Attached files

| file | filename |

|---|---|

| 8-K - 8-K FOR 3RDQ 2010 EARNINGS - TEMPLE INLAND INC | tin8k20101020.htm |

| EX-99.1 - 3RDQ 2010 EARNINGS RELEASE - TEMPLE INLAND INC | tin8kex99120101020.htm |

1

Our job is to be the best

Third Quarter 2010

14

2

This presentation contains “forward-looking statements” within the meaning of the federal

securities laws. These statements reflect management’s current views with respect to future

events and are subject to risk and uncertainties. We note that a variety of factors and uncertainties

could cause our actual results to differ significantly from the results discussed in the forward-

looking statements. Factors and uncertainties that might cause such differences include, but are

not limited to: general economic, market, or business conditions; the opportunities (or lack

thereof) that may be presented to us and that we may pursue; fluctuations in costs and expenses

including the costs of raw materials, purchased energy, and freight; changes in interest rates;

demand for new housing; accuracy of accounting assumptions related to impaired assets,

pension and postretirement costs, contingency reserves and income taxes; competitive actions by

other companies; changes in laws or regulations; our ability to execute certain strategic and

business improvement initiatives; the accuracy of certain judgments and estimates concerning the

integration of acquired operations; and other factors, many of which are beyond our control.

Except as required by law, we expressly disclaim any obligation to publicly revise any forward-

looking statements contained in this presentation to reflect the occurrence of events after the date

of this presentation.

securities laws. These statements reflect management’s current views with respect to future

events and are subject to risk and uncertainties. We note that a variety of factors and uncertainties

could cause our actual results to differ significantly from the results discussed in the forward-

looking statements. Factors and uncertainties that might cause such differences include, but are

not limited to: general economic, market, or business conditions; the opportunities (or lack

thereof) that may be presented to us and that we may pursue; fluctuations in costs and expenses

including the costs of raw materials, purchased energy, and freight; changes in interest rates;

demand for new housing; accuracy of accounting assumptions related to impaired assets,

pension and postretirement costs, contingency reserves and income taxes; competitive actions by

other companies; changes in laws or regulations; our ability to execute certain strategic and

business improvement initiatives; the accuracy of certain judgments and estimates concerning the

integration of acquired operations; and other factors, many of which are beyond our control.

Except as required by law, we expressly disclaim any obligation to publicly revise any forward-

looking statements contained in this presentation to reflect the occurrence of events after the date

of this presentation.

This presentation includes non-GAAP financial measures. The required reconciliations to

GAAP financial measures are included on our website, www.templeinland.com.

GAAP financial measures are included on our website, www.templeinland.com.

15

3

Third Quarter 2010 Consolidated Results

• Special items (after-tax)

– $0.75 per share tax benefit related to cellulosic biofuel credit

– $0.03 per share charge primarily related to Box Plant

Transformation II

|

|

Q3

2010

|

Q2

2010

|

Q3

2009

|

|

Net income per share

|

$ 1.13

|

$ 0.18

|

$ 0.61

|

|

Special items

|

(0.72)

|

0.01

|

(0.37)

|

|

Net income per share excluding special

items |

$ 0.41

|

$ 0.19

|

$ 0.24

|

|

|

|

|

|

16

4

Corrugated Packaging

($ in Millions)

|

|

Q3

2010

|

Q2

2010

|

Q3

2009

|

|

Revenues

|

$ 809

|

$ 786

|

$ 734

|

|

Costs and expenses

|

(688)

|

(723)

|

(640)

|

|

Segment operating income

|

$ 121

|

$ 63

|

$ 94

|

• Record earnings and 24% ROI

• Key drivers

– Mill performance

– Box plant transformation

– Higher box prices

– Lower input costs

– Less mill downtime

17

5

Corrugated Packaging

TIN Average Box Price *

September 2010 box prices $93 higher than February 2010 box prices

2009

Q3 Q4 Q1 Q2 Q3

2010

* Average box price realization includes the impact of mix of business

18

6

Corrugated Packaging

Key Input Cost Changes

Q3 2010 vs. Q2 2010 Q3 2010 vs. Q3 2009

19

7

Corrugated Packaging

Box Shipments

* Source: Fibre Box Association

2009

2010

20

8

Corrugated Packaging

• Q3 2010 maintenance downtime

– 4,000 tons at New Johnsonville

• Q4 2010 maintenance downtime

– 13,000 tons at Orange

21

Looking Forward

• 4th Quarter

– Higher prices

– Lower seasonal volume

– Higher input costs

9

22

10

Building Products

($ in Millions)

|

|

Q3

2010

|

Q2

2010

|

Q3

2009

|

|

Revenues

|

$ 157

|

$ 190

|

$ 151

|

|

Costs and expenses

|

(167)

|

(175)

|

(155)

|

|

Segment operating income (loss)

|

$( 10)

|

$ 15

|

$( 4)

|

23

11

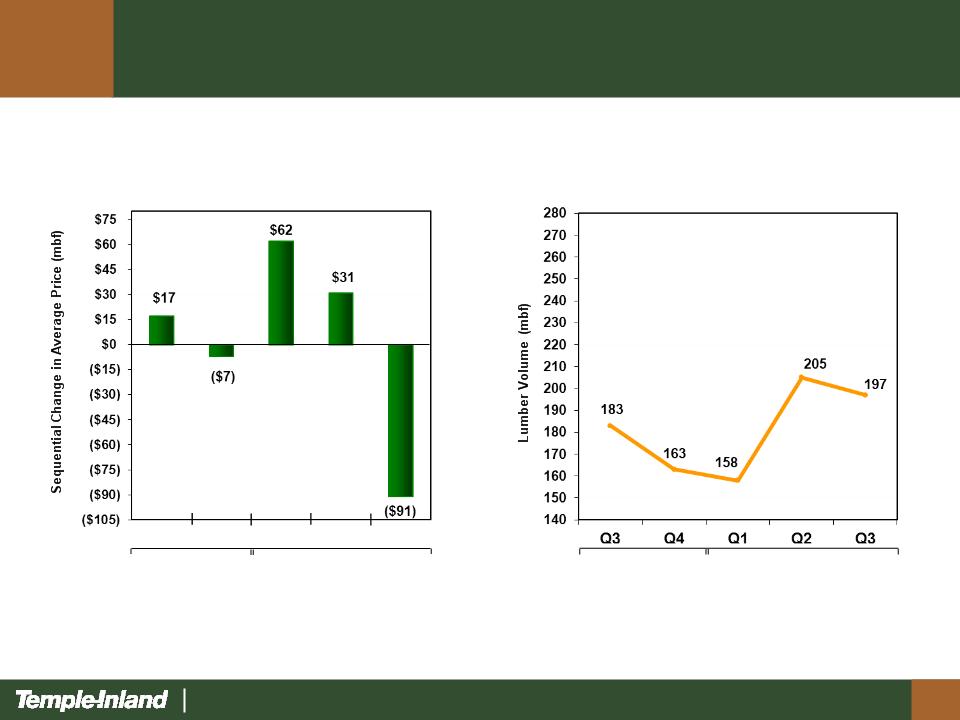

Building Products

Lumber

Price

2009

2010

Q3 Q4 Q1 Q2 Q3

Volume

2009

2010

24

12

Building Products

Gypsum

Volume

2009

2010

Q3 Q4 Q1 Q2 Q3

Price

Q3 Q4 Q1 Q2 Q3

2009

2010

25

13

Particleboard

Volume

Building Products

2009

2010

Q3 Q4 Q1 Q2 Q3

2009

2010

26

14

Housing Starts

TIN EBITDA

2006

2007

2008

2009

2010

27

15

Third Quarter 2010 Financial Highlights

• Cash provided by operations $109 million in third quarter

– Operations provided $114 million

– Working capital was a use of $5 million

• Balance sheet

– Long-term debt $709 million at third quarter-end, down $36

million from second quarter-end

million from second quarter-end

• Expense related items

– Interest expense $13 million in third quarter and $39 million year

-to-date, down 7% and 22% respectively vs. year ago

-to-date, down 7% and 22% respectively vs. year ago

– General and administrative expenses $17 million in third quarter

and $54 million year-to-date, consistent with prior guidance

and $54 million year-to-date, consistent with prior guidance

• Cellulosic Biofuel

28

16

Our job is to be the best

29