Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - DICK'S SPORTING GOODS, INC. | d8k.htm |

Dick’s Sporting Goods

Baron Funds Conference

October 22, 2010

Exhibit 99.1 |

DICK’S SPORTING GOODS, INC. SAFE HARBOR STATEMENT

REGULATION G RECONCILIATIONS AVAILABLE ON OUR WEBSITE

Our

presentation

includes,

and

our

response

to

various

questions

may

include,

“forward-looking

statements”

within

the

meaning

of

the

Private

Securities

Litigation

Reform

Act

of

1995.

Such

statements

relate

to

future

events

and

expectations

and

involve

known

and

unknown

risks

and

uncertainties

that

may

cause

the

Company’s

actual

results

or

actions

to

differ

materially

from

those

projected

in

the

forward-looking

statements.

Those

risks

and

uncertainties

include,

without

limitation:

the

current

financial

downturn

and

its

effect

on

consumer

spending;

changes

in

macro

economic

factors

and

market

conditions,

including

the

housing

market

and

fuel

costs,

that

impact

the

level

of

consumer

spending

for

the

types

of

merchandise

sold

by

the

Company;

potential

volatility

in

our

stock

price;

the

tightening

of

availability

and

higher

costs

associated

with

current

and

new

sources

of

credit

resulting

from

uncertainty

in

financial

markets;

the

impact

of

the

financial

and

economic

downturn

on

our

landlords

and

real

estate

developers

of

retail

space,

which

may

limit

the

availability

of

attractive

store

locations

and

the

availability

of

retail

store

sites

on

terms

acceptable

to

us;

the

cost

of

real

estate

and

other

items

related

to

our

stores;

our

inability

to

manage

our

growth,

open

new

stores

on

a

timely

basis

and

expand

successfully

in

new

and

existing

markets;

changes

in

consumer

demand,

the

retailing

environment

and

customer

preferences

and

spending

habits;

competitive

pressures;

unauthorized

disclosure

of

sensitive

or

confidential

information;

the

impact

of

the

current

economic

and

financial

downturn

on

our

suppliers,

vendors,

distributors,

manufacturers

and

their

ability

to

maintain

their

inventory

and

production

levels

and

provide

us

with

sufficient

quantities

of

products

at

acceptable

prices;

pricing

and

promotional

activities

of

competitors;

changes

in

law

and

regulation

including

with

respect

to

consumer

protection

and

labor;

currency

exchange

rate

fluctuations;

serious

disruption

at

our

distribution

or

return

facilities;

impairment

in

the

carrying

value

of

goodwill

or

other

acquired

intangibles;

weather

conditions;

litigation;

risks

associated

with

relying

on

foreign

sources

of

production;

the

loss

of

our

key

executives;

risks

relating

to

e-commerce;

disruption

of

our

current

management

information

systems;

and

risks

and

costs

associated

with

combining

businesses

and/or

assimilating

acquired

companies.

Known

and

unknown

risks

and

uncertainties

are

more

fully

described

in

the

Company's

Annual

Report

on

Form

10-K

for

the

year

ended

January

30,

2010,

as

filed

with

the

Securities

and

Exchange

Commission

(“SEC”)

on

March

18,

2010,

and

in

other

reports

filed

with

the

SEC.

Our

SEC

filings,

these

slides

and

reconciliation

information

required

pursuant

to

Regulation

G,

under

the

Securities

and

Exchange

Act

of

1934,

as

amended,

can

be

found

on

the

investor

relations

page

on

our

website

at

www.dickssportinggoods.com. |

FULL LINE SPORTING GOODS RETAILER

Focused on the athlete and outdoor enthusiast. |

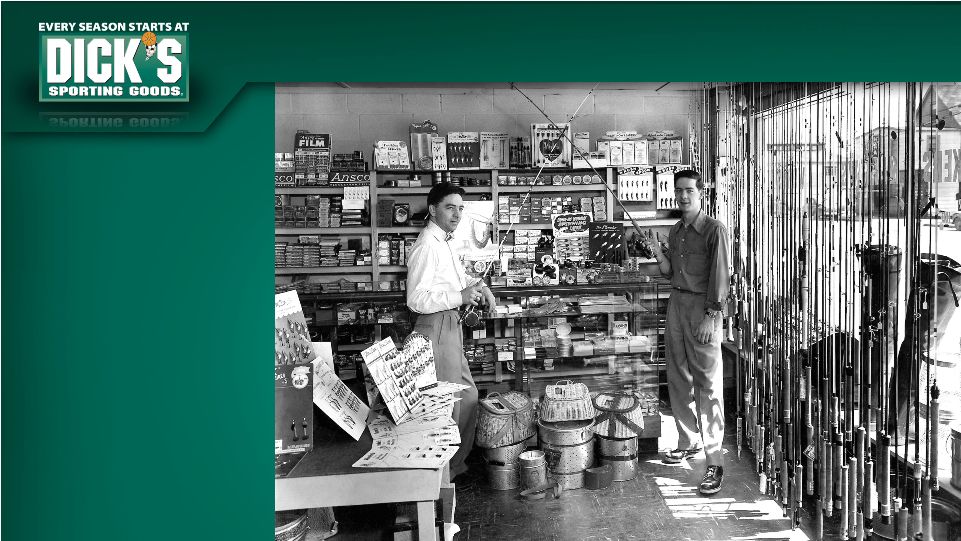

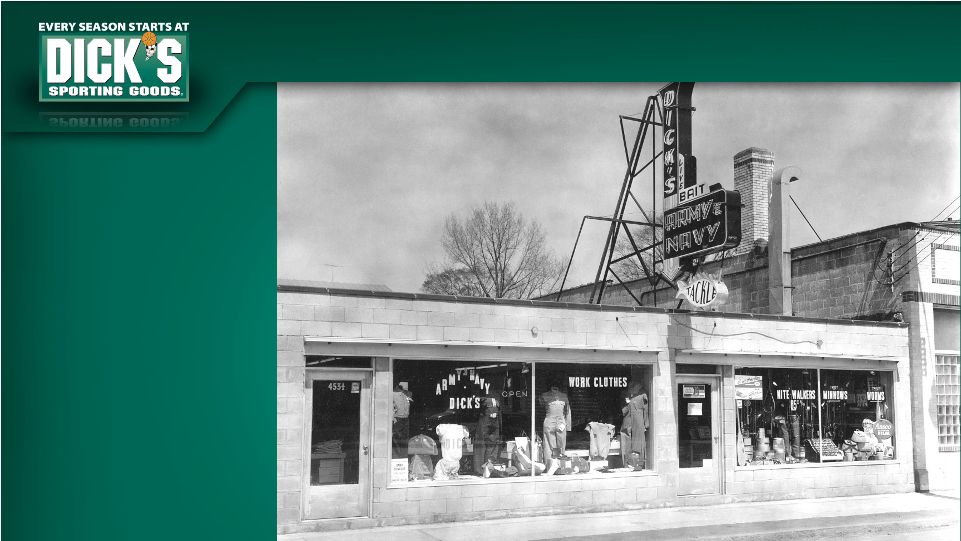

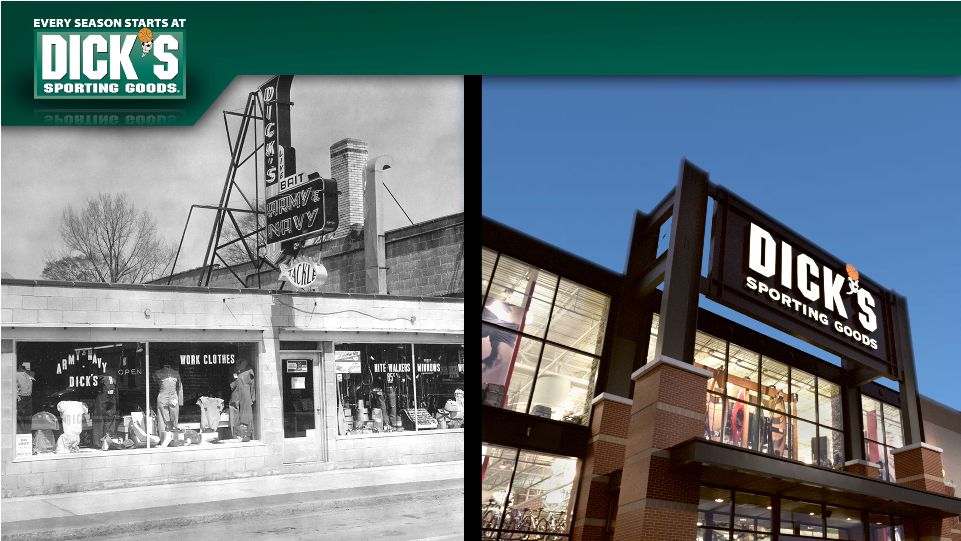

FOUNDED IN 1948

By Dick Stack as

a bait and tackle store. |

DICK’S SPORTING GOODS

ORIGINAL STORE

LOCATION

453½

Court Street

Binghamton, New York |

NEW YORK

–

Binghamton

–

Vestal |

1992 –

RAISED

$8,000,000

IN CAPITAL |

THROUGH 1996 –

RAISED ADDITIONAL

$86,000,000

IN CAPITAL |

DATE: October 16, 2002

PRICE: $3.00/Share (Split adjusted)

CAPITAL RAISED: $27.9 Million

COMMENTARY:

One of the best performing 2002 IPO’s

STORE COUNT:

141 Stores/25 States

SALES: $1.27 Billion FY2002 |

DICK’S POSITION IN THE MARKETPLACE

2009 Consolidated Sales (in millions)

Today, Dick’s is the largest full line sporting goods retailer in the country.

* Source: Company filings |

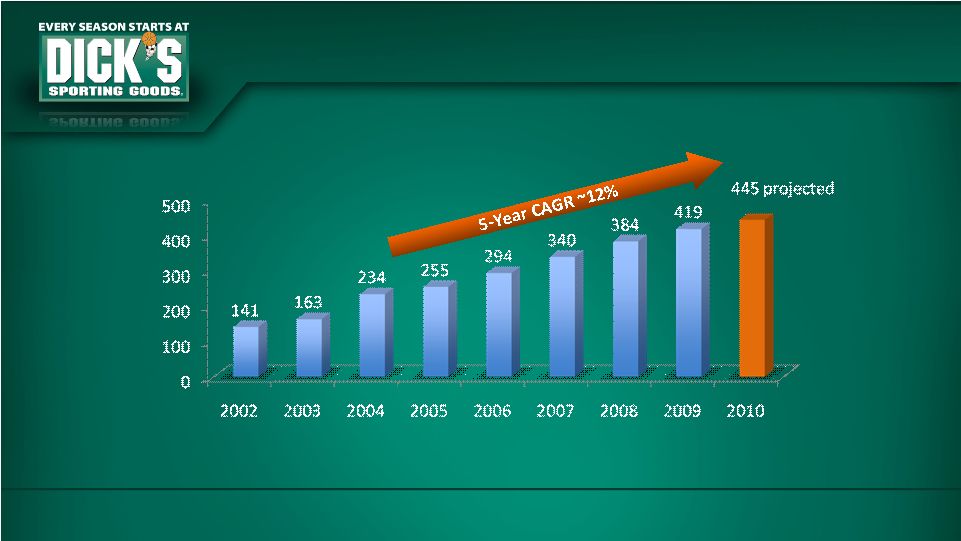

CONSISTENT STORE GROWTH

(Dick’s Stores)

Expect 26 New Stores in 2010 and approximately 34 new stores in 2011

Note:

Acquired

Galyan’s

in

July,

2004:

48

stores. |

SOLID SALES GROWTH TRAJECTORY

Consolidated Sales ($ in billions)

Note:

Acquired

Galyan’s

in

July,

2004:

48

stores,

$719

mil

sales

over

the

last

twelve

months

ended

April

2004.

Acquired

Golf

Galaxy

Feb.

13,

2007;

$275mil

sales

over

the

last

twelve

months

ended

Feb.

3,

2007. |

NET INCOME FROM CONTINUING OPERATIONS

Consolidated Income ($ in millions)

EPS

Guidance

2010

$1.46

to

$1.49 / 21.7%

to

24.2%

increase

over

2009*

*

Reflects

Company

guidance

provided

on

August

19,

2010.

Guidance

is

non-gaap

(excludes

expected

third

quarter

impact

from

the

previously

announced

closure

of

12

underperforming

Golf

Galaxy

stores).

Although

business

conditions

are

subject

to

change,

in

accordance

with

the

Company’s

policy,

this

earnings

guidance

was

effective

at

the

date

given

and

is

not

being

updated

until

the

Company

publicly

announces

updated

guidance.

Note:

Acquired

Galyan’s

in

July,

2004:

48

stores,

$719

mil

sales

over

the

last

twelve

months

ended

April,

2004;

results

include

impact

of

FSP

APB

14-1

&

exclude

M&I

costs,

store

closing

costs

&

gain

or

loss

on

sale

of

investment.

2002,

2003,

2004

&

2005

PF

includes

stock

option

expensing.

Acquired

Golf

Galaxy

Feb.

13,

2007;

$275mil

sales

over

the

last

twelve

months

ended

Feb.

3,

2007.

See

the

Reg.

G

reconciliation

on

our

web

site

under

the

IR

tab. |

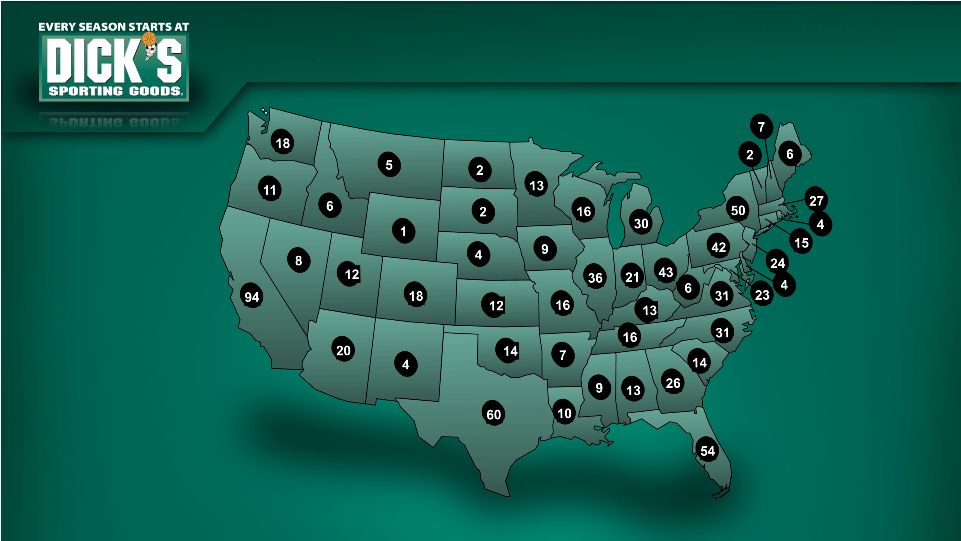

TODAY’S STORE LOCATIONS

425

Dick’s Sporting Goods stores/42 states

At the end of Q2 2010 |

TOMORROW’S FOOTPRINT

900+ store potential nationwide |

BRANDS

TOP RETAILER FOR MOST KEY BRANDS |

NIKE FIELD HOUSE

Dick’s is Nike’s key

strategic apparel partner.

Dick’s has more

Nike shops

than any other retailer. |

COMMERCIALS

2

1

3

4

5

6 |

PRIVATE BRANDS

Exclusive and award-winning brands

and styles spanning hardlines,

apparel and footwear.

Positioning for each brand.

Opportunity to increase

penetration levels. |

e-Commerce

•

Annual sales exceed $100,000,000

•

Meaningful growth opportunity |

Golf Galaxy

•

Annual sales in excess

of $300,000,000

•

81 locations *

* Based on expectations for FY2010. |

445 Dick’s Sporting Goods stores

generating over $4,300,000,000 in revenue*

* Based on expectations for FY2010. |

Dick’s Sporting Goods has significant growth

opportunities in e-Commerce, Golf Galaxy and

we can double Dick’s Sporting Goods store

count in the U.S. |

|