lines for the granulation process, injection molding, foam molding and RB products.

Our revenues grew 46.1% from $17.87 million in fiscal year 2009 to $26.11 million in fiscal year 2010. Our operating income grew 71.7% from $5.5 million in fiscal year 2009 to $9.4 million in fiscal year 2010. Our net income grew 75.0% from $3.9 million in fiscal year 2009 to $6.9 million in fiscal year 2010. We believe our growth has been driven primarily by increasing demand for athletic shoes as well as our research and development efforts which have focused on creating new products and enhancing our product performance attributes and design features.

Our Corporate History and Background

We were originally organized under the laws of the State of Florida on September 20, 1983 under the name Rapholz Silver Inc. for the purpose of purchasing mining claims, both patented and unpatented, a mill, buildings and mining equipment located in San Miguel County, Colorado. During 1986, the Company completed a public offering of 30,010,500 shares of common stock through a Registration Statement on Form S-18 (Registration No. 2-89013D). The Company realized gross proceeds of approximately $600,210 and net proceeds of approximately $463,848 which were used to purchase the mining claims and equipment mentioned above. Subsequent to the close of business on August 31, 1989, the Company liquidated all operations and assets and became a dormant entity. The Company’s former management also elected to suspend its reporting under the Exchange Act due to a lack of operating capital concurrent with the filing of an Annual Report on Form 10-K for the year ended August 31, 1989.

4

In July, 2006, the Company merged with its wholly owned subsidiary, 8888 Acquisition Corporation, a Nevada corporation formed solely for the purpose of redomiciling the Company from Florida to Nevada. In October 2006, the Company filed a Registration Statement on Form 10-SB to register the eligible issued and outstanding shares of the Company’s common stock issued by the Company.

Reverse Acquisition of Chengchang HK

On October 19, 2010, we completed a reverse acquisition transaction through a share exchange with Chengchang HK and Chengchang Shareholders, whereby we acquired 100% of the issued and outstanding capital stock of Chengchang HK, in exchange for 31,059,267 shares of our common stock, which shares constituted 98.85% of our issued and outstanding capital stock on a fully-diluted basis, as of and immediately after the consummation of the reverse acquisition. As a result of the reverse acquisition, Chengchang HK became our wholly-owned subsidiary and the Chengchang Shareholders became our controlling stockholders. For accounting purposes, the share exchange transaction with Chengchang HK was treated as a reverse acquisition, with Chengchang HK as the acquirer and 8888 Acquisition Corporation as the acquired party. Unless the context suggests otherwise, when we refer in this report to business and financial information for periods prior to the consummation of the reverse acquisition, we are referring to the business and financial information of Chengchang HK and its consolidated subsidiary.

Immediately following closing of the reverse acquisition, Mr. Zhuang and several other Chengchang Shareholders transferred an aggregate of 1,981,963 of the shares issued to them under the Share Exchange Agreement to other former shareholders of Chengchang HK and other persons who previously provided services to Chengchang HK and its subsidiary, pursuant to the Side Letter. Taking into account this share transfer, our Chairman and CEO, Mr. Zhuang owns 24,707,353 shares of our common stock, constituting 72.74% of our issued and outstanding capital stock on a fully-diluted basis.

Upon the closing of the reverse acquisition on October 19, 2010, Mr. Glenn A. Little, our sole director and officer, submitted a resignation letter in which he resigned from all offices that he held effective immediately and from his position as our director that will become effective on the tenth day following our mailing of an information statement complying with the requirements of Section 14f-1 of the Exchange Act, or the Information Statement, to our stockholders, which will be mailed on or about October 27, 2010. On the same date, Mr. Guoqing Zhuang was appointed as a director and chairman of our board of directors, effective immediately. Also upon the closing of the reverse acquisition, our board of directors appointed Mr. Zhuang to serve as our Chief Executive Officer and President, Mr. Xuanzhi Luo to serve as our Chief Financial Officer, Treasurer and Secretary, Mr. Huihuang Zhuang to serve as our Chief Operating Officer and Mr. Cansheng Li as our Chief Technology Officer effective immediately at the closing of the reverse acquisition.

As a result of our acquisition of Chengchang HK, we now own all of the issued and outstanding capital stock of Chengchang HK, which in turn owns Jinjiang Chengchang. Chengchang HK is a holding company that owns 100% of Jinjiang Chengchang, which is our PRC-based operating subsidiary. Chengchang HK was incorporated in Hong Kong as a private limited company on October 14, 1988. Chengchang HK has no active business operations or assets other than its 100% ownership of Jinjiang Chengchang. Chengchang HK acquired 100% of Jinjiang Chengchang pursuant to an equity transfer agreement, dated April 16, 2003, which was approved by Jinjiang City Foreign Economic & Trade Committee on May 4, 2003. Jinjiang Chengchang was established in the PRC on January 2, 1997 as a wholly owned foreign-invested enterprise for the purpose of manufacturing shoes and shoe materials.

We plan to change our name to Sports Power, Inc. to more accurately reflect our new business operations.

Private Placement

On October 19, 2010, we also completed a private placement transaction with an accredited investor. Pursuant to a Securities Purchase Agreement that we entered into with the investor, we issued 2,547,500 shares of our common stock for an aggregate purchase price of $4.5 million, or $1.77 per share. Under the Securities Purchase Agreement, we agreed to register the shares of our common stock issued to the investor within a pre-defined period.

In connection with the Securities Purchase Agreement, our Chairman and CEO Mr. Zhuang entered into the Make Good Escrow Agreement, whereby Mr. Zhuang pledged to several other parties, including the investors, 7,492,154 shares of our common stock owned by him in support of the Company’s obligation to satisfy a pre-established after tax net income level. If our after tax net income for the six month period ended December 31, 2010 is less than RMB 45,997,157 (approximately $6.97 million), then, based upon an agreed formula, all or a portion of the shares placed into escrow will be transferred to the investors and other parties pro rata. If, however, our after tax net income for such period equals or exceeds RMB 45,997,157 (approximately $6.97 million), the shares placed into escrow will be returned to Mr. Zhuang.

5

Our Corporate Structure

All of our business operations are conducted through our Chinese operating subsidiary Jinjiang Chengchang. The chart below presents our corporate structure as of the date of this report:

Our principal executive offices are located at Qingyanglianyu Industrial Area, Jinjiang City, Fujian Province, People’s Republic of China. The telephone number at our principal executive office is (86)0595-82889862.

Our Industry

Overview of the PRC Sports Footwear Industry

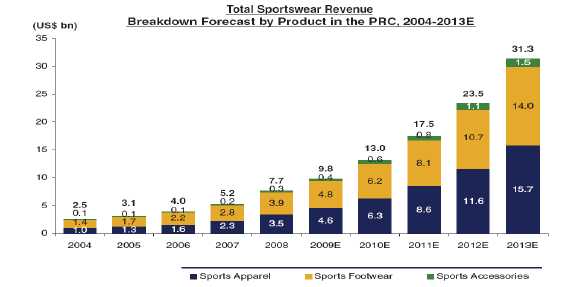

The PRC sportswear market, which includes footwear, apparel and accessories, has expanded rapidly in recent years and had an estimated size of approximately $9.8 billion in 2009. According to Frost & Sullivan, a business research and consulting firm, the footwear market was the largest segment in the PRC sportswear market in 2008 generating sales of approximately $3.9 billion. Sales of footwear generated approximately 50.5% of the total revenue in the sportswear market followed by apparel and accessories, which generated 45.5% and 4.0% of the sales revenue in the market segment, respectively. Total sales revenue of sports footwear in the PRC increased from $1.4 billion in 2004 to $3.9 billion in 2008, representing a compounded annual growth rate, or CAGR, of 36.8% for that period. The follow chart provides an overview of the historic and projected size of the overall sportswear industry broken down by market segment:

Source: Frost & Sullivan

6

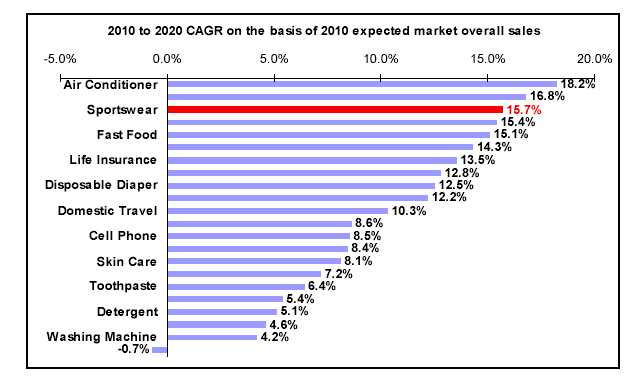

According to the UBS Investment Research, the sports footwear market is projected to reach RMB 297 billion (approximately $44 billion) by 2020 with a CAGR of 15.7% from 2010 to 2020 based on the projected overall sales of RMB 69 billion (approximately $10 billion) in 2010. The market for sports footwear is expected to grow steadily in the next decade. The UBS report estimates a CAGR of over 15% for sports footwear, ranking it third among 23 categories of consumer goods in the PRC.

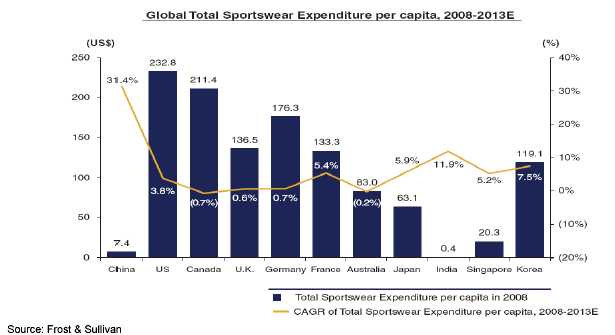

According to Frost & Sullivan, the total sportswear expenditures in China grew from $2.5 billion in 2004 to $7.7 billion in 2008, representing a CAGR of 32.2% for that period. Although total sportswear expenditure per capita in China was only $7.40 in 2008, which lags behind many developed countries, the projected CAGR for total sportswear expenditure per capita in China is 31.4% .

7

Key Drivers of Sustainable Growth in Sports Footwear Industry

We anticipate that growth in China’s sports footwear industry will mainly be driven by the following factors:

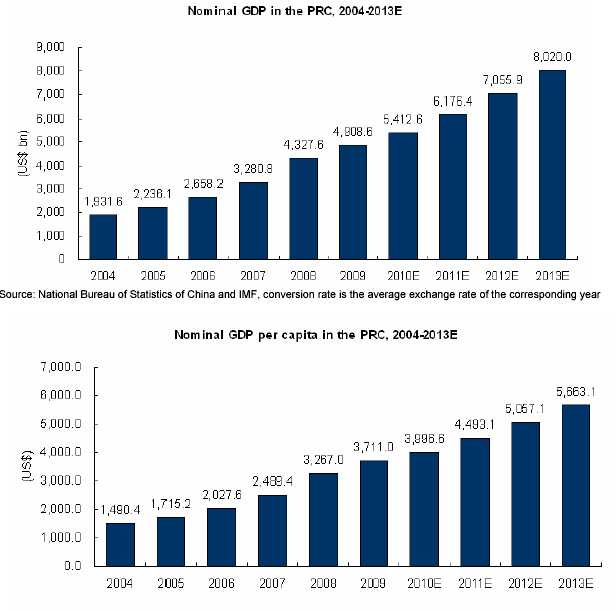

- Economic growth in China. The PRC economy has grown steadily in the past decade. According to the National Bureau of Statistics of China and International Monetary Fund, China’s nominal GDP increased at a CAGR of approximately 20.5% from approximately $1,931.6 billion in 2004 to approximately $4,908.6 billion in 2009. China’s nominal GDP is projected to grow nearly 14.0% per year from 2010 to 2013, reaching $8,020.2 billion in 2013. China’s nominal GDP per capital grew from approximately $1,490 in 2004 to $3,711 in 2009 with a CAGR of 20.0%, and is projected to further increase to $5,663 by 2013. The charts below illustrate the historical and projected nominal GDP and nominal GDP per capita in the PRC for the periods indicated.

Source: National Bureau of Statistics of China and IMF

8

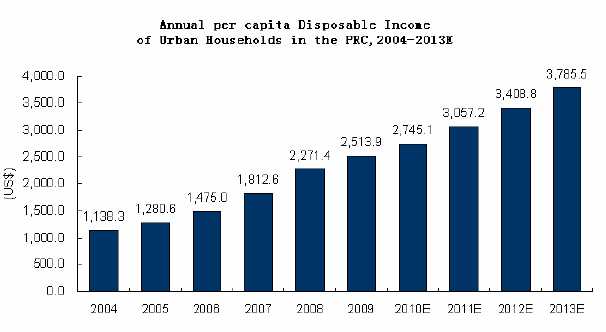

- Increasing Purchasing Power and Consumer Expenditure. With the rapid growth of the PRC economy, the disposable income level and purchasing power of urban households in China has increased in recent years. The annual per capita disposable income of urban households in China increased from approximately $1,130 in 2004 to approximately $2,510 in 2009 at a CAGR of 17.2%. According to Frost & Sullivan, the annual per capita disposable income of urban households in China is estimated to increase to approximately $3,780 in 2013.

Source: National Bureau of Statistics of China; Frost & Sullivan

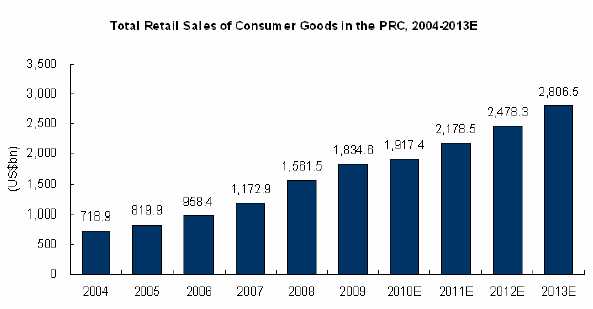

According to Euromonitor International, China currently ranks fifth in consumer spending, following the U.S., Japan, United Kingdom and Germany. China’s consumer market remained strong during the past five years due largely to the PRC’s expanding economy, a growing middle class and increasing affluence. The total value of retail sales of consumer goods grew from approximately $718.9 billion in 2004 to approximately $1,834.6 billion in 2009 at a CAGR of 20.6% and is projected to further increase to approximately $2,806.5 billion at the end of 2013.

Source: National Bureau of Statistics of China; Frost &

Sullivan

9

-

Greater health awareness and favorable government policies. We believe that the overall Chinese population is generally growing more health conscious and fitness oriented. The PRC government has implemented the Nationwide Physical Fitness Program which we believe will continue to promote awareness of good health, exercise and fitness and will contribute to the growth of the PRC sportswear market.

-

Changing consumer consumption pattern. As a result of the growing affluence in the PRC and increased purchasing power of the PRC population, we believe that PRC consumers are becoming more willing and able to purchase multiple pairs of specialized athletic shoes designed for different sporting and fitness activities. In addition, we believe that the purchasing decision of PRC consumers is becoming more predicated upon functionality, brand image, product design and style, rather than just price considerations.

-

Demand driven by high-profile sporting events. The demand of sports footwear in the PRC has been and will continue to be boosted by high-profile sporting events in China, such as the 2008 Beijing Olympics, the 2009 East Asian Games in Hong Kong, the 2010 Asian Games in Guangzhou and the 2011 World University Games. All these sporting events have contributed to a growing interest in sporting and fitness among citizens, which we believe will help to drive increased PRC demand for sportswear, particularly sports footwear.

Our Strengths

We believe that the following competitive strengths enable us to compete effectively in and capitalize on the growing sports footwear industry in China.

-

Strong and diversified customer base. We maintain good relationships with over 30 customers, many of which are well recognized domestic and international sportswear companies, such as Adidas, 361º, Exceed, Erke, Xtep and Qiaodan. During fiscal year 2010, our top customer accounted for approximately 8% of our revenue and our top five customers accounted for approximately 36% of our revenue in fiscal year 2010. By leveraging overall product quality and focusing on customer satisfaction, we qualified as the sole supplier in Jinjiang area for Taiwan Ching Lu Footwear, one of the largest OEM footwear companies of Adidas in Asia. We believe that our diversified and established customer base reduces our exposure to economic downturns and will continue to facilitate our sales efforts to new customers.

-

Proven research and development capabilities. We have committed substantial resources to research and development and believe that customers and competitors recognize us as an innovative manufacturer of high quality, high performance sole products. Our research and development team consists of nineteen professionals and we have a joint product development arrangement with Fuzhou University which enhances our new product development efforts. Through the efforts of our research and development team, we recently developed a new EVO product line which is based on our EVA compound formula, and a core product offering around which we intend to grow our business.

-

Proprietary manufacturing processes. We believe that we are one of a limited number of Jinjiang-based sole manufacturers with a manufacturing process capable of controlling the feature accuracy of finished products by using a single step physical inflation procedure following injection molding. Most of our competitors use a foam molding manufacturing process which involves multiple steps. Our single step injection molding manufacturing process reduces labor and raw materials costs.

-

Experienced management team. We have an experienced, market oriented and technically sophisticated management team led by Mr. Guoqing Zhang, our Chairman, CEO and President who has fifteen years of experience in the sports footwear industry, and Mr. Chansheng Li, our director of research and development center who has twelve years of research experience involving high performance polymer shoe materials. We are committed to attract and retain top management level executives who we believe are and will continue to be the driving force behind our product innovation and growth.

10

Our Growth Strategy

We will strive to be a leading supplier of high quality, high performance sole products for athletic and leisure shoes by pursuing the following growth strategies:

-

Increase sales to large sportswear companies with well known brands. We believe that larger global and domestic sportswear companies with well known brands will capture greater market shares in China sportswear market faster than smaller competitors with less brand recognition. By concentrating our sales and marketing effort on larger, internationally recognized sportswear companies, we believe that we can grow our business in a predictable and sustainable manner with customers that submit larger purchase orders while maintaining favorable profit margins. We intend to deepen our relationships with our larger, existing customers and focus our new sales initiatives on new customers with strong brand recognition.

-

Expand EVO market penetration. Our newly developed EVO product line is our higher margin, proprietary product offering that is an outgrowth of our core EVA product line. We recently commenced sales of our EVO compound pellets to local sole manufacturers which lack the technical expertise and manufacturing capacity to produce finished sole products with specialized finishes and features. Our EVO compound products provide a solution for these manufacturers and we anticipate the demand for our EVO products will increase in the near future as we focus marketing and sales efforts on this market segment.

-

Broaden our product portfolio and mix by developing new compound formulas. We continually strive to develop and manufacture new, high-quality products to meet the rigid product specifications of our customers. We intend to build upon our EVO compound technology in order to develop and commercialize additional EVO concept compounds with enhanced design features and improved performance. We also intend to commit research and development resources towards the development of a new RB compound which lowers product cost by using a new synthetic rubber formula.

-

Expand our manufacturing capacity. We plan to build new production lines to increase our EVO compound manufacturing capacity to meet demand from our EVO customers and expand our injection molding manufacturing capacity to meet anticipated demand, mostly from Adidas’ OEM footwear manufacturer. We intend to acquire land use rights for approximately 40,000 square meters of additional land from the local PRC government and expect to begin construction of a new plant in the first half of 2011. We expect that additional production capacity will help us meet demand and contribute to revenue growth.

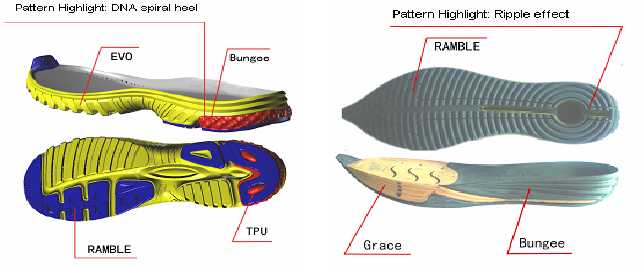

Our Products

Soles found on athletic and leisure shoes are comprised primarily of a midsole and outsole and may also include TPU components and air cushioning gels depending on the shoe’s design and functionality requirements. A pictorial depiction of the cross-section of an athletic shoe sole and an explanation of each of its components is shown below.

-

Midsole. The midsole is the middle layer of a shoe sole which restricts and controls excessive foot motion and provides cushioning and comfort.

-

Outsole. The outsole is the treaded bottom layer of a shoe sole which has direct contact with the ground and provides traction, slip-resistance, water-resistance and reduces wear and tear on the midsole.

-

TPU Components. TPU Components are made from thermoplastic polyurethane, which is a plastic with many useful properties, including elasticity, transparency, and resistance to oil, grease and abrasion. TPU components often are attached to shoe soles for both aesthetic purposes and functionality enhancing performance and ergonomic qualities of a shoe. Depending on the design preference of our customers, we often integrate TPU products, which can be dyed various colors, into our soles.

11

Our sole products are used mostly in the production of athletic and leisure shoes. We categorize our products into three product lines -- EVA sole products, RB soles and EVO sole products -- based primarily on the key raw materials and product design features. Each of our sole products has varying performance specifications, product structure and features and can be made in a variety of sizes and colors. Within these product categories, we develop specialized product designs and performance and aesthetic features.

EVA Products

Our EVA sole products are produced using ethylene vinyl acetate which is a viscous and elastic foam material that contains tiny bubbles and other additives. Our EVA sole products are lightweight, durable, cushiony and have anti-slip performance attributes. They are used in athletic shoes designed for a wide range of activities, such as running, basketball, tennis and general cross training.

RB Soles

Our RB sole products are made using a combination of synthetic and natural rubber which is formed into a single outsole piece and then glued to a midsole. RB soles are skid-resistant and highly durable, but provide little dimensional stability, cushioning and shock-absorption capabilities as compared to EVA soles. As a result, RB soles are used for leisure activity purpose. We have developed a new RB compound formula designed to enhance the comfort of RB soles by making them more lightweight than normal RB soles.

EVO Soles

Our EVO products, which stands for EVA outsole, is an outgrowth of our EVA products. Typically, EVA material is suitable only for a midsole since it lacks the abrasion resistance needed for an outsole. We have recently a compound formula based on the typical EVA formula plus proprietary additives which has favorable abrasion resistance. Consequently, EVO products can be used independently as an outsole without the need for an outsole. We have produced three specific prototypes of EVO compounds and just launched the first prototype called EVO-AR. EVO-AR is a sole product designed for high performance, enhanced cushioning and abrasion resistance thereby making RB soles unnecessary. We believe that EVO-AR and our other EVO products will be well received by shoe manufacturers as these producers can reduce raw materials and labor costs in their own manufacturing process.

EVO Compound Pellets

Our EVO pellets are made from semi-processed raw materials, such as resin and other chemical additives, which are then produced in pellet form, melted and injected into shoe sole molds. EVO pellets provide additional support, comfort and durability to a shoe sole. In 2010, we started to supply our EVO compound pellets to local sole producers which lack the technical and manufacturing capability to manufacture high quality, high performance soles on their own.

Raw Materials and Supplier Relationships

The principal raw materials used in the production of our products are ethylene vinyl acetate, resin, thermoplastic polyurethane, rubber, color dyes and other chemical additives.

12

We source all of our major raw materials from approximately 40 Chinese suppliers mostly located in Quanzhou City, Fujian Province, which are in close proximity to our production facilities. We do not rely on any single supplier for any of our key raw materials and enjoy a timely supply of raw materials at competitive pricing. By sourcing raw materials from multiple suppliers, we have been able to minimize any potential disruption of our operations and maintain sourcing stability. At the beginning of each year, we typically enter into non-binding framework agreements with several key suppliers which provide us with raw materials for the upcoming year.

For fiscal years 2009 and 2010, purchases from our top five suppliers accounted for approximately 44.64% and 43.67%, respectively, of our total purchases of raw materials.

Our Customers

We sell our products directly to athletic and leisure footwear manufactures or OEMs that manufacture shoes for branded sportswear companies. As of June 30, 2010, we had over 30 customers. Our customers include a number of well known companies in the international and domestic sportswear market, including Adidas, 361º, Exceed, Erke, Xtep and Qiaodan. Nearly all of our customers are either headquartered or base their manufacture facilities in Jinjiang area. We believe that our proximity to customers facilitates our sales efforts and after-sales support, lowers shipping and logistical costs and enhances our ability to communicate with our customers which makes it easier respond to customers’ demands and changing production specification.

We do not have long terms contracts with our customers. Instead, our customers submit purchase orders to us throughout the year based on their expected demand. Based on the size of a customer’s account and purchase order size and our view of its creditworthiness, we establish different billing and collections cycles, ranging from 60 days for our smaller customers to 120 days for our best and largest customers.

In fiscal year 2009, our largest customer, Fujian Yifeng Shoes & Apparels Co., Ltd., accounted for approximately 9.87% of our total revenues. In fiscal year 2010, our largest customer, Fujian Xidelong Sports Goods Co., Ltd., accounted for approximately 7.78% of our total revenues. We do not have any other customer accounting for more than 10% of our total revenues in fiscal year 2010.

Our Sales and Marketing Efforts

Our sales and marketing team consists of 15 full time employees as of June 30, 2010. We engage in a variety of targeted sales and marketing efforts and advertising campaigns designed to promote brand awareness and generate sales. Several times per year, our sales personnel attend industry conventions and other conferences where they promote our products and meet with existing and potential customers. At past conferences, we have promoted existing and new designs, solicited customer feedback and generated sales and sales leads, and our customers have shared with us their design specifications and expected order size for the upcoming season.

We also regularly engage in targeted advertising campaigns, mostly recently to promote our EVO products. In this regard, we advertise at industry trade shows, issue news releases and advertise in media that our customers view. We believe that our EVO product and promotional activities have attracted favorable market interest, and expect to continue these sales and marketing activities in the future.

As part of our growth strategy, we intend to focus on expanding sales to our largest existing customers and targeting the largest, most recognized shoe manufacturers.

Competition

The athletic footwear industry is keenly competitive in China and on a worldwide basis. Rapid changes in technology and consumer preferences in the markets for athletic and leisure footwear constitute significant risk factors in our operations. In China, the athletic footwear industry is highly fragmented with hundreds of companies of all sizes engaging in various aspects of the athletic and leisure footwear business. We believe that we are one of a few companies in China that offers a broad array of sole products which can be used on a wide variety of athletic and leisure shoes. Our direct competition primarily comes from approximately twenty local companies, such as Qingmei (China) Co., Ltd., Tai Ya Shoes Development, Fujian Hongwei Shoe Plastics Co., Ltd. and Wan Jia Xin (Fujian) Leather and Rubber Shoes Co., Ltd.

13

We compete primarily on the basis of product innovative, performance and design, brand recognition, operational efficiency and a low cost structure. Some of our domestic competitors have a stronger customer base, greater resources and more industry expertise than us. However, we believe that we can continue to successfully compete with our local competitors due to our innovative product offerings, such as our EVO products, that simultaneously offer customers both high performance and cost-savings. We believe that our exclusive supplier arrangement as the sole supplier of sole products in the Jinjiang area for Taiwan Ching Lu Footwear, which one of the largest OEM footwear manufacturers for Adidas in Asia, affords us a significant competitive advantage.

Research and Development

We believe that innovation is a critical element of success in the athletic and leisure shoe industry and are committed to developing new sole products with superior performance attributes and aesthetic features. As of June 30, 2010, we had 23 full time members in our research and development team and research and development expenses were approximately $124,153 and $69,280 for the fiscal years ended June 30, 2010 and 2009, respectively. In the future, we intend to allocate greater resources to research and development in order to remain competitive and innovative.

Our research and development efforts have historically focused on two areas: developing new compound formulas and creating enhanced aesthetic designs and features. Our recent product development efforts have resulted in the following high performance compounds (which are also shown in the picture below):

|

|

EVO series: |

|

|

|

High abrasive resistance: EVO-AR |

|

|

|

High softness: EVO-ST |

|

|

|

High lightness: EVO-UL |

|

|

|

High elasticity EVA: BUNGEE |

|

|

|

Lightweight rubber: RAMBLE |

|

In tandem with our internal research and development efforts, we have also entered into a agreement with Fuzhou University to jointly develop high performance polymer shoe materials. Under the terms of this agreement, we have provided Fuzhou University with research funding of RMB200,000, Fuzhou University is entitled to publish related technical papers relating to the product developments and we are entitled to all proprietary information, patents and other intellectual property rights relating to the joint development efforts. Under the agreement, Fuzhou University may not transfer any proprietary information without our consent.

14

Intellectual Property

We currently hold four registered trademarks in the PRC, which are renewable upon expiration. We also hold five utility model patents in the PRC which expire in November 2019. In addition, we filed applications for eight new trademarks in 2010 and four patents in 2009 which are under review as of the date of this report.

The four registered trademarks are the following:

|

Trademark |

Registrant |

Class/products |

Expiration |

Certificate |

|

|

Jinjiang Chengchang |

25/shoes, boots, long boots, slippers, sandals, sporting shoes, sporting boots, shoes for the seaside bathing place, rain shoes |

November 6, |

1469314 |

|

|

Jinjiang Chengchang |

25/shoes, boots, long boots, slippers, sandals, sporting shoes, sporting boots, shoes for the seaside bathing place, rain shoes |

November 27, |

1481176 |

|

|

Jinjiang Chengchang |

25/shoes, sporting shoes, sporting boots, lace-up boots, overshoes, climbing shoes, jumping shoes, low- side boots, long boots |

March 20, |

1733391 |

|

|

Jinjiang Chengchang |

25/shoes, sporting shoes, sporting boots, lace-up boots, overshoes,

climbing shoes, jumping shoes, low- side boots, long boots |

August 27, |

5485919 |

We believe that our trademarks provide significant value as they are important for marketing and building brand recognition. We are not aware of any third party currently using trademarks similar to our trademarks in the PRC on the same products.

Regulation

Because our primary operating subsidiaries are located in China, we are subject to China’s national and local laws, including those related to property ownership, environmental protection, foreign currency and taxation as detailed below. We believe that we are in material compliance with all registrations and requirements for the issuance and maintenance of all licenses required by the governing bodies and that all license fees and filings are current.

Environmental Matters

As a producer of sole products in China, we are subject to various governmental regulations related to environmental protection. We use a myriad of chemicals in our operations and produce emissions that could pose environmental risks. Our manufacturing facilities are subject to various pollution control regulations with respect to noise, water and air pollution and the disposal of waste and hazardous materials, including, China’s Environmental Protection Law, Law of the People’s Republic of China on Appraising of Environment Impacts, China’s Law on the Prevention and Control of Water Pollution and its implementing rules, China’s Law on the Prevention and Control of Air Pollution and its implementing rules, China’s Law on the Prevention and Control of Solid Waste Pollution, and China’s Law on the Prevention and Control of Noise Pollution. We are subject to periodic inspections by local environmental protection authorities. We believe we are in material compliance with the relevant PRC environmental laws and regulations. We are not currently subject to any pending actions alleging any violations of applicable PRC environmental laws.

15

Foreign Currency Exchange

The principal regulation governing foreign currency exchange in China is the Foreign Currency Administration Rules (1996), as amended (2008). Under these rules, RMB is freely convertible for current account items, such as trade and service-related foreign exchange transactions, but not for capital account items, such as direct investment, loan or investment in securities outside China unless the prior approval of, and/or registration with, the State Administration of Foreign Exchange of the People’s Republic of China, or SAFE, or its local counterparts (as the case may be) is obtained.

Pursuant to the Foreign Currency Administration Rules, foreign invested enterprises, or FIEs, in China may purchase foreign currency without the approval of SAFE for trade and service-related foreign exchange transactions by providing commercial documents evidencing these transactions. They may also retain foreign exchange (subject to a cap approved by SAFE) to satisfy foreign exchange liabilities or to pay dividends. In addition, if a foreign company acquires a company in China, the acquired company will also become an FIE. However, the relevant PRC government authorities may limit or eliminate the ability of FIEs to purchase and retain foreign currencies in the future. In addition, foreign exchange transactions for direct investment, loan and investment in securities outside China are still subject to limitations and require approvals from, and/or registration with, SAFE.

Regulation of Income Taxes

On March 16, 2007, the National People’s Congress, the Chinese legislature, passed the new Enterprise Income Tax Law, or the EIT Law, which became effective on January 1, 2008. The EIT Law applies a unified enterprise income tax, or EIT, rate at 25% to both FIEs and domestic invested enterprises. According to a grandfathering provision of the Notice on Transitional Preferential Policies of Enterprise Income Tax published by the State Council, enterprises that are subject to an EIT rate below 25% may continue to enjoy such lower rate which will be gradually transitioned to the new EIT rate within five years of the effective date of the EIT Law, and enterprises that are currently entitled to exemptions from, or reductions in, applicable EIT for a fixed term may continue to enjoy such treatment until the fixed term expires.

Dividend Distribution

The principal regulations governing distribution of dividends of wholly foreign-owned companies include:

-

The Wholly Foreign-owned Enterprise Law (1986), as amended in October 2000;

-

Implementation Rules under the Wholly Foreign-owned Enterprise Law (1990), as amended in 2001;

-

Company Law of the PRC (2005); and

-

Enterprise Income Tax Law and its Implementation Rules (2007).

Under these regulations, wholly foreign-owned enterprises in China like our company may pay dividends only out of their accumulated profits, if any, determined in accordance with PRC accounting standards and regulations. In addition, wholly foreign-owned enterprises in China are required to set aside at least 10% of their respective accumulated profits each year, if any, to fund certain reserve funds, unless such reserve funds have reached 50% of their respective registered capital. These reserves are not distributable as cash dividends.

Under the EIT Law, dividends, interests, rent, royalties and gains on transfers of property payable by a FIE in the PRC to its foreign investor who is a non-resident enterprise will be subject to a 10% withholding tax, unless such non-resident enterprise’s jurisdiction of incorporation has a tax treaty with the PRC that provides for a reduced rate of withholding tax. Jinjiang Chengchang is considered an FIE and is directly held by our subsidiary Chengchang HK. According to a 2006 tax treaty between the Mainland and Hong Kong, dividends payable by an FIE in China to the company in Hong Kong who directly holds at least 25% of the equity interests in the FIE will be subject to a no more than 5% withholding tax.

Under the EIT Law, an enterprise established outside the PRC with its “de facto management body” within the PRC is considered a resident enterprise and will be subject to the enterprise income tax at the rate of 25% on its worldwide income. The implementing rules of the EIT Law define de facto management as “substantial and overall management and control over the production and operations, personnel, accounting, and properties” of the enterprise. For detailed discussion of PRC tax issues related to resident enterprise status, see “Risk Factors – Under the Enterprise Income Tax Law, we may be classified as a ‘resident enterprise’ of China. Such classification will likely result in unfavorable tax consequences to us and our non-PRC stockholders.”

16

Moreover, under the EIT Law, foreign shareholders of an entity that is classified as a PRC resident enterprise may be subject to a 10% withholding tax upon dividends payable by such entity, unless the jurisdiction of incorporation of the foreign shareholder of such entity has a tax treaty with the PRC that provides for a reduced rate of withholding tax, and gains realized on the sale or other disposition of shares, if such income is sourced from within the PRC.

Land Use Rights

There is no private ownership of land in China and all urban land ownership is held by the government of the PRC, its agencies and collectives. Land use rights can be obtained from the government for a period of up to 50 years for industrial usage, 40 years for commercial usage and 70 years for residential usage, and are typically renewable. Land use rights can be transferred upon approval by the land administrative authorities of the PRC (State Land Administration Bureau) upon payment of the required land transfer fee. We have received the necessary land use right certificates for the properties described under “Properties” below.

Employees

As of September 30, 2010, we employed a total of 505 employees. The following table sets forth the number of our employees by function.

|

Function |

Number of Employees |

|

Sales and Marketing Department |

15 |

|

Research and Development Department |

23 |

|

Management, Financial, and Administrative Office |

28 |

|

Production |

439 |

|

Total |

505 |

Our employees in China participate in a state pension plan organized by Chinese municipal and provincial governments. We are required to contribute monthly to the plan at the rate of 18% of the average monthly salary. In addition, we are required by Chinese law to cover employees in China with various types of social insurance. We believe that we are in material compliance with the relevant PRC laws.

Insurance

We do not have any business liability, interruption or litigation insurance coverage for our operations in China. Insurance companies in China offer limited business insurance products. While business interruption insurance is available to a limited extent in China, we have determined that the risks of interruption, cost of such insurance and the difficulties associated with acquiring such insurance on commercially reasonable terms make it impractical for us to have such insurance. Therefore, we are subject to business and product liability exposure. See “Risk Factors – Risks Related to Our Business – We have limited insurance coverage in China and may not be able to recover insurance proceeds if we experience uninsured losses.”

RISK FACTORS

An investment in our common stock involves a high degree of risk. You should carefully consider the risks described below, together with all of the other information included in this report, before making an investment decision. If any of the following risks actually occurs, our business, financial condition or results of operations could suffer. In that case, the trading price of our common stock could decline, and you may lose all or part of your investment. You should read the section entitled “Special Notes Regarding Forward-Looking Statements” above for a discussion of what types of statements are forward-looking statements, as well as the significance of such statements in the context of this report.

RISKS RELATED TO OUR BUSINESS

The recent financial crisis could negatively affect our business, results of operations, and financial condition.

The footwear industry has historically been subject to substantial cyclical variations. While the financial crisis has stabilized in China, the global economy remains precarious and consumer spending remains unpredictable, which may have an adverse impact on our sales volumes, pricing levels and profitability. Our ability to access the capital markets may be restricted at a time when we would like, or need, to raise capital, which could impair on our ability to build additional sole manufacturing lines. In addition, as domestic and international economic conditions change, trends in consumer spending on discretionary items, such as multiple pairs of athletic shoes, become unpredictable and subject to reductions due to economic uncertainties. When consumers reduce discretionary spending, purchases of specialty footwear tend to decline. If demand for our products fluctuates as a result of economic conditions or otherwise, our revenue and gross margin could be harmed.

17

If we are unable to develop innovative products in response to rapid changes in consumer demands and fashion trends, we may suffer a decline in our revenues and market share.

The footwear industry is subject to constantly and rapidly changing consumer demands based on fashion trends and performance features. Our success depends, in part, on our research and development ability and ability to anticipate, gauge and respond to these changing consumer preferences in a timely manner while preserving the quality of our products. If we fail to introduce technical innovation in our products the consumer demand for our products could decline, and if we experience problems with the quality of our products, we may incur substantial expense to remedy the problems.

Our new product introductions may not be as successful as we anticipate, which could harm our business, financial condition and/or results of operations.

Our recently launched EVO product line, which is a core area around which we intend to grow our business. As is typical with new products, market acceptance of EVO products and other new designs and products we may introduce is subject to uncertainty and achieving market acceptance may require substantial marketing efforts and expenditures. We also cannot assure that our EVO products and other new products will have the same or better margins than our current products. The failure of the new product lines to gain market acceptance or our inability to maintain our current product margins with the new products could adversely affect our business, financial performance and/or results of operations.

Failure to execute our business expansion plan could adversely affect our financial condition and results of operations.

We plan to build new EVO production lines to meet our expected market demand. We also plan to expand our injection molding manufacturing capacity. The decision to increase our production capacity was based in part on our projections of market demand for our products. If actual customer demand does not meet our projections, we will likely suffer overcapacity problems and may have to leave capacity idle, which may reduce our overall profitability and adversely affect our financial condition and results of operations. Our future success depends on our ability to expand our business to address growth in demand for our current and future products. Our ability to add production capacity and increase output is subject to significant risks and uncertainties, including:

-

the unavailability of additional funding to expand our production capacity, purchase additional fixed assets and purchase raw materials on favorable terms or at all;

-

delays and cost overruns as a result of a number of factors, many of which may be beyond our control, such as problems with equipment vendors and suppliers of raw materials;

-

failure to maintain high quality control standards;

-

shortage of raw materials;

-

our inability to obtain, or delays in obtaining, required approvals by relevant government authorities;

-

diversion of significant management attention and other resources; and

-

failure to execute our expansion plan effectively.

As our business grows, we will need to implement a variety of new and upgraded operational and financial systems, procedures and controls, including improvements to our accounting and other internal management systems by dedicating additional resources to our reporting and accounting functions, and improvements to our record keeping and contract tracking system. We will need to respond to competitive market conditions and continue to enhance existing products and develop new products, and retain existing customers and attract new customers. We will also need to recruit more personnel and train and manage our growing employee base. Furthermore, we will need to maintain and expand our relationships with our current and future customers, suppliers, distributors and other third parties, and there is no guarantee that we will succeed.

If we encounter any of the risks described above, or are otherwise unable to establish or successfully operate additional production capacity or to increase production output, we may be unable to grow our business and revenues, reduce our operating costs, maintain our competitiveness or improve our profitability, and our business, financial condition, results of operations and prospects may be adversely affected.

18

The footwear industries are each highly competitive, and if we fail to compete effectively, we could lose our market position.

The footwear industry is highly competitive. We compete against approximately twenty local companies that manufacture athletic shoe soles and components, such as Qingmei (China) Co., Ltd., Tai Ya Shoes Development, Fujian Hongwei Shoe Plastics Co., Ltd. and Wan Jia Xin (Fujian) Leather and Rubber Shoes Co., Ltd. Some of our competitors may be significantly larger and have greater financial resources than we do. In order to compete effectively, we must: (1) maintain the image of our brands and our reputation for innovation and high quality; (2) be flexible and innovative in responding to rapidly changing market demands on the basis of brand image, style, performance and quality; and (3) offer consumers a wide variety of high quality products at competitive prices.

The purchasing decisions of consumers are highly subjective and can be influenced by many factors, such as brand image, marketing programs and product features. Some of our competitors enjoy competitive advantages, including greater brand recognition and greater financial resources for competitive activities, such as sales, marketing and strategic acquisitions. The number of our direct competitors and the intensity of competition may increase as we expand into other product lines or as other companies expand into our product lines. Our competitors may enter into business combinations or alliances that strengthen their competitive positions or prevent us from taking advantage of such combinations or alliances. Our competitors also may be able to respond more quickly and effectively than we can to new or changing opportunities, standards or consumer preferences. Our results of operations and market position may be adversely impacted by our competitors and the competitive pressures in the footwear industries.

A contraction in footwear sales and production could impair our results of operations and liquidity and jeopardize our supply base.

Footwear sales and production are cyclical and depend, among other things, on general economic conditions and consumer spending and preferences. As the volume of footwear production fluctuates, the demand for our products also fluctuates. A contraction in footwear sales, especially sports footwear sales and production, could harm our results of operations and liquidity. In addition, our suppliers would also be subject to many of the same consequences which could pressure their results of operations and liquidity. Depending on an individual supplier’s financial condition and access to capital, its viability could be challenged which could impact its ability to perform as we expect and consequently our ability to meet our own commitments.

If we are unable to anticipate consumer preferences and develop new products, we may not be able to maintain or increase our net revenues and profits.

Our success depends on our ability to identify, originate and define athletic shoe trends as well as to anticipate, gauge and react to changing consumer demands for athletic shoes in a timely manner. Most of our products are subject to changing consumer preferences that cannot be predicted with certainty. Our new products may not receive consumer acceptance as consumer preferences could shift rapidly to different types of performance or other sports footwear or away from these types of products altogether, and our future success depends in part on our ability to anticipate and respond to these changes. If we fail to anticipate accurately and respond to trends and shifts in consumer preferences by adjusting the mix of existing product offerings, developing new products, designs, styles and categories, we could experience lower sales, excess inventories and lower profit margins, any of which could have an adverse effect on our results of operations and financial condition.

Our business is capital intensive and our growth strategy may require additional capital which may not be available on favorable terms or at all.

We believe that our current cash and cash flow from operations are sufficient to meet our present and reasonably anticipated cash needs. We may, however, require additional cash resources due to changed business conditions, implementation of our strategy to develop new compounds and sole components, expand our manufacturing capacity or other investments or pursue strategic acquisitions. If our own financial resources are insufficient to satisfy our capital requirements, we may seek to sell additional equity or debt securities or obtain additional credit facilities. The sale of additional equity securities could result in dilution to our stockholders. The incurrence of indebtedness would result in increased debt service obligations and could require us to agree to operating and financial covenants that would restrict our operations. Given the current global economic crisis, financing may not be available in amounts or on terms acceptable to us, if at all. Any failure by us to raise additional funds on terms favorable to us, or at all, could limit our ability to expand our business operations and could harm our overall business prospects.

19

A substantial amount of our sales revenue is derived from sales to a limited number of customers, and our business will suffer if sales to these customers decline.

A significant portion of our sales revenue historically has been derived from a limited number of customers. Our top five customers accounted for approximately 42.82% and 36.02% of our revenue in fiscal years 2009 and 2010, respectively. We do not have long term contractual arrangements with these customers. Any significant reduction in demand for products manufactured by any of these major customers and any decrease in their demand for our products could harm our sales and business operations. The loss of one or more of these customers could damage our business, financial condition and results of operations.

Due to our rapid growth in recent years, our past results may not be indicative of our future performance and evaluating our business and prospects may be difficult.

Our business has grown and evolved rapidly in recent years as demonstrated by our growth in net sales, from $17.9 million for the fiscal year ended June 30, 2009 to $26.1 million for the fiscal year ended June 30, 2010. We may not be able to achieve similar growth in future periods, and our historical operating results may not provide a meaningful basis for evaluating our business, financial performance and prospects. Moreover, our ability to achieve satisfactory production results at higher volumes is unproven. Therefore, you should not rely on our past results or our historical rate of growth as an indication of our future performance.

Any decrease in the availability, or increase in the cost, of raw materials could materially affect our earnings.

Our operations depend heavily on the availability of various raw materials and energy resources, including EVA resin, TPU and rubber. We purchase raw materials for our products from various suppliers located primarily in China, and we generally do not have long-term contractual arrangements with our suppliers. We may experience a shortage in the supply of certain raw materials in the future, and if any such shortage occurs, our manufacturing capabilities and operating results of operations could be negatively affected. If any supplier is unwilling or unable to provide us with high-quality raw materials in required quantities and at acceptable pricing, we may not be able to find alternative sources on satisfactory terms in a timely manner, or at all. In addition, some of our suppliers may fail to meet qualifications and standards required by our customers now or in the future, which could impact our ability to source raw materials. Our inability to find or develop alternative supply sources could result in delays or reductions in manufacturing and product shipments. Moreover, these suppliers may delay shipments or supply us with inferior quality raw materials that may adversely impact the performance of our products. The prices of raw materials needed for our products could also increase, and we may not be able to pass these price increases on to our customers. If any of these events occur, our competitive position, reputation and business could suffer.

Any interruption in our production processes could impair our financial performance and negatively affect our brand.

We develop and manufacture soles and sole components primarily at our facilities in Jinjiang, China. Our manufacturing operations are complicated and integrated, involving the coordination of raw material and component sourcing from third parties, internal production processes and external distribution processes. While these operations are modified on a regular basis in an effort to improve manufacturing and distribution efficiency and flexibility, we may experience difficulties in coordinating the various aspects of our manufacturing processes, thereby causing downtime and delays. In addition, we may encounter interruption in our manufacturing processes due to a catastrophic loss or events beyond our control, such as fires, explosions, labor disturbances or violent weather conditions. Any interruptions in our production or capabilities at our facilities could result in our inability to produce our products, which would reduce our sales revenue and earnings for the affected period. If there is a stoppage in production at any of our facilities, even if only temporary, or delays in delivery times to our customers, our business and reputation could be severely affected. Any significant delays in deliveries to our customers could lead to increased returns or cancellations and cause us to lose future sales. We currently do not have business interruption insurance to offset these potential losses, delays and risks so a material interruption of our business operations could severely damage our business.

20

Our failure to collect the trade receivables or untimely collection could affect our liquidity

We extend credit to some of our customers while generally requiring no collateral. Depending on the size and creditworthiness of a customer, we typically expect and receive payment within 60-120 days of product delivery. We perform ongoing credit evaluations of our customers’ financial condition and generally have no difficulties in collecting our payments. But if we encounter future problems collecting amounts due from our clients or if we experience delays in the collection of amounts due from our clients, our liquidity could be negatively affected.

If we cannot extend or renew our currently outstanding short-term loans, we will have to repay these loans with cash on hand or refinance them with another lender or else face a default and potential foreclosure upon the collateral we pledged.

In January 2010, the Chinese government took steps to tighten the availability of credit including ordering banks to increase the amount of reserves they hold and to reduce or limit their lending. Our notes to banks for short-term loans as of June 30, 2010 totaled approximately RMB 18.98 million. Although these short-term bank loans contain no specific renewal terms, in China, it is customary practice for banks and borrowers to negotiate roll-overs or renewals of short-term loans on an ongoing basis shortly before they mature. Although we have renewed our short-term loans in the past, we cannot assure you that we will be able to renew these loans in the future as they mature. If we cannot renew them we will have to repay them with cash from operations. We cannot assure you that our business will generate sufficient cash to do so. Our indebtedness and the incurrence of any new indebtedness could (i) make it more difficult for us to satisfy our existing obligations, which could in turn result in an event of default on such obligations, (ii) require us to seek other sources of capital to finance cash used in operating activities, thereby reducing the availability of cash for working capital, capital expenditures, acquisitions, general corporate purposes or other purposes, (iii) impair our ability to obtain additional financing in the future for working capital, capital expenditures, acquisitions, general corporate purposes or other purposes; (iv) diminish our ability to withstand a downturn in our business, the industry in which we operate or the economy generally, (v) limit our flexibility in planning for, or reacting to, changes in our business and the industry in which we operate, or (vi) place us at a competitive disadvantage compared to competitors that have proportionately less debt. If we are unable to meet our debt service obligations, we could be forced to restructure or refinance our indebtedness, seek additional equity capital or sell assets.

We may be unable to obtain financing or sell assets on satisfactory terms, or at all, which could cause us to default on our debt service obligations and be subject to foreclosure on such loans. Additionally, we could incur additional indebtedness in the future and, if new debt is added to our current debt levels, the risks above could intensify.

If we are unable to attract and retain senior management and qualified technical and sales personnel, our operations, financial condition and prospects will be materially adversely affected.

Our future success depends in part on the contributions of our management team and key technical and sales personnel and our ability to attract and retain qualified new personnel. In particular, our success depends on the continuing employment of our CEO, Mr. Guoqing Zhuang and Huihuang Zhuang, our Chief Operating Officer. There is significant competition in our industry for qualified managerial, technical and sales personnel and we cannot assure you that we will be able to retain our key senior managerial, technical and sales personnel or that we will be able to attract, integrate and retain other such personnel that we may require in the future. If we are unable to attract and retain key personnel in the future, our business, operations, financial condition, results of operations and prospects could be materially adversely affected.

We have limited insurance coverage in China and may not be able to recover insurance proceeds if we experience uninsured losses.

Operation of our facilities involves many risks, including equipment failures, natural disasters, industrial accidents, power outages, labor disturbances and other business interruptions. We do not carry any business interruption insurance, product recall or third-party liability insurance for our production facilities or with respect to our products to cover claims pertaining to personal injury or property or environmental damage arising from defects in our products, product recalls, accidents on our property or damage relating to our operations. While business interruption insurance and other types of insurance are available to a limited extent in China, we have determined that the risks of interruption, cost of such insurance and the difficulties associated with acquiring such insurance on commercially reasonable terms make it impractical for us to have such insurance. Therefore, our existing insurance coverage may not be sufficient to cover all risks associated with our business. As a result, we may be required to pay for financial and other losses, damages and liabilities, including those caused by natural disasters and other events beyond our control, out of our own funds, which could have a material adverse effect on our business, financial condition and results of operations.

21

Our inability to protect our trademarks, patent and trade secrets may prevent us from successfully marketing our products and competing effectively.